- LARK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Landmark Bancorp (LARK) DEF 14ADefinitive proxy

Filed: 19 Apr 02, 12:00am

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registranto | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

Landmark Bancorp, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

LANDMARK BANCORP, INC.

800 Poyntz Avenue

Manhattan, Kansas 66502

(785) 565-2000

April 19, 2002

Dear Stockholder:

On behalf of the board of directors and management of Landmark Bancorp, Inc., we cordially invite you to attend our annual meeting of stockholders, to be held at 2:00 p.m. on Wednesday, May 22, 2002, at the Kansas State University Student Union, 17th and Anderson Avenue, Manhattan, Kansas. The accompanying notice of annual meeting of stockholders and proxy statement discuss the business to be conducted at the meeting. At the meeting we shall report on our operations and the outlook for the year ahead.

Your board of directors has nominated three persons to serve as Class I directors. Each of the nominees are incumbent directors. Your board of directors has selected and recommends that you ratify the appointment of KPMG LLP to continue as our independent public accountants for the year ending December 31, 2002.

We recommend that you vote your shares for the director nominees and in favor of the proposal.

We encourage you to attend the meeting in person.Whether or not you plan to attend, however, please complete, sign and date the enclosed proxy and return it in the accompanying postpaid return envelope as promptly as possible. This will ensure that your shares are represented at the meeting.

We look forward with pleasure to seeing and visiting with you at the meeting.

Very truly yours, | ||

LANDMARK BANCORP, INC. | ||

/s/ PATRICK L. ALEXANDER Patrick L. Alexander President and Chief Executive Officer |

LANMARK BANCORP, INC.

800 Poyntz Avenue

Manhattan, Kansas 66502

(785) 565-2000

NOTICE OF

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 22, 2002

To the stockholders of

LANDMARK BANCORP, INC.

The annual meeting of the stockholders of Landmark Bancorp, Inc., a Delaware corporation, will be held at the Kansas State University Student Union, 17th and Anderson Avenue, Manhattan, Kansas, 66506, on Wednesday, May 22, 2002, at 2:00 p.m., local time, for the following purposes:

The board of directors has fixed the close of business on April 5, 2002, as the record date for the determination of stockholders entitled to notice of, and to vote at, the meeting. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the meeting, the meeting may be adjourned or postponed in order to permit our further solicitation of proxies.

By order of the Board of Directors | ||

/s/ PATRICK L. ALEXANDER Patrick L. Alexander President and Chief Executive Officer | ||

Manhattan, Kansas April 19, 2002 |

LANDMARK BANCORP, INC.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

May 22, 2002

Landmark Bancorp, Inc., a Delaware corporation, is the surviving company of the merger between MNB Bancshares, Inc., the holding company for Security National Bank, and Landmark Bancshares, Inc., the holding company for Landmark Federal Savings Bank. This merger was completed on October 9, 2001. As a result of the merger, Landmark Bancorp, Inc. became the holding company for Landmark National Bank, which is the resulting bank from the merger of the two banking subsidiaries. Landmark National Bank has branches in Manhattan, Auburn, Dodge City, Garden City, Great Bend, Hoisington, LaCrosse, Osage City, Topeka and Wamego, Kansas.

This proxy statement is furnished in connection with the solicitation by the board of directors of Landmark Bancorp, Inc. of proxies to be voted at the annual meeting of stockholders to be held at the Kansas State University Student Union, 17th and Anderson Avenue, Manhattan, Kansas, 66506, on Wednesday, May 22, 2002, at 2:00 p.m., local time, and at any adjournments or postponements of the meeting. Our 2001 annual report, which includes consolidated financial statements of Landmark Bancorp, Inc. and our subsidiary, is also enclosed.

The following is information regarding the meeting and the voting process, and is presented in a question and answer format.

Why am I receiving this proxy statement and proxy card?

You are receiving a proxy statement and proxy card from us because on April 5, 2002, you owned shares of Landmark Bancorp's common stock. This proxy statement describes the matters that will be presented for consideration by the stockholders at the annual meeting. It also gives you information concerning the matters to assist you in making an informed decision.

When you sign the enclosed proxy card, you appoint the proxy holder as your representative at the meeting. The proxy holder will vote your shares as you have instructed in the proxy card, thereby ensuring that your shares will be voted whether or not you attend the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy card in advance of the meeting just in case your plans change.

If you have signed and returned the proxy card and an issue comes up for a vote at the meeting that is not identified on the card, the proxy holder will vote your shares, pursuant to your proxy, in accordance with his or her judgment.

What matters will be voted on at the meeting?

You are being asked to vote on the election of three Class I directors of Landmark Bancorp for a term expiring in 2005 and the ratification of KPMG LLP as our independent auditors for the 2002 fiscal year. These matters are more fully described in this proxy statement.

How do I vote?

You may vote either by mail or in person at the meeting. To vote by mail, complete and sign the enclosed proxy card and mail it in the enclosed pre-addressed envelope. No postage is required if mailed in the United States. If you mark your proxy card to indicate how you want your shares voted, your shares will be voted as you instruct.

If you sign and return your proxy card but do not mark the card to provide voting instructions, the shares represented by your proxy card will be voted "for" all three nominees named in this proxy statement and "for" the ratification of our auditors.

If you want to vote in person, please come to the meeting. We will distribute written ballots to anyone who wants to vote at the meeting. Please note, however, that if your shares are held in the name of your broker (or in what is usually referred to as "street name"), you will need to arrange to obtain a legal proxy from your broker in order to vote in person at the meeting. Even if you plan to attend the meeting, you should complete, sign and return your proxy card in advance of the meeting just in case your plans change.

What does it mean if I receive more than one proxy card?

It means that you have multiple holdings reflected in our stock transfer records and/or in accounts with stockbrokers. Please sign and return ALL proxy forms to ensure that all your shares are voted.

If I hold shares in the name of a broker, who votes my shares?

If you received this proxy statement from your broker, your broker should have given you instructions for directing how your broker should vote your shares. It will then be your broker's responsibility to vote your shares for you in the manner you direct.

Under the rules of various national and regional securities exchanges, brokers may generally vote on routine matters, such as the election of directors and the ratification of independent auditors, but cannot vote on non-routine matters, such as an amendment to a stock option plan, unless they have received voting instructions from the person for whom they are holding shares. If your broker does not receive instructions from you on how to vote particular shares on such non-routine matters and your broker does not have discretionary authority to vote on these matters, the broker will return the proxy card to us, indicating that he or she does not have the authority to vote on these matters. This is generally referred to as a "broker non-vote" and will affect the outcome of the voting as described below, under "How many votes are needed for approval of each proposal?" Therefore, we encourage you to provide directions to your broker as to how you want your shares voted on the matters to be brought before the meeting. You should do this by carefully following the instructions your broker gives you concerning its procedures. This ensures that your shares will be voted at the meeting.

What if I change my mind after I return my proxy?

If you hold your shares in your own name, you may revoke your proxy and change your vote at any time before the polls close at the meeting. You may do this by:

If you hold your shares in the name of your broker and desire to revoke your proxy, you will need to contact your broker to revoke your proxy.

How many votes do we need to hold the annual meeting?

A majority of the shares that are outstanding and entitled to vote as of the record date must be present in person or by proxy at the meeting in order to hold the meeting and conduct business.

Shares are counted as present at the meeting if the stockholder either:

On April 5, 2002, the record date, there were 2,016,496 shares of common stock issued and outstanding. Therefore, at least 1,008,249 shares need to be present at the annual meeting in order to hold the meeting and conduct business.

2

What happens if a nominee is unable to stand for re-election?

The board may, by resolution, provide for a lesser number of directors or designate a substitute nominee. In the latter case, shares represented by proxies may be voted for a substitute nominee. Proxies cannot be voted for more than three nominees. The board has no reason to believe any nominee will be unable to stand for re-election.

What options do I have in voting on each of the proposals?

You may vote "for" or "withhold authority to vote for" each nominee for director. You may vote "for," "against" or "abstain" on any other proposal that may properly be brought before the meeting. Abstentions will be considered in determining the presence of a quorum but will not affect the vote required for the ratification of our auditors or election of directors.

How many votes may I cast?

Generally, you are entitled to cast one vote for each share of stock you owned on the record date. The proxy card included with this proxy statement indicates the number of shares owned by an account attributable to you.

How many votes are needed for each proposal?

The three individuals receiving the highest number of votes cast "for" their election will be elected as directors of Landmark Bancorp.

The ratification of our auditors and all other matters must receive the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. Broker non-votes and abstentions will not be counted as entitled to vote, but will count for purposes of determining whether or not a quorum is present on the matter.

Where do I find the voting results of the meeting?

We will announce voting results at the meeting. The voting results will also be disclosed in our Form 10-Q for the quarter ending June 30, 2002.

Who bears the cost of soliciting proxies?

We will bear the cost of soliciting proxies. In addition to solicitations by mail, officers, directors or employees of Landmark Bancorp or its subsidiaries may solicit proxies in person or by telephone. These persons will not receive any special or additional compensation for soliciting proxies. We may reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders.

At the annual meeting of the stockholders to be held on May 22, 2002, the stockholders will be entitled to elect three Class I directors for a term expiring in 2005. The directors are divided into three classes having staggered terms of three years. The nominees for election as Class I directors are incumbent directors. We have no knowledge that any of the nominees will refuse or be unable to serve, but if any of the nominees becomes unavailable for election, the holders of the proxies reserve the right to substitute another person of their choice as a nominee when voting at the meeting.

Set forth below is information concerning the nominees for election and for the other persons whose terms of office will continue after the meeting, including the age, year first elected a director and business experience during the previous five years as of April 5, 2002. The nominees, if elected at the annual meeting of stockholders, will serve as Class I directors for three year terms expiring in 2005.We unanimously recommend that you vote FOR each of the nominees for director.

3

| Name | Age | Position with Landmark Bancorp and Landmark National Bank | Director Since(1) | |||

|---|---|---|---|---|---|---|

| CLASS I (Term Expires 2005) | ||||||

Brent A. Bowman | 52 | Director of Landmark Bancorp and Landmark National Bank | 1987 | |||

Joseph L. Downey | 65 | Director of Landmark Bancorp and Landmark National Bank | 1996 | |||

David H. Snapp | 46 | Director of Landmark Bancorp and Landmark National Bank | 1986 | |||

CONTINUING DIRECTORS | ||||||

CLASS II (Term Expires 2003) | ||||||

Richard Ball | 49 | Director of Landmark Bancorp and Landmark National Bank | 1995 | |||

Susan E. Roepke | 62 | Director of Landmark Bancorp and Landmark National Bank | 1997 | |||

C. Duane Ross | 65 | Director of Landmark Bancorp and Landmark National Bank 1986 | ||||

CLASS III (Term Expires 2004) | ||||||

Patrick L. Alexand | 49 | President, Chief Executive Officer and Director of Landmark Bancorp and Landmark National Bank | 1990 | |||

Jim W. Lewis | 46 | Director of Landmark Bancorp and Landmark National Bank | 1991 | |||

Jerry R. Pettle | 63 | Director of Landmark Bancorp and Landmark National Bank | 1978 | |||

Larry Schugart | 62 | Chairman of the Board and Director of Landmark Bancorp and Landmark National Bank | 1971 | |||

All of our directors will hold office for the terms indicated, or until their earlier death, resignation, removal or disqualification, and until their respective successors are duly elected and qualified, and all executive officers hold office for a term of one year. There are no arrangements or understandings between any of the directors, executive officers or any other person pursuant to which any of our directors or executive officers have been selected for their respective positions, except that Landmark Bancorp and Landmark National Bank have entered into employment contracts with Messrs. Alexander

4

and Schugart. No director is related to any other director or executive officer of Landmark Bancorp or its subsidiary by blood, marriage or adoption.

The business experience of each nominee and continuing director for the past five years is as follows:

Patrick L. Alexander is the president and chief executive officer of Landmark Bancorp and Landmark National Bank. He became president and chief executive officer of the Manhattan Federal Savings and Loan Association (the predecessor-in-interest to Security National Bank) in 1990, and became the president and chief executive officer of MNB Bancshares and Security National Bank in 1992 and 1993, respectively. From 1986 to 1990, Mr. Alexander served as president of the Kansas State Bank of Manhattan, Manhattan, Kansas. Mr. Alexander serves as a member of the board of directors of the Big Lakes Foundation, Inc.

Larry Schugart has served with Landmark Federal Savings Bank, Landmark Bancshares and Landmark Bancorp for over 37 years. He served as president, chief executive officer and a director of Landmark Bancshares since its incorporation in 1993 until the merger in 2001. He is a former director of the Federal Home Loan Bank of Topeka where he served on the Finance and Executive Committees. Mr. Schugart is a former member and chair of various committees of the Heartland Community Bankers Association, is a past Chairman of the Kansas-Nebraska League of Savings and served as a member of the Governmental Affairs Committee of the America's Community Bankers. In addition, Mr. Schugart has been president of numerous civic and charitable organizations in Great Bend.

Richard A. Ball, a certified public accountant, is a member of Adams, Brown, Beran & Ball, Chtd., an accounting firm with offices in Great Bend, Hays, LaCrosse, Ellinwood, Colby, Lyons, McPherson and Hutchinson, Kansas. He is also president of Ball Consulting Group, Ltd. He has served as a Board Chairman of the Great Bend Chamber of Commerce, Great Bend United Way, Petroleum Club and Barton County Community College Academic Fund Campaign. He has also served on the boards of the Kiwanis Club, Cougar Booster Club, Downtown Development, Mid-Kansas Economic Development and the Kansas Oil & Gas Museum Committee.

Brent A. Bowman has been president of Brent Bowman and Associates Architects, P.A., an architectural firm in Manhattan, Kansas, since 1979. He serves on the Big Lakes Developmental Center Board.

Joseph L. Downey served as a director of Dow Chemical Co. for ten years until his retirement from the board in 1999. He was a Dow Senior Consultant from 1995 until 1999, after having served in a variety of executive positions with that company, including senior vice president from 1991 to 1994.

Jim W. Lewis is the owner of several automobile dealerships across the state of Kansas, including Dodge City Toyota, Inc. Mr. Lewis is a member of the Dodge City Area Chamber of Commerce. He was a founding member of "The Alley," a community Teen Center in Dodge City.

Jerry R. Pettle is a dentist who practiced with Dental Associates of Manhattan, P.A., in Manhattan, Kansas, from 1965 until his retirement in 1999. Dr. Pettle is an examiner for the Kansas Dental Board.

Susan E. Roepke is a former vice president of MNB Bancshares, serving in that capacity from its inception in 1992 until she retired as an officer of MNB Bancshares and Security National Bank at the end of 1998. She also served in a number of senior management positions with Security National Bank since 1970, including senior vice president, secretary and cashier since 1993.

C. Duane Ross is president and chief executive officer of High Plains Publishers, Inc., a publishing/printing company. Mr. Ross is Vice Chairman of the Board of Commissioners of the Dodge City Housing Authority, a current member of the Dodge City Community College Endowment Board, and a past president of the Dodge City/Ford County Development Corporation. In addition, he is a past

5

president of the Dodge City Community College Foundation and is a past president of the Dodge City Area Chamber of Commerce.

David H. Snapp is a partner in the law firm of Waite, Snapp & Doll in Dodge City, Kansas. Mr. Snapp is also a board member of Arrowhead West, Inc., a mental and physical rehabilitation center, and Catholic Social Service.

Board Committees and Meetings

Since the completion of the merger, the full board of directors serves on the compensation committee and the audit committee, although Messrs. Alexander and Schugart do not have any voting authority in the audit committee and do not participate in decisions regarding their own compensation. The full board of directors also considers nominations to the board, and will consider nominations made by stockholders if such nominations are in writing and otherwise comply with our bylaws.

The audit committee is responsible for overseeing the internal and external audit functions. It approves internal audit staffing, salaries and programs. The internal auditor reports directly to the committee on audit and compliance matters. The committee also reviews and approves the scope of the annual external audit and consults with the independent auditors regarding the results of their auditing procedures. Only independent directors, as defined by the rules and regulations governing the National Association of Securities Dealers, have decision making authority on the committee. A copy of the audit committee charter is attached to this proxy statement as Exhibit A. The committee normally meets quarterly. The audit committee for Landmark Bancorp met once in 2001 after the merger. The audit committees for Landmark Bancshares and MNB Bancshares each met three times, in 2001 prior to the merger.

The compensation committee has responsibility for all matters related to compensation of executive officers of Landmark Bancorp, including review and approval of base salaries, review of salaries of executive officers compared to other financial services holding companies in the region, fringe benefits, including modification of the retirement plan, and incentive compensation. The compensation committee did not meet in 2001 after the merger. During 2001, the compensation committees for Landmark Bancshares did not meet and the committee for MNB Bancshares met two times prior to the merger.

A total of three regularly scheduled and special meetings were held by the board of directors of Landmark Bancorp during 2001 and the boards of Landmark Bancshares and MNB Bancshares each met ten times in 2001 prior to the merger. During 2001, all directors attended at least 75 percent of the meetings of the board and the committees on which they served. Directors of Landmark Bancorp receive a monthly fee of $1,250 for serving on the board of directors.

6

The following table sets forth information concerning the compensation paid or granted to our chief executive officer for the past three fiscal years and those executive officers whose salary and bonus exceeded $100,000.

| | | | | Long Term Compensation Awards | | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | Annual Compensation | | |||||||||||

| (a) Name and Principal Position | | | ||||||||||||

| (b) Fiscal Year(1) | (c) Salary($) | (d) Bonus($) | (g) Securities Underlying Options/SARs(#) | (i) All Other Compensation ($) | ||||||||||

| Patrick L. Alexander President and Chief Executive Officer(2) | 2001 2000 1999 | $ | 178,322 161,442 155,313 | $ | 15,000 — 5,000 | — — — | 9,000(3 8,590(3 8,590(3 | ) ) ) | ||||||

Larry Schugart Chairman of the Board(4) | 2001 2000 1999 | $ | 151,538 145,000 133,085 | $ | 24,750 18,600 13,695 | — — 5,000 | $ | 69,693(5 44,251(5 52,140(5 | ) ) ) | |||||

Gary L. Watkins(6) | 2001 2000 | $ | 93,231 90,000 | $ | 12,950 12,400 | — — | $ | 36,067(7 39,584(7 | ) ) | |||||

Michael E. Scheopner Executive Vice President(8) | 2001 | $ | 95,269 | $ | 10,000 | — | $ | 5,000(9 | ) | |||||

7

stock ownership plan of $40,858, $38,197 and $29,090 for the fiscal years ended September 30, 2001, 2000 and 1999, respectively. Also includes compensation deferred at the election of Mr. Schugart.

Stock Option Information

The following table sets forth certain information concerning the number and value of stock options granted in the last fiscal year to the individuals named in the Summary Compensation Table. The options granted and potential value realized are as of December 31, 2001.

OPTION GRANTS IN LAST FISCAL YEAR

| | | Individual Grants | | | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Potential realizable value at assumed annual rates of stock price appreciation for option term | ||||||||||

| (a) Name | | | (d) Exercise or Base Price $/Sh)(1) | | |||||||||||

| (b) Options Granted (#)(1) | (c) % of Total Options Granted to Employees in Fiscal Year | (e) Expiration Date | (f) 5%($) | (g) 10%($) | |||||||||||

| Patrick L. Alexander | 3,021 | 28 | % | $ | 17.29 | 1/26/11 | $ | 32,838 | $ | 83,259 | |||||

| Larry Schugart | — | — | — | — | — | — | |||||||||

| Gary L. Watkins | — | — | — | — | — | — | |||||||||

| Michael E. Scheopner | 1,923 | 18 | % | $ | 17.29 | 1/26/11 | $ | 20,903 | $ | 52,998 | |||||

8

The following table sets forth certain information concerning the number and value of stock options at December 31, 2001.

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR AND FY-END

OPTION/SAR VALUES

| | | | Number of Securities Underlying Unexercised Options/SARs at FY-End (#) (d)(1) | Value of Unexercised In-the-Money Options/SARs at FY-End ($) (e)(1) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name (a) | Shares Acquired on Exercise (#) (b) | Value Realized ($) (c) | |||||||||||||

| Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||||||||

| Patrick L. Alexander | 15,207 | (1) | $ | 169,275 | 3,021 | — | $ | 9,395 | $ | — | |||||

| Larry Schugart | 28,000 | (2) | $ | 252,770 | 33,635 | — | $ | 308,829 | $ | — | |||||

| Gary L. Watkins | — | — | — | — | $ | — | $ | — | |||||||

| Michael E. Scheopner | — | — | 9,357 | — | $ | 43,734 | $ | — | |||||||

Employment Agreements

At the time of the merger, Patrick Alexander, Larry Schugart, Mark Herpich, Michael Scheopner and Dean Thibault entered into employment agreements with Landmark Bancorp. The employment agreement for Mr. Alexander initially provides for a base salary of $200,000, which may be increased but not decreased, and an initial term of three years, with automatic one year extensions on each anniversary of the effective date of the agreement unless either party gives the other notice of its desire to terminate this automatic extension. Upon any such termination, the agreement will expire at the end of the then current three year term.

Mr. Alexander's employment agreement will terminate upon the death or disability of Mr. Alexander, in the event of certain regulatory actions or upon notice by either us or Mr. Alexander, with or without cause. The employment agreement will be suspended in the event of a regulatory suspension of Mr. Alexander's employment. If Mr. Alexander's employment is terminated without cause (which is defined in the employment agreement), we will be obligated to pay or to provide to him, as applicable, a cash payment equal to three times the sum of his then annual salary, plus an amount equal to the average of the annual performance bonuses paid to him and the contributions made for his benefit under all employee retirement plans during the most recently ended three years. We must also provide Mr. Alexander and his immediate family continued insurance coverage for the three years after this termination of employment. We will have no continuing obligation to Mr. Alexander if he voluntarily terminates his employment or we terminate him for cause, except that we will be obligated to pay him his accrued salary and benefits through the effective date of his termination of employment.

If Mr. Alexander voluntarily terminates his employment, or his employment is involuntarily terminated, within six months after a change in control of us or our bank subsidiary, then our successor will be obligated to pay or to provide to Mr. Alexander the same cash payment and benefits he would have received if he had been terminated by us without cause. For purposes of the employment agreement, Mr. Alexander's employment will be considered terminated if he is not re-elected or is

9

removed from his position as our president and chief executive officer or if we otherwise commit a breach of our obligations under the employment agreement.

The employment agreement also includes a covenant which will limit the ability of Mr. Alexander to compete with us or our bank subsidiary in an area encompassing a fifty mile radius from any of our banking offices for a period of one year following the termination of his employment. The geographic area covered by this provision constitutes a portion of our primary market area.

Except as described below, the employment agreements for Messrs. Herpich, Scheopner and Thibault contain substantially the same provisions as those included in Mr. Alexander's employment agreement. The base salaries for Messrs. Herpich, Scheopner and Thibault will be $105,000, $105,000 and $85,000, respectively. The term of these three agreements will be for one year and they will automatically extend for one additional year on each anniversary of the effective date of the agreement. If any of these officers is terminated without cause during the term of his respective agreement, he will be entitled to receive an amount equal to the sum of his then annual salary, plus an amount equal to the average of the annual performance bonuses paid to him and the contributions made for his benefit under all employee retirement plans during the most recently ended three years. The payment to be made to each of these three officers upon his voluntary termination of employment within six months after a change of control or his involuntary termination without cause within one year of a change of control will be equal to two times the sum of his then annual salary, plus an amount equal to the average of the annual performance bonuses paid to him and the contributions made for his benefit under all employee retirement plans during the most recently ended three years. Each of these employees will be subject to the same non-competition covenant as Mr. Alexander following his termination of employment.

In addition, Mr. Schugart has entered into an employment agreement to serve as chairman of the board of Landmark Bancorp and Landmark National Bank. The agreement has a fixed term of three years and provides for an annual salary of $35,000. The agreement also provides Mr. Schugart with health insurance coverage as well as the opportunity to continue to participate in his deferred compensation agreement during the term of the employment agreement.

Compensation Committee Report on Executive Compensation

The compensation committee has furnished the following report on executive compensation. The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by Landmark Bancorp shall not be deemed to include the report unless the report is specifically stated to be incorporated by reference into such document.

The compensation committee is comprised of the entire board of directors and is responsible for recommendations to the board of directors of Landmark Bancorp for compensation of executive officers of Landmark National Bank and Landmark Bancorp. Neither Messrs. Alexander nor Schugart participate in decisions relating to his own respective compensation. In determining compensation, the following factors are generally taken into consideration:

The committee considers the foregoing factors, as well as others, in determining compensation. There is no assigned weight given to any of these factors.

10

Additionally, the compensation committee considers various benefits, such as the employee stock ownership plan and the stock option plan, together with perquisites in determining compensation. The committee believes that the benefits provided through the stock based plans more closely tie the compensation of the officers to the interests of the stockholders and provide significant additional performance incentives for the officers which directly benefit the stockholders through an increase in the stock value.

Annually, the compensation committee evaluates four primary areas of performance in determining Mr. Alexander's level of compensation. These areas are:

When evaluating our financial performance, the committee considers profitability, asset growth and risk management. The primary evaluation criteria are considered to be essential to the long-term viability and are generally given equal weight in the evaluation. Finally, the committee reviews compensation packages of peer institutions to ensure that Mr. Alexander's compensation is competitive and commensurate with his level of performance.

Mr. Alexander's current compensation is based on his employment agreement, his substantial banking experience, the other factors described above as well as Mr. Alexander's guidance through the merger and the subsequent transition period. Mr. Alexander did not participate in any decisions pertaining to his compensation.

Patrick L. Alexander | Jerry R. Pettle | |

| Richard Ball | Susan E. Roepke | |

| Brent A. Bowman | C. Duane Ross | |

| Joseph L. Downey | Larry Schugart | |

| Jim W. Lewis | David H. Snapp |

11

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by Landmark Bancorp shall not be deemed to include the following performance graph and related information unless the graph and related information are specifically stated to be incorporated by reference into the document.

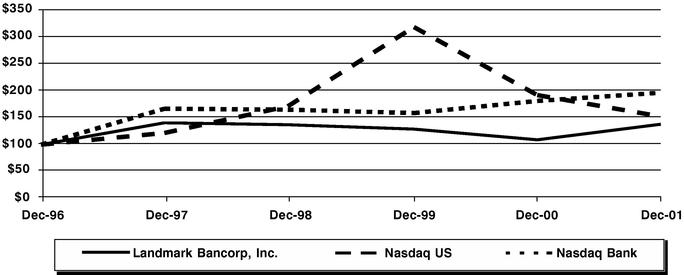

The following graph shows a comparison of cumulative total returns for Landmark Bancorp, Inc., The Nasdaq Stock Market (U.S. Companies) and the Nasdaq Bank Stocks Index. Because the Securities and Exchange Commission considers the former Landmark Bancshares, Inc. the continuing entity for accounting purposes as a result of the merger of Landmark Bancshares and MNB Bancshares into Landmark Bancorp, the following graph only presents the performance of Landmark Bancshares' common stock prior to the merger.

The cumulative stockholder return computations assume that $100 was invested in Landmark Bancshares' common stock and in each index on December 31, 1996, and assumes the reinvestment of all dividends.

CUMULATIVE TOTAL RETURN

Based upon an initial investment of $100 on December 31, 1996

with dividends reinvested

| | 12/31/96 | 12/31/97 | 12/31/98 | 12/31/99 | 12/31/00 | 12/31/01 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Landmark Bancorp, Inc. | $ | 100 | $ | 141 | $ | 138 | $ | 130 | $ | 109 | $ | 138 | ||||||

| Nasdaq Market—U.S. | 100 | 122 | 173 | 321 | 193 | 153 | ||||||||||||

| Nasdaq Bank Stocks | 100 | 167 | 166 | 160 | 182 | 197 | ||||||||||||

12

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information regarding our common stock beneficially owned on March 15, 2002 with respect to all persons known to us to be the beneficial owner of more than five percent of our common stock, each director and nominee, each executive officer named in the summary compensation table above and all directors and executive officers of as a group.

| Name of Individual and Number of Persons in Group | Amount and Nature of Beneficial Ownership(1) | Percent of Class | |||

|---|---|---|---|---|---|

5% Stockholders | |||||

Landmark Bancorp, Inc. Employee Stock Ownership Plan 800 Poyntz Avenue Manhattan, Kansas 66505 | 175,946 | (2) | 8.73 | % | |

First Manhattan Co. 437 Madison Avenue New York, New York 10022 | 101,081 | (3) | 5.01 | % | |

Larry Schugart | 131,097 | (4) | 6.39 | % | |

Other Directors and Named Executive Officers | |||||

Patrick L. Alexander | 68,642 | (5) | 3.40 | % | |

| Richard A. Ball | 18,886 | (6) | * | ||

| Brent A. Bowman | 3,507 | * | |||

| Joseph L. Downey | 8,066 | (7) | * | ||

| Jim W. Lewis | 36,251 | (8) | 1.79 | % | |

| Jerry R. Pettle | 9,332 | (9) | * | ||

| C. Duane Ross | 32,826 | (10) | 1.62 | % | |

| Susan E. Roepke | 65,526 | (11) | 3.25 | % | |

| Michael E. Scheopner | 20,899 | (12) | 1.03 | % | |

| David H. Snapp | 32,604 | (13) | 1.61 | % | |

All directors and executive officers as a group (12 persons) | 450,133 | (14) | 21.25 | % |

13

investment power and 578 shares held in is spouse's individual retirement account over which shares he has no voting or investment power.

Compliance with Section 16(a) of the Securities Exchange Act

Section 16(a) of the Securities Exchange Act of 1934 requires that our executive officers, directors and persons who own more than 10% of our common stock file reports of ownership and changes in

14

ownership with the Securities and Exchange Commission and with the exchange on which our shares of common stock are traded. These persons are also required to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of these forms, we are not aware that any of our directors, executive officers or 10% stockholders failed to comply with the filing requirements of Section 16(a) during the fiscal year ended December 31, 2001.

Our directors and officers and their associates were customers of and had transactions with Landmark Bancorp and Landmark National Bank, and their predecessors, during 2001. Additional transactions are expected to take place in the future. All outstanding loans, commitments to loan, and certificates of deposit and depository relationships, in the opinion of management, were made in the ordinary course of business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collectibility or present other unfavorable features.

The incorporation by reference of this proxy statement into any document filed with the Securities and Exchange Commission by Landmark Bancorp shall not be deemed to include the following report unless the report is specifically stated to be incorporated by reference into such document.

The audit committee assists the board in carrying out its oversight responsibilities for our financial reporting process, audit process and internal controls. The audit committee also reviews the audited financial statements and recommends to the board that they be included in our annual report on Form 10-K. At the present time, the committee is comprised of the entire board of directors, although only independent directors have decision making authority.

The audit committee has reviewed and discussed our audited financial statements for 2001 with our management and KPMG LLP, our independent auditors. The committee has also discussed with KPMG LLP the matters required to be discussed by SAS 61 (Codification for Statements on Auditing Standards) as well as having received and discussed the written disclosures and the letter from KPMG LLP required by Independence Standards Board Statement No. 1 (Independence Discussions with Audit Committees). Based on the review and discussions with management and KPMG LLP, the committee has recommended to the board that the audited financial statements be included in our annual report on Form 10-K for 2001 for filing with the Securities and Exchange Commission.

Patrick L. Alexander | Jerry R. Pettle | |

| Richard Ball | Susan E. Roepke | |

| Brent A. Bowman | C. Duane Ross | |

| Joseph L. Downey | Larry Schugart | |

| Jim W. Lewis | David H. Snapp |

INDEPENDENT PUBLIC ACCOUNTANTS

Stockholders will be asked to ratify the appointment of KPMG LLP as our independent public accountants for 2002. If the appointment of KPMG LLP is not ratified, the matter of the appointment of independent public accountants will be considered by the board of directors. Representatives of KPMG LLP are expected to be present at the meeting and will be given the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.We unanimously recommend that you vote FOR the ratification of KPMG LLP to serve as our independent accountants.

15

Changes in Accountants

Prior to the merger, Landmark Bancshares' independent auditor was Regier, Carr & Monroe, L.L.P. At the time of the merger, which occurred after Landmark Bancshares' last completed fiscal year, Landmark Bancorp, as the successor company in the merger, engaged KPMG LLP as its independent auditors for the fiscal year ended December 31, 2001. The decision to engage KPMG LLP was approved by our board and we notified Regier that the auditor-client relationship ceased on October 9, 2001, the effective date of the merger. Regier's reports on Landmark Bancshares' consolidated financial statements for the fiscal years ended September 30, 2000 and September 30, 1999 did not contain an adverse opinion or a disclaimer of opinion, and the reports were not qualified or modified as to uncertainty, audit scope or accounting principles.

During the two fiscal years ended September 30, 2000, and the interim period of October 1, 2000 through the effective date of the merger, there were no disagreements with Regier on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which, if not resolved to the satisfaction of Regier, would have caused Regier to make reference to the matter in their report, and Regier did not inform us that any of the events described in 304(a)(1)(v) of Regulation S-K had occurred.

During Landmark Bancshares' fiscal years ended September 30, 1999 and September 30, 2000, Landmark Bancshares' (or anyone on its behalf) did not consult KPMG LLP regarding (a) either the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on Landmark Bancshares' financial statements; and as such no written report was provided to Landmark Bancshares and no oral advice was provided that KPMG LLP concluded was an important factor considered by us in reaching a decision as to any accounting, auditing or financial reporting issue, or (b) any matter that was either the subject of disagreement or a reportable event.

Audit Fees

The aggregate fees and expenses billed by KPMG LLP in connection with the audit of Landmark Bancshares' annual financial statements as of and for the year ended September 30, 2001 and the consolidated financial statements of Landmark Bancorp for the three month period ended December 31, 2001 were $98,350. The aggregate fees and expenses billed by Regier for the required review of Landmark Bancshares' financial information included in its Form 10-Q filings for 2001 was $5,600.

Financial Information Systems Design and Implementation Fees

There were no fees incurred for these services for the year 2001.

All Other Fees

The aggregate fees and expenses billed by KPMG LLP for all other services rendered to Landmark Bancorp for 2001 were $41,315, which included tax services and other audit related services. Additionally, the aggregate fees and expenses billed by Regier for all other services rendered to Landmark Bancshares for 2001 was $32,578.

The audit committee, after consideration of the matter, does not believe the rendering of these services by KPMG LLP to be incompatible with maintaining its independence as our principal accountant.

16

SUBMISSION OF STOCKHOLDER PROPOSALS

Any proposal which a stockholder wishes to have included in our proxy materials relating to the next annual meeting of stockholders, which is scheduled to be held in May 2003, must be received at our principal executive offices located at 800 Poyntz Avenue, Manhattan, Kansas 66505, Attention: Mr. Patrick L. Alexander, President, no later than December 20, 2002, and must otherwise comply with the notice and other provisions of our bylaws.

WE WILL FURNISH WITHOUT CHARGE TO EACH PERSON REPRESENTING THAT HE OR SHE WAS A BENEFICIAL OWNER OF OUR COMMON STOCK AS OF THE RECORD DATE FOR THE MEETING, UPON WRITTEN REQUEST, A COPY OF OUR ANNUAL REPORT ON FORM 10-K. SUCH WRITTEN REQUEST SHOULD BE SENT TO MR. PATRICK L. ALEXANDER, LANDMARK BANCORP, INC., P.O. BOX 308, MANHATTAN, KANSAS 66505. OUR FILINGS WITH THE SECURITIES AND EXCHANGE COMMISSION ARE ALSO AVAILABLE VIA THE INTERNET AT "WWW.SEC.GOV".

By order of the Board of Directors | ||

/s/ PATRICK L. ALEXANDER Patrick L. Alexander President and Chief Executive Officer | ||

Manhattan, Kansas April 19, 2002 |

ALL STOCKHOLDERS ARE URGED TO SIGN

AND MAIL THEIR PROXIES PROMPTLY

17

Charter of the Audit Committee of the Board of Directors

I. Audit Committee Purpose

The Audit Committee is appointed by the Board of Directors to assist the Board in fulfilling its oversight responsibilities. The Audit Committee's primary duties and responsibilities are to:

The Audit Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities, and it has direct access to the independent auditors as well as anyone in the organization. The Audit Committee has the ability to retain, at the Company's expense, special legal, accounting, or other consultants or experts it deems necessary in the performance of its duties.

II. Audit Committee Composition and Meetings

Audit Committee members shall meet the requirements of the National association of Securities Dealers (NASD). The Audit Committee shall be comprised of three or more directors as determined by the Board, each of whom shall be independent nonexecutive directors, free from any relationship that would interfere with the exercise of his or her independent judgment. All members of the Committee shall have a basic understanding of finance and accounting and be able to read and understand fundamental financial statements, and at least one member of the Committee shall have accounting or related financial management expertise.

Audit Committee members shall be appointed by the Board on recommendation of the Board. If an audit committee Chair is not designated or present, the members of the Committee may designate a Chair by majority vote of the Committee membership.

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Audit Committee Chair shall prepare and/or approve an agenda in advance of each meeting. The Committee should meet privately in executive session at each Committee meeting and at least annually with management, the director of the internal auditing department, the independent auditors, and as a committee to discuss any matters that the Committee or each of these groups believe should be discussed. The Committee may ask members of management or others to attend meetings and provide pertinent information as necessary. In addition, the Committee, or at least its Chair, should communicate with management and the independent auditors quarterly to review the Company's financial statements and significant findings based upon the auditors limited review procedures.

III. Audit Committee Responsibilities and Duties

Review Procedures

A-1

significant financial risk exposures and the steps management has taken to monitor, control, and report such exposures. Review significant findings prepared by the independent auditors and the internal auditing department together with management's responses.

Independent Auditors

Internal Audit Department and Legal Compliance

Other Audit Committee Responsibilities

A-2

PROXY FOR COMMON SHARES ON BEHALF OF BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF THE STOCKHOLDERS OF

LANDMARK BANCORP, INC. TO BE HELD MAY 22, 2002

The undersigned hereby appoints Patrick L. Alexander, Jerry R. Pettle and Larry Schugart, or any two of them acting in the absence of the other, with power of substitution, attorneys and proxies, for and in the name and place of the undersigned, to vote the number of shares of common stock that the undersigned would be entitled to vote if then personally present at the annual meeting of the stockholders of Landmark Bancorp, Inc., to be held at the Kansas State University Student Union, 17th and Anderson Avenue, Manhattan, Kansas 66506, on Wednesday, May 22, 2002, at 2:00 p.m., local time, or any adjournments or postponements of the meeting, upon the matters set forth in the notice of annual meeting and proxy statement, receipt of which is hereby acknowledged, as follows:

1. ELECTION OF DIRECTORS:

| | | |

|---|---|---|

| FOR all nominees listed below (except as marked to the contrary below) | WITHHOLD AUTHORITY to vote for all nominees listed below | |

/ / | / / |

Class I (term expires 2005): Brent A. Bowman, Joseph L. Downey and David H. Snapp

(INSTRUCTIONS: TO WITHHOLD AUTHORITY TO VOTE FOR ANY INDIVIDUAL NOMINEE, STRIKE A LINE THROUGH THE NOMINEE'S NAME IN THE LIST ABOVE.)

2. APPROVE THE APPOINTMENT OF KPMG LLP AS OUR INDEPENDENT PUBLIC ACCOUNTANTS FOR THE YEAR ENDING DECEMBER 31, 2002:

| / / | / / | / / | ||

For | Against | Abstain |

3. In accordance with their discretion, upon all other matters that may properly come before the meeting and any adjournments or postponements of the meeting.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE NOMINEES LISTED UNDER PROPOSAL 1 AND FOR PROPOSAL 2.

Dated: , 2002 | ||

Signature(s) |

NOTE: PLEASE DATE PROXY AND SIGN IT EXACTLY AS NAME OR NAMES APPEAR ABOVE. ALL JOINT OWNERS OF SHARES SHOULD SIGN. STATE FULL TITLE WHEN SIGNING AS EXECUTOR, ADMINISTRATOR, TRUSTEE, GUARDIAN, ETC. PLEASE RETURN SIGNED PROXY IN THE ENCLOSED ENVELOPE.