SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the registrant þ

Filed by a party other than the registrant o

Check the appropriate box:

| | o | | Preliminary proxy statement |

| | | | |

| | o | | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)). |

| | | | |

| | þ | | Definitive proxy statement. |

| | | | |

| | o | | Definitive additional materials. |

| | | | |

| | o | | Soliciting material under Rule 14a-12. |

Trust for Professional Managers

(Name of Registrant as Specified in Its Charter)

(Names of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of filing fee (check the appropriate box):

| | þ | | No fee required. |

| | | | |

| | o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | | | |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | | | |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | | |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | 5) | | Total fee paid: |

| | o | | Fee paid previously with materials. |

| | | | |

| | o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | 1) | | Amount Previously Paid: |

| | | | |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | | | |

| | 3) | | Filing Party: |

| | | | |

| | 4) | | Date Filed: |

Alternative Strategies Mutual Fund

a series of Trust for Professional Managers

615 EAST MICHIGAN ST, 2ND FLOOR

MILWAUKEE, WI 53202

June 3, 2011

Dear Shareholder:

I am writing to inform you of the upcoming special meeting (the “Meeting”) of the shareholders of the Alternative Strategies Mutual Fund (the “Acquired Fund”), a series of Trust for Professional Managers.

The meeting is scheduled to be held at 10:00 a.m. Central time on June 22, 2011, at the offices of U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, WI 53202. Please take the time to carefully read the enclosed Proxy Statement and cast your vote by following the instructions on the enclosed proxy ballot.

The purpose of the Meeting is to seek your approval for a proposed reorganization of the Acquired Fund. The Acquired Fund is currently organized as a series of Trust for Professional Managers (“TPM”), an open-end registered management investment company with its principal offices at 615 East Michigan Street, Milwaukee, Wisconsin, 53202. After completion of the proposed tax-free reorganization, the Acquired Fund would be a series of Northern Lights Fund Trust II, an open-end registered management investment company with its principal offices at 450 Wireless Blvd., Hauppauge, New York 11788. This proposed reorganization of the Acquired Fund will not result in a change of the investment advisor or any sub-advisor to the Acquired Fund, or any change to the Acquired Fund’s investment objective, strategies or investment policies.

We think that this proposal is in the best interest of the shareholders of the Acquired Fund. The TPM Board of Trustees has unanimously recommended that shareholders of the Acquired Fund vote “FOR” the proposal.

Should you have any questions, please feel free to call us at 1-866-506-7390. We will be happy to answer any questions you may have. For voting instructions, including a toll-free number and website for voting, please refer to the enclosed proxy ballot.

Your vote is important regardless of the number of shares you own. To assure your representation at the Meeting, please follow the instructions on the enclosed proxy ballot whether or not you expect to be present at the Meeting. If you attend the Meeting, you may revoke your proxy and vote your shares in person.

Sincerely,

Joseph C. Neuberger

President

Trust for Professional Managers

Alternative Strategies Mutual Fund

a series of Trust for Professional Managers

615 EAST MICHIGAN ST, 2ND FLOOR

MILWAUKEE, WI 53202

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To Be Held June 22, 2011

Dear Shareholders:

The Board of Trustees of Trust for Professional Managers (“TPM”), an open-end registered management investment company organized as a Delaware statutory trust, has called a special meeting (the “Meeting”) of the shareholders of Alternative Strategies Mutual Fund (the “Acquired Fund”), a series of TPM, to be held at the offices of U.S. Bancorp Fund Services, LLC, 615 East Michigan Street, Milwaukee, WI 53202, on Wednesday, June 22, 2011 at 10:00 a.m., Central time, for the purpose of considering and approving the following proposals:

| 1. | to approve a proposed Agreement and Plan of Reorganization for the Acquired Fund and the Alternative Strategies Mutual Fund (the “Acquiring Fund”), a series of Northern Lights Fund Trust II (“Northern Lights II”), whereby the Acquiring Fund would acquire all of the assets and liabilities of the Acquired Fund in exchange for shares of beneficial interest of the Acquiring Fund, which would then be distributed pro-rata by the Acquired Fund to its shareholders, in complete liquidation and termination of the Acquired Fund (the “Reorganization”); and |

| 2. | to transact such other business as may properly come before the Meeting or any adjournments thereof. |

Shareholders of record at the close of business on May 10, 2011 are entitled to notice of, and to vote at, the Meeting and any adjournment(s) thereof.

By Order of the Board of Trustees

Rachel A. Spearo, Esq., Secretary

Trust for Professional Managers

June 3, 2011

YOUR VOTE IS IMPORTANT

TO ENSURE YOUR REPRESENTATION AT THE MEETING, PLEASE FOLLOW THE INSTRUCTIONS ON THE ENCLOSED PROXY BALLOT WHETHER OR NOT YOU EXPECT TO BE PRESENT AT THE MEETING. IF YOU ATTEND THE MEETING, YOU MAY REVOKE YOUR PROXY AND VOTE YOUR SHARES IN PERSON.

Alternative Strategies Mutual Fund

a Series of Trust for Professional Managers

PROXY STATEMENT

MEETING OF SHAREHOLDERS

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Trustees of Trust for Professional Managers (“TPM”), an open-end registered management investment company registered with the United States Securities and Exchange Commission (the “SEC”) with its principal office located at Trust for Professional Managers, 615 East Michigan Street, 2nd Floor, Milwaukee, WI 53202. The proxies are to be used at a special meeting (the “Meeting”) of the shareholders of Alternative Strategies Mutual Fund, a series of TPM (the “Acquired Fund”), at the offices of U.S. Bancorp Fund Services, LLC, on Wednesday, June 22, 2011 at 10:00 a.m., Central time, and any adjournment of the Meeting. The primary purpose of the Meeting is for shareholders of the Acquired Fund to consider and approve the following proposals:

| 1. | to approve a proposed Agreement and Plan of Reorganization for the Acquired Fund and the Alternative Strategies Mutual Fund (the “Acquiring Fund”), a series of Northern Lights Fund Trust II (“Northern Lights II”), whereby the Acquiring Fund would acquire all of the assets and liabilities of the Acquired Fund in exchange for shares of beneficial interest of the Acquiring Fund, which would then be distributed pro-rata by the Acquired Fund to its shareholders, in complete liquidation and termination of the Acquired Fund (the “Reorganization”); and |

| 2. | to transact such other business that may properly come before the Meeting or any adjournments thereof. |

The date of the first mailing of this Proxy Statement will be on or about June 6, 2011.

Important Notice Regarding the Availability of Proxy Materials for

the Shareholder Meeting to be Held on June 22, 2011:

This proxy statement is available at www.altmangroup.com/docs/acentiafunds, or by contacting the Fund (toll-free) at 866-506-7390. To obtain directions to attend the Meeting, please call the Fund (toll-free) at 866-506-7390. For a free copy of the Fund’s latest annual and/or semi-annual report, call (toll-free) at 866-506-7390 or visit the Fund’s website at www.ascentiafunds.com or write to:

Alternative Strategies Mutual Fund

c/o U.S. Bancorp Fund Services, LLC

P.O. Box 701

Milwaukee, Wisconsin 53201-0701

SUMMARY OF PROPOSAL

APPROVAL OF AN AGREEMENT AND PLAN OF REORGANIZATION UNDER WHICH THE ALTERNATIVE STRATEGIES MUTUAL FUND, A SERIES OF TPM, WOULD BE REORGANIZED INTO THE ALTERNATIVE STRATEGIES MUTUAL FUND, A SERIES OF NORTHERN LIGHTS II, IN A TAX-FREE REORGANIZATION.

At a meeting held on April 28, 2011, the Board of Trustees of TPM, including a majority of the Trustees who are not “interested persons” of TPM (the “Independent Trustees”) as that term is defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended (the “1940 Act”), considered and unanimously approved an Agreement and Plan of Reorganization by and among TPM, on behalf of the Acquired Fund, Northern Lights II, on behalf of the Acquiring Fund, and Ascentia Capital Partners, LLC, the investment advisor to the Acquired Fund (the “Advisor”), substantially in the form attached to this Proxy Statement as Exhibit A (the “Plan of Reorganization”). The Board of Trustees of TPM has unanimously recommended that shareholders of the Acquired Fund vote “FOR” the proposal.

If approved by shareholders of the Acquired Fund, under the Plan of Reorganization, the Acquired Fund, a series of TPM, will transfer all of its assets and liabilities to the Acquiring Fund, a newly organized series of Northern Lights II, in exchange for a number of Acquiring Fund shares equivalent in class, number and value to shares of the Acquired Fund outstanding immediately prior to the Closing Date (as defined below), followed by a distribution of those shares to Acquired Fund shareholders so that each Class A and Class I Acquired Fund shareholder would receive Class A shares and Class I shares, respectively, of the Acquiring Fund equivalent to the number of Acquired Fund shares held by such shareholder on May 10, 2011, or as soon as practicable thereafter (the “Record Date”) (this transaction is referred to as the “Reorganization”). The Acquired Fund would then be completely liquidated and terminated. Like TPM, Northern Lights II is a Delaware statutory trust and an open-end investment company registered with the SEC.

If the Reorganization is approved and implemented, Class A and Class I shareholders of the Acquired Fund will become Class A shareholders and Class I shareholders, respectively of the Acquiring Fund. The Acquiring Fund’s investment objective, principal investment strategies and investment restrictions are identical to those of the Acquired Fund. In addition, the Advisor, and each of the current sub-advisors to the Acquired Fund: Armored Wolf, LLC, DuPont Capital Management Corporation, Sage Capital Management, LLC, and Dunham & Associates Investment Counsel, Inc. (collectively, the “Sub-Advisors”), except Research Affiliates, LLC, will continue to serve as the investment advisor and sub-advisors to the Acquiring Fund. Research Affiliates, LLC served as a sub-advisor to the Acquired Fund, but will serve solely as a signal provider to the Acquiring Fund’s advisor following the Reorganization. A signal provider provides research and portfolio analysis to an advisor, but does not process trades. In addition the shares of the Acquiring Fund generally will have the same legal characteristics as the shares of the Acquired Fund with respect to voting rights, assessibility, conversion rights and transferability. However, there are some differences between the funds. The Acquiring Fund will employ an administrator, transfer agent, custodian and distributor that are different than the administrator, transfer agent, custodian and distributor utilized by the Acquired Fund. In addition, none of the members of the Board of Trustees of TPM will serve on the Board of Trustees of Northern Lights II. If approved by shareholders, the Reorganization is expected to take effect on or about June 22, 2011 (the “Closing Date”), although the date may be adjusted in accordance with the Plan of Reorganization.

The following documents have been filed with the SEC and are incorporated by reference into this Proxy Statement:

| · | Prospectus and Statement of Additional Information (“SAI”) of the Acquired Fund dated June 28, 2010; and |

| · | Annual Report to Shareholders of the Acquired Fund, including audited financial statements for the fiscal year ended February 28, 2011. |

The most recent annual report of the Acquired Fund, including audited financial statements for the fiscal year ended February 28, 2011, has been mailed previously to shareholders. If you have not received this report or would like to receive additional copies of the Annual Report to Shareholders, Prospectus and/or SAI, free of charge, please contact the Acquired Fund at the address set forth on the first page of this Proxy Statement or by calling (toll-free) 866-506-7390 and they will be sent to you by first class mail, or visit the Fund’s website at www.ascentiafunds.com.

COMPARISON OF THE ACQUIRED FUND AND THE ACQUIRING FUND

The Funds’ Investment Objectives, Principal Investment Strategies and Risks, and Limitations and Restrictions

The investment objective, principal investment strategies and risks, as well as the limitations and restrictions of the Acquired Fund and the Acquiring Fund (each a “Fund” and collectively, the “Funds”) will be identical. The Acquiring Fund is newly organized and will commence operation on the Closing Date. Each Fund’s investment objective, principal investment strategies and risks, as well as each Fund’s investment limitations and restrictions, are discussed in more detail below.

Investment Objectives

The investment objective of both Funds is long-term capital appreciation with low correlation to broad market indices.

Principal Investment Strategies

For each Fund, the Advisor is responsible for developing, constructing and monitoring the asset allocation and portfolio strategy for the Fund. In the case of each Fund, the Advisor believes that the Fund’s investment reward and risk characteristics can be enhanced by employing multiple sub-advisory firms to manage the assets of the Fund using a “manager of managers” approach. For each Fund, the Advisor selects and oversees multiple sub-advisors who manage separate segments of the Fund’s portfolio using distinct, complimentary, investment styles.

Both Funds attempt to achieve their investment objective by primarily investing in a variety of securities, including exchange-traded funds (“ETFs”) that are used to implement multiple alternative investment strategies in the Fund. Each Fund may take both long and short positions in equity securities, including common and preferred stock of U.S. companies, convertible securities, equity swaps and foreign securities. Each Fund may have up to 50% of its assets invested in foreign securities, including, but not limited to, American depositary receipts (“ADRs”) and securities in emerging markets. Each Fund is generally not constrained among the other types of equity securities in which it may invest. Each Fund may invest in companies of any size (from small-cap to mid-cap to large-cap) and in any style (from growth to value). Each Fund may invest up to 50% of its net assets in derivative securities of any kind. Each Fund’s investments in derivative securities are expected to consist primarily of future contracts on financial and commodity markets as well as equity swap transactions. Each Fund uses derivative investments to increase the potential return on an investment, otherwise known as “leverage.”

Both Funds combine the attributes of alternative investment strategies with the shareholder features of a mutual fund. For each Fund, the Advisor and Sub-Advisors determine whether to buy or sell an investment for the Fund’s portfolio by applying the following strategies:

| Long/Short Equity Strategies. Long/Short equity strategies consists of equity strategies that combine core long holdings of equities with short sales of stock or stock index options. Additionally, the long/short strategy may utilize securities that seek to track indexes on markets, sectors, and/or industries to hedge against potential adverse movements in security prices. There are multiple versions of this core strategy category that can be implemented in each Fund. The basic long/short equity strategies generally increases net long exposure in bull markets and decreases net long exposure, or even may be net short, in a bear market. The long/short equity strategies may use equity swaps, or other derivatives, in addition to or in lieu of investing in long or short positions in individual securities or securities indices. |

| Market Neutral Strategies. Market neutral strategies employ sophisticated quantitative techniques to analyze price data to ascertain information about future price movement and relationships between securities and select securities for purchase and sale. These can include both factor-based and statistical arbitrage/trading strategies. Factor-based strategies are those which use fundamental data, such as price to earnings ratios and dividend yields, as their inputs to find securities that are either attractive or unattractive based upon these fundamental metrics, and which are typically paired as one long position and one short position in equal dollar amounts, so as to be market neutral when combined. Statistical arbitrage/trading strategies are those which use statistical data, such as statistical measures of a security’s return and risk characteristics as their inputs instead of fundamental data to achieve the same dollar neutral strategy and objective. |

| Convertible Arbitrage Strategy. The convertible arbitrage strategy involves purchasing interest-bearing convertible debentures and/or high yielding, convertible preferred stocks. These long convertible positions are then hedged against stock market risk by selling short a percentage of the underlying common stock and/or by writing equity call options. Current income is derived from coupon interest and preferred dividends received from the convertible securities held long. Income is also generated from the rebate interest received from the proceeds of the short sale of common stock and/or any option premium. Investment decisions are based upon the price relationships between convertible securities and their underlying stocks in the context of the current market environment. Convertible hedge positions are purchased if they demonstrate a favorable risk/reward profile when analyzed against different market scenarios. |

| Event Driven/Merger Arbitrage Strategies. Event driven/merger arbitrage strategies focus on positions in companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated, and frequently involve additional derivative securities. Investment themes are typically developed by the Sub-Advisor on fundamental characteristics, such as attractive valuations relative to competition and, with the realization of the theme resulting from an event associated with the company or security such as announced mergers that are friendly but yet to be consummated. Merger arbitrage strategies employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. |

| International/Emerging Markets Strategies. The international/emerging markets strategies seek to invest in securities of undervalued international companies, including ADRs that provide each Fund with exposure to businesses outside of the U.S. and that are attractively priced relative to their economic fundamentals. Investments are selected using fundamental analysis of factors such as earnings, cash flows, and valuations based upon them, and are diversified among the economic and industry sectors in the Morgan Stanley Capital International Europe, Australasia and Far East Index (“MSCI EAFE”) and Emerging Markets Index (“MSCI EM”). |

| Global Macro Strategies. The global macro strategies consist of strategies that allocate capital to multiple independent proprietary technical and fundamental valuation models applied both long and short to equity, fixed income, currency and commodity markets globally. The objective of the global macro strategy is to remain current with primary market trends. Global macro can be implemented with multiple disciplines, resulting in a blend of approaches to maintain proper weights between discretionary decisions and data-driven decisions to achieve superior risk-adjusted returns. “Top down” investment themes and risk management are the focus of the global macro strategies. |

| Commodity and Currency Strategies. The commodity and currency strategies category consists of strategies that combine long and short holdings of commodity and currency positions. A strategy typically invests in listed financial and commodity futures markets and currency markets around the world. Commodity and currency strategies use various investment processes and both technical and fundamental research to determine how individual commodity contracts are used, both long and short. In addition to being specific strategies, commodity and currency strategies are often sub-sets of the Global Macro strategy, where these asset classes are used to express specific macro views in commodities and/or currencies that are part of a broader strategy. |

| Tactical Trading Strategies. Tactical trading strategies are strategies that can change their exposures quickly and significantly and are typically shorter-term in nature. These strategies are usually complimentary to medium and longer-term strategies, and are often used to help manage exposure and risk. The overlay strategy designed by the Advisor for each Fund may be used at times to mitigate long market exposure in risky asset classes in the Fund during adverse market conditions. This strategy’s objective is to identify when markets are not trending upward and thus not productive for short-term exposure. In this situation, this strategy is implemented and temporarily offsets the underlying exposure until market conditions improve. Tactical trading strategies can be executed in many different ways, both long and short, use leverage, and be implemented with different securities types ranging from options and futures, to individual securities and ETFs. |

| Temporary or Cash Investments. Under normal market conditions, the Fund will stay fully invested according to its principal investment strategies as noted above. The Fund, however, may temporarily depart from its principal investment strategies by making short-term investments in cash, cash equivalents, and high-quality, short-term debt securities and money market instruments for temporary defensive purposes in response to adverse market, economic or political conditions. This may result in the Fund not achieving its investment objectives during that period. |

Investment Risks

Many factors affect performance and neither Fund can guarantee that it will achieve its investment objective. When you redeem your shares of a Fund, the shares could be worth more or less than what you paid for them. As a result, an investor could lose money on an investment in either Fund. An investment in the Funds is not insured or guaranteed by the Federal Deposit Insurance Corporation or any government agency. Each Fund is subject to the following principal risks:

| · | Management Risk. The risk that investment strategies employed by the Advisor in selecting investments and asset allocations for the Fund may not result in an increase in the value of your investment or in overall performance equal to other similar investment vehicles having similar investment strategies. |

| | |

· | General Market Risk. The risk that the value of the Fund’s shares will fluctuate based on the performance of the Fund’s investments and other factors affecting the securities markets generally. |

| · | Strategy Risk. The risk that investment strategies employed by the Advisor and Sub-advisors in selecting investments and asset allocations for the Fund may not result in an increase in the value of your investment or in overall performance equal to other investments. |

| · | Equity Market Risk. The risk that common stocks are susceptible to general stock market fluctuations and to volatile increases and decreases in value as market confidence in and perceptions of their issuers change. |

| · | Leverage Risk. The risk that leveraging may cause the Fund to liquidate portfolio positions when it may not be advantageous to do so to satisfy its obligations or to meet segregation requirements. Leverage, including borrowing, may cause the Fund to be more volatile than if it had not been leveraged because leverage tends to exaggerate the effect of any increase or decrease in the value of the Fund’s portfolio securities. |

| | |

| · | Convertible Securities Risk. A convertible security is a fixed-income security (a debt instrument or a preferred stock) which may be converted at a stated price within a specified period of time into a certain quantity of the common stock of the same or a different issuer. The market value of a convertible security performs like that of a regular debt security, that is, if market interest rates rise the value of the convertible security falls. |

| · | Large-Cap Company Risk. The risk that larger, more established companies may be unable to respond quickly to new competitive challenges such as changes in consumer tastes or innovative smaller competitors. |

| · | Mid-Cap Company Risk. The risk that the mid-cap companies in which the Fund may invest may be more vulnerable to adverse business or economic events than larger, more established companies. In particular, these mid-sized companies may pose additional risks, including liquidity risk, because these companies tend to have limited product lines, markets and financial resources, and may depend upon a relatively small management group. Therefore, mid-cap stocks may be more volatile than those of larger companies. |

| · | Small- and Micro-Cap Company Risk. The risk that the securities of small-cap and micro-cap companies may be more volatile and less liquid than the securities of companies with larger market capitalizations. These small-cap companies may not have the management experience, financial resources, product diversification and competitive strengths of large- or mid-cap companies, and, therefore, their securities tend to be more volatile than the securities of larger, more established companies. |

| · | Fixed Income Securities Risks. Fixed income securities are subject to the risk that securities could lose value because of interest rate changes. Fixed income securities with longer maturities are subject to greater price shifts as a result of interest rate changes than fixed income securities with shorter maturities. Fixed income securities are also subject to prepayment and credit risks. |

| · | High-Yield Debt Securities Risk. The risk that high-yield debt securities or “junk bonds” are subject to a greater risk of loss of income and principal than higher-grade debt securities. Issuers of junk bonds are often highly leveraged and are more vulnerable to changes in the economy. |

| · | Short Sales Risk. The risk of loss if the value of a security sold short increases prior to the scheduled delivery date, since the Fund must pay more for the security than it has received from the purchaser in the short sale. |

| · | Shares of Other Investment Companies Risk. The risk that you will indirectly bear fees and expenses charged by the underlying funds in addition to the Fund’s direct fees and expenses and, as a result, your cost of investing in the Fund will generally be higher than the cost of investing directly in the underlying fund shares. |

| · | Exchange-Traded Funds Risk. The risk related to investing in ETFs that do not apply to investments in conventional mutual funds, including that the market price of the ETF’s shares may trade at a discount to their net asset value (“NAV”) or that an active trading market for an ETF’s shares may not develop or be maintained. |

| · | Commodities Risk. The risk that the price of securities and derivatives linked to commodity prices may not move in a manner similar to the broad commodity market. Investments in companies involved in commodity-related businesses bear the risk that the value of companies in commodity-related businesses may be affected by overall market movements and other factors affecting the value of a particular industry or commodity. |

| · | Foreign Securities and Currency Risk. The risk of investments in foreign companies involve certain risks not generally associated with investments in the securities of U.S. companies, including changes in currency exchange rates, unstable political, social and economic conditions, a lack of adequate or accurate company information, differences in the way securities markets operate, less secure international banks or securities depositories than those in the U.S. and foreign controls on investment. In addition, individual international country economies may differ favorably or unfavorably from the U.S. economy in such respects as growth of gross domestic product, rates of inflation, capital reinvestment, resources, self-sufficiency and balance of payments position. These risks may be greater in emerging markets and in less developed countries. |

| · | Swap Agreement Risk. The risk that a swap contract may not be assigned without the consent of the counter-party, and may result in losses in the event of a default or bankruptcy of the counter-party. |

| · | Arbitrage Trading Risk. The risk that the underlying relationships between securities in which the Fund takes investment positions may change in an adverse manner, in which case the Fund may realize losses. |

| · | Derivative Securities Risk. The risk that the Fund’s use of derivatives will cause losses due to the unexpected effect of market movements on a derivative’s price, or because the derivatives do not perform as anticipated, or are not correlated with the performance of other investments which they are used to hedge or if the Fund is unable to liquidate a position because of an illiquid secondary market. |

| · | Options and Futures Risk. When options are purchased over the counter, the Fund bears the risk that the counter-party that wrote the option will be unable or unwilling to perform its obligations under the option contract. Such options may also be illiquid, and in such cases, the Fund may have difficulty closing out its position. |

| · | High Portfolio Turnover Risk. The risk that a high portfolio turnover rate has the potential to result in the realization by the Fund and distribution to shareholders of a greater amount of gains than if the Fund had a low portfolio turnover rate, which may lead to a higher tax liability. To the extent that the Fund experiences an increase in brokerage commissions due to a higher turnover rate, the performance of the Fund could be negatively impacted by the increased expenses incurred by the Fund. |

| · | Tax Risk. Certain of the Fund’s investment strategies, including transactions in options and futures contracts, may be subject to the special tax rules, the effect of which may have adverse tax consequences for the Fund. |

Limitations and Restrictions

Northern Lights II (on behalf of the Acquiring Fund) has adopted the following restrictions as fundamental policies, which may not be changed without the favorable vote of the holders of a “majority of the outstanding voting securities of the Acquiring Fund,” as defined in the 1940 Act. Under the 1940 Act, the “vote of the holders of a majority of the outstanding voting securities” means the vote of the holders of the lesser of (i) 67% of the shares of the Fund represented at a meeting at which the holders of more than 50% of its outstanding shares are represented or (ii) more than 50% of the outstanding shares of the Fund.

The Acquiring Fund may not:

| 1. | Issue senior securities, borrow money or pledge its assets, except that: (i) the Fund may borrow from banks in amounts not exceeding one-third of its total assets (including the amount borrowed); and (ii) this restriction shall not prohibit the Fund from engaging in options transactions or short sales in accordance with its objective and strategies; |

| 2. | Act as underwriter (except to the extent the Fund may be deemed to be an underwriter in connection with the sale of securities in its investment portfolio); |

| 3. | Invest 25% or more of its net assets, calculated at the time of purchase and taken at market value, in securities of issuers in any one industry (other than U.S. Government securities); |

| 4. | Purchase or sell real estate unless acquired as a result of ownership of securities (although the Fund may purchase and sell securities which are secured by real estate and securities of companies that invest or deal in real estate); |

| 5. | Purchase or sell commodities, unless acquired as a result of ownership of securities or other instruments and provided that this restriction does not prevent the Fund from engaging in transactions involving currencies and futures contracts and options thereon or investing in securities or other instruments that are secured by commodities; |

| 6. | Make loans of money (except for the lending of its portfolio securities, purchases of debt securities consistent with the investment policies of the Fund and except for repurchase agreements); or |

| 7. | With respect to 75% of its total assets, invest 5% or more of its total assets in securities of a single issuer or hold more than 10% of the voting securities of such issuer (does not apply to investment in the securities of the U.S. Government, its agencies or instrumentalities, or other investment companies). |

The fundamental policies of the Acquired Fund are identical to the fundamental policies of the Acquiring Fund, as listed above, except that with respect to the Acquired Fund the policy concerning investments in commodities (number 5, above) differs to the extent that the written policy, as stated in the Acquired Fund’s SAI, applies specifically to physical commodities. However, in practice, the Acquired Fund has applied its fundamental policy concerning investments in commodities to all types of commodities, not limited to physical commodities. As such, the Acquired Fund and the Acquiring Fund will have identical policies with respect to investments in commodities, despite the difference in the written policy for the Acquired Fund.

The following lists the non-fundamental investment restrictions applicable to the Funds. These restrictions can be changed by the respective Fund’s Board of Trustees, but the change will only be effective after notice is given to shareholders of the Fund.

Each Fund may not:

Invest 15% or more of the value of its net assets, computed at the time of investment, in illiquid securities. Illiquid securities are those securities without readily available market quotations, including repurchase agreements having a maturity of more than seven days. Illiquid securities may include restricted securities not determined by the Board of Trustees to be liquid, non-negotiable time deposits, over-the-counter options and repurchase agreements providing for settlement in more than seven days after notice.

Except with respect to borrowing and illiquid securities, if a percentage or rating restriction on investment or use of assets set forth herein or in the Prospectus is adhered to at the time a transaction is effected, later changes in percentage resulting from any cause other than actions by the Funds will not be considered a violation.

Fees and Expenses

The Table of Fees and Expenses and the Examples shown below are based on fees and expenses disclosed in the prospectus for the Acquired Fund and on estimates for the Acquiring Fund’s Class A and Class I shares. The Reorganization is not expected to result in an increase in shareholder fees and expenses. However, the fees charged by the certain individual service providers are changing. The following table is designed to help you understand the fees and expenses that you may pay, both directly and indirectly, by investing in the Acquiring Fund’s Class A and Class I shares as compared to Class A and Class I shares of the Acquired Fund.

Comparison of Fees and Expenses

As of February 28, 2011

SHAREHOLDER FEES (fees paid directly from your investment) | Acquired Fund Class A | Acquiring Fund Class A (Pro Forma) | Acquired Fund Class I | Acquiring Fund Class I (Pro Forma) |

Maximum Sales Charge (Load)(1) | 5.75% | 5.75% | NONE | NONE |

| Maximum Deferred Sales Charge (Load) | 1.00% (2) | 1.00% (2) | NONE | NONE |

Maximum Sales Charge (Load) Imposed on Reinvested Dividends and Distributions | NONE | NONE | NONE | NONE |

Redemption Fees (as a percentage of amount redeemed within 30 days of purchase) (3) | 2.00% | 2.00% | 2.00% | 2.00% |

| Exchange Fees | NONE | NONE | NONE | NONE |

ANNUAL FUND OPERATING EXPENSES (expenses that are deducted from fund assets each year as a percentage of the value of your investment): | | | | |

| Management Fee | 1.95% | 1.95% | 1.95% | 1.95% |

| Distribution (12b-1)/Shareholder Servicing Fees | 0.25% | 0.25% | NONE | NONE |

Other Expenses(4) | 0.98% | 0.52% | 0.98% | 0.52% |

| Dividend Expenses on Short Positions | 0.71% | 0.71% | 0.71% | 0.71% |

Underlying Fund Fees and Expenses(5) | 0.17% | 0.17% | 0.17% | 0.17% |

| Total Annual Fund Operating Expenses | 4.06% | 3.60% | 3.81% | 3.35% |

Fee Waiver/Expense Reimbursement(6) | (0.43)% | 0.00% | (0.42)% | 0.00% |

| Net Annual Fund Operating Expenses | 3.63% | 3.60% | 3.39% | 3.35% |

| (1) | The sales load does not apply on purchases of $1,000,000 or more. |

| (2) | The amount represents the contingent deferred sales charge (“CDSC”) that will apply on purchases of $1,000,000 or more. |

| (3) | If a shareholder requests that a redemption be made by wire transfer, currently a $15.00 fee is charged. |

| (4) | “Other Expenses” include custodian, administration, transfer agency and other customary fund expenses, and are based on estimated amounts for the Acquiring Fund’s current fiscal year ending February 28, 2012. For the Acquired Fund, Other Expenses reflect actual amounts incurred by the Fund for the fiscal year ended February 28, 2011. |

| (5) | The Funds are required to disclose “Underlying Fund Fees and Expenses” in the above fee table. Underlying Fund Fees and Expenses are indirect fees that funds incur from investing in the shares of other mutual funds (“Underlying Fund(s)”). The indirect fee represents a pro rata portion of the cumulative expenses charged by the Underlying Fund. Please note that the Total Annual Fund Operating Expenses in the table above do not correlate to the ratio of Expenses to Average Net Assets found within the “Financial Highlights” section of the Acquired Fund’s prospectus. In each Fund’s prospectus “Underlying Fund Fees and Expenses” are referred to as “Acquired Fund Fees and Expenses.” The use of the term “Underlying Fund Fees and Expenses” has been used here to avoid confusion with the term “Acquired Fund,” as defined in these proxy materials. |

| (6) | With respect to each Fund, the Advisor has agreed to waive its fees and/or absorb expenses of the Fund to ensure that Total Annual Operating Expenses, excluding brokerage fees and commissions, dividend expenses on short positions, Underlying Fund Fees and Expenses, taxes and extraordinary expenses, do not exceed 2.75% of the Fund’s average net assets of Class A shares or 2.50% of the Fund’s average net assets of Class I shares through August 31, 2011 and August 31, 2012, respectively, for the Acquired Fund and Acquiring Fund. With respect to each Fund, to the extent Total Annual Operating Expenses fall below 2.75% for Class A shares and 2.50% for Class I shares in later periods, the Advisor is permitted to seek reimbursement from the Fund, subject to limitations, for fees it waived and expenses it paid with respect to the Fund and its predecessors, for three years from the date fees were waived or reimbursed, without causing Total Annual Operating Expenses (with the aforementioned exclusions) to exceed the 2.75% or 2.50% cap, as applicable. Any such reimbursement is subject to the Board of Trustees review and approval. Based on estimated assets of the Acquiring Fund for the fiscal year ended February 28, 2011, the Acquiring Fund is expected to have Total Annual Fund Operating Expenses (with the aforementioned exclusions) below the expense cap for each share class. In addition, the Advisor potentially may recapture all eligible expense reimbursements and fee waivers made with respect to the Acquired Fund and its predecessor over the prior three-year period. |

EXAMPLE

This example is intended to help you compare the costs of investing in either Fund with the costs of investing in other mutual funds. The Example assumes that you invest $10,000 in each Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year, that each Fund’s operating expenses remain the same and that the Fund’s expense limitation agreement remains in force through August 31, 2011 and August 31, 2012, for the Acquired Fund and the Acquiring Fund, respectively. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | 1 Year | 3 Years | 5 Years | 10 Years |

| Acquired Fund Class A | $919 | $1,663 | $2,462 | $4,528 |

Acquiring Fund Class A (Pro Forma) | $917 | $1,614 | $2,332 | $4,215 |

| | | | | |

| Acquired Fund Class I | $342 | $1,083 | $1,887 | $3,982 |

Acquiring Fund Class I (Pro Forma) | $338 | $1,030 | $1,745 | $3,640 |

Fund Performance

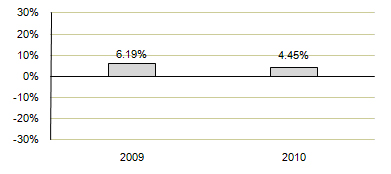

The following information shows the past performance of the Acquired Fund. The bar chart demonstrates the risks of investing in the Acquired Fund from year to year and the Average Annual Total Returns table shows how the Acquired Fund’s average annual total returns compare with that of a broad measurement of market performance. If the Reorganization is approved by shareholders, the Acquiring Fund will acquire all of the assets and liabilities of the Acquired Fund. The Acquiring Fund also will assume the performance history of the Acquired Fund. Past performance is not necessarily indicative of future performance.

Calendar Year Class I Returns as of December 31

The Acquired Fund’s calendar year-to-date return as of March 31, 2011 was 1.23%. During the period shown in the bar chart, the best performance for a quarter was 6.82% (for the quarter ended June 30, 2009). The worst performance was -6.19% (for the quarter ended March 31, 2009).

*Returns are shown in the chart for Class I shares. The performance of Class A shares will differ due to differences in expenses and sales load charges.

Performance Table

Average Annual Total Returns

Periods Ended February 28, 2011

| Acquired Fund | One Year | Since Inception (Class I: 3/3/2008); (Class A: 10/15/2008) |

| CLASS I SHARES | | |

| Return Before Taxes | 4.45% | 1.06% |

Return After Taxes on Distributions(1)(2) | 3.72% | 0.78% |

Return After Taxes on Distributions and Sale of Fund Shares(1)(3) | 3.02% | 0.78% |

| CLASS A SHARES | | |

Return Before Taxes(4) | -1.87% | 0.16% |

| S&P 500 INDEX | | |

S&P 500 Index(5) | 22.57% | 2.18% |

| (1) | After tax returns are calculated using the historical highest individual federal marginal income tax rates in effect and do not reflect the effect of state and local taxes. The after-tax returns shown are not relevant to those investors who hold their shares through tax-deferred arrangements such as 401(k) plans or IRAs. After-tax returns are shown for Class I shares only. After-tax returns for Class A shares will vary. |

| (2) | “Return After Taxes on Distributions” shows the effect of taxable distributions (dividends and capital gains distributions), but assumes that Fund shares are still held at the end of the period. |

| (3) | “Return After Taxes on Distributions and Sale of Fund Shares” shows the effect of both taxable distributions and any taxable gain or loss that would be realized if Fund shares were sold at the end of the specified period. In certain cases, the figure representing “Return After Taxes on Distributions and Sale of Fund Shares” may be higher than the other return figures for the same period. A higher after tax return results when a capital loss occurs upon redemption and provides an assumed tax deduction that benefits the investor. |

| (4) | The Return Before Taxes figure shown includes a sales load charge. |

| (5) | The S&P 500 is an unmanaged index and does not reflect the deduction of fees, expenses or taxes that mutual fund investors bear. A direct investment in an index is not possible. |

Fund Expenses

The Acquiring Fund’s Class A shares and Class I shares will have the same management, distribution and service fees as the Class A shares and Class I shares of the Acquired Fund. Fund expenses will differ with respect to “other expenses,” which include the fees of some of the Funds’ service providers as well as certain out-of-pocket expenses. The Advisor has agreed to waive its fees and/or absorb expenses of each Fund to ensure that Total Annual Operating Expenses, excluding brokerage fees and commissions, dividend expenses on short positions, Underlying Fund Fees and Expenses, taxes and extraordinary expenses, do not exceed 2.75% of the Fund’s average net assets of Class A shares or 2.50% of the Fund’s average net assets of Class I shares through August 31, 2011 and August 31, 2012, respectively, for the Acquired Fund and the Acquiring Fund. The Advisor is permitted to seek reimbursement from each Fund, subject to limitations, for fees it waived and expenses it paid with respect to the Fund and its predecessors, for three years from the date fees were waived or reimbursed, without causing Total Annual Operating Expenses (with the aforementioned exclusions) to exceed the 2.75% or 2.50% cap, as applicable.

It is anticipated that the expenses of the Acquiring Fund will not exceed those of the Acquired Fund. Certain expenses of the Acquiring Fund are expected to decrease due to economies of scale (such as legal, auditing and insurance costs). This decline in fees is expected to reduce total annual fund operating expenses before fee waivers and/or reimbursements by the Advisor.

Distribution and Service (Rule 12b-1) Fee Comparison

Each Fund has adopted a distribution plan pursuant to Rule 12b-1 (each, a “Distribution Plan”) under the 1940 Act on behalf of its Class A shares. Under the Distribution Plan, each Fund is authorized to pay its distributor for expenses relating to the sale and distribution of the Fund’s Class A shares (the “12b-1 Fee”). The maximum amount of the 12b-1 Fee authorized is 0.25% of a Fund’s average daily net assets attributable to Class A shares annually. Because these fees are paid out of the Fund’s assets on an on-going basis, over time these fees will increase the cost of your investment in Class A shares and may cost you more than paying other types of sales charges. Class I shares of both Funds are sold without a sales charge and are not currently charged a distribution and service (12b-1) fee; however, the Class I shares of each Fund are subject to the Distribution Plan and the Board may implement a fee of up to 0.25% on Class I shares.

In addition, each Fund may pay service fees to intermediaries such as banks, broker-dealers, financial advisers or other financial institutions, including affiliates of the Advisor, for sub-administration, sub-transfer agency and other shareholder services associated with shareholders whose shares are held of record in omnibus, other group accounts or accounts traded through registered securities clearing agents. The Advisor, out of its own resources, and without additional cost to a Fund or its shareholders, may provide additional cash payments or non-cash compensation to intermediaries who sell shares of the Fund. Such payments and compensation are in addition to service fees paid by the Funds, if any. These additional cash payments are generally made to intermediaries who provide shareholder servicing, marketing support and/or access to sales meetings, sales representatives and management representatives of the intermediary. Cash compensation may also be paid to intermediaries for inclusion of a Fund on a sales list, including a preferred or select sales list, in other sales programs or as an expense reimbursement in cases where the intermediary provides shareholder services to the Fund’s shareholders. The Advisor may also pay cash compensation in the form of finder’s fees that vary depending on the dollar amount of the shares sold.

Sales Charges

The Acquiring Fund’s Class A shares will have the same front-end sales charge structure (except as indicated in the table below with respect to breakpoints) and the same distribution and service (12b-1) fees as the Acquired Fund. As stated above, Fund expenses will differ with respect to “other expenses,” which include the fees of the Funds’ service providers as well as certain out-of-pocket expenses. It is anticipated that the expenses of the Acquiring Fund will not exceed those of the Acquired Fund.

Sales Charges Comparison - Class A shares of each Fund may be purchased at the public offering price, which is the next determined NAV, plus an initial sales charge of up to 5.75%. Class I shares of each Fund may be purchased at NAV and are not subject to a sales charge. The payment of an initial sales charge means that a portion of your initial investment goes toward the sales charge. Reduction and waivers of the sales charge are available in certain circumstances. The actual sales charge imposed varies depending on the amount invested as follows:

| Sales Charge as a percentage of: |

| ACQUIRED FUND CLASS A SHARES | Sales Charge as a % of Public Offering Price(1) | Sales Charge as a % of Net Amount Invested | Dealer Re-allowance as a percentage of Public Offering Price |

| Less than $100,000 | 5.75% | 6.10% | 5.75% |

| $100,000 but less than $250,000 | 4.50% | 4.71% | 4.50% |

| $250,000 but less than $500,000 | 3.50% | 3.63% | 3.50% |

| $500,000 but less than $1,000,000 | 2.50% | 2.56% | 2.50% |

$1,000,000 or more(2) | 0.00% | 0.00% | 0.00% |

| Sales Charge as a percentage of: |

| ACQUIRING FUND CLASS A SHARES | Sales Charge as a % of Public Offering Price(1) | Sales Charge as a % of Net Amount Invested | Dealer Re-allowance as a percentage of Public Offering Price |

| Less than $100,000 | 5.75% | 6.10% | 5.75% |

| $100,000 but less than $250,000 | 4.50% | 4.71% | 4.50% |

| $250,000 but less than $500,000 | 3.50% | 3.63% | 3.50% |

| $500,000 but less than $1,000,000 | 2.50% | 2.56% | 2.50% |

$1,000,000 or more(3) | 0.00% | 0.00% | 0.00% |

| (1) | Offering price includes the front-end sales load. The sales charge you pay may differ slightly from the amount set forth above because of rounding that occurs in the calculation used to determine your sales charge. |

| (2) | Class A shares of the Acquired Fund that are purchased at NAV in amounts of $1,000,000 or more may be assessed a 1.00% CDSC if they are redeemed within twelve months from the date of purchase. |

| (3) | The Advisor shall reimburse the Acquiring Fund in connection with commissions retained by authorized broker-dealers on purchases of Class A shares over $1 million calculated as follows: for sales of $1 million or more, payments may be made to those broker-dealers having at least $1 million of assets invested in the Acquiring Fund, a fee of up to 1% of the offering price of such shares up to $2.5 million, 0.5% of the offering price from $2.5 million to $5 million, and 0.25% of the offering price over $5 million. The commission rate is determined based on the purchase amount combined with the current market value of existing investments in Class A shares. |

As shown, investors that purchase $1,000,000 or more of the Acquiring Fund’s Class A shares will not pay any initial sales charge on the purchase. However, purchases of $1,000,000 or more of Class A shares may be subject to a 1% CDSC on shares redeemed during the first 12 months after their purchase in the amount of the commissions paid on those shares redeemed.

Class A Sales Charge Reduction and Waivers

Breakpoint Discounts

As the sales charge table above shows, the larger your investment in a Fund’s Class A shares, the lower your initial sales charge imposed on the purchase. Each investment threshold that qualifies for a lower sales charge is known as a “breakpoint.” You may be able to qualify for a breakpoint on the basis of a single purchase, or by aggregating the amounts of more than one purchase in the following ways:

Letter of Intent. A letter of intent (“LOI”) allows you to qualify for a breakpoint discount with respect to a current purchase, based on the total amount of purchases you intend to make in the near future. You can sign an LOI, in which you agree to invest a certain amount (your goal) in a Fund over a six-month period, and your initial sales charge will be based on your goal. A 90-day back-dated period can also be used to count previous purchases toward your goal (but you will not be entitled to a rebate of any sales charge paid on those purchases). Your goal must be at least $100,000 for the Acquired Fund or $50,000 for the Acquiring Fund’s Class A shares, and, if you do not meet your goal within the six-month period, the higher sales charge will be deducted from your account. Purchases resulting from the reinvestment of dividends and capital gains do not apply toward fulfillment of the LOI.

Right of Accumulation. A right of accumulation (“Right of Accumulation”) allows you to qualify for a breakpoint with respect to a current purchase based on the total value of your previous purchases. The applicable sales charge for the new purchase is based on the total of your current purchase and the current NAV of all other shares you own at the financial intermediary at which you are making the current purchase. For example, if your account value from shares of the Acquired Fund purchased is $90,000 and you wish to invest an additional $20,000 in the Acquired Fund, you can invest that $20,000 in Acquired Fund shares and pay the reduced sales charge rate normally applicable to a $100,000 investment. Similarly, if your account value from Class A shares of the Acquiring Fund purchased is $40,000 and you wish to invest an additional $20,000 in the Acquiring Fund Class A shares, you can invest that $20,000 in Acquiring Fund Class A shares and pay the reduced sales charge rate normally applicable to a $50,000 investment. Each Fund may terminate or change this privilege at any time upon written notice.

Combine With Family Members and Related Entities. This is the same for both Funds. You can also count towards the amount of your investment, all investments in a Fund made by your spouse and your children under age 21 (“Family Members”), including their Rights of Accumulation and goals under an LOI. You can also count the amount of all investments in a Fund under a single trust agreement with multiple beneficiaries, of which you are one, or a qualified retirement or employee plan of a single employer, of which you are a participant.

Your Responsibility With Respect to Breakpoint Discounts. This is the same for both Funds. In order to obtain any of the sales charge discounts set forth above, you must inform your financial advisor or the Fund’s transfer agent of the existence of any eligible amounts under any Rights of Accumulation or LOI, in accounts held by family members at the time of purchase. You must inform your financial advisor and/or the Fund’s transfer agent of all shares of a Fund held (i) in your account(s) at the financial advisor, (ii) in your account(s) by another financial intermediary and (iii) in any other accounts held at any financial intermediary belonging to your family members.

Purchases of Class A at Net Asset Value

Except as otherwise noted below, this is substantively substantially similar for both the Class A shares of the Acquired Fund and the Class A shares of the Acquiring Fund. Purchases of shares in an amount of $1,000,000 or more are not subject to an initial sales charge. In addition, purchases of shares in an amount less than $1,000,000 may be eligible for a waiver of the sales charge in the following circumstances:

| · | purchases by current and retired directors and officers of a Fund sponsored by the Advisor or any of its subsidiaries, their families ( e.g., spouse, children, mother or father) and any purchases referred through the Advisor. |

| · | purchases by employees of the Advisor and their families, or any full-time employee or registered representative of the distributor or of broker-dealers having dealer agreements with the distributor (a “Selling Broker”) and their immediate families (or any trust, pension, profit sharing or other benefit plan for the benefit of such persons). Please note that whereas the Acquiring Fund may waive the sales charge only for the immediate families of Selling Brokers, the Acquired Fund provided a sales charge waiver for any family members (spouse, domestic partner, parents, grandparents, children, grandchildren and siblings (including step and in-law)) of Selling Brokers. |

| · | purchases by any full-time employee of a bank, savings and loan, credit union or other financial institution that utilizes a Selling Broker to clear purchases of the Fund's shares and their immediate families. Please note that whereas the Acquiring Fund may waive the sales charge only for the immediate families of a bank, savings and loan, credit union or other financial institution that utilizes a Selling Broker to clear purchases of the Fund's shares, the Acquired Fund provided a sales charge waiver for any family members (spouse, domestic partner, parents, grandparents, children, grandchildren and siblings (including step and in-law)) of such persons. |

| · | purchases by participants in certain “wrap-fee” or asset allocation programs or other fee-based arrangements sponsored by broker-dealers and other financial institutions that have entered into agreements with the distributor. |

| · | purchases by clients of financial intermediaries that have entered into arrangements with the distributor providing for the shares to be used in particular investment products made available to such clients and for which such registered investment advisors may charge a separate fee. |

| · | purchases by institutional investors (which may include bank trust departments and registered investment advisors). |

| · | purchases by any accounts established on behalf of registered investment advisors or their clients by broker-dealers that charge a transaction fee and that have entered into agreements with the distributor. |

| · | purchases by separate accounts used to fund certain unregistered variable annuity contracts or Section 403(b) or 401(a) or (k) accounts. |

| · | purchases by employer-sponsored retirement or benefit plans with total plan assets in excess of $5 million where the plan's investments in the Fund are part of an omnibus account. A minimum initial investment of $1 million in the Fund is required. The distributor in its sole discretion may waive these minimum dollar requirements. |

Comparison of Shareholder Services

Purchase and Redemption Procedures

The Acquiring Fund will offer the same or substantially similar shareholder purchase and redemption services as the Acquired Fund, including telephone purchases and redemptions. Shares of each Fund may be purchased and redeemed at the net asset value of the shares (plus applicable sales charges for Class A shares) as next determined following receipt of a purchase or redemption order, provided the order is received in proper form. Payment of redemption proceeds from a Fund generally will be sent by mail or wire within three business days after processing by the Fund’s transfer agent after receipt of a redemption request in proper form. Payment of redemption proceeds from a Fund generally will be received within a week after processing by the Fund’s transfer agent after receipt of a redemption request in proper form.

Minimum Initial and Subsequent Investment Amounts

The Acquiring Fund will offer the same account minimums and automatic investment plan as the Acquired Fund. The initial minimum and subsequent investments applicable to both the classes of Acquired Fund shares of the Acquiring Fund are summarized below:

Type of Account | Minimum Initial Investment | Minimum Subsequent Investment | Minimum Dividend and Distribution Reinvestment |

| Regular and Automatic Investment | $2,500 | $500 | None |

| Retirement and Automatic Investment | $1,500 | $500 | None |

Both Funds reserve the right to waive or reduce the minimum investment amount under certain circumstances. Both Funds offer an automatic investment plan, which automatically deducts money from your bank account and invests it in a Fund through the use of electronic funds transfers or automatic bank drafts. The Funds permit subsequent investments of $100 under their respective automatic investment plans.

Redemptions

You may redeem any or all of your shares in a Fund by writing or telephoning the Fund, as well as by participating in either Fund’s systematic withdrawal plan. Shareholders with a current account value of at least $10,000 may adopt a systematic withdrawal plan to provide for monthly, quarterly or other periodic checks of $100 or more.

Dividends and Distributions

The Acquiring Fund will have the same dividend and distribution policy as the Acquired Fund. Shareholders who have elected to have dividends and capital gains reinvested in shares of the Acquired Fund will continue to have dividends and capital gains reinvested in the Acquiring Fund following the Reorganization.

Fiscal Year

The Acquired Fund currently operates on a fiscal year ending February 28, 2011. Following the Reorganization, the Acquiring Fund will assume the financial history of the Acquired Fund and continue to operate on a fiscal year ending February 28, 2011 of each year.

Certain Comparative Information about TPM and Northern Lights II

TPM is organized as a Delaware statutory trust under a Declaration of Trust and By-Laws (the “Governing Documents”) and Northern Lights II is organized as a Delaware statutory trust under an Agreement and Declaration of Trust and By-Laws (also “Governing Documents”). There are no material differences in shareholder rights between the Governing Documents of TPM and Northern Lights II.

THE ADVISOR

The Advisor and the terms of the advisory agreement, as discussed below for the Acquired Fund, will be substantially identical for the Acquiring Fund except where otherwise noted below.

Ascentia Capital Partners, LLC, serves as investment advisor to the Acquired Fund. Steve McCarty is the Managing Partner of the Advisor, which he founded in 2005. The Advisor is responsible for developing, constructing and monitoring the asset allocation and portfolio management for the Acquired Fund. Through a blending of sub-advisory firms, or managers, with complementary styles and approaches, the Advisor intends to manage the Fund in a “manager of managers” approach by selecting and overseeing multiple sub-advisors who manage using a distinct investment style for a segment of the Acquired Fund’s assets. Important elements of the Advisor’s oversight are the periodic rebalancing employed to ensure an appropriate mix of elements in the Acquired Fund, and ongoing evaluation of the Sub-Advisors to ensure they do not deviate from the stated investment objective or strategies. Additionally, the Advisor may invest the Acquired Fund’s assets in securities and other instruments directly. The Advisor may exercise this discretion over unallocated assets to invest the Fund’s assets directly and may reallocate to itself assets previously allocated to a Sub-Advisor. The Acquired Fund is the only mutual fund currently managed by the Advisor.

Pursuant to the terms of the Acquired Fund’s Investment Advisory Agreement, (the “Advisory Agreement”), as compensation for its investment management services the Advisor receives a fee, computed and accrued daily and paid monthly, at an annual rate of 1.95% of the Fund’s average daily net assets. The Advisor has contractually agreed to waive its fee and reimburse the Acquired Fund’s expenses so that total annual Fund operating expenses, excluding brokerage fees and commissions, dividend expenses on short positions, Underlying Fund Fees and Expenses, borrowing costs, taxes and extraordinary expenses, do not exceed 2.75% and 2.50% of its average daily net assets for Class A and Class I shares respectively, through August 31, 2011, (August 31, 2012 for the Acquiring Fund). The Advisor is permitted to seek reimbursement from the Acquired Fund (and the Acquiring Fund), subject to limitations, for fees it waived and expenses it paid with respect to both Funds, three years from the date fees were waived or reimbursed, without causing Total Annual Operating Expenses (with the aforementioned exclusions) to exceed the 2.75% and 2.50% caps. Any such reimbursement is subject to the review and approval by the Funds’ respective Boards of Trustees.

The Advisor (not the Funds) may pay certain financial institutions (which may include banks, credit unions, brokers, securities dealers and other industry professionals) a fee for providing distribution-related services and/or for performing certain administrative servicing functions for Fund shareholders, to the extent these institutions are allowed to do so by applicable statute, rule or regulation. A discussion of the factors that the Board of Trustees considered in approving each Fund’s Advisory Agreement will be included in the respective Fund’s annual or semi-annual report, as applicable.

THE SUB-ADVISORS

The Sub-Advisors and the terms of each sub-advisory agreement, as discussed below for the Acquired Fund, will be substantially identical for the Acquiring Fund except where noted below.

The Advisor, on behalf of the Acquired Fund, has entered into a sub-advisory agreement with each Sub-Advisor, and the Advisor compensates the Sub-Advisors out of the investment advisory fees it receives from the Acquired Fund. Each Sub-Advisor makes investment decisions for the assets it has been allocated to manage, subject to the overall supervision of the Acquired Fund’s portfolio manager (see “Portfolio Managers” below). The Advisor oversees the Sub-Advisors for compliance with the Acquired Fund’s investment objective, policies, strategies and restrictions, and monitors each Sub-Advisor’s adherence to its investment style. The Acquired Fund’s Board of Trustees supervises the Advisor and the Sub-Advisors, establishes policies that they must follow in their management activities, and oversees the hiring and termination of Sub-Advisors recommended by the Advisor. TPM applied for, and the SEC has granted, an exemptive order with respect to the Acquired Fund that permits the Advisor, subject to certain conditions, to terminate existing Sub-Advisors or hire new Sub-Advisors for the Fund, to materially amend the terms of particular agreements with Sub-Advisors or to continue the employment of existing Sub-Advisors after events that would otherwise cause an automatic termination of a sub-advisory agreement. The terms of the exemptive order are applicable to the Acquired Fund as well as any other registered investment company for which the Advisor serves as investment adviser including the Acquiring Fund. This arrangement has been approved by the Acquired Fund’s Board of Trustees and its initial shareholder. This arrangement has also been approved by the Acquiring Fund’s Board of Trustees and its initial Shareholder. Consequently, under the exemptive order, the Advisor has the right to hire, terminate and replace Sub-Advisors when the Board of Trustees of a Fund and the Advisor feel that a change would benefit the Fund. For both Funds, within 90 days of retaining a new Sub-Advisor, shareholders of the Fund will receive notification of the change. The manager of managers structure enables each Fund to operate with greater efficiency and without incurring the expense and delays associated with obtaining shareholder approval of sub-advisory agreements. The structure does not permit investment advisory fees paid by a Fund to be increased or change the Advisor’s obligations under the Advisory Agreement, including the Advisor’s responsibility to monitor and oversee sub-advisory services furnished to the Funds, without shareholder approval. Furthermore, any sub-advisory agreements with affiliates of a Fund or the Advisor will require shareholder approval.

Armored Wolf, LLC

The Advisor has entered into a sub-advisory agreement with Armored Wolf, LLC (“Armored Wolf”) to manage a portion of the Acquired Fund’s assets using the Fund’s Global Macro Strategies. Armored Wolf is located at 65 Enterprise, Aliso Viejo, California 92656 and is a registered investment adviser. Armored Wolf is controlled by Mr. John Brynjolfsson, the firm’s chief investment officer. Armored Wolf, which was established in 2008, offers investment advisory services and global perspective to investors. As of March 31, 2011, Armored Wolf had approximately $670 million in assets under management.

DuPont Capital Management Corporation

The Advisor has entered into a sub-advisory agreement with DuPont Capital Management Corporation (“DCM”) to manage a portion of the Acquired Fund’s assets using the Fund’s international/emerging markets Strategies. DCM is located at Delaware Corporate Center, One Righter Parkway, Suite 3200, Wilmington, Delaware 19803. DCM is a wholly owned subsidiary of the E.I. DuPont de Nemours Company, and is an independent registered investment advisor with a broadly diversified product offering. DCM, which was established in 1975 and became a SEC registered investment advisor in 1993, offers investment advisory services and global perspective to institutional investors. As of March 31, 2011, DCM had over $27 billion in assets under management.

Sage Capital Management, LLC

The Advisor has entered into a sub-advisory agreement with Sage Capital Management, LLC (“Sage Capital”) to manage a portion of the Acquired Fund’s assets using the convertible arbitrage strategy. Sage Capital is located at 665 South Orange Avenue, Suite 3, Sarasota, FL 34236, and is a registered investment advisor. Sage Capital manages a variety of domestic limited partnership funds that are open to both individual and institutional investors and a number of separately managed accounts. Sage Capital was founded in 1988 for the purpose of investing client capital in convertible securities, both on a strategic directional and arbitrage basis. As of March 31, 2011, Sage Capital managed over $165 million in assets.

Dunham & Associates Investment Counsel, Inc.

The Advisor has entered into a sub-advisory agreement with Dunham & Associates Investment Counsel, Inc. (“DAIC”) to manage a portion of the Acquired Fund’s assets using the international/emerging markets strategies. DAIC is located at 10251 Vista Sorrento Parkway, Suite 200, San Diego, CA 92121, and is a registered investment advisor. DAIC is also a registered broker-dealer under the Securities Exchange Act of 1934, as amended. DAIC is wholly owned by Dunham & Associates Holdings, Inc. (“Dunham Holdings”). Jeffrey Dunham owns a controlling 95% interest in Dunham Holdings which represents 100% of the voting shares of Dunham Holdings. DAIC, which was founded in 1985, offers investment advisory services to pension plans, pooled investment vehicles, high-net worth individuals and mutual funds. As of March 31, 2011, DAIC managed over $722 million in individual separate accounts assets and in DAIC sponsored mutual funds.

Research Affiliates, LLC

Research Affiliates, LLC also served as a sub-advisor to the Acquired Fund, but will serve solely as a signal provider to the Acquiring Fund’s Advisor following the Reorganization. A signal provider provides research and portfolio analysis to an advisor, but does not process trades.

THE PORTFOLIO MANAGERS

The portfolio managers, as discussed below for the Acquired Fund, will be identical for the Acquiring Fund except where otherwise noted.

Advisor

James P. Calhoun and James O’Shaughnessy Houssels are members of the Investment Committee that is responsible for the day-to-day management of the segment of the Acquired Fund’s portfolio managed by the Advisor, as well as to provide oversight of the Acquired Fund’s portfolio managed by the Sub-Advisors.

James P. Calhoun joined the Advisor in 2008. He has over 6 years of experience in investment management as well as extensive experience in the quantitative, fundamental and technical aspects of the securities markets with a specific emphasis on alternative portfolio management. He is a member of the Investment Committee and participates in the development and communication of the firm’s investment strategy, as well as client asset allocations and investment recommendations. Mr. Calhoun has a Bachelor of Science Degree in Business Administration with majors in Finance and Economics from the University of Nevada, Reno. His degree emphasized Derivatives and Risk Management, International Finance and Foreign Exchange, Portfolio Management and Optimization, Corporate Valuation and Forecasting, Alternative Investment Strategies, Econometrics, Macro Economics, Micro Economics, and Statistics. Prior to joining the Advisor Mr. Calhoun worked with GMH Capital Partners managing real-estate investments from 2004 to 2007, and Equitas Capital from 2003 to 2004. Mr. Calhoun is a CFA Level II candidate.

James O’Shaughnessy Houssels is a portfolio manager of the Advisor (since June 2009) and is also a Managing Member and registered investment adviser representative of Wealth Management Associates, LLC (since 2002) which serves as the backbone of his family office and is the sole investment advisor to the Houssels Family Limited Partnership. Mr. Houssels has a Bachelor’s Degree from the University of Nevada, Las Vegas.

Sub-Advisors

Armored Wolf, LLC

John Brynjolfsson is the Portfolio Manager and responsible for the day-to-day management of the segment of the Acquired Fund’s assets managed by Armored Wolf. Mr. Brynjolfsson founded Armored Wolf in 2008, acts as Chief Investment Officer and Managing Director, and is a member of the firm’s Management and Investment Committees. As Chief Investment Officer, he is responsible for overseeing all investment activity at Armored Wolf. Mr. Brynjolfsson has over 20 years of investment experience and a background in risk management. From 2003-2008, Mr. Brynjolfsson was the Managing Director at Pacific Investment Management Company, LLC (“PIMCO”), a registered investment adviser, where launched and grew PIMCO’s Real Return platform to approximately $80 billion before his departure in 2008. In this role, Mr. Brynjolfsson ran PIMCO’s 2nd, 3rd, and 4th largest public funds which included the world’s largest commodities fund and two large inflation linked bond funds. Mr. Brynjolfsson has written several books on the topic of inflation linked investing, and worked with the US Treasury to design the TIPS market in 1996.

DuPont Capital Management Corporation

Rafi U. Zaman, CFA, is the Portfolio Manager and is primarily responsible for the day-to-day management of the segment of the Acquired Fund’s assets managed by DCM. Mr. Zaman, Managing Director of Global Equities, directs and co-manages all equity groups, and joined DCM in 1998. Mr. Zaman holds a B.S. Degree with honors in Mechanical Engineering from the REC Kurukshetra in India, an M.S. Degree in Industrial Engineering from Stanford University and is a CFA charterholder.

Sage Capital Management, LLC

Peter deLisser, Karen Heston and Michael C. Ippolito, CFA are the co-Portfolio Managers primarily responsible for the day-to-day management of the segment of the Acquired Fund’s assets managed by Sage Capital. Mr. deLisser founded Sage Capital in 1988 and is the President and Senior Partner of the firm. Ms. Heston is the Chief Investment Officer for Sage Capital and has been with the firm since 1993. Mr. Ippolito serves as a Portfolio Manager and Senior Research Analyst for Sage Capital, and joined the firm in July of 1999.

Dunham & Associates Investment Counsel, Inc.