UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. [ ])

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement.

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)).

[X] Definitive Proxy Statement.

[ ] Definitive Additional Materials.

[ ] Soliciting Material Pursuant to § 240.14a-12.

TRUST FOR PROFESSIONAL MANAGERS (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

[ ] Fee paid previously with preliminary materials:

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

TRUST FOR PROFESSIONAL MANAGERS

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

February 23, 2022

Dear Shareholder:

The Board of Trustees of Trust for Professional Managers (the “Trust”) has called a special joint meeting of shareholders concerning each series of the Trust listed below (each, a “Fund,” and together, the “Funds”):

| | | | | |

| Barrett Growth Fund | Marketfield Fund |

| Bright Rock Mid Cap Growth Fund | Performance Trust Credit Fund |

| Bright Rock Quality Large Cap Fund | Performance Trust Municipal Bond Fund |

| Convergence Long/Short Equity Fund | Performance Trust Strategic Bond Fund |

| CrossingBridge Low Duration High Yield Fund | PMC Core Fixed Income Fund |

| CrossingBridge Pre-Merger SPAC ETF | PMC Diversified Equity Fund |

| CrossingBridge Responsible Credit Fund | Rockefeller Climate Solutions Fund |

| CrossingBridge Ultra-Short Duration Fund | Rockefeller Core Taxable Bond Fund |

| Dearborn Partners Rising Dividend Fund | Rockefeller Equity Allocation Fund |

| Jensen Global Quality Growth Fund | Rockefeller Intermediate Tax Exempt National Bond Fund |

| Jensen Quality Value Fund | Rockefeller Intermediate Tax Exempt New York Bond Fund |

| Mairs & Power Minnesota Municipal Bond ETF | Terra Firma US Concentrated Realty Equity Fund |

The special joint meeting of shareholders will be held at the offices of U.S. Bank Global Fund Services, administrator to the Funds, located at 615 East Michigan Street, Milwaukee, Wisconsin, 53202 on April 6, 2022, at 11:00 AM Central Time, or any adjournments or postponements thereof (the “Special Meeting”). The purpose of the Special Meeting is to elect four Trustees to the Board of Trustees (the “Board”) of the Trust. We intend to hold the Special Meeting in person. However, in light of the evolving COVID-19 pandemic, additional procedures or limitations on Special Meeting attendees may be imposed and the location of the Special Meeting may be held in a different location or solely virtually by means of remote communication. Any such updates will be announced on https://vote.proxyonline.com/TPM/docs/trust2022.pdf, and you are encouraged to check this website prior to the Special Meeting if you plan to attend in person. You are encouraged to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed Proxy Card, in advance of the Special Meeting in the event that, as of April 6, 2022, in-person attendance at the Special Meeting is either prohibited under a federal, state or local order or contrary to the advice of public health care officials.

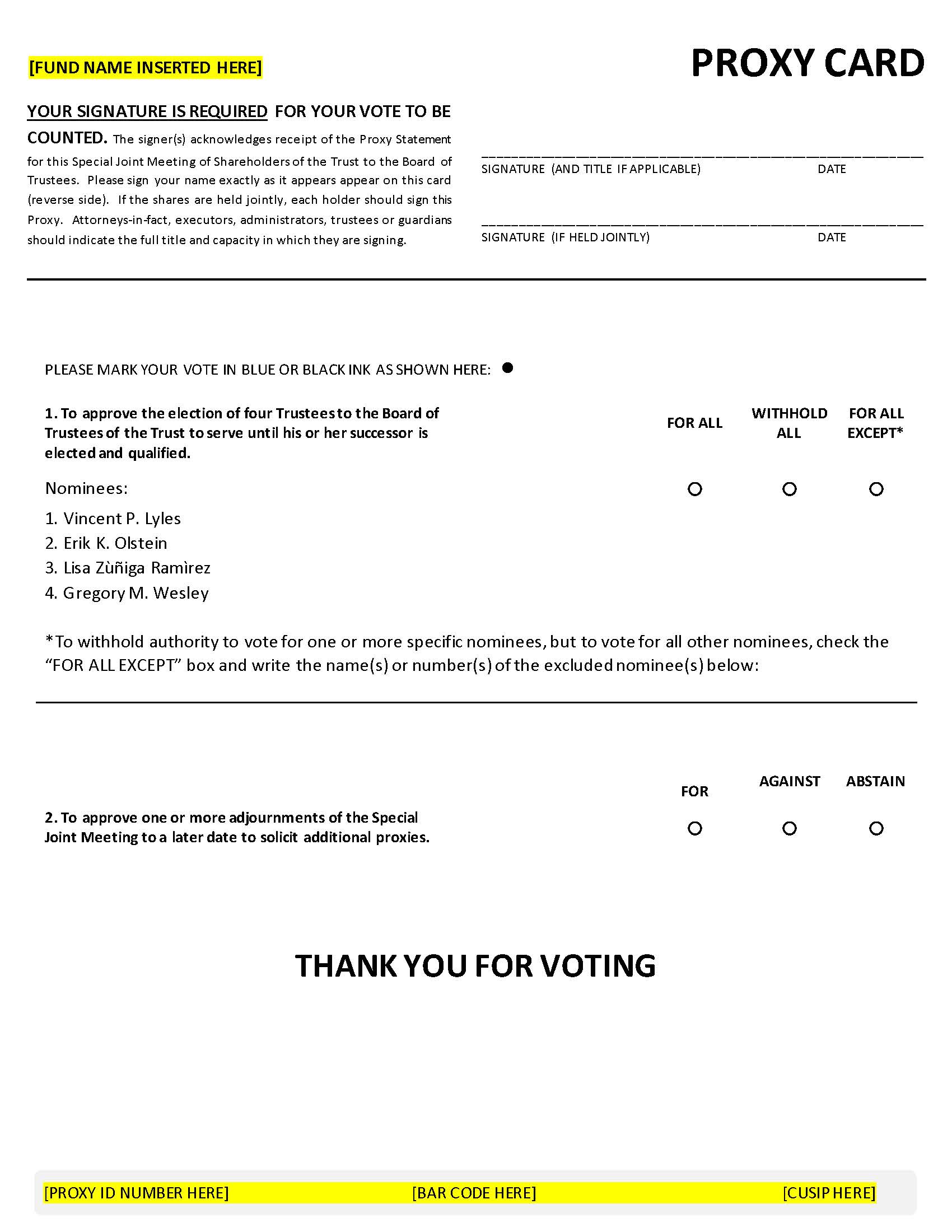

At the Special Meeting, shareholders of the Funds will be asked to elect four nominees, Mr. Vincent P. Lyles, Mr. Erik K. Olstein, Ms. Lisa Zúñiga Ramírez and Mr. Gregory M. Wesley (the “Nominees”), to the Board. The Nominating Committee of the Board, which is composed entirely of the Trustees who are not “interested persons” of the Trust (each, an “Independent Trustee”) as defined in the Investment Company Act of 1940, as amended (the “1940 Act”), has recommended to the Board the nomination of, and the Board has, in turn, nominated, each of Mr. Vincent P. Lyles, Mr. Erik K. Olstein, Ms. Lisa Zúñiga Ramírez and Mr. Gregory M. Wesley, to join the Board as Trustees.

If you are a shareholder of record of a Fund as of the close of business on February 7, 2022, you are entitled to vote at the Special Meeting and at any adjournment or postponement thereof.

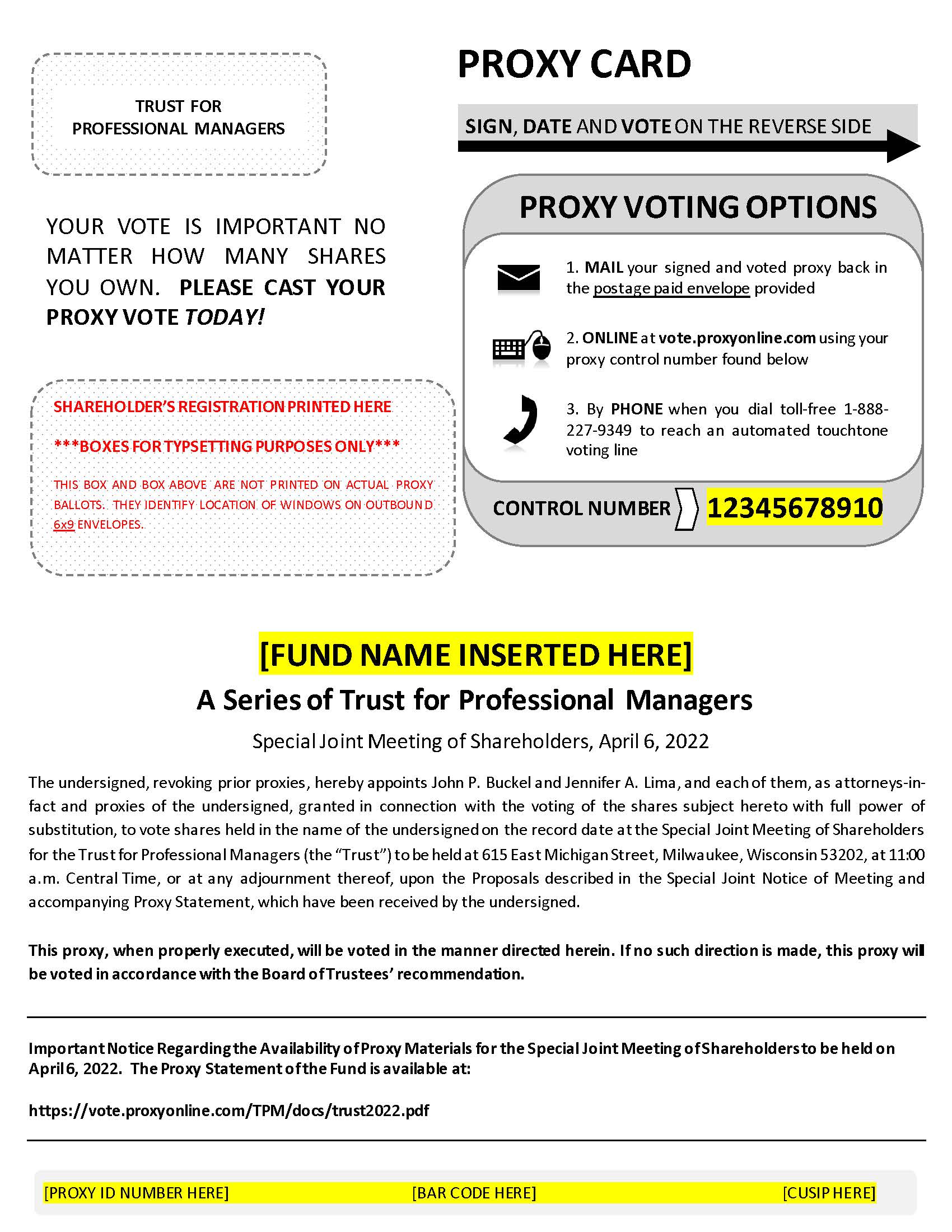

Enclosed you will find a Notice of Special Joint Meeting of Shareholders, Proxy Statement and a Proxy Card. These materials contain important information about the matters to be considered at the Special Meeting, including each Nominee’s qualifications and the voting process for shareholders of the Funds. Please read the materials carefully and vote promptly. There are several ways to vote, including by returning your proxy card in the postage-paid

envelope. You also may vote over the internet or by telephone. Please refer to the Proxy Card for further instruction on how to vote.

Your vote is very important regardless of the number of Fund shares you own. The Board of Trustees of the Trust has unanimously approved the proposals and recommends that read the enclosed materials carefully and vote in favor of each proposal.

| | | | | | | | |

| Fund/Fund Family | Investment Adviser | Fund Phone Number |

| Barrett Growth Fund | Barrett Asset Management, LLC | 877-363-6333 |

Bright Rock Funds Bright Rock Mid Cap Growth Fund Bright Rock Quality Large Cap Fund | Bright Rock Capital Management, LLC | 866-273-7223 |

| Convergence Long/Short Equity Fund | Convergence Investment Partners, LLC, | 877-677-9414 |

CrossingBridge Funds CrossingBridge Low Duration High Yield Fund CrossingBridge Pre-Merger SPAC ETF CrossingBridge Responsible Credit Fund CrossingBridge Ultra-Short Duration Fund | CrossingBridge Advisors, LLC | 888-898-2780

800-617-0004 |

| Dearborn Partners Rising Dividend Fund | Dearborn Partners, L.L.C. | 888-983-3380 |

Jensen Funds Jensen Global Quality Growth Fund Jensen Quality Value Fund | Jensen Investment Management, Inc. | 800-992-4144 |

| Mairs & Power Minnesota Municipal Bond ETF | Mairs & Power, Inc. | 855-839-2800 |

| Marketfield Fund | Marketfield Asset Management LLC | 800-311-6583 |

Performance Trust Funds Performance Trust Credit Fund Performance Trust Municipal Bond Fund Performance Trust Strategic Bond Fund | PT Asset Management, LLC (DBA: Performance Trust Asset Management) | 877-738-9095 |

PMC Funds PMC Core Fixed Income Fund PMC Diversified Equity Fund | Envestnet Asset Management, Inc. | 866-762-7338 |

Rockefeller Funds Rockefeller Climate Solutions Fund Rockefeller Core Taxable Bond Fund Rockefeller Equity Allocation Fund Rockefeller Intermediate Tax Exempt National Bond Fund Rockefeller Intermediate Tax Exempt New York Bond Fund | Rockefeller & Co. LLC | 855-369-6209 |

| Terra Firma US Concentrated Realty Equity Fund | Terra Firma Asset Management, LLC | 844-408-3772 |

If you have any questions, please contact U.S. Bank Global Fund Services at the toll-free number above shown opposite your Fund’s name.

Thank you for your continued support.

Sincerely,

/s/ John P. Buckel

John P. Buckel

President

Trust for Professional Managers

Voting is quick and easy. Delay may cause the Funds to incur additional expenses to solicit votes for the Special Meeting. Everything you need is enclosed. To cast your vote:

•MAIL: Complete the enclosed Proxy Card. BE SURE TO SIGN THE PROXY CARD before mailing it in the postage-paid envelope.

•PHONE: Call the toll-free number on the enclosed Proxy Card. Enter the control number on the Proxy Card and follow the instructions.

•INTERNET: Visit the website indicated on the enclosed Proxy Card. Enter the control number on the Proxy Card and follow the instructions.

NOTICE OF SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 6, 2022

TRUST FOR PROFESSIONAL MANAGERS

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

NOTICE IS HEREBY GIVEN that a special joint meeting of shareholders of each series of Trust for Professional Managers (the “Trust”) listed below (each, a “Fund,” and together, the “Funds”) will be held at the offices of U.S. Bank Global Fund Services, administrator to the Funds, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202 on April 6, 2022, at 11:00 a.m. Central Time, or any adjournments or postponements thereof (the “Special Meeting”):

| | | | | |

| Barrett Growth Fund | Marketfield Fund |

| Bright Rock Mid Cap Growth Fund | Performance Trust Credit Fund |

| Bright Rock Quality Large Cap Fund | Performance Trust Municipal Bond Fund |

| Convergence Long/Short Equity Fund | Performance Trust Strategic Bond Fund |

| CrossingBridge Low Duration High Yield Fund | PMC Core Fixed Income Fund |

| CrossingBridge Pre-Merger SPAC ETF | PMC Diversified Equity Fund |

| CrossingBridge Responsible Credit Fund | Rockefeller Climate Solutions Fund |

| CrossingBridge Ultra-Short Duration Fund | Rockefeller Core Taxable Bond Fund |

| Dearborn Partners Rising Dividend Fund | Rockefeller Equity Allocation Fund |

| Jensen Global Quality Growth Fund | Rockefeller Intermediate Tax Exempt National Bond Fund |

| Jensen Quality Value Fund | Rockefeller Intermediate Tax Exempt New York Bond Fund |

| Mairs & Power Minnesota Municipal Bond ETF | Terra Firma US Concentrated Realty Equity Fund |

We intend to hold the Special Meeting in person. However, in light of the evolving COVID-19 pandemic, additional procedures or limitations on Special Meeting attendees may be imposed and the location of the Special Meeting may be held in a different location or solely virtually by means of remote communication. Any such updates will be announced on https://vote.proxyonline.com/TPM/docs/trust2022.pdf, and you are encouraged to check this website prior to the Special Meeting if you plan to attend in person. You are encouraged to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed Proxy Card, in advance of the Special Meeting in the event that, as of April 6, 2022, in-person attendance at the Special Meeting is either prohibited under a federal, state or local order or contrary to the advice of public health care officials.

At the Special Meeting, shareholders of the Funds will be asked to consider and approve the following proposals, which are more fully described in the accompanying Proxy Statement:

PROPOSAL 1: To approve the election of four Trustees to the Board of Trustees of the Trust to serve until his or her successor is elected and qualified.

PROPOSAL 2: To approve one or more adjournments of the Special Meeting to a later date to solicit additional proxies.

THE BOARD OF TRUSTEES RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS.

A shareholder of record of a Fund as of the close of business on February 7, 2022 is entitled to vote at the Special Meeting and at any adjournment or postponement thereof.

Please read the accompanying Proxy Statement. Your vote is very important regardless of the number of Fund shares you own. Shareholders who do not expect to attend the Special Meeting are requested to complete, sign and promptly return the enclosed Proxy Card so that a quorum will be present and a maximum number of shares may be voted for each respective Fund. In the alternative, please call the toll-free number on the enclosed Proxy

Card to vote by telephone or go to the website shown on the enclosed Proxy Card to vote over the internet. You may revoke your proxy prior to the Special Meeting by giving written notice of such revocation to the Secretary of the Trust prior to the Special Meeting by delivering a subsequently dated Proxy Card by any of the methods described above, or by voting in-person at the Special Meeting.

By order of the Board of Trustees of the Trust:

/s/ Jay S. Fitton

Jay S. Fitton

Secretary

Trust for Professional Managers

February 23, 2022

TRUST FOR PROFESSIONAL MANAGERS

c/o U.S. Bank Global Fund Services

615 East Michigan Street

Milwaukee, WI 53202

PROXY STATEMENT

February 23, 2022

FOR THE SPECIAL JOINT MEETING OF SHAREHOLDERS

TO BE HELD ON APRIL 6, 2022

This Proxy Statement is furnished in connection with the solicitation by the Board of Trustees (the “Board”) of Trust for Professional Managers (the “Trust”) of proxies to be voted at the special joint meeting of shareholders of the Trust to be held at the offices of U.S. Bank Global Fund Services, administrator to the Funds, located at 615 East Michigan Street, Milwaukee, Wisconsin, 53202 on April 6, 2022, at 11:00 AM Central Time, or any adjournments or postponements thereof (the “Special Meeting”). We intend to hold the Special Meeting in person. However, in light of the evolving COVID-19 pandemic, additional procedures or limitations on Special Meeting attendees may be imposed and the location of the Special Meeting may be held in a different location or solely virtually by means of remote communication. Any such updates will be announced on https://vote.proxyonline.com/TPM/docs/trust2022.pdf, and you are encouraged to check this website prior to the Special Meeting if you plan to attend in person. You are encouraged to consider your options to vote by internet, telephone, or mail, as discussed in the enclosed Proxy Card, in advance of the Special Meeting in the event that, as of April 6, 2022, in-person attendance at the Special Meeting is either prohibited under a federal, state or local order or contrary to the advice of public health care officials.

PROPOSAL 1: To approve the election of four Trustees to the Board of Trustees of the Trust to serve until his or her successor is elected and qualified.

PROPOSAL 2: To approve one or more adjournments of the Special Meeting to a later date to solicit additional proxies.

Shareholders of record at the close of business on the record date, February 7, 2022 (the “Record Date”), are entitled to notice of, and to vote at, the Special Meeting. The Notice of Special Joint Meeting of Shareholders (the “Notice”), this Proxy Statement and the enclosed Proxy Card are being mailed to Shareholders on or after February 23, 2022.

The Trust is a Delaware statutory trust organized on May 29, 2001, and is registered with the Securities and Exchange Commission as an open-end management investment company. Each Fund is a series of the Trust and has its own investment objective and policies. The Trust currently consists of 24 separate series with different fiscal year-ends. Shareholders of each Fund in the Trust are being solicited to vote on the Proposals. The following is a list of the Funds in the Trust being solicited to vote on the Proposals in this Proxy Statement:

| | | | | | | | | | | |

| Fund/Fund Family | Investment Adviser | Fiscal Year End | Fund Phone Number |

| Barrett Growth Fund | Barrett Asset Management, LLC | May 31 | 877-363-6333 |

Bright Rock Funds Bright Rock Mid Cap Growth Fund Bright Rock Quality Large Cap Fund | Bright Rock Capital Management, LLC | February 28 | 866-273-7223 |

| Convergence Long/Short Equity Fund | Convergence Investment Partners, LLC | November 30 | 877-677-9414 |

| | | | | | | | | | | |

| Fund/Fund Family | Investment Adviser | Fiscal Year End | Fund Phone Number |

CrossingBridge Funds CrossingBridge Low Duration High Yield Fund CrossingBridge Pre-Merger SPAC ETF CrossingBridge Responsible Credit Fund CrossingBridge Ultra-Short Duration Fund | CrossingBridge Advisors, LLC | September 30 | 888-898-2780

800-617-0004 |

| Dearborn Partners Rising Dividend Fund | Dearborn Partners L.L.C. | February 28 | 888-983-3380 |

Jensen Funds Jensen Global Quality Growth Fund Jensen Quality Value Fund | Jensen Investment Management, Inc. | May 31 | 800-992-4144 |

| Mairs & Power Minnesota Municipal Bond ETF | Mairs & Power, Inc. | December 31 | 855-839-2800 |

| Marketfield Fund | Marketfield Asset Management LLC | December 31 | 800-311-6583 |

Performance Trust Funds Performance Trust Credit Fund Performance Trust Municipal Bond Fund Performance Trust Strategic Bond Fund | PT Asset Management, LLC | August 31 | 877-738-9095 |

PMC Funds PMC Core Fixed Income Fund* PMC Diversified Equity Fund | Envestnet Asset Management, Inc.

*Sub-advised by Neuberger Berman Investment Advisers, LLC | August 31 | 866-762-7338 |

Rockefeller Funds Rockefeller Climate Solutions Fund Rockefeller Core Taxable Bond Fund Rockefeller Equity Allocation Fund Rockefeller Intermediate Tax Exempt National Bond Fund Rockefeller Intermediate Tax Exempt New York Bond Fund | Rockefeller & Co. LLC (d/b/a Rockefeller Capital Management)

| November 30 | 855-369-6209 |

| Terra Firma US Concentrated Realty Equity Fund | Terra Firma Asset Management, LLC | December 31 | 844-408-3772 |

Important Notice Regarding the Availability of Proxy Materials for the Special Meeting

This Proxy Statement is available on the internet at https://vote.proxyonline.com/TPM/docs/trust2022.pdf. You may request a copy by mail (Trust for Professional Managers, c/o U.S. Bank Global Fund Services, LLC, P.O. Box 701, Milwaukee, Wisconsin 53201-0701). You may also call for information on how to obtain directions to be able to attend the Special Meeting and vote in person.

Financial statements for each of the Funds are included in the Annual Report of each Fund for the fiscal year-end date noted above, which have previously been delivered or made available to Fund shareholders. Shareholders may obtain copies of the applicable Annual Report or Semi-Annual Report free of charge by writing to the Trust, c/o U.S. Bank Global Fund Services, 615 East Michigan Street, Milwaukee, Wisconsin 53202, or by calling toll-free at the number above shown opposite your Fund’s name.

PROPOSAL 1 – ELECTION OF TRUSTEES TO THE BOARD OF THE TRUST

At the Special Meeting, shareholders of the Funds will be asked to elect four Trustees to the Board. Currently, the Board is composed of two Trustees who are not “interested persons” of the Trust (“Independent Trustees”) as defined by the Investment Company Act of 1940, as amended (the “1940 Act”) – Dr. Michael D. Akers and Mr. Gary A. Drska – and one Trustee who is an “interested person” of the Trust – Mr. Joseph C.

Neuberger. Each of Dr. Akers, Mr. Drska and Mr. Neuberger were previously elected to the Board by the initial shareholder of the Trust in 2001.

At a meeting of the Nominating Committee held on December 17, 2021, the Nominating Committee, which is composed solely of the Independent Trustees, considered and recommended that the number of Trustees of the Board be increased from three to seven and that Mr. Vincent P. Lyles, Mr. Erik K. Olstein, Ms. Lisa Zúñiga Ramírez and Mr. Gregory M. Wesley (together, the “Nominees”), each of whom qualify as an Independent Trustee, fill the vacant positions on the Board created by the increase in the number of Trustees on the Board. The Board of Trustees reviewed the recommendations of the Nominating Committee in materials presented to them and approved the increase in the number of Trustees of the Board from three to seven and the nomination of the Nominees at the Board meeting on December 17, 2021.

The persons named as proxies intend to vote FOR the election of the Nominees as Trustees of the Trust unless such authority has been withheld on the proxy card. Each Nominee has agreed to be named in this Proxy Statement and to serve if elected. The Board has no reason to believe that any Nominee will become unavailable for election as a Trustee. However, if that should occur before the Special Meeting, your proxy will be voted for the Nominees recommended by the Board to fill the vacancies.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE TRUST VOTE “FOR” THE ELECTION OF EACH TRUSTEE NOMINEE TO THE BOARD OF THE TRUST.

Trustees and Officers

The Board of Trustees is responsible for the oversight of the management and operations of the Trust and regularly reviews the activities of the Trust’s officers, who are responsible for the day-to-day operations of the Trust. The Trustees and officers of the Trust are listed below with their addresses, present positions with the Trust and principal occupations over at least the last five years.

| | | | | | | | | | | | | | | | | |

| Name, Address and Year of Birth | Position(s) Held with the Trust | Term of Office and Length of Time Served | Number of Portfolios in the Trust Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

| Independent Trustees |

Michael D. Akers, Ph.D.

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1955 | Trustee | Indefinite Term; Since August 22, 2001 | 24 | Professor Emeritus, Department of Accounting (June 2019-present), Professor, Department of Accounting (2004-2019), Chair, Department of Accounting (2004-2017), Marquette University.

| Independent Trustee, USA MUTUALS (an open-end investment company) (2001-2021).

|

Gary A. Drska

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1956 | Trustee | Indefinite Term; Since August 22, 2001 | 24 | Retired; Former Pilot, Frontier/Midwest Airlines, Inc. (airline company) (1986-2021).

| Independent Trustee, USA MUTUALS (an open-end investment company) (2001-2021).

|

| | | | | | | | | | | | | | | | | |

| Name, Address and Year of Birth | Position(s) Held with the Trust | Term of Office and Length of Time Served | Number of Portfolios in the Trust Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

| Interested Trustee |

Joseph C. Neuberger*

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1962 | Chairperson and Trustee | Indefinite Term; Since August 22, 2001 | 24 | President (2017-present), Chief Operating Officer (2016-2020), Executive Vice President (1994-2017), U.S. Bancorp Fund Services, LLC.

| Trustee, Buffalo Funds (an open-end investment company) (2003-2017); Trustee, USA MUTUALS (an open-end investment company) (2001-2018).

|

| Nominees for Independent Trustee |

Vincent P. Lyles

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1961 | Trustee Nominee | N/A | 24 | System Vice President of Community Relations, Advocate Aurora Health Care (health care provider) (2019-present); President and Chief Executive Officer, Boys & Girls Club of Greater Milwaukee (2012-2018).

| Independent Director, BMO Funds, Inc. (an open-end investment company) (2017-2022). |

Erik K. Olstein

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1967 | Trustee Nominee | N/A | 24 | Retired; President and Chief Operating Officer (2000-2020), Vice President of Sales and Chief Operating Officer (1995-2000), Olstein Capital Management, L.P. (asset management firm); Secretary and Assistant Treasurer, The Olstein Funds (1995-2018).

| Trustee, The Olstein Funds (an open-end investment company) (1995-2018). |

| | | | | | | | | | | | | | | | | |

| Name, Address and Year of Birth | Position(s) Held with the Trust | Term of Office and Length of Time Served | Number of Portfolios in the Trust Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

Lisa Zúñiga Ramírez

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1969 | Trustee Nominee | N/A | 24 | Retired; Principal and Senior Portfolio Manager, Segall, Bryant & Hamill, LLC (asset management firm) (2018-2020); Partner and Senior Portfolio Manager, Denver Investments LLC (asset management firm) (2009-2018).

| N/A |

Gregory M. Wesley

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1969 | Trustee Nominee | N/A | 24 | Senior Vice President of Strategic Alliances and Business Development, Medical College of Wisconsin (2016-present).

| N/A |

| Officers |

John P. Buckel

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1957 | President and Principal Executive Officer

| Indefinite Term; Since January 24, 2013

| N/A | Vice President, U.S. Bancorp Fund Services, LLC (2004-present).

| N/A |

Jennifer A. Lima

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1974 | Vice President, Treasurer and Principal Financial and Accounting Officer

| Indefinite Term; Since January 24, 2013 | N/A | Vice President, U.S. Bancorp Fund Services, LLC (2002-present). | N/A |

Deanna B. Marotz

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1965 | Chief Compliance Officer, Vice President and Anti-Money Laundering Officer | Indefinite Term; Since October 21, 2021 | N/A | Senior Vice President, U.S. Bancorp Fund Services, LLC (2021-present); Chief Compliance Officer, Keeley-Teton Advisors, LLC and Teton Advisors, Inc (2017-2021); Chief Compliance Officer, Keeley Asset Management Corp. (2015-2017).

| N/A |

| | | | | | | | | | | | | | | | | |

| Name, Address and Year of Birth | Position(s) Held with the Trust | Term of Office and Length of Time Served | Number of Portfolios in the Trust Overseen by Trustee | Principal Occupation(s) During the Past Five Years | Other Directorships Held by Trustee During the Past Five Years |

Jay S. Fitton

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1970 | Secretary | Indefinite Term; Since July 22, 2019 | N/A | Assistant Vice President, U.S. Bancorp Fund Services, LLC (2019-present); Partner, Practus, LLP (2018-2019); Counsel, Drinker Biddle & Reath LLP (2016-2018).

| N/A |

Kelly A. Strauss

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1987

| Assistant Treasurer | Indefinite Term; Since April 23, 2015 | N/A | Assistant Vice President, U.S. Bancorp Fund Services, LLC (2011-present).

| N/A |

Melissa Aguinaga

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1987

| Assistant Treasurer | Indefinite Term; Since July 1, 2015 | N/A | Assistant Vice President, U.S. Bancorp Fund Services, LLC (2010-present).

| N/A |

Laura A. Carroll

615 E. Michigan St.

Milwaukee, WI 53202

Year of Birth: 1985 | Assistant Treasurer | Indefinite Term; Since August 20, 2018 | N/A | Assistant Vice President, U.S. Bancorp Fund Services, LLC (2007-present). | N/A |

*Mr. Neuberger is deemed to be an “interested person” of the Trust as defined by the 1940 Act due to his position and material business relationship with the Trust.

During the year ended December 31, 2021, the Board held nine meetings, including regular and special meetings. All of the incumbent Trustees attended 100% of the Board meetings and the meetings of the Board committees on which they served. The Trust does not have a policy with respect to Board members’ attendance at shareholder meetings.

Role of the Board

The Board of Trustees provides oversight of the management and operations of the Trust. Like all funds, the day-to-day responsibility for the management and operation of the Trust is the responsibility of various service providers to the Trust and its individual series. The Board is also responsible for appointing officers of the Trust, who are responsible for monitoring and reporting to the Board on the Trust’s day-to-day operations. The Board has also appointed a Chief Compliance Officer who reports directly to the Board and administers the Trust’s compliance program.

Board Leadership Structure

The Board has structured itself in a manner that it believes allows it to perform its oversight function effectively. As noted above, the Board is currently composed of two Independent Trustees – Dr. Michael D. Akers and Mr. Gary A. Drska – and one Interested Trustee – Mr. Joseph C. Neuberger. Accordingly, two-thirds of the members of the Board are Independent Trustees. The Board of Trustees has established three standing committees, an Audit Committee, a Nominating Committee and a Valuation Committee, each of which are discussed in greater detail under “Board Committees” below. Each of the Audit Committee and the Nominating Committee is composed

entirely of Independent Trustees. The Independent Trustees have engaged their own independent counsel to advise them on matters relating to their responsibilities in connection with the Trust.

The Trust’s Chairperson, Mr. Neuberger, is deemed to be an “interested person” of the Trust, as defined by the 1940 Act, due to his position and material business relationship with the Trust. Mr. Neuberger also serves as President of U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services (“Fund Services”), administrator to the Funds. The Trust has not appointed a lead Independent Trustee.

In accordance with the fund governance standards prescribed under the 1940 Act, the Independent Trustees on the Nominating Committee select and nominate all candidates for Independent Trustee positions. Each Trustee and Nominee was appointed to serve on the Board of Trustees because of his or her experience, qualifications, attributes and skills as set forth in the sections entitled “Information about Each Trustee’s Qualification, Experience, Attributes or Skills” and “Information about Each Nominee’s Qualification, Experience, Attributes or Skills” below.

The Board reviews its structure regularly in light of the characteristics and circumstances of the Trust, including: the unaffiliated nature of each investment adviser and the Fund(s) managed by such adviser; the number of Funds that comprise the Trust; the variety of asset classes that those Funds reflect; the net assets of the Trust; the committee structure of the Trust; and the independent distribution arrangements of each of the Funds.

The Board has determined that the function and composition of the Audit Committee and the Nominating Committee are appropriate to address any potential conflicts of interest that may arise from the Chairperson’s status as an Interested Trustee. In addition, the inclusion of all Independent Trustees as members of the Audit Committee and the Nominating Committee allows all such Trustees to participate in the full range of the Board’s oversight duties, including oversight of risk management processes discussed below. Given the specific characteristics and circumstances of the Trust as described above, the Trust has determined that the Board’s leadership structure is appropriate.

Board Oversight of Risk Management

As part of its oversight function, the Board receives and reviews various risk management reports and assessments and discusses these matters with appropriate management and other personnel, including personnel of the Trust’s service providers. Because risk management is a broad concept composed of many elements (such as, for example, investment risk, issuer and counterparty risk, compliance risk, operational risks, business continuity risks, etc.), the oversight of different types of risks is handled in different ways. For example, the Trust’s Chief Compliance Officer regularly reports to the Board during Board meetings and meets in executive session with the Independent Trustees and their legal counsel to discuss compliance and operational risks. In addition, the Independent Trustee designated as the Audit Committee’s “audit committee financial expert” meets with the Treasurer and each Fund’s independent registered public accounting firm to discuss, among other things, the internal control structure of the Trust’s financial reporting function. The full Board receives reports from the investment advisers to the Funds and the portfolio managers as to investment risks as well as other risks that may be discussed during Audit Committee meetings.

Board Committees

The Trust has three standing committees: the Audit Committee, Nominating Committee and Valuation Committee.

Audit Committee. The Audit Committee is composed of all the Independent Trustees, Dr. Michael D. Akers and Mr. Gary A. Drska. The Audit Committee reviews financial statements and other audit-related matters for the Funds. The Audit Committee also holds discussions with management and with each of the Fund’s independent auditors concerning the scope of the audit and the auditors’ independence. Dr. Akers is designated as the Audit Committee chairman and serves as the Audit Committee’s “audit committee financial expert.” The Audit Committee meets regularly with respect to the various series of the Trust. During the year ended December 31, 2021, the Audit Committee held six meetings.

Nominating Committee. The Nominating Committee is composed of the Independent Trustees, Dr. Michael D. Akers and Mr. Gary A. Drska. The Nominating Committee is responsible for seeking and reviewing candidates for consideration as nominees for the position of trustee and meets only as necessary. As part of this

process, the Nominating Committee considers criteria for selecting candidates sufficient to identify a diverse group of qualified individuals to serve as trustees. The Nominating Committee has a charter, a copy of which is included as Exhibit A. During the year ended December 31, 2021, the Nominating Committee held four meetings.

The Nominating Committee will consider nominees recommended by shareholders for vacancies on the Board. Recommendations for consideration by the Nominating Committee should be sent to the President of the Trust in writing together with the appropriate biographical information concerning each such proposed nominee, and such recommendation must comply with the notice provisions set forth in the Trust’s Nominating Committee charter. In general, to comply with such procedures, such nominations, together with all required information, must be delivered to and received by the President of the Trust at the principal executive office of the Trust not later than 60 days prior to the shareholder meeting at which any such nominee would be voted on. Shareholder recommendations for nominations to the Board will be accepted on an ongoing basis and such recommendations will be kept on file for consideration when there is a vacancy on the Board.

Valuation Committee. The Trust has a Valuation Committee. The Valuation Committee is responsible for the following: (1) monitoring the valuation of the Funds’ securities and other investments; and (2) as required, when the Board is not in session, for determining the fair value of illiquid securities and other holdings after consideration of all relevant factors, which determinations are reported to the Board. The Valuation Committee is currently composed of Mr. John Buckel, Ms. Jennifer Lima, Ms. Kelly Strauss and Ms. Melissa Aguinaga, who each serve as an officer of the Trust. The Valuation Committee meets as necessary when a price for a portfolio security is not readily available.

Information about Each Trustee’s Qualification, Experience, Attributes or Skills

The Board believes that each of the Trustees has the qualifications, experience, attributes and skills appropriate to his continued service as a Trustee of the Trust in light of the Trust’s business and structure. The Trustees have substantial business and professional backgrounds that indicate they have the ability to critically review, evaluate and assess information provided to them. Certain of these business and professional experiences are set forth in detail in the table above. In addition, the Trustees have substantial board experience and, in their service to the Trust, have gained substantial insight as to the operation of the Trust.

In addition to the information provided in the table above, below is certain additional information concerning each individual Trustee. The information provided below, and in the table above, is not all-inclusive. Many of the Trustees’ qualifications to serve on the Board involve intangible elements, such as intelligence, integrity, work ethic, the ability to work together, the ability to communicate effectively, the ability to exercise judgment, the ability to ask incisive questions, and commitment to shareholder interests. In conducting its annual self-assessment, the Board has determined that the Trustees have the appropriate attributes and experience to continue to serve effectively as Trustees of the Trust.

Michael D. Akers, Ph.D., CPA. Dr. Akers has served as an Independent Trustee of the Trust since 2001. Dr. Akers previously served as an independent trustee of USA Mutuals, an open-end investment company, from 2001 until June 2021. Dr. Akers has been a Professor Emeritus, Department of Accounting at Marquette University since June 2019, was Professor, Department of Accounting at Marquette University from 2004 to May 2019, was Chair of the Department of Accounting at Marquette University from 2004 to 2017, and was Associate Professor, Department of Accounting at Marquette University from 1996 to 2004. Dr. Akers is a certified public accountant, a certified fraud examiner, a certified internal auditor and a certified management accountant. Through his experience as an investment company trustee and his employment experience, Dr. Akers is experienced with financial, accounting, regulatory and investment matters.

Gary A. Drska. Mr. Drska has served as an Independent Trustee of the Trust since 2001. Mr. Drska previously served as an independent trustee of USA Mutuals from 2001 to June 2021. Mr. Drska previously served as a Pilot of Frontier/Midwest Airlines, Inc., an airline company, from 1986 to September 2021. Through his experience as an investment company trustee, Mr. Drska is experienced with financial, accounting, regulatory and investment matters.

Joseph C. Neuberger. Mr. Neuberger has served as a Trustee of the Trust since 2001. Mr. Neuberger previously served as a trustee of USA Mutuals from 2001 to 2018, and as a trustee of Buffalo Funds, an open-end investment company, from 2003 to 2017. Mr. Neuberger has served as President of Fund Services, a multi-line

service provider to investment companies, since 2017. Mr. Neuberger previously served as Executive Vice President of Fund Services from 1994 to 2017 and as Chief Operating Officer of Fund Services from 2016 to 2020. Through his experience as an investment company trustee and his employment experience, Mr. Neuberger is experienced with financial, accounting, regulatory and investment matters.

Information about Each Nominee’s Qualification, Experience, Attributes or Skills

Vincent P. Lyles. Mr. Lyles has served as System Vice President of Community Relations at Advocate Aurora Health Care since 2019. He served as an Independent Director of BMO Funds, Inc., an open-end investment company, from 2017 until 2022. Mr. Lyles is a board member and finance committee member of Badger Mutual Insurance Company and a Trustee and member of the Committee of Student Experience & Mission on the Board of Trustees at Marquette University. Mr. Lyles previously served as President and Chief Executive Officer of the Boys & Girls Club of Greater Milwaukee (2012-2018), President of M&I Community Development Corporation (2006-2011), and as a Director of Public Finance of Robert W. Baird & Co. (1995-2006). He received his Juris Doctor degree from the University of Wisconsin-Madison Law School in 1987. Through his experience as an investment company trustee and his employment experience, Mr. Lyles is experienced with legal, financial, accounting, regulatory and investment matters.

Erik K. Olstein. Mr. Olstein served as President and Chief Operating Officer (2000-2020) and Vice President of Sales and Chief Operating Officer (1995-2000) at Olstein Capital Management, L.P., an asset management firm he co-founded. During his time at Olstein Capital Management, L.P., Mr. Olstein was responsible for fiduciary oversight and management of The Olstein Funds, an open-end investment company, where he served as Trustee, Secretary and Assistant Treasurer from 1995 to 2018. Mr. Olstein currently serves as President and Trustee of the Board of Trustees of the Trinity-Pawling School and has previously held Board positions with the American Friends of the National Museum of the Royal Navy, National Maritime Historical Society and U.S. Naval Service Personal Education Assistance Fund. Through his experience as an investment company trustee and his employment experience, Mr. Olstein is experienced with financial, accounting, regulatory and investment matters.

Lisa Zúñiga Ramírez, CFA®, FSA. Ms. Ramírez served as Senior Portfolio Manager at Segall Bryant & Hamill, LLC, an asset management firm, from 2018 to 2020. She served as Partner and Senior Portfolio Manager (2009-2018), Partner and Senior Equity Analyst (2002-2009) and Equity Analyst (1997-2002) at Denver Investments, LLC, an asset management firm that was acquired by Segall Bryant & Hamill, LLC in 2018. Ms. Ramírez currently serves as an Independent Director on the Bow River Capital Advisory Board, an asset management firm, and is a Director of the Denver Employees Retirement Plan. In addition, she serves on the boards of The Denver Foundation, NACD (National Association of Corporate Directors) Colorado Chapter, Latinas First Foundation and Vuela for Health. Ms. Ramírez is a CFA® charterholder (CFA® is a registered trademark owned by the CFA Institute) and holds the Fundamentals of Sustainability Accounting (FSA) credential from the Sustainability Accounting Standards Board. Through her employment experience, Ms. Ramírez is experienced with financial, accounting, ESG (environmental, social and governance), regulatory and investment matters.

Gregory M. Wesley. Mr. Wesley has served as Senior Vice President of Strategic Alliances and Business Development at the Medical College of Wisconsin since 2016. Prior to his current role at the Medical College of Wisconsin, he was a Partner at MWH Law Group LLP, a law firm (2016), and a Partner at Gonzalez, Saggio & Harlan LLP, a law firm (2002-2016). Mr. Wesley serves on the Board of Directors of the Metropolitan Milwaukee Association of Commerce, MHS Health Wisconsin, Versiti, Inc., and the Greater Milwaukee Committee. He also serves on the Board of Trustees of the Johnson Foundation at Wingspread and the Greater Milwaukee Foundation. He previously sat on the Board of Trustees of the Medical College of Wisconsin (2009-2016) and the Board of Directors of Park Bank Milwaukee (2015-2020). Mr. Wesley received his Juris Doctor degree from the University of Wisconsin-Madison Law School in 1997. Through his sustained employment and board experience, Mr. Wesley is experienced with legal, financial, accounting, regulatory and investment matters.

Ownership of Securities

As of February 7, 2022, no Trustee, Nominee or officer of the Trust beneficially owned shares of any of the Funds.

Furthermore, as of February 7, 2022, neither the Independent Trustees, Nominees nor members of their immediate families, owned securities beneficially, or of record, in any investment adviser to the Funds, any principal

underwriter to the Funds or any of their respective affiliates. In addition, during the past five years, neither the Independent Trustees, the Nominees nor members of their immediate families have had a direct or indirect interest, the value of which exceeds $120,000 in: (i) any investment adviser to the Funds, any principal underwriter of the Funds or any of their respective affiliates, or (ii) any transaction or relationship in which such entity, the Funds, any officer of the Trust, or any of their affiliates was a party.

Compensation

The Independent Trustees receive from the Trust a retainer fee of $58,000 per year, $4,500 for each regular Board meeting attended and $1,000 for each special Board meeting attended telephonically, as well as reimbursement for expenses incurred in connection with attendance at Board meetings.(1) Members of the Audit Committee receive $2,000 for each meeting of the Audit Committee attended.(2) The chairman of the Audit Committee receives an annual retainer of $2,500. Interested Trustees do not receive any compensation for their service as Trustee. For the year ended December 31, 2021, the Trustees received the following compensation from the Trust:

| | | | | | | | | | | | | | |

| Name of Person/Position | Aggregate Compensation from the Trust(3) | Pension or Retirement Benefits Accrued as Part of Fund Expenses | Estimated Annual Benefits Upon Retirement | Total Compensation from the Trust(4) Paid to Trustees |

Dr. Michael D. Akers, Independent Trustee(5)(6) | $98,333 | None | None | $98,333 |

Gary A. Drska, Independent Trustee(5) | $95,833 | None | None | $95,833 |

Jonas B. Siegel, Independent Trustee(7) | $59,750 | None | None | $59,750 |

| Joseph C. Neuberger, Interested Trustee | None | None | None | None |

(1)Prior to May 1, 2021, the Independent Trustees received a retainer fee of $52,250 per year, and $4,000 for each regular Board meeting attended and $1,000 for each special Board meeting attended.

(2)Prior to May 1, 2021, members of the Audit Committee received $1,750 for each meeting of the Audit Committee attended.

(3)Trustees’ fees and expenses are allocated among each series comprising the Trust.

(4)There are currently 24 series comprising the Trust.

(5)Audit Committee member.

(6)Audit Committee chairman.

(7)Mr. Siegel retired as a Trustee of the Trust effective May 25, 2021.

PROPOSAL 2 – ADJOURNMENTS OF THE SPECIAL MEETING

The purpose of this Proposal 2 is to authorize the holder of proxies solicited under this Proxy Statement to vote the shares represented by the proxies in favor of the adjournment of the Special Meeting from time to time in order to allow more time to solicit additional proxies, as necessary, if there are insufficient votes at the time of the Special Meeting to constitute a quorum.

THE BOARD RECOMMENDS THAT SHAREHOLDERS OF THE TRUST

VOTE “FOR” APPROVAL OF ADJOURNMENTS.

GENERAL INFORMATION

Solicitation of Proxies

Proxies will be solicited by the Trust primarily by mail. The solicitation may also include telephone, facsimile, electronic or oral communications by certain officers or employees of the Trust, none of whom will be paid for these services, or by a third-party proxy solicitation firm. The Trust has retained AST Fund Solutions, LLC to assist in the solicitation of proxies. The costs (including the costs of printing, mailing, tabulating, and soliciting proxies) associated with the Special Meeting will be paid by the Trust and are estimated to be approximately $383,620 in the aggregate. The Trust may also request broker-dealer firms, custodians, nominees and fiduciaries to forward proxy materials to the beneficial owners of the shares of the Funds held of record by such persons. The

Trust may reimburse such broker-dealer firms, custodians, nominees and fiduciaries for their reasonable expenses incurred in connection with such proxy solicitation, including reasonable expenses in communicating with persons for whom they hold shares of a Fund.

If sufficient votes are not received by the date of the Special Meeting, a person named as proxy may propose one or more adjournments of the Special Meeting to permit further solicitation of proxies.

Householding

If possible, depending on shareholder registration and address information, and unless you have otherwise opted out, only one copy of this Proxy Statement will be sent to shareholders at the same address. However, each shareholder will receive separate Proxy Cards. If you currently receive multiple copies of Proxy Statements or shareholder reports and would like to request to receive a single copy of documents in the future, please call the toll-free number previously disclosed in this Proxy Statement shown opposite your Fund’s name or write to the Funds at 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Voting Proxies

You should read the entire Proxy Statement before voting. If you sign and return the accompanying Proxy Card, you may revoke it by giving written notice of such revocation to the Secretary of the Trust prior to the Special Meeting or by delivering a subsequently dated proxy card or by attending and voting at the Special Meeting in person. Proxies voted by telephone or internet may be revoked at any time before they are voted by proxy voting again through the website or toll-free number listed in the enclosed proxy card. Properly executed proxies will be voted, as you instruct, by the persons named in the accompanying proxy card. In the absence of such direction, however, the persons named in the accompanying proxy card intend to vote “FOR” the Proposals and may vote at their discretion with respect to other matters not now known to the Board that may be presented at the Special Meeting. Attendance by a shareholder at the Special Meeting does not, in itself, revoke a proxy.

Quorum Required

The Trust must have a quorum of shares represented at the Special Meeting, in person or by proxy, to take action on any matter relating to the Trust. A quorum is constituted by the presence in person or by proxy of at least one-third of the aggregate number of outstanding shares of the Trust entitled to vote on a Proposal at the Special Meeting.

Abstentions and Broker Non-Votes

For purposes of determining the presence of a quorum for Proposal 1 and Proposal 2, abstentions and broker “non-votes” will be counted as outstanding and entitled to vote for purposes of determining whether a quorum is present at the Special Meeting, but will not be counted as shares voted with respect to the Proposals. Broker “non-votes” occur when a nominee holding Shares for a beneficial owner does not vote on a proposal because the nominee does not have discretionary voting powers with respect to that proposal and has not received instructions from the beneficial owner. Abstentions and broker non-votes will have no effect on the vote on Proposal 1. Abstentions and broker non-votes will have the effect of an “against” vote on Proposal 2 since such shares are not voted in favor of the Proposal.

Adjournment

One or more adjournments of the Special Meeting may be made without notice other than an announcement at the Special Meeting, to the extent permitted by applicable law and the Trust’s governing documents. Any adjournment of the Special Meeting must be held within a reasonable time after the date set for the Special Meeting. Any adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow the Trust’s shareholders who have already sent in their proxies to revoke them at any time before their use at the Special Meeting, as adjourned.

Required Vote

Proposal 1: The election of the Nominees will be voted upon separately by shareholders of the Funds of the Trust in the aggregate; that is, regardless of the Fund in which you are a shareholder, you have the right to vote for or to withhold your vote for each Nominee on a one vote per share basis without differentiation between the separate Funds. The Nominees will be elected as Trustees if they receive the affirmative vote of a plurality of votes cast by all shares of the Trust in the aggregate at the Special Meeting at which a quorum is present. A plurality vote means that the four Nominees that receive the largest number of votes will be elected as Trustees. Because the Nominees are running unopposed, all four Nominees are expected to be elected as Trustees as all Nominees who receive votes in favor will be elected, while votes not cast or votes to withhold will have no effect on the election outcome.

Proposal 2: The approval of any adjournment(s) of the Special Meeting requires the vote of a majority of the votes cast, either in person or by proxy, at the Special Meeting, even if the number of votes cast is fewer than the number required for a quorum.

OTHER INFORMATION ABOUT THE FUNDS

Information About Investment Advisers to the Funds

The investment advisers to the Funds, and their respective addresses, are as follows:

| | | | | | | | |

| Fund/Fund Family | Investment Adviser | Principal Business Address |

| Barrett Growth Fund | Barrett Asset Management, LLC | 90 Park Avenue,

New York, NY 10016 |

Bright Rock Funds Bright Rock Mid Cap Growth Fund Bright Rock Quality Large Cap Fund | Bright Rock Capital Management, LLC | 2036 Washington Street,

Hanover, Massachusetts 02339 |

| Convergence Long/Short Equity Fund | Convergence Investment Partners, LLC | 3801 PGA Boulevard, Suite 1001, Palm Beach Gardens, FL 33410 |

CrossingBridge Funds CrossingBridge Low Duration High Yield Fund CrossingBridge Pre-Merger SPAC ETF CrossingBridge Responsible Credit Fund CrossingBridge Ultra-Short Duration Fund | CrossingBridge Advisors, LLC | 427 Bedford Road, Suite 230, Pleasantville, New York 10570 |

| Dearborn Partners Rising Dividend Fund | Dearborn Partners L.L.C. | 200 West Madison Street, Suite 1950, Chicago, Illinois 60606 |

Jensen Funds Jensen Global Quality Growth Fund Jensen Quality Value Fund | Jensen Investment Management, Inc. | 5500 Meadows Road, Suite 200, Lake Oswego, Oregon 97035-3623 |

| Mairs & Power Minnesota Municipal Bond ETF | Mairs & Power, Inc. | W1520 First National Bank Building, 332 Minnesota Street,

St. Paul, Minnesota 55101 |

| Marketfield Fund | Marketfield Asset Management LLC | 369 Lexington Avenue, 3rd Floor, New York, New York 10017 |

Performance Trust Funds Performance Trust Credit Fund Performance Trust Municipal Bond Fund Performance Trust Strategic Bond Fund | PT Asset Management, LLC | 500 West Madison, Suite 470, Chicago, Illinois 60661 |

| | | | | | | | |

| Fund/Fund Family | Investment Adviser | Principal Business Address |

PMC Funds PMC Core Fixed Income Fund* PMC Diversified Equity Fund | Envestnet Asset Management, Inc.

*Sub-advised by Neuberger Berman Investment Advisers, LLC | 35 East Wacker Drive, Suite 2400, Chicago, Illinois 60601

*NBIA’s principal business address is 190 South LaSalle Street, Suite 2400, Chicago, Illinois 60603 |

Rockefeller Funds Rockefeller Climate Solutions Fund Rockefeller Core Taxable Bond Fund Rockefeller Equity Allocation Fund Rockefeller Intermediate Tax Exempt National Bond Fund Rockefeller Intermediate Tax Exempt New York Bond Fund | Rockefeller & Co. LLC (d/b/a Rockefeller Capital Management) | 45 Rockefeller Plaza, Fifth Floor, New York, New York 10111 |

| Terra Firma US Concentrated Realty Equity Fund | Terra Firma Asset Management, LLC | 75 Broadway Street, Suite 202,

San Francisco, California, 94111 |

Information about Other Service Providers to the Funds

Quasar Distributors, LLC, 111 East Kilbourn Avenue, Suite 2200, Milwaukee, Wisconsin 53202, serves as principal underwriter to the following Funds:

| | | | | |

| Barrett Growth Fund | Jensen Quality Value Fund |

| Bright Rock Mid Cap Growth Fund | Marketfield Fund |

| Bright Rock Quality Large Cap Fund | Rockefeller Climate Solutions Fund |

| Convergence Long/Short Equity Fund | Rockefeller Core Taxable Bond Fund |

| CrossingBridge Low Duration High Yield Fund | Rockefeller Equity Allocation Fund |

| CrossingBridge Responsible Credit Fund | Rockefeller Intermediate Tax Exempt National Bond Fund |

| CrossingBridge Ultra-Short Duration Fund | Rockefeller Intermediate Tax Exempt New York Bond Fund |

| Dearborn Partners Rising Dividend Fund | Terra Firma US Concentrated Realty Equity Fund |

| Jensen Global Quality Growth Fund | |

Foreside Fund Services, LLC, Three Canal Plaza, Suite 100, Portland, Maine 04101, serves as principal underwriter to the following Funds:

| | | | | |

| CrossingBridge Pre-Merger SPAC ETF | Performance Trust Strategic Bond Fund |

| Mairs & Power Minnesota Municipal Bond ETF | PMC Core Fixed Income Fund |

| Performance Trust Credit Fund | PMC Diversified Equity Fund |

| Performance Trust Municipal Bond Fund | |

The Funds’ administrator, transfer agent and dividend disbursing agent is U.S. Bancorp Fund Services, LLC (doing business as U.S. Bank Global Fund Services), 615 East Michigan Street, Milwaukee, Wisconsin 53202.

Information About the Independent Public Accounting Firms for the Funds

Cohen & Company, Ltd. (“Cohen”), 1350 Euclid Avenue, Suite 800, Cleveland, Ohio 44115, serves as the independent registered public accounting firm for the following Funds:

| | | | | |

| Barrett Growth Fund | Jensen Quality Value Fund |

| Convergence Long/Short Equity Fund | Jensen Global Quality Growth Fund |

| CrossingBridge Low Duration High Yield Fund | Mairs & Power Minnesota Municipal Bond ETF |

| | | | | |

| CrossingBridge Pre-Merger SPAC ETF | Performance Trust Credit Fund |

| CrossingBridge Responsible Credit Fund | Performance Trust Municipal Bond Fund |

| CrossingBridge Ultra-Short Duration Fund | Performance Trust Strategic Bond Fund |

| Dearborn Partners Rising Dividend Fund | |

Deloitte & Touche LLP (“Deloitte”), 111 South Wacker Drive, Chicago, Illinois 60606 serves as the independent registered public accounting firm for the following Funds:

| | | | | |

| Bright Rock Mid Cap Growth Fund | Rockefeller Core Taxable Bond Fund |

| Bright Rock Quality Large Cap Fund | Rockefeller Equity Allocation Fund |

| Marketfield Fund | Rockefeller Intermediate Tax Exempt National Bond Fund |

| PMC Core Fixed Income Fund | Rockefeller Intermediate Tax Exempt New York Bond Fund |

| PMC Diversified Equity Fund | Terra Firma US Concentrated Realty Equity Fund |

| Rockefeller Climate Solutions Fund | |

Further information about Cohen and Deloitte (the “Auditors”) can be found in Exhibit B. Representatives of the Auditors are not expected to be in attendance at the Special Meeting.

Outstanding Shares of the Funds and Shareholders Entitled to Vote

The Trust currently offers shares of 24 series which are operational, each of which represents a separate investment portfolio. The record holders of outstanding shares of each series of the Trust are entitled to vote one vote per share (and a fractional vote per fractional share) on all matters presented at the Special Meeting with respect to the Trust and not any individual series of the Trust, including the Proposals. Shareholders of the Trust at the close of business on February 7, 2022, the Record Date, will be entitled to be present and vote at the Special Meeting. As of that date, there were 534,673,510.963 shares of the Trust outstanding and entitled to vote, representing total net assets of approximately $11,627,003,481 of the Trust.

| | | | | | | | |

| Fund and Class | | Number of Issued and

Outstanding Shares |

| | |

| Barrett Growth Fund | | 1,149,219.387 |

| | |

| Bright Rock Mid Cap Growth Fund | |

| Institutional Class | | 3,844,796.443 |

| Investor Class | | not currently offered |

| | |

| Bright Rock Quality Large Cap Fund | |

| Institutional Class | | 15,163,760.847 |

| Investor Class | | not currently offered |

| | |

| Convergence Long/Short Equity Fund | |

| Institutional Class | | 1,698,633.966 |

| | |

| CrossingBridge Low Duration High Yield Fund | |

| Investor Class | | not currently offered |

| Institutional Class | | 45,646,190.398 |

| | |

| CrossingBridge Pre-Merger SPAC ETF | 2,390,000.000 |

| | |

| CrossingBridge Responsible Credit Fund | 1,690,497.366 |

| Institutional Class | | |

| | |

| CrossingBridge Ultra-Short Duration Fund | 5,990,334.641 |

| Institutional Class | | |

| | | | | | | | |

| Fund and Class | | Number of Issued and

Outstanding Shares |

| | |

| Dearborn Partners Rising Dividend Fund | |

| Class A | | 6,904,710.179 |

| Class C | | 5,205,037.639 |

| Class I | | 9,719,597.000 |

| | |

| Jensen Global Quality Growth Fund | |

| I Shares | | 2,227,577.889 |

| J Shares | | 145,858.648 |

| Y Shares | | 170,353.111 |

| | |

| Jensen Quality Value Fund | |

| I Shares | | 6,210,534.308 |

| J Shares | | 2,622,931.360 |

| Y Shares | | 3,129,851.369 |

| | |

| Mairs & Power Minnesota Municipal Bond ETF | 740,000.000 |

| | |

| Marketfield Fund | | |

| Class A | | 2,222,382.181 |

| Class C | | 768,852.438 |

| Class I | | 3,933,012.086 |

| | |

| Performance Trust Credit Fund | |

| Institutional Class | | 3,424,205.860 |

| | |

| Performance Trust Municipal Bond Fund | |

| Institutional Class | | 3,703,299.858 |

| Class A | | 2,297,988.272 |

| | |

| Performance Trust Strategic Bond Fund | |

| Institutional Class | | 299,074,306.158 |

| Class A | | 1,544,558.217 |

| Class C | | 2,644,008.612 |

| | |

| PMC Core Fixed Income Fund | |

| Advisor Class | | 3,546,497.867 |

| Institutional Class | | 25,113,729.697 |

| | |

| PMC Diversified Equity Fund | |

| Advisor Class | | 4,768,844.190 |

| Institutional Class | | 32,044,939.488 |

| | |

| Rockefeller Climate Solutions Fund | |

| Institutional Class | | 98,339.698 |

| Class A | | 11,370,824.280 |

| | |

| Rockefeller Core Taxable Bond Fund | |

| Institutional Class | | 6,256,900.056 |

| Advisor Class | | not currently offered |

| | |

| Rockefeller Equity Allocation Fund | |

| Institutional Class | | 5,245,709.991 |

| Advisor Class | | not currently offered |

| | |

| Rockefeller Intermediate Tax Exempt National Bond Fund |

| | | | | | | | |

| Fund and Class | | Number of Issued and

Outstanding Shares |

| Institutional Class | | 7,599,290.148 |

| Advisor Class | | not currently offered |

| | |

| Rockefeller Intermediate Tax Exempt New York Bond Fund |

| Institutional Class | | 3,876,159.251 |

| Advisor Class | | not currently offered |

| | |

| Terra Firma US Concentrated Realty Equity Fund |

| Institutional Class | | 383,251.441 |

| Open Class | | 1,255,746.010 |

Principal Holders of Trust for Professional Managers (all Funds combined)

A principal shareholder is any person who owns of record or beneficially 5% or more of the outstanding Shares of a Fund. A control person is a shareholder that owns beneficially or through controlled companies more than 25% of the voting securities of a Fund or acknowledges the existence of control. A controlling person possesses the ability to control the outcome of matters submitted for shareholder vote by the Funds. As of the Record Date, no person was a control person of any Fund, and all Trustees, Nominees and officers of the Trust as a group owned beneficially (as defined in Section 13(d) of the Securities Exchange Act of 1934) less than 1% of each share class of each Fund and the Trust as a whole.

As of the Record Date, the following shareholders were considered to be principal shareholders of the Funds:

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| | | | |

| Barrett Growth Fund | Charles Schwab & Co., Inc.

211 Main Street

San Francisco, CA 94105-1905 | 414,025.989 | 36.03% | Record |

| Mid Atlantic Trust Company FBO

Barrett Asset Management LLC

401K Profit Sharing Plan & Trust

1251 Waterfront Place, Suite 525

Pittsburgh, PA 15222-4228 | 85,163.022 | 7.41% | Record |

| Elizabeth Swope GST Tax Exempt Trust

c/o Barrett Asset Management, LLC

90 Park Avenue

New York, New York 10016-3101 | 83,721.540 | 7.29% | Beneficial |

| | | | |

| Bright Rock Mid Cap Growth Fund | | | |

| Institutional Class | SEI Private Trust Company

FBO Rockland Trust Company

1 Freedom Valley Drive

Oaks, PA 19456-9989 | 3,784,828.902 | 98.44% | Record |

| | | | |

| Bright Rock Quality Large Cap Fund | | | |

| Institutional Class | SEI Private Trust Company

FBO Rockland Trust Company

1 Freedom Valley Drive

Oaks, PA 19456-9989 | 14,654,247.702 | 96.64% | Record |

| | | | |

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| Convergence Long/Short Equity Fund | | | |

| Institutional Class | Charles Schwab & Company, Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105-1905 | 928,851.852 | 54.68% | Record |

| National Financial Services LLC

499 Washington Boulevard, 4th Floor

Jersey City, NJ 07310-1995 | 433,959.595 | 25.55% | Record |

| JP Morgan Securities LLC

1 Metrotech Center North, Floor 3

Brooklyn, NY 11201-3873 | 156,583.305 | 9.22% | Record |

| | | | |

| CrossingBridge Low Duration High Yield Fund | | | |

| Institutional Class | Charles Schwab & Company, Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105-1905 | 13,875,234.062 | 30.40% | Record |

| National Financial Services LLC

499 Washington Boulevard, 4th Floor

Jersey City, NJ 07310-1995 | 12,693,754.543 | 27.81% | Record |

| SEI Private Trust Company

Attn Mutual Funds

One Freedom Valley Drive

Oaks, PA 19456-9989 | 3,860,560.408 | 8.46% | Record |

| LPL Financial

FBO Customer Accounts

Attn Mutual Fund Operations

4707 Executive Drive

San Diego, CA 92121-3091 | 3,048,749.346 | 6.68% | Record |

| | | | |

| CrossingBridge Pre-Merger SPAC ETF | | | |

| TD Ameritrade, Inc.

For the Exclusive Benefit of Our Clients

P.O. Box 2226

Omaha, NE 68103-2226 | 1,327,857.000 | 55.56% | Record |

| Charles Schwab & Company, Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105-1905 | 408,363.000 | 17.09% | Record |

| RBC Capital Markets

3 World Financial Center

200 Vesey Street, 9th Floor

New York, NY 10281 | 255,553.000 | 10.69% | Record |

| National Financial Services LLC

499 Washington Boulevard, 4th Floor

Jersey City, NJ 07310-1995 | 140,153.000 | 5.86% | Record |

| | | | |

| CrossingBridge Responsible Credit Fund | | | |

| Institutional Class | Charles Schwab & Company, Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105-1905 | 1,408,862.379 | 83.34% | Record |

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| CrossingBridge Advisors LLC

427 Bedford Road, Suite 230

Pleasantville, NY 10570-3059 | 101,469.331 | 6.00% | Record |

| | | | |

| CrossingBridge Ultra-Short Duration Fund | | | |

| Institutional Class | National Financial Services LLC

499 Washington Boulevard, 4th Floor

Jersey City, NJ 07310-1995 | 5,481,650.271 | 91.51% | Record |

| Charles Schwab & Company, Inc.

Special Custody A/C FBO Customers

Attn: Mutual Funds

211 Main Street

San Francisco, CA 94105-1905 | 333,412.613 | 5.57% | Record |

| | | | |

| Dearborn Partners Rising Dividend Fund | | | |

| Class A | Charles Schwab & Co., Inc.

Special Custody Acct FBO Customers

Attn: Mutual Funds

211 Main St

San Francisco, CA 94105-1905 | 3,083,489.195 | 44.66% | Record |

| Pershing, LLC

PO Box 2052

Jersey City, NJ 07303-2052 | 2,598,487.290 | 37.63% | Record |

| | | | |

| Class C | Charles Schwab & Co., Inc.

Special Custody Acct FBO Customers

Attn: Mutual Funds

211 Main St

San Francisco, CA 94105-1905 | 2,985,875.434 | 57.37% | Record |

| Pershing, LLC

PO Box 2052

Jersey City, NJ 07303-2052 | 692,583.609 | 13.31% | Record |

| | | | |

| Class I | Charles Schwab & Co., Inc.

Special Custody Acct FBO Customers

Attn: Mutual Funds

211 Main St

San Francisco, CA 94105-1905 | 3,407,373.395 | 35.06% | Record |

| Pershing, LLC

PO Box 2052

Jersey City, NJ 07303-2052 | 1,256,906.523 | 12.93% | Record |

| | | | |

| Jensen Global Quality Growth Fund | | | |

| I Shares | Charles Schwab & Co., Inc.

Reinvestment Account

Special Custody Account FBO Its Customers

211 Main Street

San Francisco, CA 94105-1905 | 125,688.815 | 86.17% | Record |

| Eric H. Schoenstein & Kelly K.Douglas JTWROS

c/o Jensen Investments Management, Inc.

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-3623 | 20,169.833 | 13.83% | Beneficial |

| | | | |

| J Shares | Wells Fargo Clearing Services LLC

1 North Jefferson Avenue

MSC MO3970

St. Louis, MO 63103-2287 | 99,529.362 | 58.43% | Record |

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| Charles Schwab & Co., Inc.

Reinvestment Account

Special Custody Account FBO Its Customers

211 Main Street

San Francisco, CA 94105-1905 | 46,144.383 | 27.09% | Record |

| Eric H. Schoenstein & Kelly K.Douglas JTWROS

c/o Jensen Investments Management, Inc.

5500 Meadows Road, Suite 200

Lake Oswego, OR 97035-3623 | 20,113.298 | 11.81% | Beneficial |

| | | | |

| Y Shares | Pershing, LLC

PO Box 2052

Jersey City, NJ 07303-2052 | 2,083,400.409 | 93.53% | Record |

| | | | |

| Jensen Quality Value Fund | | | |

| I Shares | Raymond James

Omnibus for Mutual Funds

880 Carillon Parkway

St. Petersburg, FL 33716-1100 | 2,958,180.376 | 47.63% | Record |

| National Financial Services, LLC

For the Exclusive Benefit of Customers

Attn: Mutual Funds Dept.

499 West Washington Boulevard, 5th Floor

Jersey City, NJ 07310-2010 | 1,291,467.095 | 20.79% | Record |

| Charles Schwab & Co., Inc.

Reinvestment Account

Special Custody Account FBO Its Customers

211 Main Street

San Francisco, CA 94105-1905 | 641,997.661 | 10.34% | Record |

| TD Ameritrade, Inc.

For the Exclusive Benefit of Our Clients

P.O. Box 2226

Omaha, NE 68103-2226 | 456,255.316 | 7.35% | Record |

| Pershing LLC

1 Pershing Plaza

Jersey City, NJ 07399-0001 | 256,687.413 | 4.13% | Record |

| | | | |

| J Shares | Charles Schwab & Co., Inc.

Reinvestment Account

Special Custody Account FBO Its Customers

211 Main Street

San Francisco, CA 94105-1905 | 1,079,731.646 | 41.17% | Record |

| National Financial Services, LLC

For the Exclusive Benefit of Customers

Attn: Mutual Funds Dept.

499 West Washington Boulevard, 5th Floor

Jersey City, NJ 07310-2010 | 883,125.390 | 33.67% | Record |

| TD Ameritrade, Inc.

For the Exclusive Benefit of Our Clients

P.O. Box 2226

Omaha, NE 68103-2226 | 228,905.925 | 8.73% | Record |

| Wells Fargo Clearing Services LLC

1 North Jefferson Avenue

MSC MO3970

St. Louis, MO 63103-2287 | 115,290.025 | 4.40% | Record |

| | | | |

| Y Shares | Pershing, LLC

PO Box 2052

Jersey City, NJ 07303-2052 | 2,899,993.139 | 92.66% | Record |

| | | | |

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| Mairs & Power Minnesota Municipal Bond ETF | | | |

| Charles Schwab & Co., Inc.

Reinvestment Account

Special Custody Account FBO Its Customers

211 Main Street

San Francisco, CA 94105-1905 | 265,753.000 | 35.91% | Record |

| TD Ameritrade, Inc.

For the Exclusive Benefit of Our Clients

P.O. Box 2226

Omaha, NE 68103-2226 | 157,169.000 | 21.24% | Record |

| National Financial Services, LLC

For the Exclusive Benefit of Customers

Attn: Mutual Funds Dept.

499 West Washington Boulevard, 5th Floor

Jersey City, NJ 07310-2010 | 116,303.000 | 15.72% | Record |

| Vanguard Brokerage Services

P.O. Box 1170

Valley Forge, PA 19482-1170 | 64,015.000 | 8.65% | Record |

| Goldman Sachs Asset Management, L.P.

200 West Street

New York, NY 10282 | 44,788.000 | 6.05% | Record |

| | | | |

| Marketfield Fund | | | | |

| Class A | Morgan Stanley Smith Barney LLC

1 New York Plaza, Floor 12

New York, NY 10004-1965 | 429,819.454 | 19.34% | Record |

| National Financial Services, LLC

499 Washington Boulevard

Jersey City, NJ 07310-1995 | 358,335.012 | 16.12% | Record |

| Merrill Lynch Pierce, Fenner & Smith

For the Sole Benefit of its Customers

4800 Deer Lake Drive East

Jacksonville, FL 32246-6484 | 312,344.254 | 14.05% | Record |

| LPL Financial

Omnibus Customer Account

4707 Executive Drive

San Diego, CA 92121-3091 | 137,717.465 | 6.20% | Record |

| Charles Schwab & Co. Inc.

211 Main Street

San Francisco, CA 94105-1905 | 130,866.641 | 5.89% | Record |

| Wells Fargo Clearing Services LLC

Special Custody Account for the Exclusive Benefit of Customers

2801 Market Street

St. Louis, MO 63103-2523 | 118,092.064 | 5.31% | Record |

| | | | |

| Class C | UBS WM USA Special Custody Account 1000 Harbor Boulevard, 5th Floor Weehawken, NJ 07086-6761 | 251,142.265 | 32.66% | Record |

| Wells Fargo Clearing Services LLC

Special Custody Account for the Exclusive Benefit of Customers

2801 Market Street

St. Louis, MO 63103-2523 | 246,842.303 | 32.11% | Record |

| Pershing LLC

1 Pershing Plaza

Jersey City, NJ 07399-0002 | 91,859.516 | 11.95% | Record |

| National Financial Services, LLC

499 Washington Boulevard

Jersey City, NJ 07310-1995 | 39,001.465 | 5.07% | Record |

| | | | |

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| Class I | UBS WM USA Special Custody Account 1000 Harbor Boulevard, 5th Floor Weehawken, NJ 07086-6761 | 561,265.474 | 14.27% | Record |

| National Financial Services, LLC

499 Washington Boulevard

Jersey City, NJ 07310-1995 | 555,919.875 | 14.13% | Record |

| Charles Schwab & Co. Inc.

211 Main Street

San Francisco, CA 94105-1905 | 406,700.658 | 10.34% | Record |

| Michael Shaoul

c/o Marketfield Asset Management

369 Lexington Avenue, 3rd Floor

New York, NY 10017 | 404,374.903 | 10.28% | Beneficial |

| Wells Fargo Clearing Services LLC

Special Custody Account for the Exclusive Benefit of Customers

2801 Market Street

St. Louis, MO 63103-2523 | 297,194.595 | 7.56% | Record |

| TD Ameritrade Inc. For the Exclusive Benefit of Our Clients P.O. Box 2226 Omaha, NE 68103-2226 | 281,283.606 | 7.15% | Record |

| | | | |

| Performance Trust Credit Fund | | | |

| Institutional Class | Charles Schwab & Co. Inc.

211 Main Street

San Francisco, CA 94105-1905 | 1,703,406.190 | 49.75% | Record |

| Byline Bank - Wealth Management

820 Church Street

Evanston, IL 60201-5603 | 759,526.196 | 22.18% | Record |

| TD Ameritrade Inc.

P.O. Box 2226

Omaha, NE 68103-2226 | 547,639.105 | 15.99% | Record |

| National Financial Services LLC

499 Washington Boulevard

Jersey City, NJ 07310-1995 | 315,150.557 | 9.20% | Record |

| | | | |

| Performance Trust Municipal Bond Fund | | | |

| Institutional Class | Charles Schwab & Co. Inc.

211 Main Street

San Francisco, CA 94105-1905 | 9,635,318.544 | 26.99% | Record |

| National Financial Services LLC

499 Washington Boulevard

Jersey City, NJ 07310-1995 | 7,078,295.215 | 19.83% | Record |

| Raymond James

880 Carillion Parkway

St. Petersburg, FL 33716-1100 | 6,616,331.641 | 18.53% | Record |

| UBS WM USA

1000 Harbor Boulevard

Weehawken, NJ 07086-6761 | 3,423,048.180 | 9.59% | Record |

| TD Ameritrade Inc.

P.O. Box 2226

Omaha, NE 68103-2226 | 3,200,850.357 | 8.97% | Record |

| LPL Financial

4707 Executive Drive

San Diego, CA 92121-3091 | 2,630,479.046 | 7.37% | Record |

| | | | |

| Class A | Charles Schwab & Co. Inc

211 Main Street

San Francisco, CA 94105-1905 | 1,441,065.154 | 62.71% | Record |

| | | | | | | | | | | | | | |

| Fund and Class | Name and Address | Number of Shares | %

Ownership | Type of

Ownership |

| National Financial Services LLC

499 Washington Boulevard

Jersey City, NJ 07310-1995 | 428,111.779 | 18.63% | Record |

| Raymond James

880 Carillion Parkway

St. Petersburg, FL 33716-1100 | 225,299.902 | 9.80% | Record |

| TD Ameritrade Inc.

P.O. Box 2226