Semi-Annual Report

Convergence Long/Short Equity ETF

(CLSE)

May 31, 2023

Investment Adviser

Convergence Investment Partners, LLC

3801 PGA Boulevard

Suite 1001

Palm Beach Gardens, Florida 33410

Phone: 877-677-9414

Table of Contents

| LETTER TO SHAREHOLDERS | 3 |

| EXPENSE EXAMPLES | 7 |

| INVESTMENT HIGHLIGHTS | 8 |

| SCHEDULE OF INVESTMENTS | 11 |

| SCHEDULE OF SECURITIES SOLD SHORT | 18 |

| STATEMENT OF ASSETS AND LIABILITIES | 26 |

| STATEMENT OF OPERATIONS | 27 |

| STATEMENTS OF CHANGES IN NET ASSETS | 28 |

| STATEMENT OF CASH FLOWS | 29 |

| FINANCIAL HIGHLIGHTS | 30 |

| NOTES TO FINANCIAL STATEMENTS | 32 |

| STATEMENT REGARDING LIQUIDITY RISK MANAGEMENT PROGRAM | 41 |

| NOTICE OF PRIVACY POLICY & PRACTICES | 42 |

| ADDITIONAL INFORMATION | 43 |

Convergence Investment Partners

2023 Semi-Annual Shareholder Report

Convergence Long/Short Equity ETF (CLSE)

Shareholder Letter (Unaudited)

Dear Shareholder:

We are pleased to provide the semi-annual report of the Convergence Long/Short Equity ETF (the “ETF”) for the six-month period ended May 31, 2023. The net asset value (NAV) total return of the ETF was down -1.88%, net of fees, over the six months ended May 31, 2023, while the Russell 3000® Total Return Index, the ETF’s benchmark index, was up 2.38%. The ETF’s market price total return over the same period was down -1.76%.

We manage our ETF with the philosophy that over the long term strong “fundamentals” outperform weak “fundamentals.” Our ETF employs the Convergence Investment Partners, LLC (“Convergence”) systematic long/short investment approach which seeks to benefit from fundamentally strong companies outperforming their counterparts with comparatively weaker fundamentals. Over time the ETF seeks strong total returns from favored long positions with the potential for downside risk mitigation through a carefully selected program of actively selling disfavored stocks short. To construct both the long portfolio and short portfolio, our ETF utilizes the Convergence proprietary stock ranking process which analyzes the domestic investment universe and helps to identify, quantify, and rank strong and weak fundamentals.

Convergence monitors the performance of different stock market characteristics to learn what the market is rewarding or punishing at any time. Our long-term investors know that we analyze numerous statistical observations and stock factors for over 3,000 domestic stocks. Those observations are then grouped into composites to develop signals for each stock that we use to rank their potential on different dimensions to which we give names like Traditional Value and Accelerating Sales. Over the six months ended May 31, 2023, we see that much of the positive differentiation between stocks has been a combination of price momentum, historical earnings growth, and trends in profitability. Conversely, the three most inverted signals, with each showing a negative contribution, in this period were higher risk levels and both absolute and relative valuations. We believe that throughout a market cycle there can be benefits to a fundamental approach to investing that guides the signal diversification we employ at Convergence. While it is unlikely for all fundamental tilts to generate a positive spread in short time periods, we believe these fundamental spreads, based on sound economic principles, can help produce real wealth for investors over time as they provide complementary attributes. We remain steadfast to our philosophy that strong fundamentals win in the long run.

Digging a bit deeper into the performance of the past six months, our ETF trailed its benchmark index due mainly to the underperformance of the long positions. Investors should note that the ETF maintained an average net exposure of about 68% for the most recent six months ended May 31, 2023, while about 48% of fund capital was allocated to short positions. This compares to the long-only benchmark which has a 0% weight to short positions. Our long positions underperformed the Russell 3000® Total Return Index, and our short positions also underperformed the benchmark index and the long portfolio. Although the performance spread between long and short positions for the half year was positive, the larger allocation to longs than to shorts detracted from performance compared to the benchmark index. Positions in the Software, Media and Bank industry groups contributed the most to our total returns for the most recent six months. The largest detracting industry groups for the same period were Healthcare, Financial Services and Pharmaceuticals.

At Convergence, we understand that the selection of portfolio positions, be they long or short, will not add to the ETF’s outperformance in every consecutive month, quarter, or year. We do, however, firmly believe that investment decisions based on a sound and logical philosophy, paired with a long-term approach, can deliver superior results. Buying reasonably valued stocks with strong earnings and sales growth, while shorting low quality, unprofitable stocks with wild valuations is our recipe for success at Convergence.

The objective of the ETF is to achieve long-term capital growth. The ETF seeks to realize its investment objective by establishing long and short positions in equity securities of domestic companies with medium and large market capitalizations. The ETF will hold purchased securities (long positions) that Convergence believes will outperform the market, and it will sell short securities (short positions) expected to underperform the market. Convergence constructs the portfolio as an actively-managed equity strategy that adapts to ever-changing market dynamics through a market cycle. The ETF intends to maintain a net long exposure (the market value of long positions minus the market value of short positions) of approximately 50% to 100% of the ETF’s total assets. Under normal market conditions, the ETF’s long positions may range from 90% to 150% of the ETF’s total assets, and its short positions may range from 20% to 70% of the ETF’s total assets. In making investment decisions for the ETF, Convergence utilizes stock-level analysis to focus on the individual strengths of the underlying companies and the market’s preferences to judge the relative and absolute attractiveness of the companies within each industry group.

Convergence Long/Short Equity ETF Performance

In the six months ended May 31, 2023, the ETF returned -1.88% as measured by the change in ETF net asset value, versus the Russell 3000® Total Return Index at 2.38%.

Average Annual Total Returns (net of fees)

| | | | | | | | Since |

| Through | One | | | One | Three | Five | Inception |

May 31, 2023 | Month | Quarter | YTD | Year | Years | Years | Annualized |

| Convergence | | | | | | | |

| Long/Short Equity ETF | | | | | | | |

| (CLSE @ NAV) | 0.23% | 2.29% | 2.36% | -3.59% | 10.66% | 4.79% | 10.56% |

| Convergence | | | | | | | |

| Long/Short Equity ETF | | | | | | | |

| (CLSE @ Market) | 0.29% | 2.20% | 2.31% | -3.59% | 10.64% | 4.78% | 10.55% |

Russell 3000® | | | | | | | |

| Total Return Index | 0.39% | 4.17% | 8.74% | 2.03% | 12.25% | 10.07% | 12.14% |

Strategy inception = 12/29/2009

Mutual Fund inception = 12/29/2009

Mutual Fund to ETF conversion = 02/18/2022

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold, may be worth more or less than their original cost. Current performance of the ETF may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 1-877-677-9414. For the period from inception date to listing date (February 22, 2022), the NAV of the predecessor Mutual Fund is used for both NAV and market price performance. Performance includes reinvestment of

dividends and other earnings. Returns for periods shorter than one year are not annualized. For ETFs, shares are bought and sold at market price, not net asset value (NAV). The market price return is calculated from closing prices as determined by the ETF’s listing exchange. If you trade your shares at another time, your return may differ.

As of the Prospectus dated March 30, 2023, the ETF’s total expense ratio applicable to all investors is 1.25%, comprised of the management fee of 0.95% and dividends and interest on short positions of 0.30%.

The Convergence fundamental stock picking methodology is geared toward long holdings with strong cash flow, earnings, profits, and other desirable financial characteristics. We strive to achieve these favorable portfolio statistics while seeking companies that are undervalued relative to their peers. Our research has shown that, over time, companies with these characteristics have rewarded investors, as the portfolio statistics demonstrate attributes of healthy and growing companies with competitively strong business models. The Convergence process separately seeks to identify companies with weak or declining fundamentals, and our research has shown this to be effective in sourcing alpha from shorting. The current environment is especially interesting as we believe mega-cap technology stocks are likely to face challenges from rising cost pressures along with slowing revenues. Therefore, we believe the forthcoming market cycle will continue to offer opportunities for active managers such as Convergence.

In closing, as we always say, stay fundamental.

Thank you for your support.

| David J. Abitz, CFA | Justin Neuberg, CFA |

| President & Chief Investment Officer | Co-Portfolio Manager |

| Convergence Investment Partners, LLC | Convergence Investment Partners, LLC |

Disclosures

Past performance is not indicative of future results.

This commentary is for informational purposes only and should not be viewed as a recommendation to buy or sell any security. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment strategies discussed in this documentation and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities may fluctuate, and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. There is no guarantee that the views expressed will come to pass.

There are risks involved with investing including the possible loss of principal. Though not a principal investment strategy, the ETF may use derivatives which may involve risks different from, or greater than, those associated with more traditional investments. Short sales by the ETF include the risk that when the value of a security sold short increases, the value could increase without limit, and the ETF could be subject in theory to unlimited loss. However, a ETF investor’s risk is limited to that investor’s total amount of investment in the Fund. The ETF may lend securities from its portfolio to brokers, dealers, and financial institutions in order to increase the return on its portfolio, primarily through the receipt of borrowing fees and earnings on invested collateral. The ETF may invest in

foreign companies, typically through the sale and purchase of American Depositary Receipts (‘ADRs’). Exposures to foreign securities entail special risks, including political, diplomatic, economic, foreign market and trading risks. In addition, the ETF’s investments in securities denominated in other currencies could decline due to changes in local currency relative to the value of the U.S. dollar, which may affect the ETF’s returns. The annual report, semi-annual report and schedules of investments of the predecessor mutual fund have been adopted for periods prior to the ETF listing.

Must be preceded or accompanied by a prospectus.

Diversification does not assure a profit nor protect against loss in a declining market.

Foreside Fund Services, LLC, distributor.

Alpha – The excess return of an investment relative to the return of a benchmark index is the investment’s alpha.

Cash flow – A term used in financial statements that represents the amount of cash equivalents moving into and out of a company.

The Russell 3000® Total Return Index measures the total return performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market. You cannot invest directly in an index. The volatility of an index may be materially different from that of the strategy due to varying degrees of diversification and other factors. Index returns do not reflect the deduction of any fees.

CONVERGENCE LONG/SHORT EQUITY ETF

Expense Examples

(Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, such as investment management fees and dividends and interest on short positions. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund, and to compare these costs with the ongoing costs of investing in other ETFs. The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (12/1/22 – 5/31/23).

Actual Expenses

The first line of the following table provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Beginning | Ending | Expenses Paid |

| | Account Value | Account Value | During Period |

| | 12/1/22 | 5/31/23 | 12/1/22 – 5/31/23* |

| Actual | $1,000.00 | $ 981.20 | $7.31 |

| Hypothetical (5% return | | | |

| before expenses) | $1,000.00 | $1,017.55 | $7.44 |

| | * | Expenses are equal to the Fund’s annualized expense ratio of 1.48%, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). Excluding dividends on short positions, interest and broker expenses, the Fund’s annualized expense ratio would be 0.95%. |

CONVERGENCE LONG/SHORT EQUITY ETF

Investment Highlights

(Unaudited)

The investment objective of the Fund is to seek long-term capital growth. The Fund seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (plus any borrowings for investment purposes) in long and short positions in equity securities of domestic companies. The Fund focuses primarily on companies with medium and large market capitalizations, although the Fund may establish long and short positions in companies of any market capitalization. The Fund generally considers companies with medium and large market capitalizations to be those companies that comprise the upper half of the Russell 3000® Total Return Index. As of December 31, 2022, the market capitalization range of the upper half of the Russell 3000® Total Return Index was between $2.03 billion and $2,066.94 billion. The Fund will hold long (purchase) securities that the Adviser believes will outperform the market, and will sell short securities expected to underperform the market.

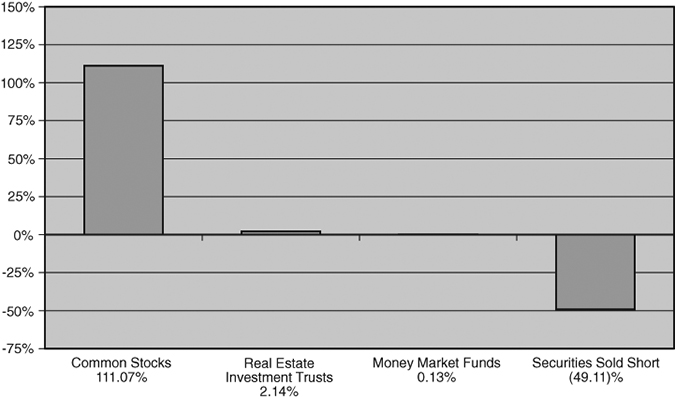

Allocation of Portfolio Holdings

(as a percentage of net assets)

Continued

CONVERGENCE LONG/SHORT EQUITY ETF

Investment Highlights (Continued)

(Unaudited)

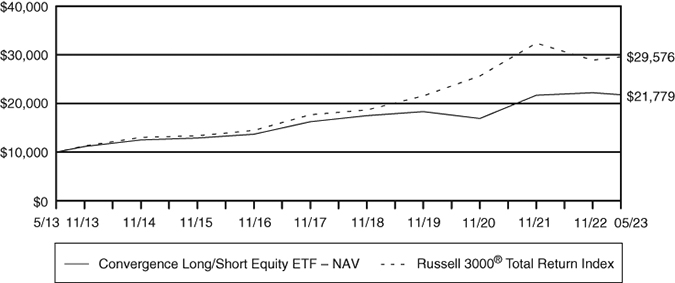

Average Annual Total Returns as of May 31, 2023

| | Six | One | Five | Ten |

| | Months | Year | Years | Years |

| Convergence Long/Short Equity ETF — NAV | -1.88% | -3.59% | 4.79% | 8.09% |

| Convergence Long/Short Equity ETF — | | | | |

| Market Price | -1.76% | -3.59% | 4.78% | 8.09% |

Russell 3000® Total Return Index | 2.38% | 2.03% | 10.07% | 11.45% |

The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on February 18, 2022. Performance data includes the Fund’s prior performance history as a mutual fund. The Market Price returns shown prior to February 18, 2022, reflect the mutual fund’s NAV.

The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling 877-677-9414.

Investment performance reflects fee waivers in effect for the Fund prior to February 18, 2022. In the absence of such waivers, total returns would be reduced for the periods prior to February 18, 2022.

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following graph illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index over the last 10 year time period. The graph does not imply any future performance.

Shares are bought and sold at market price (closing price), not net asset value (“NAV”), and are not individually redeemed from the Fund. Market performance is determined using the bid/ask midpoint at 4:00 p.m. Eastern time when the NAV is typically calculated. Brokerage commissions will reduce returns. Returns shown include the reinvestment of all dividends and distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The Russell 3000® Total Return Index measures the performance of the largest 3,000 U.S. companies representing approximately 96% of the investable U.S. equity market. One cannot invest directly in an index.

Continued

CONVERGENCE LONG/SHORT EQUITY ETF

Investment Highlights (Continued)

(Unaudited)

Growth of $10,000 Investment

CONVERGENCE LONG/SHORT EQUITY ETF

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| COMMON STOCKS – 111.15% (a) | | | | | | |

| | | | | | | |

| Accommodation – 0.47% | | | | | | |

| Las Vegas Sands Corp. (b)(c) | | | 2,175 | | | $ | 119,908 | |

| | | | | | | | | |

| Administrative and Support Services – 2.87% | | | | | | | | |

| Booking Holdings, Inc. (b) | | | 50 | | | | 125,439 | |

| Fair Isaac Corp. (b) | | | 337 | | | | 265,444 | |

| Mastercard, Inc. (c) | | | 582 | | | | 212,441 | |

| PayPal Holdings, Inc. (b) | | | 2,183 | | | | 135,324 | |

| | | | | | | | 738,648 | |

| Amusement, Gambling, and Recreation Industries – 0.46% | | | | | | | | |

| Wynn Resorts Ltd. (c) | | | 1,203 | | | | 118,736 | |

| | | | | | | | | |

| Beverage and Tobacco Product Manufacturing – 2.22% | | | | | | | | |

| Altria Group, Inc. (c) | | | 3,690 | | | | 163,910 | |

| Monster Beverage Corp. (b) | | | 1,362 | | | | 79,840 | |

| National Beverage Corp. (b) | | | 2,936 | | | | 145,097 | |

| Vector Group Ltd. | | | 15,427 | | | | 180,651 | |

| | | | | | | | 569,498 | |

| Broadcasting and Content Providers – 1.54% | | | | | | | | |

| Comcast Corp. | | | 10,059 | | | | 395,821 | |

| | | | | | | | | |

| Chemical Manufacturing – 8.57% | | | | | | | | |

| 10X Genomics, Inc. (b)(c) | | | 645 | | | | 33,837 | |

| AbbVie, Inc. (c) | | | 1,703 | | | | 234,946 | |

| ACADIA Pharmaceuticals, Inc. (b)(c) | | | 1,485 | | | | 34,898 | |

| Amgen, Inc. (c) | | | 997 | | | | 219,988 | |

| Amphastar Pharmaceuticals, Inc. (b)(c) | | | 786 | | | | 34,875 | |

| Bristol-Myers Squibb Co. (c) | | | 3,416 | | | | 220,127 | |

| elf Beauty, Inc. (b)(c) | | | 819 | | | | 85,192 | |

| Gilead Sciences, Inc. | | | 3,007 | | | | 231,359 | |

| Linde PLC | | | 296 | | | | 104,684 | |

| Merck & Co., Inc. | | | 2,102 | | | | 232,082 | |

| Pfizer, Inc. | | | 5,785 | | | | 219,946 | |

| Procter & Gamble Co. | | | 478 | | | | 68,115 | |

| TG Therapeutics, Inc. (b)(c) | | | 1,048 | | | | 27,908 | |

| Vertex Pharmaceuticals, Inc. (b)(c) | | | 1,000 | | | | 323,570 | |

| Xylem, Inc./NY (c) | | | 1,193 | | | | 119,539 | |

| | | | | | | | 2,191,066 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Investments (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Computer and Electronic Product Manufacturing – 23.00% | | | | | | |

| Allegro MicroSystems, Inc. (b)(c) | | | 2,814 | | | $ | 110,675 | |

| Alphabet, Inc. (b)(c) | | | 9,305 | | | | 1,145,623 | |

| Apple, Inc. (c) | | | 1,968 | | | | 348,828 | |

| Arista Networks, Inc. (b) | | | 1,283 | | | | 213,414 | |

| Broadcom, Inc. (c) | | | 516 | | | | 416,907 | |

| Cisco Systems, Inc. (c) | | | 9,149 | | | | 454,431 | |

| Cognex Corp. (c) | | | 1,441 | | | | 79,197 | |

| Extreme Networks, Inc. (b)(c) | | | 19,060 | | | | 392,636 | |

| Fortinet, Inc. (b)(c) | | | 6,993 | | | | 477,832 | |

| IDEXX Laboratories, Inc. (b) | | | 346 | | | | 160,810 | |

| InterDigital, Inc. | | | 3,292 | | | | 273,368 | |

| Iridium Communications, Inc. (c) | | | 3,876 | | | | 232,715 | |

| Jabil, Inc. (c) | | | 4,116 | | | | 368,464 | |

| Keysight Technologies, Inc. (b)(c) | | | 537 | | | | 86,887 | |

| Lattice Semiconductor Corp. (b) | | | 1,393 | | | | 113,265 | |

| Microchip Technology, Inc. (c) | | | 4,104 | | | | 308,867 | |

| NVIDIA Corp. | | | 1,003 | | | | 379,475 | |

| Teradata Corp. (b)(c) | | | 5,648 | | | | 264,665 | |

| Vontier Corp. | | | 2,666 | | | | 79,020 | |

| | | | | | | | 5,907,079 | |

| Construction of Buildings – 1.01% | | | | | | | | |

| NVR, Inc. (b) | | | 16 | | | | 88,868 | |

| Taylor Morrison Home Corp. (b)(c) | | | 2,310 | | | | 98,013 | |

| Tri Pointe Homes, Inc. (b)(c) | | | 2,491 | | | | 72,762 | |

| | | | | | | | 259,643 | |

| Couriers and Messengers – 0.76% | | | | | | | | |

| FedEx Corp. | | | 443 | | | | 96,565 | |

| United Parcel Service, Inc. – Class B (c) | | | 583 | | | | 97,361 | |

| | | | | | | | 193,926 | |

| Credit Intermediation and Related Activities – 5.15% | | | | | | | | |

| Bank of America Corp. | | | 4,492 | | | | 124,833 | |

| Bank of New York Mellon Corp. (c) | | | 5,302 | | | | 213,140 | |

| Citigroup, Inc. (c) | | | 4,077 | | | | 180,693 | |

| Euronet Worldwide, Inc. (b) | | | 1,903 | | | | 211,994 | |

| Hilltop Holdings, Inc. | | | 3,070 | | | | 90,626 | |

| JPMorgan Chase & Co. (c) | | | 1,678 | | | | 227,720 | |

| KeyCorp (c) | | | 8,777 | | | | 81,977 | |

| Wells Fargo & Co. (c) | | | 4,800 | | | | 191,088 | |

| | | | | | | | 1,322,071 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Investments (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Electrical Equipment, Appliance, | | | | | | |

| and Component Manufacturing – 0.75% | | | | | | |

| Rockwell Automation, Inc. | | | 684 | | | $ | 190,563 | |

| | | | | | | | | |

| Fabricated Metal Product Manufacturing – 0.81% | | | | | | | | |

| Atkore, Inc. (b)(c) | | | 1,068 | | | | 124,711 | |

| Mueller Industries, Inc. | | | 1,120 | | | | 83,171 | |

| | | | | | | | 207,882 | |

| Food and Beverage Stores – 0.49% | | | | | | | | |

| Sprouts Farmers Market, Inc. (b)(c) | | | 3,619 | | | | 125,072 | |

| | | | | | | | | |

| Food Manufacturing – 1.42% | | | | | | | | |

| Kraft Heinz Co. | | | 3,862 | | | | 147,606 | |

| Lamb Weston Holdings, Inc. (c) | | | 1,927 | | | | 214,282 | |

| | | | | | | | 361,888 | |

| Food Services and Drinking Places – 1.16% | | | | | | | | |

| Manhattan Associates, Inc. (b)(c) | | | 1,640 | | | | 297,529 | |

| | | | | | | | | |

| Furniture, Home Furnishings, Electronics, | | | | | | | | |

| and Appliance Retailers – 0.28% | | | | | | | | |

| UiPath, Inc. (b)(c) | | | 4,068 | | | | 72,777 | |

| | | | | | | | | |

| General Merchandise Retailers – 1.11% | | | | | | | | |

| Walmart, Inc. (c) | | | 1,934 | | | | 284,047 | |

| | | | | | | | | |

| Health and Personal Care Retailers – 0.96% | | | | | | | | |

| CVS Health Corp. (c) | | | 2,210 | | | | 150,346 | |

| Walgreens Boots Alliance, Inc. | | | 3,183 | | | | 96,668 | |

| | | | | | | | 247,014 | |

| Insurance Carriers and Related Activities – 5.13% | | | | | | | | |

| American Equity Investment Life Holding Co. | | | 2,683 | | | | 105,844 | |

| Arch Capital Group Ltd. (b)(c) | | | 2,544 | | | | 177,316 | |

| Cigna Group/The (c) | | | 681 | | | | 168,487 | |

| Frontdoor, Inc. (b)(c) | | | 3,298 | | | | 101,677 | |

| Humana, Inc. (c) | | | 267 | | | | 133,999 | |

| Primerica, Inc. | | | 617 | | | | 112,306 | |

| Radian Group, Inc. (c) | | | 7,324 | | | | 187,056 | |

| RenaissanceRe Holdings Ltd. (c) | | | 243 | | | | 45,774 | |

| UnitedHealth Group, Inc. | | | 343 | | | | 167,123 | |

| Unum Group (c) | | | 2,576 | | | | 111,927 | |

| | | | | | | | 1,311,509 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Investments (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Machinery Manufacturing – 3.17% | | | | | | |

| AGCO Corp. | | | 672 | | | $ | 74,108 | |

| Alamo Group, Inc. (c) | | | 682 | | | | 113,526 | |

| BellRing Brands, Inc. (b) | | | 1,233 | | | | 45,152 | |

| Caterpillar, Inc. (c) | | | 512 | | | | 105,344 | |

| General Electric Co. (c) | | | 1,654 | | | | 167,931 | |

| Mettler-Toledo International, Inc. (b) | | | 145 | | | | 191,671 | |

| Terex Corp. (c) | | | 2,469 | | | | 114,488 | |

| | | | | | | | 812,220 | |

| Management of Companies and Enterprises – 1.35% | | | | | | | | |

| FRONTLINE PLC COM (b) | | | 9,819 | | | | 138,742 | |

| StoneCo Ltd. (b)(c) | | | 16,706 | | | | 209,326 | |

| | | | | | | | 348,068 | |

| Merchant Wholesalers, Durable Goods – 1.93% | | | | | | | | |

| Arrow Electronics, Inc. (b)(c) | | | 3,206 | | | | 406,008 | |

| GMS, Inc. (b) | | | 1,418 | | | | 89,802 | |

| | | | | | | | 495,810 | |

| Merchant Wholesalers, Nondurable Goods – 2.67% | | | | | | | | |

| AmerisourceBergen Corp. (c) | | | 1,117 | | | | 190,058 | |

| Cardinal Health, Inc. (c) | | | 2,459 | | | | 202,375 | |

| McKesson Corp. (c) | | | 459 | | | | 179,396 | |

| Wingstop, Inc. (c) | | | 577 | | | | 115,031 | |

| | | | | | | | 686,860 | |

| Mining (except Oil and Gas) – 1.25% | | | | | | | | |

| Freeport-McMoRan, Inc. | | | 3,081 | | | | 105,802 | |

| Newmont Corp. (c) | | | 2,373 | | | | 96,225 | |

| Southern Copper Corp. (c) | | | 1,816 | | | | 121,254 | |

| | | | | | | | 323,281 | |

| Miscellaneous Manufacturing – 2.60% | | | | | | | | |

| Brady Corp. (c) | | | 2,592 | | | | 123,587 | |

| Haemonetics Corp. (b)(c) | | | 1,584 | | | | 134,006 | |

| Inspire Medical Systems, Inc. (b)(c) | | | 626 | | | | 183,099 | |

| Johnson & Johnson (c) | | | 1,457 | | | | 225,922 | |

| | | | | | | | 666,614 | |

| Motor Vehicle and Parts Dealers – 1.86% | | | | | | | | |

| Group 1 Automotive, Inc. (c) | | | 1,082 | | | | 241,838 | |

| Murphy USA, Inc. (c) | | | 846 | | | | 233,851 | |

| | | | | | | | 475,689 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Investments (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Nonmetallic Mineral Product Manufacturing – 0.77% | | | | | | |

| Eagle Materials, Inc. (c) | | | 632 | | | $ | 102,972 | |

| O-I Glass, Inc. (b)(c) | | | 4,611 | | | | 95,540 | |

| | | | | | | | 198,512 | |

| Nonstore Retailers – 4.89% | | | | | | | | |

| Amazon.com, Inc. (b)(c) | | | 6,758 | | | | 814,880 | |

| Box, Inc. (b) | | | 8,496 | | | | 239,332 | |

| eBay, Inc. | | | 4,750 | | | | 202,065 | |

| | | | | | | | 1,256,277 | |

| Oil and Gas Extraction – 1.08% | | | | | | | | |

| ONE Gas, Inc. (c) | | | 1,400 | | | | 113,316 | |

| Weatherford International PLC (b) | | | 2,932 | | | | 165,482 | |

| | | | | | | | 278,798 | |

| Paper Manufacturing – 1.38% | | | | | | | | |

| Boise Cascade Co. (c) | | | 2,028 | | | | 145,651 | |

| Kimberly-Clark Corp. (c) | | | 1,550 | | | | 208,134 | |

| | | | | | | | 353,785 | |

| Petroleum and Coal Products Manufacturing – 1.88% | | | | | | | | |

| Marathon Petroleum Corp. (c) | | | 1,537 | | | | 161,247 | |

| PBF Energy, Inc. (c) | | | 4,514 | | | | 166,160 | |

| Valero Energy Corp. (c) | | | 1,455 | | | | 155,743 | |

| | | | | | | | 483,150 | |

| Primary Metal Manufacturing – 0.82% | | | | | | | | |

| Constellium SE (b)(c) | | | 6,235 | | | | 92,902 | |

| Encore Wire Corp. (c) | | | 726 | | | | 118,824 | |

| | | | | | | | 211,726 | |

| Professional, Scientific, and Technical Services – 2.89% | | | | | | | | |

| Booz Allen Hamilton Holding Corp. (c) | | | 866 | | | | 87,102 | |

| Exact Sciences Corp. (b)(c) | | | 1,074 | | | | 87,617 | |

| Insperity, Inc. | | | 857 | | | | 94,887 | |

| Nutanix, Inc. (b) | | | 9,713 | | | | 287,700 | |

| Shift4 Payments, Inc. (b) | | | 2,907 | | | | 182,327 | |

| | | | | | | | 739,633 | |

| Publishing Industries – 7.05% | | | | | | | | |

| Adobe, Inc. (b)(c) | | | 772 | | | | 322,534 | |

| Block, Inc. (b)(c) | | | 6,023 | | | | 363,728 | |

| C3.ai, Inc. (b)(c) | | | 978 | | | | 39,130 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Investments (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Publishing Industries – 7.05% (Continued) | | | | | | |

| Cadence Design Systems, Inc. (b)(c) | | | 1,354 | | | $ | 312,652 | |

| Microsoft Corp. (c) | | | 1,430 | | | | 469,597 | |

| Veeva Systems, Inc. (b)(c) | | | 250 | | | | 41,425 | |

| VeriSign, Inc. (b) | | | 1,178 | | | | 263,071 | |

| | | | | | | | 1,812,137 | |

| Real Estate – 0.34% | | | | | | | | |

| Zillow Group, Inc. (b)(c) | | | 1,911 | | | | 87,161 | |

| | | | | | | | | |

| Rental and Leasing Services – 2.12% | | | | | | | | |

| Netflix, Inc. (b)(c) | | | 1,374 | | | | 543,046 | |

| | | | | | | | | |

| Securities, Commodity Contracts, and Other Financial | | | | | | | | |

| Investments and Related Activities – 1.89% | | | | | | | | |

| Ameriprise Financial, Inc. | | | 731 | | | | 218,182 | |

| DraftKings, Inc. (b)(c) | | | 5,139 | | | | 119,944 | |

| Intercontinental Exchange, Inc. | | | 1,408 | | | | 149,178 | |

| | | | | | | | 487,304 | |

| Software Publishers – 1.14% | | | | | | | | |

| Splunk, Inc. (b)(c) | | | 2,963 | | | | 294,197 | |

| | | | | | | | | |

| Specialty Trade Contractors – 0.89% | | | | | | | | |

| EMCOR Group, Inc. (c) | | | 978 | | | | 161,213 | |

| Installed Building Products, Inc. (c) | | | 635 | | | | 66,383 | |

| | | | | | | | 227,596 | |

| Support Activities for Mining – 0.55% | | | | | | | | |

| Halliburton Co. | | | 4,983 | | | | 142,763 | |

| | | | | | | | | |

| Transit and Ground Passenger Transportation – 0.45% | | | | | | | | |

| Uber Technologies, Inc. (b) | | | 2,996 | | | | 113,639 | |

| | | | | | | | | |

| Transportation Equipment Manufacturing – 2.15% | | | | | | | | |

| Ford Motor Co. (c) | | | 19,682 | | | | 236,184 | |

| Tesla, Inc. (b)(c) | | | 1,538 | | | | 313,644 | |

| | | | | | | | 549,828 | |

| Utilities – 3.60% | | | | | | | | |

| AES Corp. | | | 5,850 | | | | 115,479 | |

| Axcelis Technologies, Inc. (b)(c) | | | 2,509 | | | | 395,294 | |

| First Solar, Inc. (b)(c) | | | 824 | | | | 167,239 | |

| NextEra Energy, Inc. | | | 2,094 | | | | 153,825 | |

| NiSource, Inc. | | | 3,298 | | | | 88,683 | |

| | | | | | | | 920,520 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Investments (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Warehousing and Storage – 0.45% | | | | | | |

| Landstar System, Inc. (c) | | | 662 | | | $ | 116,102 | |

| | | | | | | | | |

| Waste Management and Remediation Services – 0.38% | | | | | | | | |

| Clean Harbors, Inc. (b)(c) | | | 704 | | | | 98,841 | |

| | | | | | | | | |

| Water Transportation – 0.45% | | | | | | | | |

| International Seaways, Inc. | | | 3,187 | | | | 114,891 | |

| | | | | | | | | |

| Web Search Portals, Libraries, Archives, | | | | | | | | |

| and Other Information Services – 2.05% | | | | | | | | |

| Meta Platforms, Inc. (b)(c) | | | 1,986 | | | | 525,734 | |

| | | | | | | | | |

| Wood Product Manufacturing – 0.94% | | | | | | | | |

| Builders FirstSource, Inc. (b) | | | 2,088 | | | | 242,103 | |

| TOTAL COMMON STOCKS (Cost $26,649,810) | | | | | | | 28,520,962 | |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS – 2.14% (a) | | | | | | | | |

| | | | | | | | | |

| Real Estate – 2.14% | | | | | | | | |

| Gaming and Leisure Properties, Inc. | | | 1,834 | | | | 88,289 | |

| Public Storage (c) | | | 325 | | | | 92,073 | |

| Simon Property Group, Inc. (c) | | | 816 | | | | 85,802 | |

| STAG Industrial, Inc. | | | 2,864 | | | | 99,667 | |

| Tanger Factory Outlet Centers, Inc. | | | 4,350 | | | | 88,610 | |

| Ventas, Inc. (c) | | | 2,181 | | | | 94,088 | |

| | | | | | | | 548,529 | |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Cost $556,219) | | | | | | | 548,529 | |

| | | | | | | | | |

| MONEY MARKET FUNDS – 0.13% | | | | | | | | |

| First American Government Obligations Fund – X Class, 4.725% (d) | | | 33,448 | | | | 33,448 | |

| TOTAL MONEY MARKET FUNDS (Cost $33,448) | | | | | | | 33,448 | |

| Total Investments (Cost $27,239,477) – 113.42% | | | | | | | 29,102,939 | |

| Liabilities in Excess of Other Assets – (13.42)% | | | | | | | (3,425,183 | ) |

| TOTAL NET ASSETS – 100.00% | | | | | | $ | 25,677,756 | |

Percentages are stated as a percent of net assets.

| PLC | Public Limited Company |

| SA | An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability. |

| SE | Societas Europaea is a term for a European Public Liability Company. |

| (a) | Unless otherwise noted, all or a portion of these securities, totaling $26,696,128 are pledged as collateral for securities sold short. |

| (b) | Non-income producing security. |

| (c) | This security is not pledged as collateral for securities sold short. |

| (d) | The rate shown represents the seven-day yield as of May 31, 2023. |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Common Stocks – (47.30)% | | | | | | |

| | | | | | | |

| Administrative and Support Services – (2.30)% | | | | | | |

| AdaptHealth Corp. (a) | | | (3,025 | ) | | $ | (31,702 | ) |

| DigitalBridge Group, Inc. | | | (1,115 | ) | | | (13,893 | ) |

| Evolent Health, Inc. (a) | | | (1,310 | ) | | | (38,173 | ) |

| Live Nation Entertainment, Inc. (a) | | | (1,016 | ) | | | (81,219 | ) |

| nCino, Inc. (a) | | | (3,385 | ) | | | (93,054 | ) |

| R1 RCM, Inc. (a) | | | (5,332 | ) | | | (86,645 | ) |

| RB Global, Inc. | | | (660 | ) | | | (34,373 | ) |

| ROBLOX Corp. (a) | | | (1,635 | ) | | | (68,441 | ) |

| SentinelOne, Inc. (a) | | | (4,856 | ) | | | (103,821 | ) |

| TransUnion | | | (584 | ) | | | (42,036 | ) |

| | | | | | | | (593,357 | ) |

| Air Transportation – (0.59)% | | | | | | | | |

| Alaska Air Group, Inc. (a) | | | (757 | ) | | | (34,011 | ) |

| Copa Holdings SA | | | (563 | ) | | | (59,149 | ) |

| Frontier Group Holdings, Inc. (a) | | | (3,373 | ) | | | (27,760 | ) |

| Southwest Airlines Co. | | | (1,050 | ) | | | (31,364 | ) |

| | | | | | | | (152,284 | ) |

| Ambulatory Health Care Services – (0.53)% | | | | | | | | |

| Guardant Health, Inc. (a) | | | (2,079 | ) | | | (60,956 | ) |

| Novocure Ltd. (a) | | | (1,035 | ) | | | (74,323 | ) |

| | | | | | | | (135,279 | ) |

| Amusement, Gambling, and Recreation Industries – (0.09)% | | | | | | | | |

| Light & Wonder, Inc. – Class A (a) | | | (403 | ) | | | (23,491 | ) |

| | | | | | | | | |

| Apparel Manufacturing – (0.10)% | | | | | | | | |

| VF Corp. | | | (1,422 | ) | | | (24,487 | ) |

| | | | | | | | | |

| Beverage and Tobacco Product Manufacturing – (0.50)% | | | | | | | | |

| Celsius Holdings, Inc. (a) | | | (509 | ) | | | (63,895 | ) |

| MGP Ingredients, Inc. | | | (670 | ) | | | (63,690 | ) |

| | | | | | | | (127,585 | ) |

| Broadcasting and Content Providers – (1.52)% | | | | | | | | |

| Liberty Broadband Corp. (a) | | | (1,208 | ) | | | (89,513 | ) |

| Madison Square Garden Sports Corp. | | | (363 | ) | | | (64,124 | ) |

| Paramount Global | | | (3,347 | ) | | | (50,908 | ) |

| Roku, Inc. (a) | | | (1,057 | ) | | | (61,517 | ) |

| Warner Bros Discovery, Inc. (a) | | | (10,991 | ) | | | (123,978 | ) |

| | | | | | | | (390,040 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Chemical Manufacturing – (4.02)% | | | | | | |

| AbCellera Biologics, Inc. (a) | | | (11,439 | ) | | $ | (79,730 | ) |

| Albemarle Corp. | | | (419 | ) | | | (81,089 | ) |

| Beam Therapeutics, Inc. (a) | | | (1,683 | ) | | | (53,688 | ) |

| Blueprint Medicines Corp. (a) | | | (1,486 | ) | | | (83,989 | ) |

| Catalent, Inc. (a) | | | (1,727 | ) | | | (64,296 | ) |

| Celanese Corp. – Class A | | | (285 | ) | | | (29,646 | ) |

| Estee Lauder Cos., Inc. – Class A | | | (206 | ) | | | (37,910 | ) |

| Intellia Therapeutics, Inc. (a) | | | (2,175 | ) | | | (81,041 | ) |

| Livent Corp. (a) | | | (1,401 | ) | | | (32,293 | ) |

| Mirati Therapeutics, Inc. (a) | | | (1,611 | ) | | | (59,865 | ) |

| Moderna, Inc. (a) | | | (919 | ) | | | (117,365 | ) |

| Morphic Holding, Inc. (a) | | | (1,013 | ) | | | (58,248 | ) |

| Olaplex Holdings, Inc. (a) | | | (15,226 | ) | | | (48,114 | ) |

| QuidelOrtho Corp. (a) | | | (1,683 | ) | | | (143,291 | ) |

| Schrodinger, Inc./United States (a) | | | (1,575 | ) | | | (52,684 | ) |

| | | | | | | | (1,023,249 | ) |

| Clothing, Clothing Accessories, Shoe | | | | | | | | |

| and Jewelry Retailers – (0.32)% | | | | | | | | |

| Boot Barn Holdings, Inc. (a) | | | (1,215 | ) | | | (82,158 | ) |

| | | | | | | | | |

| Computer and Electronic Product Manufacturing – (5.40)% | | | | | | | | |

| Bloom Energy Corp. (a) | | | (2,117 | ) | | | (29,045 | ) |

| Ciena Corp. (a) | | | (3,084 | ) | | | (144,146 | ) |

| Credo Technology Group Holding Ltd. (a) | | | (9,576 | ) | | | (128,511 | ) |

| GLOBALFOUNDRIES, Inc. (a) | | | (1,607 | ) | | | (93,736 | ) |

| Impinj, Inc. (a) | | | (1,302 | ) | | | (133,247 | ) |

| Intel Corp. | | | (4,892 | ) | | | (153,804 | ) |

| Mercury Systems, Inc. (a) | | | (737 | ) | | | (29,915 | ) |

| SiTime Corp. (a) | | | (1,104 | ) | | | (109,484 | ) |

| SunPower Corp. (a) | | | (2,877 | ) | | | (30,496 | ) |

| Vertiv Holdings Co. | | | (2,693 | ) | | | (51,975 | ) |

| Viasat, Inc. (a) | | | (4,453 | ) | | | (198,648 | ) |

| Western Digital Corp. (a) | | | (4,417 | ) | | | (171,070 | ) |

| Wolfspeed, Inc. (a) | | | (2,314 | ) | | | (111,165 | ) |

| | | | | | | | (1,385,242 | ) |

| Computing Infrastructure Providers, Data Processing, | | | | | | | | |

| Web Hosting, and Related Services – (0.25)% | | | | | | | | |

| FactSet Research Systems, Inc. | | | (168 | ) | | | (64,662 | ) |

| | | | | | | | | |

| Credit Intermediation and Related Activities – (2.95)% | | | | | | | | |

| Affirm Holdings, Inc. (a) | | | (7,535 | ) | | | (111,970 | ) |

| Ally Financial, Inc. | | | (3,344 | ) | | | (89,184 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Credit Intermediation and Related Activities – (2.95)% (Continued) | | | | | | |

| Cadence Bank | | | (2,725 | ) | | $ | (48,941 | ) |

| Columbia Banking System, Inc. | | | (2,220 | ) | | | (44,467 | ) |

| Eastern Bankshares, Inc. | | | (4,044 | ) | | | (43,877 | ) |

| M&T Bank Corp. | | | (296 | ) | | | (35,271 | ) |

| Mr Cooper Group, Inc. (a) | | | (2,232 | ) | | | (103,252 | ) |

| Prosperity Bancshares, Inc. | | | (590 | ) | | | (33,736 | ) |

| Seacoast Banking Corp. of Florida | | | (2,113 | ) | | | (43,697 | ) |

| Webster Financial Corp. | | | (2,837 | ) | | | (100,855 | ) |

| Western Alliance Bancorp | | | (1,893 | ) | | | (64,173 | ) |

| Zions Bancorp NA | | | (1,387 | ) | | | (37,851 | ) |

| | | | | | | | (757,274 | ) |

| Electrical Equipment, Appliance, | | | | | | | | |

| and Component Manufacturing – (0.67)% | | | | | | | | |

| Fluence Energy, Inc. (a) | | | (1,972 | ) | | | (48,906 | ) |

| Generac Holdings, Inc. (a) | | | (352 | ) | | | (38,340 | ) |

| Plug Power, Inc. (a) | | | (4,043 | ) | | | (33,638 | ) |

| Regal Rexnord Corp. | | | (386 | ) | | | (50,137 | ) |

| | | | | | | | (171,021 | ) |

| Fabricated Metal Product Manufacturing – (0.43)% | | | | | | | | |

| Ardagh Metal Packaging SA | | | (9,177 | ) | | | (33,129 | ) |

| RBC Bearings, Inc. (a) | | | (191 | ) | | | (37,873 | ) |

| Zurn Elkay Water Solutions Corp. | | | (1,762 | ) | | | (39,663 | ) |

| | | | | | | | (110,665 | ) |

| Food and Beverage Stores – (0.35)% | | | | | | | | |

| Grocery Outlet Holding Corp. (a) | | | (3,109 | ) | | | (89,290 | ) |

| | | | | | | | | |

| Food Manufacturing – (1.08)% | | | | | | | | |

| Bunge Ltd. | | | (357 | ) | | | (33,072 | ) |

| Darling Ingredients, Inc. (a) | | | (1,099 | ) | | | (69,655 | ) |

| Freshpet, Inc. (a) | | | (1,096 | ) | | | (65,497 | ) |

| TreeHouse Foods, Inc. (a) | | | (1,277 | ) | | | (60,466 | ) |

| Tyson Foods, Inc. – Class A | | | (921 | ) | | | (46,639 | ) |

| | | | | | | | (275,329 | ) |

| Furniture, Home Furnishings, Electronics, | | | | | | | | |

| and Appliance Retailers – (0.66)% | | | | | | | | |

| Floor & Decor Holdings, Inc. (a) | | | (960 | ) | | | (87,658 | ) |

| RH (a) | | | (340 | ) | | | (83,293 | ) |

| | | | | | | | (170,951 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| General Merchandise Retailers – (0.33)% | | | | | | |

| Dollar Tree, Inc. (a) | | | (627 | ) | | $ | (84,570 | ) |

| | | | | | | | | |

| Heavy and Civil Engineering Construction – (0.33)% | | | | | | | | |

| MasTec, Inc. (a) | | | (831 | ) | | | (84,230 | ) |

| | | | | | | | | |

| Insurance Carriers and Related Activities – (1.24)% | | | | | | | | |

| Brighthouse Financial, Inc. (a) | | | (1,023 | ) | | | (41,186 | ) |

| Equitable Holdings, Inc. | | | (4,051 | ) | | | (99,412 | ) |

| First American Financial Corp. | | | (808 | ) | | | (44,383 | ) |

| Lincoln National Corp. | | | (2,687 | ) | | | (56,212 | ) |

| Principal Financial Group, Inc. | | | (687 | ) | | | (44,971 | ) |

| Prudential Financial, Inc. | | | (385 | ) | | | (30,296 | ) |

| | | | | | | | (316,460 | ) |

| Machinery Manufacturing – (0.50)% | | | | | | | | |

| Azenta, Inc. (a) | | | (1,228 | ) | | | (53,111 | ) |

| Leslie’s, Inc. (a) | | | (7,748 | ) | | | (73,451 | ) |

| | | | | | | | (126,562 | ) |

| Management of Companies and Enterprises – (0.99)% | | | | | | | | |

| Carnival Corp. (a) | | | (2,325 | ) | | | (26,110 | ) |

| Cullen/Frost Bankers, Inc. | | | (372 | ) | | | (37,274 | ) |

| Enstar Group Ltd. (a) | | | (182 | ) | | | (42,839 | ) |

| First Interstate BancSystem, Inc. | | | (1,951 | ) | | | (43,020 | ) |

| Helen of Troy Ltd. (a) | | | (272 | ) | | | (26,188 | ) |

| Norwegian Cruise Line Holdings Ltd. (a) | | | (1,398 | ) | | | (20,760 | ) |

| Rivian Automotive, Inc. (a) | | | (4,036 | ) | | | (59,450 | ) |

| | | | | | | | (255,641 | ) |

| Merchant Wholesalers, Durable Goods – (0.16)% | | | | | | | | |

| TD SYNNEX Corp. | | | (465 | ) | | | (41,562 | ) |

| | | | | | | | | |

| Merchant Wholesalers, Nondurable Goods – (0.46)% | | | | | | | | |

| Arrowhead Pharmaceuticals, Inc. (a) | | | (2,437 | ) | | | (83,857 | ) |

| Relay Therapeutics, Inc. (a) | | | (3,076 | ) | | | (34,267 | ) |

| | | | | | | | (118,124 | ) |

| Mining (except Oil and Gas) – (0.50)% | | | | | | | | |

| CNX Resources Corp. (a) | | | (4,062 | ) | | | (62,758 | ) |

| Hecla Mining Co. | | | (6,498 | ) | | | (34,634 | ) |

| Royal Gold, Inc. | | | (277 | ) | | | (34,304 | ) |

| | | | | | | | (131,696 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Miscellaneous Manufacturing – (1.12)% | | | | | | |

| ICU Medical, Inc. (a) | | | (404 | ) | | $ | (70,656 | ) |

| National Vision Holdings, Inc. (a) | | | (1,723 | ) | | | (43,506 | ) |

| Neogen Corp. (a) | | | (4,726 | ) | | | (82,658 | ) |

| Peloton Interactive, Inc. (a) | | | (3,698 | ) | | | (26,921 | ) |

| Tandem Diabetes Care, Inc. (a) | | | (1,361 | ) | | | (35,372 | ) |

| Topgolf Callaway Brands Corp. (a) | | | (1,631 | ) | | | (27,841 | ) |

| | | | | | | | (286,954 | ) |

| Motion Picture and Sound Recording Industries – (0.30)% | | | | | | | | |

| Cinemark Holdings, Inc. (a) | | | (4,760 | ) | | | (76,208 | ) |

| | | | | | | | | |

| Motor Vehicle and Parts Dealers – (0.45)% | | | | | | | | |

| Lithia Motors, Inc. | | | (490 | ) | | | (114,307 | ) |

| | | | | | | | | |

| Nonmetallic Mineral Product Manufacturing – (0.73)% | | | | | | | | |

| Corning, Inc. | | | (5,075 | ) | | | (156,361 | ) |

| Stepan Co. | | | (360 | ) | | | (33,102 | ) |

| | | | | | | | (189,463 | ) |

| Nonstore Retailers – (0.31)% | | | | | | | | |

| Cargurus, Inc. (a) | | | (4,203 | ) | | | (78,974 | ) |

| | | | | | | | | |

| Oil and Gas Extraction – (1.79)% | | | | | | | | |

| Coterra Energy, Inc. | | | (2,380 | ) | | | (55,335 | ) |

| Dominion Energy, Inc. | | | (1,911 | ) | | | (96,085 | ) |

| EQT Corp. | | | (4,208 | ) | | | (146,312 | ) |

| Northern Oil and Gas, Inc. | | | (2,397 | ) | | | (71,694 | ) |

| Sitio Royalties Corp. | | | (1,366 | ) | | | (34,806 | ) |

| Southwestern Energy Co. (a) | | | (11,587 | ) | | | (55,270 | ) |

| | | | | | | | (459,502 | ) |

| Personal and Laundry Services – (0.34)% | | | | | | | | |

| IAC, Inc. (a) | | | (1,545 | ) | | | (86,273 | ) |

| | | | | | | | | |

| Petroleum and Coal Products Manufacturing – (0.11)% | | | | | | | | |

| Carlisle Cos., Inc. | | | (132 | ) | | | (28,042 | ) |

| | | | | | | | | |

| Plastics and Rubber Products Manufacturing – (0.99)% | | | | | | | | |

| Advanced Drainage Systems, Inc. | | | (416 | ) | | | (40,256 | ) |

| Entegris, Inc. | | | (1,120 | ) | | | (117,880 | ) |

| Goodyear Tire & Rubber Co. (a) | | | (4,038 | ) | | | (55,442 | ) |

| Newell Brands, Inc. | | | (5,018 | ) | | | (41,700 | ) |

| | | | | | | | (255,278 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Professional, Scientific, and Technical Services – (3.89)% | | | | | | |

| Alteryx, Inc. (a) | | | (2,423 | ) | | $ | (94,352 | ) |

| Aspen Technology, Inc. (a) | | | (558 | ) | | | (91,467 | ) |

| Bumble, Inc. (a) | | | (4,909 | ) | | | (75,108 | ) |

| Cytokinetics, Inc. (a) | | | (2,488 | ) | | | (93,773 | ) |

| Digital Turbine, Inc. (a) | | | (1,884 | ) | | | (17,220 | ) |

| DigitalOcean Holdings, Inc. (a) | | | (2,731 | ) | | | (106,919 | ) |

| Gen Digital, Inc. | | | (8,865 | ) | | | (155,492 | ) |

| Reata Pharmaceuticals, Inc. (a) | | | (882 | ) | | | (79,424 | ) |

| Snowflake, Inc. (a) | | | (519 | ) | | | (85,822 | ) |

| Unity Software, Inc. (a) | | | (3,396 | ) | | | (100,929 | ) |

| Vir Biotechnology, Inc. (a) | | | (3,554 | ) | | | (94,785 | ) |

| | | | | | | | (995,291 | ) |

| Publishing Industries – (0.26)% | | | | | | | | |

| Toast, Inc. (a) | | | (3,193 | ) | | | (66,957 | ) |

| | | | | | | | | |

| Real Estate – (0.13)% | | | | | | | | |

| MP Materials Corp. (a) | | | (1,614 | ) | | | (33,442 | ) |

| | | | | | | | | |

| Rental and Leasing Services – (0.25)% | | | | | | | | |

| Air Lease Corp. | | | (1,672 | ) | | | (63,569 | ) |

| | | | | | | | | |

| Repair and Maintenance – (0.38)% | | | | | | | | |

| Driven Brands Holdings, Inc. (a) | | | (962 | ) | | | (23,886 | ) |

| Mister Car Wash, Inc. (a) | | | (2,837 | ) | | | (23,405 | ) |

| Valvoline, Inc. | | | (1,299 | ) | | | (50,012 | ) |

| | | | | | | | (97,303 | ) |

| Securities, Commodity Contracts, and Other Financial | | | | | | | | |

| Investments and Related Activities – (3.05)% | | | | | | | | |

| Aramark | | | (507 | ) | | | (20,016 | ) |

| Beauty Health Co. (a) | | | (6,040 | ) | | | (48,562 | ) |

| Blue Owl Capital, Inc. | | | (4,168 | ) | | | (42,722 | ) |

| ChargePoint Holdings, Inc. (a) | | | (3,799 | ) | | | (36,736 | ) |

| Clarivate PLC (a) | | | (4,893 | ) | | | (38,165 | ) |

| E2open Parent Holdings, Inc. (a) | | | (13,910 | ) | | | (69,550 | ) |

| Enovix Corp. (a) | | | (2,645 | ) | | | (35,099 | ) |

| IonQ, Inc. (a) | | | (12,647 | ) | | | (136,461 | ) |

| Morningstar, Inc. | | | (321 | ) | | | (65,709 | ) |

| Raymond James Financial, Inc. | | | (772 | ) | | | (69,750 | ) |

| S&P Global, Inc. | | | (183 | ) | | | (67,240 | ) |

| SOFI TECHNOLOGIES INC COM (a) | | | (11,836 | ) | | | (82,142 | ) |

| Trupanion, Inc. (a) | | | (853 | ) | | | (19,167 | ) |

| Verra Mobility Corp. (a) | | | (2,982 | ) | | | (52,573 | ) |

| | | | | | | | (783,892 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Software Publishers – (1.44)% | | | | | | |

| BILL Holdings, Inc. (a) | | | (958 | ) | | $ | (99,230 | ) |

| Confluent, Inc. (a) | | | (3,225 | ) | | | (102,362 | ) |

| Okta, Inc. (a) | | | (969 | ) | | | (88,082 | ) |

| ZoomInfo Technologies, Inc. (a) | | | (3,270 | ) | | | (80,867 | ) |

| | | | | | | | (370,541 | ) |

| Specialty Trade Contractors – (0.15)% | | | | | | | | |

| Sunrun, Inc. (a) | | | (2,182 | ) | | | (38,490 | ) |

| | | | | | | | | |

| Sporting Goods, Hobby, and Musical Instrument, Book, | | | | | | | | |

| and Miscellaneous Retailers – (0.58)% | | | | | | | | |

| DoorDash, Inc. (a) | | | (631 | ) | | | (41,198 | ) |

| Wayfair, Inc. (a) | | | (2,663 | ) | | | (107,372 | ) |

| | | | | | | | (148,570 | ) |

| Support Activities for Mining – (0.20)% | | | | | | | | |

| Civitas Resources, Inc. | | | (781 | ) | | | (52,171 | ) |

| | | | | | | | | |

| Support Activities for Transportation – (0.16)% | | | | | | | | |

| GATX Corp. | | | (341 | ) | | | (40,548 | ) |

| | | | | | | | | |

| Telecommunications – (1.46)% | | | | | | | | |

| Doximity, Inc. (a) | | | (1,987 | ) | | | (60,941 | ) |

| Frontier Communications Parent, Inc. (a) | | | (2,651 | ) | | | (39,447 | ) |

| Gogo, Inc. (a) | | | (3,075 | ) | | | (46,279 | ) |

| Twilio, Inc. (a) | | | (1,512 | ) | | | (105,265 | ) |

| Zoom Video Communications, Inc. (a) | | | (1,838 | ) | | | (123,385 | ) |

| | | | | | | | (375,317 | ) |

| Transit and Ground Passenger Transportation – (0.19)% | | | | | | | | |

| Lyft, Inc. (a) | | | (5,285 | ) | | | (47,671 | ) |

| | | | | | | | | |

| Transportation Equipment Manufacturing – (0.34)% | | | | | | | | |

| Dorman Products, Inc. (a) | | | (642 | ) | | | (52,676 | ) |

| Spirit AeroSystems Holdings, Inc. – Class A | | | (1,237 | ) | | | (32,892 | ) |

| | | | | | | | (85,568 | ) |

| Truck Transportation – (0.11)% | | | | | | | | |

| Werner Enterprises, Inc. | | | (663 | ) | | | (29,119 | ) |

| | | | | | | | | |

| Utilities – (2.02)% | | | | | | | | |

| American States Water Co. | | | (311 | ) | | | (27,623 | ) |

| American Water Works Co., Inc. | | | (302 | ) | | | (43,624 | ) |

| Atmos Energy Corp. | | | (685 | ) | | | (78,967 | ) |

| Coherent Corp. (a) | | | (5,736 | ) | | | (212,002 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Schedule of Securities Sold Short (Continued) |

May 31, 2023 (Unaudited)

| | | Shares | | | Value | |

| Utilities – (2.02)% (Continued) | | | | | | |

| Constellation Energy Corp. | | | (385 | ) | | $ | (32,348 | ) |

| New Fortress Energy, Inc. | | | (2,390 | ) | | | (62,785 | ) |

| Southwest Gas Holdings, Inc. | | | (1,001 | ) | | | (58,589 | ) |

| | | | | | | | (515,938 | ) |

| Waste Management and Remediation Services – (0.10)% | | | | | | | | |

| Waste Management, Inc. | | | (160 | ) | | | (25,907 | ) |

| | | | | | | | | |

| Wood Product Manufacturing – (0.18)% | | | | | | | | |

| Enviva, Inc. | | | (1,457 | ) | | | (12,792 | ) |

| Louisiana-Pacific Corp. | | | (563 | ) | | | (32,947 | ) |

| | | | | | | | (45,739 | ) |

| TOTAL COMMON STOCKS (Proceeds $14,151,260) | | | | | | | (12,126,243 | ) |

| | | | | | | | | |

| REAL ESTATE INVESTMENT TRUSTS – (1.89)% | | | | | | | | |

| | | | | | | | | |

| Accommodation – (0.12)% | | | | | | | | |

| Sunstone Hotel Investors, Inc. | | | (3,079 | ) | | | (30,390 | ) |

| | | | | | | | | |

| Real Estate – (1.77)% | | | | | | | | |

| AGNC Investment Corp. | | | (7,358 | ) | | | (67,620 | ) |

| Annaly Capital Management, Inc. | | | (2,715 | ) | | | (51,259 | ) |

| Digital Realty Trust, Inc. | | | (348 | ) | | | (35,656 | ) |

| Healthcare Realty Trust, Inc. | | | (2,064 | ) | | | (38,411 | ) |

| Host Hotels & Resorts, Inc. | | | (2,120 | ) | | | (35,192 | ) |

| Independence Realty Trust, Inc. | | | (1,824 | ) | | | (31,501 | ) |

| Kilroy Realty Corp. | | | (1,138 | ) | | | (30,885 | ) |

| Sun Communities, Inc. | | | (299 | ) | | | (37,862 | ) |

| VICI Properties, Inc. | | | (1,408 | ) | | | (43,550 | ) |

| Vornado Realty Trust | | | (2,243 | ) | | | (30,415 | ) |

| WP Carey, Inc. | | | (728 | ) | | | (50,494 | ) |

| | | | | | | | (452,845 | ) |

| TOTAL REAL ESTATE INVESTMENT TRUSTS (Proceeds $507,357) | | | | | | | (483,235 | ) |

| | | | | | | | | |

| EXCHANGE TRADED FUNDS – (0.00)% | | | | | | | | |

| Invesco QQQ Trust Series 1 | | | (1 | ) | | | (348 | ) |

| TOTAL EXCHANGE TRADED FUNDS (Proceeds $310) | | | | | | | (348 | ) |

| TOTAL SECURITIES SOLD SHORT | | | | | | | | |

| (Proceeds $14,658,927) – (49.19)% | | | | | | $ | (12,609,826 | ) |

Percentages are stated as a percent of net assets.

| PLC | Public Limited Company |

| SA | An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability. |

| SE | Societas Europaea is a term for a European Public Liability Company. |

| (a) | Non-income producing security. |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Statement of Assets and Liabilities |

May 31, 2023 (Unaudited)

| Assets | | | |

| Investments, at value (cost $27,239,477) | | $ | 29,102,939 | |

| Receivable for investments sold | | | 4,148,288 | |

| Deposit for short sales at broker | | | 9,300,406 | |

| Dividends and interest receivable | | | 47,844 | |

| Other assets and receivables | | | 7,886 | |

| Total Assets | | | 42,607,363 | |

| | | | | |

| Liabilities | | | | |

| Securities sold short, at value (proceeds $14,658,927) | | | 12,609,826 | |

| Payable for investments purchased | | | 4,288,748 | |

| Dividends payable on short positions | | | 11,633 | |

| Payable to Custodian | | | 448 | |

| Payable to Adviser | | | 18,952 | |

| Total Liabilities | | | 16,929,607 | |

| Net Assets | | $ | 25,677,756 | |

| | | | | |

| Net Assets Consist Of: | | | | |

| Paid-in capital | | | 21,678,966 | |

| Total distributable earnings | | | 3,998,790 | |

| Net Assets | | $ | 25,677,756 | |

| | | | | |

| Shares of beneficial interest outstanding (unlimited | | | | |

| number of shares authorized, $0.001 par value) | | | 1,707,329 | |

| Net asset value, redemption price and offering price per share | | $ | 15.04 | |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

For the Six Months Ended May 31, 2023 (Unaudited)

| Investment Income | | | |

| Dividend income | | $ | 246,372 | |

| Prime broker interest income | | | 134,306 | |

| Interest Income | | | 2,554 | |

| Total Investment Income | | | 383,232 | |

| | | | | |

| Expenses | | | | |

| Management fees | | | 114,128 | |

| Dividends on short positions | | | 63,221 | |

| Other expenses | | | 317 | |

| Total Expenses | | | 177,666 | |

| Net Investment Income | | | 205,566 | |

| | | | | |

| Realized and Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain (loss) from: | | | | |

| Investments | | | (1,346,875 | ) |

| In-kind redemptions | | | 1,981,291 | |

| Short transactions | | | 644,291 | |

| Change in net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (1,550,716 | ) |

| Short transactions | | | (423,000 | ) |

| Realized and Unrealized Loss on Investments | | | (695,009 | ) |

| Net Decrease in Net Assets from Operations | | $ | (489,443 | ) |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| Statements of Changes in Net Assets |

| | | Six Months Ended | | | Year Ended | |

| | | May 31, 2023 | | | November 30, | |

| | | (Unaudited) | | | 2022(a) | |

| From Operations | | | | | | |

| Net investment income | | $ | 205,566 | | | $ | 115,342 | |

| Net realized gain (loss) from: | | | | | | | | |

| Investments | | | (1,346,875 | ) | | | (3,695,829 | ) |

| In-kind redemptions | | | 1,981,291 | | | | 2,398,166 | |

| Short transactions | | | 644,291 | | | | 4,375,199 | |

| Change in net unrealized | | | | | | | | |

| appreciation (depreciation) on: | | | | | | | | |

| Investments | | | (1,550,716 | ) | | | (3,199,363 | ) |

| Short transactions | | | (423,000 | ) | | | 757,203 | |

| Net increase (decrease) in net assets from operations | | | (489,443 | ) | | | 750,718 | |

| | | | | | | | | |

| From Distributions | | | | | | | | |

| Net dividend and distributions | | | (194,639 | ) | | | (4,719,159 | ) |

| Net decrease in net assets resulting | | | | | | | | |

| from distributions paid | | | (194,639 | ) | | | (4,719,159 | ) |

| | | | | | | | | |

| From Capital Share Transactions | | | | | | | | |

| Proceeds from shares sold | | | 11,610,516 | | | | 17,432,127 | |

| Net asset value of shares issued in | | | | | | | | |

| reinvestment of distributions to shareholders | | | — | | | | 4,325,163 | |

| Payments for shares redeemed | | | (9,623,466 | ) | | | (22,727,413 | ) |

| Net increase (decrease) in net assets from | | | | | | | | |

| capital share transactions | | | 1,987,050 | | | | (970,123 | ) |

| | | | | | | | | |

| Total Increase (Decrease) In Net Assets | | | 1,302,968 | | | | (4,938,564 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of period/year | | | 24,374,788 | | | | 29,313,352 | |

| End of period/year | | $ | 25,677,756 | | | $ | 24,374,788 | |

(a) | The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on February 18, 2022. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

For the Six Months Ended May 31, 2023(a) (Unaudited)

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | |

| Net decrease in net assets resulting from operations | | $ | (489,443 | ) |

| Adjustments to reconcile net increase in net assets | | | | |

| from operations to net cash used in operating activities: | | | | |

| Purchases of investments | | | (58,518,722 | ) |

| Purchases of short-term investments, net | | | 134,261 | |

| Proceeds from sales of long-term investments | | | 58,125,854 | |

| Return of capital distributions received from underlying investments | | | 7,555 | |

| Increase in dividends and interest receivable | | | (333 | ) |

| Increase in receivable for investment securities sold | | | (4,148,288 | ) |

| Proceeds from securities sold short | | | 29,414,721 | |

| Purchases to cover securities sold short | | | (28,042,471 | ) |

| Decrease in payable for investment securities purchased | | | 4,288,748 | |

| Increase in dividends payable on short positions | | | 4,800 | |

| Increase in payable to Adviser | | | 1,175 | |

| Unrealized depreciation on investments | | | 1,550,716 | |

| Unrealized depreciation on short transactions | | | 423,000 | |

| Net realized gain on investments | | | (634,416 | ) |

| Net realized gain on short transactions | | | (644,291 | ) |

| Net cash provided by operating activities | | | 1,472,866 | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from shares sold | | | 11,610,516 | |

| Payment on shares redeemed | | | (9,623,466 | ) |

| Cash distributions paid to shareholders | | | (194,639 | ) |

| Net cash used in financing activities | | | 1,792,411 | |

| Net change in cash | | | 3,265,277 | |

| CASH: | | | | |

| Beginning balance | | | 6,034,681 | |

| Ending balance | | $ | 9,299,958 | |

| SUPPLEMENTAL DISCLOSURES: | | | | |

| Cash paid for interest | | | 123,562 | |

| Non-cash operating activities – purchases of investment securities in-kind | | | (15,161,175 | ) |

| Non-cash operating activities – sales of investment securities in-kind | | | 16,069,429 | |

| Non-cash financing activities – proceeds from shares sold in-kind | | | (15,161,175 | ) |

| Non-cash financing activities – payment on shares redeemed in-kind | | | 16,069,429 | |

| RESTRICTED AND UNRESTRICTED CASH | | | | |

| Beginning balances: | | | | |

| Cash | | | — | |

| Deposit with brokers short sale proceeds | | | 6,034,681 | |

| Ending balances: | | | | |

| Cash | | | (448 | ) |

| Deposit with brokers short sale proceeds | | | 9,300,406 | |

(a) | The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on February 18, 2022. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

| | | Six Months Ended | |

| | | May 31, 2023(6) | |

| | | (Unaudited) | |

| Net Asset Value, Beginning of Period | | $ | 15.45 | |

| | | | | |

| Income from investment operations: | | | | |

Net investment income (loss)(1) | | | 0.13 | |

| Net realized and unrealized gain (loss) on investments | | | (0.41 | ) |

| Total from Investment Operations | | | (0.28 | ) |

| | | | | |

| Less distributions paid: | | | | |

| From net investment income | | | (0.13 | ) |

| From net realized gains | | | — | |

| Total distributions paid | | | (0.13 | ) |

| | | | | |

| Net Asset Value, End of Period | | $ | 15.04 | |

| Market Price, End of Period | | $ | 15.81 | |

| | | | | |

Total Return on NAV(2)(7) | | | -1.88 | % |

Total Return on Market Price(4)(7) | | | -1.76 | % |

| | | | | |

| Supplemental Data and Ratios: | | | | |

| Net assets at end of period (000’s) | | $ | 25,678 | |

| Ratio of expenses to average net assets: | | | | |

Before waiver, expense reimbursement and recoupments(3)(8) | | | 1.48 | % |

After waiver, expense reimbursement and recoupments(3)(8) | | | 1.48 | % |

| Ratio of net investment income (loss) to average net assets: | | | | |

Before waiver, expense reimbursement and recoupments(8) | | | 1.71 | % |

After waiver, expense reimbursement and recoupments(8) | | | 1.71 | % |

| Portfolio turnover rate | | | 165.76 | %(5)(7) |

(1) | Per share net investment income was calculated using the daily average shares outstanding method. |

(2) | Total return on net asset value (NAV) represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. |

(3) | The ratio of expenses to average net assets includes dividends on short positions, interest and broker expenses. The annualized before waiver, expense reimbursement and recoupments and after waiver, expense reimbursement and recoupments ratios excluding dividends on short positions, interest and broker expenses were 0.95% and 0.95%, 1.28% and 1.08%, 1.95% and 1.50%, 1.69% and 1.50%, 1.32% and 1.32%, 1.27% and 1.27% for the period ended May 31, 2023 and years ended November 30, 2022, November 30, 2021, November 30, 2020, November 30, 2019, and November 30, 2018, respectively. |

(4) | Total return on market price is calculated assuming an initial investment made at the market price on the first day of the period, reinvestment of dividends and distributions at market price during the period and redemption at market price on the last day of the period. |

(5) | Excludes the impact of in-kind transactions. |

(6) | The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on February 18, 2022. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

(7) | Not annualized for periods less than a full year. |

(8) | Annualized for periods less than a full year. |

The accompanying notes are an integral part of these financial statements.

Per Share Data for a Share Outstanding Throughout Each Period

| Year Ended November 30, | |

| 2022 | | | 2021 | | | 2020 | | | 2019 | | | 2018 | |

| $ | 17.94 | | | $ | 14.03 | | | $ | 19.76 | | | $ | 19.83 | | | $ | 21.03 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | 0.07 | | | | (0.03 | ) | | | 0.01 | | | | 0.14 | | | | 0.01 | |

| | 0.31 | | | | 3.98 | | | | (1.11 | ) | | | 0.65 | | | | 1.47 | |

| | 0.38 | | | | 3.95 | | | | (1.10 | ) | | | 0.79 | | | | 1.48 | |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| | — | | | | (0.04 | ) | | | (0.13 | ) | | | (0.07 | ) | | | (0.04 | ) |

| | (2.87 | ) | | | — | | | | (4.50 | ) | | | (0.79 | ) | | | (2.64 | ) |

| | (2.87 | ) | | | (0.04 | ) | | | (4.63 | ) | | | (0.86 | ) | | | (2.68 | ) |

| $ | 15.45 | | | $ | 17.94 | | | $ | 14.03 | | | $ | 19.76 | | | $ | 19.83 | |

| $ | 15.43 | | | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | | | | | | | | | | | | | |

| | 2.39 | % | | | 28.26 | % | | | -7.68 | % | | | 4.72 | % | | | 7.69 | % |

| | 2.20 | % | | | — | % | | | — | % | | | — | % | | | — | % |

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | |

| $ | 24,375 | | | $ | 29,313 | | | $ | 22,537 | | | $ | 67,741 | | | $ | 112,861 | |

| | | | | | | | | | | | | | | | | | | |

| | 1.58 | % | | | 2.56 | % | | | 2.58 | % | | | 2.18 | % | | | 2.20 | % |

| | 1.38 | % | | | 2.11 | % | | | 2.39 | % | | | 2.18 | % | | | 2.20 | % |

| | | | | | | | | | | | | | | | | | | |

| | 0.26 | % | | | (0.63 | )% | | | (0.13 | )% | | | 0.76 | % | | | 0.03 | % |

| | 0.46 | % | | | (0.18 | )% | | | 0.06 | % | | | 0.76 | % | | | 0.03 | % |

| | 244.44 | %(5) | | | 303.76 | % | | | 251.72 | % | | | 239.08 | % | | | 193.55 | % |

The accompanying notes are an integral part of these financial statements.

CONVERGENCE LONG/SHORT EQUITY ETF

Notes to Financial Statements

May 31, 2023 (Unaudited)

| (1) | Organization |

| | |

| | Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Convergence Long/Short Equity ETF (the “Fund”) represents a distinct diversified series with its own investment objectives, and policies within the Trust. The investment objective of the Fund is to seek long-term capital growth. The Fund is an actively managed exchange-traded fund (“ETF”). The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value. |

| | |

| | Effective February 18, 2022, the Fund converted from a mutual fund to an ETF, pursuant to an Agreement and Plan of Reorganization. The reorganization was accomplished by a tax-free exchange of shares (with an exception for fractional mutual fund shares). The costs of the reorganization were borne by the Fund’s investment adviser, Convergence Investment Partners, LLC (the “Adviser”). The reorganization did not result in a material change to the investment portfolio. The mutual fund offered Institutional Class shares and commenced operations on December 29, 2009. The following table illustrates the specifics of the reorganization of the mutual fund into the ETF: |

| | Shares Issued | | | |

| Convergence | to Shareholders | Convergence | | |

| Long/Short | of Convergence | Long/Short | | |

| Equity Fund | Long/Short | Equity ETF | Combined | Tax Status |

Net Assets* | Equity Fund | Net Assets | Net Assets | of Transfer |

| $26,419,556 | 1,707,329 | $ — | $26,419,556 | Non-Taxable |

| | * | Includes accumulated net investment losses, accumulated realized gains and unrealized appreciation in the amounts of $(86,871), $2,453,571, and $8,049,316, respectively. |

| | The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standard Codification Topic 946 “Financial Services–Investment Companies.” |

| | |

| (2) | Significant Accounting Policies |

| | |

| | The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”). |

| | |

| | (a) Investment Valuation |

| | |

| | Each security owned by the Fund, including long and short positions of common stock and real estate investment trusts, that is listed on a securities exchange, except those listed on the NASDAQ Stock Market LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. When the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally consider to be the principal exchange on which the stock is traded. |

CONVERGENCE LONG/SHORT EQUITY ETF

Notes to Financial Statements (Continued)

May 31, 2023 (Unaudited)

| | Fund securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security shall be valued at, (i) the mean between the most recent quoted bid and asked prices at the close of the exchange on such day or (ii) the last sales price on the Composite Market for the day such security is being valued. “Composite Market” means a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets, as published by an approved independent pricing service (“Pricing Service”). |

| | |

| | Debt securities, including short-term debt instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and the asked prices, matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. In the absence of available quotations, the securities will be priced at fair value, as described below. Any discount or premium is accreted or amortized using the constant yield method until maturity. |

| | |

| | Redeemable securities issued by open-end, registered investment companies are valued at the net asset value (“NAV”) of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security’s fair value will be determined as described below. Money market mutual funds are valued at cost. If cost does not represent current market value the securities will be priced at fair value. |

| | |