UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant's telephone number, including area code

Date of fiscal year end: August 31, 2024

Date of reporting period: February 29, 2024

Item 1. Reports to Stockholders.

Semi-Annual Report | February 29, 2024

Performance Trust Total Return Bond Fund

(Symbols: PTIAX, PTAOX, PTCOX),

Performance Trust Municipal Bond Fund

(Symbols: PTIMX, PTRMX) and

Performance Trust Multisector Bond Fund

(Symbol: PTCRX)

© 2024 PT Asset Management, LLC. All Rights Reserved.

LETTER FROM THE INVESTMENT ADVISER

Dear Fellow Shareholders:

Performance Trust Total Return Bond Fund (PTIAX) Semi-Annual

Management’s Discussion of Fund Performance: 9/1/2023 – 2/29/2024 (Unaudited)

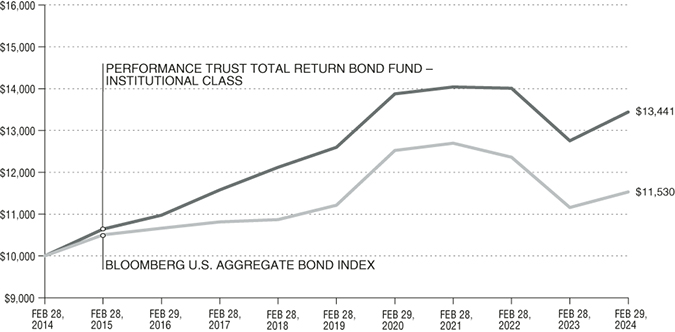

For the six-month period ended February 29, 2024, the Performance Trust Total Return Bond Fund – Institutional Class (“PTIAX” or the “Fund”) posted a return of 4.21% compared to 2.35% for the Bloomberg U.S. Aggregate Bond Index (“Index”). The Morningstar Intermediate Core-Plus Bond Fund category returned 2.45% for the period.

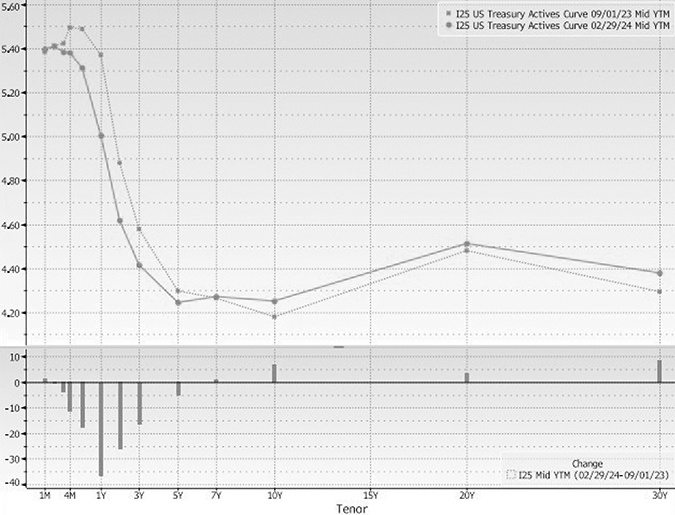

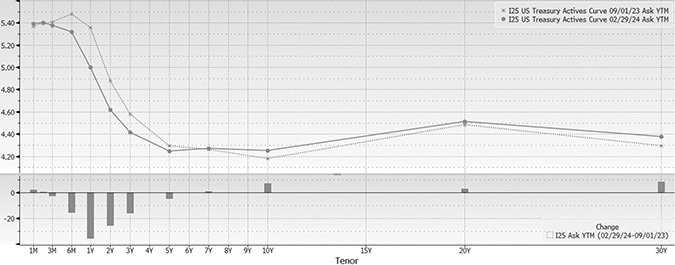

Interest rates fell at the short end of the U.S. Treasury yield curve during the semi-annual period as the Federal Reserve (Fed) hinted they may be done with their aggressive interest rate hiking cycle. The Fed kept their benchmark rate at a target range of 5.25%-5.50% throughout the semi-annual period as they sought to restore inflation to its long-term target of 2.00%. Interest rates were up slightly at the long end of the yield curve. The chart below shows the yield curve at the beginning of the semi-annual period and the end.

U.S. Treasury Yield Curve

The yield curve steepened during the semi-annual period. At the end of the period, the 1-year U.S. Treasury, which is quite sensitive to changes in the Fed Funds rate, yielded in excess of 5.00% while the benchmark 10-year U.S. Treasury yield offered just over 4.20%.

While interest rate volatility has ebbed and flowed since the Fed began its hiking cycle, the result has been a more favorable risk-taking environment. For example, high yield corporate (HY) spreads tightened 0.60% and ended the period at 3.12%, very close to the tightest level seen since Q3 2021. Investment grade corporate (IG) spreads tightened 0.22% to end the period at 0.96% (Source: Bloomberg). While inflation still exceeds the Fed’s target, it has fallen from the beginning of the semi-annual period and is now 6% lower than its peak in June 2022. The market is now anticipating that the Fed will begin cutting rates in the second half of 2024.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 3 |

LETTER FROM THE INVESTMENT ADVISER

Spread tightening across most sectors more than offset the increase in interest rates experienced at the long-end and helped to deliver strong total returns during the semi-annual period. U.S. Treasuries, Agency Mortgage-Backed Securities (MBS), and IG Corporates all provided positive total returns and assisted the Index’s performance over the semi-annual period. (Source: Bloomberg).

The Fund’s outperformance relative to the Index during the semi-annual period was driven by nearly all sectors in PTIAX and was led by select Non-Agency Commercial Mortgage-Backed Securities (CMBS), Collateralized Loan Obligations (CLOs), High-Yield (HY) Corporates, and Taxable Municipals, which delivered meaningfully positive total returns. All four sectors benefited from spread tightening experienced during the semi-annual period.

However, outperformance from the above sectors was partially offset by lower returns in long-dated U.S. Treasuries. The 20-year part of the curve has been the Fund’s recent focus and while 20-year U.S. Treasuries provided a positive total return during the semi-annual period, they are still quite sensitive to interest rate moves and cannot benefit from spread tightening like other sectors.

The table below shows a general breakdown of the Fund’s portfolio at the beginning and end of the fiscal period.

PTIAX Allocations

| | Sector Allocation PTIAX | 8/31/2023 | 2/29/2024 | |

| | Cash | 1.13% | 0.17% | |

| | Asset Backed Securities | 10.16% | 12.36% | |

| | Non-Agency RMBS | 7.58% | 5.70% | |

| | CLOs | 6.06% | 6.49% | |

| | Agency CMBS | 7.89% | 6.03% | |

| | Non-Agency CMBS | 16.73% | 14.89% | |

| | HY Corporates | 4.13% | 4.41% | |

| | U.S. Treasuries | 9.77% | 16.26% | |

| | IG Corporates | 14.46% | 13.66% | |

| | Taxable Municipals | 18.63% | 15.47% | |

| | Tax-Exempt Municipals | 3.46% | 4.56% | |

| | Other | 0.00% | 0.00% | |

The Fund increased its exposure to Asset-Backed Securities (ABS) as the inverted yield curve coupled with attractive spreads resulted in some of the highest all-in yields we have witnessed. As ABS remained our preferred method of adding Interest Rate Defense, we largely reduced or maintained other defensive sectors such as CMBS and HY Corporates. RMBS holdings also decreased as a result of ongoing amortization.

Similarly, as spreads tightened, the allocations to Municipals and IG Corporates were trimmed largely by exiting securities pricing off of the relatively unattractive belly of the yield curve. These reductions were made in favor of long-dated U.S. Treasuries. When combining long-dated U.S. Treasuries with ABS pricing off the short end of the yield curve, the resulting “barbell” (combination of short-term and long-term bonds) produces attractive total return potential in our opinion.

Looking Forward

While yields are still elevated from a historical standpoint, credit spreads have retraced much of the widening experienced during the prior fiscal year. Investors are being compensated more to take interest rate risk than nearly any other time since the Great Financial Crisis, but credit spreads are somewhat below average from a historical perspective. As a result, the Fund has increased its interest rate risk during the semi-annual period, but at the same time we have attempted to reduce credit risk.

We do not attempt to predict interest rates or credit spreads. We have positioned the Fund’s portfolio so that it has what we believe to be a balance of high-quality Interest Rate Offense (bonds with more interest rate sensitivity) and higher yielding Interest Rate Defense (bonds with less interest rate sensitivity). Within our Interest Rate Defense, we are attempting to prudently add higher yielding structured credit and corporate securities that are not exposed, in our opinion, to excessive credit risk or structural leverage.

As a total return bond fund, we seek to position ourselves in the most undervalued fixed-income securities we can find, consistent with the need for proper diversification and liquidity. To identify such opportunities, we find scenario analysis (over roughly a three-year investment horizon) to be more valuable than rate or market forecasting. We call this methodology Shape Management®, and we attribute the Fund’s historical performance largely to our allocation decisions.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 4

|

LETTER FROM THE INVESTMENT ADVISER

Performance Trust Municipal Bond Fund (PTIMX) Semi-Annual

Management’s Discussion of Fund Performance: 9/1/2023 – 2/29/2024 (Unaudited)

For the six-month period ended February 29, 2024, the Performance Trust Municipal Bond Fund – Institutional Class (“PTIMX” or the “Fund”) posted a return of 6.55% compared to 4.33% for the Bloomberg Municipal Bond Index (“Index”) and 4.01% for the Morningstar Municipal National Intermediate Bond Category (Morningstar category average). PTIMX’s outperformance can generally be attributed to the Fund’s higher allocation to bonds that carry more call protection and price off a longer part of the Municipal Market Data (MMD) AAA municipal benchmark yield curve (yield curve) making the Fund a little more responsive to movements in interest rates.

The table below shows the yield curve at the beginning and end of the period, as well as at the high in yields during the period on October 30, 2023. The yield for the 15-year spot on the yield curve decreased 51 basis points, one hundredth of one percent (bps) (0.51%), while the 10-year point on the yield curve decreased 47 bps. The 25-year maturity decreased 31 bps. The yield difference between the 10-year and 15-year points on the yield curve decreased slightly from 49 bps as of August 31, 2023, to 45 bps as of February 29, 2024, while the yield difference between the 10-year and 20-year points on the yield curve increased from 72 bps to 81 bps from the beginning to the end of the period. The 81 bps difference between these two points on the yield curve is the highest in nearly a decade. Thus, the 15 to 20-year part of the yield curve continues to provide a long-term investor with additional income as well as the potential to roll-down a portion of the yield curve that is steeper than has been observed over the last several years. In contrast, the 5-year to 10-year part of the yield curve provides less income potential and is very flat.

MMD AAA Scale

| Maturity | August 31, 2023 | February 29, 2024 | Change (bp) | October 30, 2023 |

| 1 | 3.25% | 2.98% | -27 | 3.76% |

| 5 | 2.88% | 2.44% | -44 | 3.51% |

| 7 | 2.88% | 2.44% | -44 | 3.56% |

| 10 | 2.93% | 2.46% | -47 | 3.61% |

| 15 | 3.42% | 2.91% | -51 | 4.09% |

| 20 | 3.65% | 3.27% | -38 | 4.33% |

| 25 | 3.82% | 3.51% | -31 | 4.53% |

| 30 | 3.88% | 3.59% | -29 | 4.57% |

Source: MMD AAA Scale as of August 31, 2023, February 29, 2024 and October 30, 2023

The configuration of the yield curve discussed above has persisted for several months. We do not predict the direction or magnitude of changes in interest rates. Our Shape Management® process evaluates total return outcomes across various interest rate scenarios, providing a consistent, systematic framework to guide our investment decisions. As a result, the Fund’s yield curve positioning is differentiated from that of the Morningstar category average with much more exposure to the 13 to 20-year part of the curve (43% of the Fund), while largely avoiding the less attractive 5 to 10-year maturities (2% of the Fund).

At the beginning of the period, tax-exempt yields increased relatively swiftly and by the end of October 2023, reached or exceeded levels last seen in the second half of 2013, surpassing the more recent high in yields during the fourth quarter of 2022. While these highs in tax-exempt yields were only available for a brief period prior to a meaningful decent that began in November 2023, the Fund attempted to use the opportunity to shore up call protection, or the amount of time until bonds become callable by the issuer, and lock in the higher yields provided by the interest rate environment that transpired.

In addition, as yields rose early in the period the Fund was provided with another opportunity to mitigate exposure to extension risk by moving “up in coupon” (or the interest rate paid on a bond by its issuer), primarily in the market for new issues. During the first half of the period, through the end of November 2023, approximately 64% of our new purchases were of bonds with coupons greater than 5%. The Fund’s total allocation to bonds with coupons greater than 5% was approximately 39 percent as of February 29, 2024. This is differentiated and higher than the Morningstar category average allocation to coupons greater than 5%.

After yields descended rapidly over the second half of the period, we began to target our new purchases at the very front end of the yield curve and complement the more call-protected bonds the Fund holds out on the curve. Approximately 47% of our new purchases since the beginning of December 2023 were bonds that mature in 2024.

Looking Forward

Looking forward over a longer-term investment horizon (3-years), with Shape Management® guiding our investment decisions, we remain very selective on the bond structures (coupon and call protection), and yield curve positioning that provide the most uniquely attractive total return outcomes across various interest rate scenarios. To the extent the current structure of the yield curve persists, with meaningful yield curve slope beyond 10-years, our additions are likely to remain relatively consistent with our activities during the last six months.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 5

|

LETTER FROM THE INVESTMENT ADVISER

Performance Trust Multisector Bond Fund (PTCRX) Semi-Annual

Management’s Discussion of Fund Performance: 9/1/2023 – 2/29/2024 (Unaudited)

For the six-month period ended February 29, 2024, the Institutional Class of the Performance Trust Multisector Bond Fund (“PTCRX” or the “Fund”) posted a return of 6.85%, assuming all dividends were reinvested into the Fund. The Bloomberg U.S. Aggregate Bond Index (“Index”) returned 2.35% over the same time, and the Morningstar Multisector US Bond Category (“Category”) returned 4.45%.

The Federal Reserve (Fed) held the Federal Funds Target Rate steady at a range of 5.25% to 5.50% for the six-month period ended February 29, 2024 after raising its target by 525 basis points (5.25%) since the first quarter of 2022 as part of their strategy to bring inflation back down to two percent. Looking forward, the Fed anticipates 75 basis points (0.75%) of rate cuts in 2024, and an additional 100 basis points (1.00%) in 2025. Yields across the U.S. Treasury yield curve (yield curve) were mostly unchanged, especially in the 5-year part of the curve. Rates on the longer end were slightly higher with the 10-year up 14 basis points (0.14%) and the 20-year 11 basis points (0.11%) higher. Rates on the front end of the yield curve modestly rallied especially the 1 year which saw a 39 basis point (0.39%) decline. While rates overall appeared to be less volatile, there were meaningful swings during the six-month period. For example, the 10-year started the semi-annual period at 4.11%, then sold off to just under 5.00% in October before rallying just below 3.79% by year end. The volatility we saw in rates was likely a reflection of the change in inflation expectations and perceived monetary response that persisted throughout the period.

The graph below shows the yield curve at the beginning and end of the period:

U.S. Treasury Yield Curve

Most credit markets continued to tighten during the period with the expectation that the Fed may be at the end of their tightening campaign and the prospects of a soft landing remained in play. Investment grade Bloomberg US Agg Corporate Avg OAS and high yield Bloomberg US Corporate High Yield Average OAS corporate credit spreads tightened 22 basis points (0.22%) and 60 basis points (0.60%), respectively. However, credit markets were somewhat volatile during this time with high yield corporate spreads (LF98OAS Index) widening 66 basis points (0.66%) from the beginning of the period until early November before rallying over 125 basis points (1.25%) through year-end. This spread volatility in high yield generally followed the moves in the U.S. Treasury market.

The Fund was able to outperform the Index during the semi-annual period due to its higher exposure, relative to the Index, to credit sensitive sectors which for the most part rallied. Notably, Non-Agency CMBS (NA CMBS), High Yield (HY) Corporates and Collateralized Loan Obligations (CLOs) were most responsible for the Fund’s outperformance. The biggest contributor to our outperformance was NA CMBS which rallied meaningfully as the rate outlook appeared to have stabilized allowing for NA CMBS spreads, which have been lagging other credit sectors, to tighten meaningfully during the semi-annual period. HY Corporates also contributed to our out performance as spreads in the sector tightened in the period. While NA CMBS and HY Corporates benefited from spread tightening, CLOs contributed to the Fund’s outperformance due to both spread tightening and their high coupons which are reset quarterly based on 3-Month SOFR (Secured Overnight Financing Rate). These three sectors make up a significant portion of the Fund relative to the Index.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 6 |

LETTER FROM THE INVESTMENT ADVISER

The table below shows a general breakdown of the Fund’s portfolio at the beginning and end of the semi-annual period:

| | Sector Allocations PTCRX | 8/31/2023 | 2/29/2024 | |

| | Cash | 2.43% | 1.72% | |

| | Asset Backed Securities | 8.42% | 6.45% | |

| | Non-Agency RMBS | 3.56% | 4.02% | |

| | CLOs | 12.02% | 14.81% | |

| | Agency CMBS | 3.65% | 0.00% | |

| | Non-Agency CMBS | 16.68% | 19.25% | |

| | HY Corporates | 16.96% | 23.59% | |

| | U.S. Treasuries | 5.07% | 6.15% | |

| | IG Corporates | 26.39% | 18.39% | |

| | Taxable Municipals | 2.33% | 3.26% | |

| | Tax-Exempt Municipals | 2.49% | 2.36% | |

The Fund increased its allocation to CLOs, NA CMBS and HY Corporates during the period while lowering our allocation to Investment Grade (IG) corporates. Generally, we added seasoned CLOs and shorter HY Corporates, while selling longer IG Corporates that priced off the less attractive belly of the yield curve. The NA CMBS positions we added were at compelling spreads relative to the other credit sectors we surveil.

Looking Forward

We are excited about the opportunities in the markets today. Even though credit spreads have tightened, all in-yields still look attractive on a historical basis. The fears surrounding regional banks and commercial real estate have not gone away and continue to create unique investment opportunities.

We will continue to use a balanced approach when making allocation decisions. The goal is to create a well-diversified bond portfolio that we believe can generate strong returns in multiple market environments.

Shape Management® continues to be a crucial tool for us and paired with our consistent bottom-up credit approach, will help guide us to make the right decisions as we navigate this volatile market. We will continue to selectively add credit risk. However, given this historically tight credit spread environment, we will likely focus on positions pricing off the front end of the curve, especially within HY Corporates and CLOs. We will also continue pursuing sectors such as NA CMBS that remain wide relative to other credit alternatives. We remain focused on finding the most attractive risk/reward opportunities across various sectors and look to stay nimble in this continuously changing environment.

Mutual fund investing involves risk. Principal loss is possible. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investments in lower rated and non-rated securities present a greater risk of loss to principal and interest than higher-rated securities. Investments in asset-backed and mortgage-backed securities include additional risks that investors should be aware of such as credit risk, prepayment risk, possible illiquidity and default, as well as increased susceptibility to adverse economic developments. Investments in real estate investment trusts (REITs) involve additional risks such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments. Derivatives involve investment exposure that may exceed the original cost and a small investment in derivatives could have a large potential impact on the performance of a Fund. Options and swap positions held in a Fund may be illiquid and the Fund’s investment adviser may have difficulty closing out a position. Diversification does not assure a profit or protect against a loss in a declining market. Income from tax-exempt bonds may be subject to state and local taxes and a portion of income may be subject to the federal alternative minimum tax for certain investors. Federal income tax rules will apply to any capital gains distributions.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 7

|

GROWTH OF PERFORMANCE TRUST TOTAL RETURN BOND FUND (PTIAX)

Performance Trust Total Return Bond Fund – Institutional Class (Unaudited)

Total Return vs. Bloomberg U.S. Aggregate Bond Index

Average Annual Returns—For the Periods Ended February 29, 2024 (Unaudited)

| | SIX | | | | | ANNUALIZED |

| | MONTHS | ONE | THREE | FIVE | TEN | SINCE INCEPTION |

| | NOT (ANNUALIZED) | YEAR | YEAR | YEAR | YEAR | (AUGUST 31, 2010)(1) |

| Performance Trust Total Return | | | | | | |

| Bond Fund – Institutional Class | 4.21% | 5.38% | -1.45% | 1.30% | 3.00% | 4.36% |

| Bloomberg U.S. Aggregate Bond Index | 2.35% | 3.33% | -3.16% | 0.56% | 1.43% | 1.84% |

(1) | The Performance Trust Total Return Bond Fund (the “Fund”) commenced investment operations on September 1, 2010. |

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, Bloomberg Capital dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, Mortgage-Backed Securities (agency fixed-rate and hybrid Adjustable-Rate Mortgage Passthroughs), Asset-Backed Securities, and Commercial Mortgage-Backed Securities. The Bloomberg U.S. Aggregate Bond Index was created in 1986, with index history backfilled to January 1, 1976. The chart at the top of the page assumes an initial gross investment of $10,000 made on February 28, 2014 for Institutional Class shares of the Fund.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all Fund distributions.

For a period of time following the Fund’s inception when the Fund’s asset levels were lower than current asset levels, the Fund’s investments in certain fixed-income instruments purchased in odd lot-sized transactions contributed positively to the Fund’s performance. As Fund asset levels increased, similar odd lot-sized transactions, if any, did not have the same relative impact on the Fund’s performance and are not anticipated to have the same relative impact on the Fund’s future performance.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1 (877) 738-9095 or by visiting www.PTAM.com.

The expense ratio for Institutional Class shares is 0.76% per the prospectus dated December 29, 2023. Please see the Financial Highlights in this report for the most recent expense ratio.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 8 |

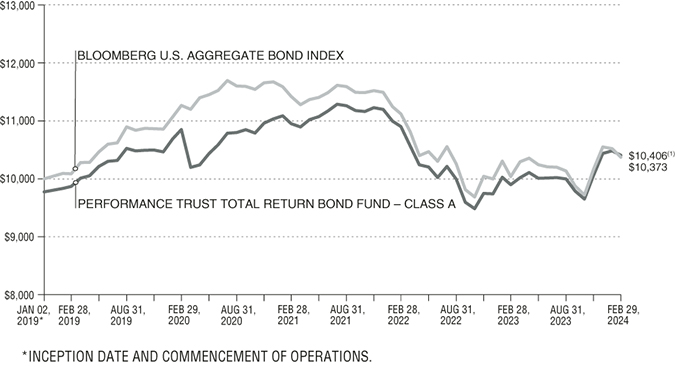

GROWTH OF PERFORMANCE TRUST TOTAL RETURN BOND FUND (PTAOX)

Performance Trust Total Return Bond Fund – Class A (Unaudited)

Total Return vs. Bloomberg U.S. Aggregate Bond Index

(1) | Reflects 2.25% initial sales load. |

Average Annual Returns—For the Periods Ended February 29, 2024 (Unaudited)

| | SIX | | | | ANNUALIZED |

| | MONTHS | ONE | THREE | FIVE | SINCE INCEPTION |

| | (NOT ANNUALIZED) | YEAR | YEAR | YEAR | (JANUARY 2, 2019) |

| Performance Trust Total Return Bond Fund – | | | | | |

| Class A (with sales charge) | 1.74% | 2.78% | -2.44% | 0.61% | 0.77% |

| Performance Trust Total Return Bond Fund – | | | | | |

| Class A (without sales charge) | 4.08% | 5.12% | -1.69% | 1.06% | 1.22% |

| Bloomberg U.S. Aggregate Bond Index | 2.35% | 3.33% | -3.16% | 0.56% | 0.71% |

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, Bloomberg Capital dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, Mortgage-Backed Securities (agency fixed-rate and hybrid Adjustable-Rate Mortgage Passthroughs), Asset-Backed Securities, and Commercial Mortgage-Backed Securities. The Bloomberg U.S. Aggregate Bond Index was created in 1986, with index history backfilled to January 1, 1976. The chart at the top of the page assumes an initial gross investment of $10,000 made on January 2, 2019, the inception date for Class A shares of the Performance Trust Total Return Bond Fund (the “Fund”).

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all Fund distributions.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1 (877) 738-9095 or by visiting www.PTAM.com.

The expense ratio for Class A shares is 1.01% per the prospectus dated December 29, 2023. Please see the Financial Highlights in this report for the most recent expense ratio.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 9 |

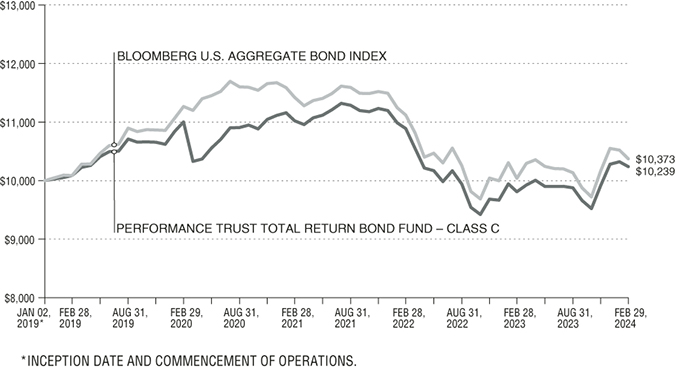

GROWTH OF PERFORMANCE TRUST TOTAL RETURN BOND FUND (PTCOX)

Performance Trust Total Return Bond Fund – Class C (Unaudited)

Total Return vs. Bloomberg U.S. Aggregate Bond Index

Average Annual Returns—For the Periods Ended February 29, 2024 (Unaudited)

| | SIX | | | | ANNUALIZED |

| | MONTHS | ONE | THREE | FIVE | SINCE INCEPTION |

| | (NOT ANNUALIZED) | YEAR | YEAR | YEAR | (JANUARY 2, 2019) |

| Performance Trust Total Return Bond Fund – | | | | | |

| Class C | 3.66% | 4.37% | -2.43% | 0.30% | 0.46% |

| Bloomberg U.S. Aggregate Bond Index | 2.35% | 3.33% | -3.16% | 0.56% | 0.71% |

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, Bloomberg Capital dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, Mortgage-Backed Securities (agency fixed-rate and hybrid Adjustable-Rate Mortgage Passthroughs), Asset-Backed Securities, and Commercial Mortgage-Backed Securities. The Bloomberg U.S. Aggregate Bond Index was created in 1986, with index history backfilled to January 1, 1976. The chart at the top of the page assumes an initial gross investment of $10,000 made on January 2, 2019, the inception date for Class C shares of the Performance Trust Total Return Bond Fund (the “Fund”).

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all Fund distributions.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1 (877) 738-9095 or by visiting www.PTAM.com.

The expense ratio for Class C shares is 1.76% per the prospectus dated December 29, 2023. Please see the Financial Highlights in this report for the most recent expense ratio.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 10

|

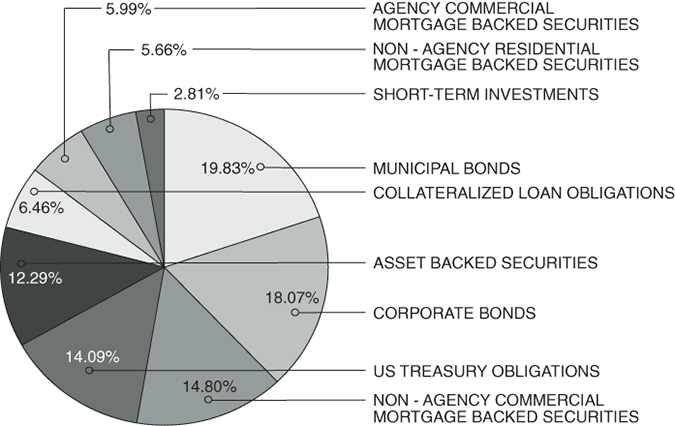

PERFORMANCE TRUST TOTAL RETURN BOND FUND (PTIAX, PTAOX, PTCOX)

Allocation of Portfolio Holdings (% of Investments) (Unaudited)

As of February 29, 2024

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 11

|

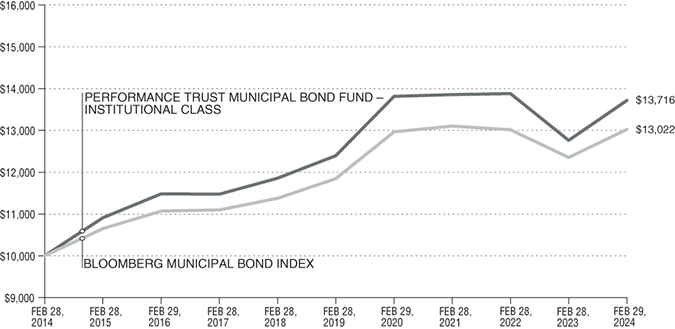

GROWTH OF PERFORMANCE TRUST MUNICIPAL BOND FUND (PTIMX)

Performance Trust Municipal Bond Fund – Institutional Class (Unaudited)

Total Return vs. Bloomberg Municipal Bond Index

Average Annual Returns—For the Periods Ended February 29, 2024 (Unaudited)

| | SIX | | | | | ANNUALIZED |

| | MONTHS | ONE | THREE | FIVE | TEN | SINCE INCEPTION |

| | (NOT ANNUALIZED) | YEAR | YEAR | YEAR | YEAR | (JUNE 30, 2011) |

| Performance Trust Municipal | | | | | | |

| Bond Fund – Institutional Class | 6.55% | 7.48% | -0.34% | 2.05% | 3.21% | 4.17% |

| Bloomberg Municipal Bond Index | 4.33% | 5.42% | -0.21% | 1.91% | 2.68% | 3.15% |

The Bloomberg Municipal Bond Index is a rules based, market-value-weighted index engineered for the long-term tax-exempt bond market. The index tracks general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds rated Baa3/ BBB or higher by at least two of the ratings agencies: Moody’s, S&P and Fitch. The Bloomberg Municipal Bond Index was created in 1986, with index history backfilled to January 1, 1976. The chart at the top of the page assumes an initial gross investment of $10,000 made on February 28, 2014 for the Institutional Class shares of the Performance Trust Municipal Bond Fund (the “Fund”).

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all Fund distributions.

For a period of time following the Fund’s inception when the Fund’s asset levels were lower than current asset levels, the Fund’s investments in certain fixed-income instruments purchased in odd lot-sized transactions contributed positively to the Fund’s performance. As Fund asset levels increased, similar odd lot-sized transactions, if any, did not have the same relative impact on the Fund’s performance and are not anticipated to have the same relative impact on the Fund’s future performance.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1 (877) 738-9095 or by visiting www.PTAM.com.

The expense ratio for Institutional Class shares is 0.50% per the prospectus dated December 29, 2023. Please see the Financial Highlights in this report for the most recent expense ratio.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 12

|

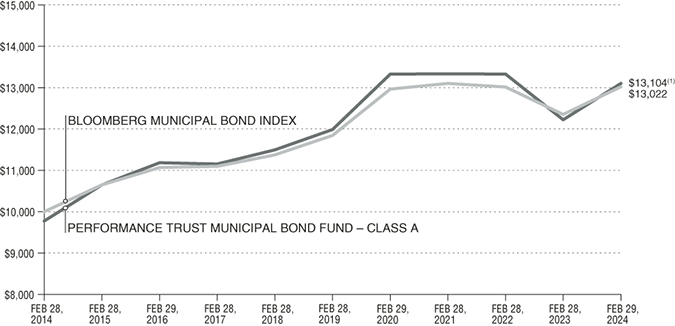

GROWTH OF PERFORMANCE TRUST MUNICIPAL BOND FUND (PTRMX)

Performance Trust Municipal Bond Fund – Class A (Unaudited)

Total Return vs. Bloomberg Municipal Bond Index

(1) | Reflects 2.25% initial sales load. |

Average Annual Returns—For the Periods Ended February 29, 2024 (Unaudited)

| | SIX | | | | | ANNUALIZED |

| | MONTHS | ONE | THREE | FIVE | TEN | SINCE INCEPTION |

| | (NOT ANNUALIZED) | YEAR | YEAR | YEAR | YEAR | (SEPTEMBER 28, 2012) |

| Performance Trust Municipal Bond | | | | | | |

| Fund – Class A (with sales charge) | 4.00% | 4.80% | -1.33% | 1.34% | 2.74% | 2.57% |

| Performance Trust Municipal Bond | | | | | | |

| Fund – Class A (without sales charge) | 6.41% | 7.20% | -0.58% | 1.80% | 2.97% | 2.77% |

| Bloomberg Municipal Bond Index | 4.33% | 5.42% | -0.21% | 1.91% | 2.68% | 2.45% |

The Bloomberg Municipal Bond Index is a rules based, market-value-weighted index engineered for the long-term tax-exempt bond market. The index tracks general obligation bonds, revenue bonds, insured bonds, and pre-refunded bonds rated Baa3/ BBB or higher by at least two of the ratings agencies: Moody’s, S&P and Fitch. The Bloomberg Municipal Bond Index was created in 1986, with index history backfilled to January 1, 1976. The chart at the top of the page assumes an initial gross investment of $10,000 made on February 28, 2014, the inception date for the Class A shares of the Performance Trust Municipal Bond Fund (the “Fund”).

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all Fund distributions.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1 (877) 738-9095 or by visiting www.PTAM.com.

The expense ratio for Class A shares is 0.75% per the prospectus dated December 29, 2023. Please see the Financial Highlights in this report for the most recent expense ratio.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 13 |

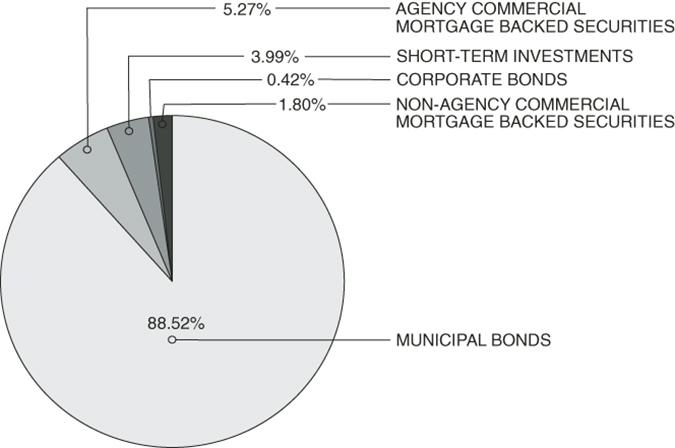

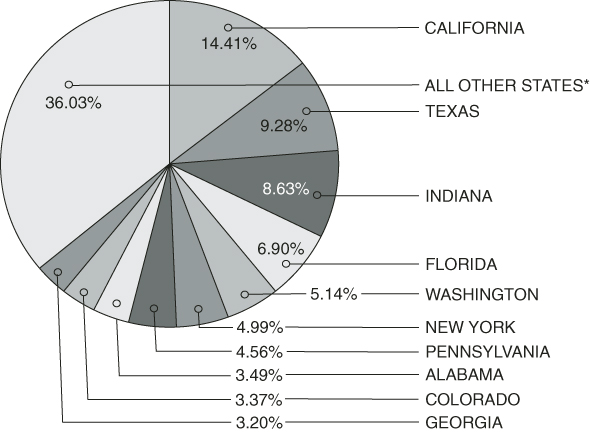

PERFORMANCE TRUST MUNICIPAL BOND FUND (PTIMX, PTRMX)

Allocation of Portfolio Holdings (% of Investments) (Unaudited)

As of February 29, 2024

* For additional details on allocation of portfolio assets by state, please see the Schedules of Investments.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 14

|

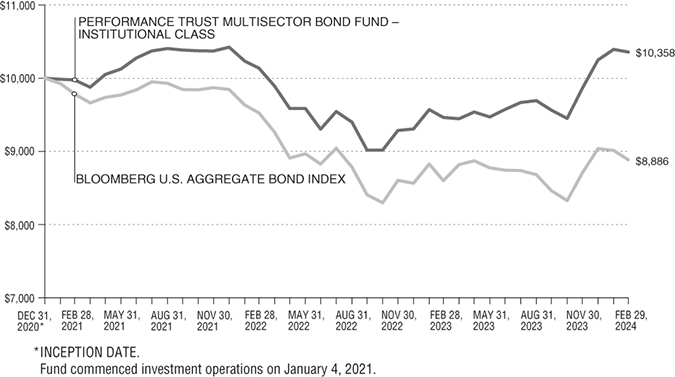

GROWTH OF PERFORMANCE TRUST MULTISECTOR BOND FUND (PTCRX)

Performance Trust Multisector Bond Fund – Institutional Class (Unaudited)

Total Return vs. Bloomberg U.S. Aggregate Bond Index

Returns—For the Periods Ended February 29, 2024 (Unaudited)

| | SIX | | | ANNUALIZED |

| | MONTHS | ONE | THREE | SINCE INCEPTION |

| | (NOT ANNUALIZED) | YEAR | YEAR | (DECEMBER 31, 2020)(1) |

| Performance Trust Multisector Bond Fund – | | | | |

| Institutional Class | 6.85% | 9.45% | 1.26% | 1.12% |

| Bloomberg U.S. Aggregate Bond Index | 2.35% | 3.33% | -3.16% | -3.67% |

(1) | The Performance Trust Multisector Bond Fund (the “Fund”) commenced investment operations on January 4, 2021. |

The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, Capital dollar denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, Mortgage-Backed Securities (agency fixed-rate and hybrid Adjustable-Rate Mortgage Passthroughs), Asset-Backed Securities, and Commercial Mortgage-Backed Securities. The Bloomberg U.S. Aggregate Bond Index was created in 1986, with index history backfilled to January 1, 1976. The chart at the top of the page assumes an initial gross investment of $10,000 made on December 31, 2020, the inception date for Institutional Class shares of the Fund.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Returns shown include the reinvestment of all Fund distributions. Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month end may be obtained by calling 1 (877) 738-9095 or by visiting www.PTAM.com.

The Fund’s investment adviser, PT Asset Management, LLC, has contractually agreed to waive its fees and/or pay for operating expenses of the Fund to ensure that total annual fund operating expenses (excluding any front-end or contingent deferred loads, Rule 12b-1 plan fees, shareholder servicing plan fees, taxes, leverage, interest, brokerage commissions and other transactional expenses, expenses incurred in connection with any merger or reorganization, dividends or interest on short positions, acquired fund fees and expenses or extraordinary expenses such as litigation expenses) do not exceed 0.99% of the average daily net assets of the Fund. This agreement is effective at least through December 29, 2024.

The gross and net expense ratios for Institutional Class shares per the prospectus dated December 29, 2023 were 1.07% and 1.00%, respectively. Please see the Financial Highlights in this report for the most recent expense ratios.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 15

|

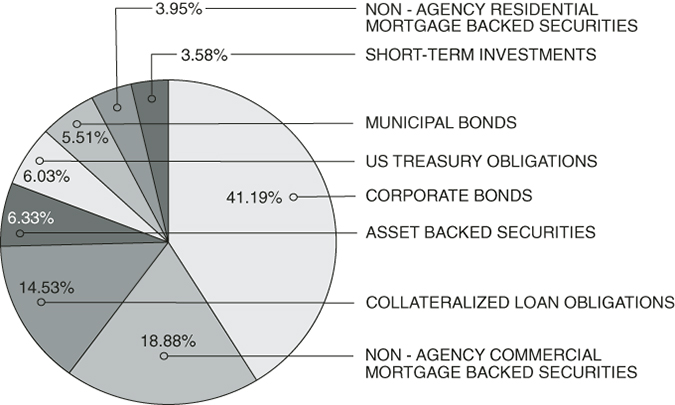

PERFORMANCE TRUST MULTISECTOR BOND FUND (PTCRX)

Allocation of Portfolio Holdings (% of Investments) (Unaudited)

As of February 29, 2024

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 16

|

(This Page Intentionally Left Blank.)

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 17

|

STATEMENTS OF ASSETS AND LIABILITIES

February 29, 2024 (Unaudited)

| | | Performance Trust | | | Performance Trust | | | Performance Trust | |

| | | Total Return | | | Municipal | | | Multisector | |

| | | Bond Fund | | | Bond Fund | | | Bond Fund | |

| Assets | | | | | | | | | |

| Investments, at value (cost $7,165,174,800, | | | | | | | | | |

| $691,515,355 and $102,352,795, respectively) | | $ | 6,673,469,858 | | | $ | 708,041,937 | | | $ | 101,938,980 | |

| Dividend and interest receivable | | | 59,845,012 | | | | 6,723,573 | | | | 1,006,615 | |

| Receivable for investments sold | | | — | | | | 4,726,760 | | | | — | |

| Receivable for fund shares sold | | | 29,791,598 | | | | 824,631 | | | | 153,252 | |

| Other assets | | | 155,371 | | | | 53,311 | | | | 18,100 | |

| Total Assets | | | 6,763,261,839 | | | | 720,370,212 | | | | 103,116,947 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Payable for investments purchased | | | 40,885,341 | | | | 20,844,893 | | | | 1,920,472 | |

| Payable for fund shares redeemed | | | 4,104,238 | | | | 399,169 | | | | 56,949 | |

| Payable to adviser | | | 2,220,855 | | | | 159,980 | | | | 34,565 | |

| Payable to affiliates | | | 620,609 | | | | 75,953 | | | | 19,146 | |

| Payable for distribution fees | | | 33,448 | | | | 6,996 | | | | — | |

| Payable for shareholder servicing fees | | | 17,813 | | | | — | | | | — | |

| Accrued expenses and other liabilities | | | 597,672 | | | | 20,255 | | | | 18,047 | |

| Total Liabilities | | | 48,479,976 | | | | 21,507,246 | | | | 2,049,179 | |

| | | | | | | | | | | | | |

| Net Assets | | | 6,714,781,863 | | | | 698,862,966 | | | | 101,067,768 | |

| | | | | | | | | | | | | |

| Net Assets Consist Of: | | | | | | | | | | | | |

| Paid-in capital | | $ | 7,696,265,816 | | | $ | 775,870,775 | | | $ | 105,339,122 | |

| Total accumulated loss | | | (981,483,953 | ) | | | (77,007,809 | ) | | | (4,271,354 | ) |

| Net Assets | | $ | 6,714,781,863 | | | $ | 698,862,966 | | | $ | 101,067,768 | |

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 18

|

STATEMENTS OF ASSETS AND LIABILITIES (CONT.)

February 29, 2024 (Unaudited)

| | | Performance Trust | | | Performance Trust | | | Performance Trust | |

| | | Total Return | | | Municipal | | | Multisector | |

| | | Bond Fund | | | Bond Fund | | | Bond Fund | |

| Total Return Bond Fund, Municipal Bond Fund | | | | | | | | | |

| and Multisector Bond Fund Shares – | | | | | | | | | |

| Institutional Class | | | | | | | | | |

| Net assets | | $ | 6,637,622,872 | | | $ | 662,508,302 | | | $ | 101,067,768 | |

| Shares of beneficial interest outstanding (unlimited | | | | | | | | | | | | |

| number of shares authorized, $0.001 par value) | | | 339,856,506 | | | | 28,771,142 | | | | 11,520,138 | |

| Net asset value, redemption | | | | | | | | | | | | |

| and offering price per share | | $ | 19.53 | | | $ | 23.03 | | | $ | 8.77 | |

| | | | | | | | | | | | | |

| Total Return Bond Fund and Municipal | | | | | | | | | | | | |

| Bond Fund Shares – Class A | | | | | | | | | | | | |

| Net assets | | $ | 30,702,911 | | | $ | 36,354,664 | | | | | |

| Shares of beneficial interest outstanding (unlimited | | | | | | | | | | | | |

| number of shares authorized, $0.001 par value) | | | 1,571,941 | | | | 1,577,432 | | | | | |

| Net asset value, redemption | | | | | | | | | | | | |

| and offering price per share | | $ | 19.53 | | | $ | 23.05 | | | | | |

| Maximum offering price per share | | | | | | | | | | | | |

(Net asset value per share divided by 0.9775)(1) | | $ | 19.98 | | | $ | 23.58 | | | | | |

| | | | | | | | | | | | | |

| Total Return Bond Fund Shares – Class C | | | | | | | | | | | | |

| Net assets | | $ | 46,456,080 | | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited | | | | | | | | | | | | |

| number of shares authorized, $0.001 par value) | | | 2,388,744 | | | | | | | | | |

| Net asset value, redemption | | | | | | | | | | | | |

| and offering price per share | | $ | 19.45 | | | | | | | | | |

| (1) | Reflects a maximum sales charge of 2.25%. |

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 19

|

PERFORMANCE TRUST TOTAL RETURN BOND FUND — SCHEDULE OF INVESTMENTS

February 29, 2024 (Unaudited)

| | | PAR | | | VALUE | |

| | | | | | | |

| MUNICIPAL BONDS – 19.7% | | | | | | |

| Alabama – 0.3% | | | | | | |

| Baldwin County Public Building | | | | | | |

| Authority, 2.00%, 03/01/2046 | | $ | 1,210,000 | | | $ | 760,273 | |

| Water Works Board of | | | | | | | | |

| the City of Birmingham | | | | | | | | |

| 2.51%, 01/01/2036 | | | 13,945,000 | | | | 11,054,913 | |

| 2.71%, 01/01/2038 | | | 6,835,000 | | | | 5,322,421 | |

| 3.57%, 01/01/2045 | | | 385,000 | | | | 311,478 | |

| | | |

| | | | 17,449,085 | |

| California – 3.4% | | | | | | | | |

| Alvord Unified School District, | | | | | | | | |

| 0.00%, 08/01/2046 (a) | | | 2,105,000 | | | | 2,432,851 | |

| Bakersfield City School District, | | | | | | | | |

| 0.00%, 05/01/2047 (a) | | | 9,765,000 | | | | 7,531,200 | |

| Chaffey Community College | | | | | | | | |

| District, 3.00%, 06/01/2038 | | | 3,705,000 | | | | 3,433,242 | |

| Chaffey Joint Union High School | | | | | | | | |

| District, 3.14%, 08/01/2043 | | | 3,790,000 | | | | 2,847,910 | |

| City of Los Angeles | | | | | | | | |

| Department of Airports | | | | | | | | |

| 1.88%, 05/15/2030 | | | 230,000 | | | | 188,063 | |

| 7.05%, 05/15/2040 | | | 2,660,000 | | | | 3,120,177 | |

| City of Ontario, CA, | | | | | | | | |

| 3.78%, 06/01/2038 | | | 3,000,000 | | | | 2,574,328 | |

| City of Sacramento, CA Transient | | | | | | | | |

| Occupancy Tax Revenue, | | | | | | | | |

| 3.86%, 06/01/2025 | | | 3,320,000 | | | | 3,256,431 | |

| City of San Francisco, CA | | | | | | | | |

| Public Utilities Commission Water | | | | | | | | |

| Revenue, 2.85%, 11/01/2041 | | | 2,000,000 | | | | 1,484,260 | |

| City of Union City, CA, | | | | | | | | |

| 0.00%, 07/01/2025 (b) | | | 2,105,000 | | | | 1,961,610 | |

| Clovis Unified School District, | | | | | | | | |

| 3.07%, 08/01/2039 | | | 14,455,000 | | | | 11,481,320 | |

| Coast Community College District, | | | | | | | | |

| 2.96%, 08/01/2038 | | | 15,000,000 | | | | 11,994,322 | |

| Cucamonga Valley Water District | | | | | | | | |

| Financing Authority, | | | | | | | | |

| 3.01%, 09/01/2042 | | | 5,000,000 | | | | 3,784,286 | |

| East Side Union High School | | | | | | | | |

| District, 5.32%, 04/01/2036 | | | 6,505,000 | | | | 6,521,622 | |

| Fullerton Public Financing Authority, | | | | | | | | |

| 7.75%, 05/01/2031 | | | 1,145,000 | | | | 1,257,512 | |

| Gateway Unified School District, CA | | | | | | | | |

| 0.00%, 08/01/2035 (b) | | | 2,315,000 | | | | 1,551,467 | |

| 0.00%, 08/01/2036 (b) | | | 2,315,000 | | | | 1,470,903 | |

| Golden State Tobacco | | | | | | | | |

| Securitization Corp. | | | | | | | | |

| 2.79%, 06/01/2031 | | | 15,930,000 | | | | 13,435,701 | |

| 3.00%, 06/01/2046 | | | 10,835,000 | | | | 9,992,920 | |

| Inland Empire Tobacco | | | | | | | | |

| Securitization Corp., | | | | | | | | |

| 3.68%, 06/01/2038 | |

| 19,965,000 | | |

| 18,829,634 | |

| Los Angeles Community College | | | | | | | | |

| District, CA, 6.60%, 08/01/2042 | | | 7,545,000 | | | | 8,712,392 | |

| Marin Community College District, | | | | | | | | |

| 2.70%, 08/01/2041 | | | 1,025,000 | | | | 737,345 | |

| Norwalk-La Mirada Unified School | | | | | | | | |

| District, 0.00%, 08/01/2038 (b) | | | 4,450,000 | | | | 2,444,868 | |

| Paramount Unified School District, | | | | | | | | |

| 3.27%, 08/01/2051 | | | 13,425,000 | | | | 9,764,437 | |

| Peralta Community College District, | | | | | | | | |

| 0.00%, 08/05/2031 (a) | | | 12,350,000 | | | | 11,537,363 | |

| Perris Union High School District, | | | | | | | | |

| 2.70%, 09/01/2042 | | | 3,000,000 | | | | 2,125,347 | |

| Riverside County Infrastructure | | | | | | | | |

| Financing Authority, | | | | | | | | |

| 3.19%, 11/01/2041 | | | 4,755,000 | | | | 3,652,950 | |

| San Diego County Regional | | | | | | | | |

| Transportation Commission, | | | | | | | | |

| 3.25%, 04/01/2048 | | | 3,155,000 | | | | 2,387,655 | |

| San Diego Unified School District, | | | | | | | | |

| 0.00%, 07/01/2036 (b) | | | 7,915,000 | | | | 5,199,806 | |

| San Francisco City & County | | | | | | | | |

| Redevelopment Financing | | | | | | | | |

| Authority, 0.00%, 08/01/2036 (b) | | | 5,240,000 | | | | 2,742,467 | |

| San Mateo Foster City School | | | | | | | | |

| District, 3.06%, 08/01/2044 | | | 2,245,000 | | | | 1,629,627 | |

| Santa Ana Unified School District, | | | | | | | | |

| 0.00%, 08/01/2037 (b) | | | 3,955,000 | | | | 2,422,725 | |

| Santa Monica Community College | | | | | | | | |

| District, 2.80%, 08/01/2044 | | | 2,300,000 | | | | 1,625,361 | |

| State of California, | | | | | | | | |

| 7.55%, 04/01/2039 | | | 28,000,000 | | | | 34,141,150 | |

| University of California | | | | | | | | |

| 4.86%, 05/15/2112 | | | 4,746,000 | | | | 4,361,180 | |

| 4.77%, 05/15/2115 | | | 7,397,000 | | | | 6,670,226 | |

| Ventura County Public Financing | | | | | | | | |

| Authority, 2.91%, 11/01/2038 | | | 10,545,000 | | | | 8,178,308 | |

| West Contra Costa Unified School | | | | | | | | |

| District, 0.00%, 08/01/2036 (b) | | | 5,000,000 | | | | 3,227,631 | |

| West Sonoma County Union | | | | | | | | |

| High School District, | | | | | | | | |

| 0.00%, 08/01/2037 (b) | | | 1,840,000 | | | | 1,108,013 | |

| William S. Hart Union High School | | | | | | | | |

| District, 0.00%, 08/01/2036 (b) | | | 1,150,000 | | | | 742,355 | |

| Yosemite Community College | | | | | | | | |

| District, 0.00%, 08/01/2038 (b) | | | 6,110,000 | | | | 3,537,474 | |

| Yuba Community College District, | | | | | | | | |

| 0.00%, 08/01/2038 (b) | | | 5,055,000 | | | | 2,968,347 | |

| | | |

| | | | 229,066,786

| |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 20

|

PERFORMANCE TRUST TOTAL RETURN BOND FUND — SCHEDULE OF INVESTMENTS (CONT.)

February 29, 2024 (Unaudited)

| | | PAR | | | VALUE | |

| | | | | | | |

| Colorado – 0.3% | | | | | | |

| City of Aurora, CO Water Revenue, | | | | | | |

| 2.72%, 08/01/2046 | | $ | 880,000 | | | $ | 595,018 | |

| City of Fountain, CO Electric Water | | | | | | | | |

| & Wastewater Utility Enterprise | | | | | | | | |

| Revenue, 3.20%, 12/01/2043 | | | 2,655,000 | | | | 1,986,873 | |

| City of Fruita, CO Healthcare | | | | | | | | |

| Revenue, 5.00%, 01/01/2028 | | | 1,825,000 | | | | 1,758,255 | |

| Colorado Health Facilities Authority | | | | | | | | |

| 3.70%, 11/01/2039 | | | 2,825,000 | | | | 2,391,344 | |

| 3.80%, 11/01/2044 | | | 11,815,000 | | | | 9,483,068 | |

| 3.85%, 11/01/2049 | | | 2,030,000 | | | | 1,580,898 | |

| | | |

| | | | 17,795,456

| |

| Connecticut – 0.5% | | | | | | | | |

| State of Connecticut | | | | | | | | |

| 3.00%, 01/15/2036 | | | 5,000,000 | | | | 4,752,217 | |

| 3.00%, 01/15/2037 | | | 7,090,000 | | | | 6,589,487 | |

| 3.00%, 06/01/2037 | | | 8,620,000 | | | | 7,946,919 | |

| State of Connecticut Special Tax | | | | | | | | |

| Revenue, 3.13%, 05/01/2040 | | | 6,975,000 | | | | 6,221,185 | |

| Town of West Hartford, CT, | | | | | | | | |

| 2.76%, 07/01/2041 | | | 7,025,000 | | | | 5,323,027 | |

| | | |

| | | | 30,832,835

| |

| District of Columbia – 0.4% | | | | | | | | |

| District of Columbia Water & Sewer | | | | | | | | |

| Authority, 4.81%, 10/01/2114 | | | 10,372,000 | | | | 9,536,516 | |

| Metropolitan Washington Airports | | | | | | | | |

| Authority Dulles Toll Road Revenue | | | | | | | | |

| 3.56%, 10/01/2041 | | | 2,995,000 | | | | 2,413,287 | |

| 8.00%, 10/01/2047 | | | 10,645,000 | | | | 13,990,896 | |

| | | |

| | | | 25,940,699

| |

| Florida – 1.0% | | | | | | | | |

| Central Florida Tourism Oversight | | | | | | | | |

| District, 2.73%, 06/01/2038 | | | 18,500,000 | | | | 14,317,951 | |

| City of Gainesville, FL | | | | | | | | |

| 0.00%, 10/01/2027 (b) | | | 4,610,000 | | | | 3,824,644 | |

| 0.00%, 10/01/2028 (b) | | | 1,400,000 | | | | 1,103,829 | |

| 3.05%, 10/01/2040 | | | 10,840,000 | | | | 8,127,209 | |

| City of Gainesville, FL Utilities | | | | | | | | |

| System Revenue, | | | | | | | | |

| 6.02%, 10/01/2040 | | | 6,015,000 | | | | 6,446,805 | |

| County of Miami-Dade, FL Transit | | | | | | | | |

| System, 5.62%, 07/01/2040 | | | 17,020,000 | | | | 17,511,720 | |

| JEA Water & Sewer System | | | | | | | | |

| Revenue, 3.00%, 10/01/2041 | | | 5,045,000 | | | | 4,355,426 | |

| Orlando Utilities Commission, | | | | | | | | |

| 5.66%, 10/01/2040 | | | 8,000,000 | | | | 8,437,675 | |

| | | |

| | | | 61,125,259

| |

| Georgia – 0.2% | | | | | | | | |

| City of Atlanta, GA Water & | | | | | | | | |

| Wastewater Revenue, | | | | | | | | |

| 2.91%, 11/01/2043 | |

| 1,625,000 | | |

| 1,189,337 | |

| Municipal Electric Authority of | | | | | | | | |

| Georgia, 2.50%, 01/01/2031 | | | 10,355,000 | | | | 8,924,694 | |

| State of Georgia, | | | | | | | | |

| 2.25%, 07/01/2039 | | | 5,000,000 | | | | 3,620,704 | |

| Tift County Hospital Authority, | | | | | | | | |

| 2.98%, 12/01/2042 | | | 2,950,000 | | | | 2,144,765 | |

| | | |

| | | | 15,879,500 | |

| Hawaii – 0.3% | | | | | | | | |

| City & County Honolulu, HI | | | | | | | | |

| Wastewater System Revenue, | | | | | | | | |

| 2.57%, 07/01/2041 | | | 5,000,000 | | | | 3,578,917 | |

| State of Hawaii | | | | | | | | |

| 2.25%, 08/01/2038 | | | 3,875,000 | | | | 2,802,892 | |

| 2.80%, 10/01/2038 | | | 10,000,000 | | | | 7,776,071 | |

| 2.83%, 10/01/2039 | | | 3,730,000 | | | | 2,858,719 | |

| 2.87%, 10/01/2041 | | | 2,270,000 | | | | 1,683,896 | |

| | | |

| | | | 18,700,495 | |

| Illinois – 0.2% | | | | | | | | |

| Illinois Finance Authority, | | | | | | | | |

| 3.51%, 05/15/2041 | | | 7,000,000 | | | | 5,306,591 | |

| Metropolitan Pier & | | | | | | | | |

| Exposition Authority | | | | | | | | |

| 0.00%, 06/15/2036 (b) | | | 4,025,000 | | | | 2,408,607 | |

| 0.00%, 12/15/2036 (b) | | | 5,000,000 | | | | 3,010,505 | |

| 0.00%, 06/15/2038 (b) | | | 2,750,000 | | | | 1,461,865 | |

| State of Illinois, 5.75%, 01/01/2037 | | | 3,000,000 | | | | 3,032,677 | |

| | | |

| | | | 15,220,245 | |

| Indiana – 0.1% | | | | | | | | |

| Indiana Finance Authority, | | | | | | | | |

| 4.81%, 07/15/2035 | | | 3,000,000 | | | | 2,922,832 | |

| Indianapolis Local Public | | | | | | | | |

| Improvement Bond Bank, | | | | | | | | |

| 2.47%, 01/01/2040 | | | 9,500,000 | | | | 7,071,317 | |

| | | |

| | | | 9,994,149 | |

| Kansas – 0.0% (c) | | | | | | | | |

| Kansas Development Finance | | | | | | | | |

| Authority, 4.93%, 04/15/2045 | | | 2,050,000 | | | | 1,971,114 | |

| | | | | | | | | |

| Kentucky – 0.1% | | | | | | | | |

| County of Warren, KY, | | | | | | | | |

| 4.40%, 12/01/2038 | | | 1,540,000 | | | | 1,425,239 | |

| Louisville and Jefferson County | | | | | | | | |

| Metropolitan Sewer District, | | | | | | | | |

| 2.25%, 05/15/2044 | | | 5,215,000 | | | | 3,636,088 | |

| | | |

| | | | 5,061,327 | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 21

|

PERFORMANCE TRUST TOTAL RETURN BOND FUND — SCHEDULE OF INVESTMENTS (CONT.)

February 29, 2024 (Unaudited)

| | | PAR | | | VALUE | |

| | | | | | | |

| Louisiana – 0.4% | | | | | | |

| City of New Orleans, LA | | | | | | |

| Water System Revenue | | | | | | |

| 1.69%, 12/01/2029 | | $ | 1,800,000 | | | $ | 1,517,332 | |

| 1.84%, 12/01/2030 | | | 3,120,000 | | | | 2,573,231 | |

| 1.94%, 12/01/2031 | | | 1,635,000 | | | | 1,317,480 | |

| 2.89%, 12/01/2041 | | | 3,050,000 | | | | 2,227,951 | |

| East Baton Rouge Sewerage | | | | | | | | |

| Commission, 2.44%, 02/01/2039 | | | 2,500,000 | | | | 1,828,770 | |

| State of Louisiana Gasoline & | | | | | | | | |

| Fuels Tax Revenue | | | | | | | | |

| 2.53%, 05/01/2041 | | | 12,055,000 | | | | 8,614,423 | |

| 2.83%, 05/01/2043 | | | 9,570,000 | | | | 6,757,627 | |

| | | |

| | | | 24,836,814 | |

| Maine – 0.2% | | | | | | | | |

| City of Portland, ME | | | | | | | | |

| 2.50%, 04/01/2039 | | | 1,760,000 | | | | 1,410,653 | |

| 2.50%, 04/01/2040 | | | 1,760,000 | | | | 1,378,759 | |

| 2.50%, 04/01/2041 | | | 1,760,000 | | | | 1,351,024 | |

| Maine Health & Higher Educational | | | | | | |

| |

| Facilities Authority, | | | | | | | | |

| 3.12%, 07/01/2043 | | | 14,250,000 | | | | 10,439,288 | |

| | | |

| | | | 14,579,724 | |

| Maryland – 0.2% | | | | | | | | |

| Maryland Health & Higher | | | | | | | | |

| Educational Facilities Authority, | | | | | | | | |

| 3.05%, 07/01/2040 | | | 10,000,000 | | | | 7,495,067 | |

| Maryland Stadium Authority, | | | | | | | | |

| 2.81%, 05/01/2040 | | | 7,000,000 | | | | 5,271,112 | |

| | | |

| | | | 12,766,179 | |

| Massachusetts – 0.1% | | | | | | | | |

| Commonwealth of Massachusetts, | | | | | | | | |

| 2.38%, 09/01/2043 | | | 3,250,000 | | | | 2,387,785 | |

| Massachusetts Educational | | | | | | | | |

| Financing Authority, | | | | | | | | |

| 3.83%, 07/01/2024 | | | 450,000 | | | | 447,652 | |

| Massachusetts School Building | | | | | | | | |

| Authority, 2.95%, 05/15/2043 | | | 1,540,000 | | | | 1,166,413 | |

| Massachusetts State College | | | | | | | | |

| Building Authority, | | | | | | | | |

| 5.93%, 05/01/2040 | | | 550,000 | | | | 566,683 | |

| | | |

| | | | 4,568,533 | |

| Michigan – 0.9% | | | | | | | | |

| City of Detroit, MI, | | | | | | | | |

| 4.00%, 04/01/2044 (d) | | | 8,700,000 | | | | 6,463,275 | |

| Detroit City School District, | | | | | | | | |

| 7.75%, 05/01/2039 | | | 11,950,000 | | | | 13,958,524 | |

| Michigan Finance Authority | | | | | | | | |

| 3.08%, 12/01/2034 | | | 5,095,000 | | | | 4,399,732 | |

| 3.27%, 06/01/2039 | | | 19,000,000 | | | | 17,279,979 | |

| Plymouth-Canton Community | | | | | | | | |

| School District, | | | | | | | | |

| 3.00%, 05/01/2040 | |

| 1,675,000 | | |

| 1,451,025 | |

| University of Michigan, | | | | | | | | |

| 4.45%, 04/01/2122 | | | 19,211,000 | | | | 16,406,292 | |

| | | |

| | | | 59,958,827 | |

| Minnesota – 0.5% | | | | | | | | |

| State of Minnesota, | | | | | | | | |

| 2.88%, 06/01/2041 | | | 16,435,000 | | | | 12,334,620 | |

| Western Minnesota Municipal | | | | | | | | |

| Power Agency, | | | | | | | | |

| 3.16%, 01/01/2039 | | | 17,700,000 | | | | 14,637,001 | |

| White Bear Lake Independent | | | | | | | | |

| School District No. 624, | | | | | | | | |

| 3.00%, 02/01/2044 | | | 8,330,000 | | | | 7,011,265 | |

| | | |

| | | | 33,982,886 | |

| | | | | | | | | |

| Mississippi – 0.1% | | | | | | | | |

| Mississippi Development Bank, | | | | | | | | |

| 5.46%, 10/01/2036 | | | 5,005,000 | | | | 5,024,906 | |

| | | | | | | | | |

| Missouri – 0.1% | | | | | | | | |

| Kansas City Land Clearance | | | | | | | | |

| Redevelopment Authority, | | | | | | | | |

| 6.40%, 10/15/2040 (e) | | | 7,915,000 | | | | 7,270,656 | |

| | | | | | | | | |

| Nebraska – 0.1% | | | | | | | | |

| Lancaster County School | | | | | | | | |

| District 001, 3.00%, 01/15/2043 | | | 6,075,000 | | | | 5,153,189 | |

| | | | | | | | | |

| Nevada – 0.3% | | | | | | | | |

| City of North Las Vegas, NV, | | | | | | | | |

| 6.57%, 06/01/2040 | | | 14,155,000 | | | | 15,736,029 | |

| County of Clark, NV | | | | | | | | |

| 3.00%, 07/01/2038 | | | 4,000,000 | | | | 3,600,775 | |

| 3.23%, 07/01/2044 | | | 2,000,000 | | | | 1,496,240 | |

| | | |

| | | | 20,833,044 | |

| New Hampshire – 0.0% (c) | | | | | | | | |

| New Hampshire Business Finance | | | | | | | | |

| Authority, 3.28%, 10/01/2037 | | | 4,815,000 | | | | 3,353,461 | |

| | | | | | | | | |

| New Jersey – 0.9% | | | | | | | | |

| City of Bayonne, NJ, | | | | | | | | |

| 2.81%, 07/01/2039 | | | 5,725,000 | | | | 4,247,291 | |

| Clifton Board Of Education, | | | | | | | | |

| 2.13%, 08/15/2044 | | | 4,560,000 | | | | 3,076,400 | |

| County of Essex, NJ, | | | | | | | | |

| 2.00%, 09/01/2044 | | | 3,560,000 | | | | 2,375,542 | |

| Mercer County Improvement | | | | | | | | |

| Authority, 8.27%, 12/01/2034 | | | 13,390,000 | | | | 15,963,111 | |

| New Jersey Economic Development | | | | | | | | |

| Authority, 0.00%, 02/15/2025 (b) | | | 20,188,000 | | | | 19,232,284 | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 22

|

PERFORMANCE TRUST TOTAL RETURN BOND FUND — SCHEDULE OF INVESTMENTS (CONT.)

February 29, 2024 (Unaudited)

| | | PAR | | | VALUE | |

| | | | | | | |

| New Jersey – 0.9% (Cont.) | | | | | | |

| New Jersey Institute of Technology | | | | | | |

| 3.32%, 07/01/2024 | | $ | 770,000 | | | $ | 764,772 | |

| 3.42%, 07/01/2042 | | | 6,455,000 | | | | 5,101,309 | |

| New Jersey Transportation | | | | | | | | |

| Trust Fund Authority | | | | | | | | |

| 0.00%, 12/15/2039 (b) | | | 5,000,000 | | | | 2,687,624 | |

| 0.00%, 12/15/2040 (b) | | | 10,045,000 | | | | 5,093,020 | |

| New Jersey Turnpike Authority, | | | | | | | | |

| 2.78%, 01/01/2040 | | | 5,220,000 | | | | 3,892,865 | |

| | | |

| | | | 62,434,218 | |

| New York – 0.6% | | | | | | | | |

| New York City Industrial | | | | | | | | |

| Development Agency, | | | | | | | | |

| 2.44%, 01/01/2036 | | | 5,850,000 | | | | 4,338,517 | |

| New York City Transitional Finance | | | | | | | | |

| Authority Building Aid Revenue, | | | | | | | | |

| 3.00%, 07/15/2038 | | | 1,400,000 | | | | 1,264,648 | |

| New York Liberty | | | | | | | | |

| Development Corp. | | | | | | | | |

| 2.25%, 02/15/2041 | | | 13,595,000 | | | | 10,072,350 | |

| 3.00%, 02/15/2042 | | | 5,500,000 | | | | 4,731,709 | |

| 3.00%, 09/15/2043 | | | 12,500,000 | | | | 10,450,945 | |

| New York State Dormitory Authority, | | | | | | | | |

| 5.10%, 08/01/2034 | | | 3,125,000 | | | | 2,806,215 | |

| Triborough Bridge & Tunnel | | | | | | | | |

| Authority, 2.92%, 05/15/2040 | | | 3,890,000 | | | | 2,940,168 | |

| Western Nassau County Water | | | | | | | | |

| Authority, 2.96%, 04/01/2041 | | | 1,500,000 | | | | 1,126,052 | |

| | | |

| | | | 37,730,604 | |

| North Carolina – 0.1% | | | | | | | | |

| North Carolina State University at | | | | | | | | |

| Raleigh, 3.02%, 10/01/2042 | | | 4,000,000 | | | | 2,975,808 | |

| University of North Carolina at | | | | | | | | |

| Charlotte, 2.76%, 04/01/2043 | | | 2,000,000 | | | | 1,446,828 | |

| | | |

| | | | 4,422,636 | |

| Ohio – 1.1% | | | | | | | | |

| American Municipal Power, Inc. | | | | | | | | |

| 7.83%, 02/15/2041 | | | 10,760,000 | | | | 13,174,616 | |

| 6.45%, 02/15/2044 | | | 5,000,000 | | | | 5,432,803 | |

| 7.50%, 02/15/2050 | | | 4,430,000 | | | | 5,425,828 | |

| County of Hamilton, OH, | | | | | | | | |

| 3.76%, 06/01/2042 | | | 11,955,000 | | | | 9,810,695 | |

| Franklin County Convention | | | | | | | | |

| Facilities Authority, | | | | | | | | |

| 2.47%, 12/01/2034 | | | 15,000,000 | | | | 11,656,883 | |

| JobsOhio Beverage System, | | | | | | | | |

| 2.83%, 01/01/2038 | | | 7,590,000 | | | | 6,139,057 | |

| Ohio Higher Educational Facility | | | | | | | | |

| Commission, 4.50%, 12/01/2026 | | | 4,025,000 | | | | 3,875,758 | |

| Ohio State University, | | | | | | | | |

| 4.80%, 06/01/2111 | |

| 14,678,000 | | |

| 13,430,069 | |

| South-Western City School District, | | | | | | | | |

| 0.00%, 12/01/2028 (b) | | | 2,735,000 | | | | 2,180,396 | |

| | | |

| | | | 71,126,105 | |

| Oklahoma – 0.5% | | | | | | | | |

| Oklahoma Development | | | | | | | | |

| Finance Authority | | | | | | | | |

| 5.45%, 08/15/2028 | | | 4,520,000 | | | | 4,070,984 | |

| 5.27%, 10/01/2042 | | | 9,854,945 | | | | 9,996,201 | |

| 4.62%, 06/01/2044 | | | 5,000,000 | | | | 4,774,027 | |

| Oklahoma Municipal | | | | | | | | |

| Power Authority | | | | | | | | |

| 2.50%, 01/01/2035 | | | 3,475,000 | | | | 2,715,385 | |

| 2.55%, 01/01/2036 | | | 2,390,000 | | | | 1,833,235 | |

| 2.80%, 01/01/2041 | | | 15,500,000 | | | | 11,438,876 | |

| | | |

| | | | 34,828,708 | |

| Oregon – 0.1% | | | | | | | | |

| Clackamas & Washington Counties | | | | | | | | |

| School District No. 3, | | | | | | | | |

| 0.00%, 06/15/2038 (b) | | | 1,900,000 | | | | 1,053,271 | |

| Salem-Keizer | | | | | | | | |

| School District No. 24J | | | | | | | | |

| 0.00%, 06/15/2039 (b) | | | 3,000,000 | | | | 1,498,925 | |

| 0.00%, 06/15/2040 (b) | | | 12,395,000 | | | | 5,865,600 | |

| State of Oregon, | | | | | | | | |

| 2.37%, 08/01/2041 | | | 1,205,000 | | | | 843,063 | |

| Tri-County Metropolitan | | | | | | | | |

| Transportation District of Oregon, | | | | | | | | |

| 2.86%, 09/01/2041 | | | 750,000 | | | | 565,968 | |

| | | |

| | | | 9,826,827 | |

| Pennsylvania – 0.7% | | | | | | | | |

| Berks County Industrial | | | | | | | | |

| Development Authority | | | | | | | | |

| 3.95%, 05/15/2024 | | | 250,000 | | | | 248,947 | |

| 4.45%, 05/15/2027 | | | 800,000 | | | | 782,685 | |

| Commonwealth Financing Authority | | | | | | | | |

| 3.66%, 06/01/2038 | | | 7,020,000 | | | | 6,069,754 | |

| 3.81%, 06/01/2041 | | | 5,060,000 | | | | 4,345,322 | |

| 2.99%, 06/01/2042 | | | 10,335,000 | | | | 7,826,978 | |

| 3.53%, 06/01/2042 | | | 3,160,000 | | | | 2,540,859 | |

| Commonwealth of Pennsylvania, | | | | | | | | |

| 3.00%, 05/15/2036 | | | 1,255,000 | | | | 1,194,041 | |

| Montgomery County Industrial | | | | | | | | |

| Development Authority, | | | | | | | | |

| 3.15%, 11/15/2028 | | | 10,000,000 | | | | 8,934,427 | |

| Pennsylvania Economic | | | | | | | | |

| Development Financing Authority, | | | | | | | | |

| 3.14%, 06/15/2042 | | | 7,600,000 | | | | 5,958,097 | |

| | | | | | | | | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 23

|

PERFORMANCE TRUST TOTAL RETURN BOND FUND — SCHEDULE OF INVESTMENTS (CONT.)

February 29, 2024 (Unaudited)

| | | PAR | | | VALUE | |

| | | | | | | |

| Pennsylvania – 0.7% (Cont.) | | | | | | |

| Pennsylvania Turnpike | | | | | | |

| Commission, 3.00%, 12/01/2042 | | $ | 9,830,000 | | | $ | 8,307,913 | |

| Union County Hospital Authority, | | | | | | | | |

| 4.40%, 08/01/2028 | | | 1,060,000 | | | | 1,040,495 | |

| | | |

| | | | 47,249,518 | |

| Puerto Rico – 0.2% | | | | | | | | |

| Commonwealth of Puerto Rico | | | | | | | | |

| 0.00%, 07/01/2024 (b) | | | 74,866 | | | | 73,877 | |

| 0.00%, 07/01/2033 (b) | | | 592,257 | | | | 381,735 | |

| 4.00%, 07/01/2037 | | | 355,042 | | | | 339,094 | |

| 4.00%, 07/01/2041 | | | 482,722 | | | | 448,369 | |

| 0.00%, 11/01/2043 (d) | | | 2,034,695 | | | | 1,192,840 | |

| 4.00%, 07/01/2046 | | | 502,024 | | | | 453,731 | |

| GDB Debt Recovery Authority of | | | | | | | | |

| Puerto Rico, 7.50%, 08/20/2040 | | | 7,991,178 | | | | 7,631,575 | |

| Puerto Rico Highway & | | | | | | | | |

| Transportation Authority, | | | | | | | | |

| 0.00%, 07/01/2026 (b) | | | 7,000,000 | | | | 5,827,980 | |

| | | |

| | | | 16,349,201 | |

| Rhode Island – 0.0% (c) | | | | | | | | |

| State of Rhode Island, | | | | | | | | |

| 2.25%, 08/01/2041 | | | 1,550,000 | | | | 1,128,397 | |

| | | | | | | | | |

| South Carolina – 0.1% | | | | | | | | |

| South Carolina Jobs-Economic | | | | | | | | |

| Development Authority, | | | | | | | | |

| 2.73%, 07/01/2030 | | | 5,725,000 | | | | 5,006,591 | |

| | | | | | | | | |

| Tennessee – 1.0% | | | | | | | | |

| County of Putnam, TN | | | | | | | | |

| 2.00%, 04/01/2038 | | | 4,115,000 | | | | 3,100,131 | |

| 2.00%, 04/01/2039 | | | 4,195,000 | | | | 3,085,101 | |

| 2.13%, 04/01/2041 | | | 4,360,000 | | | | 3,114,437 | |

| Metropolitan Government | | | | | | | | |

| Nashville & Davidson County | | | | | | | | |

| Sports Authority, | | | | | | | | |

| 5.60%, 07/01/2056 | | | 13,200,000 | | | | 13,452,669 | |

| Metropolitan Government of | | | | | | | | |

| Nashville & Davidson County, | | | | | | | | |

| 1.75%, 01/01/2037 | | | 34,350,000 | | | | 25,328,921 | |

| New Memphis Arena Public | | | | | | | | |

| Building Authority | | | | | | | | |

| 0.00%, 04/01/2044 (b) | | | 6,020,000 | | | | 2,243,922 | |

| 0.00%, 04/01/2045 (b) | | | 6,000,000 | | | | 2,107,944 | |

| 0.00%, 04/01/2046 (b) | | | 4,900,000 | | | | 1,626,099 | |

| Tennessee State School | | | | | | | | |

| Bond Authority | | | | | | | | |

| 2.56%, 11/01/2041 | | | 8,000,000 | | | | 5,667,206 | |

| 2.66%, 11/01/2045 | | | 11,605,000 | | | | 7,679,292 | |

| | | |

| | | | 67,405,722 | |

| Texas – 3.4% | | | | | | | | |

| Austin Independent School District, | | | | | | | | |

| 1.88%, 08/01/2038 | |

| 12,265,000 | | |

| 8,958,988 | |

| Board of Regents of the | | | | | | | | |

| University of Texas System, | | | | | | | | |

| 5.13%, 08/15/2042 | | | 3,410,000 | | | | 3,457,940 | |

| Central Texas Regional Mobility | | | | | | | | |

| Authority, 3.27%, 01/01/2045 | | | 3,900,000 | | | | 2,838,661 | |

| City of Dallas, TX, | | | | | | | | |

| 0.00%, 02/15/2032 (b) | | | 15,000,000 | | | | 9,950,837 | |

| City of Dallas, TX Waterworks & | | | | | | | | |

| Sewer System Revenue, | | | | | | | | |

| 2.77%, 10/01/2040 | | | 7,690,000 | | | | 5,657,767 | |

| City of Frisco, TX | | | | | | | | |

| 2.00%, 02/15/2039 | | | 4,835,000 | | | | 3,547,732 | |

| 2.00%, 02/15/2040 | | | 4,925,000 | | | | 3,514,470 | |

| City of Houston, TX | | | | | | | | |

| 6.29%, 03/01/2032 | | | 795,000 | | | | 835,545 | |

| 5.54%, 03/01/2037 | | | 7,100,000 | | | | 7,483,854 | |

| 3.96%, 03/01/2047 | | | 8,300,000 | | | | 7,245,152 | |

| City of Irving, TX, | | | | | | | | |

| 7.38%, 08/15/2044 | | | 3,500,000 | | | | 3,500,144 | |

| City of San Antonio, TX | | | | | | | | |

| Electric & Gas Systems Revenue | | | | | | | | |

| 5.99%, 02/01/2039 | | | 13,425,000 | | | | 14,391,464 | |

| 5.72%, 02/01/2041 | | | 22,150,000 | | | | 22,917,779 | |

| Colony Economic Development | | | | | | | | |

| Corp., 7.25%, 10/01/2042 | | | 5,000,000 | | | | 4,807,954 | |

| County of Bexar, TX | | | | | | | | |

| 3.03%, 08/15/2041 | | | 1,490,000 | | | | 1,101,462 | |

| 2.86%, 06/15/2043 | | | 7,100,000 | | | | 5,154,189 | |

| Dallas Convention Center Hotel | | | | | | | | |

| Development Corp., | | | | | | | | |

| 7.09%, 01/01/2042 | | | 11,075,000 | | | | 12,476,627 | |

| Dallas Fort Worth | | | | | | | | |

| International Airport | | | | | | | | |

| 3.09%, 11/01/2040 | | | 19,070,000 | | | | 15,150,331 | |

| 5.00%, 11/01/2042 | | | 1,225,000 | | | | 1,192,813 | |

| 2.84%, 11/01/2046 | | | 6,345,000 | | | | 4,636,412 | |

| 5.05%, 11/01/2047 | | | 2,500,000 | | | | 2,409,089 | |

| Downtown Dallas Development | | | | | | | | |

| Authority, 0.00%, 08/15/2036 (b) | | | 6,730,000 | | | | 3,449,276 | |

| Forney Independent School District | | | | | | | | |

| 3.00%, 02/15/2039 | | | 1,000,000 | | | | 904,091 | |

| 2.50%, 08/15/2039 | | | 7,330,000 | | | | 5,867,300 | |

| 2.50%, 08/15/2040 | | | 7,300,000 | | | | 5,715,791 | |

| 2.50%, 08/15/2041 | | | 4,385,000 | | | | 3,368,498 | |

| Fort Bend Grand Parkway Toll Road | | | | | | | | |

| Authority, 3.00%, 03/01/2039 | | | 2,150,000 | | | | 1,891,602 | |

| Metropolitan Transit Authority of | | | | | | | | |

| Harris County Sales & Use Tax | | | | | | | | |

| Revenue, 2.60%, 11/01/2037 | | | 17,015,000 | | | | 13,062,880 | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

| PERFORMANCE TRUST MUTUAL FUNDS (PTIAX, PTAOX, PTCOX, PTIMX, PTRMX, PTCRX) | PAGE 24

|

PERFORMANCE TRUST TOTAL RETURN BOND FUND — SCHEDULE OF INVESTMENTS (CONT.)

February 29, 2024 (Unaudited)

| | | PAR | | | VALUE | |

| | | | | | | |

| Texas – 3.4% (Cont.) | | | | | | |

| New Hope Cultural Education | | | | | | |

| Facilities Corp., | | | | | | |

| 4.00%, 08/01/2020 (f) | | $ | 169,148 | | | $ | 0 | |

| North Texas Tollway Authority | | | | | | | | |

| 8.41%, 02/01/2030 | | | 4,375,000 | | | | 4,842,272 | |

| 3.00%, 01/01/2038 | | | 21,695,000 | | | | 19,422,156 | |

| 3.01%, 01/01/2043 | | | 2,135,000 | | | | 1,598,890 | |

| Port of Beaumont Industrial | | | | | | | | |

| Development Authority, | | | | | | | | |

| 4.10%, 01/01/2028 (e) | | | 7,000,000 | | | | 5,796,172 | |

| Port of Houston Authority, | | | | | | | | |

| 3.00%, 10/01/2039 | | | 5,000,000 | | | | 4,513,500 | |

| Stafford Municipal School District, | | | | | | | | |

| 3.08%, 08/15/2041 | | | 1,525,000 | | | | 1,192,437 | |

| State of Texas, 2.13%, 08/01/2037 | | | 3,430,000 | | | | 2,676,454 | |

| Texas A&M University | | | | | | | | |

| 3.00%, 05/15/2039 | | | 2,050,000 | | | | 1,835,304 | |

| 2.81%, 05/15/2041 | | | 6,750,000 | | | | 5,110,020 | |

| Texas Transportation Commission | | | | | | | | |

| 2.01%, 10/01/2037 | | | 6,295,000 | | | | 4,508,806 | |

| 2.56%, 04/01/2042 | | | 3,000,000 | | | | 2,248,893 | |

| Texas Water Development Board, | | | | | | | | |

| 3.00%, 08/01/2039 | | | 3,000,000 | | | | 2,683,170 | |

| | | |

| | | | 231,916,722 | |

| Utah – 0.2% | | | | | | | | |

| County of Salt Lake, UT | | | | | | | | |

| Convention Hotel Revenue, | | | | | | | | |

| 5.75%, 10/01/2047 (e) | | | 5,000,000 | | | | 4,343,929 | |

| Utah Transit Authority, | | | | | | | | |

| 2.77%, 12/15/2038 | | | 10,785,000 | | | | 8,391,381 | |

| | | |

| | | | 12,735,310 | |

| Virginia – 0.2% | | | | | | | | |

| University of Virginia, | | | | | | | | |

| 4.18%, 09/01/2117 | | | 16,895,000 | | | | 13,473,075 | |

| Virginia Housing | | | | | | | | |

| Development Authority | | | | | | | | |

| 3.90%, 04/01/2042 | | | 3,155,000 | | | | 2,621,549 | |

| 2.96%, 09/01/2045 | | | 1,205,000 | | | | 852,045 | |

| | | |

| | | | 16,946,669 | |

| Washington – 0.7% | | | | | | | | |

| County of King, WA, | | | | | | | | |

| 2.73%, 12/01/2041 | | | 5,000,000 | | | | 3,677,756 | |

| County of King, WA Sewer | | | | | | | | |

| Revenue, 2.84%, 07/01/2047 | | | 2,000,000 | | | | 1,348,231 | |

| King County Housing Authority | | | | | | | | |

| 3.00%, 11/01/2039 | | | 3,500,000 | | | | 2,877,982 | |

| 3.00%, 06/01/2040 | | | 18,995,000 | | | | 15,180,149 | |

| 3.00%, 08/01/2040 | | | 3,195,000 | | | | 2,543,948 | |

| NJB Properties, 5.51%, 12/01/2036 | | | 6,960,000 | | | | 7,180,132 | |

| Pierce County School | | | | | | | | |

| District No. 10 Tacoma, | | | | | | | | |

| 2.36%, 12/01/2039 | |

| 16,810,000 | | |

| 12,085,171 | |

| | | |

| | | | 44,893,369 | |

| Wisconsin – 0.2% | | | | | | | | |

| County of Marathon, WI | | | | | | | | |

| 2.00%, 02/01/2037 | | | 1,495,000 | | | | 1,158,056 | |

| 2.00%, 02/01/2037 | | | 885,000 | | | | 685,538 | |

| 2.00%, 02/01/2038 | | | 1,525,000 | | | | 1,145,022 | |

| 2.00%, 02/01/2038 | | | 1,110,000 | | | | 833,426 | |

| 2.00%, 02/01/2039 | | | 1,460,000 | | | | 1,066,291 | |

| 2.00%, 02/01/2039 | | | 1,105,000 | | | | 806,328 | |

| Milwaukee Redevelopment | | | | | | | | |

| Authority, 0.00%, 04/01/2039 (b) | | | 1,000,000 | | | | 434,042 | |

| Public Finance Authority | | | | | | | | |

| 7.50%, 06/01/2029 (e) | | | 5,750,000 | | | | 5,623,813 | |

| 4.15%, 05/15/2031 | | | 3,635,000 | | | | 3,521,933 | |

| | | |

| | | | 15,274,449 | |

| TOTAL MUNICIPAL BONDS | | | | | | | | |

| (Cost $1,429,547,942) | | | | | | | 1,323,640,215 | |

| | | | | | | | | |

| CORPORATE BONDS – 18.0% | | | | | | | | |

| Aerospace & Defense – 0.3% | | | | | | | | |

| Howmet Aerospace, Inc., | | | | | | | | |

| 3.00%, 01/15/2029 | | | 11,337,000 | | | | 10,143,781 | |

| Moog, Inc., 4.25%, 12/15/2027 (e) | | | 3,610,000 | | | | 3,382,041 | |

| TransDigm, Inc., | | | | | | | | |

| 6.63%, 03/01/2032 (e) | | | 5,000,000 | | | | 5,041,715 | |

| | | |

| | | | 18,567,537 | |

| Automobile Components – 0.1% | | | | | | | | |

| Dana, Inc. | | | | | | | | |

| 4.25%, 09/01/2030 | | | 1,500,000 | | | | 1,295,409 | |

| 4.50%, 02/15/2032 | | | 4,208,000 | | | | 3,538,928 | |

| | | |

| | | | 4,834,337 | |

| Banks – 5.3% | | | | | | | | |

| Atlantic Union Bankshares Corp., | | | | | | | | |

| 2.88% to 12/15/2026 then 3 mo. | | | | | | | | |

| Term SOFR + 1.86%, 12/15/2031 | | | 5,000,000 | | | | 4,363,338 | |

| Australia & New Zealand Banking | | | | | | | | |

| Group Ltd., 6.74%, 12/08/2032 (e) | | | 7,000,000 | | | | 7,436,583 | |

| Bank of America Corp., 2.65% to | | | | | | | | |

| 03/11/2031 then SOFR + 1.22%, | | | | | | | | |

| 03/11/2032 | | | 10,000,000 | | | | 8,379,185 | |

| Bank of Montreal, 3.09% to | | | | | | | | |

| 01/10/2032 then 5 yr. CMT Rate + | | | | | | | | |

| 1.40%, 01/10/2037 | | | 15,000,000 | | | | 12,181,587 | |