UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant's telephone number, including area code

Date of fiscal year end: August 31, 2024

Date of reporting period: August 31, 2024

Item 1. Reports to Stockholders.

| | |

| Performance Trust Total Return Bond Fund | |

| Institutional Class | PTIAX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Total Return Bond Fund (the “Fund”) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-877-738-9095. This report describes changes to the Fund that occured during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $80 | 0.76% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

U.S. Treasury rates fell across the yield curve, falling most in the 1- to 5-year part of the curve. Credit spreads tightened across most fixed income sectors.

The Fund began implementing a barbell strategy in 2022, when the yield curve first inverted. The Fund continued this strategy during the fiscal year targeting the short-end of the curve (securities less than 5-years) and the long-end of the curve (particularly the 20-year part of the curve).

As credit spreads narrowed to historically tight levels and as rates fell during the fiscal year, the Fund began to shift its credit risk to the short-end of the yield curve in best efforts to mitigate risk of spreads widening.

During the fiscal year, the Fund primarily reduced positions in Commercial Mortgage-Backed Securities (CMBS), Investment Grade Corporates, and Non-Agency Residential Mortgage-Backed Securities (Non-Agency RMBS). The Fund primarily increased its positioning in U.S. Treasuries and Asset Backed Securities (ABS).

| |

Top Contributors |

| ↑ | Collateralized Loan Obligations (CLOs), CMBS, Investment-Grade Corporates, High-Yield Corporates, Non-Agency RMBS, Taxable Municipals, Tax-Exempt Municipals |

| |

Top Detractors |

| ↓ | Long U.S. Treasuries, Short U.S. Treasuries, ABS |

The Fund posted positive returns for the fiscal year ended 8/31/2024. Outperformance relative to the benchmark (Bloomberg U.S. Aggregate Bond Index) can be generally attributed to yield curve positioning, sector allocation, and security selection. Exposure to sectors experiencing meaningful spread tightening was the largest driver of outperformance over the fiscal year, led by CMBS, High-Yield Corporates, Investment-Grade Corporates, and CLOs.

Our Investment-Grade Corporates outperformed the corporate exposure in the benchmark, highlighting successful security selection and yield curve positioning during the fiscal year. Our exposure to securitized assets (especially CMBS and CLOs), Municipal bonds, and High-Yield Corporates drove outperformance of the benchmark as well, illustrating the benefit of sector allocation beyond the traditional sectors that dominate the benchmark.

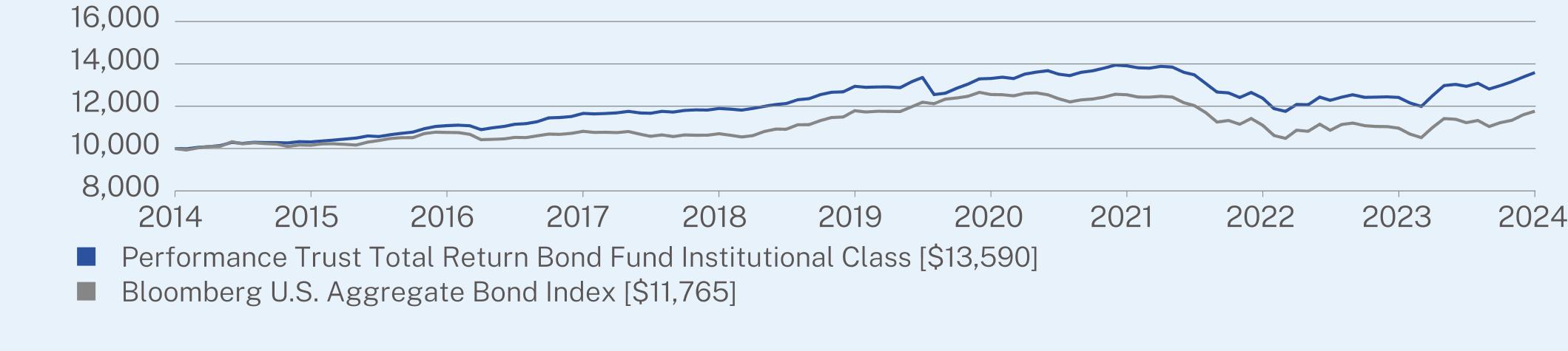

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

| Performance Trust Total Return Bond Fund | PAGE 1 | TSR-AR-89833W394 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Class (without sales charge) | 9.45 | 0.99 | 3.12 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.64 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $8,052,332,259 |

Number of Holdings | 1,566 |

Net Advisory Fee | $39,787,564 |

Portfolio Turnover | 34% |

Average Credit Quality | AA- |

Effective Duration | 6.65 years |

30-Day SEC Yield | 5.94% |

30-Day SEC Yield Unsubsidized | 5.91% |

Weighted Average Life | 12.04 years |

Distribution Yield | 4.30% |

| Performance Trust Total Return Bond Fund | PAGE 2 | TSR-AR-89833W394 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

United States Treasury Notes/Bonds | 11.1% |

Freddie Mac Multifamily Structured Pass Through Certificates | 4.2% |

Santander Drive Auto Receivables Trust | 2.7% |

United States Treasury Strip Principal | 2.6% |

Westlake Automobile Receivables Trust | 2.3% |

United States Treasury Bill | 2.2% |

Wells Fargo Commercial Mortgage Trust | 2.1% |

Benchmark Mortgage Trust | 2.0% |

Bank Securitization Trust | 2.0% |

GLS Auto Receivables Trust | 1.9% |

| |

Top Sectors | |

Mortgage Securities | 24.2% |

US Municipal | 22.0% |

Asset Backed Securities | 19.3% |

Government | 13.7% |

| Financials* | 6.2% |

| Consumer Discretionary* | 4.2% |

| Health Care* | 2.2% |

| Industrials* | 1.2% |

| Technology* | 0.8% |

Cash & Other | 6.2% |

| |

Credit Breakdown** | |

AAA | 39.7% |

AA | 24.4% |

A | 13.9% |

BBB | 10.4% |

BB | 5.4% |

B | 0.7% |

CCC | 1.1% |

CC | 0.0% |

C | 0.6% |

D | 0.1% |

Not Rated | 3.7% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

Mark Peiler, CFA and Lars Anderson, CFA were added as portfolio managers in December 2023.

The Performance Trust Strategic Bond Fund became Performance Trust Total Return Bond Fund, effective 12/29/23.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-738-9095, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Total Return Bond Fund | PAGE 3 | TSR-AR-89833W394 |

10000103131108411661118941293913311139081237912416135901000010156107611081410701117891255312542110981096511765

| | |

| Performance Trust Total Return Bond Fund | |

| Class A | PTAOX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Total Return Bond Fund (the “Fund”) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-877-738-9095. This report describes changes to the Fund that occured during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $106 | 1.01% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

U.S. Treasury rates fell across the yield curve, falling most in the 1- to 5-year part of the curve. Credit spreads tightened across most fixed income sectors.

The Fund began implementing a barbell strategy in 2022, when the yield curve first inverted. The Fund continued this strategy during the fiscal year targeting the short-end of the curve (securities less than 5-years) and the long-end of the curve (particularly the 20-year part of the curve).

As credit spreads narrowed to historically tight levels and as rates fell during the fiscal year, the Fund began to shift its credit risk to the short-end of the yield curve in best efforts to mitigate risk of spreads widening.

During the fiscal year, the Fund primarily reduced positions in Commercial Mortgage-Backed Securities (CMBS), Investment Grade Corporates, and Non-Agency Residential Mortgage-Backed Securities (Non-Agency RMBS). The Fund primarily increased its positioning in U.S. Treasuries and Asset Backed Securities (ABS).

| |

Top Contributors |

| ↑ | Collateralized Loan Obligations (CLOs), CMBS, Investment-Grade Corporates, High-Yield Corporates, Non-Agency RMBS, Taxable Municipals, Tax-Exempt Municipals |

| |

Top Detractors |

| ↓ | Long U.S. Treasuries, Short U.S. Treasuries, ABS |

The Fund posted positive returns for the fiscal year ended 8/31/2024. Outperformance relative to the benchmark (Bloomberg U.S. Aggregate Bond Index) can be generally attributed to yield curve positioning, sector allocation, and security selection. Exposure to sectors experiencing meaningful spread tightening was the largest driver of outperformance over the fiscal year, led by CMBS, High-Yield Corporates, Investment-Grade Corporates, and CLOs.

Our Investment-Grade Corporates outperformed the corporate exposure in the benchmark, highlighting successful security selection and yield curve positioning during the fiscal year. Our exposure to securitized assets (especially CMBS and CLOs), Municipal bonds, and High-Yield Corporates drove outperformance of the benchmark as well, illustrating the benefit of sector allocation beyond the traditional sectors that dominate the benchmark.

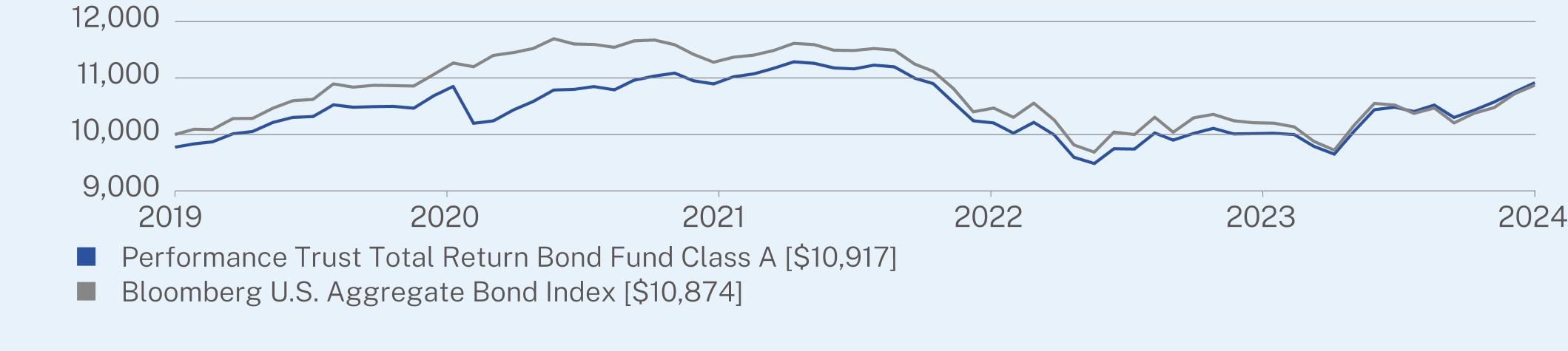

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Performance Trust Total Return Bond Fund | PAGE 1 | TSR-AR-89833W121 |

CUMULATIVE PERFORMANCE (January 2, 2019 - August 31, 2024. Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(01/02/2019) |

Class A (without sales charge) | 9.19 | 0.73 | 1.97 |

Class A (with sales charge) | 6.74 | 0.28 | 1.56 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.49 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $8,052,332,259 |

Number of Holdings | 1,566 |

Net Advisory Fee | $39,787,564 |

Portfolio Turnover | 34% |

Average Credit Quality | AA- |

Effective Duration | 6.65 years |

30-Day SEC Yield | 5.56% |

30-Day SEC Yield Unsubsidized | 5.53% |

Weighted Average Life | 12.04 years |

Distribution Yield | 4.06% |

| Performance Trust Total Return Bond Fund | PAGE 2 | TSR-AR-89833W121 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

United States Treasury Notes/Bonds | 11.1% |

Freddie Mac Multifamily Structured Pass Through Certificates | 4.2% |

Santander Drive Auto Receivables Trust | 2.7% |

United States Treasury Strip Principal | 2.6% |

Westlake Automobile Receivables Trust | 2.3% |

United States Treasury Bill | 2.2% |

Wells Fargo Commercial Mortgage Trust | 2.1% |

Benchmark Mortgage Trust | 2.0% |

Bank Securitization Trust | 2.0% |

GLS Auto Receivables Trust | 1.9% |

| |

Top Sectors | |

Mortgage Securities | 24.2% |

US Municipal | 22.0% |

Asset Backed Securities | 19.3% |

Government | 13.7% |

| Financials* | 6.2% |

| Consumer Discretionary* | 4.2% |

| Health Care* | 2.2% |

| Industrials* | 1.2% |

| Technology* | 0.8% |

Cash & Other | 6.2% |

| |

Credit Breakdown** | |

AAA | 39.7% |

AA | 24.4% |

A | 13.9% |

BBB | 10.4% |

BB | 5.4% |

B | 0.7% |

CCC | 1.1% |

CC | 0.0% |

C | 0.6% |

D | 0.1% |

Not Rated | 3.7% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

Mark Peiler, CFA and Lars Anderson, CFA were added as portfolio managers in December 2023.

The Performance Trust Strategic Bond Fund became Performance Trust Total Return Bond Fund, effective 12/29/23.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-738-9095, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Total Return Bond Fund | PAGE 3 | TSR-AR-89833W121 |

1052510799112619993999810917108961160211592102571013510874

| | |

| Performance Trust Total Return Bond Fund | |

| Class C | PTCOX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Total Return Bond Fund (the “Fund”) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-877-738-9095. This report describes changes to the Fund that occured during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $183 | 1.76% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

U.S. Treasury rates fell across the yield curve, falling most in the 1- to 5-year part of the curve. Credit spreads tightened across most fixed income sectors.

The Fund began implementing a barbell strategy in 2022, when the yield curve first inverted. The Fund continued this strategy during the fiscal year targeting the short-end of the curve (securities less than 5-years) and the long-end of the curve (particularly the 20-year part of the curve).

As credit spreads narrowed to historically tight levels and as rates fell during the fiscal year, the Fund began to shift its credit risk to the short-end of the yield curve in best efforts to mitigate risk of spreads widening.

During the fiscal year, the Fund primarily reduced positions in Commercial Mortgage-Backed Securities (CMBS), Investment Grade Corporates, and Non-Agency Residential Mortgage-Backed Securities (Non-Agency RMBS). The Fund primarily increased its positioning in U.S. Treasuries and Asset Backed Securities (ABS).

| |

Top Contributors |

| ↑ | Collateralized Loan Obligations (CLOs), CMBS, Investment-Grade Corporates, High-Yield Corporates, Non-Agency RMBS, Taxable Municipals, Tax-Exempt Municipals |

| |

Top Detractors |

| ↓ | Long U.S. Treasuries, Short U.S. Treasuries, ABS |

The Fund posted positive returns for the fiscal year ended 8/31/2024. Outperformance relative to the benchmark (Bloomberg U.S. Aggregate Bond Index) can be generally attributed to yield curve positioning, sector allocation, and security selection. Exposure to sectors experiencing meaningful spread tightening was the largest driver of outperformance over the fiscal year, led by CMBS, High-Yield Corporates, Investment-Grade Corporates, and CLOs.

Our Investment-Grade Corporates outperformed the corporate exposure in the benchmark, highlighting successful security selection and yield curve positioning during the fiscal year. Our exposure to securitized assets (especially CMBS and CLOs), Municipal bonds, and High-Yield Corporates drove outperformance of the benchmark as well, illustrating the benefit of sector allocation beyond the traditional sectors that dominate the benchmark.

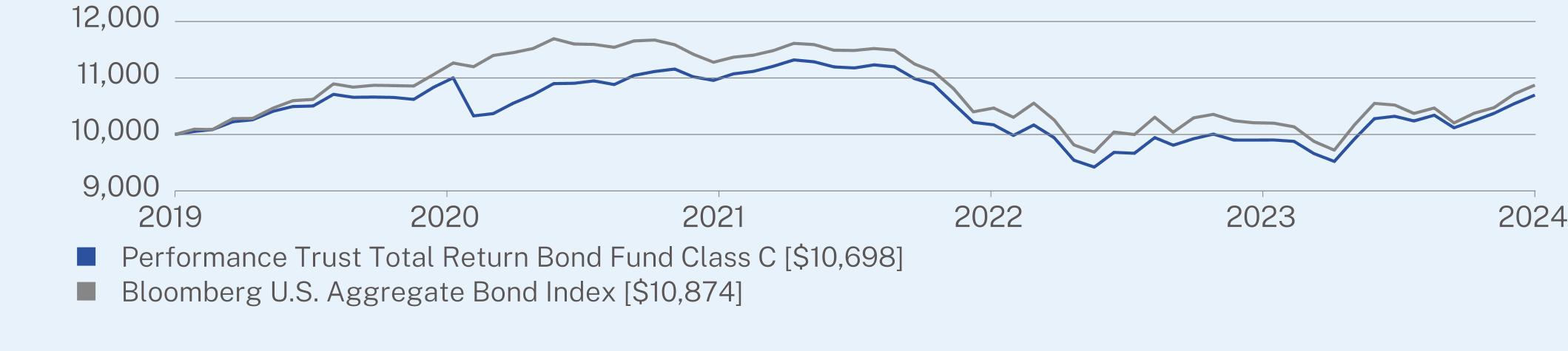

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Performance Trust Total Return Bond Fund | PAGE 1 | TSR-AR-89833W113 |

CUMULATIVE PERFORMANCE (January 2, 2019 - August 31, 2024. Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | Since Inception

(01/02/2019) |

Class C (without sales charge) | 8.31 | -0.02 | 1.20 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -0.04 | 1.49 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $8,052,332,259 |

Number of Holdings | 1,566 |

Net Advisory Fee | $39,787,564 |

Portfolio Turnover | 34% |

Average Credit Quality | AA- |

Effective Duration | 6.65 years |

30-Day SEC Yield | 4.94% |

30-Day SEC Yield Unsubsidized | 4.91% |

Weighted Average Life | 12.04 years |

Distribution Yield | 3.37% |

| Performance Trust Total Return Bond Fund | PAGE 2 | TSR-AR-89833W113 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

United States Treasury Notes/Bonds | 11.1% |

Freddie Mac Multifamily Structured Pass Through Certificates | 4.2% |

Santander Drive Auto Receivables Trust | 2.7% |

United States Treasury Strip Principal | 2.6% |

Westlake Automobile Receivables Trust | 2.3% |

United States Treasury Bill | 2.2% |

Wells Fargo Commercial Mortgage Trust | 2.1% |

Benchmark Mortgage Trust | 2.0% |

Bank Securitization Trust | 2.0% |

GLS Auto Receivables Trust | 1.9% |

| |

Top Sectors | |

Mortgage Securities | 24.2% |

US Municipal | 22.0% |

Asset Backed Securities | 19.3% |

Government | 13.7% |

| Financials* | 6.2% |

| Consumer Discretionary* | 4.2% |

| Health Care* | 2.2% |

| Industrials* | 1.2% |

| Technology* | 0.8% |

Cash & Other | 6.2% |

| |

Credit Breakdown** | |

AAA | 39.7% |

AA | 24.4% |

A | 13.9% |

BBB | 10.4% |

BB | 5.4% |

B | 0.7% |

CCC | 1.1% |

CC | 0.0% |

C | 0.6% |

D | 0.1% |

Not Rated | 3.7% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

Mark Peiler, CFA and Lars Anderson, CFA were added as portfolio managers in December 2023.

The Performance Trust Strategic Bond Fund became Performance Trust Total Return Bond Fund, effective 12/29/23.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-738-9095, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Total Return Bond Fund | PAGE 3 | TSR-AR-89833W113 |

1071010907112879942987710698108961160211592102571013510874

| | |

| Performance Trust Municipal Bond Fund | |

| Institutional Class | PTIMX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Municipal Bond Fund (the “Fund”) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-877-738-9095.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $52 | 0.50% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Given the municipal bond benchmark curve’s inversion, the Fund focused on a barbell strategy, combining short-term securities (0- to 5-years) and long-term securities (15- to 20-years). This approach focused on the highest yielding parts of the municipal bond curve, maximizing income and yield curve roll potential.

Furthermore, considering the historically relative high yielding environment for municipal bonds, the Fund also targeted a higher allocation to bonds that carry more call-protection and price off a longer part of the yield curve.

| |

Top Contributors |

| ↑ | Yield Curve Positioning, Bond Structure (Coupon and Call Protection), Longer Maturities |

The Fund posted positive returns for the fiscal year ended 8/31/2024 as rates fell across the AAA curve (all municipal bond yields quoted are sourced from the MMD AAA scale). Outperformance relative to the benchmark (Bloomberg Municipal Bond Index) and the Morningstar Category (Morningstar Municipal National Intermediate) can generally be attributed to the Fund’s higher allocation to bonds that carry more call-protection and price off a longer part of the yield curve, making the Fund a little more responsive to movements in interest rates.

Outperformance can also be attributed to the Fund’s yield curve positioning. For much of the fiscal year, the municipal bond benchmark curve was inverted and had lower yields from 5- to 10-years. This lowered or eliminated total return potential derived from income (yield) as well as yield curve roll for this part of the curve. As a result, the Fund largely avoided the 5- to 10-year part of the curve and instead focused on a combination of the short end of the curve (0- to 5-years) and the longer end of the curve (particularly the 15- to 20-year part of the curve). This positioning contributed to outperformance by increasing the Fund’s yield, allowing for greater yield curve roll potential, and increasing the Fund’s convexity.

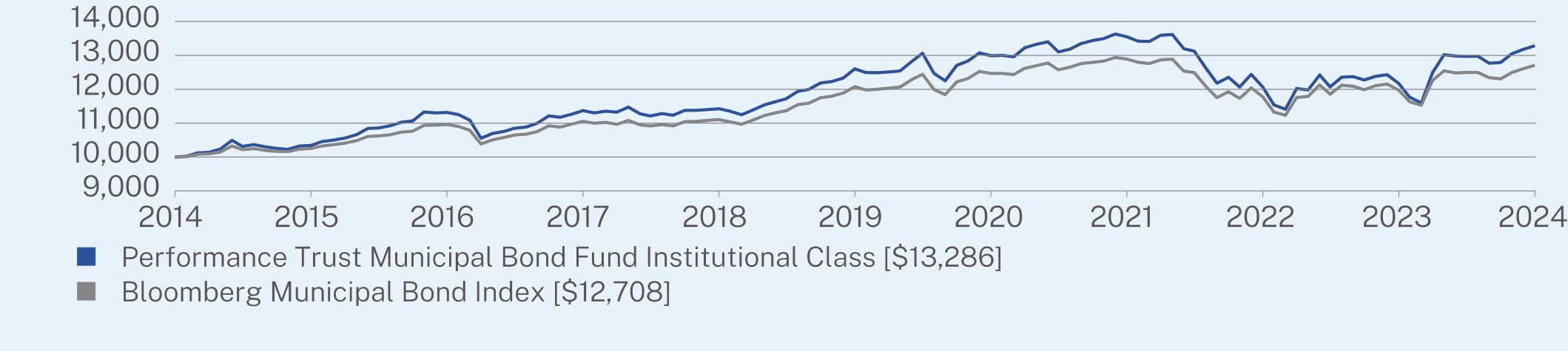

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

| Performance Trust Municipal Bond Fund | PAGE 1 | TSR-AR-89833W170 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Institutional Class (without sales charge) | 9.14 | 1.06 | 2.88 |

Bloomberg Municipal Bond Index | 6.09 | 1.02 | 2.43 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $726,757,400 |

Number of Holdings | 262 |

Net Advisory Fee | $2,681,761 |

Portfolio Turnover | 60% |

Average Credit Quality | AA |

Effective Duration | 9.83 years |

30-Day SEC Yield | 3.90% |

30-Day SEC Yield Unsubsidized | 3.90% |

Weighted Average Life | 9.83 years |

Distribution Yield | 3.74% |

| Performance Trust Municipal Bond Fund | PAGE 2 | TSR-AR-89833W170 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

Freddie Mac Multifamily ML Certificates | 5.0% |

First American Government Obligations Fund | 4.2% |

San Diego Unified School District | 2.1% |

Poway Unified School District | 2.1% |

Greater Clark Building Corp. | 2.1% |

City & County of Denver, CO Airport System Revenue | 2.0% |

University of North Carolina at Chapel Hill | 1.9% |

State of Texas | 1.8% |

Central Puget Sound Regional Transit Authority | 1.6% |

Minneapolis-St Paul Metropolitan Airports Commission | 1.5% |

| |

Top Sectors | |

US Municipal | 91.3% |

Mortgage Securities | 7.0% |

| Financials* | 0.4% |

Cash & Other | 1.3% |

| |

Credit Breakdown** | |

AAA | 16.2% |

AA | 55.6% |

A | 18.8% |

BBB | 4.6% |

BB | 0.5% |

B | 0.0% |

CCC | 0.0% |

CC | 0.0% |

C | 0.0% |

D | 0.0% |

Not Rated | 4.3% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-738-9095, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Municipal Bond Fund | PAGE 3 | TSR-AR-89833W170 |

10000103411131611372114251260212990135531206812174132861000010252109581105411108120771246812891117781197912708

| | |

| Performance Trust Municipal Bond Fund | |

| Class A | PTRMX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Municipal Bond Fund (the “Fund”) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-877-738-9095.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $77 | 0.74% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Given the municipal bond benchmark curve’s inversion, the Fund focused on a barbell strategy, combining short-term securities (0- to 5-years) and long-term securities (15- to 20-years). This approach focused on the highest yielding parts of the municipal bond curve, maximizing income and yield curve roll potential.

Furthermore, considering the historically relative high yielding environment for municipal bonds, the Fund also targeted a higher allocation to bonds that carry more call-protection and price off a longer part of the yield curve.

| |

Top Contributors |

| ↑ | Yield Curve Positioning, Bond Structure (Coupon and Call Protection), Longer Maturities |

The Fund posted positive returns for the fiscal year ended 8/31/2024 as rates fell across the AAA curve (all municipal bond yields quoted are sourced from the MMD AAA scale). Outperformance relative to the benchmark (Bloomberg Municipal Bond Index) and the Morningstar Category (Morningstar Municipal National Intermediate) can generally be attributed to the Fund’s higher allocation to bonds that carry more call-protection and price off a longer part of the yield curve, making the Fund a little more responsive to movements in interest rates.

Outperformance can also be attributed to the Fund’s yield curve positioning. For much of the fiscal year, the municipal bond benchmark curve was inverted and had lower yields from 5- to 10-years. This lowered or eliminated total return potential derived from income (yield) as well as yield curve roll for this part of the curve. As a result, the Fund largely avoided the 5- to 10-year part of the curve and instead focused on a combination of the short end of the curve (0- to 5-years) and the longer end of the curve (particularly the 15- to 20-year part of the curve). This positioning contributed to outperformance by increasing the Fund’s yield, allowing for greater yield curve roll potential, and increasing the Fund’s convexity.

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

| Performance Trust Municipal Bond Fund | PAGE 1 | TSR-AR-89833W162 |

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Class A (without sales charge) | 8.84 | 0.81 | 2.64 |

Class A (with sales charge) | 6.38 | 0.35 | 2.41 |

Bloomberg Municipal Bond Index | 6.09 | 1.02 | 2.43 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $726,757,400 |

Number of Holdings | 262 |

Net Advisory Fee | $2,681,761 |

Portfolio Turnover | 60% |

Average Credit Quality | AA |

Effective Duration | 9.83 years |

30-Day SEC Yield | 3.57% |

30-Day SEC Yield Unsubsidized | 3.57% |

Weighted Average Life | 9.83 years |

Distribution Yield | 3.48% |

| Performance Trust Municipal Bond Fund | PAGE 2 | TSR-AR-89833W162 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

Freddie Mac Multifamily ML Certificates | 5.0% |

First American Government Obligations Fund | 4.2% |

San Diego Unified School District | 2.1% |

Poway Unified School District | 2.1% |

Greater Clark Building Corp. | 2.1% |

City & County of Denver, CO Airport System Revenue | 2.0% |

University of North Carolina at Chapel Hill | 1.9% |

State of Texas | 1.8% |

Central Puget Sound Regional Transit Authority | 1.6% |

Minneapolis-St Paul Metropolitan Airports Commission | 1.5% |

| |

Top Sectors | |

US Municipal | 91.3% |

Mortgage Securities | 7.0% |

| Financials* | 0.4% |

Cash & Other | 1.3% |

| |

Credit Breakdown** | |

AAA | 16.2% |

AA | 55.6% |

A | 18.8% |

BBB | 4.6% |

BB | 0.5% |

B | 0.0% |

CCC | 0.0% |

CC | 0.0% |

C | 0.0% |

D | 0.0% |

Not Rated | 4.3% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-738-9095, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Municipal Bond Fund | PAGE 3 | TSR-AR-89833W162 |

9776100971102211048110761218612531130451158711659126901000010252109581105411108120771246812891117781197912708

| | |

| Performance Trust Multisector Bond Fund | |

| Institutional Class | PTCRX |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Multisector Bond Fund (the “Fund”) for the period of September 1, 2023, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-877-738-9095. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Institutional Class | $108 | 1.01% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

U.S. Treasury rates fell across the yield curve, falling most in the 1- to 5-year part of the curve. Credit spreads tightened across most fixed income sectors.

The Fund used different positioning tactics during the fiscal year. Generally speaking, the Fund attempted to take advantage of higher rates and wider credit spreads by targeting the intermediate part of the curve early in the fiscal year. Later in the fiscal year, as credit spreads narrowed to historically tight levels and as rates fell, the Fund began to shift its credit risk to the short-end of the curve in best efforts to mitigate risk of spreads widening.

During the fiscal year, The Fund reduced positions primarily in Investment-Grade Corporates, Agency Commercial Mortgage-Backed Securities (CMBS), and Asset Backed Securities (ABS). The Fund increased its positioning primarily in Non-Agency CMBS, Taxable Municipals, Non-Agency Residential Mortgage-Backed Securities (RMBS), and U.S. Treasuries.

| |

Top Contributors |

| ↑ | Collateralized Loan Obligations (CLOs), CMBS, Investment-Grade Corporates, High-Yield Corporates, Non-Agency RMBS, Taxable Municipals, Tax-Exempt Municipals |

| |

Top Detractors |

| ↓ | Long U.S. Treasuries, ABS |

The Fund posted positive returns for the fiscal year ended 8/31/2024. Outperformance relative to the benchmark (Bloomberg U.S. Aggregate Bond Index) can be generally attributed to yield curve positioning, greater credit risk exposure, sector allocation, and security selection. The Fund had greater exposure to credit risk compared to the benchmark. Spreads tightened across most fixed income sectors, which positively contributed to the Fund’s outperformance.

Exposure to sectors experiencing meaningful spread tightening was the largest driver of outperformance over the fiscal year, led by CMBS, High-Yield Corporates, Investment-Grade Corporates, and CLOs. The Fund has greater exposure to securitized assets, municipal bonds, and High Yield Corporates than what is found in the benchmark. Non-Agency RMBS, Taxable Municipals, and Tax-Exempt Municipals also meaningfully contributed to outperformance versus the benchmark. Furthermore, our Investment-Grade Corporates outperformed the corporate exposure in the benchmark, highlighting successful security selection and yield curve positioning during the fiscal year.

| Performance Trust Multisector Bond Fund | PAGE 1 | TSR-AR-89834E195 |

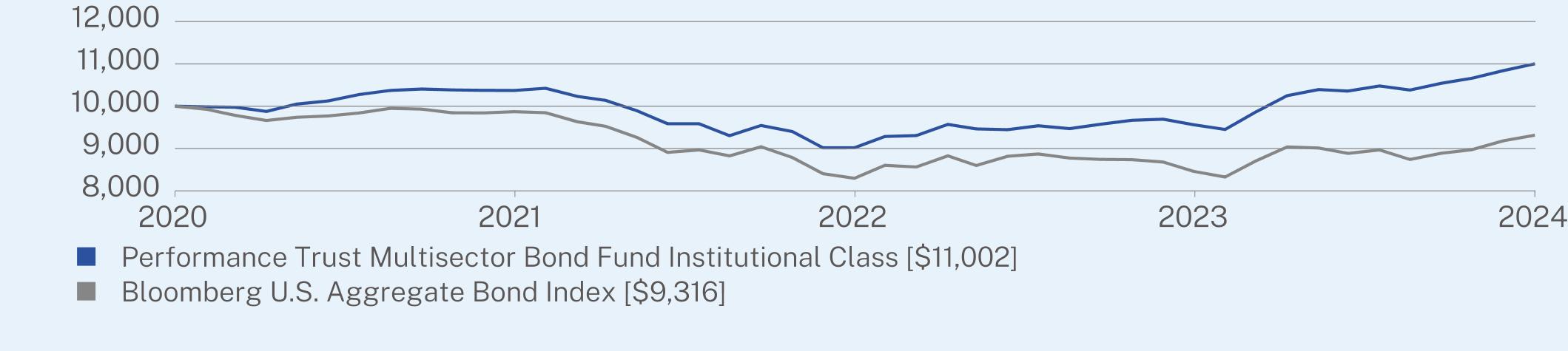

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (December 31, 2020 - August 31, 2024. Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(12/31/2020) |

Institutional Class (without sales charge) | 13.49 | 2.64 |

Bloomberg U.S. Aggregate Bond Index | 7.30 | -1.92 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $136,140,870 |

Number of Holdings | 122 |

Net Advisory Fee | $811,320 |

Portfolio Turnover | 40% |

Average Credit Quality | BBB |

Effective Duration | 4.12 years |

30-Day SEC Yield | 5.63% |

30-Day SEC Yield Unsubsidized | 5.59% |

Weighted Average Life | 8.09 years |

Distribution Yield | 5.79% |

| Performance Trust Multisector Bond Fund | PAGE 2 | TSR-AR-89834E195 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

United States Treasury Notes/Bonds | 6.4% |

First American Government Obligations Fund | 4.6% |

Benchmark Mortgage Trust | 3.3% |

Wells Fargo Commercial Mortgage Trust | 3.1% |

Bank Securitization Trust | 3.0% |

Morgan Stanley Capital I Trust | 2.5% |

Apidos CLO | 2.4% |

GLS Auto Receivables Trust | 2.3% |

ARES CLO | 2.2% |

Blackstone, Inc. | 1.8% |

| |

Top Sectors | |

Mortgage Securities | 26.9% |

Asset Backed Securities | 18.5% |

| Financials* | 15.4% |

| Consumer Discretionary* | 10.6% |

US Municipal | 6.9% |

Government | 6.4% |

| Industrials* | 3.4% |

| Communications* | 1.9% |

| Technology* | 1.7% |

Cash & Other | 8.3% |

| |

Credit Breakdown** | |

AAA | 15.5% |

AA | 4.5% |

A | 14.6% |

BBB | 26.8% |

BB | 24.9% |

B | 5.3% |

CCC | 1.1% |

CC | 0.0% |

C | 0.0% |

D | 0.8% |

Not Rated | 6.5% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

This is a summary of certain changes to the Fund. For more complete information, you may review the Fund’s prospectus.

The Performance Trust Credit Fund became Performance Trust Multisector Bond Fund, effective 12/29/23.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-738-9095, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Multisector Bond Fund | PAGE 3 | TSR-AR-89834E195 |

1040694019694110029931878786829316

| | |

| Performance Trust Short Term Bond ETF | |

| STBF (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | August 31, 2024 |

This annual shareholder report contains important information about the Performance Trust Short Term Bond ETF (the “Fund”) for the period of April 8, 2024, to August 31, 2024. You can find additional information about the Fund at https://ptam.com/resources/. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Performance Trust Short Term Bond ETF* | $66 | 0.65% |

| * | Amount shown reflects the expenses of the Fund from inception date through August 31, 2024. Expenses would be higher if the Fund had been in operations for the full year. |

HOW DID THE FUND PERFORM LAST PERIOD AND WHAT AFFECTED ITS PERFORMANCE?

Given the Fund targets an average portfolio duration of less than 4 years, the Fund targeted securities that had attractive spreads to an already historically high-yielding short-end of the U.S. Treasury yield curve.

U.S. Treasury rates fell across the yield curve, falling most in the 1- to 5-year part of the curve. Credit spreads tightened across most fixed income sectors. While offering an attractive starting yield, the Fund’s total return was only further enhanced by falling rates and tighter spreads.

During the period, the Fund mainly worked to implement its targeted portfolio allocation given its recent launch date. While Cash and U.S. Treasuries maintained the heaviest allocation at the Fund’s launch, over time, the Fund grew its allocation to Asset Backed Securities (ABS), Collateralized Loan Obligations (CLOs), and Commercial Mortgage-Backed Securities (CMBS) most significantly. It also modestly added exposure to High-Yield Corporates, Investment-Grade Corporates, Non-Agency Residential Mortgage-Backed Securities (Non-Agency RMBS), and Taxable Municipals.

| |

Top Contributors |

| ↑ | Long U.S. Treasuries, CMBS, High-Yield Corporates, Non-Agency RMBS, and Taxable Municipals |

| |

Top Detractors |

| ↓ | Cash, Short U.S. Treasuries, CLOs, and Investment-Grade Corporates |

The Fund posted positive total returns for the commencement of investment operations period beginning 4/9/24 (the Fund’s launch date) and ending 8/31/2024. Mild underperformance relative to the strategy benchmark index (Bloomberg U.S. Aggregate Bond Index) can generally be attributed to cash drag and yield curve positioning.

The Fund was able to invest in highly rated securities in sectors that provide meaningful spreads over U.S. Treasuries, where over two-thirds of the strategy benchmark index is allocated.

The Fund has an overall portfolio duration similar to that of the strategy benchmark index, but this is achieved by investing primarily at the very front end of the yield curve coupled with a modest exposure at the long end of the curve (“barbell”). This resulted in slight underperformance given the rally in the belly of the yield curve relative to the long end. Going forward, we still believe this barbell strategy will be the best approach.

Given its launch in April, the greatest detractor from Fund performance was likely cash drag as the portfolio management team was patient with initial allocations and seeking the best risk-reward profiles for the objective of the Fund.

| Performance Trust Short Term Bond ETF | PAGE 1 | TSR-AR-89834G570 |

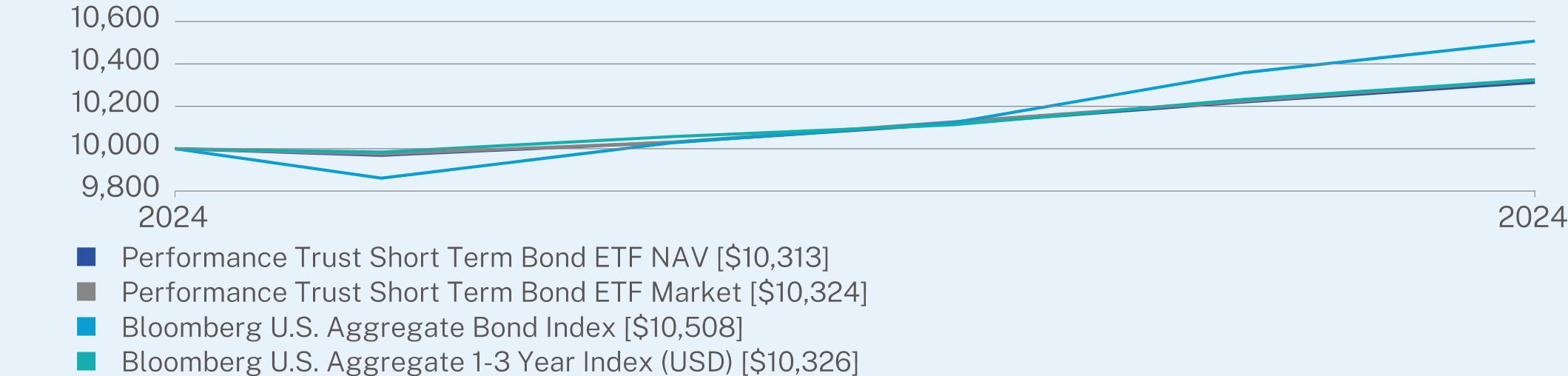

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV and market performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (April 8, 2024 - August 31, 2024. Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(04/08/2024) |

Performance Trust Short Term Bond ETF NAV | 3.13 |

Performance Trust Short Term Bond ETF Market | 3.24 |

Bloomberg U.S. Aggregate Bond Index | 5.08 |

Bloomberg U.S. Aggregate 1-3 Year Index (USD) | 3.26 |

Visit https://ptam.com/resources/ for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of August 31, 2024)

| |

Net Assets | $12,664,873 |

Number of Holdings | 54 |

Net Advisory Fee | $27,127 |

Portfolio Turnover | 13% |

Average Credit Quality | AA- |

Effective Duration | 2.00 years |

30-Day SEC Yield | 7.95% |

30-Day SEC Yield Unsubsidized | 7.95% |

Weighted Average Life | 3.87 years |

| Performance Trust Short Term Bond ETF | PAGE 2 | TSR-AR-89834G570 |

WHAT DID THE FUND INVEST IN? (% of net assets as of August 31, 2024)

| |

Top 10 Issuers | |

United States Treasury Bill | 9.8% |

Bank5 Securitization Trust | 8.8% |

Freddie Mac Multifamily Structured Pass Through Certificates | 7.3% |

United States Treasury Notes/Bonds | 5.8% |

Westlake Automobile Receivables Trust | 5.2% |

Computershare Corporate Trust | 5.2% |

Santander Drive Auto Receivables Trust | 4.9% |

GLS Auto Receivables Trust | 4.0% |

ARES CLO | 3.9% |

First American Government Obligations Fund | 2.9% |

| |

Top Sectors | |

Asset Backed Securities | 45.6% |

Mortgage Securities | 28.0% |

| Financials* | 6.3% |

Government | 5.8% |

US Municipal | 1.9% |

| Communications* | 1.4% |

Cash & Other | 11.0% |

| |

Credit Breakdown** | |

AAA | 44.0% |

AA | 18.4% |

A | 14.4% |

BBB | 15.0% |

BB | 6.0% |

B | 0.0% |

CCC | 0.0% |

CC | 0.0% |

C | 0.0% |

D | 0.0% |

Not Rated | 2.2% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by U.S. Bank Global Fund Services. |

| ** | Credit rating agencies Fitch Ratings, Moody’s Investor Service, and Standards & Poor’s Corporation (S&P) rate the credit quality of debt issues. For reporting purposes, PT Asset Management, LLC (“PTAM”), the Fund’s investment adviser, generally assigns a composite rating based on stated ratings from Nationally Recognized Statistical Ratings Organizations (‘’NRSROs’’). For example, if Fitch, Moody’s, and S&P all provide ratings, PTAM assigns the median rating. In certain instances, such as US Treasury and Agency securities, PTAM will assign an internal PTAM rating. The internal PTAM rating can only be as high as the highest stated credit rating from an NRSRO. |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://ptam.com/resources/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Performance Trust Short Term Bond ETF | PAGE 3 | TSR-AR-89834G570 |

10313103241050810326

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is incorporated by reference to the Registrant’s Form N-CSR filed on November 7, 2011.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Akers and Lisa Zúñiga Ramírez are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 8/31/2024 | FYE 8/31/2023 |

| (a) Audit Fees | $94,850 | $75,950 |

| (b) Audit-Related Fees | 0 | 0 |

| (c) Tax Fees | 12,000 | 9,000 |

| (d) All Other Fees | 0 | 0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 8/31/2024 | FYE 8/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) During the audit of the registrant’s financial statements all of the hours were attributed to work performed by persons other than full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 8/31/2024 | FYE 8/31/2023 |

| Registrant | $0 | $0 |

| Registrant’s Investment Adviser | $0 | $0 |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable

(j) Not applicable

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The committee consists of the independent members of the Board.

(b) Not applicable

Item 6. Investments

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

Performance Trust Total Return Bond Fund

Performance Trust Municipal Bond Fund

Performance Trust Multisector Bond Fund

Performance Trust Short Term Bond ETF

Core Financial Statements

August 31, 2024

TABLE OF CONTENTS

| | | | |

Schedule of Investments

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Statement of Changes in Net Assets

| | | |

| | | |

| | | |

| | | |

| | | |

Financial Highlights

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | |

TABLE OF CONTENTS

Performance Trust Total Return Bond Fund

Schedule of Investments

August 31, 2024

| | | | | | | |

MUNICIPAL BONDS - 22.0%

|

Alabama - 0.1%

| | | | | | |

Baldwin County Public Building Authority, 2.00%, 03/01/2046 | | | $1,260,000 | | | $785,014 |

Water Works Board of the City of Birmingham

| | | | | | |

2.71%, 01/01/2038 | | | 6,835,000 | | | 5,529,466 |

3.57%, 01/01/2045 | | | 385,000 | | | 320,284 |

| | | | | | 6,634,764 |

California - 5.3%

| | | | | | |

Acton-Agua Dulce Unified School District, 0.00%, 05/01/2039(a) | | | 5,550,000 | | | 3,050,002 |

Alameda County Joint Powers Authority, 7.05%, 12/01/2044 | | | 25,000,000 | | | 29,870,820 |

Alvord Unified School District,

0.00%, 08/01/2046 | | | 2,105,000 | | | 2,483,669 |

Bakersfield City School District,

0.00%, 05/01/2047 | | | 9,765,000 | | | 7,619,047 |

Bay Area Toll Authority

| | | | | | |

6.92%, 04/01/2040 | | | 7,105,000 | | | 8,322,255 |

6.26%, 04/01/2049 | | | 12,010,000 | | | 13,648,972 |

7.04%, 04/01/2050 | | | 3,455,000 | | | 4,303,033 |

6.91%, 10/01/2050 | | | 6,850,000 | | | 8,492,360 |

California Infrastructure & Economic Development Bank,

8.00%, 01/01/2050(b)(c) | | | 9,000,000 | | | 9,086,157 |

Campbell Union School District,

0.00%, 08/01/2040(a) | | | 4,600,000 | | | 2,569,596 |

Chaffey Community College District, 3.00%, 06/01/2038 | | | 3,705,000 | | | 3,441,052 |

Chaffey Joint Union High School District, 3.14%, 08/01/2043 | | | 3,790,000 | | | 2,994,698 |

City of Fresno, CA Water System Revenue, 6.75%, 06/01/2040 | | | 1,695,000 | | | 1,935,806 |

City of Los Angeles, CA Department of Airports

| | | | | | |

1.88%, 05/15/2030 | | | 230,000 | | | 196,035 |

7.05%, 05/15/2040 | | | 13,160,000 | | | 15,786,231 |

City of Los Angeles, CA Wastewater System Revenue

| | | | | | |

5.71%, 06/01/2039 | | | 20,075,000 | | | 21,634,749 |

5.81%, 06/01/2040 | | | 15,110,000 | | | 16,398,507 |

City of Ontario, CA, 3.78%, 06/01/2038 | | | 3,000,000 | | | 2,674,553 |

City of Sacramento, CA Transient Occupancy Tax Revenue,

3.86%, 06/01/2025 | | | 3,320,000 | | | 3,294,902 |

City of Union City, CA,

0.00%, 07/01/2025(a) | | | 2,105,000 | | | 2,019,111 |

Cucamonga Valley Water District Financing Authority,

3.01%, 09/01/2042 | | | 5,000,000 | | | 3,968,641 |

| | | | | | | |

| | | | | | | |

Dry Creek Joint Elementary School District

| | | | | | |

0.00%, 08/01/2037(a) | | | $2,960,000 | | | $1,894,844 |

0.00%, 08/01/2038(a) | | | 3,640,000 | | | 2,220,260 |

East Bay Municipal Utility District Water System Revenue, 5.87%, 06/01/2040 | | | 11,740,000 | | | 12,695,955 |

East Side Union High School District, 5.32%, 04/01/2036 | | | 6,240,000 | | | 6,399,579 |

Fullerton Public Financing Authority, 7.75%, 05/01/2031 | | | 1,025,000 | | | 1,148,237 |

Glendora Unified School District, 0.00%, 08/01/2039(a) | | | 5,175,000 | | | 3,019,854 |

Golden State Tobacco Securitization Corp.

| | | | | | |

2.79%, 06/01/2031 | | | 10,930,000 | | | 9,611,734 |

3.00%, 06/01/2046 | | | 9,925,000 | | | 9,185,523 |

Inland Empire Tobacco Securitization Corp., 3.68%, 06/01/2038 | | | 17,720,000 | | | 16,879,248 |

Lakeside Union School District,

0.00%, 08/01/2040(a) | | | 4,000,000 | | | 2,196,372 |

Los Angeles Community College District, CA

| | | | | | |

6.60%, 08/01/2042 | | | 13,620,000 | | | 15,707,343 |

6.75%, 08/01/2049 | | | 4,000,000 | | | 4,764,362 |

Los Angeles Department of Water & Power

| | | | | | |

6.57%, 07/01/2045 | | | 6,055,000 | | | 7,049,019 |

6.60%, 07/01/2050 | | | 2,000,000 | | | 2,359,954 |

Marin Community College District, 2.70%, 08/01/2041 | | | 1,025,000 | | | 771,431 |

Norwalk-La Mirada Unified School District, 0.00%, 08/01/2038(a) | | | 4,450,000 | | | 2,690,761 |

Paramount Unified School District, 3.27%, 08/01/2051 | | | 13,425,000 | | | 10,202,914 |

Peralta Community College District, 0.00%, 08/05/2031 | | | 12,350,000 | | | 11,805,719 |

Perris Union High School District, 2.70%, 09/01/2042 | | | 3,000,000 | | | 2,251,102 |

Poway Unified School District

| | | | | | |

0.00%, 08/01/2039(a) | | | 8,335,000 | | | 4,821,156 |

0.00%, 08/01/2040(a) | | | 12,000,000 | | | 6,577,813 |

Riverside County Infrastructure Financing Authority,

3.19%, 11/01/2041 | | | 4,755,000 | | | 3,806,286 |

Riverside County Transportation Commission Sales Tax Revenue, 6.81%, 06/01/2039 | | | 11,000,000 | | | 12,831,140 |

San Diego County Regional Transportation Commission,

5.91%, 04/01/2048 | | | 8,125,000 | | | 8,771,337 |

San Diego Unified School District, 0.00%, 07/01/2041(a) | | | 8,500,000 | | | 4,525,675 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Performance Trust Total Return Bond Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

MUNICIPAL BONDS - (Continued)

|

California - (Continued)

|

San Francisco City & County Public Utilities Commission Wastewater Revenue, 5.82%, 10/01/2040 | | | $16,035,000 | | | $17,322,540 |

San Francisco City & County Redevelopment Financing Authority, 0.00%, 08/01/2036(a) | | | 5,240,000 | | | 2,923,882 |

San Mateo Foster City School District, 3.06%, 08/01/2044 | | | 2,245,000 | | | 1,787,075 |

Santa Ana Unified School District, 0.00%, 08/01/2037(a) | | | 3,955,000 | | | 2,522,173 |

Santa Monica Community College District, 2.80%, 08/01/2044 | | | 2,300,000 | | | 1,695,804 |

State of California

| | | | | | |

7.55%, 04/01/2039 | | | 9,500,000 | | | 11,852,457 |

7.60%, 11/01/2040 | | | 18,500,000 | | | 23,208,975 |

University of California

| | | | | | |

4.86%, 05/15/2112 | | | 16,146,000 | | | 14,919,351 |

4.77%, 05/15/2115 | | | 16,372,000 | | | 14,817,680 |

West Contra Costa Unified School District, 0.00%, 08/01/2036(a) | | | 5,000,000 | | | 3,339,882 |

West Sonoma County Union High School District,

0.00%, 08/01/2037(a) | | | 1,840,000 | | | 1,155,675 |

Yosemite Community College District, 0.00%, 08/01/2038(a) | | | 6,110,000 | | | 3,691,388 |

Yuba Community College District, 0.00%, 08/01/2038(a) | | | 5,055,000 | | | 3,100,258 |

| | | | | | 430,314,954 |

Colorado - 0.4%

| | | | | | |

Board of Governors of Colorado State University System,

6.06%, 03/01/2040 | | | 3,500,000 | | | 3,757,723 |

City of Aurora, CO Water Revenue, 2.72%, 08/01/2046 | | | 890,000 | | | 655,041 |

City of Colorado Springs, CO Utilities System Revenue, 6.01%, 11/15/2039 | | | 1,000,000 | | | 1,091,409 |

City of Fountain, CO Electric Water & Wastewater Utility Enterprise Revenue, 3.20%, 12/01/2043 | | | 2,655,000 | | | 2,062,378 |

City of Fruita, CO Healthcare Revenue, 5.00%, 01/01/2028 | | | 1,825,000 | | | 1,794,147 |

Colorado Health Facilities Authority

| | | | | | |

3.80%, 11/01/2044 | | | 13,815,000 | | | 11,556,379 |

3.85%, 11/01/2049 | | | 2,030,000 | | | 1,647,056 |

Regional Transportation District Sales Tax Revenue, 5.84%, 11/01/2050 | | | 10,000,000 | | | 10,843,015 |

| | | | | | 33,407,148 |

| | | | | | | |

| | | | | | | |

Connecticut - 0.4%

| | | | | | |

State of Connecticut

| | | | | | |

3.00%, 01/15/2036 | | | $10,595,000 | | | $9,988,615 |

3.00%, 01/15/2037 | | | 7,090,000 | | | 6,614,166 |

3.00%, 06/01/2037 | | | 8,865,000 | | | 8,232,100 |

State of Connecticut Special Tax Revenue, 3.13%, 05/01/2040 | | | 7,075,000 | | | 6,356,793 |

Town of West Hartford, CT,

2.76%, 07/01/2041 | | | 7,025,000 | | | 5,454,511 |

| | | | | | 36,646,185 |

Delaware - 0.2%

| | | | | | |

University of Delaware,

5.87%, 11/01/2040 | | | 15,250,000 | | | 16,175,506 |

District of Columbia - 0.7%

| | | | | | |

District of Columbia Water & Sewer Authority

| | | | | | |

5.52%, 10/01/2044 | | | 6,450,000 | | | 6,597,887 |

4.81%, 10/01/2114 | | | 16,651,000 | | | 15,940,680 |

Metropolitan Washington Airports Authority Dulles Toll Road Revenue, 8.00%, 10/01/2047 | | | 27,000,000 | | | 35,676,971 |

| | | | | | 58,215,538 |

Florida - 0.8%

| | | | | | |

City of Gainesville, FL

| | | | | | |

0.00%, 10/01/2027(a) | | | 4,610,000 | | | 4,024,880 |

0.00%, 10/01/2028(a) | | | 1,400,000 | | | 1,171,092 |

3.05%, 10/01/2040 | | | 10,840,000 | | | 8,664,506 |

City of Gainesville, FL Utilities System Revenue, 6.02%, 10/01/2040 | | | 16,980,000 | | | 18,422,376 |

County of Miami-Dade, FL Transit System, 5.62%, 07/01/2040 | | | 17,395,000 | | | 18,472,753 |

JEA Water & Sewer System Revenue, 3.00%, 10/01/2041 | | | 5,045,000 | | | 4,408,360 |

Orlando Utilities Commission, 5.66%, 10/01/2040 | | | 9,000,000 | | | 9,561,841 |

| | | | | | 64,725,808 |

Georgia - 0.0%(d)

| | | | | | |

City of Atlanta, GA Water & Wastewater Revenue, 2.91%, 11/01/2043 | | | 2,125,000 | | | 1,607,184 |

Tift County Hospital Authority,

2.98%, 12/01/2042 | | | 2,950,000 | | | 2,249,646 |

| | | | | | 3,856,830 |

Hawaii - 0.1%

| | | | | | |

City & County Honolulu, HI Wastewater System Revenue, 2.57%, 07/01/2041 | | | 5,000,000 | | | 3,734,611 |

State of Hawaii

| | | | | | |

2.25%, 08/01/2038 | | | 3,950,000 | | | 2,979,424 |

2.83%, 10/01/2039 | | | 3,950,000 | | | 3,151,057 |

2.87%, 10/01/2041 | | | 2,270,000 | | | 1,756,848 |

| | | | | | 11,621,940 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Performance Trust Total Return Bond Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

MUNICIPAL BONDS - (Continued)

|

Illinois - 0.4%

| | | | | | |

Chicago O’Hare International Airport, 6.40%, 01/01/2040 | | | $16,730,000 | | | $18,947,640 |

Illinois Finance Authority,

3.51%, 05/15/2041 | | | 7,000,000 | | | 5,713,201 |

Metropolitan Pier & Exposition Authority

| | | | | | |

0.00%, 06/15/2036(a) | | | 4,025,000 | | | 2,483,336 |

0.00%, 06/15/2038(a) | | | 2,750,000 | | | 1,545,339 |

| | | | | | 28,689,516 |

Indiana - 0.2%

| | | | | | |

Indianapolis Local Public Improvement Bond Bank

| | | | | | |

2.47%, 01/01/2040 | | | 9,500,000 | | | 7,387,915 |

6.12%, 01/15/2040 | | | 7,700,000 | | | 8,317,321 |

| | | | | | 15,705,236 |

Kansas - 0.0%(d)

| | | | | | |

Kansas Development Finance Authority, 4.93%, 04/15/2045 | | | 2,050,000 | | | 2,050,338 |

Kentucky - 0.1%

| | | | | | |

County of Warren, KY,

4.40%, 12/01/2038 | | | 1,540,000 | | | 1,457,023 |

Louisville and Jefferson County Metropolitan Sewer District,

2.25%, 05/15/2044 | | | 5,215,000 | | | 3,599,550 |

| | | | | | 5,056,573 |

Louisiana - 0.3%

| | | | | | |

City of New Orleans, LA Water System Revenue

| | | | | | |

2.89%, 12/01/2041 | | | 3,050,000 | | | 2,412,973 |

2.99%, 12/01/2045 | | | 5,000,000 | | | 3,790,721 |

East Baton Rouge Sewerage Commission, 2.44%, 02/01/2039 | | | 2,500,000 | | | 1,929,616 |

State of Louisiana Gasoline & Fuels Tax Revenue

| | | | | | |

2.53%, 05/01/2041 | | | 12,065,000 | | | 9,030,818 |

2.83%, 05/01/2043 | | | 9,685,000 | | | 7,163,249 |

| | | | | | 24,327,377 |

Maine - 0.2%

| | | | | | |

City of Portland, ME

| | | | | | |

2.50%, 04/01/2039 | | | 1,760,000 | | | 1,429,579 |

2.50%, 04/01/2040 | | | 1,760,000 | | | 1,399,197 |

2.50%, 04/01/2041 | | | 1,760,000 | | | 1,371,450 |

Maine Health & Higher Educational Facilities Authority, 3.12%, 07/01/2043 | | | 14,250,000 | | | 11,069,045 |

| | | | | | 15,269,271 |

Maryland - 0.2%

| | | | | | |

Maryland Economic Development Corp., 5.43%, 05/31/2056 | | | 3,800,000 | | | 3,873,739 |

| | | | | | | |

| | | | | | | |

Maryland Health & Higher Educational Facilities Authority,

3.05%, 07/01/2040 | | | $10,000,000 | | | $7,723,271 |

Maryland Stadium Authority,

2.81%, 05/01/2040 | | | 7,000,000 | | | 5,520,690 |

| | | | | | 17,117,700 |

Massachusetts - 0.2%

| | | | | | |

Commonwealth of Massachusetts, 2.38%, 09/01/2043 | | | 3,250,000 | | | 2,452,998 |

Commonwealth of Massachusetts Transportation Fund Revenue,

5.73%, 06/01/2040 | | | 11,165,000 | | | 11,658,155 |

Massachusetts State College Building Authority, 5.93%, 05/01/2040 | | | 550,000 | | | 585,709 |

| | | | | | 14,696,862 |

Michigan - 1.0%

| | | | | | |

City of Detroit, MI, 4.00%, 04/01/2044(e) | | | 8,700,000 | | | 6,966,818 |

Detroit City School District,

7.75%, 05/01/2039 | | | 12,655,000 | | | 15,052,267 |

Great Lakes Water Authority Sewage Disposal System Revenue, 3.06%, 07/01/2039 | | | 2,110,000 | | | 1,749,401 |

Michigan Finance Authority

| | | | | | |

3.27%, 06/01/2039 | | | 20,070,000 | | | 19,076,035 |

3.56%, 06/15/2045 | | | 5,215,000 | | | 4,286,854 |

Michigan State University,

4.17%, 08/15/2122 | | | 12,783,000 | | | 10,371,538 |

Plymouth-Canton Community School District, 3.00%, 05/01/2040 | | | 1,675,000 | | | 1,456,244 |

University of Michigan,

4.45%, 04/01/2122 | | | 19,211,000 | | | 16,855,445 |

Western School District,

2.90%, 05/01/2040 | | | 1,500,000 | | | 1,182,162 |

| | | | | | 76,996,764 |

Minnesota - 0.3%

| | | | | | |

Southern Minnesota Municipal Power Agency, 5.93%, 01/01/2043 | | | 1,450,000 | | | 1,574,264 |

Western Minnesota Municipal Power Agency, 6.77%, 01/01/2046 | | | 13,000,000 | | | 15,128,226 |

White Bear Lake Independent School District No. 624, 3.00%, 02/01/2044 | | | 8,330,000 | | | 7,041,251 |

| | | | | | 23,743,741 |

Mississippi - 0.1%

| | | | | | |

Mississippi Development Bank,

5.46%, 10/01/2036 | | | 5,005,000 | | | 5,145,116 |

Missouri - 0.1%

| | | | | | |

Kansas City Land Clearance Redevelopment Authority,

6.40%, 10/15/2040(b) | | | 7,895,000 | | | 7,598,105 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Performance Trust Total Return Bond Fund

Schedule of Investments

August 31, 2024(Continued)

| | | | | | | |

MUNICIPAL BONDS - (Continued)

|

Nebraska - 0.1%

| | | | | | |

Lancaster County School District 001, 3.00%, 01/15/2043 | | | $6,075,000 | | | $5,195,172 |

West Haymarket Joint Public Agency, 6.75%, 12/15/2045 | | | 5,000,000 | | | 5,877,263 |

| | | | | | 11,072,435 |

Nevada - 0.4%

| | | | | | |

City of North Las Vegas, NV,

6.57%, 06/01/2040 | | | 14,700,000 | | | 16,636,884 |

County of Clark Department of Aviation, 6.82%, 07/01/2045 | | | 8,605,000 | | | 10,143,074 |

County of Clark, NV

| | | | | | |

3.00%, 07/01/2038 | | | 4,000,000 | | | 3,611,569 |

3.23%, 07/01/2044 | | | 2,000,000 | | | 1,549,577 |

| | | | | | 31,941,104 |

New Hampshire - 0.0%(d)

| | | | | | |

New Hampshire Business Finance Authority, 3.28%, 10/01/2037 | | | 4,855,000 | | | 3,644,771 |

New Jersey - 1.0%

| | | | | | |

City of Bayonne, NJ,

2.81%, 07/01/2039 | | | 5,725,000 | | | 4,487,343 |

Clifton Board Of Education,

2.13%, 08/15/2044 | | | 4,560,000 | | | 3,019,570 |

County of Essex, NJ,

2.00%, 09/01/2044 | | | 3,560,000 | | | 2,438,503 |

New Jersey Economic Development Authority, 0.00%, 02/15/2025(a) | | | 20,188,000 | | | 19,711,771 |

New Jersey Institute of Technology, 3.42%, 07/01/2042 | | | 6,455,000 | | | 5,346,952 |

New Jersey Transportation Trust Fund Authority

| | | | | | |

0.00%, 12/15/2039(a) | | | 5,000,000 | | | 2,715,143 |

0.00%, 12/15/2040(a) | | | 10,045,000 | | | 5,134,226 |

New Jersey Turnpike Authority

| | | | | | |

7.41%, 01/01/2040 | | | 11,396,000 | | | 13,929,952 |

7.10%, 01/01/2041 | | | 17,054,000 | | | 20,255,907 |

| | | | | | 77,039,367 |

New York - 1.3%

| | | | | | |

Metropolitan Transportation Authority, 7.34%, 11/15/2039 | | | 18,085,000 | | | 22,035,641 |

New York City Industrial Development Agency, 2.44%, 01/01/2036 | | | 5,850,000 | | | 4,600,686 |

New York City Municipal Water Finance Authority

| | | | | | |

5.75%, 06/15/2041 | | | 12,480,000 | | | 13,292,475 |

5.72%, 06/15/2042 | | | 5,650,000 | | | 5,982,885 |

6.01%, 06/15/2042 | | | 15,900,000 | | | 17,336,150 |

5.44%, 06/15/2043 | | | 4,000,000 | | | 4,082,147 |

5.88%, 06/15/2044 | | | 1,165,000 | | | 1,246,139 |

| | | | | | | |

| | | | | | | |

New York City Transitional Finance Authority Building Aid Revenue, 3.00%, 07/15/2038 | | | $1,400,000 | | | $1,291,826 |

New York Liberty Development Corp.

| | | | | | |

2.25%, 02/15/2041 | | | 13,595,000 | | | 9,809,165 |

3.00%, 02/15/2042 | | | 5,500,000 | | | 4,679,063 |

3.00%, 09/15/2043 | | | 12,500,000 | | | 10,485,220 |

New York State Dormitory Authority, 5.10%, 08/01/2034 | | | 3,125,000 | | | 3,000,610 |

Triborough Bridge & Tunnel Authority, 2.92%, 05/15/2040 | | | 3,890,000 | | | 3,019,908 |

Western Nassau County Water Authority, 2.96%, 04/01/2041 | | | 1,500,000 | | | 1,187,656 |

| | | | | | 102,049,571 |

North Carolina - 0.0%(d)

| | | | | | |

University of North Carolina at Charlotte, 2.76%, 04/01/2043 | | | 2,000,000 | | | 1,496,013 |

Ohio - 0.9%

| | | | | | |

American Municipal Power, Inc.

| | | | | | |

6.45%, 02/15/2044 | | | 16,620,000 | | | 18,553,061 |

8.08%, 02/15/2050 | | | 5,000,000 | | | 6,777,961 |

County of Hamilton, OH,

3.76%, 06/01/2042 | | | 11,955,000 | | | 10,174,932 |

Franklin County Convention Facilities Authority, 2.47%, 12/01/2034 | | | 15,000,000 | | | 12,200,445 |

Ohio Higher Educational Facility Commission, 4.50%, 12/01/2026 | | | 4,025,000 | | | 3,947,678 |

Ohio State University,

4.80%, 06/01/2111 | | | 18,448,000 | | | 17,302,676 |

| | | | | | 68,956,753 |

Oklahoma - 0.4%

| | | | | | |