UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant’s telephone number, including area code

Date of fiscal year end: November 30, 2024

Date of reporting period: November 30, 2024

Item 1. Reports to Stockholders.

| | |

| Convergence Long/Short Equity ETF | |

| CLSE (Principal U.S. Listing Exchange: CBOE) |

| Annual Shareholder Report | November 30, 2024 |

This annual shareholder report contains important information about the Convergence Long/Short Equity ETF for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at https://investcip.com/etfstrategies.html. You can also request this information by contacting us at 1-877-677-9414.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Convergence Long/Short Equity ETF | $172 | 1.44% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The investment objective of the Fund is to seek long-term capital growth.

The net asset value (NAV) of the Convergence Long/Short Equity ETF was up 39.57% over the twelve months ended November 30, 2024, while the Russell 3000 Total Return Index was up 34.49%.

The Fund is comprised of both long and short holdings, combining two portfolios, one of stocks owned (“long”) and the other of stock borrowed and sold (“short”). On average, positions in both the long portfolio and short portfolio positively contributed to Fund returns.

Fund holdings in the Software & Services, Semiconductors, and Capital Goods industry groups contributed the most to total return for the most recent twelve months. Only two industry groups detracted from performance for the same period. Those two were Energy and Commercial & Professional Services.

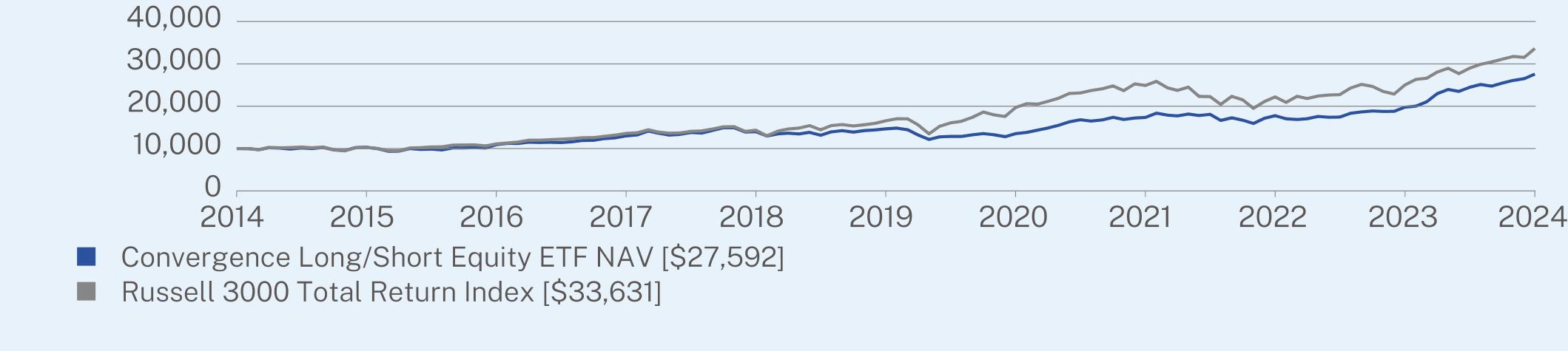

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the Fund. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Convergence Long/Short Equity ETF NAV | 39.57 | 13.49 | 10.68 |

Russell 3000 Total Return Index | 34.49 | 15.23 | 12.89 |

Visit https://investcip.com/etfstrategies.html for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Convergence Long/Short Equity ETF | PAGE 1 | TSR-AR-89834G760 |

KEY FUND STATISTICS (as of November 30, 2024)

| |

Net Assets | $206,842,070 |

Number of Holdings | 343 |

Advisory Fee | $1,047,946 |

Portfolio Turnover | 225% |

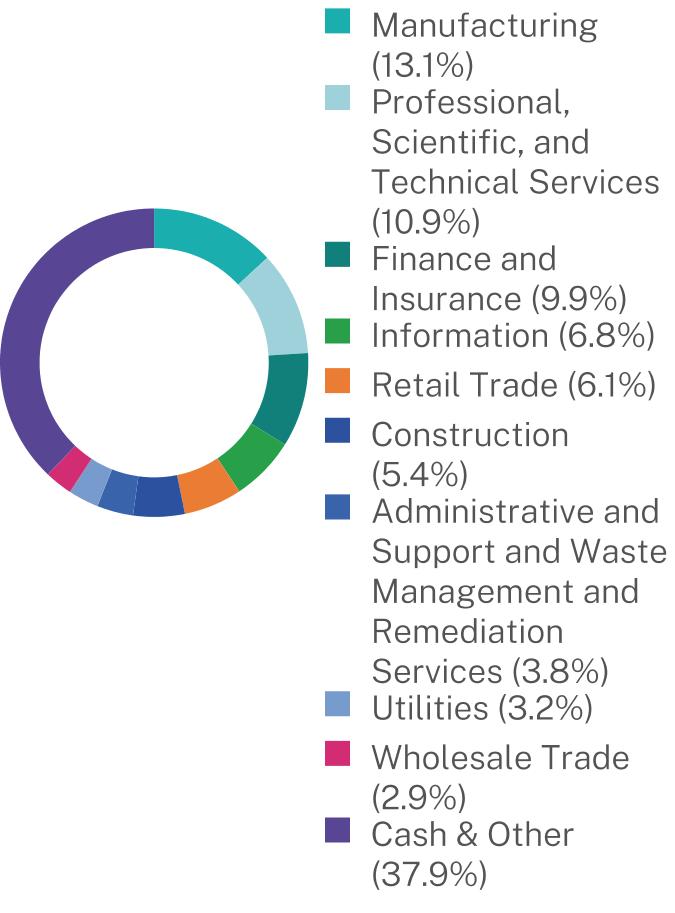

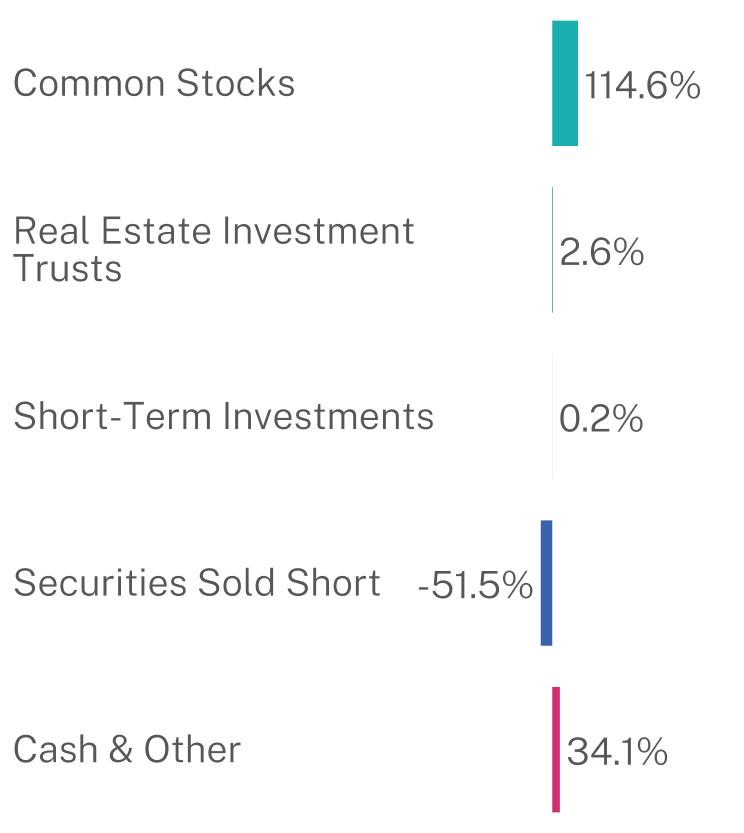

WHAT DID THE FUND INVEST IN? (% of net assets as of November 30, 2024)

| |

Top Holdings | (%) |

NVIDIA Corp. | 4.4% |

Alphabet, Inc. - Class A | 3.4% |

Meta Platforms, Inc. - Class A | 3.3% |

Amazon.com, Inc. | 2.7% |

AppLovin Corp. - Class A | 2.3% |

Arista Networks, Inc. | 2.0% |

Walmart, Inc. | 2.0% |

Hewlett Packard Enterprise Co. | 1.9% |

Carvana Co. | 1.8% |

Lam Research Corp. | 1.8% |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit https://investcip.com/etfstrategies.html

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact the Fund at 1-877-677-9414, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by the Fund or your financial intermediary.

| Convergence Long/Short Equity ETF | PAGE 2 | TSR-AR-89834G760 |

1000010315109381299513994146551352917352177661977027592100001025811111135851433616557197062489722207250073363113.110.99.96.86.15.43.83.22.937.9114.62.60.251.534.1

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. Incorporated by reference to the registrant’s Form N-CSR filed on February 3, 2017.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Akers and Lisa Zúñiga Ramírez are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 11/30/2024 | FYE 11/30/2023 |

| (a) Audit Fees | $17,500 | $17,000 |

| (b) Audit-Related Fees | $0 | $0 |

| (c) Tax Fees | $3,000 | $3,000 |

| (d) All Other Fees | $0 | $0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 11/30/2024 | FYE 11/30/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 11/30/2024 | FYE 11/30/2023 |

| Registrant | 0 | 0 |

| Registrant’s Investment Adviser | 0 | 0 |

(h) The audit committee of the board of trustees/directors has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

| (a) | The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The entire Board of Trustees is acting as the registrant’s audit committee. |

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

CONVERGENCE LONG/SHORT EQUITY ETF (CLSE)

Listed on Cboe BZX Exchange, Inc.

Core Financial Statements

November 30, 2024

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024

| | | | | | | |

COMMON STOCKS — 114.6%

| | | | | | |

Administrative and Support Services — 5.6%

| | | | | | |

Booking Holdings, Inc.(a) | | | 187 | | | $972,770 |

Bread Financial Holdings, Inc.(a) | | | 33,155 | | | 1,950,509 |

Duolingo, Inc.(a)(b) | | | 2,954 | | | 1,028,790 |

Expedia Group, Inc.(a)(b) | | | 6,972 | | | 1,287,171 |

Janus Henderson Group PLC(a) | | | 43,698 | | | 1,978,645 |

PayPal Holdings, Inc.(a)(b) | | | 33,188 | | | 2,879,723 |

Sezzle, Inc.(a)(b) | | | 3,578 | | | 1,517,179 |

| | | | | | 11,614,787 |

Air Transportation — 0.3%

| | | | | | |

United Airlines Holdings, Inc.(a)(b) | | | 7,259 | | | 702,889 |

Ambulatory Health Care Services — 1.2%

| | | | | | |

DaVita, Inc.(a)(b) | | | 10,505 | | | 1,745,616 |

Natera, Inc.(b) | | | 2,334 | | | 391,598 |

Veracyte, Inc.(a)(b) | | | 6,946 | | | 298,331 |

| | | | | | 2,435,545 |

Beverage and Tobacco Product Manufacturing — 0.8%

| | | | | | |

Altria Group, Inc.(a) | | | 29,435 | | | 1,699,577 |

Broadcasting and Content Providers — 0.3%

| | | | | | |

Fox Corp. - Class A(a) | | | 12,903 | | | 607,989 |

Building Material and Garden Equipment and Supplies Dealers — 1.2%

| | | | | | |

Home Depot, Inc.(a) | | | 5,789 | | | 2,484,234 |

Chemical Manufacturing — 5.6%

| | | | | | |

AbbVie, Inc.(a) | | | 8,793 | | | 1,608,504 |

Bristol-Myers Squibb Co.(a) | | | 36,198 | | | 2,143,646 |

CF Industries Holdings, Inc.(a) | | | 9,006 | | | 807,478 |

Corcept Therapeutics, Inc.(a)(b) | | | 7,421 | | | 428,043 |

Gilead Sciences, Inc.(a) | | | 24,098 | | | 2,230,993 |

Halozyme Therapeutics, Inc.(a)(b) | | | 26,712 | | | 1,287,518 |

Jazz Pharmaceuticals PLC(a)(b) | | | 3,501 | | | 425,687 |

Procter & Gamble Co.(a) | | | 5,544 | | | 993,817 |

United Therapeutics Corp.(a)(b) | | | 3,731 | | | 1,382,298 |

Vertex Pharmaceuticals, Inc.(a)(b) | | | 819 | | | 383,398 |

| | | | | | 11,691,382 |

Computer and Electronic Product Manufacturing — 17.8%

| | | | | | |

Advanced Energy Industries, Inc.(a) | | | 1,199 | | | 137,933 |

Amphenol Corp. - Class A(a) | | | 15,701 | | | 1,140,678 |

Apple, Inc. | | | 7,548 | | | 1,791,367 |

Arista Networks, Inc.(a)(b) | | | 10,259 | | | 4,163,307 |

Broadcom, Inc.(a) | | | 17,108 | | | 2,772,865 |

InterDigital, Inc.(a) | | | 17,329 | | | 3,395,791 |

Lam Research Corp.(a) | | | 49,976 | | | 3,692,227 |

Micron Technology, Inc.(a) | | | 29,206 | | | 2,860,728 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Computer and Electronic Product Manufacturing — (Continued)

| | | | | | |

Monolithic Power Systems, Inc.(a) | | | 1,060 | | | $601,698 |

NetApp, Inc.(a) | | | 17,583 | | | 2,156,379 |

NVIDIA Corp.(a) | | | 65,161 | | | 9,008,508 |

QUALCOMM, Inc.(a) | | | 21,889 | | | 3,470,063 |

Vertiv Holdings Co. - Class A(a) | | | 12,656 | | | 1,614,906 |

| | | | | | 36,806,450 |

Construction of Buildings — 0.4%

| | | | | | |

NVR, Inc.(a)(b) | | | 53 | | | 489,486 |

Toll Brothers, Inc.(a) | | | 2,703 | | | 446,454 |

| | | | | | 935,940 |

Credit Intermediation and Related Activities — 9.4%

| | | | | | |

Bank of America Corp.(a) | | | 36,440 | | | 1,731,264 |

Comerica, Inc.(a) | | | 17,952 | | | 1,297,032 |

Euronet Worldwide, Inc.(a)(b) | | | 10,093 | | | 1,061,077 |

Fifth Third Bancorp(a) | | | 34,100 | | | 1,638,846 |

JPMorgan Chase & Co.(a) | | | 5,475 | | | 1,367,217 |

Northern Trust Corp.(a) | | | 21,210 | | | 2,357,704 |

PNC Financial Services Group, Inc.(a) | | | 7,142 | | | 1,533,530 |

Regions Financial Corp.(a) | | | 56,995 | | | 1,553,684 |

Synchrony Financial(a) | | | 35,552 | | | 2,400,471 |

UMB Financial Corp.(a) | | | 11,108 | | | 1,393,943 |

Wells Fargo & Co.(a) | | | 21,413 | | | 1,631,028 |

Zions Bancorp NA(a) | | | 24,694 | | | 1,494,481 |

| | | | | | 19,460,277 |

Fabricated Metal Product Manufacturing — 1.4%

| | | | | | |

Mueller Industries, Inc.(a) | | | 19,397 | | | 1,566,696 |

Mueller Water Products, Inc. - Class A(a) | | | 55,515 | | | 1,390,095 |

| | | | | | 2,956,791 |

Food and Beverage Retailers — 0.2%

| | | | | | |

Kroger Co.(a) | | | 5,929 | | | 362,143 |

Food Manufacturing — 1.5%

| | | | | | |

Pilgrim's Pride Corp.(a)(b) | | | 35,123 | | | 1,812,698 |

Tyson Foods, Inc. - Class A(a) | | | 19,369 | | | 1,249,301 |

| | | | | | 3,061,999 |

Food Services and Drinking Places — 0.3%

| | | | | | |

Cava Group, Inc.(a)(b) | | | 3,857 | | | 543,451 |

Funds, Trusts, and Other Financial Vehicles — 1.3%

| | | | | | |

Garmin Ltd.(a) | | | 3,661 | | | 778,329 |

SEI Investments Co.(a) | | | 23,969 | | | 1,980,558 |

| | | | | | 2,758,887 |

General Merchandise Retailers — 2.0%

| | | | | | |

Walmart, Inc.(a) | | | 44,734 | | | 4,137,895 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Health and Personal Care Retailers — 0.0%(c)

| | | | | | |

CVS Health Corp.(a) | | | 49 | | | $2,933 |

Heavy and Civil Engineering Construction — 3.3%

| | | | | | |

Fluor Corp.(a)(b) | | | 3,752 | | | 210,600 |

Granite Construction, Inc.(a) | | | 18,100 | | | 1,798,597 |

MasTec, Inc.(a)(b) | | | 9,987 | | | 1,438,727 |

Primoris Services Corp.(a) | | | 21,063 | | | 1,763,184 |

Sterling Infrastructure, Inc.(a)(b) | | | 8,016 | | | 1,558,711 |

| | | | | | 6,769,819 |

Hospitals — 1.7%

| | | | | | |

Encompass Health Corp.(a) | | | 5,789 | | | 595,920 |

Tenet Healthcare Corp.(a)(b) | | | 9,892 | | | 1,411,390 |

Universal Health Services, Inc. - Class B(a) | | | 7,170 | | | 1,469,850 |

| | | | | | 3,477,160 |

Insurance Carriers and Related Activities — 3.3%

| | | | | | |

Allstate Corp.(a) | | | 4,760 | | | 987,176 |

Cincinnati Financial Corp.(a) | | | 1,111 | | | 177,571 |

CNA Financial Corp.(a) | | | 15,940 | | | 804,014 |

Frontdoor, Inc.(a)(b) | | | 18,771 | | | 1,099,981 |

HealthEquity, Inc.(a)(b) | | | 1,586 | | | 161,043 |

MetLife, Inc.(a) | | | 11,769 | | | 1,038,379 |

Progressive Corp.(a) | | | 3,714 | | | 998,620 |

Prudential Financial, Inc.(a) | | | 3,023 | | | 391,206 |

Reinsurance Group of America, Inc.(a) | | | 5,001 | | | 1,142,228 |

| | | | | | 6,800,218 |

Merchant Wholesalers, Durable Goods — 1.0%

| | | | | | |

Allison Transmission Holdings, Inc.(a) | | | 11,642 | | | 1,379,577 |

Avnet, Inc.(a) | | | 11,145 | | | 609,743 |

| | | | | | 1,989,320 |

Merchant Wholesalers, Nondurable Goods — 3.0%

| | | | | | |

Amneal Pharmaceuticals, Inc.(a)(b) | | | 207,970 | | | 1,719,912 |

Cardinal Health, Inc.(a) | | | 14,727 | | | 1,800,228 |

Cencora, Inc.(a) | | | 7,300 | | | 1,836,315 |

McKesson Corp.(a) | | | 1,520 | | | 955,320 |

| | | | | | 6,311,775 |

Mining (except Oil and Gas) — 1.0%

| | | | | | |

Coeur Mining, Inc.(a)(b) | | | 36,725 | | | 237,244 |

CONSOL Energy, Inc.(a) | | | 11,719 | | | 1,531,673 |

Southern Copper Corp.(a) | | | 3,887 | | | 390,072 |

| | | | | | 2,158,989 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024(Continued)

| | | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | | |

Miscellaneous Manufacturing — 1.7%

| | | | | | | | | | | | |

Johnson & Johnson(a) | | | 11,360 | | | $1,760,913 | |

Peloton Interactive, Inc. - Class A(a)(b) | | | 80,067 | | | 827,893 | |

ResMed, Inc.(a) | | | 3,384 | | | 842,684 | |

| | | | | | 3,431,490 | |

Motor Vehicle and Parts Dealers — 2.9%

| | | | | | | |

Cargurus, Inc.(a)(b) | | | 47,716 | | | 1,804,619 | |

Carvana Co.(a)(b) | | | 14,693 | | | 3,826,351 | |

Murphy USA, Inc.(a) | | | 780 | | | 427,284 | |

| | | | | | 6,058,254 | |

Nonmetallic Mineral Product Manufacturing — 1.1%

| | | | | | | |

Corning, Inc.(a) | | | 27,341 | | | 1,330,686 | |

Eagle Materials, Inc.(a) | | | 2,836 | | | 876,097 | |

Owens Corning(a) | | | 14 | | | 2,879 | |

| | | | | | 2,209,662 | |

Oil and Gas Extraction — 1.1%

| | | | | | | |

APA Corp.(a) | | | 26,137 | | | 592,003 | |

CNX Resources Corp.(a)(b) | | | 39,670 | | | 1,607,429 | |

| | | | | | 2,199,432 | |

Paper Manufacturing — 0.5%

| | | | | | | |

Sylvamo Corp.(a) | | | 12,273 | | | 1,132,675 | |

Petroleum and Coal Products Manufacturing — 0.3%

| | | | | | | |

Valero Energy Corp.(a) | | | 4,267 | | | 593,454 | |

Professional, Scientific, and Technical Services — 13.9%

| | | | | | | |

Alphabet, Inc. - Class A(a) | | | 41,394 | | | 6,993,516 | |

Alphabet, Inc. - Class C(a) | | | 5,663 | | | 965,485 | |

AppLovin Corp. - Class A(a)(b) | | | 13,852 | | | 4,664,661 | |

Booz Allen Hamilton Holding Corp.(a) | | | 2,297 | | | 340,370 | |

CACI International, Inc. - Class A(a)(b) | | | 1,588 | | | 730,289 | |

Exelixis, Inc.(a)(b) | | | 16,353 | | | 596,230 | |

F5, Inc.(a)(b) | | | 5,269 | | | 1,319,094 | |

Gen Digital, Inc.(a) | | | 62,315 | | | 1,922,418 | |

GoDaddy, Inc. - Class A(a)(b) | | | 15,131 | | | 2,989,432 | |

Leidos Holdings, Inc. | | | 4,014 | | | 663,916 | |

Nutanix, Inc. - Class A(a)(b) | | | 33,719 | | | 2,201,176 | |

Oracle Corp.(a) | | | 14,773 | | | 2,730,641 | |

Paylocity Holding Corp.(a)(b) | | | 2,350 | | | 487,719 | |

Science Applications International Corp.(a) | | | 5,284 | | | 656,537 | |

Ubiquiti, Inc.(a) | | | 4,416 | | | 1,530,100 | |

| | | | | | 28,791,584 | |

Publishing Industries — 7.3%

| | | | | | | |

ACI Worldwide, Inc.(a)(b) | | | 49,180 | | | 2,794,408 | |

Box, Inc. - Class A(a)(b) | | | 4,248 | | | 149,062 | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Publishing Industries — (Continued)

| | | | | | |

Commvault Systems, Inc.(a)(b) | | | 16,951 | | | $2,908,622 |

DocuSign, Inc.(a)(b) | | | 35,330 | | | 2,815,448 |

Hewlett Packard Enterprise Co.(a) | | | 186,618 | | | 3,960,034 |

Palantir Technologies, Inc. - Class A(a)(b) | | | 35,681 | | | 2,393,481 |

| | | | | | 15,021,055 |

Rail Transportation — 0.5%

| | | | | | |

Union Pacific Corp.(a) | | | 4,166 | | | 1,019,254 |

Real Estate — 0.2%

| | | | | | |

Jones Lang LaSalle, Inc.(a)(b) | | | 1,583 | | | 444,190 |

Rental and Leasing Services — 1.0%

| | | | | | |

Netflix, Inc.(a)(b) | | | 1,960 | | | 1,738,148 |

Ryder System, Inc.(a) | | | 2,641 | | | 445,906 |

| | | | | | 2,184,054 |

Securities, Commodity Contracts, and Other Financial Investments and Related Activities — 2.2%

| | | | | | |

Blackrock, Inc.(a) | | | 1,549 | | | 1,584,317 |

StoneX Group, Inc.(a)(b) | | | 18,070 | | | 1,874,943 |

Victory Capital Holdings, Inc. - Class A(a) | | | 14,663 | | | 1,018,786 |

| | | | | | 4,478,046 |

Specialty Trade Contractors — 1.9%

| | | | | | |

ABM Industries, Inc.(a) | | | 6,979 | | | 398,989 |

EMCOR Group, Inc.(a) | | | 3,139 | | | 1,601,267 |

IES Holdings, Inc.(a)(b) | | | 6,016 | | | 1,864,088 |

| | | | | | 3,864,344 |

Sporting Goods, Hobby, Musical Instrument, Book, and Miscellaneous Retailers — 2.8%

| | | | | | |

Amazon.com, Inc.(a)(b) | | | 26,635 | | | 5,537,150 |

Coupang, Inc.(a)(b) | | | 12,599 | | | 319,511 |

| | | | | | 5,856,661 |

Support Activities for Mining — 1.3%

| | | | | | |

Royal Gold, Inc.(a) | | | 6,779 | | | 991,497 |

TechnipFMC PLC(a) | | | 54,044 | | | 1,695,360 |

| | | | | | 2,686,857 |

Support Activities for Transportation — 0.8%

| | | | | | |

CH Robinson Worldwide, Inc.(a) | | | 11,287 | | | 1,191,682 |

Matson, Inc.(a) | | | 2,739 | | | 419,560 |

| | | | | | 1,611,242 |

Telecommunications — 1.1%

| | | | | | |

AT&T, Inc.(a) | | | 33,841 | | | 783,758 |

T-Mobile US, Inc.(a) | | | 6,126 | | | 1,512,754 |

| | | | | | 2,296,512 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Transportation Equipment Manufacturing — 2.9%

| | | | | | |

Atmus Filtration Technologies, Inc.(a) | | | 28,920 | | | $1,251,947 |

General Motors Co.(a) | | | 31,127 | | | 1,730,350 |

Tesla, Inc.(a)(b) | | | 8,635 | | | 2,980,456 |

| | | | | | 5,962,753 |

Utilities — 4.3%

| | | | | | |

Avista Corp.(a) | | | 25,925 | | | 1,003,038 |

Cheniere Energy, Inc.(a) | | | 9,574 | | | 2,144,672 |

GE Vernova, Inc.(a)(b) | | | 2,991 | | | 999,353 |

NRG Energy, Inc.(a) | | | 16,125 | | | 1,638,461 |

Pinnacle West Capital Corp.(a) | | | 7,443 | | | 697,409 |

Spire, Inc.(a) | | | 13,592 | | | 994,799 |

Vistra Corp.(a) | | | 8,488 | | | 1,356,722 |

| | | | | | 8,834,454 |

Water Transportation — 0.4%

| | | | | | |

Carnival Corp.(a)(b) | | | 31,117 | | | 791,305 |

Web Search Portals, Libraries, Archives, and Other Information

Services — 3.3%

| | | |

Meta Platforms, Inc. - Class A(a) | | | 11,829 | | | 6,793,631 |

Wood Product Manufacturing — 0.5%

| | | | | | |

Louisiana-Pacific Corp.(a) | | | 8,671 | | | 1,024,912 |

TOTAL COMMON STOCKS

(Cost $198,442,657) | | | | | | 237,056,271 |

REAL ESTATE INVESTMENT TRUSTS — 2.6%

| | | | | | |

Professional, Scientific, and Technical Services — 0.4%

| | | | | | |

Outfront Media, Inc.(a) | | | 40,205 | | | 772,338 |

Real Estate — 1.8%

| | | | | | |

CareTrust REIT, Inc.(a) | | | 28,813 | | | 858,339 |

COPT Defense Properties(a) | | | 23,643 | | | 779,037 |

Equity Residential(a) | | | 9,809 | | | 751,958 |

Lamar Advertising Co. - Class A(a) | | | 5,089 | | | 682,028 |

Simon Property Group, Inc.(a) | | | 3,860 | | | 708,696 |

| | | | | | 3,780,058 |

Securities, Commodity Contracts, and Other Financial Investments and Related Activities — 0.4%

| | | | | | |

Innovative Industrial Properties, Inc.(a) | | | 7,057 | | | 769,354 |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Cost $4,926,405) | | | | | | 5,321,750 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Investments

November 30, 2024(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS — 0.2%

| | | | | | |

Money Market Funds — 0.2%

| | | | | | |

First American Government Obligations Fund - Class X, 4.56%(d) | | | 467,866 | | | $467,866 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $467,866) | | | | | | 467,866 |

TOTAL INVESTMENTS — 117.4%

(Cost $203,836,928) | | | | | | $242,845,887 |

Liabilities in Excess of Other Assets — (17.4)% | | | | | | (36,003,817) |

TOTAL NET ASSETS — 100.0% | | | | | | $206,842,070 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| All or a portion of security has been pledged as collateral. The total value of assets committed as collateral as of November 30, 2024 is $238,066,004. |

(b)

| Non-income producing security. |

(c)

| Represents less than 0.05% of net assets. |

(d)

| The rate shown represents the 7-day annualized effective yield as of November 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024

| | | | | | | |

COMMON STOCKS — (49.5)%

| | | | | | |

Accommodation — (0.3)%

| | | | | | |

Hilton Grand Vacations, Inc. | | | (2,787) | | | $(118,141) |

Penn Entertainment, Inc. | | | (4,521) | | | (97,608) |

Vail Resorts, Inc. | | | (2,679) | | | (480,184) |

| | | | | | (695,933) |

Administrative and Support Services — (1.9)%

| | | | | | |

ACV Auctions, Inc. - Class A | | | (11,585) | | | (262,053) |

Live Nation Entertainment, Inc. | | | (4,651) | | | (643,001) |

MSCI, Inc. | | | (1,772) | | | (1,080,264) |

RB Global, Inc. | | | (2,627) | | | (256,815) |

Remitly Global, Inc. | | | (34,326) | | | (705,743) |

ROBLOX Corp. - Class A | | | (13,878) | | | (695,704) |

Six Flags Entertainment Corp. | | | (3,936) | | | (181,804) |

| | | | | | (3,825,384) |

Air Transportation — (0.1)%

| | | | | | |

JetBlue Airways Corp. | | | (24,624) | | | (147,005) |

Amusement, Gambling, and Recreation Industries — (0.2)%

| | | | | | |

Walt Disney Co. | | | (3,359) | | | (394,582) |

Beverage and Tobacco Product Manufacturing — (0.5)%

| | | | | | |

Celsius Holdings, Inc. | | | (19,523) | | | (555,430) |

Monster Beverage Corp. | | | (9,118) | | | (502,675) |

| | | | | | (1,058,105) |

Broadcasting and Content Providers — (0.4)%

| | | | | | |

Warner Bros Discovery, Inc. | | | (88,139) | | | (923,697) |

Chemical Manufacturing — (2.9)%

| | | | | | |

Air Products and Chemicals, Inc. | | | (958) | | | (320,288) |

Albemarle Corp. | | | (3,232) | | | (348,087) |

Apellis Pharmaceuticals, Inc. | | | (10,455) | | | (354,738) |

Arrowhead Pharmaceuticals, Inc. | | | (13,050) | | | (339,692) |

Bridgebio Pharma, Inc. | | | (24,637) | | | (667,416) |

Coty, Inc. - Class A | | | (47,448) | | | (350,641) |

elf Beauty, Inc. | | | (4,314) | | | (558,749) |

Estee Lauder Cos., Inc. - Class A | | | (3,786) | | | (273,046) |

Exact Sciences Corp. | | | (2,847) | | | (176,742) |

Huntsman Corp. | | | (8,488) | | | (166,195) |

Ionis Pharmaceuticals, Inc. | | | (12,943) | | | (462,453) |

Madrigal Pharmaceuticals, Inc. | | | (1,148) | | | (376,762) |

Moderna, Inc. | | | (27,992) | | | (1,205,336) |

QuidelOrtho Corp. | | | (8,038) | | | (329,558) |

| | | | | | (5,929,703) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Clothing, Clothing Accessories, Shoe, and Jewelry Retailers — (0.3)%

|

Foot Locker, Inc. | | | (9,984) | | | $(251,098) |

Lululemon Athletica, Inc. | | | (1,053) | | | (337,655) |

| | | | | | (588,753) |

Computer and Electronic Product Manufacturing — (10.8)%

| | | | | | |

Allegro MicroSystems, Inc. | | | (46,274) | | | (1,005,534) |

Bruker Corp. | | | (12,330) | | | (714,523) |

Cisco Systems, Inc. | | | (21,971) | | | (1,300,903) |

Cognex Corp. | | | (27,373) | | | (1,094,373) |

Dell Technologies, Inc. - Class C | | | (8,821) | | | (1,125,471) |

Dolby Laboratories, Inc. - Class A | | | (11,649) | | | (912,350) |

EchoStar Corp. - Class A | | | (37,033) | | | (936,565) |

Enphase Energy, Inc. | | | (3,600) | | | (256,860) |

First Solar, Inc. | | | (13,148) | | | (2,620,002) |

Intel Corp. | | | (76,204) | | | (1,832,706) |

Lattice Semiconductor Corp. | | | (18,447) | | | (1,046,867) |

Masimo Corp. | | | (2,158) | | | (372,341) |

Microchip Technology, Inc. | | | (20,606) | | | (1,404,711) |

ON Semiconductor Corp. | | | (11,596) | | | (824,707) |

Roper Technologies, Inc. | | | (2,486) | | | (1,408,170) |

Super Micro Computer, Inc. | | | (27,087) | | | (884,120) |

Teledyne Technologies, Inc. | | | (2,353) | | | (1,141,817) |

Texas Instruments, Inc. | | | (8,189) | | | (1,646,235) |

Western Digital Corp. | | | (20,788) | | | (1,517,316) |

Zebra Technologies Corp. - Class A | | | (898) | | | (365,486) |

| | | | | | (22,411,057) |

Construction of Buildings — (0.2)%

| | | | | | |

Century Communities, Inc. | | | (1,551) | | | (140,148) |

LGI Homes, Inc. | | | (1,763) | | | (193,031) |

| | | | | | (333,179) |

Credit Intermediation and Related Activities — (2.6)%

| | | | | | |

Banc of California, Inc. | | | (31,974) | | | (550,912) |

Citigroup, Inc. | | | (5,714) | | | (404,951) |

Credit Acceptance Corp. | | | (1,662) | | | (827,177) |

Eastern Bankshares, Inc. | | | (19,711) | | | (367,413) |

First Citizens BancShares, Inc./NC - Class A | | | (328) | | | (752,760) |

Flagstar Financial, Inc. | | | (49,577) | | | (593,437) |

KeyCorp | | | (23,076) | | | (449,520) |

Mr Cooper Group, Inc. | | | (6,270) | | | (618,661) |

Popular, Inc. | | | (3,017) | | | (299,769) |

Truist Financial Corp. | | | (4,454) | | | (212,367) |

Western Alliance Bancorp | | | (4,219) | | | (394,941) |

| | | | | | (5,471,908) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Data Processing, Hosting & Related Services — (0.8)%

| | | | | | |

Airbnb, Inc. - Class A | | | (6,632) | | | $(902,681) |

Alight, Inc. - Class A | | | (33,057) | | | (264,456) |

Five9, Inc. | | | (12,439) | | | (513,482) |

| | | | | | (1,680,619) |

Electrical Equipment, Appliance, and Component Manufacturing — (0.2)%

|

SharkNinja, Inc. | | | (3,186) | | | (320,352) |

Fabricated Metal Product Manufacturing — (0.4)%

| | | | | | |

Chart Industries, Inc. | | | (1,782) | | | (344,372) |

Enovis Corp. | | | (9,866) | | | (481,559) |

| | | | | | (825,931) |

Food Manufacturing — (0.7)%

| | | | | | |

Darling Ingredients, Inc. | | | (9,748) | | | (395,086) |

Hershey Co. | | | (2,658) | | | (468,154) |

Lamb Weston Holdings, Inc. | | | (6,589) | | | (508,934) |

| | | | | | (1,372,174) |

Furniture, Home Furnishings, Electronics, and Appliance Retailers — (1.1)%

|

Floor & Decor Holdings, Inc. - Class A | | | (10,379) | | | (1,164,627) |

RH | | | (3,121) | | | (1,202,022) |

| | | | | | (2,366,649) |

General Merchandise Retailers — (1.4)%

| | | | | | |

Dollar General Corp. | | | (10,572) | | | (816,898) |

Dollar Tree, Inc. | | | (12,717) | | | (906,341) |

Five Below, Inc. | | | (13,018) | | | (1,206,769) |

| | | | | | (2,930,008) |

Insurance Carriers and Related Activities — (1.7)%

| | | | | | |

Arthur J Gallagher & Co. | | | (1,151) | | | (359,388) |

Assured Guaranty Ltd. | | | (3,464) | | | (323,122) |

Berkshire Hathaway, Inc. - Class B | | | (2,853) | | | (1,378,056) |

Brighthouse Financial, Inc. | | | (6,428) | | | (335,991) |

Kinsale Capital Group, Inc. | | | (870) | | | (442,343) |

Markel Group, Inc. | | | (163) | | | (290,616) |

RenaissanceRe Holdings Ltd. | | | (1,046) | | | (299,313) |

| | | | | | (3,428,829) |

Machinery Manufacturing — (1.3)%

| | | | | | |

AGCO Corp. | | | (3,934) | | | (398,160) |

Brunswick Corp./DE | | | (2,208) | | | (177,766) |

General Electric Co. | | | (7,365) | | | (1,341,608) |

Terex Corp. | | | (6,700) | | | (367,093) |

Xylem, Inc./NY | | | (3,742) | | | (474,299) |

| | | | | | (2,758,926) |

Management of Companies and Enterprises — (1.6)%

| | | | | | |

Atlanta Braves Holdings, Inc. - Class C | | | (5,793) | | | (233,748) |

CNH Industrial NV | | | (33,489) | | | (420,622) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Management of Companies and Enterprises — (Continued)

| | | | | | |

Rivian Automotive, Inc. - Class A | | | (88,236) | | | $(1,079,126) |

Smurfit WestRock PLC | | | (7,004) | | | (385,360) |

StoneCo Ltd. - Class A | | | (54,793) | | | (519,438) |

U-Haul Holding Co. | | | (5,103) | | | (318,631) |

White Mountains Insurance Group Ltd. | | | (216) | | | (434,158) |

| | | | | | (3,391,083) |

Merchant Wholesalers, Durable Goods — (1.0)%

| | | | | | |

LKQ Corp. | | | (8,950) | | | (351,646) |

Pool Corp. | | | (3,502) | | | (1,320,569) |

SiteOne Landscape Supply, Inc. | | | (2,204) | | | (337,763) |

| | | | | | (2,009,978) |

Merchant Wholesalers, Nondurable Goods — (0.2)%

| | | | | | |

Birkenstock Holding PLC | | | (7,232) | | | (373,605) |

Mining (except Oil and Gas) — (0.7)%

| | | | | | |

Martin Marietta Materials, Inc. | | | (438) | | | (262,800) |

Summit Materials, Inc. - Class A | | | (9,010) | | | (458,969) |

Uranium Energy Corp. | | | (49,812) | | | (413,938) |

Vulcan Materials Co. | | | (921) | | | (265,368) |

| | | | | | (1,401,075) |

Miscellaneous Manufacturing — (1.8)%

| | | | | | |

Dexcom, Inc. | | | (17,993) | | | (1,403,274) |

Edwards Lifesciences Corp. | | | (7,986) | | | (569,801) |

Inari Medical, Inc. | | | (6,755) | | | (350,720) |

Inspire Medical Systems, Inc. | | | (3,910) | | | (753,692) |

Neogen Corp. | | | (37,228) | | | (527,893) |

PROCEPT BioRobotics Corp. | | | (2,094) | | | (200,165) |

| | | | | | (3,805,545) |

Motor Vehicle and Parts Dealers — (0.2)%

| | | | | | |

Asbury Automotive Group, Inc. | | | (1,183) | | | (307,379) |

Oil and Gas Extraction — (0.7)%

| | | | | | |

EQT Corp. | | | (11,589) | | | (526,604) |

Expand Energy Corp. | | | (4,488) | | | (444,133) |

Northern Oil & Gas, Inc. | | | (10,280) | | | (447,077) |

| | | | | | (1,417,814) |

Performing Arts, Spectator Sports, and Related Industries — (0.3)%

| | | | | | |

Caesars Entertainment, Inc. | | | (8,002) | | | (307,997) |

Churchill Downs, Inc. | | | (2,612) | | | (371,191) |

| | | | | | (679,188) |

Plastics and Rubber Products Manufacturing — (0.6)%

| | | | | | |

West Pharmaceutical Services, Inc. | | | (4,036) | | | (1,314,444) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Primary Metal Manufacturing — (0.2)%

| | | | | | |

Alcoa Corp. | | | (4,934) | | | $(229,086) |

Steel Dynamics, Inc. | | | (1,931) | | | (280,516) |

| | | | | | (509,602) |

Professional, Scientific, and Technical Services — (3.4)%

| | | | | | |

Accenture PLC - Class A | | | (3,116) | | | (1,129,145) |

Aspen Technology, Inc. | | | (6,881) | | | (1,720,250) |

Atlassian Corp. - Class A | | | (3,770) | | | (993,697) |

CG oncology, Inc. | | | (6,280) | | | (218,230) |

Charles River Laboratories International, Inc. | | | (1,404) | | | (279,480) |

Cleanspark, Inc. | | | (36,407) | | | (522,441) |

Cytokinetics, Inc. | | | (11,049) | | | (573,001) |

Elastic NV | | | (6,655) | | | (728,456) |

Take-Two Interactive Software, Inc. | | | (4,135) | | | (778,951) |

| | | | | | (6,943,651) |

Publishing Industries — (3.0)%

| | | | | | |

Braze, Inc. - Class A | | | (30,986) | | | (1,230,764) |

Cadence Design Systems, Inc. | | | (3,033) | | | (930,555) |

Dayforce, Inc. | | | (3,664) | | | (293,083) |

News Corp. - Class B | | | (36,367) | | | (1,167,017) |

NEXTracker, Inc. - Class A | | | (11,716) | | | (447,083) |

Paycor HCM, Inc. | | | (16,854) | | | (304,383) |

Synopsys, Inc. | | | (1,912) | | | (1,067,833) |

ZoomInfo Technologies, Inc. | | | (68,393) | | | (748,219) |

| | | | | | (6,188,937) |

Real Estate — (0.1)%

| | | | | | |

St Joe Co. | | | (3,253) | | | (166,163) |

Rental and Leasing Services — (0.3)%

| | | | | | |

Air Lease Corp. | | | (11,673) | | | (594,156) |

Repair and Maintenance — (0.5)%

| | | | | | |

Driven Brands Holdings, Inc. | | | (17,791) | | | (299,778) |

Mister Car Wash, Inc. | | | (25,820) | | | (206,560) |

Valvoline, Inc. | | | (15,763) | | | (625,949) |

| | | | | | (1,132,287) |

Securities, Commodity Contracts, and Other Financial Investments and Related Activities — (2.0)%

| | | | | | |

Aurora Innovation, Inc. | | | (97,414) | | | (630,269) |

Franklin Resources, Inc. | | | (33,206) | | | (755,769) |

Goldman Sachs Group, Inc. | | | (1,568) | | | (954,238) |

LPL Financial Holdings, Inc. | | | (2,196) | | | (714,029) |

Nasdaq, Inc. | | | (7,646) | | | (634,541) |

XP, Inc. - Class A | | | (25,141) | | | (340,409) |

| | | | | | (4,029,255) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024(Continued)

| | | | | | | |

COMMON STOCKS — (Continued)

| | | | | | |

Support Activities for Mining — (1.0)%

| | | | | | |

Atlas Energy Solutions, Inc. | | | (20,878) | | | $(492,095) |

Gulfport Energy Corp. | | | (3,011) | | | (529,334) |

Patterson-UTI Energy, Inc. | | | (65,075) | | | (546,630) |

Valaris Ltd. | | | (12,286) | | | (567,490) |

| | | | | | (2,135,549) |

Support Activities for Transportation — (0.3)%

| | | | | | |

Norfolk Southern Corp. | | | (1,000) | | | (275,850) |

XPO, Inc. | | | (2,060) | | | (313,965) |

| | | | | | (589,815) |

Telecommunications — (0.5)%

| | | | | | |

Charter Communications, Inc. - Class A | | | (2,437) | | | (967,404) |

Transportation Equipment Manufacturing — (1.4)%

| | | | | | |

AAR Corp. | | | (5,582) | | | (388,061) |

AeroVironment, Inc. | | | (1,278) | | | (248,571) |

Aptiv PLC | | | (11,982) | | | (665,360) |

Boeing Co. | | | (6,608) | | | (1,027,147) |

Gentex Corp. | | | (6,160) | | | (188,250) |

Oshkosh Corp. | | | (2,926) | | | (332,423) |

| | | | | | (2,849,812) |

Truck Transportation — (0.3)%

| | | | | | |

Knight-Swift Transportation Holdings, Inc. | | | (3,276) | | | (194,463) |

Saia, Inc. | | | (763) | | | (434,208) |

| | | | | | (628,671) |

Utilities — (1.0)%

| | | | | | |

AES Corp. | | | (22,405) | | | (292,161) |

American Water Works Co., Inc. | | | (3,933) | | | (538,585) |

Atmos Energy Corp. | | | (1,333) | | | (201,710) |

Brookfield Infrastructure Corp. - Class A | | | (6,046) | | | (271,405) |

Essential Utilities, Inc. | | | (12,816) | | | (513,024) |

Sempra | | | (3,558) | | | (333,278) |

| | | | | | (2,150,163) |

Web Search Portals, Libraries, Archives, and Other Information

Services — (0.4)%

|

Pinterest, Inc. - Class A | | | (30,234) | | | (916,695) |

Wood Product Manufacturing — (0.2)%

| | | | | | |

Trex Co., Inc. | | | (4,913) | | | (368,622) |

TOTAL COMMON STOCKS

(Proceeds $100,252,698) | | | | | | (102,333,687) |

REAL ESTATE INVESTMENT TRUSTS — (1.5)%

| | | | | | |

Forestry and Logging — (0.1)%

| | | | | | |

PotlatchDeltic Corp. | | | (5,551) | | | (248,907) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Schedule of Securities Sold Short

November 30, 2024(Continued)

| | | | | | | |

REAL ESTATE INVESTMENT TRUSTS — (Continued)

| | | | | | |

Real Estate — (1.0)%

| | | | | | |

Equinix, Inc. | | | (305) | | | $(299,351) |

Kite Realty Group Trust | | | (12,448) | | | (343,191) |

Prologis, Inc. | | | (1,936) | | | (226,086) |

Public Storage | | | (1,391) | | | (484,138) |

Rayonier, Inc. | | | (4,712) | | | (150,171) |

Rexford Industrial Realty, Inc. | | | (7,573) | | | (318,672) |

Starwood Property Trust, Inc. | | | (17,732) | | | (361,201) |

| | | | | | (2,182,810) |

Securities, Commodity Contracts, and Other Financial Investments and Related Activities — (0.2)%

| | | | | | |

Americold Realty Trust, Inc. | | | (13,939) | | | (332,584) |

Warehousing and Storage — (0.2)%

| | | | | | |

Extra Space Storage, Inc. | | | (1,910) | | | (326,534) |

TOTAL REAL ESTATE INVESTMENT TRUSTS

(Proceeds $3,036,742) | | | | | | (3,090,835) |

EXCHANGE TRADED FUNDS — (0.5)%

| | | | | | |

Invesco QQQ Trust Series 1 | | | (1,987) | | | (1,012,854) |

iShares Core S&P 500 ETF | | | (2) | | | (1,210) |

TOTAL EXCHANGE TRADED FUNDS

(Proceeds $1,000,932) | | | | | | $(1,014,064) |

TOTAL SECURITIES SOLD SHORT — (51.5)%

(Proceeds $104,290,372) | | | | | | $(106,438,586) |

| | | | | | | |

Percentages are stated as a percent of net assets.

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Statement of Assets and Liabilities

November 30, 2024

| | | | |

Assets

| | | |

Investments, at value (cost $203,836,928) | | | $242,845,887 |

Deposit for short sales at broker | | | 70,375,555 |

Dividends and interest receivable | | | 238,592 |

Cash | | | 28 |

Total assets | | | 313,460,062 |

Liabilities

| | | |

Securities sold short, at value (proceeds $104,290,372) | | | 106,438,586 |

Dividends payable on short positions | | | 27,686 |

Payable to Adviser | | | 151,720 |

Total liabilities | | | 106,617,992 |

Net Assets | | | $206,842,070 |

Net Assets Consist of:

| | | |

Paid-in capital | | | 186,896,579 |

Total distributable earnings | | | 19,945,491 |

Net assets | | | $206,842,070 |

Shares of beneficial interest outstanding (unlimited number of shares authorized, $0.001 par value) | | | 8,797,329 |

Net asset value, redemption price and offering price per share | | | $23.51 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Statement of Operations

For the Year Ended November 30, 2024

| | | | |

Investment Income

| | | |

Dividend income | | | $1,625,453 |

Prime broker interest income, net | | | 1,609,253 |

Interest Income | | | 21,345 |

Total investment income | | | 3,256,051 |

Expenses

| | | |

Management fees | | | 1,047,946 |

Dividends on short positions | | | 543,784 |

Other expenses | | | 1,220 |

Total expenses | | | 1,592,950 |

Net investment income | | | 1,663,101 |

Realized and Unrealized Gain (Loss) on Investments

| | | |

Net realized gain (loss) from:

| | | |

Investments | | | (2,367,051) |

In-kind redemptions | | | 13,020,196 |

Short transactions | | | (14,565,219) |

Change in net unrealized appreciation (depreciation) on:

| | | |

Investments | | | 35,029,112 |

Short positions | | | (3,140,226) |

Realized and Unrealized Gain on Investments | | | 27,976,812 |

Net Increase in Net Assets from Operations | | | $29,639,913 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Statements of Changes in Net Assets

| | | | | | | |

From Operations

| | | | | | |

Net investment income | | | $1,663,101 | | | $372,285 |

Net realized gain (loss) from:

| | | | | | |

Investments | | | (2,367,051) | | | (1,792,565) |

In-kind redemptions | | | 13,020,196 | | | 4,103,411 |

Short transactions | | | (14,565,219) | | | 1,128,853 |

Change in net unrealized appreciation (depreciation) on:

| | | | | | |

Investments | | | 35,029,112 | | | 565,669 |

Short positions | | | (3,140,226) | | | (1,480,089) |

Net increase in net assets from operations | | | 29,639,913 | | | 2,897,564 |

From Distributions

| | | | | | |

Dividend and distributions | | | (389,482) | | | (194,639) |

Decrease in net assets resulting from distributions paid | | | (389,482) | | | (194,639) |

From Capital Share Transactions

| | | | | | |

Proceeds from shares sold | | | 192,047,617 | | | 23,548,901 |

Payments for shares redeemed | | | (46,297,986) | | | (18,785,490) |

Payments for transaction fees (Note 8) | | | 838 | | | 46 |

Net increase in net assets from capital share transactions | | | 145,750,469 | | | 4,763,457 |

Total Increase In Net Assets | | | 175,000,900 | | | 7,466,382 |

Net Assets

| | | | | | |

Beginning of year | | | 31,841,170 | | | 24,374,788 |

End of year | | | $ 206,842,070 | | | $31,841,170 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Statement of Cash Flows

For the Year Ended November 30, 2024

| | | | |

CASH FLOWS FROM OPERATING ACTIVITIES:

| | | |

Net increase in net assets resulting from operations | | | $29,639,913 |

Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities:

| | | |

Purchases of investments | | | (503,419,595) |

Proceeds from sales of short-term investments, net | | | 76,562 |

Proceeds from sales of long-term investments | | | 343,555,762 |

Return of capital distributions received from underlying investments | | | 134,667 |

Increase in dividends and interest receivable | | | (178,657) |

Decrease in receivable for investment securities sold | | | 655,080 |

Proceeds from securities sold short | | | 275,735,999 |

Purchases to cover securities sold short | | | (202,152,863) |

Decrease in payable for investment securities purchased | | | (1,034,665) |

Increase in dividends payable on short positions | | | 7,507 |

Increase in payable to Adviser | | | 129,279 |

Net change in unrealized appreciation on investments | | | (35,029,112) |

Net change in unrealized on short positions | | | 3,140,226 |

Net realized gain on investments | | | (10,653,145) |

Net realized gain on short transactions | | | 14,565,219 |

Net cash used in operating activities | | | (84,827,823) |

CASH FLOWS FROM FINANCING ACTIVITIES:

| | | |

Proceeds from shares sold | | | 192,388,653 |

Payment on shares redeemed | | | (46,297,986) |

Proceeds from transaction fees | | | 838 |

Cash distributions paid to shareholders | | | (389,482) |

Net cash provided by financing activities | | | 145,702,023 |

Net change in cash | | | 60,874,200 |

CASH:

| | | |

Beginning balance | | | 9,501,383 |

Ending balance | | | $70,375,583 |

SUPPLEMENTAL DISCLOSURES:

| | | |

Cash received for interest | | | 1,779,194 |

Cash paid for interest | | | (169,940) |

Non-cash operating activities - purchases of investment securities in-kind | | | (47,402,303) |

Non-cash operating activities - sales of investment securities in-kind | | | 213,314,189 |

Non-cash financing activities - proceeds from shares sold in-kind | | | (47,402,303) |

Non-cash financing activities - payment on shares redeemed in-kind | | | 213,314,189 |

Non-cash financing activities - increase in receivable for fund shares sold | | | 341,036 |

RESTRICTED AND UNRESTRICTED CASH

| | | |

Beginning balances

| | | |

Cash | | | — |

Deposit for short sales at broker | | | 9,501,383 |

| | | 9,501,383 |

Ending balances

| | | |

Cash | | | 28 |

Deposit for short sales at broker | | | 70,375,555 |

| | | 70,375,583 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Convergence Long/Short Equity ETF

Financial Highlights

Per Share Data for a Share Outstanding Throughout Each Year

| | | | |

Net asset value, beginning of year | | | $17.05 | | | $15.45 | | | $17.94 | | | $14.03 | | | $19.76 |

Income from investment operations:

| | | | | | | | | | | | | | | |

Net investment income (loss)(1) | | | 0.32 | | | 0.23 | | | 0.07 | | | (0.03) | | | 0.01 |

Net realized and unrealized gain (loss) on investments | | | 6.34 | | | 1.49 | | | 0.31 | | | 3.98 | | | (1.11) |

Total from Investment Operations | | | 6.66 | | | 1.72 | | | 0.38 | | | 3.95 | | | (1.10) |

Less distributions paid:

| | | | | | | | | | | | | | | |

From net investment income | | | (0.20) | | | (0.12) | | | — | | | (0.04) | | | (0.13) |

From net realized gains | | | — | | | — | | | (2.87) | | | — | | | (4.50) |

Total distributions paid | | | (0.20) | | | (0.12) | | | (2.87) | | | (0.04) | | | (4.63) |

Net asset value, end of year | | | $23.51 | | | $17.05 | | | $15.45 | | | $17.94 | | | $14.03 |

Market Price, End of Year | | | $23.55 | | | $17.04 | | | $15.43 | | | $— | | | $— |

Total Return on NAV(2) | | | 39.57% | | | 11.28% | | | 2.39% | | | 28.26% | | | −7.68% |

Supplemental Data and Ratios:

| | | | | | | | | | | | | | | |

Net assets at end of year (000’s) | | | $206,842 | | | $31,841 | | | $24,375 | | | $29,313 | | | $22,537 |

Ratio of expenses to average net assets:

| | | | | | | | | | | | | | | |

Before waiver, expense reimbursement and

recoupments(3) | | | 1.44% | | | 1.55% | | | 1.58% | | | 2.56% | | | 2.58% |

After waiver, expense reimbursement and recoupments(3) | | | 1.44% | | | 1.55% | | | 1.38% | | | 2.11% | | | 2.39% |

Ratio of net investment income (loss) to average net assets:

| | | | | | | | | | | | | | | |

Before waiver, expense reimbursement and recoupments | | | 1.51% | | | 1.50% | | | 0.26% | | | (0.63)% | | | (0.13)% |

After waiver, expense reimbursement and recoupments | | | 1.51% | | | 1.50% | | | 0.46% | | | (0.18)% | | | 0.06% |

Portfolio turnover rate | | | 225.05%(4) | | | 283.70%(4) | | | 244.44%(4) | | | 303.76% | | | 251.72% |

| | | | | | | | | | | | | | | | |

(1)

| Per share net investment income (loss) was calculated using the daily average shares outstanding method. |

(2)

| Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of dividends. Total return represented is total return of Net Asset Value. |

(3)

| The ratio of expenses to average net assets includes dividends on short positions, interest and broker expenses. The annualized before waiver, expense reimbursement and recoupments after waiver, expense reimbursement and recoupments ratios excluding dividends on short positions, interest and broker expenses were 0.95% and 0.95%, 0.95% and 0.95%, 1.28% and 1.08%, 1.95% and 1.50%, 1.69% and 1.50%, for the years ended November 30, 2024, November 30, 2023, November 30, 2022, November 30, 2021, November 30, 2020, respectively.

|

(4)

| Excludes the impact of in-kind transactions. |

(5)

| The Fund converted from a mutual fund to an ETF pursuant to an Agreement and Plan of Reorganization on February 18, 2022. See Note 1 in the Notes to Financial Statements for additional information about the Reorganization. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024

(1) ORGANIZATION

Trust for Professional Managers (the “Trust”) was organized as a Delaware statutory trust under a Declaration of Trust dated May 29, 2001. The Trust is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company. The Convergence Long/Short Equity ETF (the “Fund”) represents a distinct diversified series with its own investment objective and policies within the Trust. The investment objective of the Fund is to seek long-term capital growth. The Fund is an actively managed exchange-traded fund (“ETF”). The Trust may issue an unlimited number of shares of beneficial interest at $0.001 par value.

Effective February 18, 2022, the Fund converted from a mutual fund to an ETF, pursuant to an Agreement and Plan of Reorganization. The reorganization was accomplished by a tax-free exchange of shares (with an exception for fractional mutual fund shares). The costs of the reorganization were borne by the Fund’s investment adviser, Convergence Investment Partners, LLC (the “Adviser”). The reorganization did not result in a material change to the investment portfolio. The mutual fund offered Institutional Class shares and commenced operations on December 29, 2009. The following table illustrates the specifics of the reorganization of the mutual fund into the ETF:

| | | | | | | | | | | | | | |

| | $26,419,556 | | | 1,707,329 | | | $ — | | | $26,419,556 | | | Non-Taxable |

| | | | | | | | | | | | | | |

*

| Includes accumulated net investment losses, accumulated realized gains and unrealized appreciation in the amounts of $(86,871), $2,453,571, and $8,049,316, respectively. |

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 “Financial Services – Investment Companies.”

(2) SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of the financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

(a)

| Investment Valuation. Each security owned by the Fund, including long and short positions of common stock and real estate investment trusts, that is listed on a securities exchange, except those listed on the NASDAQ Stock Market LLC (“NASDAQ”), is valued at its last sale price on that exchange on the date as of which assets are valued. When the security is listed on more than one exchange, the Fund will use the price of the exchange that the Fund generally considers to be the principal exchange on which the stock is traded. |

Fund securities listed on NASDAQ will be valued at the NASDAQ Official Closing Price, which may not necessarily represent the last sale price. If there has been no sale on such exchange or on NASDAQ on such day, the security shall be valued at, (i) the mean between the most recent quoted bid and asked prices at the close of the exchange on such day or (ii) the last sales price on the Composite Market for the day such security is being valued. “Composite Market” means a consolidation of the trade information provided by national securities and foreign exchanges and over-the-counter markets, as published by an approved independent pricing service (“Pricing Service”).

Debt securities, including short-term debt instruments having a maturity of 60 days or less, are valued at the mean in accordance with prices supplied by a Pricing Service. Pricing Services may use various valuation methodologies such as the mean between the bid and

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024(Continued)

the asked prices, matrix pricing and other analytical pricing models as well as market transactions and dealer quotations. If a price is not available from a Pricing Service, the most recent quotation obtained from one or more broker-dealers known to follow the issue will be obtained. Quotations will be valued at the mean between the bid and the offer. In the absence of available quotations, the securities will be priced at fair value, as described below. Any discount or premium is accreted or amortized using the constant yield method until maturity.

Redeemable securities issued by open-end, registered investment companies, including money market mutual funds are valued at the net asset value (“NAV”) of such companies for purchase and/or redemption orders placed on that day. If, on a particular day, a share of an investment company is not listed on NASDAQ, such security’s fair value will be determined as described below.

When market quotations are not readily available, any security or other asset is valued at its fair value in accordance with Rule 2a-5 of the 1940 Act as determined under the Adviser’s fair value pricing procedures, subject to oversight by the Trust’s Board of Trustees. These fair value procedures will also be used to price a security when corporate events, events in the securities market or world events cause the Adviser to believe that a security’s last sale price may not reflect its actual fair market value. The intended effect of using fair value pricing procedures is to ensure that the Fund is accurately priced.

FASB Accounting Standards Codification, “Fair Value Measurements and Disclosures” Topic 820 (“ASC 820”), establishes an authoritative definition of fair value and sets out a hierarchy for measuring fair value. ASC 820 requires an entity to evaluate certain factors to determine whether there has been a significant decrease in volume and level of activity for the security such that recent transactions and quoted prices may not be determinative of fair value and further analysis and adjustment may be necessary to estimate fair value.

ASC 820 also requires enhanced disclosures regarding the inputs and valuation techniques used to measure fair value in those instances as well as expanded disclosure of valuation levels for each class of investments. These inputs are summarized in the three broad levels listed below:

Level 1 –

Quoted prices in active markets for identical securities.

Level 2 –

Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 –

Significant unobservable inputs (including a Fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The following is a summary of the inputs used to value the Fund’s investments carried at fair value as of November 30, 2024:

| | | | | | | | | | | | | |

Assets(1):

| | | | | | | | | | | | |

Common Stock | | | $237,056,271 | | | $ — | | | $ — | | | $237,056,271 |

Real Estate Investment Trusts | | | 5,321,750 | | | — | | | — | | | 5,321,750 |

Short-Term Investments | | | 467,866 | | | — | | | — | | | 467,866 |

Total Assets | | | $242,845,887 | | | $— | | | $— | | | $242,845,887 |

| | | | | | | | | | | | | |

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024(Continued)

| | | | | | | | | | | | | |

Liabilities:

| | | | | | | | | | | | |

Securities Sold Short

| | | | | | | | | | | | |

Common Stocks | | | $(102,333,687) | | | $ — | | | $ — | | | $(102,333,687) |

Real Estate Investment Trusts | | | (3,090,835) | | | — | | | — | | | (3,090,835) |

Exchange Traded Funds | | | (1,014,064) | | | — | | | — | | | (1,014,064) |

Total Securities Sold Short | | | (106,438,586) | | | — | | | — | | | (106,438,586) |

Total Liabilities | | | $(106,438,586) | | | $— | | | $— | | | $(106,438,586) |

| | | | | | | | | | | | | |

(1)

| See the Schedule of Investments for industry classifications. |

The Fund did not hold any Level 3 securities during the year ended November 30, 2024.

Except for securities sold short, the Fund did not invest in any derivative securities or engage in hedging activities during the year ended November 30, 2024.

(b)

| Short Positions. The Fund may sell a security it does not own in anticipation of a decline in the fair value of that security. When the Fund sells a security short, it must borrow the security sold short and deliver it to the broker-dealer through which it made the short sale. A gain, limited to the price at which the Fund sold the security short, or a loss, unlimited in size, will be recognized upon the termination of a short sale. For financial statement purposes, an amount equal to the settlement amount is included in the Statement of Assets and Liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current value of the short positions. Subsequent fluctuations in the market prices of the securities sold, but not yet purchased, may require purchasing the securities at prices which could differ from the amount reflected in the Statement of Assets and Liabilities. The Fund is liable for any dividends or interest payable on securities while those securities are in a short position. Such amounts are recorded on the ex-dividend date as a dividend expense, and interest expense is accrued daily. As collateral for its short positions, the Fund is required to maintain segregated assets consisting of cash, cash equivalents or liquid securities. The segregated assets are valued consistent with Note 2a above. The amount of segregated assets is required to be adjusted daily to the extent additional collateral is required based on the change in fair value of the securities sold short. The Fund’s securities sold short and deposits for short sales are held with one major securities broker-dealer. The Fund does not require this broker-dealer to maintain collateral in support of the receivable for proceeds on securities sold short. |

In accordance with the terms of its prime brokerage agreements with broker-dealers, the Fund may receive rebate income or be charged a fee for borrowed securities. Such income or fee is calculated on a daily basis based upon the market value of each borrowed security and a variable rate that is dependent upon the availability of such security. The Fund records these prime broker charges on a net basis as interest income or interest expense. During the year ended November 30, 2024, the Fund has incurred $1,779,193 of interest income and $169,940 of interest expense, for a total net income of $1,609,253 on borrowed securities which is reflected in prime broker interest income on the Statement of Operations.

Rule 18f-4 imposes limits on the amount of derivatives a fund can enter into, eliminates the asset segregation framework currently used by funds to comply with Section 18 of the 1940 Act, treats derivatives as senior securities and requires funds whose use of derivatives is more than a limited specified exposure amount to establish and maintain a comprehensive derivatives risk management program and appoint a derivatives risk manager. Effective August 19, 2022, the Fund has adopted a Full Derivatives Fund Program and the Adviser has nominated a Derivatives Risk Manager.

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024(Continued)

(c)

| Federal Income Taxes. The Fund complies with the requirements of Subchapter M of the Internal Revenue Code, as amended, necessary to qualify as a regulated investment company and makes the requisite distributions of income and capital gains to their shareholders sufficient to relieve them from all or substantially all federal income taxes. Therefore, no federal income tax provision has been provided. |

As of and during the year ended November 30, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the year ended November 30, 2024, the Fund did not incur any interest or penalties. The Fund’s tax returns for the prior three tax years remain subject to examinations by the Fund’s major tax jurisdictions, which include the Untied States of America and the state of Delaware.

(d)

| Distributions to Shareholders. The Fund will distribute any net investment income and any net capital gains at least annually. Distributions from net realized gains for book purposes may include short-term capital gains. All short-term capital gains are included in ordinary income for tax purposes. Distributions to shareholders are recorded on the ex-dividend date. The Fund may also pay a special distribution at the end of the calendar year to comply with federal tax requirements. |

(e)

| Use of Estimates. The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. |

(f)

| Share Valuation. The NAV per share of the Fund is calculated by dividing the sum of the fair value of the securities held by the Fund, plus cash or other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange is closed for trading. The Fund does not charge a redemption fee, and therefore the offering and redemption price per share are equal to the Fund’s NAV per share. |

(g)

| Allocation of Income, Expenses and Gains/Losses. Expenses associated with a specific fund in the Trust are charged to that fund. Common Trust expenses are typically allocated evenly between the funds of the Trust, or by other equitable means. |

(h)

| Other. Investment transactions are recorded on the trade date. The Fund determines the gain or loss from investment transactions on the identified cost basis by comparing original cost of the security lot sold with the net sale proceeds. Dividend income and expense is recognized on the ex-dividend date and interest income and expense is recognized on an accrual basis. Dividend income from real estate investment trusts (“REITs”) is recognized on the ex-date and included in dividend income. The calendar year-end classification of distributions received from REITs during the fiscal year are reported subsequent to year end; accordingly, the Fund estimates the character of REIT distributions based on the most recent information available and adjusts for actual classifications in the calendar year the information is reported. |

Withholding taxes on foreign dividends, net of any reclaims, have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024(Continued)

(3) FEDERAL TAX MATTERS

The tax character of distributions paid by the Fund during the fiscal years ended November 30, 2024 and November 30, 2023 was as follows:

| | | | |

Ordinary Income | | | $389,482 | | | $194,639 |

Long-Term Capital Gain | | | $— | | | $— |

| | | | | | | |

As of November 30, 2024, the components of distributable earnings on a tax basis were as follows:

| | | | |

Cost basis of investments for federal income tax purposes(1) | | | $102,956,854 |

Gross tax unrealized appreciation | | | $46,128,048 |

Gross tax unrealized depreciation | | | (12,677,601) |

Net tax unrealized appreciation | | | 33,450,447 |

Undistributed ordinary income | | | 1,637,694 |

Undistributed long-term capital gain | | | — |

Other accumulated losses | | | (15,142,650) |

Total distributable earnings | | | $19,945,491 |

| | | | |

(1)

| Includes securities sold short. |

The tax basis of distributable earnings for tax and financial reporting purposes differs principally due to the deferral of losses on wash sales.

At November 30, 2024, the Fund had short-term capital loss carryovers of $14,816,397.

Income and capital gains distributions may differ from GAAP, primarily due to timing differences in the recognition of income, gains and losses, and tax equalization by the Fund. To the extent that these differences are attributable to permanent book and tax accounting differences, the components of net assets have been adjusted. Additionally, GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications are due to redemptions in-kind and excise tax expense and have no effect on net assets or NAV per share. For the year ended November 30, 2024, the following table shows the reclassifications made:

| | | | |

Paid-in capital | | | $12,733,059 |

Total distributable earnings | | | $(12,733,059) |

| | | | |

(4) INVESTMENT ADVISER

Pursuant to the Investment Advisory Agreement (the “Agreement”) between the Trust, on behalf of the Fund and the Adviser, the Adviser is responsible for managing the Fund in accordance with its investment objectives. For the services it provides the Fund, the Fund pays the Adviser a unitary management fee, which is calculated daily and paid monthly, at an annual rate of 0.95% of the Fund’s average daily net assets. Under this agreement, the Adviser has agreed to pay all expenses of the Fund except for the management fee paid to the Adviser pursuant to this Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Fund under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act, and the unitary management fee payable to the Adviser.

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024(Continued)

(5) RELATED PARTY TRANSACTIONS

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or the “Administrator”), acts as the Fund’s administrator under an Administration Agreement. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund; prepares reports and materials to be supplied to the Trustees; monitors the activities of the Fund’s custodian, transfer agent and accountant; coordinates the preparation and payment of the Fund’s expenses and reviews the Fund’s expense accruals. Fund Services also serves as the fund accountant and transfer agent to the Fund. U.S. Bank National Association (“U.S. Bank”), an affiliate of Fund Services, serves as the Fund’s custodian. The Trust’s Chief Compliance Officer is also an employee of Fund Services. Fees incurred for these services are paid by the Adviser. Under the terms of a Fund Servicing Agreement, the Adviser pays the Fund Administration and Accounting, Transfer Agency and Custody fees for the Fund.

Certain officers of the Fund are also employees of Fund Services. A Trustee of the Trust is affiliated with Fund Services and U.S. Bank.

(6) CAPITAL SHARE TRANSACTIONS

Transactions in the Fund were as follows:

| | | | |

Shares sold | | | 9,150,000 | | | 1,520,000 |

Shares reinvested | | | — | | | — |

Shares redeemed | | | (2,220,000) | | | (1,230,000) |

Net increase | | | 6,930,000 | | | 290,000 |

| | | | | | | |

(7) INVESTMENT TRANSACTIONS

The aggregate purchases and sales of securities (excluding short-term investments and securities sold short), creations in-kind and redemptions in-kind for the Fund for the year ended November 30, 2024 is summarized below. There were no purchases or sales of U.S. government securities for the Fund.

| | | | | | | | | | | |

| | $290,105,406 | | | $296,175,886 | | | $213,314,189 | | | $47,402,303 |

| | | | | | | | | | | |

(8) CREATION AND REDEMPTION TRANSACTIONS

Shares of the Fund are listed and traded on the Cboe BZX Exchange, Inc. (the “Exchange”). The Fund issues and redeems shares on a continuous basis at NAV only in large blocks of shares called “Creation Units.” A Creation Unit generally consists of 10,000 shares. Creation Units are to be issued and redeemed principally in kind for a basket of securities and a balancing cash amount. Shares generally will trade in the secondary market in amounts less than a Creation Unit at market prices that change throughout the day. Market prices for the shares may be different from their NAV. The NAV is determined as of the close of trading (generally, 4:00 p.m. Eastern Time) on each day the NYSE is open for trading. The NAV of the shares of the Fund will be equal to the Fund’s total assets minus the Fund’s total liabilities divided by the total number of shares outstanding. The NAV that is published will be rounded to the nearest cent; however, for purposes of determining the price of Creation Units, the NAV will be calculated to five decimal places.

Only “Authorized Participants” may purchase or redeem shares directly from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors

TABLE OF CONTENTS

CONVERGENCE LONG/SHORT EQUITY ETF

NOTES TO FINANCIAL STATEMENTS

November 30, 2024(Continued)