UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

(513) 520-5925

Registrant’s telephone number, including area code

Date of fiscal year end: December 31, 2024

Date of reporting period: December 31, 2024

Item 1. Reports to Stockholders.

| | |

| Mairs & Power Growth Fund | |

| MPGFX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the Mairs & Power Growth Fund (the “Fund”) for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at mairsandpower.com/funds/growth-fund. You can also request this information by contacting us at 1-800-304-7404.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Growth Fund | $68 | 0.62% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Similar to last year, the market was driven by a handful of large-cap Technology stocks. Thanks to our concerted effort to diversify into Technology stocks over the past several years, the Fund partially benefited from this upswell. Still, the Fund historically lags in robust bull markets and this year was no exception. In particular, the Fund’s exposure to Midwest-based and small-cap companies hurt relative performance, as they did not keep pace with the broader benchmark index. The Fund also has core, long-term holdings that are tied to the strength of the housing market, and as such, have been hit by the housing downturn. We remain focused on our long-term, regional, and multi-cap investment strategy that has led to historically favorable results for more than 94 years. Additional commentary is available on the Fund’s website.

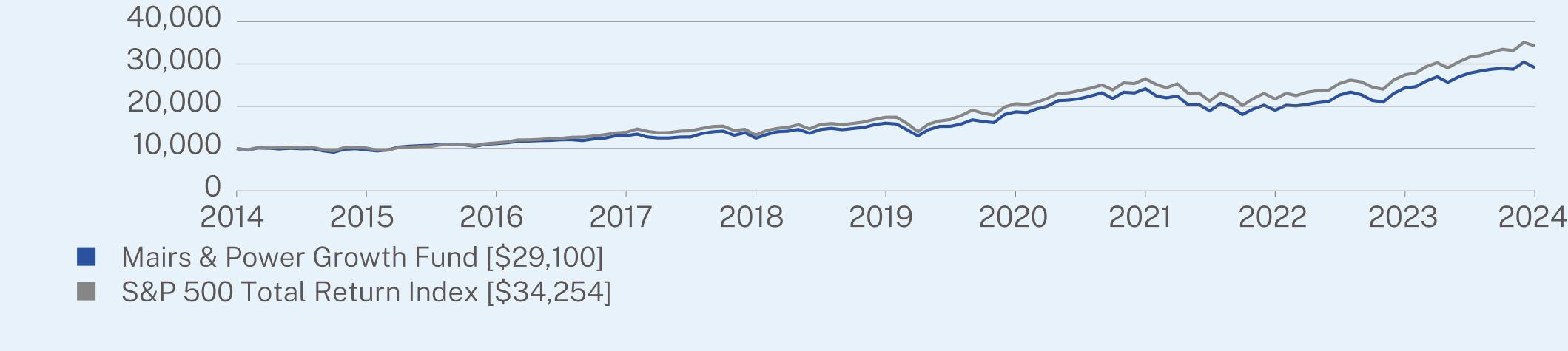

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Mairs & Power Growth Fund | 19.62 | 12.70 | 11.27 |

S&P 500 Total Return Index | 25.02 | 14.53 | 13.10 |

Visit mairsandpower.com/funds/growth-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Mairs & Power Growth Fund | PAGE 1 | TSR-AR-89834G711 |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $5,477,434,283 |

Number of Holdings | 47 |

Net Advisory Fee | $29,892,909 |

Portfolio Turnover | 10% |

30-Day SEC Yield | 0.78% |

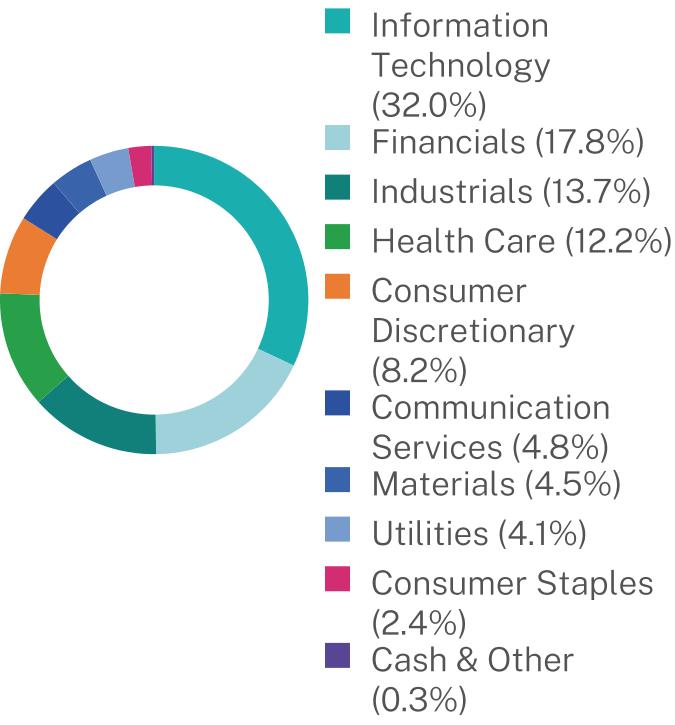

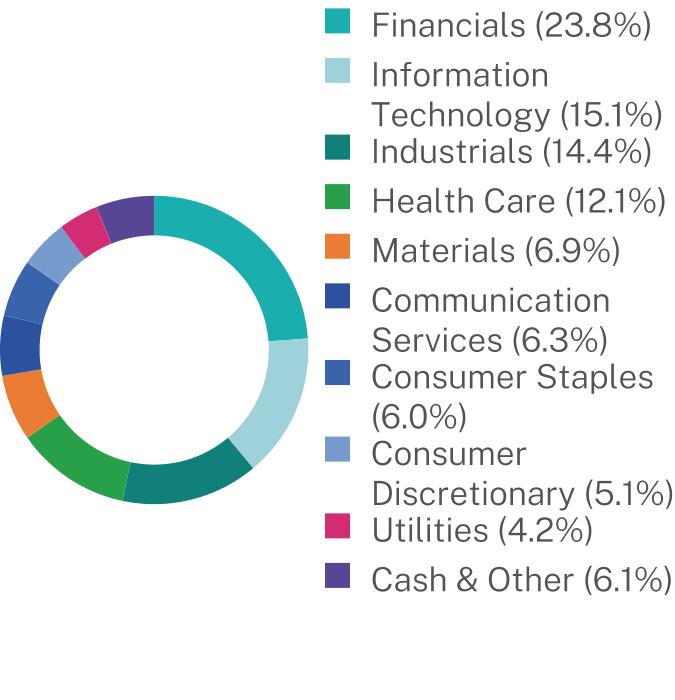

WHAT DID THE FUND INVEST IN? (% of net assets as of December 31, 2024)

| |

Top Holdings | (%) |

Microsoft Corp. | 10.1% |

NVIDIA Corp. | 8.3% |

Amazon.com, Inc. | 6.7% |

JPMorgan Chase & Co. | 5.5% |

UnitedHealth Group, Inc. | 5.0% |

Apple, Inc. | 4.5% |

Fiserv, Inc. | 3.7% |

Graco, Inc. | 3.2% |

Alphabet, Inc. - Class C | 3.0% |

Alliant Energy Corp. | 3.0% |

| |

Security Type | (%) |

Common Stocks | 99.7% |

Money Market Funds | 0.3% |

Cash & Other | 0.0% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by Mairs & Power, Inc. |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit mairsandpower.com/funddocuments.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Mairs & Power Funds at 1-800-304-7404, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Mairs & Power Funds or your financial intermediary.

| Mairs & Power Growth Fund | PAGE 2 | TSR-AR-89834G711 |

100009693111831303112465160051867224138190512432829100100001013811351138291322317386205852649421696273993425432.017.813.712.28.24.84.54.12.40.3

| | |

| Mairs & Power Balanced Fund | |

| MAPOX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the Mairs & Power Balanced Fund (the “Fund”) for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at mairsandpower.com/funds/balanced-fund. You can also request this information by contacting us at 1-800-304-7404. This report describes changes to the Fund that occurred during the reporting period.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Balanced Fund | $74 | 0.71% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Mega-cap Technology stocks were once again key drivers of market performance in 2024, which impacted the relative performance of the Fund. While the Fund’s asset allocation contributed positively to relative performance due to the outperformance of equities versus bonds, the Fund’s diversified approach left the portfolio underexposed to this narrow market leadership group. As a result, the Fund’s equity performance lagged the benchmark. Conversely, the fixed income portion of the portfolio outperformed its benchmark, as an overweight to corporate bonds benefited from a tightening of credit spreads and portfolio duration short of the benchmark aided relative performance to a lesser extent as interest rates rose during 2024. The Fund will continue to balance potential return against potential risk across the portfolio, adding to positions when valuations become attractive. Additional commentary is available on the Fund’s website.

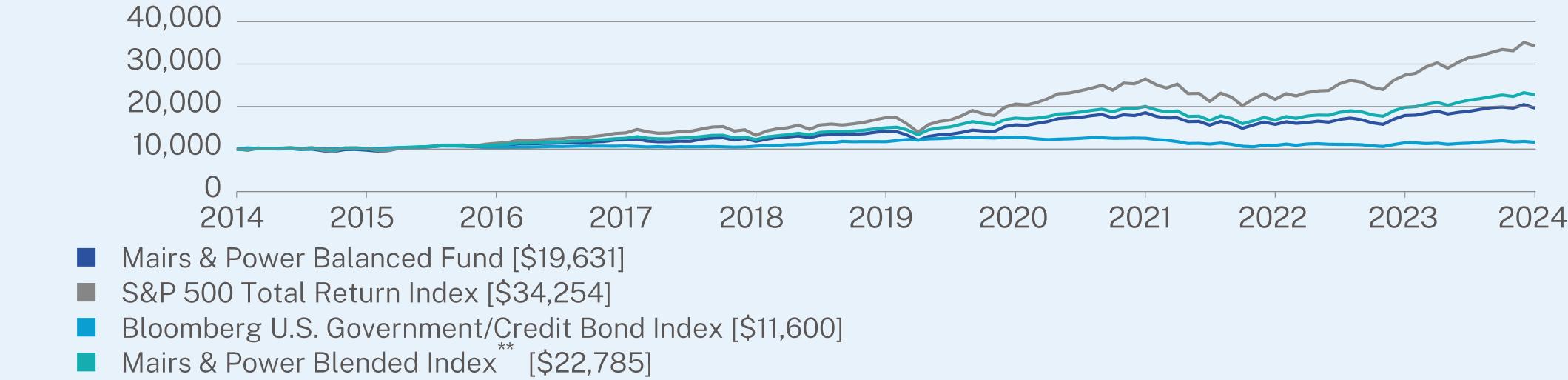

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Mairs & Power Balanced Fund | 9.60 | 6.68 | 6.98 |

S&P 500 Total Return Index | 25.02 | 14.53 | 13.10 |

Bloomberg U.S. Government/Credit Bond Index | 1.18 | -0.21 | 1.50 |

Mairs & Power Blended Index** | 15.01 | 8.71 | 8.58 |

Visit mairsandpower.com/funds/balanced-fund for more recent performance information.

| Mairs & Power Balanced Fund | PAGE 1 | TSR-AR-89834G695 |

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| ** | The Mairs & Power Blended Index reflects an unmanaged portfolio comprised of 60% of the S&P 500 Total Return Index and 40% of the Bloomberg U.S. Government/Credit Bond Index. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $754,064,762 |

Number of Holdings | 263 |

Net Advisory Fee | $4,630,877 |

Portfolio Turnover | 11% |

Weighted Average Maturity | 7.48 years |

Effective Duration | 5.57 years |

30-Day SEC Yield | 2.25% |

Average Credit Quality | BBB |

WHAT DID THE FUND INVEST IN? (% of net assets as of December 31, 2024)

| |

Top 10 Issuers | (%) |

Microsoft Corp. | 3.9% |

Alphabet, Inc. | 3.5% |

JPMorgan Chase & Co. | 3.4% |

Fiserv, Inc. | 3.3% |

UnitedHealth Group, Inc. | 2.8% |

Visa, Inc. | 2.4% |

Motorola Solutions, Inc. | 2.3% |

Graco, Inc. | 2.3% |

Texas Instruments, Inc. | 2.2% |

United States Treasury Note/Bond | 2.1% |

| |

Security Type | (%) |

Common Stocks | 64.2% |

Corporate Bonds | 31.3% |

U.S. Treasury Securities | 2.1% |

Municipal Bonds | 1.0% |

Asset-Backed Securities | 0.7% |

Money Market Funds | 0.4% |

Cash & Other | 0.3% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by Mairs & Power, Inc. |

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

This is a summary of certain changes and planned changes to the Fund. For more complete information, you may review the Fund’s prospectus and supplements thereto upon request at 1-855-839-2800.

Effective October 1, 2024, Mr. Brent S. Miller, CFA, has been added as a portfolio manager of the Fund. On or around June 30, 2025, Robert (Bob) W. Thompson, co-portfolio manager of the Fund, will retire. The Fund will continue to be managed by Kevin V. Earley and Brent S. Miller.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit mairsandpower.com/funddocuments.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Mairs & Power Funds at 1-800-304-7404, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Mairs & Power Funds or your financial intermediary.

| Mairs & Power Balanced Fund | PAGE 2 | TSR-AR-89834G695 |

10000974610859121511181114211156951856615798179121963110000101381135113829132231738620585264942169627399342541000010015103201073210688117251277212548108451146511600100001011310971125521223615005173022002916824198112278523.815.114.412.16.96.36.05.14.26.1

| | |

| Mairs & Power Small Cap Fund | |

| MSCFX |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the Mairs & Power Small Cap Fund (the “Fund”) for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at mairsandpower.com/funds/small-cap-fund. You can also request this information by contacting us at 1-800-304-7404.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Small Cap Fund | $97 | 0.94% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund underperformed the benchmark, S&P SmallCap 600 Total Return Index, during 2024, but stock selection remained a positive contributor to relative performance, giving us confidence in our philosophy and process. However, stock selection was more than offset by sector allocation. Market conditions showed improvement in fundamentals, but lingering effects stemming from post-pandemic excess inventory in several sectors resulted in stock volatility. Our long-term investment horizon led us to look through these conditions and stay invested in several Industrials, Consumer Discretionary, Health Care, and Consumer Staples stocks, each of which experienced inventory cycles that impacted growth and performance. Positive stock selection in Financials, Technology, and Materials was partially offset by weak selection in Industrials, Consumer Discretionary, and Health Care. Our focus on fundamentals and valuation led us to add to several positions in Financials and Industrials, as well as stay underweight Consumer Discretionary and Energy, decisions which benefited relative performance. Additional commentary is available on the Fund’s website.

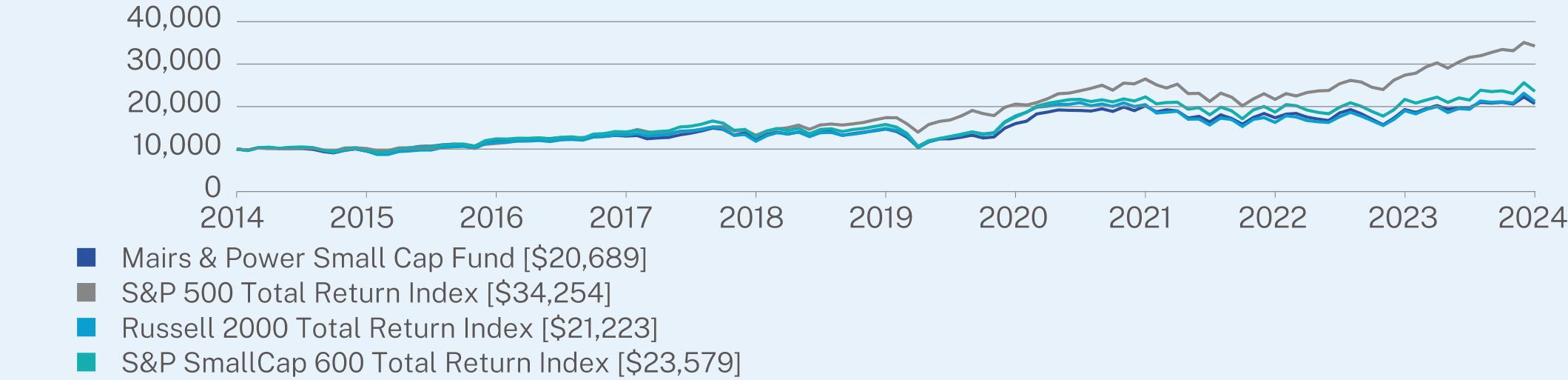

HOW DID THE FUND PERFORM OVER THE PAST 10 YEARS?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

| Mairs & Power Small Cap Fund | PAGE 1 | TSR-AR-89834G687 |

ANNUAL AVERAGE TOTAL RETURN (%)

| | | |

| | 1 Year | 5 Year | 10 Year |

Mairs & Power Small Cap Fund | 7.25 | 7.04 | 7.54 |

S&P 500 Total Return Index | 25.02 | 14.53 | 13.10 |

Russell 2000 Total Return Index | 11.54 | 7.40 | 7.82 |

S&P SmallCap 600 Total Return Index | 8.70 | 8.36 | 8.96 |

Visit mairsandpower.com/funds/small-cap-fund for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $311,107,086 |

Number of Holdings | 41 |

Net Advisory Fee | $2,539,182 |

Portfolio Turnover | 14% |

30-Day SEC Yield | 0.03% |

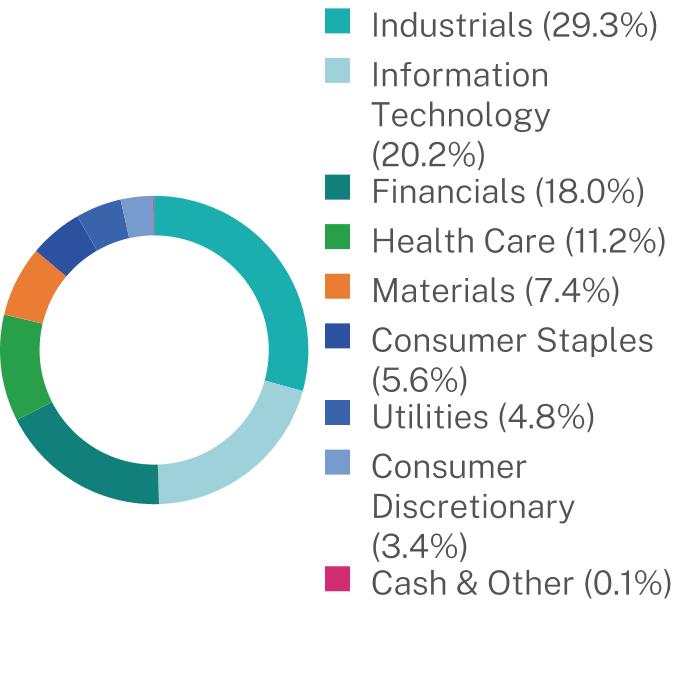

WHAT DID THE FUND INVEST IN? (% of net assets as of December 31, 2024)

| |

Top Holdings | (%) |

John Bean Technologies Corp. | 5.3% |

AZEK Co., Inc. | 4.3% |

Plexus Corp. | 4.1% |

Knife River Corp. | 4.0% |

Hub Group, Inc. - Class A | 4.0% |

Casey’s General Stores, Inc. | 3.7% |

Workiva, Inc. | 3.7% |

AAR Corp. | 3.7% |

Littelfuse, Inc. | 3.5% |

Medpace Holdings, Inc. | 3.4% |

| |

Security Type | (%) |

Common Stocks | 99.9% |

Money Market Funds | 0.2% |

Cash & Other | -0.1% |

| * | The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by Mairs & Power, Inc. |

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit mairsandpower.com/funddocuments.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Mairs & Power Funds at 1-800-304-7404, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Mairs & Power Funds or your financial intermediary.

| Mairs & Power Small Cap Fund | PAGE 2 | TSR-AR-89834G687 |

100009532121321305912157147261601920183173721929120689100001013811351138291322317386205852649421696273993425410000955911595132941183014849178132045316273190282122310000980312406140481285615785175672227818692216922357929.320.218.011.27.45.64.83.40.1

| | |

| Mairs & Power Minnesota Municipal Bond ETF | |

MINN (Principal U.S. Listing Exchange: CBOE BZX Exchange, Inc.CboeBZX) |

| Annual Shareholder Report | December 31, 2024 |

This annual shareholder report contains important information about the Mairs & Power Minnesota Municipal Bond ETF (the “Fund”) for the period of January 1, 2024 to December 31, 2024. You can find additional information about the Fund at mairsandpower.com/funds/mn-muni-bond-etf. You can also request this information by contacting us at 1-855-839-2800. This report describes changes to the Fund.

WHAT WERE THE FUND COSTS FOR THE PAST YEAR? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Mairs & Power Minnesota Municipal Bond ETF | $25 | 0.25% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

The Fund slightly underperformed its benchmark index in 2024 but continues to execute the strategy of buying mostly higher-quality credits for the long term. The Fund’s portfolio shows a clear preference for local bonds, seen through more than half of the portfolio invested in unlimited tax general obligation securities and about 10% in state general obligation bonds. The Fund remains highly selective in the higher yielding, lower quality municipal universe, with a small allocation to this subset of municipal debt. The Fund’s duration to worst has moved slightly short to the index with plans to keep investing in the 20 year and lower maturity range. Overall, the Fund’s emphasis on AA equivalent and higher rated credits would position it relatively well should there be an economic reversal. Additional commentary is available on the Fund’s website.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| | |

| | 1 Year | Since Inception

(03/11/2021) |

Mairs & Power Minnesota Municipal Bond ETF | 0.38 | -1.62 |

Bloomberg Municipal Bond Index: Minnesota | 0.72 | -0.24 |

Visit mairsandpower.com/funds/mn-muni-bond-etf for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| Mairs & Power Minnesota Municipal Bond ETF | PAGE 1 | TSR-AR-89834G836 |

KEY FUND STATISTICS (as of December 31, 2024)

| |

Net Assets | $23,339,785 |

Number of Holdings | 113 |

Net Advisory Fee | $49,999 |

Portfolio Turnover | 45% |

Weighted Average Maturity | 10.1 years |

Effective Duration | 6.02 years |

30-Day SEC Yield | 3.19% |

Average Credit Quality | AA |

WHAT DID THE FUND INVEST IN? (% of net assets as of December 31, 2024)

| |

Top 10 Issuers | (%) |

State of Minnesota | 11.3% |

Minnesota Higher Education Facilities Authority | 5.6% |

University of Minnesota | 3.2% |

City of Northfield MN | 2.6% |

Forest Lake Independent School District No 831 | 2.2% |

St Paul Independent School District No 625 | 2.1% |

County of Wright MN | 2.1% |

City of St Cloud MN | 1.9% |

City of Apple Valley MN | 1.8% |

Housing & Redevelopment Authority of The City of St Paul Minnesota | 1.8% |

| |

Security Type | (%) |

Municipal Bonds | 98.6% |

Money Market Funds | 0.1% |

Cash & Other | 1.3% |

| |

Credit Breakdown* | (%) |

AAA | 29.9% |

AA | 49.3% |

A | 13.0% |

BBB & Lower | 4.0% |

Unrated | 1.8% |

Cash & Cash Equivalent | 2.0% |

| * | Mairs & Power uses lower of the S&P or Moody’s ratings and chooses to display credit ratings using S&P’s rating convention, although the rating itself might be sourced from another Nationally Recognized Statistical Rating Agency. The ratings apply to the credit worthiness of the issuers of the underlying securities and not to the Fund itself. Ratings are expressed as letters ranging from ‘AAA’, which is the highest grade, to ‘D’, which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the rating agency will classify the security as unrated. |

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

This is a summary of certain planned changes to the Fund. For more complete information, you may review the Fund’s prospectus and supplement thereto upon request at 1-855-839-2800.

On or around June 30, 2025, Robert (Bob) W. Thompson, co-portfolio manager of the Fund, will retire. The Fund will continue to be managed by Brent S. Miller, the Fund’s lead portfolio manager.

For additional information about the Fund, including its prospectus, financial information, holdings and proxy voting information, scan the QR code above or visit mairsandpower.com/funddocuments.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Fund documents not be householded, please contact Mairs & Power Funds at 1-855-839-2800, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Mairs & Power Funds or your financial intermediary.

| Mairs & Power Minnesota Municipal Bond ETF | PAGE 2 | TSR-AR-89834G836 |

10000101298893936193961000010106936298379908

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report. A copy of the registrant’s Code of Ethics is incorporated by reference to the Registrant’s Form N-CSR filed on March 9, 2023.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Dr. Michael Akers and Lisa Zúñiga Ramírez are the “audit committee financial experts” and are considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. The following table details the aggregate fees billed or expected to be billed for the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 12/31/2024 | FYE 12/31/2023 |

| (a) Audit Fees | $64,500 | $61,000 |

| (b) Audit-Related Fees | 0 | 0 |

| (c) Tax Fees | 12,000 | 15,000 |

| (d) All Other Fees | 0 | 0 |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 12/31/2024 | FYE 12/31/2023 |

| Audit-Related Fees | 0% | 0% |

| Tax Fees | 0% | 0% |

| All Other Fees | 0% | 0% |

(f) All of the principal accountant’s hours spent on auditing the registrant’s financial statements were attributed to work performed by full-time permanent employees of the principal accountant.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two fiscal years.

| Non-Audit Related Fees | FYE 12/31/2024 | FYE 12/31/2023 |

| Registrant | 0 | 0 |

| Registrant’s Investment Adviser | 0 | 0 |

(h) The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Registrants.

| (a) | The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The entire Board of Trustees is acting as the registrant’s audit committee. |

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 7(a) of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

TABLE OF CONTENTS

Mairs & Power Growth Fund

Schedule of Investments

December 31, 2024

| | | | | | | |

COMMON STOCKS - 99.7%

| | | | | | |

Communication Services - 4.8%

| | | | | | |

Alphabet, Inc. - Class C | | | 870,140 | | | $165,709,461 |

Verizon Communications, Inc. | | | 2,421,000 | | | 96,815,790 |

| | | | | | 262,525,251 |

Consumer Discretionary - 8.2%

| | | | | | |

Amazon.com, Inc.(a) | | | 1,672,000 | | | 366,820,080 |

Best Buy Co., Inc. | | | 655,700 | | | 56,259,060 |

Ulta Beauty, Inc.(a) | | | 54,900 | | | 23,877,657 |

| | | | | | 446,956,797 |

Consumer Staples - 2.4%

| | | | | | |

Casey’s General Stores, Inc. | | | 42,748 | | | 16,938,040 |

Hormel Foods Corp. | | | 2,171,592 | | | 68,122,841 |

Kraft Heinz Co. | | | 1,145,000 | | | 35,162,950 |

Target Corp. | | | 75,870 | | | 10,256,107 |

| | | | | | 130,479,938 |

Financials - 17.8%

| | | | | | |

Charles Schwab Corp. | | | 555,000 | | | 41,075,550 |

Fiserv, Inc.(a) | | | 989,000 | | | 203,160,380 |

JPMorgan Chase & Co. | | | 1,263,000 | | | 302,753,730 |

Piper Sandler Cos. | | | 168,000 | | | 50,391,600 |

Principal Financial Group, Inc. | | | 385,000 | | | 29,802,850 |

US Bancorp/MN | | | 2,574,000 | | | 123,114,420 |

Visa, Inc. - Class A | | | 459,000 | | | 145,062,360 |

Wells Fargo & Co. | | | 1,140,500 | | | 80,108,720 |

| | | | | | 975,469,610 |

Health Care - 12.2%

| | | | | | |

Abbott Laboratories | | | 255,829 | | | 28,936,818 |

Bio-Techne Corp. | | | 1,393,800 | | | 100,395,414 |

Eli Lilly & Co. | | | 124,539 | | | 96,144,108 |

Johnson & Johnson | | | 405,725 | | | 58,675,950 |

Roche Holding AG - ADR | | | 3,117,509 | | | 108,738,714 |

UnitedHealth Group, Inc. | | | 543,000 | | | 274,681,980 |

| | | | | | 667,572,984 |

Industrials - 13.7%

| | | | | | |

CH Robinson Worldwide, Inc. | | | 525,000 | | | 54,243,000 |

Donaldson Co., Inc. | | | 534,324 | | | 35,986,721 |

Fastenal Co. | | | 1,462,000 | | | 105,132,420 |

Graco, Inc. | | | 2,059,774 | | | 173,618,351 |

nVent Electric PLC | | | 1,318,919 | | | 89,897,519 |

Rockwell Automation, Inc. | | | 250,000 | | | 71,447,500 |

Tennant Co. | | | 786,000 | | | 64,082,580 |

Toro Co. | | | 1,974,523 | | | 158,159,292 |

| | | | | | 752,567,383 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Growth Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Information Technology - 32.0%(b)

| | | | | | |

Apple, Inc. | | | 973,800 | | | $243,858,996 |

Clearfield, Inc.(a) | | | 80,000 | | | 2,480,000 |

Entegris, Inc. | | | 397,000 | | | 39,326,820 |

Littelfuse, Inc. | | | 473,000 | | | 111,462,450 |

Microsoft Corp. | | | 1,315,000 | | | 554,272,500 |

Motorola Solutions, Inc. | | | 288,500 | | | 133,353,355 |

NVIDIA Corp. | | | 3,403,898 | | | 457,109,462 |

QUALCOMM, Inc. | | | 821,000 | | | 126,122,020 |

Salesforce, Inc. | | | 114,000 | | | 38,113,620 |

Workiva, Inc. (a) | | | 432,857 | | | 47,397,842 |

| | | | | | 1,753,497,065 |

Materials - 4.5%

| | | | | | |

Ecolab, Inc. | | | 278,015 | | | 65,144,475 |

HB Fuller Co. | | | 1,087,674 | | | 73,396,241 |

Sherwin-Williams Co. | | | 324,000 | | | 110,137,320 |

| | | | | | 248,678,036 |

Utilities - 4.1%

| | | | | | |

Alliant Energy Corp. | | | 2,753,000 | | | 162,812,420 |

WEC Energy Group, Inc. | | | 655,000 | | | 61,596,200 |

| | | | | | 224,408,620 |

TOTAL COMMON STOCKS

(Cost $2,346,132,866) | | | | | | 5,462,155,684 |

SHORT-TERM INVESTMENTS - 0.3%

| | | | | | |

Money Market Funds - 0.3%

| | | | | | |

First American Government Obligations Fund - Class X, 4.41%(c) | | | 15,443,036 | | | 15,443,036 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $15,443,036) | | | | | | 15,443,036 |

TOTAL INVESTMENTS - 100.0%

(Cost $2,361,575,902) | | | | | | $5,477,598,720 |

Liabilities in Excess of Other Assets - (0.0)% (d) | | | | | | (164,437) |

TOTAL NET ASSETS - 100.0% | | | | | | $5,477,434,283 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

PLC - Public Limited Company

(a)

| Non-income producing security.

|

(b)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024.

|

(d)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024

| | | | | | | |

COMMON STOCKS - 64.2%

| | | | | | |

Communication Services - 4.7%

| | | | | | |

Alphabet, Inc. - Class C | | | 137,797 | | | $26,242,061 |

Walt Disney Co. | | | 83,000 | | | 9,242,050 |

| | | | | | 35,484,111 |

Consumer Discretionary - 1.3%

| | | | | | |

Home Depot, Inc. | | | 24,702 | | | 9,608,831 |

Consumer Staples - 5.0%

| | | | | | |

Casey’s General Stores, Inc. | | | 21,000 | | | 8,320,830 |

Hershey Co. | | | 23,000 | | | 3,895,050 |

Hormel Foods Corp. | | | 240,182 | | | 7,534,509 |

Procter & Gamble Co. | | | 37,000 | | | 6,203,050 |

Sysco Corp. | | | 93,046 | | | 7,114,297 |

Target Corp. | | | 33,225 | | | 4,491,356 |

| | | | | | 37,559,092 |

Financials - 13.1%

| | | | | | |

American Express Co. | | | 26,574 | | | 7,886,898 |

Ameriprise Financial, Inc. | | | 16,000 | | | 8,518,880 |

Fiserv, Inc.(a) | | | 116,396 | | | 23,910,066 |

JPMorgan Chase & Co. | | | 89,339 | | | 21,415,452 |

Principal Financial Group, Inc. | | | 11,276 | | | 872,875 |

US Bancorp/MN | | | 177,768 | | | 8,502,643 |

Visa, Inc. - Class A | | | 57,000 | | | 18,014,280 |

Wells Fargo & Co. | | | 136,089 | | | 9,558,891 |

| | | | | | 98,679,985 |

Health Care - 10.8%

| | | | | | |

Abbott Laboratories | | | 116,843 | | | 13,216,112 |

Bio-Techne Corp. | | | 62,876 | | | 4,528,958 |

Eli Lilly & Co. | | | 16,144 | | | 12,463,168 |

Johnson & Johnson | | | 69,000 | | | 9,978,780 |

Medtronic PLC | | | 137,000 | | | 10,943,560 |

Neogen Corp.(a) | | | 195,000 | | | 2,367,300 |

Roche Holding AG - ADR | | | 197,000 | | | 6,871,360 |

UnitedHealth Group, Inc. | | | 41,794 | | | 21,141,913 |

| | | | | | 81,511,151 |

Industrials - 11.2%

| | | | | | |

3M Co. | | | 6,527 | | | 842,571 |

Automatic Data Processing, Inc. | | | 39,000 | | | 11,416,470 |

CH Robinson Worldwide, Inc. | | | 37,000 | | | 3,822,840 |

Donaldson Co., Inc. | | | 53,000 | | | 3,569,550 |

Fastenal Co. | | | 130,000 | | | 9,348,300 |

Graco, Inc. | | | 203,915 | | | 17,187,995 |

Honeywell International, Inc. | | | 30,091 | | | 6,797,256 |

nVent Electric PLC | | | 58,433 | | | 3,982,793 |

Rockwell Automation, Inc. | | | 25,000 | | | 7,144,750 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Industrials - (Continued)

|

Tennant Co. | | | 68,750 | | | $5,605,188 |

Toro Co. | | | 186,323 | | | 14,924,472 |

| | | | | | 84,642,185 |

Information Technology - 12.0%

| | | | | | |

Entegris, Inc. | | | 67,000 | | | 6,637,020 |

Littelfuse, Inc. | | | 50,000 | | | 11,782,500 |

Microsoft Corp. | | | 70,213 | | | 29,594,780 |

Motorola Solutions, Inc. | | | 27,753 | | | 12,828,269 |

QUALCOMM, Inc. | | | 65,311 | | | 10,033,076 |

Salesforce, Inc. | | | 8,010 | | | 2,677,983 |

Texas Instruments, Inc. | | | 90,000 | | | 16,875,900 |

| | | | | | 90,429,528 |

Materials - 4.4%

| | | | | | |

Ecolab, Inc. | | | 65,600 | | | 15,371,392 |

HB Fuller Co. | | | 96,205 | | | 6,491,913 |

Sherwin-Williams Co. | | | 34,000 | | | 11,557,620 |

| | | | | | 33,420,925 |

Utilities - 1.7%

| | | | | | |

Xcel Energy, Inc. | | | 184,700 | | | 12,470,944 |

TOTAL COMMON STOCKS

(Cost $259,169,872) | | | | | | 483,806,752 |

| | | Par | | | |

CORPORATE BONDS - 31.3%

| | | | | | |

Communication Services - 1.6%

| | | | | | |

AT&T, Inc., 4.50%, 05/15/2035 | | | $3,000,000 | | | 2,776,942 |

Comcast Corp., 4.25%, 01/15/2033 | | | 2,000,000 | | | 1,868,550 |

Cox Communications, Inc., 4.80%, 02/01/2035(b) | | | 1,880,000 | | | 1,719,853 |

Discovery Communications LLC, 4.95%, 05/15/2042 | | | 570,000 | | | 433,103 |

Netflix, Inc., 5.88%, 11/15/2028 | | | 1,688,000 | | | 1,750,378 |

T-Mobile USA, Inc., 5.75%, 01/15/2034 | | | 2,000,000 | | | 2,051,967 |

WarnermediaHoldings, Inc.

| | | | | | |

4.28%, 03/15/2032 | | | 1,000,000 | | | 881,759 |

5.05%, 03/15/2042 | | | 800,000 | | | 644,778 |

| | | | | | 12,127,330 |

Consumer Discretionary - 3.8%

| | | | | | |

Advance Auto Parts, Inc., 3.90%, 04/15/2030 | | | 2,000,000 | | | 1,785,140 |

AutoNation, Inc., 3.80%, 11/15/2027 | | | 1,110,000 | | | 1,073,417 |

Block Financial LLC

| | | | | | |

5.25%, 10/01/2025 | | | 1,064,000 | | | 1,065,337 |

3.88%, 08/15/2030 | | | 1,000,000 | | | 923,346 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Consumer Discretionary - (Continued)

|

Choice Hotels International, Inc.

| | | | | | |

3.70%, 12/01/2029 | | | $1,000,000 | | | $928,781 |

5.85%, 08/01/2034 | | | 750,000 | | | 752,149 |

eBay, Inc., 6.30%, 11/22/2032 | | | 2,000,000 | | | 2,127,642 |

Ford Motor Co.

| | | | | | |

6.10%, 08/19/2032 | | | 500,000 | | | 498,089 |

4.75%, 01/15/2043 | | | 1,000,000 | | | 790,084 |

Ford Motor Credit Co. LLC, 3.63%, 06/17/2031 | | | 1,750,000 | | | 1,514,860 |

General Motors Co.

| | | | | | |

4.20%, 10/01/2027 | | | 1,000,000 | | | 982,099 |

5.15%, 04/01/2038 | | | 1,000,000 | | | 921,993 |

General Motors Financial Co., Inc., 5.75%, 02/08/2031 | | | 500,000 | | | 506,843 |

Hasbro, Inc., 3.90%, 11/19/2029 | | | 2,000,000 | | | 1,882,505 |

Kohl’s Corp.

| | | | | | |

4.63%, 05/01/2031(c) | | | 1,000,000 | | | 801,237 |

6.88%, 12/15/2037 | | | 500,000 | | | 372,544 |

5.55%, 07/17/2045 | | | 1,073,000 | | | 696,072 |

Lear Corp., 3.80%, 09/15/2027 | | | 2,245,000 | | | 2,180,743 |

Lowe’s Cos., Inc., 4.65%, 04/15/2042 | | | 880,000 | | | 771,402 |

McDonald’s Corp., 3.70%, 02/15/2042 | | | 1,000,000 | | | 787,258 |

Mohawk Industries, Inc., 3.63%, 05/15/2030 | | | 2,000,000 | | | 1,848,039 |

Polaris, Inc., 6.95%, 03/15/2029 | | | 1,806,000 | | | 1,901,575 |

Tapestry, Inc., 3.05%, 03/15/2032 | | | 500,000 | | | 426,390 |

United Airlines 2014-2 Class A Pass Through Trust, Series A,

3.75%, 09/03/2026 | | | 346,882 | | | 339,945 |

Whirlpool Corp.

| | | | | | |

5.75%, 03/01/2034 | | | 1,000,000 | | | 982,494 |

5.15%, 03/01/2043 | | | 1,100,000 | | | 921,686 |

Wildlife Conservation Society, 3.41%, 08/01/2050 | | | 1,000,000 | | | 650,537 |

| | | | | | 28,432,207 |

Consumer Staples - 1.0%

| | | | | | |

Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc.,

4.70%, 02/01/2036 | | | 1,000,000 | | | 948,848 |

Land O’ Lakes Capital Trust I, 7.45%, 03/15/2028(b) | | | 1,949,000 | | | 1,921,046 |

Land O’ Lakes, Inc.

| | | | | | |

7.25%, Perpetual(b) | | | 2,500,000 | | | 2,121,417 |

7.00%, Perpetual(b) | | | 2,500,000 | | | 2,038,958 |

Smithfield Foods, Inc., 3.00%, 10/15/2030(b) | | | 250,000 | | | 216,593 |

| | | | | | 7,246,862 |

Energy - 0.8%

| | | | | | |

Kinder Morgan Energy Partners LP

| | | | | | |

5.80%, 03/15/2035 | | | 1,200,000 | | | 1,210,958 |

6.95%, 01/15/2038 | | | 1,000,000 | | | 1,085,555 |

Kinder Morgan, Inc., 5.30%, 12/01/2034 | | | 1,200,000 | | | 1,172,140 |

Murphy Oil Corp., 5.88%, 12/01/2042(c) | | | 500,000 | | | 431,997 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Energy - (Continued)

|

Northern Natural Gas Co., 4.10%, 09/15/2042(b) | | | $1,021,000 | | | $825,274 |

ONEOK Partners LP, 6.20%, 09/15/2043 | | | 1,203,000 | | | 1,203,239 |

| | | | | | 5,929,163 |

Financials - 10.7%

| | | | | | |

Allstate Corp., 5.25%, 03/30/2033 | | | 1,000,000 | | | 998,636 |

American Express Co., 4.99% to 05/26/2032 then SOFR + 2.26%, 05/26/2033 | | | 500,000 | | | 488,067 |

AmFam Holdings, Inc., 2.81%, 03/11/2031(b) | | | 1,540,000 | | | 1,202,102 |

Associated Banc-Corp.

| | | | | | |

4.25%, 01/15/2025 | | | 1,127,000 | | | 1,126,554 |

6.46% to 08/29/2029 then SOFR + 3.03%, 08/29/2030 | | | 1,151,000 | | | 1,174,292 |

Assurant, Inc., 3.70%, 02/22/2030 | | | 2,300,000 | | | 2,144,155 |

BAC Capital Trust XIV, 5.02% (3 mo. Term SOFR + 0.66%), Perpetual | | | 500,000 | | | 425,995 |

Bank of America Corp.

| | | | | | |

5.02% to 07/22/2032 then SOFR + 2.16%, 07/22/2033 | | | 1,000,000 | | | 980,759 |

4.00%, 08/15/2034 | | | 538,000 | | | 480,008 |

Bank of Montreal, 3.09% to 01/10/2032 then 5 yr. CMT Rate + 1.40%, 01/10/2037 | | | 2,150,000 | | | 1,791,855 |

Bank of New York Mellon Corp., 3.75% to 12/20/2026 then 5 yr. CMT Rate + 2.63%, Perpetual | | | 2,000,000 | | | 1,895,150 |

Blackstone Holdings Finance Co. LLC, 2.55%, 03/30/2032(b) | | | 1,000,000 | | | 836,801 |

Capital One Financial Corp., 5.25% to 07/26/2029 then SOFR + 2.60%, 07/26/2030 | | | 4,000,000 | | | 3,988,695 |

CBRE Services, Inc., 5.95%, 08/15/2034 | | | 2,000,000 | | | 2,063,917 |

Charles Schwab Corp., 4.00% to 12/01/2030 then 10 yr. CMT Rate + 3.08%, Perpetual | | | 6,000,000 | | | 5,187,306 |

Cincinnati Financial Corp., 6.13%, 11/01/2034 | | | 1,301,000 | | | 1,353,397 |

Citigroup, Inc., 3.07% to 02/24/2027 then SOFR + 1.28%, 02/24/2028 | | | 500,000 | | | 480,838 |

CNA Financial Corp., 5.50%, 06/15/2033 | | | 2,000,000 | | | 2,017,239 |

Farmers Exchange Capital, 7.05%, 07/15/2028(b) | | | 1,650,000 | | | 1,709,197 |

First American Financial Corp., 5.45%, 09/30/2034 | | | 1,000,000 | | | 965,512 |

Fiserv, Inc., 4.20%, 10/01/2028 | | | 1,000,000 | | | 972,933 |

FMR LLC, 6.45%, 11/15/2039(b) | | | 1,141,000 | | | 1,259,233 |

Fulton Financial Corp., 3.75% to 03/15/2030 then 3 mo. Term SOFR + 2.70%, 03/15/2035 | | | 3,000,000 | | | 2,441,976 |

Goldman Sachs Group, Inc., 2.65% to 10/21/2031 then SOFR + 1.26%, 10/21/2032 | | | 2,000,000 | | | 1,691,735 |

Hartford Financial Services Group, Inc., 6.63%, 04/15/2042 | | | 2,300,000 | | | 2,451,584 |

HSBC Holdings PLC, 4.25%, 08/18/2025 | | | 2,000,000 | | | 1,992,999 |

Huntington National Bank, 4.60%, 02/27/2025 | | | 1,050,000 | | | 1,049,027 |

JPMorgan Chase & Co.

| | | | | | |

3.65% to 06/01/2026 then 5 yr. CMT Rate + 2.85%, Perpetual | | | 3,000,000 | | | 2,916,146 |

4.13%, 12/15/2026 | | | 1,000,000 | | | 989,961 |

Kemper Corp., 4.35%, 02/15/2025 | | | 4,000,000 | | | 3,989,207 |

Liberty Mutual Insurance Co., 8.50%, 05/15/2025(b) | | | 250,000 | | | 252,602 |

LPL Holdings, Inc., 6.00%, 05/20/2034 | | | 2,000,000 | | | 2,038,048 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Financials - (Continued)

|

M&T Bank Corp., 5.13% to 11/01/2026 then 3 mo. Term SOFR + 3.78%, Perpetual | | | $1,000,000 | | | $987,316 |

Mercury General Corp., 4.40%, 03/15/2027 | | | 4,000,000 | | | 3,923,008 |

Morgan Stanley

| | | | | | |

2.94% to 01/21/2032 then SOFR + 1.29%, 01/21/2033 | | | 1,700,000 | | | 1,458,130 |

2.48% to 09/16/2031 then SOFR + 1.36%, 09/16/2036 | | | 750,000 | | | 610,443 |

Old Republic International Corp.

| | | | | | |

3.88%, 08/26/2026 | | | 790,000 | | | 777,412 |

5.75%, 03/28/2034 | | | 1,000,000 | | | 1,002,885 |

Park National Corp., 4.50% to 09/01/2025 then 3 mo. Term SOFR + 4.39%, 09/01/2030 | | | 500,000 | | | 487,500 |

Penn Mutual Life Insurance Co., 6.65%, 06/15/2034(b) | | | 470,000 | | | 489,286 |

Penske Truck Leasing Co. Lp/ PTL Finance Corp.

| | | | | | |

5.70%, 02/01/2028(b) | | | 500,000 | | | 508,721 |

6.05%, 08/01/2028(b) | | | 500,000 | | | 514,809 |

PNC Bank NA, 3.88%, 04/10/2025 | | | 1,000,000 | | | 996,982 |

PNC Financial Services Group, Inc., 3.40% to 09/15/2026 then 5 yr. CMT Rate + 2.60%, Perpetual | | | 4,000,000 | | | 3,764,491 |

Principal Financial Group, Inc., 4.35%, 05/15/2043 | | | 500,000 | | | 424,993 |

Prudential Insurance Co. of America, 8.30%, 07/01/2025(b) | | | 1,000,000 | | | 1,016,685 |

Synchrony Financial

| | | | | | |

4.50%, 07/23/2025 | | | 1,000,000 | | | 996,330 |

5.94% to 08/02/2029 then SOFR + 2.13%, 08/02/2030 | | | 1,000,000 | | | 1,010,050 |

2.88%, 10/28/2031 | | | 2,000,000 | | | 1,660,303 |

Unum Group, 7.25%, 03/15/2028 | | | 250,000 | | | 263,833 |

US Bancorp, 5.85% to 10/21/2032 then SOFR + 2.09%, 10/21/2033 | | | 2,000,000 | | | 2,045,620 |

Wells Fargo & Co., 4.10%, 06/03/2026 | | | 1,000,000 | | | 989,900 |

Wintrust Financial Corp., 4.85%, 06/06/2029 | | | 3,500,000 | | | 3,334,485 |

| | | | | | 80,619,108 |

Health Care - 1.3%

| | | | | | |

AbbVie, Inc., 3.80%, 03/15/2025 | | | 2,000,000 | | | 1,996,602 |

Bristol-Myers Squibb Co.

| | | | | | |

3.88%, 08/15/2025 | | | 43,000 | | | 42,786 |

2.35%, 11/13/2040 | | | 1,500,000 | | | 997,663 |

CVS Health Corp.

| | | | | | |

4.78%, 03/25/2038 | | | 1,400,000 | | | 1,211,920 |

2.70%, 08/21/2040 | | | 1,500,000 | | | 989,526 |

Humana, Inc., 5.95%, 03/15/2034 | | | 1,000,000 | | | 1,007,570 |

Laboratory Corp. of America Holdings, 4.55%, 04/01/2032 | | | 1,000,000 | | | 957,719 |

Quest Diagnostics, Inc., 6.40%, 11/30/2033 | | | 500,000 | | | 536,078 |

Viatris, Inc., 2.30%, 06/22/2027 | | | 1,500,000 | | | 1,407,170 |

Zimmer Biomet Holdings, Inc., 4.25%, 08/15/2035 | | | 700,000 | | | 630,835 |

| | | | | | 9,777,869 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Industrials - 3.2%

| | | | | | |

Ashtead Capital, Inc., 5.80%, 04/15/2034(b) | | | $1,000,000 | | | $1,001,652 |

Eaton Corp., 4.00%, 11/02/2032 | | | 2,000,000 | | | 1,872,308 |

Equifax, Inc., 7.00%, 07/01/2037 | | | 2,000,000 | | | 2,187,661 |

FedEx Corp., 4.10%, 04/15/2043 | | | 1,000,000 | | | 797,390 |

Flowserve Corp., 3.50%, 10/01/2030 | | | 1,000,000 | | | 913,528 |

GATX Corp.

| | | | | | |

4.90%, 03/15/2033 | | | 1,000,000 | | | 965,240 |

5.45%, 09/15/2033 | | | 1,000,000 | | | 1,003,421 |

6.05%, 03/15/2034 | | | 500,000 | | | 523,435 |

6.90%, 05/01/2034 | | | 500,000 | | | 549,597 |

Hillenbrand, Inc., 3.75%, 03/01/2031 | | | 3,000,000 | | | 2,624,656 |

Howmet Aerospace, Inc., 5.95%, 02/01/2037 | | | 1,000,000 | | | 1,039,300 |

Kennametal, Inc., 4.63%, 06/15/2028 | | | 1,500,000 | | | 1,482,305 |

Leidos Holdings, Inc., 5.95%, 12/01/2040 | | | 1,400,000 | | | 1,351,619 |

nVent Finance Sarl, 5.65%, 05/15/2033 | | | 1,495,000 | | | 1,494,834 |

Quanta Services, Inc., 5.25%, 08/09/2034 | | | 1,000,000 | | | 978,679 |

Resideo Funding, Inc., 6.50%, 07/15/2032(b) | | | 1,500,000 | | | 1,503,782 |

Steelcase, Inc., 5.13%, 01/18/2029 | | | 1,375,000 | | | 1,321,374 |

Toro Co., 7.80%, 06/15/2027 | | | 500,000 | | | 529,394 |

United Rentals North America, Inc., 3.75%, 01/15/2032 | | | 2,000,000 | | | 1,753,379 |

| | | | | | 23,893,554 |

Information Technology - 3.1%

| | | | | | |

Analog Devices, Inc., 2.80%, 10/01/2041 | | | 1,000,000 | | | 708,889 |

Arrow Electronics, Inc., 4.00%, 04/01/2025 | | | 1,031,000 | | | 1,028,339 |

Autodesk, Inc., 2.40%, 12/15/2031 | | | 1,000,000 | | | 840,868 |

Avnet, Inc.

| | | | | | |

3.00%, 05/15/2031 | | | 2,000,000 | | | 1,706,839 |

5.50%, 06/01/2032 | | | 1,000,000 | | | 980,567 |

Broadcom, Inc.

| | | | | | |

3.47%, 04/15/2034(b) | | | 1,000,000 | | | 867,369 |

4.93%, 05/15/2037(b) | | | 1,500,000 | | | 1,428,383 |

Entegris, Inc., 4.75%, 04/15/2029(b) | | | 3,000,000 | | | 2,875,132 |

Fortinet, Inc., 2.20%, 03/15/2031 | | | 2,000,000 | | | 1,700,593 |

Hewlett Packard Enterprise Co., 4.90%, 10/15/2025(c) | | | 1,000,000 | | | 1,000,364 |

HP, Inc.

| | | | | | |

2.65%, 06/17/2031 | | | 1,000,000 | | | 856,774 |

5.50%, 01/15/2033 | | | 2,000,000 | | | 2,019,527 |

Micron Technology, Inc., 5.88%, 02/09/2033 | | | 1,000,000 | | | 1,024,924 |

Motorola Solutions, Inc.

| | | | | | |

4.60%, 02/23/2028 | | | 2,500,000 | | | 2,478,198 |

5.50%, 09/01/2044 | | | 2,000,000 | | | 1,938,191 |

Oracle Corp., 3.60%, 04/01/2040 | | | 3,000,000 | | | 2,350,469 |

| | | | | | 23,805,426 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

CORPORATE BONDS - (Continued)

|

Materials - 2.5%

| | | | | | |

Albemarle Corp., 5.45%, 12/01/2044 | | | $325,000 | | | $290,800 |

Albemarle Wodgina Pty Ltd., 3.45%, 11/15/2029 | | | 1,175,000 | | | 1,040,060 |

Cabot Corp.

| | | | | | |

3.40%, 09/15/2026 | | | 1,500,000 | | | 1,462,992 |

4.00%, 07/01/2029 | | | 1,800,000 | | | 1,723,867 |

Celanese US Holdings LLC, 6.95%, 11/15/2033(c) | | | 2,000,000 | | | 2,078,001 |

Eastman Chemical Co.

| | | | | | |

3.80%, 03/15/2025 | | | 756,000 | | | 754,300 |

5.63%, 02/20/2034 | | | 1,000,000 | | | 1,000,840 |

Freeport-McMoRan, Inc., 4.25%, 03/01/2030 | | | 3,000,000 | | | 2,852,939 |

HB Fuller Co., 4.25%, 10/15/2028 | | | 1,700,000 | | | 1,606,880 |

International Flavors & Fragrances, Inc.

| | | | | | |

1.83%, 10/15/2027(b) | | | 486,000 | | | 446,725 |

2.30%, 11/01/2030(b) | | | 1,200,000 | | | 1,019,978 |

3.27%, 11/15/2040(b) | | | 1,000,000 | | | 715,654 |

Mosaic Co., 5.45%, 11/15/2033 | | | 2,000,000 | | | 1,983,120 |

Newmont Corp., 4.88%, 03/15/2042 | | | 1,000,000 | | | 915,702 |

Union Carbide Corp., 7.50%, 06/01/2025 | | | 865,000 | | | 872,494 |

| | | | | | 18,764,352 |

Technology - 0.8%

| | | | | | |

CDW LLC / CDW Finance Corp., 5.55%, 08/22/2034 | | | 1,000,000 | | | 989,765 |

Dell, Inc., 5.40%, 09/10/2040 | | | 1,000,000 | | | 948,618 |

Leidos, Inc., 5.50%, 07/01/2033 | | | 3,850,000 | | | 3,802,849 |

| | | | | | 5,741,232 |

Utilities - 2.5%

| | | | | | |

Alliant Energy Finance LLC, 3.60%, 03/01/2032(b) | | | 1,000,000 | | | 890,352 |

Black Hills Corp.

| | | | | | |

4.35%, 05/01/2033 | | | 1,000,000 | | | 923,140 |

6.15%, 05/15/2034 | | | 2,000,000 | | | 2,080,896 |

Duke Energy Carolinas LLC, 6.10%, 06/01/2037 | | | 1,000,000 | | | 1,042,392 |

Duke Energy Progress LLC, 5.70%, 04/01/2035 | | | 1,165,000 | | | 1,193,464 |

Interstate Power and Light Co.

| | | | | | |

6.30%, 05/01/2034 | | | 500,000 | | | 522,112 |

6.25%, 07/15/2039 | | | 2,000,000 | | | 2,123,586 |

National Fuel Gas Co.

| | | | | | |

3.95%, 09/15/2027 | | | 2,000,000 | | | 1,944,139 |

4.75%, 09/01/2028 | | | 1,000,000 | | | 986,413 |

Niagara Mohawk Power Corp., 4.28%, 10/01/2034(b) | | | 2,000,000 | | | 1,808,874 |

Public Service Co. of Colorado, 6.50%, 08/01/2038 | | | 2,000,000 | | | 2,169,697 |

Southwestern Public Service Co., 6.00%, 10/01/2036 | | | 1,000,000 | | | 1,019,866 |

Toledo Edison Co., 2.65%, 05/01/2028(b) | | | 416,000 | | | 383,079 |

Virginia Electric and Power Co., 6.35%, 11/30/2037 | | | 1,065,000 | | | 1,137,111 |

Wisconsin Power and Light Co., 4.95%, 04/01/2033 | | | 1,000,000 | | | 971,488 |

| | | | | | 19,196,609 |

TOTAL CORPORATE BONDS

(Cost $249,695,629) | | | | | | 235,533,712 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

U.S. TREASURY SECURITIES - 2.1%

| | | | | | |

United States Treasury Note/Bond

| | | | | | |

0.75%, 03/31/2026 | | | $1,000,000 | | | $957,969 |

0.75%, 04/30/2026 | | | 1,000,000 | | | 955,273 |

1.13%, 10/31/2026 | | | 1,000,000 | | | 945,430 |

2.63%, 05/31/2027 | | | 3,000,000 | | | 2,888,320 |

1.25%, 06/30/2028 | | | 1,000,000 | | | 901,094 |

1.00%, 07/31/2028 | | | 1,000,000 | | | 890,312 |

1.25%, 09/30/2028 | | | 1,000,000 | | | 893,789 |

2.63%, 02/15/2029 | | | 2,000,000 | | | 1,870,078 |

1.38%, 11/15/2031 | | | 2,000,000 | | | 1,634,609 |

2.88%, 05/15/2032 | | | 2,000,000 | | | 1,796,680 |

3.25%, 05/15/2042 | | | 1,000,000 | | | 814,668 |

3.00%, 02/15/2049 | | | 2,000,000 | | | 1,457,969 |

TOTAL U.S. TREASURY SECURITIES

(Cost $17,266,389) | | | | | | 16,006,191 |

MUNICIPAL BONDS - 1.0%

| | | | | | |

Borough of Naugatuck CT, 3.09%, 09/15/2046 | | | 1,000,000 | | | 688,387 |

Crowley Independent School District, 3.01%, 08/01/2038 | | | 1,000,000 | | | 802,406 |

DeKalb Kane & LaSalle Counties Etc Community College District No 523 Kishwaukee, 3.02%, 02/01/2036 | | | 500,000 | | | 400,928 |

Desert Community College District, 2.46%, 08/01/2040 | | | 300,000 | | | 215,636 |

Glendale Community College District/CA, 2.11%, 08/01/2031 | | | 650,000 | | | 552,022 |

Idaho Bond Bank Authority, 2.35%, 09/15/2038 | | | 500,000 | | | 368,626 |

Massachusetts Development Finance Agency, 2.55%, 05/01/2040 | | | 885,000 | | | 634,824 |

Michigan State University, 4.50%, 08/15/2048 | | | 1,000,000 | | | 907,768 |

Pierre School District No 32-2, 2.04%, 08/01/2033 | | | 920,000 | | | 753,017 |

Redondo Beach Unified School District, 2.04%, 08/01/2034 | | | 500,000 | | | 390,819 |

Socorro Independent School District, 2.13%, 08/15/2031 | | | 500,000 | | | 426,464 |

Village of Ashwaubenon WI, 2.97%, 06/01/2040 | | | 505,000 | | | 381,090 |

Woodbury County Law Enforcement Center Authority, 3.09%, 06/01/2040 | | | 750,000 | | | 575,046 |

Worthington Independent School District No 518, 3.30%, 02/01/2039 | | | 850,000 | | | 707,451 |

TOTAL MUNICIPAL BONDS

(Cost $9,965,159) | | | | | | 7,804,484 |

ASSET-BACKED SECURITIES - 0.7%

| | | | | | |

American Airlines Group, Inc.

| | | | | | |

3.60%, 09/22/2027 | | | 114,684 | | | 110,670 |

Series 2013-1, 3.95%, 11/15/2025 | | | 317,261 | | | 313,708 |

Series 2014-1, 3.70%, 10/01/2026 | | | 938,684 | | | 909,397 |

Series 2015-1, 3.38%, 05/01/2027 | | | 243,980 | | | 233,001 |

Series 2015-2, 4.00%, 09/22/2027 | | | 373,920 | | | 357,094 |

Series 2016-3B, 3.75%, 10/15/2025 | | | 381,315 | | | 372,736 |

Series 2017-1B, 4.95%, 02/15/2025 | | | 404,745 | | | 404,745 |

British Airways PLC, Series 2018-1, 4.13%, 09/20/2031(b) | | | 564,039 | | | 531,607 |

Hawaiian Holdings, Inc., Series 2013-1, 3.90%, 01/15/2026 | | | 1,147,449 | | | 1,124,500 |

Spirit Airlines, Inc., Series 2015-1, 4.10%, 04/01/2028 | | | 69,518 | | | 64,304 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Balanced Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

ASSET-BACKED SECURITIES - (Continued)

| | | | | | |

United Airlines, Inc.

| | | | | | |

Series A, 4.30%, 08/15/2025 | | | $528,560 | | | $524,595 |

Series A, 4.00%, 04/11/2026 | | | 412,418 | | | 407,263 |

TOTAL ASSET-BACKED SECURITIES

(Cost $5,473,136) | | | | | | 5,353,620 |

| | | Shares | | | |

SHORT-TERM INVESTMENTS - 0.4%

| | | | | | |

Money Market Funds - 0.4%

| | | | | | |

First American Government Obligations Fund - Class X, 4.41%(d) | | | 3,353,237 | | | 3,353,237 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $3,353,237) | | | | | | 3,353,237 |

TOTAL INVESTMENTS - 99.7%

(Cost $544,923,422) | | | | | | $751,857,996 |

Other Assets in Excess of Liabilities - 0.3% | | | | | | 2,206,766 |

TOTAL NET ASSETS - 100.0% | | | | | | $754,064,762 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor.

ADR - American Depositary Receipt

AG - Aktiengesellschaft

CMT - Constant Maturity Treasury

PLC - Public Limited Company

SOFR - Secured Overnight Financing Rate

(a)

| Non-income producing security. |

(b)

| Security is exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may only be resold in transactions exempt from registration to qualified institutional investors. As of December 31, 2024, the value of these securities total $30,105,164 or 4.0% of the Fund’s net assets. |

(c)

| Step coupon bond. The rate disclosed is as of December 31, 2024. |

(d)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Small Cap Fund

Schedule of Investments

December 31, 2024

| | | | | | | |

COMMON STOCKS - 99.9%

| |

Consumer Discretionary - 3.4%

| | | | | | |

Gentherm, Inc.(a) | | | 150,880 | | | $6,023,884 |

Life Time Group Holdings, Inc.(a) | | | 109,800 | | | 2,428,776 |

Polaris, Inc. | | | 38,400 | | | 2,212,608 |

| | | | | | 10,665,268 |

Consumer Staples - 5.6%

| | | | | | |

Casey’s General Stores, Inc. | | | 29,246 | | | 11,588,142 |

MGP Ingredients, Inc. | | | 150,610 | | | 5,929,516 |

| | | | | | 17,517,658 |

Financials - 18.0%

| | | | | | |

Alerus Financial Corp. | | | 96,441 | | | 1,855,525 |

Associated Banc-Corp. | | | 322,211 | | | 7,700,843 |

Cullen/Frost Bankers, Inc. | | | 72,450 | | | 9,726,412 |

Glacier Bancorp, Inc. | | | 149,961 | | | 7,531,041 |

Piper Sandler Cos. | | | 31,907 | | | 9,570,505 |

QCR Holdings, Inc. | | | 112,178 | | | 9,046,034 |

Wintrust Financial Corp. | | | 85,046 | | | 10,606,087 |

| | | | | | 56,036,447 |

Health Care - 11.2%

| | | | | | |

Bio-Techne Corp. | | | 98,000 | | | 7,058,940 |

CVRx, Inc.(a) | | | 142,456 | | | 1,804,918 |

Exact Sciences Corp.(a) | | | 58,600 | | | 3,292,734 |

Inspire Medical Systems, Inc.(a) | | | 52,125 | | | 9,662,932 |

Medpace Holdings, Inc.(a) | | | 31,970 | | | 10,621,393 |

Neogen Corp.(a) | | | 192,100 | | | 2,332,094 |

| | | | | | 34,773,011 |

Industrials - 29.3%(b)

| | | | | | |

AAR Corp.(a) | | | 185,561 | | | 11,371,178 |

AZEK Co., Inc.(a) | | | 280,977 | | | 13,337,978 |

Generac Holdings, Inc.(a) | | | 54,121 | | | 8,391,461 |

Hub Group, Inc. - Class A | | | 279,720 | | | 12,464,323 |

John Bean Technologies Corp. | | | 128,735 | | | 16,362,219 |

nVent Electric PLC | | | 112,257 | | | 7,651,437 |

Oshkosh Corp. | | | 39,750 | | | 3,779,033 |

Tennant Co. | | | 112,364 | | | 9,161,037 |

Toro Co. | | | 107,800 | | | 8,634,780 |

| | | | | | 91,153,446 |

Information Technology - 20.2%

| | | | | | |

Altair Engineering, Inc. - Class A(a) | | | 4,210 | | | 459,353 |

Clearfield, Inc.(a) | | | 330,293 | | | 10,239,083 |

Clearwater Analytics Holdings, Inc. - Class A(a) | | | 57,810 | | | 1,590,931 |

Entegris, Inc. | | | 81,307 | | | 8,054,271 |

Jamf Holding Corp.(a) | | | 381,667 | | | 5,362,421 |

Littelfuse, Inc. | | | 46,327 | | | 10,916,958 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Small Cap Fund

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

COMMON STOCKS - (Continued)

|

Information Technology - (Continued)

| |

Plexus Corp.(a) | | | 80,870 | | | $12,654,538 |

SkyWater Technology, Inc.(a) | | | 139,390 | | | 1,923,582 |

Workiva, Inc.(a) | | | 105,767 | | | 11,581,487 |

| | | | | | 62,782,624 |

Materials - 7.4%

| | | | | | |

HB Fuller Co. | | | 155,109 | | | 10,466,755 |

Knife River Corp.(a) | | | 123,650 | | | 12,567,786 |

| | | | | | 23,034,541 |

Utilities - 4.8%

| | | | | | |

Black Hills Corp. | | | 136,200 | | | 7,970,424 |

Northwestern Energy Group, Inc. | | | 132,600 | | | 7,088,796 |

| | | | | | 15,059,220 |

TOTAL COMMON STOCKS

(Cost $228,346,239) | | | | | | 311,022,215 |

SHORT-TERM INVESTMENTS - 0.2%

| | | | | | |

Money Market Funds - 0.2%

| | | | | | |

First American Government Obligations Fund - Class X, 4.41%(c) | | | 546,719 | | | 546,719 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $546,719) | | | | | | 546,719 |

TOTAL INVESTMENTS - 100.1%

(Cost $228,892,958) | | | | | | $311,568,934 |

Liabilities in Excess of Other Assets - (0.1)% | | | | | | (461,848) |

TOTAL NET ASSETS - 100.0% | | | | | | $311,107,086 |

| | | | | | | |

Percentages are stated as a percent of net assets.

The Global Industry Classification Standard (“GICS®”) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI and S&P and has been licensed for use by the Advisor.

PLC - Public Limited Company

(a)

| Non-income producing security. |

(b)

| To the extent that the Fund invests more heavily in a particular industry or sector of the economy, its performance will be especially sensitive to developments that significantly affect those industries or sectors.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Minnesota Municipal Bond ETF

Schedule of Investments

December 31, 2024

| | | | | | | |

MUNICIPAL BONDS - 98.6%

| | | | | | |

Minnesota - 98.6%

|

Alden-Conger Independent School District No 242, 3.00%, 02/01/2027 | | | $330,000 | | | $326,794 |

Alexandria Lake Area Sanitation District, 4.00%, 02/01/2036 | | | 150,000 | | | 152,631 |

Anoka-Hennepin Independent School District No 11, 4.00%, 02/01/2032 | | | 320,000 | | | 329,489 |

Bold Independent School District No 2534, 5.00%, 02/01/2044 | | | 200,000 | | | 216,588 |

Centennial Independent School District No 12, 5.00%, 02/01/2025 | | | 125,000 | | | 125,185 |

City of Apple Valley MN

| | | | | | |

4.00%, 09/01/2030 | | | 160,000 | | | 159,032 |

4.00%, 09/01/2041 | | | 290,000 | | | 264,825 |

City of Center City MN

| | | | | | |

4.00%, 11/01/2027 | | | 135,000 | | | 136,327 |

4.50%, 11/01/2034 | | | 100,000 | | | 100,017 |

City of Chaska MN, 4.00%, 02/01/2040 | | | 350,000 | | | 348,106 |

City of Chaska MN Electric Revenue, 5.00%, 10/01/2025 | | | 140,000 | | | 142,059 |

City of Cold Spring MN, 4.00%, 02/01/2044 | | | 150,000 | | | 145,586 |

City of Coon Rapids MN, 2.50%, 02/01/2036 | | | 100,000 | | | 84,616 |

City of Delano MN, 5.00%, 02/01/2038 | | | 250,000 | | | 272,513 |

City of Elk River MN Electric Revenue, 3.00%, 08/01/2032 | | | 140,000 | | | 134,281 |

City of Grand Rapids MN, 4.00%, 02/01/2038 | | | 250,000 | | | 258,023 |

City of Greenfield MN, 5.00%, 12/15/2030 | | | 115,000 | | | 126,439 |

City of Hastings MN, 5.00%, 02/01/2027 | | | 175,000 | | | 182,446 |

City of Hermantown MN, 4.00%, 02/01/2043 | | | 300,000 | | | 297,162 |

City of Hutchinson MN, 2.00%, 02/01/2034 | | | 300,000 | | | 244,247 |

City of Jordan MN, 4.00%, 02/01/2033 | | | 135,000 | | | 141,374 |

City of Madelia MN, 2.00%, 02/01/2033 | | | 115,000 | | | 98,286 |

City of Minneapolis MN

| | | | | | |

5.00%, 11/15/2036 | | | 150,000 | | | 154,556 |

4.00%, 11/15/2040 | | | 100,000 | | | 98,677 |

5.00%, 11/15/2052(a) | | | 130,000 | | | 137,257 |

City of Minnetrista MN, 4.00%, 02/01/2031 | | | 145,000 | | | 152,120 |

City of New Prague MN, 4.00%, 02/01/2037 | | | 315,000 | | | 323,719 |

City of Northfield MN

| | | | | | |

5.00%, 02/01/2041 | | | 385,000 | | | 419,716 |

4.00%, 02/01/2044 | | | 200,000 | | | 198,520 |

City of Richfield MN, 4.00%, 02/01/2027 | | | 100,000 | | | 102,046 |

City of Rochester MN, 5.00%, 02/01/2040 | | | 150,000 | | | 166,544 |

City of Rosemount MN, 5.00%, 02/01/2037 | | | 250,000 | | | 274,273 |

City of St Cloud MN

| | | | | | |

2.00%, 02/01/2034 | | | 200,000 | | | 162,831 |

5.00%, 05/01/2043 | | | 250,000 | | | 270,219 |

City of Wayzata MN, 3.00%, 12/01/2027 | | | 100,000 | | | 98,540 |

City of Winona MN, 5.00%, 02/01/2032 | | | 180,000 | | | 201,684 |

Cleveland Independent School District No 391, 4.00%, 02/01/2026 | | | 105,000 | | | 105,941 |

County of Beltrami MN, 4.00%, 12/01/2042 | | | 250,000 | | | 252,367 |

County of Carlton MN, 5.00%, 02/01/2042 | | | 250,000 | | | 273,711 |

County of Hennepin MN, 5.00%, 12/01/2030 | | | 195,000 | | | 206,928 |

County of Hubbard MN, 4.00%, 02/01/2036 | | | 250,000 | | | 260,515 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Minnesota Municipal Bond ETF

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

MUNICIPAL BONDS - (Continued)

|

Minnesota - (Continued)

|

County of Itasca MN, 4.00%, 02/01/2044 | | | 200,000 | | | $198,779 |

County of Koochiching MN, 5.00%, 02/01/2035 | | | $300,000 | | | 330,362 |

County of Pennington MN, 2.38%, 02/01/2035 | | | 100,000 | | | 83,874 |

County of St Louis MN, 2.00%, 12/01/2035 | | | 350,000 | | | 273,674 |

County of Wright MN

| | | | | | |

3.00%, 12/01/2038 | | | 295,000 | | | 261,914 |

3.00%, 12/01/2039 | | | 250,000 | | | 221,876 |

Crookston Independent School District No 593, 5.00%, 02/01/2029 | | | 250,000 | | | 268,773 |

Dakota County Community Development Agency

| | | | | | |

2.00%, 01/01/2032 | | | 65,000 | | | 56,285 |

4.20%, 05/01/2043 | | | 150,000 | | | 145,634 |

Duluth Independent School District No 709, 0.00%, 02/01/2031(b) | | | 200,000 | | | 151,077 |

Eastern Carver County Schools Independent School District No 112,

4.00%, 02/01/2035 | | | 250,000 | | | 258,433 |

Edina Independent School District No 273, 5.00%, 02/01/2030 | | | 250,000 | | | 250,348 |

Elk River Independent School District No 728, 4.00%, 02/01/2026 | | | 125,000 | | | 126,492 |

Fergus Falls Independent School District No 544, 5.00%, 02/01/2034 | | | 100,000 | | | 109,830 |

Forest Lake Independent School District No 831, 4.00%, 02/01/2039 | | | 500,000 | | | 509,156 |

Hibbing Independent School District No 701, 3.00%, 03/01/2033 | | | 300,000 | | | 287,941 |

Housing & Redevelopment Authority of The City of St Paul Minnesota

| | | | | | |

3.50%, 09/01/2026 | | | 65,000 | | | 64,028 |

3.13%, 11/15/2032 | | | 110,000 | | | 101,532 |

4.00%, 10/01/2037 | | | 250,000 | | | 250,077 |

Metropolitan Council

| | | | | | |

5.00%, 03/01/2026 | | | 100,000 | | | 102,392 |

5.00%, 12/01/2028 | | | 100,000 | | | 107,844 |

4.00%, 03/01/2030 | | | 140,000 | | | 142,669 |

Minneapolis-St Paul Metropolitan Airports Commission

| | | | | | |

5.00%, 01/01/2029 | | | 60,000 | | | 62,123 |

5.00%, 01/01/2031 | | | 150,000 | | | 155,200 |

Minnesota Agricultural & Economic Development Board, 5.00%, 01/01/2042 | | | 250,000 | | | 272,511 |

Minnesota Higher Education Facilities Authority

| | | | | | |

5.00%, 10/01/2029 | | | 255,000 | | | 275,057 |

5.00%, 10/01/2034 | | | 260,000 | | | 277,033 |

4.00%, 03/01/2036 | | | 215,000 | | | 215,899 |

3.00%, 10/01/2036 | | | 200,000 | | | 178,670 |

3.00%, 10/01/2041 | | | 300,000 | | | 256,455 |

3.00%, 03/01/2043 | | | 125,000 | | | 105,807 |

Minnesota State Colleges And Universities Foundation, 4.00%, 10/01/2029 | | | 200,000 | | | 200,091 |

Northfield Independent School District No 659, 5.00%, 02/01/2025 | | | 230,000 | | | 230,339 |

Otsego Economic Development Authority, 4.00%, 02/01/2044 | | | 350,000 | | | 336,597 |

Owatonna Independent School District No 761/MN, 4.00%, 02/01/2028 | | | 150,000 | | | 154,241 |

Pine City Independent School District No 578, 2.00%, 04/01/2032 | | | 200,000 | | | 173,837 |

Princeton Public Utilities Commission, 5.00%, 04/01/2031 | | | 100,000 | | | 108,271 |

Redwood Area Schools Independent School District No 2897, 4.00%, 02/01/2039 | | | 360,000 | | | 364,452 |

Robbinsdale Independent School District No 281, 5.00%, 02/01/2034 | | | 250,000 | | | 276,411 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Minnesota Municipal Bond ETF

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

MUNICIPAL BONDS - (Continued)

|

Minnesota - (Continued)

|

Rochester Independent School District No 535

| | | | | | |

4.00%, 02/01/2031 | | | $200,000 | | | $204,838 |

2.50%, 02/01/2039 | | | 250,000 | | | 196,791 |

Rocori Area Schools Independent School District No 750, 4.00%, 02/01/2038 | | | 300,000 | | | 302,711 |

St Cloud Housing & Redevelopment Authority

| | | | | | |

2.00%, 02/01/2031 | | | 130,000 | | | 116,519 |

2.00%, 02/01/2033 | | | 160,000 | | | 136,745 |

St Cloud Independent School District No 742/MN, 5.00%, 02/01/2041 | | | 225,000 | | | 238,702 |

St Francis Independent School District No 15, 4.00%, 02/01/2036 | | | 150,000 | | | 156,135 |

St Louis Park Independent School District No 283, 5.00%, 04/01/2032 | | | 150,000 | | | 164,295 |

St Paul Independent School District No 625

| | | | | | |

3.00%, 02/01/2033 | | | 200,000 | | | 195,107 |

2.25%, 02/01/2035 | | | 100,000 | | | 83,712 |

5.00%, 02/01/2042 | | | 200,000 | | | 219,898 |

State of Minnesota

| | | | | | |

5.00%, 08/01/2025 | | | 310,000 | | | 313,527 |

5.00%, 08/01/2025 | | | 180,000 | | | 182,048 |

5.00%, 10/01/2025 | | | 425,000 | | | 431,282 |

5.00%, 08/01/2026 | | | 250,000 | | | 258,203 |

5.00%, 08/01/2028 | | | 155,000 | | | 166,427 |

5.00%, 08/01/2034 | | | 250,000 | | | 266,106 |

5.00%, 08/01/2035 | | | 185,000 | | | 202,809 |

4.00%, 08/01/2037 | | | 150,000 | | | 156,466 |

5.00%, 08/01/2043 | | | 400,000 | | | 442,156 |

5.00%, 08/01/2044 | | | 200,000 | | | 222,070 |

State of Minnesota Department of Iron Range Resources & Rehabilitation,

5.00%, 10/01/2035 | | | 220,000 | | | 249,697 |

Stillwater Independent School District No 834, 5.00%, 02/01/2040 | | | 250,000 | | | 272,083 |

Truman Independent School District No 458, 4.00%, 02/01/2044 | | | 300,000 | | | 297,313 |

University of Minnesota

| | | | | | |

5.00%, 10/01/2026 | | | 220,000 | | | 227,967 |

5.00%, 04/01/2033 | | | 350,000 | | | 356,836 |

5.00%, 04/01/2040 | | | 150,000 | | | 158,570 |

Waconia Independent School District No 110, 3.00%, 02/01/2028 | | | 100,000 | | | 98,160 |

Western Minnesota Municipal Power Agency, 5.00%, 01/01/2025 | | | 120,000 | | | 120,000 |

Westonka Independent School District No 277, 4.00%, 02/01/2041 | | | 100,000 | | | 100,323 |

Zumbro Education District

| | | | | | |

4.00%, 02/01/2034 | | | 125,000 | | | 119,856 |

4.00%, 02/01/2038 | | | 275,000 | | | 254,056 |

TOTAL MUNICIPAL BONDS

(Cost $23,954,658) | | | | | | 23,003,582 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

Mairs & Power Minnesota Municipal Bond ETF

Schedule of Investments

December 31, 2024(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 0.1%

| | | | | | |

Money Market Funds - 0.1%

| | | | | | |

First American Government Obligations Fund - Class X, 4.41%(c) | | | 25,827 | | | $25,827 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $25,827) | | | | | | 25,827 |

TOTAL INVESTMENTS - 98.7%

(Cost $23,980,485) | | | | | | $23,029,409 |

Other Assets in Excess of Liabilities - 1.3% | | | | | | 310,376 |

TOTAL NET ASSETS - 100.0% | | | | | | $23,339,785 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| Coupon rate is variable or floats based on components including but not limited to reference rate and spread. These securities may not indicate a reference rate and/or spread in their description. The rate disclosed is as of December 31, 2024.

|

(b)

| Zero coupon bonds make no periodic interest payments.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of December 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

STATEMENTS OF ASSETS AND LIABILITIES

December 31, 2024

| | | | | | | | | | | | | |

ASSETS

| | | | | | | | | | | | |

Investments, at fair value (Note 2)*: | | | $ 5,477,598,720 | | | $751,857,996 | | | $311,568,934 | | | $23,029,409 |

Receivable for Fund shares sold | | | 463,179 | | | 34,225 | | | 136,977 | | | — |

Receivable for securities sold | | | — | | | 658,986 | | | — | | | — |

Dividends and interest receivable | | | 4,795,917 | | | 3,904,002 | | | 68,894 | | | 309,659 |

Receivable from Adviser | | | — | | | — | | | — | | | 717 |

Prepaid expenses and other assets | | | 33,005 | | | 18,418 | | | 12,686 | | | — |

| | | 5,482,890,821 | | | 756,473,627 | | | 311,787,491 | | | 23,339,785 |

LIABILITIES

| | | | | | | | | | | | |

Payable for Fund shares redeemed | | | 2,286,363 | | | 796,725 | | | 415,150 | | | — |

Payable for securities purchased | | | — | | | 1,123,440 | | | — | | | — |

Payable to related parties (Note 6) | | | 437,687 | | | 70,568 | | | 31,280 | | | — |

Payable to ReFlow (Note 9) | | | 45,006 | | | 8,492 | | | 3,299 | | | — |

Accrued investment management fees (Note 4) | | | 2,556,928 | | | 381,068 | | | 214,176 | | | — |

Other accrued fees | | | 130,554 | | | 28,572 | | | 16,500 | | | — |

| | | 5,456,538 | | | 2,408,865 | | | 680,405 | | | — |

NET ASSETS | | | $ 5,477,434,283 | | | $754,064,762 | | | $311,107,086 | | | $23,339,785 |

Net Assets Consist of

| | | | | | | | | | | | |

Paid-in capital | | | $2,302,236,898 | | | $547,178,482 | | | $223,622,602 | | | $1,060 |

Additional paid-in capital | | | — | | | — | | | — | | | 25,720,691 |

Total distributable earnings/(accumulated loss) | | | 3,175,197,385 | | | 206,886,280 | | | 87,484,484 | | | (2,381,966) |

Total net assets | | | $ 5,477,434,283 | | | $754,064,762 | | | $311,107,086 | | | $23,339,785 |

Fund shares, par value | | | $ 0.001 | | | $ 0.001 | | | $ 0.001 | | | $ 0.001 |

Authorized | | | unlimited | | | unlimited | | | unlimited | | | unlimited |

Fund shares issued and outstanding | | | 32,287,662 | | | 6,906,169 | | | 10,156,581 | | | 1,060,000 |

Net asset value per share | | | $169.64 | | | $109.19 | | | $30.63 | | | $22.02 |

* Cost of investments | | | $2,361,575,902 | | | $544,923,422 | | | $228,892,958 | | | $23,980,485 |

| | | | | | | | | | | | | |

See accompanying Notes to Financial Statements.

TABLE OF CONTENTS

STATEMENTS OF OPERATIONS

December 31, 2024

| | | | | | | | | | | | | |

INVESTMENT INCOME

| | | | | | | | | | | | |

Income:

| | | | | | | | | | | | |

Dividends* | | | $80,805,356 | | | $8,194,304 | | | $3,204,570 | | | $— |

Interest income | | | 676,135 | | | 12,795,176 | | | 35,449 | | | 585,252 |

Total income | | | 81,481,491 | | | 20,989,480 | | | 3,240,019 | | | 585,252 |

Expenses:

| | | | | | | | | | | | |

Investment management fees (Note 4) | | | 29,897,401 | | | 4,645,829 | | | 2,555,596 | | | 49,999 |

Transfer agent fees (Note 6) | | | 1,808,179 | | | 319,112 | | | 167,458 | | | — |

Fund administration fees (Note 6) | | | 902,299 | | | 142,604 | | | 65,927 | | | — |