UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10401

Trust for Professional Managers

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, Wl 53202

(Address of principal executive offices) (Zip code)

Jay S. Fitton

U.S. Bancorp Fund Services, LLC

615 East Michigan Street

Milwaukee, Wl 53202

(Name and address of agent for service)

(513) 520-5925

Registrant's telephone number, including area code

Date of fiscal year end: May 31, 2024

Date of reporting period: November 30, 2023

Item 1. Reports to Stockholders.

(a)

| | | | | | | | | |

| | | | | | | | | |

| | SEMI-ANNUAL

REPORT | | | Jensen Quality

Value Fund | | Jensen Global

Quality Growth Fund | |

| | 11/30/2023 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | Class I Shares | Class Y Shares | Class J Shares | |

| | | | | | | | | |

Letter from The Investment Adviser

Dear Fellow Shareholders,

The Jensen Quality Value Fund (the “Fund”)—Class Y Shares—posted a return of 7.13% for the six-month period ended November 30, 2023, compared to a return of 8.15% for the Russell Midcap Total Return Index. Please see pages 13 through 15 of this report for complete standardized performance information for the Fund.

Market Perspective

After a challenging 2022, punctuated by inflationary pressure, rising interest rates and ongoing geopolitical risk, 2023 saw market performance improve, driven by easing recessionary fears, the potential end of interest rate hikes from the Federal Reserve and slowing in the rate of inflation. However, risks to the “soft landing” narrative remain, including geopolitical conflicts, slowing growth and rising unemployment in China, a financially stressed U.S. consumer, and concerns that interest rates may remain “higher for longer” to combat persistent inflation.

The Effect at Jensen

For the six months ended November 30, 2023, the Fund’s performance relative to the Russell Midcap Total Return Index was aided by overweight positions in the Industrials sector; underweights in the Utilities, Real Estate and Communication Services sectors; and specific companies in the Information Technology, Health Care, Consumer Discretionary and Materials sectors. Performance was hindered by overweight positions in the Consumer Staples and Health Care sectors, underweights in the Financials and Energy sectors, and specific companies in the Consumer Staples sector.

During the period, the strategy continued its high allocation to quality companies as defined by the S&P Earnings and Dividend Quality Rankings. The Fund’s allocation to the highest-quality companies, those rated A+, A and A-, averaged 48% of portfolio assets compared to 23% of the Russell Midcap Total Return Index. This significant overweight to quality was modestly supportive of the Fund’s relative returns during the period. While low-quality businesses can outperform in some periods, we believe that over the full market cycle, investors in higher-quality businesses have the potential to be rewarded with better returns and lower volatility.

The top contributor to Fund performance for the six-month period was Lennox International (LII), a designer and manufacturer of heating, ventilation and air conditioning equipment. During the period, Lennox reported solid revenue and earnings growth that exceeded the expectations of many investors. Lennox was selected for the Fund because of its compelling valuation at the time of purchase and its positive fundamental attributes, including strong free cash flow production, healthy balance sheet, well-known brands, attractive long-term growth drivers and a solid market position.

Other notable companies that contributed positively to portfolio performance are: Broadridge Financial Solutions (BR), a provider of investor communications and trading services for the financial industry; Williams-Sonoma (WSM), a specialty retailer of home products including the Pottery Barn brand; United Rentals (URI), the largest tool and equipment rental company in the

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 1 |

United States; and Laboratory Corporation of America (LH), a provider of medical laboratory services and diagnostic testing.

The largest negative contributor to Fund performance during the period was ResMed (RMD), a medical device company focused on treatments for respiratory disorders. During the period, ResMed reported strong sales growth, but relatively weak profit margins due to rising input costs. Additionally, investors expressed concern that new GLP-1 diet drugs may become a substitute for ResMed’s products. ResMed was originally selected for the Fund due to its attractive valuation at the time of purchase and its compelling fundamental attributes, which include its strong long-term growth drivers, leading market position, good balance sheet and recurring revenue business model.

Other notable holdings that weighed on relative performance included: General Mills (GIS), a packaged foods company; Bio-Techne (TECH), a provider of life sciences reagents and diagnostics tools; Kellanova (K), the packaged foods company formerly known as Kellogg; and Campbell Soup (CPB), also a packaged foods company. In general, food company stocks underperformed during the period due to slow revenue growth rates and high commodity prices, which pressured profit margins.

Fund Additions and Eliminations

During the six months ended November 30, 2023, the investment team continued to purchase the shares of companies we considered undervalued and sell the shares of companies we believed to be overvalued. The team added the following companies to the Fund’s portfolio:

| • | Booz Allen Hamilton (BAH) is a technology and management consulting company providing services to governments, corporations and non-profits. We believe the company’s skilled workforce, technical know-how and long-term client relationships make it the vendor of choice for premier government and corporate contracts. |

| • | ULTA Beaty (ULTA) is a specialty retailer of beauty products, including cosmetics, haircare, perfumes and skincare products. We believe ULTA possesses a strong brand, unique and differentiated product offerings, a robust omnichannel distribution model, and a strong market position as the leading beauty destination in the United States. |

| • | Waters Corporation (WAT) is a provider of scientific measurement devices, including liquid chromatography and mass spectrometry equipment. We believe the company benefits from a large installed base of instruments, technology leadership, vertically integrated production and a diversified customer base. |

During the six-month period, the investment team also sold the following companies in order to upgrade the fundamental quality of the Fund’s portfolio: Hasbro (HAS), a toy and games company, and ResMed (RMD), as described previously. As of November 30, 2023, the Fund held 39 companies.

| | | |

| 2 | Jensen Quality Value Fund | Semi-Annual Report |

The Jensen Outlook

As we look forward to 2024, we maintain a more cautious outlook for market returns in the coming months. Returns in the overall market in 2023 have been better than 2022 but we are mindful that the economic challenges that have been building over the last couple of years are still very much present today. While there are some signs of improvement, particularly with softening inflation from the generationally high levels reached in the middle of 2022, overall inflation remains above long-term targets of the U.S. Federal Reserve. The Federal Reserve has paused on its path of increasing interest rates—which was seen as a positive sign by many investors. This will, however, keep interest costs at higher levels than in the past, reducing the cash available for more productive uses for highly leveraged businesses. The full effect of higher interest rates has likely not fully impacted the economy, and this may remain a substantial headwind for many companies when older debts are refinanced at higher rates. There also remain increased tensions that threaten the geopolitical status quo of the last 40 years.

In addition to, or perhaps because of, these factors, we note that the business performance of companies and recent market return patterns could influence the outlook for 2024, and reverse or at least pause the “risk-on” character of 2023. We would also note that the threat of an economic recession in the U.S. has not disappeared. The U.S. Treasury yield curve has been inverted since early July 2022 with the yield on two-year Treasury bonds exceeding the yield on 10-year Treasury bonds. Such occurrences are relatively rare and have accurately predicted the 10 most recent economic recessions. While the economy currently appears to be weathering the threat of a recession, there is still much debate about whether one will occur.

In our view, there are many opportunities for higher-quality, more resilient businesses to garner favor from investors looking for lower volatility in the face of the issues discussed here. We continue to have confidence in the high-quality businesses owned in the Fund because of our focus that favors characteristics such as strong and resilient business models, durable competitive advantages, pricing power, steady operating margins, and strong free cash flow generation that is consistently reinvested into future growth opportunities, rewarding shareholders in the shorter term via growing dividends and stock buybacks. Likewise, our disciplined approach to valuation, which utilizes our deep research to construct discounted cash flow models reflecting the opportunities (and threats) to the companies in which we invest, has provided us confidence to invest in these sound businesses.

While the economic uncertainty and the corresponding volatility of market returns have been worrying for many investors over the last year, the Jensen Investment Team remains convinced that the strategy and process guiding our management of the Fund is sound. Our goal remains the ownership of a portfolio of companies positioned to accrue business value. We seek to participate in this value creation as investors via the long-term ownership of fairly priced, high-quality stocks. We believe the attributes noted above allow quality companies to generate business returns consistently above their cost of capital, ultimately resulting in shareholder value creation.

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 3 |

Lastly, we remain steadfast in our belief that paying attention to company fundamentals can help investors manage risk. This should offer a measure of capital protection in more volatile or generally lower-market-return environments and provide the opportunity for long-term capital appreciation.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our partners and fellow shareholders. Thank you.

We invite you to seek additional information about the Jensen Quality Value Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Quality Value Investment Team

| | | |

| 4 | Jensen Quality Value Fund | Semi-Annual Report |

This discussion and analysis of the Fund is as of November 30, 2023, and is subject to change; any forecasts made cannot be guaranteed and should not be considered investment advice. Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security. For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Mutual fund investing involves risk, and principal loss is possible. The Fund invests in mid- and smaller capitalization companies, which involve additional risks such as limited liquidity and greater volatility. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. The Russell Midcap Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000 Index. S&P Earnings and Dividend Quality Rankings: S&P ranks index constituents from A+ through C based on trailing earnings and dividend consistency. We consider stocks rated A- and above as high quality and those rated B+ and below as low quality. Risk-on risk-off is an investment paradigm where asset prices are dictated by changes in investors’ risk tolerance and investment choices. Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures. Earnings Growth: The annual rate of growth of earnings typically measured as Earnings Per Share Growth. Must be preceded or accompanied by a prospectus for the Jensen Quality Value Fund. The Jensen Quality Value Fund is distributed by Quasar Distributors, LLC. |

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 5 |

Letter from the Investment Adviser

Dear Fellow Shareholders,

The Jensen Global Quality Growth Fund (the “Fund”)—Class Y Shares—returned 4.22% for the six-month period ended November 30, 2023, compared to 8.28% for the MSCI All Country World Index Net (USD) over this period. Please see pages 17 through 19 of this report for complete standardized performance information for the Fund.

Market Perspective

After a robust start to calendar 2023, when investors focused on the anticipation of declining inflation and looked through concerns of higher interest rates impacting economies around the world, global stock markets pivoted somewhat in response to the impact of higher inflation and rising commodity and oil prices in the six-month period ended November 30, 2023.

Nonetheless, despite the challenges facing companies and their investors, including ongoing inflationary pressures, generationally high interest rates, continuing hawkish commentary from central banks in developed economies and rising geopolitical risk, overall global stock market returns remained positive during the period and for the entire year.

The market sentiment was fueled by strong performance from energy companies as oil prices were elevated for much of the period. Additionally, information technology companies continued to rebound from the substantial declines in their share prices last year—a trend that also benefited the Fund. Offsetting this performance was the momentum-driven impact from a concentrated number of U.S.-domestic companies in which the Fund has no exposure, including Nvidia (NVDA) in the IT sector, Meta Platforms (META) in the Communication Services sector, and Tesla (TSLA) and Amazon (AMZN) in the Consumer Discretionary sector. Neither Nvidia, Tesla nor Amazon qualify for inclusion in the Jensen investable universe due to a pattern of inconsistent returns on equity. While such concentrations were noticeably lower in the global benchmark compared to domestic indexes, the impact was still a meaningful headwind to the Fund’s relative performance. At the same time, the Fund’s consumer-facing companies were less favored during the period as inflation, economic slowing and consumer sentiment weighed on global spending on goods.

The Fund’s performance was also held back by its focus on higher-quality stocks during the period, as investment performance from lower-quality stocks (B+ and lower, as measured by the S&P Earnings and Dividend Quality Rankings) was stronger than that of higher-quality stocks (A+, A and A-, as measured by the S&P Earnings and Dividend Quality Rankings).

The Effect at Jensen

From a sector perspective, stock selection contributed positively to the Fund’s relative performance in the Industrials and Information Technology sectors, while detracting from returns in the Consumer Discretionary and Consumer Staples sectors. A relative overweight allocation to the Information Technology sector contributed positively to the Fund’s relative performance, as did a lack of exposure to the Utilities and Real Estate sectors, while underweight allocations detracted from relative returns in the Energy and Financials sectors. Typically, very few companies in the Utilities, Real Estate, Energy and Financials sectors qualify for investment in the Fund due to

| | | |

| 6 | Jensen Global Quality Growth Fund | Semi-Annual Report |

our strict requirement for portfolio companies to deliver high and prolonged profitability, as measured by Return on Equity (ROE). Consequently, our lack of exposure to sectors that do not deliver consistently high business returns will periodically add or detract from the Fund’s relative performance.

Leading contributors to performance during the period were Microsoft (MSFT) and Intuit (INTU). Microsoft benefited from strong performance in its core cloud services in Enterprise, namely Azure services and Office 365. Offsetting this was a slowdown in PC sales and gaming revenue due to challenging comparisons from the prior year that saw robust performance arising from the COVID pandemic. More recently, the market reacted positively to the company’s announcement of its $10 billion investment in OpenAI and the subsequent inclusion of OpenAI’s ChatGPT into its search results. ChatGPT represents a key advancement in generative Artificial Intelligence (“AI”), enabling Microsoft to jump ahead of the current AI leader, Google, which stumbled in its attempt to respond too quickly to Microsoft’s initiative. (Alphabet Inc., Google’s parent and a Fund portfolio holding, has since recovered.) From our perspective, overall enthusiasm for the influence of the AI industry has driven much of the momentum during the last six months.

Intuit is a software company specializing in financial tools and cloud services with products including TurboTax and QuickBooks. The company’s stock experienced a boost as investors responded positively to the announcement that it will integrate AI into its products and services. Furthermore, Intuit’s well-received investor day at the close of the third calendar quarter further reinforced its standing in the eyes of the investment community.

Significant detractors from the Fund’s performance for the period included Diageo (DGE.L) and AstraZeneca (AZN.L). Diageo is a London-based multinational alcoholic beverage company, with a portfolio of a number of the world’s leading spirits brands. The company’s stock has been hampered recently by a material slowing of its business in Latin America due to a worsening regional economic environment. This was in addition to concerns about slowing growth and consumer trade down away from the premium alcohol segment which represents much of Diageo’s competitive strength. As a result, the company reduced its guidance for the next year, resulting in a material stock pullback. We maintain our confidence in the long-term prospects for the company and view recent results as a potential bottoming after exceptional sales that occurred during the pandemic.

AstraZeneca is a multinational biopharmaceutical company with a diverse portfolio of oncology, cardiovascular and rare disease treatments. We believe weakness in AZN shares during the period was attributable to a growth slowdown and potential new competition for Tagrisso, the company’s second-largest drug franchise, and newly approved competition for Ultomiris, a key drug in the Rare Disease portfolio. Longer term, our investment thesis is based on AstraZeneca’s financial strength and its global scale in terms of drug development, regulatory expertise and commercialization. We believe these factors will allow the company to leverage a deep drug pipeline and maintain attractive growth rates into the future. Consequently, the company remains one of the top holdings in the Fund.

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 7 |

We are constantly evaluating all the businesses owned by the Fund as well as other investment candidates to determine whether better opportunities exist in our investable universe. Such determinations ultimately reflect a combination of fundamental considerations, valuation opportunities and overall risk profiles of our companies.

Fund Additions and Eliminations

During the period, the Jensen Investment Team enacted the purchase of three new holdings and sold two holdings. We initiated new positions in KLA (KLAC), ASML (ASML) and Waters Corporation (WAT) due to solid business fundamentals and attractive valuations for those companies. We sold our positions in KONE (KNEBV) and Johnson & Johnson (JNJ) as part of ongoing efforts to upgrade the overall quality of the Fund. A brief synopsis of the changes follows.

KLA Corporation (“KLA”) is, in our assessment, one of the most essential semiconductor production equipment (“SPE”) manufacturers worldwide. The company makes highly differentiated machines needed in the process of manufacturing computer chips. More specifically, KLA is the leader in process control equipment, which ensures that crucial chip production steps are performed with the lowest possible error rate. KLA not only dominates the process control market with more than a 50% market share, but it has also gained market share over time; the process control segment now accounts for up to 90% of the company’s revenues.

The SPE industry benefits from strong secular demand drivers. Computer chips are found in many more devices beyond traditional personal computers, such as mobile phones, data centers, cars, gaming consoles and AI applications. The growing demand for more powerful computing also drives demand for more powerful and complex computer chips. Higher technological complexity opens the possibility for increased errors in chip production, necessitating more process control equipment, which benefited KLA.

As the global semiconductor process control leader, KLA is, in our opinion, protected by a wide economic moat. KLA’s long-tenured company leadership has consistently opted to return capital to investors through dividends and share buybacks. Also, the business of servicing its installed machines, which accounts for more than 20% of revenues, has been the role model for the industry and, we believe, will likely continue to drive KLA’s growth and profitability.

KLA possesses many of the qualitative business aspects that we prize at Jensen. These include high barriers to entry due to decades of accumulated knowledge, larger-than-peers’ R&D budgets in its chosen niche areas of focus, patents, and an established ecosystem of partner companies. Its competitive position is further cemented by high switching costs due to the risk of interrupting well-running chip production processes, the highly customized nature of the tools provided and scale advantages.

Given KLA’s attractive fundamental business characteristics, its long-term history of shareholder value creation, and our valuation work that aims to identify long-term attractive investment opportunities, we are pleased to have added the company to the Fund.

| | | |

| 8 | Jensen Global Quality Growth Fund | Semi-Annual Report |

ASML Holding NV (“ASML”) is a maker of critical equipment and provider of services that enable the manufacturing of leading-edge semiconductors. The company is the undisputed leader in Extreme Ultraviolet (“EUV”) lithography tools, which are a critical technology for making the world’s most advanced computer chips. Demand for advanced computer chips is supported by strong secular growth drivers, including the “digitalization of everything,” demand for consumer goods (such as the latest iPhone) and AI applications. ASML is in a unique position as one of the few listed monopolies with secular growth drivers—it has a 100% market share in EUV lithography tools and is in the process of finalizing its next technology, EUV High-NA, while competitors have failed to master EUV technology.

ASML benefits from decades of accumulated knowledge and highly-focused R&D spending—it consistently has one of the largest R&D budgets among semi equipment makers. In addition, three decades of proven innovation, a well-developed ecosystem of key technology partners, high switching costs and the lack of credible alternatives to its products further solidify its position as one of the most moated quality growth businesses we know. Given its products are without substitute for making the world’s most advanced computer chips, ASML’s tools are vital for chipmakers that want to compete at the leading edge. Price is not a key consideration for the chip makers, as the benefits of having timely access to the best tools outweigh marginal cost considerations. We expect ASML to continue to grow and create business value due to market growth, strong pricing power and an increase in the importance of its high-margin business servicing its advanced machines.

Waters Corporation (“Waters”) is an analytical laboratory instrument and software company headquartered in Milford, Massachusetts. Its scientific tools are used for liquid chromatography, mass spectrometry and thermal analysis. The company serves a variety of end markets, but most of its revenue is derived from new equipment, disposables and service contract sales to life sciences customers for drug discovery, drug development and manufacturing quality control. Waters benefits from a large and stable installed base of equipment, particularly in its liquid chromatography business. The company’s tools are an integral part of the quality assurance process for pharmaceutical drug manufacturing, and it is common for Waters’ products to be used in all phases of a drug’s lifecycle including discovery, development and quality control. We expect Waters to grow and create business value due to end market growth, new product development, and improved attachment rates for consumables and service contracts.

First added to the Fund in December 2020, Kone Oyj (“KONE”), based in Helsinki, Finland, is a leading global manufacturer and maintenance services provider for elevators and escalators. KONE’s competitive advantages include its global scale and a leading market position in China. However, our investment thesis and outlook for KONE became impaired by both a macroeconomic slowdown in the China property market and market share erosion in an increasingly competitive Chinese new equipment market. Given these growth challenges and a decline in the company’s operating performance, we exited the Fund’s stake in KONE in favor of more compelling investment opportunities.

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 9 |

First added to the Fund upon inception of the Fund in April 2020, Johnson & Johnson (“JNJ”) is a global healthcare company focused on medical devices and pharmaceuticals. We chose to sell the stock due to a combination of elevated price valuation and better opportunities with our global investment universe. We maintain a positive view on the company’s competitive advantages including global scale, entrenched relationships with healthcare providers and intellectual property. However, we believe that the business model has recently become less attractive due to the distraction from talcum powder litigation and higher reliance on successful execution of the pharmaceutical segment following the sale of the consumer business. We intend to closely monitor JNJ and may consider reestablishing a position based on improvement in the company’s valuation, fundamentals and/or risk characteristics.

There were no other wholesale changes to the Fund, but the Investment Team remained active in adding to or trimming from existing positions to reflect Jensen’s convictions in the businesses and relative valuation opportunities within the context of the ongoing economic volatility.

The Jensen Outlook

The last two years have provided a roller coaster of returns as the sharp negative returns in calendar 2022 have been largely offset over the course of this year. Despite the positive momentum in 2023, we maintain a cautious outlook for near-term market returns as we head into the coming year.

The economic challenges that have been building in recent years are still very much present today. While there are some signs of improvement, particularly with softening inflation from the generationally high levels reached last year, overall inflation still remains higher than “normal” in much of the world. Likewise, earlier this year, the U.S. Federal Reserve paused its path of increasing interest rates—which was seen as a positive sign by many investors. Despite expectations that U.S. interest rates will be cut aggressively over the course of 2024, current indications indicate that any cuts will likely be limited to 1.00% or less. This will keep interest costs at higher levels relative to a few quarters ago and the impact on highly leveraged businesses will continue to be evidenced in stressed balance sheets and reduced cash flows that might otherwise be available for more productive uses. Elsewhere, other global central banks have not ruled out the potential for higher rates and any pause in their interest rates may not occur for some time. Thus, the effect of higher interest rates may not have fully impacted many global economies and may represent a substantial headwind to many companies’ financial performance. We are also mindful of increased tensions that challenge the geopolitical status quo of the last 40 years. Lastly, 2024 brings a U.S. presidential campaign and election that may well produce volatility in global stock markets.

We continue to have confidence in the high-quality businesses owned in the Fund that favors characteristics such as strong and resilient business models, durable competitive advantages, pricing power, steady operating margins and strong free cash flow generation that is consistently reinvested into future growth opportunities, rewarding shareholders in the shorter term via growing dividends and stock buybacks. Likewise, our disciplined approach to valuation, which utilizes our deep research to construct discounted cash flow models that reflect the opportunities for (and threats to) the companies in which we invest, has provided us confidence to invest in these sound businesses.

| | | |

| 10 | Jensen Global Quality Growth Fund | Semi-Annual Report |

The Jensen Global Investment Team remains confident in the strategy and process guiding our management of the Portfolio. Our goal remains the ownership of a portfolio of companies positioned to grow and accrue business value in a stable manner. We seek to participate in this value creation as investors via the long-term ownership of what we believe are appropriately priced, high-quality stocks. We believe the attributes noted above enable quality companies to generate business returns consistently above their cost of capital, ultimately resulting in shareholder value creation.

We remain steadfast in our belief that paying attention to company fundamentals can help investors manage risk. This should offer a measure of capital protection in more volatile or generally lower-market-return environments and provide the opportunity for long-term capital appreciation.

We are tremendously grateful for the ongoing support of our firm and investment strategies from our shareholders, partners and clients. Thank you.

We invite you to seek additional information about the Jensen Global Quality Growth Fund at www.jenseninvestment.com where additional content, including updated holdings and performance information, is available. We take our investment responsibilities seriously and appreciate the trust you have placed in us. As always, we welcome your feedback.

Sincerely,

The Jensen Global Quality Growth Investment Team

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 11 |

This discussion and analysis of the Fund is as of November 2023 and is subject to change, and any forecasts made cannot be guaranteed.

Past performance is no guarantee of future results. Fund holdings and sector weightings are subject to change and are not recommendations to buy or sell any security.

MSCI All Country World Index (MSCI ACWI): is a market capitalization weighted index designed to provide a broad measure of equity-market performance throughout the world. It is maintained by Morgan Stanley Capital International (MSCI) and is comprised of stocks from 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries.

S&P Earnings and Dividend Quality Rankings: S&P ranks index constituents from A+ through C based on trailing earnings and dividend consistency. We consider stocks rated A- and above as high quality and those rated B+ and below as low quality.

For more complete information regarding performance and holdings, please refer to the financial statements and schedule of investments headings of this report. Current and future portfolio holdings are subject to risk.

The Fund is nondiversified, meaning that it may concentrate its assets in fewer individual holdings than a diversified fund and is therefore more exposed to individual stock volatility than a diversified fund.

Return on Equity: Is equal to a company’s after-tax earnings (excluding non-recurring items) divided by its average stockholder equity for the year.

Free Cash Flow: Is equal to the after-tax net income of a company plus depreciation and amortization less capital expenditures.

For use only when preceded or accompanied by a current prospectus for the Fund.

The Jensen Global Quality Growth Fund is distributed by Quasar Distributors, LLC.

| | | |

| 12 | Jensen Quality Value Fund | Semi-Annual Report |

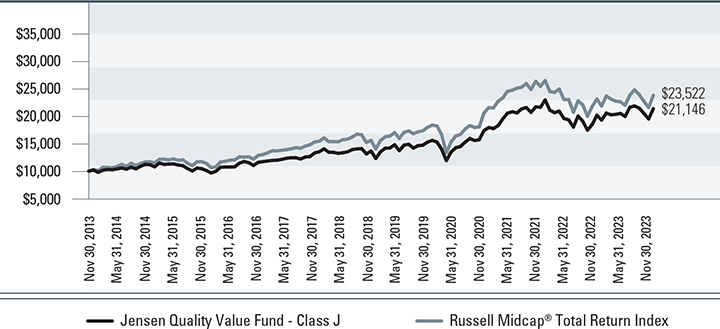

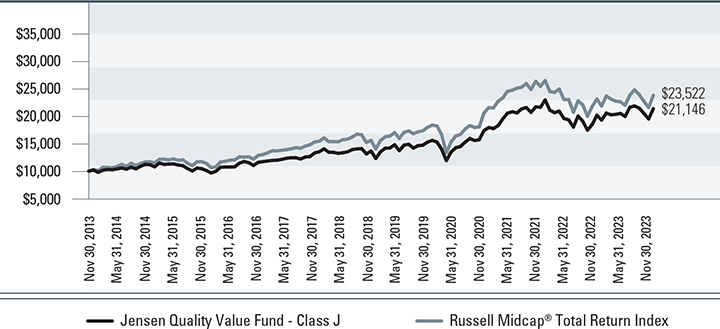

Jensen Quality Value Fund - Class J (Unaudited)

Total Returns vs. Russell Midcap® Total Return Index

Average Annual Total Returns –

For periods ended November 30, 2023 (Unaudited) | 1 year | 3 years | 5 years | 10 years | Since Inception

(3/31/2010) |

| Jensen Quality Value Fund - Class J | 5.91% | 7.05% | 9.26% | 7.78% | 9.35% |

| Russell Midcap® Total Return Index | 2.94% | 4.91% | 8.72% | 8.93% | 10.88% |

The Russell Midcap® Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000® Index.

The chart at the top of the page assumes an initial gross investment of $10,000 made on November 30, 2013. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 1.10%

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 13 |

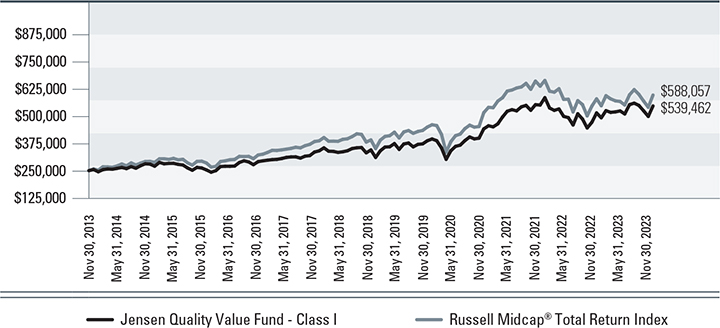

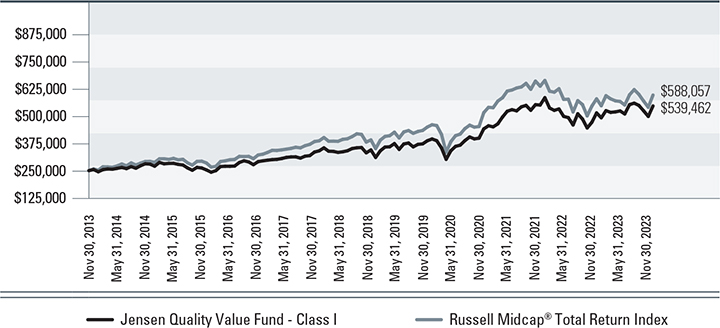

Jensen Quality Value Fund - Class I (Unaudited)

Total Returns vs. Russell Midcap® Total Return Index

Average Annual Total Returns –

For periods ended November 30, 2023 (Unaudited) | 1 year | 3 years | 5 years | 10 years | Since Inception

(3/31/2010) |

| Jensen Quality Value Fund - Class I | 6.16% | 7.29% | 9.52% | 7.99% | 9.56% |

| Russell Midcap® Total Return Index | 2.94% | 4.91% | 8.72% | 8.93% | 10.88% |

The Russell Midcap® Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000® Index.

The chart at the top of the page assumes an initial gross investment of $250,000 made on November 30, 2013. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 0.87%

| | | |

| 14 | Jensen Quality Value Fund | Semi-Annual Report |

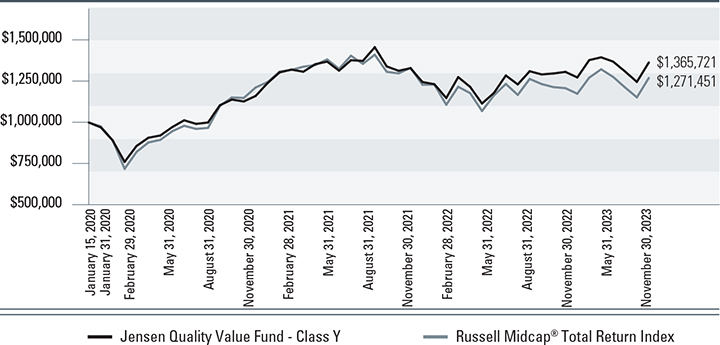

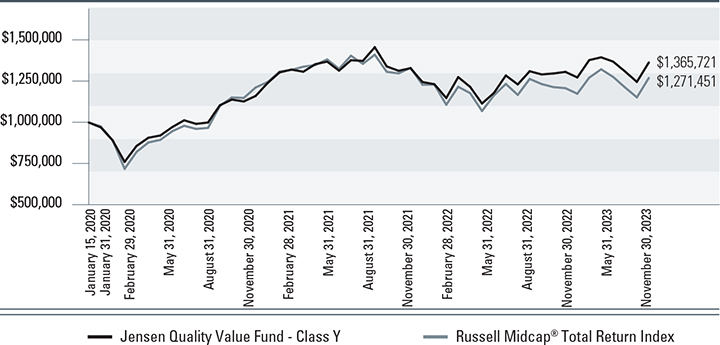

Jensen Quality Value Fund - Class Y (Unaudited)

Total Returns vs. Russell Midcap® Total Return Index

Average Annual Total Returns –

For periods ended November 30, 2023 (Unaudited) | 1 year | 3 year | Since Inception

(1/15/2020) |

| Jensen Quality Value Fund - Class Y | 6.13% | 7.30% | 8.37% |

| Russell Midcap® Total Return Index | 2.94% | 4.91% | 6.39% |

The Russell Midcap® Total Return Index is an unmanaged index, which measures the performance of the 800 smallest companies in the Russell 1000® Index.

The chart at the top of the page assumes an initial gross investment of $1,000,000 made on January 15, 2020, the inception date for Class Y shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 0.85%

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 15 |

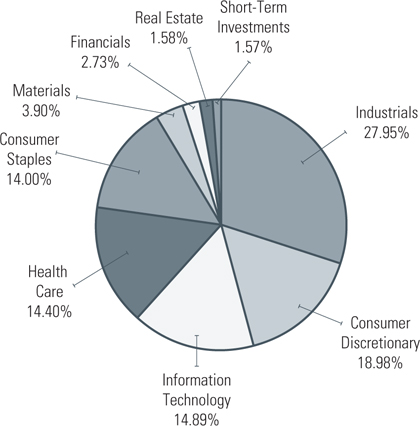

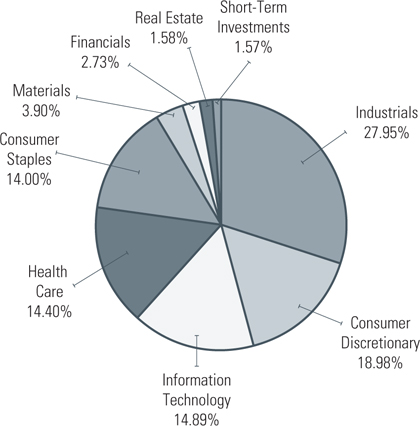

Jensen Quality Value Fund

Investments by Sector as of November 30, 2023

(As a Percentage of Total Investments) (Unaudited)

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services.

| | | |

| 16 | Jensen Quality Value Fund | Semi-Annual Report |

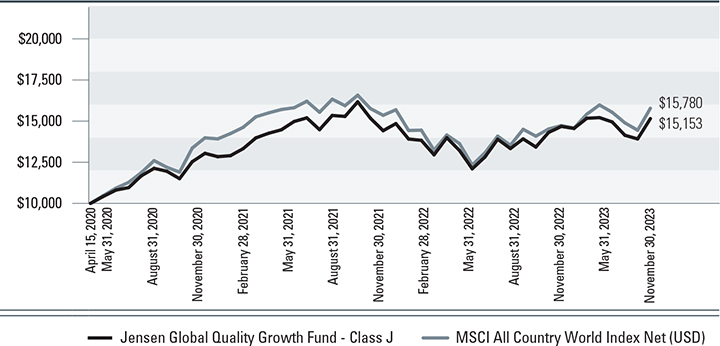

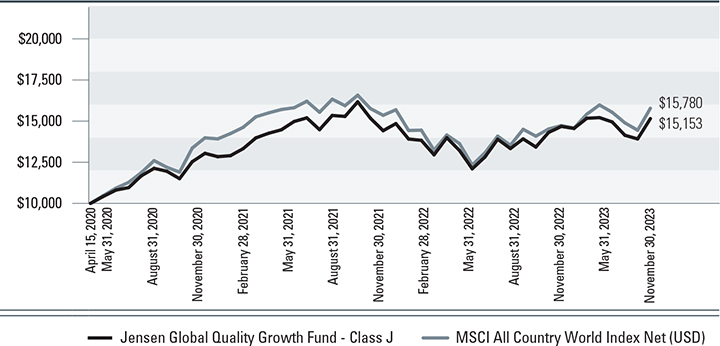

Jensen Global Quality Growth Fund - Class J (Unaudited)

Total Returns vs. MSCI All Country World Index Net (USD)

Average Annual Total Returns –

For periods ended November 30, 2023 (Unaudited) | 1 year | 3 year | Since Inception

(4/15/2020) |

| Jensen Global Quality Growth Fund - Class J | 9.01% | 6.53% | 12.14% |

| MSCI All Country World Index Net (USD) | 12.01% | 5.69% | 13.40% |

The MSCI All Country World Index Net (USD) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The chart at the top of the page assumes an initial gross investment of $10,000 made on April 15, 2020, the inception date for Class J shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 1.61%

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 17 |

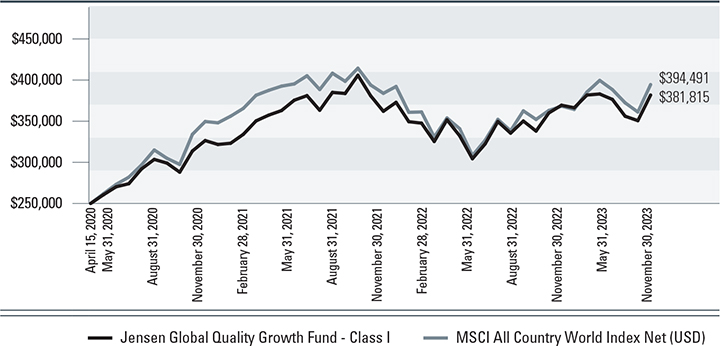

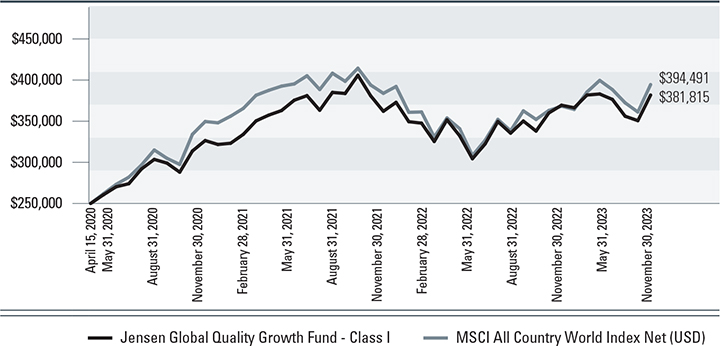

Jensen Global Quality Growth Fund - Class I (Unaudited)

Total Returns vs. MSCI All Country World Index Net (USD)

Average Annual Total Returns –

For periods ended November 30, 2023 (Unaudited) | 1 year | 3 year | Since Inception

(4/15/2020) |

| Jensen Global Quality Growth Fund - Class I | 9.23% | 6.76% | 12.38% |

| MSCI All Country World Index Net (USD) | 12.01% | 5.69% | 13.40% |

The MSCI All Country World Index Net (USD) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The chart at the top of the page assumes an initial gross investment of $250,000 made on April 15, 2020, the inception date for Class I shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 1.36%

| | | |

| 18 | Jensen Global Quality Growth Fund | Semi-Annual Report |

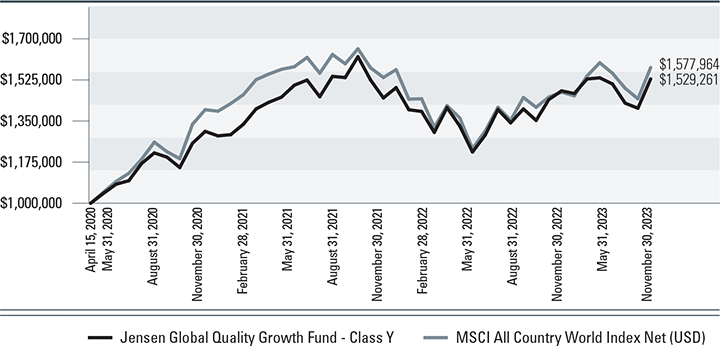

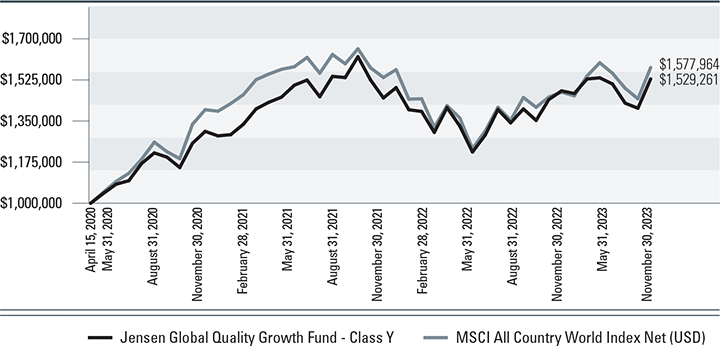

Jensen Global Quality Growth Fund - Class Y (Unaudited)

Total Returns vs. MSCI All Country World Index Net (USD)

Average Annual Total Returns –

For periods ended November 30, 2023 (Unaudited) | 1 year | 3 year | Since Inception

(4/15/2020) |

| Jensen Global Quality Growth Fund - Class Y | 9.32% | 6.80% | 12.42% |

| MSCI All Country World Index Net (USD) | 12.01% | 5.69% | 13.40% |

The MSCI All Country World Index Net (USD) (“MSCI ACWI”) is a free float-adjusted market capitalization weighted index that measures the equity performance of global developed and emerging markets. The MSCI ACWI total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The chart at the top of the page assumes an initial gross investment of $1,000,000 made on April 15, 2020, the inception date for Class Y shares. Returns shown include the reinvestment of all Fund distributions. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total returns would be reduced.

Performance data shown represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance shown. Performance data current to the most recent month-end may be obtained by calling 800-992-4144 or by visiting www.jenseninvestment.com.

Gross expense ratio: 1.36%

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 19 |

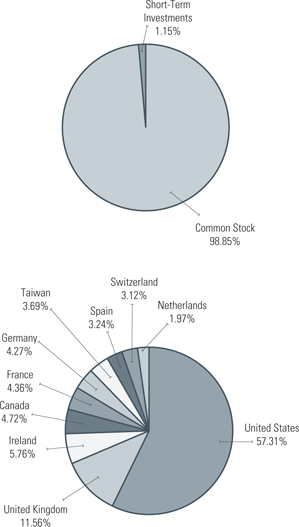

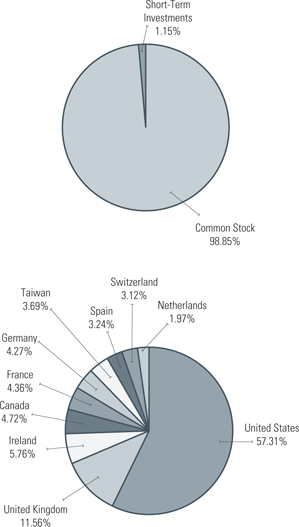

Jensen Global Quality Growth Fund

Allocation of Portfolio Holdings as of November 30, 2023

(As a Percentage of Total Investments) (Unaudited)

| | | |

| 20 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Statements of Assets & Liabilities

November 30, 2023 (Unaudited)

| Assets: | Jensen

Quality

Value Fund | Jensen

Global Quality

Growth Fund |

| Investments, at value (cost $155,435,368 and $39,353,922) | $178,370,547 | $46,812,122 |

| Income receivable | 276,286 | 78,200 |

| Receivable for capital stock issued | 148,645 | – |

| Other Assets | 32,676 | 27,496 |

| Total Assets | 178,828,154 | 46,917,818 |

| | | |

| Liabilities: | | |

| Payable for capital stock redeemed | 72,995 | – |

| Payable for 12b-1 fees - Class J | 9,345 | 2,158 |

| Payable to adviser | 79,069 | 13,434 |

| Payable to affiliates | 27,844 | 20,136 |

| Accrued expenses and other liabilities | 29,181 | 10,319 |

| Total Liabilities | 218,434 | 46,047 |

| NET ASSETS | $178,609,720 | $46,871,771 |

| | | |

| NET ASSETS CONSIST OF: | | |

| Capital stock | $158,940,123 | $40,142,244 |

| Total distributable earnings | 19,669,597 | 6,729,527 |

| Total Net Assets | $178,609,720 | $46,871,771 |

| | | |

| NET ASSETS CONSIST OF: | | |

| Class J Shares: | | |

| Net Assets | $28,849,588 | $2,203,130 |

| Shares of beneficial interest outstanding | 1,700,460 | 147,257 |

| Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | $16.97 | $14.96 |

| Class I Shares: | | |

| Net Assets | $89,977,340 | $2,333,622 |

| Shares of beneficial interest outstanding | 5,314,424 | 155,959 |

| Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | $16.93 | $14.96 |

| Class Y Shares: | | |

| Net Assets | $59,782,792 | $42,335,019 |

| Shares of beneficial interest outstanding | 3,538,969 | 2,827,924 |

| Net Asset Value, Offering Price and Redemption Price Per Share (unlimited number of shares authorized, $.001 par value) | $16.89 | $14.97 |

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 21 |

Jensen Quality Value Fund

Schedule of Investments

November 30, 2023 (Unaudited)

Common Stocks - 98.31%

| shares | Air Freight & Logistics - 0.77% | value |

| 11,380 | Expeditors International of Washington, Inc. | $1,369,469 |

| | | |

| shares | Automobile Components - 2.64% | value |

| 154,820 | Gentex Corp. | $4,708,076 |

| | | |

| shares | Building Products - 3.45% | value |

| 15,170 | Lennox International, Inc. | $6,169,032 |

| | | |

| shares | Capital Markets - 2.73% | value |

| 10,750 | FactSet Research Systems, Inc. | $4,874,695 |

| | | |

| shares | Commercial Services & Supplies - 3.87% | value |

| 137,810 | Copart, Inc. (a) | $6,920,818 |

| | | |

| shares | Communications Equipment - 2.18% | value |

| 22,750 | F5, Inc. (a) | $3,894,573 |

| | | |

| shares | Consumer Staples Distribution & Retail - 3.42% | value |

| 137,980 | Kroger Co. | $6,108,375 |

| | | |

| shares | Containers & Packaging - 3.89% | value |

| 80,820 | Crown Holdings, Inc. | $6,951,328 |

| | | |

| shares | Distributors - 4.65% | value |

| 41,040 | Genuine Parts Co. | $5,449,291 |

| 8,240 | Pool Corp. | $2,861,917 |

| | | $8,311,208 |

| | | |

| shares | Electronic Equipment, Instruments & Components - 4.64% | value |

| 48,530 | Amphenol Corp. - Class A | $4,415,744 |

| 28,540 | Keysight Technologies, Inc. | $3,878,301 |

| | | $8,294,045 |

The accompanying notes are an integral part of these financial statements.

| | | |

| 22 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Quality Value Fund

Schedule of Investments continued

November 30, 2023 (Unaudited)

| shares | Food Products - 7.54% | value |

| 101,670 | Campbell Soup Co. | $4,085,101 |

| 75,940 | General Mills, Inc. | $4,834,340 |

| 86,320 | Kellogg Co. | $4,535,253 |

| | | $13,454,694 |

| | | |

| shares | Health Care Providers & Services - 7.83% | value |

| 105,540 | Encompass Health Corp. | $6,878,042 |

| 32,710 | Laboratory Corp. of America Holdings | $7,095,126 |

| | | $13,973,168 |

| | | |

| shares | Household Products - 3.03% | value |

| 56,010 | Church & Dwight Co., Inc. | $5,412,246 |

| | | |

| shares | Life Sciences Tools & Services - 6.56% | value |

| 52,060 | Bio-Techne Corp. | $3,274,574 |

| 25,530 | Charles River Laboratories International, Inc. (a) | $5,031,452 |

| 12,170 | Waters Corp. (a) | $3,415,024 |

| | | $11,721,050 |

| | | |

| shares | Machinery - 3.23% | value |

| 42,060 | Donaldson Co., Inc. | $2,558,930 |

| 38,740 | Toro Co. | $3,215,420 |

| | | $5,774,350 |

| | | |

| shares | Professional Services - 14.62% | value |

| 16,310 | Booz Allen Hamilton Holding Corp. | $2,040,870 |

| 35,129 | Broadridge Financial Solutions, Inc. | $6,808,703 |

| 34,240 | Equifax, Inc. | $7,454,389 |

| 150,910 | Genpact Ltd. | $5,124,904 |

| 30,330 | Maximus, Inc. | $2,532,252 |

| 8,850 | Verisk Analytics, Inc. | $2,136,656 |

| | | $26,097,774 |

| | | |

| shares | Real Estate Management & Development - 1.58% | value |

| 35,770 | CBRE Group, Inc. - Class A (a) | $2,824,399 |

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 23 |

Jensen Quality Value Fund

Schedule of Investments continued

November 30, 2023 (Unaudited)

| shares | Semiconductors & Semiconductor Equipment - 3.40% | value |

| 72,840 | Microchip Technology, Inc. | $6,077,770 |

| | | |

| shares | Software - 4.64% | value |

| 10,730 | Cadence Design Systems, Inc. (a) | $2,932,187 |

| 24,040 | Manhattan Associates, Inc. (a) | $5,362,122 |

| | | $8,294,309 |

| | | |

| shares | Specialty Retail - 9.43% | value |

| 67,290 | Best Buy Co., Inc. | $4,773,553 |

| 26,200 | Tractor Supply Co. | $5,318,862 |

| 7,710 | Ulta Beauty, Inc. (a) | $3,284,383 |

| 18,360 | Williams-Sonoma, Inc. | $3,443,234 |

| | | $16,820,032 |

| | | |

| shares | Textiles, Apparel & Luxury Goods - 2.24% | value |

| 258,640 | Levi Strauss & Co. - Class A | $4,006,334 |

| | | |

| shares | Trading Companies & Distributors - 1.97% | value |

| 7,390 | United Rentals, Inc. | $3,517,788 |

| | | |

| Total Common Stocks | value |

| (Cost $152,640,354) | $175,575,533 |

| | | |

| Money Market Funds - 1.56% | |

| shares | | value |

| 2,795,014 | First American Treasury Obligations Fund - X Class, 5.265% (b) | $2,795,014 |

| | | |

| Total Money Market Funds | value |

| (Cost $2,795,014) | $2,795,014 |

The accompanying notes are an integral part of these financial statements.

| | | |

| 24 | Jensen Quality Value Fund | Semi-Annual Report |

Jensen Quality Value Fund

Schedule of Investments continued

November 30, 2023 (Unaudited)

| Total Investments - 99.87% | value |

| (Cost $155,435,368) | $178,370,547 |

| Other Assets in Excess of Liabilities - 0.13% | $239,173 |

| TOTAL NET ASSETS - 100.00% | $178,609,720 |

Percentages are stated as a percent of net assets.

(a) Non-income producing security.

(b) The rate shown represents the seven-day yield as of November 30, 2023.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. (“MSCI”) and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 25 |

Jensen Global Quality Growth Fund

Schedule of Investments

November 30, 2023 (Unaudited)

Common Stocks - 98.72%

| shares | Canada - 4.71% | value |

| 8,970 | Alimentation Couche-Tard, Inc. | $511,646 |

| 14,630 | Canadian National Railway Co. | $1,697,660 |

| | | $2,209,306 |

| | | |

| shares | France - 4.35% | value |

| 22,308 | Dassault Systemes SE | $1,046,253 |

| 480 | Hermes International SCA | $994,802 |

| | | $2,041,055 |

| | | |

| shares | Germany - 4.26% | value |

| 12,560 | SAP SE | $1,997,917 |

| | | |

| shares | Ireland - 5.75% | value |

| 8,090 | Accenture PLC - Class A | $2,695,103 |

| | | |

| shares | Netherlands - 1.96% | value |

| 1,350 | ASML Holding NV | $920,056 |

| | | |

| shares | Spain - 3.23% | value |

| 22,080 | Amadeus IT Group SA | $1,515,933 |

| | | |

| shares | Switzerland - 3.12% | value |

| 12,840 | Nestle SA | $1,461,047 |

| | | |

| shares | Taiwan, Province Of China - 3.69% | value |

| 17,770 | Taiwan Semiconductor Manufacturing Co. Ltd.-ADR | $1,729,199 |

| | | |

| shares | United Kingdom - 11.56% | value |

| 16,200 | AstraZeneca PLC | $2,085,045 |

| 72,520 | Compass Group PLC | $1,835,949 |

| 42,610 | Diageo PLC | $1,491,409 |

| | | $5,412,403 |

The accompanying notes are an integral part of these financial statements.

| | | |

| 26 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Jensen Global Quality Growth Fund

Schedule of Investments continued

November 30, 2023 (Unaudited)

| shares | United States - 56.09% | value |

| 14,410 | Alphabet, Inc. - Class A (a) | $1,909,757 |

| 5,280 | Aon PLC - Class A | $1,734,427 |

| 9,660 | Apple, Inc. - Class A | $1,834,917 |

| 6,070 | Automatic Data Processing, Inc.. | $1,395,615 |

| 3,860 | Broadridge Financial Solutions, Inc. | $748,145 |

| 5,020 | Equifax, Inc. | $1,092,904 |

| 2,900 | Home Depot, Inc. | $909,121 |

| 2,580 | Intuit, Inc. | $1,474,367 |

| 1,470 | KLA Corp. | $800,591 |

| 2,370 | Mastercard, Inc. - Class A | $980,777 |

| 8,330 | Microsoft Corp. | $3,156,319 |

| 9,610 | NIKE, Inc. - Class B | $1,059,695 |

| 12,370 | PepsiCo, Inc. | $2,081,747 |

| 30,050 | Pfizer, Inc. | $915,624 |

| 13,310 | Starbucks Corp. | $1,321,683 |

| 4,980 | Stryker Corp. | $1,475,723 |

| 5,070 | Texas Instruments, Inc. | $774,240 |

| 2,260 | UnitedHealth Group, Inc. | $1,249,712 |

| 3,790 | Verisk Analytics, Inc. | $915,020 |

| 1,650 | Waters Corp. (a) | $463,007 |

| | | $26,293,391 |

| | | |

| Total Common Stocks | value |

| (Cost $38,817,210) | $46,275,410 |

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 27 |

Jensen Global Quality Growth Fund

Schedule of Investments continued

November 30, 2023 (Unaudited)

| Money Market Funds - 1.15% | |

| shares | | value |

| 536,712 | First American Treasury Obligations Fund - X Class, 5.265% (b) | $536,712 |

| | | |

| Total Money Market Funds | value |

| (Cost $536,712) | $536,712 |

| | | |

| Total Investments | value |

| (Cost $39,353,922) - 99.87% | $46,812,122 |

| Other Assets in Excess of Liabilities - 0.13% | $59,649 |

| TOTAL NET ASSETS - 100.00% | $46,871,771 |

Percentages are stated as a percent of net assets.

| ADR | American Depositary Receipt |

| NV | Naamloze Vennootschap is a Dutch term for publicly traded companies. |

| PLC | Public Limited Company |

| SA | An abbreviation used by many countries to signify a stock company whereby shareholders have limited liability. |

| SCA | Societe en commandite par actions is a Belgian term for limited partnership with share capital. |

| SE | Societas Europaea is a term for a European Public Liability Company. |

(a) Non-income producing security.

(b) The rate shown represents the seven-day yield as of November 30, 2023.

The accompanying notes are an integral part of these financial statements.

| | | |

| 28 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Statements of Operations

For the Six Months Ended November 30, 2023 (Unaudited)

| Investment Income: | Jensen

Quality

Value Fund | Jensen

Global Quality

Growth Fund |

| Dividend income | $1,308,914 | $326,731(1) |

| Interest income | 68,660 | 7,075 |

| Total Investment Income | 1,377,574 | 333,806 |

| | | |

| Expenses: | | |

| Investment management fees | 591,763 | 169,273 |

| 12b-1 fees - Class J | 36,572 | 3,134 |

| Federal and state registration fees | 14,746 | 14,650 |

| Reports to shareholders | 17,217 | 2,284 |

| Administration fees | 23,367 | 11,265 |

| Transfer agent fees | 23,422 | 22,782 |

| Fund accounting fees | 21,407 | 12,811 |

| Trustees’ fees | 11,100 | 10,916 |

| Legal fees | 12,986 | 8,605 |

| Shareholder servicing fees - Class I | 9,464 | 227 |

| Audit and tax fees | 8,967 | 9,516 |

| Transfer agent expenses | 8,411 | 1,274 |

| Chief Compliance Officer fees | 6,222 | 6,222 |

| Custody fees | 3,559 | 7,048 |

| Insurance expense | 3,284 | 2,555 |

| Other | 6,628 | 4,498 |

| Total expenses | 799,115 | 287,060 |

| Less waivers and reimbursements by Adviser (Note 4) | (22,523) | (58,002) |

| Net expenses | 776,592 | 229,058 |

| | | |

| Net Investment Income | 600,982 | 104,748 |

| | | |

| Realized and Unrealized Gain (Loss) on Investments: | | |

| Net realized gain (loss) on: | | |

| Investments | 1,797,392 | (16,907) |

| Foreign currency translations | – | (4,246) |

| Change in unrealized appreciation on: | | |

| Investments | 9,958,086 | 1,805,474 |

| Foreign currency translations | – | 855 |

| Net realized and unrealized gain on investments | 11,755,478 | 1,785,176 |

| Net Increase in Net Assets Resulting from Operations | $12,356,460 | $1,889,924 |

| (1) | Net of $9,286 in dividend withholding tax. |

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 29 |

Statements of Changes in Net Assets

| | Jensen Quality Value Fund |

| Operations: | Six Months

Ended

November 30,

2023 (Unaudited) | Year Ended

May 31, 2023 |

| Net investment income | $600,982 | $1,341,545 |

| Net realized gain (loss) on investment transactions | 1,797,392 | (3,299,475) |

| Change in unrealized appreciation on investments | 9,958,086 | 7,604,792 |

| Net increase in net assets resulting from operations | 12,356,460 | 5,646,862 |

| | | |

| Capital Share Transactions: | | |

| Shares Sold - Class J | 2,026,146 | 3,811,677 |

| Shares Sold - Class I | 10,894,738 | 20,342,482 |

| Shares Sold - Class Y | 1,616,129 | 1,402,074 |

| Shares issued to holders in reinvestment of dividends - Class J | 63,710 | 854,505 |

| Shares issued to holders in reinvestment of dividends - Class I | 315,747 | 2,927,455 |

| Shares issued to holders in reinvestment of dividends - Class Y | 200,138 | 1,621,912 |

| Shares redeemed - Class J | (3,475,433) | (15,322,382) |

| Shares redeemed - Class I | (21,184,534) | (34,488,895) |

| Shares redeemed - Class Y | (928,330) | (5,090,649) |

| Net decrease in net assets from capital share transactions | (10,471,689) | (23,941,821) |

| | | |

| Dividends and Distributions to Shareholders: | | |

| Net dividends and distributions to shareholders - Class J | (63,865) | (854,505) |

| Net dividends and distributions to shareholders - Class I | (315,844) | (2,928,735) |

| Net dividends and distributions to shareholders - Class Y | (200,138) | (1,621,912) |

| Total dividends and distributions | (579,847) | (5,405,152) |

| Increase (Decrease) In Net Assets | 1,304,924 | (23,700,111) |

| | | |

| Net Assets: | | |

| Beginning of period | $177,304,796 | $201,004,907 |

| End of period | $178,609,720 | $177,304,796 |

The accompanying notes are an integral part of these financial statements.

| | | |

| 30 | Jensen Quality Value Fund | Semi-Annual Report |

Statements of Changes in Net Assets

| | Jensen Global Quality Growth Fund |

| Operations: | Six Months

Ended

November 30,

2023 (Unaudited) | Year Ended

May 31, 2023 |

| Net investment income | $104,748 | $252,484 |

| Net realized loss on: | | |

| Investments | (16,907) | (592,160) |

| Foreign currency translations | (4,246) | (24,406) |

| Change in unrealized appreciation on: | | |

| Investments | 1,805,474 | 3,107,771 |

| Foreign currency translations | 855 | 115 |

| Net increase in net assets resulting from operations | 1,889,924 | 2,743,804 |

| | | |

| Capital Share Transactions: | | |

| Shares Sold - Class J | 216,430 | 383,956 |

| Shares Sold - Class I | 5,000 | 2,681,873 |

| Shares Sold - Class Y | 1,274,651 | 5,514,454 |

| Shares issued to holders in reinvestment of dividends - Class J | 5,358 | 7,364 |

| Shares issued to holders in reinvestment of dividends - Class I | 7,166 | 21,477 |

| Shares issued to holders in reinvestment of dividends - Class Y | 131,055 | 222,211 |

| Shares redeemed - Class J | (591,652) | (137,655) |

| Shares redeemed - Class I | (15,678) | (3,278,755) |

| Shares redeemed - Class Y | (217,816) | (1,452,394) |

| Net increase in net assets from capital share transactions | 814,514 | 3,962,531 |

| | | |

| Dividends and Distributions to Shareholders: | | |

| Net dividends and distributions to shareholders - Class J | (5,363) | (7,364) |

| Net dividends and distributions to shareholders - Class I | (7,166) | (21,477) |

| Net dividends and distributions to shareholders - Class Y | (131,055) | (222,211) |

| Total dividends and distributions | (143,584) | (251,052) |

| Increase in Net Assets | 2,560,854 | 6,455,283 |

| | | |

| NET ASSETS: | | |

| Beginning of period | $44,310,917 | $37,855,634 |

| End of period | $46,871,771 | $44,310,917 |

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 31 |

Financial Highlights

Jensen Quality Value Fund - Class J

| Per Share Data: | six months

ended

November 30,

2023

(unaudited) | year

ended

May 31,

2023 | year

ended

May 31,

2022 | year

ended

May 31,

2021 | year

ended

May 31,

2020 | year

ended

May 31,

2019 |

| Net asset value, beginning of period | $15.89 | $15.85 | $17.47 | $12.17 | $12.24 | $12.59 |

| Income (loss) from investment operations: | | | | | | |

| Net investment income(1) | 0.04 | 0.08 | 0.05 | 0.06 | 0.08 | 0.1 |

| Net realized and unrealized gain (loss) on investments | 1.08 | 0.40 | (1.21) | 5.43 | 0.41 | 0.22 |

| Total from investment operations | 1.12 | 0.48 | (1.16) | 5.49 | 0.49 | 0.32 |

| Less distributions: | | | | | | |

| Dividends from net investment income | (0.04) | (0.06) | (0.04) | (0.06) | (0.08) | (0.10) |

| Distributions from net realized gain on investments | - | (0.38) | (0.42) | (0.13) | (0.48) | (0.57) |

| Total distributions | (0.04) | (0.44) | (0.46) | (0.19) | (0.56) | (0.67) |

| Net asset value, end of period | $16.97 | $15.89 | $15.85 | $17.47 | $12.17 | $12.24 |

| Total return(2) | 7.03% | 3.12% | (6.98)% | 45.37% | 3.72% | 2.89% |

| Supplemental data and ratios: | | | | | | |

| Net assets, end of period (000’s) | $28,850 | $28,366 | $38,942 | $37,105 | $6,569 | $2,444 |

| Ratio of expenses to average net assets | | | | | | |

| Before waivers and reimbursements of expenses(3) | 1.07% | 1.10% | 1.11% | 1.25% | 1.57% | 1.50% |

| After waivers and reimbursements of expenses(3) | 1.05% | 1.05% | 1.05% | 1.05% | 1.05% | 1.05% |

| Ratio of net investment income to average net assets | | | | | | |

| Before waivers and reimbursements of expenses(3) | 0.44% | 0.47% | 0.25% | 0.18% | 0.16% | 0.39% |

| After waivers and reimbursements of expenses(3) | 0.46% | 0.52% | 0.31% | 0.38% | 0.68% | 0.84% |

| Portfolio turnover rate(2) | 12.20% | 15.57% | 17.78% | 18.15% | 36.19% | 42.51% |

(1) Per share amounts are calculated using the average shares outstanding method.

(2) Not annualized for periods less than one year.

(3) Annualized for periods less than one year.

The accompanying notes are an integral part of these financial statements.

| | | |

| 32 | Jensen Quality Value Fund | Semi-Annual Report |

Financial Highlights

Jensen Quality Value Fund - Class I

| Per Share Data: | six months

ended

November 30,

2023

(unaudited) | year

ended

May 31,

2023 | year

ended

May 31,

2022 | year

ended

May 31,

2021 | year

ended

May 31,

2020 | year

ended

May 31,

2019 |

| Net asset value, beginning of period | $15.86 | $15.81 | $17.43 | $12.13 | $12.18 | $12.52 |

| Income (loss) from investment operations: | | | | | | |

| Net investment income(1) | 0.06 | 0.12 | 0.09 | 0.09 | 0.12 | 0.13 |

| Net realized and unrealized gain (loss) on investments | 1.07 | 0.40 | (1.21) | 5.42 | 0.39 | 0.23 |

| Total from investment operations | 1.13 | 0.52 | (1.12) | 5.51 | 0.51 | 0.36 |

| Less distributions: | | | | | | |

| Dividends from net investment income | (0.06) | (0.09) | (0.08) | (0.08) | (0.08) | (0.13) |

| Distributions from net realized gain on investments | – | (0.38) | (0.42) | (0.13) | (0.48) | (0.57) |

| Total distributions | (0.06) | (0.47) | (0.50) | (0.21) | (0.56) | (0.70) |

| Net asset value, end of period | $16.93 | $15.86 | $15.81 | $17.43 | $12.13 | $12.18 |

| Total return(2) | 7.10% | 3.38% | -6.79% | 45.80% | 3.88% | 3.25% |

| Supplemental data and ratios: | | | | | | |

| Net assets, end of period (000's) | $89,977 | $89,977 | $104,867 | $44,113 | $2,491 | $33,470 |

| Ratio of expenses to average net assets | | | | | | |

| Before waivers and reimbursements of expenses(3) | 0.84% | 0.87% | 0.88% | 1.00% | 1.23% | 1.27% |

| After waivers and reimbursements of expenses(3) | 0.82% | 0.82% | 0.82% | 0.82% | 0.82% | 0.82% |

| Ratio of net investment income to average net assets | | | | | | |

| Before waivers and reimbursements of expenses(3) | 0.66% | 0.70% | 0.50% | 0.42% | 0.51% | 0.62% |

| After waivers and reimbursements of expenses(3) | 0.68% | 0.75% | 0.56% | 0.60% | 0.92% | 1.07% |

| Portfolio turnover rate(2) | 12.20% | 15.57% | 0.18% | 18.15% | 36.19% | 42.51% |

(1) Per share amounts are calculated using the average shares outstanding method.

(2) Not annualized for periods less than one year.

(3) Annualized for periods less than one year.

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Quality Value Fund | 33 |

Financial Highlights

Jensen Quality Value Fund - Class Y

| Per Share Data: | six months

ended

November 30,

2023

(unaudited) | year

ended

May 31,

2023 | year

ended

May 31,

2022 | year

ended

May 31,

2021 | period

ended

May 31,

2020 (1) |

| Net asset value, beginning of period | $15.82 | $15.78 | $17.39 | $12.11 | $13.38 |

| Income (loss) from investment operations: | | | | | |

| Net investment income(2) | 0.06 | 0.12 | 0.09 | 0.10 | 0.04 |

| Net realized and unrealized gain (loss) on investments | 1.07 | 0.39 | (1.20) | 5.40 | (1.28) |

| Total from investment operations | 1.13 | 0.51 | (1.11) | 5.50 | (1.24) |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.06) | (0.09) | (0.08) | (0.09) | (0.03) |

| Distributions from net realized gain on investments | – | (0.38) | (0.42) | (0.13) | – |

| Total distributions | (0.06) | (0.47) | (0.50) | (0.22) | (0.03) |

| Net asset value, end of period | $16.89 | $15.82 | $15.78 | $17.39 | $12.11 |

| Total return(3) | 7.13% | 3.34% | -6.73% | 45.72% | -9.24% |

| Supplemental data and ratios: | | | | | |

| Net assets, end of period (000’s) | $59,783 | $59,783 | $57,196 | $50,693 | $35,326 |

| Ratio of expenses to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 0.82% | 0.85% | 0.86% | 1.05% | 1.52% |

| After waivers and reimbursements of expenses(4) | 0.80% | 0.80% | 0.80% | 0.80% | 0.80% |

| Ratio of net investment income to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 0.69% | 0.73% | 0.50% | 0.40% | 0.23% |

| After waivers and reimbursements of expenses(4) | 0.71% | 0.78% | 0.56% | 0.65% | 0.95% |

| Portfolio turnover rate(3) | 12.20% | 15.57% | 17.78% | 18.15% | 36.19% |

(1) Class Y shares commenced operations on January 15, 2020.

(2) Per share amounts are calculated using the average shares outstanding method.

(3) Not annualized for periods less than one year.

(4) Annualized for periods less than one year.

The accompanying notes are an integral part of these financial statements.

| | | |

| 34 | Jensen Quality Value Fund | Semi-Annual Report |

Financial Highlights

Jensen Global Quality Growth Fund - Class J

| Per Share Data: | six months

ended

November 30,

2023

(unaudited) | year

ended

May 31,

2023 | year

ended

May 31,

2022 | year

ended

May 31,

2021 | period

ended

May 31,

2020(1) |

| Net asset value, beginning of period | $14.40 | $13.73 | $14.20 | $10.81 | $10.00 |

| Income (loss) from investment operations: | | | | | |

| Net investment income(2) | 0.02 | 0.05 | 0.05 | 0.06 | 0.02 |

| Net realized and unrealized gain (loss) on investments | 0.57 | 0.66 | (0.48) | 3.38 | 0.79 |

| Total from investment operations | 0.59 | 0.71 | (0.43) | 3.44 | 0.81 |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.03) | (0.04) | (0.04) | (0.05) | – |

| Total distributions | (0.03) | (0.04) | (0.04) | (0.05) | – |

| Net asset value, end of period | $14.96 | $14.40 | $13.73 | $14.20 | $10.81 |

| Total return(3) | 4.10% | 5.23% | -3.02% | 31.94% | 8.10% |

| Supplemental data and ratios: | | | | | |

| Net assets, end of period (000's) | $2,203 | $2,526 | $2,145 | $1,700 | $454 |

| Ratio of expenses to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 1.51% | 1.61% | 1.64% | 2.68% | 33.40% |

| After waivers and reimbursements of expenses(4) | 1.25% | 1.25% | 1.25% | 1.25% | 1.25% |

| Ratio of net investment income to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | (0.04)% | 0.02% | (0.06)% | (0.92)% | (30.52)% |

| After waivers and reimbursements of expenses(4) | 0.22% | 0.38% | 0.33% | 0.51% | 1.63% |

| Portfolio turnover rate(3) | 5.68% | 16.82% | 3.04% | 4.05% | 0.00% |

(1) The Fund commenced operations on April 15, 2020.

(2) Per share amounts are calculated using the average shares outstanding method.

(3) Not annualized for periods less than one year.

(4) Annualized for periods less than one year.

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 35 |

Financial Highlights

Jensen Global Quality Growth Fund - Class I

| Per Share Data: | six months

ended

November 30,

2023

(unaudited) | year

ended

May 31,

2023 | year

ended

May 31,

2022 | year

ended

May 31,

2021 | period

ended

May 31,

2020(1) |

| Net asset value, beginning of period | $14.40 | $13.75 | $14.21 | $10.81 | $10.00 |

| Income (loss) from investment operations: | | | | | |

| Net investment income(2) | 0.03 | 0.08 | 0.09 | 0.11 | 0.02 |

| Net realized and unrealized gain (loss) on investments | 0.57 | 0.65 | (0.48) | 3.37 | 0.79 |

| Total from investment operations | 0.60 | 0.73 | (0.39) | 3.48 | 0.81 |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.04) | (0.08) | (0.07) | (0.08) | – |

| Total distributions | (0.04) | (0.08) | (0.07) | (0.08) | – |

| Net asset value, end of period | $14.96 | $14.40 | $13.75 | $14.21 | $10.81 |

| Total return(3) | 4.22% | 5.39% | -2.74% | 32.27% | 8.10% |

| Supplemental data and ratios: | | | | | |

| Net assets, end of period (000's) | $2,334 | $2,249 | $2,350 | $1,842 | $227 |

| Ratio of expenses to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 1.28% | 1.36% | 1.42% | 2.11% | 33.49% |

| After waivers and reimbursements of expenses(4) | 1.02% | 1.02% | 1.02% | 1.02% | 1.02% |

| Ratio of net investment income to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 0.20% | 0.28% | 0.17% | (0.28)% | (30.60)% |

| After waivers and reimbursements of expenses(4) | 0.46% | 0.62% | 0.57% | 0.81% | 1.87% |

| Portfolio turnover rate(3) | 5.68% | 16.82% | 3.04% | 4.05% | 0.00% |

(1) The Fund commenced operations on April 15, 2020.

(2) Per share amounts are calculated using the average shares outstanding method.

(3) Not annualized for periods less than one year.

(4) Annualized for periods less than one year.

The accompanying notes are an integral part of these financial statements.

| | | |

| 36 | Jensen Global Quality Growth Fund | Semi-Annual Report |

Financial Highlights

Jensen Global Quality Growth Fund - Class Y

| Per Share Data: | six months

ended

November 30,

2023

(unaudited) | year

ended

May 31,

2023 | year

ended

May 31,

2022 | year

ended

May 31,

2021 | period

ended

May 31,

2020(1) |

| Net asset value, beginning of period | $14.41 | $13.75 | $14.21 | $10.81 | $10.00 |

| Income (loss) from investment operations: | | | | | |

| Net investment income(2) | 0.03 | 0.08 | 0.09 | 0.11 | 0.03 |

| Net realized and unrealized gain (loss) on investments | 0.57 | 0.66 | (0.48) | 3.37 | 0.78 |

| Total from investment operations | 0.60 | 0.74 | (0.39) | 3.48 | 0.81 |

| Less distributions: | | | | | |

| Dividends from net investment income | (0.04) | (0.08) | (0.07) | (0.08) | – |

| Total distributions | (0.04) | (0.08) | (0.07) | (0.08) | – |

| Net asset value, end of period | $14.97 | $14.41 | $13.75 | $14.21 | $10.81 |

| Total return(3) | 4.22% | 5.48% | -2.72% | 32.29% | 8.10% |

| Supplemental data and ratios: | | | | | |

| Net assets, end of period (000's) | $42,335 | $39,536 | $33,361 | $23,555 | $1,206 |

| Ratio of expenses to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 1.26% | 1.36% | 1.40% | 2.15% | 32.29% |

| After waivers and reimbursements of expenses(4) | 1.00% | 1.00% | 1.00% | 1.00% | 1.00% |

| Ratio of net investment income to average net assets | | | | | |

| Before waivers and reimbursements of expenses(4) | 0.22% | 0.27% | 0.18% | (0.32)% | (29.29)% |

| After waivers and reimbursements of expenses(4) | 0.48% | 0.63% | 0.58% | 0.82% | 2.00% |

| Portfolio turnover rate(3) | 5.68% | 16.82% | 3.04% | 4.05% | 0.00% |

(1) The Fund commenced operations on April 15, 2020.

(2) Per share amounts are calculated using the average shares outstanding method.

(3) Not annualized for periods less than one year.

(4) Annualized for periods less than one year.

The accompanying notes are an integral part of these financial statements.

| | | |

Semi-Annual Report | Jensen Global Quality Growth Fund | 37 |

Notes to Financial Statements

November 30, 2023 (Unaudited)

1. Organization