SCHEDULE 14A

PROXY STATEMENT

PURSUANT TO SECTION 14(A) OF THE SECURITIES EXCHANGE ACT OF 1934

Filed by Registrant [X]

Filed by Party other than the Registrant

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential for Use of the Commission Only as permitted by Rule 14a-6(e)(2)

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11c or Rule 14a-12

| Alpine Series Trust |

| (Name of Registrant as Specified in Its Charter) |

| |

| (Name of Person(s) Filing Proxy Statement) |

Payment of Filing Fee (Check the appropriate box):

[X] No fee required

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

| (1) | | Title of each class of securities to which transaction applies: |

| | | |

| (2) | | Aggregate number of securities to which transaction applies: |

| |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11. (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | | Proposed maximum aggregate value of transaction: |

| |

| (5) | | Total fee paid: |

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| (1) | | Amount previously paid: |

| | | |

| (2) | | Form, Schedule or Registration Statement No.: |

| |

| (3) | | Filing Party: |

| |

| (4) | | Date Filed: |

ALPINE SERIES TRUST Alpine Foundation Fund |

c/o Boston Financial Data Services, Inc.

PO Box 8061

Boston, MA 02266

1-888-785-5578

June 17, 2014

Dear Shareholder:

The Special Meeting of Shareholders (the “Meeting”) of Alpine Foundation Fund (the “Fund”), a series of Alpine Series Trust, will be held on July 24, 2014 at 10:30 am Eastern Time, at 2500 Westchester Avenue, Purchase, New York 10577. A Notice of the Special Meeting of Shareholders, Proxy Statement regarding the Meeting, proxy card for your vote, and postage prepaid envelope in which to return your proxy card are enclosed.

The matter on which you, as a shareholder of the Fund, are being asked to vote is the change to the Fund’s fundamental investment objective. The Board of Trustees (the “Board”) believes that this proposal is in the best interests of the Fund and its shareholders, and unanimously recommends that you vote “FOR” the change to the Fund’s fundamental investment objective.

Detailed information about the proposal is contained in the enclosed materials. Please exercise your right to vote by completing, dating and signing the enclosed proxy card. A self-addressed, postage-paid envelope has been enclosed for your convenience. It is very important that you vote and that your voting instructions be received as soon as possible.

If you have any questions after considering the enclosed materials, please call 1-877-896-3199.

| | Alpine Series Trust, on behalf of Alpine Foundation Fund |

| | |

| | Respectfully, |

| | |

| | |

| | |

| | Samuel A. Lieber |

| | President |

ALPINE SERIES TRUST

Alpine Foundation Fund

NOTICE OF THE SPECIAL MEETING OF SHAREHOLDERS

June 17, 2014

To the Shareholders of Alpine Foundation Fund:

NOTICE IS HEREBY GIVEN that the Special Meeting of Shareholders (the “Meeting���) of Alpine Foundation Fund will be held on July 24, 2014, at 2500 Westchester Avenue, Purchase, New York 10577, beginning at 10:30 am Eastern Time, for the following purposes:

| | 1. | To approve a change to the Fund’s fundamental investment objective; and |

| | 2. | To transact such other business as may properly come before the Meeting or any adjournments or postponements thereof. |

| | |

The Board of Trustees (the “Board”) has fixed the close of business on June 5, 2014 as the record date for the determination of Shareholders entitled to notice of and to vote at the Meeting or any adjournments or postponements thereof.

You are cordially invited to attend the Meeting. Shareholders who do not expect to attend the Meeting in person are requested to vote by telephone, by Internet or by completing, dating and signing the enclosed proxy card and returning it promptly in the envelope provided for that purpose. You may nevertheless vote in person at the Meeting if you choose to attend. The enclosed proxy is being solicited by the Board.

| | By order of the Board, |

| | |

| |  |

| | |

| | Samuel A. Lieber |

| | President |

June 17, 2014

ALPINE SERIES TRUST

Alpine Foundation Fund

c/o Boston Financial Data Services, Inc.

PO Box 8061

Boston, MA 02266

1-888-785-5578

_______________

PROXY STATEMENT

_______________

INTRODUCTION

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of Alpine Series Trust (the “Trust”) on behalf of Alpine Foundation Fund (the “Fund”) for use at the Special Meeting of Shareholders (the “Meeting”), to be held on July 24, 2014, at 2500 Westchester Avenue, Purchase, New York 10577, at 10:30 am Eastern Time, and at any adjournments or postponements thereof.

This Proxy Statement and proxy card are being mailed to shareholders of record at the close of business on June 5, 2014 on or about June 18, 2014. Any shareholder giving a proxy has the power to revoke it prior to its exercise by submitting a superseding proxy by phone, Internet or mail following the process described on the proxy card or by submitting a notice of revocation to the Trust or in person at the Meeting. A proxy purporting to be executed by or on behalf of a shareholder shall be deemed valid unless challenged at or prior to its exercise, with the burden of proving invalidity resting on the challenger.

In order to transact business at the Meeting, a “quorum” must be present. Under the Trust’s By-Laws, a quorum is constituted by the presence in person or by proxy of shareholders representing 40% of the shares of the Trust entitled to vote on a matter.

Abstentions and broker non-votes (i.e., proxies from brokers or nominees indicating that they have not received instructions from the beneficial owners on an item for which the brokers or nominees do not have discretionary power to vote) will be treated as present for determining whether a quorum is present with respect to a particular matter. Abstentions and broker non-votes will not, however, be treated as votes cast at the Meeting.

The chairman of the Meeting shall have the power to adjourn the Meeting without further notice other than announcement at the Meeting. The Board of Trustees also has the power to postpone the Meeting to a later date and/or time in advance of the Meeting. Abstentions and broker non-votes will have the same effect at any adjourned or postponed meeting as noted above. Any business that might have been transacted at the Meeting may be transacted at any such adjourned or postponed session(s) at which a quorum is present.

Written notice of an adjournment of the Meeting, stating the place, date and hour thereof, shall be given to each shareholder entitled to vote thereat, at least ten (10) days prior to the Meeting, if the Meeting is adjourned to a date more than one hundred twenty (120) days after the original Record Date set for the Meeting.

The following proposal will be considered and acted upon at the Meeting:

| | Proposal |

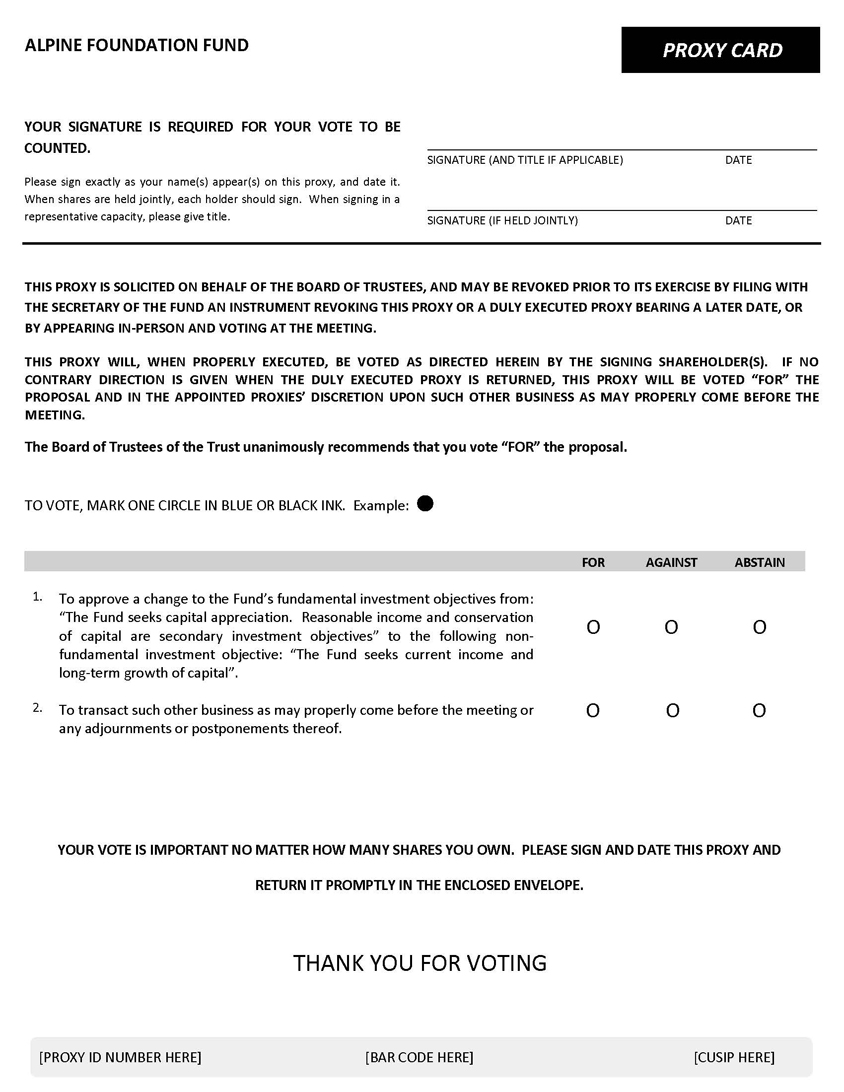

| 1. | To approve a change to the Fund’s fundamental investment objectives from: “The Fund seeks capital appreciation. Reasonable income and conservation of capital are secondary investment objectives” to the following non-fundamental investment objective: “The Fund seeks current income and long-term growth of capital.” |

The Board of Trustees have fixed the close of business on June 5, 2014 as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and at any adjournments or postponements thereof. Shareholders on the record date will be entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Fund had the following shares outstanding and entitled to vote at the Meeting:

| Name of Fund | Number of Shares Outstanding and Entitled to Vote |

| Alpine Series Trust | Class A | Institutional Class |

| Alpine Foundation Fund | 262,879 | 5,602,658 |

Management of the Trust knows of no item of business other than that mentioned in Proposal 1 of the Notice of Meeting that will be presented for consideration at the Meeting.

The Trust will furnish, without charge, copies of its annual report for the fiscal year ended October 31, 2013 and the most recent semi-annual report succeeding such annual report, if any, to any shareholder requesting such a report. Requests for an annual or semi-annual report should be made by contacting Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, by accessing the Fund’s website at www.alpinefunds.com or by calling 1-888-785-5578.

IMPORTANT INFORMATION

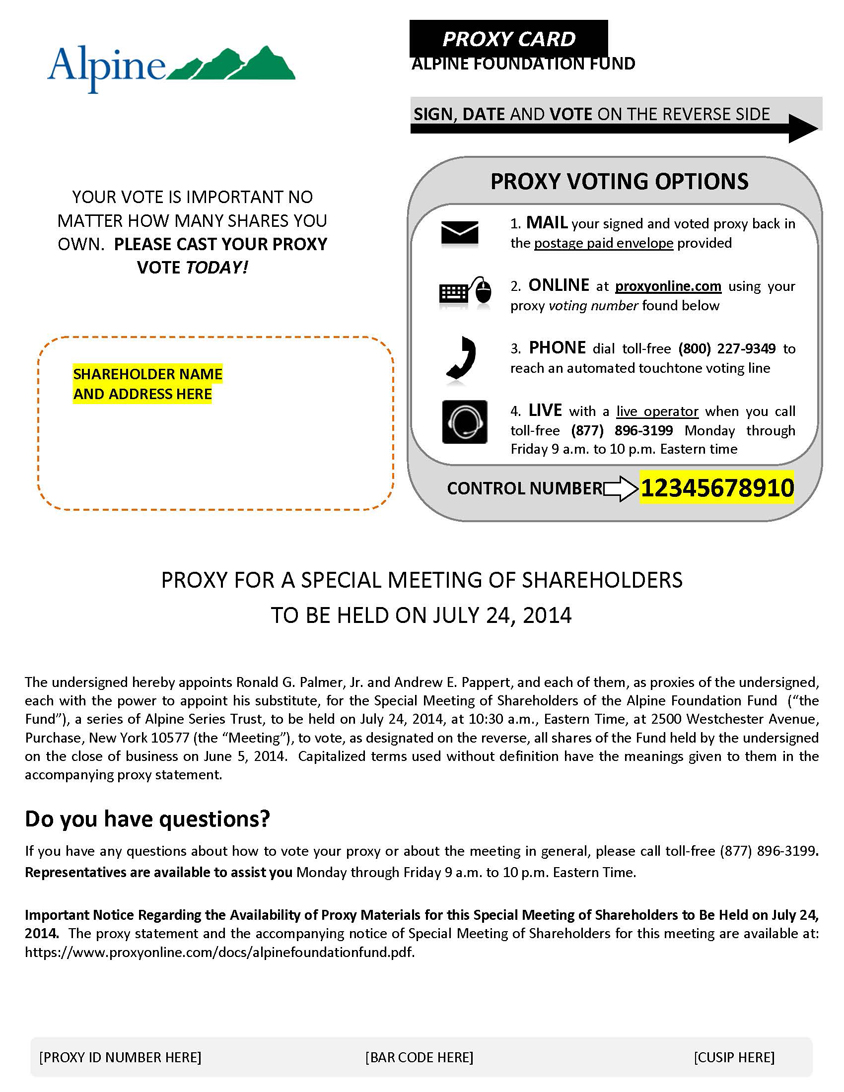

The Proxy Statement discusses important matters affecting the Fund. Please take the time to read the Proxy Statement, and then cast your vote. There are multiple ways to vote. Choose the method that is most convenient for you. To vote by telephone or Internet, follow the instructions provided on the proxy card. To vote by mail simply fill out the proxy card and return it in the enclosed postage-paid reply envelope. Please do not return your proxy card if you vote by telephone or Internet. To vote in person, attend the Meeting and cast your vote. The Meeting will be held at 2500 Westchester Avenue, Purchase, New York 10577. To obtain directions to the Meeting, please call 1-888-785-5578. Properly executed proxies will be voted as instructed on the proxy card. In the absence of such direction, executed proxies received prior to the Meeting or any adjournment thereof will be voted “FOR” Proposal 1. Proxy holders may vote in their discretion with respect to any other matters properly coming before the Meeting.

PROPOSAL 1

FUNDAMENTAL INVESTMENT OBJECTIVE

The Fund’s current fundamental investment objective is as follows: “The Fund seeks capital appreciation. Reasonable income and conservation of capital are secondary investment objectives.” The Board proposes that the Fund’s investment objective be changed to the following non-fundamental investment objective: “The Fund seeks current income and long-term growth of capital.”

The Investment Company Act of 1940 (the “1940 Act”) permits a fund to designate any of its policies as fundamental policies but does not require that an investment objective be classified as fundamental, and it is common practice for investment objectives of investment companies to be classified as non-fundamental. A fundamental investment policy may be changed only with the approval of a majority of a Fund’s outstanding voting securities, as defined in the 1940 Act,1 while a non-fundamental investment policy may be changed by the Board without shareholder approval. Designating the Fund’s investment objective as non-fundamental would provide the Board greater flexibility to respond to changing conditions, in the manner it determines to be in the best interests of the Fund and its shareholders without the cost of a proxy solicitation. The Fund’s proposed non-fundamental investment objective, if approved by shareholders, may be changed by the Board upon 60 days prior notice to shareholders.

The Fund currently pursues its investment objectives by investing its assets primarily in a combination of equity securities of large U.S. companies and high quality fixed income securities. The Fund’s investments in common stocks currently emphasize stocks that (at the time of investment) pay dividends and have capital appreciation potential. Currently, the Fund’s strategy requires that at least 25% of the Fund’s assets be invested in fixed-income securities.

To conform to the new investment objective, the Fund’s principal investment strategies would be revised to provide that the Fund will, under normal circumstances, invest at least 80% of its net assets, plus borrowings for investment purposes, if any, in equity securities. The Fund will invest primarily in income-producing securities, targeting an investment in such securities of at least 65% of its total assets. The Fund’s name will also be changed to Alpine Equity Income Fund. These additional changes have been approved by the Board, contingent upon the shareholder approval of the Proposal, and do not require shareholder approval.

If the Proposal is approved, and once the other changes contingent on approval are implemented, the Fund may invest up to 20% of its net assets in fixed income securities, but will not be required to invest in fixed income assets to any particular degree. The Fund may invest in fixed income securities when the Adviser believes such securities provide attractive income opportunities and to generate yield. The Fund may continue to invest up to 5% of its net assets in fixed income securities rated below “A” by S&P or by Moody’s; this limit does not apply to convertible debt securities. The Fund may take temporary defensive positions; in such a case, the Fund will not be pursuing its principal investment strategies.

The Fund will continue to have the ability to invest up to 15% of its net assets in the securities of foreign issuers that are publicly traded in the United States or on foreign exchanges.

Alpine Woods Capital Investors, LLC (the “Investment Adviser”) proposes to make changes to the Fund’s investment strategies in order to position the Fund as an equity income fund. Accordingly, the Fund may be largely or wholly invested in equity securities if the changes are approved. However, the Fund would still have the ability to invest up to 20% of its net assets in fixed income securities. The principal risks of the Fund would remain the same, as the Fund may invest to a reduced extent in fixed income securities.

If the changes are approved, the Fund’s portfolio will be repositioned to align with the new investment strategies. It is anticipated that there will be purchases and sales of portfolio securities and that the Fund will realize gains from the sale of certain of its holdings.

Why are these changes being proposed?

The Board is proposing to make changes to the Fund’s name, investment objective and strategies because it believes that the repositioned Fund may generate more interest in the marketplace, potentially resulting in increased assets and economies of scale.

| 1 | Under Section 2(a)(42) of the 1940 Act, “[t]he vote of a majority of the outstanding voting securities of a company means the vote, at the annual or a special meeting of the security holders of such company duly called, (A) of 67 per centum or more of the voting securities present at such meeting, if the holders of more than 50 per centum of the outstanding voting securities of such company are present or represented by proxy; or (B) of more than 50 per centum of the outstanding voting securities of such company, whichever is the less.” |

What vote is required to approve the proposed changes to the Fund’s fundamental investment objective?

The 1940 Act requires the affirmative vote of the lesser of: (1) 67% or more of the Fund’s shares represented at the meeting if the holders of more than 50% of the outstanding shares are present in person or by proxy; or (2) more than 50% of the Fund’s outstanding shares. Shareholders of all classes of the Fund vote together on the proposal affecting the Fund. You should be aware that the principals of the Investment Adviser, their family members and the Investment Adviser’s affiliates beneficially own and have voting authority over more than 50% of the Fund’s outstanding voting securities (as of June 5, 2014), and such shares are expected to be voted in favor of the Proposal, which will control the outcome of the vote. Shares of the Fund held by institutes and charitable trusts overseen by the principals of the Investment Adviser, but for which they do not maintain a beneficial ownership interest, will be voted in proportion to the total votes received from shareholders who are not principals of the Investment Adviser, their family members or affiliates of the Investment Adviser.

If the proposed amendment to the Fund’s investment objective is approved by shareholders, it is expected to become effective on or about July 28, 2014. A supplement to the Fund’s registration statement will be sent to shareholders to notify them of the changes.

The Board of Trustees of the Fund, including the Fund’s independent trustees, recommends that shareholders of the Fund vote FOR the proposal.

GENERAL INFORMATION

MANAGEMENT AND OTHER SERVICE PROVIDERS

Investment Adviser

Alpine Woods Capital Investors, LLC, located at 2500 Westchester Avenue, Suite 215, Purchase, New York 10577, serves as the investment adviser to the Fund.

Administrator and Transfer Agent

State Street Bank and Trust Company (“State Street”), located at One Lincoln Street, Boston, Massachusetts 02111, serves as the administrator for the Fund pursuant to an administration agreement. State Street also serves as the Fund’s Custodian.

The Fund’s transfer and dividend disbursing agent is Boston Financial Data Services, Inc. (“BFDS”), 2000 Crown Colony Drive, Quincy, Massachusetts 02169.

Distributor

Quasar Distributors, LLC, located at 615 East Michigan Street, Milwaukee, Wisconsin 53202, serves as the distributor of the Fund’s shares pursuant to a Distribution Agreement with the Trust.

OTHER BUSINESS

The Board does not intend to present any other business at the Meeting. If, however, any other matters are properly brought before the Meeting, the persons named in the accompanying form of proxy will vote thereon in accordance with their judgment.

SUBMISSION OF SHAREHOLDER PROPOSALS

The Fund does not hold annual shareholder meetings.

Any shareholder intending to submit a proposal to be presented at a meeting of shareholders may transmit such proposal to the Trust (addressed to Alpine Series Trust, c/o Andrew Pappert, Secretary of the Trust, Alpine Woods Capital Investors, LLC, 2500 Westchester Avenue, Suite 215, Purchase, New York 10577) to be received within a reasonable time before the solicitation of proxies for such meeting in order for such proposal to be considered for inclusion in that proxy statement relating to such meeting. Whether a proposal is included in a proxy statement will be determined in accordance with applicable federal and state law. The timely submission of a proposal does not guarantee its inclusion.

DELIVERY OF PROXY MATERIALS AND ANNUAL REPORTS

To avoid sending duplicate copies of materials to households, please note that only one annual or semi-annual report or proxy statement, as applicable, may be delivered to two or more shareholders of the Fund who share an address, unless the Fund has received instructions to the contrary. A shareholder may provide such instructions by contacting the Fund at the address or phone number listed below. A shareholder may obtain additional copies of the Notice of the Special Meeting, Proxy Statement and proxy card by accessing www.proxyonline.com/docs/alpinefoundationfund.pdf or by calling 1-877-896-3199. Requests for an annual or semi-annual report should be made by contacting Alpine Funds c/o Boston Financial Data Services, Inc., PO Box 8061, Boston, MA 02266, by accessing the Fund’s website at www.alpinefunds.com or by calling 1-888-785-5578.