Exhibit 99.1

MeriStar Hospitality Corporation

Analyst Meeting – September 20, 2005

[hotel photos]

Company and Industry Overview

[hotel photo]

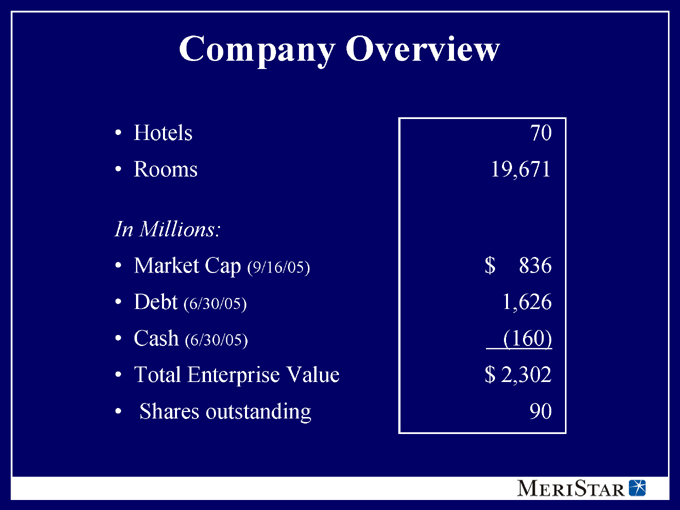

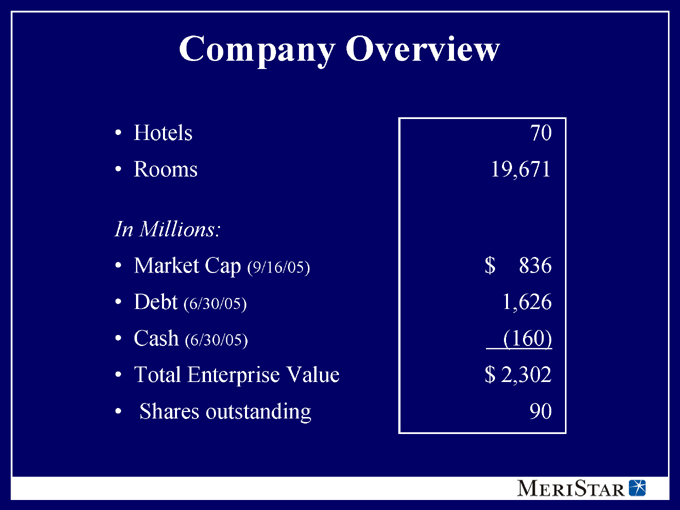

Company Overview

Hotels 70

Rooms 19,671

In Millions:

Market Cap (9/16/05) $836

Debt (6/30/05) 1,626

Cash (6/30/05) (160)

Total Enterprise Value $2,302

Shares outstanding 90

Company Strategy

Maximize internal growth

Upgrade core portfolio

Improve capital structure

Position for growth

[hotel photo]

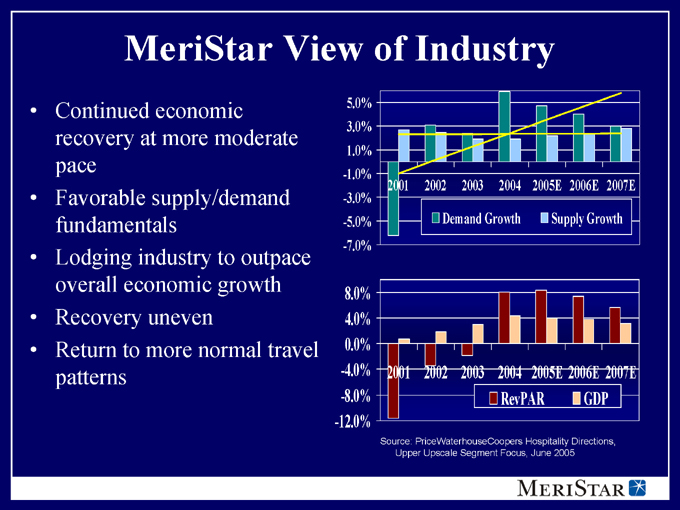

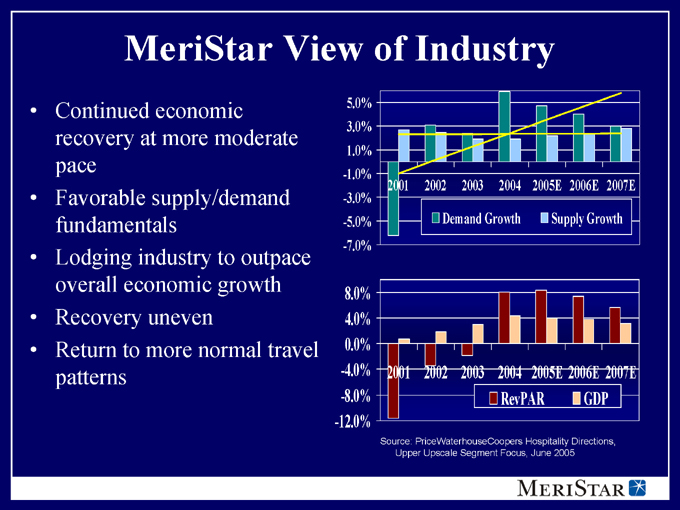

MeriStar View of Industry

Continued economic recovery at more moderate pace

Favorable supply/demand fundamentals

Lodging industry to outpace overall economic growth

Recovery uneven

Return to more normal travel patterns

5.0% 3.0% 1.0% -1.0% -3.0% -5.0% -7.0%

2001 2002 2003 2004 2005E 2006E 2007E

8.0%

4.0%

0.0%

-4.0%

-8.0%

-12.0%

2001 2002 2003 2004 2005E 2006E 2007E

RevPAR

GDP

Demand Growth

Supply Growth

Source: PriceWaterhouseCoopers Hospitality Directions, Upper Upscale Segment Focus, June 2005

Maximize Internal Growth

Higher growth potential with core hotels

Upgraded product through extensive capex program

[hotel photo]

Aggressive ownership programs

Active management oversight

Revenue management function

Cost control programs

Enhanced operating teams

Maximize Internal Growth

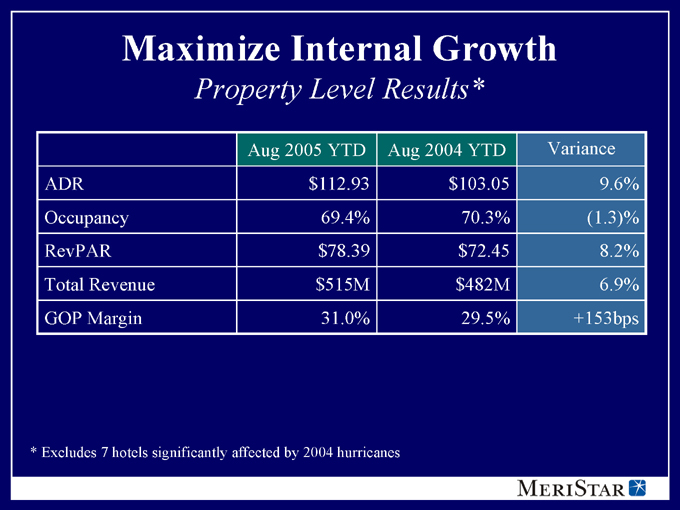

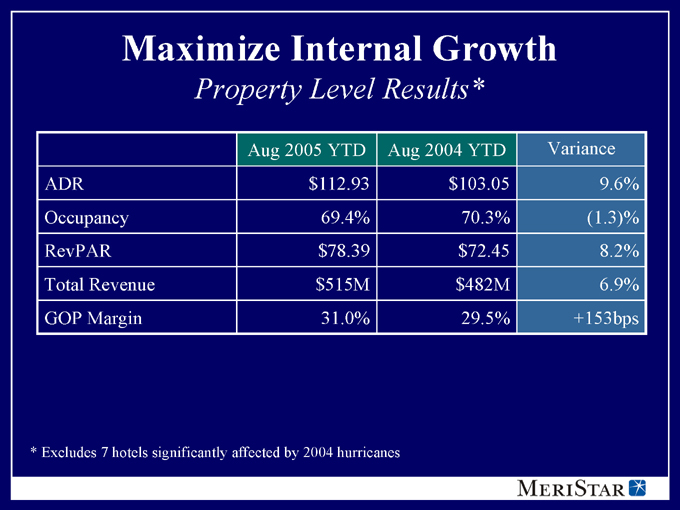

Property Level Results*

Aug 2005 YTD Aug 2004 YTD Variance

ADR $112.93 $103.05 9.6%

Occupancy 69.4% 70.3% (1.3)%

RevPAR $78.39 $72.45 8.2%

Total Revenue $515M $482M 6.9%

GOP Margin 31.0% 29.5% +153bps

* Excludes 7 hotels significantly affected by 2004 hurricanes

Maximize Internal Growth

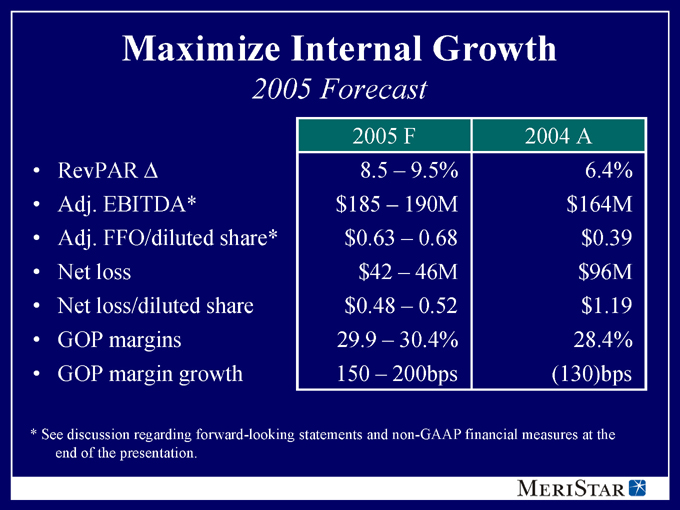

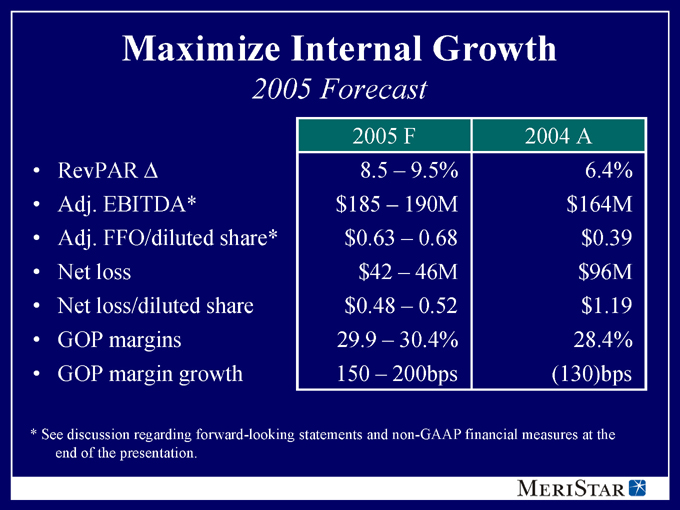

2005 Forecast

2005 F 2004 A

RevPAR 8.5 – 9.5% 6.4%

Adj. EBITDA* $185 – 190M $164M

Adj. FFO/diluted share* $0.63 – 0.68 $0.39

Net loss $42 – 46M $96M

Net loss/diluted share $0.48 – 0.52 $1.19

GOP margins 29.9 – 30.4% 28.4%

GOP margin growth 150 – 200bps (130)bps

* See discussion regarding forward-looking statements and non-GAAP financial measures at the end of the presentation.

Upgrade Core Portfolio

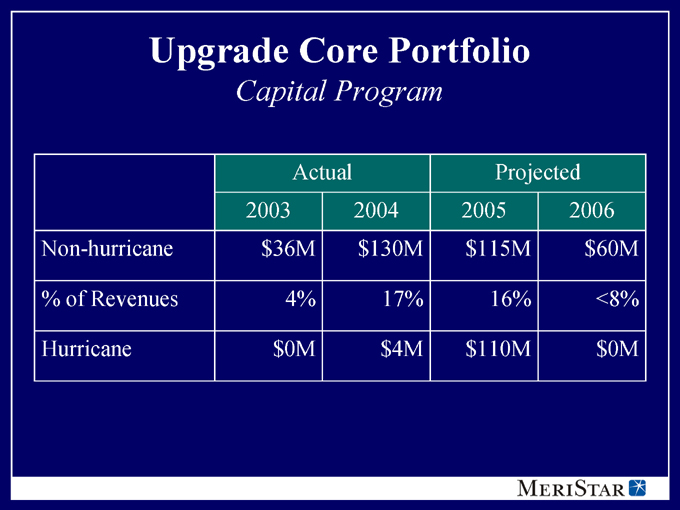

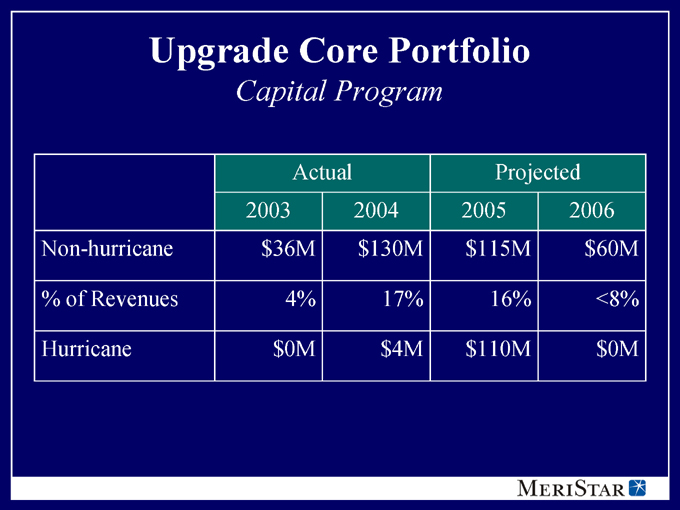

Capital Program

Actual Projected

2003 2004 2005 2006

Non-hurricane $36M $130M $115M $60M

% of Revenues 4% 17% 16% <8%

Hurricane $0M $4M $110M $0M

Upgrade Core Portfolio

Capital Program

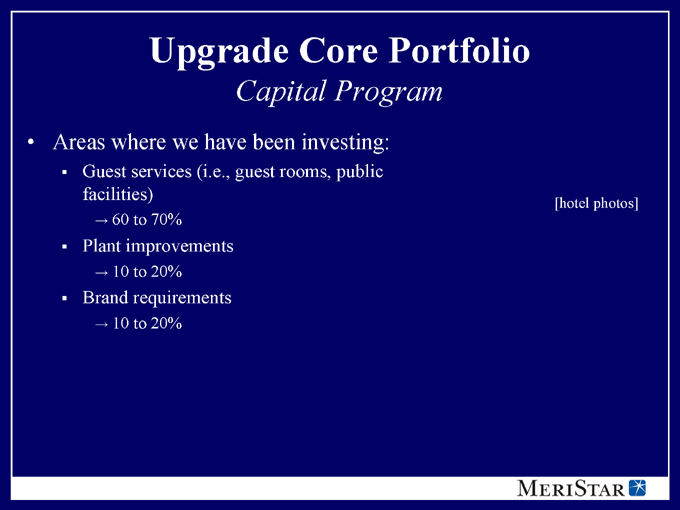

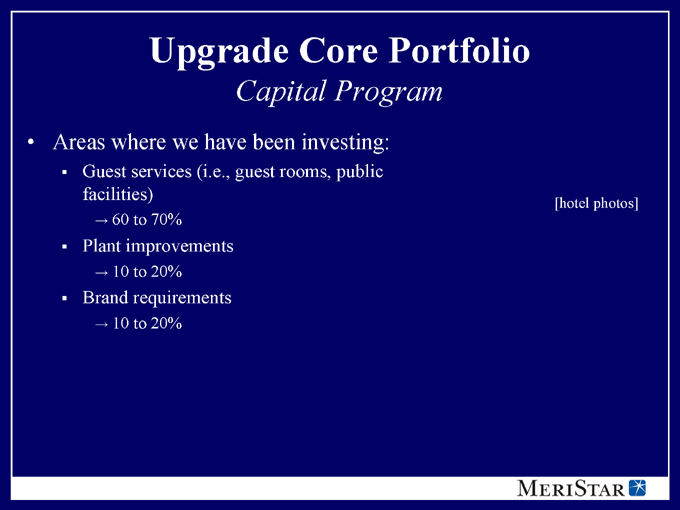

Areas where we have been investing:

Guest services (i.e., guest rooms, public facilities)

60 to 70%

Plant improvements

10 to 20%

Brand requirements

10 to 20%

[hotel photos]

Upgrade Core Portfolio

Capital Program – Product Improvement

Marriott Downtown LA

Renovated public space

RevPAR up 10.3% YTD

ADR up 9.5% YTD

GOP margins increased by 370bps YTD

GOP up $1 million YTD

[hotel photo]

Upgrade Core Portfolio

Capital Program – Product Improvement

Hilton Arlington, TX

Renovated guestrooms and public space

RevPAR up 9.9% YTD

GOP margin up 155bps YTD

[hotel photo]

Upgrade Core Portfolio

Capital Program – Product Improvement

Hilton Crystal City at National Airport

Completely renovated guestrooms and public areas

ADR up 14.7% YTD

RevPAR up 13.8% YTD

[hotel photo]

Upgrade Core Portfolio

Capital Program – Product Improvement

Radisson Chicago

ADR up 19.9% YTD

RevPAR up 18.4% YTD

GOP margin up 241 bps YTD

[hotel photo]

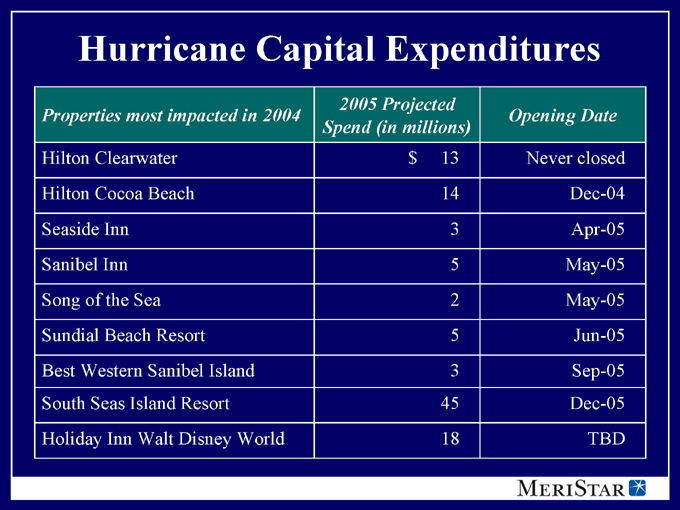

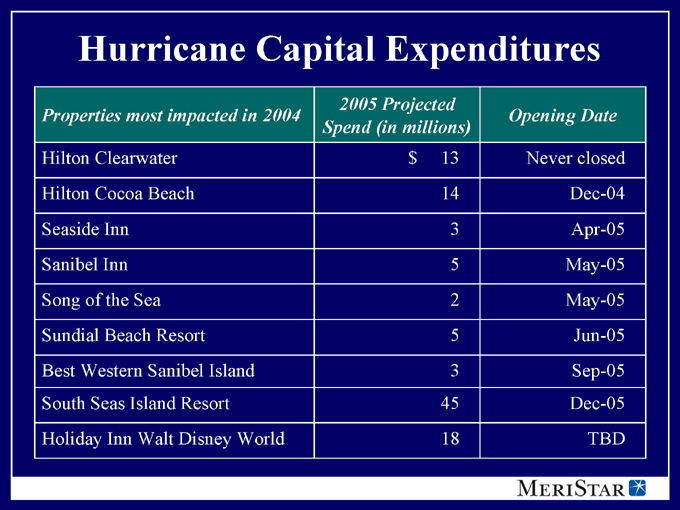

Hurricane Capital Expenditures

Properties most impacted in 2004 2005 Projected

Spend (in millions) Opening Date

Hilton Clearwater $13 Never closed

Hilton Cocoa Beach 14 Dec-04

Seaside Inn 3 Apr-05

Sanibel Inn 5 May-05

Song of the Sea 2 May-05

Sundial Beach Resort 5 Jun-05

Best Western Sanibel Island 3 Sep-05

South Seas Island Resort 45 Dec-05

Holiday Inn Walt Disney World 18 TBD

Hilton Clearwater

[hotel photos]

Hilton Cocoa Beach

[hotel photos]

South Seas Island Resort

Before

[hotel photos]

After

Property Level Results

Hurricane-Affected Properties

Properties emerging in first-rate condition

Hilton Clearwater

ADR up 13% YTD

Hilton Cocoa Beach

ADR up 24% YTD

[hotel photo]

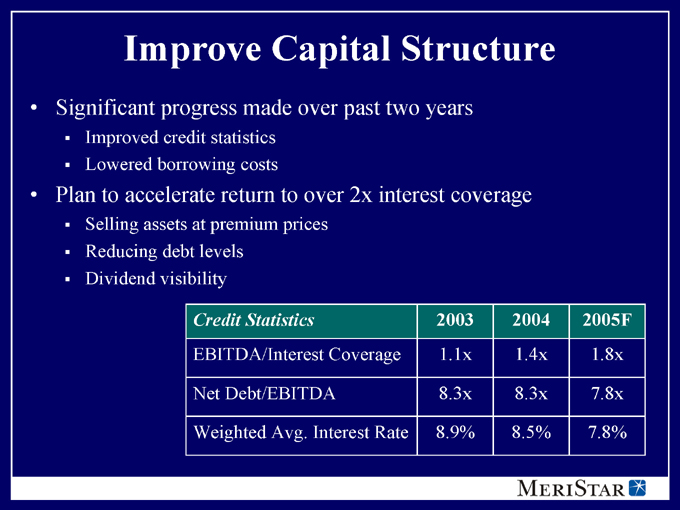

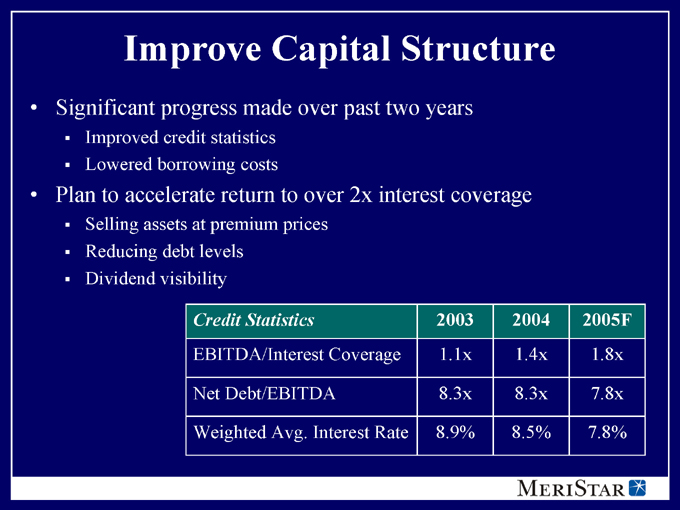

Improve Capital Structure

Significant progress made over past two years

Improved credit statistics

Lowered borrowing costs

Plan to accelerate return to over 2x interest coverage

Selling assets at premium prices

Reducing debt levels

Dividend visibility

Credit Statistics 2003 2004 2005F

EBITDA/Interest Coverage 1.1x 1.4x 1.8x

Net Debt/EBITDA 8.3x 8.3x 7.8x

Weighted Avg. Interest Rate 8.9% 8.5% 7.8%

Improve Capital Structure

2005 Capital Markets Activity To Date

Placed $82 million in long-term (10-yr) low interest-rate (5.7 – 5.8%) mortgages on the Hiltons in Crystal City and Clearwater

Repurchased $41 million in senior notes

Called remaining $33 million senior subordinated notes at par

Expanded secured revolving credit facility by $100 million while lowering the total borrowing rate by 100 bps

Refinanced $300 million CMBS at a rate over 300 bps lower

$9 million annualized interest savings

Increased portfolio flexibility

$45 million in escrows released

Position for Growth

Focus on core hotels

Strategic locations in large urban markets or destination resorts with high barriers to entry

Branded, larger hotels with significant meeting space

Strong current cash returns

Focus on operations

Right-size capital structure

Complete portfolio repositioning

[hotel photo]

Business Plan Modifications

Sell additional assets

Retire debt

ROI capital

Very selective investments

[hotel photo]

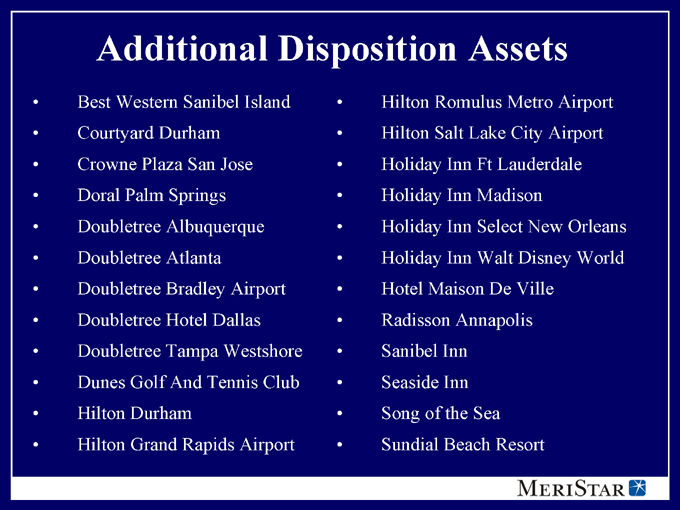

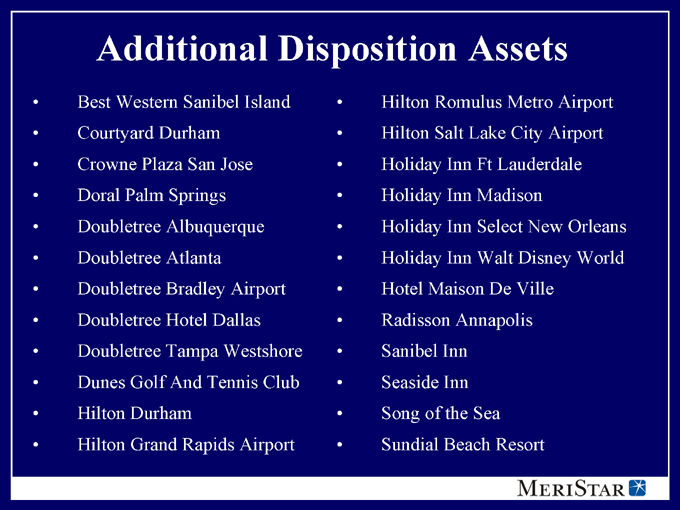

Additional Disposition Assets

Best Western Sanibel Island

Courtyard Durham

Crowne Plaza San Jose

Doral Palm Springs

Doubletree Albuquerque

Doubletree Atlanta

Doubletree Bradley Airport

Doubletree Hotel Dallas

Doubletree Tampa Westshore

Dunes Golf And Tennis Club

Hilton Durham

Hilton Grand Rapids Airport

Hilton Romulus Metro Airport

Hilton Salt Lake City Airport

Holiday Inn Ft Lauderdale

Holiday Inn Madison

Holiday Inn Select New Orleans

Holiday Inn Walt Disney World

Hotel Maison De Ville

Radisson Annapolis

Sanibel Inn

Seaside Inn

Song of the Sea

Sundial Beach Resort

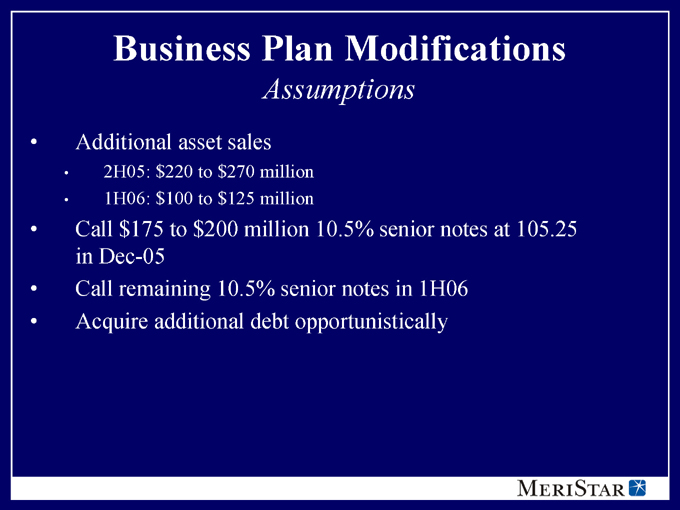

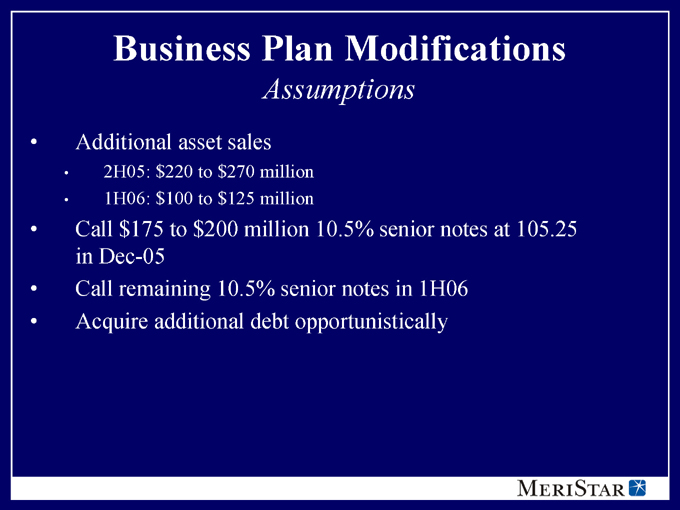

Business Plan Modifications

Assumptions

Additional asset sales

2H05: $220 to $270 million

1H06: $100 to $125 million

Call $175 to $200 million 10.5% senior notes at 105.25 in Dec-05

Call remaining 10.5% senior notes in 1H06

Acquire additional debt opportunistically

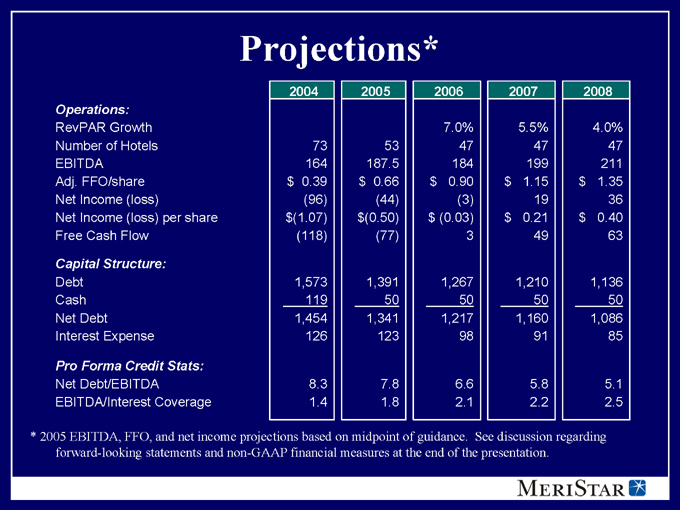

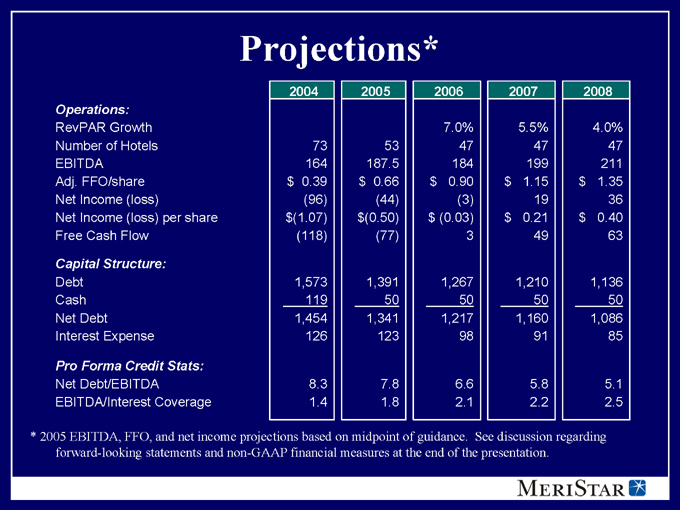

Projections*

2004 2005 2006 2007 2008

Operations:

RevPAR Growth 7.0% 5.5% 4.0%

Number of Hotels 73 53 47 47 47

EBITDA 164 187.5 184 199 211

Adj. FFO/share $0.39 $0.66 $0.90 $1.15 $1.35

Net Income (loss) (96) (44) (3) 19 36

Net Income (loss) per share $(1.07) $(0.50) $(0.03) $0.21 $0.40

Free Cash Flow (118) (77) 3 49 63

Capital Structure:

Debt 1,573 1,391 1,267 1,210 1,136

Cash 119 50 50 50 50

Net Debt 1,454 1,341 1,217 1,160 1,086

Interest Expense 126 123 98 91 85

Pro Forma Credit Stats:

Net Debt/EBITDA 8.3 7.8 6.6 5.8 5.1

EBITDA/Interest Coverage 1.4 1.8 2.1 2.2 2.5

* 2005 EBITDA, FFO, and net income projections based on midpoint of guidance. See discussion regarding forward-looking statements and non-GAAP financial measures at the end of the presentation.

Operations Overview

[hotel photo]

Maximize Internal Growth

Execution of Operating Strategy

Aggressive asset management

Operating company dialogue

Pro-active, on-going revenue management

Focus on operating margins/flow-through

Strategically directed capital expenditures

[hotel photo]

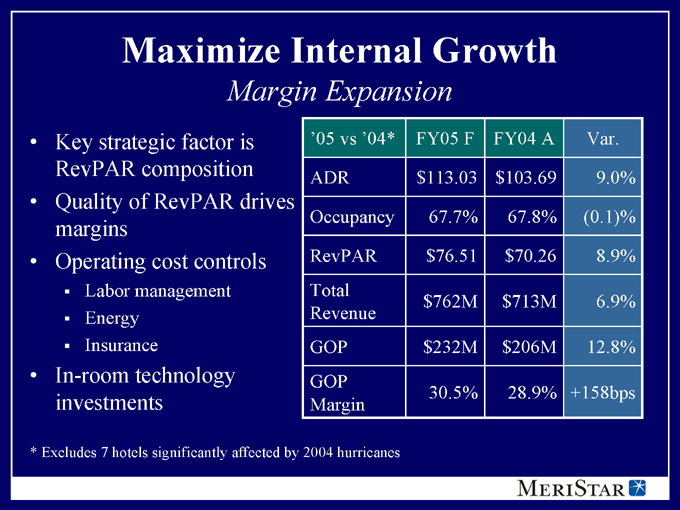

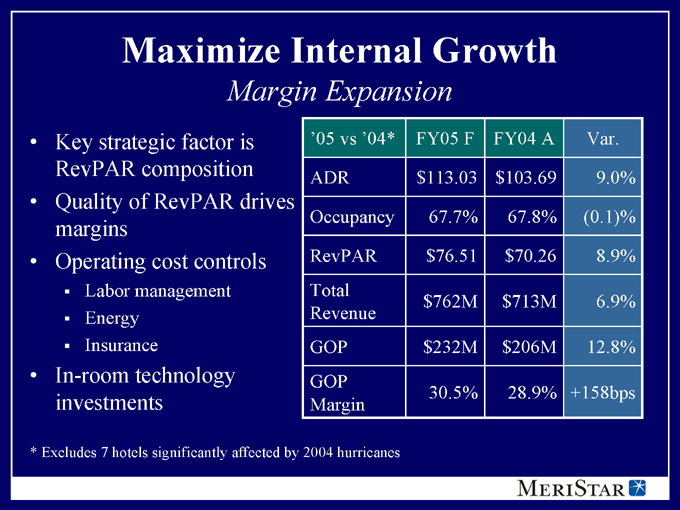

Maximize Internal Growth

Margin Expansion

Key strategic factor is ’05 vs ’04* FY05 F FY04 A Var.

RevPAR composition ADR $113.03 $103.69 9.0%

Quality of RevPAR drives margins Occupancy 67.7% 67.8% (0.1)%

Operating cost controls RevPAR $76.51 $70.26 8.9%

Labor management Total $762M $713M 6.9%

Energy Revenue

Insurance GOP $232M $206M 12.8%

In-room technology investments GOP Margin 30.5% 28.9% +158bps

* Excludes 7 hotels significantly affected by 2004 hurricanes

Maximize Internal Growth

2006 Outlook

Currently expect RevPAR growth of 7 to 8 percent

Margin growth of 75 to 125 basis points

Active cost management

Reduced renovation disruption

[hotel photo]

Upgrade Core Portfolio

Product Improvement

Returns on invested dollars

Improved competitive position

Property level confidence to execute rate-driven strategy

Reduction of repairs and maintenance

Increased energy efficiency

Brand standards

Competitive escalation of standards

Focuses the capital investment decision

[hotel photos]

Position for Growth

MeriStar Outlook on Market

Seller’s market

Abundant investment capital

Historically low interest rates

Positive industry fundamentals

Exploiting market conditions

Reduce debt levels

Exiting secondary markets

[hotel photo]

Position for Growth

Asset Sales

24x LTM EBITDA multiples on non-core asset disposition program in 2003/2004

14 – 15x LTM EBITDA multiples expected on expanded asset sale program in 2005/2006

Typical buyers are regional

24 assets now on the market

8 under contract or letter of intent

Projected completion by end of 1Q06

Assets with alternate uses

[hotel photo]

Position for Growth

Selective Investments

Acquisitions in 2004 continue to exceed expectations

The Ritz-Carlton, Pentagon City

Marriott Irvine

Radisson Lexington Avenue

Purchase/invested amounts are only 9x 2005 projected EBITDA

Actively in touch with the marketplace

[hotel photos]

Financial Overview

[hotel photo]

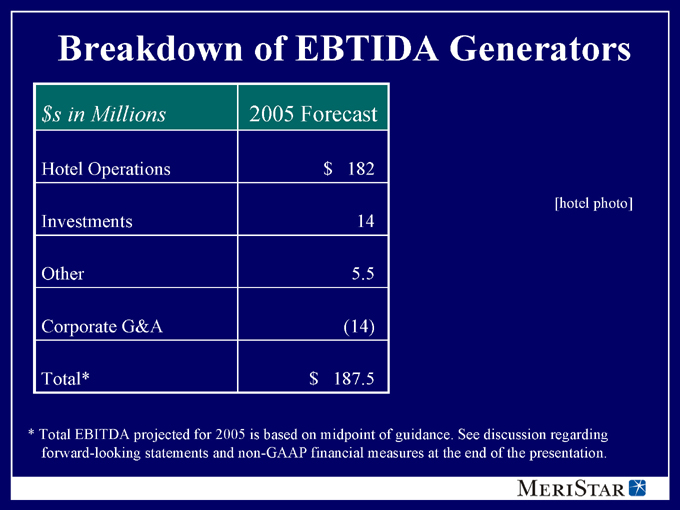

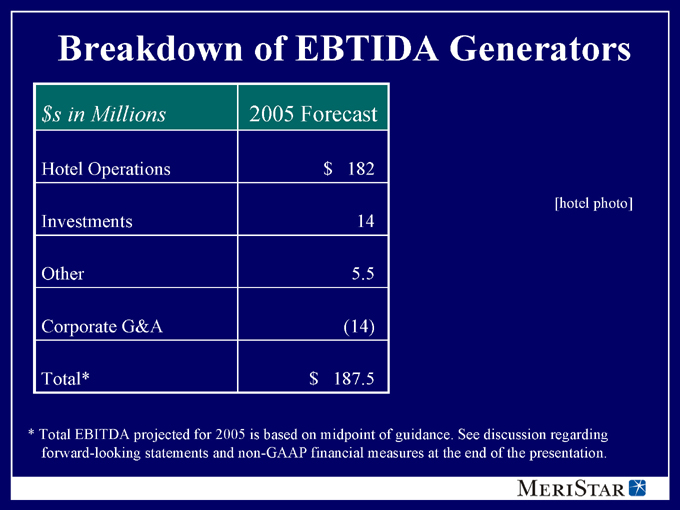

Breakdown of EBTIDA Generators

$s in Millions 2005 Forecast

Hotel Operations $182

Investments 14

Other 5.5

Corporate G&A (14)

Total* $187.5

[hotel photo]

* Total EBITDA projected for 2005 is based on midpoint of guidance. See discussion regarding forward-looking statements and non-GAAP financial measures at the end of the presentation.

Status of Insurance Claims

2004 Hurricanes Charley and Frances

Nearly all hotel operations restored by year end

Continuing to adjust claims

Process requires company to advance money

2005 Hurricane Katrina

3 hotels (566 rooms) had some impact/one re-opened

All in sale category

Short-term operating impact

[hurricane photo]

Improve Capital Structure

Look for opportunities to:

Reduce overall debt

Lower borrowing costs

Improve credit statistics

Made significant progress in past two years

Modifications to business plan accelerate return to over 2x coverage

[hotel photo]

Improve Capital Structure

2005 Capital Markets Activity To Date

Placed $82 million in long-term (10-yr) low interest-rate (5.7 –5.8%) mortgages on the Hiltons in Crystal City and Clearwater

Repurchased $41 million in senior notes

Called remaining $33 million senior subordinated notes at par

Expanded secured revolving credit facility by $100 million while lowering the total borrowing rate by 100 bps

Refinanced $300 million CMBS at a rate over 300 bps lower

$9 million annualized interest savings

Increased portfolio flexibility

$45 million in escrows released

Improve Capital Structure

Planned Capital Markets Activity

Call $175 to 200 million in 10½ percent senior notes in Dec-05

Call remaining 10½ percent senior notes in 1H06

Repay additional debt opportunistically

[hotel photo]

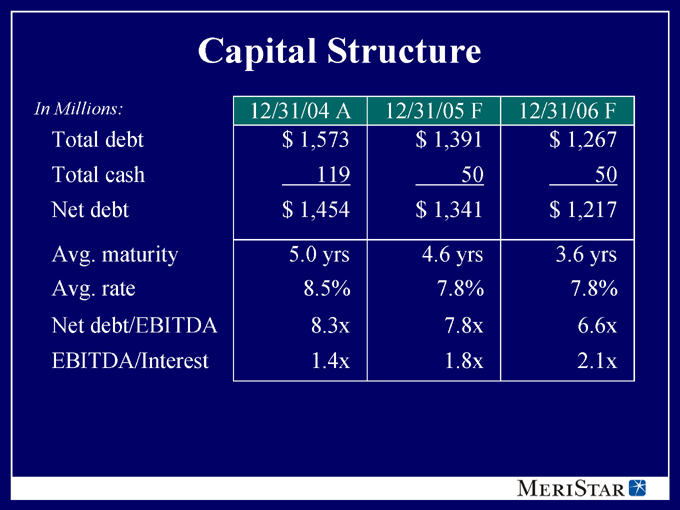

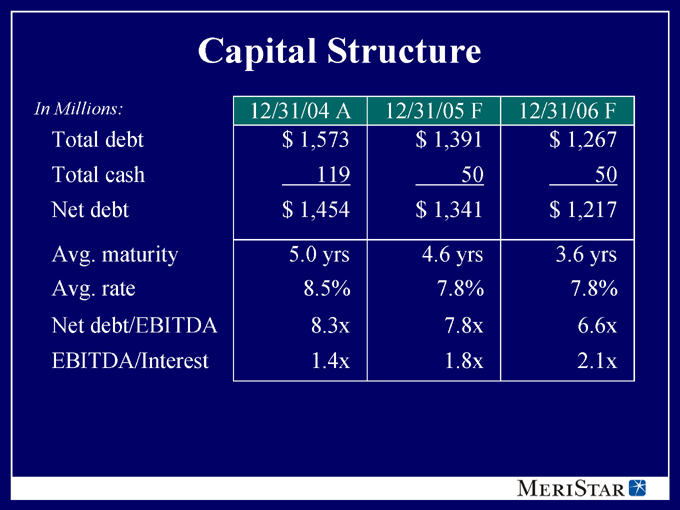

Capital Structure

In Millions: 12/31/04 A 12/31/05 F 12/31/06 F

Total debt $1,573 $1,391 $1,267

Total cash 119 50 50

Net debt $1,454 $1,341 $1,217

Avg. maturity 5.0 yrs 4.6 yrs 3.6 yrs

Avg. rate 8.5% 7.8% 7.8%

Net debt/EBITDA 8.3x 7.8x 6.6x

EBITDA/Interest 1.4x 1.8x 2.1x

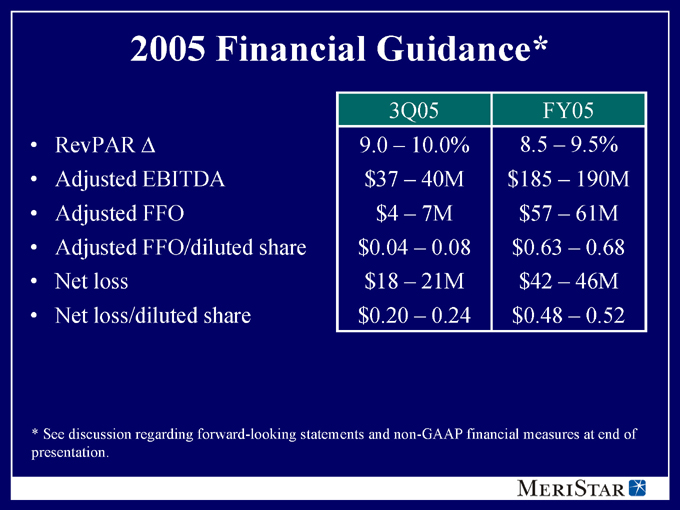

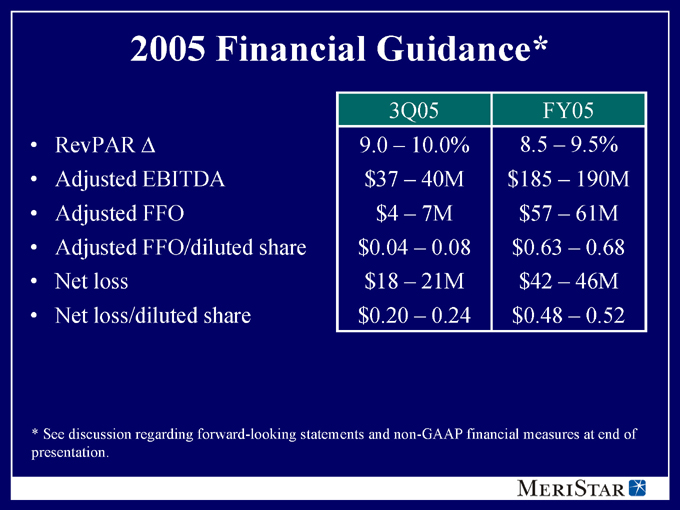

2005 Financial Guidance*

3Q05 FY05

RevPAR 9.0 – 10.0% 8.5 – 9.5%

Adjusted EBITDA $37 – 40M $185 – 190M

Adjusted FFO $4 – 7M $57 – 61M

Adjusted FFO/diluted share $0.04 – 0.08 $0.63 – 0.68

Net loss $18 – 21M $42 – 46M

Net loss/diluted share $0.20 – 0.24 $0.48 – 0.52

* See discussion regarding forward-looking statements and non-GAAP financial measures at end of presentation.

Looking Forward

[hotel photo]

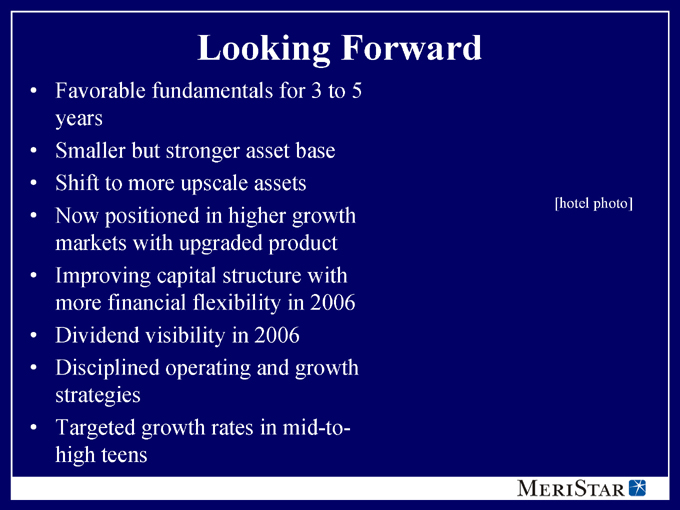

Looking Forward

Favorable fundamentals for 3 to 5 years

Smaller but stronger asset base

Shift to more upscale assets

Now positioned in higher growth markets with upgraded product

Improving capital structure with more financial flexibility in 2006

Dividend visibility in 2006

Disciplined operating and growth strategies

Targeted growth rates in mid-to-high teens

[hotel photo]

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements, which are based on various assumptions and describe our future plans, strategies and expectations, are generally identified by our use of words such as “intend,” “plan,” “may,” “should,” “will,” “project,” “estimate,” “anticipate,” “believe,” “expect,” “continue,” “potential,” “opportunity,” and similar expressions, whether in the negative or affirmative. We cannot guarantee that we actually will achieve these plans, intentions or expectations. All statements regarding our expected financial position, business and financing plans are forward-looking statements. Except for historical information, matters discussed in this presentation are subject to known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by such forward-looking statements. Factors which could have a material adverse effect on our operations and future prospects include, but are not limited to: economic conditions generally and the real estate market specifically; supply and demand for hotel rooms in our current and proposed market areas; other factors that may influence the travel industry, including health, safety and economic factors; competition; cash flow generally, including the availability of capital generally, cash available for capital expenditures, and our ability to refinance debt; the effects of threats of terrorism and increased security precautions on travel patterns and demand for hotels; the threatened or actual outbreak of hostilities and international political instability; governmental actions, including new laws and regulations and particularly changes to laws governing the taxation of real estate investment trusts; weather conditions generally and natural disasters; rising interest rates; and changes in U.S. generally accepted accounting principles, policies and guidelines applicable to real estate investment trusts. These risks and uncertainties should be considered in evaluating any forward-looking statements contained in this presentation or incorporated by reference herein. All forward-looking statements speak only as of the date of this presentation or, in the case of any document incorporated by reference, the date of that document. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are qualified by the cautionary statements in this section. We undertake no obligation to update or publicly release any revisions to forward-looking statements to reflect events, circumstances or changes in expectations after the date of this presentation.

SEC Regulation G requires any non-GAAP financial measure to be reconciled to the most directly comparable GAAP measure. To see the reconciliation of these numbers to the most directly comparable financial measures calculated and presented in accordance with GAAP, see the next slide and our press releases relating to the results of the quarter ended June 30, 2005, and the year ended December 31, 2004, which can be accessed on our website at www.MeriStar.com.

Free Cash Flow is EBITDA less capital expenditures and cash interest payments. It is considered to be an important indicator of the Company’s performance, including its ability to reduce net debt, make strategic investments, pay dividends to common shareholders and repurchase stock. Management believes that the presentation of free cash flow provides useful information to investors regarding our financial condition because it is a measure of cash generated which management evaluates for alternative uses. Free cash flow is not a substitute for any U.S. GAAP financial measure, such as net income.

Net debt is defined as total debt less cash and cash equivalents. Management uses net debt to evaluate the Company’s capital structure. Management believes that the presentation of net debt provides useful information to investors regarding our financial condition because accumulated cash can be used for debt repayment, if appropriate. Net debt is not a substitute for any U.S. GAAP financial measure. In addition, the calculation of net debt contained in this document may not be consistent with that of other companies.

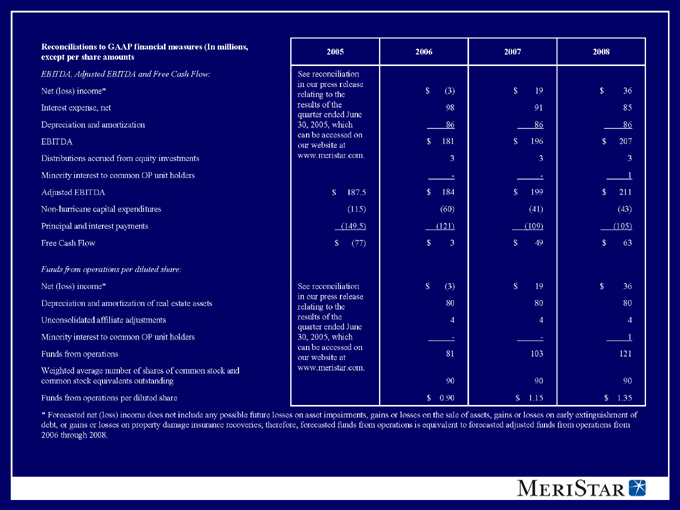

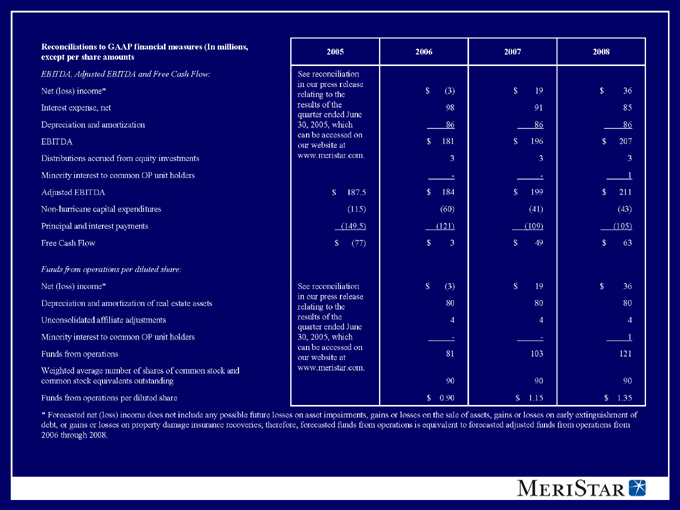

Reconciliations to GAAP financial measures (In millions, 2005 2006 2007 2008

except per share amounts

EBITDA, Adjusted EBITDA and Free Cash Flow: See reconciliation

in our press release

Net (loss) income* relating to the $(3) $19 $36

Interest expense, net results of the 98 91 85

quarter ended June

Depreciation and amortization 30, 2005, which 86 86 86

can be accessed on

EBITDA our website at $181 $196 $207

Distributions accrued from equity investments www.meristar.com. 3 3 3

Minority interest to common OP unit holders - - 1

Adjusted EBITDA $187.5 $184 $199 $211

Non-hurricane capital expenditures (115) (60) (41) (43)

Principal and interest payments (149.5) (121) (109) (105)

Free Cash Flow $(77) $3 $49 $63

Funds from operations per diluted share:

Net (loss) income* See reconciliation $(3) $19 $36

in our press release

Depreciation and amortization of real estate assets relating to the 80 80 80

Unconsolidated affiliate adjustments results of the 4 4 4

quarter ended June

Minority interest to common OP unit holders 30, 2005, which - - 1

can be accessed on

Funds from operations our website at 81 103 121

Weighted average number of shares of common stock and www.meristar.com.

common stock equivalents outstanding 90 90 90

Funds from operations per diluted share $0.90 $1.15 $1.35

* Forecasted net (loss) income does not include any possible future losses on asset impairments, gains or losses on the sale of assets, gains or losses on early extinguishment of debt, or gains or losses on property damage insurance recoveries; therefore, forecasted funds from operations is equivalent to forecasted adjusted funds from operations from 2006 through 2008.

MeriStar Hospitality Corporation (NYSE:MHX)

4501 N. Fairfax Drive, Suite 500

Arlington, VA 22203

(703) 812-7200

(703) 812-7255 fax

www.MeriStar.com