Exhibit 99.1

Nexstar Broadcasting Group

December 2003

Safe Harbor Act

The following information contains, or may be deemed to contain, “forward-looking statements” (as defined in the U.S. Private Securities Litigation Reform Act of 1995). By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. Future results will vary from the results expressed in, or implied by, the following forward looking statements, possibly to a material degree. We undertake no obligation to update these statements or publicly release the result of any revisions to these statements.

1

Management Introduction

Perry A. Sook – Chief Executive Officer and President

| Ø | Over 24 years of broadcasting experience |

| | • | Founded Nexstar with ABRY in 1996 |

| | • | Founded Superior Communications Group in 1991, operated for four years |

| | • | Gaylord Broadcasting Company and Cox Communications |

Bob Thompson – EVP and Chief Financial Officer

| Ø | Over 10 years of finance and operational experience with Paging Network, Inc. (PageNet), a high growth, public company in a consolidating industry |

| Ø | Six years in public accounting with Ernst & Young, LLP |

2

Nexstar Broadcasting Group

Leading independent station group and acquiror in mid-size markets

| Ø | Pro forma for the acquisition of Quorum, KPOM, KFAA and sale of WTVW: |

| | – | 28 stations owned and operated |

| | – | 14 stations under Local Service Agreements offer economic benefits of ownership |

| | • | Leading duopoly operator |

| | • | Leading acquisition platform |

| | – | 19 acquisitions since inception |

| | • | Reaching over 7% of U.S. television households |

3

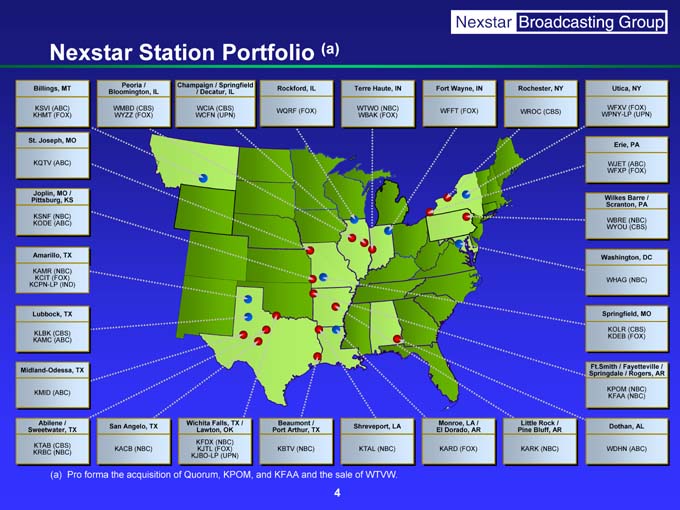

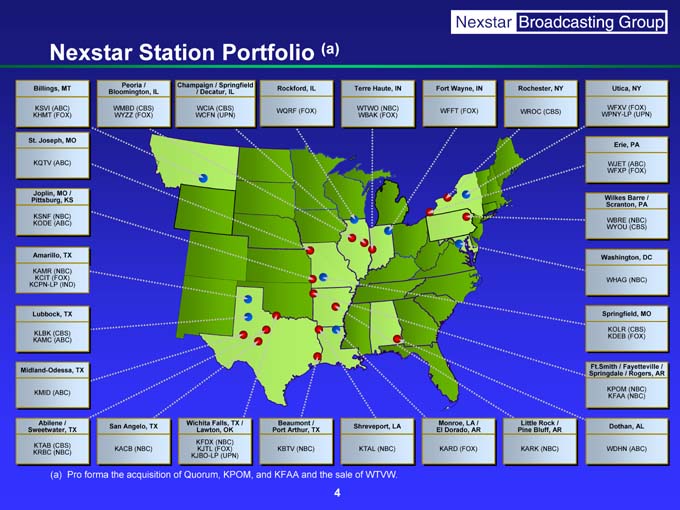

Utica, NY WFXV (FOX)WPNY-LP (UPN) Erie, PA WJET (ABC)WFXP (FOX) Wilkes Barre / Scranton, PA WBRE (NBC)WYOU (CBS) Washington, DC WHAG (NBC) Springfield, MO KOLR (CBS)KDEB (FOX) Ft.Smith / Fayetteville /Springdale / Rogers, AR KPOM (NBC)KFAA (NBC) Dothan, AL WDHN (ABC) Rochester, NY WROC (CBS) Little Rock / Pine Bluff, AR KARK (NBC) Fort Wayne, IN WFFT (FOX) Monroe, LA / El Dorado, AR KARD (FOX) .WOR Terre Haute, IN WTWO (NBC)WBAK (FOX) Shreveport, LA KTAL (NBC) sale of WTVW. (a) 4 Rockford, IL WQRF (FOX) Beaumont / Port Arthur, TX KBTV (NBC) Champaign / Springfield / Decatur, IL WCIA (CBS)WCFN (UPN) Wichita Falls, TX / Lawton, OK KFDX (NBC)KJTL (FOX) KJBO-LP (UPN) Peoria /Bloomington, IL WMBD (CBS)WYZZ (FOX) San Angelo, TX KACB (NBC) Pro forma the acquisition of Quorum, KPOM, and KFAA and the Nexstar Station Portfolio Billings, MT KSVI (ABC)KHMT (FOX) St. Joseph, MO KQTV (ABC) Joplin, MO / Pittsburg, KS KSNF (NBC)KODE (ABC) Amarillo, TX KAMR (NBC)KCIT (FOX)KCPN-LP (IND) Lubbock, TX KLBK (CBS)KAMC (ABC) Midland-Odessa, TX KMID (ABC) Abilene / Sweetwater, TX KTAB (CBS)KRBC (NBC) (a)

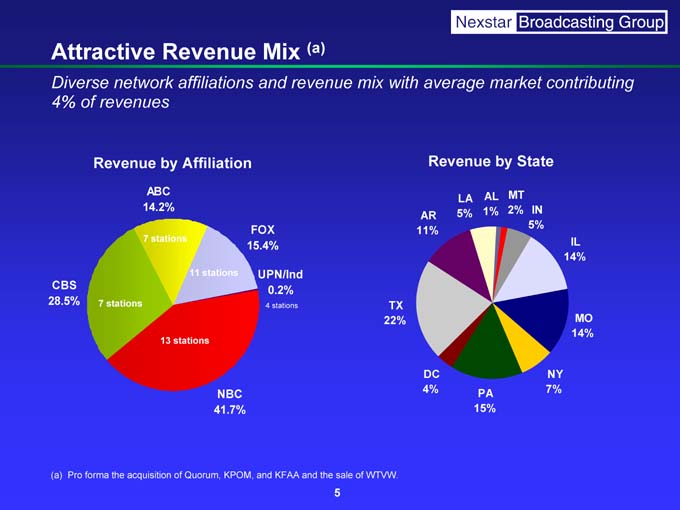

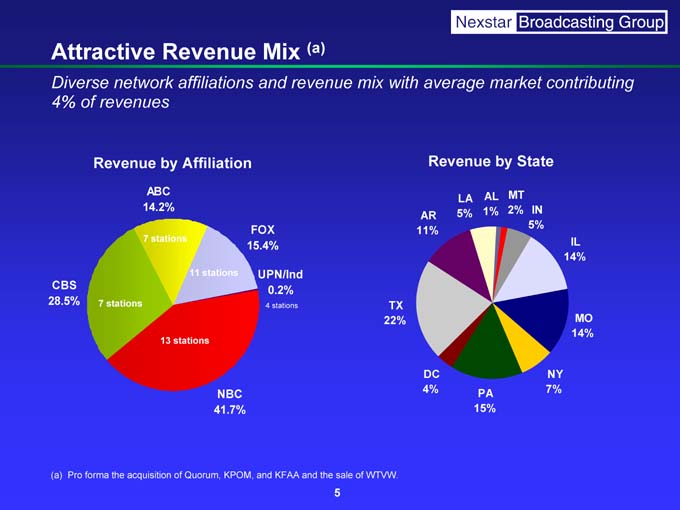

IL 14% MO 14% contributing NY 7% IN 5% MT 2% AL 1% PA 15% Revenue by State LA 5% AR 11% DC 4% TX 22% sale of WTVW. 5 (a) UPN/Ind 0.2% 4 stations FOX 15.4% 11 stations NBC 41.7% 13 stations ABC 14.2% 7 stations Revenue by Affiliation 7 stations Pro forma the acquisition of Quorum, KPOM, and KFAA and the Attractive Revenue Mix Diverse network affiliations and revenue mix with average market 4% of revenues CBS 28.5% (a)

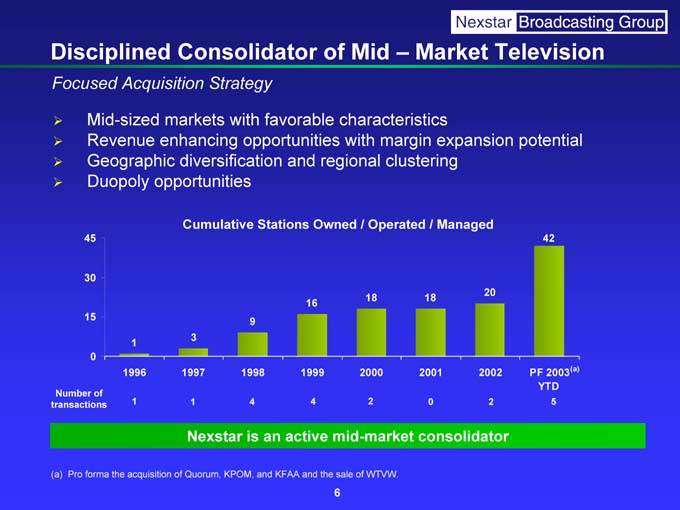

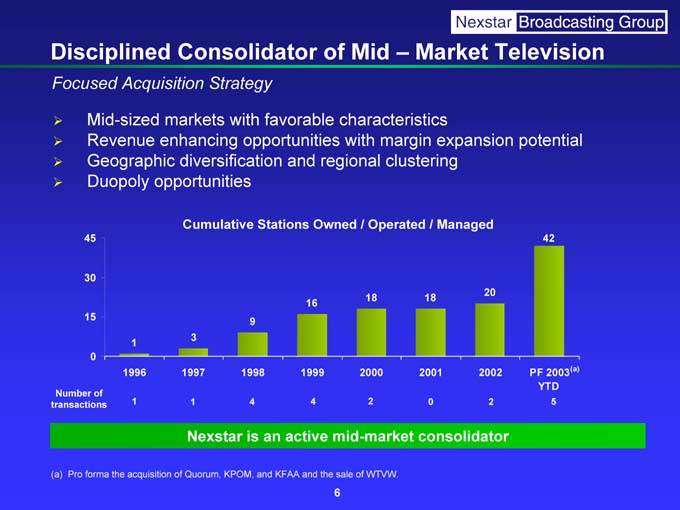

(a) 42 PF 2003 YTD 5 20 2002 2 Market Television 18 2001 0 18 2000 2 sale of WTVW. 6 16 1999 4 9 1998 4 Cumulative Stations Owned / Operated / Managed 3 1997 1 Nexstar is an active mid-market consolidator 1 1996 1 Mid-sized markets with favorable characteristics Revenue enhancing opportunities with margin expansion potential Geographic diversification and regional clustering Duopoly opportunities 45 30 15 0 Number of Pro forma the acquisition of Quorum, KPOM, and KFAA and the Disciplined Consolidator of Mid – Focused Acquisition Strategy transactions (a)

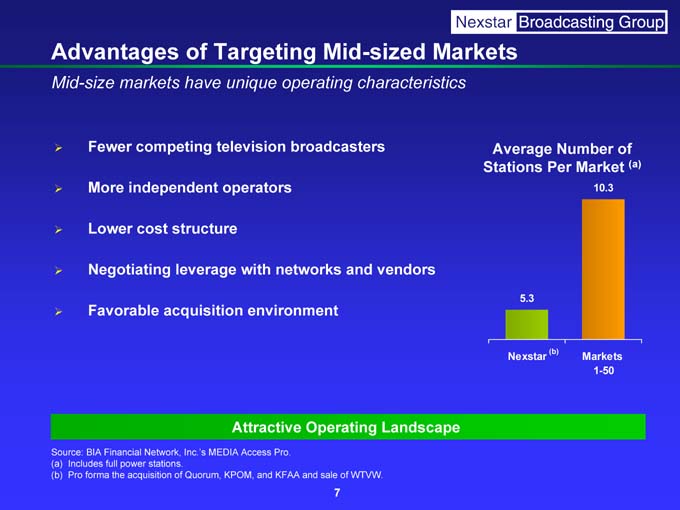

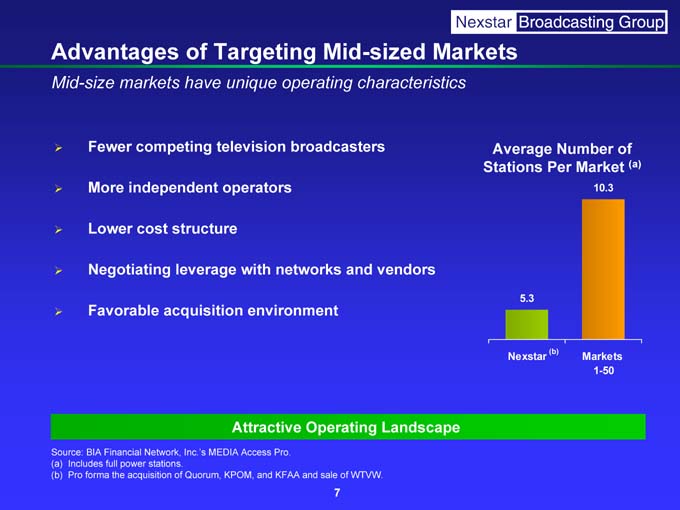

(a) 10.3 Markets 1-50 (b) Average Number of Stations Per Market 5.3 Nexstar Attractive Operating Landscape 7 Fewer competing television broadcasters More independent operators Lower cost structure Negotiating leverage with networks and vendors Favorable acquisition environment Includes full power stations. Pro forma the acquisition of Quorum, KPOM, and KFAA and sale of WTVW. Advantages of Targeting Mid-sized Markets Mid-size markets have unique operating characteristics Source: BIA Financial Network, Inc.’s MEDIA Access Pro. (a) (b)

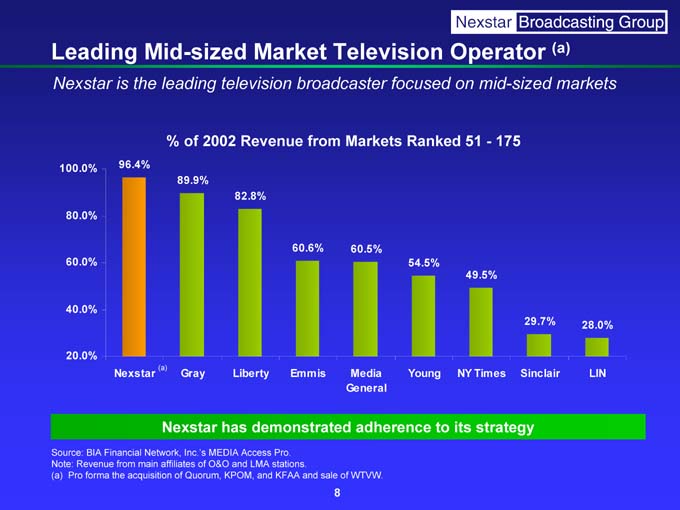

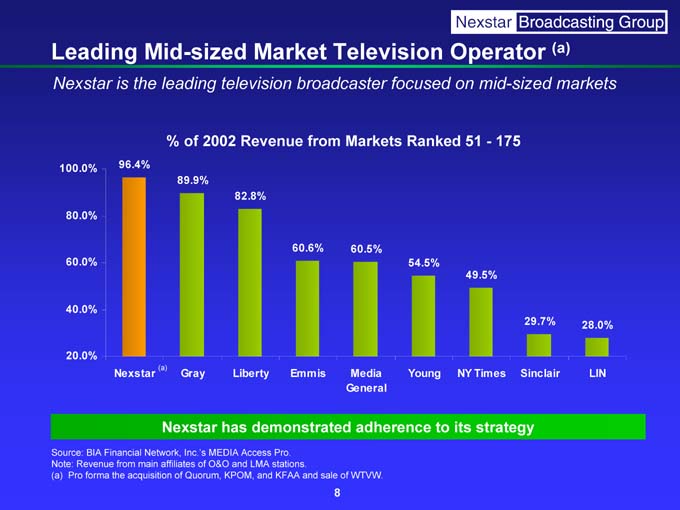

• markets 28.0% LIN • (a) • 29.7% Sinclair • 175 • mid-sized—49.5% Times strategy • 51 • Operator on NY its • to focused Ranked 54.5% Young adherence • Markets 60.5% Media General WTVW. of • Television from sale 8 • broadcaster 60.6% Emmis and • Pro. stations. KFAA • Market Revenue 82.8% Liberty demonstrated Access LMA and television has and KPOM, • 2002 MEDIA O&O • Inc.’s of Quorum, of 89.9% Gray

leading % Nexstar affiliates of • Mid-sized (a) Network, • the 96.4% main acquisition is Nexstar Financial from the BIA Revenue forma • Nexstar 100.0% 80.0% 60.0% 40.0% 20.0% Source: Pro • Leading Note:

• National Local • consultative / Mix 65.6% revenues • Local growth 2002 Revenue local • through Spot 34.4% revenue brand Nexstar’s National controllable local advertisers and drives stations’ partnerships local stable 9 strength in development marketing with more • market influence Revenue 1971-2002 9.5% Local on • ad investment advertiser added • emphasis Ad 7.5% National focuses Advertising. • local on new value greater TV CAGRs of sales on on Nexstar Bureau • Capitalize Focus Develop Achieve selling Television • Local Capitalize Source:

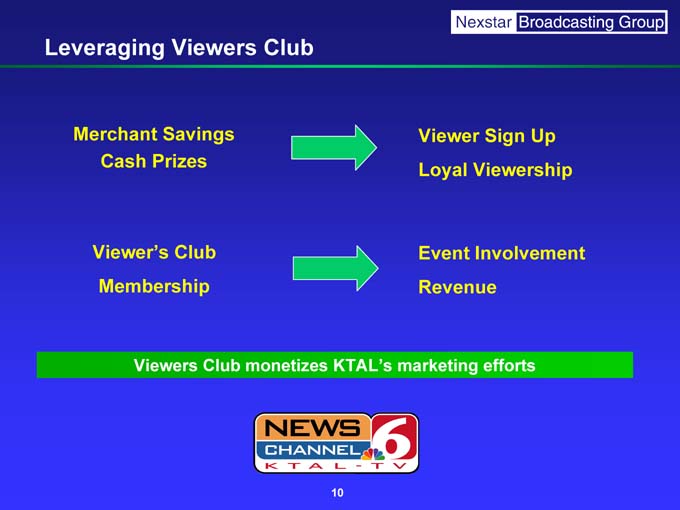

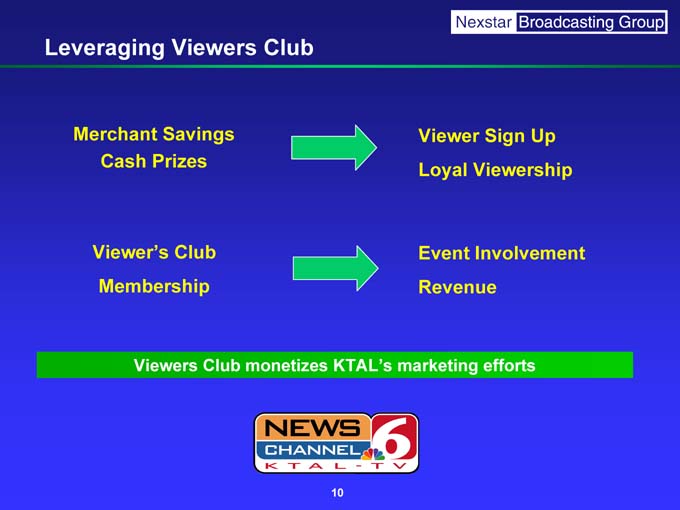

Viewer Sign Up Loyal Viewership Event Involvement Revenue marketing efforts Viewers Club monetizes KTAL’s 10 Leveraging Viewers Club Merchant Savings Cash Prizes Viewer’s Club Membership

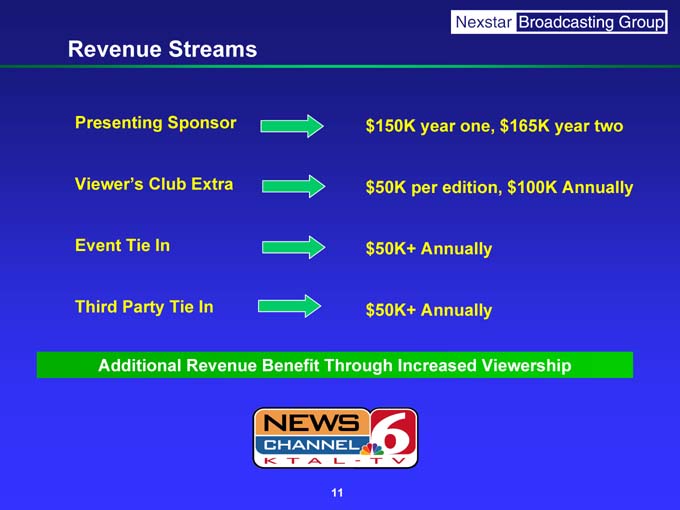

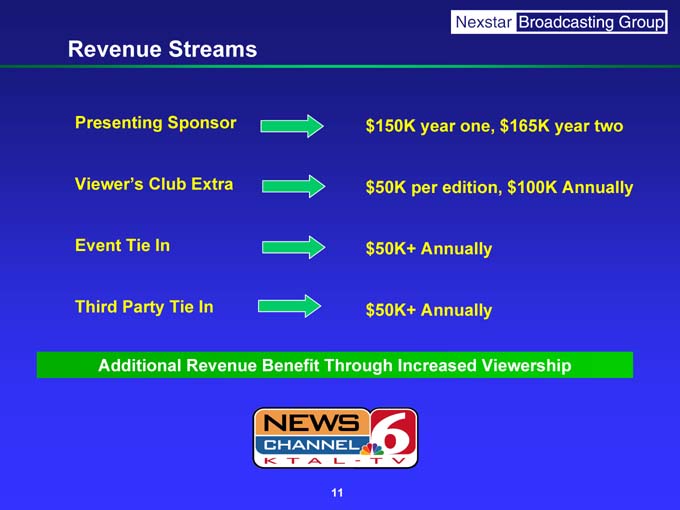

$150K year one, $165K year two $50K per edition, $100K Annually $50K+ Annually $50K+ Annually Additional Revenue Benefit Through Increased Viewership 11 Revenue Streams Presenting Sponsor Viewer’s Club Extra Event Tie In Third Party Tie In

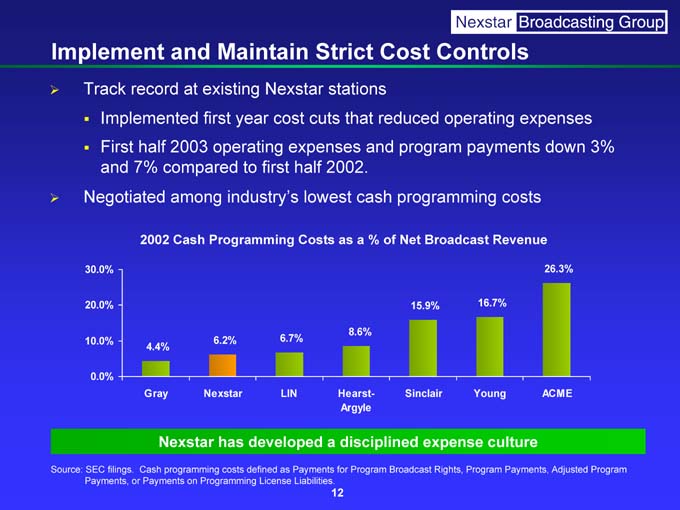

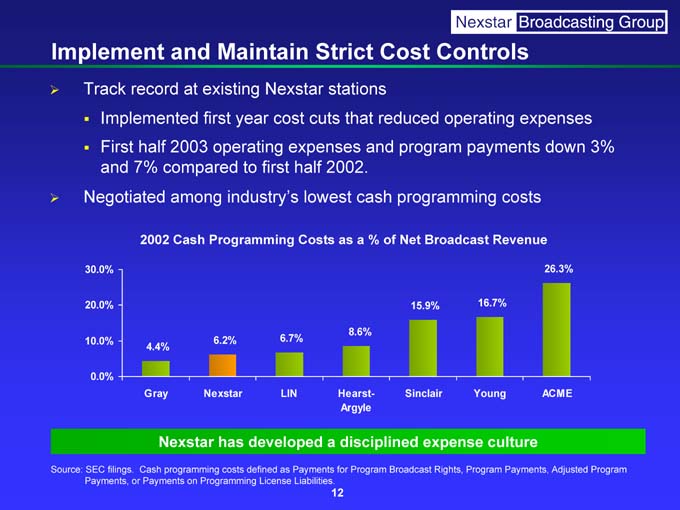

26.3% ACME 16.7% Young 15.9% Sinclair 8.6% Hearst- Argyle for Program Broadcast Rights, Program Payments, Adjusted Program 12 6.7% LIN 6.2% Nexstar Nexstar has developed a disciplined expense culture Implemented first year cost cuts that reduced operating expenses First half 2003 operating expenses and program payments down 3% and 7% compared to first half 2002. 2002 Cash Programming Costs as a % of Net Broadcast Revenue 4.4% Gray Cash programming costs defined as Payments 30.0% 20.0% 10.0% 0.0% Payments, or Payments on Programming License Liabilities. Implement and Maintain Strict Cost Controls Track record at existing Nexstar stations ?? ?? Negotiated among industry’s lowest cash programming costs Source: SEC filings.

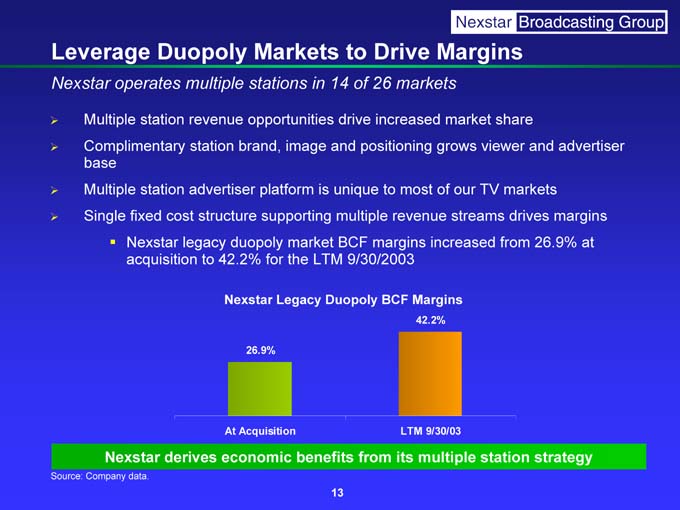

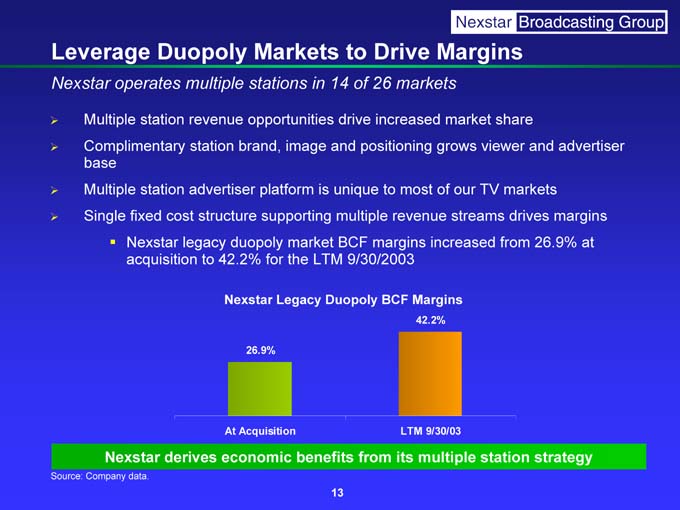

markets 42.2% LTM 9/30/03 13 Nexstar legacy duopoly market BCF margins increased from 26.9% at acquisition to 42.2% for the LTM 9/30/2003 Nexstar Legacy Duopoly BCF Margins 26.9% At Acquisition ?? Nexstar derives economic benefits from its multiple station strategy Leverage Duopoly Markets to Drive Margins Nexstar operates multiple stations in 14 of 26 markets Multiple station revenue opportunities drive increased market share Complimentary station brand, image and positioning grows viewer and advertiser base Multiple station advertiser platform is unique to most of our TV Single fixed cost structure supporting multiple revenue streams drives margins Source: Company data.

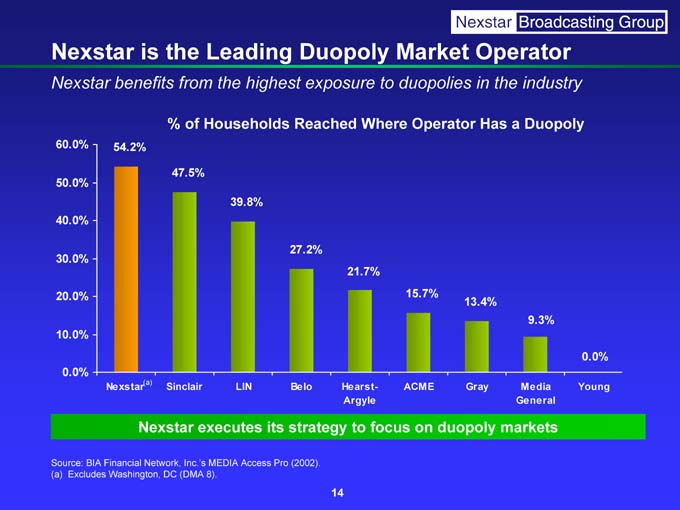

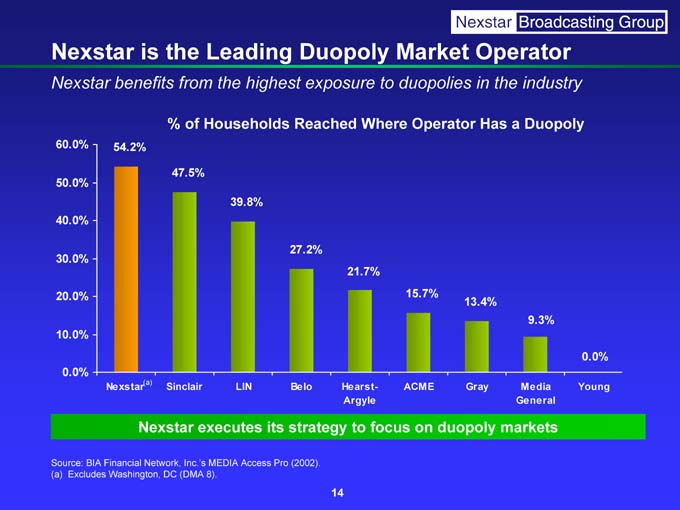

0.0% Young 9.3% Media General 13.4% Gray 15.7% ACME 21.7% Hearst- Argyle 14 27.2% Belo 39.8% LIN % of Households Reached Where Operator Has a Duopoly 47.5% Sinclair (a) Nexstar executes its strategy to focus on duopoly markets 54.2% Nexstar Excludes Washington, DC (DMA 8). Nexstar is the Leading Duopoly Market Operator Nexstar benefits from the highest exposure to duopolies in the industry 60.0%

50.0% 40.0% 30.0% 20.0% 10.0% 0.0% Source: BIA Financial Network, Inc.’s MEDIA Access Pro (2002). (a)

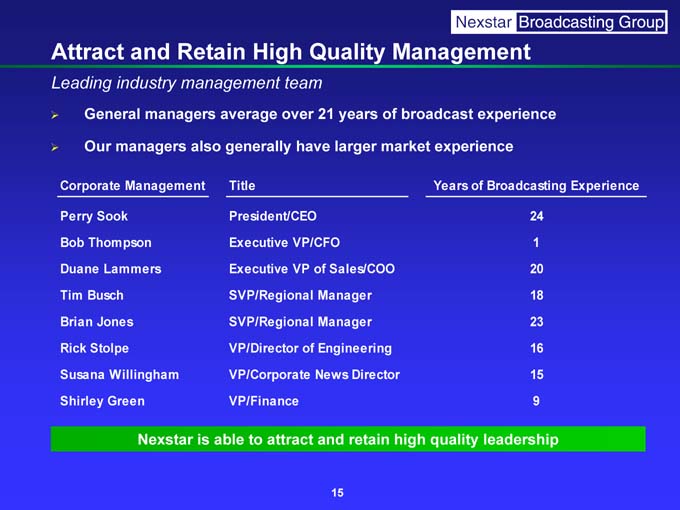

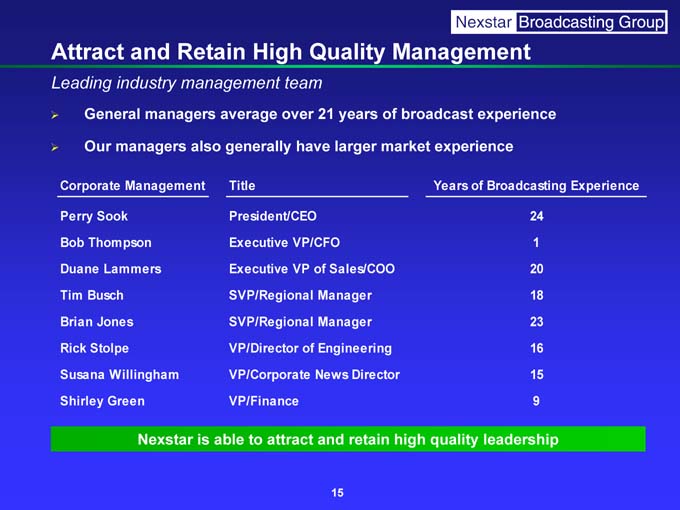

• Experience experience Broadcasting 24 1 20 18 23 16 15 9 leadership • experience of broadcast Years quality • Management high • of market Director retain years larger • Sales/COO 15 Quality 21 of Manager Manager Engineering News and • team over have VP/CFO VP of attract • High to • average generally Title President/CEO Executive Executive SVP/Regional SVP/Regional VP/Director VP/Corporate VP/Finance able • Retain management managers also is • and industry managers Management Willingham Nexstar Sook Thompson Lammers Jones Stolpe Green • General Our Busch • Attract Leading Corporate Perry Bob Duane Tim Brian Rick Susana Shirley •

• opportunities expansion 30% least competition margin at less of 16 stations markets and with operations growth returns markets affiliated duopoly equity Strategy network underperforming revenue mid-sized on additional Significant annualized Acquisition Target Focus Create Pursue ?? Target •

175 (a) 16.1% 629 Markets Ranked 51- % of Stations Owned 83.9% (b) Top 10 TV Broadcasters All Other TV Broadcasters 17 50 (a) 47.4% 515 Markets Ranked 1- % of Stations Owned 52.6% Nexstar has significant additional consolidation opportunities Mid-sized Markets Offer Acquisition Opportunities Total Stations Based upon full power, commercial television stations. Ranked by number of full power, commercial television stations owned. Station ownership in mid-sized markets is more fragmented than in the Top 50 markets Source: BIA Financial Network, Inc.’s MEDIA Access Pro. (a) (b)

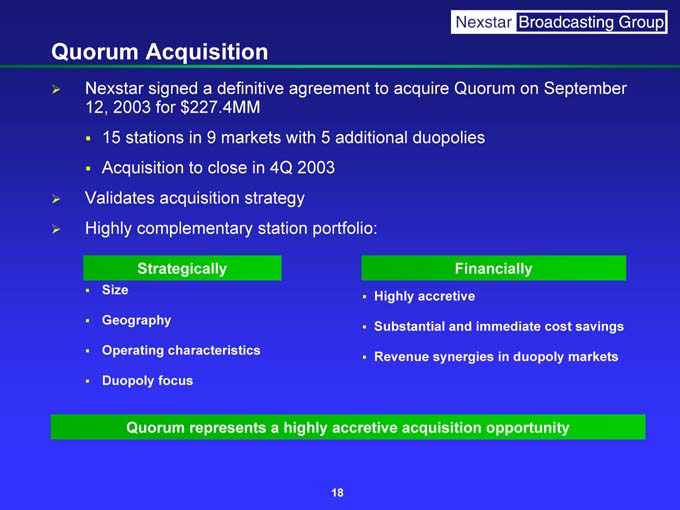

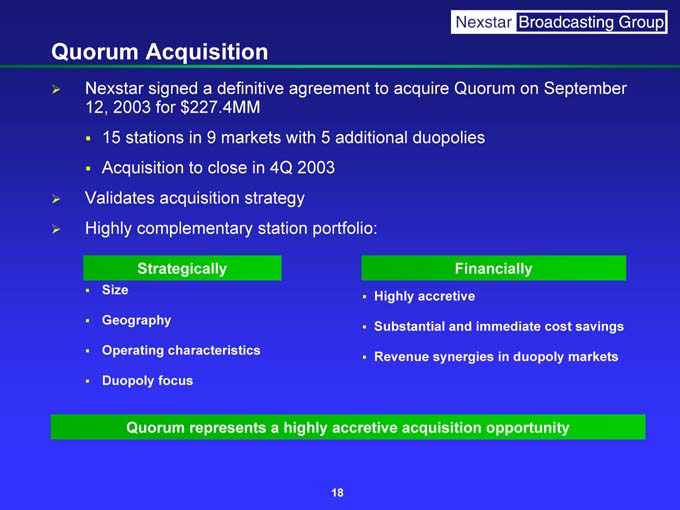

Financially Highly accretive Substantial and immediate cost savings Revenue synergies in duopoly markets ?? ?? ?? 18 15 stations in 9 markets with 5 additional duopolies Acquisition to close in 4Q 2003 Strategically Quorum represents a highly accretive acquisition opportunity Size Geography Operating characteristics Duopoly focus Quorum Acquisition Nexstar signed a definitive agreement to acquire Quorum on September 12, 2003 for $227.4MM ?? ?? Validates acquisition strategy Highly complementary station portfolio: ?? ?? ?? ??

(continued) Station level and combined corporate overhead 19 Quorum Acquisition Substantial financial upside Substantial cost reductions identified ? Source: Company data.

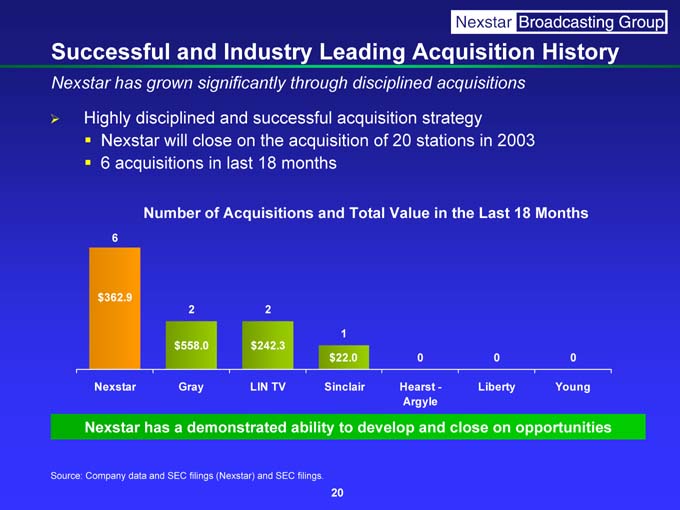

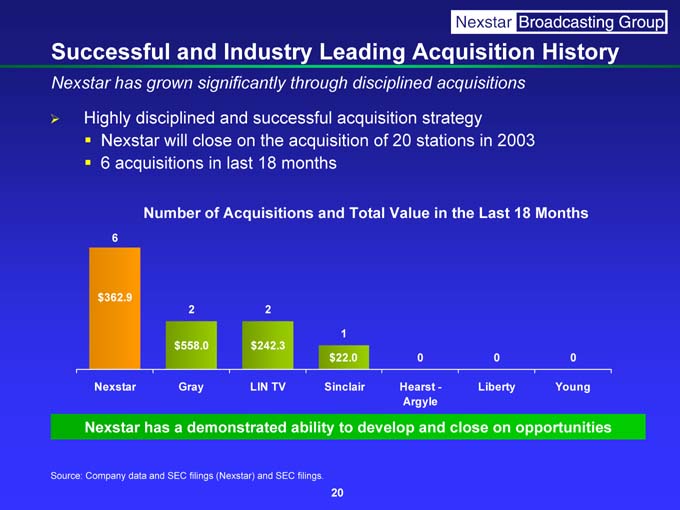

• History Months 0 Young opportunities • 2003 18 • 0 on • in Last Liberty • the close acquisitions strategy in—and • Acquisition stations 0 Hearst Argyle • 20 Value disciplined of Total develop acquisition 1 to • Leading and $22.0 Sinclair 20 • through acquisition months ability filings. • TV SEC • successful the 18 2 $242.3 LIN and • Industry and on last Acquisitions (Nexstar) significantly close in of and 2 Gray demonstrated filings • will $558.0 a SEC • grown disciplined Number has and has

acquisitions data Nexstar 6 • 6 $362.9 Nexstar Nexstar Company • Successful Nexstar Highly ?? ?? • Source:

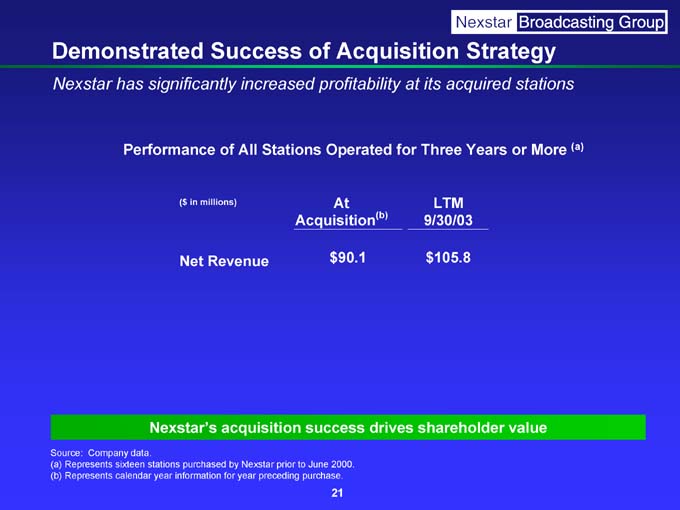

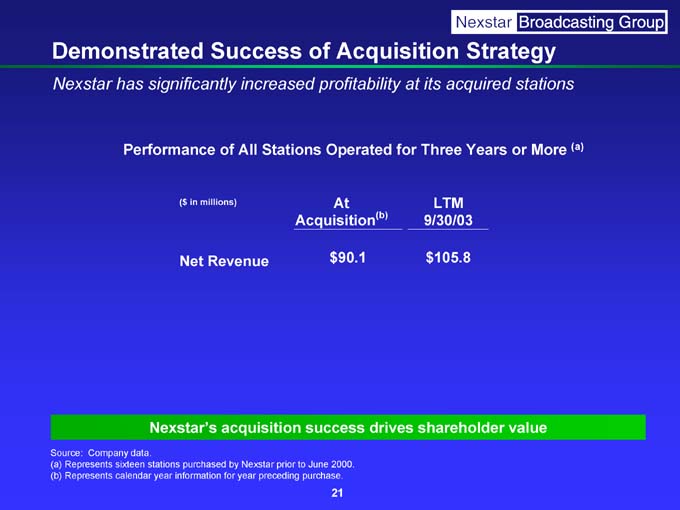

(a) LTM 9/30/03 $105.8 (b) At Acquisition $90.1 21 Performance of All Stations Operated for Three Years or More ($ in millions) Net Revenue Nexstar’s acquisition success drives shareholder value Demonstrated Success of Acquisition Strategy Nexstar has significantly increased profitability at its acquired stations Company data. (a) Represents sixteen stations purchased by Nexstar prior to June 2000. (b) Represents calendar year information for year preceding purchase. Source:

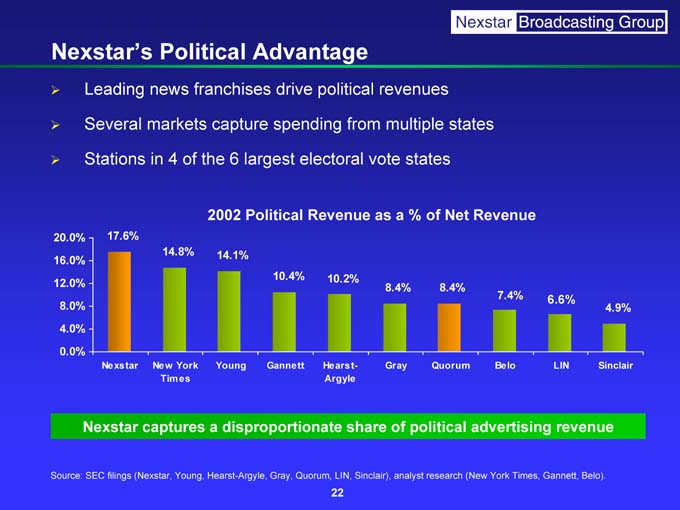

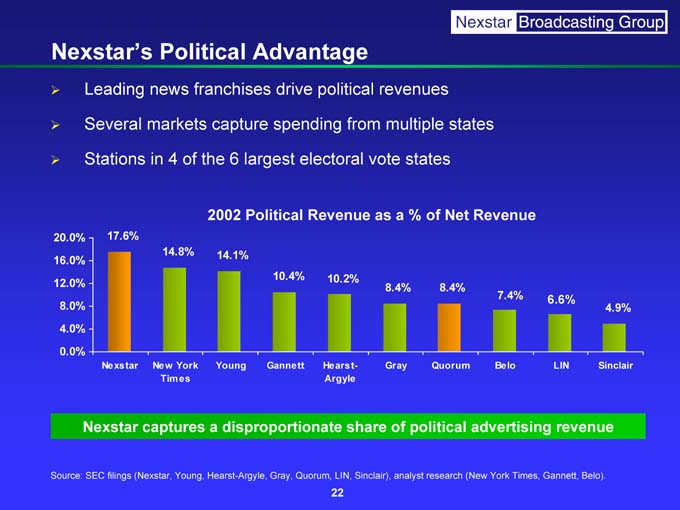

• 4.9% Sinclair • revenue Belo). • 6.6% LIN Gannett, Times, • Revenue 7.4% Belo advertising York states (New • Net 8.4% Quorum research • of political states % revenues multiple a 8.4% Gray of analyst • vote as Sinclair), • from share political electoral Revenue 10.2% Hearst- Argyle LIN, 22 • Quorum, • Advantage drive spending largest Political 10.4% Gannett Gray, capture 6 14.1% Young disproportionate • franchises the 2002 a Hearst-Argyle, of York Young, • Political 4 14.8% New Times • news markets in captures (Nexstar, • 17.6% Nexstar filings • Leading Several Stations Nexstar SEC • Nexstar’s 20.0% 16.0% 12.0% 8.0% 4.0% 0.0% Source: •

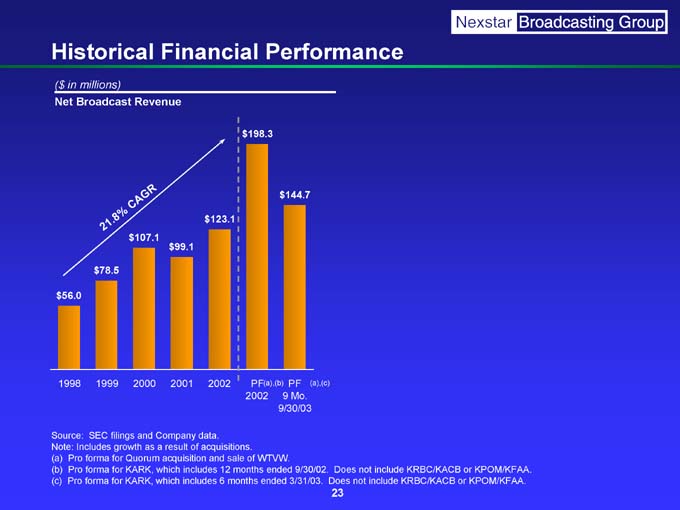

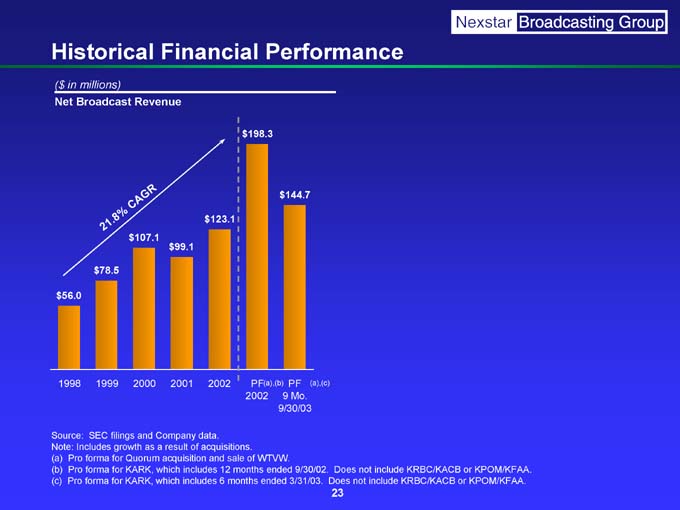

Does not include KRBC/KACB or KPOM/KFAA. Does not include KRBC/KACB or KPOM/KFAA. 23 (a),(c) $144.7 PF 9 Mo. 9/30/03 (a),(b) $198.3 PF 2002 $123.1 2002 $99.1 2001 RG A 2000 C $107.1 % 8 . 12 $78.5 1999 SEC filings and Company data. Pro forma for Quorum acquisition and sale of WTVW. Pro forma for KARK, which includes 12 months ended 9/30/02. Pro forma for KARK, which includes 6 months ended 3/31/03. ($ in millions) Net Broadcast Revenue $56.0 1998 Source: Historical Financial Performance Note: Includes growth as a result of acquisitions. (a) (b) (c)

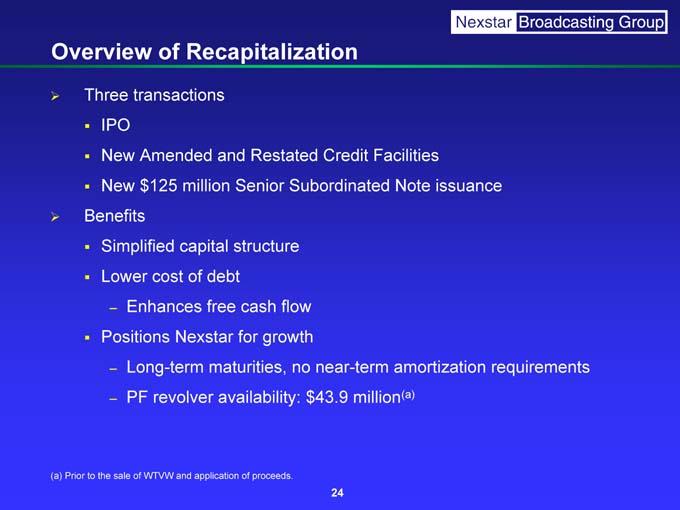

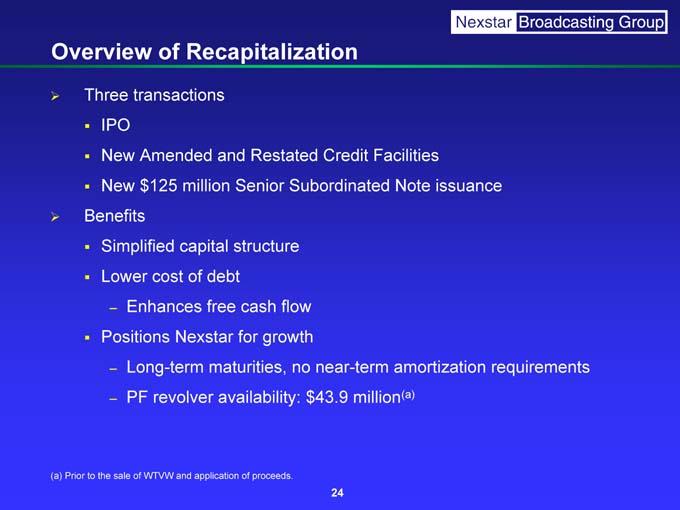

(a) 24 Enhances free cash flow Long-term maturities, no near-term amortization requirements PF revolver availability: $43.9 million IPO New Amended and Restated Credit Facilities New $125 million Senior Subordinated Note issuance Simplified capital structure Lower cost of debt – Positions Nexstar for growth – – Overview of Recapitalization Three transactions ?? ?? ?? Benefits ?? ?? ?? (a) Prior to the sale of WTVW and application of proceeds.

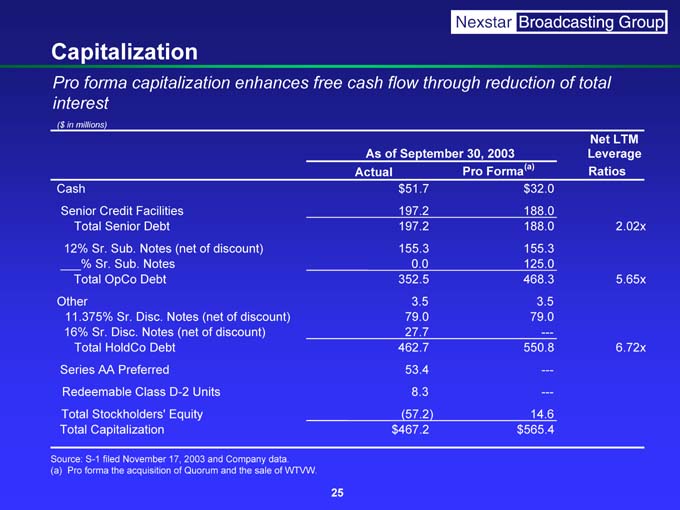

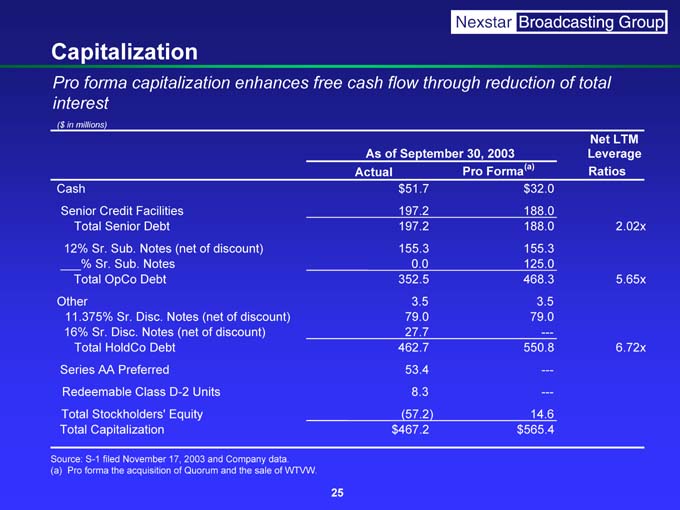

Net LTM 2.02x 5.65x 6.72x Leverage Ratios 3.5 79.0 —- —- —- 14.6 (a) $32.0 188.0 188.0 155.3 125.0 468.3 550.8 $565.4 Pro Forma As of September 30, 2003 $51.7 197.2 197.2 155.3 0.0 352.5 3.5 79.0 27.7 462.7 53.4 8.3 (57.2) $467.2 Actual 25 Debt Debt ($ in millions) Senior Credit Facilities Total Senior Debt 12% Sr. Sub. Notes (net of discount) % Sr. Sub. Notes Total OpCo 11.375% Sr. Disc. Notes (net of discount) 16% Sr. Disc. Notes (net of discount) Total HoldCo Series AA Preferred Redeemable Class D-2 Units Total Stockholders’ Equity Total Capitalization Pro forma the acquisition of Quorum and the sale of WTVW. Capitalization Pro forma capitalization enhances free

cash flow through reduction of total interest Cash Other Source: S-1 filed November 17, 2003 and Company data. (a)