- NXST Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Nexstar Media (NXST) DEF 14ADefinitive proxy

Filed: 13 Apr 04, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Pursuant to § 240.14a-12

Nexstar Broadcasting Group, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value or transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

¨ Fee paid previously with preliminary materials.

¨ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

NEXSTAR BROADCASTING GROUP, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on May 26, 2004

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of Nexstar Broadcasting Group, Inc. will be held at The Four Seasons Resort and Club, 4150 North MacArthur Boulevard, Irving, Texas 75038, on Wednesday, May 26, 2004 at 9:00 a.m., Central Standard Time, for the following purposes:

| 1. | To elect a Board of Directors to serve for the ensuing year and until their successors are duly elected and qualified. |

| 2. | The ratification of the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2004. |

| 3. | To consider and act upon such other business and matters or proposals as may properly come before the Annual Meeting or any adjournment or adjournments thereof. |

Nexstar is mailing this proxy statement and the related proxy on or about April 15, 2004 to its stockholders of record on April 9, 2004. Only stockholders of record at that time are entitled to notice of, and to vote at, the Annual Meeting and any adjournment or postponement thereof. A list of stockholders entitled to vote at the Annual Meeting will be available for examination by any stockholder, for any purpose germane to the Annual Meeting, at the Annual Meeting and for ten days prior to the Annual Meeting during ordinary business hours at 909 Lake Carolyn Parkway, Suite 1450, Irving, Texas 75039.

By Order of the Board of Directors

/s/ Shirley E. Green

Shirley E. Green

Secretary

April 13, 2004

IF YOU DO NOT EXPECT TO BE PRESENT AT THIS MEETING AND WISH YOUR SHARES OF COMMON STOCK TO BE VOTED, YOU ARE REQUESTED TO SIGN AND MAIL PROMPTLY THE ENCLOSED PROXY WHICH IS BEING SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. A RETURN ENVELOPE WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES IS ENCLOSED FOR THAT PURPOSE.

NEXSTAR BROADCASTING GROUP, INC.

909 Lake Carolyn Parkway, Suite 1450

Irving, TX 75039

PROXY STATEMENT

Annual Meeting of Stockholders

May 26, 2004

This proxy statement is furnished in connection with the solicitation by and on behalf of the Board of Directors of Nexstar Broadcasting Group, Inc., a Delaware corporation (“Nexstar”), of proxies for use at Nexstar’s Annual Meeting of Stockholders to be held, pursuant to the accompanying Notice of Annual Meeting, on Wednesday, May 26, 2004 at 9:00 a.m. (Central Standard Time), and at any adjournment or adjournments thereof (the “Annual Meeting”). Actions will be taken at the Annual Meeting to (1) elect a Board of Directors to serve until the next Annual Meeting of Stockholders; (2) to ratify the selection of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2004, and (3) to transact any other business which may properly come before the meeting.

Shares of Nexstar common stock, par value $0.01, (“Common Stock”), represented by a properly executed proxy that is received by Nexstar prior to the Annual Meeting, will, unless revoked, be voted as directed in the proxy. If a proxy is signed and returned, but does not specify how the shares represented by the proxy are to be voted, the proxy will be voted (i)FOR the election of the nominees named therein (ii)FOR PricewaterhouseCoopers LLP as Nexstar’s auditors in 2004 and (iii) in such manner as the proxies shall decide on any other matters that may properly come before the Annual Meeting.

This Proxy Statement, the accompanying notice and the enclosed proxy card are first being mailed to stockholders on or about April 15, 2004.

Nexstar’s principal mailing address is 909 Lake Carolyn Parkway, Suite 1450, Irving, TX 75039.

ANNUAL REPORT AND INDEPENDENT AUDITORS

Nexstar’s Annual Report to Stockholders for the fiscal year ended December 31, 2003, including Nexstar’s financial statements and PricewaterhouseCoopers LLP’s report on the financial statements, is being mailed with this proxy statement to each of Nexstar’s stockholders of record on April 9, 2004. Exhibits will be provided at no charge to any stockholder upon written request to Nexstar Broadcasting Group, Inc., attention: Bob Thompson, Chief Financial Officer. Representatives of PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting where they will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions.

VOTING SECURITIES

Stockholders of record on April 9, 2004 may vote at the Annual Meeting. On that date, there were 13,589,289 shares of Class A Common Stock; 13,411,588 shares of Class B Common Stock and 1,362,529 shares of Class C Common Stock outstanding. Holders of our Class A Common Stock and our Class B Common Stock will generally vote together as a single class on all matters submitted to a vote of our stockholders. The holders of Class A Common Stock are entitled to one vote per share and the holders of Class B Common Stock are entitled to 10 votes per share. Holders of our Class C Common Stock have no voting rights. If a quorum is present at the Annual Meeting, the directors will be elected by a plurality of the votes cast at the Annual Meeting by the holders of shares entitled to vote. Votes may be cast in favor of a nominee for director or withheld. Votes that are withheld or broker non-votes will have no effect on the outcome of the election of directors. (Broker non-votes occur when brokers or nominees holding stock in “street name” indicate on proxies that they do not have discretionary authority to vote the shares on a particular matter.)

Stockholders of record may vote their proxies by signing, dating and returning the enclosed Proxy Card. If no instructions are indicated, the shares represented by such proxy will be voted according to the recommendations of our Board of Directors. Each proxy that is properly received by Nexstar prior to the Annual Meeting will, unless revoked, be voted in accordance with the instructions given on such proxy. Any stockholder giving a proxy prior to the Annual Meeting has the power to revoke it at any time before it is exercised by a written revocation received by the Secretary of Nexstar or by executing and returning a proxy bearing a later date. Any stockholder of record attending the Annual Meeting may vote in person, whether or not a proxy has been previously given, but the mere presence of a stockholder at the Annual Meeting will not constitute revocation of a previously given proxy. In addition, stockholders whose shares of Common Stock are not registered in their own name will need to obtain a legal proxy from the record holder of such shares to vote in person at the Annual Meeting.

VOTE NECESSARY TO APPROVE PROPOSALS

| • | Proposal 1: Election of Directors |

The election of directors requires a plurality of the votes cast, and votes may be cast in favor of the nominees or withheld. A plurality means that the nominee receiving the most votes for election to a director position is elected to that position. Votes that are withheld and broker non-votes will be excluded entirely from the vote to elect directors and have no effect.

| • | Proposal 2: Ratification of the Selection of Independent Auditors |

The ratification of the selection of our independent auditors requires the affirmative vote of a majority of the votes cast at the meeting, and votes may be cast for, against or abstain. Abstentions will count in the tabulations of votes cast on this proposal, while broker non-votes are not counted as votes cast or shares voting on such matter and will have no effect on the voting on such matter.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of Nexstar’s Common Stock as of March 9, 2004 by (i) those persons known to Nexstar to be the beneficial owners of more than five percent of the outstanding shares of Common Stock of Nexstar, (ii) each director of Nexstar, (iii) the Named Executive Officers and (iv) all directors and executive officers of Nexstar as a group. This information has been furnished by the persons named in the table below or in filings made with the Securities and Exchange Commission. Where the number of shares set forth below includes shares beneficially owned by spouses and minor children, the named persons disclaim any beneficial interest in the shares so included.

Class A Common Stock | Class B Common Stock | Class C Common Stock | Percent of Total | ||||||||||||||||||

| Number | Percent | Number | Percent | Number | Percent | Economic Interest | Voting Power | ||||||||||||||

ABRY(1) | 3,490,883 | 25.7 | % | 13,024,501 | 97.1 | % | — | — | 58.2 | % | 90.5 | % | |||||||||

Banc of America Capital Investors L.P. (2) | — | — | — | — | 1,362,529 | 100.0 | % | 4.8 | % | — | |||||||||||

Hunter Global Investors L.P.(3) | 858,800 | 6.3 | % | — | — | — | — | 3.0 | % | * | |||||||||||

Wellington Management Company, LLP(4) | 1,891,200 | 13.9 | % | — | — | — | — | 6.7 | % | 1.3 | % | ||||||||||

Royce Yudkoff(5)(6) | 3,490,883 | 25.7 | % | 13,024,501 | 97.1 | % | — | — | 58.2 | % | 90.5 | % | |||||||||

Perry A. Sook(7)(8) | — | — | 387,087 | 2.9 | % | — | — | 1.4 | % | 2.6 | % | ||||||||||

G. Robert Thompson(8) | — | — | — | — | — | — | — | — | |||||||||||||

Duane A. Lammers(8) | 1,318 | * | — | — | — | — | * | * | |||||||||||||

Brian Jones(8) | 500 | * | — | — | — | — | * | * | |||||||||||||

Shirley E. Green(8) | 497 | * | — | — | — | — | * | * | |||||||||||||

Timothy C. Busch(8) | 214 | * | — | — | — | — | * | * | |||||||||||||

Susana G. Willingham(8) | 85 | * | — | — | — | — | * | * | |||||||||||||

Richard Stolpe(8) | 85 | * | — | — | — | — | * | * | |||||||||||||

Blake R. Battaglia(6) | — | — | — | — | — | — | — | — | |||||||||||||

Erik Brooks(6) | 1,000 | * | — | — | — | — | * | * | |||||||||||||

Jay M. Grossman(6) | 5,000 | * | — | — | — | — | * | * | |||||||||||||

Peggy Koenig(6) | 3,500 | * | — | — | — | — | * | * | |||||||||||||

Geoff Armstrong | — | — | — | — | — | — | — | — | |||||||||||||

Michael Donovan | 6,700 | * | — | — | — | — | * | * | |||||||||||||

I. Martin Pompadur | — | — | — | — | — | — | — | — | |||||||||||||

All directors and executive officers as a group (17 persons) | 3,509,782 | 25.8 | % | 13,411,588 | 100.0 | % | –– | –– | 59.6 | % | 93.2 | % | |||||||||

1

| * | Less than 1% |

| (1) | Represents 7,147,964 shares owned by ABRY Broadcast Partners II, L.P. and 5,796,307 shares owned by ABRY Broadcast Partners III, L.P., which are affiliates of ABRY Broadcast Partners, LLC. The address of ABRY is 111 Huntington Avenue, 30th Floor, Boston, MA 02199. |

| (2) | The address of Banc of America Capital Investors L.P. is 100 North Tryon Street, 25th Floor, Charlotte, NC 28255-0001. |

| (3) | Represents 302,295 shares owned by Hunter Global Investors Fund I L.P. and 19,742 shares owned by Hunter Global Investors Fund II, L.P. and 536,763 shares held by two offshore funds, Hunter Global Investors Offshore Fund, Ltd., and Hunter Global Investors Offshore Fund II Ltd., each with an address at 350 Park Avenue, 11th Floor, New York, NY 10022. |

| (4) | Represents shares held by Wellington Management Company, LLP (“Wellington”) in its capacity as investment adviser on behalf of its clients. Wellington’s SEC filings state that no beneficial owner that holds Nexstar Group’s securities through Wellington owns or has the right or power with respect to more than five percent of the class of securities. Wellington is at 75 State Street, Boston, MA 02109. |

| (5) | Mr. Yudkoff is the sole trustee of ABRY Holdings III, Co., which is the sole member of ABRY Holdings III LLC, which is the sole general partner of ABRY Equity Investors, L.P., the sole general partner of ABRY Broadcast Partners III, L.P. Mr. Yudkoff is also the trustee of ABRY Holdings Co., which is the sole member of ABRY Holdings LLC, which is the sole general partner of ABRY Capital, L.P., which is the sole general partner of ABRY Broadcast Partners II, L.P. |

| (6) | The address of Mr. Yudkoff, Mr. Battaglia, Mr. Brooks, Mr. Grossman and Ms. Koenig is the address of ABRY. |

| (7) | Represents shares owned by PS Sook Ltd., of which Mr. Sook and his spouse are the beneficial owners. |

| (8) | The address for Mr. Sook, Mr. Thompson, Mr. Lammers, Ms. Green, Mr. Busch, Ms. Willingham, Mr. Jones and Mr. Stolpe is c/o Nexstar Broadcasting Group, Inc., 909 Lake Carolyn Parkway, Suite 1450, Irving, TX 75039. |

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934, as amended, requires Nexstar’s directors, executive officers and persons who beneficially own more than ten percent of a registered class of Nexstar’s equity securities to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of Nexstar. Officers, directors and greater than ten percent beneficial owners are required to furnish Nexstar with copies of all Section 16(a) forms they file.

To Nexstar’s knowledge, based solely on review of the copies of Section 16(a) reports furnished to Nexstar, during the fiscal year ended December 31, 2003, all Section 16(a) filing requirements applicable to Nexstar’s executive officers, directors and greater than ten percent beneficial owners were timely satisfied.

2

DIRECTORS AND NOMINEES FOR DIRECTORS

PROPOSAL 1—ELECTION OF DIRECTORS

At this annual meeting of stockholders, directors will be elected to hold office until the next meeting of stockholders for such purpose. The persons named in the enclosed proxy will vote to elect as directors the nominees named below, unless the proxy is marked otherwise. If a stockholder returns a proxy without contrary instructions, the persons names as proxies will vote to elect as directors the nominees named below.

Name and Age | Principal Occupation and Business Experience | |

Perry A. Sook, 46 | Mr. Sook formed our predecessor in 1996. Since our inception, Mr. Sook has served as our Chairman of the Board, President and Chief Executive Officer and as a Director. From 1991 to 1996, Mr. Sook was a principal of Superior Communications Group, Inc. Mr. Sook currently serves as a director of Penton Media, Inc. and the Television Bureau of Advertising and serves as trustee for the Ohio University Foundation. | |

Blake R. Battaglia, 31 | Mr. Battaglia has served as a Director since April 2002. Mr. Battaglia is a Vice President at ABRY, which he joined in 1998. Prior to joining ABRY, he was an investment banker at Morgan Stanley & Co. Mr. Battaglia currently serves as a director of WideOpenWest Holdings, LLC. | |

Erik Brooks, 37 | Mr. Brooks has served as a Director since March 2002. Mr. Brooks is a Principal at ABRY, which he joined in 1999. Prior to joining ABRY, from 1995 to 1999, Mr. Brooks was a Vice President at NCH Capital, a private equity investment fund. Mr. Brooks is a director of Country Road Communications, LLC. | |

Jay M. Grossman, 44 | Mr. Grossman has served as a Director since 1997 and was our Vice President and Assistant Secretary from 1997 until March 2002. Mr. Grossman has been a Partner of ABRY since 1996. Prior to joining ABRY, Mr. Grossman was an investment banker specializing in media and entertainment at Kidder Peabody and at Prudential Securities. Mr. Grossman currently serves as a director (or the equivalent) of several private companies including Consolidated Theaters LLC, Country Road Communications LLC, Monitronics, International, Inc. and WideOpenWest Holdings, LLC. | |

Peggy Koenig, 47 | Ms. Koenig has served as a Director since March 2002 and was our Vice President and Assistant Secretary from 1997 until March 2002. Ms. Koenig is a Partner of ABRY, which she joined in 1993. From 1988 to 1992, Ms. Koenig was a Vice President, Partner and member of the board of directors of Sillerman Communication Management Corporation, a merchant bank, which made investments principally in the radio industry. From 1986 to 1988, Ms. Koenig was the Director of Finance for Magera Management, an independent motion picture financing company. She is presently a director (or the equivalent) of Gallarus Media Holdings, Inc., Commerce Connect Media Holdings, Inc., Fanfare Media Works Holdings, Inc., WideOpenWest Holdings, LLC and Hispanic Yellowpages Network LLC. | |

3

Name and Age | Principal Occupation and Business Experience | |

Royce Yudkoff, 48 | Mr. Yudkoff has served as a Director since 1997 and was our Vice President and Assistant Secretary from 1997 until March 2002. Since 1989, Mr. Yudkoff has served as the President and Managing Partner of ABRY. Prior to joining ABRY, Mr. Yudkoff was affiliated with Bain & Company, serving as a Partner from 1985 to 1988. Mr. Yudkoff is presently a director (or the equivalent) of several companies, including Metrocall Wireless, Inc., Muzak Holdings LLC, Quorum Broadcast Holdings, LLC and Talent Partners. | |

Geoff Armstrong, 46 | Mr. Armstrong has served as a Director since November 2003. Mr. Armstrong is Chief Executive Officer of 310 Partners, a private investment firm. From March 1999 through September 2000, Mr. Armstrong was the Chief Financial Officer of AMFM, Inc., which was publicly traded on the New York Stock Exchange until it was purchased by Clear Channel Communications in September 2000. From June 1998 to February 1999, Mr. Armstrong was Chief Operating Officer and a director of Capstar Broadcasting Corporation, which merged with AMFM, Inc. in July 1999. Mr. Armstrong was a founder of SFX Broadcasting, which went public in 1993, and subsequently served as Chief Financial Officer, Chief Operating Officer, and a director until the company was sold in 1998 to AMFM. Mr. Armstrong has served as a director and the chairman of the audit committee of Radio One, Inc. since June 2001 and May 2002, respectively. | |

Michael Donovan, 63 | Mr. Donovan has served as a Director since November 2003. He is the founder and majority stockholder of Donovan Data Systems Inc., a privately held supplier of computer services to the advertising and media industries. Mr. Donovan has served as Chairman and Chief Executive Officer of Donovan Data Systems Inc. since 1967. He is also a director of the Statue of Liberty/Ellis Island Foundation and on the board of advisors of the Yale Divinity School. | |

I. Martin Pompadur, 68 | Mr. Pompadur has served as a Director since November 2003. In June of 1998, Mr. Pompadur joined News Corporation as Executive Vice President of News Corporation, President of News Corporation Eastern and Central Europe and a member of News Corporation’s Executive Management Committee. In January 2000, Mr. Pompadur was appointed Chairman of News Corp Europe. Prior to joining News Corporation, Mr. Pompadur was President of RP Media Management and held executive positions at several other media companies. He currently sits on the Boards of Metromedia International, Linkshare, News Out of Home B.V., Balkan Bulgarian, RP Coffee Ventures, and Sky Italia. | |

Committees of the Board of Directors

The Board of Directors currently has the following three standing committees:

(a)Compensation Committee, consisting of Messrs. Grossman, Armstrong and Yudkoff. The function of the Compensation Committee is to review compensation paid to Nexstar’s officers and employees and to administer Nexstar’s stock option and other incentive plans.

4

(b)Audit Committee, consisting of Messrs. Armstrong, Donovan and Pompadur. The function of the Audit Committee is to consult with Nexstar’s independent auditors to ascertain compliance with appropriate audit procedures. The members of the audit committee are “independent” as that term is defined in the National Association of Securities Dealers Listing Standards. The Board has determined that Mr. Armstrong is an “audit committee financial expert” for purposes of the SEC’s rules. The Audit Committee operates under a written charter adopted by the Board of Directors, which is attached as Annex A hereto.

(c)Nominating and Corporate Governance Committee, consisting of Messrs. Armstrong, Donovan and Pompadur. The members of the committee are “independent” as defined in the marketplace rules which govern Nasdaq Stock Market. The function of the Nominating and Corporate Governance Committee is to identify individuals qualified to serve on Nexstar’s Board of Directors; to recommend to the Board of Directors the persons to be nominated by the Board of Directors for election as directors at the annual meeting of stockholders; to develop and recommend to the Board of Directors a set of corporate governance principles applicable to us; and to oversee the evaluation of the Board of Directors and management.

The Board of Directors has adopted a Nominating and Corporate Governance Charter stating the duties and purpose of the Nominating and Governance Committee. A copy of such charter is attached as Annex B hereto.

The Board of Directors has not adopted a nominating policy to be used for identifying and evaluating nominees for director, including director candidates recommended by stockholders, and has not established any specific, minimum qualifications that director nominees must possess. Instead, the Nominating and Governance Committee plans to determine the qualifications and skills required to fill a vacancy to complement the existing qualifications and skills, as a vacancy arises in the Board of Directors. However, if it is determined that a nominating policy would be beneficial to Nexstar, the Board of Directors may in the future adopt a nominating policy.

Nexstar is a “controlled company” in accordance with rules and regulations of NASDAQ, because ABRY Partners, LLC through its affiliated funds controls a majority of the outstanding voting stock. As a result, we are not required to maintain a majority of independent directors on our Board of Directors or to have the compensation of our executive officers and the nomination of directors be determined by independent directors.

During fiscal year 2003, the Board of Directors met two times. The Nominating and Corporate Governance and Audit Committees did not meet in 2003 because the Board of Directors, as a whole, addressed the Nominating and Audit Committee’s responsibilities. Each director attended the meetings of the Board of Directors except for Mr. Yudkoff and Ms. Koenig who did not attend the meetings of the Board of Directors, and Mr. Battaglia who did not attend one meeting of the Board of Directors. Messrs. Donovan, Armstrong and Pompadur joined the Board of Directors on November 28, 2003, and assumed their roles on the Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee at that time.

Code of Ethics

The Board of Directors adopted a code of ethics that applies to our chief executive officer, chief financial officer, the other executive officers and directors, and persons performing similar functions. The purpose of the code of ethics is to promote honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships, to promote full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by Nexstar Broadcasting Group, Inc. and its subsidiaries, and to promote compliance with all applicable rules and regulations that apply to Nexstar Broadcasting Group, Inc. and its subsidiaries and their respective officers and directors. The code of ethics is attached as an exhibit to Nexstar’s Annual Report for the year ended December 31, 2003 on Form 10-K filed with the Securities and Exchange Commission. Any amendments to or waivers from a provision of this code of ethics will be posted on our web site or filed in a Current Report on Form 8-K.

5

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors is appointed by the Board of Directors and currently consists of three independent directors. On behalf of the Board of Directors, the Audit Committee oversees Nexstar’s controls and procedures and Nexstar’s system of internal controls over financial reporting and accounting. Management is vested with primary responsibility for the development and maintenance of Nexstar’s financial statements, financial reporting process and system of internal controls. In order to discharge its oversight role effectively, the Audit Committee is empowered to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of Nexstar and has the power to retain outside legal counsel, auditors or other experts for this purpose.

Nexstar’s independent auditors, PricewaterhouseCoopers LLP, are responsible for expressing an opinion on the conformity of the audited financial statements with generally accepted accounting principles. Their opinion, titled “Report of Independent Auditors,” may be found in Nexstar’s Annual Report on Form 10-K. The Audit Committee reviewed with the independent auditors their judgments as to the quality and acceptability of Nexstar’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards, including those described in Statement on Auditing Standards No. 61, as amended “Communication with Audit Committees.” Additionally, the Audit Committee discussed with the independent auditors the auditors’ independence from management and from Nexstar, including the matters in the written disclosures required by the Independence Standards Board Standard No. 1 provided to the Audit Committee by the auditors.

In fulfilling its oversight responsibilities for the fiscal year ended December 31, 2003, the Audit Committee reviewed the financial statements published in Nexstar’s Annual Report on Form 10-K with management by examining and discussing the quality and acceptability of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. In addition, the Audit Committee discussed with Nexstar’s independent auditors the overall scope of and plans for its audit. The Audit Committee met with the independent auditors, with and without management present, to discuss the results of its examination, its evaluation of Nexstar’s internal controls and the overall quality for Nexstar’s financial reporting.

The Audit Committee has determined that the provision of non-audit services provided by the independent auditors in fiscal year 2003 was compatible with maintaining PricewaterhouseCoopers LLP’s independence.

The Audit Committee operates under a written charter adopted by the Board of Directors of Nexstar.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board of Directors approved) that the audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended December 31, 2003 for filing with the Securities and Exchange Commission. The Audit Committee intends to recommend to the Board of Directors that it select PricewaterhouseCoopers LLP as independent auditors of Nexstar for the fiscal year ended December 31, 2004.

Respectfully submitted,

Michael Donovan, Chair

Geoff Armstrong

I. Martin Pompadur

6

Director Compensation

Messrs. Sook, Battaglia, Brooks, Grossman, Yudkoff, and Ms. Koenig serve on the Board of Directors without additional compensation. Messrs. Donovan, Armstrong and Pompadur each receives an annual retainer of $15,000 plus $1,500 for each in-person meeting of the Board committee of which they are a member and $750 for telephone attendance at a meeting. In addition, members of the Board of Directors are reimbursed for expenses they incur in attending meetings. In 2004, Nexstar expects to grant options to purchase our Class A Common Stock.

Directors hold office until the next meeting of the stockholders of Nexstar for the election of directors and until their successors are elected and qualified. There are no family relationships among directors or executive officers of Nexstar.

Executive Officers

The executive officers of Nexstar are:

Name | Age | Position With Nexstar | ||

Perry A. Sook | 46 | President, Chief Executive Officer and Director | ||

G. Robert Thompson | 41 | Chief Financial Officer and Executive Vice President | ||

Duane A. Lammers | 42 | Chief Operating Officer and Executive Vice President | ||

Timothy C. Busch | 40 | Senior Vice President, Regional Manager | ||

Brian Jones | 43 | Senior Vice President, Regional Manager | ||

Shirley E. Green | 44 | Vice President, Finance | ||

Susana G. Willingham | 37 | Vice President, Corporate News Director | ||

Richard Stolpe | 47 | Vice President, Director of Engineering | ||

Paul Greeley | 52 | Vice President, Marketing and Promotions |

Perry A. Sook has served as our President and Chief Executive Officer and as a Director since 1996. From 1991 to 1996, Mr. Sook was a principal of Superior Communications Group, Inc. Mr. Sook currently serves as a director of Penton Media, Inc. and the Television Bureau of Advertising and serves as trustee for the Ohio University Foundation.

G. Robert Thompsonhas served as our Chief Financial Officer and Executive Vice President since May 2002. Prior to that time, Mr. Thompson was a Senior Vice President of Operations Staff and Vice President-Finance for Paging Network, Inc. Mr. Thompson joined Paging Network, Inc. in 1990. In August 2000, Paging Network, Inc. filed for Chapter 11 bankruptcy protection.

Duane A. Lammers has served as our Chief Operating Officer and Executive Vice President since October 2002. Prior to that time, Mr. Lammers served as our Executive Vice President from February 2001 until September 2002 and as our Vice President, Director of Sales and Marketing from 1998 until January 2001. He was employed as a Nexstar based station General Manager from 1997 to 1999. Prior to joining Nexstar, Mr. Lammers was the General Manager of WHTM, the ABC affiliate in Harrisburg, Pennsylvania from 1994 to 1997.

Timothy C. Buschhas served as our Senior Vice President and Regional Manager since October 2002. Prior to that time, Mr. Busch served as our Vice President and General Manager at WROC, Rochester, New York from 2000 to October 2002. Prior to that time, he served as General Sales Manager and held various other sales management positions at WGRZ, Buffalo, New York from 1993 to 2000.

Brian Joneshas served as our Senior Vice President and Regional Manager since May 2003. Prior to that time, Mr. Jones served as Vice President and General Manager at KTVT and KTXA, Dallas-Fort Worth, Texas from 1995 to 2003.

7

Shirley E. Green has served as our Vice President, Finance since February 2001. Prior to that time, Ms. Green served as our Controller since from 1997 to 2001. Prior to joining Nexstar, from 1994 to 1997, Ms. Green was Business Manager at KOCB, Oklahoma City, Oklahoma, which was owned by Superior Communications Group, Inc.

Susana G. Willingham has served as our Vice President, Corporate News Director since 1997. Prior to joining Nexstar, Ms. Willingham served as Assistant News Director for WHTM from 1994 to 1997. Prior to that time, Ms. Willingham was the News Director for KFDX from 1992 to 1993.

Richard Stolpe has served as our Vice President, Director of Engineering since January 2000. Prior to that time, Mr. Stolpe served as Chief Engineer of WBRE from 1998 to 2000. Prior to joining Nexstar, Mr. Stolpe was employed by WYOU from 1996 to 1998 as Chief Engineer.

Paul Greeley has served as our Vice President, Marketing and Promotions since January 2004. Prior to joining Nexstar, Mr. Greeley was a partner with Grim and Greeley Marketing from March 2002 to January 2004. From December 2000 to November 2001, he was the Director of Creative Services for WWL in New Orleans, Louisiana, and was the Director of Creative Services for WESH in Orlando, Florida from September 1997 to April 2000.

8

COMPENSATION OF EXECUTIVE OFFICERS

The following table contains a summary of the annual, long-term and other compensation paid or accrued during the fiscal years ended December 31, 2001, 2002 and 2003 to those persons who were the Chief Executive Officer and our five other most highly compensated executive officers of Nexstar in 2003 (collectively, the “Named Executive Officers”).

Summary Compensation Table

| Fiscal Year | Annual Compensation | All Other Compensation | |||||||||||||||

| Salary | Bonus | Other (1) | |||||||||||||||

Perry A. Sook | 2003 | $ | 638,951 | $ | 4,325,000 | (2) | $ | 7,031 | $ | — | |||||||

President, Chief Executive Officer and Director | 2002 2001 | | | 437,308 289,230 | | 350,000 150,000 | (3) (3) | | 4,017 3,402 | | — 1,629 | (4) | |||||

Duane A. Lammers | 2003 | 274,808 | 250,000 | 4,101 | — | ||||||||||||

Chief Operating Officer, Executive Vice President | 2002 2001 | | | 219,365 184,681 | | 100,000 — | | | 3,013 1,376 | | — — | | |||||

G. Robert Thompson | 2003 | 217,792 | 60,000 | — | — | ||||||||||||

Chief Financial Officer, Executive Vice President | 2002 | (5) | 118,396 | 20,000 | — | — | |||||||||||

Timothy C. Busch | 2003 | 229,788 | 75,000 | 2,538 | — | ||||||||||||

Senior Vice President, Regional Manager | 2002 2001 | | | 156,584 141,346 | | 30,604 15,000 | | | 930 2,020 | | — 14,848 | (4) | |||||

Shirley E. Green | 2003 | 165,774 | 75,000 | 3,758 | — | ||||||||||||

Vice President, Finance | 2002 2001 | | | 123,077 98,980 | | 20,000 — | | | 3,982 5,145 | | — — | | |||||

Brian Jones | 2003 | (6) | 169,404 | 50,000 | — | — | |||||||||||

Senior Vice President, Regional Manager | |||||||||||||||||

| (1) | Represents as to all executive officers the value of the personal use of automobiles. |

| (2) | Includes $4,000,000 paid to Mr. Sook and used to repay a loan guaranteed by Nexstar. |

| (3) | In 2001, represents advance against future bonus payments, which was netted against the $350,000 earned in 2002. |

| (4) | Represents reimbursement for moving expenses. |

| (5) | Joined Nexstar in May 2002. |

| (6) | Joined Nexstar in May 2003. |

9

OPTION GRANTS DURING FISCAL YEAR 2003

The following table sets forth information concerning stock option grants made to each of the name executive officers during the fiscal year ended December 31, 2003:

| Number of Securities Underlying Options Granted(1) | Percent of Total Options Granted to Employees in Fiscal Year | Exercise Price Per Share(2) | Expiration Date | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option | ||||||||||||

| 5% | 10% | |||||||||||||||

Perry A. Sook | 300,000 | 23.6 | % | $ | 14.00 | 11/28/2013 | $ | 2,641,357 | $ | 6,693,718 | ||||||

Duane A. Lammers | 100,000 | 7.9 | % | $ | 14.00 | 11/28/2013 | $ | 880,452 | $ | 2,231,239 | ||||||

G. Robert Thompson | 50,000 | 3.9 | % | $ | 14.00 | 11/28/2013 | $ | 440,226 | $ | 1,115,620 | ||||||

Timothy C. Busch | 50,000 | 3.9 | % | $ | 14.00 | 11/28/2013 | $ | 440,226 | $ | 1,115,620 | ||||||

Shirley E. Green | 30,000 | 2.4 | % | $ | 14.00 | 11/28/2013 | $ | 264,135 | $ | 669,371 | ||||||

Brian Jones | 50,000 | 3.9 | % | $ | 14.00 | 11/28/2013 | $ | 440,226 | $ | 1,115,620 | ||||||

| (1) | Options are non-qualified options granted under the 2003 Long Term Incentive Plan and generally are not exercisable until six months after their grant, vest over the span of five years and expire 10 years from the date of grant. Options granted to Mr. Lammers and Ms. Green vest 50% at grant date, with the remainder vesting over five years. Options granted to Mr. Busch vest 30% at grant date, with the remainder vesting over five years. Options granted to Mr. Thompson vest over five years commencing on May 13, 2002. Options granted to Mr. Sook vest 16.7% at grant date, with the remainder vesting over five years. Options granted to Mr. Jones vest over five years. |

| (2) | Options are granted at an exercise price equal to the last reported sale price of our common stock, as reported on the NASDAQ on the date of grant. The options granted to the named executive officers were granted at the time of the initial public offering of the Company on November 28, 2003. |

| (3) | The potential realizable value is calculated based on the term of the stock option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to rules promulgated by the SEC and does not represent our prediction of our stock price performance. The potential realizable values at 5% and 10% appreciation are calculated by assuming that the exercise price on the date of grant appreciates at the indicated rate for the entire term of the stock option and that the stock option is exercised at the exercise price and sold on the last day of its term at the appreciated price. |

10

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

There were no options exercised by any Named Executive Officer during the fiscal year ended December 31, 2003. The following table sets forth information as of December 31, 2003 concerning unexercised stock options held by the Named Executive Officers.

Number of Securities Options at Fiscal Year End | Value of Securities Underlying Unexercised In-the-Money Options at Fiscal Year End($)(1) | |||||||||

Name | Exercisable(2) | Unexercisable | Exercisable | Unexercisable | ||||||

Perry A. Sook | 50,000 | 250,000 | $ | — | $ | — | ||||

Duane A. Lammers | 50,000 | 50,000 | $ | — | $ | — | ||||

G. Robert Thompson | 10,000 | 40,000 | $ | — | $ | — | ||||

Timothy C. Busch | 15,000 | 35,000 | $ | — | $ | — | ||||

Shirley E. Green | 15,000 | 15,000 | $ | — | $ | — | ||||

Brian Jones | — | 50,000 | $ | — | $ | — | ||||

| (1) | Based upon a fair market value of $13.71 per share of Nexstar’s Class A Common Stock, which was the closing price per share on December 31, 2003. |

| (2) | The options are not exercisable within 180 days of the grant date. |

EMPLOYEE AGREEMENTS

Perry A. Sook

Mr. Sook is employed as President and Chief Executive Officer under an employment agreement with us. The term of the agreement expires on December 31, 2008 and automatically renews for successive one-year periods unless either party notifies the other of its intention not to renew the agreement. Under the agreement, effective as of October 1, 2002, Mr. Sook’s base salary was $600,000 in 2002 and $615,000 in 2003, and is $630,000 in 2004, $650,000 in 2005, $675,000 in 2006, $700,000 in 2007 and $750,000 in 2008. In addition to his base salary, Mr. Sook is eligible to earn a targeted annual bonus of $315,000 for 2004, $325,000 for 2005, $337,500 for 2006, $350,000 for 2007 and $375,000 for 2008, upon achievement of goals established by our board of directors. In the event of termination for reasons other than cause, or if Mr. Sook resigns for good reason, as defined in the agreement, Mr. Sook is eligible to receive his base salary for a period of one year. Pursuant to an amendment to Mr. Sook’s employment agreement, upon the completion of Nexstar’s initial public offering, Mr. Sook was paid $4 million, which he used to repay in full his loan from Bank of America, N.A., which was guaranteed by us and had an outstanding principal amount of $3 million. Simultaneous with the repayment of the loan, the guaranty was terminated.

Duane A. Lammers

Effective October 1, 2002, Mr. Lammers became Chief Operating Officer and Executive Vice President under an employment agreement with us. Prior to that time, Mr. Lammers served as Executive Vice President. The agreement terminates on June 30, 2008 and automatically renews for successive one-year periods unless either party notifies the other of its intention not to renew the agreement. Under the agreement, Mr. Lammers’ base salary is $300,000 from July 1, 2003 through June 30, 2004, $310,000 through June 30, 2005, $320,000 through June 30, 2006, $330,000 through June 30, 2007 and $340,000 through June 30, 2008 and thereafter. In addition to his base salary, Mr. Lammers is eligible to earn a targeted annual bonus of $155,000 for 2004, $160,000 for 2005, $165,000 for 2006 and $170,000 for 2007 and thereafter at the discretion of our chief executive officer, based on Mr. Lammers’ attainment of, among other things, certain financial performance targets. In the event of termination upon change of control or for reasons other than cause, or if Mr. Lammers resigns for good reason, as defined in the agreement, Mr. Lammers is eligible to receive his base salary for a period of one year.

11

G. Robert Thompson

Mr. Thompson is employed as Chief Financial Officer and Executive Vice President under an employment agreement with us. The term of the agreement expires on May 12, 2007 and automatically renews for successive one-year periods unless either party notifies the other of its intention not to renew the agreement. Under the agreement, Mr. Thompson’s base salary is $225,000 from September 1, 2003 through August 31, 2004, $235,000 through August 31, 2005, $240,000 through August 31, 2006 and $250,000 through September 1, 2007 and thereafter. In addition to his base salary, Mr. Thompson is eligible to receive a targeted bonus of $40,000 for 2004, $45,000 for 2005, $50,000 for 2006 and thereafter. In the event of termination upon change of control or for reasons other than cause, or if Mr. Thompson resigns for good reason, as defined in the agreement, Mr. Thompson is eligible to receive his base salary for a period of one year.

Shirley E. Green

Ms. Green is employed as Vice President, Finance under an employment agreement with us. The term of the agreement ends on June 30, 2007 and automatically renews for successive one-year periods unless either party notifies the other of its intention not to renew the agreement. Under the agreement, Ms. Green’s base salary is $175,000 from July 1, 2003 through August 31, 2004, $180,000 through August 31, 2005, $185,000 through August 31, 2006 and $190,000 though August 31, 2007 and thereafter. In addition to her base salary, Ms. Green is eligible to earn a targeted annual bonus of $20,000 for each year through June 30, 2007 at the discretion of our chief executive officer, based on Ms. Green’s attainment of goals set by our chief executive officer. In the event of termination upon change of control or for reasons other than cause, or if Ms. Green resigns for good reason, as defined in the agreement, Ms. Green is eligible to receive her base salary for a period of one year.

Timothy C. Busch

Mr. Busch is employed as Senior Vice President, Regional Manager under an employment agreement with us. The initial term of his agreement terminates on June 30, 2008 and automatically renews for successive one-year periods unless either party notifies the other of its intention not to renew the agreement. Under the agreement, Mr. Busch’s base salary is $250,000 from July 1, 2003 through June 30, 2004, $260,000 through June 30, 2005, $270,000 through June 30, 2006, $280,000 through June 30, 2007 and $290,000 through June 30, 2008 and thereafter. In addition to his base salary, Mr. Busch is eligible to earn a targeted annual bonus of $105,000 for 2004, $110,000 for 2005, $115,000 for 2006 and $120,000 for 2007 and thereafter. In the event of termination upon change of control or for reasons other than cause, or if Mr. Busch resigns for good reason, as defined in the agreement, Mr. Busch is eligible to receive his base salary for a period of one year.

Brian Jones

Mr. Jones is employed as Senior Vice President, Regional Manager under an employment agreement with us. The initial term of his agreement terminates on May 1, 2008 and automatically renews for successive one-year periods unless either party notifies the other of its intention not to renew the agreement. Under the agreement, Mr. Jones’ base salary is $250,000 from May 1, 2003 through April 30, 2004, $260,000 through April 30, 2005, $270,000 through April 30, 2006, $280,000 through April 30, 2007 and $290,000 through April 30, 2008 and thereafter. In addition to his base salary, Mr. Jones is eligible to earn a targeted annual bonus of $105,000 for 2004, $110,000 for 2005, $115,000 for 2006 and $120,000 for 2007 and thereafter. In the event of termination upon a change of control or for reasons other than cause, or if Mr. Jones resigns for good reason, as defined in the agreement, Mr. Jones is eligible to receive his base salary for a period of one year.

12

2003 Long Term Incentive Plan

Prior to our initial public offering, our board of directors and stockholders adopted our long-term equity incentive plan. The plan is intended to motivate and reward directors, executive officers and other key employees and to enable us to obtain and retain the services of directors, employees and consultants we consider essential to our long-term success. The plan provides for awards to be granted in the form of incentive stock options, non-qualified stock options, stock appreciation rights (“SARs”), either alone or in tandem with options, restricted stock, performance awards, or any combination of the foregoing. Awards under the plan may be granted only to persons who are our or our subsidiaries’ executives, directors, other key employees and consultants. Our board of directors has delegated the administration of the plan to the board’s compensation committee, which has the authority to grant awards under the plan and to determine any terms, conditions, or restrictions relating to such awards.

As of December 31, 2003 options to purchase an aggregate of 1,270,000 shares of our Class A Common Stock were issued at the time of completion of the initial public offering and the Quorum merger to certain individuals under our plan. Through February 29, 2004, we have granted an additional 70,000 stock options to employees of Nexstar. There have been no grants of SARs, restricted stock, performance awards, or other rights or benefits under the plan, and any future grants have not been determined. The number of shares of our common stock with respect to which benefits may be granted under the plan may not exceed 3,000,000 shares of our Class A Common Stock. If there is any change in our common stock, the number and type of shares available under the plan and/or the price thereof will be appropriately adjusted.

Options granted under the plan that are intended to qualify as incentive stock options must be exercised within ten years of the date of grant of the option or the expiration date set forth in the option grant, if earlier, subject to earlier expiration upon termination of the holder’s employment. The exercise price of all options intended to qualify as incentive stock options must be at least equal to the fair market value of the underlying shares of common stock on the date of the grant. Incentive stock options granted to any participant who owns 10% or more of our outstanding common stock must have an exercise price equal to or exceeding 110% of the fair market value of a share of common stock on the date of the grant and must not be exercisable for longer than five years. No participant will be granted in any one calendar year either options or SARs to purchase a number of shares in excess of 10% of the total number of shares authorized under the plan.

SARs granted under the plan are subject to such terms and conditions as the compensation committee specifies, except that SARs granted in tandem with options may be exercised only at the same time and on the same conditions as the related options. All SARs are exercised automatically on the day before the expiration of the SARs or any related options, and SARs granted in tandem with options expire at the same time the related options expire, so long as the fair market value of a share of common stock on such date exceeds the exercise price of the SAR or any related option, as applicable. Grants of restricted stock under the plan are generally subject to restrictions of at least six months’ duration unless otherwise specified by the compensation committee.

Performance awards granted under the plan may include specific dollar-value target awards, performance units (the value of which is determined by the compensation committee at time of grant), and/or performance shares. The value of each performance award may be fixed or may fluctuate based on a performance factor selected by the compensation committee, which has complete discretion in determining the amount, type and period of performance measurement for each performance award. The performance goals and objectives of any such award are also established by the compensation committee.

Our board of directors or the compensation committee may amend or terminate the plan, but the plan may not be amended without the approval of our stockholders if such amendment would violate any law or agreement or the rules of any exchange upon which our common stock is listed.

13

The options outstanding under the plan will be subject to vesting. As of December 31, 2003 options to purchase 350,000 shares of our Class A Common Stock will be vested, and options to purchase 920,000 shares of our Class A Common Stock will vest ratably over five years from the date of grant.

Following the termination of a participant’s services, the vesting schedule and/or exercisability of the participant’s options and SARs may change, or the participant may be required to forfeit his options and SARs. If a participant’s services are terminated for cause, then all of the participant’s options and SARs are immediately forfeited. Following the retirement of a participant, (1) the participant’s options and SARs that are exercisable on the date of retirement will be exercisable until the earlier of 90 days after the participant’s retirement and the expiration of the options and SARs and (2) the participant’s options and SARs that are not exercisable on the date of retirement are immediately forfeited, provided that such options and SARs may become fully vested and exercisable in the discretion of the committee. Except as otherwise determined by the compensation committee, if a participant’s services are terminated due to any reason other than cause, retirement, death or disability, then (1) the participant’s options and SARs that are exercisable on the date of termination will be exercisable until the earlier of 30 days from the date of termination and the expiration of the options and SARs and (2) the options and SARs that are not exercisable on the date of termination are immediately forfeited.

Except as otherwise determined by the compensation committee or as described below with respect to the termination of a participant’s services in certain circumstances including a change of control, no grant under the plan may be exercised, and no restrictions relating to the grant may lapse, within six months of the date of the grant. Each employee to whom a grant is made under the plan will enter into a written agreement with us that will contain additional provisions relating to the vesting of the grant.

If a participant’s services are terminated within one year following a change of control, then all of the participant’s options and SARs become immediately fully vested and exercisable and remain so for up to one year after the date of termination but in no event after the expiration date of the award. In addition, the compensation committee may grant options that become fully vested and immediately exercisable automatically upon a change of control, whether or not the participant is subsequently terminated. Further, upon a change of control all restrictions on shares of restricted stock granted to a participant immediately lapse, and a participant who has been granted a performance award will earn no less than the portion of the performance award that he would have earned if the applicable performance cycle had terminated on the date of the change of control.

New Plan Benefits

The number of shares of our Class A Common Stock with respect to which benefits may be granted under our long-term incentive plan may not exceed 3,000,000 shares of our Class A Common Stock. The following table sets forth the number of shares of our Class A Common Stock underlying these options to: (i) each of our executive officers named in the Summary Compensation Table, (ii) our executive officers as a group; (iii) all current directors who are not executive officers as a group; and (iv) all of our employees as a group other than our executive officers. We granted these options concurrent with the initial public offering at an exercise price equal to the initial public offering price.

14

Long-Term Incentive Plan

Name and Position | Number of Options | |

Perry A. Sook | 300,000 | |

President, Chief Executive Officer and Director | ||

Duane A. Lammers | 100,000 | |

Chief Operating Officer, Executive Vice President | ||

G. Robert Thompson | 50,000 | |

Chief Financial Officer, Executive Vice President | ||

Shirley E. Green | 30,000 | |

Vice President, Finance | ||

Timothy C. Busch | 50,000 | |

Senior Vice President, Regional Manager | ||

Brian Jones | 50,000 | |

Senior Vice President, Regional Manager | ||

Executive Group | 610,000 | |

Non-Executive Director Group | 0 | |

Non-Executive Officer Employee Group | 660,000 | |

15

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

In 2003, our board of directors performed the functions that will be delegated prospectively to the compensation committee. The compensation committee’s primary responsibilities will be reviewing and recommending to the board of directors the compensation and benefits of all of our officers and directors, including equity-based awards, and establishing and reviewing general policies relating to the compensation and benefits of our employees. During the year ended December 31, 2003, Perry A. Sook, our Chief Executive Officer, participated in deliberations of the board of directors with respect to executive compensation.

Compensation Committee Interlocks and Insider Participation

None of our directors or executive officers served, and we anticipate that no member of our board of directors or executive officers will serve, as a member of the board of directors or compensation committee of any other company that has one or more executive officers serving as a member of our board of directors.

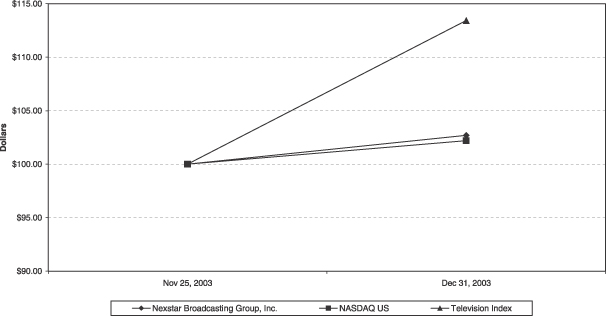

Comparative Stock Performance Graph

The following graph compares the total return of our Class A Common Stock based on closing prices for the period from November 25, 2003, the date our Class A Common Stock was first traded on NASDAQ, through December 31, 2003 with (i) the NASDAQ Composite Index and (ii) a peer index consisting of the following pure play television companies: ACME Communications, Inc., Granite Broadcasting Corporation, Gray Communications Systems, Inc., Hearst Argyle Television, Inc., Liberty Corp., LIN TV Corp., Sinclair Broadcasting Group, Inc. and Young Broadcasting Inc. (the “Television Index”). The graph assumes the investment of $100 in our Class A Common Stock and in each of the such indices on November 25, 2003. The performance shown is not necessarily indicative of future performance.

| 11/25/2003 | 12/31/2003 | |||||

Nexstar Broadcasting Group, Inc. (NXST) | $ | 100.00 | $ | 102.70 | ||

NASDAQ Composite Index | $ | 100.00 | $ | 102.20 | ||

Television Index (TV) | $ | 100.00 | $ | 113.43 | ||

16

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Nexstar Transactions with ABRY

Equity Transactions

ABRY Partners, L.L.C. and its affiliated funds (“ABRY”), our principal stockholder, made the following investments in our predecessor, Nexstar Broadcasting Group, L.L.C.:

| • | In June 1996, ABRY purchased approximately $2.9 million of common membership interests, which were exchanged into shares of Class B common stock in connection with our corporate reorganization on November 28, 2003; |

| • | In April 1997, ABRY purchased approximately $17.3 million of common membership interests, which were exchanged into shares of Class B common stock in connection with our corporate reorganization on November 28, 2003; |

| • | In January 1998, ABRY purchased approximately $37.0 million of common membership interests, which were exchanged into shares of Class B common stock in connection with our corporate reorganization on November 28, 2003; |

| • | In November 1999, ABRY purchased approximately $2.9 million of common membership interests, which were exchanged into shares of Class B common stock in connection with our corporate reorganization on November 28, 2003; |

| • | In January 2001, ABRY purchased approximately $14.6 million of common membership interests, which were exchanged into shares of Class B common stock in connection with our corporate reorganization on November 28, 2003; |

| • | In August 2001, ABRY purchased approximately $24.4 million of common membership interests, which were exchanged into shares of Class B common stock in connection with our corporate reorganization on November 28, 2003; and |

| • | In November 2001, ABRY purchased $15.0 million of Series BB preferred membership interests, which were converted into common membership interests on May 14, 2003; in connection with the conversion, an accrued dividend of approximately $3.7 million was paid to ABRY. |

In connection with the initial public offering, ABRY’s membership interests in Nexstar was converted into 12,896,149 shares of our Class B common stock.

On January 12, 2001, ABRY purchased preferred membership interests in Nexstar Finance Holdings II, L.L.C. (formerly Nexstar Finance Holdings, L.L.C.), a wholly-owned subsidiary of Nexstar Broadcasting Group, L.L.C., for a total consideration of $50.0 million. The preferred membership interests were subsequently redeemed in aggregate for the original purchase price on May 17, 2001 and August 7, 2001. In connection with the redemption, an accrued dividend of approximately $2.4 million was paid to ABRY.

ABRY Management and Consulting Services Agreement

Pursuant to a second amended and restated management and consulting services agreement between us and ABRY Partners, L.L.C., dated as of January 5, 1998, ABRY Partners, L.L.C. was entitled to a management fee for certain financial and management consulting services provided to us, including in connection with any acquisitions or divestitures in which ABRY Partners, L.L.C. substantially assisted in the organization or structuring. Under the agreement, the management fee was based on the purchase price of any such acquisition or divestiture, as well as a certain amount per annum paid for each broadcast station owned or managed by us. Pursuant to this agreement, we paid ABRY Partners, L.L.C. $265,000 in 1999 and $276,000 in 2000. ABRY Partners, L.L.C. terminated the agreement effective December 31, 2000; however, ABRY Partners, L.L.C. continues to be reimbursed for any reasonable out-of-pocket expenses incurred.

17

Quorum (merged with Nexstar) Transactions with ABRY

Equity Transactions

ABRY made the following investments in Quorum:

| • | In May 1998, ABRY purchased approximately $21.4 million of common membership interests; |

| • | In October 1998, ABRY purchased $38.0 million in common membership interests; |

| • | In December 1998, ABRY purchased approximately $2.6 million in common membership interests; |

| • | In January 1999, ABRY purchased $12.7 million in common membership interests; |

| • | In April 1999, ABRY purchased approximately $11.6 million in common membership interests; |

| • | In December 1999, ABRY loaned the Company $1.5 million, which was repaid with accrued interest of $65,000 in June 2000; |

| • | In January 2000, ABRY loaned the Company $3.5 million, which was repaid with accrued interest of $131,000 in June 2000; |

| • | In April 2001, ABRY loaned the Company $3.0 million, which converted automatically into Series B preferred membership interests and common membership interests eighteen months later; |

| • | In May 2001, ABRY loaned the Company $22.0 million, which converted automatically into Series B preferred membership interests and common membership interests eighteen months later; |

| • | In February 2002, ABRY purchased $5.0 million in Series B preferred membership interests and common membership interests. |

In connection with Nexstar’s acquisition of Quorum, ABRY’s preferred and common membership interests in Quorum were exchanged for 3,033,130 shares of our Class A Common Stock.

ABRY Management and Consulting Agreement

Pursuant to a management and consulting agreement between Quorum and ABRY Partners, L.L.C., an affiliate of ABRY, ABRY Partners, L.L.C. is entitled to a management fee for certain management and financial advisory services. Since 1998, management fees of approximately $1.1 million and reimbursable expenses of approximately $0.1 million have accrued under this agreement. The accrued management fees were settled by issuance of 80,230 shares of our Class B Common Stock, and the reimbursable expenses were paid in cash and the agreement was terminated upon the completion of the Quorum acquisition on December 30, 2003.

Transactions with Perry A. Sook

Equity Transactions

Perry A. Sook, our President and Chief Executive Officer, made the following investments in Nexstar Broadcasting Group, L.L.C.:

| • | In June 1996, Mr. Sook purchased approximately $78,000 of common membership interests; |

| • | In April 1997, Mr. Sook purchased approximately $462,000 of common membership interests; |

| • | In January 1998, Mr. Sook purchased approximately $986,000 of common membership interests; |

| • | In November 1999, Mr. Sook purchased approximately $78,000 of common membership interests; |

| • | In January 2001, Mr. Sook purchased approximately $390,000 of common membership interests; and |

| • | In August 2001, Mr. Sook purchased approximately $651,000 of common membership interests. |

In connection with our corporate reorganization, Mr. Sook owns 387,087 shares of our Class B Common Stock upon conversion of his common membership interests.

18

Perry A. Sook Guaranty

Pursuant to an individual loan agreement dated January 5, 1998, Bank of America, N.A., an affiliate of Banc of America Securities LLC, which was one of the underwriters of our initial public offering on November 28, 2003, established a loan facility under which Mr. Sook was allowed to borrow an aggregate amount of up to $3.0 million, of which approximately $3.0 million in principal amount of loans were outstanding under that facility immediately prior to our initial public offering. The proceeds of those loans have been used by Mr. Sook, in part to, invest in us. We have guaranteed the payment of up to $3.0 million in principal amount of those loans. In addition, Mr. Sook’s employment agreement contains and, since 1998 has contained, provisions requiring us to provide a loan to Mr. Sook, had Mr. Sook not been able to secure a third-party loan, to meet any obligations to pay interest and fees on the Bank of America loan. The original employment agreement, as amended, was scheduled to terminate in December 31, 2004 and contained automatic one-year extensions if not cancelled by either party with 90 days notice. In August 25, 2003, we amended Mr. Sook’s employment agreement to, among other things, extend the termination date of the employment agreement to December 31, 2008. No amendments were made to the provision requiring us to provide a loan to Mr. Sook as described above or to the guaranty. We do not believe that this extension of Mr. Sook’s employment agreement was a “material modification” of the provision requiring us to provide a loan or of the guaranty, each as described above, and consequently we do not believe that the extension was a violation of the Sarbanes-Oxley Act of 2002. Nevertheless, there is no case law directly on point, and we cannot assure you that a court would not decide differently. It is unclear what the consequences to us would be if a court determined the extension constituted a “material modification” of the provision requiring us to provide a loan as described above; however, we do not believe that any consequences would have a material adverse effect. Mr. Sook’s loan expires on December 31, 2004. In accordance with the requirements of the Sarbanes-Oxley Act of 2002, our guarantee of Mr. Sook’s loan will not be renewed after the expiration of Mr. Sook’s existing loan. Upon the completion of the initial public offering, we paid Mr. Sook a success fee of $4 million with which he repaid the loan in full. Simultaneous with the repayment of the loan, the guaranty was terminated.

19

PROPOSAL 2 – RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS

Subject to ratification by the stockholders, the audit committee of our Board of Directors has selected the firm of PricewaterhouseCoopers LLP as our independent auditors for the fiscal year ending December 31, 2004. PricewaterhouseCoopers LLP has served as our independent auditors since 1997. If the stockholders do not ratify the selection of PricewaterhouseCoopers LLP as our independent auditors, the selection of such independent auditors will be reconsidered by the audit committee.

Representatives of PricewaterhouseCoopers LLP will be present at the Annual Meeting. They will have the opportunity to make a statement if they desire to do so and will be available to respond to appropriate questions from stockholders.

The Board of Directors believes that the selection of PricewaterhouseCoopers LLP as the independent auditors for the fiscal year ending December 31, 2004 is in the best interests of the Company and its stockholders and therefore recommends that the stockholders voteFOR this proposal.

Independent Auditors Fees and Other Matters

In addition to retaining PricewaterhouseCoopers LLP to audit the financial statements of Nexstar Broadcasting Group, Inc. and its direct and indirect subsidiaries (including Nexstar, collectively, “Nexstar Entities”) for the fiscal year ended December 31, 2003, and review the financial statements included in each of Nexstar Entity’s Quarterly Reports on Form 10-Q during such fiscal year, Nexstar Broadcasting Group, Inc. retained PricewaterhouseCoopers LLP to assist with the preparation of filings in connection with our initial public offering, two public debt offerings, provide due diligence services, audit certain acquired stations and tax compliance matters. The aggregate fees, including expenses, billed for professional services incurred by Nexstar Broadcasting Group, Inc. and rendered by PricewaterhouseCoopers LLP in fiscal year 2003 and 2002 for these various services were:

| Fiscal Year Ended | ||||||

Type of Fees | December 31, 2003 | December 31, 2002 | ||||

Audit Fees (1) | $ | 738,000 | $ | 600,000 | ||

Audit Related Fees (2) | 1,385,000 | 495,000 | ||||

Tax Fees (3) | 747,000 | 408,000 | ||||

All Other Fees | — | — | ||||

Total | $ | 2,870,000 | $ | 1,503,000 | ||

| (1) | “Audit Fees” are fees paid to PricewaterhouseCoopers LLP for professional services for the audit of our consolidated financial statements included in our Annual Report on Form 10-K and review of financial statements included in our Quarterly Reports on Form 10-Q, or for services that are normally provided by the auditors in connection with statutory and regulatory filings or engagements. |

| (2) | “Audit Related Fees” are fees billed by PricewaterhouseCoopers LLP for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements, which were primarily rendered in connection with our initial public offering. |

| (3) | “Tax Fees” are fees billed by PricewaterhouseCoopers LLP for tax compliance, tax advice and tax planning. In 2003, $393,000 pertained to planning and advisory services related to the Quorum merger and our initial public offering. |

The Audit Committee has established policies and procedures for the approval and pre-approval of audit services and permitted non-audit services. Commencing with the 2003 audit fees, the audit committee pre-approves all services relating to PricewaterhouseCoopers LLP. All other audit related tax and other fees will be approved by the audit committee prospectively.

20

OTHER INFORMATION

Other Matters

As of the date of this Proxy Statement, the Board of Directors does not intend to present any matter for action at the Annual Meeting other than as set forth in the Notice and Proxy Statement for the Annual Meeting. If any other matters properly come before the meeting, it is intended that the holders of the proxies will act in accordance with their best judgment.

Stockholder Proposals for the 2005 Annual Meeting

Proposals of stockholders intended to be presented at the 2005 Annual Meeting pursuant to Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended, must be received by us no later that the close of business on December 12, 2004 in order that they may be included in the proxy statement and form of proxy relating to that meeting. Proposals should be addressed to Shirley E. Green, Secretary, Nexstar Broadcasting Group, Inc., 909 Lake Carolyn Parkway, Suite 1450, Irving, TX 75039.

In addition, our bylaws require that we be given advance notice of other business that stockholders wish to present for action at an Annual Meeting of Stockholders (other than matters included in our proxy statement in accordance with Rule 14a-8), including stockholder nominations for the election to our Board of Directors. Such proposals and nominations for the 2005 Annual Meeting, other than those made by or on behalf of the Board of Directors, shall be made by notice in writing delivered or mailed by first class United States mail, postage prepaid, to our executive offices, and received not less than 60 days nor more than 90 days prior to the Annual Meeting. In the event that less than 70 days notice or prior public announcement of the date of the meeting is given or made to stockholders, notice by the stockholder must be received not later than the close of business on the 10th day following the date on which such notice of the date of the Annual Meeting was mailed or such public announcement was made. Our bylaws require that such notice contain certain additional information. Copies of the bylaws can be obtained without charge by writing our Corporate Secretary at the address shown on the cover of this proxy statement.

Cost of Proxy Solicitation and Annual Meeting

The cost of the solicitation of proxies will be borne by us. In addition to the solicitation of proxies by mail, certain of our officers and employees, without extra remuneration, may solicit proxies personally, by telephone, mail or facsimile. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

Householding of Annual Meeting Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of our proxy statement or annual report may have been sent to multiple stockholders in a stockholder’s household. We will promptly deliver a separate copy of either document to any stockholder upon written request to Nexstar Broadcasting Group, Inc., 909 Lake Carolyn Parkway, Suite 1450, Irving, TX 75039, Attention: Bob Thompson, Chief Financial Officer. If any stockholder wants to receive separate copies of the annual report and proxy statement in the future, or if any stockholder is receiving multiple copies and would like to receive only one copy for his or her household, such stockholder should contact his or her bank, broker, or other nominee record holder, or such stockholder may contact us at the above address and phone number.

By Order of the Board of Directors,

/s/ Shirley E. Green

Shirley E. Green

Secretary

April 13, 2004

21

Annex A

CHARTER OF THE AUDIT COMMITTEE

OF THE BOARD OF DIRECTORS

OF NEXSTAR BROADCASTING GROUP, INC.

(As Adopted on January 15, 2004)

The Board of Directors (“Board”) of Nexstar Broadcasting Group, Inc. (“Company”) has established an Audit Committee (“Committee”) as a permanent standing committee with authority, responsibility and specific duties as described herein. This Charter of the Audit Committee of the Board of Directors (“Charter”) and the composition of the Committee are intended to comply with applicable law, including state and federal securities laws, the rules and regulations of the Securities and Exchange Commission (“SEC”) and the National Association of Securities Dealers Automated Quotation System (“NASDAQ”), and the Company’s Bylaws.

| I. | Purpose and Scope |

The purpose of the Committee is to assist the Board to fulfill its responsibility for oversight of the quality and integrity of the accounting, auditing and financial reporting practices of the Company and to perform such other duties as may be required of it by the Board. The Committee’s duties and responsibilities include, without limitation, oversight of: (i) the accounting and financial reporting processes and systems of internal accounting and financial controls of the Company; (ii) the performance of the internal audits and integrity of the financial statements of the Company; (iii) the annual independent audit of the Company’s financial statements, the engagement of the independent auditor and the annual evaluation of the independent auditor’s function, qualifications, services, performance and independence; (iv) the performance of the Company’s internal and independent audit functions; (v) the compliance by the Company with legal and regulatory requirements related to this Charter, including the Company’s disclosure controls and procedures; and (vi) the evaluation of the Company’s risk issues.

| II. | Audit Committee Charter, Membership and Organization |

| A. | Charter. This Charter shall be reviewed and reassessed by the Committee at least annually. Any proposed changes shall be submitted to the Board for its approval. |

| B. | Members. The Committee shall consist of no fewer than three members of the Company’s Board based on the recommendation of the Nominating and Corporate Governance Committee. The Committee shall be comprised of Directors who meet the independence, experience and expertise requirements of the SEC, NASDAQ and any other applicable law. The Nominating and Corporate Governance Committee will assess and determine the qualifications of the Committee members. |

| C. | Term of Members and Selection of Chair. The members of the Committee shall be appointed annually by the Board. The Board shall also select the Chair of the Committee. Committee members may not simultaneously serve on the audit committee of more than two other public companies without the consent of the Board obtained in each case. |