Acquisition of Tribune Media Company December 3, 2018 Enhancing Nexstar’s Position as North America’s Leading Local Media Company Exhibit 99.2

Forward-Looking Statements This Presentation includes forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. Forward-looking statements include information preceded by, followed by, or that includes the words "guidance," "believes," "expects," "anticipates," "could," or similar expressions. For these statements, Nexstar Media and Tribune Media claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this presentation, concerning, among other things, the ultimate outcome, benefits and cost savings of any possible transaction between Nexstar Media and Tribune Media and timing thereof, and future financial performance, including changes in net revenue, cash flow and operating expenses, involve risks and uncertainties, and are subject to change based on various important factors, including the timing of and any potential delay in consummating the proposed transaction; the risk that a condition to closing of the proposed transaction may not be satisfied and the transaction may not close; the risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained or is obtained subject to conditions that are not anticipated, the risk of the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement; the risk that Nexstar Media fails to obtain the necessary financing arrangements set forth in the debt commitment letters delivered pursuant to the Merger Agreement, the impact of changes in national and regional economies, the ability to service and refinance our outstanding debt, successful integration of Tribune Media (including achievement of synergies and cost reductions), pricing fluctuations in local and national advertising, future regulatory actions and conditions in the television stations' operating areas, competition from others in the broadcast television markets, volatility in programming costs, the effects of governmental regulation of broadcasting, industry consolidation, technological developments and major world news events. Unless required by law, Nexstar Media and Tribune Media undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this presentation might not occur. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this release. For more details on factors that could affect these expectations, please see Tribune Media’s and Nexstar Media’s filings with the Securities and Exchange Commission. Additional Information and Where to Find It This communication is being made in respect of a proposed business combination involving Tribune Media and Nexstar. In connection with the proposed transaction, Tribune Media intends to file relevant materials with the U.S. Securities and Exchange Commission (the “SEC”), including a preliminary proxy statement on Schedule 14A. The information in the preliminary proxy statement will not be complete and may be changed. Tribune Media will deliver the definitive proxy statement to its shareholders as required by applicable law. This communication does not constitute a solicitation of any vote or approval and is not a substitute for any proxy statement or any other document that may be filed with the SEC in connection with the proposed business combination. INVESTORS AND SECURITY HOLDERS OF TRIBUNE MEDIA ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain these materials (when they are available) and other documents filed with the SEC free of charge at the SEC’s website, www.sec.gov. Copies of documents filed with the SEC by Tribune Media (when they become available) may also be obtained free of charge from Tribune Media’s website at www.tribunemedia.com. Certain Information Regarding Participants Tribune Media and Nexstar and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from shareholders of Tribune Media in favor of the proposed transaction under the rules of the SEC. Information about Tribune Media’s directors and executive officers is available in Tribune Media’s Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on March 1, 2018 and Tribune Media’s definitive proxy statement, dated April 19, 2018, for its 2018 annual meeting of shareholders. Information about Nexstar Media’s directors and executive officers is available in Nexstar Media’s Annual Report on Form 10-K for the year ended December 31, 2017, which was filed with the SEC on March 1, 2018, and Nexstar Media’s definitive proxy statement, dated April 27, 2018, for its 2018 annual meeting of shareholders. Additional information regarding participants in the proxy solicitations and a description of their direct and indirect interests will be included in the proxy statement and the other relevant documents filed with the SEC when they become available. Disclaimer

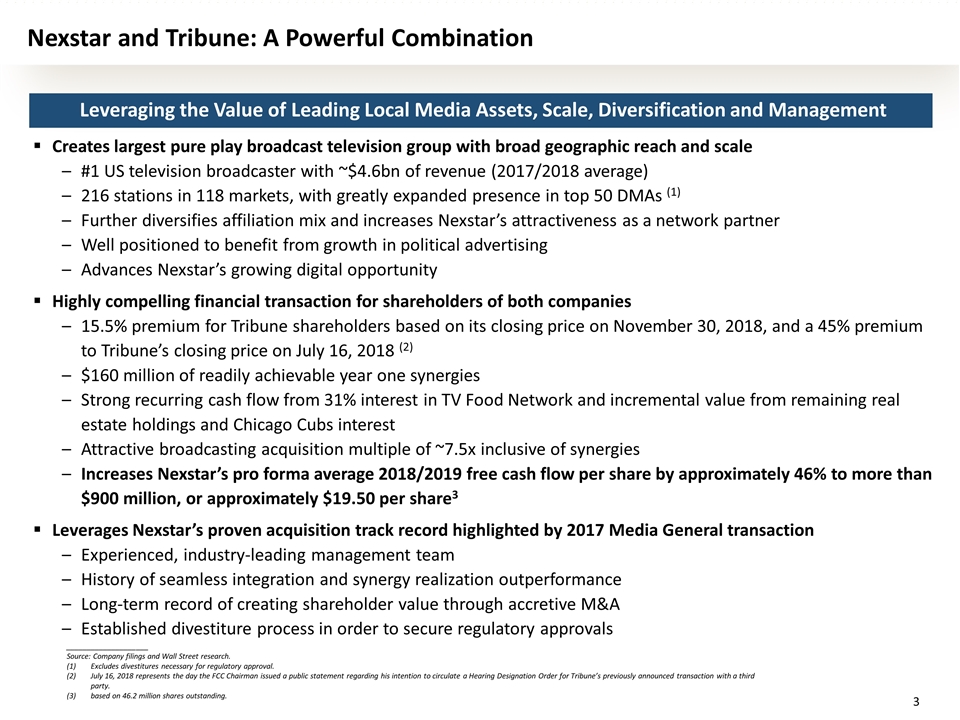

____________________ Source: Company filings and Wall Street research. Excludes divestitures necessary for regulatory approval. July 16, 2018 represents the day the FCC Chairman issued a public statement regarding his intention to circulate a Hearing Designation Order for Tribune’s previously announced transaction with a third party. based on 46.2 million shares outstanding. Creates largest pure play broadcast television group with broad geographic reach and scale #1 US television broadcaster with ~$4.6bn of revenue (2017/2018 average) 216 stations in 118 markets, with greatly expanded presence in top 50 DMAs (1) Further diversifies affiliation mix and increases Nexstar’s attractiveness as a network partner Well positioned to benefit from growth in political advertising Advances Nexstar’s growing digital opportunity Highly compelling financial transaction for shareholders of both companies 15.5% premium for Tribune shareholders based on its closing price on November 30, 2018, and a 45% premium to Tribune’s closing price on July 16, 2018 (2) $160 million of readily achievable year one synergies Strong recurring cash flow from 31% interest in TV Food Network and incremental value from remaining real estate holdings and Chicago Cubs interest Attractive broadcasting acquisition multiple of ~7.5x inclusive of synergies Increases Nexstar’s pro forma average 2018/2019 free cash flow per share by approximately 46% to more than $900 million, or approximately $19.50 per share3 Leverages Nexstar’s proven acquisition track record highlighted by 2017 Media General transaction Experienced, industry-leading management team History of seamless integration and synergy realization outperformance Long-term record of creating shareholder value through accretive M&A Established divestiture process in order to secure regulatory approvals Leveraging the Value of Leading Local Media Assets, Scale, Diversification and Management Nexstar and Tribune: A Powerful Combination

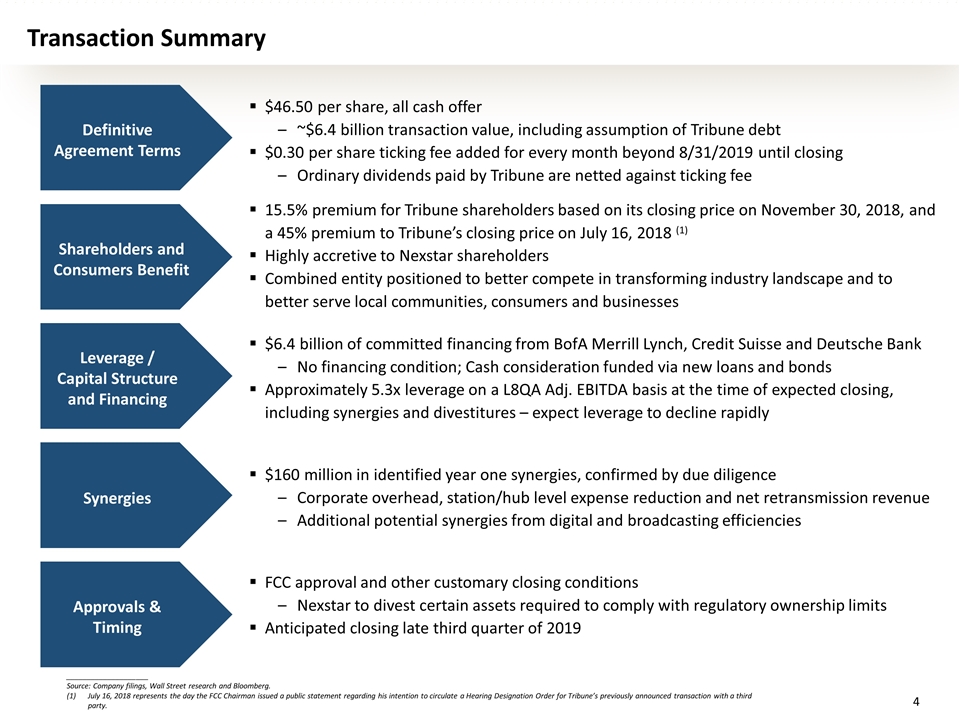

Transaction Summary Definitive Agreement Terms $46.50 per share, all cash offer ~$6.4 billion transaction value, including assumption of Tribune debt $0.30 per share ticking fee added for every month beyond 8/31/2019 until closing Ordinary dividends paid by Tribune are netted against ticking fee Synergies $160 million in identified year one synergies, confirmed by due diligence Corporate overhead, station/hub level expense reduction and net retransmission revenue Additional potential synergies from digital and broadcasting efficiencies Leverage / Capital Structure and Financing $6.4 billion of committed financing from BofA Merrill Lynch, Credit Suisse and Deutsche Bank No financing condition; Cash consideration funded via new loans and bonds Approximately 5.3x leverage on a L8QA Adj. EBITDA basis at the time of expected closing, including synergies and divestitures – expect leverage to decline rapidly Approvals & Timing FCC approval and other customary closing conditions Nexstar to divest certain assets required to comply with regulatory ownership limits Anticipated closing late third quarter of 2019 Shareholders and Consumers Benefit 15.5% premium for Tribune shareholders based on its closing price on November 30, 2018, and a 45% premium to Tribune’s closing price on July 16, 2018 (1) Highly accretive to Nexstar shareholders Combined entity positioned to better compete in transforming industry landscape and to better serve local communities, consumers and businesses ____________________ Source: Company filings, Wall Street research and Bloomberg. (1)July 16, 2018 represents the day the FCC Chairman issued a public statement regarding his intention to circulate a Hearing Designation Order for Tribune’s previously announced transaction with a third party.

Strategic Rationale Enhances Nexstar’s position as America’s leading local television broadcast and local media company Increases geographic diversification and scale Meaningful realizable synergies Strong financial profile with prospects for near and long-term growth Committed financing and clear pathway to meet regulatory requirements for approval Disciplined management team with history of successful M&A execution, integration, leverage reduction and return of capital to shareholders

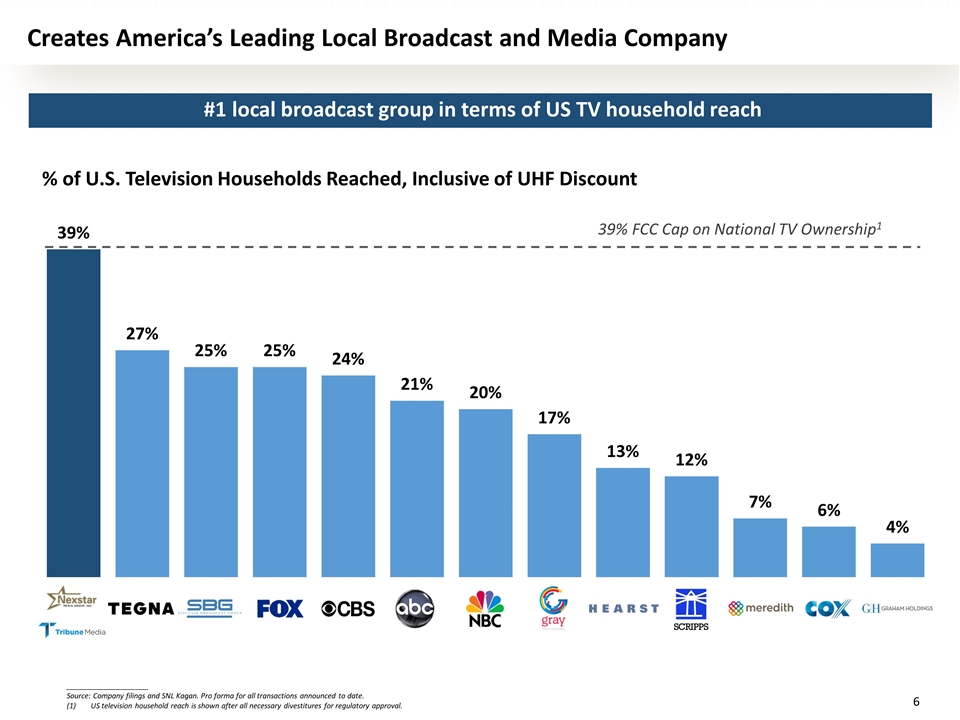

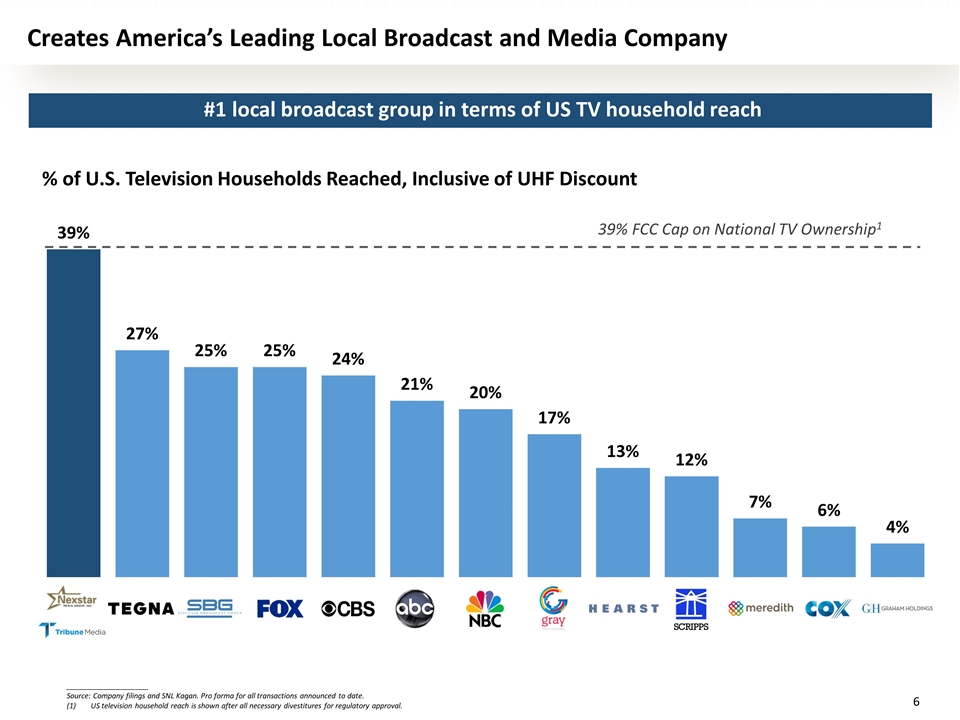

#1 local broadcast group in terms of US TV household reach Creates America’s Leading Local Broadcast and Media Company 39% FCC Cap on National TV Ownership1 ____________________ Source: Company filings and SNL Kagan. Pro forma for all transactions announced to date. US television household reach is shown after all necessary divestitures for regulatory approval. % of U.S. Television Households Reached, Inclusive of UHF Discount

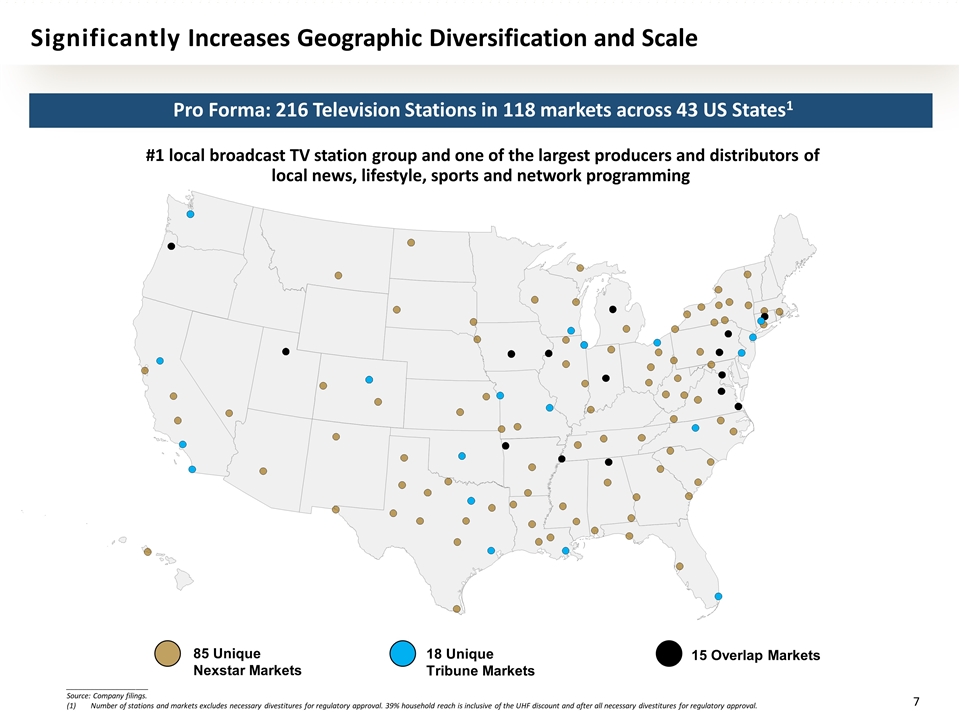

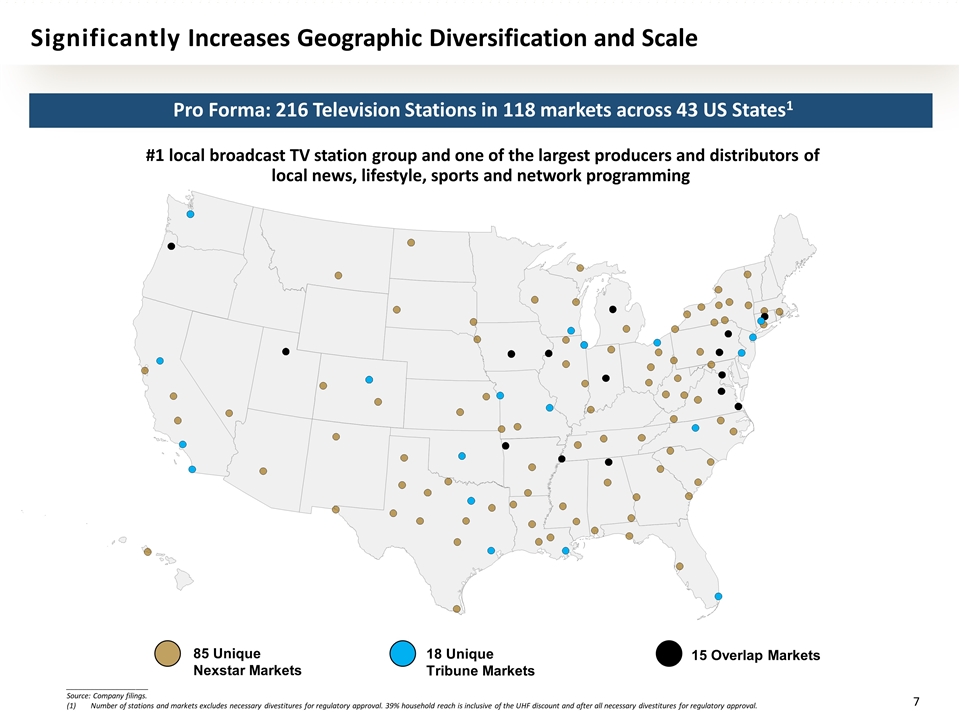

Significantly Increases Geographic Diversification and Scale 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 1130101_1.wor Ny008U43 Pro Forma: 216 Television Stations in 118 markets across 43 US States1 ____________________ Source: Company filings. Number of stations and markets excludes necessary divestitures for regulatory approval. 39% household reach is inclusive of the UHF discount and after all necessary divestitures for regulatory approval. 85 Unique Nexstar Markets 18 Unique Tribune Markets 15 Overlap Markets #1 local broadcast TV station group and one of the largest producers and distributors of local news, lifestyle, sports and network programming

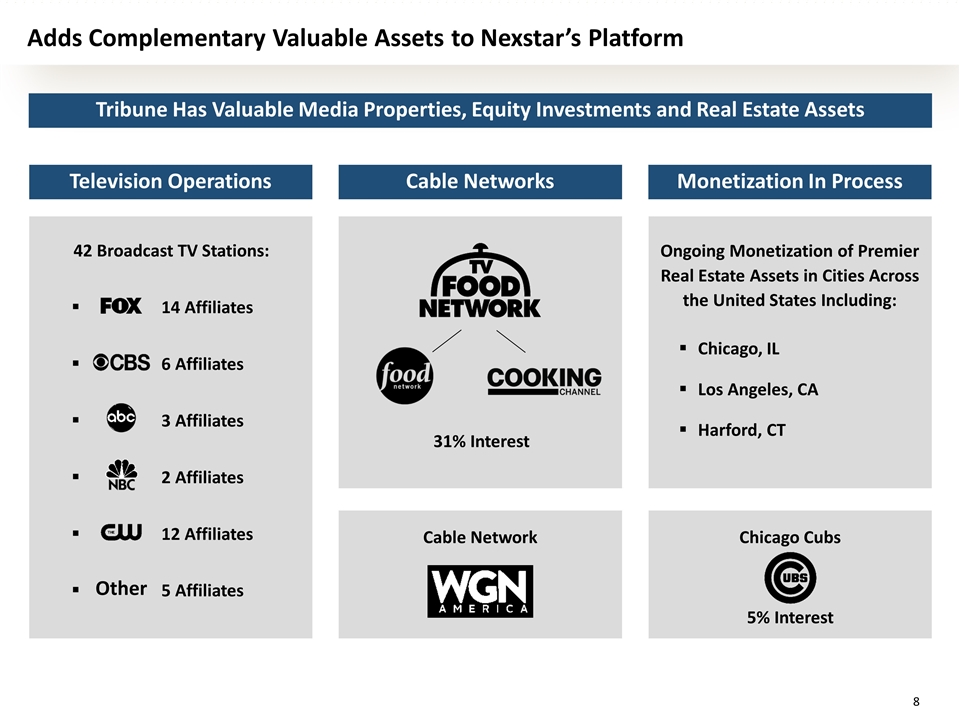

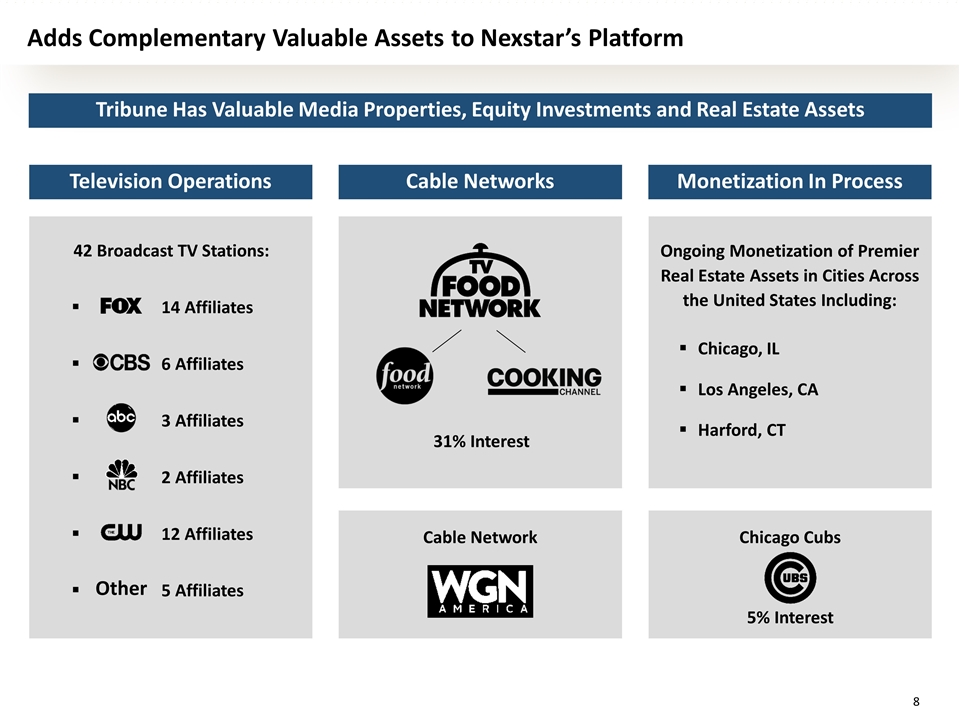

Adds Complementary Valuable Assets to Nexstar’s Platform Tribune Has Valuable Media Properties, Equity Investments and Real Estate Assets Television Operations 42 Broadcast TV Stations: 14 Affiliates 6 Affiliates 3 Affiliates 2 Affiliates 12 Affiliates 5 Affiliates Cable Networks Monetization In Process Cable Network 31% Interest Chicago Cubs 5% Interest Ongoing Monetization of Premier Real Estate Assets in Cities Across the United States Including: Chicago, IL Los Angeles, CA Harford, CT Other

Increased scale positions Nexstar to more effectively compete with other media and innovate Enhanced Competitive Position in Converging Media Industry Landscape Local / National Cable & Regional Sports Networks Digital Video Programming Social Media Outdoor Internet Local / Nat. Print and Digital Media OTA and Streaming Radio

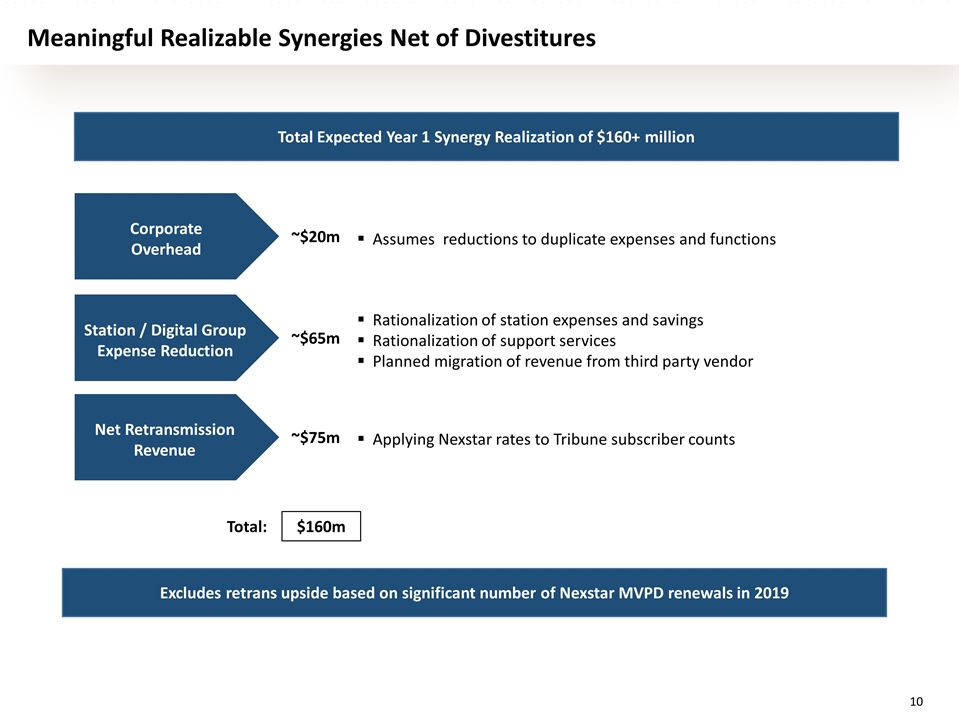

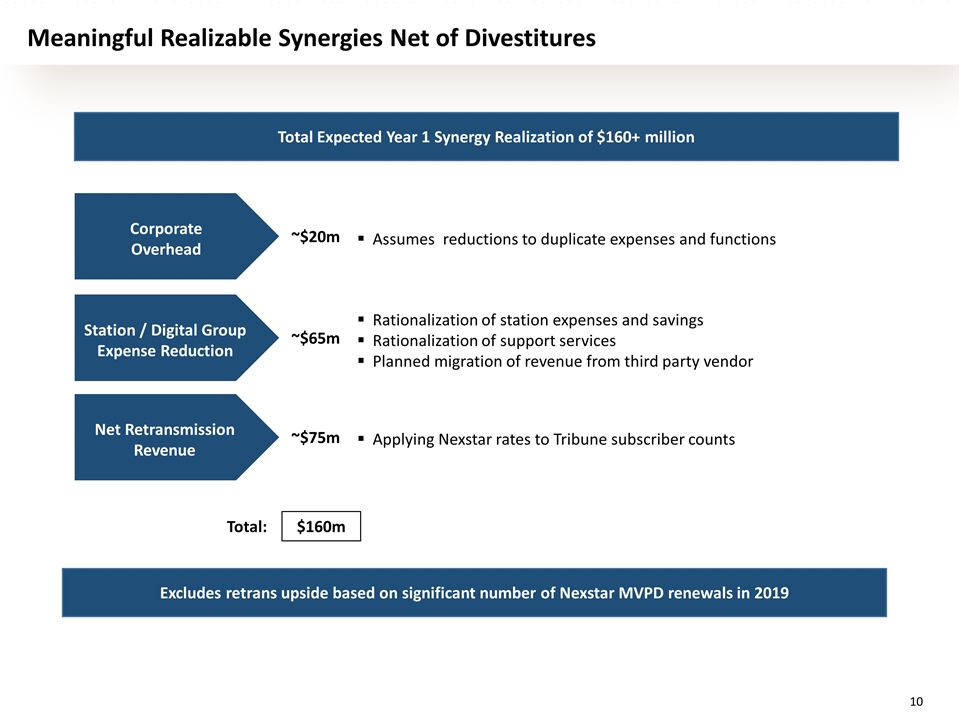

Meaningful Realizable Synergies Net of Divestitures Rationalization of station expenses and savings Rationalization of support services Planned migration of revenue from third party vendor Net Retransmission Revenue Applying Nexstar rates to Tribune subscriber counts Corporate Overhead Assumes reductions to duplicate expenses and functions Station / Digital Group Expense Reduction ~$20m ~$65m $160m Total: ~$75m Total Expected Year 1 Synergy Realization of $160+ million Excludes retrans upside based on significant number of Nexstar MVPD renewals in 2019

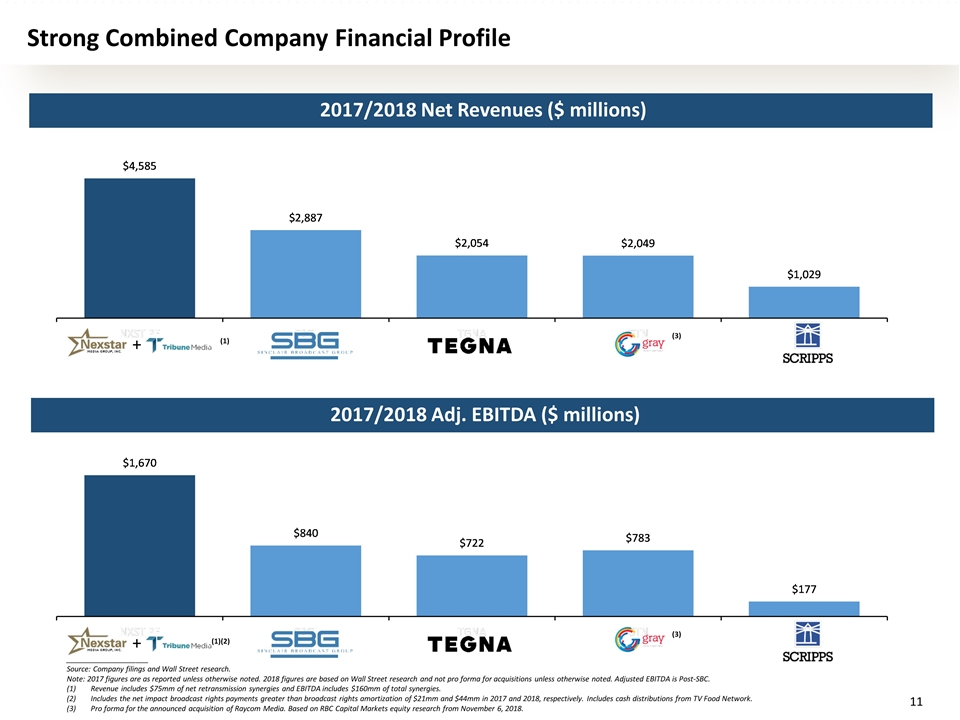

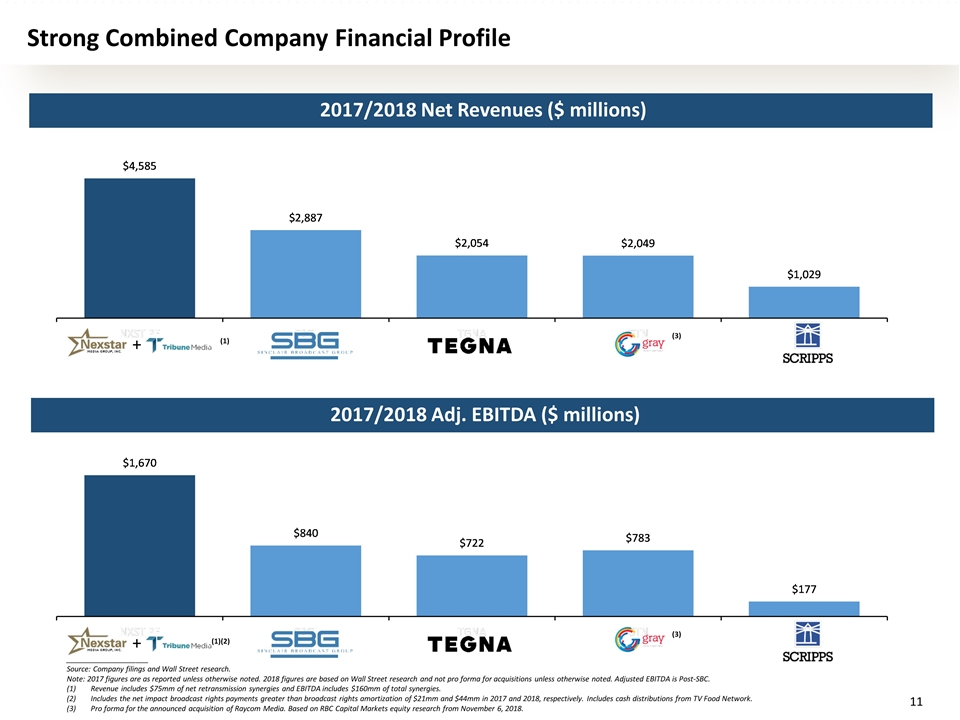

Strong Combined Company Financial Profile 2017/2018 Net Revenues ($ millions) 2017/2018 Adj. EBITDA ($ millions) ____________________ Source: Company filings and Wall Street research. Note: 2017 figures are as reported unless otherwise noted. 2018 figures are based on Wall Street research and not pro forma for acquisitions unless otherwise noted. Adjusted EBITDA is Post-SBC. Revenue includes $75mm of net retransmission synergies and EBITDA includes $160mm of total synergies. Includes the net impact broadcast rights payments greater than broadcast rights amortization of $21mm and $44mm in 2017 and 2018, respectively. Includes cash distributions from TV Food Network. Pro forma for the announced acquisition of Raycom Media. Based on RBC Capital Markets equity research from November 6, 2018. + + (3) (3) (1) (1)(2)

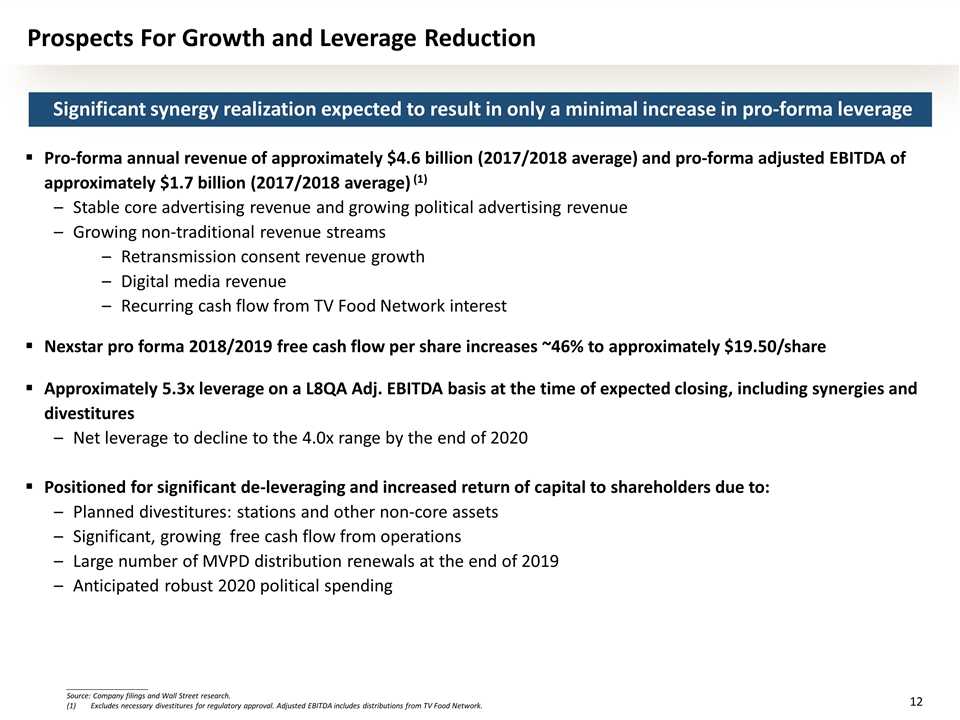

____________________ Source: Company filings and Wall Street research. Excludes necessary divestitures for regulatory approval. Adjusted EBITDA includes distributions from TV Food Network. Pro-forma annual revenue of approximately $4.6 billion (2017/2018 average) and pro-forma adjusted EBITDA of approximately $1.7 billion (2017/2018 average) (1) Stable core advertising revenue and growing political advertising revenue Growing non-traditional revenue streams Retransmission consent revenue growth Digital media revenue Recurring cash flow from TV Food Network interest Nexstar pro forma 2018/2019 free cash flow per share increases ~46% to approximately $19.50/share Approximately 5.3x leverage on a L8QA Adj. EBITDA basis at the time of expected closing, including synergies and divestitures Net leverage to decline to the 4.0x range by the end of 2020 Positioned for significant de-leveraging and increased return of capital to shareholders due to: Planned divestitures: stations and other non-core assets Significant, growing free cash flow from operations Large number of MVPD distribution renewals at the end of 2019 Anticipated robust 2020 political spending Significant synergy realization expected to result in only a minimal increase in pro-forma leverage Prospects For Growth and Leverage Reduction

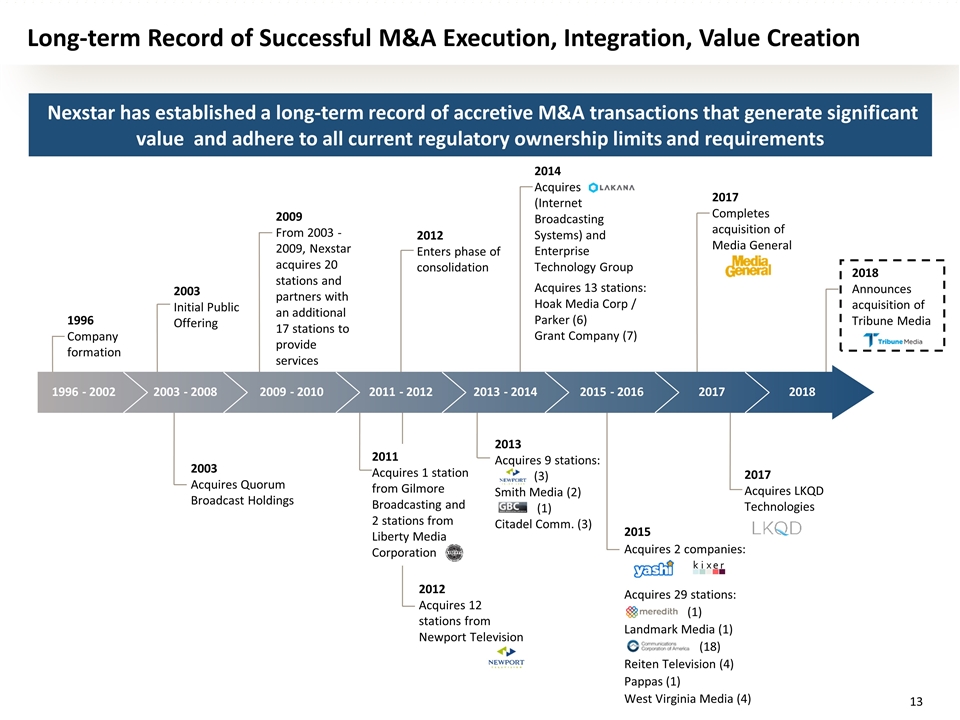

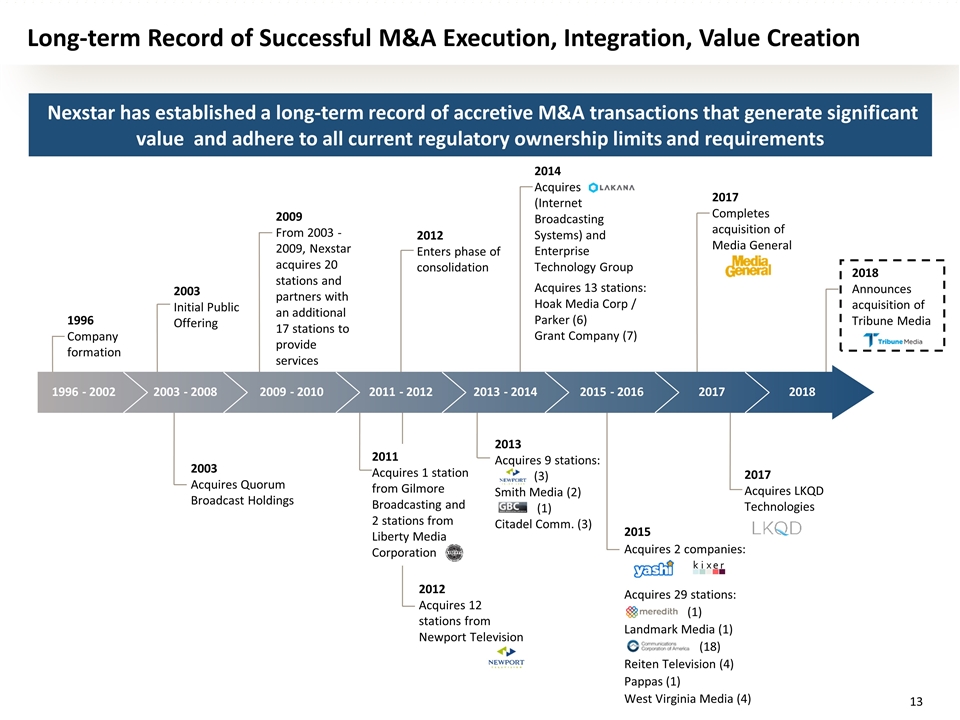

Long-term Record of Successful M&A Execution, Integration, Value Creation 2011 - 2012 2013 - 2014 2015 - 2016 2017 2003 - 2008 2009 - 2010 1996 - 2002 1996 Company formation 2003 Initial Public Offering 2012 Enters phase of consolidation 2017 Completes acquisition of Media General 2011 Acquires 1 station from Gilmore Broadcasting and 2 stations from Liberty Media Corporation 2012 Acquires 12 stations from Newport Television 2015 Acquires 2 companies: Acquires 29 stations: (1) Landmark Media (1) (18) Reiten Television (4) Pappas (1) West Virginia Media (4) 2017 Acquires LKQD Technologies 2013 Acquires 9 stations: (3) Smith Media (2) (1) Citadel Comm. (3) 2014 Acquires (Internet Broadcasting Systems) and Enterprise Technology Group Acquires 13 stations: Hoak Media Corp / Parker (6) Grant Company (7) 2003 Acquires Quorum Broadcast Holdings 2009 From 2003 -2009, Nexstar acquires 20 stations and partners with an additional 17 stations to provide services 2018 2018 Announces acquisition of Tribune Media Nexstar has established a long-term record of accretive M&A transactions that generate significant value and adhere to all current regulatory ownership limits and requirements

Significant growth opportunity Creates leading pure-play broadcast operator and one of the nation’s leading providers of local news, entertainment, sports, lifestyle and network programming and content through its broadcast and digital media platform Expanded scale and reach appeals to local and national advertising clients Increases scale and reach of combined digital operations providing incremental growth Economically compelling to shareholders of both companies 15.5% premium for Tribune shareholders over November 30, 2018 closing price Substantial free cash flow accretion to Nexstar shareholders Over $900 million of average annual free cash flow or more than $19.50/share per year over the 2018/2019 period Annual revenue of ~$4.6 billion Strong financial profile and growth prospects $160 million of readily achievable year one synergies Retransmission consent re-negotiations Well positioned to generate strong political advertising revenue Led by Nexstar management team with extraordinary record of delivering FCF growth and shareholder value Nexstar and Tribune: A strategically, financially and operationally compelling combination Summary