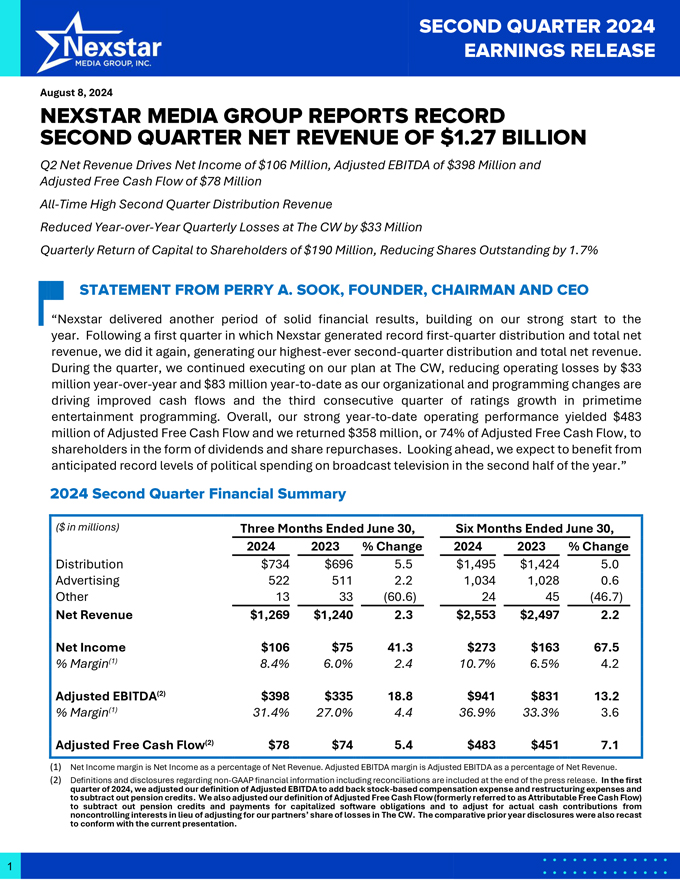

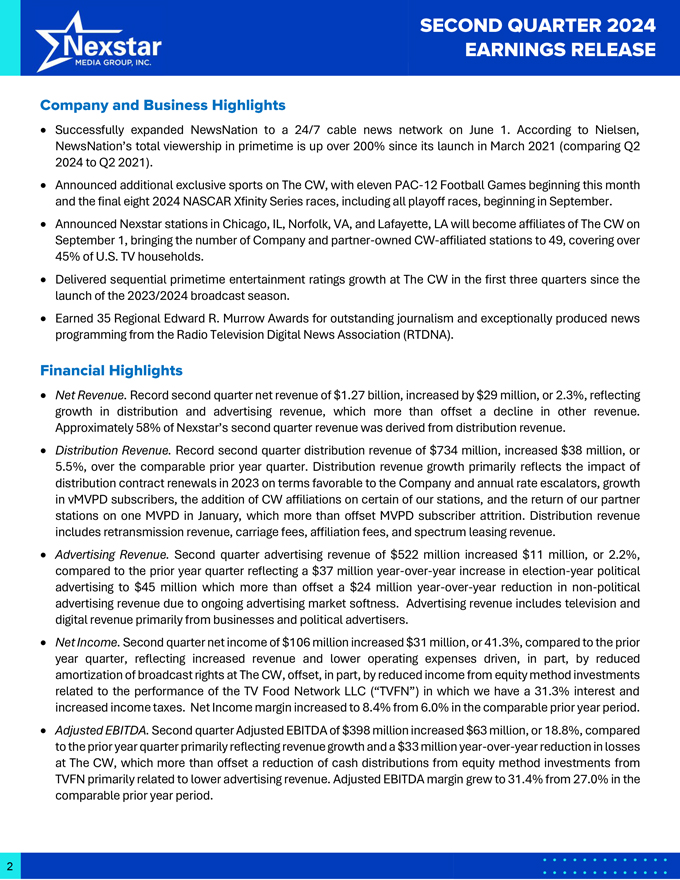

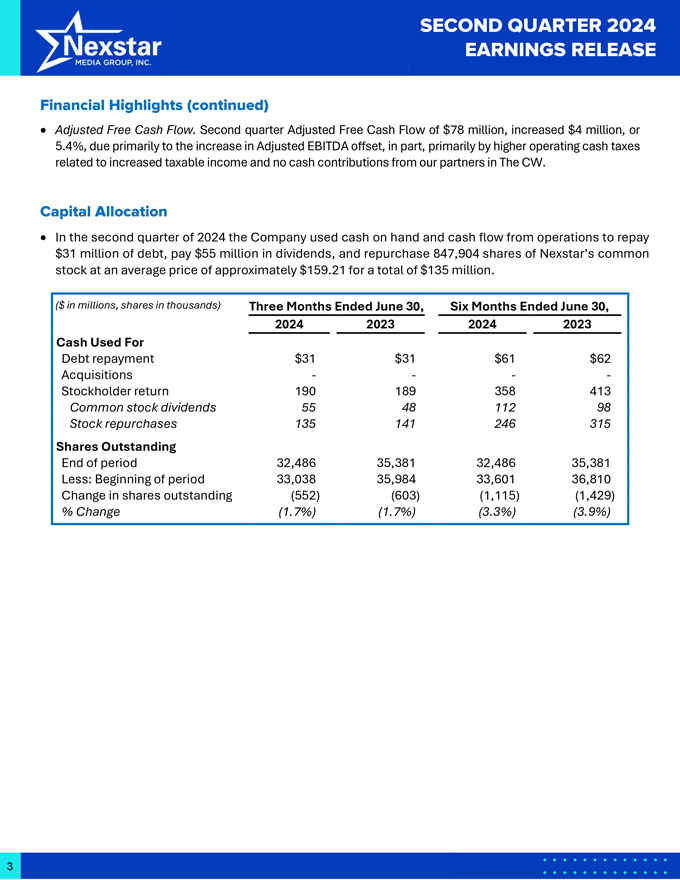

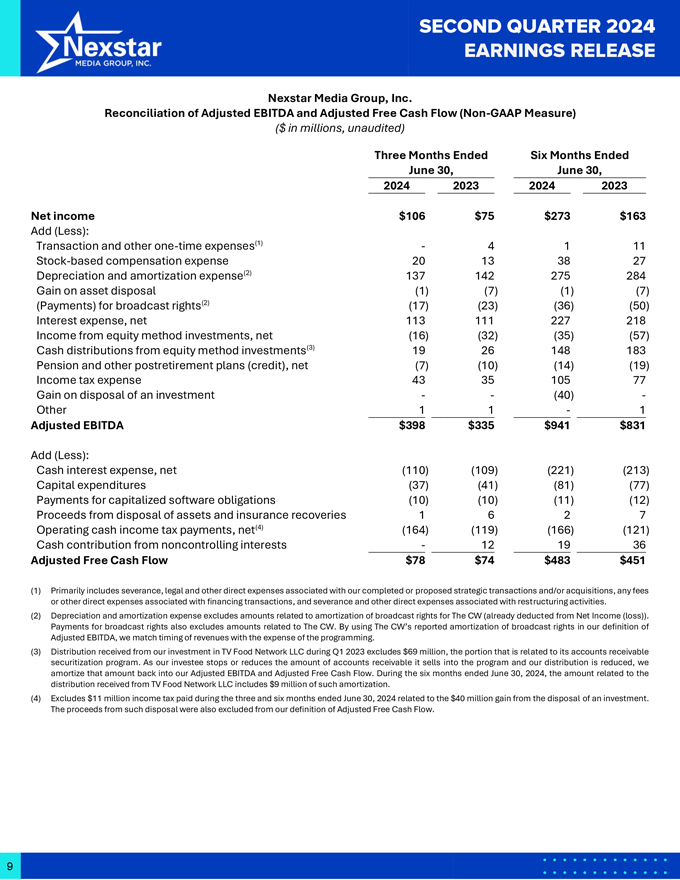

SECOND QUARTER 2024 EARNINGS RELEASE Definitions and Disclosures Regarding Non-GAAP Financial Information Adjusted EBITDA is calculated as net income, plus or (minus): transaction and other one-time expenses, stock-based compensation expense, depreciation and amortization expense (excluding amortization of broadcast rights for The CW), (payments) for broadcast rights (excluding broadcast rights payments for The CW), (gain) loss on asset disposal, impairment charges, interest expense, net, (income) loss from equity method investments, cash distributions from equity method investments, pension and other postretirement plans costs (credit), income tax expense (benefit) and other expense (income). We consider Adjusted EBITDA to be an indicator of our assets’ operating performance and a measure of our ability to service debt. It is also used by management to identify the cash available for strategic acquisitions and investments, maintain capital assets and fund ongoing operations and working capital needs. We also believe that Adjusted EBITDA is useful to investors and lenders as a measure of valuation. Adjusted Free Cash Flow is calculated as net income, plus or (minus) transaction and other one-time expenses, stock-based compensation expense, depreciation and amortization expense (excluding amortization of broadcast rights for The CW), (payments) for broadcast rights (excluding broadcast rights payments for The CW), (gain) loss on asset disposal, impairment charges, interest expense, net, (income) loss from equity method investments, cash distributions from equity method investments, pension and other postretirement plans costs (credit), income tax expense (benefit) and other expense (income) minus cash interest expense, capital expenditures, payments for capitalized software obligations and operating cash income tax payments, plus proceeds from disposal of assets and insurance recoveries and cash contribution from noncontrolling interests. We consider Adjusted Free Cash Flow to be an indicator of our assets’ operating performance. In addition, this measure is useful to investors because it is frequently used by industry analysts, investors and lenders as a measure of valuation for broadcast companies, although their definitions of free cash flow may differ from our definition. For a reconciliation of these non-GAAP financial measurements to the GAAP financial results cited in this news announcement, please see the supplemental tables at the end of this release. With respect to our forward-looking guidance, no reconciliation between a non-GAAP measure to the closest corresponding GAAP measure is included in this release because we are unable to quantify certain amounts that would be required to be included in the GAAP measure without unreasonable efforts. We believe such reconciliations would imply a degree of precision that would be confusing or misleading to investors. In particular, a reconciliation of forward-looking Adjusted Free Cash Flow to the closest corresponding GAAP measure is not available without unreasonable efforts on a forward-looking basis due to the high variability, complexity and low visibility with respect to the charges excluded from these non-GAAP measures. For example, the definition of Adjusted Free Cash Flow excludes stock-based compensation expenses specific to equity compensation awards that are directly impacted by unpredictable fluctuations in our stock price. In addition, the definition of Adjusted Free Cash Flow excludes the impact of non-recurring or unusual items such as impairment charges, transaction-related costs and gains or losses on sales of assets which are unpredictable. We expect the variability of these items to have a significant, and potentially unpredictable, impact on our future GAAP financial results.