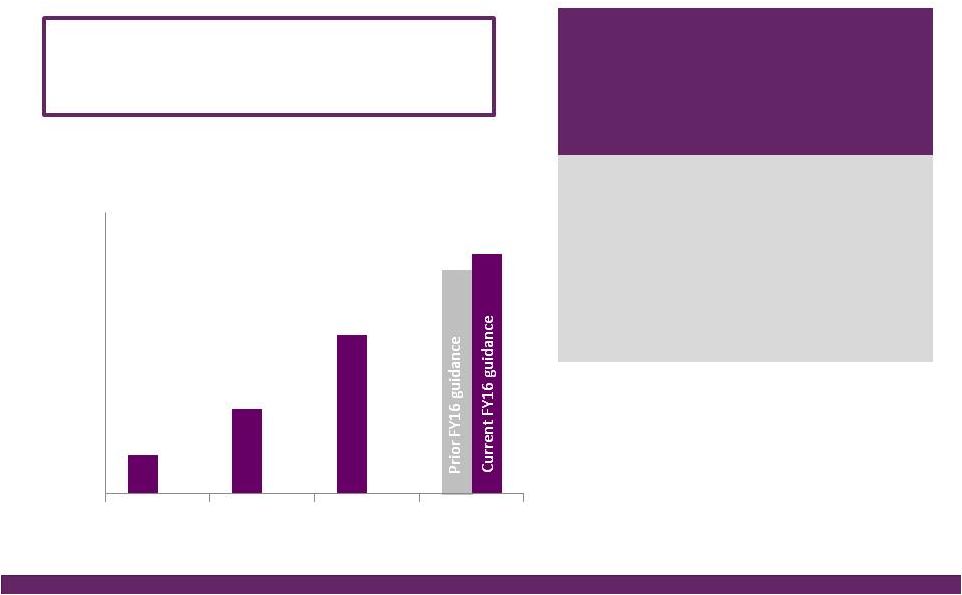

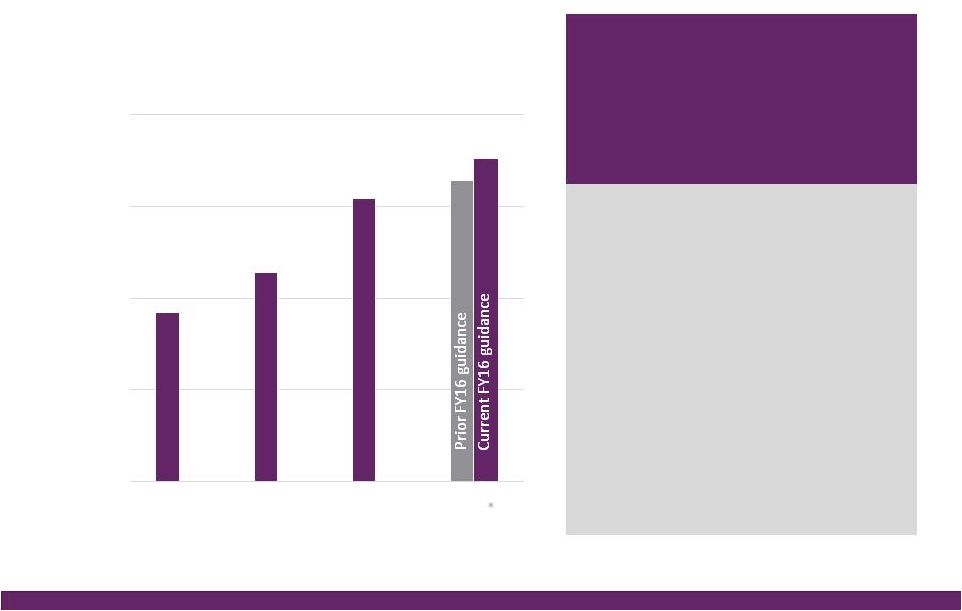

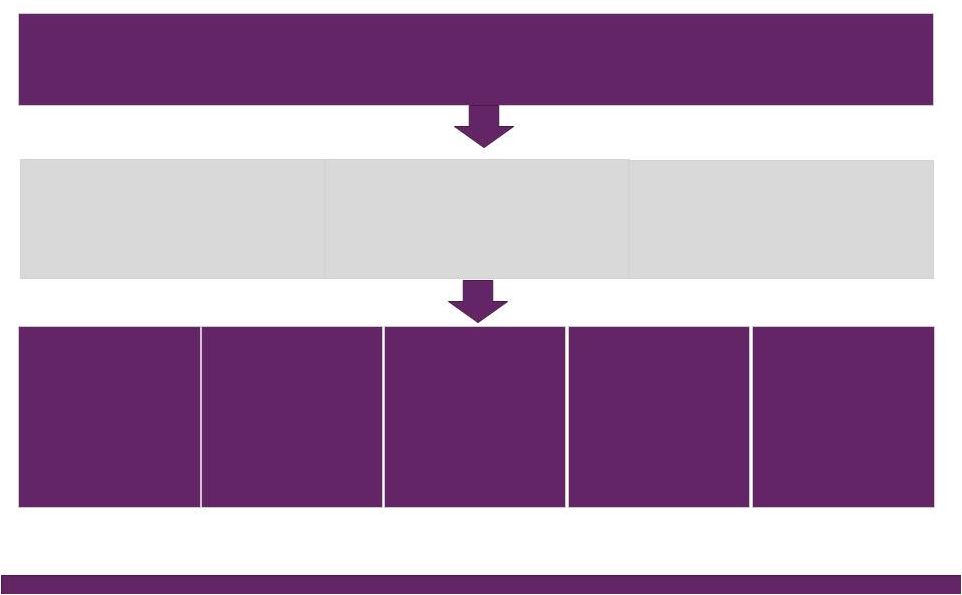

©2016 NuVasive®, Inc. ©2016 NuVasive®, Inc. FY16 Guidance Performance Drivers Revenues • As reported ~$962.0M, ~18.5% YoY growth^ ~$53M NSO contribution, ~$27M Biotronic; ~$1M currency impact • U.S. Spinal Hardware • U.S. Surgical Support • International ~16.6% YoY growth ~14.2% YoY growth ~37.7% YoY growth Strong expected lumbar, cervical and NSO product performance Biotronic contribution as of July 1, 2016 ~36% constant currency impact; comprised of core NuVasive growth of ~20%, NSO product growth of ~17% Non-GAAP Gross Margin ~76.4% ~40 bps increase due to 2-year suspension of med device tax, partially offset by the lower gross margin profile of Biotronic Non-GAAP Sales, Marketing & Admin. ~55.4% ~100 bps improvement driven by core NuVasive asset and sales force efficiencies, support function management, International scale; partial improvement related to SM&A profile of Biotronic Non-GAAP Research & Development ~5.1% ~80 bps increase in organic and inorganic investment in innovation Non-GAAP Operating Profit Margin ~16.0% ~150 bps of core NuVasive margin improvement, primarily offset by NSO investment Non-GAAP Earnings Per Share ~$1.64 ~25% YoY growth Adjusted EBITDA Margin ~25.4% ~20 bps increase Non-GAAP Effective Tax Rate ~37.0% ~500 bps improvement from 42% in 2015; ASU adoption 2016-09 Non-GAAP diluted WASO ~52.0M shares Increased from ~51.3M shares due to higher share price impact on remaining 2017 convertible note dilution; ASU adoption 2016-09 Reflects impact of acquisitions, convertible note issuance, note repurchases, expected currency rates & adoption of the ASU Full Year 2016 Financial Performance Guidance* 14 *NuVasive financial performance guidance as of July 26, 2016; ^Constant currency as reported |