- NUVA Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Nuvasive (NUVA) DEF 14ADefinitive proxy

Filed: 6 Apr 21, 4:06pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant R

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

R Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under §240.14a-12

NuVasive, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| R | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

2021

Annual Meeting of Stockholders |

NuVasive at a Glance | |||

NuVasive, Inc. is a global medical technology company focused on developing, manufacturing, selling and providing procedural solutions for spine surgery, with a guiding purpose to transform surgery, advance care and change lives. We offer a comprehensive portfolio of procedurally integrated spine surgery solutions, including surgical access instruments, spinal implants, fixation systems, biologics, and enabling technologies, as well as systems and services for intraoperative neuromonitoring. In addition, we develop and sell magnetically adjustable implant systems for spine and specialized orthopedic procedures.

| ~2,700 global workforce |

| 50+ international markets | |||

| Leader in less-invasive spine surgery |

| 15+ years of industry-leading experience in enabling technologies | |||

Since our incorporation in 1997, we have grown from a small developer of specialty spinal implants into a leading medical technology company delivering procedurally integrated solutions for spine surgery. A key driver of our growth has been our focus on innovative products and technologies that drive reproducible outcomes for patients, surgeons and providers.

2020 Accomplishments and Achievements | ||

COVID-19 safety and wellbeing

|

COVID-19 Response:

During 2020, the safety and wellbeing of our employees was a key priority. We invested in the safety of our people by implementing rigorous COVID-19 health and safety protocols, distributing personal protective equipment to ensure those working in clinical and operational settings were protected, deploying health and wellness training, and offering remote work options where possible. We showed our commitment to our patients, surgeons and hospitals by navigating numerous challenges to support surgical procedures. While COVID-19 resulted in lower surgery volumes and deferred elective procedures, we took steps to preserve and strengthen our business by raising additional capital and building up our cash reserves, controlling expenses, improving our operations, and investing in research and development (R&D) to further our progress in support of our long-term strategy. | |

Net sales of $1.051 billion | Financial Results and Solid Foundation for Growth:

Despite the considerable challenges we faced related to COVID-19, we delivered global net sales of $1.051 billion in 2020, comprised of U.S. net sales of $821.8 million and International net sales (which excludes Puerto Rico) of $228.8 million. We also took steps to control expenses and improve cash flows, and we drove non-GAAP operating margin* of 11.1%. In addition, we raised additional capital to solidify our financial foundation and to fund our long-term growth. | |

15 products launched |

R&D Investment and New Product Launches:

As innovation is a key pillar to our leadership in spine, we maintained our level of R&D investment during COVID-19, and we launched 15 new products in 2020. We have continued to focus on developing innovative and enabling technologies to drive increased adoption of less-invasive surgery and improve clinical, financial and operational outcomes. | |

Clinical education | Enhanced Clinical Education and Training:

In 2020, our Clinical Professional Development team launched a new campaign to equip surgeons and hospitals with resources to support the adoption of less-invasive surgical techniques. With in-person training impacted by COVID-19, we developed virtual labs and created a Virtual Spine Conference series to enhance remote surgeon education and provide clinical insights. | |

| * A reconciliation of certain non-GAAP financial measures is provided in the Appendix. | ||

2021

Annual Meeting of Stockholders |

Notice of 2021 Annual Meeting of Stockholders | |||

| 2021 Annual Meeting of Stockholders | Items of Business | |||

| Date: May 18, 2021 | Proposal 1—Election of Directors: To elect four “Class II” Directors to hold office until the 2024 Annual Meeting of Stockholders and until their successors are elected and qualified; | ||

| Time: 8:00 AM Pacific | Proposal 2—Ratification of Independent Auditor: To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021; | ||

| Place: The meeting will be held virtually at: www.proxydocs.com /NUVA | Proposal 3—Annual “Say-on-Pay” Vote: To hold a non-binding advisory vote on the compensation of the Company’s named executive officers for the fiscal year ended December 31, 2020; and

To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. | ||

Due to the public health and travel safety concerns relating to the COVID-19 pandemic, the Annual Meeting will be held in a virtual meeting format only. You will not be able to attend the Annual Meeting in-person. The accompanying proxy materials include instructions on how to participate in the meeting and how you may vote your shares.

Our Board of Directors recommends a vote “FOR” each of the Director nominees and “FOR” Proposals 2 and 3. Only stockholders of record at the close of business on March 29, 2021, the Record Date, will be entitled to notice of, and to vote at, the 2021 Annual Meeting. For ten days prior to the Annual Meeting, a complete list of the stockholders of record on March 29, 2021, will be available at our corporate headquarters, located at 7475 Lusk Boulevard, San Diego, CA 92121, for examination during ordinary business hours by any stockholder for any purpose relating to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting virtually via the Internet, we encourage you to vote your shares. You can vote your shares via the Internet, telephone or mail, and instructions regarding all three methods of voting are provided on the proxy card. If you hold shares through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from such firm, bank or other nominee to vote your shares.

By order of the Board of Directors

J. Christopher Barry, Chief Executive Officer

San Diego, California, on April 6, 2021

2021

Annual Meeting of Stockholders |

Solicitation of Proxies for Annual Meeting of Stockholders | |||

This proxy statement (this “Proxy Statement”) and the accompanying proxy are furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of NuVasive, Inc. (the “Company” or “NuVasive”) for use at the Company’s 2021 Annual Meeting of Stockholders (the “Annual Meeting”), and any adjournments or postponements thereof, for the purposes described in the Notice of 2021 Annual Meeting of Stockholders.

The Annual Meeting will be held virtually on May 18, 2021 at 8:00 AM Pacific. You will be able to attend the Annual Meeting virtually via the Internet and vote and submit questions by visiting www.proxydocs.com/NUVA. The Board of Directors has made proxy materials available on the Internet, and, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies by the Board for use at the Annual Meeting. The Proxy Statement for the Annual Meeting was filed with the U.S. Securities and Exchange Commission on April 6, 2021, which is also the approximate date on which the Proxy Statement and the accompanying proxy were first sent or made available to stockholders.

IMPORTANT NOTICE REGARDING THE INTERNET AVAILABILITY

OF PROXY MATERIALS FOR THE NUVASIVE, INC.

2021 ANNUAL MEETING OF STOCKHOLDERS

The NuVasive, Inc. Proxy Statement and Annual Report

for the fiscal year ended December 31, 2020 are available electronically

at www.proxydocs.com/NUVA

Your vote is important

ALL STOCKHOLDERS OF RECORD AT THE CLOSE OF BUSINESS ON MARCH 29, 2021 ARE INVITED TO ATTEND AND VOTE THEIR SHARES AT THE NUVASIVE, INC. 2021 ANNUAL MEETING OF STOCKHOLDERS

Whether or not you plan to attend the Annual Meeting virtually via the Internet, we encourage you to read the accompanying Proxy Statement and submit your proxy or voting instructions as soon as possible to vote your shares.

VOTE BY INTERNET, TELEPHONE, MAIL, OR AT THE ANNUAL MEETING

|

|  |  |

For specific instructions on how to vote your shares, please refer to the instructions on the Notice of Internet Availability of Proxy Materials you received in the mail, the question “How do I Vote my Shares?” in the accompanying Proxy Statement, or, if you requested printed proxy materials by mail, your enclosed proxy card. This will ensure the presence of a quorum at the Annual Meeting. If you attend the Annual Meeting, you may vote via the Internet during the meeting if you wish to do so, even if you have previously submitted your proxy or voting instructions.

2021

Annual Meeting of Stockholders |

Proxy Statement Table of Contents | |||

NuVasive, Inc. | 2021 Proxy Statement | TABLE OF CONTENTS |

2021

Annual Meeting of Stockholders |

Summary | |||

The following summary information is provided to assist you in reviewing the Proxy Statement for the Annual Meeting. It does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

Annual Meeting Highlights

| ||||||

| Date and Time: May 18, 2021 8:00 AM Pacific |  | Place: The meeting will be held virtually via the Internet at: www.proxydocs.com/NUVA | |||||||

Record Date: March 29, 2021 | ||||||||||

Proposals and Voting Recommendations | ||||||

Proposal 1—Election of Directors: To elect four “Class II” Directors to hold office until the 2024 Annual Meeting of Stockholders and until their successors are elected and qualified (see page 1) |

The Board recommends

| |||||

Proposal 2—Ratification of Independent Auditor: To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2021 (see page 33)

|

The Board recommends | |||||

Proposal 3—Annual “Say-on-Pay” Vote: To hold a non-binding advisory vote on the compensation of the Company’s named executive officers for the fiscal year ended December 31, 2020 (see page 36) |

The Board recommends

| |||||

| Director Name | | Member Since | Director Background/Skills | Current Committee Service | ||||||||||||||||||||||

|

Healthcare

|

|

|

Leadership

|

|

|

Finance

|

|

|

Innovation

|

|

|

Global

|

| ||||||||||||

Vickie L. (Independent) |

|

June |

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit: Chair and “financial expert” Nominating, Corporate Gov. and Compliance: Member | ||||||||||

John A. DeFord, Ph.D. (Independent) |

|

February |

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominating, Corporate Gov. and Compliance: Member | ||||||||||

R. Scott Huennekens (Independent) |

|

October |

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit: Member | ||||||||||

Siddhartha C. Kadia, Ph.D. (Independent) |

|

February |

|

| ��

|

|

|

|

|

|

|

|

|

|

|

Compensation: Member | ||||||||||

i NuVasive, Inc. | 2021 Proxy Statement | PROXY STATEMENT SUMMARY |

2021

Annual Meeting of Stockholders |

Proxy Statement Summary (continued) | |||

The following summary information is provided to assist you in reviewing the Proxy Statement for the Annual Meeting. It does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

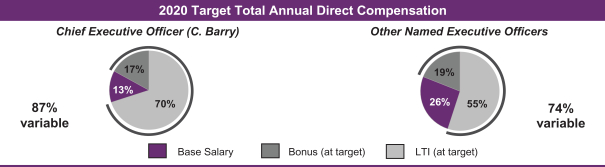

Compensation and Governance Highlights

| ||

|

At the 2020 Annual Meeting, NuVasive stockholders voted 94% in favor of our “say-on-pay” proposal | |

NuVasive took a number of steps in 2020 to navigate the challenges associated with the COVID-19 pandemic. In response to the pandemic, we implemented expense control measures, and our executive officers and Directors voluntarily agreed to temporary reductions in compensation. In addition, we funded the 2020 annual bonus plan below target and did not make modifications to any long-term incentives.

| ||||||

| Compensation Practices and Policies (see page 49) | ||||||

| Clawback policy for incentive compensation, if material restatement |

| Independent compensation consultant engaged by Compensation Committee | |||

| No tax gross-ups for payments upon a change-in-control |

| Compensation risk assessment conducted annually | |||

| Stock Ownership Guidelines for Directors and senior management |

| Hedging transactions prohibited under the Company’s Insider Trading Policy | |||

| Corporate Governance Practices and Policies (see page 19) | ||||||||||||||||||

Eight of the Company’s ten Board members are independent (80%). Our Directors exhibit an effective mix of skills, experience, diversity and perspectives.

| ||||||||||||||||||

|

Healthcare |

Leadership |

Finance |

Innovation |

Global |

Law |

Government |

Hospital |

| |||||||||

Average Director Tenure 4.4 YEARS | Average Director Age 58.8 YEARS | Board Diversity 30% | ||||||||||||||||

| Our Board structure provides for a Lead Independent Director | | Our Chief Executive Officer does not serve as our Board Chair | |||||||||||||||

| Our independent Directors meet frequently in executive session | | Our Board service is limited by our retirement age policy (Directors may not stand for election after age 72) | |||||||||||||||

| Our Board and Committees engage in annual self-evaluations | | We have majority voting for uncontested Director elections | |||||||||||||||

ii NuVasive, Inc. | 2021 Proxy Statement | PROXY STATEMENT SUMMARY |

2021

Annual Meeting of Stockholders |

Election of Directors | |||

At the Annual Meeting, we are asking our stockholders to elect four individuals nominated for re-election to our Board. Our Board is divided into three classes, and our “Class II” Directors are subject to election at the Annual Meeting for a three-year term. Our current Class II Directors are Vickie L. Capps, John A. DeFord, Ph.D., R. Scott Huennekens, and Siddhartha C. Kadia, Ph.D., and each has been nominated for re-election to the Board, as discussed further below.

| OUR BOARD RECOMMENDS YOU VOTE “FOR” EACH OF HUENNEKENS AND SIDDHARTHA C. KADIA TO SERVE AS A CLASS II DIRECTOR |

Our Board, upon the recommendation of our Nominating, Corporate Governance and Compliance Committee (the “Nominating Committee”), nominated each of Ms. Capps, Dr. DeFord, Mr. Huennekens, and Dr. Kadia for re-election as Class II Directors at the Annual Meeting. Information regarding Ms. Capps, Dr. DeFord, Mr. Huennekens, and Dr. Kadia, including the qualifications, attributes and skills that led our Board to nominate each as a Director, can be found below under “Board Members and Nominees for Election.”

Ms. Capps, Dr. DeFord, Mr. Huennekens, and Dr. Kadia have each indicated that they are willing and able to serve as Directors. If any of the Board’s nominees for Director declines to serve or becomes unavailable for any reason, or in the event of a Board vacancy, the Nominating Committee may seek out other potential Director candidates, and one or more of such candidates may be elected as a Director in accordance with the Company’s organizational documents. If Ms. Capps, Dr. DeFord, Mr. Huennekens, and Dr. Kadia are elected at the Annual Meeting, each will serve as a Class II Director for a three-year term until the 2024 Annual Meeting of Stockholders, or his or her earlier resignation or removal, and in each case until their respective successors are duly elected and qualified.

As each of the nominees for Director is an incumbent Director, if a nominee fails to receive “FOR” votes representing a majority of votes cast, the Director shall promptly tender his or her resignation to the Board, subject to acceptance by the Board. The Nominating Committee of the Board would then be charged with making a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the recommendation of the Nominating Committee, and publicly disclose its decision regarding the tendered resignation and the rationale behind the decision. If the Board determines not to accept the resignation of the incumbent Director, the incumbent Director will continue to serve until his or her successor is duly elected, or his or her earlier resignation or removal.

Vote Required and Board Recommendation

Directors are elected by a majority of the votes cast at the Annual Meeting. A majority of votes cast means that the number of shares voted “FOR” a nominee exceeds the number of votes cast “AGAINST” that nominee. Votes to “ABSTAIN” and broker non-votes are not counted as votes cast with respect to that Director and will have no direct effect on the outcome of the election of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE “FOR”

THE ELECTION OF EACH OF VICKIE L. CAPPS, JOHN A. DEFORD, R. SCOTT

HUENNEKENS, AND SIDDHARTHA C. KADIA AS A “CLASS II” DIRECTOR.

1 NuVasive, Inc. | 2021 Proxy Statement | PROPOSAL 1 — ELECTION OF DIRECTORS |

2021

Annual Meeting of Stockholders |

and Nominees for Election | |||

In this section of the Proxy Statement, we discuss the composition of our Board of Directors, the Directors standing for election at the Annual Meeting, and Directors not standing for election at the Annual Meeting and continuing in office.

As we continue to focus on developing innovative and enabling technologies to drive increased adoption of less-invasive surgery and improve clinical, financial and operational outcomes, we rely on our talented and experienced Board to provide leadership, guidance and oversight. Our Board is comprised of individuals with a strong background in executive leadership and management, accounting and finance, and Company and industry knowledge. We believe that the diversity of our Directors’ backgrounds and experiences results in different perspectives, ideas, and viewpoints, which make our Board more effective in carrying out its duties. We believe that our Directors hold themselves to the highest standards of integrity and that they are committed to representing the long-term interests of our stockholders.

INDEPENDENCE 80% INDEPENDENT | AVERAGE TENURE 4.4 YEARS | AVERAGE AGE 58.8 YEARS | DIVERSITY 30% | |||

Eight of the Company’s ten Board members are independent (80%). Our Directors exhibit an effective mix of skills, experience, diversity and perspectives. | ||||||||||||||||||

Healthcare |

Leadership |

Finance |

Innovation |

Global |

Law |

Government |

Hospital | |||||||||||

| Nine have significant healthcare industry experience |

| Eight have leadership experience as public company executives | |||||||||||||||

| Three have accounting and finance experience as prior Chief Financial Officers |

| Four have significant product development and innovation experience | |||||||||||||||

| Eight have significant international business experience |

| Two are lawyers with compliance and risk management experience | |||||||||||||||

| One has prior government leadership experience (Centers for Medicare & Medicaid Services) |

| One has prior hospital system leadership experience (Memorial Hermann) | |||||||||||||||

In March 2021, we announced that Gregory T. Lucier, who has served as a Director since 2013, informed the Company that he will be retiring from the Board effective May 18, 2021. At that time, we anticipate that the size of the Board will be reduced from ten to nine Directors. Following Mr. Lucier’s departure, our Board will be comprised of nine Directors, 89% of whom are independent, and 33% of whom are female or from an underrepresented community. Further, as of May 18, 2021, our average Board tenure will be 4.2 years and average age will be 59.1 years.

2 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

The table below lists the name, age and certain other information of each member of the Board, as of March 29, 2021, the Record Date for our Annual Meeting. We have also included below a summary of the business experience of each of our Directors and their educational background, including a discussion of the qualifications, attributes and skills that led our Board to the conclusion that each of our Directors should serve as a Director of NuVasive. There are no family relationships among any of the Company’s Directors or executive officers.

Board Member

| Age

| Director

| Term

|

Committee Membership(2) | ||||||||

Audit

| Compensation

| Nominating

| ||||||||||

J. Christopher Barry | 48 | I | 2023 | — | — | — | ||||||

Vickie L. Capps+ | 59 | II | 2021 | Chair | — | X | ||||||

John A. DeFord, Ph.D.+ | 59 | II | 2021 | — | — | X | ||||||

Robert F. Friel+ | 65 | III | 2022 | — | X | — | ||||||

R. Scott Huennekens+ | 56 | II | 2021 | X | — | — | ||||||

Siddhartha C. Kadia, Ph.D.+ | 51 | II | 2021 | — | X | — | ||||||

Gregory T. Lucier (3) | 56 | I | 2023 | — | — | — | ||||||

Leslie V. Norwalk, Esq.+ | 55 | I | 2023 | X | — | Chair | ||||||

Donald J. Rosenberg, Esq.+ | 70 | III | 2022 | — | X | X | ||||||

Daniel J. Wolterman+ † | 64 | III | 2022 | — | Chair | — | ||||||

| + | Denotes an independent director. |

| † | Mr. Wolterman currently serves as Lead Independent Director. |

| (1) | Term expires at Annual Meeting of Stockholders in year indicated. |

| (2) | Reflects membership as of the Record Date on each of the Board’s three standing committees: Audit Committee, Compensation Committee and Nominating, Corporate Governance and Compliance Committee. |

| (3) | In March 2021, the Company announced that Mr. Lucier informed the Company that he will be retiring from the Board effective May 18, 2021. |

3 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Directors Standing for Election at the Annual Meeting

Set forth below is information as of March 29, 2021, regarding the four Director nominees for election as Class II Directors at the Annual Meeting: Vickie L. Capps, John A. DeFord, R. Scott Huennekens and Siddhartha C. Kadia.

Vickie L. Capps

| Board member since June 2015

| |||||||||||||

Chair of Audit Committee; Member of Nominating Committee

|

Ms. Capps is currently a Senior Advisory Board Member of Consonance Capital Partners, a healthcare investment firm.

Ms. Capps previously served as chief financial officer of several public and private companies. From 2002 to 2013, Ms. Capps served as the Executive Vice President, Chief Financial Officer and Treasurer at DJO Global, Inc. a leading global provider of medical device solutions for musculoskeletal health, vascular health and pain management, where she was recognized as CFO of the Year by the San Diego Business Journal in 2009 and 2010. Earlier in her career, she served as a senior audit and accounting professional at Ernst & Young LLP.

| |||||||||||||

Ms. Capps’ executive leadership at global companies in the healthcare industry, including her financial expertise as a chief financial officer, provide valuable financial and accounting experience to our Board.

|

Healthcare

|

Leadership

|

Finance

|

Global

| ||||||||||

BUSINESS EXPERIENCE

• Consonance Capital Partners, Senior Advisory Board Member

• DJO Global, Inc., Chief Financial Officer

• Ernst & Young LLP

CURRENT PUBLIC COMPANY BOARDS

• Amedisys, Inc. (Chair of Audit Committee, Member of Compensation Committee, Member of Nominating and Corporate Governance Committee)

• Otonomy, Inc. (Chair of Audit Committee, Member of Corporate Governance and Nominating Committee)

• Silverback Therapeutics, Inc. (Chair of Audit Committee, Member of Nominating and Corporate Governance Committee)

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in business administration/accounting from San Diego State University

• California Certified Public Accountant

ADDITIONAL INFORMATION

• Board of Directors, San Diego State University Research Foundation

• Previously served on Board of Directors of Synthorx, Inc. (2018-2020) and Connecture, Inc. (2014-2018) | |||||||||||||

4 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

John A. DeFord, Ph.D.

|

Board member since February 2018

| |||||||||||||

Member of Nominating Committee

|

Dr. DeFord is currently the Executive Vice President and Chief Technology Officer for Becton, Dickinson and Company (BD), a global medical technology company.

Dr. DeFord previously served as Senior Vice President, Research and Development, Interventional Segment for BD from December 2017 to June 2018 following its acquisition of C.R. Bard, Inc., where he had served as Senior Vice President, Science, Technology and Clinical Affairs since June 2007. Dr. DeFord joined Bard in 2004, and served in science and technology roles of increasing responsibility since that time. Prior to joining Bard, Dr. DeFord was Managing Director of Early Stage Partners LP, a venture capital fund. Prior to joining Early Stage Partners, Dr. DeFord was President and CEO of Cook Incorporated, a privately held medical device manufacturer.

| |||||||||||||

Dr. DeFord brings to our Board valuable strategy, technology development and clinical affairs leadership experience within the medical device industry, having served as an executive at large global healthcare companies.

|

Healthcare

|

Leadership

|

Innovation

|

Global

| ||||||||||

BUSINESS EXPERIENCE

• Becton, Dickinson and Company, Executive Vice President and Chief Technology Officer (prior roles include Senior Vice President, Research and Development)

• C.R. Bard, Inc., Senior Vice President, Science, Technology and Clinical Affairs

CURRENT PUBLIC COMPANY BOARDS

• Nordson Corporation (Member of Audit Committee)

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree and Master’s Degree in electrical engineering from Purdue University

• Ph.D. in electrical/biomedical engineering from Purdue University

ADDITIONAL INFORMATION

• Published in numerous scientific journals and holds numerous patents and multiple industry honors

| |||||||||||||

5 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

R. Scott Huennekens

| Board member since October 2018

| |||||||||||||

Member of Audit Committee

|

Mr. Huennekens most recently served as the President, Chief Executive Officer and Chairman of the Board of Verb Surgical, a start-up company formed by Google and Johnson & Johnson to develop an advanced digital surgery platform, from August 2015 to December 2018.

Prior to joining Verb Surgical, Mr. Huennekens was the President, Chief Executive Officer and a member of the Board of Directors of Volcano Corporation, a medical technology company focused on diagnostic and therapeutic solutions for coronary and peripheral artery disease, from 2002 until Volcano was acquired by Royal Philips in February 2015. Prior to joining Volcano, Mr. Huennekens served as the President and Chief Executive Officer of Digirad Corporation, a diagnostic imaging solutions provider, and previously served as its Chief Financial Officer.

| |||||||||||||

Mr. Huennekens brings to our Board medical device leadership experience and strategic insight, as well as significant knowledge and experience in robotics, data analytics and advanced surgical technologies. Additionally, his experience as a former chief financial officer brings valuable financial expertise to our Board.

|

Healthcare

|

Leadership

|

Innovation

|

Finance

| ||||||||||

BUSINESS EXPERIENCE

• Verb Surgical, President, CEO and Chairman

• Volcano Corporation, President and CEO

CURRENT PUBLIC COMPANY BOARDS

• Acutus Medical, Inc. (Executive Chairman of the Board)

• Envista Holdings Corporation (Chairman of the Board, Member of Audit Committee, Member of Nominating and Governance Committee)

• ViewRay Inc. (Chair of Compensation Committee, Member of Audit Committee)

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in business administration from the University of Southern California

• Master of Business Administration Degree from Harvard Graduate School of Business

ADDITIONAL INFORMATION

• Previously served on Board of Directors of Reva Medical Corp. (2015-2018), Endochoice Holdings, Inc. (2013-2016) and Volcano Corporation (2006-2015)

• Member of the Board of Directors and past Chairman of the Medical Device Manufacturers Association

• Chairman of VIDA FLaSH Acquisitions, a special purpose acquisition company, which filed a Registration Statement on Form S-1 with the SEC on February 22, 2021 relating to a proposed initial public offering

| |||||||||||||

6 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Siddhartha C. Kadia, Ph.D.

| Board member since February 2021

| |||||||||||||

Member of Compensation

|

Dr. Kadia most recently served as President and CEO of EAG Laboratories, a global scientific services company providing analytical testing and consulting solutions, from 2014 through 2018.

Prior to joining EAG Laboratories, Dr. Kadia spent nine years with Life Technologies Corporation and its predecessor Invitrogen Corporation. Dr. Kadia held a number of management positions, including President of the Life Sciences Division, Chief Marketing Officer, President of Life Technologies Greater China and President of Life Technologies Japan Ltd. Prior to joining Life Technologies, Dr. Kadia was a management consultant at McKinsey & Company in the Healthcare Practice, assisting global medical device companies, local and state governments and healthcare providers.

| |||||||||||||

Dr. Kadia brings to our Board medical technology leadership experience, including international leadership experience, as well as significant knowledge and experience commercializing disruptive medical technology.

|

Healthcare

|

Leadership

|

Innovation

|

Global

| ||||||||||

BUSINESS EXPERIENCE

• EAG Laboratories, President and CEO

• Life Technologies, President, Life Sciences Division

• McKinsey & Company, Management Consultant

CURRENT PUBLIC COMPANY BOARDS

• ALS Limited (Member of Sustainability and Innovation Committee, Member of the People Committee)

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in electronics and telecommunications from Gujarat University (India)

• Master’s Degree in biomedical engineering from Rutgers University

• Ph.D. in biomedical engineering from Johns Hopkins University

ADDITIONAL INFORMATION • Previously served on Board of Directors of Horizon Discovery Group plc (2020), Newport Corporation (2014-2016), and Volcano Corporation (2013-2015)

• Director of VIDA FLaSH Acquisitions, a special purpose acquisition company, which filed a Registration Statement on Form S-1 with the SEC on February 22, 2021 relating to a proposed initial public offering

| |||||||||||||

7 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Directors Continuing in Office

Set forth below is information as of March 29, 2021, regarding the six Directors continuing in office and who are not up for election at the Annual Meeting: J. Christopher Barry, Robert F. Friel, Gregory T. Lucier, Leslie V. Norwalk, Esq., Donald J. Rosenberg, Esq., and Daniel J. Wolterman. In March 2021, the Company announced that Mr. Lucier informed the Company that he will be retiring from the Board effective May 18, 2021.

J. Christopher Barry

| Board member since February 2018

| |||||||||||||

Chief Executive Officer

|

Mr. Barry has served as our Chief Executive Officer and a Director since November 2018.

Prior to joining NuVasive, Mr. Barry served as Senior Vice President and President of Surgical Innovations for Medtronic plc, a global medical technology company, from January 2015 to October 2018. Mr. Barry joined Medtronic following its January 2015 acquisition of Covidien plc, a global healthcare technology and medical supplies provider. Mr. Barry previously spent 15 years with Covidien in various sales and leadership roles, most recently as President, Advanced Surgical Technologies, from October 2013 to January 2015.

| |||||||||||||

Mr. Barry’s executive experience in the medical technology industry, including his experience as a strategic operator who has led teams globally, managed complex research and development programs and driven commercial initiatives, provides operational and strategic knowledge in the medical technology industry and valuable leadership experience to our Board.

|

Healthcare

|

Leadership

|

Global

|

| ||||||||||

BUSINESS EXPERIENCE

• NuVasive, Inc., CEO

• Medtronic plc, Senior Vice President and President of Surgical Innovations

• Covidien plc, President, Advanced Surgical Technologies

CURRENT PUBLIC COMPANY BOARDS

• N/A

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in environmental science from Texas Tech University

ADDITIONAL INFORMATION

• N/A

| |||||||||||||

8 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Robert F. Friel

| Board member since February 2016

| |||||||||||||

Member of Compensation Committee

|

Mr. Friel most recently served as the Chairman and Chief Executive Officer of PerkinElmer, Inc., a global leader focused on improving the health and safety of people and the environment, until his retirement in December 2019.

Mr. Friel served as PerkinElmer’s Chief Executive Officer from February 2008 until December 2019 and Chairman from April 2009 until December 2019. From August 2007 to January 2019, Mr. Friel also served as PerkinElmer’s President. Since joining PerkinElmer in February 1999 as Chief Financial Officer, Mr. Friel also held the roles of Chief Operating Officer and Vice Chairman and President of PerkinElmer’s Life and Analytical Sciences unit. Prior to joining PerkinElmer, he held several senior management positions with AlliedSignal, Inc., now Honeywell International.

| |||||||||||||

Mr. Friel’s executive experience with a global human and environmental health company, including experience as a chief financial officer, provide valuable leadership and financial experience to our Board.

|

Healthcare

|

Leadership

|

Finance

|

Global

| ||||||||||

BUSINESS EXPERIENCE

• PerkinElmer, Inc., Chairman and CEO (prior roles include President and CFO)

• AlliedSignal, Inc., Vice President, Treasurer

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in economics from Lafayette College

• Master’s Degree in taxation from Fairleigh Dickinson University

| |||||||||||||

CURRENT PUBLIC COMPANY BOARDS

• West Pharmaceutical Services, Inc. (Member of Audit Committee, Member of Finance Committee)

• Xylem, Inc. (Chairman of the Board, Member of Nominating and Governance Committee)

| ADDITIONAL INFORMATION

• Previously served on Board of Directors of PerkinElmer, Inc. (2006-2019) and CareFusion Corporation (2009-2015)

| |||||||||||||

9 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Gregory T. Lucier

| Board member since December 2013

| |||||||||||||

Chairman of the Board

|

Mr. Lucier serves as our Chairman of the Board. Mr. Lucier is currently Chief Executive Officer of Corza Health, Inc.

Mr. Lucier previously served as Chief Executive Officer of NuVasive from May 2015 to November 2018. Mr. Lucier has served as a member of our Board of Directors since December 2013 and our Chairman of the Board since November 2018. Mr. Lucier has over 25 years of executive management experience and served as Chairman and Chief Executive Officer of Life Technologies Corporation, a global biotechnology company, from May 2003 until its acquisition by Thermo Fisher Scientific Inc. in February 2014. Prior to joining Life Technologies, Mr. Lucier served as Chief Executive Officer and President at GE Medical Systems Information Technologies, Vice President for Global Services at GE Medical Systems and served as a corporate officer of the General Electric Corporation.

| |||||||||||||

Mr. Lucier’s executive experience in the biotechnology industry provides strategic and practical knowledge to our Board related to strategy, finance, regulatory, clinical research and other operational areas in our industry. |

Healthcare |

Leadership |

Global |

| ||||||||||

BUSINESS EXPERIENCE

• Corza Health, Inc., CEO

• NuVasive, Inc., Chairman and CEO

• Life Technologies Corporation, Chairman and CEO

• GE Medical Systems Information Technologies, CEO and President

• General Electric Corporation

CURRENT PUBLIC COMPANY BOARDS

• Berkeley Lights, Inc. (Chair of Compensation Committee, Chair of Nominating and Corporate Governance Committee)

• Catalent, Inc. (Chair of Compensation and Leadership Committee, Member of Mergers and Acquisitions Committee)

• Dentsply Sirona Inc. (Member of Executive Committee, Member of Human Resources Committee)

• Maravai LifeSciences Holdings, Inc.

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree with high distinction in industrial engineering from Pennsylvania State University

• Master of Business Administration Degree from Harvard Graduate School of Business Administration

ADDITIONAL INFORMATION

• Previously served on Board of Directors of Invuity, Inc. (2014-2018), CareFusion Corporation (2009-2015) and Life Technologies Corporation (2003-2014) | |||||||||||||

10 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Leslie V. Norwalk, Esq.

| Board member since May 2014

| |||||||||||||

Chair of Nominating Committee; Member of Audit Committee

|

Ms. Norwalk is currently Strategic Counsel to Epstein Becker & Green, P.C., EBG Advisors and National Health Advisors. She also serves as a healthcare, regulatory and policy advisor to several private equity firms.

Ms. Norwalk previously served the Bush Administration as the Acting Administrator for the Centers for Medicare & Medicaid Services (CMS). She managed the day-to-day operations of Medicare, Medicaid, State Child Health Insurance Programs, Survey and Certification of health care facilities and other federal health care initiatives. For four years prior to that, she was the agency’s Deputy Administrator, responsible for the implementation of the hundreds of changes made under the Medicare Modernization Act, including the Medicare Prescription Drug Benefit. Prior to serving the Bush Administration, she practiced law in the Washington, D.C. office of Epstein Becker & Green, P.C. where she advised clients on a variety of health policy matters. She also served in the first Bush administration in the White House Office of Presidential Personnel, and the Office of the U.S. Trade Representative. Ms. Norwalk currently sits on the boards of directors of several private companies, and she is a member of APCO Worldwide’s International Advisory Council.

| |||||||||||||

Ms. Norwalk’s deep knowledge of, and experience with, the healthcare industry and government regulations provides valuable guidance and insight to our Board. Additionally, with her legal background, she brings important compliance and risk management experience to the Board.

|

Healthcare

|

Law

|

Government

|

| ||||||||||

BUSINESS EXPERIENCE

• Epstein Becker & Green, P.C., EBG Advisors and National Health Advisors, Special Counsel

• Centers for Medicare and Medicaid Services, Acting Administrator

CURRENT PUBLIC COMPANY BOARDS

• Arvinas, Inc. (Member of Audit Committee)

• Magellan Health, Inc. (Chair of Compliance Committee, Member of Management Compensation Committee)

• Neurocrine Biosciences, Inc. (Chair of Nominating / Corporate Governance Committee)

• ModivCare Inc. (Chair of Nominating and Governance Committee, Member of Audit Committee)

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree, cum laude, in economics and international relations from Wellesley College

• Juris Doctor Degree from the George Mason University School of Law

ADDITIONAL INFORMATION

• Previously served on Board of Directors of Press Ganey Associates, Inc. (2012-2016), Volcano Corporation (2011-2015) and Endologix, Inc. (2015-2020) | |||||||||||||

11 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Donald J. Rosenberg, Esq.

| Board member since February 2016

| |||||||||||||

Member of |

Mr. Rosenberg is currently the Executive Vice President, General Counsel and Corporate Secretary of QUALCOMM Incorporated, a global leader in the development and commercialization of wireless technologies.

Prior to joining QUALCOMM in October 2007, Mr. Rosenberg served as Senior Vice President, General Counsel and Corporate Secretary of Apple Inc. from November 2006 to October 2007. From May 1975 to November 2006, Mr. Rosenberg held numerous positions at IBM Corporation, including Senior Vice President and General Counsel.

Mr. Rosenberg is a member of the Council on Foreign Relations, the International Advisory Board, University of California San Diego (UCSD) School of Global Policy and Strategy, and the China Leadership Board for the 21st Century China Center at UCSD. He has served as an adjunct professor of law at New York’s Pace University School of Law, where he taught courses in intellectual property and antitrust law.

| |||||||||||||

Mr. Rosenberg brings to our Board significant experience in legal and compliance matters. Additionally, as an executive with a large global technology company, he brings global leadership experience to our Board. |

Leadership

|

Law

|

Global

|

| ||||||||||

BUSINESS EXPERIENCE

• QUALCOMM Incorporated, Executive Vice President, General Counsel and Corporate Secretary

• Apple Inc., Senior Vice President, General Counsel and Corporate Secretary

• IBM Corporation, Senior Vice President and General Counsel

CURRENT PUBLIC COMPANY BOARDS

• N/A |

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in mathematics from the State University of New York at Stony Brook

• Juris Doctor Degree from St. John’s University School of Law

ADDITIONAL INFORMATION

• Board member of the Lawyers’ Committee for Civil Rights Under Law (previously National Co-Chairman)

| |||||||||||||

12 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

Daniel J. Wolterman

| Board member since July 2015

| |||||||||||||

Lead Independent

|

Mr. Wolterman is currently Chief Executive Officer of Wolterman Consulting LLC, a provider of strategic and operational consulting services to healthcare providers and other entities.

From January 2018 to May 2019, Mr. Wolterman served as Chief Executive Officer of ColubrisMX, Inc. and X-Cath, Inc., both privately held medical device companies. Mr. Wolterman previously served as President and Chief Executive Officer of Memorial Hermann Health System, the largest not-for-profit health system in Southeast Texas, from 2002 until his retirement from Memorial Hermann in May 2016. He has more than 38 years of experience in the healthcare industry and a long history of community involvement.

| |||||||||||||

Mr. Wolterman’s extensive knowledge of the healthcare industry and his leadership of a large health system provide valuable perspective and guidance to our Board. Additionally, as a leader of and consultant for medical device companies, he brings product and technology experience to the Board.

|

Healthcare

|

Innovation

|

Hospital

|

| ||||||||||

BUSINESS EXPERIENCE

• Wolterman Consulting, LLC, CEO

• ColubrisMX, Inc., CEO

• X-Cath, Inc., CEO

• Memorial Hermann Health System, President

CURRENT PUBLIC COMPANY BOARDS

• N/A

|

EDUCATIONAL/PROFESSIONAL BACKGROUND

• Bachelor’s Degree in business administration and a Master of Business Administration Degree in finance from the University of Cincinnati

• Master’s Degree in healthcare administration from Xavier University

ADDITIONAL INFORMATION • Previously served on Board of Directors of Invuity, Inc. (2017-2018) and Volcano Corporation (2013-2015)

| |||||||||||||

13 NuVasive, Inc. | 2021 Proxy Statement | BOARD MEMBERS AND NOMINEES FOR ELECTION |

2021

Annual Meeting of Stockholders | Identification, Selection and Evaluation | |||

In this section of the Proxy Statement, we discuss how Director nominees are identified and considered for election to our Board, as well as our process for evaluating Board effectiveness.

Identification and Evaluation of Director Nominees

One of the Nominating Committee’s key responsibilities is the identification and evaluation of Director nominees. The Nominating Committee believes that the Company is well served by its current Directors, but also believes that Board refreshment is important as our business grows and evolves over time, and that fresh viewpoints and perspectives are regularly considered. Since 2018, the Nominating Committee has helped identify and recruit four new Directors to join our Board to replace three Directors who have retired or left our Board.

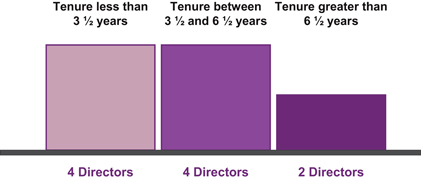

Our Board has demonstrated a commitment to Board refreshment.

Since 2018, four new Directors have joined our Board, and our average Board tenure now stands at 4.4 years.

| ||||||||

| ||||||||

In the ordinary course, absent special circumstances, the Nominating Committee will generally re-nominate incumbent Directors who continue to be qualified for Board service and are willing to continue as Directors. From time to time, the Nominating Committee may also consider and evaluate potential new Director candidates who meet the criteria for selection as a Board nominee and have specific qualities or skills identified by the Board, and one or more of such candidates may be appointed as Directors as appropriate and in accordance with the Company’s organizational documents.

Director candidates will be selected based on input from members of the Board, senior management of the Company and, if the Nominating Committee deems appropriate, a third-party search firm. The Nominating Committee will evaluate each candidate’s qualifications and check relevant references. In addition, candidates will be interviewed by members of the Nominating Committee. Candidates meriting serious consideration will also meet other members of the Board. Based on this input, the Nominating Committee will evaluate whether a prospective candidate is qualified to serve as a Director and whether the Nominating Committee should recommend to the Board whether such candidate should be appointed to fill a vacancy on the Board, or presented for approval of the stockholders, as appropriate.

14 NuVasive, Inc. | 2021 Proxy Statement | DIRECTOR IDENTIFICATION, SELECTION AND EVALUATION |

Consideration of Director Experience, Skills and Diversity

In identifying and evaluating Director candidates for appointment or re-election to the Board, the Nominating Committee considers the appropriate balance of experience, skills and characteristics required of the Board, seeks to ensure that at least a majority of the Directors are independent under the rules of the Nasdaq Stock Market (“Nasdaq”), and that members of the Audit Committee meet the financial literacy and sophistication requirements under Nasdaq rules (including that at least one member qualifies as an “audit committee financial expert” under the rules of the Securities and Exchange Commission (“SEC”)). Nominees for Director are selected based on their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business environment, and willingness to devote adequate time to Board duties. Additionally, the Nominating Committee will consider diversity in personal and professional backgrounds and seeks diverse individuals, such as women and individuals from minority groups, to include in the pool of candidates for Board nomination; however, there is no formal policy with respect to diversity considerations in identifying Director nominees. In assessing Director candidates, the Nominating Committee will also consider the retirement age policy under our Corporate Governance Guidelines. The Company’s retirement age policy provides that a Director may not stand for re-election after age 72, but need not resign until the end of his or her term.

As a publicly held company with a principal executive office in California, the Company is subject to the requirements of California Senate Bill 826, which was signed into law in September 2018 (“SB 826”), and California Assembly Bill 979, which was signed into law in September 2020 (“AB 979”). Under SB 826, which addresses Board gender diversity, the Company is required to have a minimum of one female Director by December 31, 2019 and at least three female Directors by December 31, 2021. Under AB 979, which address Board racial diversity, the Company is required to have a minimum of one Director from an “underrepresented community” by December 31, 2021 and at least three Directors from an “underrepresented community” by December 31, 2022. While the Company was in compliance with SB 826 as of December 31, 2020, the Company will need to increase female representation on the Board prior to December 31, 2021 to meet the requirements of SB 826. The Board currently has one Director from an “underrepresented community.”

Since 2018, we have brought additional skills and experience to the Board with the addition of four new Directors: Mr. Barry, Dr. DeFord, Mr. Huennekens, and Dr. Kadia. As a result of our retirement age policy, two of our Directors did not stand for re-election at our 2018 Annual Meeting and retired as Directors immediately following the 2018 Annual Meeting. In anticipation of their retirement, the Board engaged a director search firm to identify potential new Director candidates. The Nominating Committee oversaw the Director search process, which led to the recruitment of Dr. DeFord and Mr. Huennekens. Upon the recommendation of the Nominating Committee, the Board approved the election of Dr. DeFord and Mr. Huennekens (elected in February 2018 and October 2018, respectively), each to serve as a Class II Director until the 2021 Annual Meeting. In August 2019, one of our Directors resigned from the Board for personal reasons. The Board subsequently undertook an assessment of our Board composition and commenced a new Director recruitment process. The Nominating Committee identified potential Director candidates, and in February 2021, Dr. Kadia was elected to the Board to serve as a Class II Director until the 2021 Annual Meeting.

The Nominating Committee and the Board believe that each of Ms. Capps, Dr. DeFord, Mr. Huennekens, and Dr. Kadia brings a strong and unique set of qualifications, attributes and skills and provides the Board as a whole with a balance of experience, leadership and competencies in areas of importance to our Company. In the section of this Proxy Statement captioned “Board Members and Nominees for Election”, we provide an overview of each Director nominee’s principal occupation, business experience and other directorships, together with other key attributes that we believe provide value to the Board, the Company and its stockholders.

Under our Corporate Governance Guidelines and Nasdaq rules, our Board is required to be comprised of a majority of independent Directors. The Nominating Committee evaluates our Directors’ compliance with Nasdaq rules regarding independence, as well as other factors, in making a recommendation to the Board as to whether Directors can be considered independent. Under applicable SEC and Nasdaq rules, the existence of certain “related party” transactions between a Director and the Company with dollar amounts

15 NuVasive, Inc. | 2021 Proxy Statement | DIRECTOR IDENTIFICATION, SELECTION AND EVALUATION |

above certain thresholds are required to be disclosed and preclude a finding by the Board that the Director is independent. In addition to transactions required to be disclosed under SEC and Nasdaq rules, the Board considered certain other relationships in making its independence determinations, and determined, in each case, that such other relationships did not impair the Director’s ability to exercise independent judgment on behalf of the Company. Based on the recommendation of the Nominating Committee, the Board determined that the following eight Directors are independent under the Nasdaq rules and our Corporate Governance Guidelines: Vickie L. Capps, John A. DeFord, Robert F. Friel, R. Scott Huennekens, Siddhartha C. Kadia, Leslie V. Norwalk, Donald J. Rosenberg, and Daniel J. Wolterman. Gregory T. Lucier, who served as our Chief Executive Officer through November 4, 2018, and who provided consulting services to the Company during 2020, and J. Christopher Barry, our current Chief Executive Officer, are not considered independent.

Stockholder Recommendations for Director Nominees

In nominating candidates for election as a Director, the Nominating Committee will consider written proposals from stockholders for Director nominees. Any such nominations should be submitted to the Nominating Committee, care of the Secretary of the Company, and should include the following information: (a) all information relating to such nominee that is required to be disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the Proxy Statement as a nominee and to serving as a Director if elected), and (b) all information required by the Company’s Restated Bylaws, as amended (the “Bylaws”) (including the names and addresses of the stockholders making the nomination and the appropriate biographical information and a statement as to the qualification of the nominee). For more information, see the discussion under the caption “Other Information.”

The Company has never received a proposal from a stockholder to nominate a Director. Although the Nominating Committee has not adopted a formal policy with respect to stockholder nominees, the Nominating Committee expects that the evaluation process for a stockholder nominee would be similar to the process outlined above.

Consideration of Director Board Service and “Over-Boarding”

As discussed above, in identifying and evaluating Director candidates for appointment or re-election to the Board, the Nominating Committee takes into consideration a candidate’s willingness to devote adequate time to Board duties. As part of the Board’s evaluation and assessment process, the Board considers individual Director performance, including attendance, participation and engagement at Board meetings. This is particularly important when considering Director candidates that serve on multiple boards of directors. As of the Record Date for the Annual Meeting, none of the Company’s Directors serve on more than five public company boards (including the NuVasive Board). Each of Ms. Norwalk and Mr. Lucier serve on five public company boards (including the NuVasive Board), as discussed further below.

At our 2020 annual meeting of stockholders, Ms. Norwalk was re-elected to the Board with 56% of the votes cast. Based on the Company’s investor outreach efforts, we believe that a number of stockholders did not vote in favor of Ms. Norwalk’s re-election to the Board due to concerns regarding “over-boarding.” At the time of Ms. Norwalk’s re-election to the Board, she was serving on five public company boards (including the NuVasive Board). Ms. Norwalk currently serves on five public company boards (including the NuVasive Board), but intends to step down from the board of Magellan Health upon the completion of the closing of the acquisition of Magellan Health by Centene, which was announced in January 2021.

When Mr. Lucier was re-elected to the Board at our 2020 annual meeting of stockholders, he was serving on three public company boards (including the NuVasive Board). Mr. Lucier also serves on boards of private companies, and since the 2020 annual meeting of stockholders, two such companies completed initial public offerings and are now public companies. As a result, Mr. Lucier currently serves on five public company boards (including the NuVasive Board). In March 2021, we announced that Mr. Lucier informed the Company that he will be retiring from the Board effective May 18, 2021.

Certain proxy advisory firms have adopted over-boarding policies, where they will recommend a vote against directors who serve on what the proxy advisory firm believes to be too many boards. Further, certain institutional investors will vote against directors if they believe they are over-boarded. These policies are generally intended to address concerns that directors on multiple boards may lack sufficient time to

16 NuVasive, Inc. | 2021 Proxy Statement | DIRECTOR IDENTIFICATION, SELECTION AND EVALUATION |

perform their board duties effectively. The Board acknowledges these concerns, but believes additional factors should be considered in determining whether a director on multiple boards should continue to serve on the Company’s Board. Among other things, the Board believes that consideration should be given to the skills and abilities that a Director brings to the Board, how a Director contributes to Board diversity and the overall mix of perspectives and backgrounds on the Board, and whether the Director dedicates the appropriate time, attention and energy to his or her Director duties. The Board discusses these considerations generally in connection with its evaluation and assessment process, and given the 2020 annual meeting voting results, specifically discussed these considerations for Ms. Norwalk. In the case of Ms. Norwalk, the Board noted that in the last three years, she has attended every Board meeting, as well as every meeting of each Committee on which she serves, and that she is well prepared for and fully participates in meetings. Further, Ms. Norwalk dedicates significant time outside of meetings to engage with, and provide advice and counsel to, members of management. The Board also noted that Ms. Norwalk, who served as the Acting Administrator for the Centers for Medicare & Medicaid Services (CMS) during the Bush Administration, and with her overall knowledge and expertise in the area of healthcare and government regulations, brings a unique and highly relevant and valuable skill set to the Board. In addition, Ms. Norwalk contributes to overall diversity of views and perspectives in the Boardroom, as well as gender diversity, which the Board believes is important.

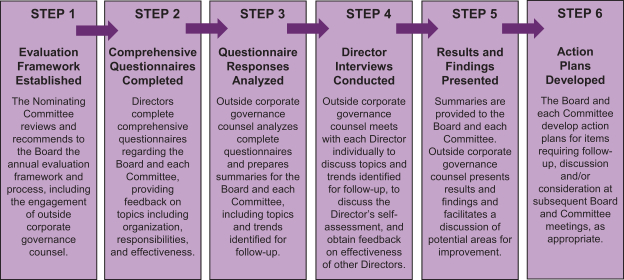

Evaluation of Board Effectiveness

On an annual basis, the Nominating Committee oversees a comprehensive Board evaluation and assessment process. The Board believes that an annual evaluation process is an important component of strong corporate governance practices and promoting ongoing Board effectiveness. Each year, the Board conducts a comprehensive evaluation and assessment process to review Board, Committee and Director effectiveness. The Board and each of its Committees performs a self-assessment to evaluate their effectiveness in fulfilling their obligations. As part of the process, outside corporate governance counsel conducts individual Director interviews to discuss Board and Committee effectiveness, as well as individual Director effectiveness. The Board, Committee and individual Director evaluations cover a wide range of topics, including, among others, the fulfillment of the Board and Committee responsibilities identified in the Corporate Governance Guidelines and charters for each Committee.

Our Board has implemented a comprehensive annual process to review Board, Committee and Director effectiveness.

|

The Board believes that the overall annual evaluation process works well and that using outside corporate governance counsel to conduct the individual Director interviews and to present the results and findings to the Board and the Committees leads to candid feedback and discussion. When feedback warrants follow-up with individual Directors, the Chair of the Nominating Committee will work directly with each Director, as appropriate. As a result of the Board evaluation process, the Company will often update its

17 NuVasive, Inc. | 2021 Proxy Statement | DIRECTOR IDENTIFICATION, SELECTION AND EVALUATION |

Board topical calendar and meeting planner for the ensuing year to incorporate feedback from the Board. For example, the Company modified the frequency and time allocation for certain meeting topics and dedicated more time for hands-on demonstrations and discussions of Company products and technology. Further, the process can help elevate discussion topics to action items, including matters related to Board composition, Board diversity, and Board succession planning.

18 NuVasive, Inc. | 2021 Proxy Statement | DIRECTOR IDENTIFICATION, SELECTION AND EVALUATION |

2021

Annual Meeting of Stockholders |

and Corporate Responsibility | |||

In this section of the Proxy Statement, we discuss our approach to Board governance and corporate responsibility and sustainability. We also discuss how our Board and Company have taken steps to respond to COVID-19.

Our Board has adopted a number of governance best practices.

| ||||||||

| Our Board structure provides for a Lead Independent Director |

| Our Chief Executive Officer does not serve as our Board Chair |

| ||||

| Our independent Directors meet frequently in executive session |

| Our Board service is limited by our retirement age policy (Directors may not stand for election after age 72) | |||||

| We have a comprehensive annual Board evaluation process |

| We have majority voting for uncontested Director elections | |||||

We are committed to maintaining the highest standards of corporate governance. As discussed below under “Board Leadership and Organization Structure,” our Board has established three standing committees to assist in fulfilling its responsibilities to the Company and its stockholders: the Audit Committee, the Compensation Committee and the Nominating, Corporate Governance and Compliance Committee (the “Nominating Committee”). In 2017, as part of our continuing efforts to implement good governance practices, we expanded the responsibility of our Nominating and Corporate Governance Committee and renamed it the Nominating, Corporate Governance and Compliance Committee). The Nominating Committee’s charter was revised to reflect that, in addition to its existing responsibilities related to Director nominations, Board structure and composition, and corporate governance matters, the Nominating Committee assumed oversight responsibilities for quality and regulatory matters, ethics and compliance matters, and other related matters. Under this revised structure, the Audit Committee has retained oversight responsibilities for financial reporting, accounting, internal accounting controls, auditing and related matters. In February 2019, we further revised the Nominating Committee’s charter to reflect that it would also assume responsibility for periodically reviewing and revising our Code of Conduct, as well as addressing violations thereof.

Corporate Governance Guidelines

Our Corporate Governance Guidelines are designed to address effective corporate governance of our Company. Our Corporate Governance Guidelines cover topics including, but not limited to, Director independence and qualification criteria, Director responsibilities, Director compensation, Board evaluation, Committee matters, succession planning and stock ownership guidelines for Directors and management. Our Corporate Governance Guidelines are reviewed regularly by the Nominating Committee and revised when appropriate.

In 2019 and 2020, we revised our Corporate Governance Guidelines to clarify the role of the Lead Independent Director, and to update language regarding Director independence and executive sessions of independent Directors. We also made other changes to clarify the process for the Chief Executive Officer performance review and compensation determinations, including the role of the Compensation Committee and the independent compensation consultant. Overall, we believe these changes help further advance corporate governance and improve the overall organization and readability of the Corporate Guidelines.

19 NuVasive, Inc. | 2021 Proxy Statement | BOARD GOVERNANCE AND CORPORATE RESPONSIBILITY |

We have adopted a Code of Conduct, which includes our code of ethics for our senior financial officers. The Code of Conduct applies to all of our officers, employees and Directors and establishes policies pertaining to, among other things, employee conduct in the workplace, workplace safety, confidentiality, conflicts of interest, accuracy of books, records and financial statements, securities trading, anti-corruption, competition laws, interactions with health care professionals and political and charitable activities. In February 2021, we revised the Code of Conduct to, among other things, reflect our commitment to diversity and inclusion and discuss our belief in responsible economic, social and environmental practices.

The Nominating Committee and the Audit Committee share oversight responsibilities related to the Code of Conduct. The Nominating Committee is responsible for oversight of compliance programs related to ethics and compliance and related matters, including the Company’s policies, procedures and practices designed to ensure compliance with applicable laws and regulations related to federal healthcare program requirements; the Fraud and Abuse Laws and other medical device laws; the Foreign Corrupt Practices Act; the Anti-Kickback Statute and other anti-bribery and anti-corruption laws. The Audit Committee is responsible for oversight of compliance matters relating to financial reporting, accounting, internal accounting controls, auditing and related matters.

The Audit Committee reviews and approves all waivers of the Code of Conduct for executive officers or Directors and provides for prompt disclosure of all waivers required to be disclosed under applicable law. We will disclose future amendments to the Code of Conduct, or waivers required to be disclosed under applicable law from the Code of Conduct for our principal executive officer, principal financial officer, principal accounting officer or controller, and our other executive officers and our Directors, on our website, www.nuvasive.com, within four business days following the date of the amendment or waiver.

In addition, we maintain an Integrity Hotline by which employees and third parties may report violations of the Code of Conduct or seek guidance on business conduct matters. The Integrity Hotline is a third-party hosted service and has multi-lingual representatives available to take calls 24 hours a day, seven days a week.

Information about corporate governance at NuVasive, including our key

| ||||||||

| Corporate Governance Guidelines |

| Charters of the Board Committees | |||||

| Code of Conduct

|

| Charter of the Lead Independent Director

|

| ||||

Printed copies may be obtained upon request to our Investor Relations Department. Any stockholder may request copies of these materials in print, without charge, by contacting our Investor Relations Department at investorrelations@nuvasive.com.

| ||||||||

Corporate Responsibility and Sustainability

We recognize the growing interest of our investors, employees, patients, surgeons and hospital customers in corporate responsibility and sustainability, including environmental, social and governance (“ESG”) matters. Our focus as a Company is developing innovative and enabling technologies to drive increased adoption of less-invasive surgery and improve clinical, financial and operational outcomes. Our guiding purpose is to transform surgery, advance care and change lives, and enabling safer, more reproducible surgical procedures is at the heart of what we do. When patients undergo less-invasive spine surgery, they typically experience less blood loss and trauma than traditional, open spine surgery procedures, with less time under anesthesia, which generally results in faster patient recovery times and better results. This is good for the patient, but also good for the hospital and the overall healthcare system. Less-invasive surgery often requires greater use of x-rays and other imaging technologies, which can expose the patient, surgeon and operating room staff to radiation. We take the health and safety of our patients, surgeons and hospital staff seriously, and our Lessray® technology platform is designed to address radiation exposure in the operating room. Lessray is an image enhancement platform designed to reduce radiation exposure by allowing surgeons to take low-quality, low-dose images and improve them to look like

20 NuVasive, Inc. | 2021 Proxy Statement | BOARD GOVERNANCE AND CORPORATE RESPONSIBILITY |

conventional full-dose images. Further, Lessray and our other enabling technologies are designed to improve operating room workflow, which in turn can reduce the cost of care. We believe that this focus, which benefits patients, surgeons and hospitals, will also benefit our investors as we continue to grow our business and create long-term stockholder value.

We also recognize the value associated with building our human capital and believe that success comes from investing in our people. We have expanded our efforts to advance diversity, inclusion and engagement, while providing professional development opportunities for our employees. As we seek to create a more diverse and inclusive workforce, we have begun to monitor voluntarily disclosed diversity data to review hiring, promotion and attrition overall at the Company and at the department level. With dedicated resources focused on our diversity and inclusion vision, strategy and priorities, and through our Women in Spine employee resource group, we are working to reinforce and build upon our culture of inclusion. Additionally, we have committed resources and personnel to ensure a healthy and safe environment for our employees and our communities. Our key objectives in this area include corporate compliance with responsible hazardous waste management, recycling, emergency preparedness, as well as various initiatives to improve our environmental health and safety programs. In 2020, this became a significant area of focus, as we worked to ensure the safety and wellbeing of employees during the COVID-19 pandemic. We are also giving back to our community. Our employees and sales representatives have a long history of supporting the communities where we have facilities, donating time, resources and funds to local causes. Since 2009, we have leveraged our expertise in spine care to give back to local and global communities through the NuVasive Spine Foundation™ (“NSF”). NSF supports life-changing spine surgery for individuals around the world with limited access to high quality medical treatment by working with surgeons to advance the quality of spine care in disadvantaged communities. In addition, through our grants program, we support medical research and education, charitable and philanthropic endeavors. We believe in giving back, and we also believe it is important to operate our Company in a socially responsible manner.

To ensure guidance and support of NuVasive’s corporate responsibility and sustainability initiatives, we created an ESG Steering Committee. The ESG Steering Committee is comprised of a cross-functional team of senior leaders and is intended to support NuVasive’s on-going commitment to corporate responsibility and sustainability, including ESG matters. The ESG Steering Committee is responsible for formalizing the Company’s policies and disclosures and making recommendations for evolving the Company’s ESG practices, while working with existing programs and activities to support and advance overall corporate responsibility and sustainability at NuVasive. We recognize that a range of frameworks and standards exist for measuring, managing, and reporting sustainability information, including the standards set forth by the Sustainability Accounting Standards Board (SASB). We are in the process of developing a general understanding of the various sustainability frameworks and standards, and we are reviewing peer disclosures to better understand information needs and expectations. While we have more work to do in this area before we will be ready to publish a sustainability report, we are committed to advancing corporate responsibility and sustainability at NuVasive.

During 2020, we faced a number of challenges resulting from the COVID-19 pandemic. As the pandemic unfolded, we created a COVID-19 task force to monitor developments and make recommendations for policies and actions. Our Board participated in regular calls to monitor and provide oversight related to our COVID-19 risk and to assist in navigating the Company through the pandemic. Throughout the pandemic, the safety and wellbeing of our employees has been our priority. We recognize the important role that our employees play in the support of our patients, surgeons and hospital customers, and we invested in the safety of our people by implementing rigorous COVID-19 health and safety protocols, distributing personal protective equipment to ensure those working in clinical and operational settings were protected, deploying health and wellness training, and offering remote work options where possible.

While the pandemic led to lower surgery volumes and deferred elective spine surgery procedures during 2020, many spine surgeries are not elective. Patients that suffer from debilitating back pain or who require emergent surgery due to trauma or other factors often cannot defer or delay surgery. As spine surgeries continued during the pandemic, we often faced challenges in supporting surgeries, but our committed employees worked with our surgeon and hospital customers to comply with new and changing hospital protocols to allow spine surgeries to proceed. We were also forced to change the way we interact

21 NuVasive, Inc. | 2021 Proxy Statement | BOARD GOVERNANCE AND CORPORATE RESPONSIBILITY |

with surgeons. With in-person surgeon education and training impacted by COVID-19, our Clinical Professional Development team developed virtual labs and created a Virtual Spine Conference series to enhance remote surgeon education and provide clinical insights.