QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

|

United Online, Inc.

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

NOVEMBER 12, 2002

TO OUR STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the annual meeting of stockholders of United Online, Inc. will be held on Tuesday, November 12, 2002, at 10:00 a.m. Pacific time at the Park Hyatt Hotel, 2151 Avenue of the Stars, Los Angeles, California 90067, for the following purposes:

- •

- to elect two directors to serve on our Board of Directors for a three-year term ending in the year 2005 or until their successors are duly elected and qualified;

- •

- to ratify the appointment of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending June 30, 2003; and

- •

- to transact such other business as may properly come before the meeting or any adjournment or adjournments thereof.

Please refer to the attached proxy statement, which forms a part of this notice and is incorporated herein by reference, for further information with respect to the business to be transacted at the annual meeting.

Only stockholders of record at the close of business on September 27, 2002, the record date, are entitled to notice of and to vote at the annual meeting. Our stock transfer books will remain open between the record date and the date of the meeting. A list of stockholders entitled to vote at the annual meeting will be available for inspection at the meeting and at our executive offices located at 2555 Townsgate Road, Westlake Village, California 91361.

All stockholders are cordially invited to attend the meeting in person. Whether or not you plan to attend, please sign and return the enclosed proxy as promptly as possible in the enclosed envelope. Should you receive more than one proxy because your shares are registered in different names and addresses, each proxy should be signed and returned to assure that all your shares will be voted. You may revoke your proxy at any time prior to the close of voting at the annual meeting. If you attend the annual meeting and vote by ballot, your proxy will be revoked automatically and only your vote at the annual meeting will be counted.

| | | Sincerely, |

|

|

|

| | | Mark R. Goldston

Chairman, Chief Executive Officer

and President |

Westlake Village, California

October 11, 2002

United Online, Inc.

2555 Townsgate Road

Westlake Village, California 91361

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON NOVEMBER 12, 2002

General

This proxy statement is furnished to our stockholders in connection with the solicitation of proxies by our Board of Directors for use at our annual meeting of stockholders to be held on Tuesday, November 12, 2002, at 10:00 a.m. Pacific time at the Park Hyatt Hotel, 2151 Avenue of the Stars, Los Angeles, California 90067, for the purposes of:

- •

- electing two directors to serve on our Board of Directors for a three-year term ending in the year 2005 or until their successors are duly elected and qualified;

- •

- ratifying the appointment of PricewaterhouseCoopers LLP as our independent accountants for the fiscal year ending June 30, 2003; and

- •

- transacting such other business as may properly come before the meeting or any adjournment or adjournments thereof.

These proxy solicitation materials were mailed on or about October 17, 2002 to all stockholders entitled to vote at the annual meeting.

Voting; Quorum

Our outstanding common stock constitutes the only class of securities entitled to vote at the annual meeting. Common stockholders of record at the close of business on September 27, 2002, the record date for the annual meeting, are entitled to notice of and to vote at the meeting. On the record date, 40,580,679 shares of our common stock were issued and outstanding. Each share of common stock is entitled to one vote. The presence at the meeting, in person or by proxy, of a majority of the shares of the common stock issued and outstanding on September 27, 2002 will constitute a quorum.

All votes will be tabulated by the inspector of elections appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted as present for purposes of determining whether or not there is a quorum for the transaction of business. Abstentions will be counted towards the tabulations of votes cast on proposals presented to the stockholders and will have the same effect as negative votes, whereas broker non-votes will not be counted for purposes of determining whether a proposal has been approved. In the election of directors, the nominees receiving the highest number of affirmative votes shall be elected; broker non-votes and votes marked "withheld" will not affect the outcome of the election. Ratification of the appointment of PricewaterhouseCoopers LLP requires the affirmative vote of a majority of the outstanding shares of common stock represented at the annual meeting and entitled to vote.

Voting Procedure

Stockholders of record may vote by completing and returning the enclosed proxy card prior to the annual meeting, voting in person at the annual meeting or submitting a signed proxy card at the annual meeting. If the enclosed form of proxy is properly signed, dated and returned, the shares represented thereby will be voted at the annual meeting in accordance with the instructions specified thereon.

Unless there are different instructions on the proxy, all shares represented by valid proxies (and not revoked before they are voted) will be voted at the annual meeting FOR the election of the director nominees listed in proposal 1 (unless the authority to vote for the election of such directors is withheld) and FOR the ratification of the appointment of PricewaterhouseCoopers LLP as our independent accountants as described in proposal 2.

YOUR VOTE IS IMPORTANT. PLEASE SIGN AND RETURN THE ACCOMPANYING PROXY CARD WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON.

You may revoke your proxy at any time before it is actually voted at the meeting by:

- •

- delivering written notice of revocation to our corporate Secretary at 2555 Townsgate Road, Westlake Village, California 91361;

- •

- submitting a later dated proxy; or

- •

- attending the meeting and voting in person.

Your attendance at the meeting will not, by itself, constitute a revocation of your proxy. You may also be represented by another person present at the meeting by executing a form of proxy designating that person to act on your behalf.

Shares may only be voted by or on behalf of the record holder of shares as indicated in our stock transfer records. If you are a beneficial stockholder but your shares are held of record by another person such as a stock brokerage firm or bank, that person as the record holder is entitled to vote the shares. Accordingly, a beneficial holder must provide voting instructions to the appropriate record holder.

Solicitation

This solicitation is made on behalf of our Board of Directors, and we will pay the costs of solicitation. Copies of solicitation materials will be furnished to brokerage houses, fiduciaries and custodians holding shares in their names that are beneficially owned by others so that they may forward this solicitation material to such beneficial owners. We will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for reasonable expenses incurred by them in sending proxy materials to our stockholders. In addition to the solicitation of proxies by mail, our directors, officers and employees may solicit proxies by telephone, fax or personal interview. No additional compensation will be paid to these individuals for any such services. Except as described above, we do not presently intend to solicit proxies other than by mail.

Stockholder Proposals for 2003 Annual Meeting

Stockholder proposals that are intended to be presented at our 2003 annual meeting and included in our proxy materials relating to the 2003 annual meeting must be received by us no later than June 19, 2003, which is 120 calendar days prior to the anniversary of the mailing date for this year's proxy materials. All stockholder proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for the 2003 annual meeting.

If a stockholder wishes to present a proposal at our 2003 annual meeting and the proposal is not intended to be included in our proxy statement relating to the 2003 annual meeting, the stockholder must give advance notice to us prior to the deadline for the annual meeting determined in accordance with our amended and restated bylaws (the "Bylaw Deadline"). Under our bylaws, in order to be deemed properly presented, the notice of a proposal must be delivered to our Secretary no less than 90 days and no more than 120 days prior to the anniversary of the date for this year's annual meeting.

2

However, if we determine to change the date of the 2003 annual meeting so that it occurs more than 30 days prior to, or more than 30 days after, November 12, 2003, stockholder proposals intended for presentation at the 2003 annual meeting must be received by our Secretary no later than the close of business on the tenth day following the day on which such notice of the date of the 2003 annual meeting is mailed or public disclosure of the date of the annual meeting was made, whichever first occurs. If a stockholder gives notice of such proposal after the Bylaw Deadline, the stockholder will not be permitted to present the proposal to the stockholders for a vote at the meeting. All stockholder proposals must be in the form required by our bylaws.

The Rules of the Securities and Exchange Commission also establish a different deadline for submission of stockholder proposals which are not intended to be included in our proxy statement but as to which the holders of proxies solicited by our Board of Directors will not have discretionary voting power (the "Discretionary Vote Deadline"). The Discretionary Vote Deadline for the year 2003 annual meeting is September 2, 2003, which is 45 calendar days prior to the anniversary date of the mailing of this proxy statement. If a stockholder gives notice of such proposal after the Discretionary Vote Deadline, next year's proxy holders will be allowed to use their discretionary voting authority to vote the shares they represent as our Board of Directors may recommend, which may include a vote against a stockholder proposal, when and if the proposal is raised at the 2003 annual meeting.

We have not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this year's annual meeting. The enclosed proxy grants the proxy holders discretionary authority to vote on any matter properly brought before the annual meeting.

3

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL ONE: ELECTION OF DIRECTORS

Our Board of Directors is divided into three classes with staggered three-year terms. The class whose term expires at this annual meeting contains two directors, James T. Armstrong and Dennis Holt, who are both nominated for re-election. Each of the directors elected at this annual meeting will hold office for a three-year term, expiring at the 2005 annual meeting or until his successor is duly elected and qualified. If both nominees are elected, our Board of Directors will consist of six individuals.

The nominees named below have agreed to serve if elected, and we have no reason to believe that they will be unavailable to serve. If, however, the nominees named below are unable to serve or decline to serve at the time of the annual meeting, the proxies will be voted for any nominee who may be designated by our Board of Directors. Unless a stockholder specifies otherwise, a returned proxy will be voted FOR the election of the nominees listed below.

On September 25, 2001, NetZero, Inc. and Juno Online Services, Inc. merged into two wholly-owned subsidiaries of United Online (the "Merger") and each of the directors of NetZero became a director of United Online pursuant to the terms of the Merger. Each of the nominees named below was a director of NetZero prior to the Merger.

Nominees for the Term Expiring at the 2005 Annual Meeting of Stockholders

The following table sets forth information with respect to the persons nominated for re-election at the meeting.

Name

| | Age

| | Director

Since

| | Committee Membership

|

|---|

| James T. Armstrong | | 36 | | 2001 | | Audit Committee |

| Dennis Holt | | 66 | | 2001 | | |

James T. Armstrong has served as one of our directors since the Merger and was a director of NetZero from 1998 until the Merger. Mr. Armstrong has been a Managing Director with Clearstone Venture Partners (formerly idealab! Capital Partners) since August 1998. From May 1995 to August 1998, Mr. Armstrong was an associate with Austin Ventures. From September 1989 to March 1992, Mr. Armstrong was a senior auditor with Ernst & Young. Mr. Armstrong serves on the board of directors of several private companies. Mr. Armstrong received his B.A. in Economics from the University of California at Los Angeles and his M.B.A. from the University of Texas.

Dennis Holt has been one of our directors since the Merger and was a director of NetZero from January 2001 until the Merger. Mr. Holt founded Western International Media, a media buying service, in 1970 and was the Chairman from 1970 through January 2002. Mr. Holt currently serves as Chairman and Chief Executive Officer of Patriot Communications LLC, a telecommunications service bureau, which he created in 1990 as a subsidiary of Western International Media. Mr. Holt also serves on the Board of Directors of Westwood One, Inc. and several private and philanthropic companies. Mr. Holt received his B.A. in Administration from the University of Southern California.

4

Continuing Directors

Our other directors, whose terms will expire upon the annual meeting of the year indicated below, are as follows:

Name

| | Age

| | Director

Since

| | Term Expires

| | Positions

|

|---|

| Mark R. Goldston | | 47 | | 2001 | | 2004 | | Chairman, Chief Executive Officer, President and Director |

| Robert Berglass(2) | | 64 | | 2001 | | 2003 | | Director |

| Kenneth L. Coleman(1)(2) | | 59 | | 2001 | | 2003 | | Director |

| Jennifer S. Fonstad(1) | | 36 | | 2001 | | 2004 | | Director |

- (1)

- Member of the Audit Committee.

- (2)

- Member of the Compensation Committee.

Mark R. Goldston has been our Chairman, Chief Executive Officer and President and a director since the Merger. He served as NetZero's Chairman and Chief Executive Officer and one of its directors from March 1999 until the Merger. Prior to joining NetZero, Mr. Goldston served as Chairman and Chief Executive Officer of The Goldston Group, a strategic advisory firm, from December 1997 to March 1999. From April 1996 to December 1997, he served as President, Chief Executive Officer and a director of Einstein/Noah Bagel Corp. after founding and serving his initial term with The Goldston Group from June 1994 to April 1996. Mr. Goldston also served as President and Chief Operating Officer of L.A. Gear from September 1991 to June 1994 and as a principal of Odyssey Partners, L.P., a private equity firm, from September 1989 to September 1991. Before joining Odyssey Partners, L.P., Mr. Goldston held various executive positions including Chief Marketing Officer of Reebok, President of Faberge USA, Inc. and Vice President of Marketing Worldwide for fragrance and skincare at Revlon, Inc. Mr. Goldston is the author of a business book entitled,The Turnaround Prescription, which was published in 1992 and is the named inventor on 12 separate U.S. patents on products such as inflatable pump athletic shoes and lighted footwear. Mr. Goldston received his B.S.B.A. in Marketing and Finance from Ohio State University and his M.B.A. (M.M.) from the J.L. Kellogg School at Northwestern University. He serves on the Dean's Advisory Board of the J.L. Kellogg School and the Dean's Advisory Board of the Ohio State University Fisher School of Business.

Robert Berglass has served as one of our directors since the Merger and was a director of NetZero from November 2000 until the Merger. Since January 2002, Mr. Berglass has been the Chairman of Davexlabs LLC. From 1998 until April 2001, Mr. Berglass was the Chairman, Chief Executive Officer and President of Schwarzkopf & DEP, Inc. (formerly DEP Corporation), a division of Henkel KGAA. Mr. Berglass had held those positions following Henkel KGAA's acquisition of DEP Corporation in 1998. From 1969 to 1998, Mr. Berglass was the Chairman, Chief Executive Officer and President of DEP Corporation. Before joining DEP Corporation, Mr. Berglass held various positions at Faberge, Inc., including Corporate Executive Vice President.

Kenneth L. Coleman has served as one of our directors since September 2001. Mr. Coleman founded ITM Software and has been its Chairman and Chief Executive Officer since May 2002. In May 2001, Mr. Coleman founded Coleman Consulting and consulted on various strategic matters for several companies through May 2002. From 1987 through May 2001, he held various positions, including Executive Vice President of Global Sales, Service and Marketing, with Silicon Graphics, Inc. Mr. Coleman serves on the board of directors of MIPS Technologies, Inc. and Acclaim Entertainment, Inc. Mr. Coleman received his B.S. and M.B.A. from Ohio State University.

5

Jennifer S. Fonstad has served as one of our directors since the Merger and was a director of NetZero from January 1999 until the Merger. Ms. Fonstad has been a Managing Director of Draper Fisher Jurvetson, a venture capital firm, since August 1999. From August 1997 to July 1999, she was a fellow with Kauffman Fellows, a venture capital firm. January 1997 to May 1997, she worked with SensAble Technologies. She held management positions with the Planning Technologies Group, now part of the Nextera Group, from January 1995 to May 1996. Ms. Fonstad also serves on the board of directors of several private companies. Ms. Fonstad received her B.S. cum laude in Economics from Georgetown University and her M.B.A. with distinction from Harvard.

Board Committees and Meetings

Our Board of Directors held five meetings during the fiscal year ended June 30, 2002. Our Board of Directors has an Audit Committee and a Compensation Committee. During the 2002 fiscal year, each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which such director served. Our Board of Directors also consulted informally with management from time to time during the 2002 fiscal year.

- •

- Audit Committee. The Audit Committee currently consists of three directors, Messrs. Armstrong and Coleman and Ms. Fonstad. The Audit Committee has responsibility for reviewing and making recommendations regarding the appointment of our independent accountants, the annual audit of our financial statements, and our internal controls, accounting practices and policies. The Audit Committee was formed on September 25, 2001 and held three meetings during the 2002 fiscal year. Our Board of Directors has adopted and approved a charter for the Audit Committee, a copy of which is attached hereto as Appendix A. Our Board of Directors has determined that all members of the Audit Committee are "independent" as that term is defined in Rule 4200 of the listing standards of the National Association of Securities Dealers.

- •

- Compensation Committee. The Compensation Committee currently consists of two directors, Messrs. Berglass and Coleman. The Compensation Committee has responsibility for determining the nature and amount of compensation for our executive officers and for administering our equity incentive plans. The Compensation Committee was formed on September 25, 2001 and held four meetings during the 2002 fiscal year.

Compensation Committee Interlocks and Insider Participation

From the Merger to October 2001, the Compensation Committee consisted of Messrs. Berglass and Holt. Mr. Coleman joined the Compensation Committee in October 2001 and Mr. Holt resigned from the committee in January 2002. None of these individuals were employed by us at any time during the 2002 fiscal year, and none of them has ever acted as one of our officers.

None of our current executive officers have ever served as a member of the board of directors or compensation committee of any other entity that has or has had one or more of its executive officers serve as a member of our Board of Directors or our Compensation Committee.

Director Compensation

During the 2002 fiscal year, our non-employee directors received an annual fee of $25,000, which was paid quarterly in arrears, as well as $1,000 for each meeting attended (including committee meetings). Ms. Fonstad waived her right to this compensation and did not receive an annual fee or payment for meetings attended during the 2002 fiscal year.

Under our 2001 Stock Incentive Plan, non-employee directors may receive option grants, direct issuances of common stock and other equity incentives. Following the consummation of the Merger, on

6

September 26, 2001, Messrs. Armstrong, Berglass, Coleman and Holt and Ms. Fonstad were each granted an immediately exercisable option to purchase 40,000 shares of common stock at an exercise price of $1.84 per share, the fair market value of our common stock on the grant date. The shares purchased under each such option will be subject to repurchase by us, at the original purchase price paid per share, should the optionee cease to serve as a Board member prior to vesting in those shares. The shares will vest in thirty-six (36) successive equal monthly installments upon the optionee's completion of each month of Board service over the thirty-six (36) month period measured from the grant date. In the event of a change of control, the shares subject to each of those options will immediately vest in full, and upon a hostile takeover, these options may be surrendered to us for a cash payment based on the take-over price paid per share of our common stock.

Recommendation of the Board of Directors

Our Board of Directors recommends that the stockholders vote FOR the election of the nominees listed above.

7

PROPOSAL TWO: RATIFICATION OF INDEPENDENT ACCOUNTANTS

Our Board of Directors has appointed the firm of PricewaterhouseCoopers LLP, our independent accountants for the 2002 fiscal year, to serve in the same capacity for the fiscal year ending June 30, 2003, and is asking the stockholders to ratify this appointment. A representative of PricewaterhouseCoopers LLP is expected to be present at the annual meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions. In the event the stockholders fail to ratify the appointment of PricewaterhouseCoopers LLP as our independent accountants, the Board of Directors may reconsider its selection.

Audit and Other Fees

Fees Billed to us by PricewaterhouseCoopers LLP for the Fiscal Year Ended June 30, 2002:

Audit Fees. Audit fees billed to us by PricewaterhouseCoopers LLP for the fiscal year ended June 30, 2002 for audit of our annual consolidated financial statements and review of those interim financial statements included in our quarterly reports on Forms 10-Q totaled approximately $255,000.

Financial Information Systems Design and Implementation Fees. United Online did not engage PricewaterhouseCoopers LLP to provide advice or services to United Online regarding financial information systems design and implementation during the fiscal year ended June 30, 2002.

All Other Fees. Other audit-related fees for the fiscal year ended June 30, 2002 were an additional $437,000, including $382,000 in connection with the registration statement filed for the Merger and $55,000 for, among other things, fees for other registration statements. Fees for non-audit-related services rendered by PricewaterhouseCoopers LLP for the fiscal year ended June 30, 2002, including fees for tax compliance and tax consulting services, were approximately $70,000. In the aggregate, all such other fees, including audit-related fees, totaled approximately $507,000.

Determination of Independence

In making its determination of independence, the Audit Committee of the Board of Directors considered whether the provision by PricewaterhouseCoopers LLP of the services covered under the headings "Financial Information Systems Design and Implementation Fees" and "All Other Fees" above is compatible with maintaining PricewaterhouseCoopers LLP's independence and found it to be.

Recommendation of the Board of Directors

Our Board of Directors recommends that the stockholders vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP to serve as our independent accountants for the fiscal year ending June 30, 2003.

OTHER MATTERS

We do not know of any matters to be presented at the annual meeting other than those mentioned in this proxy statement. If any other matters properly come before the annual meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as our Board of Directors recommends.

8

OWNERSHIP OF SECURITIES

The following table sets forth certain information known to us with respect to the beneficial ownership of our common stock as of September 27, 2002, by (i) each person who, to our knowledge, beneficially owns 5% or more of the outstanding shares of our common stock, (ii) each of our directors and nominees for director, (iii) each named executive officer (as listed in the summary compensation table), and (iv) all current directors and executive officers as a group.

Name and Address of Beneficial Owner

| | Shares

Beneficially

Owned

| | Percentage

Beneficial

Ownership(1)

| |

|---|

| Directors and Named Executive Officers: | | | | | |

| Mark R. Goldston(2) | | 3,036,526 | | 7.1 | % |

| Jon O. Fetveit(3) | | 390,093 | | * | |

| Charles S. Hilliard(4) | | 680,501 | | 1.7 | % |

| Gerald J. Popek(5) | | 474,998 | | 1.2 | % |

| Frederic A. Randall, Jr.(6) | | 653,724 | | 1.6 | % |

| James T. Armstrong(7) | | 68,403 | | * | |

| Robert Berglass(8) | | 58,000 | | * | |

| Kenneth L. Coleman(9) | | 40,200 | | * | |

| Dennis Holt(10) | | 68,000 | | * | |

| Jennifer S. Fonstad(11) | | 3,050,135 | | 7.5 | % |

| 5% stockholders: | | | | | |

| Bill Gross and Affiliated Entities and Individuals(12) | | 4,730,238 | | 11.7 | % |

Draper Fisher Jurvetson Management Company V, LLC(13)

400 Seaport Court, Suite 250

Redwood City, CA 94063 | | 3,010,135 | | 7.4 | % |

| All directors and executive officers as a group(14) (12 persons) | | 9,288,700 | | 20.6 | % |

- *

- Represents beneficial ownership of less than 1% of the outstanding shares of common stock.

- (1)

- Based on 40,580,679 shares of common stock outstanding on September 27, 2002. Beneficial ownership is determined in accordance with the rules of the Commission and generally includes voting or investment power with respect to securities. Shares of common stock subject to options and warrants which are currently exercisable, or will become exercisable within 60 days of September 27, 2002, are deemed outstanding for computing the percentage of the person or entity holding such securities but are not outstanding for computing the percentage of any other person or entity. Except as indicated by footnote, and subject to the community property laws where applicable, to our knowledge the persons named in the table above have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them. Unless otherwise indicated, the address for each person is our address at 2555 Townsgate Road, Westlake Village, California 91361.

- (2)

- Includes (i) 1,035,221 shares owned by the Mark and Nancy Jane Goldston Family Trust dated November 8, 1997, over which Mr. Goldston exercises voting power, as trustee; and (ii) 2,001,305 shares exercisable within 60 days of September 27, 2002.

- (3)

- Includes 335,652 shares exercisable within 60 days of September 27, 2002.

- (4)

- Includes 385,000 shares exercisable within 60 days of September 27, 2002.

9

- (5)

- Includes 474,998 shares exercisable within 60 days of September 27, 2002.

- (6)

- Includes 450,653 shares exercisable within 60 days of September 27, 2002.

- (7)

- Includes (i) 28,403 shares owned by Mr. Armstrong; and (ii) 40,000 shares exercisable within 60 days of September 27, 2002. It does not include shares beneficially owned by Clearstone Venture Partners and its affiliated entities because Mr. Armstrong does not have voting or dispositive power over such shares, although he is a managing director of Clearstone Venture Partners.

- (8)

- Includes 58,000 shares exercisable within 60 days of September 27, 2002.

- (9)

- Includes 40,000 shares exercisable within 60 days of September 27, 2002.

- (10)

- Includes 48,000 shares exercisable within 60 days of September 27, 2002.

- (11)

- Includes (i) 40,000 shares exercisable within 60 days of September 27, 2002; and (ii) 3,010,135 shares owned by entities affiliated with Draper Fisher Jurvetson, as set forth in note (13) below. Ms. Fonstad is a partner of Draper Fisher Jurvetson and disclaims beneficial ownership of such shares, except to the extent of her pecuniary interest therein.

- (12)

- Includes shares beneficially owned by Bill Gross, Idealab, William S. Elkus and Clearstone Venture Management I, L.L.C. This information is derived solely from the Schedule 13G filed with the Commission by these individuals and entities on February 13, 2002. The address for Bill Gross and Idealab is 130 West Union Street, Pasadena, California 91103. The address for William S. Elkus and Clearstone Venture Partners is 1351 Fourth Street, 4th Floor, Santa Monica, California 90401.

- (13)

- Includes (i) 2,784,375 shares owned by Draper Fisher Jurvetson Fund V, L.P. and (ii) 225,760 shares owned by Draper Fisher Jurvetson Partners V, LLC. Draper Fisher Jurvetson Management Company V, LLC is the general partner of Draper Fisher Jurvetson Fund V, L.P. and is therefore deemed to exercise voting and investment power over those shares. Draper Fisher Jurvetson Management Company V, LLC has three individual managing members. Those same three individuals are also the managing members of Draper Fisher Jurvetson Partners V, LLC and are therefore deemed to exercise voting and investment power over those shares.

- (14)

- Includes 4,615,839 shares of common stock subject to options exercisable within 60 days of September 27, 2002.

10

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Executive Officers

The following table sets forth certain information regarding all our executive officers as of September 27, 2002:

Name

| | Age

| | Positions

|

|---|

| Mark R. Goldston | | 47 | | Chairman, Chief Executive Officer, President and Director |

| Jon O. Fetveit | | 32 | | Executive Vice President and Chief Strategy Officer |

| Charles S. Hilliard | | 39 | | Executive Vice President, Finance and Chief Financial Officer |

| Gerald J. Popek | | 55 | | Executive Vice President and Chief Technology Officer |

| Frederic A. Randall, Jr. | | 45 | | Executive Vice President, General Counsel and Secretary |

| Robert J. Taragan | | 46 | | Executive Vice President and General Manager of CyberTarget |

| Brian Woods | | 42 | | Executive Vice President, Chief Marketing Officer |

The following is a brief description of the capacities in which each of the executive officers has served during the past five years. The biography for Mr. Goldston appears earlier in this proxy statement under the heading "Proposal One: Election of Directors."

Jon O. Fetveit has been our Executive Vice President and Chief Strategy Officer since the Merger. Prior to that, he served as NetZero's Senior Vice President and Chief Strategy Officer from July 2001 until the Merger. Mr. Fetveit joined NetZero in May 1999 as Director, Strategic Planning and served as NetZero's Vice President, Strategic Planning from April 2000 to July 2001. Prior to joining NetZero, Mr. Fetveit was engaged in the start-up of SRP Software, an enterprise software company, from July 1997 to May 1999. From June 1992 to July 1997, Mr. Fetveit was an investment banker in the corporate finance department of Hambrecht & Quist LLC, most recently as Vice President, Software Investment Banking. Charles Hilliard and Mr. Fetveit are brothers-in-law. Mr. Fetveit received his B.S. in Symbolic Systems with distinction from Stanford University.

Charles S. Hilliard has been our Executive Vice President, Finance and Chief Financial Officer since the Merger. Prior to that, he served as NetZero's Senior Vice President, Finance and Chief Financial Officer from April 1999 to September 2001. Prior to joining NetZero, Mr. Hilliard served as an investment banker with Morgan Stanley & Co. from May 1994 to April 1999, most recently as a Principal in the Corporate Finance Department. From August 1990 to May 1994, he served in the Mergers & Acquisitions and Corporate Finance departments of Merrill Lynch & Co. Mr. Hilliard served as a tax accountant with Arthur Andersen & Co. from September 1985 to July 1988 and was licensed as a Certified Public Accountant in January 1988. Mr. Hilliard received his B.S. in Business Administration from the University of Southern California and his M.B.A. with distinction from the University of Michigan.

Gerald J. Popek has been our Executive Vice President and Chief Technology Officer since the Merger. Prior to that, he served as NetZero's Senior Vice President and Chief Technology Officer from October 2000 to September 2001. Prior to joining NetZero, Mr. Popek was Chief Technology Officer at CarsDirect.com from August 1999 to September 2000 and Chief Technology Officer at PLATINUM

11

Technology, Inc. from August 1995 to August 1999. In the late 1970s, he was a member of the Defense Science Board, which selected the technology base for the United States Department of Defense that became the Internet. Mr. Popek has a B.S. in Nuclear Engineering, with honors, from New York University and a Ph.D. in Applied Mathematics from Harvard University.

Frederic A. Randall, Jr. has been our Executive Vice President, General Counsel and Secretary since the Merger. Prior to that, he served as NetZero's Senior Vice President and General Counsel from March 1999 until the Merger and was the Secretary from May 1999 to September 2001. Prior to joining NetZero, Mr. Randall was a partner at Brobeck, Phleger & Harrison LLP from January 1991 to March 1999, and an associate from 1984 to December 1990. Mr. Randall received his B.A. in English Literature with distinction from the University of Michigan and his J.D., cum laude, from the University of San Francisco School of Law.

Robert J. Taragan has been our Executive Vice President and General Manager of CyberTarget since the Merger. Prior to that, he served as NetZero's Senior Vice President and General Manager of CyberTarget from March 2000 until the Merger. Prior to joining NetZero, Mr. Taragan held various management positions with Nielsen Media Research for 21 years. His positions included Executive Vice President of Marketing and General Manager of Local Services. Mr. Taragan received his B.A. in Economics from Colgate University.

Brian Woods has been our Executive Vice President and Chief Marketing Officer since the Merger. Prior to that, he served as NetZero's Senior Vice President and Chief Marketing Officer from December 1999 until the Merger. Mr. Woods served as Chairman and Chief Executive Officer of AimTV, Inc. from May 1999 until NetZero acquired AimTV in December 1999. Prior to his position with AimTV, Mr. Woods was affiliated with Planet Hollywood from 1996 until 1998 as the President of the Entertainment Division for Planet Hollywood International. From 1988 to 1996, Mr. Woods served in several management positions at Blockbuster Entertainment Group, including Executive Vice President and Chief Marketing Officer. Mr. Woods was also Co-Chairman of the Viacom Marketing Council from 1993 to 1995.

12

Summary of Cash and Certain Other Compensation

The following table provides certain summary information concerning the compensation earned for services rendered during the 2000, 2001 and 2002 fiscal years by our Chief Executive Officer and each of the four other most highly compensated executive officers whose aggregate salary and bonus for the 2002 fiscal year were in excess of $100,000. The information provided for the 2000 and 2001 fiscal years and the portion of the 2002 fiscal year prior to the Merger is the compensation that was paid to each individual by NetZero, and the securities appearing in the table have been adjusted to reflect the exchange ratio by which shares of NetZero common stock and options for shares of NetZero common stock were converted upon the Merger into shares of United Online common stock and options for shares of United Online common stock. No other executive officer who would have otherwise been included in such table on the basis of salary and bonus earned for the 2002 fiscal year has been excluded by reason of his or her termination of employment or change in executive status during that year. The listed individuals are sometimes referred to herein as the "named executive officers."

SUMMARY COMPENSATION TABLE

| |

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

|---|

| | Annual Compensation

| |

| |

|---|

Name and Principal Position

| | Restricted

Stock

Award($)(1)

| | Securities

Underlying

Options(#)

| |

|---|

| | Year

| | Salary($)

| | Bonus($)

| |

|---|

Mark R. Goldston

Chairman, Chief Executive Officer and

President | | 2002

2001

2000 | | 605,000

456,000

200,000 | | 652,500

275,000

637,500 | | —

4,321,889

— | | 1,710,000

400,000

314,319 |

(2) |

Jon O. Fetveit

Executive Vice President and

Chief Strategy Officer |

|

2002

2001

2000 |

|

225,000

135,000

105,000 |

|

287,500

70,000

35,000 |

|

—

165,000

— |

|

350,000

20,000

12,000 |

(2) |

Charles S. Hilliard

Executive Vice President, Finance and

Chief Financial Officer |

|

2002

2001

2000 |

|

275,000

240,000

140,000 |

|

312,500

125,000

122,171 |

|

—

660,000

— |

|

450,000

85,000

48,000 |

(2) |

Gerald J. Popek

Executive Vice President and

Chief Technology Officer |

|

2002

2001

2000 |

|

275,000

178,000

— |

|

262,500

125,000

— |

|

—

—

— |

|

350,000

125,000

— |

|

Frederic A. Randall, Jr.

Executive Vice President and

General Counsel |

|

2002

2001

2000 |

|

275,000

209,000

135,000 |

|

312,500

112,500

117,500 |

|

—

577,500

— |

|

420,000

85,000

42,000 |

(2) |

- (1)

- The restricted stock awards listed were made on July 12, 2000, when the closing price of NetZero's common stock on the Nasdaq National Market was $27.50 per share (as adjusted pursuant to the Merger). The awards were to vest and the stock subject to the awards was to be issued in 12 successive equal quarterly installments beginning in August 2000. In November 2001, our Compensation Committee accelerated the vesting of the awards in full.

- (2)

- The options appearing in this table for Messrs. Goldston, Fetveit, Hilliard and Randall for the 2000 fiscal year were cancelled in July 2001 and, in exchange for the cancellation, NetZero's compensation committee authorized grants of restricted stock to these individuals. The cancelled options had exercise prices significantly in excess of the then current fair market value of NetZero's common stock. NetZero's compensation committee and board of directors approved the restricted stock grants because they believed that the grants were necessary to continue providing incentives for the executive officers to continue their service to NetZero.

13

Option/SAR Grants in Last Fiscal Year

The following table contains information concerning the stock options granted to the named executive officers during the 2002 fiscal year. All options granted after the Merger were granted under our 2001 Stock Incentive Plan. Options granted prior to the Merger were granted under NetZero's 1999 Stock Incentive Plan. No stock appreciation rights were granted to the named executive officers during such fiscal year.

OPTION/SAR GRANTS IN LAST FISCAL YEAR

| |

| | Individual Grants

|

|---|

| |

| | % of Total

Options

Granted to

Employees in

Fiscal Year

2002(2)

| |

| |

| | Potential Realization Value at

Assumed Annual Rates of

Stock Price Appreciation for

Option Term($)(4)

|

|---|

| | Number of

Securities

Underlying

Options

Granted(#)(1)

| |

| |

|

|---|

Name

| | Exercise

Price Per

Share($)

| | Expiration

Date(3)

|

|---|

| | 5%

| | 10%

|

|---|

| Mark R. Goldston | | 1,160,000

550,000 | | 18.1

8.6 | %

% | 1.84

8.65 | | 09/26/2011

05/07/2012 | | 1,342,313

2,991,966 | | 3,401,684

7,582,230 |

| Jon O. Fetveit | | 50,000

200,000

100,000 | (5)

| 0.8

3.1

1.6 | %

%

% | 3.05

1.84

8.65 | | 07/24/2011

09/26/2011

05/07/2012 | | 95,906

231,433

543,994 | | 243,046

586,497

1,378,587 |

| Charles S. Hilliard | | 300,000

150,000 | | 4.7

2.3 | %

% | 1.84

8.65 | | 09/26/2011

05/07/2012 | | 347,150

815,991 | | 879,746

2,067,881 |

| Gerald J. Popek | | 50,000

200,000

100,000 | (5)

| 0.8

3.1

1.6 | %

%

% | 3.05

1.84

8.65 | | 07/24/2011

09/26/2011

05/07/2012 | | 95,906

231,433

543,994 | | 243,046

586,497

1,378,587 |

| Frederic A. Randall, Jr. | | 300,000

120,000 | | 4.7

1.9 | %

% | 1.84

8.65 | | 09/26/2011

05/07/2012 | | 347,150

652,793 | | 879,746

1,654,305 |

- (1)

- Each option will vest in accordance with the following schedule: 25% of the option vests upon the optionee's completion of one year of service with us measured from the grant date, and the remainder vests in 36 equal monthly installments upon the optionee's completion of each additional month of service thereafter. In the event that we are acquired by merger or asset sale, each outstanding option, which is not to be assumed or replaced by the successor corporation, will immediately vest and become exercisable for all the option shares. See "Employment Contracts, Termination of Employment and Change in Control Arrangements" for other vesting acceleration provisions.

- (2)

- Options to purchase 6,394,000 shares were granted to our employees in the 2002 fiscal year.

- (3)

- All of the options appearing in this table expire ten years from the date of grant.

- (4)

- The 5% and 10% assumed rates of appreciation are prescribed by the rules and regulations of the Commission and do not represent our estimate or projection of the future trading prices of our common stock. Unless the market price of the common stock appreciates over the option term, no value will be realized from those option grants made to the named executive officers with an exercise price equal to the fair market value of the option shares on the grant date. Actual gains, if any, on stock option exercises are dependent on numerous factors, including, without limitation, our future performance, overall business and market conditions and the option holder's continued employment with us throughout the entire vesting period, which factors are not reflected in this table.

- (5)

- These options were granted by NetZero's board of directors prior to the Merger.

14

Aggregated Option Exercises and Fiscal Year End Values

The following table provides information with respect to the named executive officers concerning the exercise of options during the 2002 fiscal year and unexercised options held by them at the end of that fiscal year. None of the named executive officers exercised any stock appreciation rights during the 2002 fiscal year and no stock appreciation rights were held by the named executive officers at the end of that year.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR END VALUES

| |

| |

| | Number of Securities

Underlying Unexercised

Options(#)(2)

| | Value of Unexercised

in-the-Money Options at

Fiscal Year End($)(3)

|

|---|

Name

| | Shares

Acquired on

Exercise(#)

| | Value

Realized($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Mark R. Goldston | | 108,694 | | 256,518 | | 2,001,305 | | — | | 15,363,785 | | — |

| Jon O. Fetveit | | 64,347 | | 219,059 | | 345,652 | | — | | 2,662,638 | | — |

| Charles S. Hilliard | | 150,000 | | 354,000 | | 385,000 | | — | | 2,629,200 | | — |

| Gerald J. Popek | | — | | — | | 474,998 | | — | | 2,996,993 | | — |

| Frederic A. Randall, Jr. | | 54,347 | | 128,259 | | 450,653 | | — | | 3,501,848 | | — |

- (1)

- Based upon the closing selling price per share on the Nasdaq National Market on the exercise date less the exercise price per share.

- (2)

- All options appearing in this table are immediately exercisable. Each option vests in accordance with the following schedule: 25% of the option vests upon the optionee's completion of one year of service with us measured from the grant date, and the remainder vests in 36 equal monthly installments upon the optionee's completion of each additional month of service thereafter. To the extent an option is exercised prior to vesting, the shares purchased under the option will be subject to repurchase by us, at the original purchase price paid per share, until they have vested. In the event that we are acquired by merger or asset sale, each outstanding option, which is not to be assumed or replaced by the successor corporation, will immediately vest for all the option shares. See "Employment Contracts, Termination of Employment and Change in Control Arrangements" for other vesting acceleration provisions.

- (3)

- Based upon the closing selling price per share on the Nasdaq National Market on the last day of the 2002 fiscal year less the exercise price per share.

Employment Contracts, Termination of Employment and Change in Control Arrangements

Mr. Goldston entered into an employment agreement effective until February 2005. Under this agreement, his salary and bonus are subject to increases as determined by our Board of Directors. If Mr. Goldston's employment is terminated without cause or, if following a change in control, Mr. Goldston resigns for specified reasons, he will be entitled to receive a lump sum severance payment of four times his base salary and annual bonus, and all of his option shares will vest immediately. In the event his employment is terminated by reason of death or permanent disability, Mr. Goldston will be credited with an additional twenty-four months of vesting on his option shares. Mr. Goldston has agreed that, for a period of eighteen months following the termination of his employment, he will not engage in specified competitive business activities.

Messrs. Hilliard and Randall both have an employment agreement with us, effective until February 2005. Under these agreements, their salaries and bonuses are subject to increases as

15

determined by our Board of Directors. If either their employment is terminated without cause or their employment is otherwise involuntarily terminated following a change in control, they will be entitled to receive a lump sum payment of four times their base salary and annual bonus, and all of their options shall vest immediately. In the event their employment is terminated without cause in the absence of a change in control, or their employment is terminated by reason of death or permanent disability, they will receive an additional twelve months of vesting credited to their options. Both Messrs. Hilliard and Randall have agreed that, for a period of eighteen months following the termination of their employment, they will not engage in specified competitive business activities.

Our other executive officers generally are entitled to a severance payment equal to one year of their base salary if they are terminated without cause and are entitled to accelerated vesting on a portion of their option shares if they are terminated without cause following a change of control.

10b5-1 Selling Plans

As a result of the promulgation of Rule 10b5-1, certain of our officers have entered into selling plans for sales of our common stock. Messrs. Goldston, Hilliard and Randall are our only officers that currently have sales plans and these selling plans are on file with our corporate Secretary. Pursuant to such plans, Mr. Goldston may sell up to 500,000 shares of our common stock from August 2002 through February 2003; Mr. Hilliard may sell up to 30,000 shares of our common stock during November 2002; and Mr. Randall may sell up to 90,000 shares of our common stock from August 2002 through December 2002. As of September 27, 2002, Mr. Goldston beneficially owned 3,036,526 shares of our common stock, Mr. Hilliard beneficially owned 680,501 shares of our common stock and Mr. Randall beneficially owned 653,724 shares of our common stock.

Management Indebtedness

In March 1999, Mr. Goldston exercised a compensatory option to purchase 1,257,276 shares of our common stock. Mr. Goldston paid the aggregate purchase price for the shares with a promissory note in the principal amount of $628,638. The note is full recourse to Mr. Goldston and is collateralized by the shares of common stock issued upon exercise of the option. The note bears interest at a rate of 4.83% per annum and will become due and payable on March 20, 2004. The amount outstanding on the note as of September 30, 2002 was $535,000 and the largest aggregate amount of indebtedness outstanding at any time during the 2002 fiscal year on the note was $530,000.

In April 1999, Mr. Hilliard exercised a compensatory option to purchase 240,000 shares of our common stock. Mr. Hilliard paid the aggregate purchase price for the shares with a promissory note in the principal amount of $400,000. The note is full recourse to Mr. Hilliard and is collateralized by the shares of common stock issued upon exercise of the option. The note bears interest at a rate of 5.28% per annum and will become due and payable on April 16, 2004. The amount outstanding on the note as of September 30, 2002 was $321,000 and the largest aggregate amount of indebtedness outstanding at any time during the 2002 fiscal year on the note was $335,000.

In February 2002, our Board of Directors authorized loans to each of our executive officers for up to $200,000 to be used to exercise their outstanding stock options. Several of our named executive officers participated in this loan program. All notes executed in connection with the program were full recourse and secured by the shares of common stock purchased with the note. In each case, the principal balance of the note, together with all accrued interest, will become due in full on February 5, 2007 or earlier if an event of acceleration, such as termination of employment, occurs.

Under this loan program, Mr. Goldston purchased 108,694 shares of our common stock by issuing a promissory note for $200,000 to us. The note has an interest rate of Prime plus 1%. As of September 30, 2002, the outstanding balance (principal and accrued interest) of his loan was $203,000,

16

and the largest aggregate amount of indebtedness outstanding on the note at any time during the 2002 fiscal year was $203,000.

Under this loan program, Mr. Hilliard purchased 108,694 shares of our common stock by issuing a promissory note for $200,000 to us. The note has an interest rate of Prime plus 1%. As of September 30, 2002, the outstanding balance (principal and accrued interest) of his loan was $203,000, and the largest aggregate amount of indebtedness outstanding on the note at any time during the 2002 fiscal year was $203,000.

Under this loan program, Mr. Fetveit purchased 54,347 shares of our common stock by issuing a promissory note for $100,000 to us. The note has an interest rate of Prime plus 2%. As of September 30, 2002, the outstanding balance (principal and accrued interest) of his loan was $102,000, and the largest aggregate amount of indebtedness outstanding on the note at any time during the 2002 fiscal year was $102,000.

Under this loan program, Mr. Randall purchased 54,347 shares of our common stock by issuing a promissory note for $100,000 to us. The note has an interest rate of Prime plus 1%. As of September 30, 2002, the outstanding balance (principal and accrued interest) of his loan was $101,000, and the largest aggregate amount of indebtedness outstanding on the note at any time during the 2002 fiscal year was $101,000.

Under this loan program, Mr. Woods purchased 54,347 shares of our common stock by issuing a promissory note for $100,000 to us. The note has an interest rate of Prime plus 1%. As of September 30, 2002, the outstanding balance (principal and accrued interest) of his loan was $101,000, and the largest aggregate amount of indebtedness outstanding on the note at any time during the 2002 fiscal year was $101,000.

Other Related Party Transactions

During the year ended June 30, 2002, we purchased marketing services totaling less than $60,000 from Patriot Communications. Mr. Holt, who sits on our Board of Directors, is Chairman and Chief Executive Officer of Patriot Communications.

Indemnification Agreements

In addition to the indemnification provisions contained in our certificate of incorporation and bylaws, we have entered into separate indemnification agreements with each of our directors and executive officers. These agreements require that we, among other things, indemnify the person against expenses (including attorneys' fees), judgments, fines and settlements paid by such individual in connection with any action, suit or proceeding arising out of such individual's status or service as a director or officer of the company (other than liabilities arising from willful misconduct or conduct that is knowingly fraudulent or deliberately dishonest) and to advance expenses incurred by such individual in connection with any proceeding against such individual with respect to which such individual may be entitled to indemnification by us.

17

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

It is the duty of the Compensation Committee to determine the salaries and bonuses of the company's executive officers, including the Chief Executive Officer, and to establish the general compensation policies for such individuals. The Compensation Committee is also responsible for administering the company's equity incentive plans. The Committee was formed on September 25, 2001 upon the consummation of the Merger.

The Compensation Committee believes that the compensation programs for the company's executive officers should reflect the company's performance and the value created for its stockholders. In addition, the compensation programs should support the short-term and long-term strategic goals and values of the company and should reward individual contributions to the company's success. The company is engaged in a very competitive industry, and its success depends upon its ability to attract and retain qualified executives through the competitive compensation packages it offers to such individuals.

General Compensation Policy. The Compensation Committee's policy is to provide the executive officers with compensation opportunities that are based upon their personal performance, the performance of the company and their contribution to that performance, and that are competitive enough to attract and retain highly skilled individuals. Each executive officer's compensation package is comprised of three elements: (i) base salary, (ii) annual variable incentive awards, and (iii) long-term stock-based incentive awards designed to strengthen the mutuality of interests between the executive officers and the company's stockholders. The principal factors that were taken into account in establishing each executive officer's compensation package for the 2002 fiscal year are described below.

Base Salary. The base salary for each executive officer is established on the basis of each individual's personal performance and internal and external alignment considerations. The salary established for the executive officers are set forth in the Summary Compensation Table.

Bonuses. The Compensation Committee awarded two bonuses during the 2002 fiscal year. The annual incentive bonus for each executive officer is based on a percentage of each individual's base pay, but is adjusted to reflect the actual financial performance of the company in comparison to the company's business plan as well as the individual officer's performance. In the 2002 fiscal year, the company exceeded expectations and achieved EBITDA profitability in the March 2002 quarter. The annual incentive bonuses awarded reflect this significant achievement. In addition to the annual incentive bonus, the Compensation Committee awarded each of the executive officers a one-time bonus in appreciation for their successful integration efforts and cost savings overhead reductions on the Merger of NetZero and Juno. The actual bonus amounts awarded to the executive officers are set forth in the Summary Compensation Table.

Long-Term Incentives. Each stock option grant is designed to align the interests of the executive officer with those of the stockholders and provide each individual with a significant incentive to manage the company from the perspective of an owner with an equity stake in the business. Each grant allows the officer to acquire shares of the company's common stock at a fixed price per share (generally, the market price on the grant date) over a specified period of time (up to ten years). In general, each option is immediately exercisable but vests over a four-year period, contingent upon the officer's continued employment with the company. Accordingly, the option will provide a return to the executive officer only if he or she remains employed by the company during the vesting period, and then only if the market price of the shares appreciates over the option term.

The Compensation Committee granted options on a company-wide basis, including to the company's executive officers, in September 2001, following consummation of the Merger, and in May 2002, following the successful integration of a significant portion of the operations of Juno and NetZero. The size of the option granted to each executive officer was set by the Compensation

18

Committee at a level that was intended to create a meaningful opportunity for stock ownership based upon the individual's current position with the company, the individual's personal performance in recent periods and his or her potential for future responsibility and promotion over the option term. The Compensation Committee also took into account the number of unvested options held by the executive officer in order to maintain an appropriate level of equity incentive for that individual. The relevant weight given to each of these factors varied from individual to individual.

In November 2001, the Committee accelerated the vesting of approximately 165,000 shares of restricted stock held by Messrs. Goldston, Fetveit, Hilliard and Randall and certain other employees that otherwise would have vested over the following two years. In March 2002, the Committee accelerated the vesting of approximately another 525,000 shares of stock that were subject to vesting restrictions held by Messrs. Goldston, Fetveit, Hilliard and Randall and certain other employees that would otherwise have vested over the following year. A benefit to the company associated with these actions was to accelerate the recognition of compensation expense associated with such shares. These expenses would otherwise have been recognized over the ensuing two years, which would have adversely affected the company's financial performance during such time. The Committee determined that the acceleration of these grants was appropriate based on the performance of the executive officers particularly in light of their dedication to the company during a difficult transitional period and their success in guiding the company to improved financial performance. In addition, the Committee believed that accelerating the vesting of these shares would not adversely impact the executive's incentive to remain in the company's employment because the accelerated shares consisted of only a small percentage of each executive's total equity holdings.

CEO Compensation. Mr. Goldston became the company's Chairman, Chief Executive Officer and President upon consummation of the Merger. His compensation, including base salary and eligibility for annual variable cash compensation is set by the Compensation Committee and, in accordance with his employment agreement, may not be decreased. See "Employment Contracts, Termination of Employment and Change in Control Arrangements." In determining his base salary, the Compensation Committee considered Mr. Goldston's professional experience and leadership and strategic vision for the company. In determining his bonuses, the Compensation Committee considered the company's performance and successes and Mr. Goldston's contributions to those successes. The options granted to Mr. Goldston during the 2002 fiscal year were in recognition of his personal performance and leadership role and were intended to provide him with a incentive to continue in the company's employ.

Compliance with Internal Revenue Code Section 162(m). Section 162(m) of the Internal Revenue Code disallows a tax deduction to publicly held companies for compensation paid to certain of their executive officers, to the extent that compensation, whether payable in cash or stock, exceeds $1 million per covered officer in any fiscal year. The limitation applies only to compensation that is not considered to be performance-based. Non-performance based compensation paid to Mr. Goldston for the 2002 fiscal year exceeded the $1 million limit subject to Section 162(m). The Compensation Committee has determined that the level of compensation provided to him is appropriate, despite the fact that a portion of it will be non-deductible. In addition, the Compensation Committee has decided that it is not appropriate at this time to take any action to limit the company's discretion to design the compensation packages payable to the company's executive officers.

Submitted by the Compensation Committee of the Board of Directors:

| |

|

|---|

| | | Robert Berglass

Kenneth L. Coleman |

19

AUDIT COMMITTEE REPORT

The following is the report of the Audit Committee with respect to the company's audited financial statements for the fiscal year ended June 30, 2002, included in the company's Annual Report on Form 10-K for that period.

The Audit Committee has reviewed and discussed these audited financial statements with management of United Online.

The Audit Committee has discussed with the company's independent accountants, PricewaterhouseCoopers LLP, the matters required to be discussed by SAS 61 (Codification of Statements on Auditing Standards, AU Section 380), as may be modified or supplemented.

The Audit Committee has received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1 ("Independence Discussions with Audit Committees"), as may be modified or supplemented, and has discussed with PricewaterhouseCoopers LLP its independence from the company.

Based on the review and discussions referred to above in this report, the Audit Committee recommended to the company's Board of Directors that the audited financial statements be included in the company's Annual Report on Form 10-K for the year ended June 30, 2002 for filing with the Commission.

Submitted by the Audit Committee of the Board of Directors:

| |

|

|---|

| | | James T. Armstrong

Kenneth L. Coleman

Jennifer S. Fonstad |

20

Stock Performance Graph

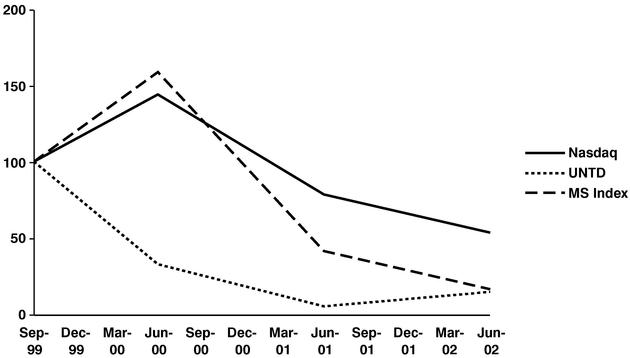

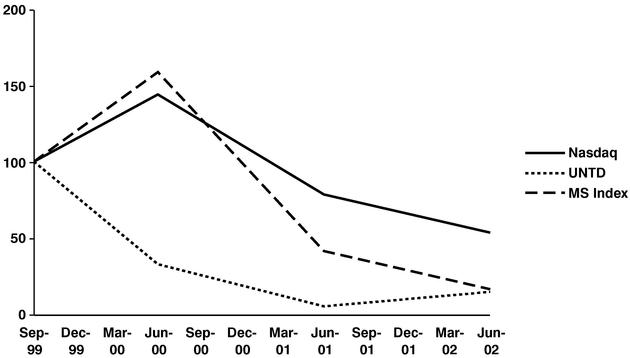

The graph depicted below shows a comparison of cumulative total stockholder returns for the company, the Nasdaq Stock Market (U.S.) Index and the Morgan Stanley Internet Composite.

The graph covers the period from September 23, 1999, the date of NetZero's initial public offering, to June 30, 2002. The graph assumes that $100.00 was invested in NetZero's common stock on September 23, 1999 at the initial public offering price of $16.00 per share and in each index, and that all dividends were reinvested. No cash dividends have been declared on our common stock. Stockholder returns over the indicated period should not be considered indicative of future stockholder returns

Notwithstanding anything to the contrary in any of our previous or future filings under the Securities Act of 1933, as amended, or the Exchange Act, as amended, that might incorporate this proxy statement or future filings made by us under those statutes, the compensation committee report, the audit committee report, the audit committee charter, reference to the independence of the audit committee members and the stock performance graph are not deemed filed with the Commission and shall not be deemed incorporated by reference into any of those prior filings or into any future filings made by us under those statutes.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires that our executive officers and directors, and persons who own more than ten percent of a registered class of our equity securities, file reports of ownership and changes in ownership (Forms 3, 4 and 5) with the Commission. Executive officers, directors and greater-than-ten-percent beneficial owners are required to furnish us with copies of all of the forms that they file.

Based solely on our review of these reports or written representations from certain reporting persons, we believe that during the 2002 fiscal year, all filing requirements applicable to our officers, directors, greater-than-ten-percent beneficial owners and other persons subject to Section 16(a) of the Exchange Act were complied with.

21

Annual Report

A copy of our Annual Report on Form 10-K for the fiscal year ended June 30, 2002, filed with the Commission on September 30, 2002, accompanies this proxy statement being mailed to all stockholders. The Annual Report is not incorporated into this proxy statement and is not considered proxy solicitation material.

Form 10-K; Available Information

Stockholders may obtain an additional copy of our Annual Report on Form 10-K, free of charge, by writing to our corporate Secretary at United Online, Inc., 2555 Townsgate Road, Westlake Village, California 91361.

| |

|

|---|

| | | BY ORDER OF THE BOARD OF DIRECTORS OF UNITED ONLINE, INC. |

|

|

|

| | | Frederic A. Randall, Jr.

Executive Vice President, General Counsel

and Secretary |

Westlake Village

October 11, 2002

22

APPENDIX A

AUDIT COMMITTEE CHARTER

I. PURPOSE

The primary function of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities by reviewing the financial information which will be provided to the shareholders and others, the systems of internal controls which management and the Board of Directors have established, and the Corporation's audit and financial reporting process.

The independent accountants' ultimate responsibility is to the Board of Directors and the Audit Committee, as representatives of the shareholders. These representatives have the ultimate authority to select, evaluate, and, where appropriate, replace the independent accountants.

The Audit Committee will primarily fulfill these responsibilities by carrying out the activities enumerated in Section IV of this Charter.

II. COMPOSITION

The Audit Committee shall be comprised of three or more independent directors.

All members of the Committee shall have a working familiarity with basic finance and accounting practices, and at least one member of the Committee shall have accounting or related financial management expertise.

III. MEETINGS

The Committee shall meet on a regular basis and shall hold special meetings as circumstances require.

IV. RESPONSIBILITIES AND DUTIES

To fulfill its responsibilities and duties the Audit Committee shall:

- 1.

- Review this Charter at least annually and recommend any changes to the Board.

- 2.

- Review the organization's annual financial statements and any other relevant reports or other financial information.

- 3.

- Review the regular internal financial reports prepared by management and any internal auditing department.

- 4.

- Recommend to the Board of Directors the selection of the independent accountants and approve the fees and other compensation to be paid to the independent accountants. On an annual basis, the Committee shall obtain a formal written statement from the independent accountants delineating all relationships between the accountants and the Corporation consistent with Independence Standards Board Standard 1, and shall review and discuss with the accountants all significant relationships the accountants have with the Corporation to determine the accountants' independence.

- 5.

- Review the performance of the independent accountants and approve any proposed discharge of the independent accountants when circumstances warrant.

- 6.

- Following completion of the annual audit, review separately with the independent accountants, the internal auditing department, if any, and management any significant difficulties encountered during the course of the audit.

- 7.

- Perform any other activities consistent with this Charter, the Corporation's Bylaws and governing law, as the Committee or the Board deems necessary or appropriate.

DETACH PROXY CARD HERE

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

UNITED ONLINE, INC.

The undersigned revokes all previous proxies, acknowledges receipt of the Notice of the Annual Meeting of Stockholders to be held on November 12, 2002 and the Proxy Statement, and appoints Mark R. Goldston and Charles S. Hilliard and each of them, the Proxy of the undersigned, with full power of substitution, for and in the name of the undersigned, to vote all shares of common stock, par value $0.0001 per share, of United Online, Inc., a Delaware corporation, that the undersigned would be entitled to vote at the Annual Meeting of Stockholders of United Online, Inc. to be held on Tuesday, November 12, 2002 at 10:00 a.m. Pacific time, at the Park Hyatt Hotel, 2151 Avenue of the Stars, Los Angeles, California 90067, or at any and all adjournments and postponements thereof, with the same force and effect as the undersigned might or could do if personally present thereat. The shares represented by this Proxy shall be voted in the manner set forth below.

(Continued, and to be marked, dated and signed, on the other side)

DETACH PROXY CARD HERE IF YOU ARE NOT VOTING BY THE INTERNET OR TELEPHONE

Please Detach Here

You Must Detach This Portion of the Proxy Card

Before Returning it in the Enclosed Envelope

- 1.

- To elect two directors to serve for a three-year term ending in the year 2005 or until their successors are duly elected and qualified:

| ELECTION OF DIRECTORS | | o | | FOR all nominees listed below | | o | | WITHHOLD AUTHORITY to vote for all nominees listed below | | o | | FOR ALL, EXCEPT as indicated to the contrary below |

Nominees: 01 James T. Armstrong 02 Dennis Holt

(INSTRUCTION: To withhold authority to vote for any individual nominee, mark "For All Except" box and write that nominee's name in the space provided below.)

- 2.

- To ratify the appointment of PricewaterhouseCoopers LLP as independent auditors of United Online, Inc. for the fiscal year ending June 30, 2003.

o FOR o AGAINST o ABSTAIN

- 3.

- In accordance with the discretion of the proxy holders, to act upon all matters incident to the conduct of the meeting and upon other matters as may properly come before the meeting.

o FOR o AGAINST o ABSTAIN

The Board of Directors recommends a vote IN FAVOR OF the directors listed above and a vote IN FAVOR OF each of the listed proposals. This Proxy, when property executed, will be voted as specified above.IF NO SPECIFICATION IS MADE, THIS PROXY WILL BE VOTED IN FAVOR OF THE ELECTION OF THE NOMINEES LISTED ABOVE AND IN FAVOR OF THE OTHER PROPOSALS.

| | Please sign exactly as the name appears on your stock certificate. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the President or other authorized officer. If a partnership, please sign in partnership name by an authorized person. |

|

Please print the name(s) appearing on each share certificate(s) over which you have voting authority: |

|

(Print name(s) on certificate) |

| | Please sign | | |

| | your name: | |

|

|

Date: |

|

|

| | | | |

| |

(Signature, Joint Owner) |

|

Date: |

|

|

QuickLinks

MATTERS TO BE CONSIDERED AT ANNUAL MEETING PROPOSAL ONE: ELECTION OF DIRECTORSPROPOSAL TWO: RATIFICATION OF INDEPENDENT ACCOUNTANTSOTHER MATTERSOWNERSHIP OF SECURITIESEXECUTIVE COMPENSATION AND OTHER INFORMATIONSUMMARY COMPENSATION TABLEAGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR END VALUESCOMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATIONAPPENDIX A AUDIT COMMITTEE CHARTER