QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of: March, 2005

Commission File Number: 001-31561

WHEATON RIVER MINERALS LTD.

1560-200 Burrard Street

Vancouver, British-Columbia

V6C 3L6

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40 F.

Form 20-F o Form 40-F ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes o No ý

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes o No ý

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g-3 under the Securities Exchange Act of 1934.

Yes o No ý

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

SIGNATURES:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | WHEATON RIVER MINERALS LTD. |

March 16, 2005 |

|

By: |

/s/ Peter Barnes

Name: Peter Barnes

Title: Chief Financial Officer |

WHEATON RIVER MINERALS LTD.

NOTICE OF SPECIAL MEETING

AND

MANAGEMENT INFORMATION CIRCULAR

ARRANGEMENT INVOLVING

WHEATON RIVER MINERALS LTD.,

ITS SHAREHOLDERS,

GOLDCORP INC. AND

GOLDCORP ACQUISITION (WHEATON) LTD.

SPECIAL MEETING OF SHAREHOLDERS

OF WHEATON RIVER MINERALS LTD.

TO BE HELD ON APRIL 12, 2005

March 15, 2005

March 15, 2005

Dear Wheaton shareholder:

Second Step Acquisition

As you are aware, on December 29, 2004 Goldcorp Inc. made an offer to purchase all of the common shares of Wheaton River Minerals Ltd. on the basis of 0.25 of a Goldcorp common share for each Wheaton common share. Goldcorp's offer expired on February 28, 2005. Under Goldcorp's offer, it acquired a total of 470,379,130 Wheaton common shares, representing approximately 82% of all outstanding Wheaton common shares.

Under the acquisition agreement entered into between Wheaton and Goldcorp in connection with Goldcorp's offer, Goldcorp agreed to effect a second step acquisition transaction to acquire all Wheaton common shares not acquired under Goldcorp's offer.

It is proposed that Goldcorp will acquire all Wheaton common shares not currently owned by it pursuant to a plan of arrangement under theBusiness Corporations Act (Ontario). Under the arrangement, Wheaton shareholders (other than Goldcorp) will receive the same consideration of 0.25 of a Goldcorp common share for each Wheaton common share as was offered under Goldcorp's offer.

In order to become effective, the arrangement requires, among other things, approval by at least 662/3% of the votes cast by Wheaton shareholders at a special meeting. You are invited to attend the special meeting which will be held at 9:00 a.m. (Toronto time) on Tuesday, April 12, 2005 at the offices of Davies Ward Phillips & Vineberg LLP, 1 First Canadian Place, Suite 4400, Toronto, Ontario.Goldcorp has agreed to vote all Wheaton common shares held by it in favour of the arrangement. As a result, approval of the arrangement at the special meeting is assured based on the current number of outstanding Wheaton common shares.

As part of the arrangement, each Wheaton warrant will be exchanged for one Goldcorp warrant to acquire 0.25 of a Goldcorp common share for an exercise price equal to the exercise price for one Wheaton common share under such Wheaton warrant and all Wheaton options will be exchanged for Goldcorp options to acquire Goldcorp common shares based on the number of Goldcorp common shares that an optionholder would have been entitled to receive under the arrangement had such holder exercised Wheaton options prior to the arrangement. Holders of Wheaton warrants and Wheaton options need not take any action to receive Goldcorp warrants and Goldcorp options under the arrangement.

You are urged to carefully consider the information presented in the accompanying management information circular. Please consider seeking advice from your financial, tax and other professional advisors in the event you have any questions about the arrangement.

Wheaton shareholders are requested to complete and return the enclosed form of proxy to ensure that your shares will be represented at the special meeting, whether or not you are personally able to attend. In addition, Wheaton shareholders must complete and return the enclosed letter of transmittal, together with the share certificates representing your Wheaton common shares, in order to receive certificates representing the Goldcorp common shares you will be entitled to pursuant to the arrangement. Envelopes have been provided for your convenience in returning the form of proxy, the letter of transmittal and the share certificates representing your Wheaton common shares.

Kingsdale Shareholder Services has been retained by Wheaton as a proxy solicitation agent in connection with the special meeting. Any questions and requests by Wheaton shareholders for assistance relating to the special meeting may be directed to Kingsdale Shareholder Services toll-free at 1-866-749-5464.

| | | Sincerely, |

| | | |

| | | (Signed) Ian W. Telfer |

| | | Chairman and Chief Executive Officer |

TABLE OF CONTENTS

| | Page

|

|---|

| NOTICE OF SPECIAL MEETING OF SHAREHOLDERS | | iii |

| NOTICE TO UNITED STATES SHAREHOLDERS | | iv |

| CURRENCY AND FINANCIAL INFORMATION | | iv |

| FORWARD-LOOKING STATEMENTS | | v |

| INFORMATION CONCERNING GOLDCORP | | v |

| CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES | | v |

| BACKGROUND TO AND REASONS FOR THE ARRANGEMENT | | 1 |

| RECOMMENDATION OF THE BOARD OF DIRECTORS | | 3 |

| THE ARRANGEMENT | | 4 |

| | Pre-Arrangement Steps | | 4 |

| | Conditions to and Required Approvals for the Arrangement | | 4 |

| | Plan of Arrangement | | 5 |

| | Exchange of Share Certificates and Dividends | | 7 |

| | Certificates Not Surrendered | | 8 |

| | Effective Date of the Arrangement | | 8 |

| | Treatment of Wheaton Warrants and Wheaton Options | | 8 |

| | Dissent Rights | | 9 |

| | Expenses of the Arrangement | | 11 |

| PLANS FOR WHEATON FOLLOWING THE ARRANGEMENT | | 12 |

| GOLDCORP | | 12 |

| CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS | | 12 |

| | Shareholders Resident in Canada | | 13 |

| | Shareholders Not Resident in Canada | | 15 |

| | Holders of Wheaton Warrants | | 16 |

| CERTAIN UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | 16 |

| | Scope of Disclosure | | 16 |

| | Certain United States Federal Income Tax Consequences of the Arrangement | | 18 |

| | United States Federal Income Tax Consequences of the Ownership and Disposition of Goldcorp Shares | | 20 |

| OWNERSHIP OF SECURITIES OF WHEATON | | 22 |

| PRINCIPAL HOLDERS OF COMMON SHARES | | 23 |

| INTENTIONS OF DIRECTORS, OFFICERS AND OTHERS | | 23 |

| RULE 61-501 AND POLICY Q-27 | | 23 |

| GENERAL PROXY INFORMATION | | 24 |

| | Solicitation of Proxies | | 24 |

| | Proxy | | 24 |

| | Voting Rights and Proxy Information | | 24 |

| | Appointment of Nominees and Revocability of Proxies | | 24 |

| | Voting of Proxies | | 25 |

| | Non-Registered Voters | | 25 |

| | The Meeting | | 26 |

| INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS | | 27 |

| | | |

i

| STATEMENT OF EXECUTIVE COMPENSATION | | 28 |

| | Summary Compensation Table | | 28 |

| | Stock Options | | 28 |

| | Aggregated Option Exercises During 2004 and Year-End Option Values | | 29 |

| | Employment Agreements | | 29 |

| | Luismin Pension Plan | | 30 |

| | Compensation of Directors | | 30 |

| | Directors' and Officers' Liability Insurance | | 31 |

| | Composition of the Compensation Committee | | 31 |

| | Report on Executive Compensation | | 31 |

| INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS | | 33 |

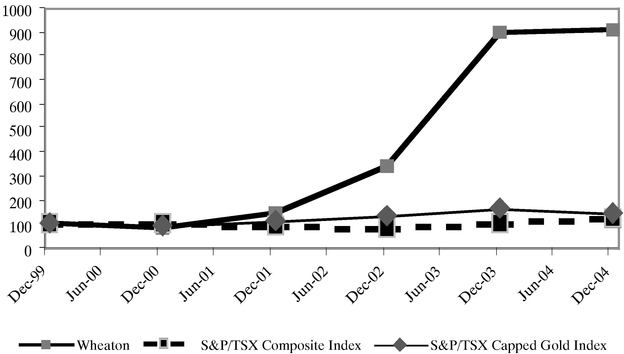

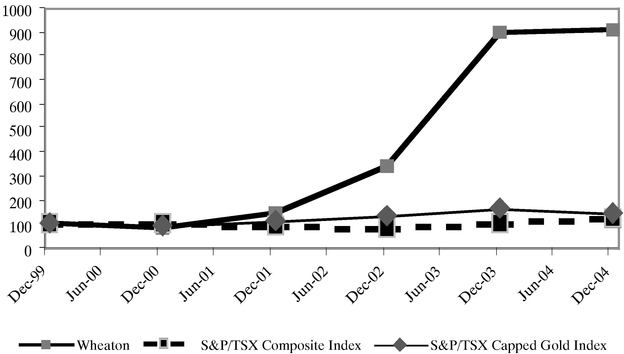

| PERFORMANCE GRAPH | | 34 |

| AUDITORS, REGISTRAR AND TRANSFER AGENT | | 34 |

| PRICE RANGES AND TRADING VOLUMES | | 35 |

| | Wheaton | | 35 |

| | Goldcorp | | 35 |

| PREVIOUS PURCHASES AND SALES OF SECURITIES | | 36 |

| DIVIDEND POLICY | | 36 |

| DOCUMENTS INCORPORATED BY REFERENCE | | 36 |

| DOCUMENTS RELATING TO THE GOLDCORP OFFER | | 38 |

| AVAILABILITY OF DOCUMENTS INCORPORATED BY REFERENCE OR RELATING TO THE GOLDCORP OFFER | | 38 |

| NO MATERIAL CHANGES | | 38 |

| ADDITIONAL INFORMATION | | 38 |

| LEGAL MATTERS | | 38 |

| CONSENT OF DELOITTE & TOUCHE LLP | | 39 |

| CONSENT OF KPMG LLP | | 39 |

| DIRECTORS' APPROVAL | | 40 |

| APPENDIX "A" — GLOSSARY | | 41 |

| SCHEDULE A — ARRANGEMENT RESOLUTION | | A-1 |

| SCHEDULE B — ARRANGEMENT AGREEMENT | | B-1 |

| SCHEDULE C — PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS OF GOLDCORP | | C-1 |

| SCHEDULE D — INTERIM ORDER | | D-1 |

| SCHEDULE E — NOTICE OF APPLICATION FOR FINAL ORDER | | E-1 |

| SCHEDULE F — SECTION 185 OF THEBUSINESS CORPORATIONS ACT (ONTARIO) | | F-1 |

| SCHEDULE G — MERRILL LYNCH FAIRNESS OPINION | | G-1 |

ii

WHEATON RIVER MINERALS LTD.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that a special meeting (the "Meeting") of the shareholders of Wheaton River Minerals Ltd. ("Wheaton") will be held at the offices of Davies Ward Phillips & Vineberg LLP, 1 First Canadian Place, Suite 4400, Toronto, Ontario on Tuesday, April 12, 2005 at 9:00 a.m. (Toronto time) to transact the following matters:

- 1.

- to consider and, if deemed advisable, to pass, with or without variation, a resolution (the "Arrangement Resolution") approving an arrangement (the "Arrangement") pursuant to section 182 of theBusiness Corporations Act (Ontario) involving Wheaton, its shareholders, Goldcorp Inc. and Goldcorp Acquisition (Wheaton) Ltd., as more particularly described in the accompanying management information circular; and

- 2.

- to transact such further and other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof.

The full text of the Arrangement Resolution and a copy of the arrangement agreement (the "Arrangement Agreement") dated March 14, 2005 between Goldcorp Inc., Goldcorp Acquisition ULC and Wheaton are attached as Schedules A and B, respectively, to the accompanying management information circular. A copy of the Plan of Arrangement implementing the Arrangement is attached as Exhibit A to the Arrangement Agreement.

Only holders of common shares ("Common Shares") of Wheaton (collectively, the "Shareholders") at the close of business on March 7, 2005 (the "Record Date") will be entitled to vote in respect of the matters to be voted on at the Meeting or any adjournment(s) or postponement(s) thereof, except that a person who has acquired Common Shares subsequent to the Record Date will be entitled to vote such shares upon making a written request to that effect not later than 5:00 p.m. (Toronto time) on the day that is 10 days before the Meeting to the Director, Investor Relations of Wheaton at the offices of Wheaton, 200 Burrard Street, Suite 1560, Vancouver, British Columbia V6C 3L6 and establishing that such person owns such shares. A form of proxy for the Meeting has been enclosed herewith. Shareholders who are unable to attend the Meeting are kindly requested to specify on the enclosed form of proxy the manner in which the Common Shares represented thereby are to be voted and sign and return the same in the envelope provided.

Common Shares represented by properly executed forms of proxy in favour of the persons designated in the enclosed form of proxy will be voted in accordance with the specifications made on any ballot that may be called.Common Shares will be VOTED FOR the approval of the Arrangement Resolution if no specification has been made in the form of proxy.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to the matters identified in this Notice of Special Meeting of Shareholders and other matters that may properly come before the Meeting. Management is not aware of any amendments or variations to matters identified herein or any other matters that may be presented for action at the Meeting.

To be used at the Meeting, a completed form of proxy must be deposited with CIBC Mellon Trust Company, 1066 West Hastings Street, Suite 1600, Vancouver, British Columbia V6E 3X1 at any time up to 5:00 p.m. (Toronto time) on Friday, April 8, 2005, being the second business day preceding the date of the Meeting, or, if the Meeting is adjourned or postponed, not later than 5:00 p.m. (Toronto time) on the second day (excluding Saturdays, Sundays and holidays) preceding the date of any adjourned or postponed meeting.

| DATED this 15th day of March, 2005. | | |

| | | Sincerely, |

| | | On behalf of the Board of Directors |

| | | |

| | | (Signed) Ian W. Telfer |

| | | Chairman and Chief Executive Officer |

iii

NOTICE TO UNITED STATES SHAREHOLDERS

This solicitation of proxies is not subject to the requirements of Section 14(a) of the United StatesSecurities Exchange Act of 1934, as amended (the "U.S. Exchange Act"). Accordingly, such solicitation is made in the United States with respect to securities of a Canadian foreign private issuer in accordance with Canadian corporate and securities laws and the management information circular attached hereto, including the Schedules attached thereto and the documents incorporated by reference therein (collectively, the "Circular"), has been prepared in accordance with disclosure requirements applicable in Canada. Shareholders of Wheaton River Minerals Ltd. ("Wheaton") in the United States should be aware that such requirements are different from those of the United States applicable to proxy statements under the U.S. Exchange Act.

The common shares of Goldcorp Inc. ("Goldcorp") and the warrants and options to acquire common shares of Goldcorp being issued under the plan of arrangement described in the Circular are being issued in reliance on the exemption from the registration requirements of theUnited States Securities Act of 1933, (the "Securities Act") as amended, set forth in Section 3(a)(10) of the Securities Act on the basis of the approval of the Court as described under "The Arrangement — Conditions to and Required Approvals for the Arrangement".

The historical financial information for Wheaton and Goldcorp and thepro forma financial information of Goldcorp included or incorporated by reference in the Circular are presented in United States dollars and have been prepared in accordance with Canadian generally accepted accounting principles.

Enforcement by shareholders of civil liabilities under the United States securities laws may be affected adversely by the fact that each of Wheaton and Goldcorp is organized under the laws of a jurisdiction other than the United States, that certain of the officers and directors of Wheaton and Goldcorp are residents of a country other than the United States, that some of the experts named in the Circular are residents of Canada and that a substantial portion of the assets of each of Wheaton and Goldcorp and such persons are located outside of the United States.

Goldcorp's consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles and filed with appropriate regulatory authorities in Canada and the United States. Wheaton's consolidated financial statements are prepared in accordance with Canadian generally accepted accounting principles and filed with appropriate regulatory authorities in Canada and the United States.

The unauditedpro forma consolidated financial statements of Goldcorp set out in Schedule C to the Circular have been presented in accordance with the requirements of paragraph 4.5 of National Instrument 44-101 and have been prepared in accordance with Canadian generally accepted accounting principles. The unauditedpro forma consolidated financial statements of Goldcorp have not been reconciled to United States generally accepted accounting principles and do not purport to be in compliance with Article 11 of Regulation S-X of the Rules and Regulations of the United States Securities and Exchange Commission (the "SEC").

CURRENCY AND FINANCIAL INFORMATION

All dollar references in the Circular are in United States dollars, unless otherwise indicated. References to "C$" are to Canadian dollars. The following table sets forth, for each of the periods indicated, the exchange rate of one United States dollar into Canadian dollars at the end of each such period, the average exchange rate during each such period and the range of high and low rates for each such period.

| | Year Ended December 31,

|

|---|

| | 2004

| | 2003

| | 2002

| | 2001

| | 2000

|

|---|

| Rate at end of period(1) | | 1.2020 | | 1.2923 | | 1.5800 | | 1.5925 | | 1.4995 |

| Average rate(2) | | 1.3015 | | 1.4012 | | 1.5706 | | 1.5490 | | 1.4855 |

| High rate(1) | | 1.3957 | | 1.5750 | | 1.6128 | | 1.6023 | | 1.5600 |

| Low rate(1) | | 1.1759 | | 1.2923 | | 1.5108 | | 1.4933 | | 1.4350 |

- (1)

- The rate of exchange means the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York.

- (2)

- The average rate means the average of the exchange rates on the last day of each month during the period.

iv

On March 11, 2005, the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York was $1.00 = C$1.2041.

FORWARD-LOOKING STATEMENTS

Certain statements included in the Circular constitute "forward-looking statements". Such forward-looking statements, including, but not limited to, those with respect to the prices of gold, copper and silver, the timing and amount of estimated future production, costs of production, capital expenditures, reserves determination, costs and timing of the development of new deposits and permitting time lines, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Goldcorp or Wheaton to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the actual results of current exploration activities, actual results of current reclamation activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined and the future prices of gold, copper and silver. Although Wheaton has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements.

Many of these factors are beyond the control of Goldcorp, Wheaton and their respective subsidiaries. Consequently, all of the forward-looking statements made in the Circular are qualified by these cautionary statements and there can be no assurance that the expected results or developments will be realized.

INFORMATION CONCERNING GOLDCORP

The information concerning Goldcorp contained in the Circular has been taken from, or is based upon, publicly available documents and records on file with the Canadian securities regulatory authorities, and other public sources. Although Wheaton has no knowledge that would indicate that any statements contained therein relating to Goldcorp taken from or based upon such documents, records and sources are untrue or incomplete, neither Wheaton, nor any of its officers or directors, assumes any responsibility for the accuracy or completeness of the information relating to Goldcorp taken from or based upon such documents, records and sources, or for any failure by Goldcorp to disclose events which may have occurred or which may affect the significance or accuracy of any such information but which are unknown to Wheaton.

CAUTIONARY NOTE TO UNITED STATES INVESTORS CONCERNING ESTIMATES OF MEASURED, INDICATED AND INFERRED RESOURCES

The Circular uses the terms "measured", "indicated" and "inferred" mineral resources. United States investors are advised that while such terms are recognized and required under Canadian securities legislation, the SEC does not recognize them. "Inferred mineral resources" have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or other economic studies.United States investors are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be converted into mineral reserves. United States investors are also cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable.

v

MANAGEMENT INFORMATION CIRCULAR

Unless the context otherwise requires, terms not defined herein have the meanings set forth in the Glossary attached as Appendix "A" to this management information circular ("Circular"). Unless otherwise stated, the information contained in this Circular is given as at March 11, 2005.

BACKGROUND TO AND REASONS FOR THE ARRANGEMENT

On December 29, 2004, Goldcorp Inc. ("Goldcorp") and Goldcorp Acquisition ULC ("Goldcorp ULC") made an offer (the "Goldcorp Offer") to acquire all of the outstanding common shares (the "Common Shares") of Wheaton River Minerals Ltd. ("Wheaton") on the basis of 0.25 of a common share of Goldcorp ("Goldcorp Share") for each Common Share. As of March 3, 2005, Goldcorp and Goldcorp ULC had acquired 470,379,130 Common Shares, representing approximately 82% of all outstanding Common Shares, pursuant to the Goldcorp Offer.

Pursuant to the acquisition agreement dated December 23, 2004 between Goldcorp and Wheaton (the "Acquisition Agreement"), Goldcorp and Wheaton agreed that following the acquisition of a minimum of 662/3% of the Common Shares by Goldcorp and Goldcorp ULC pursuant to the Goldcorp Offer, they would take all necessary steps to proceed with a subsequent acquisition transaction whereby Goldcorp would acquire all Common Shares not tendered to the Goldcorp Offer. In addition, Goldcorp stated in the Offer and Circular that it would use its reasonable best efforts to seek to cause a meeting of Shareholders to consider a statutory arrangement that would result in the acquisition by Goldcorp of all Common Shares not acquired under the Goldcorp Offer.

On March 14, 2005, Wheaton, Goldcorp and Goldcorp ULC entered into an arrangement agreement (the "Arrangement Agreement") providing for the acquisition by Goldcorp of all Common Shares not acquired under the Goldcorp Offer by way of a plan of arrangement (the "Arrangement") pursuant to section 182 theBusiness Corporations Act (Ontario) (the "OBCA") involving Wheaton, the Shareholders, Goldcorp and Goldcorp Acquisition (Wheaton) Ltd. ("Goldcorp Subco"). See "The Arrangement". Under the Arrangement, Shareholders (other than Goldcorp and Dissenting Shareholders) will receive the same consideration of 0.25 of a Goldcorp Share for each Common Share as was offered under the Goldcorp Offer.

The following sets out certain events leading to the acquisition of Common Shares by Goldcorp and Goldcorp ULC pursuant to the Goldcorp Offer:

- •

- On December 5, 2004, Wheaton and Goldcorp executed and announced a letter of intent for the acquisition of Wheaton by Goldcorp pursuant to a share-exchange take-over bid followed by a subsequent acquisition transaction on the basis of 0.25 of a Goldcorp Share for each Common Share.

- •

- On December 16, 2004, Glamis Gold Ltd. ("Glamis") announced its intention to make a take-over bid for Goldcorp on the basis of 0.89 of a Glamis common share for each Goldcorp Share.

- •

- On December 23, 2004, Wheaton and Goldcorp executed and announced the entering into of the Acquisition Agreement.

- •

- On December 29, 2004, Goldcorp mailed its offer and take-over bid circular (the "Offer and Circular") to the Shareholders providing for the Goldcorp Offer. Contemporaneously with the mailing of the Offer and Circular, Wheaton mailed its directors' circular in which the Board of Directors recommended that Shareholders accept the Goldcorp Offer. The recommendation of the Board of Directors was based, in part, upon the recommendation of a special committee (the "Special Committee") of the Board of Directors formed to consider the Goldcorp Offer. The Special Committee received an opinion from Merrill Lynch, Pierce, Fenner & Smith Incorporated that the consideration under the Goldcorp Offer was fair, from a financial point of view, to the Shareholders.

- •

- On January 7, 2005, Goldcorp mailed a management information circular and proxy statement to the shareholders of Goldcorp in connection with a meeting of Goldcorp shareholders (the "Goldcorp Meeting") called to consider a resolution approving the issuance of Goldcorp Shares pursuant to the Goldcorp Offer.

1

- •

- On January 7, 2005, Glamis commenced a take-over bid for Goldcorp on the basis of 0.89 of a Glamis common share for each Goldcorp Share (the "Glamis Offer").

- •

- On January 17, 2005, Glamis mailed a dissident proxy circular to the Goldcorp shareholders with respect to the Goldcorp Meeting.

- •

- On January 21, 2005, Goldcorp mailed a directors' circular and supplemental management information circular to the shareholders of Goldcorp in response to the Glamis Offer. For the reasons detailed in Goldcorp's directors' circular, the Board of Directors recommended that Goldcorp's shareholders reject the Glamis Offer.

- •

- On January 24, 2005, Goldcorp mailed a Notice of Extension to the Shareholders, notifying Shareholders that the expiry date of the Goldcorp Offer had been extended from February 3, 2005 to February 14, 2005.

- •

- On February 7, 2005, Glamis announced its intention to increase the consideration under the Glamis Offer from 0.89 to 0.92 of a common share of Glamis for each Goldcorp Share and extending the expiry date of the Glamis Offer from February 14, 2005 to February 24, 2005. Glamis filed with applicable securities regulatory authorities its revised offer to Goldcorp shareholders on February 8, 2005.

- •

- On February 8, 2005, Goldcorp announced that a special cash dividend of $0.50 per Goldcorp Share would be paid, subject to the successful completion of the Goldcorp Offer, to Goldcorp shareholders of record as of February 16, 2005. Wheaton consented to the payment of this dividend.

- •

- On February 10, 2005, Goldcorp shareholders voted in favour of the issuance of Goldcorp Shares to Shareholders pursuant to the Goldcorp Offer at the Goldcorp Meeting.

- •

- On February 10, 2005, Glamis announced that, because Goldcorp shareholders approved the issuance of Goldcorp Shares to Shareholders pursuant to the Goldcorp Offer, the conditions to the Glamis Offer could not be satisfied and, therefore, Glamis intended to allow the Glamis Offer to expire as scheduled on February 24, 2005 without taking up any Goldcorp Shares. On February 24, 2005, the Glamis Offer expired without Glamis taking up any Goldcorp Shares.

- •

- On February 14, 2005, contemporaneously with the taking up of the Common Shares by Goldcorp and Goldcorp ULC, the Goldcorp Offer was extended by a Notice of Extension and Subsequent Offering Period.

- •

- On February 17, 2005, Goldcorp and Goldcorp ULC paid for 403,165,952 Common Shares deposited pursuant to the Goldcorp Offer, representing approximately 70% of the outstanding Common Shares. Between February 17, 2005 and March 10, 2005, Goldcorp and Goldcorp ULC took up and paid for an additional 67,213,178 Common Shares, which brought the aggregate holdings of Goldcorp and Goldcorp ULC to 470,379,130 Common Shares, representing approximately 82% of the outstanding Common Shares.

- •

- On February 28, 2005, Goldcorp paid the special dividend declared on February 8, 2005 to Goldcorp shareholders of record on February 16, 2005. The special dividend was not paid to holders of Common Shares who tendered their Common Shares to the Goldcorp Offer. On the same day, the Goldcorp Offer expired.

In addition, during 2004 Wheaton and IAMGold Corporation entered into an arrangement agreement proposing the acquisition of Wheaton by IAMGold Corporation and Wheaton was subject to an unsolicited take-over bid from Coeur d'Alene Mines Corporation. The details of such proposals are set out in the directors' circular of Wheaton dated December 29, 2004 in respect of the Goldcorp Offer (the "Wheaton Directors Circular") under the heading "Background to the Goldcorp Offer" (which section of the Wheaton Directors Circular is incorporated by reference herein).

2

RECOMMENDATION OF THE BOARD OF DIRECTORS

After considering the terms of the Arrangement, together with the matters summarized below, the Board of Directors unanimously determined on March 14, 2005 that the Arrangement is fair to Shareholders (excluding Goldcorp and its affiliates and associates) and is in the best interests of Wheaton.The Board of Directors unanimously recommends that Shareholders VOTE IN FAVOUR of the Arrangement Resolution.

In making its determination and recommendation, the Board of Directors considered a number of factors, including:

- •

- The reasons for the combination of Goldcorp and Wheaton referred to in the Wheaton Directors Circular under the heading "Recommendation of the Special Committee to the Board of Directors" (which section of the Wheaton Directors Circular is incorporated by reference herein). Such reasons assumed that Goldcorp would acquire all of the Common Shares not acquired by it under the Goldcorp Offer in a subsequent acquisition transaction.

- •

- The consideration that Shareholders (other than Goldcorp and Dissenting Shareholders) will receive for each Common Share pursuant to the Arrangement is identical to the consideration per Common Share that was received by Shareholders under the Goldcorp Offer.

- •

- In connection with the Goldcorp Offer, Merrill, Lynch, Pierce, Fenner & Smith Incorporated provided to the Board of Directors an opinion that, as of February 7, 2005 and subject to the assumptions and qualifications contained therein, the share exchange ratio under the Goldcorp Offer is fair, from a financial point of view, to the Shareholders (the "Fairness Opinion"). The Fairness Opinion assumed that Goldcorp would acquire all of the Common Shares not acquired by it under the Goldcorp Offer in a subsequent acquisition transaction. A copy of the Fairness Opinion is attached to this Circular as Schedule G.

- •

- The Arrangement would allow Goldcorp to acquire all Common Shares not acquired by it under the Goldcorp Offer. This would facilitate the realization of the synergies contemplated by the combination of Goldcorp and Wheaton, including the reduction of public company costs.

- •

- The reduced liquidity of the Common Shares as a result of the acquisition of approximately 82% of the Common Shares by Goldcorp and Goldcorp ULC pursuant to the Goldcorp Offer and the significantly greater liquidity of the Goldcorp Shares.

- •

- The Arrangement has been structured in a manner such that the consideration under the Arrangement should be received on a tax-deferred "rollover" basis for Canadian and U.S. federal income tax purposes by Canadian and U.S. Shareholders and holders of Wheaton Warrants. See "Certain Canadian Federal Income Tax Considerations" and "Certain United States Federal Income Tax Considerations".

- •

- Goldcorp and Wheaton agreed in the Acquisition Agreement that upon satisfaction of the minimum tender condition of the Goldcorp Offer, they would take all necessary steps to proceed with a subsequent acquisition transaction so that Goldcorp may acquire all Common Shares not acquired by Goldcorp under the Goldcorp Offer.

The foregoing summary of the factors considered by the Board of Directors is not intended to be exhaustive of all of the factors considered by the Board of Directors in reaching its conclusions and making its recommendation. The members of the Board of Directors evaluated the various factors summarized above in light of their own knowledge of the business, financial condition and prospects of Wheaton and Goldcorp and based upon the advice of its advisors. In view of the numerous factors considered in connection with their evaluation of the Arrangement, the Board of Directors did not find it practicable to, and did not, quantify or otherwise attempt to assign relative weight to specific factors in reaching its conclusions and recommendation. In addition, individual members of the Board of Directors may have given different weight to different factors.

The process followed by the Board of Directors and the special committee to the Board of Directors in approving the Acquisition Agreement and recommending that Shareholders accept the Goldcorp Offer is set out in the Wheaton Directors Circular under the headings "Background to the Goldcorp Offer" and "Recommendation of the Board of Directors" (which sections of the Wheaton Directors Circular are incorporated by reference herein).

3

THE ARRANGEMENT

The Arrangement effects a series of transactions as a result of which Goldcorp will acquire all of the Common Shares that it does not own for consideration of 0.25 of a Goldcorp Share per Common Share (except for Common Shares held by Dissenting Shareholders). The terms of the Arrangement are set out in the Arrangement Agreement, which is attached as Schedule B to this Circular, and the Plan of Arrangement, which is attached as Exhibit A to the Arrangement Agreement. The following summary of the Arrangement and the Arrangement Agreement is qualified in its entirety by the full text of the Arrangement Agreement and the Plan of Arrangement, which Shareholders are urged to read in full.

Pre-Arrangement Steps

Prior to the Arrangement, Goldcorp ULC will be wound up and, on or prior to the winding-up, all of its assets will be transferred to Goldcorp and Goldcorp will assume all of the liabilities of Goldcorp ULC. As a result, all Common Shares held by Goldcorp ULC will be transferred to Goldcorp.

Conditions to and Required Approvals for the Arrangement

Conditions under the Arrangement Agreement

The obligations of Wheaton and Goldcorp to complete the Arrangement are subject to the fulfilment of the following conditions:

- (a)

- the winding-up of Goldcorp ULC shall have been completed;

- (b)

- the Arrangement Resolution shall have been approved by the vote of Shareholders at the Meeting required pursuant to the Interim Order;

- (c)

- there shall not be in force any order or decree of a court or other tribunal of competent jurisdiction restraining or enjoining the consummation of the Arrangement;

- (d)

- all consents, orders, regulations and approvals, including regulatory and judicial approvals and orders, required or necessary for the completion of the Arrangement shall have been obtained or received from the persons, authorities or bodies having jurisdiction in the circumstances, and none of such consents, orders, regulations or approvals shall contain terms or conditions that are unsatisfactory or unacceptable to Goldcorp or Wheaton, acting reasonably;

- (e)

- the Interim Order shall have been granted in form and substance satisfactory to Goldcorp and Wheaton, acting reasonably;

- (f)

- the Final Order shall have been granted in form and substance satisfactory to Goldcorp and Wheaton, acting reasonably, and shall not have been set aside or modified in a manner unacceptable to such parties on appeal or otherwise; and

- (g)

- the number of Common Shares held by Shareholders that have validly exercised their dissent rights in respect of the Arrangement shall not exceed 5% of the number of Common Shares outstanding on March 14, 2005.

The foregoing conditions are for the benefit of each of Wheaton and Goldcorp and may be waived, in whole or in part, by either of Wheaton or Goldcorp. If any of the foregoing conditions are not satisfied or waived on or before June 28, 2005, or such other date as may be agreed, then Wheaton or Goldcorp may terminate the Arrangement Agreement.

Shareholder Approval

The Interim Order requires the approval of the Arrangement Resolution by at least 662/3% of the votes cast by Shareholders present in person or represented by proxy at the Meeting. Goldcorp and Goldcorp ULC currently own 470,379,130 Common Shares, representing approximately 82% of the outstanding Common Shares.Goldcorp and Goldcorp ULC have agreed in the Arrangement Agreement to vote all Common Shares held by them (including, in the case of Goldcorp, Common Shares it acquires on the winding-up of

4

Goldcorp ULC) for the approval of the Arrangement Resolution. Therefore, the approval of the Arrangement Resolution by the Shareholders is assured based on the number of Common Shares currently outstanding.

Court Approval

An arrangement of a corporation under the OBCA requires Court approval. Prior to the mailing of this Circular, Wheaton obtained the Interim Order authorizing Wheaton to call, hold and conduct the Meeting in accordance with the Notice of Special Meeting, the OBCA and the Interim Order and, in that connection, to submit the Arrangement to the Meeting and to seek approval thereof from the Shareholders in the manner set forth in the Interim Order. A copy of the Interim Order is attached to this Circular as Schedule D.

Subject to the requisite approval of the Arrangement Resolution, the hearing in respect of the Final Order is scheduled to take place on April 14, 2005 at 10:00 a.m. (Toronto time) in the Court at 393 University Avenue, Toronto, Ontario, or as soon thereafter as is reasonably practicable. At the hearing, any Shareholder or other interested party who wishes to participate or to be represented or to present evidence or argument may do so, subject to filing with the Court a notice in accordance with the Ontario Rules of Civil Procedure, serving such notice setting out the basis for opposition and a copy of the materials to be used to oppose the application upon the solicitors of Wheaton and Goldcorp and upon all other parties who have filed a notice of appearance before 5:00 p.m. (Toronto time) on April 8, 2005 or such shorter time as the Court, by order, may allow. At the hearing for the Final Order, the Court will consider, among other things, the fairness and reasonableness of the Arrangement. The Court may approve the Arrangement either as proposed or as amended in any manner the Court may direct, subject to compliance with such terms and conditions, if any, as the Court deems fit. The Notice of Application for the Final Order is attached to this Circular as Schedule E.

Plan of Arrangement

Assuming the Final Order is granted, and that the other conditions set forth in the Arrangement Agreement are satisfied or waived, then articles of arrangement will be filed with the Director appointed pursuant to the OBCA to give effect to the Arrangement. Upon filing of such articles of arrangement, pursuant to the Plan of Arrangement, at the commencement of the day (the "Effective Time") shown on the certificate of arrangement issued under the OBCA giving effect to the Arrangement (the "Effective Date"), the following will occur and will be deemed to have occurred in the following order without any further act or formality:

- (a)

- Wheaton and Goldcorp Subco will be amalgamated and continue as one company under the OBCA and the following provisions will apply to Amalgamated Wheaton:

- (i)

- the name of Amalgamated Wheaton will be "Wheaton River Minerals Ltd." and the registered office of Amalgamated Wheaton will be located at 145 King Street West, Suite 2700, Toronto, Ontario M5H 1J8;

- (ii)

- the authorized capital of Amalgamated Wheaton will be an unlimited number of common shares with the rights, privileges, restrictions and conditions described in Schedule A to the Plan of Arrangement;

- (iii)

- there will be no restrictions on the business which Amalgamated Wheaton is authorized to carry on or the powers which Amalgamated Wheaton may exercise;

- (iv)

- the board of directors of Amalgamated Wheaton will, until otherwise changed in accordance with the OBCA, consist of a minimum of one and a maximum of 10 directors. The number of directors of Amalgamated Wheaton will initially be three. The first directors of Amalgamated Wheaton will be the persons whose names and municipality of residence appear below:

Name

| | Municipality of Residence

|

|---|

| Ian W. Telfer | | West Vancouver, British Columbia |

| Peter Barnes | | North Vancouver, British Columbia |

| R. Gregory Laing | | Oakville, Ontario |

5

- (b)

- on the amalgamation referred to in paragraph (a) above:

- (i)

- each issued and outstanding Common Share held by Shareholders (other than Dissenting Shareholders and Goldcorp) will be cancelled and, subject to rounding for fractional shares, each Shareholder (other than Dissenting Shareholders and Goldcorp) will be issued by Goldcorp 0.25 of a Goldcorp Share for each of such holder's Common Shares so cancelled;

- (ii)

- each issued and outstanding Common Share held by Goldcorp will be exchanged for one common share of Amalgamated Wheaton;

- (iii)

- each issued and outstanding common share of Goldcorp Subco will be exchanged for one common share of Amalgamated Wheaton;

- (iv)

- all of the issued and outstanding Wheaton Series A Warrants will be cancelled and each holder thereof will be issued by Goldcorp one Goldcorp Series A Warrant for each of such holder's Wheaton Series A Warrants so cancelled;

- (v)

- all of the issued and outstanding Wheaton Series B Warrants will be cancelled and each holder thereof will be issued by Goldcorp one Goldcorp Series B Warrant for each of such holder's Wheaton Series B Warrants so cancelled;

- (vi)

- all of the issued and outstanding Wheaton Share Purchase Warrants will be cancelled and each holder thereof will be issued by Goldcorp one Goldcorp Share Purchase Warrant for each of such holder's Wheaton Share Purchase Warrants so cancelled; and

- (vii)

- all of the issued and outstanding Wheaton Options will be cancelled and each holder thereof will be issued by Goldcorp a Goldcorp Option to acquire that number of Goldcorp Shares equal to the number of Common Shares to which such holder was entitled to receive upon the exercise of such holder's Wheaton Option multiplied by 0.25 (rounded down to the nearest whole number) at an exercise price per Goldcorp Share equal to the exercise price per Common Share pursuant to such holder's Wheaton Option multiplied by four, for each of such holder's Wheaton Options so cancelled;

- (c)

- in consideration for Goldcorp issuing Goldcorp Shares to Shareholders (other than Dissenting Shareholders and Goldcorp) pursuant to paragraph (b)(i) above, Amalgamated Wheaton will issue to Goldcorp that number of common shares of Amalgamated Wheaton equal to 25% of the number of Goldcorp Shares issued to Shareholders pursuant to paragraph (b)(i) above;

- (d)

- in consideration for Goldcorp issuing Goldcorp Series A Warrants to holders of Wheaton Series A Warrants pursuant to paragraph (b)(iv) above, Amalgamated Wheaton will issue to Goldcorp that number of common shares of Amalgamated Wheaton equal to the number of Wheaton Series A Warrants cancelled pursuant to paragraph (b)(iv) above;

- (e)

- in consideration for Goldcorp issuing Goldcorp Series B Warrants to holders of Wheaton Series B Warrants pursuant to paragraph (b)(v) above, Amalgamated Wheaton will issue to Goldcorp that number of common shares of Amalgamated Wheaton equal to the number of Wheaton Series B Warrants cancelled pursuant to paragraph (b)(v) above;

- (f)

- in consideration for Goldcorp issuing Goldcorp Share Purchase Warrants to holders of Wheaton Share Purchase Warrants pursuant to paragraph (b)(vi) above, Amalgamated Wheaton will issue to Goldcorp that number of common shares of Amalgamated Wheaton equal to the number of Wheaton Share Purchase Warrants cancelled pursuant to paragraph (b)(vi) above;

6

- (g)

- in consideration for Goldcorp issuing Goldcorp Options to holders of Wheaton Options pursuant to paragraph (b)(vii) above, Amalgamated Wheaton will issue to Goldcorp that number of common shares of Amalgamated Wheaton equal to the number of Common Shares that could be purchased if all the Wheaton Options cancelled pursuant to paragraph (b)(vii) above were exercised instead of cancelled;

- (h)

- each Shareholder who is entitled to receive under the Arrangement Goldcorp Shares will be removed from the register of holders of Common Shares and, subject to the submission of a Letter of Transmittal accompanied by the relevant certificates formerly representing Common Shares, added to the register of holders of Goldcorp Shares;

- (i)

- each holder of Wheaton Series A Warrants who is entitled to receive under the Arrangement Goldcorp Series A Warrants will be removed from the register of holders of Wheaton Series A Warrants and added to the register of holders of Goldcorp Series A Warrants;

- (j)

- each holder of Wheaton Series B Warrants who is entitled to receive under the Arrangement Goldcorp Series B Warrants will be removed from the register of holders of Wheaton Series B Warrants and added to the register of holders of Goldcorp Series B Warrants;

- (k)

- each holder of Wheaton Share Purchase Warrants who is entitled to receive under the Arrangement Goldcorp Share Purchase Warrants will be removed from the register of holders of Wheaton Share Purchase Warrants and added to the register of holders of Goldcorp Share Purchase Warrants; and

- (l)

- a voluntary winding-up of Amalgamated Wheaton into Goldcorp shall commence pursuant to section 197 of the OBCA, with such winding-up to be implemented in accordance with sections 193 to 205 of the OBCA and, in furtherance thereof, Amalgamated Wheaton and Goldcorp will enter into a general conveyance and assumption of liabilities agreement.

No fractional Goldcorp Shares will be issued pursuant to the Plan of Arrangement. Any fractional number of Goldcorp Shares equal to or greater than 0.5 will be rounded up to the nearest whole number and less than 0.5 will be rounded down to the nearest whole number.

Exchange of Share Certificates and Dividends

After the Effective Date, each former holder of Common Shares (other than Dissenting Shareholders and Goldcorp) will be entitled to receive Goldcorp Shares, upon receipt by the Depositary of a duly completed and executed Letter of Transmittal enclosed with this Circular accompanied by the certificates evidencing the Common Shares held by such Shareholder. The Depositary will deliver to such Shareholder (i) a certificate representing the number of Goldcorp Shares which such holder has the right to receive pursuant to the Plan of Arrangement and (ii) any dividends or other distributions declared or made with respect to such Goldcorp Shares with a record date on or after the Effective Date and which have been paid by Goldcorp. The certificate which immediately prior to the Effective Time represented such Common Shares will be cancelled. Until surrendered, each certificate which immediately prior to the Effective Time represented Common Shares will be deemed at and after the Effective Time to represent only the right to receive on its surrender (i) a certificate representing the Goldcorp Shares to which its holder is entitled pursuant to the Plan of Arrangement and (ii) any dividends or other distributions declared or made with respect to such Goldcorp Shares with a record date on or after the Effective Date.

Prior to the time of surrender of any certificate which immediately prior to the Effective Time represented Common Shares, any dividends or other distributions declared or made with respect to Goldcorp Shares with a record date on or after the Effective Date which the holder of such certificate is entitled to receive, will be made or paid to the Depositary to be held by it in trust for such holder. All monies so held in trust by the Depositary will be deposited in an interest-bearing account and any interest earned on such funds will be for the account of Goldcorp.

Details of the procedures for the submission of Letters of Transmittal to the Depositary, accompanied by certificates evidencing Common Shares, are set out in the Letter of Transmittal accompanying this Circular. Shareholders who have not received a Letter of Transmittal should contact the Depositary. Each Shareholder must submit a properly completed and signed Letter of Transmittal, accompanied by certificates evidencing its

7

Common Shares, in order to receive certificates evidencing the Goldcorp Shares to which it is entitled pursuant to the Arrangement. Any use of the mail to transmit share certificates and Letters of Transmittal is at the risk of the Shareholder. If such documents are to be mailed, it is recommended that registered mail, properly insured, be used with acknowledgment of receipt requested.

Certificates Not Surrendered

Any certificate or certificates which immediately prior to the Effective Time represented Common Shares that were cancelled pursuant to the Arrangement but which have not been surrendered, together with a Letter of Transmittal, to the Depositary on or prior to the fifth anniversary of the Effective Date will, subject to applicable law, cease to represent a claim or interest of any kind or nature as a shareholder of Wheaton, Amalgamated Wheaton or Goldcorp. On such date, the Goldcorp Shares to which the former holder of the certificate or certificates referred to in the preceding sentence was ultimately entitled will be deemed to have been surrendered to Goldcorp, together with all entitlements to dividends, distributions and interests thereon held for such holder.

Effective Date of the Arrangement

If the Meeting is held on April 12, 2005, as scheduled, and not adjourned or postponed, and provided that all other conditions precedent to the Arrangement, other than the obtaining of the Final Order, have been satisfied, Wheaton intends to apply to the Court for the Final Order permitting the Arrangement to be effected on April 14, 2005. It is not possible to specify exactly when the Effective Date of the Arrangement will occur, although Wheaton currently anticipates that the Effective Date will be April 15, 2005.

The Effective Date could be delayed for a number of reasons, including an objection before the Court at its hearing of the motion for the Final Order. As soon as the Effective Date has been determined, it will be publicized through the issuance of a press release by Goldcorp.

Treatment of Wheaton Warrants and Wheaton Options

Wheaton Warrants

As at March 11, 2005, there were 56,282,637 Wheaton Series A Warrants, 64,136,974 Wheaton Series B Warrants and 54,359,322 Wheaton Share Purchase Warrants outstanding.

Pursuant to the existing terms of the Wheaton Warrant Indentures, upon the exercise of any Wheaton Warrants after the implementation of an arrangement or an amalgamation involving Wheaton, each holder of Wheaton Warrants is entitled to receive, in lieu of the number of Common Shares otherwise issuable upon such exercise, that number of shares or any other consideration paid in such arrangement or amalgamation which such holder would have been entitled to receive as a result of such arrangement or amalgamation, if such holder had been the registered holder of the number of Common Shares to which such holder was entitled upon such exercise immediately prior to the effective time of such arrangement or amalgamation.

While the above result is provided for under the Wheaton Warrant Indentures, the Board of Directors, upon the advice of its advisors, determined to include the cancellation of Wheaton Warrants and the issuance of Goldcorp Warrants in consideration for such cancellation in the Plan of Arrangement on terms economically equivalent to the result arising under the existing terms of the Wheaton Warrant Indentures to ensure that the holders of Wheaton Warrants do not have a taxable disposition of such warrants for Canadian federal income tax purposes. See "Certain Canadian Federal Income Tax Considerations".

The Plan of Arrangement provides that all of the Wheaton Warrants will be cancelled and each holder thereof will be issued by Goldcorp one Goldcorp Warrant entitling the holder thereof to purchase 0.25 of a Goldcorp Share (at an exercise price per 0.25 of a Goldcorp Share equal to the exercise price per Common Share under the relevant Wheaton Warrant) for each of such holder's Wheaton Warrants so cancelled. However, Goldcorp Warrants may only be exercised for whole Goldcorp Shares.

8

Goldcorp has applied to list all classes of the Goldcorp Warrants on the TSX and to reserve for listing on the TSX and the NYSE the Goldcorp Shares issuable upon exercise of the Goldcorp Warrants. Goldcorp intends to apply to list the Goldcorp Share Purchase Warrants and the Goldcorp Series A Warrants on the NYSE. The Goldcorp Series B Warrants issued upon cancellation of the outstanding Wheaton Series B Warrants will constitute "restricted" securities under the Securities Act to the same extent that such outstanding Wheaton Series B Warrants constitute "restricted" securities.

Holders of Wheaton Warrants are not required to deposit their Wheaton Warrant certificates to take advantage of the treatment of the Wheaton Warrants pursuant to the Plan of Arrangement. After the Effective Time, certificates formerly representing Wheaton Warrants will be deemed to represent Goldcorp Warrants on the basis provided for in the Plan of Arrangement, provided that upon any transfer of certificates formerly representing Wheaton Warrants after the Effective Time, Goldcorp will issue a new certificate representing the relevant Goldcorp Warrants and such certificate formerly representing Wheaton Warrants will be deemed to be cancelled.

Wheaton Options

As at March 11, 2005, Wheaton Options to purchase an aggregate of 20,272,498 Common Shares were outstanding.

All Wheaton Options are currently exercisable pursuant to their terms and the Wheaton Share Option Plans. The Wheaton Share Option Plans provide that in the event of, among other things, an exchange of Common Shares, the Wheaton Board of Directors may make such provision for the protection of the rights of the participants in the Wheaton Share Option Plans as the Board of Directors, in its discretion, deems appropriate. The determination of the Board of Directors as to any adjustment, or as to there being no need for adjustment, will be final and binding on all parties. The Arrangement constitutes an event entitling the Board of Directors to make such provision.

The Plan of Arrangement provides that all of the Wheaton Options will be cancelled and each holder thereof will be issued by Goldcorp a Goldcorp Option to acquire such number of Goldcorp Shares equal to the number of Common Shares to which such holder was entitled to receive upon the exercise of such holder's Wheaton Option multiplied by 0.25 (rounded down to the nearest whole number) at an exercise price per Goldcorp Share equal to the exercise price per Common Share pursuant to such holder's Wheaton Option multiplied by four, for each of such holder's Wheaton Options so cancelled.

Dissent Rights

A registered Shareholder is entitled to dissent under the Plan of Arrangement and to be paid the fair value of such Shareholder's Common Shares if such Shareholder duly objects to the Arrangement Resolution and the Arrangement becomes effective. The Plan of Arrangement provides for dissent rights that are substantially similar to those provided for under section 185 of the OBCA. The following summary is otherwise qualified in its entirety by the Plan of Arrangement and the provisions of section 185 of the OBCA, the text of which is set forth as Schedule F to this Circular.

In addition to any other right that a Dissenting Shareholder may have, a Dissenting Shareholder who complies with the dissent procedures of the Plan of Arrangement and the Interim Order is entitled, when the Arrangement becomes effective, to require Wheaton to pay such Shareholder the fair value of such Shareholder's Common Shares, determined as of the close of business on the date before the Arrangement Resolution is adopted. A registered Shareholder wishing to exercise such right must ensure that the Executive Vice President and Chief Financial Officer of Wheaton, at 200 Burrard Street, Suite 1560, Vancouver, British Columbia V6C 3L6 (fax: (604) 696-3001), shall have received from such Dissenting Shareholder prior to 5:00 p.m. (Toronto time) on the last business day preceding the Meeting, a Notice of Dissent to the Arrangement Resolution with respect to all the Common Shares held by such Shareholder.

The Arrangement Agreement provides that it is a condition to the completion of the Arrangement for the benefit of Wheaton and Goldcorp that dissent rights shall not have been exercised by Shareholders holding more than 5% of the number of Common Shares outstanding on March 14, 2005. If Shareholders holding in excess of

9

this number of Common Shares exercise their dissent rights, unless the condition is waived, the Arrangement will not occur.

Section 185 of the OBCA provides that a shareholder may only make a claim under the section with respect to all the shares of a class held by the shareholder on behalf of any one beneficial owner and registered in the shareholder's name. One consequence of the provision is that a holder of Common Shares may only exercise the right to dissent under section 185 in respect of Common Shares which are registered in that holder's name. In many cases, shares beneficially owned by a person are registered in the name of an intermediary or a clearing agency. Accordingly, a non-registered Shareholder will not be entitled to exercise the right to dissent under section 185 directly (unless the Common Shares are re-registered in the non-registered Shareholder's name). A non-registered Shareholder who wishes to exercise the right of dissent should immediately contact the intermediary with whom the non-registered Shareholder deals with in respect of his or her Common Shares and either (i) instruct the intermediary to exercise the right to dissent on the non-registered Shareholder's behalf (which, if the Common Shares are registered in the name of a clearing agency, would require that the Common Shares first be re-registered in the name of the intermediary), or (ii) instruct the intermediary to re-register the Common Shares in the name of the non-registered Shareholder, in which case the non-registered Shareholder would have to exercise the right to dissent directly.

The filing of a Notice of Dissent does not deprive a Shareholder of the right to vote at the Meeting; however the OBCA provides, in effect, that a Shareholder who has submitted a Notice of Dissent and who votes in favour of the Arrangement Resolution will be deprived of further rights under section 185 of the OBCA. The OBCA does not provide, and Wheaton will not assume, that a vote against the Arrangement Resolution or an abstention constitutes a Notice of Dissent, but a Shareholder need not vote his or her Common Shares against the Arrangement Resolution in order to dissent. Similarly, the revocation of a proxy conferring authority on the proxyholder to vote in favour of the Arrangement Resolution does not constitute a Notice of Dissent. However, any proxy granted by a Shareholder who intends to dissent, other than a proxy that instructs the proxyholder to vote against the Arrangement Resolution, should be validly revoked in order to prevent the proxyholder from voting such Common Shares in favour of the Arrangement Resolution and thereby causing the Shareholder to forfeit his or her right to dissent.

Within 10 days of the Shareholders adopting the Arrangement Resolution, Wheaton is required to notify each Dissenting Shareholder in writing that the Arrangement Resolution has been adopted, unless the Dissenting Shareholder voted in favour of the Arrangement Resolution or has withdrawn such Shareholder's Notice of Dissent. That notice must set out the rights of the Dissenting Shareholder and the procedures to be followed to exercise those rights. A Dissenting Shareholder shall, within 20 days after such Shareholder receives notice of the adoption of the Arrangement Resolution, or if such Shareholder does not receive such notice, within 20 days after such Shareholder learns that the Arrangement Resolution has been adopted, send to Wheaton a written notice (the "Demand for Payment") containing such Shareholder's name and address, the number of Common Shares in respect of which such Shareholder dissents and a Demand for Payment of the fair value of the Common Shares held by such Shareholder. Within 30 days of the sending of such Shareholder's Demand for Payment, the Dissenting Shareholder must send the certificates representing the Common Shares in respect of which such Shareholder dissents to Wheaton or Wheaton's transfer agent. Wheaton or its transfer agent will endorse thereon notice that the Shareholder is a Dissenting Shareholder and will then return the share certificates to the Dissenting Shareholder. After sending a Demand for Payment, a Dissenting Shareholder ceases to have any rights as a Shareholder other than the right to be paid the fair value of the Common Shares held by such Shareholder, except where (i) the Dissenting Shareholder withdraws such Shareholder's Demand for Payment before Wheaton makes an offer to the Dissenting Shareholder in accordance with the OBCA; (ii) Wheaton fails to make an offer as hereinafter described and the Dissenting Shareholder withdraws such Shareholder's Demand for Payment; or (iii) the Arrangement Agreement is terminated; in which case such Shareholder's rights as a Shareholder are reinstated as of the date such Shareholder sent the Demand for Payment. Not later than seven days after the later of the Effective Date and the day Wheaton receives a Demand for Payment, Wheaton is required to send to each Dissenting Shareholder who has sent a Demand for Payment, an offer to pay for the Common Shares of the Dissenting Shareholder in an amount considered by the Board of Directors to be the fair value thereof, accompanied by a statement showing how the fair value was

10

determined, or, if applicable, a notification that Wheaton is unable lawfully to pay Dissenting Shareholders for their Common Shares.

Every offer to pay for Common Shares held by Dissenting Shareholders must be on the same terms and is to be paid by Wheaton within 10 days of the acceptance, but an offer to pay lapses if Wheaton has not received an acceptance thereof within 30 days of making the offer to pay. If an offer to pay is not made by Wheaton or if a Dissenting Shareholder does not accept an offer to pay, Wheaton may within 50 days after the Effective Date, or within such further period as the Court may allow, apply to the Court to fix a fair value for the Common Shares of any Dissenting Shareholder. At the present time, Wheaton does not intend to apply to the Court to fix a fair value for the Common Shares. If Wheaton fails to apply to the Court, a Dissenting Shareholder may apply to the Court for the same purpose within a further period of 20 days or within such further period as the Court may allow.

Before making an application to the Court, or not later than seven days after receiving notice of an application to the Court by a Dissenting Shareholder, as the case may be, Wheaton shall give to each Dissenting Shareholder who, at the date upon which the notice is given (a) has sent to Wheaton a Demand for Payment and (b) has not accepted the offer to pay made by Wheaton, notice of the date, place and consequences of the application and of such Shareholder's right to appear and be heard in person or by counsel. A similar notice shall be given to each Dissenting Shareholder who, after the date of such first mentioned notice and before the termination of the proceedings commenced by the application, satisfies the conditions in (a) and (b) above within three days after such Shareholder satisfies such conditions. All Dissenting Shareholders who satisfy the conditions in (a) and (b) above shall be deemed to be joined in the application on the later of the date upon which the application is brought and the date upon which they satisfy the conditions, and such Shareholders are bound by the decision rendered by the Court in the proceedings commenced by the application. Upon an application to the Court, the Court may determine whether any other person is a Dissenting Shareholder who should be joined as a party and the Court is to fix a fair value for the Common Shares of all Dissenting Shareholders.

A Shareholder who dissents but elects to receive the fair value of such Shareholder's Common Shares and does not accept the offer to pay made by Wheaton, or if the offer to pay lapses and Wheaton has not received an acceptance thereof, will be bound to accept the amount determined by the Court to be the fair value of the Common Shares even if such amount is lower than the amount offered by Wheaton.

The above is only a summary of the dissent rights granted in the Plan of Arrangement and the Interim Order, which are technical and complex. It is suggested that any Shareholders wishing to avail themselves of their rights under those provisions seek their own legal advice, as failure to comply strictly with the provisions of the Plan of Arrangement, the Interim Order and the OBCA may prejudice their right of dissent.

Common Shares held by a Dissenting Shareholder will not be acquired by Wheaton on the Effective Date. Notwithstanding the above, Dissenting Shareholders who duly exercise dissent rights and who are ultimately entitled to be paid fair value for their Common Shares shall be deemed to have transferred their Common Shares without any further authorization, act or formality and free and clear of all liens, charges, claims and encumbrances, to Wheaton in consideration of a payment equal to such fair value, contemporaneously with the first step of the Arrangement described above under "- Plan of Arrangement". Shareholders who exercise, or purport to exercise, dissent rights, and who are ultimately determined not to be entitled, for any reason, to be paid fair value for their Common Shares, will be deemed to have participated in the Arrangement on the same basis as any non-dissenting Shareholder as at and from the Effective Time.

Expenses of the Arrangement

All fees and expenses incurred by Wheaton in connection with the Arrangement, including, without limitation, financial advisors' fees, filing fees, legal and accounting fees and printing and mailing costs will be paid for by Goldcorp. For greater certainty, Goldcorp will not pay for fees and expenses incurred by Wheaton in respect of the Goldcorp Offer. Wheaton expects to incur C$375,000 in expenses in connection with the Arrangement.

11

PLANS FOR WHEATON FOLLOWING THE ARRANGEMENT

Following the Arrangement, an application will be made to the Ontario Securities Commission and to the securities regulatory authorities in the other provinces of Canada where Wheaton is a reporting issuer for orders deeming Wheaton to no longer be a reporting issuer for purposes of applicable Canadian securities legislation. In addition, following the Arrangement, an application will be made to delist the Common Shares from the TSX and the AMEX and to deregister the Common Shares under the U.S. Exchange Act. Upon such orders being issued and such delistings and deregistering being effected, Wheaton will no longer be subject to the ongoing disclosure and other obligations currently imposed upon Wheaton as a reporting issuer under the securities laws of Canada and the United States.

GOLDCORP

Goldcorp is a North American based gold producer. Goldcorp owns and acquires properties, explores for precious metals, develops mines and produces primarily gold. Goldcorp owns one of the highest-grade gold deposits in the world, the Red Lake Mine, which is located in Ontario, Canada and has produced more than 500,000 ounces of gold annually since 2001. The Red Lake Mine is the largest producing gold mine in Canada. Goldcorp also produces gold at the Wharf Mine in the historic Lead mining area in the Black Hills of South Dakota in the United States. Goldcorp also owns an industrial minerals operation, Saskatchewan Minerals, in Saskatchewan, Canada. It produces sodium sulphate used primarily in the detergent industry.

On February 17, 2005, Goldcorp and Goldcorp ULC took up and paid for 403,165,952 Common Shares pursuant to the Goldcorp Offer. From February 17, 2005 to March 10, 2005, Goldcorp and Goldcorp ULC took up and paid for an additional 67,213,178 Common Shares to bring their holdings to 470,379,130 Common Shares, representing approximately 82% of the outstanding Common Shares. In connection with the payment for these Common Shares, Goldcorp issued 125,602,711 Goldcorp Shares. Goldcorp expects to issue an additional approximately 28 million Goldcorp Shares upon the completion of the Arrangement.

The Goldcorp Shares are listed on the TSX and the NYSE under the symbols "G" and "GG", respectively. Goldcorp has applied to list the Goldcorp Shares to be issued pursuant to the Arrangement on the TSX and to reserve for listing on the TSX the Goldcorp Shares issuable upon exercise of the Goldcorp Warrants and the Goldcorp Options. Goldcorp has received conditional approval from the NYSE for the listing of the Goldcorp Shares to be issued pursuant to the Arrangement and the reservation for listing on the NYSE of the Goldcorp Shares issuable upon exercise of the Goldcorp Warrants and the Goldcorp Options.

Following the successful completion of the Arrangement and the winding-up of Amalgamated Wheaton into Goldcorp commenced as part of the Arrangement, the business of Wheaton will be carried on by Goldcorp.

Goldcorp ULC was formed solely for the purpose of making the Goldcorp Offer and is a wholly-owned subsidiary of Goldcorp. Goldcorp Subco was formed solely for the purpose of participating in the Arrangement and is a wholly-owned subsidiary of Goldcorp.

The consolidatedpro forma financial statements of Goldcorp giving effect to the acquisition of Wheaton as at and for the financial year ended December 31, 2004 are attached as Schedule C to this Circular.

Goldcorp's registered office is Suite 2700, 145 King Street West, Toronto, Ontario, Canada M5H 1J8. Effective February 25, 2005, Goldcorp's head office became Suite 1560, Waterfront Centre, 200 Burrard Street, Vancouver, British Columbia V6C 3L6.

Additional information regarding Goldcorp is incorporated by reference herein under "Documents Incorporated by Reference".

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following summary describes the principal Canadian federal income tax considerations of the Arrangement generally applicable to Shareholders and holders of Wheaton Warrants ("Warrantholders", and collectively with Shareholders, "Securityholders"). This summary is not applicable to a Securityholder that is a "financial institution", as defined in theIncome Tax Act (Canada) (the "Tax Act"), for purposes of the mark-to-market rules, that is a "specified financial institution", as defined in the Tax Act, or that is a

12

Securityholder an interest in which is a "tax shelter investment", as defined in the Tax Act. Such Securityholders should consult their own tax advisors.

This summary is based upon the current provisions of the Tax Act and the regulations thereunder in force as of the date hereof (the "Regulations") and counsel's understanding, based on publicly available published materials, of the current administrative practices of the Canada Revenue Agency ("CRA"). This summary takes into account all specific proposals to amend the Tax Act and the Regulations publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the "Tax Proposals"). This summary does not otherwise take into account or anticipate any changes in law or administrative practice whether by legislative, regulatory, administrative or judicial action, nor does it take into account tax legislation or considerations of any province, territory or foreign jurisdiction, which may differ significantly from those discussed herein.

This summary is of a general nature only and is not intended to be legal or tax advice to any particular Securityholder. This summary is not exhaustive of all Canadian federal income tax considerations. Accordingly, Securityholders should consult their own tax advisors having regard to their own particular circumstances.

Shareholders Resident in Canada

The following portion of the summary is generally applicable to a Shareholder who, at all relevant times for purposes of the Tax Act, is or is deemed to be resident in Canada, holds Common Shares, and will hold Goldcorp Shares acquired on the amalgamation of Goldcorp Subco and Wheaton pursuant to the Plan of Arrangement (the "Amalgamation"), as capital property, deals with Wheaton, Goldcorp and Goldcorp Subco at arm's length, and is not affiliated with Wheaton, Goldcorp or Goldcorp Subco (a "Resident Shareholder"). Generally, Common Shares and Goldcorp Shares will be capital property to a Shareholder provided the Shareholder does not hold the Common Shares or Goldcorp Shares in the course of carrying on a business and did not acquire the Common Shares or Goldcorp Shares as part of an adventure or concern in the nature of trade. Certain Resident Shareholders whose Common Shares or Goldcorp Shares might not otherwise be capital property may, in certain circumstances, be entitled to have such Common Shares or Goldcorp Shares, and all other "Canadian securities" as defined in the Tax Act, treated as capital property by making the irrevocable election permitted by subsection 39(4) of the Tax Act.

Participation in the Amalgamation

A Resident Shareholder will not realize a capital gain or capital loss as a result of the exchange of Common Shares for Goldcorp Shares on the Amalgamation and the cost of the Goldcorp Shares received will be equal to the aggregate adjusted cost base of the Common Shares to the Resident Shareholder immediately before the Amalgamation. The holder's cost of such Goldcorp Shares must be averaged with the adjusted cost base of any other Goldcorp Shares held by the holder at that time as capital property to determine the holder's adjusted cost base of each such Goldcorp Share.

Exercise of Dissent Rights

Under the current administrative practice of the CRA, Resident Shareholders who exercise their right of dissent in respect of the Arrangement should be considered to have disposed of their Common Shares for proceeds of disposition equal to the amount paid by Amalgamated Wheaton to any such dissenting Resident Shareholder therefor, other than interest awarded by a court. Such Shareholder will realize a capital gain (or a capital loss) equal to the amount by which such proceeds exceed (or are less than) the aggregate adjusted cost base of such Resident Shareholder's Common Shares and any reasonable costs of disposition. Because of uncertainties under the relevant legislation as to whether such amounts paid to a dissenting Resident Shareholder would be treated entirely as proceeds of disposition or in part as the payment of a deemed dividend, dissenting Resident Shareholders should consult with their own tax advisors in this regard. The taxation of capital gains and capital losses is described below under the heading "Taxation of Capital Gains and Capital Losses".

Any interest awarded to a dissenting Resident Shareholder by a court will be included in the Resident Shareholder's income for the purposes of the Tax Act and, where the Resident Shareholder is a "Canadian-controlled private corporation" (as defined in the Tax Act), will be included in its "aggregate investment

13

income" for purposes of the additional refundable tax described below under the heading "Taxation of Capital Gains and Capital Losses".

Holding and Disposing of Goldcorp Shares

In the case of a Resident Shareholder who is an individual, dividends received or deemed to be received on the Goldcorp Shares will be included in computing the Resident Shareholder's income, and will be subject to the gross-up and dividend tax credit rules normally applicable to taxable dividends received from taxable Canadian corporations.