UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 10-K

____________________

(Mark One) | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024 | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | | | |

| | For the transition period from to |

Commission File No.: 001-16753

AMN HEALTHCARE SERVICES, INC.

(Exact Name of Registrant as Specified in Its Charter) | | | | | | | | |

| Delaware | | 06-1500476 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| |

| 2999 Olympus Boulevard | Suite 500 | |

| Dallas | Texas | 75019 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (866) 871-8519

____________________

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of Each Class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01 par value | AMN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large Accelerated Filer | ☒ | | Accelerated filer | ☐ | | Non-accelerated filer | ☐ | |

| Smaller reporting company | ☐ | | Emerging growth company | ☐ | | | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☒ No ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2024, was $1,934,078,967 based on a closing sale price of $51.23 per share.

As of February 18, 2025, there were 38,189,048 shares of common stock, $0.01 par value, outstanding.

Documents Incorporated By Reference: Portions of the registrant’s definitive proxy statement for the annual meeting of stockholders scheduled to be held on May 2, 2025 have been incorporated by reference into Part III of this Form 10-K.

Auditor Name: KPMG LLP Auditor Location: San Diego, California Auditor Firm ID: 185

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Page |

| | |

| PART I | |

| | |

| 1. | | |

| 1A. | | |

| 1B. | | |

| 1C. | | |

| 2. | | |

| 3. | | |

| 4. | | |

| | |

| PART II | |

| | |

| 5. | | |

| 6. | | |

| 7. | | |

| 7A. | | |

| 8. | | |

| 9. | | |

| 9A. | | |

| 9B. | | |

| 9C. | | |

| | |

| PART III | |

| | |

| 10. | | |

| 11. | | |

| 12. | | |

| 13. | | |

| 14. | | |

| | |

| PART IV | |

| | |

| 15. | | |

| 16. | | |

| | |

References in this Annual Report on Form 10-K to “AMN Healthcare,” “AMN,” the “Company,” “we,” “us” and “our” refer to AMN Healthcare Services, Inc. and its wholly owned subsidiaries. This Annual Report contains references to our trademarks and service marks. For convenience, trademarks, service marks and trade names referred to in this Annual Report do not appear with the ®, TM, or SM symbols, but the lack of references is not intended to indicate that we will not assert our right to these trademarks, service marks and trade names.

PART I

10-K Introduction

This section provides an overview of AMN Healthcare Services, Inc. It does not contain all of the information you should consider. Please read the entire Annual Report on Form 10-K carefully before voting or making an investment decision.

| | | | | | | | |

| In Particular, Please See the Following Sections |

| Forward-Looking Statements | | Risk

Factors |

| | |

| Management’s Discussion & Analysis | | Financial

Statements |

| | |

Index of frequently requested 10-K information

| | | | | |

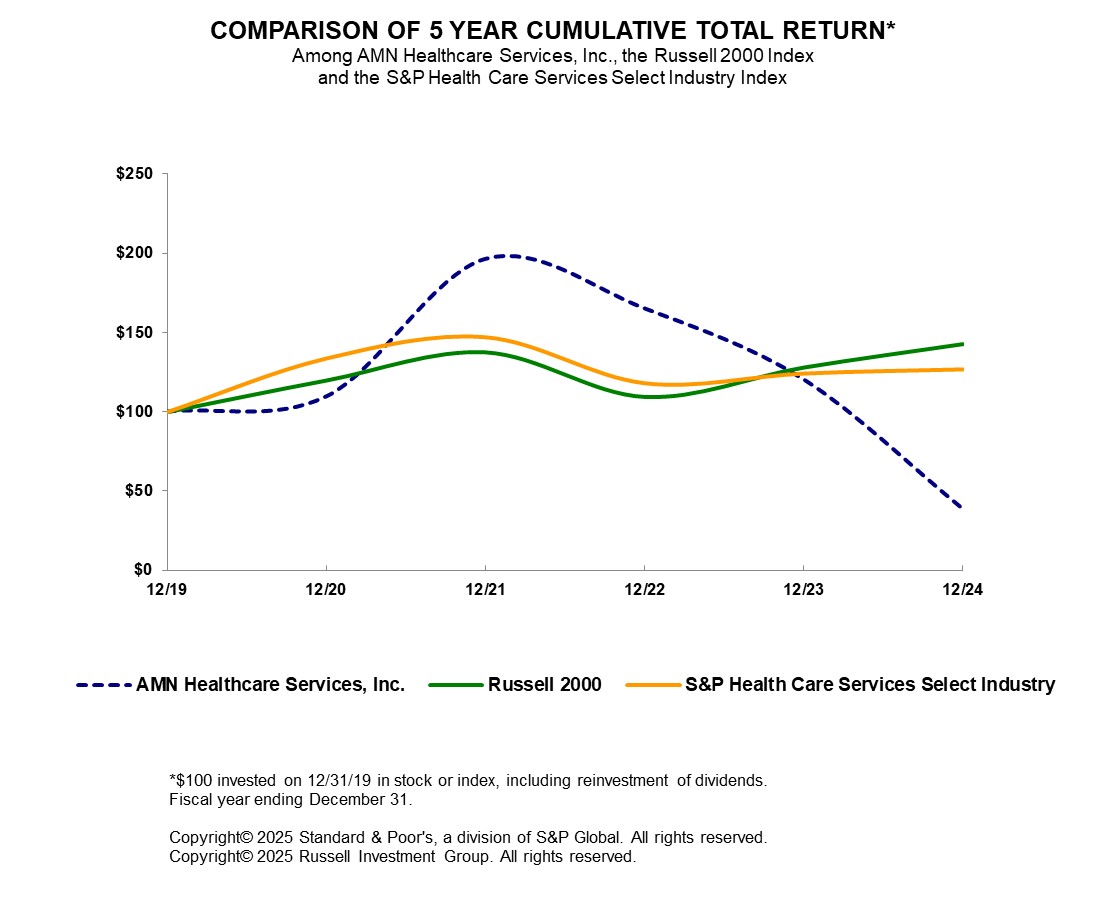

| Five-Year Performance Graph | |

| Results of Operations | |

| Liquidity and Capital Resources | |

| Financial Statement Footnotes | |

Item 1. Business

Overview of Our Company and Business Strategy

AMN Healthcare empowers the future of care through one of the nation’s broadest network of highly-qualified healthcare professionals. As the leader and innovator in total talent solutions for the healthcare sector in the United States, we tailor our solutions to our clients’ workforce challenges and goals, and provide staffing, talent optimization strategies, and technology solutions to support caregivers and patient care. We are passionate about all aspects of our mission to:

•Deliver the right talent and insights to help healthcare organizations optimize their workforce.

•Provide healthcare professionals opportunities to do their best work toward high-quality patient care.

•Create an innovative and values-based culture in which our team members can achieve their goals.

Our solutions enable our clients to build a quality, cost effective workforce, increase efficiency, and elevate the patient experience. Our comprehensive suite of talent solutions provides management, staffing, recruitment, language services, technology, predictive and market analytics, and related services to build and manage all or part of our clients’ healthcare workforce needs. We offer temporary and permanent career opportunities to our healthcare professionals, from nurses, physicians, and allied health professionals to healthcare leaders and executives in a variety of settings across the nation.

Our strategy is designed to support growth in the number and size of customer relationships and expansion of the markets we serve as care delivery settings continue to evolve and expand. Driving increased adoption of our numerous talent solutions through cross-selling will deepen and broaden our customer relationships. We will continue to innovate, develop and invest in new, complementary service and technology solutions that optimize and manage our clients’ workforce, enhance the patient experience, better engage our talent network and expand into different healthcare delivery settings. We expect this will enable us to expand our strategic customer relationships, while driving more recurring revenue, improve margin mix, and be less sensitive to economic cycles.

Over the past decade, our business has evolved beyond traditional healthcare staffing and recruitment services; we have become a strategic total talent solutions partner with our clients. We expanded our portfolio to serve a diverse and growing set of healthcare talent-related needs. In addition to our traditional staffing services, our suite of healthcare workforce solutions includes managed services programs (“MSP”), vendor management systems (“VMS”), medical language interpretation services, predictive labor analytics, workforce optimization technology and consulting, clinical labor scheduling, recruitment process outsourcing (“RPO”), and revenue cycle solutions. We enable clients to build, manage and optimize their healthcare talent to deliver great patient outcomes and experiences. Our talent network includes thousands of highly skilled, experienced professionals who trust us to place them in environments that expand and leverage their qualifications and expertise.

When developing and acquiring talent solutions, both services and technology, we consider many important criteria: (1) identifying and addressing the most pressing current and future needs of our clients and talent network; (2) alignment with our core operations, expertise, and access to healthcare professionals; (3) ways to deepen and broaden our client and healthcare professional relationships; (4) talent and technology solutions that expand the markets we serve; and (5) businesses that reduce our sensitivity to economic cycles and enhance our profitability.

Continuous improvement of our operations and business technology is a core component of our growth strategy and profitability goals. We have accelerated the integration of technology-based solutions in our core recruitment processes through investment in digital capabilities, mobile applications, brand consolidation and data analytics. These technology investments provide a more seamless and efficient workflow for our team members, our healthcare professionals and our clients. For example, during 2024, we launched WorkWise, a healthcare technology solution that quantifies staffing demand with predictive scheduling, automates workforce and vendor management in one solution, and seeks to improve the clinician experience. We added capabilities and functionalities for ShiftWise Flex, AMN Healthcare’s next-generation VMS that leverages the power of automation to increase efficiency of talent matching, credentialing, and candidate self-service, enabling our clients to develop sustainable workforces to deliver better outcomes for patients and caregivers alike. ShiftWise Flex is also integrated with AMN Passport, our top clinician-rated mobile application with more than 270,000 registered users as of January 2025. AMN Passport provides a centralized experience for nurses and allied professionals to find, book and manage assignments, access time and pay details, and receive instantaneous alerts and updates, while also creating operational efficiencies through the ability to customize job preferences, store and manage credentials, electronically sign important documents and contact our dedicated recruiters. We believe our investments in technology systems will help us realize greater scale, agility, speed, and cost efficiencies and will improve the experience for our healthcare professionals and clients.

Human Capital Management

Our human capital management strategy is a foundation of our business strategy as we strive to address the short- and long-term talent needs of our clients. Development of a broad base of healthcare professionals and corporate team members who feel valued, respected and supported is essential to driving shareholder value and achieving our long-term growth objectives. To support these objectives, our human capital management strategy focuses on talent acquisition, engagement, retention, employee well-being and belonging.

Employee Well-being

Our commitment to supporting the mental, physical, and economic well-being of our team members and healthcare professionals continued throughout 2024. The care, support and safety of our frontline healthcare professionals remains at the forefront for us. We have provided our healthcare professionals with additional support through access to employee assistance programs, on demand mental health resources through nonprofit partners and third-party vendors, wellness products and services to care for them while they are caring for our communities. We have also updated AMN Passport, our top clinician-rated mobile application, to allow users to see their impact on the patients they support. The app now includes an impact tracker in user profiles that shows the amount of patient care hours they provide and how many communities they serve over their career with us.

We also continued our AMN Healthcare Hardship Fund and our AMN Caring for Caregivers Fund, through which corporate team members and healthcare professionals, respectively, can receive financial support for qualifying events such as life-threatening or serious illnesses, natural disasters, funeral costs, or other events causing financial strain. This support is in addition to the insurance and other benefits and employee assistance programs available to support our team members and healthcare professionals.

To reward our employees for their efforts and dedication to advancing AMN Healthcare and supporting our clients and healthcare professionals and to further align their interests with that of our shareholders, we continued to offer an employee stock purchase plan (“ESPP”) to attract, motivate and retain employees and to provide a way for our employees to acquire an equity interest in our company.

For our corporate team members, we provide comprehensive benefit options, including health insurance, a prescription drug benefit, life and disability insurance, and paid time off. We also provide a variety of other voluntary programs to support

the health and well-being of our team members and their families, such as health and flexible spending accounts, family leave, adoption assistance, education assistance, retirement plans, employee assistance programs, and financial wellness programs.

We embrace a flexible work environment, with team members working a combination of in office and virtually to fully support our clients and healthcare professionals with the highest level of service, regardless of location and without disruption to our business operations. We believe it is important to bring our teams together to instill and reinforce our values-based culture, provide an opportunity to build meaningful connections with each other and the communities we serve as well as provide ongoing professional development and advancement opportunities. Our team members are located across the country, and we have offices in Dallas, TX; San Diego, CA; Boca Raton, FL; Florham Park, NJ; and Atlanta, GA.

As of December 31, 2024, we had 2,968 corporate team members, which includes both full-time and part-time employees. During the fourth quarter of 2024, we had an average of (1) 9,206 nurses, allied and other healthcare professionals, (2) 257 executive and clinical leadership interim staff, and (3) 2,819 medically qualified interpreters working for us. This does not include independent contractors, such as our locum tenens and contract interpreters, who were not our employees in 2024. In addition to our team members and independent contractors, we also leverage global partners to support our 24/7 client service model.

Learning and Professional Development

To help our team members and healthcare professionals achieve their personal and professional goals, we continue to make significant investments in our multi-faceted professional development programs.

We serve the clinical education needs of our healthcare professionals through a multi-pronged approach: pre-hire skills checklists to self-assess current clinical expertise, skills, and knowledge; pre-assignment knowledge assessments to test knowledge in a specialty practice area; pre-assignment required training; access to free continuing education courses while on assignment; and opportunities to transition into practice in specialty settings.

Throughout 2024, nearly 500 team members were promoted or transferred internally into new positions, representing approximately 17% of our corporate team members. Our professional development education assistance program provides reimbursement to our corporate team members to advance their knowledge and skills through certificate and degree programs. We offer leadership development curriculums led by our team of learning and talent development professionals for newly hired and promoted leaders, called LEAD at AMN, as well as a leadership curriculum for our individual contributors who are seeking leadership positions, which we call our emerging leaders program. Additionally, our mentorship program allows team members the opportunity to connect with colleagues across the company to support their development, strengthen their skills, and deepen relationships. Approximately 10% of our team members were enrolled in the mentoring program during 2024, which resulted in approximately 100 mentoring connections. These programs are supplemented with resources from our corporate memberships in large industry associations, to which every team member has access.

Our training and development programs include curriculum that promotes our values-based culture and commitment to ethics and compliance. In 2024, we had a 98% completion rate for our ethics and compliance training program, which includes, but is not limited to, training on our Code of Conduct, harassment prevention and cybersecurity.

Team Member Communication and Engagement

Team member engagement is of critical importance to our success. In 2024, we continued to prioritize engaging with our team members through quarterly town halls and an enterprise-wide company meeting with our chief executive officer and other senior executives. To assess the engagement of our team members and take action to mitigate risks associated with workforce engagement, development and retention, we conducted our annual survey to assess team member engagement, with 79% enterprise participation.

In 2024, we continued our focus on creating opportunities for team members to build connections with colleagues through our ten employee resource groups (“ERG”). Best practice research indicates that team member engagement and retention is positively impacted if team members are connected to peers who share their viewpoints and backgrounds and leaders who are invested in their success. These resource groups continue to foster engagement through their close alignment with the interests and backgrounds of our team members. As of December 31, 2024, more than 45% of our corporate team members participate in one or more ERG. Each ERG is sponsored by one or more members of our executive team, and in 2024, AMN’s collective ERGs hosted more than 150 member events and meetings.

While our team members’ backgrounds and experiences are broad, here is a snapshot of the demographics of our corporate team members as of December 31, 2024: 68% of our team members are women; 73% of our supervisor through senior manager roles are held by women; 44% of our board of directors are women; 37% of our team members identify as black, indigenous, or people of color (“BIPOC”); our team is 57% Millennials, 32% Generation X, 6% Baby Boomers, and 5% Generation Z; and team members self-identified as veterans, disabled, and LGBTQ+, each representing approximately 3% of our team.

Board Oversight

Our Board of Directors plays an active role in overseeing our human capital management strategy and programs. Our Talent and Compensation Committee provides oversight of our human capital management programs, including talent strategies, compensation plans and policies, and talent acquisition, development, engagement and retention.

Our Services

In 2024, we conducted our business through three reportable segments: (1) nurse and allied solutions, (2) physician and leadership solutions, and (3) technology and workforce solutions. We describe each segment’s revenue and operating results under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Results of Operations.” Our go-to-market strategy blends solutions from all three reportable segments, combining staffing, talent planning and acquisition, and technology-enabled solutions.

Workforce Staffing

(1) Nurse Staffing. We offer a range of specialty recruitment and temporary assignment lengths for nursing. A rigorous quality process ensures that each nursing candidate possesses the necessary training, licensure, and clinical competencies needed for a client facility. Nurse staffing solutions that we offer include (a) travel nurse staffing which are typically for a 13-week assignment but can support a wide range of assignment lengths, (b) international nurse staffing for which we recruit registered nurses from outside of the United States on long-term contracts ranging from 24 to 36 months, (c) international nurse permanent placement which provides our clients with direct placement of nurses from outside of the United States, (d) crisis nurse staffing (commonly referred to as critical staffing and rapid response nursing) for which we quickly deploy registered nurses on assignment during critical periods such as unexpected specialty gaps and urgent needs, including pandemic surges, natural disasters and other emergency situations, (e) labor disruption staffing for which we provide crucial support for clients involved in strikes of nurses and allied professional staff, and (f) local staffing of all nursing specialties, covering short-term assignments with same-day shifts that potentially last for several weeks.

(2) Allied Staffing. We provide allied health professionals to acute-care hospitals and other healthcare facilities such as skilled nursing facilities, rehabilitation clinics, schools, and pharmacies. Allied health professionals include such disciplines as physical therapists, respiratory therapists, occupational therapists, medical and radiology technologists, lab technicians, speech pathologists, rehabilitation assistants and pharmacists. Our solutions for schools feature an advanced teletherapy platform, Televate, and qualified school speech-language pathologists, psychologists, nurses, social workers, and other care providers who provide customized care and interactive learning plans to engage students.

(3) Revenue Cycle Solutions. We provide skilled labor solutions for remote medical coding, clinical documentation improvement, case management, and clinical data registry, and also provide auditing and advisory services.

(4) Physician and Advanced Practice Staffing. We provide locum tenens staffing services through which we offer clients thousands of physicians of all specialties and advanced practice and other clinicians. Typically on an independent contractor basis, locum tenens professionals are placed on temporary assignments with all types of healthcare organizations throughout the United States, including hospitals, health systems, medical groups, occupational medical clinics, psychiatric facilities, government institutions and insurance companies. We also offer full-service, permanent physician search (also referred to as physician permanent placement) across many specialties and modalities, specializing in recruiting and placing top physicians and advanced practitioner talent in jobs across the country.

(5) Interim Leadership Staffing. We provide executive and clinical leadership interim staffing. Practice areas include senior healthcare executives, physician executives, chief nursing officers and other clinical and operational leaders. Interim leaders provide strategic guidance and assist in setting short and long-term goals to offer immediate support, maintain momentum, and contribute leading practices and perspectives. Our interim leaders enjoy the flexibility of a consulting role with the stability of full-time employment.

(6) Executive Search and Academic Leadership. Augmenting our permanent placement service offerings, we provide executive leadership search services across the healthcare industry with areas of focus including academic medical centers and children’s hospitals nationwide. This business line provides us greater access to the “C-suite” of our clients and prospective clients, which we believe helps improve our visibility as a strategic partner to them and helps provide us with cross-selling opportunities.

Talent Planning & Acquisition

(7) Managed Services Programs. Many of our clients and prospective clients use a number of healthcare staffing agencies to fulfill their healthcare professional needs. We offer a comprehensive managed services program, in which we manage all or a portion of a client’s contingent staffing needs. Through our MSPs, we place our own healthcare professionals and utilize other staffing agencies to fulfill the client’s needs. We believe an MSP increases efficiencies and often provides cost savings while enhancing provider experiences. We often use our own VMS technology as part of our staffing-led and vendor-neutral MSPs, which we believe further enhances the value of our service offering. In 2024, we had approximately $2.0 billion in spend under management through our MSPs and approximately 45% of our consolidated revenue flowed through MSP relationships. Together with the vendor-neutral spend through our VMS programs (as discussed below), we had approximately $4.0 billion of spend under management during 2024.

(8) Recruitment Solutions. We partner with clients to streamline their permanent workforce planning and recruitment process through one efficient, agile solution. Our recruitment solutions, which many refer to as RPO, are customized to the client’s particular needs, in which we recruit, hire and/or onboard permanent clinical and nonclinical positions on their behalf. We provide technology and data intelligence that enable sustainable, long-term improvement and offer flexible solution options and agile, scalable processes in our pay-for-performance model.

Technology

(9) Language Interpretation. AMN Language Services provides healthcare interpretation services via proprietary platforms that enable video remote interpretation, over the phone interpretation, onsite interpretation, and telehealth interoperability, with more than 375 health systems, more than 2,600 hospitals, and thousands of clinics using our solutions. These services are all supported by proprietary technology platforms which enable real-time routing of video and audio calls, drive client efficiency with an in-person scheduling mobile application, and power interoperability with multiple telehealth platforms and EMRs.

(10) Vendor Management Systems. In addition to our MSP capabilities, we are also a leading provider for vendor-neutral VMS technology and support services for clients that prefer to self-manage the procurement of contingent clinical labor and their internal float pool. If clients use other staffing companies (associate vendors), our software as a service (“SaaS”)-based VMS technologies help them track and efficiently organize their staffing process. Our leading VMS products, which collectively serve clients of all sizes and complexity, are ShiftWise Flex, Medefis and b4health. Our VMS technologies provide, among other things, control over a wide variety of tasks via a single system and consolidated reporting. In 2024, we had approximately $2.0 billion in spend flow through our VMS programs, for which we typically earn a fee as a percentage of spend.

(11) Scheduling and Staff Planning. We offer Smart Square, healthcare scheduling software that combines demand forecasting (predictive analytics) with robust scheduling functionality, enterprise transparency, patented open shift management, and business intelligence tools all-in-one application. The SaaS platform provides fast implementations and is utilized in acute care, clinics, ancillary, long-term care and senior care settings. We also provide consulting services to our clients to evaluate their staffing spend and offer recommendations for savings by optimizing workforce and scheduling capabilities.

We typically experience modest seasonal fluctuations during our fiscal year, and they tend to vary among our businesses and reportable segments. These fluctuations can vary slightly in intensity from year to year.

Our Healthcare Professionals

The recruitment of a sufficient number of qualified healthcare professionals to work on temporary assignments and for placement at healthcare organizations is critical to the success of our business. Healthcare professionals choose temporary assignments for a variety of reasons that include seeking flexible work opportunities, exploring diverse practice settings, building skills and experience by working at prestigious healthcare facilities, working through life and career transitions, and as a means of access into a permanent staff position.

We recruit our healthcare professionals, depending on the particular service line, under the following brands: AMN Healthcare, Nursefinders, O’Grady Peyton International, Connetics, Medical Search International, DRW Healthcare Staffing, and B.E. Smith. Our recruiting strategy is supported by innovative and effective digital-first marketing programs that focus on lead management, including our digital presence on websites, social media, and mobile applications. Word-of-mouth referrals from the thousands of current and former healthcare professionals we have placed enhance our effectiveness at reaching healthcare professionals.

Our process to attract and retain healthcare professionals for temporary assignments and permanent placement depends on (1) offering a large selection of assignments and placements in a variety of geographies and settings with opportunities for career development, (2) creating competitive compensation packages, (3) developing passionate, knowledgeable recruiters and service professionals who understand the needs of our healthcare professionals and provide a personalized approach, and (4) maintaining a reputation for service excellence. The attractive compensation, benefits and reimbursement package that we provide our temporary healthcare professionals includes a competitive wage, professional development opportunities, professional liability insurance, 401(k) plan, ESPP, health insurance and reimbursements for housing, meals and travel expenses.

Our Geographic Markets and Client Base

During each of the past three years, (1) we generated substantially all our revenue in the United States and (2) substantially all our long-lived assets were located in the United States. We typically generate revenue in all 50 states. During 2024, the largest percentages of our revenue were concentrated in California, New York and Texas.

More than half of our temporary and contract healthcare professional assignments occur at acute-care hospitals. In addition to acute-care hospitals, we provide services to sub-acute healthcare facilities, physician groups, rehabilitation centers, schools, home health service providers and ambulatory surgery centers. Our clients include many of the largest and most prestigious and progressive health care systems in the country. Kaiser Foundation Hospitals (and its affiliates), to whom we provide clinical managed services, comprised approximately 16% of our consolidated revenue and 23% of our nurse and allied solutions segment revenue for the fiscal year ended December 31, 2024. No other client healthcare system or single client facility comprised more than 5% of our consolidated revenue for the fiscal year ended December 31, 2024.

Our Industry

The primary healthcare service markets in which we compete are U.S. temporary and contract healthcare staffing, workforce vendor neutral (i.e., VMS) and managed service programs, locum tenens, and language services. We also operate within the interim leadership, executive search, physician permanent placement, RPO, and workforce optimization and consulting services markets.

Industry Demand Drivers

Many factors affect the demand for contingent and permanent healthcare talent, which, accordingly, affects the size of the markets in which we primarily operate. Of these many factors, we believe the following serve as some of the most significant drivers of demand.

•Economic Environment and Employment Rate. Demand for our services is affected by growth of the U.S. economy and the employment rate. Growth in real U.S. gross domestic product generally drives rising employment rates. Favorable macro drivers typically result in increased demand for our services. Generally, we believe a positive economic environment and low unemployment lead to increasing demand for healthcare services. As employment levels rise, healthcare facilities, like employers in many industries, experience higher levels of employee attrition and find it increasingly difficult to obtain and retain permanent staff.

•Supply of Healthcare Professionals. While reports differ on the existence and extent of current and future healthcare professional shortages, many regions of the United States are experiencing a shortage of physicians and nurses that we believe will persist in the future. The Association of American Medical Colleges estimates a nationwide physician shortage up to 86,000 by 2036. In nursing, the World Health Organization estimates a worldwide shortage of 4.5 million by 2030. According to the National Council of State Boards of Nursing, approximately 900,000 registered nurses are anticipated to leave the workforce by the end of 2027. Demand for our services is positively correlated with activity in the permanent labor market. When nurse vacancy rates increase, temporary nurse staffing orders typically increase as well.

•General Demand for Healthcare Services. Changes in demand for healthcare services, particularly at acute healthcare hospitals and other inpatient facilities, like skilled nursing facilities, affect the demand for our services. According to the U.S. Department of Health and Human Services, with the passage of the Affordable Care Act, the uninsured population declined by more than 18 million people between 2010 and 2018. Growth of the insured population contributed to a relatively sharp increase in national healthcare expenditures beginning in 2014. Additionally, the U.S. population continues to age, and medical technology advances are contributing to longer life expectancy. A pronounced shift in U.S. age demographics is expected to boost growth of national health spending, projected by the Centers for Medicare & Medicaid Services to grow at average annual rates of 4.9% and 5.6% from 2025-2026 and 2027-2032, respectively, while Medicare spending growth is projected to increase to average annual rates of 7.1% and 7.6% for the same time periods, respectively. According to the U.S. Census Bureau, the number of adults age 65 or older grew by 9.4% from

2020 to 2023 and is projected to grow an estimated 31% between 2022 and 2035. People over 65 are three times more likely to have a hospital stay and twice as likely to visit a physician office compared with the rest of the population. These dynamics could place upward pressure on demand for the services we provide in the coming years. Not only does the age-demographic shift affect healthcare services demand, it also complicates the supply of skilled labor, as an increasing number of clinicians are aging out of the workforce.

•Adoption of Workforce Solutions. We believe healthcare organizations increasingly seek sophisticated, innovative and economically beneficial total talent solutions that improve patient experience and outcomes. We believe the prevalence of workforce solutions, such as MSP, VMS, RPO and workforce optimization tools, in the healthcare industry is still underpenetrated in comparison with non-healthcare sectors. During 2024, approximately 45% of our consolidated revenues were generated through MSP relationships.

Industry Competition

The healthcare staffing and workforce solutions industry is highly competitive. We compete in national, regional and local markets for healthcare organization clients and healthcare professionals. We believe that our comprehensive suite of total talent solutions, our commitment to quality and service excellence, our execution capabilities, and our national footprint create a compelling value proposition for our existing and prospective clients that give us distinct, scalable advantages over smaller, local and regional competitors and companies whose solution offerings, sales and execution capabilities are not as robust. The breadth of our talent solutions allows us to provide even greater value through a more strategic and consultative approach to our clients. In addition, we believe that our size, scale and sophisticated candidate acquisition processes give us access to a larger pool of available, highly-qualified candidates than most of our competitors, while substantial word-of-mouth referral networks enable us to attract, engage, and grow a diverse, high-quality network of healthcare professionals.

Larger firms, such as us, also generally have a deeper, more comprehensive infrastructure with a more established operating model and processes that provide the long-term stability and foundation for quality standards recognition, such as the Joint Commission staffing agency certification. As compared to many private firms, we also offer transparency and financial and operational controls, which we believe further enhance the value of our service offering. In its 2024 ratings for MSPs, HRO Today recognized AMN Healthcare in the Baker’s Dozen for overall quality of services, breadth of services and size of deals.

We are a leading provider of nurse, allied and locum tenens staffing in the United States. With the historic levels of demand as a result of the COVID-19 pandemic, the healthcare staffing industry grew significantly and has been further fragmented. In nurse and allied staffing, we compete with several national competitors together with numerous smaller, regional and local companies. The locum tenens staffing market consists of many small- to mid-sized companies with only a small number of national competitors of which we are one. The healthcare interim leadership staffing, healthcare executive search services, and physician permanent placement services markets, where we believe we hold leading positions, are also highly fragmented and consist of many small- to mid-sized companies that do not have a national footprint. We also believe we have a market-leading share in vendor neutral and managed services solutions, including VMS and MSP, and healthcare language interpretation services. With the stronger competitive market, we believe AMN Healthcare is well-positioned as a tech-centric total talent solutions partner to capitalize on the larger, addressable market through our comprehensive set of workforce and tech-enabled solutions. Our leading competitors vary by segment and include Amergis, Aya Healthcare, CHG Healthcare Services, Cross Country Healthcare, HealthTrust Workforce Solutions, Ingenovis Health, Jackson Healthcare, LanguageLine Solutions, and Medical Solutions. When recruiting for healthcare professionals, in addition to other executive search and staffing firms, we also compete with hospital systems that have developed their own recruitment departments and internal travel agencies.

Licensure For Our Business

Some states require state licensure for businesses that employ, assign and/or place healthcare professionals. We believe we are currently licensed in all states that require such licenses and take measures to ensure compliance with all state licensure requirements. In addition, the healthcare professionals who we employ or independently contract with are required to be individually licensed or certified under applicable state laws. We believe we take appropriate and reasonable steps to validate that our healthcare professionals possess all necessary licenses and certifications. We design our internal processes to ensure that the healthcare professionals that we directly place with clients have the appropriate experience, credentials and skills. Our nurse, allied healthcare and locum tenens staffing divisions have received Joint Commission certification. We have also obtained our Credentials Verification Organization certification from the National Committee for Quality Assurance.

Government Regulation

We are subject to the laws of the United States and certain foreign jurisdictions in which we operate and the rules and regulations of various governing bodies, which may differ among jurisdictions. Additionally, individual states often have regulations governing healthcare staffing agencies and technology platforms, requiring registration and various types of certifications and reporting. Compliance with these laws, rules and regulations has not had, and is not expected to have, a material effect on our capital expenditures, results of operations, or competitive position.

Additional Information

We maintain a corporate website at www.amnhealthcare.com. We make available our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to these reports, as well as proxy statements and other information free of charge through our website as soon as reasonably practicable after being filed with or furnished to the Securities and Exchange Commission (“SEC”). Such reports, proxy statements and other information are also available on the SEC’s website, http://www.sec.gov. The information found on our website and the SEC’s website is not part of this Annual Report on Form 10-K or any other report we file with or furnish to the SEC.

Special Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K, including the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” contains, and certain oral statements made by management from time to time, may contain, “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are subject to safe harbors under the Securities Act and the Exchange Act. We base these forward-looking statements on our current expectations, estimates, forecasts and projections about future events and the industry in which we operate. Forward-looking statements are identified by words such as “believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “should,” “would,” “project,” “may,” “could,” variations of such words and other similar expressions. In addition, statements that refer to projections of financial items; anticipated growth; future growth and revenue; future economic conditions and performance; plans, objectives and strategies for future operations; and other characterizations of future events or circumstances, are forward-looking statements. Our actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Factors that could cause actual results to differ from those implied by the forward-looking statements in this Annual Report on Form 10-K are described under the caption “Risk Factors” below, elsewhere in this Annual Report on Form 10-K and in our other filings with the SEC. Stockholders, potential investors, and other readers are urged to consider these factors in evaluating the forward-looking statements and cautioned not to place undue reliance on such forward-looking statements. The Company disclaims any obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

Item 1A. Risk Factors

You should carefully read the following risk factors in connection with evaluating us and the forward-looking statements contained in this Annual Report on Form 10-K. Any of the following risks could materially adversely affect our business or our consolidated operating results, financial condition or cash flows, which, in turn, could cause the price of our common stock to decline. The risk factors described below and elsewhere in this Annual Report on Form 10-K are not the only risks we face. Factors we currently do not know, factors that we currently consider immaterial or factors that are not specific to us, such as general economic conditions, may also materially adversely affect our business or our consolidated operating results, financial condition or cash flows. The risk factors described below qualify all forward-looking statements we make, including forward-looking statements within this section entitled “Risk Factors.”

To develop and prioritize the following risk factors, we review risks to our business that are informed by our formal Enterprise Risk Management program, industry trends, the external market and financial environment as well as dialogue with leaders throughout our organization. Our risk factor descriptions are intended to convey our assessment of each applicable risk and such assessments are integrated into our strategic and operational planning.

Risk Factors that May Affect the Demand for Our Services

The ability of our clients to increase the efficiency and effectiveness of their staffing management and recruiting efforts may affect the demand for our services that could negatively affect our business.

If our clients are able to increase the effectiveness of their staffing and recruitment functions through analytics, automation, machine learning, artificial intelligence (“AI”) or other advanced technologies or otherwise increase the effectiveness of their permanent hiring or retention of permanent employees, their need for our services may decline. With the

advent of technology and more sophisticated staffing management and recruitment processes, including internal “travel,” other healthcare staffing models, and the increasing adoption of AI technologies, clients may be able to successfully increase the efficiency and effectiveness of their internal staffing management and recruiting efforts, through more effective planning and analytic tools, internet- or social media-based recruiting or otherwise. Such new technologies and processes could reduce the demand for our services, which could negatively affect our business.

The widespread outbreak of illness or other public health crisis could have an adverse effect on our business, financial condition and results of operations.

We could be negatively affected by the widespread outbreak of an illness or any other public health crisis. The COVID-19 pandemic negatively impacted the global economy and created significant volatility and disruption of financial markets.

Demand for our staffing services and workforce technology solutions fluctuated over the course of the COVID-19 pandemic. Initially, in 2020, demand for some temporary healthcare professionals and services decreased as the demand for non-essential and elective healthcare was initially negatively impacted by the COVID-19 pandemic. As the pandemic subsided, demand and bill rates, especially in our nurse and allied solutions businesses, decreased from the levels seen during the pandemic. This decrease in demand has had a negative impact on our revenue, financial condition, and results of operations. However, we are unable to predict the duration and extent to which demand for our services or bill rates will be negatively impacted.

The COVID-19 pandemic disrupted, and any other future outbreak of illness or other public health crises or reemergence or future strain of COVID-19 may also disrupt, our operations due to the unavailability of our corporate team members or healthcare professionals due to illness, risk of illness, quarantines, travel restrictions, vaccine mandates or other factors that limit our existing or potential workforce and pool of candidates. In addition, we have and may in the future experience negative financial effects related a pandemic or other future outbreaks of illness due to higher workers’ compensation and health insurance costs, for which we are largely self-insured, and payroll costs associated with quarantine of our healthcare professionals. We may also be subject to claims regarding the health and safety of our healthcare professionals and our corporate team members.

The economic impact of the COVID-19 pandemic negatively impacted the financial condition of many hospitals and healthcare systems, and our clients continue to face cost pressures and in turn are looking to decrease expenses, including for contingent labor and other services. Demand for our services may be impacted by these cost pressures and we may be subject to claims from these clients relating to the ability to provide services under terms and conditions that they believe are fair and reasonable.

Additionally, outbreaks of illness, public health crises or reemergence or future strain of COVID-19 could occur and may have similar or even more significant impact on our business.

Economic downturns, inflation and slow recoveries could result in less demand from clients and pricing pressure that could negatively impact our financial condition.

Demand for staffing services is sensitive to changes in economic activity. Many healthcare facilities utilize temporary healthcare professionals to accommodate an increase in hospital admissions. Conversely, when hospital admissions decrease in economic downturns or periods of high inflation, due to reduced consumer spending, the demand for our temporary healthcare professionals typically declines.

As economic activity slows, hospitals and other healthcare entities typically experience decreased attrition and reduce their use of temporary employees before undertaking layoffs of their regular employees, which results in decreased demand for many of our service offerings. In times of economic downturn and inflation, permanent full-time and part-time healthcare facility staff are generally inclined to work more hours and overtime, resulting in fewer available vacancies and less demand for our services. Fewer placement opportunities for our temporary clinicians, physicians and leaders also impairs our ability to recruit and place them both on a temporary and permanent basis. This may have an even greater negative effect on demand for physicians in certain specialties such as surgery, radiology and anesthesiology. In addition, we may experience pricing pressure during periods of decreased patient occupancy and hospital admissions, negatively affecting our revenue and profitability.

During challenging economic times or in the event of a reduction or elimination of government assistance, our clients, in particular those that rely on government funding, may face reduced demand for their services, reduced revenue, and issues gaining access to sufficient credit, which has resulted in and could in the future result in an impairment or further impairment of their ability to make payments to us, timely or otherwise, for services rendered. If that were to occur, we may further increase our allowance for expected credit losses and our days sales outstanding would be negatively affected.

If we are unable to anticipate and quickly respond to changing marketplace conditions, such as alternative modes of healthcare delivery, reimbursement and client needs, we may not remain competitive.

Patient delivery settings continue to evolve, giving rise to alternative modes of healthcare delivery, such as retail medicine, telemedicine and home health. In addition, changes in reimbursement models and government mandates are also impacting healthcare environments.

Our success depends upon our ability to develop innovative workforce solutions, quickly adapt to changing marketplace conditions, such as reimbursement changes, and evolving client needs, comply with new federal or state regulations and differentiate our services and abilities from those of our competitors. The markets in which we compete are highly competitive, and our competitors may respond more quickly to new or emerging client needs and marketplace conditions. The development of new service lines and business models requires close attention to emerging trends and proposed federal and state legislation related to the healthcare industry. If we are unable to anticipate changing marketplace conditions, adapt our current business model to adequately meet changing conditions in the healthcare industry and develop and successfully implement innovative services, we may not remain competitive.

Consolidation of healthcare delivery organizations could negatively affect pricing of our services and increase our concentration risk.

Consolidation of healthcare delivery organizations provides them with greater leverage in negotiating pricing for services. Consolidations may also result in us losing our ability to work with certain clients because the party acquiring or consolidating with our client may have a previously established service provider they elect to maintain. In addition, our clients may increase their use of intermediaries such as vendor management service companies and group purchasing organizations that may enhance their bargaining power or clients with a larger network of healthcare professionals may develop their own temporary staffing models. These dynamics each separately or together could negatively affect pricing for our services and our ability to maintain certain clients.

Hospital concentration coupled with our managed services contracts means our revenues from some larger health systems have grown and may continue to grow substantially relative to our other revenue sources. For example, Kaiser Foundation Hospitals (and its affiliates) (collectively, “Kaiser”) comprised approximately 16% of our consolidated revenue in 2024. If we were to lose Kaiser as a client or were unable to provide a significant amount of services to Kaiser, whether directly or as a subcontractor, such loss may have a material adverse effect on our revenue, results of operations and cash flows.

Intermediary organizations may impede our ability to secure new and profitable contracts with our clients.

Our business depends upon our ability to maintain our existing contracts and secure new, profitable contracts. Outside of our managed services contracts, our client contracts are not typically exclusive and our clients are generally free to offer temporary staffing assignments to our competitors. Additionally, our clients may choose to purchase these services through intermediaries such as group purchasing organizations or competitors offering MSP services, with whom we establish relationships in order to continue to provide our staffing services to certain healthcare facilities. These intermediaries may negatively affect our ability to obtain new clients and maintain our existing client relationships by impeding our ability to access and contract directly with clients and may also negatively affect the profitability of these client relationships. In addition, our inability to establish relationships with these intermediaries may result in us losing our ability to work with certain healthcare facilities.

The repeal or significant erosion of the Patient Protection and Affordable Care Act (“ACA”) without a corresponding replacement may negatively affect the demand for our services.

In 2010, the adoption of the ACA brought significant reforms to the health care system that included, among other things, a requirement that all individuals have health insurance (with limited exceptions). As a result of the ACA, the uninsured population has declined significantly. If there is a rollback of aspects of the ACA, such as Medicaid expansion, it may lead to a reduction in demand for healthcare services and the demand for our services may decline.

Regulatory and Legal Risk Factors

Investigations, claims and legal proceedings alleging medical malpractice, anti-competitive conduct, violations of employment, privacy and wage regulations and other theories of liability asserted against us could subject us to substantial liabilities.

Like all employers, we must also comply with various laws and regulations relating to employment and pay practices and from time to time may be subject to individual, representative and class action lawsuits related to alleged wage and hour violations under California and Federal law. We are subject to possible claims alleging discrimination, sexual harassment and other similar activities in which we or our hospital and healthcare facility clients and their agents have allegedly engaged. We are also subject to examination of our payroll practices from various federal and state taxation authorities from time to time. While we believe that our employment and pay practices materially comply with relevant laws and regulations, interpretations of these laws change. Because of the nature of our business, the impact of these employment and payroll laws and regulations may have a more pronounced effect on our business. There is a risk that we could be subject to payment of significant additional wages, insurance and employment, and payroll-related taxes and sizeable statutory penalties negatively impacting our financial position, results of operations and cash flows. These laws and regulations may also impede our ability to grow the size and profitability of our operations. In addition, our involvement in these matters and any related adverse rulings may result in increased costs and expenses, cause us from time to time to significantly increase our legal accruals and/or modify our pay practices, all of which would likely have an adverse impact on our financial performance and profitability.

We, along with our clients and healthcare professionals, are subject to investigations, claims and legal actions alleging malpractice or related legal theories. At times, plaintiffs name us in these lawsuits and actions regardless of our contractual obligations, the competency of the healthcare professionals, the standard of care provided by the healthcare professionals, the quality of service that we provided or our actions. In certain instances, we are contractually required to indemnify our clients against some or all of these potential legal actions.

The size and nature of our business requires us to collect substantial personal information of healthcare professionals and other team members that is subject to a myriad of privacy-related laws from multiple jurisdictions that regulate the use and disclosure of such information. In addition, many of our healthcare professionals have access to client proprietary information systems and patient confidential information. We may be required to incur significant costs to comply with mandatory privacy and security standards and protocols imposed by law, regulation, industry standards or contractual obligations with our clients. In addition, an inherent risk of the collection and access to such information includes possible claims from unintentional or intentional misuse, disclosure or use of this information. Such claims may result in negative publicity, injunctive relief, criminal investigations or charges, civil litigation, payment by us of monetary damages or fines, or other adverse effects on our business, which may be material.

We are also subject to certain laws and regulations applicable to recruitment and employment placement agencies with which we must comply in order to continue to conduct business in that specific state.

As we grow and increase our leadership position, we are at greater risk for anti-competitive conduct claims and investigations, such as violation of federal and state antitrust laws and unfair business practices. An environment of high-demand for healthcare staffing support coupled with the healthcare labor shortage, especially with respect to nurse and allied healthcare professionals, has led and may continue to lead to higher wages for healthcare professionals and higher costs to our clients for healthcare staffing. This may lead to claims and investigations into pricing and competitive conduct in the healthcare staffing industry. While we believe that our business practices, including pricing and competitive conduct, comply with all applicable laws and regulations, we may nonetheless be subject to inquiries, claims or investigations which could negatively impact our reputation and business.

As we incorporate AI and machine learning into our business there are uncertainties in the legal regulatory regime relating to AI that may require significant resources to modify and maintain our business practices to comply with U.S. and non-U.S. laws, the nature of which cannot be determined at this time. If the jurisdictions in which we operate decide to adopt laws governing AI, such legislation may render the use of such technologies challenging, impossible or financially prohibitive.

We maintain various types of insurance coverage for many types of claims, including professional liability, errors and omissions, employment practices and cyber, through commercial insurance carriers and a wholly-owned captive insurance

company and for other claims such as wage and hour practices and competition actions, we are uninsured. The cost of defending such claims, even if groundless, could be substantial and the associated negative publicity could adversely affect our ability to attract, retain and place qualified employees and healthcare professionals in the future. We may also experience increased insurance premiums and retention and deductible accruals that we may not be able to pass on to our clients, thereby reducing our profitability. Moreover, our insurance coverage and reserve accruals may not be sufficient to cover all claims against us.

We are subject to federal and state healthcare industry regulation including conduct of operations, costs and payment for services and payment for referrals as well as laws regarding immigration and government contracting.

The healthcare industry is subject to extensive and complex federal and state laws and regulations related to conduct of operations, costs and payment for services and payment for referrals. We provide talent solutions and technologies on a contract basis to our clients, who pay us directly. Accordingly, Medicare, Medicaid and insurance reimbursement policy changes generally do not directly impact us. Nevertheless, reimbursement changes in government programs, particularly Medicare and Medicaid, can and do indirectly affect the demand and the prices paid for our services. For example, our clients could receive reduced or no reimbursements because of a change in the rates or conditions set by federal or state governments that would negatively affect the demand and the prices for our services. Moreover, our hospital, healthcare facility and physician practice group clients could suffer civil and criminal penalties, and be excluded from participating in Medicare, Medicaid and other healthcare programs for failure to comply with applicable laws and regulations that may negatively affect our profitability.

In our international nurse business, we recruit registered nurses from outside of the United States who rely on visas to be eligible to be placed or hired directly with healthcare facilities. Visa retrogression, where the date(s) that determine availability for applying for a visa are moved to a later date, has had and may in the future have a negative impact on our international nursing volumes. Additionally, other changes in immigration policy, laws and processes could negatively impact our financial performance.

A portion of our hospital and healthcare facility clients are state and federal government agencies, where our ability to compete for new contracts and orders, and the profitability of these contracts and orders, may be affected by government legislation, regulation or policy. Additionally, in providing services to state and federal government clients and to clients who participate in state and federal programs, we are also subject to specific laws and regulations, which government agencies have broad latitude to enforce. If we were to be excluded from participation in these programs or should there be regulatory or policy changes or modification of application of existing regulations adverse to us, it would likely materially adversely affect our brand, business, results of operations and cash flows.

We are also subject to certain state laws and regulations applicable to healthcare staffing and “nursing pools” with which we must comply in order to continue to conduct business in that particular state. Regulation relating to healthcare staffing agencies has increased the operational and administrative requirements and increased the cost to provide various of our services in certain states. If regulation of our services continues to increase it could have a negative impact on our ability to profitably provide services in some states. We may also be subject to state laws that impose caps or other limitations on amounts that may be charged to clients for certain types of healthcare staffing, which in turn impacts the wages paid to healthcare professionals and may impact our ability to attract healthcare professionals to assignments in these states. In addition, it is generally our practice to pass along the increased costs associated with higher wages for healthcare professionals on to our clients. If new or additional caps or other price limitations were imposed that prevented us from passing these increased costs on or if the amount that we were able to pass on to our clients is limited, it would likely have an adverse impact on our financial performance and profitability.

The challenge to the classification of certain of our healthcare professionals as independent contractors could adversely affect our profitability.

Historically, we have treated our locum tenens, which include physicians and certain advanced practitioners, such as certified nurse anesthetists, nurse practitioners and physician assistants, as independent contractors. Certain state laws regarding classification of independent contractors have been modified in the past few years and as a result, we have altered our classification of certain locum tenens providers in certain instances. Other states and/or the Federal government may choose to adopt similar restrictions that may require us to expand our employee classifications for locum tenens. If this occurs, it could increase our employee costs and expenses and could negatively impact our profitability.

In addition, Federal or state taxing authorities may take the position that locum tenens are employees exposing us to additional wage and insurance claims and employment and payroll-related taxes. A reclassification of our locum tenens to employees from independent contractors could result in liability that would have a significant negative impact on our profitability for the period in which such reclassification was implemented, and would require changes to our payroll and

related business processes, which could be costly. In addition, many states have laws that prohibit non-physician owned companies from employing physicians, referred to as the “corporate practice of medicine.” If our independent contractor physicians were classified as employees in states that prohibit the corporate practice of medicine, we may be prohibited from conducting our locum tenens staffing business in those states under our current business model, which may have a substantial negative effect on our revenue, results of operations and profitability.

Risk Factors Related to Our Operations, Personnel and Information Systems

If we do not continue to recruit and retain sufficient quality healthcare professionals at reasonable costs, it could increase our operating costs and negatively affect our business and our profitability.

We rely significantly on our ability to recruit and retain a sufficient number of healthcare professionals who possess the skills, experience and licenses necessary to meet the requirements of our clients. With continuing clinician burnout rates, an ongoing shortage of certain qualified nurses and physicians in many areas of the United States and low unemployment rates for nurses and physicians, competition for the hiring of these professionals remains intense. Our ability to recruit temporary and permanent healthcare professionals may be exacerbated by continued low levels of unemployment.

We compete with healthcare staffing companies, recruitment and placement agencies, including online staffing and recruitment agencies, and with hospitals, healthcare facilities and physician practice groups to attract healthcare professionals based on the quantity, diversity and quality of assignments offered, compensation packages, the benefits that we provide and speed and quality of our service. We rely on our tech-enabled, relationship-oriented approach and national infrastructure to enable us to compete in all aspects of our business. We must continually evaluate and expand our healthcare professional network to serve the needs of our clients.

The costs of recruitment of quality healthcare professionals and providing them with competitive compensation packages may be higher than we anticipate, or we may be unable to pass these costs on to our hospital and healthcare facility clients, which may reduce our profitability. Moreover, if we are unable to recruit temporary and permanent healthcare professionals, our service execution may deteriorate and, as a result, we could lose clients or not meet our service level agreements with these clients that have negative financial repercussions.

Our inability to implement new infrastructure and technology systems and technology disruptions may adversely affect our operating results and ability to manage our business effectively.

We have technology, operations and human capital infrastructures to support our existing business. Our ability to deliver services to our clients and to manage our commercial technologies, internal systems and data depends largely upon our access to and the performance of our management information and communications systems, including our SaaS-based solutions, client relationship management systems and client/healthcare professional-facing self-service websites and applications. These technology systems also maintain accounting and financial information upon which we depend to fulfill our financial reporting obligations. We must continue to invest in this infrastructure to support our growth, enhance our management and utilization of data and improve our efficiency.

Upgrading current systems and implementing new systems is costly and involves inherent risks, including loss of information, disruption to our normal operations, changes in accounting procedures and internal control over financial reporting, as well as problems achieving accuracy in the conversion of electronic data. Failure to properly or adequately address these issues could result in increased costs, loss of clients, healthcare professionals and talent, the diversion of management’s and employees’ attention and resources and could materially adversely affect our growth, financial and operating results, internal controls over financial reporting and ability to manage our business effectively.

Additionally, the current legacy systems are subject to other non-environmental risks, including technological obsolescence for which there may not be sufficient redundancy or backup. These systems, and our access to these systems, are not impervious to floods, fire, storms, or other natural disasters, or service interruptions. There also is a potential for intentional and deliberate attacks to our systems, including ransomware, that may lead to service interruptions, data corruption, data theft or data unavailability. If our current or planned systems do not adequately support our operations, are damaged or disrupted or if we are unable to replace, repair, maintain or expand them, it may adversely affect our business operations and our profitability.

Our business could be harmed if we fail to further develop and evolve our current talent solutions technology offerings and capabilities.

To achieve our strategic objectives and to remain competitive, we must continue to develop and enhance our talent solutions technology offerings and capabilities. This may require the acquisition of equipment and software and the development of new proprietary software and capabilities, either internally or through independent consultants, which may require significant investment of capital. If we are unable to design, develop, acquire, implement and utilize, in a cost-effective manner, technology and information systems that provide the capabilities necessary for us to compete effectively, or for any reason any interruption or loss of our information processing capabilities occurs, this could harm our business, results of operations and financial condition.

In addition, as technology continues to evolve, more tasks currently performed by people may continue to be replaced by automation, robotics, machine learning, AI and other technological advances that may be outside of our control. These technological changes may reduce demand for our services, enable the development of competitive products or services or enable our customers to reduce or bypass the use of our services.

Disruption to or failures of our SaaS-based or technology-enabled services, or our inability to adequately protect our intellectual property rights with respect to such technologies, could reduce client satisfaction, harm our reputation and negatively affect our business.

The performance, reliability and security of our technology-enabled services, including our language interpretation services and SaaS-based technologies, such as AMN Language Services, ShiftWise Flex, Medefis, b4health, and Avantas Smart Square are critical to such offerings’ operations, reputation and ability to attract new clients. Some of our clients rely on our SaaS-based technologies to perform certain of their operational functions. Accordingly, any degradation, errors, defects, disruptions or other performance problems with our SaaS-based technologies could damage our or our clients’ operations and reputations and negatively affect our business. If any of these problems occur, our clients may, among other things, terminate their agreements with us or make indemnification or other claims against us, which may also negatively affect us.

Additionally, if we fail to protect our intellectual property rights adequately with respect to our SaaS-based technologies, our competitors might gain access to it, and our business might be harmed. Moreover, if any of our intellectual property rights associated with our SaaS-based technologies are challenged by others or invalidated through litigation, defending our intellectual property rights might also entail significant expense. Accordingly, despite our efforts, we may be unable to prevent third parties from using or infringing upon or misappropriating our intellectual property with respect to our SaaS-based technologies, which may negatively affect our business as it relates to our SaaS-based and technology-enabled service offerings.

Security breaches and cybersecurity incidents could compromise our information and systems adversely affecting our business operations and reputation subject us to substantial liabilities.

Security breaches, including cyber incidents can result from deliberate attacks or unintentional events. These incidents can include, but are not limited to, gaining unauthorized access to digital systems for purposes of misappropriating assets or sensitive information, ransomware attacks, corrupting data, or causing operational disruption. In the ordinary course of our business, we collect and store sensitive data, such as our proprietary business information and that of our clients as well as personally identifiable information of our healthcare professionals and team members, including full names, social security numbers, addresses, birth dates and payroll-related information, in our data centers, on our networks and in hosted SaaS-based solutions provided by third parties. Our employees and third-party vendors may also have access to, receive and use personal health information in the ordinary course of our business. The secure access to, processing, maintenance and transmission of this information is critical to our operations.