2

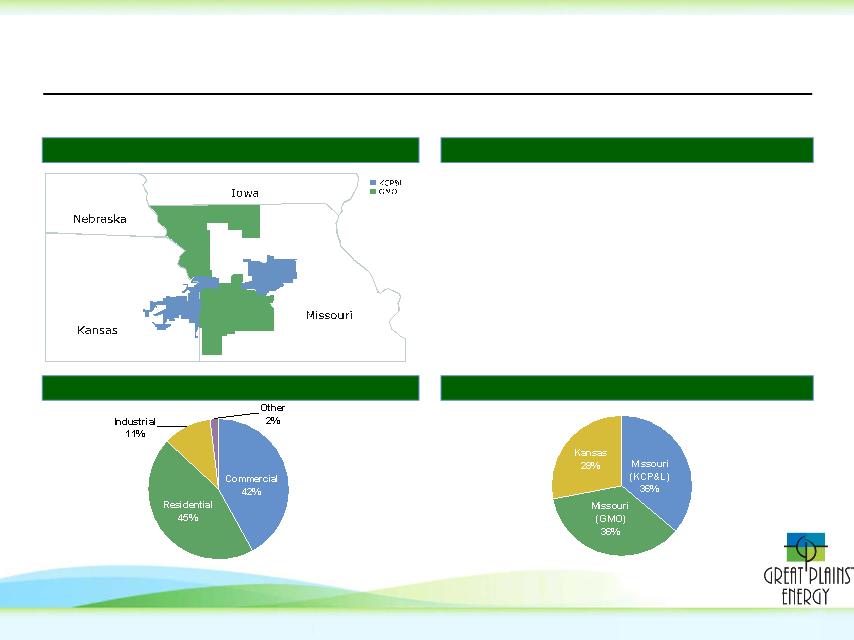

• Strong Midwest electric utility holding company focused on regulated operations in Missouri and Kansas

• Diversified customer base includes 820,000 residential, commercial, and industrial customers

• ~6,000 Megawatts of generation capacity

• Low-cost generation mix - projected 76% coal, 17% nuclear (Wolf Creek) in 2009

100% Regulated

Electric Utility

Operations Focus

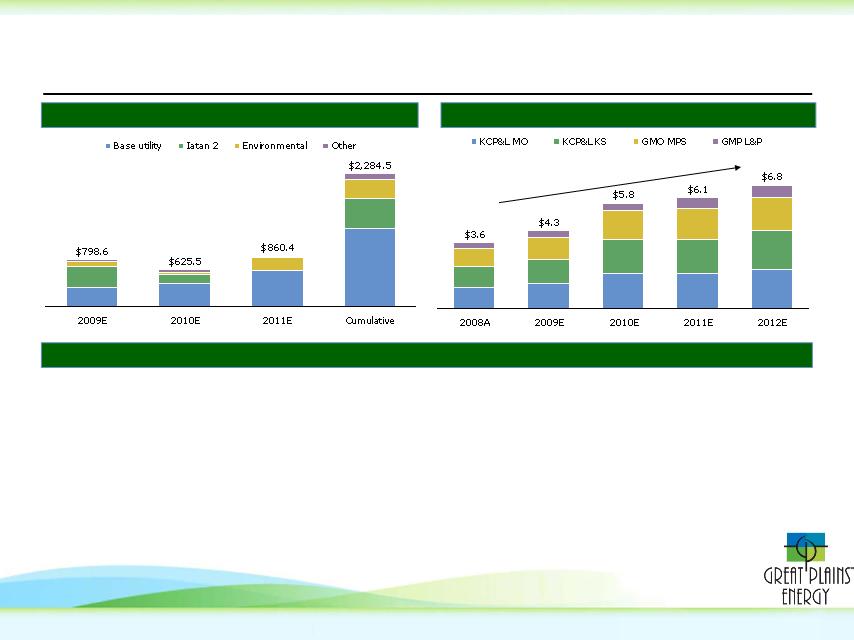

• Significant projected rate base growth from $3.6bn in 2008 to $6.8bn in 2012 - 15% CAGR

• Growth and stability in earnings driven by sizable regulated investments as part of the Comprehensive Energy Plan

(“CEP”)

• Wind and environmental retrofit components of CEP in place; Iatan 2 baseload coal plant targeted for

completion in summer 2010

• Anticipated growth beyond 2010 driven by additional environmental capex and wind

Attractive Platform

for Long-Term

Earnings Growth

• Successful outcomes in 2006 and 2007 rate cases in Missouri and Kansas

• Recent successful settlements in Missouri highlight rate recovery prospects

• Combined annual rate increases of $159mm and $72mm pending Commission approval in Missouri and Kansas,

respectively; new rates expected by September 2009

Focused Regulatory

Approach

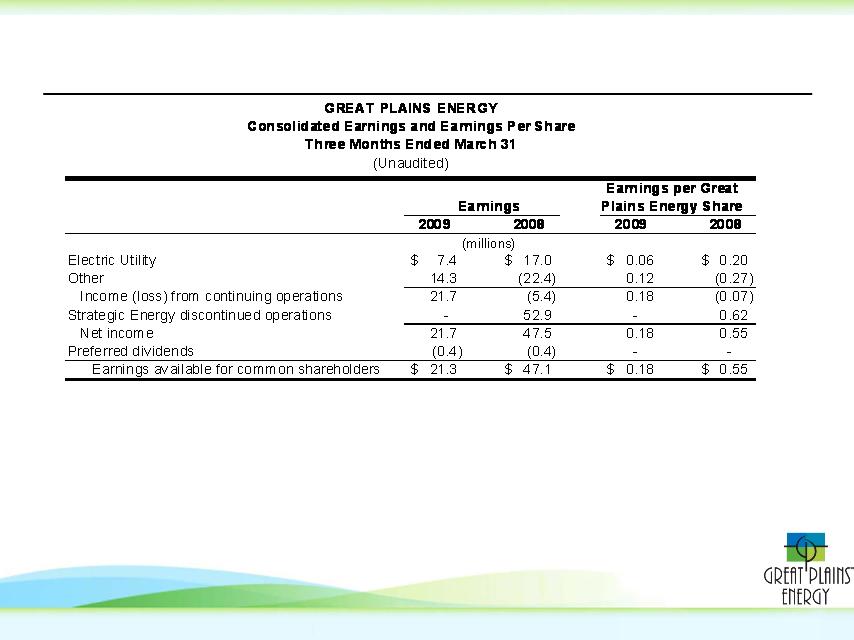

• Cash flow and earnings heavily driven by regulated operations and rate recovery mechanisms

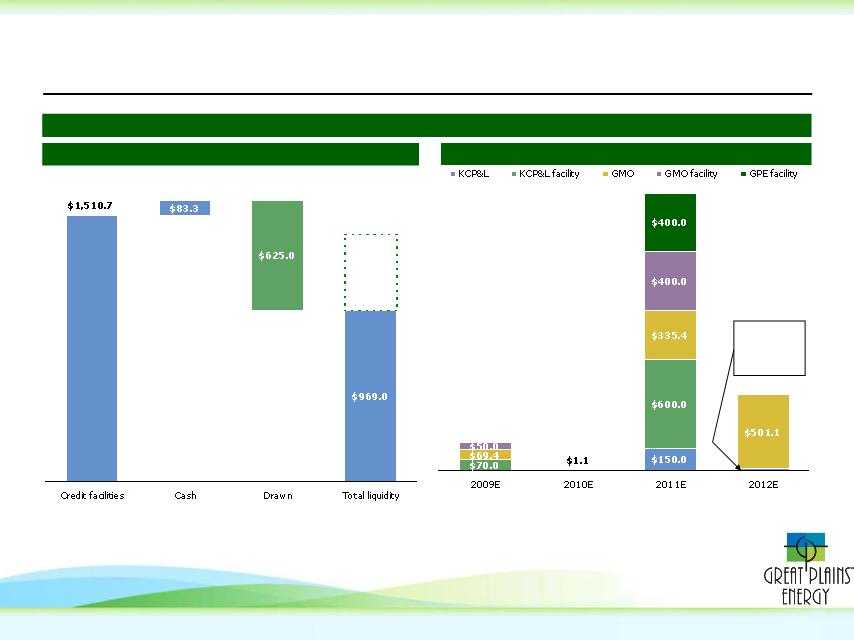

• Ample liquidity of ~$890mm1 currently available under $1.5bn revolving credit facilities

• Sustainable dividend and pay-out, right-sized to fund growth and to preserve liquidity

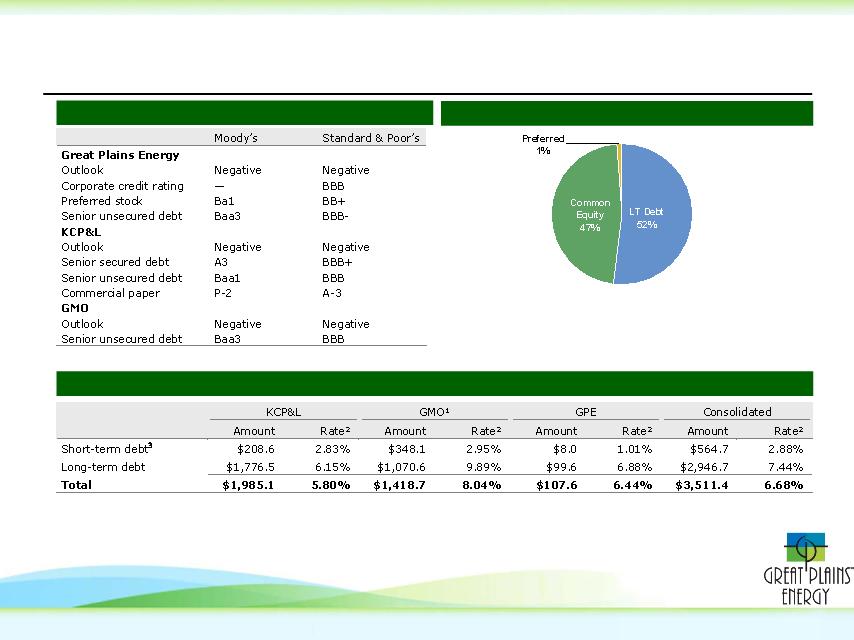

• Committed to maintaining current investment grade credit ratings

Stable and Improving

Financial Position

1 $1,400mm pro forma for net offering proceeds

Key Investment Highlights