Investor Presentation December 2014 Exhibit 99.1

Forward-Looking Statement Statements made in this presentation that are not based on historical facts are forward-looking, may involve risks and uncertainties, and are intended to be as of the date when made. Forward-looking statements include, but are not limited to, the outcome of regulatory proceedings, cost estimates of capital projects and other matters affecting future operations. In connection with the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Great Plains Energy and KCP&L are providing a number of important factors that could cause actual results to differ materially from the provided forward-looking information. These important factors include: future economic conditions in regional, national and international markets and their effects on sales, prices and costs; prices and availability of electricity in regional and national wholesale markets; market perception of the energy industry, Great Plains Energy and KCP&L; changes in business strategy, operations or development plans; the outcome of contract negotiations for goods and services; effects of current or proposed state and federal legislative and regulatory actions or developments, including, but not limited to, deregulation, re-regulation and restructuring of the electric utility industry; decisions of regulators regarding rates the companies can charge for electricity; adverse changes in applicable laws, regulations, rules, principles or practices governing tax, accounting and environmental matters including, but not limited to, air and water quality; financial market conditions and performance including, but not limited to, changes in interest rates and credit spreads and in availability and cost of capital and the effects on nuclear decommissioning trust and pension plan assets and costs; impairments of long-lived assets or goodwill; credit ratings; inflation rates; effectiveness of risk management policies and procedures and the ability of counterparties to satisfy their contractual commitments; impact of terrorist acts, including but not limited to cyber terrorism; ability to carry out marketing and sales plans; weather conditions including, but not limited to, weather- related damage and their effects on sales, prices and costs; cost, availability, quality and deliverability of fuel; the inherent uncertainties in estimating the effects of weather, economic conditions and other factors on customer consumption and financial results; ability to achieve generation goals and the occurrence and duration of planned and unplanned generation outages; delays in the anticipated in-service dates and cost increases of generation, transmission, distribution or other projects; Great Plains Energy’s ability to successfully manage transmission joint venture; the inherent risks associated with the ownership and operation of a nuclear facility including, but not limited to, environmental, health, safety, regulatory and financial risks; workforce risks, including, but not limited to, increased costs of retirement, health care and other benefits; and other risks and uncertainties. This list of factors is not all-inclusive because it is not possible to predict all factors. Other risk factors are detailed from time to time in Great Plains Energy’s and KCP&L’s quarterly reports on Form 10-Q and annual report on Form 10-K filed with the Securities and Exchange Commission. Each forward-looking statement speaks only as of the date of the particular statement. Great Plains Energy and KCP&L undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. 2 December 2014 Investor Presentation

Recent Events Earnings Review Third quarter 2014 earnings per share of $0.95 compared with $0.93 in 2013 September 30, 2014 year to date earnings per share of $1.44 compared with $1.51 for the same period in 2013 Current 2014 earnings per share guidance range of $1.52 - $1.62 Dividend Increased quarterly common stock dividend from $0.23 per share to $0.245 per share Operations & Regulatory Update KCP&L filed general rate case in Missouri - docket ER-2014-0370 Commenced start-up testing on La Cygne environmental upgrade project – tie-in outage work on Unit 2 underway 3 December 2014 Investor Presentation

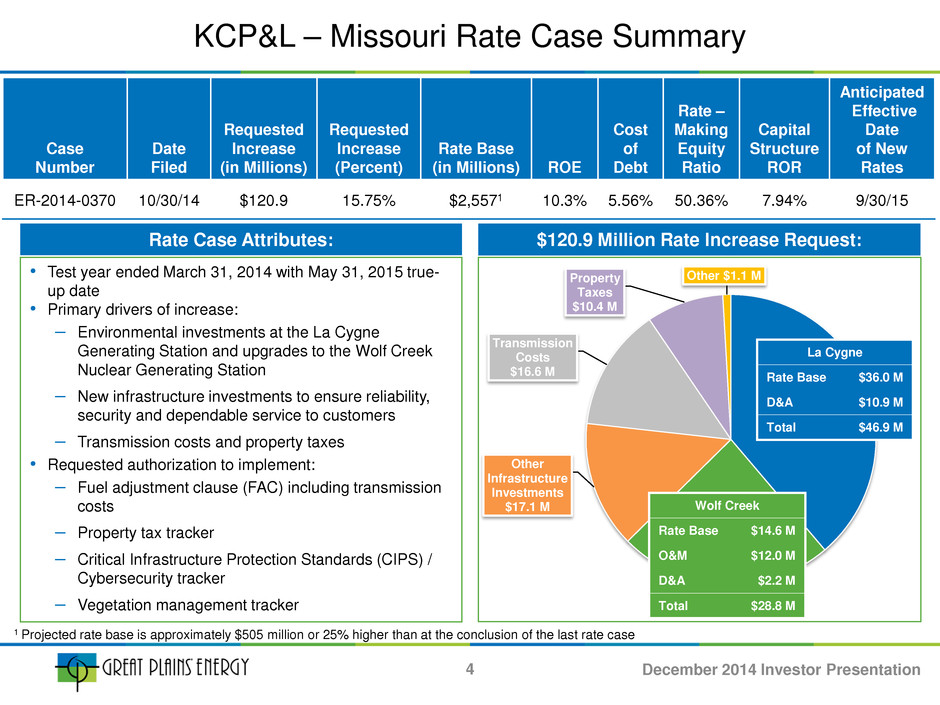

KCP&L – Missouri Rate Case Summary Case Number Date Filed Requested Increase (in Millions) Requested Increase (Percent) Rate Base (in Millions) ROE Cost of Debt Rate – Making Equity Ratio Capital Structure ROR Anticipated Effective Date of New Rates ER-2014-0370 10/30/14 $120.9 15.75% $2,5571 10.3% 5.56% 50.36% 7.94% 9/30/15 1 Projected rate base is approximately $505 million or 25% higher than at the conclusion of the last rate case Other Infrastructure Investments $17.1 M Transmission Costs $16.6 M Property Taxes $10.4 M Other $1.1 M $120.9 Million Rate Increase Request: • Test year ended March 31, 2014 with May 31, 2015 true- up date • Primary drivers of increase: – Environmental investments at the La Cygne Generating Station and upgrades to the Wolf Creek Nuclear Generating Station – New infrastructure investments to ensure reliability, security and dependable service to customers – Transmission costs and property taxes • Requested authorization to implement: – Fuel adjustment clause (FAC) including transmission costs – Property tax tracker – Critical Infrastructure Protection Standards (CIPS) / Cybersecurity tracker – Vegetation management tracker Rate Case Attributes: La Cygne Rate Base $36.0 M D&A $10.9 M Total $46.9 M Wolf Creek Rate Base $14.6 M O&M $12.0 M D&A $2.2 M Total $28.8 M 4 December 2014 Investor Presentation

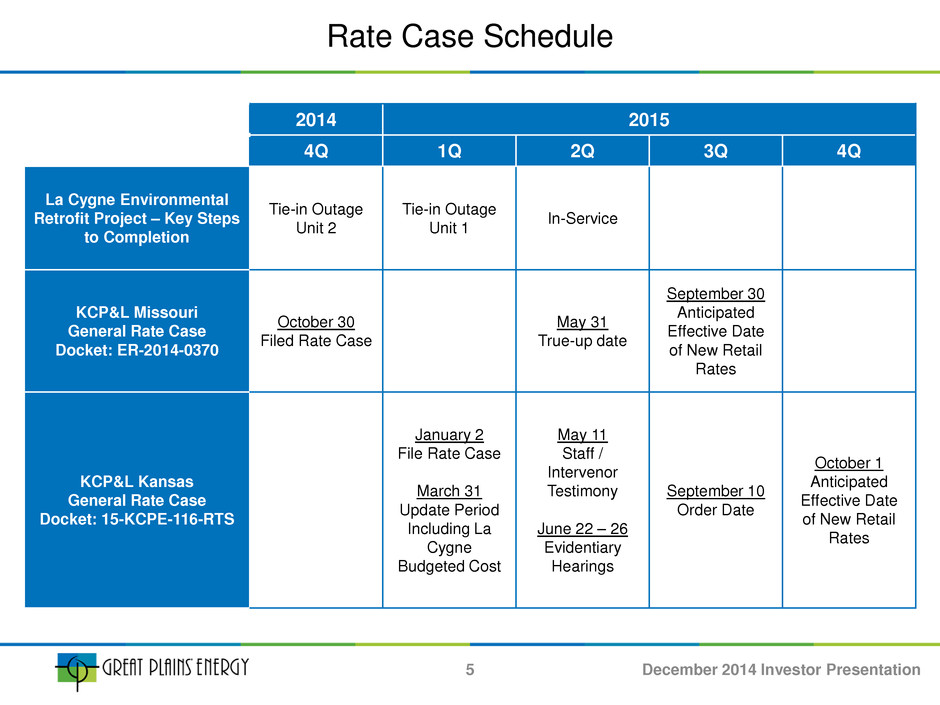

Rate Case Schedule 2014 2015 4Q 1Q 2Q 3Q 4Q La Cygne Environmental Retrofit Project – Key Steps to Completion Tie-in Outage Unit 2 Tie-in Outage Unit 1 In-Service KCP&L Missouri General Rate Case Docket: ER-2014-0370 October 30 Filed Rate Case May 31 True-up date September 30 Anticipated Effective Date of New Retail Rates KCP&L Kansas General Rate Case Docket: 15-KCPE-116-RTS January 2 File Rate Case March 31 Update Period Including La Cygne Budgeted Cost May 11 Staff / Intervenor Testimony June 22 – 26 Evidentiary Hearings September 10 Order Date October 1 Anticipated Effective Date of New Retail Rates 5 December 2014 Investor Presentation

85% 12% 1% 2% Coal Nuclear Natural Gas and oil Wind 37% 49% 14% Residential Commercial Industrial 27% 37% 36% Kansas Missouri (KCP&L) GMO • Solid Midwest fully regulated electric utility operating under the KCP&L brand • Company attributes – Regulated operations in Kansas and Missouri – ~836,100 customers / ~3,000 employees – ~6,600 MW of primarily low-cost coal baseload generation – ~3,700 circuit miles of transmission lines; ~22,400 circuit miles of distribution lines – ~$9.8 billion in assets at 2013YE – ~$5.7 billion in rate base Total: ~ 23,031 MWhs1 Total: ~ 23,031 MWhs1 1 In thousands Total: ~ 27,165 MWhs1 Solid Vertically Integrated Midwest Utilities 2013 Retail MWh Sold by Customer Type 2013 Retail MWh Sales by Jurisdiction 2013 MWh Generated by Fuel Type Service Territories: KCP&L and GMO Business Highlights 6 December 2014 Investor Presentation

Investment Thesis • Solid track record of execution and constructive regulatory treatment • Focused on providing competitive total shareholder returns through earnings growth and a competitive dividend • Flexible investment opportunities with improved risk profile • Well positioned on the environmental investment curve • Expect growing competitive transmission opportunities through Transource Energy, LLC 7 December 2014 Investor Presentation

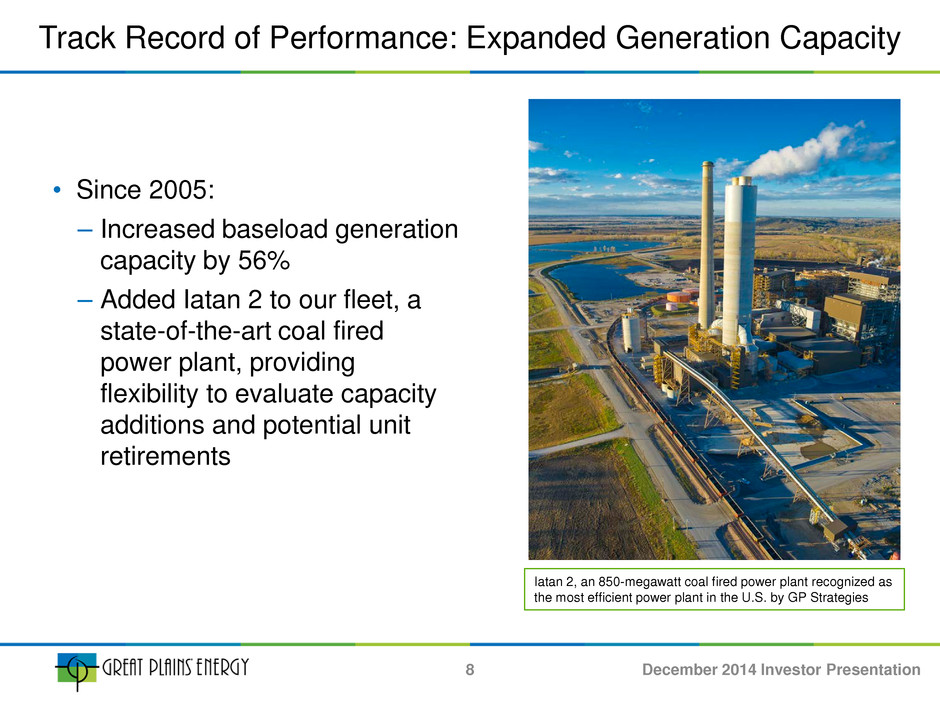

Track Record of Performance: Expanded Generation Capacity • Since 2005: – Increased baseload generation capacity by 56% – Added Iatan 2 to our fleet, a state-of-the-art coal fired power plant, providing flexibility to evaluate capacity additions and potential unit retirements Iatan 2, an 850-megawatt coal fired power plant recognized as the most efficient power plant in the U.S. by GP Strategies 8 December 2014 Investor Presentation

Track Record of Performance: Improved Environmental Footprint • Since 2005, invested approximately $1 billion on state-of-the-art emission controls • Additional $700 million in investments, with clear timeline for compliance, for air emission controls • Providing customers with affordable, reliable energy while also improving regional air quality SO2 NOX 0 10 20 30 40 50 60 70 2005 2006 2007 2008 2009 2010 2011 2012 2013 (t on s in th ou sa nd s) Reduced Air Emissions 2005 – 2013: Reduced SO2 and NOx emissions by 63% 9 December 2014 Investor Presentation

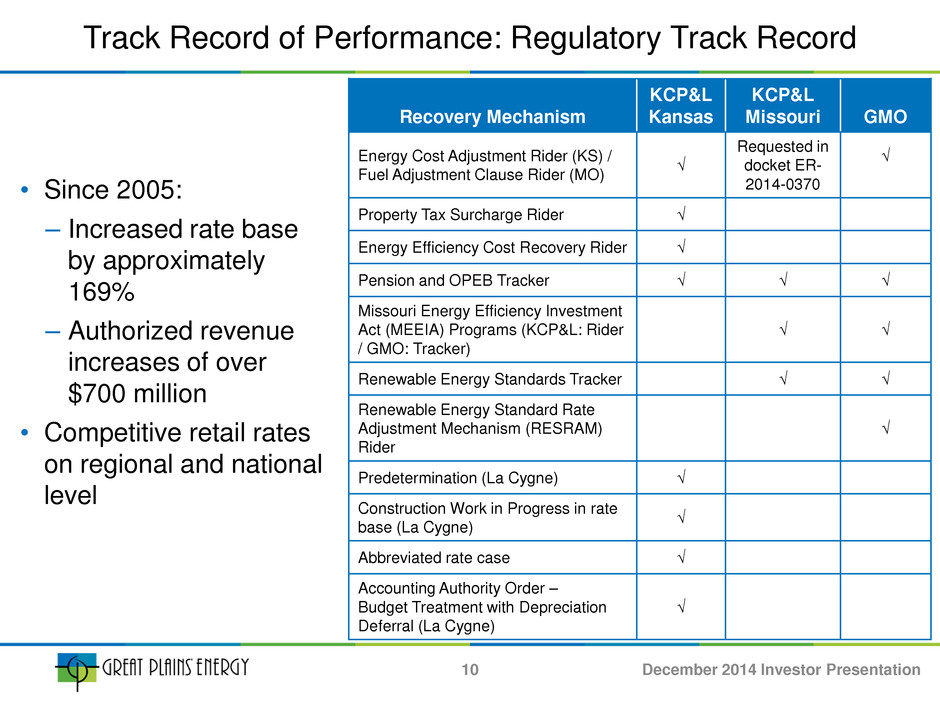

Track Record of Performance: Regulatory Track Record • Since 2005: – Increased rate base by approximately 169% – Authorized revenue increases of over $700 million • Competitive retail rates on regional and national level Recovery Mechanism KCP&L Kansas KCP&L Missouri GMO Energy Cost Adjustment Rider (KS) / Fuel Adjustment Clause Rider (MO) √ Requested in docket ER- 2014-0370 √ Property Tax Surcharge Rider √ Energy Efficiency Cost Recovery Rider √ Pension and OPEB Tracker √ √ √ Missouri Energy Efficiency Investment Act (MEEIA) Programs (KCP&L: Rider / GMO: Tracker) √ √ Renewable Energy Standards Tracker √ √ Renewable Energy Standard Rate Adjustment Mechanism (RESRAM) Rider √ Predetermination (La Cygne) √ Construction Work in Progress in rate base (La Cygne) √ Abbreviated rate case √ Accounting Authority Order – Budget Treatment with Depreciation Deferral (La Cygne) √ 10 December 2014 Investor Presentation

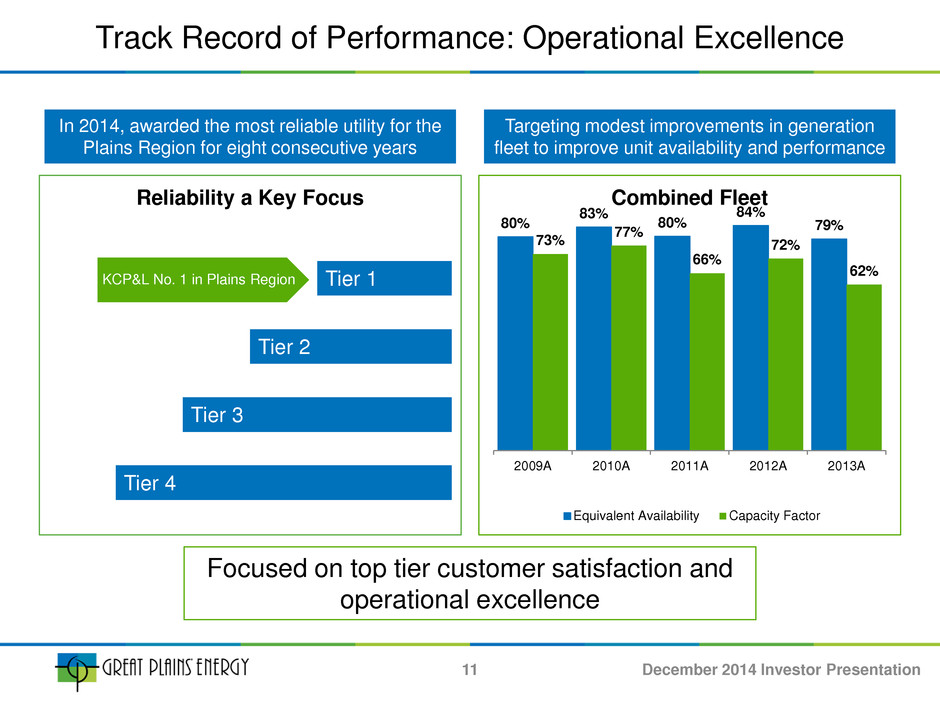

Focused on top tier customer satisfaction and operational excellence Tier 4 Tier 3 Tier 2 Tier 1 Reliability a Key Focus In 2014, awarded the most reliable utility for the Plains Region for eight consecutive years 80% 83% 80% 84% 79% 73% 77% 66% 72% 62% 2009A 2010A 2011A 2012A 2013A Combined Fleet Equivalent Availability Capacity Factor Targeting modest improvements in generation fleet to improve unit availability and performance Track Record of Performance: Operational Excellence KCP&L No. 1 in Plains Region 11 December 2014 Investor Presentation

$1.25 $1.35 $1.62 2011A 2012A 2013A 2014E Earnings Per Share Track Record of Performance: Improved Financial Profile $1.62 $1.52 12 • Earnings per share increased 20% from 2012 to 2013 • Continued focus on diligent cost management • Reducing regulatory lag through cost recovery mechanisms • General rate cases expected to support targeted annualized earnings growth of 4% - 6% from 2014 - 2016 December 2014 Investor Presentation

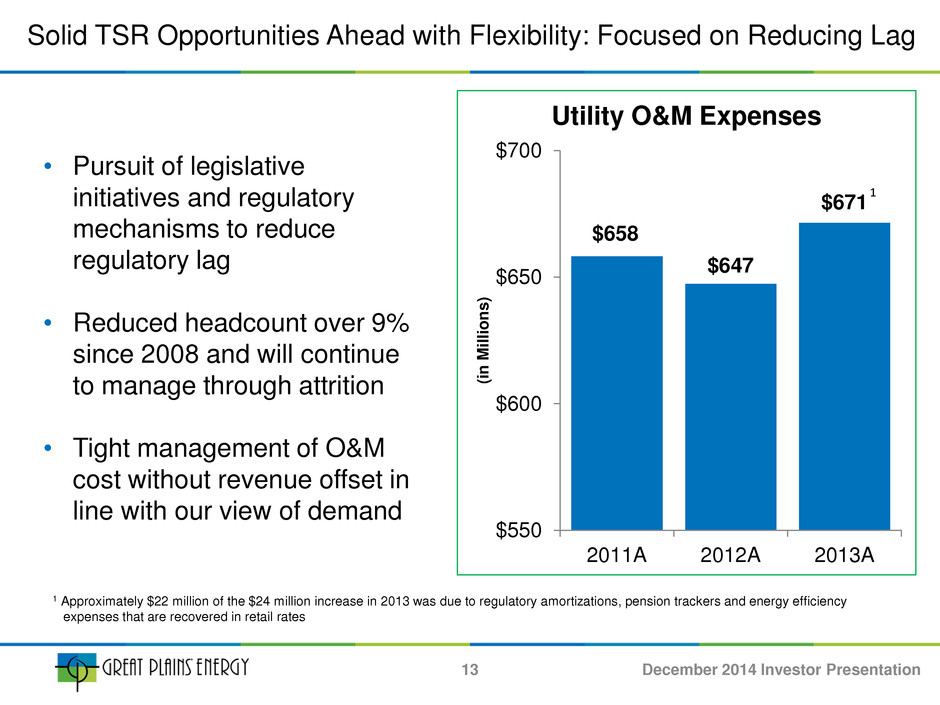

Solid TSR Opportunities Ahead with Flexibility: Focused on Reducing Lag $658 $647 $671 $550 $600 $650 $700 2011A 2012A 2013A (in M ill io ns ) Utility O&M Expenses • Pursuit of legislative initiatives and regulatory mechanisms to reduce regulatory lag • Reduced headcount over 9% since 2008 and will continue to manage through attrition • Tight management of O&M cost without revenue offset in line with our view of demand 1 Approximately $22 million of the $24 million increase in 2013 was due to regulatory amortizations, pension trackers and energy efficiency expenses that are recovered in retail rates 1 13 December 2014 Investor Presentation

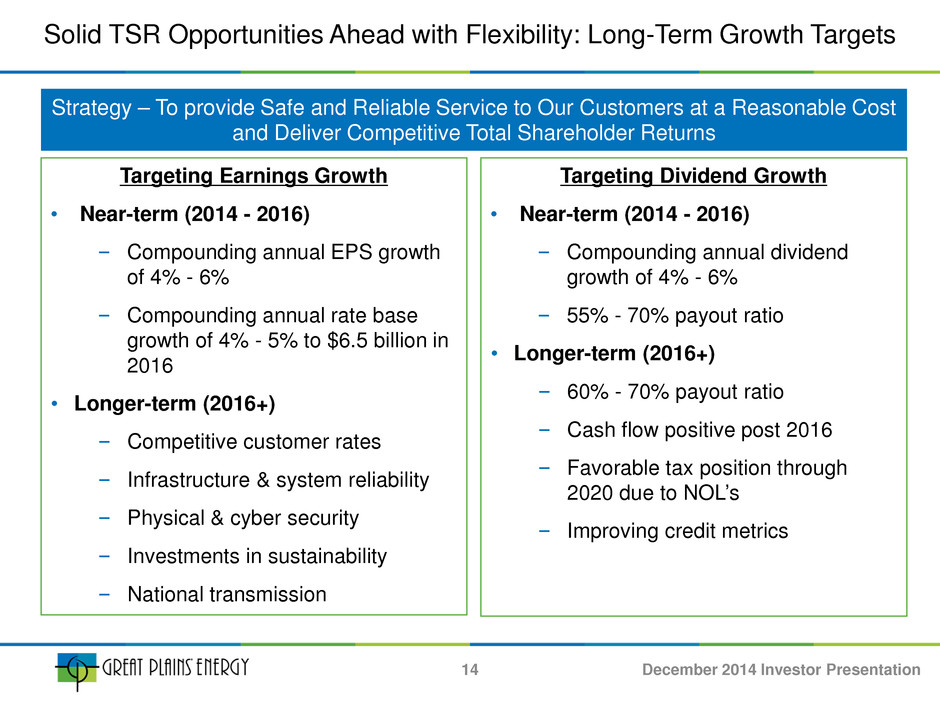

Solid TSR Opportunities Ahead with Flexibility: Long-Term Growth Targets Targeting Earnings Growth • Near-term (2014 - 2016) ‒ Compounding annual EPS growth of 4% - 6% ‒ Compounding annual rate base growth of 4% - 5% to $6.5 billion in 2016 • Longer-term (2016+) ‒ Competitive customer rates ‒ Infrastructure & system reliability ‒ Physical & cyber security ‒ Investments in sustainability ‒ National transmission Strategy – To provide Safe and Reliable Service to Our Customers at a Reasonable Cost and Deliver Competitive Total Shareholder Returns Targeting Dividend Growth • Near-term (2014 - 2016) ‒ Compounding annual dividend growth of 4% - 6% ‒ 55% - 70% payout ratio • Longer-term (2016+) ‒ 60% - 70% payout ratio ‒ Cash flow positive post 2016 ‒ Favorable tax position through 2020 due to NOL’s ‒ Improving credit metrics 14 December 2014 Investor Presentation

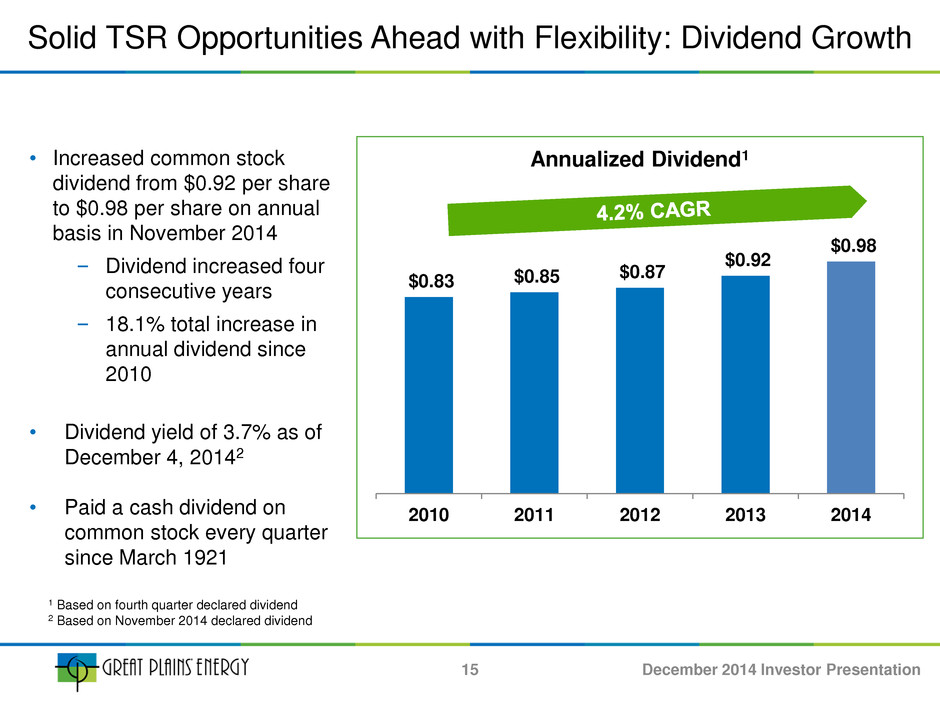

Solid TSR Opportunities Ahead with Flexibility: Dividend Growth $0.83 $0.85 $0.87 $0.92 $0.98 2010 2011 2012 2013 2014 Annualized Dividend1 • Increased common stock dividend from $0.92 per share to $0.98 per share on annual basis in November 2014 ‒ Dividend increased four consecutive years ‒ 18.1% total increase in annual dividend since 2010 • Dividend yield of 3.7% as of December 4, 20142 • Paid a cash dividend on common stock every quarter since March 1921 1 Based on fourth quarter declared dividend 2 Based on November 2014 declared dividend 15 December 2014 Investor Presentation

Focused on Shareholder Value Creation • Target significant reduction in regulatory lag • Seek to deliver earnings growth and increasing and sustainable dividends as a key component of total shareholder return • Improvement in / stability of key credit metrics is a priority Flexible Investment Opportunities • Environmental – approximately $700 million capital projects planned with clear timeline for compliance; additional $600 - $800 million to comply with proposed or final environmental regulations where timeline for compliance is uncertain, does not include potential impact of Clean Power Plan proposed in June 2014 • Transmission – formed Transource Energy, LLC joint venture to pursue competitive transmission projects • Renewables – driven by Missouri and Kansas Renewable Portfolio Standards • Other Growth Opportunities – selective future initiatives that will leverage our core strengths Diligent Regulatory Approach • Proven track record of constructive regulatory treatment • Credibility with regulators in terms of planning and execution of large, complex projects • Competitive retail rates on a regional and national level supportive of potential future investment Excellent Relationships with Key Stakeholders • Customers – focused on top tier customer satisfaction • Suppliers – strategic supplier alliances focused on long-term supply chain value • Employees – strong relations between management and labor (3 IBEW locals) • Communities – leadership, volunteerism and high engagement in the areas we serve GXP – Attractive Platform for Shareholders 16 December 2014 Investor Presentation

• NYSE: GXP • www.greatplainsenergy.com • Company Contacts: Lori Wright Vice President – Investor Relations and Treasurer (816) 556-2506 lori.wright@kcpl.com Tony Carreño Director, Investor Relations (816) 654-1763 anthony.carreno@kcpl.com Investor Relations Information 17 December 2014 Investor Presentation

Appendix Pages Operations Overview 19 – 29 2015 and 2016 Considerations and Projected Capital Expenditures Plan 30 – 31 Third Quarter and Year-to-Date September 30, 2014 Update 32 – 38 18 December 2014 Investor Presentation

Environmental1 63% 9% 28% % of Coal Fleet with Emission- Reducing Scrubbers Installed La Cygne Not Installed • Estimated cost to comply with final regulations2 with clear timelines for compliance – Estimated Cost: approximately $700 million – Projects include: • La Cygne – on schedule for completion in 2015 ‒ Unit 1 (368 MW3) – scrubber and baghouse ‒ Unit 2 (341 MW3) – full Air Quality Control System (AQCS) • Mercury and Air Toxics Standards (MATS) environmental investments • Estimated cost of compliance with proposed or final regulations where timing is uncertain4 – Estimated Cost: $600 – $800 million – Includes Clean Air Act and Clean Water Act • Flexibility provided by environmental investments already made 1 KCP&L and GMO filed annual updates to Integrated Resource Plans (IRP) with the Missouri Public Service Commission in March 2014, outlining various resource planning scenarios for environmental compliance with its operations 2 Best Available Retrofit Technology and Mercury and Air Toxics Standards 3 KCP&L’s share of jointly-owned facility 4 Does not include potential impact of Clean Power Plan proposed in June 2014 19 December 2014 Investor Presentation

Key Steps to Completion Status • New Chimney Shell Erected Completed (2Q 2012) • Site Prep; Major Equipment Purchase Completed (3Q 2012) • Installation of Over-fired Air and Low Nox Burners for La Cygne 2 Completed (2Q 2013) • Major Construction (excluding misc. finish work) Essentially Complete (3Q 2014) • Commence Startup Testing Completed (3Q 2014) • Tie-in Outage Unit 2 4Q 2014 On schedule • Tie-in Outage Unit 1 1Q 2015 On schedule • In-service 2Q 2015 On schedule La Cygne Generation Station • La Cygne Coal Unit 1 368 MW1 - Wet scrubber, baghouse, activated carbon injection • La Cygne Coal Unit 2 341 MW1 - Selective catalytic reduction system, wet scrubber, baghouse, activated carbon injection, over-fired air, low Nox burners • Project cost estimate, excluding AFUDC, $615 million1. Kansas jurisdictional share is approximately $280 million • 2011 predetermination order issued in Kansas deeming project as requested and cost estimate to be reasonable • Project is on schedule and at or below budget La Cygne Environmental Upgrade, Construction Update 1 KCP&L’s 50% share 20 December 2014 Investor Presentation

• Company-owned assets and commitments in place that will increase renewable portfolio to approximately 1,150 MW of wind, hydroelectric, landfill gas and solar power • Future renewable requirements driven by the Renewable Portfolio Standards (RPS) in Kansas and Missouri ‒ Well positioned to satisfy requirements in Kansas through 2023 and Missouri through at least 2035 • Flexibility regarding acquisition of future renewable resources: – Through Purchased Power Agreements (PPAs) and purchases of Renewable Energy Credits (RECs); or – Adding to rate base if supported by credit profile and available equity and debt financing • Energy efficiency expected to be a key component of future resource portfolio: – Aggressive pursuit planned with appropriate regulatory recovery 10% 10% 15% 15% 15% 15% 20% 0% 5% 10% 15% 20% 25% 2014 2015 2016 2017 2018 2019 2020 Kansas Renewable Portfolio Standards 5% 5% 5% 5% 10% 10% 10% 15% 0% 2% 4% 6% 8% 10% 12% 14% 16% 2014 2015 2016 2017 2018 2019 2020 2021 Missouri Renewable Portfolio Standards Based on three-year average peak retail demand Based on electricity provided to retail customers Renewable Energy and Energy Efficiency 21 December 2014 Investor Presentation

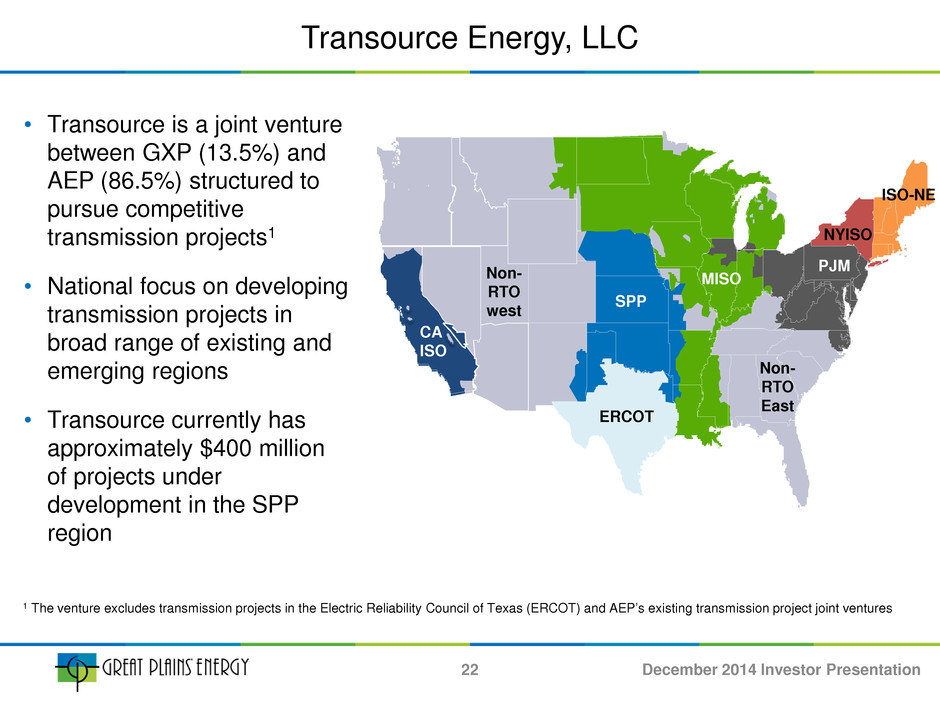

SPP ERCOT CA ISO Non- RTO west Non- RTO East MISO PJM NYISO ISO-NE Transource Energy, LLC • Transource is a joint venture between GXP (13.5%) and AEP (86.5%) structured to pursue competitive transmission projects1 • National focus on developing transmission projects in broad range of existing and emerging regions • Transource currently has approximately $400 million of projects under development in the SPP region 1 The venture excludes transmission projects in the Electric Reliability Council of Texas (ERCOT) and AEP’s existing transmission project joint ventures 22 December 2014 Investor Presentation

Transource’s Competitive Advantage 23 Transource combines the scale and unique capabilities of GXP and AEP Operational Excellence Successful history in operating and maintaining electric grid safely and reliably in multiple RTOs Environmental & asset stewardship Focused Results Extensive track record for delivering low cost solutions, project management, design and construction Broad knowledge and experience in the regulatory and regional environment Long-term growth opportunities Earnings diversity Enhanced financial flexibility Thought Leadership Execution Strength Effective Solutions Delivering beneficial solutions to customers and the grid Industry leader in developing and delivering innovative technology solutions Market Success December 2014 Investor Presentation

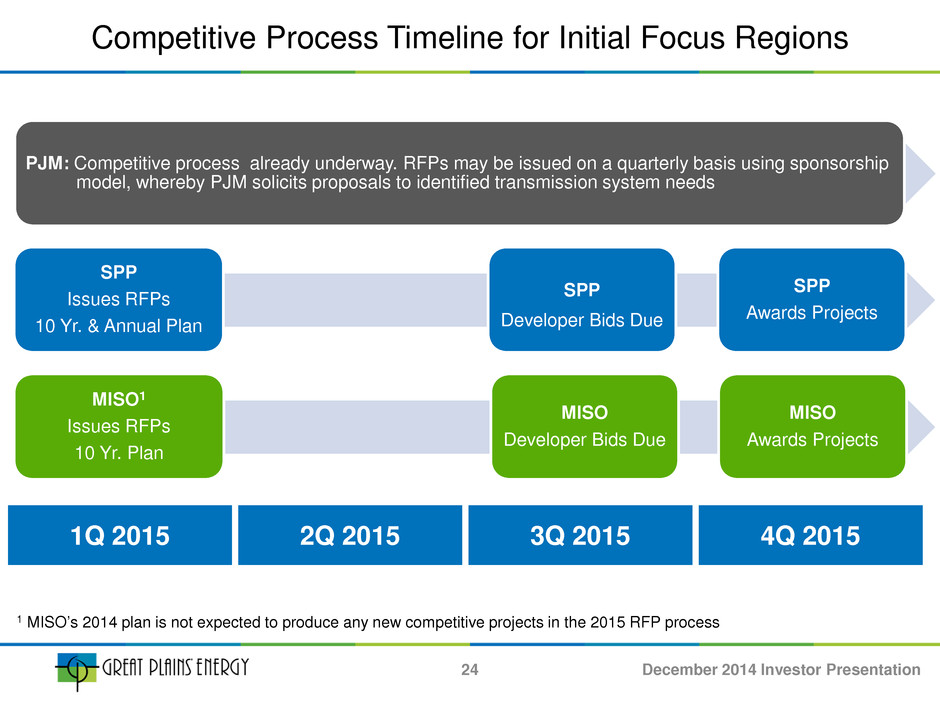

Competitive Process Timeline for Initial Focus Regions 24 1Q 2015 2Q 2015 3Q 2015 4Q 2015 SPP Issues RFPs 10 Yr. & Annual Plan SPP Developer Bids Due SPP Awards Projects MISO1 Issues RFPs 10 Yr. Plan MISO Developer Bids Due MISO Awards Projects PJM: Competitive process already underway. RFPs may be issued on a quarterly basis using sponsorship model, whereby PJM solicits proposals to identified transmission system needs 1 MISO’s 2014 plan is not expected to produce any new competitive projects in the 2015 RFP process December 2014 Investor Presentation

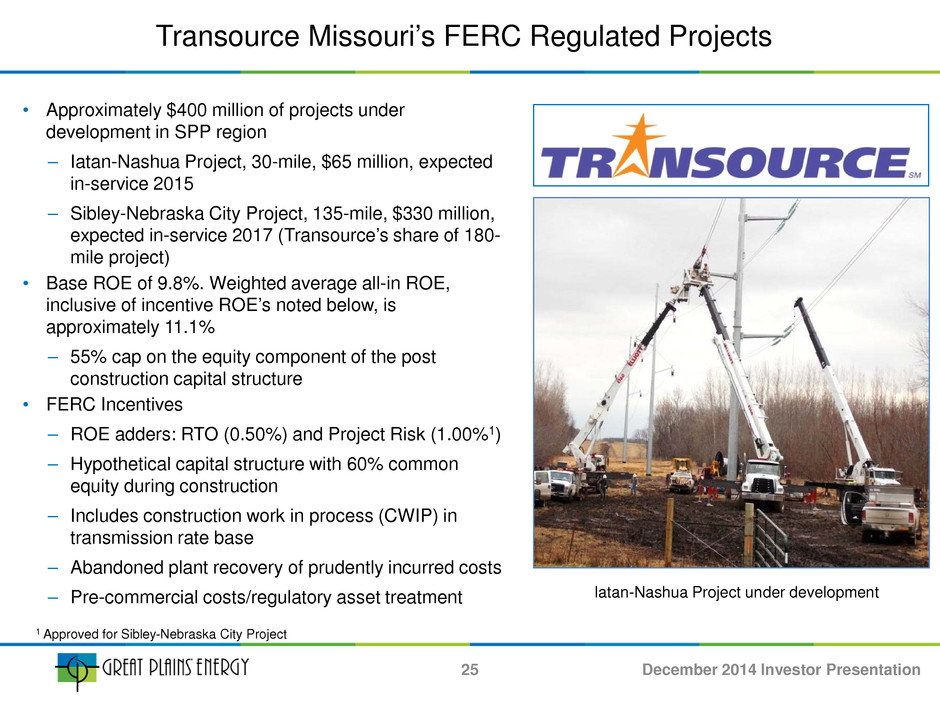

• Approximately $400 million of projects under development in SPP region – Iatan-Nashua Project, 30-mile, $65 million, expected in-service 2015 – Sibley-Nebraska City Project, 135-mile, $330 million, expected in-service 2017 (Transource’s share of 180- mile project) • Base ROE of 9.8%. Weighted average all-in ROE, inclusive of incentive ROE’s noted below, is approximately 11.1% – 55% cap on the equity component of the post construction capital structure • FERC Incentives – ROE adders: RTO (0.50%) and Project Risk (1.00%1) – Hypothetical capital structure with 60% common equity during construction – Includes construction work in process (CWIP) in transmission rate base – Abandoned plant recovery of prudently incurred costs – Pre-commercial costs/regulatory asset treatment Transource Missouri’s FERC Regulated Projects 25 Iatan-Nashua Project under development 1 Approved for Sibley-Nebraska City Project December 2014 Investor Presentation

Economic Development Activity Robust investments in the region by top-tier automobile manufacturers leading to additions and expansion in manufacturing sector Cerner Corporation broke ground in November 2014 on $4.5 billion business expansion that is expected to create up to 16,000 new jobs when completed by 2024 Well-developed transportation and distributed network strengthened by BNSF Railways new state-of-the art intermodal facility Housing Recovery in the housing market remains steady • October 2014 year to date single family building permits highest since 2007 • October 2014 year to date multi-family housing building permits up over 30% compared to the same period in 2013 Employment1 Kansas City area employment levels in October 2014 highest since 2008 Kansas City area unemployment rate of 6.0% in September 2014 compared with the national average of 5.7% Local Economy 1 On a non-seasonally adjusted basis 26 December 2014 Investor Presentation

Kansas Abbreviated Rate Case Summary • Kansas Corporation Commission issued an Order on July 17, 2014 approving Stipulation & Agreement • Rate base increase includes approximately $104 million1,2 of additional La Cygne environmental upgrade CWIP and $17 million1,2 of investments placed into service – Based on CWIP incurred since June 30, 2012, with known and measurable changes through February 28, 2014 – KCP&L’s share of project cost estimate is $615 million3 and the Kansas jurisdictional share is approximately $280 million3 o Approximately $92 million1,3 of remaining Kansas jurisdictional share expected to be added to rate base in 2015 general rate case • Maintained authorized ROE of 9.5% and common equity ratio of 51.8% based on 2012 KCC rate case order • Includes KCP&L’s proposed reductions to amortization for pension and OPEB and rate case expense 1 Reflects update to abbreviated rate case for known and measurable changes to CWIP as of February 28, 2014 2 Includes AFUDC 3 Excludes AFUDC Jurisdiction Docket Date Filed Annual Increase (in millions) Percent Increase Rate Base (in millions) Effective Date of New Rates KCP&L – KS 14-KCPE-272-RTS Dec. 9, 2013 $11.5(1) 2.2%(1) $1,916 July 25, 2014 27 December 2014 Investor Presentation

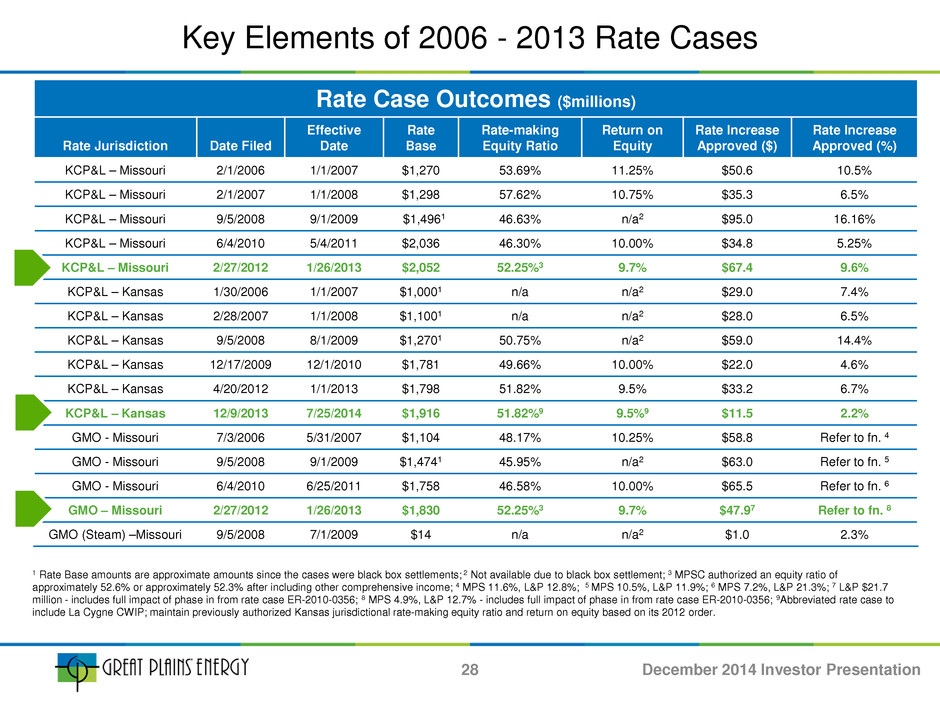

Key Elements of 2006 - 2013 Rate Cases Rate Case Outcomes ($millions) Rate Jurisdiction Date Filed Effective Date Rate Base Rate-making Equity Ratio Return on Equity Rate Increase Approved ($) Rate Increase Approved (%) KCP&L – Missouri 2/1/2006 1/1/2007 $1,270 53.69% 11.25% $50.6 10.5% KCP&L – Missouri 2/1/2007 1/1/2008 $1,298 57.62% 10.75% $35.3 6.5% KCP&L – Missouri 9/5/2008 9/1/2009 $1,4961 46.63% n/a2 $95.0 16.16% KCP&L – Missouri 6/4/2010 5/4/2011 $2,036 46.30% 10.00% $34.8 5.25% KCP&L – Missouri 2/27/2012 1/26/2013 $2,052 52.25%3 9.7% $67.4 9.6% KCP&L – Kansas 1/30/2006 1/1/2007 $1,0001 n/a n/a2 $29.0 7.4% KCP&L – Kansas 2/28/2007 1/1/2008 $1,1001 n/a n/a2 $28.0 6.5% KCP&L – Kansas 9/5/2008 8/1/2009 $1,2701 50.75% n/a2 $59.0 14.4% KCP&L – Kansas 12/17/2009 12/1/2010 $1,781 49.66% 10.00% $22.0 4.6% KCP&L – Kansas 4/20/2012 1/1/2013 $1,798 51.82% 9.5% $33.2 6.7% KCP&L – Kansas 12/9/2013 7/25/2014 $1,916 51.82%9 9.5%9 $11.5 2.2% GMO - Missouri 7/3/2006 5/31/2007 $1,104 48.17% 10.25% $58.8 Refer to fn. 4 GMO - Missouri 9/5/2008 9/1/2009 $1,4741 45.95% n/a2 $63.0 Refer to fn. 5 GMO - Missouri 6/4/2010 6/25/2011 $1,758 46.58% 10.00% $65.5 Refer to fn. 6 GMO – Missouri 2/27/2012 1/26/2013 $1,830 52.25%3 9.7% $47.97 Refer to fn. 8 GMO (Steam) –Missouri 9/5/2008 7/1/2009 $14 n/a n/a2 $1.0 2.3% 28 1 Rate Base amounts are approximate amounts since the cases were black box settlements; 2 Not available due to black box settlement; 3 MPSC authorized an equity ratio of approximately 52.6% or approximately 52.3% after including other comprehensive income; 4 MPS 11.6%, L&P 12.8%; 5 MPS 10.5%, L&P 11.9%; 6 MPS 7.2%, L&P 21.3%; 7 L&P $21.7 million - includes full impact of phase in from rate case ER-2010-0356; 8 MPS 4.9%, L&P 12.7% - includes full impact of phase in from rate case ER-2010-0356; 9Abbreviated rate case to include La Cygne CWIP; maintain previously authorized Kansas jurisdictional rate-making equity ratio and return on equity based on its 2012 order. December 2014 Investor Presentation

State Commissioners Missouri Public Service Commission (MPSC) Kansas Corporation Commission (KCC) Mr. Robert S. Kenney (D) Chair (since March 2013) Term began: July 2009 Term expires: April 2015 Ms. Shari Feist Albrecht (I) Chair (since January 2014) Term began: June 2012 Term expires: March 2016 Mr. Stephen M. Stoll (D) Commissioner Term began: June 2012 Term expires: December 2017 Mr. Jay S. Emler (R) Commissioner Term began: January 2014 Term expires: March 2015 Mr. William P. Kenney (R) Commissioner Term began: January 2013 Term expires: January 2019 Mr. Pat Apple (R) Commissioner Term began: March 2014 Term expires: March 2018 Mr. Daniel Y. Hall (D) Commissioner Term began: September 2013 Term expires: September 2019 Mr. Scott T. Rupp (R) Commissioner Term began: March 2014 Term expires: March 2020 MPSC consists of five (5) members, including the Chairman, who are appointed by the Governor and confirmed by the Senate. • Members serve six-year terms (may continue to serve after term expires until reappointed or replaced) ��� Governor appoints one member to serve as Chairman KCC consists of three (3) members, including the Chairman, who are appointed by the Governor and confirmed by the Senate. • Members serve four-year terms (may continue to serve after term expires until reappointed or replaced) • Commissioners elect one member to serve as Chairman 29 December 2014 Investor Presentation

2015 and 2016 Considerations 2015 2016 Monitor Demand and Tightly Control O&M • Assumes 0.5% - 1% weather-normalized sales • Proactive management of base O&M in-line with view of demand growth • Assumes 0.5% - 1% weather-normalized sales • Proactive management of base O&M in-line with view of demand growth Operational and Regulatory • Approximately seven months of new Kansas retail rates from abbreviated rate case • Increasing transmission and property taxes under- recovered in Missouri • La Cygne environmental upgrade in-service 2Q 2015 • October 1, 2015, anticipated effective date of new retail rates in Kansas ‒ Includes authorization to use budgeted project expenditures and depreciation deferral for La Cygne environmental upgrade • Effective date of new KCP&L retail rates in Missouri on or about September 30, 2015 ‒ Expect to implement fuel adjustment clause (FAC) ‒ Request to include transmission costs in FAC ‒ Property taxes trued up • Projected total company rate base of approximately $6.5 billion at the conclusion of rate cases • Anticipated full year of new retail rates for KCP&L in Kansas and Missouri • File general rate case in Missouri for GMO Improve Cash Flow Position and Support Targeted Dividend Growth • Minimal financial requirements ‒ Potential long-term debt issuance at KCP&L; no plans to issue equity ‒ Utilization of NOLs, minimizing cash income tax payments • Minimal financial requirements ‒ No plans to issue equity ‒ Utilization of NOLs, minimizing cash income tax payments 30 December 2014 Investor Presentation

Considerations Generating facilities • Includes expenditures associated with KCP&L’s 47% interest in Wolf Creek Distribution and Transmission facilities • Includes expenditures associated with vehicle fleet, expanding service areas and infrastructure replacement General facilities • Expenditures associated with information systems and facilities Environmental • KCP&L’s share of environmental upgrades at La Cygne to comply with the Best Available Retrofit Technology (BART) rule • Upgrades to comply with the Mercury and Air Toxic Standards (MATS) rule • Estimates for compliance with the Clean Air Act and Clean Water Act based on proposed or final regulations where the timing is uncertain. Projected Utility Capital Expenditures1,2 Projected Utility Capital Expenditures (In Millions) 2014E 2015E 2016E 2017E 2018E Generating facilities $ 232.7 $ 220.7 $ 211.2 $201.8 $224.4 Distribution and transmission facilities 202.0 201.6 200.2 199.9 214.1 General facilities 100.6 78.5 60.3 58.3 22.7 Nuclear fuel 47.4 21.9 21.9 42.1 27.2 Environmental 150.7 147.8 101.5 100.4 99.9 Total utility capital expenditures $ 733.4 $ 670.5 $ 595.1 $602.5 $588.3 1 Projected capital expenditures excludes Allowance for Funds Used During Construction (AFUDC) 2 Great Plains Energy accounts for its 13.5% ownership in Transource Energy, LLC (Transource) under the equity method of accounting. Great Plains Energy’s capital contributions to Transource will not be reflected in projected capital expenditures 31 December 2014 Investor Presentation

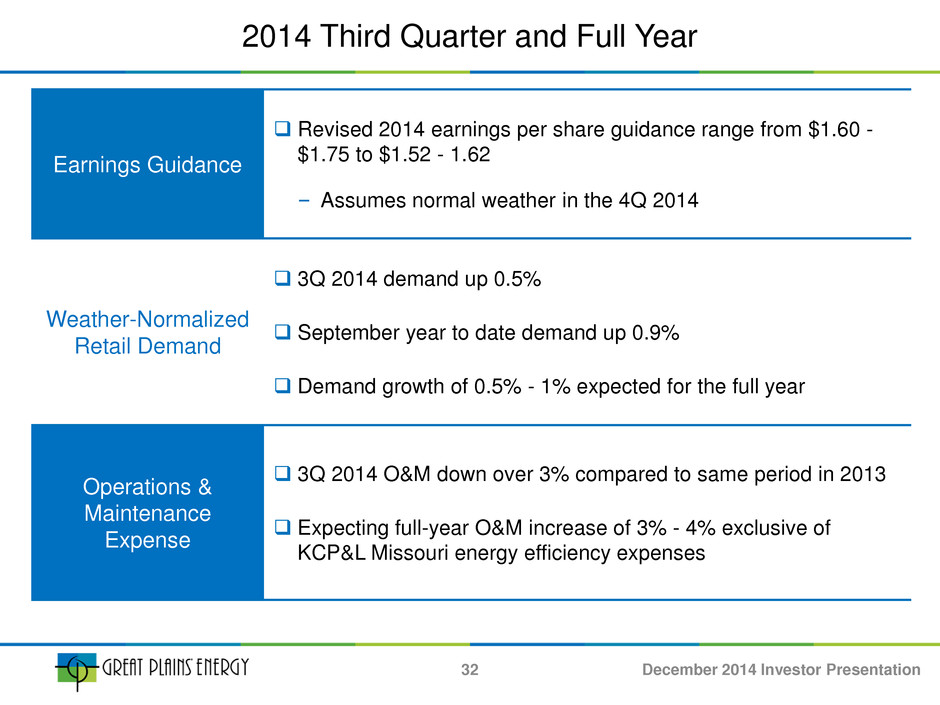

2014 Third Quarter and Full Year 32 Earnings Guidance Revised 2014 earnings per share guidance range from $1.60 - $1.75 to $1.52 - 1.62 ‒ Assumes normal weather in the 4Q 2014 Weather-Normalized Retail Demand 3Q 2014 demand up 0.5% September year to date demand up 0.9% Demand growth of 0.5% - 1% expected for the full year Operations & Maintenance Expense 3Q 2014 O&M down over 3% compared to same period in 2013 Expecting full-year O&M increase of 3% - 4% exclusive of KCP&L Missouri energy efficiency expenses December 2014 Investor Presentation

2014 Third Quarter EPS Reconciliation Versus 2013 Note: Numbers may not add due to the effect of dilutive shares on EPS 1 As of September 30 33 Contributors to Change in 2014 EPS Compared to 2013 New Retail Rates Release of Uncertain Tax Positions WN Demand Weather Wolf Creek O&M Other O&M General Taxes Depreciation & Amortization Other Total 1Q 2014 $ 0.04 - $ 0.02 $ 0.05 $ (0.04) $ (0.05) $ (0.02) $ (0.02) - $ (0.02) 2Q 2014 - - $ 0.01 $ 0.01 $ (0.02) $ (0.05) $ (0.01) $ (0.01) $ (0.07) 3Q 2014 $ 0.01 $ 0.05 - $ (0.06) $ 0.01 $ 0.02 $ (0.01) $ (0.01) $ 0.01 $ 0.02 YTD1 $ 0.05 $ 0.05 $ 0.03 - $ (0.04) $ (0.08) $ (0.04) $ (0.04) - $ (0.07) 2014 EPS 2013 EPS Change in EPS 1Q $ 0.15 $ 0.17 $ (0.02) 2Q $ 0.34 $ 0.41 $ (0.07) 3Q $ 0.95 $ 0.93 $ 0.02 YTD1 $ 1.44 $ 1.51 $ (0.07) December 2014 Investor Presentation

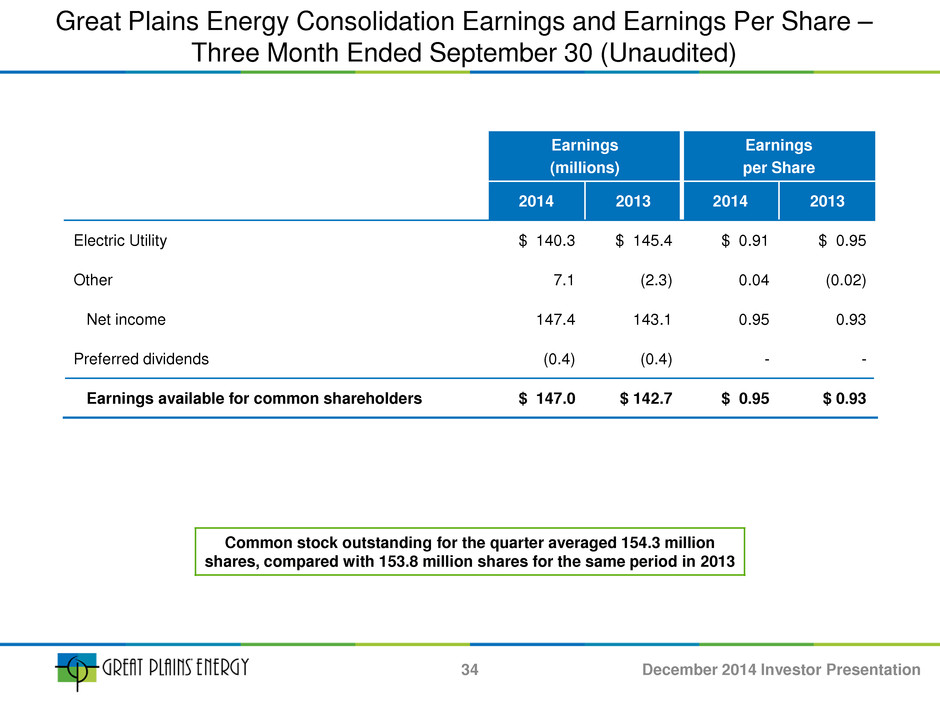

Great Plains Energy Consolidation Earnings and Earnings Per Share – Three Month Ended September 30 (Unaudited) 34 Common stock outstanding for the quarter averaged 154.3 million shares, compared with 153.8 million shares for the same period in 2013 Earnings (millions) Earnings per Share 2014 2013 2014 2013 Electric Utility $ 140.3 $ 145.4 $ 0.91 $ 0.95 Other 7.1 (2.3) 0.04 (0.02) Net income 147.4 143.1 0.95 0.93 Preferred dividends (0.4) (0.4) - - Earnings available for common shareholders $ 147.0 $ 142.7 $ 0.95 $ 0.93 December 2014 Investor Presentation

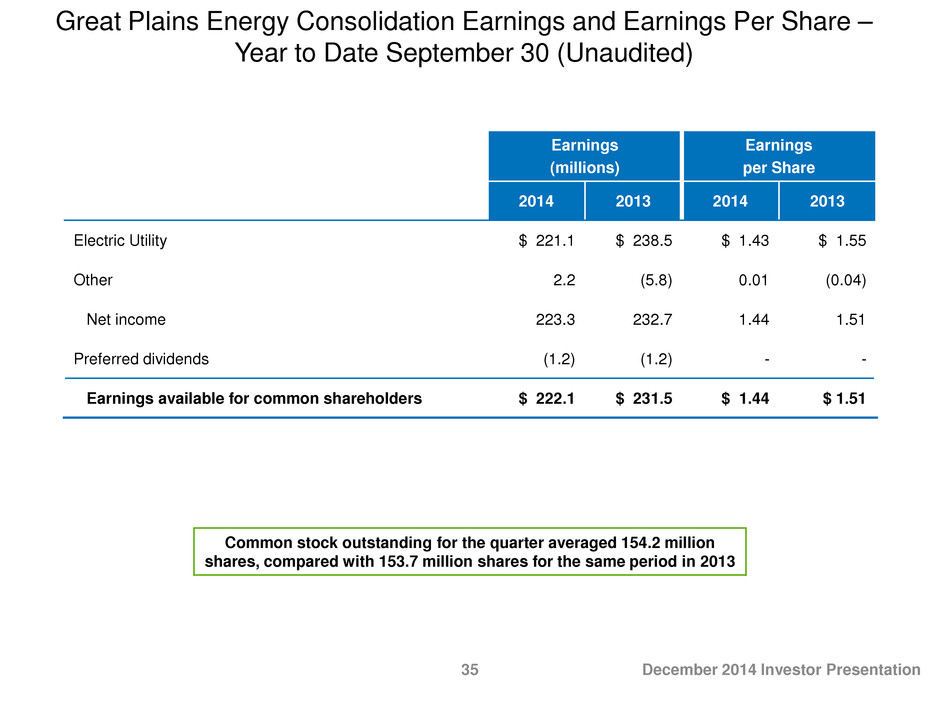

Great Plains Energy Consolidation Earnings and Earnings Per Share – Year to Date September 30 (Unaudited) 35 Common stock outstanding for the quarter averaged 154.2 million shares, compared with 153.7 million shares for the same period in 2013 Earnings (millions) Earnings per Share 2014 2013 2014 2013 Electric Utility $ 221.1 $ 238.5 $ 1.43 $ 1.55 Other 2.2 (5.8) 0.01 (0.04) Net income 223.3 232.7 1.44 1.51 Preferred dividends (1.2) (1.2) - - Earnings available for common shareholders $ 222.1 $ 231.5 $ 1.44 $ 1.51 December 2014 Investor Presentation

Great Plains Energy Reconciliation of Gross Margin to Operating Revenues (Unaudited) Gross margin is a financial measure that is not calculated in accordance with generally accepted accounting principles (GAAP). Gross margin, as used by Great Plains Energy, is defined as operating revenues less fuel, purchased power and transmission. The Company’s expense for fuel, purchased power and transmission, offset by wholesale sales margin, is subject to recovery through cost adjustment mechanisms, except for KCP&L’s Missouri retail operations. As a result, operating revenues increase or decrease in relation to a significant portion of these expenses. Management believes that gross margin provides a more meaningful basis for evaluating the Electric Utility segment’s operations across periods than operating revenues because gross margin excludes the revenue effect of fluctuations in these expenses. Gross margin is used internally to measure performance against budget and in reports for management and the Board of Directors. The Company’s definition of gross margin may differ from similar terms used by other companies. A reconciliation to GAAP operating revenues is provided in the table above. 36 Three Months Ended September 30 (millions) Year to Date September 30 (millions) 2014 2013 2014 2013 Operating revenues $ 782.5 $ 765.0 $ 2,016.0 $ 1,907.5 Fuel (142.3) (156.6) (392.9) (410.0) Purchased power (61.2) (25.7) (185.7) (99.4) Transmission of electricity by others (19.3) (13.6) (55.6) (37.9) Gross margin $ 559.7 $ 569.1 $ 1,381.8 $ 1,360.2 December 2014 Investor Presentation

September 30, 2014 Debt Profile and Credit Ratings Great Plains Energy Debt ($ in Millions) KCP&L GMO1 GPE Consolidated Amount Rate2 Amount Rate2 Amount Rate2 Amount Rate2 Short-term debt $ 315.6 0.47% $ 80.4 0.69% $ 0.0 $ 396.0 0.51% Long-term debt3 2,312.4 5.13% 448.7 5.05% 742.1 5.30% 3,503.2 5.16% Total $2,628.0 4.57% $529.1 4.39% $742.1 5.30% $3,899.24 4.68% Current Credit Ratings Moody’s Standard & Poor’s Great Plains Energy Outlook Corporate Credit Rating Preferred Stock Senior Unsecured Debt Stable - Ba1 Baa2 Stable BBB+ BBB- BBB KCP&L Outlook Senior Secured Debt Senior Unsecured Debt Commercial Paper Stable A2 Baa1 P-2 Stable A BBB+ A-2 GMO Outlook Senior Unsecured Debt Commercial Paper Stable Baa2 P-2 Stable BBB+ A-2 $ $100 $200 $300 $400 $500 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 D e b t ($ i n m il li o n s) Maturity GPE KCP&L GMO 1 Great Plains Energy guarantees approximately 22% of GMO’s debt; 2 Weighted Average Rates – excludes premium/discounts and other amortizations; 3 Includes current maturities of long-term debt; 4 Secured debt = $775M (20%), Unsecured debt = $3,124M (80%); 5 Includes long-term debt maturities through December 31, 2023 Long-Term Debt Maturities5 37 December 2014 Investor Presentation

Customer Consumption 1 As of September 30 2 Weighted average Retail MWh Sales Growth Rates 3Q 2014 Compared to 3Q 2013 YTD 2014 Compared to YTD 20131 Total Change in MWh Sales Weather – Normalized Change in MWh Sales % of Retail MWh Sales Total Change in MWh Sales Weather – Normalized Change in MWh Sales % of Retail MWh Sales Residential (8.3%) (2.4%) 40% 0.1% 0.0% 39% Commercial 0.3% 2.4% 47% 1.8% 1.0% 47% Industrial 2.2% 3.3% 13% 3.8% 3.9% 14% (3.1%) 0.5%2 1.4% 0.9%2 38 December 2014 Investor Presentation