Exhibit 13.1

| | |

| TABLE OF CONTENTS |

| |

President’s Message | | 1 |

| |

Selected Financial Data | | 4 |

| |

Management’s Discussion and Analysis of Financial Condition and Results of Operations | | 5 |

| |

Management’s Report on Internal Control Over Financial Reporting | | 20 |

| |

Report of Independent Registered Public Accounting Firm | | 21 |

| |

Consolidated Balance Sheets | | 22 |

| |

Consolidated Statements of Income | | 23 |

| |

Consolidated Statements of Changes in Shareholders’ Equity | | 24 |

| |

Consolidated Statements of Cash Flows | | 25 |

| |

Notes to Consolidated Financial Statements | | 26 |

| |

Regional Board Members | | 44 |

| |

| Shareholder Information | | Inside Back Cover |

PRESIDENT’S MESSAGE

DEAR SHAREHOLDER

It’s hard to believe that twenty years have passed since we first opened our doors and embarked on this journey together. From the beginning, we resolved to operate by a simple philosophy: “Treat others like you want to be treated yourself.” I realize that this philosophy may sound a bit trite in the growing complexity of the financial services industry and I know some are tired of hearing me repeat the phrase. However, I have always been a proponent of and continue to believe strongly that community banking is a good and important business. By adhering to our operating philosophy and consistently delivering outstanding customer service, Bank of Hampton Roads has succeeded over the past twenty years in becoming one of the most successful and well-respected banks in the Commonwealth of Virginia. We have done so while returning a great percentage of our earnings and otherwise delivering enhanced value to our shareholders, perhaps our most important measure of success. The growth of our business and strong financial performance in 2007 suggests that our business philosophy is working well. We are determined to continue to build on this foundation.

Last year at this time, I advised that I was looking forward to a banner year in keeping with our twenty year milestone. I am pleased to say that we achieved and realized the expected success. For the twentieth consecutive year, I have the distinct pleasure of reporting record earnings on behalf of our Company. Net income for 2007 was $6,810,613, an increase of 13% or $775,074 over 2006. The fact that we were able to achieve this despite the changing market conditions in the financial services industry that began in earnest during the fourth quarter of the year is a testament to our credit quality and focus on customer-oriented relationship banking.

This customer service-oriented approach to banking as well as our increased legal lending limit which resulted from our growth in 2007 and our 2006 stock offering helped to produce over $102 million in net new loans in 2007. Total loans outstanding at year-end were $477,149,232 compared to $375,044,161 a year ago. As a result of this strong loan growth, total assets ended 2007 at a record high of $563,828,128. Competition is especially acute in our market but we enjoy strong loyalty and commitment from our customers.

Our return on average assets ended the year very strong at 1.31%. This was the fifteenth year in a row that this ratio exceeded 1.20%. For 2007, the return on average assets for our Federal Financial Institutions Examination Council (“FFIEC”) peer group was 1.11% so we remain a leader by this measure.

Loan demand throughout 2007 was consistently high and peaked in the last four months of the year when the Federal Reserve initiated four interest rate cuts totaling 150 basis points. Since year-end, interest rates have decreased another 125 basis points and at the time of this letter, at least one more rate cut is predicted to help bolster the economy. While these actions are designed to benefit consumers and the macro economy, they pose a specific challenge for our industry. Because of these rate cuts and the increased cost of funding loans, net interest margins are facing pressure throughout the industry. At December 31, 2007, our net interest margin was 4.95%, down 25 basis points from year-end 2006. Managing this ratio will be among our greatest priorities in 2008.

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 1 |

Despite the slowing national economy, many commentators report that the Hampton Roads economy is fundamentally stable and projected to hold its own or perhaps even outperform the national economy this year. According to a recently released economic development study, the local port now contributes $12.3 billion to Hampton Roads’ economy and employs directly or indirectly 100,000 people with a $4.1 billion payroll. With the strong presence of the U.S. Navy and other branches of the armed forces, military spending makes up more than 25% of our region’s economy. Consequently, we believe that port activity and local defense spending will help to moderate and stabilize economic conditions in Hampton Roads.

As many of you know, Bank of Hampton Roads enjoys a long established reputation as Hampton Roads’ premier construction lender. Because of our history in this regard, you may be concerned about how the challenging housing market of late has affected this segment of our business, namely construction loans. I am proud to say that we provide construction financing to some of the best and most experienced custom home builders in our market. Many of these builders had the foresight to reduce their inventories of speculative homes and have started fewer contract homes over the last year. As a result, our construction loans as a percent of our total loans outstanding actually decreased from 2006 to 2007.

Demonstrating that Bank of Hampton Roads is the top choice for construction financing by our area’s top builders was the presence of our “Financing By” signs at Tidewater Builders Association’s 2007 Homearama. Bank of Hampton Roads financed seven of the seventeen castle-themed homes on display in Chesapeake’s prestigious Edinburgh neighborhood. Because of the beauty and overall appeal of the Edinburgh development, six of the seven homes we financed were already pre-sold or under contract prior to the event.

As visitors entered the site of this year’s Homearama, they all passed by the site of Bank of Hampton Roads’ new Edinburgh Office. It is located in the Edinburgh Commons North Shopping Center, which is anchored by Target and fronts the highly traveled Chesapeake Expressway. Our friendly staff is currently serving customers out of a temporary facility located on our property there while the office is under construction. We are very optimistic about the potential of this office with Edinburgh being the largest retail center between the Greenbrier area of Chesapeake and the Outer Banks of North Carolina. Edinburgh features a variety of national and specialty retailers, restaurants and services as well as a beautiful planned community.

With the addition of the Edinburgh location, Bank of Hampton Roads now has eighteen convenient branch offices, including nine in Chesapeake, four in Virginia Beach, four in Norfolk and one Suffolk. The Bank also has ATMs located in two of Norfolk’s most prominent entertainment venues: Scope and Chrysler Hall. Thanks to the efforts of all of our employees, but most especially those in our branches, our deposits increased 19% in 2007 to end the year at a record $431 million. We remain diligent in exploring opportunities for additional branches throughout Hampton Roads and, as we have evidenced historically, we will do that which is necessary to provide convenient personal service to our customers.

The safety and soundness of our Bank is something we pay attention to every day but the issue always draws more scrutiny in challenging times. Giving our depositors even more peace of mind beyond FDIC insurance are the numerous acknowledgements Bank of Hampton Roads has received throughout the years for its commitment to safety and soundness. The Bank has been awarded a 5-Star rating by BauerFinancial for fifty-three consecutive quarters, or just over thirteen years. In addition, the Bank was recently awarded a financial safety rating of “A” by TheStreet.com Ratings. Both ratings signify excellent financial stability for our customers, vendors and employees.

Hampton Roads Bankshares also received its own share of accolades in 2007. In September, we were notified by NASDAQ that our shares qualified for listing on the elite NASDAQ Global Select Market. Only about 1,200 companies are listed on the Global Select Market, having met NASDAQ’s most stringent financial, liquidity and corporate governance requirements. In 2007, our stock was also selected by the Russell Investment Group for inclusion in their Microcap Index. Our affiliation with NASDAQ has resulted in many new ways for us to introduce Hampton Roads Bankshares and our achievements to new investors.

Our Company has enjoyed much prosperity during its two decades of operations and it has a rich history of sharing its success with its shareholders and the community in general.

In consideration of our strong financial performance in 2007 and the tax-advantaged status of dividend payments, our Board of Directors increased the cash dividend 10% to an annualized rate of $0.44 per share. Since 1992, our Company has paid dividends to shareholders totaling $26,912,035 or 53% of our total net income for that period.

In 2007, our 11th Annual Charitable Golf Classic raised a record-breaking $170,000 for local charities, non-profit organizations and worthwhile causes. Since the tournament’s inception, the Bank has raised nearly $900,000 for the community. Every year, we match the proceeds from the golf tournament dollar for dollar and use that money to help as many different charities as we can. Recipients include local colleges and universities, CHKD, St. Jude Children’s Research Hospital, CHIP of Virginia, Cerebral Palsy of Virginia, Norfolk Botanical Garden and the Virginia Aquarium.

Bank of Hampton Roads also developed a very special partnership with the Foodbank of Southeastern Virginia in 2007. If you’ve visited our Deep Creek, Great Bridge or Great Neck Offices lately, you may have noticed some rather unusual looking employees – Cash Cows that stand about six feet tall. Our Cash Cows are coin counters similar to the machines you see in grocery stores where you can take in your loose coins, dump them in, and get bills in exchange for your coin. Our Cash Cows charge $0.05 for every $1.00 of change they count. All of the proceeds from the machines are donated to the Foodbank’s Kids Café, which can feed four children with every $1.00 that we contribute.

| | |

| 2 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

We were so humbled and proud of all that the Foodbank does for our community that we couldn’t help but want to do more for the organization. We recently started selling special edition Bank of Hampton Roads piggy banks to benefit the Foodbank’s Kids Café and couldn’t be more pleased with the results of this fundraiser. In less than a month, our kind-hearted customers purchased nearly $3,000 worth of the piggy banks at a cost of just $5.00 each. Local television station WTKR gave the Bank airtime during a recent evening newscast to present the first of what we hope is many more donations. Our donation of $3,000 enabled the Foodbank to provide 12,000 meals for people in our area who may have otherwise gone hungry.

2008 is likely going to be one of the busiest, most challenging and, by far, one of the most exciting years in the history of our company. Pending shareholder and regulatory approval, Shore Financial Corporation, the parent company of Shore Bank, will merge into Hampton Roads Bankshares. Shore Bank has an excellent reputation, a similar performance-driven culture, and operating strengths that are highly complimentary to ours. Shore Bank serves the Eastern Shore of Maryland and Virginia through eight full-service banking facilities and twenty-two ATMs. Through its affiliates, Shore also offers title insurance and investment products. As of December 31, 2007, Shore Financial Corporation had total assets of $267 million, total deposits of $197 million, total loans of $222 million, and total stockholders’ equity of $28 million. We believe that both of our organizations share a vision to grow and be the market leader without compromising profitability. By joining together, our two banks can execute a strategy through the Delmarva Peninsula which will result in a vibrant and visible bank franchise that serves both the divergent needs of our customers and provides rewarding opportunities for our employees. Most importantly and what always motivates our decision making, we believe that you, our shareholders, will enjoy the enhanced value and related benefits of our mutual vision.

I would be remiss if I did not take a moment to thank our people for all of the hard work and effort they put forth to ensure that our twentieth anniversary year was our best yet. Our staff is professional, knowledgeable and friendly and I could not ask for a better group of people working on behalf of our organization. As a testament to how we value our people, of the original ten Bank employees, myself included, four remain with the Bank and three have retired from the Bank. I would be surprised if such loyalty is not unique in community banking today. The Bank also enjoys the benefit of stable and talented executive management and I would expect that Shore Bank’s senior management will do nothing less than add depth and perspective to our Company as a whole. I feel the same way about our Board and thank them for their leadership and their confidence in our future potential. Again, Shore Bank’s Board members will only add to the value of our Company and I look forward to working with them in the future.

I will go on record stating that 2008 will be one of the most challenging years that we have ever faced. The 75 basis point cut in the federal funds rate on January 22, 2008 was the most the Federal Reserve had cut rates in a single action since 1991. Eight days later, the rate dropped another 50 basis points and is predicted to continue to decline, at least for the short-term. These actions have already affected our margins and further rate cuts will only add to our challenges in 2008. Rest assured that our management team will work diligently to protect our earnings.

One of the best measures of our ability to perform under any economic circumstances is to look at a chronicle of our past year-end net interest margins. For the last ten years, our net interest margin has consistently been at least 50 basis points higher than that reported by our FFIEC peer group.

N E T I N T E R E S T M A R G I N

| | | | |

| | | Hampton Roads

Bankshares | | FFIEC Peer

Group Average |

| | |

1998 | | 5.75% | | 4.46% |

1999 | | 5.49% | | 4.48% |

2000 | | 5.75% | | 4.53% |

2001 | | 5.24% | | 4.29% |

2002 | | 4.83% | | 4.31% |

2003 | | 4.65% | | 4.12% |

2004 | | 4.71% | | 4.11% |

2005 | | 5.26% | | 4.19% |

2006 | | 5.20% | | 4.21% |

2007 | | 4.95% | | 4.02% |

You can help us overcome the challenges we will face this year by always giving us the opportunity to meet your banking needs as well as referring your friends and business associates to us. The prime rate is at its lowest level in two years making it an attractive time to borrow. Bank of Hampton Roads is also implementing remote deposit capture, a new state-of-the-art product designed for commercial customers who would like to virtually eliminate their trips to the bank. Remote deposit capture uses a desktop scanner that connects to your PC and the Internet. With it, businesses can scan their customers’ checks and transmit their deposits electronically to us, anytime day or night.

Again, I express my thanks to our Board of Directors, Regional Board Members, employees, shareholders and customers for the contributions each of you has made to our extraordinary success over the last twenty years. We look forward to serving you with innovative products, delivered with exceptional service for many more years to come.

Very truly yours,

Jack W. Gibson

President & Chief Executive Officer

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 3 |

SELECTED FINANCIAL DATA

Years Ended December 31,

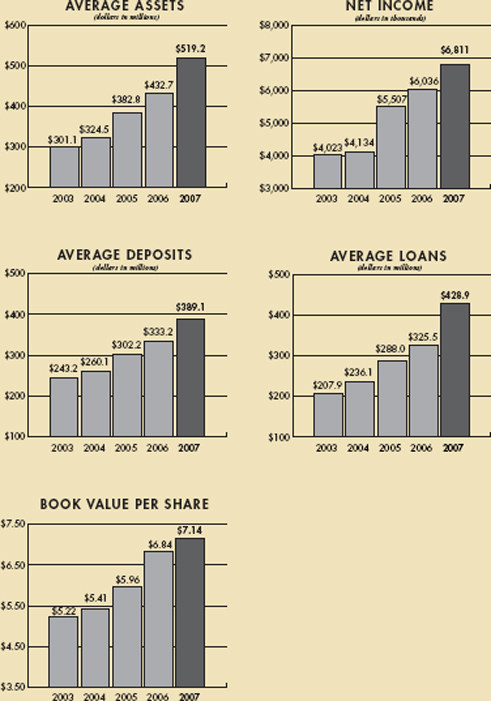

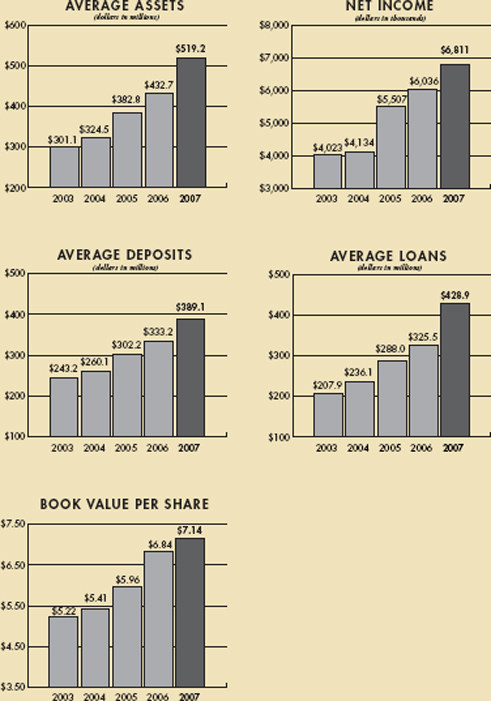

The financial information presented below for the years ended December 31, 2003, 2004, 2005, 2006 and 2007 has been derived from our audited consolidated financial statements. Our consolidated financial statements as of and for the years ended December 31, 2003, 2004, 2005 and 2006 have been audited by KPMG LLP, our former independent auditors. Our consolidated financial statements as of and for the year ended December 31, 2007 have been audited by Yount, Hyde & Barbour, P.C., our current independent auditors. This information is only a summary and should be read together with our consolidated historical financial statements and management’s discussion and analysis appearing elsewhere in this annual report.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands except per share data) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Operating Results: | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 38,203 | | | $ | 30,021 | | | $ | 24,558 | | | $ | 18,068 | | | $ | 17,469 | |

Interest expense | | | 14,016 | | | | 9,123 | | | | 5,869 | | | | 3,911 | | | | 4,417 | |

Net interest income | | | 24,187 | | | | 20,898 | | | | 18,689 | | | | 14,157 | | | | 13,052 | |

Provision for loan losses | | | 1,232 | | | | 180 | | | | 486 | | | | 926 | | | | 370 | |

Noninterest income | | | 3,440 | | | | 3,398 | | | | 3,214 | | | | 3,791 | | | | 3,410 | |

Noninterest expense | | | 15,994 | | | | 14,946 | | | | 13,040 | | | | 10,794 | | | | 9,983 | |

Income taxes | | | 3,590 | | | | 3,134 | | | | 2,870 | | | | 2,140 | | | | 2,086 | |

Income before cumulative effect of change in accounting principle | | | 6,811 | | | | 6,036 | | | | 5,507 | | | | 4,088 | | | | 4,023 | |

Cumulative effect of change in accounting principle, net | | | — | | | | — | | | | — | | | | 46 | | | | — | |

Net income | | $ | 6,811 | | | $ | 6,036 | | | $ | 5,507 | | | $ | 4,134 | | | $ | 4,023 | |

| | | | | |

Per Share Data: | | | | | | | | | | | | | | | | | | | | |

Basic earnings after change in accounting principle | | $ | 0.67 | | | $ | 0.66 | | | $ | 0.68 | | | $ | 0.52 | | | $ | 0.52 | |

Diluted earnings after change in accounting principle | | | 0.65 | | | | 0.65 | | | | 0.66 | | | | 0.50 | | | | 0.50 | |

Book value | | | 7.14 | | | | 6.84 | | | | 5.96 | | | | 5.41 | | | | 5.22 | |

Basic weighted average shares outstanding | | | 10,228,638 | | | | 9,092,980 | | | | 8,137,244 | | | | 7,973,844 | | | | 7,805,231 | |

Diluted weighted average shares outstanding | | | 10,431,554 | | | | 9,275,788 | | | | 8,407,821 | | | | 8,236,169 | | | | 7,994,251 | |

Shares outstanding at year-end | | | 10,314,899 | | | | 10,251,336 | | | | 8,242,822 | | | | 8,059,528 | | | | 7,908,708 | |

| | | | | |

Year-End Balances: | | | | | | | | | | | | | | | | | | | | |

Assets | | $ | 563,828 | | | $ | 476,299 | | | $ | 409,517 | | | $ | 344,969 | | | $ | 316,473 | |

Overnight funds sold | | | 183 | | | | 9,524 | | | | 18,294 | | | | 7,294 | | | | 10,038 | |

Loans | | | 477,149 | | | | 375,044 | | | | 285,330 | | | | 275,190 | | | | 210,775 | |

Investment securities | | | 47,081 | | | | 59,545 | | | | 73,826 | | | | 38,995 | | | | 72,046 | |

Deposits | | | 431,457 | | | | 363,261 | | | | 327,447 | | | | 275,115 | | | | 257,433 | |

Shareholders’ equity | | | 73,660 | | | | 70,163 | | | | 49,131 | | | | 43,626 | | | | 41,314 | |

| | | | | |

Average Balances: | | | | | | | | | | | | | | | | | | | | |

Assets | | $ | 519,175 | | | $ | 432,716 | | | $ | 382,821 | | | $ | 324,485 | | | $ | 301,073 | |

Overnight funds sold | | | 691 | | | | 4,558 | | | | 7,132 | | | | 6,509 | | | | 10,179 | |

Loans | | | 428,874 | | | | 325,506 | | | | 287,979 | | | | 236,082 | | | | 207,853 | |

Investment securities | | | 53,946 | | | | 67,130 | | | | 52,706 | | | | 57,455 | | | | 61,705 | |

Deposits | | | 389,055 | | | | 333,242 | | | | 302,167 | | | | 260,110 | | | | 243,177 | |

Shareholders’ equity | | | 71,545 | | | | 57,640 | | | | 44,855 | | | | 41,960 | | | | 39,311 | |

Ratios: | | | | | | | | | | | | | | | | | | | | |

Return on average assets | | | 1.31 | % | | | 1.39 | % | | | 1.44 | % | | | 1.27 | % | | | 1.34 | % |

Return on average equity | | | 9.52 | | | | 10.47 | | | | 12.28 | | | | 9.85 | | | | 10.23 | |

Average equity to average assets | | | 13.78 | | | | 13.32 | | | | 11.72 | | | | 12.93 | | | | 13.06 | |

Allowance for loan losses to year-end loans | | | 1.06 | | | | 1.04 | | | | 1.26 | | | | 1.12 | | | | 1.40 | |

Net interest margin | | | 4.95 | | | | 5.20 | | | | 5.26 | | | | 4.71 | | | | 4.65 | |

Dividend payout ratio | | | 64.18 | | | | 75.76 | | | | 52.94 | | | | 63.46 | | | | 80.77 | |

Efficiency ratio | | | 57.89 | | | | 61.52 | | | | 59.54 | | | | 60.14 | | | | 60.64 | |

| | |

| 4 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

MANAGEMENT’S DISCUSSION AND ANALYSIS

of Financial Condition and Results of Operations

Introduction

Hampton Roads Bankshares, Inc. (the “Company”) is headquartered in Norfolk, Virginia and conducts its primary operations through its wholly owned subsidiary, Bank of Hampton Roads (the “Bank”). Unless the context otherwise requires, the term the “Company” is also used to refer to Hampton Roads Bankshares, Inc. and its consolidated subsidiaries on a combined basis. The Company is a financial services holding company with $564 million in total assets providing a variety of community banking and investment services in the Southeastern portion of Virginia known as South Hampton Roads. In addition to the Bank, the Company owns Hampton Roads Investments, Inc. (“HRI”). This non-bank subsidiary provides clients with a variety of securities and insurance products.

The following commentary provides information about the major components of our results of operations and financial condition, liquidity, and capital resources. This discussion and analysis should be read in conjunction with the Consolidated Financial Statements and Notes to Consolidated Financial Statements presented elsewhere in this Annual Report. It should also be read in conjunction with the “Caution About Forward-Looking Statements” section at the end of this discussion.

Financial Overview

The Company’s primary source of revenue is net interest income earned by the Bank. Net interest income represents interest and fees earned from lending and investment activities less the interest paid to fund these activities. In addition to net interest income, noninterest income is another important source of revenue for the Company. Noninterest income is derived primarily from service charges on deposits and fees earned from bank services. Other factors that impact net income are the provision for loan losses and noninterest expense.

Net income for 2007 increased 12.84% to $6.81 million from $6.04 million for 2006. Diluted earnings per share remained constant at $0.65 for both 2007 and 2006 due to an increased average number of shares outstanding during 2007. In the third quarter of 2006, the Company raised approximately $19 million in capital through a rights offering to existing shareholders and a public offering, resulting in the issuance of 1,849,200 new shares of common stock. Book value per share increased to $7.14 for 2007 compared to $6.84 for 2006. Net income for 2005 was $5.51 million with diluted earnings per share of $0.66 and book value per share of $5.96.

The increase in equity from the stock offerings also explains the decrease in return on average equity experienced during 2007 to 9.52% from 10.47% in 2006 and 12.28% in 2005. Return on average assets was 1.31% for 2007, 1.39% for 2006, and 1.44% for 2005. This profitability indicator was influenced by a decreasing net interest margin.

During 2007, the Company’s net interest margin declined to 4.95% from 5.20% in 2006 and 5.26% in 2005. The Federal Reserve Bank kept short term interest rates steady during the first eight months of 2007, but then began to decrease the targeted federal funds rate, first by 50 basis points in September 2007 and again by 25 basis points in each of October and December of 2007. Due to the asset sensitive nature of the Bank’s balance sheet, with assets such as variable rate loans repricing more quickly than liabilities such as certificates of deposit, a decreasing interest rate environment tends to cause a decline in net interest margin. The Company manages interest rate risk associated with assets and liabilities repricing on different bases in several ways including using floors and caps on variable interest rate loans and keeping the terms on both assets and liabilities short with most maturing or repricing within five years.

Despite the declining net interest margin, net interest income rose during 2007 to $24.19 million, a 15.74% increase over 2006. This increase in net interest income was the primary factor involved in the increase in net income for 2007 and resulted from the strong growth in loans experienced during the year.

In 2007, the Company continued to benefit from high growth rates in assets, loans, and deposits. Total assets increased to $563.83 million at year-end 2007, up 18.38% from $476.30 million at year-end 2006. The majority of this growth occurred in the loan portfolio with total loans increasing to $477.15 million at year-end 2007, up 27.22% from $375.04 million at year-end 2006. The funding for this loan growth came in the form of increased borrowings from the Federal Home Loan Bank, increased deposits, and proceeds from investment maturities. Deposits accounted for the largest portion of the funding with total deposits rising to $431.46 million at year-end 2007, up 18.77% from $363.26 million at year-end 2006.

In order to maintain its liquidity position during 2007, the Company expanded its sources of funding to include brokered and national market certificates of deposit. Competition for local market deposits has caused the pricing for local deposits to rise making brokered and national market certificates of deposit a cost efficient source of funds. The Company monitors its portfolio of brokered and national market certificates closely and has set limits on the types and amounts of funding that will be obtained in this manner.

The higher net interest income was offset partially by an increase in the provision for loan losses. The provision increased to $1.23 million in 2007 compared to $180 thousand in 2006 and $486 thousand in 2005. The increase in the loan loss provision

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 5 |

reflected the growth in the loan portfolio during 2007 as well as the nature of the economic environment. As seen by the Company’s asset quality ratios, the loan portfolio quality remains high. Nonperforming assets to total assets were 0.47% at year-end 2007 compared to 0.34% at year-end 2006. Allowance for loan losses to nonperforming assets was 190.67% at year-end 2007 compared to 239.94% at year-end 2006.

Results of Operations

Net Interest Income

Net interest income is the difference between interest income and interest expense and represents the gross profit margin. The following influences may significantly impact net interest income and net interest margin:

| | • | | Variations in the volume and mix of interest earning assets and interest bearing liabilities; |

| | • | | Changes in the yields earned and rates paid; and |

| | • | | The level of noninterest bearing liabilities available to support earning assets. |

Table 1presents the average interest earning assets and average interest bearing liabilities, the average yields earned on such assets and rates paid on such liabilities, and the net interest margin for the indicated periods. The variance in interest income and expense caused by differences in average balances and rates is shown inTable 2.

2007 Compared to 2006

Net interest income increased 15.74% in 2007 to $24.19 million, or $3.29 million over the 2006 total. The increase in net interest income during 2007 was attained by strong increases in the average balance of interest earning assets, most notably in average loans. Interest rates also were a factor in net interest income and the net interest margin in 2007. The average yield on interest earning assets increased from 7.47% in 2006 to 7.82% in 2007 and the average rate paid on interest bearing liabilities increased from 3.37% in 2006 to 4.11% in 2007. These changes in average yield and rate produced a net interest spread which compressed from 4.10% in 2006 to 3.71% in 2007.

Net interest margin, which is calculated by expressing net interest income as a percentage of average interest earning assets, is an indicator of effectiveness in generating income from earning assets. The Company’s net interest margin was 4.95% in 2007, as compared to 5.20% in 2006 and 5.26% in 2005. The net interest margin decreased in 2007 as a result of a declining rate environment. Based on economic forecasts and initial interest rate movements in 2008, the declining trend in interest rates is likely to continue, in which case further compression of the net interest margin can be expected.

Interest income from loans, including loan fees, rose to $35.60 million for the year 2007, an increase of $8.78 million over 2006. During 2007, average loans increased $103.37 million, or 31.76%, while the average interest yield increased 6 basis points. New loan production was strong throughout 2007. At December 31, 2007, approximately 54.43% of the loan portfolio consisted of variable rate loans, compared with 49.73% and 49.88% at December 31, 2006 and 2005, respectively.

Interest income from investment securities decreased $405 thousand from 2006 to 2007. This decrease is related to a decrease in average investment securities of $13.18 million partially offset by an increase in the average interest yield of 24 basis points. As investments matured during 2007, the proceeds were used to fund loan growth.

A shift in the mix of funding sources was a factor in the Company’s net interest margin in 2007. Average noninterest bearing demand deposits made up only 25.53% of the average deposit portfolio in 2007 compared to 29.97% in 2006 and 32.98% in 2005. Time deposits, a higher cost funding source, made up 43.41% of the average deposit portfolio in 2007 compared to 35.09% in 2006 and 32.37% in 2005. Savings deposits, including the premium savings account product, made up 20.56% of the average deposit portfolio in 2007 compared to 21.10% in 2006 and 17.35% in 2005. The Company also increased rates on deposit accounts in order to attract deposits to fund loan growth. Interest expense on deposits increased $4.03 million from 2006 to 2007 as average interest bearing deposits increased $56.38 million or 24.06% and the average rate paid on interest bearing deposits increased 75 basis points. Interest on other borrowings increased $865 thousand from 2006 to 2007 resulting from an increase in average other borrowings of $14.37 million and a 56 basis point increase in the average rate paid on other borrowings.

2006 Compared to 2005

Net interest income in 2006 increased $2.21 million, or 11.82%, over the 2005 amount. The increase in net interest income during 2006 was attributable to growth in average interest earning assets and higher rates on those assets netted against higher rates paid on interest bearing liabilities. The average yield on interest earning assets increased from 6.92% in 2005 to 7.47% in 2006 and the average rate paid on interest bearing liabilities increased from 2.51% in 2005 to 3.37% in 2006. These changes in average yield and rate produced a net interest spread which compressed from 4.41% in 2005 to 4.10% in 2006.

Interest income from loans, including loan fees, increased $4.49 million to $26.83 million in 2006 over the 2005 amount due to an increase of 48 basis points in the average interest yield and an increase of $37.53 million in the average loan balance. Interest income on investment securities increased $1.00 million from 2005 to 2006. This increase was caused by an increase in the average yield on investment securities of 79 basis points, along with an increase in average investment securities of $14.42 million. Interest expense increased $3.25 million from 2005 to 2006 due to a $36.88 million increase in average interest bearing liabilities and an 86 basis point increase in the average rate paid on interest bearing liabilities.

| | |

| 6 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

Table 1: Average Balance Sheet and Net Interest Margin Analysis

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands) | | Average

Balance | | | 2007

Interest

Income/

Expense | | Average

Yield/

Rate | | | Average

Balance | | | 2006

Interest

Income/

Expense | | Average

Yield/

Rate | | | Average

Balance | | | 2005

Interest

Income/

Expense | | Average

Yield/

Rate | |

Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans | | $ | 428,874 | | | $ | 35,604 | | 8.30 | % | | $ | 325,506 | | | $ | 26,827 | | 8.24 | % | | $ | 287,979 | | | $ | 22,342 | | 7.76 | % |

Investment securities | | | 53,946 | | | | 2,316 | | 4.29 | | | | 67,130 | | | | 2,721 | | 4.05 | | | | 52,706 | | | | 1,720 | | 3.26 | |

Interest-bearing deposits in other banks | | | 4,870 | | | | 248 | | 5.09 | | | | 4,761 | | | | 244 | | 5.12 | | | | 7,184 | | | | 246 | | 3.42 | |

Overnight funds sold | | | 691 | | | | 35 | | 5.07 | | | | 4,558 | | | | 229 | | 5.02 | | | | 7,132 | | | | 250 | | 3.51 | |

Total interest earning assets | | | 488,381 | | | | 38,203 | | 7.82 | | | | 401,955 | | | | 30,021 | | 7.47 | | | | 355,001 | | | | 24,558 | | 6.92 | |

Noninterest earning assets | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Cash and due from banks | | | 15,907 | | | | | | | | | | 16,194 | | | | | | | | | | 15,801 | | | | | | | |

Premises and equipment | | | 11,961 | | | | | | | | | | 11,808 | | | | | | | | | | 10,432 | | | | | | | |

Other assets | | | 7,354 | | | | | | | | | | 6,527 | | | | | | | | | | 4,986 | | | | | | | |

Less: Allowance for loan losses | | | (4,428 | ) | | | | | | | | | (3,768 | ) | | | | | | | | | (3,399 | ) | | | | | | |

Total assets | | $ | 519,175 | | | | | | | | | $ | 432,716 | | | | | | | | | $ | 382,821 | | | | | | | |

|

Liabilities and Shareholders’ Equity: | |

Interest bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest bearing demand | | $ | 40,863 | | | $ | 678 | | 1.66 | % | | $ | 46,132 | | | $ | 522 | | 1.13 | % | | $ | 52,268 | | | $ | 319 | | 0.61 | % |

Savings deposits | | | 79,994 | | | | 2,866 | | 3.58 | | | | 70,315 | | | | 2,180 | | 3.10 | | | | 52,415 | | | | 1,156 | | 2.21 | |

Time deposits | | | 168,886 | | | | 8,113 | | 4.80 | | | | 116,918 | | | | 4,927 | | 4.21 | | | | 97,823 | | | | 3,391 | | 3.47 | |

Other borrowings | | | 51,336 | | | | 2,359 | | 4.60 | | | | 36,968 | | | | 1,494 | | 4.04 | | | | 30,944 | | | | 1,003 | | 3.24 | |

Total interest bearing liabilities | | | 341,079 | | | | 14,016 | | 4.11 | | | | 270,333 | | | | 9,123 | | 3.37 | | | | 233,450 | | | | 5,869 | | 2.51 | |

Noninterest bearing liabilities | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Demand deposits | | | 99,312 | | | | | | | | | | 99,877 | | | | | | | | | | 99,661 | | | | | | | |

Other liabilities | | | 7,239 | | | | | | | | | | 4,866 | | | | | | | | | | 4,855 | | | | | | | |

Shareholders’ equity | | | 71,545 | | | | | | | | | | 57,640 | | | | | | | | | | 44,855 | | | | | | | |

Total liabilities and shareholders’ equity | | $ | 519,175 | | | | | | | | | $ | 432,716 | | | | | | | | | $ | 382,821 | | | | | | | |

Net interest income | | | | | | $ | 24,187 | | | | | | | | | $ | 20,898 | | | | | | | | | $ | 18,689 | | | |

Net interest spread | | | | | | | | | 3.71 | % | | | | | | | | | 4.10 | % | | | | | | | | | 4.41 | % |

Net interest margin | | | | | | | | | 4.95 | % | | | | | | | | | 5.20 | % | | | | | | | | | 5.26 | % |

Note: Interest income from loans included fees of $1,414,086 in 2007, $1,359,262 in 2006, and $2,408,180 in 2005. Nonaccrual loans are not material and are included in loans above.

Table 2: Effect of Changes in Rate and Volume on Net Interest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | 2007 Compared to 2006 | | | 2006 Compared to 2005 | | | 2005 Compared to 2004 | |

| | | Interest | | | | | | | | | Interest | | | | | | | | Interest | | | | | |

| | | Income/ | | | Variance | | | Income/ | | | Variance | | | Income/ | | Variance | |

| | | Expense | | | Attributable to | | | Expense | | | Attributable to | | | Expense | | Attributable to | |

| (In thousands) | | Variance | | | Rate | | | Volume | | | Variance | | | Rate | | Volume | | | Variance | | Rate | | Volume | |

Interest Earning Assets: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loans | | $ | 8,777 | | | $ | 197 | | | $ | 8,580 | | | $ | 4,485 | | | $ | 1,451 | | $ | 3,034 | | | $ | 5,967 | | $ | 2,090 | | $ | 3,877 | |

Investment securities | | | (405 | ) | | | 175 | | | | (580 | ) | | | 1,001 | | | | 470 | | | 531 | | | | 104 | | | 215 | | | (111 | ) |

Interest-bearing deposits in other banks | | | 4 | | | | (2 | ) | | | 6 | | | | (2 | ) | | | 4 | | | (6 | ) | | | 241 | | | 36 | | | 205 | |

Overnight funds sold | | | (194 | ) | | | 4 | | | | (198 | ) | | | (21 | ) | | | 102 | | | (123 | ) | | | 178 | | | 171 | | | 7 | |

Total interest earning assets | | $ | 8,182 | | | $ | 374 | | | $ | 7,808 | | | $ | 5,463 | | | $ | 2,027 | | $ | 3,436 | | | $ | 6,490 | | $ | 2,512 | | $ | 3,978 | |

|

Interest Bearing Liabilities: | |

Deposits | | $ | 4,028 | | | $ | 1,967 | | | $ | 2,061 | | | $ | 2,763 | | | $ | 1,708 | | $ | 1,055 | | | $ | 1,516 | | $ | 957 | | $ | 559 | |

Other borrowings | | | 865 | | | | 226 | | | | 639 | | | | 491 | | | | 275 | | | 216 | | | | 441 | | | 49 | | | 392 | |

Total interest bearing liabilities | | | 4,893 | | | | 2,193 | | | | 2,700 | | | | 3,254 | | | | 1,983 | | | 1,271 | | | | 1,957 | | | 1,006 | | | 951 | |

Net interest income | | $ | 3,289 | | | $ | (1,819 | ) | | $ | 5,108 | | | $ | 2,209 | | | $ | 44 | | $ | 2,165 | | | $ | 4,533 | | $ | 1,506 | | $ | 3,027 | |

Note: The change in interest due to both rate and volume has been allocated to variance attributable to rate and variance attributable to volume in proportion to the relationship for the absolute amounts of the change in each.

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 7 |

Noninterest Income

2007 Compared to 2006

As shown inTable 3, the Company reported an increase in total noninterest income of $42 thousand, or 1.24%, in 2007 over 2006. Noninterest income comprised 8.26% of total revenue in 2007, 10.17% in 2006 and 11.57% in 2005.

Service charges on deposit accounts, the Company’s primary source of noninterest income, increased 6.51% from 2006 to 2007. This increase was due to an increase in non sufficient funds (“NSF”) fees and service charges on commercial checking accounts.

Other service charges and fees decreased $80 thousand or 5.25% from 2006 to 2007 due primarily to equity method losses on the Company’s investment in a financial services equity fund and decreases in the commission income earned by the Company’s investment services subsidiary, HRI.

2006 Compared to 2005

Noninterest income increased $184 thousand or 5.72% from 2005 to 2006. From 2005 to 2006, service charges on deposit accounts decreased 3.65% due to a decline in NSF fees and stop payment fees. Other bank service charges and fees increased $255 thousand, or 20.09%, from 2005 to 2006 due primarily to an increase in commission income earned by the Company’s investment services subsidiary, HRI.

Table 3: Noninterest Income

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, | | | | | | | | 2007 Compared

to 2006 | | | 2006 Compared

to 2005 | |

| (In thousands) | | 2007 | | 2006 | | 2005 | | Amount | | | % | | | Amount | | | % | |

Service charges on deposit accounts | | $ | 1,996 | | $ | 1,874 | | $ | 1,945 | | $ | 122 | | | 6.51 | % | | $ | (71 | ) | | (3.65 | )% |

Other service charges and fees | | | 1,444 | | | 1,524 | | | 1,269 | | | (80 | ) | | (5.25 | ) | | | 255 | | | 20.09 | |

Total noninterest income | | $ | 3,440 | | $ | 3,398 | | $ | 3,214 | | $ | 42 | | | 1.24 | % | | $ | 184 | | | 5.72 | % |

Noninterest Expense

2007 Compared to 2006

Noninterest expense represents the overhead expenses of the Company. One of the core operating principles of management continues to be the careful monitoring and control of these expenses. The efficiency ratio, calculated by dividing noninterest expense by the sum of net interest income and noninterest income, improved to 57.89% in 2007 compared to 61.52% in 2006 and 59.54% in 2005. As shown inTable 4, total noninterest expense increased $1.05 million, or 7.01%, for the year ended December 31, 2007 to $15.99 million, compared to $14.95 million in 2006.

Table 4: Noninterest Expense

| | | | | | | | | | | | | | | | | | | | | | | |

December 31, | | | | | | 2007 Compared

to 2006 | | | 2006 Compared

to 2005 | |

| (In thousands) | | 2007 | | 2006 | | 2005 | | Amount | | | % | | | Amount | | | % | |

Salaries and employee benefits | | $ | 9,954 | | $ | 9,106 | | $ | 7,962 | | $ | 848 | | | 9.31 | % | | $ | 1,144 | | | 14.37 | % |

Occupancy | | | 1,668 | | | 1,677 | | | 1,109 | | | (9 | ) | | (0.54 | ) | | | 568 | | | 51.22 | |

Data processing | | | 612 | | | 598 | | | 560 | | | 14 | | | 2.34 | | | | 38 | | | 6.79 | |

Directors’ and regional board fees | | | 307 | | | 284 | | | 313 | | | 23 | | | 8.10 | | | | (29 | ) | | (9.27 | ) |

Bank franchise tax | | | 464 | | | 280 | | | 251 | | | 184 | | | 65.71 | | | | 29 | | | 11.55 | |

Equipment | | | 343 | | | 304 | | | 205 | | | 39 | | | 12.83 | | | | 99 | | | 48.29 | |

Professional fees | | | 279 | | | 367 | | | 380 | | | (88 | ) | | (23.98 | ) | | | (13 | ) | | (3.42 | ) |

Telephone and postage | | | 305 | | | 294 | | | 282 | | | 11 | | | 3.74 | | | | 12 | | | 4.26 | |

ATM and VISA Check Card expense | | | 500 | | | 423 | | | 467 | | | 77 | | | 18.20 | | | | (44 | ) | | (9.42 | ) |

Advertising and marketing | | | 326 | | | 481 | | | 304 | | | (155 | ) | | (32.22 | ) | | | 177 | | | 58.22 | |

Other | | | 1,236 | | | 1,132 | | | 1,207 | | | 104 | | | 9.19 | | | | (75 | ) | | (6.21 | ) |

Total noninterest expense | | $ | 15,994 | | $ | 14,946 | | $ | 13,040 | | $ | 1,048 | | | 7.01 | % | | $ | 1,906 | | | 14.62 | % |

Salaries and employee benefits accounted for the largest portion of noninterest expense during each of the years in the three-year period ended December 31, 2007. During 2007, salaries and benefits were $9.95 million, an increase of $848 thousand over 2006. This increase was driven by annual incentive increases and an increase in the number of full-time equivalent employees, including one executive officer.

| | |

| 8 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

Occupancy expense decreased $9 thousand for the year ended December 31, 2007 to $1.67 million. This decrease was primarily due to a decrease in building maintenance expense netted against an increase in rent expense.

Data processing expense increased $14 thousand, or 2.34%, to $612 thousand from 2006 to 2007. This increase is due to costs associated with improvements made to the online banking product and implementation of deposit capture in the branches.

All other expenses combined to cause an increase of $195 thousand from 2006 to 2007. The largest change occurred in the bank franchise tax category which increased $184 thousand from 2006 to 2007 as a result of higher Bank equity after the rights and public offerings in 2006.

2006 Compared to 2005

From 2005 to 2006, the increase in noninterest expense was $1.91 million, or 14.62%. Salaries and employee benefits accounted for $1.14 million of that increase due to annual incentive increases, an increase in the number of full time equivalent employees, and increases in certain employee benefit costs designed to reward employees for generating new business. From 2005 to 2006, occupancy expense increased $568 thousand due to the addition of the Great Bridge branch on January 31, 2005 and the Dominion Tower branch on August 16, 2005 as well as moving the Company’s headquarters to downtown Norfolk in November 2005. From 2005 to 2006, data processing expense increased $38 thousand related to the cost of upgrading branch networking equipment including the purchase of new network servers and computer equipment. In 2006, other expenses combined to cause an increase of $155 thousand over the amount recorded in 2005. The largest of these increases occurred in the advertising and marketing category which was $177 thousand higher in 2006 over 2005 due to a television campaign running from December 2005 through May 2006.

Provision for Income Taxes

Income tax expense for 2007, 2006, and 2005 was $3.59 million, $3.13 million, and $2.87 million, respectively. The Company’s effective tax rate for the years ended December 31, 2007, 2006, and 2005 was 34.52%, 34.18%, and 34.26%, respectively, and differed from the statutory rate of 34.18% on 2007 and 34.00% in 2006 and 2005 due primarily to nondeductible expenses.

Financial Condition

Loans

As a community bank, the Company has a primary objective of meeting the business and consumer credit needs within its market where standards of profitability, client relationships and credit quality can be met. As shown inTable 5, the overall loan portfolio grew $102.11 million, or 27.22%, from year-end 2006 to year-end 2007.

Table 5: Loans by Classification

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

| (In thousands) | | Balance | | | % | | | Balance | | | % | | | Balance | | | % | | | Balance | | | % | | | Balance | | % | |

Loan Classification: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Commercial | | $ | 109,783 | | | 23.01 | % | | $ | 72,133 | | | 19.23 | % | | $ | 60,972 | | | 21.37 | % | | $ | 58,501 | | | 21.26 | % | | $ | 59,334 | | 28.15 | % |

Construction | | | 165,469 | | | 34.68 | | | | 116,812 | | | 31.15 | | | | 85,205 | | | 29.86 | | | | 73,508 | | | 26.71 | | | | 44,465 | | 21.10 | |

Real estate -commercial mortgage | | | 151,601 | | | 31.77 | | | | 140,260 | | | 37.40 | | | | 104,313 | | | 36.56 | | | | 108,314 | | | 39.36 | | | | 74,865 | | 35.52 | |

Real estate -residential mortgage | | | 38,523 | | | 8.07 | | | | 25,523 | | | 6.81 | | | | 20,011 | | | 7.01 | | | | 17,900 | | | 6.50 | | | | 15,595 | | 7.40 | |

Installment loans to individuals | | | 11,976 | | | 2.51 | | | | 20,599 | | | 5.49 | | | | 15,107 | | | 5.30 | | | | 17,251 | | | 6.27 | | | | 16,493 | | 7.82 | |

Deferred loan fees and related costs | | | (203 | ) | | (0.04 | ) | | | (283 | ) | | (0.08 | ) | | | (278 | ) | | (0.10 | ) | | | (284 | ) | | (0.10 | ) | | | 23 | | 0.01 | |

Total loans | | $ | 477,149 | | | 100.00 | % | | $ | 375,044 | | | 100.00 | % | | $ | 285,330 | | | 100.00 | % | | $ | 275,190 | | | 100.00 | % | | $ | 210,775 | | 100.00 | % |

Commercial loans are loans to businesses which typically are not collateralized by real estate. Generally the purpose of commercial loans is for the financing of accounts receivable, inventory, or the purchase of equipment and machinery. The commercial loan portfolio increased $37.65 million from the 2006 year-end balance of $72.13 million to the 2007 year-end balance of $109.78 million. The commercial loan category grew 18.31% from year-end 2005 to year-end 2006.

Construction loans increased $48.66 million from the year-end 2006 balance of $116.81 million to the year-end 2007 balance of $165.47 million. Construction and development loans are made to individuals and businesses for the purpose of construction of single family residential properties, multi-family properties and commercial projects, as well as the development of residential neighborhoods and commercial office parks. The Company has been, and continues to be, a leader in Hampton Roads in the construction and development market. The Company’s success is partially attributable to the years of experience held by senior management and the construction and development lending team at the Company. The construction loan category grew 37.10% from year-end 2005 to year-end 2006.

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 9 |

The Company makes real estate-commercial mortgage loans for the purchase and re-financing of owner occupied commercial properties as well as non-owner occupied income producing properties. These loans are secured by various types of commercial real estate including office, retail, warehouse, industrial, storage facilities and other non-residential types of properties. The real estate-commercial mortgage loan portfolio increased $11.34 million from the 2006 year-end balance of $140.26 million to the 2007 year-end balance of $151.60 million. The real estate-commercial mortgage loan category increased 34.46% from year-end 2005 to year-end 2006.

The real estate-residential mortgage portfolio includes first and second mortgage loans, home equity lines of credit and other term loans secured by first and second mortgages. First mortgage loans are generally for the purchase of permanent residences, second homes or residential investment property. Second mortgages and home equity loans are generally for personal, family and household purposes such as home improvements, major purchases, education and other personal needs. The Company refers a substantial portion of its residential real estate business to its affiliate, THF. The Company owns 19% of THF and accounts for its ownership using the equity method. Through its affiliation with THF, the Company is able to provide its customers with enhanced mortgage products. The real estate-residential mortgage loan portfolio increased $13.00 million from the 2006 year-end balance of $25.52 million to the 2007 year-end balance of $38.52 million. The real estate-residential mortgage loan category increased 27.54% from year-end 2005 to year-end 2006.

Installment loans to individuals are made on a regular basis for personal, family, and general household purposes. More specifically, the Company makes automobile loans, home improvement loans, loans for vacations, and debt consolidation loans with the majority of the portfolio made up of automobile loans. Due to low interest rates offered by auto dealership financial programs, this segment of our loan portfolio has remained a small portion of the overall loan portfolio. The installment loan portfolio decreased $8.62 million from the 2006 year-end balance of $20.60 million to the 2007 year-end balance of $11.98 million. The installment loan category increased 36.35% from year-end 2005 to year-end 2006.

The Company’s specialization in construction and development lending has resulted in a loan concentration, defined as 10.00% of the total loan portfolio, in loans to real estate developers. As of year-end 2007, the Company had $165.47 million, or 34.68% of total loans, in loans outstanding to finance construction and development. These loans are collateralized by the underlying real estate. No other loan concentrations existed as of December 31, 2007.

Loan growth will continue to be one of the Company’s primary goals for 2008 and beyond. The long-range objective for growth in the loan portfolio will be achieved through continued community involvement, relationships with existing customers, enhancement of the Company’s image as a community asset, and management’s strengthened efforts to offer competitively-priced products, while offering high quality, personalized service. Furthermore, to balance the emphasis on loan growth, prudent business practices and internal guidelines and underwriting standards will continue to be followed in making lending decisions in order to manage exposure to loan losses.

Table 6sets forth the maturity periods of the Company’s loan portfolio as of December 31, 2007. Demand loans are reported as due within one year. Loans are included in the period in which they contractually mature. Since the majority of the Company’s loan portfolio is short-term, and 54.43% of the loan portfolio as of December 31, 2007 had adjustable or floating rates, the Company can re-price its portfolio frequently to adjust the portfolio to current market rates.

Table 6: Loan Maturities Schedule

| | | | | | | | | | | | | | | | | | |

| December 31, 2007 | | | | | | | | | | | | |

| (In thousands) | | Commercial | | Construction | | R/E Commercial | | R/E Residential | | Installment | | Total |

Variable Rate: | | | | | | | | | | | | | | | | | | |

Within 1 year | | $ | 34,531 | | $ | 149,660 | | $ | 42,679 | | $ | 14,244 | | $ | 2,758 | | $ | 243,872 |

1 to 5 years | | | 3,284 | | | 1,128 | | | — | | | 10,689 | | | 746 | | | 15,847 |

After 5 years | | | — | | | — | | | — | | | — | | | 126 | | | 126 |

Total variable rate | | $ | 37,815 | | $ | 150,788 | | $ | 42,679 | | $ | 24,933 | | $ | 3,630 | | $ | 259,845 |

| | | | | | |

Fixed Rate: | | | | | | | | | | | | | | | | | | |

Within 1 year | | $ | 9,232 | | $ | 11,704 | | $ | 20,927 | | $ | 2,138 | | $ | 3,731 | | $ | 47,732 |

1 to 5 years | | | 61,019 | | | 2,977 | | | 87,977 | | | 11,435 | | | 4,577 | | | 167,985 |

After 5 years | | | 1,717 | | | — | | | 18 | | | 17 | | | 38 | | | 1,790 |

Total fixed rate | | $ | 71,968 | | $ | 14,681 | | $ | 108,922 | | $ | 13,590 | | $ | 8,346 | | $ | 217,507 |

Total maturities | | $ | 109,783 | | $ | 165,469 | | $ | 151,601 | | $ | 38,523 | | $ | 11,976 | | $ | 477,352 |

| | |

| 10 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

Non-Performing Assets

Total non-performing assets were $2.64 million, or 0.47% of total assets at year-end 2007, as compared to $1.63 million, or 0.34% of total assets at year-end 2006 and $1.82 million, or 0.44% of total assets at year-end 2005. Management classifies non-performing assets as those loans in nonaccrual status, those loans on which payment has been delinquent 90 days or more, but are still accruing interest, and real estate acquired in settlement of loans. Management closely reviews the composition of non-performing assets and related collateral values.

Loans categorized as 90 days or more past due were $852 thousand at December 31, 2007. The Company did not have any loans categorized as 90 days or more past due at December 31, 2006, but did have $30 thousand at December 31, 2005.

Nonaccrual loans were $1.79 million at December 31, 2007 compared to $1.63 million and $1.79 million at December 31, 2006 and 2005, respectively. Nonaccrual loans at year-end 2007 consisted of one commercial loan and one construction loan. The commercial loan is being treated as an impaired loan and, accordingly, the balance has been written down to the present value of expected future payments. As a general rule, loans are placed in nonaccrual status when principal or interest is 90 days or more past due, or when management deems collection of all principal and interest doubtful. Had income on nonaccrual loans been recorded under original terms, $164,006, $153,128, and $136,878 of additional interest income would have been recorded in 2007, 2006 and 2005, respectively. There were no interest payments recorded in 2007 as interest income for nonaccrual loans.

The Company did not have any real estate acquired in settlement of loans at December 31, 2007, 2006 or 2005.

Allowance for Loan Losses and Provision for Loan Losses

The Company continuously reviews its loan portfolio and maintains an allowance for loan losses sufficient to absorb incurred losses inherent in the portfolio. In addition to the review of credit quality through ongoing credit review processes, the Company constructs a comprehensive allowance analysis for its loan portfolio at least quarterly. This analysis includes two basic elements: specific allowances for individual loans, and general allowances for loan pools which factor in historical loan loss experience for the Company, loan portfolio growth and trends, and economic conditions.

As part of the loan loss reserve methodology, loans are categorized into one of six pools: commercial, construction, commercial real estate, residential real estate, consumer installment, and credit cards. These categories are further subdivided by assigned asset quality. Loss factors are calculated using the above mentioned qualitative data and then are applied to each of the loan pools to determine a reserve level for each of the six pools of loans. In addition, special allocations may be assigned to nonaccrual or other problem credits.

After considering these factors, the allowance for loan losses was $5.04 million, or 1.06% of outstanding loans at year-end 2007. This compares to an allowance of $3.91 million, or 1.04% of total loans and $3.60 million, or 1.26% of total loans at year-end 2006 and 2005, respectively, as seen inTable 7. At present, management believes that the allowance for loan losses is adequate. However, the allowance is subject to regulatory examinations and determination as to adequacy, which may take into account such factors as the methodology used to calculate the allowance and the size of the allowance in comparison to peer banks identified by regulatory agencies. Such agencies may require the Company to recognize additions to the allowance for loan losses based on their judgments about information available at the time of their examinations.

The Company’s provision for loan losses in 2007 was $1.23 million compared to $180 thousand in 2006 and $486 thousand in 2005. The increased provision for loan losses during 2007 was attributable to the growth in the loan portfolio and the current economic environment. Additionally, during 2006, recoveries on loans exceeded charge-offs, which resulted in a lower provision for loan losses that year.

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 11 |

Table 7: Allowance for Loan Losses Analysis

| | | | | | | | | | | | | | | | | | | | |

| December 31, | | | | | | | | | | | | | | | |

| (In thousands) | | 2007 | | | 2006 | | | 2005 | | | 2004 | | | 2003 | |

Allowance for Loan Losses: | | | | | | | | | | | | | | | | | | | | |

Balance at beginning of year | | $ | 3,911 | | | $ | 3,597 | | | $ | 3,071 | | | $ | 2,948 | | | $ | 2,843 | |

Charge-offs: | | | | | | | | | | | | | | | | | | | | |

Commercial | | | — | | | | — | | | | (24 | ) | | | (845 | ) | | | (142 | ) |

Construction | | | (91 | ) | | | — | | | | — | | | | — | | | | — | |

Real estate - commercial mortgage | | | — | | | | — | | | | — | | | | — | | | | — | |

Real estate - residential mortgage | | | — | | | | — | | | | — | | | | — | | | | — | |

Installment loans to individuals | | | (18 | ) | | | (59 | ) | | | (75 | ) | | | (95 | ) | | | (157 | ) |

Total charge-offs | | | (109 | ) | | | (59 | ) | | | (99 | ) | | | (940 | ) | | | (299 | ) |

Recoveries: | | | | | | | | | | | | | | | | | | | | |

Commercial | | | — | | | | 166 | | | | 119 | | | | 110 | | | | 16 | |

Construction | | | — | | | | — | | | | — | | | | — | | | | — | |

Real estate - commercial mortgage | | | — | | | | — | | | | — | | | | — | | | | — | |

Real estate - residential mortgage | | | — | | | | — | | | | — | | | | — | | | | — | |

Installment loans to individuals | | | 9 | | | | 27 | | | | 20 | | | | 27 | | | | 18 | |

Total recoveries | | | 9 | | | | 193 | | | | 139 | | | | 137 | | | | 34 | |

Net (charge-offs) recoveries | | | (100 | ) | | | 134 | | | | 40 | | | | (803 | ) | | | (265 | ) |

Provision for loan losses | | | 1,232 | | | | 180 | | | | 486 | | | | 926 | | | | 370 | |

Balance at end of year | | $ | 5,043 | | | $ | 3,911 | | | $ | 3,597 | | | $ | 3,071 | | | $ | 2,948 | |

Allowance for loan losses to year-end loans | | | 1.06 | % | | | 1.04 | % | | | 1.26 | % | | | 1.12 | % | | | 1.40 | % |

Ratio of net (charge-offs) recoveries to average loans | | | (0.02 | )% | | | 0.04 | % | | | 0.01 | % | | | (0.34 | )% | | | (0.13 | )% |

The Company has allocated the allowance for loan losses to the categories as shown inTable 8. Notwithstanding these allocations, the entire allowance for loan losses is available to absorb charge-offs in any category of loan.

Table 8: Allocation of Allowance for Loan Losses

| | | | | | | | | | | | | | | |

| December 31, | | | | | | | | | | |

| (In thousands) | | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

Commercial | | $ | 1,447 | | $ | 1,058 | | $ | 1,068 | | $ | 1,040 | | $ | 1,003 |

Construction | | | 1,522 | | | 993 | | | 767 | | | 588 | | | 358 |

Real estate - commercial mortgage | | | 1,395 | | | 1,192 | | | 978 | | | 961 | | | 734 |

Real estate - residential mortgage | | | 264 | | | 160 | | | 130 | | | 118 | | | 174 |

Installment loans to individuals | | | 166 | | | 290 | | | 307 | | | 310 | | | 364 |

Unallocated | | | 249 | | | 218 | | | 347 | | | 54 | | | 315 |

Total allowance for loan losses | | $ | 5,043 | | $ | 3,911 | | $ | 3,597 | | $ | 3,071 | | $ | 2,948 |

Investment Securities and Overnight Funds Sold

The Company’s investment portfolio primarily consists of available-for-sale U.S. Agency securities. At year-end 2007, the estimated market value of available-for-sale investment securities held by the Company was $42.38 million, down 23.74% from $55.57 million at year-end 2006. This decrease was the result of the maturity of investment securities with proceeds of $15.17 million, netted against the purchase of investment securities with a cost of $1.24 million, the change in unrealized gains and losses, and unamortized premiums/unaccreted discounts on the remaining securities. As securities matured during 2007, the proceeds were used to fund loan growth to the extent that they were not replaced to fulfill pledging requirements. At year-end 2006, investment securities available-for-sale decreased 21.86% to $55.57 million from $71.11 million at year-end 2005. This decrease was the result of the maturity of investment securities with proceeds of $18.13 million, netted against the purchase of investment securities with a cost of $2.31 million, the change in unrealized gains and losses, and unamortized premiums/unaccreted discounts on the remaining securities.

| | |

| 12 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

Table 9displays the contractual maturities and weighted average yields from investment securities at year-end 2007. Actual maturities may differ from contractual maturities because certain issuers may have the right to call or prepay obligations with or without call or prepayment penalties.

Table 9: Investment Maturities and Yields

| | | | | | | | | |

| December 31, 2007 | | Amortized

Cost | | Market

Value | | Average

Yield | |

| (In thousands) | | | |

Maturities: | | | | | | | | | |

U.S. Agency securities: | | | | | | | | | |

Within 1 year | | $ | 15,013 | | $ | 14,994 | | 3.92 | % |

After 1 year, but within 5 years | | | 25,931 | | | 26,279 | | 4.41 | |

Total U.S. Agency securities | | | 40,944 | | | 41,273 | | 4.23 | |

State and Municipal securities | | | | | | | | | |

After 5 years, but within 10 years | | | 244 | | | 250 | | 5.34 | |

Mortgage-backed securities | | | 642 | | | 641 | | 4.74 | |

Equity securities | | | 472 | | | 213 | | — | |

Total investment securities available-for-sale | | $ | 42,302 | | $ | 42,377 | | 4.25 | % |

The Company’s investment portfolio serves as a source of liquidity to fund future loan growth and to meet the necessary collateral requirements of the State Treasury Department, Federal Reserve Bank (“FRB”) and Federal Home Loan Bank (“FHLB”). As part of the Company’s asset/liability management policy, management has invested in high quality securities with varying maturity dates which provides for a natural hedge against changes in interest rates.

The Company does not use derivatives or other off-balance sheet transactions, such as futures contracts, forward obligations, interest rate swaps, or options.

Overnight funds sold are temporary investments used for daily cash management purposes, as well as management of short-term interest rate opportunities and interest rate risk, and as a result, daily balances vary. As of year-end 2007, overnight funds sold were $183 thousand compared to $9.52 million as of year-end 2006. This decrease was caused by the loan growth experienced during 2007. Overnight funds are comprised of federal funds sold and high quality money market instruments consisting of short-term debt securities that are U.S. Government issued or guaranteed.

Deposits

Deposits are the most significant source of the Company’s funds for use in lending and general business purposes. The Company’s balance sheet growth is largely determined by the availability of deposits in its markets, the cost of attracting the deposits, and the prospects of profitably utilizing the available deposits by increasing the loan or investment portfolios. In 2007, average deposits increased $55.81 million, or 16.75%, to a new high of $389.06 million. This increase was a continuation of the growth experienced in 2006 of $31.08 million, or 10.28%, to $333.24 million.

SeeTable 10for a comparison of year-end deposits by classification for the previous three years. Total deposits at December 31, 2007 increased $68.20 million, or 18.77%, to $431.46 million as compared to year-end 2006 total deposits of $363.26 million. Year-end 2006 total deposits grew $35.81 million from the year-end 2005 total deposits of $327.45 million, an increase of 10.94%.

In 2007 the Company experienced a shift in the classification of deposits resulting from the strong competition for deposit accounts within the local market. Noninterest bearing demand deposits increased $2.99 million to $100.55 million while interest bearing demand deposits decreased $2.19 million to $40.30 million. Savings accounts increased $8.26 million to $82.09 million with a large portion of the increase coming from the premium savings accounts, a high interest rate bearing savings account with some characteristics of a money market account. The increase in total deposits was heavily concentrated in rate sensitive certificates of deposits. Time deposits with balances less than $100,000 increased $38.08 million, or 49.61%, during 2007 over the 2006 balance of $76.76 million. Time deposits with balances of $100,000 or more increased $21.05 million, or 28.98%, during 2007 over the 2006 balance of $72.63 million. The increase in total time deposits was the result of efforts by the Company to remain competitive by increasing rates offered on time deposits within its local market. During 2007, the Company also tapped into the national certificate of deposit market by posting certificate of deposit rates on a rate board viewed on-line by registered depositors nation-wide. The Company can control the type and amount of deposits generated in this manner as well as the rates posted. Due to strong local competition for deposits, the deposits generated via the national rate board are frequently obtained at lower interest rates than local deposits of similar terms. The national rate board certificates of deposit are not brokered funds as the Company communicates directly with the depositors and does not pay a fee to a broker to obtain these funds, however, the Company does have $5 million in brokered funds as of December 31, 2007.

| | |

| 2 0 0 7 A N N U A L R E P O R T | | 13 |

Table 10: Deposits by Classification

| | | | | | | | | | | | | | | | | | |

| December 31, | | 2007 | | | 2006 | | | 2005 | |

| (In thousands) | | Balance | | % | | | Balance | | % | | | Balance | | % | |

Deposit Classifications: | | | | | | | | | | | | | | | | | | |

Noninterest bearing demand | | $ | 100,553 | | 23.30 | % | | $ | 97,559 | | 26.86 | % | | $ | 104,930 | | 32.05 | % |

Interest bearing demand | | | 40,299 | | 9.34 | | | | 42,486 | | 11.70 | | | | 47,492 | | 14.50 | |

Savings | | | 82,093 | | 19.03 | | | | 73,831 | | 20.32 | | | | 79,514 | | 24.28 | |

Time deposits less than $ 100,000 | | | 114,833 | | 26.62 | | | | 76,757 | | 21.13 | | | | 61,117 | | 18.67 | |

Time deposits $ 100,000 or more | | | 93,679 | | 21.71 | | | | 72,628 | | 19.99 | | | | 34,394 | | 10.50 | |

Total deposits | | $ | 431,457 | | 100.00 | % | | $ | 363,261 | | 100.00 | % | | $ | 327,447 | | 100.00 | % |

The Company will continue funding assets with deposit liability accounts and focus on core deposit growth as its primary source of liquidity and stability. Core deposits consist of noninterest bearing demand accounts, interest checking accounts, money market accounts, savings accounts and time deposits of less than $100,000. Core deposits totaled $337.78 million, or 78.29% of total deposits at year-end 2007 compared to $290.63 million, or 80.01% of total deposits at year-end 2006, and $293.05 million, or 89.50% of total deposits at year-end 2005.

Capital

Total shareholders’ equity increased $3.50 million, or 4.98%, to $73.66 million at December 31, 2007. This increase was due to current year net income, stock option exercises, dividends reinvested, change in unrealized gains and losses on securities available-for-sale and stock issued as a part of the employee benefit plans, net of dividends paid and common stock repurchased.

The Company and the Bank are subject to regulatory risk-based capital guidelines that measure capital relative to risk-weighted assets and off-balance sheet financial instruments. Tier I capital is comprised of shareholders’ equity, net of unrealized gains or losses on available-for-sale securities, less intangible assets, while total risk-based capital adds certain debt instruments and qualifying allowances for loan losses.

Under FRB rules, the Company and the Bank were considered “well-capitalized,” the highest category of capitalization defined by the regulators, as of December 31, 2007. For more information on the Company’s regulatory capital requirements, see Note No. 16 in the accompanying Notes to Consolidated Financial Statements. The Company continually monitors current and projected capital adequacy positions of both the Company and the Bank. Maintaining adequate capital levels is integral to providing stability to the Company, resources to achieve the Company’s growth objectives, and returns to the shareholders in the form of dividends.

During 2007, the Company repurchased 232,490 shares of its common stock in open market and privately negotiated transactions at prices ranging from $12.14 to $14.62. During 2006, the Company repurchased 380,613 shares of its common stock in open market and privately negotiated transactions at prices ranging from $10.50 to $12.18. During 2005, the Company repurchased 104,649 shares of its common stock in open market and privately negotiated transactions at prices ranging from $10.00 to $11.75.

Liquidity

Liquidity represents an institution’s ability to meet present and future financial obligations through either the sale or maturity of existing assets or the acquisition of additional funds through liability management. At December 31, 2007, cash and due from banks, overnight funds sold, interest-bearing deposits in other banks, and investment securities and loans maturing within one year were $332.18 million, or 58.92% of total assets. As a result of the Company’s management of liquid assets and the ability to generate liquidity through liability funding, management believes the Company maintains overall liquidity sufficient to satisfy its depositors’ requirements and meet its customers’ credit needs.

The Company also maintains additional sources of liquidity through a variety of borrowing arrangements. The Bank maintains federal funds lines with large regional and national banking institutions. These available lines total approximately $13 million, none of which were outstanding at December 31, 2007. Federal funds purchased during 2007 averaged $609 thousand compared to an average of $119 thousand during 2006.

The Bank has a credit line in the amount of $156.1 million at the FHLB. This line may be utilized for short and/or long term borrowing. The Bank has utilized the credit line for overnight funding throughout 2007 and 2006 with average balances of $1.06 million and $2.12 million, respectively, with none outstanding at year-end 2007 or 2006. Long-term FHLB borrowings were $53.00 million at year-end 2007 and $38.00 million at year-end 2006.

Off-Balance Sheet Arrangements

The Company is a party to financial instruments with off-balance sheet risk in the normal course of business to meet the financing needs of its customers. For more information on the Company’s off-balance sheet arrangements, see Note No. 8 in the accompanying Notes to Consolidated Financial Statements.

| | |

| 14 | | H A M P T O N R O A D S B A N K S H A R E S , I N C . |

Interest Rate Sensitivity

The Company’s primary market risk is exposure to interest rate volatility. Fluctuations in interest rates will impact both the level of interest income and interest expense and the market value of the Company’s interest earning assets and interest bearing liabilities.

The primary goal of the Company’s asset/liability management strategy is to optimize net interest income while limiting exposure to fluctuations caused by changes in the interest rate environment. The Company’s ability to manage its interest rate risk depends generally on the Company’s ability to match the maturities and re-pricing characteristics of its assets and liabilities while taking into account the separate goals of maintaining asset quality and liquidity and achieving the desired level of net interest income.

The Company’s management, guided by the Asset/Liability Committee (“ALCO”), determines the overall magnitude of interest sensitivity risk and then formulates policies governing asset generation and pricing, funding sources and pricing, and off-balance sheet commitments. These decisions are based on management’s expectations regarding future interest rate movements, the state of the national and regional economy, and other financial and business risk factors.

The primary method that the Company uses to quantify and manage interest rate risk is simulation analysis, which is used to model net interest income from assets and liabilities over a specified time period under various interest rate scenarios and balance sheet structures. This analysis measures the sensitivity of net interest income over a relatively short time horizon. Key assumptions in the simulation analysis relate to the behavior of interest rates and spreads, the changes in product balances and the behavior of loan and deposit customers in different rate environments.

Table 11illustrates the expected effect on net interest income for the twelve months following each of the two year-ends 2007 and 2006 due to a shock in interest rates. Estimated changes set forth below are dependent on material assumptions, such as those previously discussed.

Table 11: Effect on Net Interest Income

| | | | | | | | | | | | | | |

| | | 2007 | | | 2006 | |

| December 31, | | Change in Net Interest Income | | | Change in Net Interest Income | |

| (in thousands) | | Amount | | | % | | | Amount | | | % | |

Change in Interest Rates: | | | | | | | | | | | | | | |

+200 basis points | | $ | 4,494 | | | 19.39 | % | | $ | 3,130 | | | 14.12 | % |

+ 100 basis points | | | 2,249 | | | 9.70 | | | | 1,561 | | | 7.04 | |

- 100 basis points | | | (2,230 | ) | | (9.62 | ) | | | (1,567 | ) | | (7.06 | ) |

- 200 basis points | | | (4,333 | ) | | (18.69 | ) | | | (3,141 | ) | | (14.17 | ) |

As indicated inTable 11, a decrease in interest rates would tend to reduce net interest income, while an increase would tend to enhance net interest income. Thus, the Company’s interest rate sensitivity position is asset-sensitive. In the current declining interest rate environment and absent any mitigating factors, the Company could experience a substantial reduction in net interest income. It should be noted, however, that the simulation analysis is based upon equivalent changes in interest rates for all categories of assets and liabilities. In normal operating conditions, interest rate changes rarely occur in such a uniform manner. Many factors affect the timing and magnitude of interest rate changes on financial instruments. In addition, management may deploy strategies that offset some of the impact of changes in interest rates. Consequently, variations should be expected from the projections resulting from the controlled conditions of the simulation analysis.