QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material under Rule 14a-12 | |

Gladstone Capital Corporation | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

| ý | No fee required | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

| o | Fee paid previously with preliminary materials. | |||

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

GLADSTONE CAPITAL CORPORATION

1616 Anderson Road, Suite 208, McLean, Virginia 22102

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FEBRUARY 24, 2003

To The Stockholders Of Gladstone Capital Corporation:

Notice Is Hereby Given that the Annual Meeting of Stockholders of Gladstone Capital Corporation, a Maryland corporation (the "Company"), will be held on Monday, February 24, 2003 at 10:00 a.m. local time in the third floor conference room of the Company's principal executive office at 1616 Anderson Road, McLean, VA 22102 for the following purposes:

(1) To elect two directors to hold office until the 2006 Annual Meeting of Stockholders.

(2) To approve an amendment to the Company's Amended and Restated 2001 Equity Incentive Plan, as amended, to increase the aggregate number of shares of common stock authorized for issuance under such plan by 500,000 shares.

(3) To ratify the selection of PricewaterhouseCoopers LLP as independent auditors of the Company for its fiscal year ending September 30, 2003.

(4) To transact such other business as may properly come before the meeting or any adjournment or postponement thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice.

The Board of Directors has fixed the close of business on January 13, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at this Annual Meeting and at any adjournment or postponement thereof.

| By Order of the Board of Directors | ||

| /s/ TERRY BRUBAKER Terry Brubaker Secretary |

McLean, Virginia

January 17, 2003

ALL STOCKHOLDERS ARE CORDIALLY INVITED TO ATTEND THE MEETING IN PERSON. WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY AS PROMPTLY AS POSSIBLE IN ORDER TO ENSURE YOUR REPRESENTATION AT THE MEETING. A RETURN ENVELOPE (WHICH IS POSTAGE PREPAID IF MAILED IN THE UNITED STATES) IS ENCLOSED FOR THAT PURPOSE. EVEN IF YOU HAVE GIVEN YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH TO VOTE AT THE MEETING, YOU MUST OBTAIN FROM THE RECORD HOLDER A PROXY ISSUED IN YOUR NAME.

GLADSTONE CAPITAL CORPORATION

1616 Anderson Road, Suite 208, McLean, Virginia 22102

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

February 24, 2003

INFORMATION CONCERNING SOLICITATION AND VOTING

General

The enclosed proxy is solicited on behalf of the Board of Directors of Gladstone Capital Corporation, a Maryland corporation ("Gladstone" or the "Company"), for use at the Annual Meeting of Stockholders to be held on February 24, 2003, at 10:00 a.m. local time (the "Annual Meeting"), or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting. The Annual Meeting will be held in the third floor conference room of the Company's principal executive office at 1616 Anderson Road, McLean, VA 22102. The Company intends to mail this proxy statement and accompanying proxy card on or about January 17, 2003 to all stockholders entitled to vote at the Annual Meeting.

Solicitation

The Company will bear the entire cost of solicitation of proxies, including preparation, assembly, printing and mailing of this proxy statement, the proxy card and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage houses, fiduciaries and custodians holding in their names shares of the Company's common stock beneficially owned by others to forward to such beneficial owners. The Company may reimburse persons representing beneficial owners of the Company's common stock for their costs of forwarding solicitation materials to such beneficial owners. Original solicitation of proxies by mail may be supplemented by telephone, telegram or personal solicitation by directors, officers or other regular employees of the Company or, at the Company's request, Georgeson Shareholder Communications Company ("Georgeson"). No additional compensation will be paid to directors, officers or other regular employees for such services, but Georgeson will be paid its customary fee, estimated to be about $6,000, if it renders solicitation services.

Voting Rights and Outstanding Shares

Only holders of record of the Company's common stock at the close of business on January 13, 2003 will be entitled to notice of and to vote at the Annual Meeting. At the close of business on January 13, 2003 the Company had outstanding and entitled to vote 10,071,844 shares of common stock.

Each holder of record of the Company's common stock on such date will be entitled to one vote for each share held on all matters to be voted upon at the Annual Meeting.

All votes will be tabulated by the inspector of election appointed for the meeting, who will separately tabulate affirmative and negative votes, abstentions and broker non-votes. Abstentions and broker non-votes are counted towards a quorum but are not counted for any purpose in determining whether a matter is approved.

1

Revocability of Proxies

Any person giving a proxy pursuant to this solicitation has the power to revoke it at any time before it is voted, unless the proxy states that it is irrevocable and is coupled with an interest. It may be revoked by filing with the Secretary of the Company at the Company's principal executive office, 1616 Anderson Road, Suite 208, McLean, Virginia 22102, a written notice of revocation or a duly executed proxy bearing a later date, or it may be revoked by attending the meeting and voting in person.

Attendance at the meeting will not, by itself, revoke a proxy. However, no proxy is valid after eleven months from its date, unless otherwise provided in the proxy.

Stockholder Proposals

The deadline for submitting a stockholder proposal for inclusion in the Company's proxy statement and form of proxy for the Company's 2004 annual meeting of stockholders pursuant to Rule 14a-8 of the Securities and Exchange Commission (the "SEC") is September 19, 2003. Stockholders wishing to submit proposals or director nominations that are not to be included in such proxy statement and proxy must deliver notice to the Secretary at the principal executive offices of the Company not later than the close of business on the sixtieth day nor earlier than the close of business on the ninetieth day prior to the first anniversary of the preceding year's annual meeting. Stockholders are also advised to review the Company's Bylaws, which contain additional requirements with respect to advance notice of stockholder proposals and director nominations.

Proposal 1

Election Of Directors

The Company's Board of Directors (the "Board") is divided into three classes of two directors each, with each class having a three-year term. In general, vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. However, if the stockholders of any class or series are entitled separately to elect one or more directors, a majority of the remaining directors elected by that class or series or the sole remaining director elected by that class or series may fill any vacancy in the directors elected by that class or series. A director elected by the Board to fill a vacancy shall be elected to hold office until the next annual meeting of stockholders or until his or her successor is elected and qualified.

The Board presently has six members. The terms of office for two of the directors are expiring in 2003. The nominees for election to this class are currently directors of the Company, both of whom were previously appointed to the Board prior to the Company's initial public offering. If elected at the Annual Meeting, each nominee would serve until the 2006 annual meeting and until his successor is elected and has qualified, or until his earlier death, resignation or removal. Neither nominee is being proposed for election pursuant to any agreement or understanding between him and the Company.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. In the event that any of the nominees should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominees as management may propose. The nominees have agreed to serve if elected, and management has no reason to believe that either of them will be unable to serve.

Set forth below is biographical information for each person nominated, each person whose term of office as a director will continue after the Annual Meeting, and each executive officer who is not a director.

2

Nominees for Election for a Three-year Term Expiring at the 2006 Annual Meeting

| Name and Year First Elected Director | Age | Background Information | ||

|---|---|---|---|---|

| Terry Lee Brubaker (2001)* | 59 | Mr. Brubaker has been our president and chief operating officer and a director since May 2001. In March 1999, Mr. Brubaker founded, and now serves as chairman of, Heads Up Systems, a company providing process industries with leading edge technology. From 1996 to 1999, Mr. Brubaker served as vice president of the paper group for the American Forest & Paper Association. From 1992 to 1995, Mr. Brubaker served as president of Interstate Resources, a pulp and paper company. From 1991 to 1992, Mr. Brubaker served as president of IRI, a radiation measurement equipment manufacturer. From 1981 to 1991, Mr. Brubaker held several management positions at James River Corporation, a forest and paper company, including vice president of strategic planning from 1981 to 1982, group vice president of the Groveton Group and Premium Printing Papers from 1982 to 1990 and vice president of human resources development in 1991. From 1976 to 1981, Mr. Brubaker was strategic planning manager and marketing manager of white papers at Boise Cascade. Previously, Mr. Brubaker was a senior engagement manager at McKinsey & Company from 1972 to 1976. Mr. Brubaker holds a MBA degree from the Harvard Business School and a BSE from Princeton University. | ||

David A.R. Dullum (2001) | 54 | Mr. Dullum has been a director since August 23, 2001. From 1995 to the present, Mr. Dullum has been a partner of New England Partners, a venture capital firm focused on investments in small and medium sized businesses in the Mid-Atlantic and New England regions. From 1973 to 1990, Mr. Dullum was the managing general partner of Frontenac Company, a Chicago-based venture capital firm. Mr. Dullum holds a MBA from Stanford Graduate School of Business and a BME from the Georgia Institute of Technology. |

The Board Of Directors Recommends

A Vote In Favor Of Each Named Nominee.

3

Directors Continuing in Office Until the 2004 Annual Meeting

| Name and Year First Elected Director | Age | Background Information | ||

|---|---|---|---|---|

| David Gladstone (2001)* | 60 | Mr. Gladstone is a founder of Gladstone Capital Corporation and has been our chief executive officer and chairman of our board of directors since our inception in May 2001. Prior to founding Gladstone Capital Corporation, Mr. Gladstone served as chairman or vice chairman of the board of directors of American Capital Strategies, a publicly traded leveraged buyout fund and mezzanine debt finance company, from April 1997 to August 2001. From 1974 to February 1997, Mr. Gladstone held various positions, including chairman and chief executive officer, with Allied Capital Corporation, Allied Capital Corporation II, Allied Capital Lending Corporation, Allied Capital Commercial Corporation and Allied Capital Advisors, Inc. The Allied companies were the largest group of publicly traded mezzanine debt funds and were managers of two private venture capital limited partnerships. From 1992 to 1997, Mr. Gladstone served as a director, president and chief executive officer of Business Mortgage Investors, a private mortgage REIT managed by Allied Capital Advisors, Inc. Mr. Gladstone served as a director of The Riggs National Corporation (the parent of Riggs Bank) from 1993 to May 1997. He has served as a trustee of The George Washington University and currently is a trustee emeritus. Mr. Gladstone was the founder and managing member of The Capital Investors, a group of angel investors, and is currently a member emeritus. He is also the chairman and owner of B & G Berry Corporation, a large strawberry farming operation in California. Mr. Gladstone holds a MBA degree from the Harvard Business School, a MA from American University and a BA from the University of Virginia. Mr. Gladstone has authored two books on financing for small and medium sized businesses, Venture Capital Handbook and Venture Capital Investing. | ||

Paul Adelgren (2003) | 60 | Mr. Adelgren was appointed to our board of directors in January 2003. From 1997 to the present, Mr. Adelgren has served as the pastor of Missionary Alliance Church. From 1991 to 1997, Mr. Adelgren was pastor of New Life Alliance Church. From 1988 to 1991, Mr. Adelgren was a vice president of the finance and materials division of Williams & Watts, Inc., a logistics management and procurement business located in Fairfield, NJ. Prior to joining Williams & Watts, Mr. Adelgren served in the United States Navy, where he served in a number of capacities, including as the director of the Strategic Submarine Support Department, as an executive officer at the Naval Supply Center and as the director of the Joint Uniform Military Pay System. Mr. Adelgren holds a MBA from Harvard University and a BA from the University of Kansas. |

4

Directors Continuing in Office Until the 2005 Annual Meeting

| Name and Year First Elected Director | Age | Background Information | ||

|---|---|---|---|---|

| Anthony W. Parker (2001) | 57 | Mr. Parker has been a director of the Company since August 23, 2001. In 1997, Mr. Parker founded Medical Funding Corporation, a company which purchases medical receivables, and has served as its chairman from inception to present. In the summer of 2000, Medical Funding Corporation purchased a Snelling Personnel Agency franchise in Washington, DC which provides full staffing services for the local business community. From 1992 to 1996, Mr. Parker was chairman of, and a 50% stockholder of, Capitol Resource Funding, Inc. ("CRF"), a commercial finance company with offices in Dana Point, California and Arlington, Virginia. Mr. Parker joined CRF shortly after its inception and was instrumental in growing the company from a startup to one that by 1996 was purchasing receivables at the rate of $150 million per year, with over 40 employees. Mr. Parker practiced corporate and tax law for over 15 years—from 1980 to 1983 at Verner, Liipfert, Bernhard & McPherson, and from 1983 to 1992 in private practice. From 1973 to 1977, Mr. Parker served as executive assistant to the administrator of the U.S. Small Business Administration. Mr. Parker received his JD and Masters in Tax Law from Georgetown Law Center and his undergraduate degree from Harvard College. | ||

Michela A. English (2002) | 52 | Ms. English has been a director since June 5, 2002. Ms. English currently serves as the president of Discovery Consumer Products, a division of Discovery Communications, Inc. Since March 1996, Ms. English has held the positions of president of Discovery Enterprises Worldwide and president of Discovery.com. Ms. English is a director of the NEA Foundation for the Improvement of Education and the Educational Testing Service and serves as chairman of the board of Sweet Briar College. Ms. English received a Master of Public and Private Management degree from Yale University and a BA in International Affairs from Sweet Briar College. |

5

Executive Officers Who Are Not Directors

| Name | Age | Background Information | ||

|---|---|---|---|---|

| Harry Brill* | 54 | Mr. Brill has been our treasurer and chief financial officer since May 2001. From 1995 to April 2001, Mr. Brill served as a personal financial advisor. From 1975 to 1995, Mr. Brill held various positions, including treasurer, chief accounting officer and controller, with Allied Capital Corporation where Mr. Brill was responsible for all of the accounting work for Allied Capital and its family of funds. Mr. Brill received his degree in accounting from Ben Franklin University. | ||

George Stelljes, III* | 41 | Mr. Stelljes has been our executive vice president and chief investment officer since September 2002. Until joining the company as executive vice president and chief investment officer, Mr. Stelljes had served as a director of the Company since August 23, 2001. Prior to becoming our executive vice president and chief investment officer, Mr. Stelljes also served as a managing member of St. John's Capital, a vehicle used to make private equity investments. From 1999 to 2001, Mr. Stelljes was a co-founder and managing member of Camden Partners, a private equity firm which finances high growth companies in the communications, healthcare and business services sectors. From 1997 to 1999, Mr. Stelljes was a partner of Columbia Capital, a venture capital firm focused on investments in communications and information technology. Prior to joining Columbia, Mr. Stelljes was an executive vice president and a principal at Allied Capital Corporation from 1989 to 1997. Mr. Stelljes currently serves as a general partner and investment committee member of Patriot Capital, a private equity fund. He is also a former board member and regional president of the National Association of Small Business Investment Companies. Mr. Stelljes holds a MBA from the University of Virginia and a BA in Economics from Vanderbilt University. |

- *

- Messrs. Gladstone, Brubaker, Brill and Stelljes are interested persons of the Company, within the meaning of the Investment Company Act of 1940, as amended, due to their positions as officers of the Company.

Board Committees and Meetings

During the fiscal year ended September 30, 2002 the Board held eleven meetings. The Board has an audit committee, a compensation committee and an executive committee.

The audit committee operates pursuant to a written charter and makes recommendations concerning the engagement of independent public accountants, reviews with our independent public accountants the plans and results of the audit engagement, approves professional services provided by our independent public accountants, reviews the independence of our independent public accountants and reviews the adequacy of our internal accounting controls. Membership of the audit committee is comprised of Ms. English and Messrs. Dullum and Parker, each of whom is considered an independent director under the rules promulgated by the Nasdaq Stock Market. The audit committee met four times during the last fiscal year.

6

The compensation committee determines compensation for our executive officers and administers the Company's Amended and Restated 2001 Equity Incentive Plan, as amended. Membership of the compensation committee is comprised of Messrs. Parker and Dullum, each of whom is an independent director. The compensation committee met five times during the last fiscal year.

The executive committee has the authority to exercise all powers of the Board except for actions that must be taken by the full Board under the Maryland General Corporation Law, including electing the Chairman of the Board and the President. The Board may appoint not fewer than three members to the executive committee; currently, the membership is comprised of Messrs. Gladstone and Dullum. The executive committee did not meet during the last fiscal year.

During the fiscal year ended September 30, 2002, each Board member attended 75% or more of the aggregate of the meetings of the Board and of the committees on which he or she served, held during the period for which he or she was a director or committee member, respectively.

Report of the Audit Committee of the Board of Directors(1)

The Company's audit committee is comprised of Ms. English and Messrs. Dullum and Parker, each of whom is not an officer or employee of the Company. Under the applicable Nasdaq rules, all members are independent. The Board has adopted a written charter for the audit committee.

The audit committee met after the close of the fiscal year to review and discuss the audited financial statements with management and the accountants, Ernst & Young LLP. Based on these discussions, the audit committee recommended to the Board that the audited financial statements be included in the Company's Annual Report on Form 10-K.

The discussions with Ernst & Young LLP also included the matters required by Statement on Auditing Standards No. 61. The audit committee received from Ernst & Young LLP written disclosures and the letter regarding its independence as required by Independence Standards Board Standards No. 1. This information was discussed with Ernst & Young LLP.

Audit Committee of the Board of Directors

| Anthony W. Parker, Chairman | David A.R. Dullum | Michela A. English |

- (1)

- The material in this report is not "soliciting material," is not deemed "filed" with the SEC, and is not to be incorporated by reference into any filing of the Company under the 1933 or 1934 Act.

Proposal 2

Approval of the Amendment to the Amended

And Restated 2001 Equity Incentive Plan, as Amended

In June 2001, the Board adopted the Company's 2001 Equity Incentive Plan. In July 2001, the Board and the stockholders approved an amendment and restatement of the 2001 Equity Incentive Plan, adopting the Amended and Restated 2001 Equity Incentive Plan (the "2001 Plan"). In August 2001, the Board adopted, and the stockholders approved, an amendment to the 2001 Plan increasing the number of shares of common stock authorized for issuance under the 2001 Plan to a total of 1,500,000 shares.

In December 2002, the Board approved an amendment to the 2001 Plan (attached hereto as Appendix A), subject to stockholder approval, to increase the number of shares of common stock authorized for issuance under the 2001 Plan by 500,000 shares, to a total of 2,000,000 shares. The Board adopted this amendment to ensure that the Company can continue to grant stock options at levels determined appropriate by the Board.

7

As of December 31, 2002, awards (net of canceled or expired awards) covering an aggregate of 1,410,000 shares of the Company's common stock had been granted under the 2001 Plan. Only 90,000 shares of the Company's common stock (plus any shares that might in the future be returned to the 2001 Plan as a result of cancellations or expiration of awards or the reacquisition by the Company of issued shares) remained available for future grants under the 2001 Plan. Upon receipt of an order from the SEC (which is currently pending), our non-employee directors will be entitled to receive options to purchase an aggregate of 60,000 shares of common stock and each will be entitled to an additional option to purchase 10,000 shares of common stock at the time of the Annual Meeting. Accordingly, unless the stockholders approve the proposed amendment to the 2001 Plan, the Company will have no shares available under the 2001 Plan for grant following the issuance of the options to the Company's non-employee directors.

During the last fiscal year, the Company granted options under the 2001 Plan (i) to current executive officers to purchase 100,000 shares of common stock at an exercise price of $17.11 per share and (ii) to all employees as a group (excluding executive officers) to purchase 60,000 shares of common stock at an exercise price of $17.18 per share.

Stockholders are requested in this Proposal 2 to approve the amendment to the 2001 Plan. The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the meeting will be required to approve the amendment to the 2001 Plan. Abstentions will be counted towards the tabulation of votes cast on proposals presented to the stockholders and will have the same effect as negative votes. Broker non-votes are counted towards a quorum, but are not counted for any purpose in determining whether this matter has been approved.

The Board Of Directors Recommends

A Vote In Favor Of Proposal 2.

The essential features of the 2001 Plan are outlined below:

General

The 2001 Plan provides for the grant of incentive stock options, nonstatutory stock options and restricted stock purchase awards (collectively, "awards"). Incentive stock options granted under the 2001 Plan are intended to qualify as "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"). Nonstatutory stock options granted under the 2001 Plan are not intended to qualify as incentive stock options under the Code. See "Federal Income Tax Information" for a discussion of the tax treatment of awards. To date, the Company has granted only stock options under the 2001 Plan.

Purpose

The Board adopted the 2001 Plan to provide a means by which selected employees (including officers) and directors of the Company and its affiliates (collectively, "participants") may be given an opportunity to purchase stock in the Company, to assist in retaining the services of such persons, to secure and retain the services of persons capable of filling such positions and to provide incentives for such persons to exert maximum efforts for the success of the Company and its affiliates.

Administration

The Board administers the 2001 Plan. Subject to the provisions of the 2001 Plan, the Board has the power to construe and interpret the 2001 Plan and to determine the persons to whom, and the dates on which, awards will be granted, the number of shares of the Company's common stock to be subject to each award, the time or times during the term of each award within which all or a portion of

8

such award may be exercised, the exercise price, the type of consideration and other terms of the award.

The Board has the power to delegate administration of the 2001 Plan to a committee composed of one or more members of the Board. In the discretion of the Board, a committee may consist solely of two or more outside directors in accordance with Section 162(m) of the Code or solely of two or more non-employee directors in accordance with Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). The Board has delegated administration of the 2001 Plan to the compensation committee of the Board. As used herein with respect to the 2001 Plan, the "Board" refers to the compensation committee as well as to the Board itself.

Compliance with Section 162(m) of the Code allows a company to recognize a business expense deduction in connection with compensation recognized by "covered employees" (the chief executive officer and the other four most highly compensated officers). In addition to other requirements, the directors who serve as members of the committee responsible for administering the incentive plan with respect to these covered employees must be "outside directors." The Board currently limits the directors who may serve as members of the compensation committee to those who are "outside directors" as defined in Section 162(m) of the Code. This limitation would exclude from the committee directors who are (i) current employees of the Company or an affiliate, (ii) former employees of the Company or an affiliate receiving compensation for past services (other than benefits under a tax-qualified pension plan), (iii) current or former officers of the Company or an affiliate, (iv) directors currently receiving direct or indirect remuneration from the Company or an affiliate in any capacity (other than director) and (v) any other person who is otherwise not considered an "outside director" for purposes of Section 162(m) of the Code. The definition of an "outside director" under Section 162(m) of the Code is generallynarrower than the definition of a "non-employee director" under Rule 16b-3 of the Exchange Act.

Eligibility

Incentive stock options may be granted under the 2001 Plan only to employees (including officers) of the Company and its affiliates. Employees (including officers) and, subject to receipt of an order from the SEC, non-employee directors of both the Company and its affiliates are eligible to receive all other types of awards under the 2001 Plan. All of the Company's employees are, and upon receipt of an order from the SEC each of the Company's non-employee directors will be, eligible to receive awards under the 2001 Plan.

No incentive stock option may be granted under the 2001 Plan to any person who, at the time of the grant, owns (or is deemed to own) stock possessing more than 10% of the total combined voting power of the Company or any affiliate of the Company, unless the option exercise price is at least 110% of the fair market value of the stock subject to the option on the date of grant, and the term of the option does not exceed five years from the date of grant. In addition, the aggregate fair market value, determined at the time of grant, of the shares of the Company's common stock with respect to which incentive stock options are exercisable for the first time by a participant during any calendar year (under the 2001 Plan and all other such plans of the Company and its affiliates) may not exceed $100,000. No employee may be granted options under the 2001 Plan covering more than 800,000 shares of the Company's common stock during any calendar year (the "Section 162(m) Limitation").

Stock Subject to the 2001 Plan

Subject to this Proposal 2, an aggregate of 2,000,000 shares of the Company's common stock is authorized for issuance under the 2001 Plan. If awards granted under the 2001 Plan expire or otherwise terminate without being exercised, the shares of the Company's common stock not acquired pursuant to such awards again become available for issuance under the 2001 Plan. If the Company reacquires

9

unvested stock issued under the 2001 Plan, the reacquired stock will again become available for reissuance under the 2001 Plan.

Terms of Options

The following is a description of the permissible terms of options under the 2001 Plan. Individual option grants may be more restrictive as to any or all of the permissible terms described below.

Exercise Price; Payment. The exercise price of incentive stock options under the 2001 Plan may not be less than 100% of the fair market value of the stock subject to the option on the date of grant, and in some cases (see "Eligibility" above), may not be less than 110% of such fair market value. The exercise price of nonstatutory options under the 2001 Plan may not be less than 85% of the fair market value of the stock subject to the option on the date of grant. If options are granted to covered executives with exercise prices below market value, deductions for compensation attributable to the exercise of such options could be limited by Section 162(m) of the Code. See "Federal Income Tax Information." As of January 13, 2003, the closing price of the Company's common stock as reported on the Nasdaq National Market was $16.30 per share.

The exercise price of options granted under the 2001 Plan must be paid either in cash at the time the option is exercised or at the discretion of the Board at the time of grant of the option (or subsequently in the case of a nonstatutory stock option) (i) by delivery of other shares of the Company's capital stock, (ii) by delivery of a promissory note or (iii) in any other form of legal consideration acceptable to the Board. Unless otherwise specifically provided in the option, the purchase price of capital stock acquired pursuant to an option that is paid by delivery to the Company of other capital stock acquired, directly or indirectly from the Company, may be paid only by shares of the capital stock of the Company that have been held for more than six months (or such longer or shorter period of time required to avoid a charge to earnings for financial accounting purposes).

If an option holder elects to pay the exercise price of his or her option with a promissory note, interest on the note will accrue at a commercially reasonable market rate and the note will be subject to such other repayment terms and conditions as are established by the compensation committee. The Company has from time to time permitted its employees, including its executive officers, to exercise options by promissory note in the past. However, the Sarbanes-Oxley Act of 2002 effectively prohibits the Company from making loans to its executive officers for exercising options in the future, although loans outstanding prior to July 30, 2002—including the promissory notes the Company has received from certain of its executive officers—were explicitly exempted from this prohibition. Furthermore, prior to permitting non-employee directors to exercise their options with a promissory note, the Company would be required to receive an order from the SEC permitting such a loan on the basis that the terms of the loan are fair and reasonable and not overreaching. The Company currently does not intend to apply for such an order from the SEC.

Option Exercise. Options granted under the 2001 Plan may become exercisable ("vest") in cumulative increments as determined by the Board. Shares covered by currently outstanding options under the 2001 Plan typically vest immediately with respect to 50% of the shares subject to the option, with the remaining 50% vesting after one year of employment by, or service as a director of, the Company or an affiliate of the Company (collectively, "service"). Shares covered by options granted in the future under the 2001 Plan may be subject to different vesting terms. The Board has the power to accelerate the time during which an option may vest or be exercised. In addition, options granted under the 2001 Plan may permit exercise prior to vesting, but in such event the participant may be required to enter into an early exercise stock purchase agreement that allows the Company to repurchase shares not yet vested should the participant's service terminate before vesting. To the extent provided by the terms of an option, a participant may satisfy any federal, state or local tax withholding obligation relating to the exercise of such option by a cash payment upon exercise, by authorizing the Company to

10

withhold a portion of the stock otherwise issuable to the participant, by delivering already-owned stock of the Company or by a combination of these means.

Term. The maximum term of options under the 2001 Plan is ten years, except that in certain cases (see "Eligibility" above) the maximum term is five years. Options under the 2001 Plan generally terminate three months after termination of the participant's service with the Company or any affiliate of the Company, unless (i) such termination is due to the participant's permanent and total disability (as defined in the Code), in which case the option may, but need not, provide that it may be exercised (to the extent the option was exercisable at the time of the termination of service) at any time within 12 months of such termination; (ii) the participant dies before the participant's service has terminated or the participant dies within the period, if any, specified in the option agreement after the termination of the participant's service for a reason other than death, in which case the option may, but need not, provide that it may be exercised (to the extent the option was exercisable at the time of the participant's death) by the person or persons to whom the rights to such option pass by will or by the laws of descent and distribution, but only within the period ending on the earlier of (x) the date that is 18 months after the participant's death or (y) the expiration of the term of such option as set forth in the option agreement; or (iii) the option by its terms specifically provides otherwise. A participant may designate who may exercise the option following the participant's death. Individual options by their terms may provide for exercise within a longer period of time following termination of service. The option term may also be extended in the event that exercise of the option within these periods is prohibited for specified reasons. The option term generally is extended in the event that exercise of the option within these periods is prohibited.

An option agreement may provide that if the exercise of the option following the termination of the participant's service would be prohibited because the issuance of stock would violate the registration requirements under the Securities Act of 1933, as amended (the "Securities Act"), then the option will terminate on the earlier of (i) the expiration of the term of the option or (ii) three months after the termination of the participant's service during which the exercise of the option would not be in violation of such registration requirements.

Terms of Purchases of Restricted Stock

Payment. The Board determines the purchase price under a restricted stock purchase agreement but the purchase price (i) may not be less than 100% of the fair market value of the Company's common stock on the date the award is made or on the date of purchase and (ii) may not be less than or equal to the net asset value per share of the Company's common stock on the date of purchase.

The purchase price of stock acquired pursuant to a restricted stock purchase agreement under the 2001 Plan must be paid either (i) in cash at the time of purchase, (ii) at the discretion of the Board, pursuant to a promissory note or other similar arrangement or (iii) in any other form of legal consideration acceptable to the Board.

Vesting. Shares of stock sold under the 2001 Plan may, but need not be, subject to a repurchase option in favor of the Company in accordance with a vesting schedule as determined by the Board. The Board has the power to accelerate the vesting of stock acquired pursuant to a restricted stock purchase agreement under the 2001 Plan.

Restrictions on Transfer. Rights to acquire shares of capital stock under the restricted stock purchase agreement are transferable only upon such terms and conditions as are set forth in the restricted stock purchase agreement, as the Board shall determine in its discretion, so long as the stock awarded under the restricted stock purchase agreement remains subject to the terms of the restricted stock purchase agreement.

11

Adjustment Provisions

In the event any change is made in the common stock subject to the 2001 Plan, or subject to any stock award, as a result of a merger, consolidation, reorganization, stock dividend, dividend in property other than cash, stock split, combination of shares, exchange of shares, change in corporate structure or other transaction not involving receipt of consideration by the Company, the 2001 Plan will be appropriately adjusted as to the class and maximum number of shares of common stock subject to the 2001 Plan and the Section 162(m) Limitation, and outstanding awards will be appropriately adjusted as to the class, number of shares and price per share of common stock subject to such outstanding awards.

Effect of Certain Corporate Transactions

The 2001 Plan provides that, in the event of a disposition of substantially all of the assets of the Company, specified types of merger, or other corporate reorganization (collectively, a "corporate transaction"), any surviving or acquiring corporation shall either assume any awards outstanding under the 2001 Plan or substitute similar awards for those outstanding under the 2001 Plan. If any surviving or acquiring corporation declines to assume awards outstanding under the 2001 Plan, or to substitute similar awards, then with respect to participants whose service with the Company or any of its affiliates has not terminated, the vesting and the time during which such awards may be exercised will be accelerated in full and the options will terminate if not exercised at or prior to the effective date of the corporate transaction. The acceleration of an award in the event of a corporate transaction may be viewed as an anti-takeover provision, which may have the effect of discouraging a proposal to acquire or otherwise obtain control of the Company. In the event of a dissolution or liquidation of the Company, all outstanding stock awards will terminate immediately prior to such event.

Duration, Amendment and Termination

The Board may suspend or terminate the 2001 Plan without stockholder approval or ratification at any time. Unless sooner terminated, the 2001 Plan will terminate on June 1, 2011.

The Board may also amend the 2001 Plan at any time or from time to time. However, no amendment will be effective unless approved by the stockholders of the Company within 12 months before or after its adoption by the Board to the extent stockholder approval is necessary to satisfy the requirements of Section 422 of the Code, Rule 16b-3 promulgated under the Exchange Act, or any Nasdaq or other securities exchange listing requirements. The Board may in its sole discretion submit any other amendment to the 2001 Plan for stockholder approval, including, but not limited to, amendments intended to satisfy the requirements of Section 162(m) of the Code regarding the exclusion of performance-based compensation from the limitation on the deductibility of compensation paid to certain employees.

Restrictions on Transfer

A participant in the 2001 Plan may not transfer an incentive stock option other than by will or by the laws of descent and distribution. During the lifetime of a participant, an incentive stock option may be exercised only by the participant. A nonstatutory stock option is transferable to the extent provided in the option agreement. If the option agreement for a nonstatutory stock option does not provide for transferability, then the nonstatutory stock option is not transferable except by will or by the laws of descent and distribution and is exercisable during the lifetime of the participant only by the participant. In addition, shares subject to repurchase by the Company under an early exercise stock purchase agreement may be subject to restrictions on transfer that the Board deems appropriate.

Rights under a restricted stock purchase agreement may be transferred only on such terms and conditions as the Board may provide in the restricted stock purchase agreement.

12

Federal Income Tax Information

Long-term capital gains currently are subject to lower tax rates than ordinary income or short-term capital gains. The maximum long-term capital gains rate for federal income tax purposes is currently 20% while the maximum ordinary income rate and short-term capital gains rate is effectively 38.6%. Slightly different rules may apply to participants who acquire stock subject to certain repurchase options or who are subject to Section 16(b) of the Exchange Act.

Incentive Stock Options. Incentive stock options under the 2001 Plan are intended to be eligible for the favorable federal income tax treatment accorded "incentive stock options" under the Code.

There generally are no federal income tax consequences to the participant or the Company by reason of the grant or exercise of an incentive stock option. However, the exercise of an incentive stock option may increase the participant's alternative minimum tax liability, if any.

If a participant holds stock acquired through exercise of an incentive stock option for at least two years from the date on which the option is granted and at least one year from the date on which the shares are transferred to the participant upon exercise of the option, any gain or loss on a disposition of such stock will be a long-term capital gain or loss if the participant held the stock for more than one year.

Generally, if the participant disposes of the stock before the expiration of either of these holding periods (a "disqualifying disposition"), then at the time of disposition the participant will realize taxable ordinary income equal to the lesser of (i) the excess of the stock's fair market value on the date of exercise over the exercise price, or (ii) the participant's actual gain, if any, on the purchase and sale. The participant's additional gain or any loss upon the disqualifying disposition will be a capital gain or loss, which will be long-term or short-term depending on whether the stock was held for more than one year.

To the extent the participant recognizes ordinary income by reason of a disqualifying disposition, the Company will generally be entitled (subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation) to a corresponding business expense deduction in the tax year in which the disqualifying disposition occurs.

Nonstatutory Stock Options and Restricted Stock Purchase Awards. Nonstatutory stock options and restricted stock purchase awards granted under the 2001 Plan will generally have the following federal income tax consequences:

There are no tax consequences to the participant or the Company by reason of the grant. Upon acquisition of the stock, the participant normally will recognize taxable ordinary income equal to the excess, if any, of the stock's fair market value on the acquisition date over the purchase price. However, to the extent the stock is subject to certain types of vesting restrictions, the taxable event will be delayed until the vesting restrictions lapse unless the participant elects to be taxed on receipt of the stock. With respect to employees, the Company is generally required to withhold from regular wages or supplemental wage payments an amount based on the ordinary income recognized. Subject to the requirement of reasonableness, the provisions of Section 162(m) of the Code and the satisfaction of a tax reporting obligation, the Company will generally be entitled to a business expense deduction equal to the taxable ordinary income realized by the participant.

Upon disposition of the stock, the participant will recognize a capital gain or loss equal to the difference between the selling price and the sum of the amount paid for such stock plus any amount recognized as ordinary income upon acquisition (or vesting) of the stock. Such gain or loss will be long-term or short-term depending on whether the stock was held for more than one year. Slightly different rules may apply to participants who acquire stock subject to certain repurchase options or who are subject to Section 16(b) of the Exchange Act.

13

Potential Limitation on Company Deductions. Section 162(m) of the Code denies a deduction to any publicly held corporation for compensation paid to certain "covered employees" in a taxable year to the extent that compensation to such covered employee exceeds $1 million. It is possible that compensation attributable to awards, when combined with all other types of compensation received by a covered employee from the Company, may cause this limitation to be exceeded in any particular year.

Certain kinds of compensation, including qualified "performance-based compensation," are disregarded for purposes of the deduction limitation. In accordance with Treasury regulations issued under Section 162(m) of the Code, compensation attributable to stock options will qualify as performance-based compensation if the award is granted by a compensation committee comprised solely of "outside directors" and either (i) the plan contains a per-employee limitation on the number of shares for which awards may be granted during a specified period, the per-employee limitation is approved by the stockholders, and the exercise price of the award is no less than the fair market value of the stock on the date of grant (the 2001 Plan has a stockholder-approved per-employee limit of 800,000 shares during any calendar year) or (ii) the award is granted (or exercisable) only upon the achievement (as certified in writing by the compensation committee) of an objective performance goal established in writing by the compensation committee while the outcome is substantially uncertain, and the award is approved by stockholders.

Awards to purchase restricted stock will qualify as performance-based compensation under the Treasury regulations only if (i) the award is granted by a compensation committee comprised solely of "outside directors," (ii) the award is granted (or exercisable) only upon the achievement of an objective performance goal established in writing by the compensation committee while the outcome is substantially uncertain, (iii) the compensation committee certifies in writing prior to the granting (or exercisability) of the award that the performance goal has been satisfied and (iv) prior to the granting (or exercisability) of the award, stockholders have approved the material terms of the award (including the class of employees eligible for such award, the business criteria on which the performance goal is based, and the maximum amount—or formula used to calculate the amount—payable upon attainment of the performance goal).

Proposal 3

Ratification Of Selection Of Independent Auditors

Ernst & Young LLP has audited the Company's financial statements since its inception in 2001. However, on December 5, 2002, the Company dismissed Ernst & Young and engaged PricewaterhouseCoopers LLP as its new independent auditor for the fiscal year ending September 30, 2003. The Company's decision to change auditors was made by the audit committee of the Board. After careful consideration, the audit committee determined that it was in the best interests of the Company and its stockholders to select PricewaterhouseCoopers to serve as the Company's independent auditors for the fiscal year ending September 30, 2003. The audit committee based its decision in part upon PricewaterhouseCoopers' position as the largest accounting firm in the world and its considerable experience with investment companies. The Board has directed that management submit the selection of PricewaterhouseCoopers as the Company's independent auditors for ratification by the stockholders at the Annual Meeting.

Ernst & Young's reports on the Company's consolidated financial statements for the fiscal year ended September 30, 2002 and the period from May 30, 2001 (inception) through September 30, 2001 did not contain an adverse opinion or disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles.

In connection with the audits of the Company's financial statements for the fiscal year ended September 30, 2002 and the period from May 30, 2001 (inception) through September 30, 2001, and in the subsequent interim period, there were no disagreements with Ernst & Young on any matters of accounting principles or practices, financial statement disclosure, or auditing scope and procedures which, if not resolved to the satisfaction of Ernst & Young, would have caused Ernst & Young to make reference to the matter in its report. There were no "reportable events" as that term is described in Item 304(a)(1)(v) of Regulation S-K.

14

During the fiscal year ended September 30, 2002 and the period from May 30, 2001 (inception) through September 30, 2001, and through the date of the engagement of PricewaterhouseCoopers, the Company did not consult PricewaterhouseCoopers with respect to the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's consolidated financial statements, or regarding any other matters or reportable events described under Item 304(a)(2)(i) and (ii) of Regulation S-K.

Representatives of Ernst & Young LLP and PricewaterhouseCoopers LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Stockholder ratification of the selection of PricewaterhouseCoopers LLP as the Company's independent auditors is not required by the Company's Bylaws or otherwise. However, the Board is submitting the selection of PricewaterhouseCoopers LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the audit committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the audit committee and the Board in their discretion may direct the appointment of different independent auditors at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

The affirmative vote of the holders of a majority of the shares present in person or represented by proxy and voting at the Annual Meeting will be required to ratify the selection of PricewaterhouseCoopers LLP. For purposes of this vote abstentions and broker non-votes will not be counted for any purpose in determining whether this matter has been approved.

Audit Fees. During the fiscal year ended September 30, 2002, the aggregate fees billed by Ernst & Young LLP for the audit of the Company's financial statements for such fiscal year and for the review of the Company's interim financial statements was $57,195.

Financial Information Systems Design and Implementation Fees. During the fiscal year ended September 30, 2002, the aggregate fees billed by Ernst & Young LLP for information technology consulting fees was $0.

All Other Fees. During the fiscal year ended September 30, 2002, the aggregate fees billed by Ernst & Young LLP for professional services other than audit and information technology consulting fees was $33,777.

During the fiscal year ended September 30, 2002, the Company was not billed by PricewaterhouseCoopers LLP for any professional services; however, PricewaterhouseCoopers LLP has performed certain tax related services for the Company during the current fiscal year.

The audit committee has determined that the rendering of the information technology consulting services and all other non-audit services by Ernst & Young LLP was compatible with maintaining Ernst & Young's independence and that the rendering of the tax services described above by PricewaterhouseCoopers is compatible with maintaining PricewaterhouseCoopers' independence.

The Board Of Directors Recommends

A Vote In Favor Of Proposal 3.

Security Ownership of

Certain Beneficial Owners and Management

The following table sets forth certain information regarding the ownership of the Company's common stock as of January 13, 2003 by: (i) each director and nominee for director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors

15

of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent of its common stock. Except as otherwise noted, the address of the individuals below is c/o Gladstone Capital Corporation, 1616 Anderson Road, Suite 208, McLean, VA 22102.

| | Beneficial Ownership(1) | ||||

|---|---|---|---|---|---|

| Name and Address | Number of Shares | Percent of Total | |||

| Ruane, Cunniff & Co., Inc.(2) 767 Fifth Avenue New York, NY 10153-4798 | 1,304,248 | 12.95 | % | ||

David Gladstone(3) | 998,131 | 9.53 | % | ||

Terry Lee Brubaker(4) | 226,877 | 2.23 | % | ||

George Stelljes, III(5) 1101 Pennsylvania Avenue, N.W., Suite 6614 Washington, DC 20005 | 101,000 | * | |||

Harry Brill(6) | 50,500 | * | |||

Anthony W. Parker(7) c/o Medical Funding Corporation 818 Connecticut Avenue, Suite 325 Washington, DC 20036 | 2,915 | * | |||

David A.R. Dullum(7) 215 Great Falls Street Falls Church, VA 22046 | 2,000 | * | |||

Michela A. English(8) 3220 Nebraska Avenue, NW Washington, DC 20016 | 0 | * | |||

Paul Adelgren(8) 45 Woodland Drive Marion, NC 28752-4187 | 0 | * | |||

All executive officers and directors as a group (8 persons)(9) | 1,381,423 | 12.88 | % | ||

- *

- Less than 1%

- (1)

- This table is based upon information supplied by officers, directors and principal stockholders. Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on 10,071,844 shares outstanding on January 13, 2003, adjusted as required by rules promulgated by the SEC.

- (2)

- This information has been obtained from a Schedule 13G filed by Ruane, Cunniff & Co. with the SEC on June 10, 2002. According to the Schedule 13G, Ruane, Cunniff & Co. had sole voting power with respect to 1,274,043 of the 1,304,248 shares reported as beneficially owned.

- (3)

- Includes 406,666 shares underlying options that are immediately exercisable.

- (4)

- Includes 106,666 shares underlying options that are immediately exercisable.

- (5)

- Includes (i) 60,000 shares underlying options that are immediately exercisable and (ii) 40,000 shares underlying options that may be acquired pursuant to early exercise features of the options

16

and that vest on September 12, 2003 and are subject to a repurchase right in favor of the Company if the holder does not satisfy the option's vesting requirements. In any event, shares acquired upon an early exercise may not be disposed of until the vesting period has been satisfied.

- (6)

- Includes 40,000 shares underlying options that are immediately exercisable.

- (7)

- Excludes 20,000 shares underlying options that we intend to issue to the non-employee director upon the receipt of an order from the SEC approving such grant. Upon grant, 5,000 shares underlying such options will be immediately exercisable. The Company's application to the SEC is currently pending.

- (8)

- Excludes 10,000 shares underlying options that we intend to issue to the non-employee director upon the receipt of an order from the SEC approving such grant. Upon grant, none of the shares underlying such options will be immediately exercisable. The Company's application to the SEC is currently pending.

- (9)

- Includes (i) 613,332 shares underlying options that are immediately exercisable and (ii) 40,000 shares underlying options that may be acquired pursuant to early exercise features of the options and that vest on September 12, 2003 and are subject to a repurchase right in favor of the Company if the holder does not satisfy the option's vesting requirements. In any event, shares acquired upon an early exercise may not be disposed of until the vesting period has been satisfied.

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights(a) | Weighted-average exercise price of outstanding options, warrants and rights(b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(c) | ||||

|---|---|---|---|---|---|---|---|

| Equity compensation plans approved by security holders | 811,664 | $ | 15.41 | 90,000 | |||

| Equity compensation plans not approved by security holders | 0 | n/a | n/a | ||||

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's directors and executive officers, and persons who own more than ten percent of a registered class of the Company's equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company's knowledge, based solely on a review of the copies of such reports furnished to the Company and written representations that no other reports were required, during the fiscal year ended September 30, 2002, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with, except that Michela A. English filed a Form 3 late and George Stelljes, III reported one transaction late on Form 4.

17

Compensation of Directors and Executive Officers

Summary of Compensation

The following table shows for the fiscal year ended September 30, 2002 compensation awarded or paid to, or earned by, all the directors and the two highest paid executive officers of the Company (collectively, the "Compensated Persons") in each capacity in which each Compensated Person served. Certain of the Compensated Persons served as both officers and directors of the Company.

Compensation Table

| Name of Person, Position | Aggregate Compensation From the Company(1) | Pension or Retirement Benefits Accrued as Part of Company Expenses | Total Compensation From Company Paid to Compensated Persons | ||||||

|---|---|---|---|---|---|---|---|---|---|

| David Gladstone, Chief Executive Officer and Chairman of the Board of Directors | $ | 200,000 | $ | 4,500 | $ | 204,500 | |||

| Terry Lee Brubaker, President, Chief Operating Officer and Director | 200,000 | 4,500 | 204,500 | ||||||

| David A.R. Dullum, Director | 6,000 | — | 6,000 | ||||||

| Anthony W. Parker, Director(2) | 6,000 | — | 6,000 | ||||||

| Michela A. English, Director(3) | 3,000 | — | 3,000 | ||||||

| Paul Adelgren, Director(4) | — | — | — | ||||||

- (1)

- The Company paid no perquisites to Compensated Persons in excess of the lesser of $50,000 or 10% of the Compensated Person's aggregate salary and bonus for the year.

- (2)

- The Company paid an aggregate of $31,750 in commissions to Medical Funding Corporation, an affiliate of Mr. Parker, in return for employee referrals during the year. For additional information, see Certain Transactions.

- (3)

- Ms. English joined the board of directors on June 5, 2002.

- (4)

- Mr. Adelgren joined the board of directors on January 6, 2003.

18

Stock Option Grants And Exercises

The following tables show for the fiscal year ended September 30, 2002, certain information regarding options granted to, exercised by, and held at year end by the Company's four executive officers (the "Executive Officers"):

Option Grants in Last Fiscal Year

| | Individual Grants | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(1) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options Granted (#) | % of Total Options Granted to Employees in Fiscal Year | Exercise or Base Price ($/Share) | Expiration Date | 5% ($) | 10% ($) | |||||||

| David Gladstone | — | — | — | — | — | — | |||||||

| Terry Lee Brubaker | — | — | — | — | — | — | |||||||

| Harry Brill | — | — | — | — | — | — | |||||||

| George Stelljes, III | 100,000 | 62.5 | % | $ | 17.11 | 9/11/12 | 1,076,038 | 2,726,893 | |||||

- (1)

- The potential realizable value is based on the term of the option at the time of its grant (10 years). It is calculated by assuming that the stock price on the date of the grant appreciates at the indicated annual rate, compounded annually for the entire term of the option and that the option is exercised and the underlying shares sold on the last day of its term for the appreciated stock price. The amounts represent certain assumed rates of appreciation only, in accordance with the rules of the SEC, and do not reflect the Company's estimate or projection of future stock price performance. Actual gains, if any, are dependent on the actual future performance of the Company's common stock and no gain to the optionee is possible unless the stock price increases over the option term, which will benefit all stockholders.

Aggregated Option Exercises in Fiscal 2002

and Value of Options at End of Fiscal 2002

| | | | | | Value of Unexercised In-the-Money Options at FY-End ($)(3) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | Number of Securities Underlying Unexercised Options at FY-End (#) | |||||||||

| Name | Shares Acquired on Exercise (#) | Value Realized ($)(1) | ||||||||||

| Vested | Unvested(2) | Vested | Unvested | |||||||||

| David Gladstone | — | — | 406,666 | — | 764,532 | — | ||||||

| Terry Lee Brubaker | — | — | 106,666 | — | 200,532 | — | ||||||

| Harry Brill | — | — | 40,000 | — | 75,200 | — | ||||||

| George Stelljes, III | — | — | 60,000 | 40,000 | — | — | ||||||

- (1)

- Value realized is calculated as the closing market price on the date of exercise, net of option exercise price, but before any tax liabilities or transaction costs.

- (2)

- The unvested options held by Mr. Stelljes vest on September 12, 2003. Shares underlying unvested options may be acquired pursuant to early exercise features of the options and are subject to a repurchase right in favor of the Company if the executive does not satisfy the option's vesting requirements. In any event, shares acquired upon an early exercise may not be disposed of until the vesting period has been satisfied.

19

- (3)

- The value of unexercised options is calculated as the closing market price on September 30, 2002 less the exercise price. "In-the-money" options are those with an exercise price that is less than the closing market price on September 30, 2002.

Employment Agreements

In June, 2001, the Company entered into employment agreements with Messrs. Gladstone and Brubaker as senior executive officers of the Company. In September, 2002, the Company also entered into an employment agreement with Mr. Stelljes to serve as the Company's Chief Investment Officer. Each employment agreement provides for a three-year term. The initial three-year term will be extended for additional successive periods of one year, unless the Company gives three months' prior written notice of its intention to terminate the agreement without cause. Messrs. Gladstone, Brubaker and Stelljes each have the right to terminate their respective employment agreement at any time by giving the Company three months' prior written notice.

The base salary under the employment agreements of Messrs. Gladstone, Brubaker and Stelljes is $200,000 per year. The Board has the right to increase their base salary during the terms of their employment agreements and also, generally, to decrease it, but not below $200,000.

The employment agreements provide that each of Messrs. Gladstone, Brubaker and Stelljes is entitled to receive a cash bonus of up to 100% of his base salary based upon a determination by the compensation committee of the Board.

Each of Messrs. Gladstone, Brubaker and Stelljes is also entitled to participate in the Company's 2001 Plan. Pursuant to the terms of their employment agreements, Mr. Gladstone and Mr. Brubaker received options to purchase 800,000 shares and 200,000 shares, respectively, of the Company's common stock simultaneously with the completion of the Company's initial public offering, and Mr. Stelljes received options to purchase 100,000 shares of the Company's common stock upon accepting his position as chief investment officer. Mr. Gladstone and Mr. Brubaker's stock options fully vested over the one year period following the date of grant. Mr. Stelljes's stock options were immediately vested with respect to 60,000 shares and the remainder vest on the first anniversary of the date of grant.

If the Company should terminate Messrs. Gladstone, Brubaker or Stelljes's employment by reason of his disability, he would be entitled to receive, for two years, the difference between his then current base salary plus annual bonus and any long-term disability benefits. Additionally, any unvested options which would have vested within two years of the termination date would immediately vest. All vested options would expire unless exercised (and all outstanding loans resulting from the prior exercise of any options would have to be repaid) within 18 months of the termination date. If the Company should terminate Messrs. Gladstone, Brubaker or Stelljes's employment for any reason other than disability or cause, he would be entitled to receive his base salary and annual bonus for a period of two years from the date of termination, although he could choose to forgo the payments and thus obtain a release from non-compete provisions applicable during this period. These payments would also be made if he resigned for good reason, which generally includes the Company's materially and adversely changing his responsibilities and duties or materially breaching its compensation obligations under the employment agreement. Messrs. Gladstone, Brubaker and Stelljes will also receive severance if they are terminated in connection with a change of control or if they are not notified that the employment agreement will be continued upon a change in control. Mr. Gladstone's employment agreement also defines "good reason" as a determination by him of a material difference with the Board. Additionally, any unvested stock options held by Messrs. Gladstone, Brubaker or Stelljes would generally vest if employment were terminated for any reason other than a disability or cause or if he resigned with good reason. In the event that Messrs. Gladstone, Brubaker or Stelljes's employment were terminated in connection with a

20

change of control, all vested options would expire unless exercised within 12 months of the termination date.

If Messrs. Gladstone, Brubaker or Stelljes dies, his estate will be entitled to receive an amount equal to any bonus received in the year prior to his death. Additionally, he will be considered to have vested on the date of death in those options which would vest within one year of the date of death, and would forfeit any unvested options scheduled to vest after one year from the date of death. All such vested options would expire unless exercised (and all outstanding loans resulting from the prior exercise of any options would have to be repaid) within 18 months of the date of death.

In the event that the Company should terminate Messrs. Gladstone, Brubaker or Stelljes's employment for cause or in the event that he voluntarily terminates his employment for other than good reason, all unvested stock options would be forfeited and he would have no more than 90 days to exercise any vested but unexercised options (and to repay any outstanding loans resulting from the prior exercise of any options).

Upon termination of employment, Messrs. Gladstone, Brubaker and Stelljes would be subject to certain non-compete covenants. In the case of Mr. Brubaker and Mr. Stelljes, these covenants would generally apply for two years, although should Mr. Brubaker or Mr. Stelljes resign for good reason, the covenants would apply for only one year following the date of resignation. In the case of Mr. Gladstone, the covenants would generally apply for one year. As noted above, during periods when Messrs. Gladstone, Brubaker or Stelljes are receiving severance payments from the Company, they may terminate these covenants prohibiting competition by forgoing such severance payments.

Each of the employment agreements also provides that the officer will maintain the confidentiality of the Company's confidential information during and after the period of his employment.

Compensation of Directors

As compensation for serving on the Board, each of its non-employee directors receives an annual fee of $10,000 and an additional $1,000 per each meeting of the Board attended, with no additional fee paid in connection with attending committee meetings. In addition, the Company will reimburse its directors for their reasonable out-of-pocket expenses incurred in attending meetings of the Board. Each non-employee director of the Company is eligible to receive stock option grants under the 2001 Plan. The Company has submitted an application to the SEC for the approval of option grants to its non-employee directors, as required by SEC rules governing business development companies. This application is currently pending. Upon receipt of an order from the SEC approving such grants, each non-employee member of the Board will receive an option to purchase 10,000 shares of the Company's common stock, the vesting of which will date back to the date that they joined the Board. In addition, following the Company's receipt of the order, each of the Company's non-employee directors who was serving on the date of the Company's 2002 Annual Meeting of Stockholders will receive an additional option to purchase 10,000 shares of the Company's common stock, with the vesting of such option dating back to the date of the 2002 Annual Meeting. At the time of each annual meeting of stockholders, each incumbent non-employee director shall receive an additional option to purchase 10,000 shares of common stock. In the fiscal year ended September 30, 2002, the total compensation paid to non-employee directors was $22,000.

The exercise price of options granted under the 2001 Plan is 100% of the fair market value of the common stock subject to the option on the date of the option grant (except with respect to the grants described above for which the vesting will date back to a prior event). Each option to be issued to the Company's non-employee directors will become exercisable as to 50% of the option shares on the first anniversary of the date of the grant, and will become fully exercisable on the second anniversary of the date of the grant. The term of options granted to the non-employee directors will be ten years. In the event of a merger of the Company with or into another corporation or a consolidation, acquisition of

21

assets or other change-in-control transaction involving the Company, each option either will continue in effect, if the Company is the surviving entity, or will be assumed or an equivalent option will be substituted by the successor corporation, if the Company is not the surviving entity. If the successor corporation does not assume the options, the vesting of each option will accelerate and the option will terminate if not exercised prior to the consummation of the transaction.

Report of the Compensation Committee of the Board of Directors on

Executive Compensation

Section 162(m) of the Code limits the Company to a deduction for federal income tax purposes of no more than $1 million for compensation paid to certain Executive Officers in a taxable year. Compensation above $1 million may be deducted if it is "performance-based compensation" within the meaning of the Code.

The statute containing this law and the applicable proposed Treasury regulations offer a number of transitional exceptions to this deduction limit for pre-existing compensation plans, arrangements and binding contracts. As a result, the compensation committee believes that at the present time it is quite unlikely that the compensation paid to any executive officer in a taxable year which is subject to the deduction limit will exceed $1 million. Therefore, the compensation committee has not yet established a policy for determining which forms of incentive compensation awarded to its executive officers shall be designed to qualify as "performance-based compensation." The compensation committee intends to continue to evaluate the effects of the statute and any final Treasury regulations and to comply with Code Section 162(m) in the future to the extent consistent with the best interests of the Company.

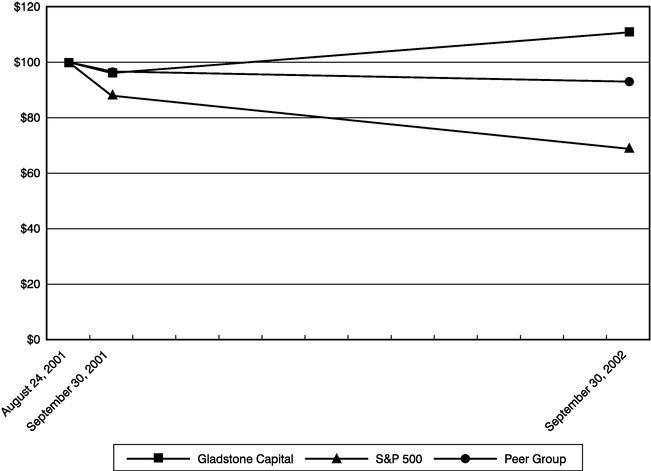

Compensation Committee Report