UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

EvergreenBancorp, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | 2) | Aggregate number of securities to which transaction applies: |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | 2) | Form, Schedule or Registration Statement No.: |

April 24, 2009

TO OUR SHAREHOLDERS:

You are cordially invited to attend the 2009 Annual Meeting of Shareholders of EvergreenBancorp, Inc. that will be held at 3:30 p.m. on Thursday, May 21, 2009, at 1111 3rd Ave., Suite 300, Seattle, Washington. Following is a formal notice of the meeting and a Proxy Statement that fully describes the business to be conducted.

We hope you can attend this meeting in person, but if not, please remember it is important that your shares be represented, regardless of the number you own. Whether or not you plan to attend the Annual Meeting, we urge you to promptly vote and submit your proxy by telephone, the Internet, or by mail in the envelope provided in order to ensure the presence of a quorum. If you attend the meeting in person, you may revoke the proxy and vote in person. If you hold your shares through an account at a brokerage firm, please follow the instructions you receive from them to vote your shares.

|

| Sincerely, |

|

|

| Gerald O. Hatler |

| President and Chief Executive Officer |

EVERGREENBANCORP, INC.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 21, 2009

| | |

| TIME | | 3:30 p.m. on Thursday, May 21, 2009 |

| |

| PLACE | | 1111 3rd Avenue, Suite 300 |

| | Seattle, Washington |

| |

| ITEMS OF BUSINESS | | (1) To elect three directors for a three-year term. |

| |

| | (2) To ratify the appointment of Crowe Horwath LLP as the Company’s independent registered public accounting firm for fiscal year 2009. |

| |

| | (3) To transact such other business as may properly come before the meeting or any adjournment thereof. |

| |

| RECORD DATE | | You are entitled to vote at the Annual Meeting and at any adjournments or postponements thereof if you were a shareholder at the close of business on April 14, 2009. |

| |

| VOTING BY PROXY | | Please submit your proxy card as soon as possible so that your shares can be voted at the Annual Meeting in accordance with your instructions. For specific instructions on voting, please refer to the instructions in the Proxy Statement and on your enclosed proxy form. |

|

| By Order of the Board of Directors |

|

|

| Gerald O. Hatler |

| President and Chief Executive Officer |

YOUR VOTE IS IMPORTANT

Whether or not you plan to attend the Annual Meeting of Shareholders, we urge you to vote and submit your proxy by telephone, the Internet, or by mail as promptly as possible to ensure the presence of a quorum for the meeting.

For additional instructions on voting by telephone or the Internet, please refer to your proxy card. To vote and submit your proxy by mail, please complete, sign, and date the enclosed proxy card and return it in the enclosed postage pre-paid envelope. Submitting your proxy promptly will save the Company the expense of further requests for proxies in order to ensure a quorum. If you attend the meeting in person, you may revoke the proxy and vote in person. If you hold your shares through an account at a brokerage firm, please follow the instructions you receive from them to vote your shares.

TABLE OF CONTENTS

i

ii

EVERGREENBANCORP, INC.

1111 3rd Avenue, Suite 2100

Seattle, Washington 98101

(206) 628-4250

PROXY STATEMENT

Important Notice Regarding the Availability of Proxy Materials for the 2009 Shareholders Meeting:

A copy of this Proxy Statement and the Annual Report to Shareholders for the year ended

December 31, 2008 are available atwww.EvergreenBancorp.com

INTRODUCTION

This Proxy Statement and the accompanying proxy are being sent to shareholders on or about April 24, 2009, for use in connection with the Annual Meeting of Shareholders of EvergreenBancorp, Inc. to be held on Thursday, May 21, 2009, for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. In this Proxy Statement, the term “we” and “us” refers to EvergreenBancorp, Inc. (the “Company”) or EvergreenBank (the “Bank”) where applicable.

INFORMATION ABOUT THE MEETING

Purpose of the Meeting

The purpose of the meeting is to: (1) elect three persons to serve as members of the Board of Directors of the Company for a three-year term; (2) ratify the appointment of Crowe Horwath LLP (formerly Crowe Chizek and Company LLC) as the Company’s independent registered public accounting firm for fiscal year 2009; and (3) conduct such other business as may properly come before the meeting.

Shareholders of Record

If you were a shareholder on April 14, 2009 (the “Record Date”), you are entitled to vote at the Annual Meeting. There were 2,544,819 shares of common stock outstanding on the Record Date. You are entitled to cast one vote for each share registered in your name upon any matter voted upon. Nominees for election of directors who receive the highest number of votes will be elected. Shareholders are not permitted to cumulate their votes for the election of directors.

Quorum

The presence, in person or by proxy, of at least a majority of the outstanding shares entitled to vote at the Annual Meeting constitutes a quorum. Abstentions and “broker non-votes” (shares held by a broker or nominee that does not have the authority, either express or discretionary, to vote on a particular matter) are counted for purposes of determining a quorum for the transaction of business at the Annual Meeting.

1

Solicitation of Proxies

The Board of Directors of the Company is soliciting shareholder proxies and we will pay the associated costs. Solicitation may be made by directors and officers or their agents by use of mail, telephone, facsimile and personal interview. It is not expected that we will engage an outside proxy solicitation firm to render proxy solicitation services; however, if we do, we will pay a fee for such services.

Voting Requirements to Approve Matters Presented

Election of Directors. The three nominees for election as directors at the Annual Meeting with three-year terms to expire in 2012 who receive the highest number of affirmative votes will be elected. Shareholders are not permitted to cumulate their votes for the election of directors. Votes may becast fororwithheld fromeach nominee. Votes that are withheld and broker non-votes will have no effect on the outcome of the election.

Ratification of Accountants. The proposal to ratify the Company’s independent registered public accounting firm requires the affirmative vote FOR the proposal by holders of a majority of the shares present in person or by proxy and entitled to vote on the proposal. You may votefor, against orabstain from the ratification of the independent public accountants. Abstentions and broker non-votes will have no effect on the outcome of the votes.

Voting and Revocation of Proxies.Shares represented by properly executed proxies that are received in time and not revoked will be voted in accordance with the instructions indicated on the proxies. If no instructions are indicated, the persons named in the proxy will vote the shares represented by the proxy FOR the director nominees listed in this Proxy Statement and FOR the ratification of the independent registered public accounting firm. Any proxy given by a shareholder may be revoked before its exercise by (1) giving notice to us in writing, (2) delivering to us a subsequently dated proxy, or (3) notifying us at the Annual Meeting before the shareholder vote is taken. Shareholders of record are entitled to one vote per share on the proposals.

Voting of Proxies by Shareholders of Record and by Beneficial Owners. As summarized below, there are some differences between shares held of record and those owned beneficially.

Shareholders of Record. If your shares are registered directly in your name with the Company’s transfer agent, Registrar and Transfer Company, you are considered, with respect to those shares, the shareholder of record, and these proxy materials are being sent to you by the Company through Registrar and Transfer Company. As the shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting. The Company has enclosed a proxy card for you to use.

Beneficial Owner. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered, with respect to those shares, the shareholder of record. As the beneficial owner, you have the right to direct your broker on how to vote. Your broker or nominee has enclosed a voting instruction card for you to use in directing your broker or nominee as to how to vote your shares.

Brokers cannot vote on behalf of beneficial owners on “non-routine” proposals. A “broker non-vote” occurs when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the proposal is not routine and the broker therefore lacks discretionary authority to vote the shares, and (2) the beneficial owner does not submit voting instructions to the broker.

2

The election of directors and ratification of the appointment of accountants are considered “routine” proposals, and your brokerage firm can vote your shares in its discretion on these proposals.

Voting in Person at the Annual Meeting

Shareholders of Record. Shares held directly in your name as the shareholder of record may be voted in person at the Annual Meeting. If you choose to vote your shares in person at the Annual Meeting, please bring the enclosed proxy card or proof of identification. Even if you plan to attend the Annual Meeting, we recommend that you vote your shares in advance as described above so that your vote will be counted if you later decide not to attend the Annual Meeting.

Beneficial Owner. Shares held in street name may be voted in person by you only if you bring an account statement or letter from the nominee indicating that you were the beneficial owner of the shares on the record date.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our Amended and Restated Articles of Incorporation provide that the number of directors on the Board will be within a range of seven to fifteen and that the exact number of directors will be fixed and determined by resolution of the Board of Directors from time to time. The Board currently has eight directors.

The Board of Directors is divided into three classes. Each class consists, as nearly as possible, of one-third of the total number of directors. Directors are elected for a term of three years or until their successors are elected and qualified.

The Board of Directors has nominated for re-election current directors Robert J. Grossman, Gerald O. Hatler and Stan W. McNaughton each to serve a three-year term expiring in 2012. The nominees have consented to serve as directors of the Company if elected. If, at the time of the Annual Meeting, any of the nominees should refuse or become unable to serve, your Proxy will be voted for the person the Board of Directors designates to replace that nominee.

Other nominations, if any, may be made only in accordance with the prior notice provisions contained in our Bylaws as described under the section entitled“Information Concerning Shareholder Proposals and Director Nominations” of this Proxy Statement.

The Board of Directors recommends that you vote“FOR”the nominees to be elected as directors.

Information Regarding Nominees and Continuing Directors

Information regarding each of the nominees and continuing directors is provided below, including each nominee’s and continuing director’s name and age, principal occupation during the past five years, and the year first elected a director. Directors of the Company also serve as directors of the Bank.

3

Director Nominees

Terms to Expire in 2012

| | |

| Robert J. Grossman | | Director since 2003 |

Mr. Grossman, 73, is an Independent Architectural Consultant and a retired Principal Architect; Director, President, and Managing Principal of the Seattle office of Northwest Architectural Company, P.S.

| | |

| Gerald O. Hatler | | Director since 1998 |

Mr. Hatler, 60, is the Vice Chairman, President, and Chief Executive Officer of EvergreenBancorp, Inc. and EvergreenBank. Mr. Hatler serves on the Boards of Directors of Seattle Central Community College Foundation, Junior Achievement of Greater Puget Sound, previous Chairman of the Washington Bankers Association, and previous Director of the Western Independent Bankers Association.

| | |

| Stan W. McNaughton | | Director since 1998 |

Mr. McNaughton, 58, is the Chairman of EvergreenBancorp, Inc. and EvergreenBank. He is also the Chairman, President, and Chief Executive Officer of PEMCO Mutual Insurance Company, PEMCO Insurance Company, PEMCO Life Insurance Company, Public Employees Insurance Agency, Inc., and PEMCO Corporation. He also serves on the Boards of Directors of PEMCO Technology Services, Inc., PCCS, Inc., and the Federal Reserve Bank of San Francisco – Seattle Branch, and as Treasurer and Director of PEMCO Foundation Inc.

Continuing Directors

Terms to Expire 2011

| | |

| Richard W. Baldwin | | Director since 2001 |

Mr. Baldwin, 64, is Chairman and CEO of Baldwin Resource Group, Inc., a business consulting company that specializes in acquisitions and mergers, strategic planning, and risk-management services. He also serves on the Board of Directors of the Washington State Hotel & Lodging Association and has served as past Chairman of Strategic Planning, IBA West, and the Discovery Institute.

| | |

| Craig O. Dawson | | Director since 2007 |

Mr. Dawson, 46, is the President and Chief Executive Officer of Retail Lockbox, Inc., a company specializing in payment processing, digital image capture, and retrieval services. Mr. Dawson also serves on the Board of Directors of the Washington Roundtable, the BOLD Initiative Advisory Board, the Community Development Roundtable (CDRT), the Greater Seattle Chamber of Commerce Urban Enterprise Center (UEC), the University of Washington Business and Economic Development Center (UW BEDC) Committee, Seattle Academy of Arts and Sciences Committee, the Children’s Hospital and Regional Medical Center (CHRMC) Hematology/Oncology Family Advisory Board, and is an active member of the Rotary of Downtown Seattle. He is also the past President of Tabor 100, an organization which focuses on creating initiatives for CEO’s of minority-owned businesses.

4

Terms to Expire in 2010

| | |

| Carole J. Grisham | | Director since 2000 |

Ms. Grisham, 59, is the former Executive Director of IslandWood, a unique 255-acre outdoor science, technology and arts learning center located on Bainbridge Island, WA. IslandWood’s mission is to provide exceptional learning experiences and inspire lifelong environmental and community stewardship. Prior to serving in that role, Ms. Grisham was the Associate Director (serving as both the COO and CFO) of the Pacific Science Center located in Seattle.

| | |

| Russel E. Olson | | Director since 2003 |

Mr. Olson, 77, is the former Vice President of Finance and Treasurer of Puget Sound Power and Light Company. He is also a former Director of Pacific Northwest Bank and Pacific Northwest Bancorp.

| | |

| Joseph M. Phillips | | Director since 2007 |

Dr. Phillips, 52, is the Dean of the Albers School of Business and Economics for Seattle University. Dr. Phillips also serves on the Board of Directors of Junior Achievement of Greater Puget Sound and the MadreMonte Foundation. In addition, he is past President of the Western Association of Collegiate Schools of Business.

CORPORATE GOVERNANCE

Corporate Governance Guidelines

The Board of Directors is committed to good business practices, transparency in financial reporting, and the highest level of corporate governance. We operate within a comprehensive plan of corporate governance for the purpose of defining responsibilities, setting high standards of professional and personal conduct, and assuring compliance with such responsibilities and standards. We regularly monitor developments in the area of corporate governance and our corporate governance guidelines and practices, including committee charters, are reviewed periodically and updated as necessary or appropriate to reflect changes in regulatory requirements and evolving oversight practices.

Code of Ethics

The Company adopted a Code of Ethics for Senior Financial Officers, which applies to its principal executive officer, principal financial officer, principal accounting officer, and any persons performing similar functions.

You can obtain a copy of our current charters, including our Code of Ethics, Audit Committee and Compensation Committee charters and our Bylaws by writing to: EvergreenBancorp, Inc., c/o the Corporate Secretary, 1111 3rd Avenue, Suite 2100, Seattle, Washington 98101.

5

Shareholder Communications

The Company and the Board of Directors welcome communication from shareholders and have established a formal method for receiving such communication. The preferred method is by mail. Shareholders may send written communications to the entire Board or to individual members, addressing such communications to EvergreenBancorp, Inc., 1111 3rd Avenue, Suite 2100, Seattle, Washington 98101, Attention: Corporate Secretary. These communications will be reviewed and if they are relevant to and consistent with the Company’s operations and policies, such communications will be forwarded to the entire Board for review and consideration.

Director Independence

As part of its commitment to good business practices and the result of increased regulatory requirements, the Board has implemented certain corporate governance standards, including maintaining an independent board. The Board has analyzed the independence of each director and nominee and has determined that each of the following members of the Board meet the applicable Securities and Exchange Commission (“SEC”) requirements and Nasdaq listing standards regarding “independence” and that each such director is free of relationships that would interfere with the individual exercise of independent judgment. In determining the independence of each director, the Board considered many factors, including any lending with the directors, each of which were made on the same terms as comparable transactions made with other persons. Such arrangements are discussed in detail in the section entitled “Transactions with Management.”

Based on these standards, the Board determined that each of the following non-employee directors, serving until the 2009 Annual Meeting, is independent and has no other relationship with the Company, except as a director and shareholder:

| | | | | | |

| | Richard W. Baldwin | | Craig O. Dawson | | |

| | Carole J. Grisham | | Russel E. Olson | | |

| | Joseph M. Phillips | | Robert J. Grossman | | |

In addition, based on such standards, the Board has determined that Gerald O. Hatler and Stan W. McNaughton are not independent. Mr. Hatler, President and Chief Executive Officer of the Company and the Bank, in 2008 served as a director of PEMCO Technology Services, Inc., resigning in March of 2009. Mr. McNaughton, Chairman of the Company and the Bank, is also the Chairman, President, and Chief Executive Officer of PEMCO Mutual Insurance Company, PEMCO Insurance Company, PEMCO Life Insurance Company, Public Employees Insurance Agency, Inc., and PEMCO Corporation, a director of PEMCO Technology Services, Inc. and PCCS, Inc., and a director and Treasurer of PEMCO Foundation, Inc. Some of these companies provide services to, or contract with the Company and/or the Bank for various services in the normal course of business and are described further under “Transactions with Management.”

Executive Compensation Interlocks and Insider Participation.During the most recent fiscal year, no executive officer of the Company served on the Compensation Committee (or equivalent), or the board of directors of another entity whose executive officer served on the Company’s Compensation Committee.

6

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Board of Directors

The Board of Directors holds regularly scheduled meetings. The Board held 10 meetings (including regularly scheduled and special meetings) during the fiscal year. In addition to meetings of the full Board, directors attended meetings of Board committees, as well as educational programs and strategic planning sessions with senior management. The Company encourages, but does not require, members of the Board to attend its Annual Meetings. All members of the Board attended the Company’s 2008 Annual Meeting.

Certain Committees of the Board of Directors

The Board has established, among others, certain standing committees including separate Audit, Compensation and Nominating/Executive Committees to serve the Company and the Bank. Each director who served the entire year attended at least 75 percent of the meetings of the aggregate of (i) the total meetings of the Board of Directors, and (ii) the total number of meetings held by all committees on which he or she served. The following table shows the membership of the various committees.

Committee Membership

| | | | | | |

| Name | | Audit | | Compensation | | Executive/

Nominating |

Richard W. Baldwin | | ¨ | | x | | ¨ |

| | | |

Craig O. Dawson | | ¨ | | x | | ¨ |

| | | |

C. Don Filer* | | ¨ | | ¨ | | ¨ |

| | | |

Carole J. Grisham | | x ** | | ¨ | | x |

| | | |

Robert J. Grossman | | ¨ | | x ** | | x |

| | | |

Gerald O. Hatler | | ¨ | | ¨ | | ¨ |

| | | |

Stan W. McNaughton | | ¨ | | x | | x ** |

| | | |

Russel E. Olson | | x | | ¨ | | x |

| | | |

Joseph M. Phillips | | x | | ¨ | | ¨ |

| * | Mr. Filer retired effective at the 2008 Annual Meeting. |

Audit Committee

The Audit Committee is currently comprised of three directors, each of whom is considered “independent” as defined by the Nasdaq listing standards and applicable SEC rules. In addition, the Board has determined that the Audit Committee’s Chair, Carole J. Grisham, is an “audit committee financial expert” as defined in the rules adopted by the SEC under the Sarbanes-Oxley Act of 2002. The Audit Committee operates under a formal written charter that is reviewed annually and revised as deemed necessary. The Audit Committee held 13 meetings during the fiscal year 2008, eight of which included executive sessions held outside the presence of management.

The main function of the Audit Committee is to assist the Board of Directors in monitoring the integrity of the Company’s financial statements, the Company’s compliance with applicable legal and regulatory requirements, and the independence and performance of the Company’s internal and external auditors.

7

Among other things, the Audit Committee:

| | • | | Is directly responsible for the appointment, compensation, retention, and oversight of the independent registered public accounting firm performing or issuing an audit report; |

| | • | | Approves the engagement and pre-approves all auditing services and permissible non-audit services to be provided to the Company by the independent auditors, except for certain de minimus services as defined in the Sarbanes-Oxley Act of 2002; |

| | • | | Maintains procedures for the receipt, retention, and treatment of complaints regarding financial and other matters; and |

| | • | | Reviews related person transactions. |

Compensation Committee

The Compensation Committee is comprised of four directors, a majority of whom are considered “independent” as defined by the Nasdaq listing standards and applicable SEC rules. Mr. McNaughton, who serves on the Compensation Committee, is not deemed to be “independent” because of his relationship during 2008 with the PEMCO companies discussed under “Transactions with Management.” The Compensation Committee met six times during the fiscal year 2008. The Committee operates under a formal written charter, a copy of which is attached asAttachment A.

The Compensation Committee recommends overall corporate philosophy and long-term strategies for executive compensation programs of the Company. The Committee reviews and evaluates the Chief Executive Officer’s performance in light of Company goals and objectives, including shareholder return. The Committee reports the results of its evaluation and makes recommendations to the Board during an executive session of non-management directors for approval of the total compensation paid to the Chief Executive Officer, including cash, non-cash, and equity compensation. In determining the recommended compensation of Mr. Hatler for 2008, the Compensation Committee considered both qualitative and quantitative factors. The Compensation Committee considered certain qualitative accomplishments by Mr. Hatler in 2007, including his leadership in strategically positioning the Company for future development and growth in the marketplace. In reviewing quantitative factors, the Compensation Committee reviewed the Company’s actual 2007 financial results compared to forecasted results.

The Compensation Committee also reviews and recommends to the full Board for approval all equity-based compensation granted to employees and officers and compensation paid to directors, including committee fees. The process and procedures used in determining Board compensation is discussed in the section “Compensation of Directors.”

Nominating and Executive Committee

The Executive Committee also serves as the Nominating Committee. In 2008, the Executive Committee was comprised of the Chairman, who is not deemed “independent” and three independent directors as that term is defined by the Nasdaq listing standards and applicable SEC rules. Its primary function is supervisory control and oversight of ongoing operations and performance. The Executive Committee meets as necessary to review these issues, as well as corporate development matters, strategic plans, and policy.

The Executive Committee, in its role as the Nominating Committee, recommends candidates for election to fill vacancies on the Board, including the nominations of members whose terms are due to expire. The members of the Nominating Committee have ongoing discussions concerning the direction of the Company and the desired qualifications for future director candidates. The Committee will consider

8

nominees recommended by a reasonable source, including officers, directors, and shareholders, provided that the recommendations are made in accordance with the procedures described in this Proxy Statement under “Information Concerning Shareholder Proposals and Director Nominations.”

The Committee does not operate under a formal written charter; however, in discharging its responsibilities to nominate candidates for election to the Board of Directors, the Committee endeavors to identify, recruit, and nominate candidates characterized by wisdom, maturity, sound judgment, excellent business skills, and high integrity. The Committee seeks to assure that the Board is composed of individuals of diverse backgrounds who have a variety of complementary experience, training and relationships relevant to the needs of the Company. In nominating candidates to fill vacancies created by the expiration of the term of a member of the Board, the Committee determines whether the incumbent director is willing to stand for re-election. If so, the Committee evaluates his or her performance in office to determine suitability for continued service, taking into consideration the value of continuity and familiarity with the Company’s business. The Committee evaluates all candidates, including shareholder-proposed candidates, using the same methods and criteria. During 2008, the entire Board acted as the Nominating Committee and took action to nominate the three candidates for re-election to the Board of Directors.

AUDIT COMMITTEE REPORT

The Audit Committee of the Board of Directors makes the following report, which notwithstanding anything to the contrary set forth in any of the Company’s filings under the Security Act of 1933 or the Securities Exchange Act of 1934, will not be incorporated by reference into any such filings and will not otherwise be deemed to be proxy soliciting materials or to be filed under such Acts.

The Audit Committee has discussed with the independent registered public accountants the matters required to be discussed by Statement of Auditing Standards No. 61, “Communication with Audit Committee,” as amended. The Audit Committee has received the written disclosures and the letter from the independent registered public accountants required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accountant’s communications with the Audit Committee concerning independence, and has discussed with Crowe Horwath LLP their independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s 2008 Annual Report on Form 10-K for the year ended December 31, 2008 filed with the SEC.

2008 Audit Committee Members

Carole J. Grisham (Chair)

Russel E. Olson

Joseph M. Phillips

9

COMPENSATION OF DIRECTORS

Directors receive compensation in the form of cash, benefits, and, as applicable, awards in the form of restricted stock or stock options.

The following table shows compensation paid or accrued for the last fiscal year to the Company’s directors. The footnotes to the table describe the details of each form of compensation paid to directors. The table includes only those columns that relate to compensation paid to or earned by directors in 2008.

2008 Director Compensation Table

| | | | | | | | | | | | | | | | |

Name (a) | | Fees Earned or

Paid in Cash

($)

(b)(1) | | | Stock Awards

($)

(c)(2) | | Option Awards

($)

(d)(3) | | All Other

Compensation

($)

(e)(4) | | Total

($)

(f) |

Richard W. Baldwin | | $ | 24,000 | | | $ | 0 | | $ | 3,127 | | $ | 0 | | $ | 27,127 |

| | | | | |

Craig O. Dawson | | $ | 18,167 | | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 18,167 |

| | | | | |

C. Don Filer* | | $ | 8,833 | | | $ | 0 | | $ | 1,315 | | $ | 0 | | $ | 10,148 |

| | | | | |

Carole J. Grisham | | $ | 21,500 | | | $ | 0 | | $ | 2,581 | | $ | 0 | | $ | 24,081 |

| | | | | |

Robert J. Grossman | | $ | 19,000 | | | $ | 0 | | $ | 2,581 | | $ | 0 | | $ | 21,581 |

| | | | | |

Gerald O. Hatler | | $ | 0 | (4) | | $ | 0 | | $ | 2,581 | | $ | 0 | | $ | 2,581 |

| | | | | |

Stan W. McNaughton | | $ | 24,000 | | | $ | 0 | | $ | 2,581 | | $ | 0 | | $ | 26,581 |

| | | | | |

Russel E. Olson | | $ | 26,500 | | | $ | 0 | | $ | 2,581 | | $ | 0 | | $ | 29,081 |

| | | | | |

Joseph M. Phillips | | $ | 21,500 | (8) | | $ | 0 | | $ | 0 | | $ | 0 | | $ | 21,500 |

| * | Mr. Filer retired effective at the 2008 Annual Meeting. |

| (1) | Amounts shown reflect the payment of the annual retainer and Committee fees paid to non-employee directors and includes $3,000 for Mr. Olson deferred under the Deferred Compensation Plan, the material terms of which are discussed below. |

| (2) | Represents the grant date market value of the stock award in accordance with SFAS 123(R). |

| (3) | Reflects the dollar amount recognized for financial statement reporting purposes for the fiscal year ended December 31, 2008 in accordance with SFAS 123(R) and includes amounts awarded in and prior to 2008. Additional information regarding assumptions used is contained in Note 11 to the Company’s audited financial statements for the year ended December 31, 2008 included in the Company’s accompanying Annual Report. |

At fiscal year end, directors had outstanding stock option awards to purchase shares of the company as follows: Richard W. Baldwin, 1,050 shares; Carole J. Grisham, 1,050 shares; Robert J. Grossman, 700 shares; Gerald O. Hatler, 700 shares (see page 14 for outstanding stock option awards granted to Mr. Hatler as an employee); Stan W. McNaughton, 1,050 shares; and Russel E. Olson, 1,050 shares, for an aggregate total of 5,600 shares.

| (4) | Director fees paid to Mr. Hatler are reflected in the Summary Compensation Table. |

2008 Director Fees

Cash Compensation

For the year 2008, directors of the Company each received an annual retainer fee of $16,500 for their services. In addition, non-employee directors received an additional fee of $5,000 for serving on each of the Credit Committee and the Audit Committee and an additional fee of $2,500 for serving on the Compensation Committee. At this time, the Company does not pay additional fees for meeting attendance or to committee chairpersons. The Board of Directors determined in early 2009 that as a result of the economic uncertainty,

10

director fees for 2009 would be half of the fees paid in 2008. The fees paid to directors are recommended by the Compensation Committee and approved by the full Board on an annual basis. Currently, the Bank does not pay a separate fee to its directors, other than Committee fees.

Directors also receive reimbursement for reasonable travel expenses associated with Board and/or Committee meetings, as well as costs and expenses incurred while attending director educational programs.

Equity Compensation

Upon the recommendation of the Compensation Committee, awards may be granted to our directors under the Company’s Stock Option and Equity Compensation Plan (the “Plan”). The Plan authorizes the Board, or a committee of the Board, to administer the Plan (referred to as the “Plan Administrator”). The Plan Administrator has the authority to grant awards to directors and to determine the terms and conditions of such awards. Prior to 2008, only nonqualified stock options and restricted stock awards were awarded under the Plan. The Plan Administrator also has the ability to grant directors alternate types of equity-based compensation, such as stock appreciation rights (“SARs”), and restricted stock units under the Plan. In 2008, no stock grants were awarded to directors. For a description of the material terms of the Plan, see “Executive Compensation – Equity Compensation Plans.”

EvergreenBank Deferred Compensation Plan

The EvergreenBank Deferred Compensation Plan (the “Deferred Plan”) is available to all non-employee directors and executive officers of the Company and the Bank. Under the Deferred Plan, directors may voluntarily elect to defer all or a portion of their directors’ fees that would otherwise be paid to them in a calendar year. Directors are fully vested in their benefits under the Deferred Plan at all times. Benefit payments from the Deferred Plan are taxed as ordinary income in the year they are received by participants. The Company will generally receive a deduction for the deferred directors’ fees at that time. A complete description of the general terms of the Deferred Plan is set forth in the section entitled “Executive Compensation - EvergreenBank Deferred Compensation Plan.”

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table shows, as of January 31, 2009, the amount of common stock beneficially owned by (a) each director and director nominee; (b) the executive officers named in the compensation table; (c) all persons who are beneficial owners of 5% or more of the Company’s common stock; and (d) all of the Company’s directors and executive officers as a group. Beneficial ownership is a technical term broadly defined by the SEC to mean more than ownership in the usual sense. In general, beneficial ownership includes any shares a director or executive officer can vote or transfer and stock options that are exercisable currently or become exercisable within 60 days. Except as noted below, each holder has sole voting and investment power for all shares shown as beneficially owned. Where beneficial ownership was less than one percent of all outstanding shares, the percentage is not reflected in the table. All share numbers and prices have been adjusted for applicable stock splits and stock dividends.

11

| | | | | | | | |

Name | | Position with Company and/or Bank | | Number of

Shares(1) (2) | | | Percentage of

Shares(1) | |

Executive Officers and Directors | | | | | | | | |

| | | |

Richard W. Baldwin | | Director | | 7,259 | | | * | |

| | | |

Valerie K. Blake | | Sr. Vice President of the Bank | | 38,067 | | | 1.50 | % |

| | | |

Gordon D. Browning | | Executive Vice President and Chief Financial Officer of the Company and the Bank | | 8,243 | | | * | |

| | | |

Craig O. Dawson | | Director | | 1,155 | | | * | |

| | | |

Carole J. Grisham | | Director | | 10,992 | (3) | | * | |

| | | |

Robert J. Grossman | | Director | | 6,954 | | | * | |

| | | |

Gerald O. Hatler | | Vice Chairman, President, and Chief Executive Officer of the Company and the Bank | | 90,375 | (4) | | 3.55 | % |

| | | |

Barrie M. Macdonald | | Executive Vice President and Chief Lending Officer of the Bank | | 2,625 | | | | |

| | | |

Stan W. McNaughton | | Chairman | | 29,999 | | | 1.18 | % |

| | | |

Russel E. Olson | | Director | | 8,470 | | | * | |

| | | |

Joseph M. Phillips | | Director | | 1,470 | | | * | |

| | | |

Michael H. Tibbits | | Executive Vice President & Chief Credit Officer of the Bank | | 10,956 | | | * | |

| | | |

Michelle P. Worden | | Executive Vice President of the Bank | | 31,361 | | | 1.23 | % |

| | | |

Directors and executive officers as a group (13 persons) | | | | 247,926 | | | 9.74 | % |

* Represents less than 1% of the Company’s outstanding common stock. (1) Amounts reflect all applicable stock splits and dividends paid on the Company’s common stock. (2) Includes options granted under the Plan that are exercisable within 60 days as follows: Mr. Baldwin, 701 shares; Ms. Blake, 33,620 shares; Mr. Browning, 1,260 shares; Ms. Grisham, 701 shares; Mr. Grossman, 351 shares; Mr. Hatler, 49,774 shares; Mr. McNaughton, 701 shares; Mr. Olson, 701 shares; Mr. Tibbits, 5,181 shares; and Ms. Worden, 24,588 shares. (3) Includes 3,150 shares owned by Ms. Grisham’s spouse. (4) Includes 3,693 shares owned by Mr. Hatler’s spouse. 5% Shareholder | |

Clara McNaughton | | | | 137,225 | | | 5.39 | % |

16109 Evanston Avenue North | | | | | | | | |

Shoreline, Washington | | | | | | | | |

12

MANAGEMENT

Executive Officers Who Are Not Directors

The following table sets forth information with respect to the executive officers who are not director nominees or directors of the Company, including employment history for the last five years.

| | | | | | |

Name | | Age | | Position with Bank and Five Year Employment History | | Tenure as an Officer

of the Bank |

| Gordon D. Browning | | 54 | | Executive Vice President and Chief Financial Officer | | 2006 |

| | | |

| Michael H. Tibbits | | 47 | | Executive Vice President and Chief Credit Officer | | 2006 |

| | | |

| Barrie M. Macdonald | | 59 | | Executive Vice President and Chief Lending Officer(1) | | 2008 |

| | | |

| Michelle P. Worden | | 47 | | Executive Vice President | | 2005 |

| | | |

| Valerie K. Blake | | 59 | | Senior Vice President | | 1998 |

| (1) | Mr. Macdonald joined the Bank on June 16, 2008 with over 34 years of financial management experience in the banking industry. He previously was the proposed President and Chief Executive Officer for a bank in organization which received regulatory approval but determined not to proceed due to the inability to raise its minimum target capital. Prior to that he served as area executive at Ironstone Bank. |

EXECUTIVE COMPENSATION

Compensation Tables

The following table sets forth the compensation paid or accrued for the last three fiscal years to the Company’s Chief Executive Officer and the two other most highly compensated executive officers (“Named Executives”), whose total compensation during the last fiscal year exceeded $100,000. The table includes only those columns that relate to compensation earned by the Named Executives for the last three years. The Company granted stock awards, but does not have an incentive compensation plan. Deferred compensation earnings for Mr. Hatler are not disclosed as the amount did not reach a level of “above-market earnings”.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | |

Name and Principal Position (a) | | Year

(b) | | Salary

($)(1)

(c) | | Bonus

($)

(d) | | Stock

Awards

($)(2)

(e) | | Option

Awards

($)(3)

(f) | | All Other

Compensation

($)(4)(5)(6)(7)(8)

(g) | | Total

($)

(h) |

Gerald O. Hatler,

President & CEO of Company and Bank | | 2008 | | $ | 331,500 | | $ | 0 | | $ | 0 | | $ | 11,403 | | $ | 55,803 | | $ | 398,706 |

| | 2007 | | $ | 322,039 | | $ | 80,000 | | $ | 0 | | $ | 21,835 | | $ | 53,915 | | $ | 477,789 |

| | 2006 | | $ | 270,923 | | $ | 35,000 | | $ | 0 | | $ | 17,461 | | $ | 27,958 | | $ | 351,342 |

| | | | | | | |

Gordon D. Browning,

Executive Vice President & CFO of Company and Bank* | | 2008 | | $ | 145,282 | | $ | 0 | | $ | 8,163 | | $ | 2,867 | | $ | 35,446 | | $ | 191,758 |

| | 2007 | | $ | 156,812 | | $ | 53,665 | | $ | 3,073 | | $ | 2,867 | | $ | 18,687 | | $ | 235,104 |

| | 2006 | | $ | 39,039 | | $ | 0 | | $ | 0 | | $ | 956 | | $ | 0 | | $ | 39,995 |

| | | | | | | |

Michael H. Tibbits,

Executive Vice President & CCO of Bank | | 2008 | | $ | 140,730 | | $ | 0 | | $ | 8,163 | | $ | 7,416 | | $ | 35,506 | | $ | 191,815 |

| | 2007 | | $ | 146,923 | | $ | 50,980 | | $ | 3,073 | | $ | 7,416 | | $ | 17,907 | | $ | 226,299 |

| | 2006 | | $ | 119,327 | | $ | 20,000 | | $ | 0 | | $ | 5,925 | | $ | 17,185 | | $ | 162,437 |

| * | Mr. Browning joined the Company on September 11, 2006. |

| (1) | Includes director fees paid by the Company during the fiscal year 2008 for the benefit of Mr. Hatler in the amount of $16,500. |

| (2) | Reflects the dollar amounts recognized for financial statement reporting purposes for the year ended December 31, 2008 in accordance with SFAS 123(R) and include amounts awarded in 2008. Additional information regarding assumptions used is contained in Note 11 to the Company’s audited financial statements for the year ended December 31, 2008 included in the Company’s accompanying Annual Report. The amount recognized for stock awards received by Mr. Hatler as a director is included in the Director Compensation Table on page 10. |

13

| (3) | Reflects the dollar amounts recognized for financial statement reporting purposes for the year ended December 31, 2008 in accordance with SFAS 123(R) and include amounts awarded in 2008. Additional information regarding assumptions used is contained in Note 11 to the Company’s audited financial statements for the year ended December 31, 2008 included in the Company’s accompanying Annual Report. The amount recognized for options received by Mr. Hatler as a director is included in the Director Compensation Table on page 10. |

| (4) | The Bank paid life insurance premiums for the benefit of the executives as follows: Mr. Hatler, $468; Mr. Browning, $243; and Mr. Tibbits, $235. |

| (5) | The Bank paid the following amounts as matching contributions to the 401(k) Plan: Mr. Hatler, $30,500; Mr. Browning, $23,960; and Mr. Tibbits, $24,319 |

| (6) | Amount for Mr. Hatler for 2007 includes payments made in exchange for executive’s right to receive post-retirement medical benefits as the result of the Company’s elimination of the plan, $25,915. |

| (7) | Includes a one time payment made in 2008 due to changes in the vacation accrual policy. |

| (8) | Does not include perquisites and personal benefits received by any officer, including the personal use of vehicles provided by the Bank and club memberships, the total of which did not exceed $10,000. |

Equity Compensation Plan

At the 2008 Annual Meeting, the shareholders approved amendments to the Company’s Second Amended 2000 Stock Option and Equity Compensation Plan including, but not limited to, restating and renaming the plan the “Stock Option and Equity Compensation Plan” (the “Plan”) and extending the term of the Plan to January 17, 2018. The Plan provides for the grant of awards in the form of incentive stock options, nonqualified stock options, restricted stock awards, stock appreciation rights (“SAR’s”) and restricted stock units (collectively, the “Awards”) to certain employees, officers, directors and independent contractors. However, only an employee of the Company or a related corporation may be granted an incentive stock option.

The Plan is administered by the Board of Directors or, in the event the Board shall appoint or authorize a committee to administer the Plan. The Plan currently provides for the grant of up to 472,210 shares of the Company’s common stock. At December 31, 2008, the aggregate number of shares represented by granted and by unexercised options under the Plan was 169,152 and the number of shares remaining available for future grant was 152,118. During 2008, restricted stock awards totaling 13,283 were granted under the Plan. Awards available under the Plan have been adjusted to reflect all applicable stock splits and dividends paid by the Company’s common stock.

14

Outstanding Equity Awards at Fiscal Year-End 2008

| | | | | | | | | | | | | | | | |

| | | Option Awards* | | Stock Awards |

| Name | | Number of

Securities

Underlying

Options

(#)

Exercisable | | Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable | | | Option

Exercise

Price

($) | | Option

Expiration

Date | | Number of

Shares or

Units of

Stock That

Have Not

Vested

(#) | | | Market Value

of Shares or

Units of

Stock That

Have Not

Vested

($) |

Gerald O. Hatler** | | 5,364 | | 0 | | | $ | 6.5123 | | 10/24/2010 | | 0 | | | | 0 |

| | 16,600 | | 0 | | | | 6.6253 | | 1/20/2011 | | | | | | |

| | 11,068 | | 0 | | | | 7.6341 | | 5/17/2012 | | | | | | |

| | 7,699 | | 0 | | | | 8.4686 | | 3/26/2013 | | | | | | |

| | 4,212 | | 1,749 | (1) | | | 10.1429 | | 7/16/2014 | | | | | | |

| | 1,120 | | 2,238 | (2) | | | 13.0357 | | 8/19/2015 | | | | | | |

| | 351 | | 349 | (3) | | | 13.5714 | | 8/19/2009 | | | | | | |

| | 840 | | 2,520 | (4) | | | 13.5714 | | 5/19/2016 | | | | | | |

| | 1,260 | | 5,040 | (5) | | | 14.5238 | | 3/16/2017 | | | | | | |

| | | | | | |

Gordon D. Browning | | 1,260 | | 1,890 | (6) | | $ | 14.333 | | 9/12/2016 | | 2,625 | (9) | | $ | 36,875 |

| | | | | | | | | | | | 1,050 | (10) | | $ | 9,450 |

| | | | | | |

Michael H. Tibbits | | 1,681 | | 1,118 | (7) | | $ | 11.7857 | | 1/21/2015 | | 2,625 | (9) | | $ | 36,875 |

| | 841 | | 558 | (8) | | | 13.2143 | | 6/17/2015 | | 1,050 | (10) | | | |

| | 2,100 | | 3,150 | (4) | | | 13.5714 | | 5/19/2016 | | | | |

| * | Nonqualified stock options granted to employees vest annually at 20% over a five-year period and are exercisable for ten years from date of grant. Options may be exercised for a period ninety days following termination of employment and for one year following death or permanent and total disability. |

| ** | Nonqualified stock options granted to Mr. Hatler as a director vest annually at 33.3% over a three-year period and are exercisable for three years and ninety days from date of grant. |

Amounts have been adjusted to reflect all applicable stock splits and dividends paid on the Company’s common stock.

(2) | Vests equally on 8/18/2009 and 8/18/2010. |

(4) | Vests equally on 5/18/2009, 5/18/2010, and 5/18/2011. |

(5) | Vests equally on 3/15/2009, 3/15/2010, 3/15/2011 and 3/15/2012. |

(6) | Vests equally on 9/11/2009, 9/11/2010 and 9/11/2011. |

(7) | One-fifth vested on 1/20/2009 and the remaining vests on 1/20/2010. |

(8) | Vests equally on 6/16/2009 and 6/16/2010. |

2008 Non-Qualified Deferred Compensation

| | | | | | | | | | | | | |

Name (a) | | Executive

Contribution

in Last FY

($)

(b) | | Registrant

Contributions

in Last FY

($)

(c) | | Aggregate

Earnings in Last

FY

($)

(d)(1) | | | Aggregate Balance

at Last FYE

($)

(e)(1) |

Gerald O. Hatler | | $ | 37,226 | | $ | 0 | | $ | (36,569 | ) | | $ | 123,071 |

| | | | |

Gordon D. Browning | | | 0 | | | 0 | | | 0 | | | | 0 |

| | | | |

Michael H. Tibbits | | | 0 | | | 0 | | | 0 | | | | 0 |

| (1) | Reflects earnings deferred under the Deferred Plan, the terms of which are described below. Deferred compensation is invested in a group of investment funds offered through ING. |

15

401(k) Retirement Plan and Profit Sharing Plan

We participate in a defined contribution retirement plan (“401(k) Plan”) that qualifies for special tax treatment under Section 401(k) of the Internal Revenue Code and covers all employees. The 401(k) Plan allows for tax-deferred employee contributions up to IRS maximum limits of 15 percent of gross salary per month. For eligible employees, during 2008 the Bank matched 200 percent of the first six percent of the employee contribution. Employee elective contributions are 100 percent vested at all times. Matching and discretionary contributions vest 20 percent after two years of employment and are 100 percent vested upon five years, after which the employee is fully vested in all contributions. The expense relating to the Bank’s contributions for the year ended December 31, 2008 was $455,000.

As a result of the tax qualification of the 401(k) Plan, employees are not subject to federal or state income taxation on the employee elective contributions, contributions or earnings thereon until those amounts are distributed from the 401(k) Plan, although we continue to receive a compensation expense deduction for compensation paid.

EvergreenBank Deferred Compensation Plan

The Board adopted the Deferred Plan in September of 2007. The Deferred Plan is a non-qualified deferred compensation plan under which eligible management or highly-compensated employees may elect to defer payment of up to 20 percent of their salary and bonus. The plan allows for additional deferral of taxable income because of regulatory restrictions imposed on higher compensated employees’ participation in the Company’s 401(k) Plan. The Company does not contribute to the Deferred Plan and funds deferred are held at ING. The Company will make distributions in accordance with individual elections. ERISA and the Internal Revenue Code’s tax-qualified plan rules generally do not apply to this plan. The Deferred Plan is consistent with the Internal Revenue Code Section 409A.

Post Employment and Termination Benefits

Below is a summary of the Company’s agreements with the Named Executives listed in the Summary Compensation Table. These summaries are qualified in their entirety by the individual agreements.

The Bank has entered into individual Change of Control Severance Agreements (the “Agreements”) with each of the Named Executives. The Agreements provide for severance benefits if the executives’ employment is terminated under certain defined circumstances within twelve months following a change of control, as defined in the Agreements. Those circumstances include termination of employment for “good reason” or other than “termination for cause,” as those terms are defined in the Agreements.

Severance benefits for the executives consist of: (i) for Mr. Hatler and Mr. Browning, a sum equal to two times the executive’s W-2 income, before salary deferral, received from the Bank for the calendar year ending before, or simultaneously with, the effective date of the change of control; for Mr. Tibbits a sum equal to one times his W-2 income, before salary deferral, received from the Bank for the calendar year ending before, or simultaneously with, the effective date of the change of control; and (ii) a continuation, for twelve months after the effective date of termination, of life, medical, dental, and disability coverage substantially identical to the coverage maintained by the Bank or the Company for the executive immediately prior to the effective date of termination, except to the extent such coverage may be changed in its application to all Bank or Company employees on a nondiscriminatory basis.

If the severance benefits payable under the respective Agreement, together with any other payments made or to be made for the executive’s benefit would be a “parachute payment” as defined in Section 280G

16

of the Internal Revenue Code, then payment under the Agreement shall be reduced so that the total amount does not constitute a parachute payment. The Agreement is further limited so that no payment would constitute a “golden parachute” payment under identified regulatory rules.

The Agreements contain termination provisions that can become effective under stated circumstances. As part of the consideration for the benefits provided, the executive agrees to honor certain confidentiality and non-competition provisions described in the Agreements.

The table below shows the maximum amounts that could be paid to executives Hatler, Browning and Tibbits under their respective agreements. The following information is based on (i) the executive’s salary at December 31, 2008; and (ii) assumes the triggering event was December 31, 2008.

| | | | | | | | | | | | | | | | | | | | | |

| | | Termination

Prior to

Change in

Control | | Termination by Bank without Cause or by Executive With Good Reason

Following Change in Control | | Total Payments to

Executive |

| | | | | Salary | | Life | | Medical | | Dental | | Disability | | |

Gerald O. Hatler | | $ | 0 | | $ | 550,000 | | $ | 468 | | $ | 4,560 | | $ | 888 | | $ | 1,090 | | $ | 557,006 |

Gordon D. Browning | | $ | 0 | | $ | 310,000 | | $ | 243 | | $ | 6,552 | | $ | 1,488 | | $ | 563 | | $ | 318,846 |

Michael H. Tibbits | | $ | 0 | | $ | 150,000 | | $ | 235 | | $ | 4,560 | | $ | 888 | | $ | 545 | | $ | 156,198 |

TRANSACTIONS WITH MANAGEMENT

Transactions between the Company or its affiliates and related persons (including directors and executive officers of the Company and the Bank, or their immediate family) are reviewed by the Audit Committee and recommended, when appropriate, to the full Board for approval. A transaction between a “related person” shall be consummated only if a majority of the disinterested independent members of the Board approves or ratifies such transaction, and if the transaction is on terms comparable to those that could be obtained in arm’s length dealings with an unrelated third party. While this has been the Company’s practice over the years, it has not adopted formal written policies or procedures for related person transactions.

Loans to Management and Directors

During 2008, the Bank has had, and expects to have in the future, banking transactions, including loans, in the ordinary course of business with directors, executive officers, their immediate family members and their associates, on substantially the same terms, including interest rates and collateral, as those prevailing at the same time for comparable transactions with other persons, which transactions do not involve more than the normal risk of collection or present other unfavorable features. All such loans were made in the ordinary course of the Bank’s business, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other customers and in the opinion of management, do not involve any undue credit risk to the Bank.

Data Processing Services

During 2008, we contracted with PCCS, Inc., PEMCO Corporation, PEMCO Mutual Insurance Company, and PEMCO Technology Services, Inc. for data processing services. Those companies were compensated at rates customary for such services and totaled $336,000. Mr. McNaughton is Chairman and/or director and officer of all four companies. Mr. Hatler served as a director of PEMCO Technology Services, Inc. until his recent resignation in 2009.

17

COMPLIANCE WITH SECTION 16(a) FILING REQUIREMENTS

Section 16(a) of the Securities Exchange Act of 1934, as amended, (“Section 16(a)”) requires that all executive officers and directors of the Company and all persons who beneficially own more than 10 percent of our common stock file reports with respect to beneficial ownership of our securities. We have adopted procedures to assist our directors and executive officers in complying with the Section 16(a) filings.

Based solely upon our review of the copies of the filings that we received with respect to the fiscal year ended December 31, 2008 or written representations from certain reporting persons, the Company believes that all reporting persons made all filings required by Section 16(a) on a timely basis with the SEC except (i) respective Form 4’s filed on behalf of Valerie Blake, Gordon Browning, Michael Tibbits, Barrie Macdonald and Michelle Worden when they received stock grants in August and (ii) the amended Form 4 filed on behalf of Gerald Hatler to correct the number of shares previously held by Mr. Hatler’s spouse which were inadvertently omitted. A Form 4 was subsequently filed by the Company on behalf of each of the named individuals.

AUDITORS

The firm of Crowe Horwath LLP performed the audit of the consolidated financial statements of the Company and its subsidiary for the year ended December 31, 2008.

Fees Paid to Independent Auditors

The following table sets forth the aggregate fees paid by the Company to Crowe Horwath LLP in 2008 and 2007 for audit and tax services rendered in connection with the audited consolidated financial statements and reports for the 2008 and 2007 fiscal years and for other services rendered during the 2008 and 2007 fiscal years to the Company.

| | | | | | | | | | | | |

Fee Category | | Fiscal 2008 | | % of Total | | | Fiscal 2007 | | % of Total | |

Audit Fees | | $ | 174,827 | | 89.08 | % | | $ | 99,050 | | 80.29 | % |

| | | | |

Audit-Related Fees | | | 11,959 | | 6.09 | % | | | 11,265 | | 9.13 | % |

| | | | |

Tax Fees | | | 9,475 | | 4.83 | % | | | 13,050 | | 10.58 | % |

| | | | |

All Other Fees: | | | | | | | | | | | | |

Compliance Consulting | | | 0 | | | | | | 0 | | | |

Other Consulting | | | 0 | | | | | | 0 | | | |

| | | | |

Total Other Fees | | | 0 | | | | | | 0 | | | |

| | | | |

Total Fees | | $ | 196,261 | | 100 | % | | $ | 123,365 | | 100 | % |

| | | | | | | | | | | | |

Audit Fees. Audit fees are fees for the audit and quarterly review of the Company’s consolidated financial statements, assistance with and review of documents filed with the SEC, consent procedures, and accounting consultations relating to transactions and the adoption of new accounting pronouncements.

Audit-Related Fees. Audit-related fees are fees for services that are reasonably related to the performance of the audit or the review of the Company’s consolidated financial statements and principally include consultation concerning financial accounting and reporting standards.

18

Tax Fees.Tax fees are primarily fees for tax preparation services, including tax planning and compliance issues.

Crowe Horwath LLP did not provide any other services to the Company in 2008 or 2007.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

The Audit Committee has established procedures for pre-approval of all audit and permissible non-audit services provided by the independent registered public accounting firm. These services include audit and audit-related services, tax services, compliance services, consulting and other services. For audit services, the independent registered public accounting firm provides the Audit Committee with an engagement letter at the beginning of the fiscal year outlining the scope of the audit services proposed to be performed during the year, together with an audit services fee proposal. Before the audit commences, the engagement letter and fee proposal must be approved by the Audit Committee. The Audit Committee also pre-approves all other permissible services based on specified project and service details, fee estimates and aggregate fee limits for each service category.

The Audit Committee considered the services provided by Crowe Horwath LLP and determined that they were compatible with maintaining auditor independence.

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

The Audit Committee has selected Crowe Horwath LLP to continue to serve as the Company’s independent registered public accounting firm for the 2009 fiscal year. A representative of Crowe Horwath LLP is expected to be present at the 2009 Annual Meeting and will have an opportunity to make a statement if so desired and is expected to be available to respond to appropriate shareholder questions.

Although the Company is not required to seek shareholder approval of this appointment, the Board believes it to be sound corporate governance to do so. If the appointment is not ratified, the Audit Committee will investigate the reasons for shareholder rejection and will reconsider the appointment.

The Board of Directors unanimously recommends a vote FOR the ratification of the Audit Committee’s appointment of Crowe Horwath LLP as the Company’s independent registered public accounting firm.

OTHER BUSINESS

The Board of Directors knows of no other matters to be brought before the shareholders at the Annual Meeting. In the event other matters are presented for a vote at the meeting, the proxy holders will vote shares represented by properly executed proxies in their discretion in accordance with their judgment on such matters.

At the meeting, management will report on our business and shareholders will have the opportunity to ask questions.

SHAREHOLDER PROPOSALS AND DIRECTOR NOMINATIONS

Shareholders may submit proposals for consideration at future annual shareholder meetings, including director nominations.

19

Shareholder Proposals

Proposals of shareholders intended to be presented at the 2010 Annual Meeting of shareholders must be received by the Company’s Corporate Secretary before December 25, 2009, for inclusion in the 2010 Proxy Statement and form of proxy. A shareholder who intends to present a proposal at the Company’s Annual Meeting in 2010, other than pursuant to Rule 14a-8 under the Securities Exchange Act of 1934, must provide the Company notice of such intention by at least March 9, 2010 or the persons named as proxies in the form of proxy will have discretionary authority at the 2010 Annual Meeting with respect to any such proposal without discussion of the matter in the Company’s Proxy Statement.

Director Nominations

The Company’s Bylaws provide for the nomination of director candidates by its shareholders. In order for the Nominating Committee to consider a person for inclusion as a director nominee in the Company’s proxy statement for next year’s annual meeting, the Company must receive written notice by December 25, 2009. Persons who wish to suggest potential nominees for the 2010 Annual Meeting may address their suggestions in writing to EvergreenBancorp, Inc. 1111 3rd Ave., Suite 2100, Seattle, Washington 98101, Attention: Corporate Secretary.

ADDITIONAL INFORMATION

The Company currently files periodic reports and other information with the SEC. Such information and reports may be read and copied at the SEC’s Public Reference Room at 450 Fifth Street N.W., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at (800) SEC-0330. Reports and information filed by the Company electronically will be available on an Internet site that the SEC maintains atwww.sec.gov, as well as the Company’s website atwww.EvergreenBancorp.com. Additional information, including recent press releases, is also available on the Company’s website.

ANNUAL REPORT TO SHAREHOLDERS

Any shareholder may obtain without charge a copy of our Annual Report on Form 10-K filed with the SEC under the Securities Exchange Act of 1934 for the year ended December 31, 2008, including financial statements. Written requests for the Form 10-K should be addressed to Gordon Browning, Executive Vice President and Chief Financial Officer, EvergreenBancorp, Inc., 1111 3rd Avenue, Suite 2100, Seattle, Washington 98101.

|

By Order of the Board |

|

|

Gerald O. Hatler |

President and Chief Executive Officer |

Dated: April 24, 2009

20

Exhibit A

EvergreenBancorp

Compensation Committee Charter

I. Purpose

The primary purpose of the Compensation Committee (the “Committee”) is to assist the Board in discharging its responsibilities in respect of compensation of the Company’s executive officers, to annually review the compensation paid to directors and make recommendations for any adjustments; and recommend to the Board all awards of equity compensation.

II. Composition of Committee

The Committee will be composed of three or more non-employee members of the Board, a majority of whom is determined by the Board to be “independent” under applicable Nasdaq rules.

III. Appointment and Removal

Each member of the Committee will be appointed by the Board of Directors and will serve until such member’s successor is duly appointed and qualified or until such member’s earlier resignation or removal by the Board. The Committee’s chairperson shall be designated by the full Board or if it does not do so, the Committee members shall elect a chairperson by vote of a majority of the full Committee.

IV. Meetings

The chairperson of the Committee will preside at each meeting of the Committee and, in consultation with the other members of the Committee and the Company’s CEO, shall set the frequency and length of each meeting and the agenda of items to be addressed at each meeting. The Committee will prepare written minutes of its meetings, which will be maintained with the books and records of the Company. As necessary or desirable, the chairperson of the Committee may invite any director, officer or employee of the Company, or other persons whose advice and counsel are sought by the Committee, to be present at meetings of the Committee.

V. Duties

The duties of the Committee are as follows:

| 1. | Recommend overall corporate philosophy and long-term strategies for executive compensation programs of the Company that appropriately compensates executives and directors for executing their assigned responsibilities and rewards executives for achieving performance objectives; |

A-1

| 2. | Periodically review peer director and executive officer compensation; including all forms of benefits and compensation; evaluate Company obligations in light of terminations, retirements, or change in control/severance provisions. |

| 3. | Annually review and evaluate the CEO’s performance in light of Company goals and objectives, report the results of such evaluation, and make recommendations to the Board at an executive session of non-management directors on any changes to the CEO’s compensation, including salary structure and short-term and long-term incentive compensation payments and awards. In reviewing the CEO’s compensation, the Committee will consider both qualitative and quantitative factors, including the Company’s performance and shareholder return; |

| 4. | Review compensation amounts for all named executive officers of the Company, including base salary amounts, short-term and long-term incentive compensation payments and awards; |

| 5. | Review the Directors’ compensation and recommend changes to the Board as appropriate; |

| 6. | Establish the criteria for the granting of equity based compensation and review and recommend to the Board the granting of all awards of equity-based compensation granted to employees, officers, and directors; |

| 7. | Review and approve the Compensation Committee Report for inclusion in the Company’s annual proxy statement or annual report on Form 10-K as required by applicable laws and regulations; |

| 8. | Review and discuss with management the Compensation Discussion and Analysis (“CD&A”) required by the Securities and Exchange Commission and recommend to the Board that the CD&A be included in the Company’s proxy statement; assure availability to management of access to the information reasonably necessary for management to prepare the CD&A and to execute the CEO and CFO certifications required to be filed in the Company’s reports with the SEC; |

| 9. | Report regularly to the Board following meetings of the Committee with respect to those matters that are relevant to the Committee’s discharge of its responsibilities; and |

| 10. | Review and reassess this Charter on a periodic basis and recommend any proposed changes to the Board. |

A-2

VI. Performance Evaluation

The Committee shall perform an annual evaluation of its own performance, which shall compare the performance of the Committee with the requirements of its Charter.

VII. Committee Resources

The Committee shall be empowered, without the approval of the Board or management, to engage and compensate independent legal, accounting and other advisors, as it determines necessary to carry out its duties. The Committee shall have the sole authority to retain and terminate any consultant that it uses to assist in the Committee’s evaluation of director, CEO or executive compensation and shall have the sole authority to approve that consultant’s fees and other retention terms.

(Rev. 6/19/2008)

A-3

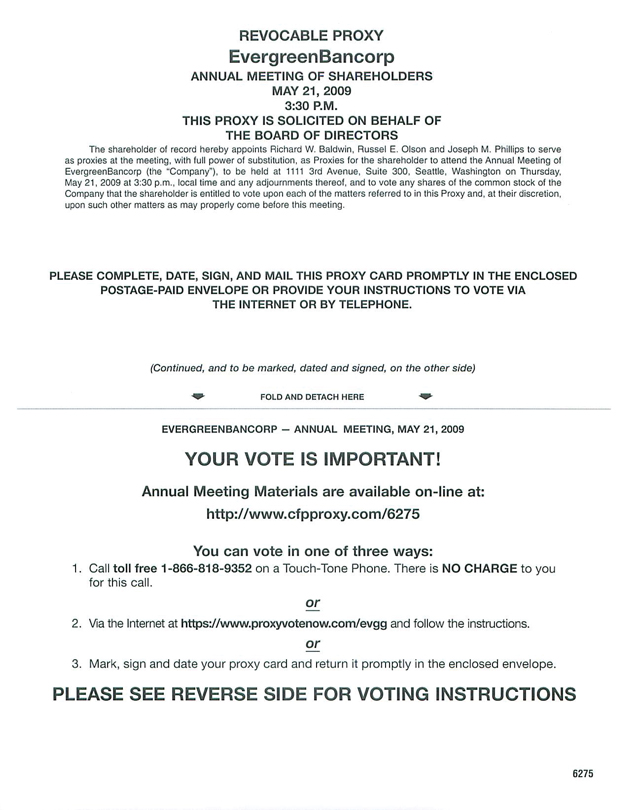

REVOCABLE PROXY

EvergreenBancorp

ANNUAL MEETING OF SHAREHOLDERS

MAY 21,2009

3:30 P.M.

THIS PROXY IS SOLICITED ON BEHALF OF

THE BOARD OF DIRECTORS

The shareholder of record hereby appoints Richard W. Baldwin, Russel E. Olson and Joseph M. Phillips to serve

as proxies at the meeting, with full power of substitution, as Proxies for the shareholder to attend the Annual Meeting of

EvergreenBancorp (the “Company”), to be held at 1111 3rd Avenue, Suite 300, Seattle, Washington on Thursday,

May 21, 2009 at 3:30 p.m., local time and any adjournments thereof, and to vote any shares of the common stock of the

Company that the shareholder is entitled to vote upon each of the matters referred to in this Proxy and, at their discretion,

upon such other matters as may properly come before this meeting.

PLEASE COMPLETE, DATE, SIGN, AND MAIL THIS PROXY CARD PROMPTLY IN THE ENCLOSED

POSTAGE-PAID ENVELOPE OR PROVIDE YOUR INSTRUCTIONS TO VOTE VIA

THE INTERNET OR BY TELEPHONE.

(Continued, and to be marked, dated and signed, on the other side)

FOLD AND DETACH HERE

EVERGREENBANCORP—ANNUAL MEETING, MAY 21,2009

YOUR VOTE IS IMPORTANT!

Annual Meeting Materials are available on-line at:

http://www.cfpproxy.com/6275

You can vote in one of three ways:

1. Call toll free 1-866-818-9352 on a Touch-Tone Phone. There is NO CHARGE to you

for this call.

or

2. Via the Internet at https://www.proxyvotenow.com/evgg and follow the instructions.

or

3. Mark, sign and date your proxy card and return it promptly in the enclosed envelope.

PLEASE SEE REVERSE SIDE FOR VOTING INSTRUCTIONS

6275

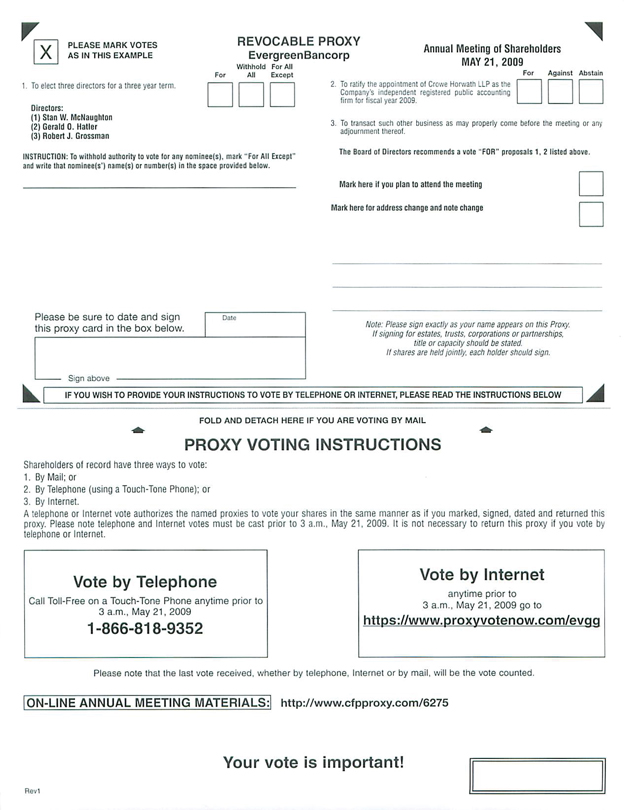

X PLEASE MARK VOTES

AS IN THIS EXAMPLE

1. To elect three directors for a three year term.

Directors:

(1) Stan W. McNaughton

(2) Gerald O. Hatler

(3) Robert J. Grossman

REVOCABLE PROXY

EvergreenBancorp

For Withhold All For All Except

INSTRUCTION: To withhold authority to vote for any nominee(s), mark “For All Except” and write that nominee(s’) name(s) or number(s) in the space provided below.

Please be sure to date and sign this proxy card in the box below. Date

Sign above

Annual Meeting of Shareholders

MAY 21, 2009

For Against Abstain

2. To ratify the appointment of Crowe Horwath LLP as the Company’s independent registered public accounting firm for fiscal year 2009.

3. To transact such other business as may properly come before the meeting or any adjournment thereof.

The Board of Directors recommends a vote “FOR” proposals 1, 2 listed above.

Mark here if you plan to attend the meeting

Mark here for address change and note change

Note: Please sign exactly as your name appears on this Proxy.

If signing for estates, trusts, corporations or partnerships,

title or capacity should be stated.

If shares are held jointly, each holder should sign.

IF YOU WISH TO PROVIDE YOUR INSTRUCTIONS TO VOTE BY TELEPHONE OR INTERNET, PLEASE READ THE INSTRUCTIONS BELOW

FOLD AND DETACH HERE IF YOU ARE VOTING BY MAIL

PROXY VOTING INSTRUCTIONS

Shareholders of record have three ways to vote:

1. By Mail; or

2. By Telephone (using a Touch-Tone Phone); or

3. By Internet.

A telephone or Internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed, dated and returned this proxy. Please note telephone and Internet votes must be cast prior to 3 a.m., May 21, 2009. It is not necessary to return this proxy if you vote by telephone or Internet.

Vote by Telephone

Call Toll-Free on a Touch-Tone Phone anytime prior to

3 a.m., May 21, 2009

1-866-818-9352

Vote by Internet

anytime prior to

3 a.m., May 21, 2009 go to

https://www.proxyvotenow.com/evgg

Please note that the last vote received, whether by telephone, Internet or by mail, will be the vote counted.

ON-LINE ANNUAL MEETING MATERIALS: http://www.cfpproxy.com/6275

Your vote is important!

Rev1