Doug Buth, Chairman

Mark Richards, CEO and President

Dale Parker, Chief Financial Officer

Coated

Solutions

Thermal and

Advanced

Technical

Products

Security

Products

Performance

Packaging

100% employee owned

In business since 1907, Appleton creates product

solutions for customers through coating formulations

and applications, encapsulation, security, printing

and packaging technologies

Introduction to Appleton

2

Executive Succession

Mark Richards – CEO and President

Joined Appleton April 2005

Former President Engineered Support

Structures Division of Valmont Industries

Bachelors Degree – Packaging, Michigan State

Masters Degree – Business, Northwestern

3

Appleton

4

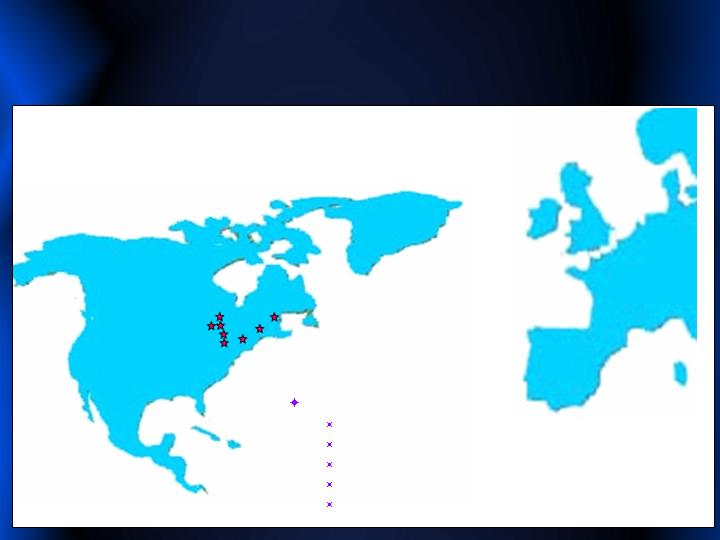

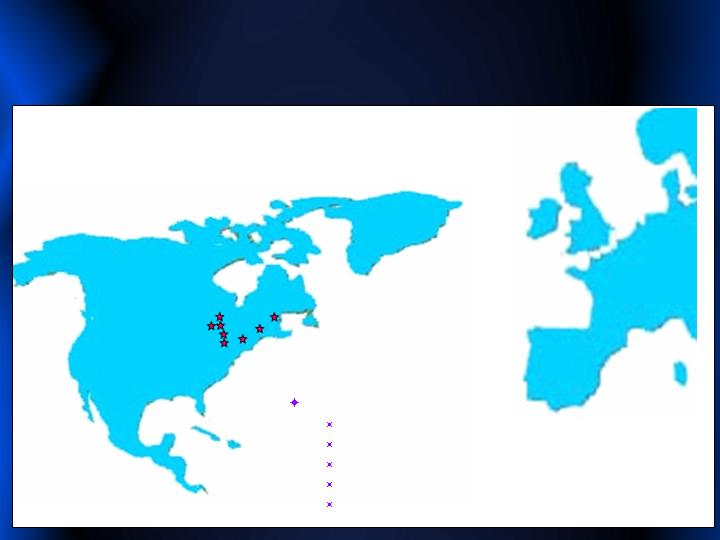

11 Manufacturing Locations

2 Paper Mills

1 Coating Plant

1 Capsule Plant

4 Packaging Plants

3 Printing Plants

Utrecht

Turners Falls, MA

Teesside

Hull

Derby

West Carrollton, OH

Roaring Spring, PA

Wisconsin

Appleton

Merrill

Rhinelander

Portage

Milton

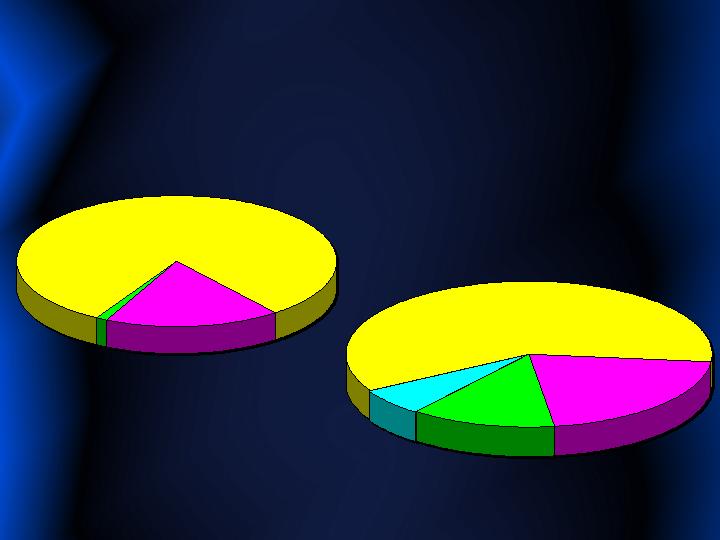

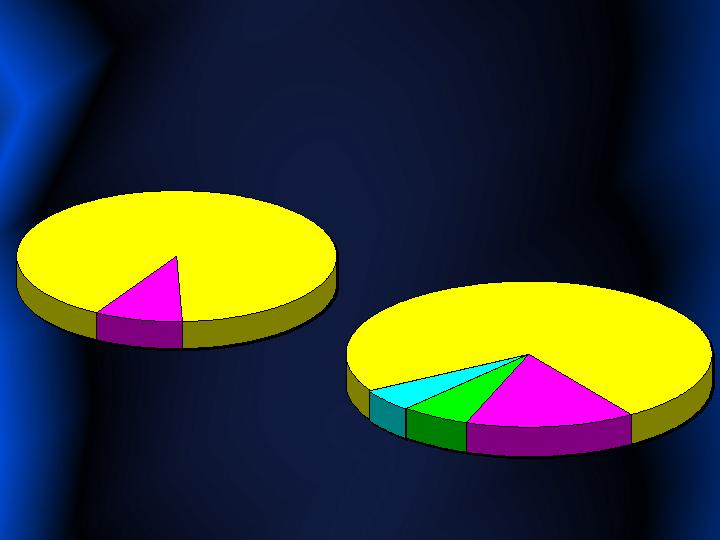

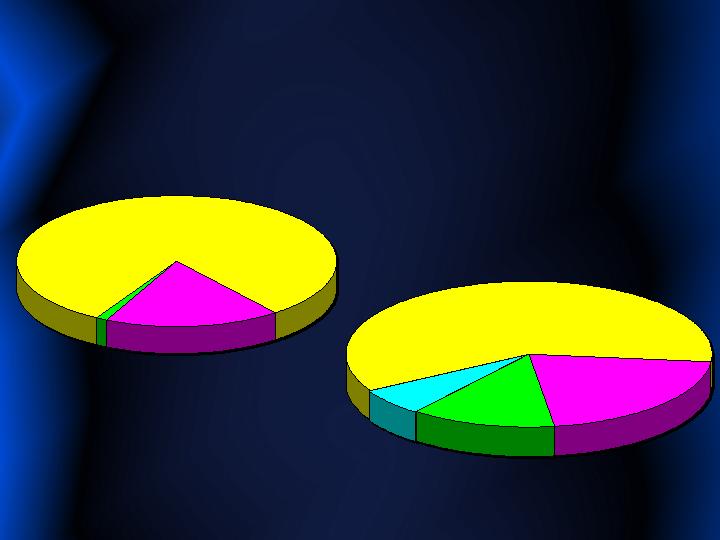

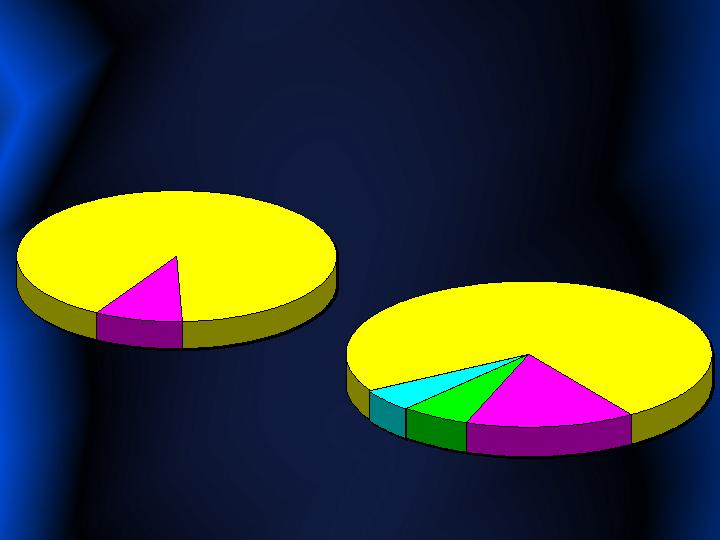

The Changing Revenue Profile of Appleton

2001

LTM 4/3/05

Thermal

18%

Coated Solutions

60%

Coated Solutions

81%

Thermal

21%

Security

13%

Performance

Packaging

6%

Security

1%

$955 Million

$992 Million

5

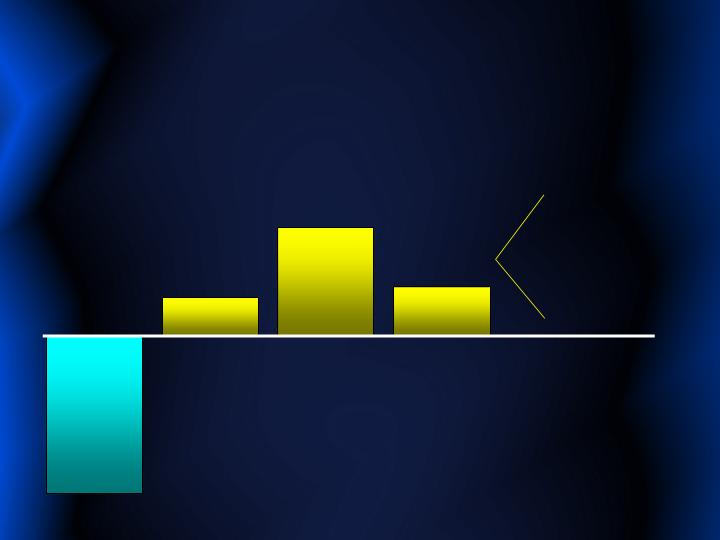

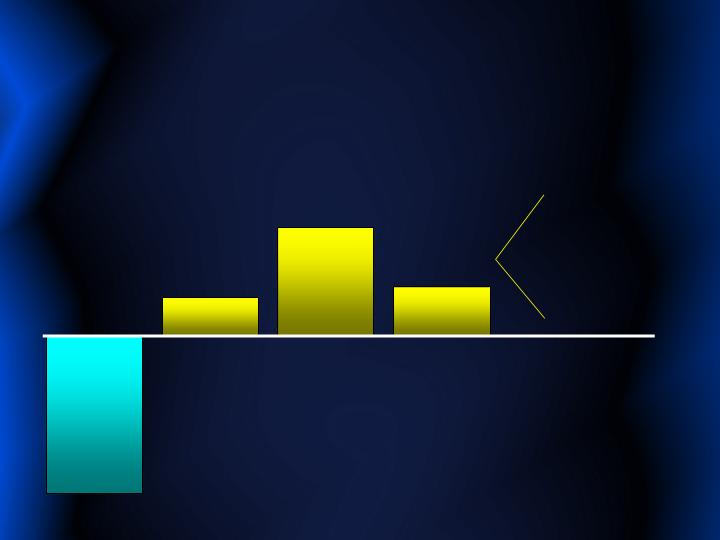

Change in Revenue 2001 - 2004

-150

+37

+103

$ Millions

+47

Carbonless

Thermal

Security

Packaging

Growth

Organic +$ 50

Acquisitions +$137

+$187

6

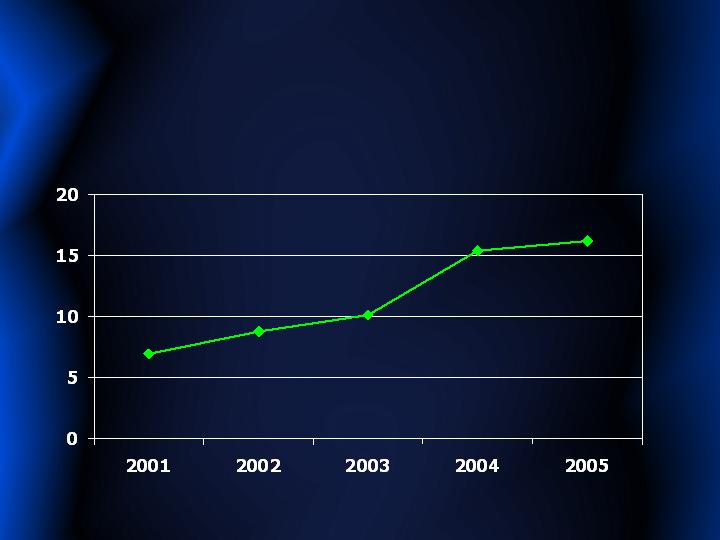

Revenue Growth

Q1 Q2 Q3 Q4 Q1

$ Millions $251 $234 $244 $261 $253

% Growth vs +23% +11% +12% +14% +1%

prior year quarter

2004

2005

7

The Changing EBITDA Profile of Appleton

2001(1)

LTM 4/3/05 (1)

Thermal

9%

Coated Solutions

74%

Coated Solutions

91%

Thermal

15%

Security

6%

Performance

Packaging

5%

$183 Million

$142 Million

(1) Excluding business development and restructuring charges

8

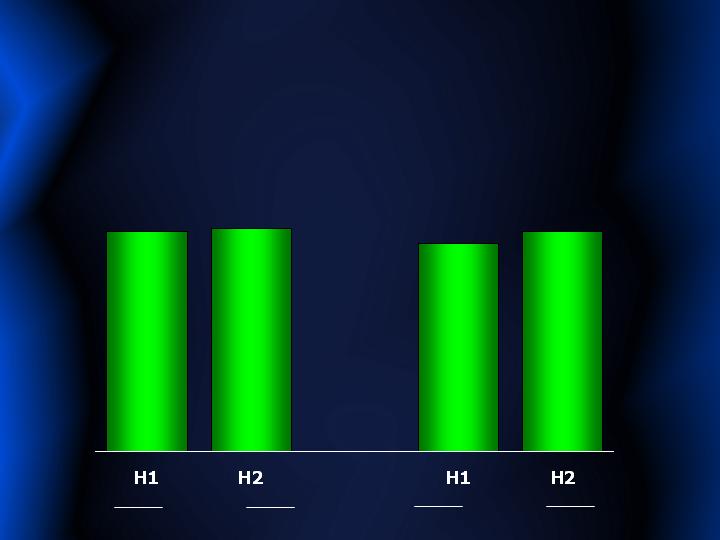

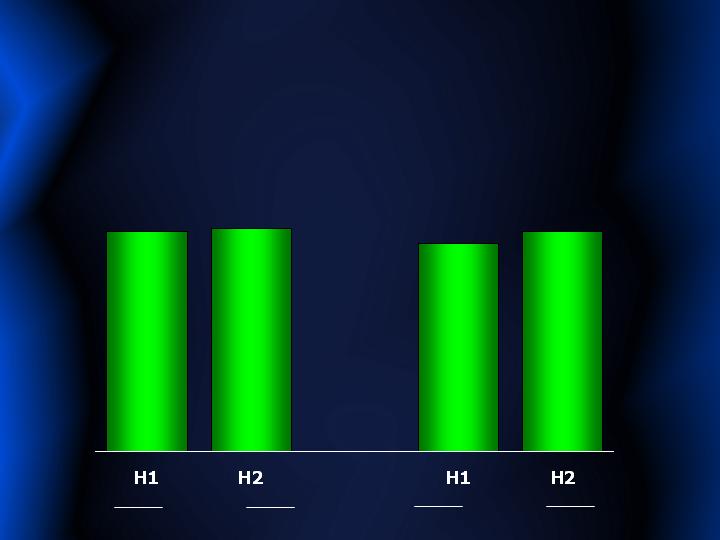

EBITDA Beginning To Stabilize

2003

2004

76

77

72

76

$ Millions

Excluding business development and restructuring charges

9

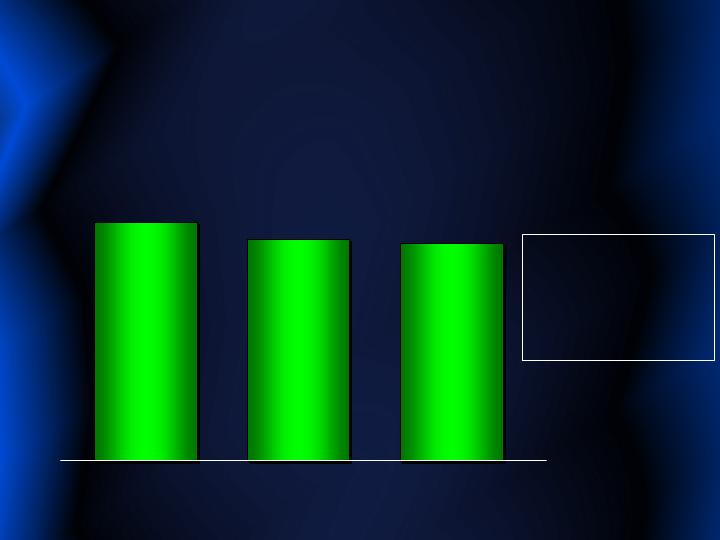

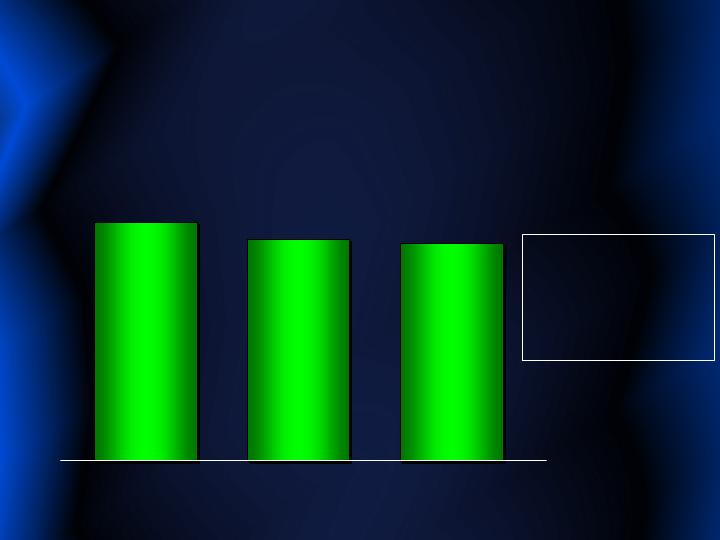

Carbonless Paper Shipments

2004 Full Year

Decline Rate: -2%

2005 YTD April

Decline Rate: -7%

2004

2003

(000 tons)

355

348

382

2002

10

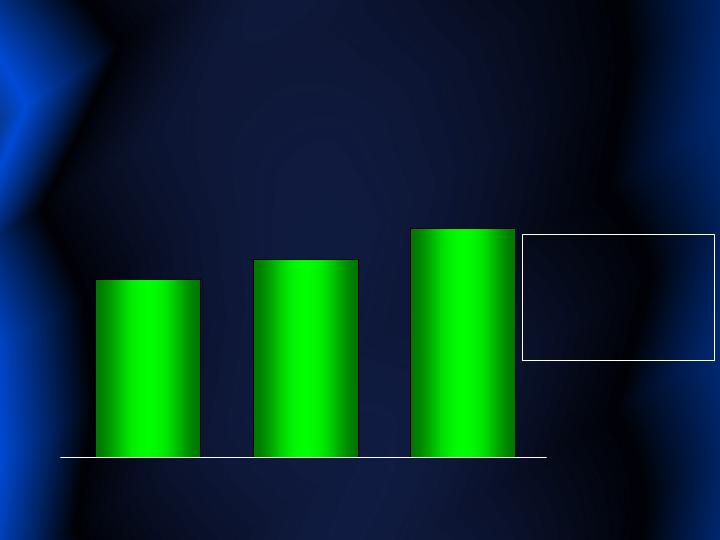

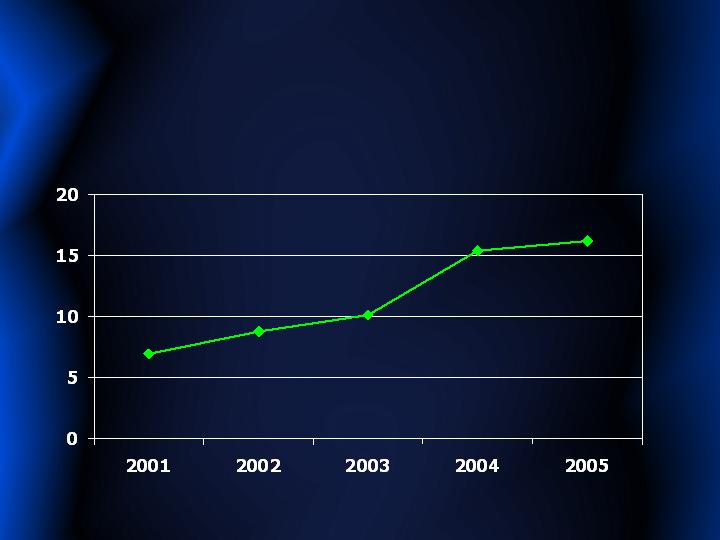

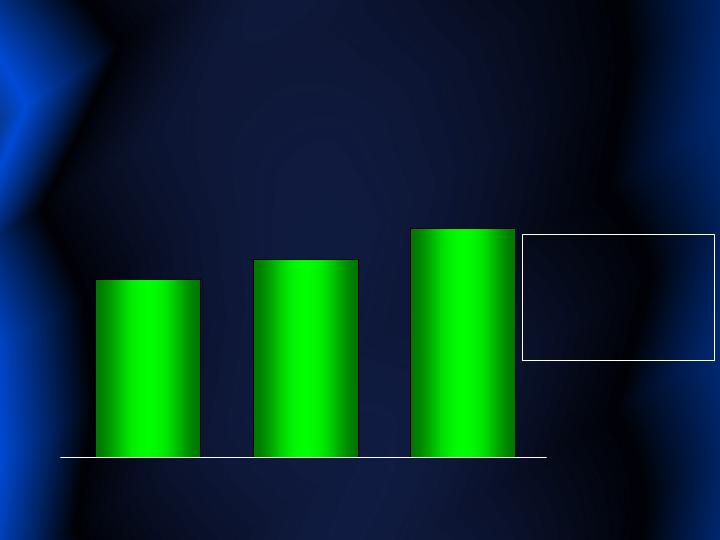

Thermal Paper Shipments

2004 Full Year

Growth Rate: +16%

2005 YTD April 0%

2004

2003

(000 tons)

82

95

2002

74

11

Security Paper Shipments

(000 tons)

+26%

+16%

+52%

LTM 4/3/05

+39%

12

BemroseBooth

High value added security printer

Over $100 million revenue

850 employees

Manufacturing in England

Derby

Hull

Thornaby

13

BemroseBooth Revenue

11

110

$ Millions

108

2003

2004

LTM 4/3/05

Acquired December 2003

14

Performance Packaging – Film

American Plastics - Rhinelander, WI

Produces high barrier, multilayered films and

commercial packaging

C&H Packaging - Merrill, WI

Prints and laminates films for flexible packaging

materials

NEX – Turners Falls, MA

Produces single and multilayer polyethylene films

15

Building A Film Business Revenue

($ Millions) LTM

2003 2004 4/3/05

American Plastics/ $30 $47 $47

C&H Packaging

(Acquired 4/03)

New England Extrusion -- -- $12

(Acquired 1/05)

$30 $47 $59

16

Dale Parker

Chief Financial Officer

17

Income Statement

($ Millions) Q1 Q2 Q3 Q4 Q1

Net Sales $251 $234 $244 $261 $253

Gross Profit $68 $57 $66 $63 $61

% Margin 27% 25% 27% 24% 24%

SG&A/Other $50 $50 $48 $52 $54

Operating Income $18 $ 7 $18 $11 $ 7

Depreciation & Amortization 20 20 19 18 20

EBITDA $38 $27 $37 $29 $27

% Margin 15% 12% 15% 11% 11%

2004

2005

18

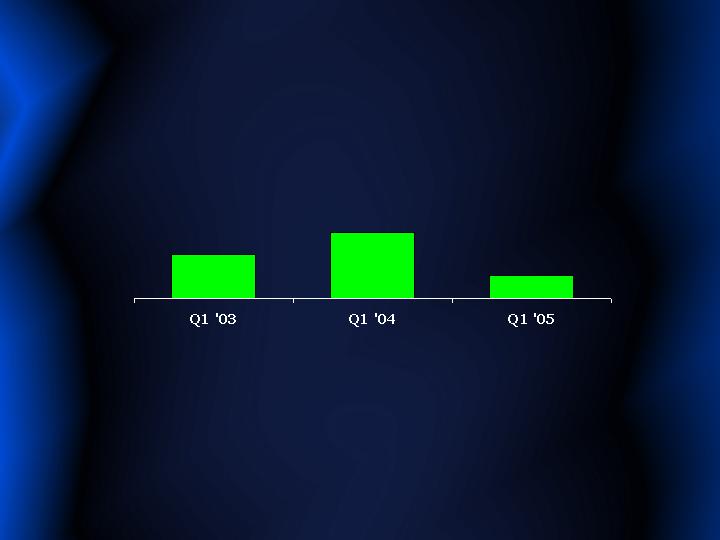

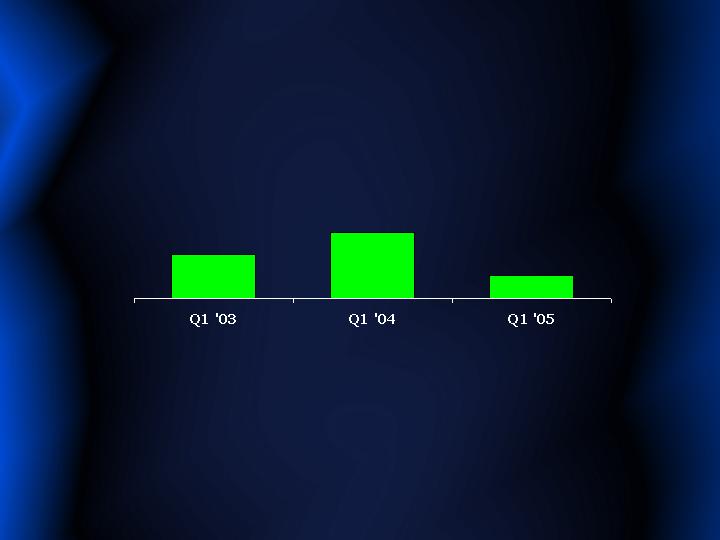

Carbonless Shipments

000’s

tons

89

93

85

19

($ millions)

Adjustment for abnormally high Q1 2004 carbonless shipments $2

Net carbonless movements (improved pricing less manufacturing operations,

raw material and utility increases) 5

Business development investments 1

Restructuring charges 3

Q1 2005 vs Q1 2004 EBITDA deviation $11

Reconciliation of change in EBITDA

for Q1 2005 vs Q1 2004

20

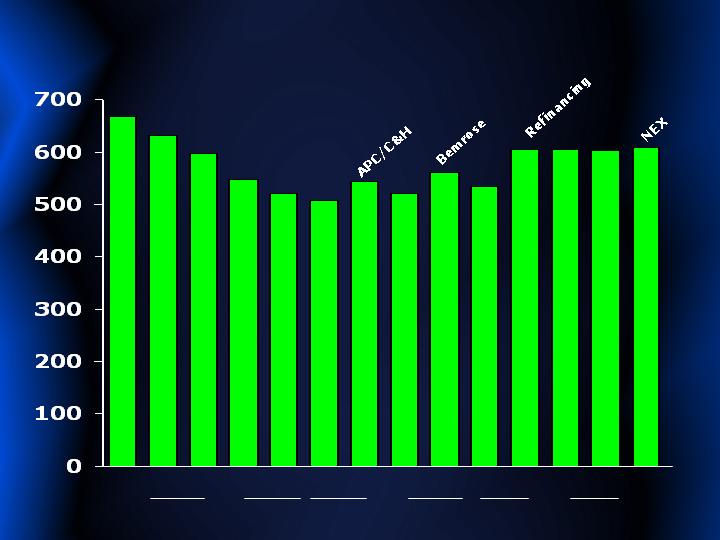

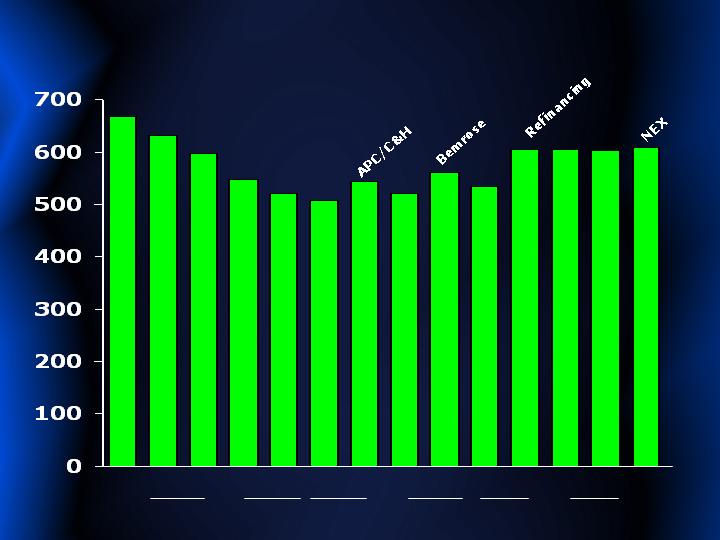

Total Company Debt

($ millions)

Appleton refinanced debt structure in June 2004 and retired deferred payment obligation.

11/09

3/31

6/30

9/29

12/28

2002

3/30

6/29

9/28

2003

1/03

4/04

7/04

10/03

2004

1/01

4/03

2005

2001

21

Investment in Appleton Since 11/01

Debt Reduction &nbs p; $ 60

Acquisitions 182

Capital Expenditures 114

Organic Growth &nbs p; 37

Total & nbsp; $393

22

Liquidity as of 4/03/05

($-millions)

Cash &n bsp; $ 14

Revolver Availability &nb sp; $100

Total Liquidity &nb sp; $114

23