Exhibit 99.2

CONSENT SOLICITATION STATEMENT

May 26, 2006

APPLETON PAPERS INC.

Solicitation of Consents to Amendments of

Certain Provisions of the Indentures Governing its

8 1/8% Senior Notes due 2011 (CUSIP No. 038101AE1)

9 3/4% Senior Subordinated Notes due 2014 (CUSIP No. 038101AH4)

THE CONSENT SOLICITATION WILL EXPIRE AT 11:59 P.M., NEW YORK CITY TIME, ON JUNE 9, 2006, UNLESS OTHERWISE EXTENDED (SUCH DATE AND TIME, AS IT MAY BE EXTENDED FROM TIME TO TIME, THE “EXPIRATION DATE”). CONSENTS DELIVERED MAY BE REVOKED BY HOLDERS ON TERMS AND CONDITIONS SET FORTH HEREIN. SEE “THE CONSENT SOLICITATION— REVOCATION OF CONSENTS.”

Subject to the terms and conditions set forth in this Consent Solicitation Statement (the “Consent Solicitation Statement”), Appleton Papers Inc., a Delaware corporation (“we,” “us,” “Appleton” or the “Company”), is soliciting consents of Holders (as hereinafter defined) on the Record Date (as hereinafter defined) of its 8 1/8% Senior Notes due 2011 (the “Senior Notes”) and its 9 3/4% Senior Subordinated Notes due 2014 (the “Senior Subordinated Notes” and together with the Senior Notes, collectively, the “Notes”) of Appleton, to amendments (the “Proposed Amendments”) of certain provisions of the indenture (in effect on the date hereof) governing the Senior Notes (the “Senior Note Indenture”) and certain provisions of the indenture (in effect on the date hereof) governing the Senior Subordinated Notes (the “Senior Subordinated Note Indenture” and together with the Senior Note Indenture, collectively, the “Indentures”). The purposes of this solicitation (the “Consent Solicitation”) are to permit us to make (i) distributions to Paperweight Development Corp. (“Paperweight”) to enable Paperweight to make certain payments in respect of our employee stock ownership plan (“ESOP” or the “Company Stock Fund”) to comply with our obligations thereunder and with applicable law, (ii) other related changes to the restricted payments covenant of each of the Indentures to reflect obligations that were not reflected in the Indentures as originally drafted and (iii) other amendments to the documentation of our ESOP that are not reasonably likely to result in a material adverse change to the Company. See “Summary—Purposes and Background of the Consent Solicitation” and “Description of the Proposed Amendments,” for further description of the Proposed Amendments.

Holders are requested to read and carefully consider the information contained in this Consent Solicitation Statement and to give their consent to the Proposed Amendments by properly completing and executing the accompanying consent form and delivering the executed forms (the “Consent Forms”) to Global Bondholder Services Corporation, as tabulation agent (the “Tabulation Agent”), prior to the Expiration Date, at its address listed in the Consent Form, by mail, first-class postage prepaid, overnight courier, hand delivery, or facsimile. Appleton’s obligation to accept the consents and pay the Consent Payment (as hereinafter defined) shall be conditioned upon (i) receipt by the Tabulation Agent of properly executed and completed (and not revoked) Consent Forms in respect of at least a majority in aggregate principal amount of each of the Senior Notes and Senior Subordinated Notes that are outstanding (determined in accordance with the respective Indenture) (such number of consents hereinafter referred to as the “Requisite Consents”) on or prior to the Expiration Date, (ii) execution and delivery of the supplemental indenture to the Senior Note Indenture and the supplemental indenture to the Senior Subordinated Note Indenture giving effect to the Proposed Amendments (respectively, the “Senior Supplemental Indenture” and the “Senior Subordinated Supplemental Indenture,” collectively, the “Supplemental Indentures”) by Appleton, U.S. Bank National Association, as trustee (the “Trustee”) under each of the Indentures and Paperweight and the guarantors named therein (the “Guarantors”) (the forms of which are attached hereto asExhibit A andExhibit B, respectively) and (iii) execution and delivery by the requisite parties of a consent to the Credit Agreement (the “Credit Agreement”), by and among Appleton, Paperweight, Rose Holdings Limited, Bear Stearns Corporate Lending Inc., as administrative agent, and the other financial institutions party thereto (the “Lenders”), with respect to the Proposed Amendments to the Indentures and payment of fees (and payment of related fees and expenses) in connection with this Consent Solicitation (the “Bank Consent”). The foregoing are collectively referred to in this Consent Solicitation Statement as the “Conditions”. Promptly after all the Conditions are satisfied, Appleton will pay all registered holders of Notes as of the close of business on the Record Date $10 in cash (the “Consent Payment”) for each $1,000 principal amount of Notes for which consents have been received and accepted prior to the Expiration Date and not validly revoked. Appleton is seeking consents to all the Proposed Amendments as a single proposal. Accordingly, a Consent Form purporting to consent to only some of the Proposed Amendments will not be valid.If the Proposed Amendments become effective, they will be binding upon all Holders, whether or not such Holders have delivered their Consent Form.

The Solicitation Agent for the Consent Solicitation is:

UBS Investment Bank

The Expiration Date may be extended (including on a daily basis) at any time in the sole discretion of Appleton, and the Consent Solicitation may be terminated at any time in the sole discretion of Appleton.

Only Holders will be eligible to consent to the Proposed Amendments. The term “Holder” as used herein means (i) those persons in whose name Notes were registered (“Registered Holders”) as of the close of business on May 25, 2006 (the “Record Date”) or (ii) any other person who has been authorized by proxy or in any other manner acceptable to Appleton (or any other person possessing title by or through such person) to vote the applicable Notes on behalf of such Registered Holder. Appleton reserves the right to establish from time to time any new date as the Record Date and, thereupon, that new date will be deemed to be the “Record Date” for purposes of the Consent Solicitation.

Appleton will not be deemed to have accepted any Consent Form until all of the Conditions are satisfied or waived by Appleton in its sole discretion. If the Proposed Amendments become effective, they will be binding upon all Holders, whether or not such Holders have delivered their Consent Form.

The transfer of Notes after the Record Date will not have the effect of revoking any consent theretofore validly given by a Holder, and each properly completed and executed Consent Form will be counted notwithstanding any transfer of the Notes to which such Consent Form relates, unless the procedure for revoking consents described herein has been complied with.

Terms used in this document that are not otherwise defined will have the meanings set forth in the Indentures.

Appleton has not authorized any person to give any information or make any representation in connection with the solicitation of consents other than those contained herein and, if given or made, such information or representations must not be relied upon as having been authorized. The delivery of this Consent Solicitation Statement shall not, under any circumstances, create any implication that the information contained herein is correct after the date hereof.

Consents may be revoked in accordance with the procedure set forth herein. Consents in respect of both the Senior Notes and the Senior Subordinated Notes will become irrevocable upon receipt by the Tabulation Agent of properly executed and completed (and not revoked) Consent Forms in respect of the Proposed Amendments representing at least a majority in aggregate principal amount ofeither the Senior Notes or the Senior Subordinated Notes that are outstanding (the “Withdrawal Threshold”). See “The Consent Solicitation—Revocation of Consents.” Once the Withdrawal Threshold has been reached for either series of Notes, Holders may not withdraw their previously delivered consents to the Proposed Amendments.

This Consent Solicitation Statement does not constitute a solicitation of a consent in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such a solicitation.

Under no circumstances should any Holder tender or deliver Notes.

Appleton anticipates that the Depository Trust Company (“DTC”), as nominee holder of Notes, will execute an omnibus proxy that will authorize its participants (the “DTC Participants”) to consent with respect to the Notes owned by such DTC Participants and held in the name of Cede & Co. as specified on the DTC position listing as of the Record Date. In each such case, all references to Holders shall, unless otherwise specified, include DTC Participants.

Recipients of this Consent Solicitation Statement are not to construe the contents of the Consent Solicitation Statement as legal, business or tax advice. Each recipient should consult its own attorney, business advisor and tax advisor as to legal, business, tax and related matters concerning this solicitation.

ii

IN NO EVENT SHALL THIS CONSENT SOLICITATION STATEMENT OR THE CONSENT FORM BE CONSTRUED AS A STATEMENT OR RECOMMENDATION BY THE TABULATION AGENT (AS DEFINED HEREIN) OR THE SOLICITATION AGENT OR THEIR RESPECTIVE OFFICERS, DIRECTORS, AGENTS, EMPLOYEES, AFFILIATES OR COUNSEL, AS TO THE TRANSACTIONS DESCRIBED HEREIN.

Each Holder is requested to read and carefully consider the information contained herein and to give its consent to the Proposed Amendments by properly completing and executing the accompanying Consent Form in accordance with the instructions set forth herein and therein.

Questions and requests for assistance may be directed to either the Solicitation Agent or the Information Agent (as defined herein) at its respective address and telephone number set forth on the back cover of this Consent Solicitation Statement. Holders may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Consent Solicitation. Requests for additional copies of this Consent Solicitation Statement, the accompanying Consent Form and other related documents should also be directed to the Information Agent. All executed Consent Forms and any other documents required by the Consent Forms should be directed to the Tabulation Agent at the address set forth in the Consent Form.

AVAILABLE INFORMATION

Appleton currently files and furnishes periodic reports and other information with the U.S. Securities and Exchange Commission (the “Commission”) pursuant to the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Such reports and other information filed and furnished by Appleton with the Commission may be inspected and copied at the public reference room maintained by the Commission at 100 F Street, N.W., Washington, D.C. 20549. Copies of such material can also be obtained upon written request addressed to the public reference room of the Commission at 100 F Street, N.W., Washington, D.C. 20549, at prescribed rates, or from the Commission’s website at http://www.sec.gov.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The following documents filed by Appleton with the Commission are hereby incorporated by reference:

| | • | | Annual Report on Form 10-K for the fiscal year ended December 31, 2005; |

| | • | | Quarterly Report on Form 10-Q for the quarter ended April 2, 2006; and |

| | • | | Current Reports on Form 8-K filed on May 4, 2006. |

All documents which Appleton files pursuant to Sections 13, 14, or 15(d) of the Exchange Act after the date of this Consent Solicitation Statement and prior to the termination of the Consent Solicitation shall be deemed to be incorporated by reference in this Consent Solicitation Statement and to be a part of this Consent Solicitation Statement from the date of filing of such documents. Any statement contained in a document incorporated by reference in this Consent Solicitation Statement shall be deemed to be modified or superseded for purposes of this Consent Solicitation Statement to the extent that a statement in this Consent Solicitation Statement or in any subsequently filed document that also is or is deemed to be incorporated by reference modifies or replaces such statement.

Appleton will provide without charge to each person to whom a copy of this Consent Solicitation Statement has been delivered, upon the written or oral request of any such person, a copy of any or all of the documents incorporated by reference herein, other than exhibits to such documents, unless such exhibits are specifically incorporated by reference into the information that this Consent Solicitation Statement incorporates. You should direct written or oral requests for such copies to: Appleton Papers Inc., 825 East Wisconsin Avenue, P.O. Box 359, Appleton, Wisconsin 54912-0359, Attention: Corporate Secretary, telephone (920) 734-9841.

iii

FORWARD-LOOKING STATEMENTS

This Consent Solicitation Statement contains and incorporates by reference forward-looking statements. The words “will,” “may,” “should,” “believes,” “anticipates,” “intends,” “estimates,” “expects,” “projects,” “plans,” “seek” or similar expressions are intended to identify forward-looking statements. All statements other than statements of historical fact, including statements which address our strategy, future operations, future financial position, estimated revenues, projected costs, prospects, plans and objectives of management and events or developments that we expect or anticipate will occur, are forward-looking statements. All forward-looking statements speak only as of the date on which they are made. They rely on a number of assumptions concerning future events and are subject to a number of risks and uncertainties, many of which are outside our control that could cause actual results to differ materially from such statements. These risks and uncertainties include, but are not limited to, the factors that are discussed in Appleton’s public filings and submissions with the Commission. Many of these factors are beyond our ability to control or predict. Given these uncertainties, you should not place undue reliance on the forward-looking statements. We disclaim any obligation to update or revise publicly any forwardlooking statements, whether as a result of new information, future events or otherwise.

iv

TABLE OF CONTENTS

| | |

AVAILABLE INFORMATION | | iii |

| |

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE | | iii |

| |

FORWARD-LOOKING STATEMENTS | | iv |

| |

SUMMARY | | 1 |

Purposes and Background of the Consent Solicitation | | 1 |

Summary of the Consent Solicitation | | 8 |

| |

DESCRIPTION OF THE PROPOSED AMENDMENTS | | 10 |

| |

THE CONSENT SOLICITATION | | 14 |

General | | 14 |

Record Date | | 14 |

Effectiveness | | 14 |

Expiration Date; Extensions; Amendment | | 15 |

How to Consent | | 15 |

Revocation of Consents | | 16 |

Solicitation Agent, Information Agent and the Tabulation Agent | | 16 |

Assistance/Additional Materials | | 17 |

Fees and Expenses | | 17 |

| |

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES | | 17 |

Effect of Proposed Amendments | | 17 |

Backup Withholding | | 18 |

Non-U.S. Holders | | 18 |

Internal Revenue Service Circular 230 Disclosure | | 18 |

| |

MISCELLANEOUS | | 19 |

| |

EXHIBIT A: Form of Senior Supplemental Indenture | | A-1 |

| |

EXHIBIT B: Form of Senior Subordinated Supplemental Indenture | | B-1 |

| |

EXHIBIT C: Text of Indentures and Proposed Amendments | | C-1 |

v

SUMMARY

The following is a summary of certain information contained elsewhere in this Consent Solicitation Statement and is qualified in its entirety by the more detailed information contained elsewhere in this Consent Solicitation Statement or incorporated herein by reference. Descriptions in this Consent Solicitation Statement of the provisions of the Indentures are summaries of the respective provisions and such provisions are incorporated herein by reference as part of such summaries, which are qualified in their entirety by such reference. Copies of the Indentures will be provided upon request made to the Information Agent.

Purposes and Background of the Consent Solicitation

Purposes of the Consent Solicitation

The purposes of the Proposed Amendments are to permit us to make (i) distributions to Paperweight to enable Paperweight to make certain payments in respect of the ESOP to comply with our obligations thereunder and with applicable law, (ii) other related changes to the restricted payments covenant of each of the Indentures to reflect obligations that were not reflected in the Indentures as originally drafted and (iii) other amendments to the documentation of the ESOP that are not reasonably likely to result in a material adverse change to the Company.

Appleton is required to make significant distributions to enable Paperweight to satisfy its share repurchase obligations under the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), the Internal Revenue Code of 1986, as amended (the “Code”), and the terms of the Appleton Papers Retirement Savings and Employee Stock Ownership Plan (the “KSOP”) to current and former employees who are participants in the ESOP component of the KSOP. Even though Appleton expects that the ESOP will convert all eligible repurchase obligations to an installment basis, it appears that the covenants in the Indentures may be read to provide that the total projected payments to satisfy repurchase obligations will exceed the restricted payments covenant limitations established by the Indentures.

The Proposed Amendments would:

| | • | | modify the restricted payments covenants of the Indentures; |

| | • | | allow changes to the documentation for our ESOP that are not reasonably likely to result in a material adverse change to the Company; |

| | • | | provide for additional interest on the Notes in certain circumstances pertaining to ESOP-related payments; and |

| | • | | modify the definitions of Code, Consolidated Cash Flow, Consolidated Net Income and Fixed Charges and create new definitions of Adjusted Fixed Charge Coverage Ratio and Credit Agreement Reference Amount under the Indentures. |

For more information on the Proposed Amendments, see “Description of the Proposed Amendments” below.

Background of the Consent Solicitation

Our company is owned by its employees through the ESOP component of the KSOP. The KSOP is a tax-qualified retirement plan that is available to our U.S. employees. The ESOP component of the KSOP is a tax-qualified employee stock ownership plan that has invested and will continue to invest in Paperweight common stock.

1

Appleton is a wholly-owned subsidiary of Paperweight. The ESOP owns 100% of the shares of common stock of Paperweight. On November 9, 2001, Paperweight and a wholly-owned subsidiary acquired Appleton from Arjo Wiggins Appleton p.l.c., which is now known as Arjo Wiggins Appleton Limited (“Arjowiggins”), a European manufacturer of paper products, and two of its subsidiary holding companies, which we sometimes refer to as the sellers or as affiliates of Arjowiggins. In connection with the acquisition, approximately 90% of our employees invested approximately $107 million in the Company Stock Fund. State Street Global Advisers, acting as the ESOP trustee, purchased 100% of the common stock of Paperweight. Paperweight simultaneously used all the proceeds from the sale of those shares of common stock to finance a portion of the purchase price of the acquisition.

Paperweight has elected to be treated as a subchapter S corporation for federal and, where recognized, state and local income tax purposes and has elected that its eligible subsidiaries be treated as qualified subchapter S subsidiaries for federal and, where recognized, state and local income tax purposes. This tax treatment, together with 100% ownership of Paperweight’s common stock by the tax-exempt ESOP, has resulted in substantial corporate tax savings and enhanced cash flow. Paperweight does not conduct any business apart from undertaking matters incidental to its ownership of the stock of its subsidiaries and matters relating to the ESOP and taking actions required to be taken under ancillary acquisition agreements. Paperweight relies upon Appleton for cash flows to support its ESOP share repurchases obligations (as described below).

It may be necessary for Appleton to make significant distributions to enable Paperweight (1) to repurchase shares from the ESOP upon a participant’s retirement, death, disability, resignation, dismissal or permanent layoff and (2) to repurchase shares from the ESOP upon a participant’s election to diversify a portion of the common stock held in the participant’s account, as required by ERISA, the Code and the terms of the KSOP.

Legally Required Distributions

Upon a participant’s retirement, death, disability, resignation, dismissal or permanent layoff, the value of such participant’s account balance will be paid to that participant, or that participant’s beneficiary, in the case of the participant’s death. Requests for lump sum distributions from the Company Stock Fund will be granted in accordance with a uniform, nondiscriminatory policy established by the ESOP committee. For repurchases in 2003 and 2004, Paperweight completed share repurchases to former employees by single lump sum distributions. Pursuant to a uniform, nondiscriminatory policy, during 2005, the ESOP committee exercised its right to satisfy requests for distributions to former participants by making five annual installments. Appleton currently expects that some of Paperweight’s share repurchase obligations to former participants required by the ESOP throughout the remainder of fiscal 2006 will be made on an installment basis, as permitted under the terms of the ESOP.

Legally Required Diversification

In addition, per the Code and the terms of the KSOP, participants who reach the age of 55 with at least 10 years of service have certain rights to diversify the investments in their ESOP accounts, which otherwise would be invested in shares of Paperweight. If a participant elects to exercise such diversification rights, Paperweight is legally obligated to repurchase its common stock from the ESOP. In addition, the ESOP committee may, under the ESOP Documentation, allow additional diversification rights. Appleton has determined that the approximately $16 million of the semi-annual payments for share repurchases in the second quarter of 2006 will consist of approximately $5.95 million of distributions made in installment payments and $10.05 million of mandatory diversification payments made in single lump sum distributions.

As discussed above, Paperweight is required to make distributions to former participants or participants who are entitled to diversification rights in the ESOP under the terms of the KSOP, ERISA and the Code. Satisfaction of the obligations to make distributions to such former or current participants is necessary in order to maintain the ESOP’s status as a tax qualified retirement plan. If the ESOP loses its status as a tax qualified retirement plan: (a) participants would be required to take into income vested contributions made by Appleton in the year the ESOP is disqualified; (b) the ESOP would lose its tax-exempt

2

status (which allows trust income to accumulate tax-free); and (c) Appleton would lose its status as an electing S corporation and accordingly would be subject to corporate income tax. The amount of Paperweight’s repurchase obligations, however, may at any time exceed our payment limitations in the Indentures. Further, Paperweight, as a guarantor of our indebtedness, may also be limited to some extent from making payments to the ESOP or its beneficiaries by the terms of Paperweight’s and our indebtedness. As a result of Paperweight’s legally and contractually imposed repurchase obligations, we and/or Paperweight may be forced to violate the distribution and/or payment limitations contained in the Indentures, which may ultimately result in a default under the Notes. Defaults on either of the Notes could result in an acceleration of all of our then outstanding indebtedness and cause us to dispose of our assets or declare bankruptcy, and as a result we may not have sufficient funds to satisfy our obligations under the Senior Notes and Senior Subordinated Notes.

Event of Chapter 11

Under a Chapter 11 scenario, a creditor with an allowed secured claim normally has priority (with respect to assets that secure its position) over prepetition creditors. To the extent that the secured creditors’ collateral is inadequate to cover its claim, the remaining stub claim is usually treated as a general unsecured claim entitled to pro rata treatment with other general unsecured claims. Under the Bankruptcy Code, certain employee claims, such as any mandatory distributions under the ESOP or installment payments due under the ESOP, may be treated as general unsecured claims ranking pari-passu with other unsecured claims. These priority rules are based on the U.S. Bankruptcy Code. Further, if the Company files for Chapter 11, payment of general unsecured claims, including those under creditor agreements, are normally suspended during the bankruptcy case.

Limitations on Restricted Payments

The covenants in both the Credit Agreement and the Indentures restrict Appleton’s ability to pay dividends to Paperweight, which could limit Paperweight’s ability to repurchase shares distributed to ESOP participants who have terminated employment or who are entitled to diversification rights. While the Company believes that the Credit Agreement currently provides sufficient flexibility to satisfy anticipated share repurchases pursuant to the ESOP Documentation, the restricted payments covenants under the Indentures do not.

Under the Credit Agreement, Appleton may make restricted payments to Paperweight to: (1) satisfy Paperweight’s obligations to repurchase its common stock pursuant to the ESOP Documentation from accounts allocated to participants in the ESOP upon the death, disability or termination of employment of such participants or upon a participant’s election to exercise his or her legal right to diversify a portion of the common stock held in the account; (2) to make loans to the ESOP to permit the ESOP to make loans to participants in the ESOP in accordance with the ESOP Documentation; and (3) to provide funds to the ESOP to permit the ESOP to fund hardship distributions to participants in the ESOP in accordance with the ESOP Documentation; so long as (x) the aggregate amount of such restricted payments to Paperweight in any fiscal year (when aggregated with certain loans and advances made for such purposes) does not exceed the sum of (A) available contributions under the ESOP for such fiscal year plus (B) $25 million in any fiscal year and (y) Paperweight and its subsidiaries are in pro forma compliance with the financial covenants contained in the Credit Agreement after giving effect thereto. Under the terms of the Credit Agreement, Paperweight had the capacity to repurchase its common stock in the amount of $34.1 million in 2004 and $34.5 million in 2005.

Under the Indentures, Appleton can make certain restricted payments and permitted investments, including, among other things, ESOP-related payments. Appleton’s ability to make such ESOP-related payments under the restricted payments covenants under the Indentures, however, is limited by a general restricted payment basket (under Section 4.07(a)) of the respective Indenture which, as provided in more detail therein, is comprised of (a) 50% of Consolidated Net Income, (b) 100% of net cash and non-cash proceeds received by Paperweight from issuances of common equity, and (c) certain returns from restricted investments previously made, upon redesignation of an unrestricted subsidiary as a restricted subsidiary and 50% of dividends received from unrestricted subsidiaries. There is also a $10 million restricted payment

3

basket pursuant to Section 4.07(b)(13) of the Senior Note Indenture and Section 4.07(b)(12) of the Senior Subordinated Note Indenture.

As of the date hereof, the Company estimates that its available cumulative restricted payment baskets as described in the immediately preceding paragraph equal approximately $10.5 million under each Indenture. If the Proposed Amendments are adopted, Paperweight will have greater flexibility to make restricted payments under Section 4.07(b) of the Indentures, but will agree to modifications of Section 4.07(a), which will provide that the general restricted payments baskets under Section 4.07(a) shall not be increased by cash proceeds received by Paperweight after January 1, 2006 from the ESOP to the extent the same constitute proceeds of employee deferrals which are invested by the ESOP in common equity of Paperweight.

The table below shows the calculation of our currently available restricted payments baskets under the Indentures, as currently in effect, as well as projected availability thereunder through June 30, 2006.

Restricted Payments

| | | | | | | | | | | | |

| | | As at | |

| ($’s in 000’s, unless otherwise specified) | | Dec 31,

2004 | | | Dec 31,

2005 | | | June 30,

2006 | |

Cumulative 50% of net income (100% of net losses) | | $ | 634 | | | | ($2,105 | ) | | $ | 1,400 | |

Cumulative deferrals | | | 4,667 | | | | 14,523 | | | | 18,607 | |

| | | | | | | | | | | | |

Cumulative net income and deferrals | | | 5,301 | | | | 12,418 | | | | 20,007 | |

Prior cumulative restricted payments made from net income and deferrals basket | | | — | | | | (5,301 | ) | | | (12,418 | ) |

| | | | | | | | | | | | |

Availability under cumulative net income and deferrals basket | | | 5,301 | | | | 7,117 | | | | 7,589 | |

Payment made (or projected) in period | | | (10,190 | ) | | | (9,336 | ) | | | (16,000 | ) |

| | | | | | | | | | | | |

Deficit funded (or projected) from §4.07(b) $10 million basket | | | (4,889 | ) | | | (2,219 | ) | | | (8,411 | ) |

| | | | | | | | | | | | |

Balance under (or projected under) baskets | | | 5,111 | | | | 2,892 | | | | (5,519 | ) |

| | | | | | | | | | | | |

Summary of Payments | | | | | | | | | | | | |

Total Available to Make Restricted Payments | | | | | | | | | | | | |

Cumulative net income and deferrals | | $ | 5,301 | | | $ | 12,418 | | | $ | 20,007 | |

Cumulative payment made | | | — | | | | (5,301 | ) | | | (12,418 | ) |

| | | | | | | | | | | | |

Availability under cumulative net income and deferrals basket | | | 5,301 | | | | 7,117 | | | | 7,589 | |

Balance under §4.07(b) $10 million basket (beginning of period) | | | 10,000 | | | | 5,111 | | | | 2,892 | |

| | | | | | | | | | | | |

Total available to make restricted payments | | | 15,301 | | | | 12,228 | | | | 10,481 | |

Payment made (or projected) in period | | | (10,190 | ) | | | (9,336 | ) | | | (16,000 | ) |

| | | | | | | | | | | | |

Surplus / (or projected deficit) | | $ | 5,111 | | | $ | 2,892 | | | | ($5,519 | ) |

| | | | | | | | | | | | |

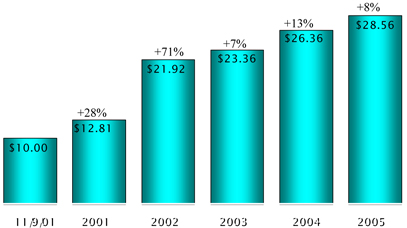

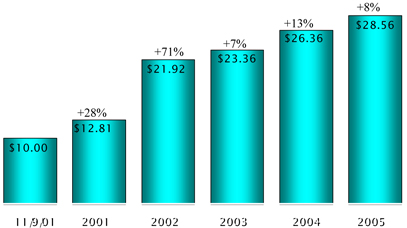

The Indentures, when originally drafted, failed to address the Company’s ESOP-related payment obligations in the time period 2006 – 2010. During these five years, we expect that an increasing number of employees belonging to the “baby-boomer” generation will be entitled to payouts as they reach an age at which distribution and diversification rights are triggered. The payout amounts in the future will be affected by the number of retiring or terminated employees and the age of employees, which affect diversification rights, and by the value of Paperweight common stock, which has increased significantly in the past four years (as outlined in the chart below).

4

Paperweight Year-End Share Appraisal

The following table shows the total amount of historical ESOP distributions from 2002 to 2005, as well as the expected ESOP distributions for the six month period ended 2006.

ESOP Distributions

| | | | | | | | | | | | | | | |

| | | Full Year | | Six Months |

| ($’s in 000’s, unless otherwise specified) | | 2002 | | 2003 | | 2004(1) | | 2005 | | 2006 |

Payment Made | | | | | | | | | | | | | | | |

Distribution from ESOP | | $ | 300 | | $ | 12,840 | | $ | 23,630 | | $ | 6,464 | | $ | 5,950 |

ESOP diversification | | | 160 | | | 1,550 | | | 3,760 | | | 2,872 | | | 10,050 |

| | | | | | | | | | | | | | | |

Total payments | | $ | 460 | | $ | 14,390 | | $ | 27,390 | | $ | 9,336 | | $ | 16,000 |

| | | | | | | | | | | | | | | |

Note: (1) $17.2 million of payments were made prior to issuance of current debt securities

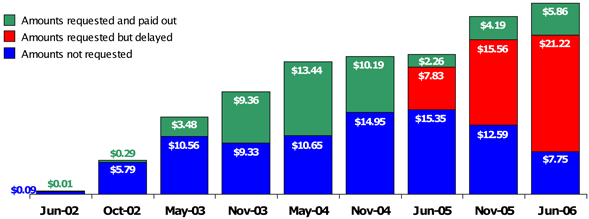

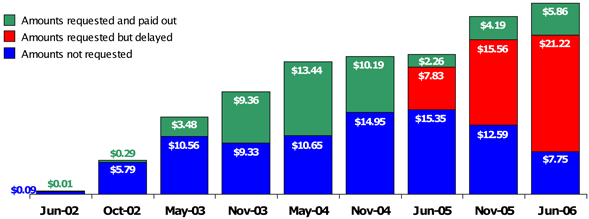

The chart below plots the total value of account balances held by former employees and the amounts Paperweight has paid upon requests for share repurchases due to its share repurchase obligations under ERISA and the Code. The columns for June 2005 and November 2005 show the effect of the ESOP committee exercising its right to satisfy such share repurchase requests to former employees by making five annual installment payments. The column for June 2006 shows the anticipated effect of the Company continuing to make payments in five annual installments.

5

Distributions from the ESOP (in millions)

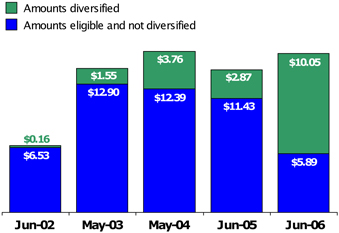

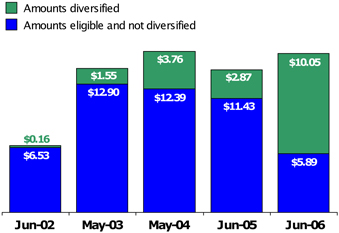

Eligible employees make diversification elections annually. The chart below shows the total dollars eligible for diversification and the amount participants elected to transfer out of the ESOP. The column below for June 2006 shows the expected amount of total dollars eligible for diversification and the expected amount participants will elect to transfer out of the ESOP.

ESOP Diversification (in millions)

Each period represented in the chart above shows the amounts diversified for each period by eligible plan participants. The balances do not accumulate from prior periods.

In the years 2001 to 2005, participants have diversified a total of $8.34 million from the ESOP, which is within our forecasted range. Appleton anticipates this diversification percentage will increase in 2006 because the stock price has grown and the work force is aging. No assurances can be given as to the amount of diversification requests that will be made in any period.

6

The table below shows the total number of shares of Paperweight common stock currently held by employees under the ESOP by age group as of December 31, 2005 and the amount of money Appleton would be required to pay upon request for share repurchases pursuant to the ESOP based upon the December 31, 2005 share price.

| | | | | | | | |

| | | At December 31, 2005 |

Age | | Number of shares of

Paperweight

Common Stock | | Cost Basis of

Shares of

Paperweight

Common Stock | | Value of Shares of

Paperweight

Common stock at

$28.56/share |

>70 | | 2,550.8161 | | $ | 25,078.59 | | $ | 72,851.31 |

66-70 | | 97,446.4660 | | | 1,059,887.47 | | | 2,783,071.07 |

61-65 | | 708,846.1782 | | | 8,217,595.50 | | | 20,244,646.85 |

56-60 | | 1,964,284.3117 | | | 23,464,675.28 | | | 56,099,959.94 |

51-55 | | 2,336,766.1293 | | | 29,677,396.32 | | | 66,738,040.65 |

46-50 | | 3,212,976.9119 | | | 39,872,735.66 | | | 91,762,620.60 |

41-45 | | 2,207,896.5073 | | | 28,705,829.17 | | | 63,057,524.25 |

36-40 | | 973,579.5667 | | | 13,649,081.11 | | | 27,805,432.42 |

31-35 | | 356,849.8804 | | | 5,705,362.61 | | | 10,191,632.58 |

26-30 | | 63,894.9965 | | | 1,252,508.95 | | | 1,824,841.10 |

21-25 | | 12,547.9863 | | | 298,172.32 | | | 358,370.49 |

<21 | | 419.0258 | | | 11,374.90 | | | 11,967.38 |

| | | | | | | | |

| | 11,938,058.7762 | | $ | 151,939,697.88 | | $ | 340,950,958.64 |

As a reference, 27% of shares of Paperweight common stock currently held by employees under the ESOP reside with employees who are 55 years of age or older and 75% of shares of Paperweight common stock held by employees under the ESOP reside with employees who are 45 years of age or older. In addition, Paperweight’s share price, as assessed by an independent, third-party appraiser selected by State Street Global Advisors, the ESOP trustee, has nearly tripled in the past four years. This increase translates into higher payment obligations when shares of Paperweight common stock are bought back. Additionally, there have been more “early” payouts resulting from early retirements and layoffs than anticipated when the Notes were issued. No assurances can be given as to how these trends will develop in future periods.

As noted above, Appleton currently expects that, in order to comply with the restricted payments covenants in the Indentures, some of Paperweight’s share repurchase obligations required by the ESOP throughout the remainder of fiscal 2006 will be satisfied on an installment basis, as permitted under the terms of the ESOP. Appleton estimates that in the second fiscal quarter of 2006, semi-annual payments for share repurchases will total approximately $16 million, approximately $5.95 million of which will be in installment payments. Even though Appleton expects that the ESOP committee will convert all eligible redemption payments to an installment basis, it appears that the covenants in the Indentures may be read to provide that the total projected payments to satisfy share repurchase obligations will exceed the restricted payments covenant limitations established by the Indentures. Accordingly, Appleton, in consultation with financial and legal advisors, is considering various possible alternatives to ensure that the projected payments are in compliance with such covenants, including the Proposed Amendments.

7

Summary of the Consent Solicitation

| | |

| Vote Required | | The Tabulation Agent must receive the unrevoked Consent Forms representing a majority in aggregate principal amount of each of the outstanding Senior Notes and Senior Subordinated Notes (determined in accordance with the respective Indenture). |

| |

| Payment for Consents | | Promptly after the Proposed Amendments become effective, Appleton will pay all Holders of Notes as of the close of business on the Record Date $10 in cash for each $1,000 principal amount of Notes held on the Record Date for which consents have been received and accepted prior to the Expiration Date and not validly revoked. The Consent Payment will not be paid if any of the Conditions is not satisfied. |

| |

| Acceptance of Consents | | Appleton may accept all properly completed and executed Consent Forms received and not validly revoked on or before the Expiration Date. If the Requisite Consents are not received by this time, Appleton may extend the Consent Solicitation and the Tabulation Agent would continue to accept Consent Forms. Appleton may, however, elect, at any time, to terminate the Consent Solicitation. Appleton intends for the Supplemental Indentures giving effect to the Proposed Amendments to be executed as soon as the Requisite Consents for both Series of Notes are received. |

| |

| Procedure for Consents | | Consent Forms, to be effective, must be properly completed and executed in accordance with the instructions contained herein and in the accompanying Consent Form. Only Holders of record on the Record Date, or duly authorized agents of such Holders, are entitled to consent. |

| |

| Revocation of Consents | | Consents in respect of both the Senior Notes and the Senior Subordinated Notes may be revoked at any time prior to the date upon which the Withdrawal Threshold has been reached. Accordingly, once the Withdrawal Threshold has been reached in respect of one series of Notes, consents in respect of both series of Notes received and not validly revoked prior to, or received after, the date upon which the Withdrawal Threshold has been reached may not be revoked. The Company will make a public announcement promptly upon reaching the Withdrawal Threshold. Any Holder desiring to revoke a consent must timely file with the Tabulation Agent a written revocation of such consent. |

8

| | |

| Delivery of Consents | | Executed Consent Forms should be sent to the Tabulation Agent as follows: By hand delivery or overnight courier: Global Bondholder Services Corporation 65 Broadway – Suite 723 New York, New York 10006 By mail, first-class postage prepaid: Global Bondholder Services Corporation 65 Broadway – Suite 723 New York, New York 10006 By facsimile (eligible institutions only): (212) 430-3775/3779 Confirm by telephone: (212) 430-3774 Consent Forms should not be delivered directly to Appleton or the Solicitation Agent. In no event should a Holder tender or deliver its Notes. |

| |

| The Solicitation Agent | | UBS Securities LLC |

| |

| The Information Agent and Tabulation Agent | | Global Bondholder Services Corp. |

9

DESCRIPTION OF THE PROPOSED AMENDMENTS

Set forth below is a brief description of the Proposed Amendments to the Indentures for which consents are being sought pursuant to this Consent Solicitation. The descriptions set forth below are qualified by reference to the full provisions of the existing Indentures and the provisions of each proposed Supplemental Indenture. Please seeExhibit C for the full text of the provisions of the Senior Supplemental Indenture and the Senior Subordinated Supplemental Indenture to be added, deleted or modified. The form of the Senior Supplemental Indenture (which may be modified or supplemented prior to the execution thereof in a manner that would not require additional consents under the Senior Note Indenture) to implement the Proposed Amendments contemplated hereby is contained inExhibit A hereto. The form of the Senior Subordinated Supplemental Indenture (which may be modified or supplemented prior to the execution thereof in a manner that would not require additional consents under the Senior Subordinated Note Indenture) to implement the Proposed Amendments contemplated hereby is contained inExhibit B hereto.

| | A. | The Proposed Amendments would amend Section 1.01 of the Senior Note Indenture and the Senior Subordinated Note Indenture by adding the definition “Adjusted Fixed Charge Coverage Ratio” to mean for any period the Fixed Charge Coverage Ratio of Paperweight for such period (determined on a pro forma basis), adjusted so that Fixed Charges is increased by the amount of the ESOP Distribution (as defined below) then being paid by Paperweight, and by all other ESOP Distributions made during the same fiscal quarter and during any of the three preceding fiscal quarters (acknowledging that the period for which such ESOP Distributions are so included will differ from the period of determination for the other components of Fixed Charges for the respective period being tested). |

| | B. | The Proposed Amendments would amend Section 1.01 of the Senior Note Indenture and the Senior Subordinated Note Indenture by amending the definition of “Code” to include any successor of the Internal Revenue Code of 1986. |

| | C. | The Proposed Amendments would amend Section 1.01 of the Senior Note Indenture and the Senior Subordinated Note Indenture by amending the definition of “Consolidated Cash Flow” to (1) clarify that (a) amortization includes the amortization of deferred debt issuance or modification costs, (b) other non-cash charges from employee compensation expenses arising from deferrals would include cash paid to the ESOP trustee, to the extent such cash is used to purchase Paperweight’s common stock and is returned to Appleton and (c) any requirement under applicable law or the ESOP Documentation that Paperweight’s common stock be repurchased would not be construed to cause any “non-cash” charges from employee compensation expense to be treated as a “cash” expense; and (2) add back, for purposes of determining Consolidated Cash Flow for the respective period, severance charges, restructuring charges, and other similar charges to the extent such items were deducted in computing Consolidated Net Income. |

| | D. | The Proposed Amendments would amend the definition of “Consolidated Net Income” in Section 1.01 of the Senior Note Indenture and the Senior Subordinated Note Indenture to provide that to the extent that Consolidated Net Income for any period is reduced by fees, expenses, costs and/or charges incurred in connection with consents, amendments, modifications, waivers, repayments and/or refinancings of Appleton’s indebtedness, such amounts shall be added back for purposes of determining Consolidated Net Income for such period. |

| | E. | The Proposed Amendments would add a new definition “Credit Agreement Reference Amount” in Section 1.01 of the Senior Note Indenture and the Senior Subordinated Note Indenture to mean the sum of (x) $15 million and (y) the maximum amount permitted to be used (whether so used or not, and without deduction for other permitted uses of the same basket amount or for loans or other investments for similar purposes) for the fiscal quarter in which the respective ESOP Distribution is being made and for the three |

10

| | immediately preceding fiscal quarters pursuant to the terms of the Credit Agreement as then in effect for the making of the ESOP Distributions; provided that (i) the above determination shall be made without reference to whether any default or event of default then exists pursuant to the Credit Agreement or whether there is, or would be, pro forma compliance with any financial covenants, (ii) if the relevant period of measurement pursuant to the Credit Agreement as then in effect is a fiscal or calendar year, the same shall be construed as if the relevant period of measurement under the Credit Agreement was instead the relevant period of four fiscal quarters described in preceding clause (y) (i.e., taking the quarter in which the respective restricted payment is being made together with the preceding three fiscal quarters) and (iii) if (and for so long as) there is no Credit Agreement then in effect, the Credit Agreement Reference Amount shall be deemed to be $45 million. |

| | F. | The Proposed Amendments would amend Section 1.01 of the Senior Note Indenture and the Senior Subordinated Note Indenture by amending the definition of “Fixed Charges” to provide that to the extent Fixed Charges for any period would otherwise include any amortization of fees or expenses paid in connection with consents, modifications or waivers to Appleton’s outstanding indebtedness or the related documentation, then amortization of such amounts shall be deducted (and excluded) from Fixed Charges for such period. |

| | G. | The Proposed Amendments would amend Section 2.01(a) of the Senior Note Indenture and the Senior Subordinated Note Indenture, as well as the form of Senior Notes and Senior Subordinated Notes, to add a provision to the Notes providing that the Company will pay additional interest at the rates and for the periods provided in Section 2.13 (as described above). |

| | H. | The Proposed Amendments would add a new provision Section 2.13 of the Senior Note Indenture and the Senior Subordinated Note Indenture to provide that at the time of making any ESOP Distribution (as defined below), the Company shall (1) calculate the Adjusted Fixed Charge Coverage Ratio for Paperweight’s most recently ended four full fiscal quarter for which internal financial statements are available immediately preceding the date on which the respective restricted payment is made, and (2) deliver such calculation to the Trustee within a required time period. So long as no Default exists as a result of a violation of the Adjusted Fixed Charge Coverage Ratio Test (as defined below), from and after the date of the delivery of a Compliance Certificate (as defined below) until the date of the delivery of the next Compliance Certificate, if the Adjusted Fixed Charge Coverage Ratio was less than 1.5:1, the per annum interest rate otherwise applicable to the Notes shall be increased by 1% per annum in excess of the rate otherwise then in effect, to the extent lawful. The rate increases pursuant to this clause shall not be cumulative, and the maximum increase at any time pursuant to this cause shall be limited to 1% per annum. Once the Adjusted Fixed Charge Coverage Ratio is greater than or equal to 1.5:1 and the Company delivers the Compliance Certificate in the next or any subsequent period, however, this additional interest would no longer apply to the Notes. If the Company fails to deliver the Compliance Certificate within the time period required, then for the period from the date of required delivery of the Compliance Certificate until the respective Compliance Certificate is actually delivered, the Company shall be deemed to have delivered a Compliance Certificate showing an Adjusted Fixed Charge Coverage Ratio of less than 1.5:1. Notwithstanding anything to the contrary in this provision, during all periods when any Default exists as a result of a violation of the Adjusted Fixed Charge Coverage Ratio Test, no additional interest shall accrue on the Notes pursuant to Section 2.13 of the Senior Note Indenture and the Senior Subordinated Note Indenture. |

| | I. | The Proposed Amendments would amend Section 4.03(a) of the Senior Note Indenture and the Senior Subordinated Note Indenture to provide that the reports required to be |

11

| | furnished pursuant to the Indentures would be provided with respect to Paperweight, as opposed to Appleton. |

| | J. | The Proposed Amendments would amend the compliance certificate covenant of the Indentures to add Section 4.04(d) of the Senior Note Indenture and the Senior Subordinated Note Indenture to require, within 10 Business Days after the making of any ESOP Distribution, the Company to deliver to the Trustee an Officers’ Certificate showing the calculation of the Adjusted Fixed Charge Coverage Ratio of Paperweight after giving effect to the making of the respective restricted payments. |

| | K. | The Proposed Amendments would amend the restricted payments covenant of the Indentures under second clause (3) of Section 4.07(a) of the Senior Note Indenture and the Senior Subordinated Note Indenture to (1) exclude from the calculation of the general restricted payments basket under Section 4.07(a), Hardship Distributions (as defined below) that in the aggregate amount do not exceed $2 million in any fiscal year and ESOP Distributions that comply with the tests described in clause M below and (2) provide that, for purposes of calculating the general restricted payments basket under Section 4.07(a), the calculation of aggregate net cash and non-cash proceeds received by Paperweight excludes any proceeds received by Paperweight from the ESOP after January 1, 2006 to the extent they constitute proceeds of employee deferrals which are invested by the ESOP in Paperweight common stock. |

| | L. | The Proposed Amendments would amend the restricted payments covenant of the Indentures to add Section 4.07(b)(14) of the Senior Note Indenture and Section 4.07(b)(13) of the Senior Subordinated Note Indenture to provide that Paperweight may make restricted payments to satisfy its obligations to repurchase its common stock pursuant to the ESOP Documentation from accounts allocated to participants in the ESOP to the extent representing “hardship” (as determined in accordance with the Code and the ESOP Documentation) distributions to the participants in the ESOP in accordance with the Code and the ESOP Documentation (“Hardship Distributions”), so long as the aggregate amount of such restricted payments shall not exceed $2 million in any fiscal year. |

| | M. | The Proposed Amendments would amend the restricted payments covenant of the Indentures to add Section 4.07(b)(15) of the Senior Note Indenture and Section 4.07(b)(14) of the Senior Subordinated Note Indenture to provide that Paperweight may make restricted payments (the “ESOP Distributions”) to satisfy its obligations to repurchase its common stock pursuant to the ESOP Documentation from accounts allocated to participants in the ESOP upon (a) a participant’s election to exercise his or her legal right to diversify a portion of the common stock held in the account and/or (b) a participant’s death, disability, resignation, dismissal or permanent layoff; so long as either (x) the aggregate amount of ESOP Distributions then being made, when aggregated with all other such ESOP Distributions during the same fiscal quarter and during the three immediately preceding fiscal quarters would not exceed the Credit Agreement Reference Amount as then in effect or (y) immediately after giving effect to each such payment, the Adjusted Fixed Charge Ratio for Paperweight’s most recently ended four full fiscal quarters for which internal financial statements are available immediately preceding the date on which the respective restricted payment is made would have been at least 1.5 to 1 (“Adjusted Fixed Charge Ratio Test”). |

12

The payments to be made under Section 4.07(b)(15) of the Senior Note Indenture, and Section 4.07(b)(14) of the Senior Subordinated Note Indenture (each to be added as described in M above) can be summarized as follows:

Section 4.07(b)(15) (or (14), as the case may be) Payments

| | | | | | | | |

| | | If greater than: Credit Agreement Reference Amount AND | | If less than or equal to: Credit Agreement Reference Amount AND | | If less than or equal to: Credit Agreement Reference Amount AND | | If greater than: Credit Agreement Reference Amount AND |

Adjusted Fixed Charge Coverage Ratio | | If greater than or

equal to:

1.5:1 | | If greater than or

equal to:

1.5:1 | | If less than:

1.5:1 | | If less than:

1.5:1 |

| | | | |

Action | | Permitted Payment | | Permitted Payment | | Permitted Payment

with Additional

Interest | | Payment creates a

Default |

The Company estimates that the Credit Agreement Reference Amount at December 31, 2005 was approximately $34.5 million.

| | N. | The Proposed Amendments would amend the restricted payments covenant of the Indentures to add a new sentence to Section 4.07(b) of the Senior Note Indenture and the Senior Subordinated Note Indenture to provide that in the event that an item meets the criteria of more than one category of permitted restricted payments pursuant to Section 4.07(b) or may be made pursuant to Section 4.07(a) or as a Permitted Investment, the Company shall be permitted to classify such item on the date of the respective payment in any manner that complies with the restricted payment covenant for purposes of determining compliance with Section 4.07. |

| | O. | The Proposed Amendments would amend Section 4.09(a) of the Senior Note Indenture and the Senior Subordinated Note Indenture to provide that the Fixed Charge Coverage Ratio would be of Paperweight rather than Appleton. |

| | P. | The Proposed Amendments would amend Section 4.16(c) of the Senior Note Indenture and Section 4.17(c) of the Senior Subordinated Note Indenture to provide that, notwithstanding anything to the contrary contained therein, amendments, supplements or other modifications of the ESOP Documentation shall be permitted so long as the Board of Directors or an officer of Appleton determines in good faith on, or within 5 Business Days of, the date the respective amendment, supplement or modification becomes effective, that the respective such amendment, supplement or modification is not reasonably likely to result in a material adverse change in the business, financial condition or results of operations of Appleton and its Subsidiaries taken as whole. |

The execution and delivery of the Senior Supplemental Indenture will be subject to (i) execution and delivery of the Bank Consent, (ii) the receipt by the Trustee of evidence satisfactory to it of the Requisite Consents with respect to the Senior Notes, and (iii) the satisfaction of certain other closing conditions. The execution and delivery of the Senior Subordinated Supplemental Indenture will be subject to (i) execution and delivery of the Bank Consent, (ii) the receipt by the Trustee of evidence satisfactory to it of the Requisite Consents with respect to the Senior Subordinated Notes, and (iii) the satisfaction of certain other closing conditions.

Appleton is unable to predict the effect, if any, that the Proposed Amendments would have on the market price of the Notes.

13

THE CONSENT SOLICITATION

General

In order to adopt the Proposed Amendments, the Tabulation Agent must receive the Requisite Consents on or prior to the Expiration Date. As of the Record Date, $172 million in principal amount of the Senior Notes were issued and outstanding and $150 million in principal amount of the Senior Subordinated Notes were issued and outstanding.

The delivery of a Consent Form will not affect a Holder’s right to sell or transfer the Notes. Failure to deliver a Consent Form will have the same effect as if a Holder had voted “No” to the Proposed Amendments. No advance notice of receipt of the Requisite Consents will be provided.

If the Requisite Consents are received by the Tabulation Agent, and if Appleton, the Trustee and the Guarantors execute and deliver the Supplemental Indentures and the Conditions are satisfied, Appleton will pay to each Registered Holder of Notes as of the close of business on the Record Date a one-time cash payment of $10 per $1,000 principal amount of Notes held on such date for which a consent has been delivered prior to the Expiration Date and not validly revoked.

Record Date

This Consent Solicitation Statement and the accompanying Consent Form are being sent to Holders of record at the close of business on May 25, 2006, the Record Date for the determination of Holders entitled to give consents pursuant to the Consent Solicitation, and to certain persons known to Appleton to be beneficial owners of Notes on the Record Date. Appleton reserves the right to establish from time to time any new date as the Record Date and, thereupon, that new date will be deemed to be the “Record Date” for purposes of the Consent Solicitation.

If the Proposed Amendments become effective, they will be binding on all Holders and their transferees, whether or not such Holders have delivered their Consent Forms.

Effectiveness

If the Tabulation Agent receives the Requisite Consents in respect of both series of Notes, Appleton, the Trustee and the Guarantors may enter into the Supplemental Indentures at any time on or after the time such Consent Forms are received.

The Proposed Amendments to each Indenture shall become effective upon:

| | • | | execution and delivery of the Senior Subordinated Indenture and the Senior Subordinated Supplemental Indenture by the Company, the Trustee and the Guarantors; |

| | • | | execution and delivery of the Bank Consent, whereby the lenders consent to (a) the Proposed Amendments of the Indentures as set forth in this Consent Solicitation Statement and (b) the payment of fees (and the payment of related fees and expenses) in connection with such Proposed Amendments; |

| | • | | receipt by the Trustee of evidence satisfactory to it of the Requisite Consents; |

| | • | | delivery of certain other closing documents, including: |

| | • | | legal opinions as to the due authorization, execution and delivery of the Supplemental Indentures, and the legal, binding and enforceable effect of those agreements on the parties thereto; and |

| | • | | closing certificates; and |

14

| | • | | payment of the Consent Payment to Holders for which consents have been received prior to the Expiration Date and not validly revoked. |

Expiration Date; Extensions; Amendment

The term “Expiration Date” means 11:59 p.m., New York time, on June 9, 2006, unless Appleton, in its sole discretion, extends the period during which the Consent Solicitation is open, in which case the term “Expiration Date” means the latest date and time to which such Consent Solicitation is extended.

The Company will promptly announce an extension of the Expiration Date in a press release.

If the Consent Solicitation is amended in a manner determined by Appleton to be materially adverse to Holders, Appleton will promptly disclose such amendment in a written notice to the Holders, and Appleton will extend the Consent Solicitation for a period deemed by it to comply with applicable law.

Notwithstanding anything to the contrary set forth in this Consent Solicitation Statement, Appleton reserves the right, at any time prior to effectiveness of the Proposed Amendments, to extend, amend or terminate the Consent Solicitation subject to applicable law.

How to Consent

All Consent Forms that are properly executed and delivered to the Tabulation Agent prior to the Expiration Date and not validly revoked will be given effect in accordance with the specifications thereof.

Appleton intends for the Supplemental Indentures giving effect to the Proposed Amendments to be executed as soon as the Requisite Consents for both series of Notes are received.

Holders who desire to consent to the Proposed Amendments should so indicate by marking the appropriate boxes on, and signing and dating, the accompanying Consent Form included herewith and delivering it to the Tabulation Agent at the address set forth in the Consent Form, in accordance with the instructions contained therein. However, if none of the boxes on the Consent Form is checked, but the Consent Form is otherwise completed and signed, the Holder will be deemed to have consented to the Proposed Amendments.

Consent Forms by the Registered Holder(s) must be executed in exactly the same manner as the name(s) appear(s) on the Notes. If Notes to which a Consent Form relates are held of record by two or more joint Holders, all such Holders must sign the Consent Form. If a signature is by a trustee, executor, administrator, guardian, attorneyinfact, officer of a corporation or other Registered Holder acting in a fiduciary or representative capacity, such person should so indicate when signing and must submit proper evidence satisfactory to Appleton of such person’s authority to so act. If Notes are registered in different names, separate Consent Forms must be executed covering each form of registration. If a Consent Form is executed by a person other than the Registered Holder, then such person must have been authorized by proxy or in some other manner acceptable to Appleton to vote the applicable Notes on behalf of the Registered Holder.

Appleton anticipates that DTC, as nominee holder of Notes, will execute an omnibus proxy that will authorize DTC Participants to consent with respect to the Notes owned by such DTC Participants held in the name of Cede & Co. as specified on the DTC position listing as of the Record Date. In such case, all references to Holder shall, unless otherwise specified, include DTC Participants. Consents by DTC Participants whose Notes are registered in the name of Cede & Co. should be signed in the manner in which their names appear on the position listing of DTC with respect to the Notes.

A HOLDER WHO DESIRES TO CONSENT TO THE PROPOSED AMENDMENTS MUST COMPLETE, SIGN AND DATE THE CONSENT FORM (OR PHOTOCOPY THEREOF) FOR SUCH HOLDER’S NOTES AND DELIVER SUCH CONSENT FORM TO THE TABULATION AGENT. SUCH CONSENTS MAY BE DELIVERED TO THE TABULATION AGENT BY MAIL, FIRST CLASS POSTAGE PREPAID, OVERNIGHT COURIER, HAND DELIVERY OR FACSIMILE AT THE ADDRESS SET FORTH IN

15

THE CONSENT FORM. DELIVERY OF CONSENT FORMS SHOULD BE MADE SUFFICIENTLY IN ADVANCE OF THE EXPIRATION DATE TO ASSURE THAT APPLETON RECEIVES THE CONSENTS PRIOR TO THE EXPIRATION DATE. IN NO EVENT SHOULD A HOLDER TENDER OR DELIVER CERTIFICATES EVIDENCING SUCH HOLDER’S NOTES.

Appleton reserves the right to receive Consent Forms by any other reasonable means or in any form that reasonably evidences the giving of consent.

All questions as to the validity, form, eligibility (including time of receipt) and acceptance of the consents will be determined by Appleton in its sole discretion, which determination will be final and binding. Appleton reserves the right to reject any and all Consent Forms not validly given or any Consent Forms Appleton’s acceptance of which would, in the opinion of Appleton or its counsel be unlawful. Appleton also reserves the right to waive any defects or irregularities or conditions of the Consent Solicitation. The interpretation of the terms and conditions of the Consent Solicitation (including the form of consent and the instructions thereto) by Appleton shall be final and binding on all parties. Unless waived, any defects or irregularities in connection with deliveries of Consent Forms must be cured within such time as Appleton shall determine. None of Appleton, the Tabulation Agent, nor any other person shall be under any duty to give notification of defects or irregularities with respect to deliveries of Consent Forms, nor shall any of them incur any liability for failure to give such notification.

Revocation of Consents

All properly completed and executed Consent Forms received by the Tabulation Agent prior to the Expiration Date will be counted, notwithstanding any transfer of Notes to which such Consent Forms relate, unless, with respect to the Proposed Amendments, the Tabulation Agent receives from a Holder a properly completed and executed written notice of revocation or a changed Consent Form bearing a date later than the date of the prior Consent Form at any time prior to the time and date that such Holder’s revocation rights with respect to such Proposed Amendments expire. A consent to the Proposed Amendments by a Holder shall bind that Holder and every subsequent Holder of a Note or portion of a Note that evidences the same debt as the consenting Holder’s Note, even if notation of the consent is not made on any Note. However, any such Holder (or a subsequent Holder which has received a proxy) may revoke the consent to the Proposed Amendments if the Tabulation Agent receives properly executed and completed (and not revoked) Consent Forms in respect of the Proposed Amendments representing at least a majority in aggregate principal amount ofeither the Senior Notes or the Senior Subordinated Notes that are outstanding (determined in accordance with the respective Indenture), which we refer to as the “Withdrawal Threshold”. Accordingly, once the Withdrawal Threshold has been reached for one series of Notes, consents in respect of both series of Notes received and not validly revoked prior to, or received after, the date upon which such Withdrawal Threshold has been reached may not be revoked. The Company will make a public announcement promptly upon reaching the Withdrawal Threshold. Receipt of the Requisite Consents by the Tabulation Agent will not obligate Appleton to execute or deliver the Supplemental Indentures.

A transfer of Notes after the Record Date must be accompanied by a duly executed proxy if the subsequent transferee is to have revocation rights with respect to the relevant consent to the Proposed Amendments. To be effective, a notice of revocation must be in writing, must indicate the certificate number or numbers of the Note or Notes to which it relates and the aggregate principal amount represented by such Note or Notes and must be (a) signed in the same manner as the original Consent Form or (b) accompanied by a proxy or other authorization (in form satisfactory to Appleton). Revocation of consents must be sent to the Tabulation Agent at its address set forth in the Consent Form.

All questions as to the validity (including the time of receipt) of revocation of consents to the Proposed Amendments will be determined by Appleton, whose determination will be final and binding. None of Appleton, the Tabulation Agent or any other person will be under any duty to give notification of any defects or irregularities in any revocation, nor shall any of them incur any liability for failure to give any such notification.

Solicitation Agent, Information Agent and the Tabulation Agent

Appleton has retained UBS Securities LLC as solicitation agent (the “Solicitation Agent”) to advise and assist it in connection with the Consent Solicitation. The Solicitation Agent will be paid a fee if the Proposed

16

Amendments become effective and Appleton has agreed to reimburse the Solicitation Agent for certain of its reasonable out-of-pocket fees and expenses incurred in connection with its services as Solicitation Agent. Appleton has agreed to indemnify the Solicitation Agent against certain liabilities and expenses, including liabilities under securities laws, in connection with the Consent Solicitation.

Appleton has retained Global Bondholders Securities Corporation as information agent (the “Information Agent”) to assist in responding to questions or requests for assistance in filling out and delivering the Consent Form or for additional copies of this Consent Solicitation Statement, Consent Form and other related documents. In addition, Appleton has retained Global Bondholders Securities Corporation as tabulation agent (the “Tabulation Agent”) to receive and examine Consent Forms and tabulate the consents granted thereby. Appleton will pay the Information Agent and Tabulation Agent customary fees, reimburse it for certain expenses and indemnify it against certain liabilities.

Assistance/Additional Materials

Questions and requests for assistance may be directed to either the Solicitation Agent or the Information Agent at its respective address and telephone number set forth on the back cover of this Consent Solicitation Statement. Holders may also contact their broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Consent Solicitation. Requests for additional copies of this Consent Solicitation Statement, the accompanying Consent Form and other related documents should also be directed to the Information Agent.All executed Consent Forms and any other documents required by the Consent Forms should be directed to the Tabulation Agent at the address set forth in the Consent Form.

Fees and Expenses

Appleton will bear the costs of the Consent Solicitation. Appleton will reimburse the Tabulation Agent for expenses that the Tabulation Agent incurs in connection with the Consent Solicitation. Appleton will also reimburse the Solicitation Agent, banks, trust companies, securities dealers, nominees, custodians and fiduciaries for their reasonable expenses in forwarding Consent Forms and other materials to beneficial owners of Notes.

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES

In the opinion of White & Case LLP, Special Tax Counsel to Appleton, the following is a summary of certain U.S. federal income tax consequences of the Consent Solicitation that may be relevant to a beneficial owner of Notes that is a citizen or resident of the United States or a domestic corporation or otherwise subject to U.S. federal income tax on a net income basis in respect of the Notes (a “U.S. Holder”). The summary is based on laws, regulations, rulings and decisions now in effect, all of which are subject to change. The discussion does not deal with classes of Holders subject to special tax rates, and does not describe any tax consequences arising out of the laws of any state or local or non-U.S. jurisdiction. The discussion assumes that the Notes are held as “capital assets” within the meaning of section 1221 of the Code.

Effect of Proposed Amendments

Under general principles of federal income tax law, the modification of a debt instrument creates a deemed exchange upon which gain or loss is realized (a “Deemed Exchange”) if the modified debt instrument differs materially either in kind or in extent from the original debt instrument. A modification of a debt instrument that is not a “significant modification” does not create a Deemed Exchange.

The modifications to the Indentures pursuant to the Proposed Amendments, other than the provisions for additional interest in certain circumstances relating to ESOP-related payments, and the payment of the Consent Payments should not cause a Deemed Exchange of the Notes because such modifications do not constitute significant modifications to the terms of the Notes for U.S. federal income tax purposes as defined in Treasury Regulation section 1.1001-3. The modification to the Indentures providing for the payment of additional interest in certain circumstances relating to ESOP-related payments will not cause a Deemed Exchange if such modification is not “economically significant” within the meaning of Treasury Regulation section 1.1001-3. Although there is no

17

guidance regarding the determination of whether such modification would be treated as “economically significant” within the meaning of Treasury Regulation section 1.1001-3, if the likelihood that such additional interest would be paid is remote, such modification should not be treated as “economically significant.” Based on Appleton’s expectation that it will not violate the Adjusted Fixed Charge Coverage Ratio Test, such modification should not be treated as “economically significant.” Accordingly, a U.S. Holder should not recognize any gain or loss, for U.S. federal income tax purposes, upon the adoption of the Proposed Amendments, regardless of whether the U.S. Holder consents to the Proposed Amendments, and should have the same adjusted tax basis and holding period in the Notes after the adoption of the Proposed Amendments that such U.S. Holder had in the Notes immediately before such adoption.

The payment of $10 in cash for each $1,000 principal amount of Notes held by a U.S. Holder on the Record Date will be includible in a U.S. Holder’s gross income as ordinary income in accordance with the Holder’s usual method of tax accounting.

If the modifications to the Indentures pursuant to the Proposed Amendments were considered to be a Deemed Exchange of the Notes, the Deemed Exchange should be considered to occur in a recapitalization of Appleton. In such event, a U.S. Holder would recognize gain, but not loss, on the Deemed Exchange and the resulting new debt instrument (“New Instrument”) issued in the exchange may be treated as issued with original issue discount (“OID”). If a New Instrument is treated as issued with OID, a U.S. Holder generally must include in gross income a portion of the total OID that accrues on each day the U.S. Holder holds the New Instrument, calculated under a constant yield method, regardless of such Holder’s method of accounting and without regard to the timing of actual payments.

Backup Withholding

A U.S. Holder may be subject to backup withholding on the cash payments unless such U.S. Holder: (i) is a corporation or comes within certain other exempt categories and demonstrates this fact; or (ii) provides a correct taxpayer identification number, certifies as to no loss of exemption from backup withholding and otherwise complies with applicable requirements of the backup withholding rules. The amount of any backup withholding from a cash payment will be allowed as a credit against such Holder’s federal income tax liability and may entitle such U.S. Holder to a refund,provided that the required information is furnished to the Internal Revenue Service.

Non-U.S. Holders

Beneficial owners of Notes who are not “United States persons” (within the meaning of section 7701(a)(30) of the Code) are urged to consult their own tax advisors regarding the application of U.S. federal income tax withholding, including eligibility for a withholding tax exemption and refund procedures.

THE ABOVE SUMMARY IS NOT INTENDED TO CONSTITUTE A COMPLETE ANALYSIS OF ALL TAX CONSEQUENCES RELATING TO THE CONSENT SOLICITATION. NOTE HOLDERS SHOULD CONSULT THEIR OWN TAX ADVISORS CONCERNING THE TAX CONSEQUENCES OF THEIR PARTICULAR SITUATIONS.

Internal Revenue Service Circular 230 Disclosure

Pursuant to Internal Revenue Service Circular 230, we hereby inform you that this opinion was not intended or written by White & Case LLP to be used, and it cannot be used by any taxpayer, for the purpose of avoiding any penalties that may be imposed on the taxpayer. This opinion was written to support the marketing of the Transaction or matters addressed by our opinion. Taxpayers should seek advice based on the taxpayer’s particular circumstances from an independent tax advisor.

18

MISCELLANEOUS

The Consent Solicitation is not being made to, nor will Consent Forms be accepted from or on behalf of, Holders in any jurisdiction in which the making of the Consent Solicitation or the acceptance thereof would not be in compliance with the laws of such jurisdiction. However, Appleton may in its discretion take such action as it may deem necessary to make the Consent Solicitation in any such jurisdiction and extend the Consent Solicitation to Holders in such jurisdiction. In any jurisdiction in which the securities laws or blue sky laws require the Consent Solicitation to be made by a licensed broker or dealer, the Consent Solicitation will be deemed to be made on behalf of Appleton by the Solicitation Agent or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

The statements contained in this Consent Solicitation Statement are made as of the date hereof, and the delivery of this Consent Solicitation Statement and the accompanying materials will not, under any circumstances, create any implication that the information contained herein is correct at any time subsequent to the date hereof.

No person has been authorized to give any information or make any representation on behalf of Appleton, the Trustee, the Guarantors, the Solicitation Agent, the Information Agent or the Tabulation Agent not contained herein or in the accompanying Consent Form and other materials and, if given or made, such information or representation must not be relied on as having been authorized.

19

Exhibit A

SECOND SUPPLEMENTAL INDENTURE

dated as of [ ], 2006

among

APPLETON PAPERS INC.,

Issuer,