UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________________________

FORM 10-K

__________________________________

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

OR

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-32594

______________________________________________

HEARTLAND PAYMENT SYSTEMS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 22-3755714 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

90 Nassau Street, Princeton, New Jersey 08542

(Address of principal executive offices) (Zip Code)

(609) 683-3831

(Registrant’s telephone number, including area code)

____________________________________________________________

Securities registered pursuant to 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, $0.001 par value | New York Stock Exchange | |

| Securities registered pursuant to 12(g) of the Act: | ||

| (NONE) | ||

| (title of Class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. o YES x NO

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. o YES x NO

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x YES o NO

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x YES o NO

Indicate by check mark if disclosure of delinquent filer pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | o | |||

| Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o YES x NO

The aggregate market value of the voting and non-voting common stock held by non-affiliates computed by reference to the price at which the common stock was last sold on the New York Stock Exchange on June 30, 2012 was approximately $1.1 billion.

As of February 25, 2013, there were 36,928,070 shares of the registrant’s Common Stock, $0.001 par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Specifically identified portions of the registrant's definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A in connection with the 2013 annual meeting of shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K for fiscal year ended December 31, 2012.

Heartland Payment Systems, Inc.

Annual Report on Form 10-K

For the Year Ended December 31, 2012

TABLE OF CONTENTS

| Page | ||

| Item 1. | ||

| Item 1A. | ||

| Item 1B. | ||

| Item 2. | ||

| Item 3. | ||

| Item 4. | MINE SAFETY DISCLOSURES | |

| Item 5. | ||

| Item 6. | ||

| Item 7. | ||

| Item 7A. | ||

| Item 8. | ||

| Item 9. | ||

| Item 9A. | ||

| Item 9B. | ||

| Item 10. | ||

| Item 11. | ||

| Item 12. | ||

| Item 13. | ||

| Item 14. | ||

| Item 15. | ||

FORWARD LOOKING STATEMENTS

Unless the context requires otherwise, references in this report to “the Company,” “we,” “us,” and “our” refer to

Heartland Payment Systems, Inc. and our subsidiaries.

Some of the information in this Annual Report on Form 10-K may contain forward‑looking statements that are based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities, the effects of future regulation and the effects of competition. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. You should understand that many important factors, in addition to those discussed elsewhere in this report, could cause our results to differ materially from those expressed in the forward-looking statements. Certain of these factors are described in Item 1A. Risk Factors and include, without limitation, our competitive environment, the business cycles and credit risks of our merchants, chargeback liability, merchant attrition, problems with our bank sponsor, our relationships with third-party bankcard payment processors, our inability to pass increased interchange fees along to our merchants, economic conditions, systems failures and government regulation.

PART I

ITEM 1. BUSINESS

Overview of Our Company

We were incorporated in Delaware in June 2000. Our headquarters are located at 90 Nassau Street, Princeton, NJ 08542, and our telephone number is (609) 683-3831.

Our primary business is to provide bankcard payment processing services to merchants in the United States. This involves facilitating the exchange of information and funds between merchants and cardholders' financial institutions, providing end-to-end electronic payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant assistance and support and risk management. Our card-accepting customers primarily fall into two categories: our core small and mid-sized merchants (referred to as "Small and Midsized Enterprises," or “SME merchants”) and Network Services merchants, predominately petroleum industry merchants of all sizes (referred to as “Network Services Merchants”). We provide additional services to SME merchants, such as full-service payroll processing and related tax filing services, marketing solutions including loyalty and gift cards, and we sell and rent point-of-sale devices. We also offer K to 12 school nutrition and point-of-sale solutions and payment solutions through Heartland School Solutions, open- and closed-loop payment solutions and higher education loan services to colleges and universities through Campus Solutions, and prepaid and stored-value card solutions through Micropayments.

Bankcard Payment Processing

At December 31, 2012, we provided bankcard payment processing services to 169,994 active SME bankcard merchants located across the United States. This compares to 171,801 active SME bankcard merchants at December 31, 2011. At December 31, 2012, we provided bankcard payment processing services to 396 Network Services Merchants with approximately 47,064 locations. Our total bankcard processing volume for the year ended December 31, 2012 was $100.4 billion, a 19.9% increase from the $83.7 billion processed during the year ended December 31, 2011. Our 2012 SME bankcard processing volume was $71.7 billion, a 6.3% increase over $67.5 billion in 2011. Bankcard processing volume for 2012 includes $27.9 billion of settled volume for Network Services Merchants, compared to $15.5 billion for 2011. In addition to settling Visa and MasterCard transactions, Network Services processes a wide range of payment transactions for its predominantly petroleum customer base, including providing 2.5 billion transaction authorizations through its front-end card processing systems (primarily for Visa and MasterCard) in 2012 and 2.7 billion such transactions for the year ended December 31, 2011.

According to The Nilson Report, in 2011 we were the 6th largest merchant acquirer in the United States ranked by transaction count and the 9th largest merchant acquirer by processed dollar volume, which consists of both credit and debit Visa and MasterCard, American Express, Discover, Diners Club and JCB transactions. These rankings represented 2.8 billion transactions and 4% of the total U.S. bankcard processing market, respectively.

Our bankcard processing revenue from SME merchants is recurring in nature. We typically enter into three-year service contracts with our SME merchants that, in order to qualify for the agreed-upon pricing, require the achievement of agreed bankcard processing volume minimums from these merchants. Our SME gross bankcard processing revenue is driven by cardholders making purchases at these merchants using mostly Visa and MasterCard credit and signature-debit cards, but also American Express and Discover cards. In December 2007, we signed a sales and servicing program agreement (“OnePoint”) with American Express Travel Related Services Company, Inc. (referred to as “American Express”) under which we sign up and service new merchants on behalf of American Express. In June 2008, we signed an agreement with DFS Services, LLC (referred to as “Discover”) that transferred ownership of Discover-related contracts to us, and provided us with economics on Discover transactions matching that of Visa or MasterCard transactions.

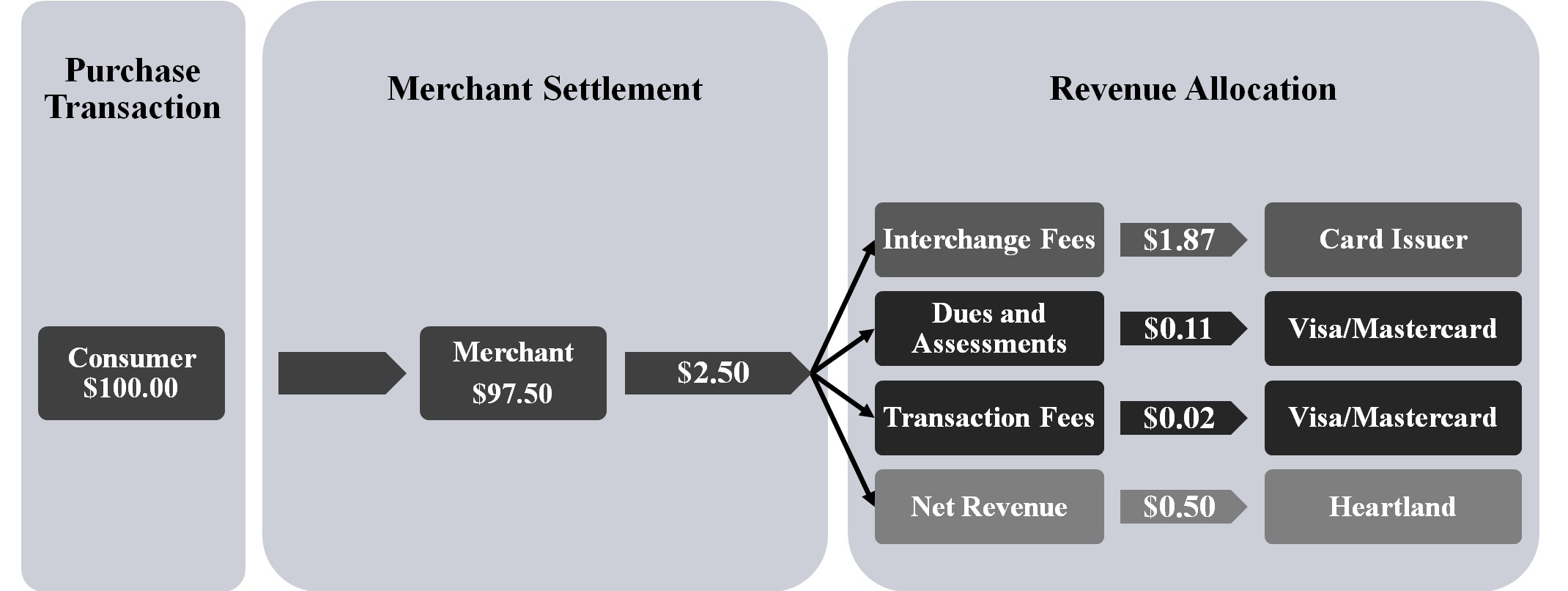

We generally benefit from consumers' increasing use of bankcards in place of cash and checks, and sales growth (if any) experienced by our retained SME merchants. Most of our SME revenue is from gross processing fees, which are primarily a combination of a percentage of the dollar amount of each card transaction we process plus a flat fee per transaction. We make mandatory payments of interchange fees to card issuing banks through card networks and dues, assessments and transaction authorization fees to Visa, MasterCard and Discover, and we retain the remainder as net revenue. For example, in a transaction using a Visa or MasterCard credit card, the allocation of funds resulting from a $100 transaction is depicted below.

1

Our bankcard processing revenue from our Network Services Merchants is also recurring in nature. We typically enter into five-year contracts with our large national merchants and three year contracts with our other merchants. However, in contrast to SME merchants, our processing revenues from Network Services Merchants generally consist of a flat fee per transaction and thus revenues are driven primarily by the number of transactions we process (whether settled, or only authorized), not bankcard processing volume.

We sell and market our SME bankcard payment processing services through a nationwide direct sales force (see "— Sales" for a discussion of our direct sales force). We focus our sales efforts on low-risk bankcard merchants and have developed systems and procedures designed to minimize our exposure to potential merchant losses. In 2012, 2011 and 2010, we experienced merchant losses in amounts equal to 0.28 basis points (0.0028%), 0.76 basis points (0.0076%) and 1.44 basis points (0.0144%) of SME bankcard processing volume, respectively. The higher loss rate in 2010 tracked with the stressed economic conditions in that year, which contributed to increased incidences of merchant fraud. We attribute the improved merchant loss rate in 2012 and 2011 to the combination of a stronger economy and our improved credit monitoring. We have developed significant expertise in industries that we believe present relatively low risks as the customers are generally present and the products or services are generally delivered at the time the transaction is processed. These industries include restaurants, brick and mortar retailers, convenience and liquor stores, automotive sales and repair shops, gas stations, professional service providers, lodging establishments and others. As of December 31, 2012, approximately 25.7% of our SME bankcard merchants were restaurants, approximately 18.7% were brick and mortar retailers, approximately 11.7% were convenience and liquor stores, approximately 7.6% were automotive sales and repair shops, approximately 11.6% were professional service providers, approximately 3.3% were lodging establishments, and approximately 1.5% were gas stations.

We have developed a number of proprietary payment processing systems to increase our operating efficiencies and distribute our processing and merchant data to our three main constituencies: our merchant base, our sales force and our customer service staff. We provide authorization and data capture services to our SME merchants through our own front-end processing system, which we call HPS Exchange. We provide clearing, settlement and merchant accounting services through our own internally developed back-end processing system, which we call Passport. Our control over our front-end and back-end systems enables us to more effectively customize these services to the needs of our Relationship Managers and merchants, and to minimize our processing costs. At December 31, 2012, our internally developed systems are providing substantially all aspects of a merchant's processing needs for most of our SME merchants and providing all aspects of our Network Services Merchants' processing needs.

We launched our End-to-End Encryption solution (known as E3™) in May 2010 to protect sensitive card data as it moves through the merchant's network and our platforms, resulting in a more secure payments network. Over 45,000 E3-enabled terminals have been deployed to small and mid-sized business owners across the country to protect their businesses and their customers

Payroll Processing Services

We provide a full-service nationwide payroll processing service, including check printing, direct deposit, related federal, state and local tax deposits, accounting documentation and human resources information. We developed a comprehensive payroll management system, which we refer to as PlusOne Payroll, that streamlines all aspects of the payroll

2

process to enable time and cost savings. PlusOne Payroll was made available to new and existing customers beginning in 2010, and during 2011 we converted all of our existing payroll customers to PlusOne Payroll.

On December 31, 2012, we acquired Ovation Payroll, Inc. ("Ovation") adding over 10,000 customers to our existing payroll business. At December 31, 2012, we processed payroll for 22,553 customers, including Ovation's, an increase of 90.5% from 11,841 payroll customers at December 31, 2011. In 2012, 2011 and 2010, we installed 3,399, 3,723 and 4,858 new payroll processing customers in our existing business, respectively, excluding Ovation's installation activity.

Heartland School Solutions

We provide school nutrition, point-of-sale solutions, and associated payment solutions including online prepayment, to K to 12 schools throughout the United States. We offer back office management software, hardware, annual technical support, and training to our customer school districts. At December 31, 2012, our Heartland School Solutions business provided services to over 29,000 schools, compared to over 19,000 schools at December 31, 2011. Our Heartland School Solutions business has been built through a series of five acquisitions in 2010, 2011 and 2012. Most recently, on June 29, 2012 we acquired the K to 12 school solutions business of Lunch Byte Systems, Inc. (a.k.a "Nutrikids") accounting for the increase in the number of schools served in 2012.

Campus Solutions

We provide open- and closed-loop payment solutions and higher education loan services to colleges and universities throughout the United States and Canada. Besides payment processing, our Campus Card solution enables personal identification, door access, cashless vending transactions, cashless laundry, meal plans and cashless printing at campus facilities. Our loan services include student loan payment processing, delinquency and default services, refund management, tuition payment plans, electronic billing and payment, tax document services, and business outsourcing. At December 31, 2012, our Campus Solutions business served more than 2,000 colleges and universities, compared to approximately 200 at December 31, 2011. The increase reflects our acquisition of Educational Computer Systems, Inc. ("ECSI") on December 14, 2012, expanding our Campus Solutions business into higher education and post-graduate school/student services.

For other products and services which we offer, see “—Our Services and Products.”

Industry and Competitive Overviews

Payment Processing. The payment processing industry provides merchants with credit, debit, gift and loyalty card and other payment processing services, along with related information services. The industry continues to grow as a result of wider merchant acceptance, increased consumer use of bankcards and advances in payment processing and telecommunications technology. According to The Nilson Report, total expenditures for all card type transactions by U.S. consumers were $3.6 trillion in 2011, and are expected to grow to $5.4 trillion by 2016, representing a compound annual growth rate of 8.5%. The proliferation of bankcards has made the acceptance of bankcard payments a virtual necessity for many businesses, regardless of size, in order to remain competitive. This increased use of bankcards and prepaid cards, enhanced technology initiatives, efficiencies derived from economies of scale and the availability of more sophisticated products and services to all market segments has resulted in a highly competitive and specialized industry.

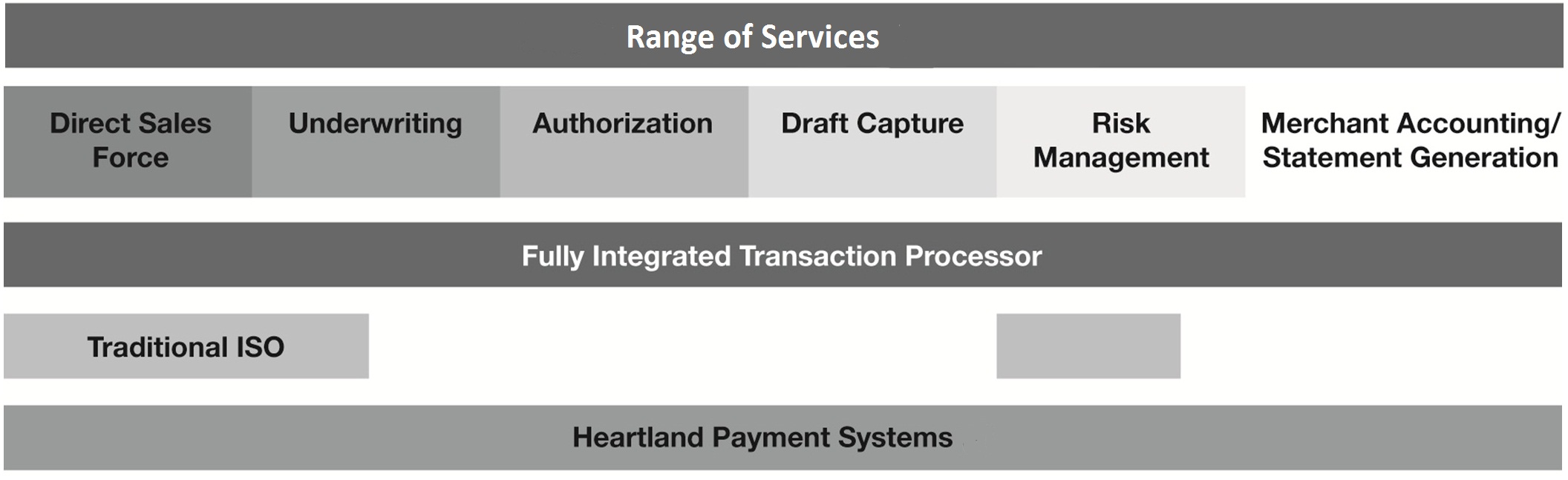

The payment processing industry is dominated by a small number of large, fully-integrated payment processors that sell directly to, and handle the processing needs of, the nation's largest merchants. These processors include First Data Corporation, Global Payments Inc., Vantiv, Inc., Chase Paymentech Solutions, Bank of America Merchant Services, Wells Fargo and Elavon, Inc., that serve a broad market spectrum from large to small merchants; further, certain of these provide banking, ATM and other payment-related services and systems in addition to bankcard payment processing. Large national merchants (i.e., those with multiple locations and high volumes of bankcard transactions) typically demand and receive the full range of payment processing services at low per-transaction costs.

SME merchants' payment processing needs generally are served by a large number of smaller payment processors, including banks and Independent Sales Organizations, that generally procure most of the payment processing services they offer from large payment processors. It is difficult, however, for banks and Independent Sales Organizations to customize payment processing services for the SME merchant on a cost-effective basis or to provide sophisticated value-added services. Accordingly, services to the SME merchant market segment historically have been characterized by basic payment processing without the availability of the more customized and sophisticated processing, information-based services or customer service

3

that is offered to large merchants. The continued growth in bankcard transactions is expected to cause SME merchants to increasingly value sophisticated payment processing and information services similar to those provided to large merchants.

We compete with both the large and small organizations in providing payment processing and related services to a wide range of merchants. Our competitors sell their services either through a direct sales force, generally concentrating on larger accounts, or through Independent Sales Organizations, telemarketers or banks, generally concentrating on smaller accounts. The following table sets forth the typical range of services provided directly (in contrast to using outsourced providers) by fully integrated transaction processors, traditional Independent Sales Organizations and us.

We compete with other providers of payment processing services on the basis of the following factors:

| • | sales force effectiveness |

| • | range of product offering; |

| • | quality of service; |

| • | reliability of service; |

| • | professional association endorsements; |

| • | ability to evaluate, undertake and manage risk; |

| • | speed in approving merchant applications; and |

| • | price. |

Some of our large competitors have substantially greater capital resources than we have and operate as subsidiaries of financial institutions or bank holding companies, which may allow them on a consolidated basis to own and conduct depository and other banking activities that we do not have the regulatory authority to own or conduct. Since they are affiliated with financial institutions or banks, these competitors do not incur the costs associated with being sponsored by a bank for registration with card networks and they can settle transactions quickly for their own merchants. We believe that our direct sales focus, our competitive payments product set, and our understanding of the needs and risks associated with providing payment processing services to those merchants, gives us a competitive advantage over larger competitors, which do not have our focus, and over competitors of a similar or smaller size that may lack our experience and sales resources.

Payroll Processing. The payroll processing services industry is highly competitive, with services provided by outsourced providers like us, but also accounting firms and self service options. Overall the industry breaks into two major segments: large national full-service payroll providers, and numerous much smaller national, regional, local and on-line providers. While large national payroll service firms such as ADP, Paychex, Ceridian, and Intuit are highly recognized, their combined market share in the industry approximates only 15%. We compete with both segments.

Competition in the payroll processing industry is primarily based on service responsiveness, accuracy, quality, reputation, range of product offering and price. The payroll industry faces continually evolving tax, regulatory and technology environments, which for smaller competitors create increasingly complex tax compliance, technology, service, and platform development challenges that they may lack the technical and financial resources to overcome. We believe we are well-positioned to gain payroll customers from those challenged providers. Additionally, we believe our competitive position is enhanced through our ability to offer payment processing services to payroll customers and thus offer an integrated services suite which will provide our customers with efficient and convenient options.

4

Our Competitive Strengths

We believe our competitive strengths related to Bankcard Payment Processing, particularly SME, include the following:

Large, Experienced, Efficient, Direct Sales Force

We sell and market our SME bankcard payment processing services through a nationwide direct sales force of 739 Relationship Managers and Territory Managers who work exclusively for us. In addition, Ovation employed 29 sales persons, who have augmented our SME sales force. Many of our competitors rely on Independent Sales Organizations that often generate merchant accounts for multiple payment processing companies simultaneously. Our sales professionals have local merchant relationships and industry-specific knowledge that allow them to effectively compete for merchants; additionally these relationships are also supported by our customer service and support teams located in our service center.

Our same direct sales force sells payroll processing services, loyalty and gift card marketing solutions. We compensate our sales force primarily through commissions, which are based upon the performance of their merchant accounts. Our sales professionals have considerable latitude in pricing a new account, but we believe that the shared economics motivate them to sign attractively priced contracts with merchants generating significant processing volume. The residual commissions our sales force receives from their merchant accounts give them an incentive to maintain a continuing dialogue and servicing presence with their merchants. We believe that our compensation structure is atypical in our industry and contributes to building profitable, long-term relationships with our merchants. In 2012, our sales force installed approximately 40,000 new SME bankcard merchants, 3,399 payroll processing customers and 4,782 loyalty and gift card marketing solutions customers.

Recurring and Predictable Revenue

We generate recurring revenue in most of our businesses and products. In particular, revenue from our payment processing services is recurring in nature because we typically enter into multi-year service contracts with our SME and Network Services Merchants. This recurring revenue grows as the number of transactions or dollar volume processed for an SME merchant increases or as we add new SME merchants and as we add transactions or merchants in Network Services. In 2012, approximately 90% of our SME bankcard processing volume came from merchants we installed in 2011 and earlier.

Internal Growth

We grow our SME payment processing business exclusively through internal expansion by generating new SME merchant contracts submitted by our own direct sales force. All of our SME merchants were originally underwritten by our staff, and we have substantial experience responding to the SME merchants' processing needs and the risks associated with them. We believe our control of sales, underwriting and servicing both enhances our SME merchant retention and reduces our risks. We believe that internally generated SME merchant contracts generally are of a higher quality and are more predictable than contracts acquired from third parties, and the costs associated with such contracts generally are lower than the costs associated with contracts acquired from third parties.

While we continue to pursue internal growth, we have selectively taken advantage of acquisition opportunities and continue to expand into other products and markets that we previously did not have the technical or operational capabilities to support. See “—Our Strategy — Pursue Strategic Acquisitions” and “—Our Services and Products” later in this section for descriptions of these acquisitions.

Strong Position and Substantial Experience in Our Target Markets

As of December 31, 2012, we were providing payment processing services to 169,994 active SME merchants located across the United States. We believe our understanding of the needs of SME merchants and the risks inherent in doing business with them, combined with our efficient direct sales force, provides us with a competitive advantage over larger service providers that access this market segment indirectly. We also believe that we have a competitive advantage over service providers of a similar or smaller size that may lack our extensive experience and resources, and so do not benefit from the economies of scale that we have achieved.

At December 31, 2012, we also provided bankcard payment processing services to approximately 396 Network Services Merchants with approximately 47,064 locations. These Network Services Merchants are predominately in the

5

petroleum industry. We believe that our understanding of the processing needs of petroleum merchants and the products we offer them provides us with a competitive advantage.

Also at December 31, 2012 we provided payroll processing services to 22,553 customers, Heartland School Solutions to over 29,000 schools, and Campus Solutions to approximately 2,000 colleges and universities, all of which provided us with competitive and growing market shares.

Industry Expertise

Historically, we have focused our sales efforts on SME merchants who have certain key attributes and on industries in which we believe our direct sales model is most effective and the risks associated with bankcard processing are relatively low. These attributes include owners who are typically on location, interact with customers in person, value a local sales and servicing presence and often consult with trade associations and other civic groups to help make purchasing decisions.

To further promote our products and services, we have entered into referral arrangements with various trade associations, with an emphasis on state restaurant and hospitality groups. We believe that these partnerships have enabled us to gain exposure and credibility within the restaurant industry and have provided us with opportunities to market our products to new merchants. On January 19, 2010, we formed a strategic partnership with The National Restaurant Association to foster our delivery of a unified payments processing platform to the restaurant industry. This alliance has provided restaurateurs nationwide with effective tools, solutions and resources that help them reduce their expenses, improve operations and increase profitability all from one source with integrated technology product platforms.

In December 2012, the restaurant industry represented approximately 36.0% of our SME bankcard processing volume and 49.6% of our SME transactions, consistent with prior years. We believe that the restaurant industry will remain an area of focus, though its growth will likely approximate the growth in the overall portfolio. Restaurants represent an attractive segment for us: according to a report by the National Restaurant Association, restaurant industry sales are expected to reach approximately $660.5 billion in 2013, which would represent a 3.8% increase over projected industry sales for 2012 and the twenty-first consecutive year of growth. The projected restaurant industry growth for 2013 is in spite of a challenging economy and this steady growth profile, combined with the industry's low seasonality, makes restaurant merchant bankcard processing volume stable and predictable. In addition, the incidence of chargebacks is very low among restaurants, as the service typically is provided before the card is used. Our industry focus not only differentiates us from other payment processors, but also allows us to forge relationships with key trade associations that attract merchants to our business. Our industry focus also allows us to better understand a merchant's needs and tailor our services accordingly.

Although we have historically focused significant sales and marketing efforts on the restaurant industry, our SME merchant base also includes a broad range of brick and mortar retailers, lodging establishments, automotive repair shops, convenience and liquor stores, professional service providers, and gas stations. See “—Our Bankcard Processing Merchant Base” for detail on December 2012 bankcard processing volume by merchant category.

Our historical focus on SME merchants has diversified our merchant portfolio and we believe has reduced the risks associated with revenue concentration. In 2012, no single SME merchant represented more than 0.98% of our total bankcard processing volume, consistent with prior years.

Our Network Services business has further diversified our total merchant portfolio adding a substantial base of large national merchants, predominately in the petroleum industry.

Merchant Focused Culture

We have built a corporate culture and established practices that we believe improve the quality of services and products we provide to our merchants. We developed and endorsed The Merchant Bill of Rights, an advocacy initiative that details ten principles we believe should characterize all merchants' processing relationships. The Merchant Bill of Rights allows our sales team to differentiate our approach to bankcard processing from alternative approaches, and we believe that a focus on these principles by our merchants will enhance our merchant relationships. We believe that our culture and practices allow us to maintain strong merchant relationships and differentiate ourselves from our competitors in obtaining new merchants.

Our merchant-focused culture spans from our sales force, which maintains a local market presence to provide rapid, personalized customer service, through our service center, which is segmented into regional teams to optimize responsiveness,

6

and to our technology organization, which has developed a customer management interface and information system that alerts our Relationship Managers to any problems a merchant has reported and provides them with detailed information on the merchants in their portfolio. Additionally, we believe that we are one of the few companies that fully discloses our pricing to merchants. We think this approach contributes substantially to building long-term merchant relationships.

Scalable Operating Structure

Our scalable operating structure generally allows us to expand our operations without proportionally increasing our fixed and semi-fixed support costs. In addition, our card processing technology platform, including both HPS Exchange and Passport, was designed with the flexibility to support significant growth and drive economies of scale with relatively low incremental costs. Most of our operating costs are related to the number of individuals we employ. We have in the past used, and expect in the future to use, technology to leverage our personnel, which should cause our personnel costs to increase at a slower rate than our bankcard processing volume.

Advanced Technology

We employ information technology systems which use the Internet to improve management reporting, enrollment processes, customer service, sales management, productivity, merchant reporting and problem resolution. We believe that these systems help attract both new merchants and Relationship Managers and provide us with a competitive advantage over many of our competitors who rely on less flexible legacy systems.

We provide authorization and data capture services to our SME merchants through our internally-developed front-end processing system, HPS Exchange. This system incorporates real time reporting tools through interactive point-of-sale database maintenance via the Internet. These tools enable merchants, and our employees, to change the messages on credit card receipts and to view sale and return transactions entered into the point-of-sale device with a few second delay on any computer linked to the Internet. During the years ended December 31, 2012, 2011 and 2010, approximately 95%, 93% and 90%, respectively, of our SME transactions were processed through HPS Exchange.

We provide clearing, settlement and merchant accounting services through our own internally developed back-end processing system, Passport. Passport enables us to customize these services to the needs of our Relationship Managers and merchants. At December 31, 2012 , 2011 and 2010, approximately 99% of total SME bankcard merchants were processing on Passport. At December 31, 2012 and 2011, our internally developed systems have been providing substantially all aspects of a merchant's processing needs for most of our SME merchants and all of our Network Services Merchants' processing needs.

We launched our End-to-End Encryption solution (known as E3™) in May 2010 to protect sensitive card data as it moves through the merchant's network and our platforms, resulting in a more secure payments network. Over 45,000 E3-enabled terminals have been deployed to small and mid-sized business owners across the country to protect their businesses and their customers.

We actively leverage the latest advances in technology to provide the best payments experience for merchants with reliability levels that we believe exceed industry norms. In 2011, we enabled our first cloud computing datacenter and consolidated several legacy data centers. This consolidation reduced processing costs while giving us even more flexibility, scalability, leverage and availability for our front-end processing, back-end processing, and other products.

Comprehensive Underwriting and Risk Management System

Through our experience in assessing risks associated with providing payment processing services to SME merchants, we have developed procedures and systems that provide risk management and fraud prevention solutions designed to minimize losses. Our underwriting processes help us to evaluate merchant applications and balance the risks of accepting a merchant against the benefit of the bankcard processing volume we anticipate the merchant will generate. We believe our systems and procedures enable us to identify potentially fraudulent activity and other questionable business practices quickly, thereby minimizing both our losses and those of our merchants. As evidence of our ability to manage these risks, and notwithstanding the challenging economic environment faced by our SME merchants in recent years, in 2012, 2011 and 2010 we experienced SME merchant losses in amounts equal to 0.28 basis points, 0.76 basis points and 1.44 basis points of SME bankcard processing volume, respectively. The higher level of merchant losses in 2010 tracked the stressed economic conditions in that year, which contributed to increased incidences of merchant fraud.

7

Our Strategy

Our current growth strategy is to increase our market share as a provider of payment processing services to merchants in the United States. We believe that continuing increases in the use of bankcards and other technology as a payment method, combined with our approaches to sales, marketing and development of broad payment-product offerings, will continue to present us with significant growth opportunities. Additionally, we intend to continue growing our payroll processing business, Heartland School Solutions, Campus Solutions, and enhance our other products such as Heartland Marketing Solutions and Micropayments. Key elements of our strategy include:

Expand Our Direct Sales Force

Unlike many of our competitors who rely on Independent Sales Organizations or salaried salespeople and telemarketers, we have built a direct, commission-only sales force. Our sales model divides the United States into 7 primary markets overseen by Executive Directors of Business Development. These Executive Directors are responsible for hiring Relationship Managers and increasing the number of installed merchants in their markets.

During the third quarter of 2010, we focused our sales organization toward improving individual sales persons' productivity, and so we reduced our Relationship Manager count, but at the same time, more fully engaged our Territory Managers in the sales process by requiring them to achieve individual minimum monthly gross margin install targets. Combining our Relationship Managers and Territory Managers gives us a count of 739 at December 31, 2012, compared to 790 at December 31, 2011 and 917 at December 31, 2010. In addition, Ovation employed 29 sales persons, who we expect to add to our SME sales force. We anticipate renewed growth in our sales force in the next few years in order to increase our share of our target markets, while maintaining the enhanced sales productivity levels of recent quarters.

Further Penetrate Existing SME Bankcard Target Markets and Enter Into New Markets

We believe that we have an opportunity to grow our business by further penetrating the SME market through our direct sales force and alliances with local trade organizations, banks and value-added resellers. We believe that our sales model, combined with our community-based strategy that involves our Relationship Managers building relationships with various trade groups and other associations in their territory, will enable our Relationship Managers to continuously add new merchants. We intend to further expand our bankcard processing sales efforts into new target markets with relatively low risk characteristics, including markets that have not traditionally accepted electronic payment methods. These markets include governments, schools and the business-to-business market.

Expand Our Services and Product Offerings

We have focused on offering a broad set of payment-related products to our customers. In addition to our bankcard processing services, our current product offerings include payroll processing, Heartland School Solutions, Campus Solutions, Micropayments, and Heartland Marketing Solutions. See “— Our Services and Products” for descriptions of these services. In 2010, 2011 and 2012 in a series of five acquisitions, we added Heartland School Solutions to our product set, expanding our customer base by offering school nutrition, point-of-sale solutions, and associated payment solutions including online prepayment solutions, to a wide base of schools, students and their parents (see “— Our Services and Products — Heartland School Solutions” for more information).

In 2012, we added to our Campus Solutions services by acquiring ECSI, which provides a suite of solutions to support administrative services for higher education including student loan payment processing, delinquency and default services, refund management, tuition payment plans, electronic billing and payment, tax document services, and business outsourcing(see “— Our Services and Products — Campus Solutions” for more information).

We also distribute products that will help our merchants reduce their costs and grow their businesses, such as SmartLink. SmartLink is our state of the art technology for consolidating multiple in-store devices onto a single lower-cost, high-speed broadband circuit. SmartLink transmits both transactional data as well as integral back-office information. It streamlines networked services, reduces costs and enhances operational efficiency for our merchants.

We may develop new products and services internally, enter into arrangements with third-party providers of these products or selectively acquire new technology and products. Many of these new service offerings are designed to work on the same point-of-sale devices that are currently in use, enabling merchants to purchase a greater volume of their services from us and eliminating their need to purchase additional hardware. We believe that these new products and services will enable us to

8

leverage our existing infrastructure and create opportunities to cross-sell our products and services among our various merchant bases, as well as enhance merchant retention and increase processing revenue.

Leverage Our Technology

We intend to continue leveraging our technology platforms to increase operating efficiencies and provide real-time processing and data to our merchants, sales force and customer service staff. Since our inception, we have been developing Internet-based systems to improve and streamline our information systems, including customer-use reporting, management reporting, enrollment, customer service, sales management and risk management reporting tools. We continually develop enriched back office solutions which allow merchants to integrate their payment processing data into any of the major small business accounting software packages, and remain on the leading edge of the merchant marketplace. We continue to make material investments in our payment processing capabilities, which allow us to offer a differentiated payment processing product that is faster, less expensive, and more comprehensive than competing products.

In 2012, we added to our existing payroll processing business with our acquisition of Ovation, which serves over 10,000 clients in 48 states providing payroll processing, payroll tax preparation, Internet payroll reporting, and direct deposit. With this acquisition, we added scale to our PlusOne Payroll platform, leveraging operating costs (see “— Our Services and Products — Payroll Processing Services” for more information).

Enhance Merchant Retention

By providing our merchants with a consistently high level of service and support, we strive to enhance merchant retention. We recognize that our ability to maintain strong merchant relationships is important to not only maintain our recurring revenues, but to our growth. We believe that our practice of fully disclosing our pricing policies to our merchants creates goodwill. We developed and endorsed The Merchant Bill of Rights, an advocacy initiative that details ten principles we believe should characterize all merchants' processing relationships.

We have passed on to our merchants the benefits of reductions in debit interchange rates mandated by the “Durbin Amendment,” which was part of the July 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act and went into effect on October 1, 2011. The Durbin Amendment places limits on debit card interchange rates that card issuing banks with assets in excess of $10 billion may charge. We believe that the Merchant Bill of Rights and our approach to passing along the benefits of the Durbin Amendment to our merchants allows our sales force to differentiate our approach to bankcard processing from alternative approaches, and we believe that a focus on these principles by our merchants will enhance our merchant relationships.

We have developed a customer management interface that alerts our Relationship Managers to any problems an SME merchant has reported and provides them with detailed information on the merchants in their portfolio. In addition, we believe that our flexible back-end processing platform, Passport, allows us to tailor our services to the needs of our sales force and merchants, which we believe will further enhance merchant retention. Passport's flexibility allows us to enhance the information available to our merchants, and to offer new services to them.

Pursue Strategic Acquisitions

Although we intend to continue to pursue organic growth through the efforts of our direct sales force, we may also expand our merchant base or gain access to other target markets by acquiring complementary businesses, products or technologies, including other providers of payment processing.

We have made a number of acquisitions which have expanded our product offerings and added complementary businesses. In 2007, we initiated our Campus Solutions business with the acquisition of General Meters Corp and in 2012 we added to our Campus Solutions by acquiring ECSI, which provides a suite of solutions to support administrative services for higher education including student loan payment processing, delinquency and default services, refund management, tuition payment plans, electronic billing and payment, tax document services, and business outsourcing. In 2010, 2011 and 2012 in a series of five acquisitions, we added Heartland School Solutions to our product set, expanding our customer base by offering school nutrition and point-of-sale solutions, including Internet payment capability, to a wide base of schools, students and their parents. In 2008, we acquired Network Services which handles a wide range of payment transactions for merchants of all sizes for its predominantly petroleum customer base. Our acquisition of Debitek in 2006 established our Micropayments product and our acquisition of Chockstone in 2008 provided for expansion into the loyalty marketing and gift card solutions market, which is now our Heartland Marketing Solutions business.

9

Our Services and Products

SME Merchant Bankcard Payment Processing

We derive the majority of our SME processing revenues from fee income relating to Visa and MasterCard payment processing, which is primarily comprised of a percentage of the dollar amount of each transaction we process, as well as a flat fee per transaction. The percentage we charge is typically a fixed margin over interchange, which is the fee paid to the issuing bank that is set by Visa and MasterCard depending on the type of card used and the way the transaction is handled by the merchant. On average, the gross revenue we generate from processing a Visa or MasterCard transaction equals approximately $2.50 for every $100 we process. We also receive fees from American Express, Discover, and JCB for facilitating their transactions with our SME merchants. Our American Express agreement includes a compensation model which provides us percentage-based residuals on the American Express volume we process, plus fees for every transaction we process. Under our agreement with Discover, our revenue model is similar to our Visa and MasterCard models.

We receive revenues as compensation for providing bankcard payment processing services to merchants, including merchant set-up and training, transaction authorization and electronic draft capture, clearing and settlement, merchant accounting, merchant support and chargeback resolution. In 2005, we began providing clearing, settlement and accounting services through Passport, our own internally developed back-end processing system. Passport enables us to customize these services to the needs of our Relationship Managers and merchants. At December 31, 2012 and 2011, approximately 99% of our SME bankcard merchants were processing on Passport. In addition, we sell and rent point-of-sale devices and supplies and provide additional services to our merchants, such as gift and loyalty programs, paper check authorization and chargeback processing. These payment-related services and products are described in more detail below:

Merchant Set-up and Training— After we establish a contract with a merchant, we create the software configuration that is downloaded to the merchant's existing, newly purchased or rented point-of-sale terminal, cash register or computer. This configuration includes the merchant identification number, which allows the merchant to accept Visa and MasterCard as well as any other cards, such as American Express, Discover and JCB, provided for in the contract. The configuration might also accommodate check verification, gift and loyalty programs and allow the terminal or computer to communicate with a pin-pad or other device. After the download has been completed by the Relationship Manager, service center or Account Manager, we conduct a training session on use of the system. We also offer our merchants flexible low-cost financing options for point-of-sale terminals, including installment sale and monthly rental programs.

Authorization and Draft Capture— We provide electronic payment authorization and draft capture services for all major bankcards. Authorization generally involves approving a cardholder's purchase at the point of sale after verifying that the bankcard is not lost or stolen and that the purchase amount is within the cardholder's credit or account limit. The electronic authorization process for a bankcard transaction begins when the merchant “swipes” the card through its point-of-sale terminal and enters the dollar amount of the purchase. After capturing the data, the point-of-sale terminal transmits the authorization request through HPS Exchange or the third-party processor to the card-issuing bank for authorization. The transaction is approved or declined by the card-issuing bank and the response is transmitted back through HPS Exchange or the third-party processor to the merchant. At the end of each day, and, in certain cases, more frequently, the merchant will “batch out” a group of authorized transactions, transmitting them through us to the bankcard networks for payment.

We operate HPS Exchange, our internally developed front-end processing system. During the years ended December 31, 2012, 2011 and 2010, approximately 95%, 93% and 90%, respectively, of our SME transactions were processed through HPS Exchange. The remainder of our front-end processing is outsourced to third-party processors, primarily TSYS Acquiring Solutions. Although we will continue to install new SME merchants, whose terminals or point-of-sale platforms are not certified for HPS Exchange, on TSYS' systems, we anticipate that the percentage of SME transactions that are outsourced will continue to decline as we install a high percentage of new merchants on HPS Exchange. Additionally, in the fourth quarter of 2010 we sold many of our remaining merchant accounts that had not been converted onto HPS Exchange and were still processing on third party front-end platforms other than TSYS. The purpose of the sale was to eliminate servicing inefficiencies associated with these merchant accounts.

Clearing and Settlement— Clearing and settlement processes, along with merchant accounting, represent the “back-end” of a transaction. After a transaction has been “batched out” for payment, the payment processor transfers the merchant data to Visa or MasterCard who then collect funds from the card issuing banks. This is typically referred to as “clearing.” After a transaction has been cleared, the transaction is “settled” by Visa or MasterCard by payment of funds to the payment processor's sponsor bank the next day. The payment processor creates an electronic payment file in ACH format for that day's cleared

10

activity and sends the ACH file to its sponsor bank. The ACH payments system generates credits to the merchants' bank accounts for the value of the file. The merchant thereby receives payment for the value of the purchased goods or services, generally two business days after the sale. Under the terms of the agreements with American Express and Discover, the process is substantially similar to the Visa and MasterCard process, and the merchant receives one deposit for all cards accepted, in contrast to the previously existing arrangement, where a merchant accepting Visa and MasterCard, American Express and Discover would have received three deposits.

Passport, our internally developed back-end system, enables us to customize these services to the needs of our merchants and Relationship Managers. For example, in 2012 we implemented Optimized Funding for SME merchants. Optimized Funding gives us the ability to pay our merchants for their transactions faster than previously and complements our Next Day Funding relationships with certain banks.

Merchant Accounting— Utilizing Passport, we organize our SME merchants' transaction data into various files for merchant accounting and billing purposes. We send our SME merchants detailed monthly statements itemizing daily deposits and fees, and summarizing activity by bankcard type. These detailed statements allow our SME merchants to monitor sales performance, control expenses, disseminate information and track profitability. We also provide information related to exception item processing and various other items of information, such as volume, discounts, chargebacks, interchange qualification levels and funds held for reserves to help them track their account activity. SME merchants may access this archived information through our customer service representatives or online through our Internet-based customer service reporting system.

Merchant Support Services— We provide merchants with ongoing service and support for their processing needs. Customer service and support includes answering billing questions, responding to requests for supplies, resolving failed payment transactions, troubleshooting and repair of equipment, educating merchants on Visa and MasterCard compliance and assisting merchants with pricing changes and purchases of additional products and services. We maintain a toll-free help-line 24 hours a day, seven days a week, which is staffed by our customer service representatives and, during 2012, answered an average of approximately 145,000 customer calls per month. The information access and retrieval capabilities of our intranet-based systems provide our customer service representatives prompt access to merchant account information and call history. This data allows them to quickly respond to inquiries relating to fees, charges and funding of accounts, as well as technical issues.

Chargeback Services— In the event of a billing dispute between a cardholder and a merchant, we assist the merchant in investigating and resolving the dispute as quickly and accurately as possible with card issuers and the bankcard networks, ensuring that the merchant is adequately represented under the bankcard network rules. We immediately notify the merchant and pass through a debit to the merchant's account for the chargeback. For Visa and MasterCard, the merchant is reimbursed as soon as they provide us with a valid response, as the act of representing the items allows us to reclaim the funds. Under American Express and Discover rules, the funds are reimbursed to us, and to the merchant, as soon as the case is resolved in the merchant's favor. After a merchant incurs three chargebacks per anniversary year, we typically charge our merchants a $25 fee for each subsequent chargeback they incur.

Network Services Merchant Bankcard Payment Processing

Network Services is a provider of payment processing solutions, serving large national merchants in a variety of industries such as petroleum/convenience stores, parking and retail. Our products/services include payment processing, prepaid services, POS terminals, helpdesk services, managed network services and merchant bankcard services. In addition to Visa and MasterCard transactions, Network Services handles a wide range of payment transactions for its predominantly petroleum customer base. More recently, we added petroleum functionality for merchants of all sizes to our payment processing product. This new product enables us to reach various sized petroleum/convenience store merchants. We also developed the SmartLink Managed Network Services product which is available to merchants in many markets and can be sold to other processors' merchants as well. SmartLink is our managed network services product platform for consolidating multiple in-store devices onto a single lower-cost, high-speed broadband circuit. SmartLink transmits both transactional data as well as integral back-office information, streamlines networked services, reduces costs and enhances operational efficiency for our merchants.

Our bankcard processing revenue from Network Services Merchants is recurring in nature. In contrast to SME merchants, our processing revenues from Network Services Merchants generally consist of a flat fee per transaction and thus are primarily driven by the number of transactions we process (whether settled, or only authorized), not processing volume.

11

Authorization and Draft Capture— Network Services provides electronic payment authorization and draft capture for all major bankcards, client private label cards and fleet cards. Authorization generally involves approving a cardholder's purchase at the point of sale after verifying that the purchase amount is within the cardholder's credit or account limit and that the card is not lost or stolen. The electronic authorization process for a card transaction begins when the merchant “swipes” the card through its point-of-sale terminal and enters the dollar amount of the purchase. Network Services offers two front-end processing hosts, VAPS and NWS. After capturing the data, the point-of-sale terminal transmits the authorization request through the VAPS or NWS host to the card-issuing entity for authorization. The transaction is approved or declined by the card-issuing entity and the response is transmitted back through the VAPS or NWS host or the third-party processor to the merchant. At the end of each day, and, in certain cases, more frequently, the merchant will “batch out” a group of authorized transactions, transmitting them through us to the bankcard networks for payment. VAPS and NWS provide distinct functionality and processing options for our large corporate customers. These hosts provide efficient transaction payment processing and real-time authorizations using fully redundant routing paths. Our Network Services Merchants can rely on quick response times and high availability.

Clearing and Settlement— Clearing and settlement processes represent the “back-end” of a transaction. After a transaction has been “batched out” for payment, we transfer the completed transaction detail file to our Passport back-end processing system for clearing and settlement. During the “clearing” process, the transaction detail is split out and sent to Visa or MasterCard who then collect funds from the card issuing banks. After a transaction has been cleared, the transaction is “settled” by Visa or MasterCard by payment of funds to our sponsor bank the next day. We then create either electronic payment files for wire or ACH for that day's cleared activity and send the files to our sponsor bank. The payments system generates a wire or credit to the merchant's bank accounts for the value of the file.

We provide deposit information to our Network Services settlement merchants each day via our Internet-based settlement reporting system. Deposits are broken out by card type and show gross sales, less chargebacks, interchange, and miscellaneous adjustments.

Merchant Boarding— The Merchant Support area supports new site setup requests, changes to existing locations, and any deletions. In addition, we provide Network Services Merchants with a web-based system, Prometheus, that allows merchants to manage their sites' data in the mainframe database after their initial setup has been completed. The benefits of Prometheus include reducing complexity, decreasing delay in boarding, allowing merchants to control their data entry, and minimizing the learning curve and data entry. The only requirements are Windows and a user ID. Boarding merchants using Prometheus access allows direct connect into Prometheus through a network connection.

Merchant Reporting—Merchants interested in flexible reporting alternatives have been provided with InfoCentral, an information database. InfoCentral is an architecture that consists of various technologies, which include relational and multi-dimensional databases and user reporting tools. Other than a suitable web browser, no additional software is required to access InfoCentral. Users can access InfoCentral from any location anywhere and at any time from any PC that has access to the Internet. Heartland InfoCentral Reporting allows the users to view their back-end settlement reporting to include funding, interchange qualifications, fees and disputes. These reports are viewable at the client and location level. Some merchants choose to receive a Daily Activity File (DAF), and Daily Dispute File (DDF) to import into their accounting systems.

Help Desk Services— The large national merchant Help Desk manages merchant trouble ticket initiation, escalation and resolution. The Help Desk also provides vendor and technician support, password resets, supply order servicing, and assists with special projects.

Our Help Desk's operating philosophy focuses on providing the highest level of quality support to our customers. To provide this high level of support, we train our Help Desk agents to focus on resolving the caller's issue or concern during the first call. As a result, our agents are not limited by restrictive and unproductive talk time limits so that they can focus on delivering a working solution to the caller. Our merchant Help Desk is open 24 hours a day, seven days a week with full Help Desk support.

The Help Desk provides three possible levels of support on all point-of-sale (“POS”) solutions that are certified to process on our network:

| • | 1st level support includes full support of all of the POS functions, downloading of the POS, and replacement of the POS (when applicable), as well as all of the support functions provided at 2nd and 3rd level. |

| • | 2nd level support includes full support of the communication between the POS and our network and minor support of the POS functions, mostly limited to those functions related to communication or network identification, as well as any support provided at 3rd level. |

| • | 3rd level support includes research and analysis of data being sent by the POS to our network. |

12

Chargeback Services— In the event of a billing dispute between a cardholder and a merchant, we assist the merchant in investigating and resolving the dispute as quickly and accurately as possible with card issuers and the bankcard networks, ensuring that the merchant is adequately represented under the bankcard network rules. We provide detailed online reporting to help our Network Services Merchants manage chargebacks received from Visa, MasterCard and Discover.

Payroll Processing Services

Through our wholly-owned subsidiary, Heartland Payroll Company, we operate a full-service nationwide payroll processing service. Revenues for our Payroll Processing Services were $21.4 million, $19.5 million and $17.3 million, respectively, in 2012, 2011 and 2010. Our payroll services include check printing, direct deposit, related federal, state and local tax deposits, accounting documentation and human resources information. In addition, we offer a “PayAdvantage” card, which provides employees the opportunity to have all, or a portion, of their payroll deposited to a Visa debit card account. In order to improve operating efficiencies and ease-of-use for our customers and to decrease our own processing costs, we offer electronic and paperless payroll processing that allows an employer to submit its periodic payroll information to us via the Internet. If a customer chooses the online option, all reports and interactions between the employer and us can be managed electronically, eliminating the need for cumbersome paperwork. Approximately 65% of our payroll customers currently submit their information electronically. However, if a customer chooses not to submit their payroll data online, they may submit such information via phone or facsimile. Regardless of input method, clients can choose to have Heartland Payroll Company print and ship their payroll package or to receive this information electronically.

On December 31, 2012, we acquired Ovation, adding over 10,000 customers to our existing payroll business. As of December 31, 2012, 2011 and 2010, we provided payroll processing services to 22,553, including Ovation, 11,841 and 11,131 customers, respectively. In 2012, 2011 and 2010, we installed 3,399, 3,723 and 4,858 new payroll processing customers, respectively, excluding Ovation's installation activity.

We operate a comprehensive payroll management platform, which we refer to as PlusOne Payroll, that streamlines all aspects of the payroll process to enable time and cost savings. PlusOne Payroll was made available to new and existing customers beginning in 2010. By December 31, 2011, all of our payroll processing customers were processing on PlusOne Payroll. We consider our PlusOne Payroll platform to be state-of-the art, enabling us to process payroll on a large scale and provide customizable solutions for businesses of all sizes. PlusOne Payroll enables faster processing and continuous updates to help businesses remain compliant with payroll, tax and human resources regulations. The platform features web-hosted access, enabling businesses and their accountants to securely access all payroll data from virtually anywhere with SSL-encryption protection. It also provides robust, easy-to-use reporting for better business analysis. PlusOne Payroll is equipped to interface with the leading providers of accounting and time and attendance applications, as well as restaurant and retail point-of-sale systems. During 2011 and 2012, we have continued to build upon this platform and have completed the Employee Self Serve web portal that allows employees to review copies of their paychecks, vouchers, payroll detail and maintain their individual demographic information. The acquisition of Ovation will add scale to our PlusOne Payroll platform, leveraging operating costs once conversion is complete in 2014, and also adds experienced management, a new sales approach including an affinity partner network, and enhanced product and servicing capabilities.

Heartland School Solutions

Heartland School Solutions provides cafeteria point of sale solutions to more than 29,000 schools, making us the largest provider of K-12 food-service technology in the nation. In conjunction with this core POS business, approximately 88% of our customer schools use Heartland's online prepayment solutions to allow parents to fund accounts for school lunches or other on-campus activities. Parents can opt to establish recurring payments with customized low balance thresholds, make one-time payments, or simply see what their students ate for lunch that day. With a consistently high annual renewal rate for POS customers, those platforms serve as a reliable base on which to offer additional value-added products and services. We offer back office management software, hardware, annual technical support, and training to our customer school districts.

Heartland School Solutions has been built through a series of five acquisitions in 2010, 2011 and 2012. On June 29, 2012, Heartland completed its latest K-12 acquisition of Rochester, NY based Nutrikids, Inc. Following that acquisition in 2012, we focused on merging the management and operational structures of the five acquired companies that make up the School Solutions group. The more than 200 School Solutions professionals now operate under a single management structure and go-to-market strategy. While continuing to maintain legacy POS platforms for the foreseeable future, we combined all online prepayment activity into two platforms: MySchoolBucks and MyLunchMoney. Together these two systems service more than 3.5 million users. During 2012, we made significant investment in our consumer-focused marketing strategy in order to

13

encourage more widespread adoption of our online payments products, which resulted in non-acquisition related growth of total volume by 18% between 2011 and 2012. Revenues for Heartland School Solutions were $36.6 million and $11.2 million, respectively, in 2012 and 2011.

Campus Solutions

In December 2012, we added to our Campus Solutions product by acquiring ECSI, which provides a suite of solutions to support administrative services for higher education including student loan payment processing, delinquency and default services, refund management, tuition payment plans, electronic billing and payment, tax document services, and business outsourcing. ECSI's core services support the management, payment and collection of student loans including Perkins and institutional financing. ECSI has the experience of printing and mailing over 500 million billing statements, managing 400+ million tuition and loan payments, processing over five million tax documents, and managing accounts for over seven million students and borrowers. ECSI currently serves over 1,800 colleges and universities across multiple higher education sectors including Non-Profit, For-Profit, Private, and Community Colleges.

Our existing Campus Solutions product also continues to provide open- or closed-loop payment solutions for college or university campuses to efficiently process small value electronic transactions. Besides payment processing, our One-Card product enables personal identification, door access, cashless vending transactions, cashless laundry, meal plans and cashless printing at campus facilities. Our innovative Give Something Back Network adds Internet and phone accessible closed-loop debit card based financial services to the students, faculty, staff and local community merchants of an educational institution. In addition, our Acceluraid program, which we introduced in 2010, addresses the major operational needs of campuses by providing an open-loop debit card based platform for making financial aid refunds. At December 31, 2012, we had twenty-seven colleges enrolled, representing 150,000 students and over $300 million in annual reimbursement under the Acceluraid program. We currently have 194 OneCard and Acceluraid college and university accounts. Revenues for Campus Solutions were $8.1 million, $6.5 million and $6.3 million, respectively, in 2012, 2011 and 2010.

Micropayments

We began providing payment solutions within the small value transaction market in 2006. Revenues for Micropayments were $8.2 million, $7.2 million and $7.2 million, respectively, in 2012, 2011 and 2010. We manufacture and sell solutions comprising unattended online wireless credit card based payment systems, and unattended value top up systems for off-line closed loop smart (chip) card based payment systems. Our electronic cash systems provide small value transaction processing for laundromat machines, vending machines, and cash registers, in apartment laundries, cruise ships, corporate and university campuses, and penitentiaries. These systems offer consumers convenient ways to use their debit and credit cards in laundromats with our new Waverider system, purchase and reload electronic cash cards, and spend the value on the card for small value purchases in both attended and unattended point of sale locations. In addition, we provide merchants financial settlement between the value (electronic cash card) issuer and the vendor/merchant who accepts the card as payment. We believe that there is increasing consumer demand for, and merchant interest in, card-based solutions for small denomination transactions, and expect to make additional investments in the future in developing solutions in this area.

Heartland Marketing Solutions

We continue to leverage our November 2008 acquisition of Chockstone, Inc. to provide a suite of marketing solutions including gift and rewards. Revenues for Heartland Marketing Solutions were $13.4 million, $12.0 million and $9.2 million, respectively, in 2012, 2011 and 2010. Through our Marketing Solutions group, we deliver a full suite of mobile and card-based marketing services to merchant locations through real-time communications with the merchant point-of-sale, enabling us to leverage existing installations across our merchant base and enhancing our overall value proposition to the merchant community. In addition to servicing the SME merchant market, the Marketing Solutions Group also provides gift and rewards services to regional and national brands.

In September 2009, we initiated a gift card marketing program called Enhanced Rewards, which strengthens an SME merchant's marketing initiatives by combining traditional, loyalty and promotional gift and loyalty card features into one integrated card program. Merchants are using Enhanced Rewards to increase customer loyalty and acquire new customers through the use of real-time offers and rewards delivered at the merchant point-of-sale. In addition to Enhanced Rewards, Heartland Marketing Solutions launched a simple gift card program in October 2012 to meet the demand for a gift-only solution, signing 479 Merchants in the fourth quarter of 2012. As of December 31, 2012, Heartland Marketing Solutions has signed 10,239 merchant locations and loaded $68 million on approximately 2.0 million consumer gift cards, compared to 8,300 merchant locations and $49 million loaded on approximately 1.5 million cards as of December 31, 2011.

14

Collective Point of Sale Solutions Ltd.

In the fourth quarter of 2012, the Company, along with the 30% non-controlling shareholders of Collective Point of Sale, Ltd. (“CPOS”), entered into an agreement to sell CPOS to a third party. CPOS, which operates as a provider of payment processing services in Canada, was not a significant subsidiary and the Company will have no continuing involvement in its operations. After receiving regulatory approval, the buyer settled this sale on January 31, 2013. The total sales price was $30.3 million in cash including net working capital, of which the Company received $20.9 million for its 70% ownership position. During the first quarter of 2013, the Company expects to record a material gain on the sale.

Sales

We sell and market our products and services to our SME merchants exclusively through our sales force. As of December 31, 2012, we employed 739 Relationship Managers and Territory Managers in 50 states plus the District of Columbia. In addition, Ovation employed 29 sales persons, who have augmented our SME sales force. We employ a geographic sales model that divides the United States into 7 markets overseen by Executive Directors of Business Development. Executive Directors of Business Development are responsible for sales and service in their region and are ultimately responsible for increasing the number of installed merchants in their territory. Executive Directors of Business Development manage their territories through Division Managers and Territory Managers. Division Managers do not sell our products and services. Instead, their sole responsibility is to hire, train and manage Territory and Relationship Managers in their assigned geography. In contrast, Territory Managers are Relationship Managers who are also responsible for hiring and training a small number of Relationship Managers in their territory. Our Relationship Managers employ a community-based strategy that involves cold calling, obtaining referrals from existing merchants and building relationships with various trade groups, banks and value-added resellers to create sales opportunities.