(4) | Beneficial ownership consists of 7,723,960 shares of common stock held by Carr Holdings, L.L.C., a New Jersey limited liability company owned and managed by Robert O. Carr and Jill Carr, Mr. Robert O. Carr’s wife; 1,750,000 shares of common stock held by Robert O. Carr; 400,000 shares of common stock held by The Robert O. Carr 2001 Charitable Remainder Unitrust; 38,558 shares of common stock held by The Robert O. Carr 2000 Irrevocable Trust for Emily Carr; 24,669 shares of common stock held by The Robert O. Carr 2000 Irrevocable Trust for Ryan Carr; 34,391 shares of common stock held by The Robert O. Carr 2000 Irrevocable Trust for Kelly Carr; 8,086 shares of common stock held by The Robert O. Carr 2003 Grantor Retained Annuity Trust; 13,889 shares of common stock held by The Jill A Carr 2000 Irrevocable Trust for Hilary Carr; 8,086 shares of common stock held by The Jill A Carr 2003 Grantor Retained Annuity Trust, and options to purchase 475,000 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(5) | Beneficial ownership consists of 333,576 shares of common stock held by Mr. Baldwin, 138,524 shares of common stock held by Margaret J. Sieck and Whitney H. Baldwin as Trustees for an Indenture created June 30, 2004, and options to purchase 512,500 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(6) | Beneficial ownership consists of 550,000 shares of common stock held by the B. Terrell Limited Partnership, a Texas limited partnership of which Brooks L. Terrell is the general partner; 68,000 shares of common stock held by Brooks L. Terrell, and options to purchase 91,500 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(7) | Beneficial ownership consists of 400,000 shares of common stock held by the MCMJH, LLC, an Arizona limited liability company of which Michael C. Hammer is the Managing Partner, and options to purchase 159,500 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(8) | Beneficial ownership consists of 65,105 shares of common stock held by Mr. Sheridan, and options to purchase 69,219 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(9) | Beneficial ownership consists of 80,000 shares of common stock held by Mr. Brown, and options to purchase 114,038 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(10) | Beneficial ownership includes options issued to Mr. Bok to purchase 5,000 shares of common stock under our 2000 Equity Incentive Plan. All such options are exercisable within 60 days of March 2, 2006. |

| |

(11) | Beneficial ownership includes options issued to Mr. Hollin to purchase 5,000 shares of common stock under our 2000 Equity Incentive Plan. All such options are exercisable within 60 days of March 2, 2006. |

| |

(12) | Beneficial ownership consists of 89,000 shares of common stock held by Mr. Niehaus, and options to purchase 5,000 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(13) | Beneficial ownership consists of 5,000 shares of common stock held by Dr. Ostro, and options to purchase 35,000 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(14) | Beneficial ownership consists of 39,321 shares of common stock held by Mr. Palmer, and options to purchase 5,000 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(15) | Beneficial ownership consists of 2,000 shares of common stock held by Mr. Raymond, and options to purchase 25,000 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

| |

(16) | Includes options to purchase an aggregate of 1,501,757 shares of common stock under our 2000 Equity Incentive Plan which are exercisable within 60 days of March 2, 2006. |

Other than the transactions described below, there has not been, nor is there currently planned, any transaction or series of similar transactions to which we were or are a party in which the amount involved exceeds $60,000 and in which any director, executive officer or holder of more than 5% of our capital stock or any member of such person’s immediate family had or will have a direct or indirect material interest.

Scott L. Bok, the U.S. President of Greenhill & Co., Inc. and a Senior Member of GCP 2000, LLC and a Managing Director of Greenhill Capital Partners, LLC, which control the general partners of Greenhill Capital Partners, Robert H. Niehaus, the Chairman and a Senior Member of GCP 2000, LLC and Chairman and a Managing Director of Greenhill Capital Partners, LLC and Mitchell L. Hollin, a partner of LLR Partners Inc., are members of our Board of Directors. In July 2003, Greenhill Capital Partners and LLR Equity Partners granted Robert O. Carr, our Chief Executive Officer and Chairman, an irrevocable option to purchase up to an aggregate of 1,750,000 shares of our common stock at any time on or before July 31, 2006 at a purchase price of $7.14 per share. On February 22, 2006, Mr. Carr exercised options to purchase 1,750,000 shares of our common stock from Greenhill Capital Partners and LLR Equity Partners.

On March 28, 2005, Carr Holdings, L.L.C., an entity controlled and managed by Robert O. Carr, our Chief Executive Officer and Chairman, and his wife, sold 40,000 shares of our common stock to Thomas M. Sheridan, our Chief Portfolio Officer, at a price of $9.28 per share. In addition, Carr Holdings, L.L.C. granted Mr. Sheridan an option to purchase an additional 40,000 shares of our common stock at any time prior to the earlier of (i) March 31, 2006, if we have not consummated our initial public offering or (ii) six months and 15 days after the consummation of our initial public offering. On August 8, 2005, Mr. Sheridan exercised options to purchase 12,000 shares of our common stock from Carr Holdings, L.L.C. On February 22, 2006, the remaining options to purchase 28,000 shares of our common stock from Carr Holdings, L.L.C. were cancelled by mutual agreement between Mr. Sheridan and Carr Holdings, L.L.C. As consideration for the cancellation, Mr. Sheridan received a payment of $361,900 from Carr Holdings L.L.C. The amount of the consideration was determined by subtracting the $9.28 exercise price of the options from the closing price of our common stock on the NYSE on the day before the date of this cancellation agreement, or $22.20, and multiplying the difference by 28,000.

On May 6, 2005, Carr Holdings, L.L.C., an entity controlled and managed by Robert O. Carr, our Chief Executive Officer and Chairman, and his wife, sold 27,236 shares of our common stock to LLR Equity Partners, L.P., an entity controlled by Mitchell L. Hollin, one of our directors, and 2,764 shares of our common stock to LLR Equity Partners Parallel, L.P., an entity controlled by Mitchell L. Hollin, one of our Directors, at a price of $9.80 per share. We paid the expenses incurred by Carr Holdings, L.L.C. in connection with the sale, which expenses totaled approximately $1,000.

Jeffrey T. Nichols, the son-in-law of Robert O. Carr, our Chief Executive Officer and Chairman, is our Model Office Team Leader and was paid a salary of $161,260 in the year ended December 31, 2005.

We have entered into change in control arrangements with some of our executive officers and granted options under our stock option plans to some of our executive officers. We have also entered into indemnification agreements with each of our executive officers and Directors. See “Executive Officers of the Registrant—Change in Control Arrangements” and “Executive Officers of the Registrant —Indemnification Arrangements.”

All future transactions, if any, between us and our officers, Directors and principal stockholders and their affiliates and any transactions between us and any entity with which our officers, Directors or five percent stockholders are affiliated, will be approved by a majority of the Board of Directors, including a majority of the independent and disinterested outside Directors, and will be on terms no less favorable to us than could be obtained from unaffiliated third parties.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

Independent Public Accountants

Deloitte & Touche LLP (“Deloitte”) served as our independent accountants for the years ending December 31, 2005 and 2004.

Audit Fees

The aggregate fees billed by Deloitte for professional services rendered for the audit of our annual financial statements, the reviews of the financial statements included in our quarterly reports on Form 10-Q, and services that are normally provided by the independent public accountant in connection with statutory and regulatory filings or engagements were $380,530 for 2005. For 2004, fees of $446,563 were billed by Deloitte for professional services rendered for audits of our annual financial statements.

Audit-Related Fees

The aggregate fees billed by Deloitte for professional services rendered for assurance and related services that are related to the performance of the audit or review of our financial statements were $1,340,547 for 2005 and $282,000 for 2004. Audit-related services in 2005 and 2004 included fees for consents to registration statements on Form S-1.

Tax Fees

The aggregate fees billed by Deloitte for professional services rendered for tax compliance, tax advice, and tax planning were $70,538 for 2005 and $68,050 for 2004. The fees primarily related to services provided in connection with our tax return preparation and compliance and sales tax return preparation and compliance.

16

All Other Fees

No other fees were billed by Deloitte in 2005 or 2004.

Audit Committee Pre-Approval Policies

Our Audit Committee pre-approves any audit and audit-related services and any permissible non-audit services provided by Deloitte prior to the commencement of the services. In determining whether to pre-approve a non-audit service, the Audit Committee considers whether providing the non-audit services is compatible with maintaining the auditor’s independence. To minimize potential impairments to the objectivity of the independent auditor, it has been the Audit Committee’s practice to limit the non-audit services that may be provided by our independent auditor to tax return, compliance and planning services.

All of the services described under the captions Audit Fees, Audit-Related Fees, Tax Fees, and All Other Fees were approved by the Audit Committee in accordance with the foregoing policy.

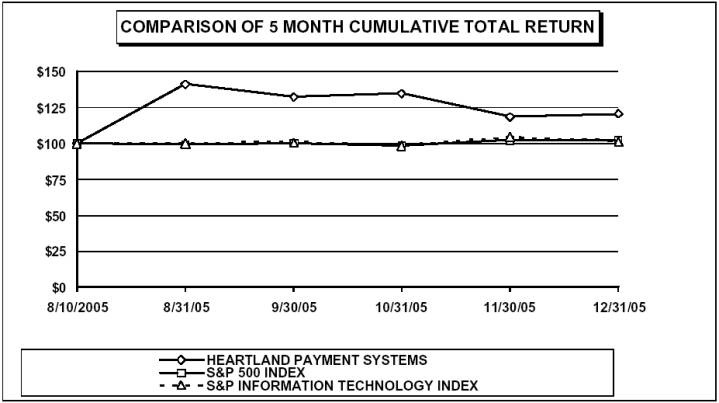

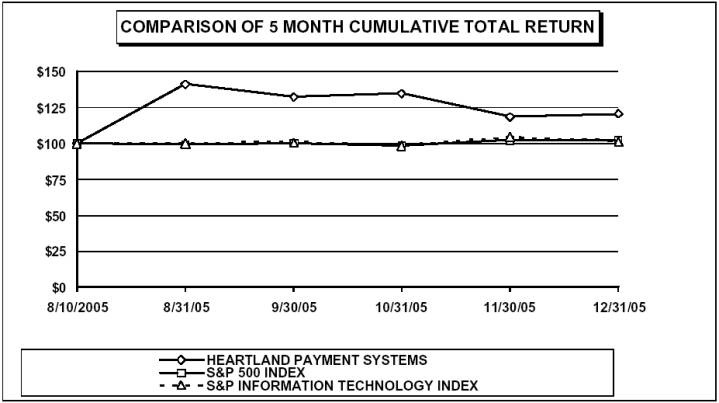

STOCKHOLDER RETURN ANALYSIS

The following graph compares the percentage change in cumulative total stockholder return on our common stock since August 10, 2005, the date our common stock was priced in connection with our initial public offering, with the cumulative total return over the same period of (i) the S&P 500 Index and (ii) the S&P Information Technology Index.

Pursuant to rules of the SEC, the comparison assumes $100 was invested on August 10, 2005 in our common stock and in each of the indices and assumes reinvestment of dividends, if any. Historical stock prices are not indicative of future stock price performance.

| | Heartland | | S&P 500 | | S&P Information

Technology | |

| |

| |

| |

| |

August 10, 2005 | | $ | 100.00 | | $ | 100.00 | | $ | 100.00 | |

August 31, 2005 | | $ | 141.00 | | $ | 99.50 | | $ | 100.17 | |

September 30, 2005 | | $ | 132.56 | | $ | 100.30 | | $ | 100.46 | |

October 31, 2005 | | $ | 134.56 | | $ | 98.63 | | $ | 98.25 | |

November 30, 2005 | | $ | 118.50 | | $ | 102.36 | | $ | 104.58 | |

December 31, 2005 | | $ | 120.33 | | $ | 102.39 | | $ | 101.53 | |

17

Stockholder Proposals To Be Presented At Next Annual Meeting

In order to be considered for inclusion in the proxy materials to be distributed in connection with next year’s Annual Meeting, we must receive stockholder proposals for such meeting at our principal office not less than one hundred fifty days prior to the date of the meeting and the proposal must satisfy the conditions established by the SEC for stockholder proposals. If a stockholder intends to submit a proposal at next year’s Annual Meeting, which proposal is not intended to be included in our proxy statement and form of proxy relating to that meeting, the stockholder must give appropriate notice to us not less than 120 calendar days before the date of our proxy statement released to our shareholders in connection with the 2006 Annual Meeting.

OTHER MATTERS

Expenses of Solicitation

The accompanying proxy is solicited by and on behalf of our Board of Directors, and the entire cost of such solicitation will be borne by us. Proxies may also be solicited by our Directors, officers and employees, without additional compensation, by personal interview, telephone and facsimile. Arrangements will be made with brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation material and annual reports to the beneficial owners of stock held of record by such persons, and we will reimburse them for reasonable out-of-pocket and clerical expenses incurred by them in connection therewith.

Discretionary Authority

The Annual Meeting is called for the specific purposes set forth in the Notice of Meeting and discussed above, and also for the purpose of transacting such other business as may properly come before the Annual Meeting. At the date of this Proxy Statement, we do not expect that any other matters will be submitted for consideration at the Annual Meeting other than those specifically referred to above. If any other matters properly come before the Annual Meeting, the proxy holders will be entitled to exercise discretionary authority to the extent permitted by applicable law.

| By Order of the Board of Directors, |

| |

| |

| /s/ Robert H.B. Baldwin, Jr. |

| |

|

| Chief Financial Officer and Corporate Secretary |

| Date: April 14, 2006 |

18

APPENDIX I

HEARTLAND PAYMENT SYSTEMS, INC.

AUDIT COMMITTEE CHARTER

Purpose of Committee

The Audit Committee (the “Committee”) is appointed by and generally acts on behalf of the Board of Directors (the “Board”) to assist the Board in monitoring (1) the integrity of the financial statements of Heartland Payment Systems, Inc. (the “Company”) and the Company’s financial reporting and disclosure practices; (2) the compliance by the Company with ethical policies and legal and regulatory requirements; (3) the appointment, compensation, qualifications, independence and performance of the Company’s internal and external auditors; (4) the performance of the Company’s internal audit function and (5) the financial reporting process and systems of internal accounting and internal control over financial reporting (the “Internal Controls”). The Committee shall also prepare an audit committee report as required by the Securities and Exchange Commission (the “SEC”) for inclusion in the Company’s annual proxy statement.

Committee Membership

The Committee shall be comprised of at least three directors, each of whom shall, in the business judgment of the Board, meet the independence requirements of the New York Stock Exchange, Inc. (the “NYSE”) and Section 10A(m)(3) of the Securities Exchange Act of 1934 (the “Exchange Act”), as amended, and each of whom shall not have participated in the preparation of the financial statements of the Company at any time during the past three years.

In addition, all of the Committee members must be “financially literate” and at least one member of the Committee must have “accounting or related financial management expertise,” as such qualifications are interpreted by the Board in its business judgment. The Board shall also determine whether any member of the Committee is an “audit committee financial expert,” as defined by rules of the SEC. If the Board has determined that a member of the Committee is an audit committee financial expert, it may presume that such member has accounting or related financial management expertise.

No director may serve a as member of the Committee if such director serves on the audit committees of more than two other public companies unless the Board determines that such simultaneous service would not impair the ability of such director to effectively serve on the Committee, and discloses this determination in the Company’s annual proxy statement.

The members of the Committee shall be appointed by the Board for such term or terms as the Board may determine in its discretion and serve at the pleasure of the Board. The Board shall appoint the Chairperson of the Committee.

Committee Duties and Responsibilities

| The Committee shall make regular reports to the Board. |

| | |

| The Committee shall: |

| | |

| 1. | Review with management and the independent auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Company’s financial statements. |

| 2. | Review with management and the independent auditor the Company’s annual audited financial statements and quarterly financial statements prior to the filing of the Company’s Forms 10-K and 10-Q, including (i) the results of the independent auditor’s reviews of such financial statements, (ii) major issues regarding accounting and auditing principles and practices, (iii) the adequacy of Company’s Internal Controls that could significantly affect the Company’s financial statements and (iv) the Company’s disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. |

1

| 3. | Discuss with management and the independent auditor, as appropriate, earnings press releases and financial information. |

| 4. | Recommend, for stockholder approval, the appointment of the independent auditor, which firm is ultimately accountable to the Committee and the Board. |

| 5. | Be directly responsible for the compensation, retention and oversight of the work of the independent auditor, who shall report directly to the Committee. |

| 6. | Resolve disagreements between management and the independent auditor regarding financial reporting. |

| 7. | Ensure that the independent auditor prepares and delivers annually an auditor’s statement (it being understood that the independent auditor is responsible for the accuracy and completeness of this statement), to discuss with the independent auditor any relationships or services disclosed in this statement that may impact the quality of audit services or the objectivity and independence of the Company’s independent auditors, and to recommend that the Board take appropriate action in response to the independent auditor’s report to satisfy itself of the independent auditor’s independence. |

| 8. | Review the experience and qualifications of the senior members of the independent auditor team and the quality control procedures of the independent auditor. |

| 9. | Review the experience and qualifications of the Company’s senior finance executives. |

| 10. | Review the appointment and retention of the senior internal auditing executive. |

| 11. | Meet with the senior internal auditing executive to discuss the internal auditing department’s significant reports to management and management’s responses thereto. |

| 12. | Approve all audit engagement fees to be paid to the independent auditor. |

| 13. | Evaluate together with the Board the performance of the independent auditor and, whether it is appropriate to rotate independent auditors on a regular basis, but in no event no less frequently than is required by law. If so determined by the Committee, recommend that the Board replace the independent auditor. |

| 14. | Establish policies for the hiring of employees and former employees of the independent auditor, taking into consideration any policies that the independent auditor may have in this regard. |

| 15. | Obtain from the independent auditor assurance that Section 10A of the Private Securities Litigation Reform Act of 1995 has not been implicated. |

| 16. | Pre-approve all audit services to be provided by the independent auditor. |

| 17. | Pre-approve all permitted non-audit services to be performed by the independent auditor and establish policies and procedures for the engagement of the independent auditor to provide permitted non-audit services. |

| 18. | Review and reassess the adequacy of this Charter and the independence of the independent auditor annually and recommend any proposed changes to the Board for approval. |

| 19. | Receive periodic reports from the independent auditor regarding the auditor’s independence consistent with Independence Standards Board Standard 1, discuss such reports with the auditor, and if so determined by the Committee, take or recommend that the full Board take appropriate action to oversee the independence of the auditor. |

| 20. | Review an analysis prepared by management and the independent auditor of significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements; |

| 21. | Meet periodically with management to review the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures; |

| 22. | Review major changes to the Company’s auditing and accounting principles and practices as suggested by the independent auditor, internal auditors or management; |

| 23. | Review the significant reports to management prepared by the internal auditing department and management’s responses. |

| 24. | Meet with the independent auditor prior to the audit to review the scope, planning and staffing of the audit. |

| 25. | Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. |

| 26. | Review with the independent auditor any problems or difficulties the auditor may have encountered and any management letter provided by the auditor and the Company’s response to that letter. |

2

| | | Such review should include: |

| | (a) | Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to required information; |

| | (b) | Any changes required in the planned scope of the internal audit; and |

| | (c) | The internal audit department responsibilities, budget and staffing. |

| 27. | Prepare the report required by the rules of the Securities and Exchange Commission to be included in the Company’s annual proxy statement. |

| 28. | Advise the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations and with the Company’s Code of Business Conduct and Ethics. |

| 29. | Meet at least annually with the chief financial officer, the senior internal auditing executive and the independent auditor in separate executive sessions. |

| 30. | Review all related-party transactions for potential conflict of interest situations. |

| 31. | Discuss with the Company’s management any significant legal, compliance or regulatory matters that may have a material effect on the financial statements or the Company’s business, financial statements or compliance policies, including material notices to or inquires received from governmental agencies. |

| 32. | Conduct an annual evaluation of the Committee’s performance in carrying out these duties and responsibilities, and prepare and issue the evaluation report required under “Performance Evaluation” below. |

| 33. | Establish procedures for the confidential and anonymous receipt, retention and treatment of complaints and concerns regarding the Company’s accounting, internal accounting controls and auditing matters. |

| 34. | Perform any other duties or responsibilities consistent with this Charter, the Company’s articles or incorporation and bylaws, each as from time to time amended and restated, and governing law as the Committee or the Board deems necessary or appropriate. |

Meetings and Reporting

The Committee shall meet in person or telephonically no less frequently than four per year, or more frequently as circumstances dictate. The Committee should meet separately periodically with management, the senior internal auditing executive and the independent auditor to discuss any matters that the Committee or any of these persons or firms believe should be discussed privately. The proceedings of all Committee meetings shall be reflected in written minutes, which shall be maintained with the records of proceedings of the Board. The Committee shall report to the Board at appropriate intervals (but no less than once per year) on the activities of the Committee and its findings.

The Committee is governed by the same rules regarding meetings (including meetings by teleconference or similar communications equipment), action without meetings, notice, waiver of notice, and quorum and voting requirements as are applicable to the Board, except that in the event of a tie vote on any issue, the Chairperson’s vote shall decide the issue. The Committee may request any officer or employee of the Company or the Company’s outside counsel or independent auditor to attend a meeting of the Committee or to meet with any members of, or advisors to, the Committee.

Performance Evaluation

The Committee shall prepare and review with the Board an annual performance evaluation of the Committee, which evaluation shall compare the performance of the Committee with the requirements of this Charter. The performance evaluation shall recommend to the Board any improvements to the Committee’s charter deemed necessary or desirable by the Committee. The performance evaluation by the Committee shall be conducted in such manner as the Committee deems appropriate. The report to the Board may take the form of an oral report by the Committee or any member thereof designated by the Committee to make such report.

Resources and Authority

The Committee shall have the resources and authority necessary to discharge its duties and responsibilities, including the authority to retain outside counsel or other experts or consultants, as it deems appropriate. The Committee shall have sole authority to approve related fees and retention terms.

3

Committee members shall receive no compensation other than for Board or Committee services.

Delegation to Subcommittee

The Committee may, in its discretion, delegate its authority in accordance with the Delaware General Corporation Law to subcommittees established by the Committee from time to time, which subcommittees will consist of one or more members of the Committee and shall report to the Committee.

Limitation of Audit Committee’s Role.

The Committee’s role is one of oversight. Management is responsible for preparing the Company’s financial statements, and the independent auditors are responsible for auditing those financial statements. Management is responsible for the fair presentation of the information set forth in the financial statements in conformity with GAAP. The independent auditor’s responsibility is to provide their opinion, based on their audits, that the financial statements fairly present, in all material respects, the financial position, results of operations and cash flows of the Company in conformity with GAAP. While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements and disclosures are complete and accurate and are in conformity with GAAP. Further, it is not the duty of the Audit Committee to assure compliance with applicable laws and regulations, the Corporation’s Code of Ethical Conduct or its environmental compliance program.

Adoption of Charter

This Charter was originally adopted by the Board of Directors on May 10, 2004.

4

PROXY

HEARTLAND PAYMENT SYSTEMS, INC.

90 NASSAU STREET

PRINCETON, NEW JERSEY 08542

The undersigned holder of Common Stock of Heartland Payment Systems, Inc. (the “Company”) hereby constitutes and appoints Robert O. Carr and Robert H.B. Baldwin, Jr. and each of them, attorneys and proxies with full power of substitution to each, for and in the name of the undersigned to vote the shares of Common Stock of the Company, which the undersigned would be entitled to vote if personally present at the Annual Meeting of Stockholders of the Company to be held at The Nassau Inn, 10 Palmer Square, Princeton, New Jersey 08540, on Monday, May 15, 2006 at 1:30 p.m., local time, or at any and all adjournments thereof, on all matters as may properly come before the meeting. The undersigned hereby revokes any and all proxies heretofore given with respect to such meetings.

Each of such attorneys and proxies present at the meeting shall and may exercise the powers granted hereunder.

Said attorneys are hereby instructed to vote as specified below. IF NO SPECIFICATION IS MADE, THIS PROXY WILL BE VOTED FOR ITEM 1 BELOW.

| 1. | Election of the following seven (7) nominees to serve as directors until the next Annual Meeting of Shareholders and until their successors are elected and qualified. |

Nominees: | | Robert O. Carr | | Robert H. Niehaus | | Jonathan J. Palmer |

| | Scott L. Bok | | Marc J. Ostro, Ph.D | | George F. Raymond |

| | Mitchell L. Hollin | | | | |

o FOR ALL NOMINEES | | o WITHHOLD AUTHORITY FOR ALL NOMINEES | |

|

| | | | TO WITHHOLD AUTHORITY FOR ANY INDIVIDUAL NOMINEE, WRITE THAT NOMINEE’S NAME IN THE SPACE PROVIDED ABOVE. |

| 2. | In their discretion, to vote upon such other matters as may properly come before the meeting. |

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

| Dated: _________________, 2006 |

| |

| |

|

|

| Signature |

| |

| |

|

|

| Signature(s) if held jointly |

Please sign your name as it appears hereon. In the case of joint owners or tenants in common, each should sign. If signing as a trustee, guardian or in any other representative capacity or on behalf of a corporation or partnership, please indicate your title.