EXHIBIT 2A

BARBARA K. CEGAVSKE Secretary of State

KIMBERLEY PERONDI

Deputy Secretary

for Commercial Recordings | STATE OF NEVADA

| Commercial Recordings Division 202 N. Carson Street Carson City, NV89701-4201 Telephone (775) 684-5708 Fax (775) 684-7138 |

| | OFFICE OF THE SECRETARY OF STATE | |

| RUSSELL KIDDER | | Job:C20190418-0414

April 18, 2019 |

| NV | | |

| Special | | Handling Instructions: |

24HR A&A EMAILED BACK R TUIN 4-18-2019

JOB#C20190418-0414

RKASSOCIATESLA@GMAIL.COM

Charges

| Description | | Document Number | | Filing Date/Time | | Qty | | Price | | Amount |

| Entity Copies | | 00011302311-92 | | | | | | | 69 | | | $ | 2.00 | | | $ | 138.00 | |

| 24-HR Copy Expedite | | 00011302311-92 | | | | | | | 1 | | | $ | 125.00 | | | $ | 125.00 | |

| Total | | | | | | | | | | | | | | | | $ | 263.00 | |

Payments

| Type | | Description | | Amount |

| Credit | | | 5556259499566010304060 | | | $ | 263.00 | |

| Total | | | | | | $ | 263.00 | |

| Credit Balance: | | | | | | $ | 0.00 | |

Job Contents:

NV Corp Copy Request Cover Letter

RUSSELL KIDDER

NV

BARBARA K. CEGAVSKE Secretary of State

KIMBERLEY PERONDI Deputy Secretary for Commercial Recordings | STATE OF NEVADA

| Commercial Recordings Division 202 N. Carson Street Carson City, NV 89701 -4201 Telephone (775) 684-5708 Fax(775) 684-7138 |

| | OFFICE OF THE

SECRETARY OF STATE | |

| Copy Request |

| | | April 18, 2019 |

| Job Number: | C20190418-0414 | |

| Reference Number: | 00011302311-92 | |

| Expedite: | | |

| Through Date: | | |

| Document Number(s) | Description | Number of Pages |

| C8085-2001-001 | Articles of Incorporation | 3 Pages/1 Copies |

| C8085-2001-004 | Amendment | 1 Pages/1 Copies |

| C8085-2001-005 | Amendment | 1 Pages/1 Copies |

| C8085-2001-006 | Amendment | 5 Pages/1 Copies |

| 20060816039-85 | Amendment | 1 Pages/1 Copies |

| 20090373285-29 | Amendment | 8 Pages/1 Copies |

| 20090622175-84 | Amendment | 2 Pages/1 Copies |

| 20120347156-81 | Amendment | 1 Pages/1 Copies |

| 20120496211-18 | Amendment | 1 Pages/1 Copies |

| 20130670341-07 | Certificate of Designation | 13 Pages/1 Copies |

| 20140139603-39 | Certificate of Correction | 15 Pages/1 Copies |

| 20180265185-18 | Certificate of Designation | 7 Pages/1 Copies |

| 20180279709-45 | Amendment | 1 Pages/1 Copies |

| 20180311196-32 | Certificate of Correction | 1 Pages/1 Copies |

| 20190083042-59 | Stock Split | 1 Pages/1 Copies |

| 20190151550-59 | Amended Designation | 4 Pages/1 Copies |

| 20190166807-60 | Certificate of Correction | 2 Pages/1 Copies |

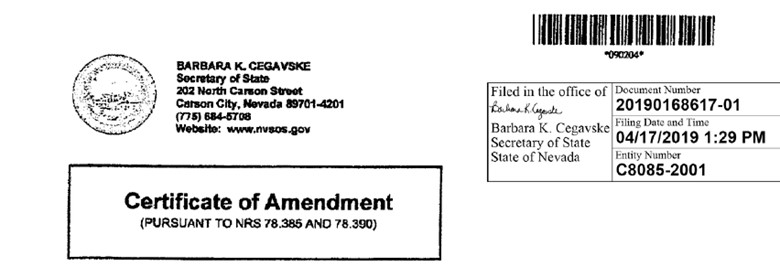

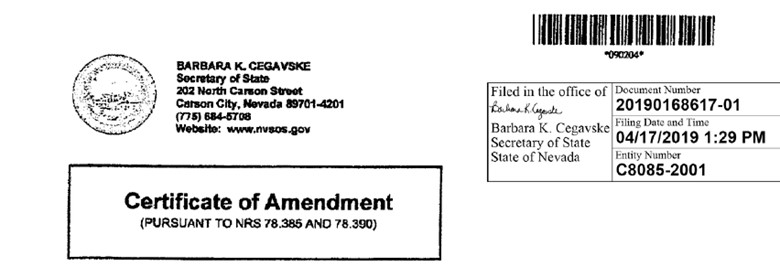

| 20190168617-01 | Amendment | 2 Pages/1 Copies |

Commercial Recording Division

202 N. Carson Street

Carson City, Nevada 897014201

Telephone (775) 684-5708

Fax (775) 684-7138

| | Respectfully, |

| |  |

| | |

| | Barbara K. Cegavske

Secretary of State |

ARTICLES OF INCORPORATION

OF

Superior Clean, Inc.

1. Name of Company:

Superior Clean, Inc.

2. Resident Agent:

| The resident agent of the Company is: | GoPublicToday.com, Inc.

1701 Valmora Street

Las Vegas, Nevada 89102 |

3. Board of Directors:

The Company shall initially have one director (1) who is Micah Gautier and whose address is 500 N. Rainbow Blvd. Suite 300 Las Vegas, MV 89107. This individual shall serve as director until their successor or successors have been elected and qualified. The number of directors may be increased or decreased by a duly adopted amendment to the By-Laws of the Corporation.

4. Authorized Shares:

The aggregate number of shares which the corporation shall have authority to issue shall consist of 20,000,000 shares of Common Stock having a $.001 par value, and 5,000,000 shares of Preferred Stock having a $.001 par value. The Common and/or Preferred Stock of the Company may be issued from time to time without prior approval by the stockholders. The Common and/or Preferred Stock may be issued for such consideration as may be fixed from time to time by the Board of Directors. The Board of Directors may issue such share of Common and/or Preferred Stock in one or more series, with such voting powers, designations, preferences and rights or qualifications, limitations or restrictions thereof as shall be stated in the resolution or resolutions.

5. Preemptive Rights and Assessment of Shares:

Holders of Common Stock or Preferred Stock of the corporation shall not have any preference, preemptive right or right of subscription to acquire shares of the corporation authorized, issued, or sold, or to be authorized, issued or sold, or to any obligations or shares authorized or issued or to be authorized or issued, and convertible into shares of the corporation, nor to any right of subscription thereto, other than to the extent, if any. the Board of Directors in its sole discretion, may determine from time to time.

The Common Stock of the Corporation, after the amount of the subscription price has been fully paid in, in money, property or services, as the directors shall determine, shall not he subject to assessment to pays the debts of the corporation, nor for any other purpose, and no Common Stock, issued as folly paid shall ever be assessable or assessed, and the Articles of Incorporation shall not be amended to provide for such assessment.

6. Directors’ and Officers’ Liability

A director or officer of the corporation shall not be personally liable to this corporation or its stockholders for damages for breach of fiduciary duty as a director or officer, but this Article shall not eliminate or limit the liability of a director or officer for (i) acts or omissions which involve intentional misconduct, fraud or a knowing violation of the law or (it) the unlawful payment of dividends. Any repeal or modification of this Article by stockholders of the corporation shall be prospective only, and shall not adversely affect any limitation on the personal liability of a director or officer of the corporation for acts or omissions prior to such repeal or modification.

7. Indemnity

Every person who was or is a parry to, or is threatened to be made a parry to, or is involved in any such action, suit or proceeding, whether civil, criminal, administrative or investigative, by the reason of the fact that be or she, or a person with whom he or she is a legal representative, is or was a director of the corporation, or who is serving at the request of the corporation as a director or officer of another corporation, or is a representative in a partnership, joint venture, trust or other enterprise, shall be indemnified and held harmless to the fullest extent legally permissible under die laws of the Slate of Nevada from time to time against all expenses, liability and loss (including attorneys’ fees, judgments, fines, and amounts paid or to be paid in a settlement) reasonably incurred or suffered by him or her in connection therewith. Such right of indemnification shall be a contract right which may be enforced in any manner desired by such person. The expenses of officers and directors incurred in defending a civil suit or proceeding must be paid by the corporation as incurred and in advance of the final disposition of the action. suit, or proceeding, under receipt of an undertaking by or on behalf of the director or officer to repay the amount if it is ultimately determined by a court of competent jurisdiction that he or she is not entitled to be indemnified by the corporation. Such right of indemnification shall not be exclusive of any other right of such directors, officers or representatives may have or hereafter acquire, and, without limiting the generality of such statement, they shall be entitled to their respective rights of indemnification under any bylaw, agreement, vote of stockholders, provision of law, or otherwise, as well as their rights under this article.

Without limiting the application of the foregoing, the Board of Directors may adopt By-Laws from time to time without respect to indemnification, to provide at all times the fullest indemnification permitted by the laws of the State of Nevada, and may cause the corporation to purchase or maintain insurance on behalf of any person who is or was a director or officer

8. Amendments

Subject at all times to the express provisions of Section 5 on the Assessment of Shares, this corporation reserves the right to amend, alter, change, or repeal any provision contained in these Articles of Incorporation or its By-Laws, in the manner now or hereafter prescribed by statute or the Articles of Incorporation or said By-Laws, and all rights conferred upon shareholders are granted subject to this reservation.

9. Power of Directors

In furtherance, and not in limitation of those powers conferred by statute, the Board of Directors is expressly authorized:

(a) Subject to the By-Laws, if any, adopted by the shareholders, to make, alter or repeal the By-Laws of the corporation;

(b) To authorize and caused to be executed mortgages and Hens, with or without limitations as to amount, upon the real and personal property of the corporation;

(c) To authorize the guaranty by the corporation of the securities, evidences of indebtedness and obligations of other persons, corporations or business entities;

(d) To set apart out of any funds of the corporation available for dividends a reserve or reserves for any proper purpose and to abolish any such reserve;

(e) By resolution adopted by the majority of the whole board, to designate one or more committees to consist of one or more directors of the of the corporation, which, to the extent provided on the resolution or in the By-Laws of the corporation, shall have and may exercise the powers of the Board of Directors in the management of the affairs of the corporation, and may authorize the seal of the corporation to be affixed to all papers which may require it. Such committee or committees shall have name and names as may be stated in the By-Laws of the corporation or as may be determined from time to time by resolution adopted by the Board of Directors.

All the corporate powers of the corporation shall be exercised by the Board of Directors except as otherwise herein or in the By-Laws or by law.

IN WITNESS WHEREOF, I hereunder set my hand this Thursday. March 29*, 2001 hereby declaring and certifying that the facts stated hereinabove are true.

Signature of Incorporator

| Name: | Stephen Brock | |

| Address: | 1701 Valmora Street Las Vegas, Nevada 89102 | |

| Signature: |  | |

Certificate of Acceptance of Appointment as Resident Agent: I. Stephen Brock, as the President of GoPublicToday.com, Inc. (GPT), hereby accept appointment of GPT as the resident agent for the above referenced company.

| | Signature: |  |

| | | Stephen Brock for GPT |

Registry Number: C8085-2001

Certificate of Amendment

to Articles of Incorporation

(Articles of Incorporation)

SUTERIORCLEAN, INC.

I, the undersigned being the Resident of SUPERIORCLEAN, INC, do hereby certify that a majority of the stockholders holding shares in SUPERIORCLEAN, INC., have voted in favor of:

1. That Article 4 of the original Articles of Incorporation is amended to read as follow*:

The aggregate number of shares which the corporation shall have authority to issue shall consist of 50,000,000 shares of Common Stock having a $.001 par value, and 5,000,000 shares of Preferred Stock having a $.001 par value. The Common and/or Preferred Stock of the Company may be issued from time to time without prior approval by the stockholders. The Common and/or Preferred Stock may be issued for such consideration as may be fixed from time to time by the Board of Directors. The Board of Directors may issue such mare of Common and/or Preferred Stock in one or more series, with such voting powers, designations, preferences and rights or qualifications, limitations or restrictions. thereof as shall be stated in the resolution or resolutions.

The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, as required by the provisions of the articles of incorporation, have voted in favor of the amendment is: 52%.

| 8/11/03 |

| Aldo Rotondi, President | Date |

Registry Number CS085-2001

Certificate of Amendment

to Articles of Incorporation

(Pursuant to NRS 78-385 and 78.390 - After Issuance of Stock)

SUPERIORCLEAN, INC.

I, the undersigned being the President of SUPERIORCLEAN, INC., do hereby certify that a majority of the stockholders holding shares in SUPERIORCLEAN, INC., have voted in favor of:

1. That Article 1 of the origin a! Armies of Incorporation is amended to read as follows:

“Megola, Inc.”

The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, as required by the provisions of the articles of incorporation, have voted in favor of the amendment is: 52%. .

| September 25, 2003 |

| Aldo Rotondi, President | Date |

Important Read attached instructions before completing form. ABOVE SPACE IS IS FOR OFFICE USE ONLY

(Pursuant to Nevada Revised Statutes Chapter 92A)

(excluding 92A.200(4b))

SUBMIT IN DUPLICATE

1) Name and jurisdiction of organization of each constituent entity (NRS 92A.2G0). If there are more than two constituent entities, check box ☐ and attach an 8 1/2” x 11” blank sheet listing the entities continued from article one.

| Megola, Inc. |

| Name of acquired entity | | |

| | | |

| Nevada | | Corporation |

| Jurisdiction | | Entity type* |

| | | |

| and. | | |

| | | |

| Megola, Inc. | | |

| Name of acquiring entity | | |

| | | |

| Ontario. Canada | | Corporation |

| Jurisdiction | | Entity type* |

2) The undersigned declares that a plan of exchange has bean adopted by each constituent entity (NRS 92A.200).

*Corporation, non-profit corporation, limited partnership, limited-liability limited partnership, limited-liability company or business trust

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

Important Read attached instructions before completing form.

ABOVE SPACE IS IS FOR OFFICE USE ONLY

3) Owners approval (NRS 92A.200)(options a, b, or c must be used for each entity) (if there are more than two constituent entities, check box ☐ and attach an 8 1/2” x 11” blank sheet listing the entities continued from article three);

| (a) | | Owner’s approval was not required from: |

| | | |

| | | Megola, Inc. |

| | | Name of acquired entity, if applicable |

| | | |

| | | arid, or, |

| | | |

| | | Name of acquiring entity, if applicable |

| | | |

| (b) | | The plan was approved by the required consent of the owners of*: |

| | | |

| | | Name of acquired entity, if applicable |

| | | |

| | | and, or, |

| | | |

| | | Megola, Inc. |

| | | Name of acquiring entity, if applicable |

• Unless otherwise provided in the certificate of trust or governing Instrument of a business trust an exchange must be approved by all the trustees and beneficial owners of each business trust that is a constituent entity in the exchange.

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

Important Read attached Instructions before completing form. ABOVE SPACE IS IS FOR OFFICE USE ONLY

(e) Approval of plan of exchange for Nevada non-profit corporation (NRS 92A.160):

The plan of exchange has been approved by the directors of the corporation and by each public officer or other person whose approval of the plan of exchange is required by the articles of incorporation of the domestic corporation.

| | | Name of acquired entity, if applicable |

| | | |

| | | arid, or, |

| | | |

| | | Name of acquiring entity, if applicable |

| | | |

| (4) | Location of Plan of Exchange (check a or b): |

| | | |

| ____ | (a) | The entire plan of exchange is attached; |

| | | |

| | | or, |

| | | |

| ☒ | (b) | The entire plan of exchange Is on file at the registered office of the acquiring corporation, limited-liability company or business trust or at the records office address if a limited partnership, or other place of business of the acquiring entity (NRS 92A-200). |

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

Important Read attached instructions before completing form. ABOVE SPACE IS IS FOR OFFICE USE ONLY

5) Effective date (optional)*:

6) Signatures - Must be signed by: An officer of each Nevada corporation; Ail general partners of each Nevada limited partnership; All general partners of each Nevada limited partnership; A manager of each Nevada limited-liability company with managers or all the members if there are no managers; A trustee of each Nevada business trust (NRS 92A230)** (if there are more than two constituent entities, check box ☐ and attach an 8” x 11” blank sheet listing the entities continued from article eight):

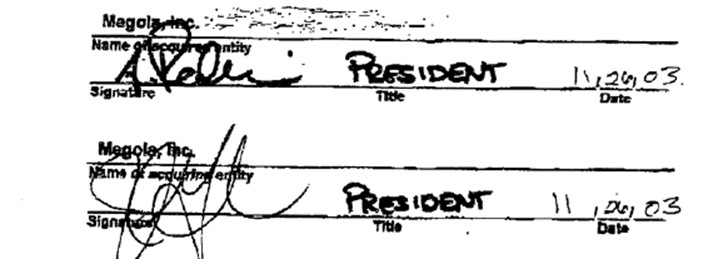

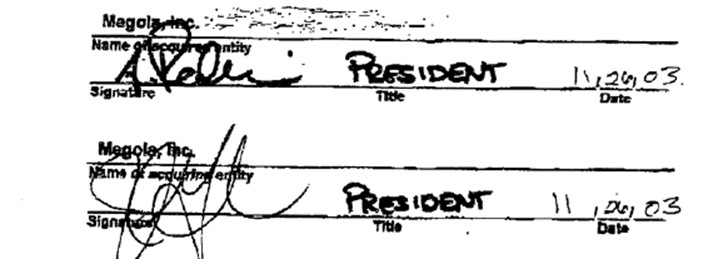

| Megola, Inc. |

| Name of acquired entity |

| |

| |

| Signature | Title | Date |

| |

| Megola, inc. |

| Name of acquiring entity |

| |

| |

| Signature | Title | Date |

* An exchange takes effect upon filing the articles of exchange or upon a later date as specified In the articles, which must not be more than 90 days after the articles are filed (NRS 92A.240).

“The articles of exchange must be signed by each foreign constituent entity in the manner provided by the law governing It (NRS 92A.230). Additional signature blocks may be added to this page or as an attachment as needed.

IMPORTANT: Failure to include any of the above information and submit the proper feet may cause this filing to be rejected.

FILING FEE: $350.00

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

Important Read attached instructions before completing form. ABOVE SPACE IS IS FOR OFFICE USE ONLY

7) Effective date (optional) : ______________________

8) Signatures – Must be signed by : An officer of each Nevada corporation; All general Partners of each Nevada limited partnership; All general partners of each Nevada limited partnership; A manager of each Nevada limited-liability company with managers or as the members if there are no managers; A trustee of each Nevada business trust (NRS 92A.230)** (If there are more than two constituent entities, check box ☐ and attach an 8 1/2” x 11” blank sheet listing the entities continued from article right):

* An exchange takes effect upon filing the articles of exchanges or upon a later date as specified in the articles which must not be more than 80 days after the articles are filed (NRS 92A.240).

* The articles of exchange must be signed by each foreign constituent entity in the manner provided by the law governing (NRS 92A.230). Additional signature blocks may be added to this page or as an attachment, as needed.

IMPORTANT: Failure to include any of the above information and submit the proper fees may cause this filing to be rejected.

FILING FEE: $350.00

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

Important: Read attached instructions before completing form. ABOVE SPACE IS FOR OFFICE USE ONLY

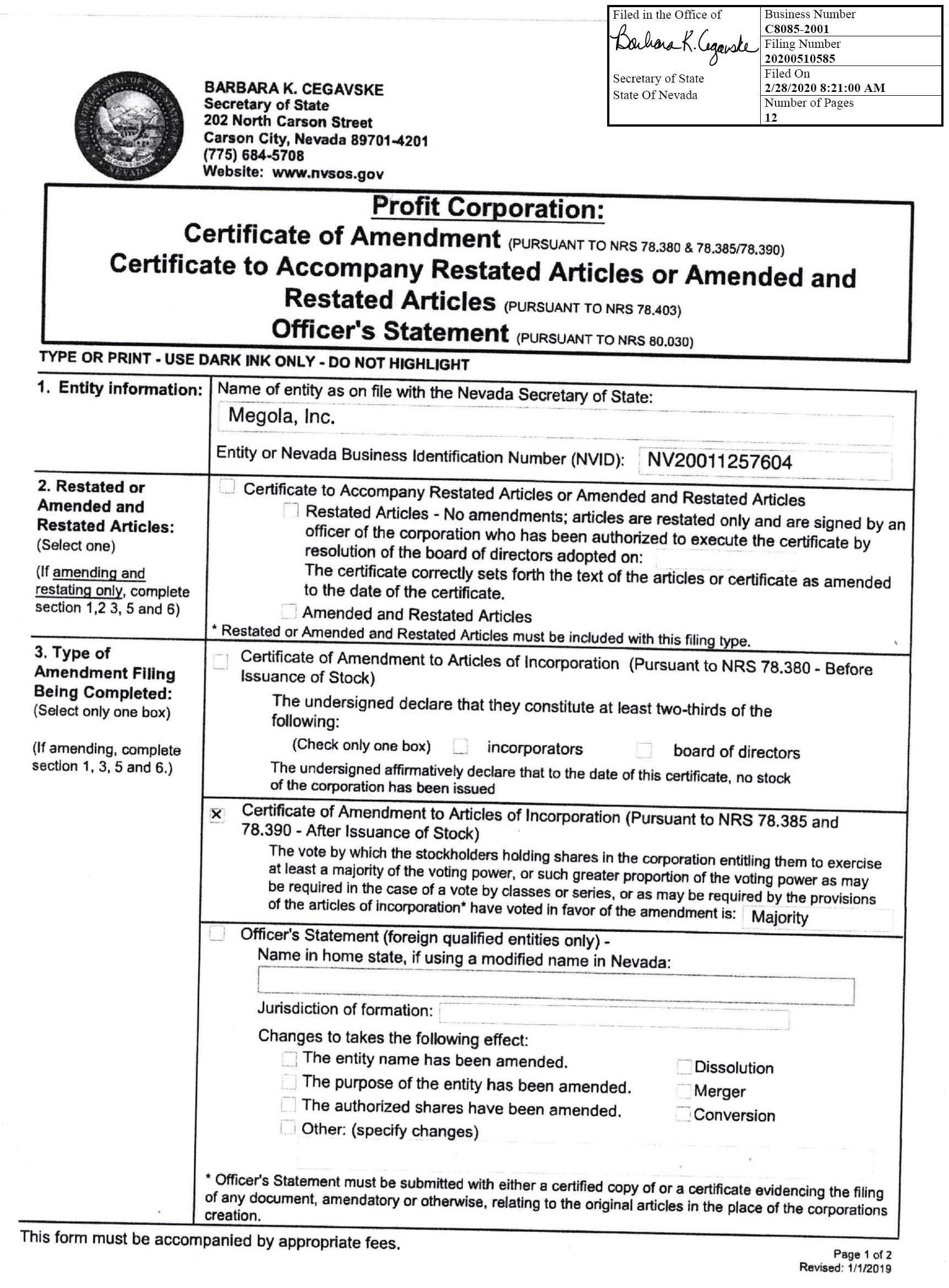

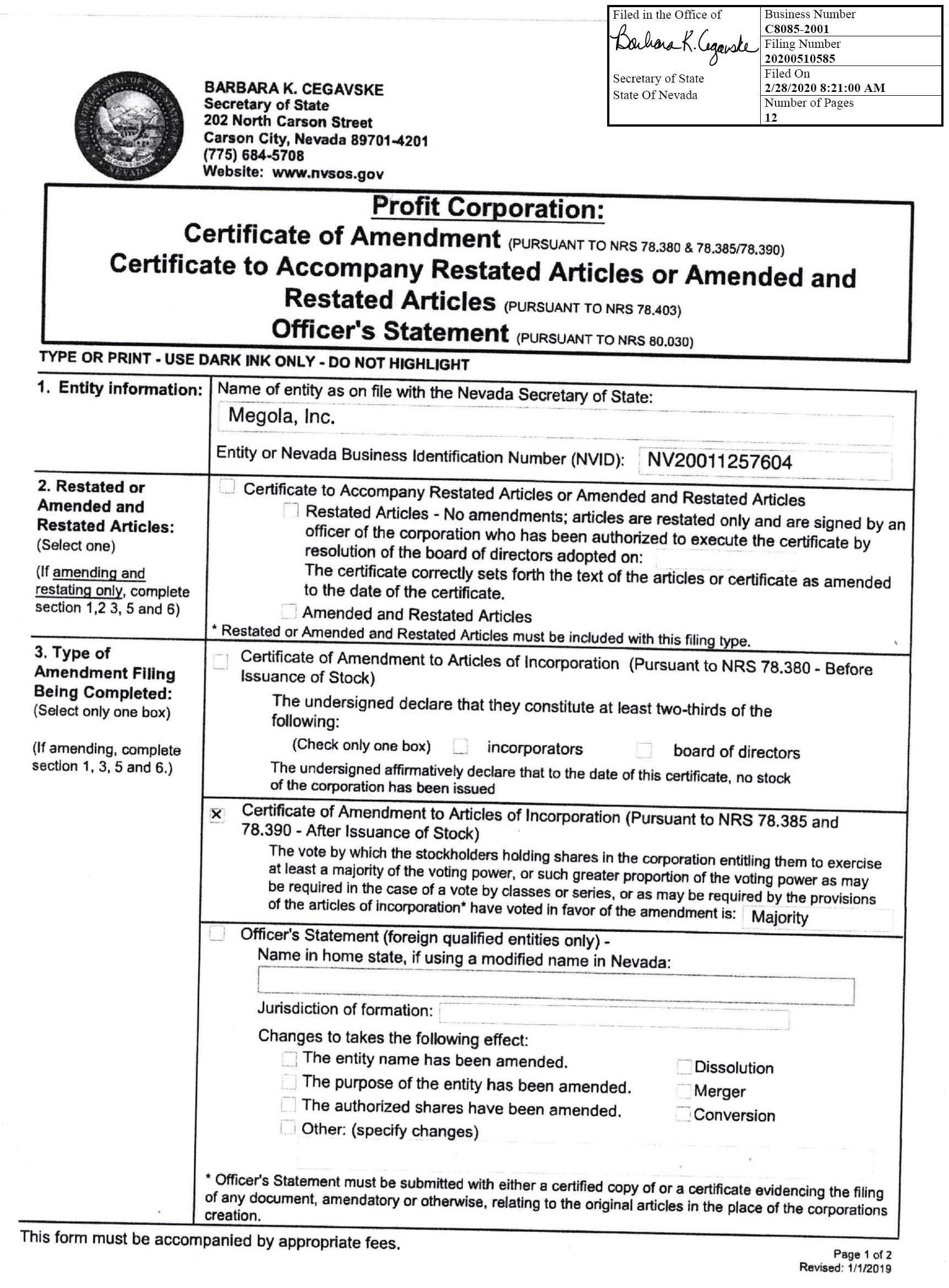

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 – After Issuance of Stock)

| 1. | Name of corporation: Megola Inc |

| 2. | The articles have been amended as follows (provide article numbers, if available): |

Article 3

Currently shows $55,000,000

Please amend to show $200,000,000

$ 0.001 per value

| 3. | The vote by which the stockholders holding shares in the corporation entitling them to exercise at least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation have voted in favor of the amendment is: 51.8% |

| 4. | Effective date of filing (optional): |

| 5. | Officer Signatures (required): /s/ signature |

*If any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless of limitations or restrictions on the voting power thereof.

IMPORTANT: Failure to include any of the above information and submit the proper Fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporation

(Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

1. Name of corporation:

Megola, Inc.

2. The articles have been amended as follows: (provide article numbers, if available)

By adding the attached CERTIFICATE OF DESIGNATION, PREFERENCES AND RIGHTS of SERIES A AND SERIES B CONVERTIBLE PREFERRED STOCK to the Articles of Incorporation section authorizing stock.

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise a least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of Incorporation* have voted In favor of the amendment is: Not required

| 4. | Effective date of filing: (optional) (must not be later than 90 days after the certificate is filed) |

5. Signature: (required)

X | |

| Signature of Officer | |

*If any proposed amendment would after or change any preference or any relative or other right given to any class or series of outstanding shares, the* the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT: Failure to include any of the above Information and submit with the proper fees may cause this filling to be rejected.

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

ARTICLES OF AMENDMENT TO

ARTICLES OF INCORPORATION OF

MEGOLA, INC

CERTIFICATE OF DESIGNATION,

PREFERENCES AND RIGHTS

of

SERIES A AND SERIES B CONVERTIBLE PREFERRED STOCK

Megola, Inc., a corporation organized and existing under the laws of the State of Nevada (the “Corporation”), hereby certifies that the Board of Directors of the Corporation (the “Board of Directors” or the “Board”), pursuant to authority of the Board of Directors as required by applicable corporate law, and in accordance with the provisions of its Certificate of Incorporation and Bylaws, has and hereby authorizes a series of the Corporation’s previously authorized Preferred Stock, par value $0,001 per share (the “Preferred Stock”), and hereby states the designation and number of shares, and fixes the rights, preferences, privileges, powers and restrictions thereof, as follows:

SERIES A PREFERRED STOCK DESIGNATION AND AMOUNT

3,500,000 shares of the authorized and unissued Preferred Stock of the Corporation are hereby designated “Series A Convertible Preferred Stock” with the following rights, preferences, powers, privileges, restrictions, qualifications and limitations.

1. Stated Value. For every twenty five (25) shares of the Company’s Common Stock tendered in Company’s April 2009 Exchange Offer (the “Exchange Offer”) to exchange Series A Convertible Preferred Stock for shares of common stock, the holder of such Common Stock will receive one (1) share of the Company’s Series A Convertible Preferred Stock. The stated value of each issued share of Series A Convertible Preferred Stock shall be deemed to be $5.00 (me “Stated Value”).

2. Dividends. No dividends are payable on the Series A Convertible Preferred Stock.

3. Voting. On any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation (or by written consent of stockholders in lieu of a meeting), each holder of outstanding shares of Series A Convertible Preferred Stock shall be entitled to cast one hundred (100) votes for each Series A Convertible Preferred Stock, Except as Provided by law, holders of Series A Convertible Preferred Stock shall vote together with the holders of Common Stock, and with the holders of any other series of Preferred Stock the terms of which so provide, together as a single class.

4. Liquidation, Dissolution, or Winding-Up; Certain Mergers, Consolidations and Asset Sales.

a. Payments to Holders of Series A Convertible Preferred Stock. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, the holders of the shares of Series A Convertible Preferred Stock shall be paid, before any payment shall be paid to the holders of Common Stock, or any other stock ranking on liquidation junior to me Series A Convertible Preferred Stock, an amount for each share of Series A Convertible Preferred Stock held by such holder equal to the Stated Value.

b. Payments to Holders of Junior Stock. After the payment of all preferential amounts required to be paid to the holders of the Series A Convertible Preferred Stock and any other class or series of stock of the Corporation ranking on liquidation senior to or on a parity with the Series A Convertible Preferred Stock, the holders of shares of Junior Stock then outstanding shall be entitled to receive the remaining assets of the Corporation available for distribution to its stockholders as otherwise set forth in the Certificate of Incorporation.

5. Optional Conversion. The holders of Series A Convertible Preferred Shares shall have the conversion rights as follows (the “Conversion Rights”).

(e) Right to Convert. Each share of Series A Convertible Preferred Stock shall be convertible, at the option of the holder thereof, at any time after the “Conversion Date” (as defined in Section 9 below), and without the payment of additional consideration by the holder Thereof, into such number of fully-paid and nonassessable shares of Common Stock as is determined by dividing (1) the Stated Value per share by (2) the Series A Conversion Price in effect at the time of conversion. The “Series A Conversion Price” shall be $0.20 per share or the “Value of the Common Stock” at the time of conversion, whichever is less. That “Value of the Common Stock” will be equal to the average “Closing Price” (as defined in Section 9 below) of the Common Stock for each of the ten (10) consecutive trading days immediately prior to the date of conversion. The Series A Conversion Price, and the rate at which shares of Series A Convertible Preferred Stock may be converted into shares of Common Stock, shall not be subject to further adjustment.

(b) Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series A Convertible Preferred Stock. In lieu of any fractional shares to which the holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied by the fair market value of a share of Common Stock as determined in good faith by the Board of Directors, or round-up to the next whole number of shares, at the Corporation’s option. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of die total number of shares of Series A Convertible Preferred Stock the holder is at the time converting into Common Stock and die aggregate number of shares of Common Stock issuable upon such conversion.

(c) Mechanics of Conversion.

(i) For a holder of Series A Convertible Preferred Stock to voluntarily convert shares of Series A Convertible Preferred Stock into shares of Common Stock, that holder shall surrender die certificate or certificates for such shares of Series A Convertible Preferred Stock (or, if the registered holder alleges that such certificate has been lost, stolen, or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against die Corporation on account of the alleged loss, theft, or destruction of such certificate) at the office of the transfer agent for the Series A Convertible Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent), together with written notice that the holder elects to convert all or any number of the shares of the Series A Convertible Preferred Stock represented by such certificate or certificates and, if applicable, any event on which such conversion is contingent The notice shall state the holder’s name or the names of the nominees issued. If required by the Corporation, certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the registered holder or his, her, or its attorney duly authorized in writing. The close of business on the date of receipt by the transfer agent of such certificates (or lost certificate affidavit and agreement) and notice (or by the Corporation if the Corporation serves as its own transfer agent) shall be the time of conversion (the “Conversion Time”), and the shares of Common Stock issuable upon conversion of die shares represented by such certificate shall be deemed to be outstanding of record as of that date. The Corporation shall, as soon as practicable after me Conversion Time, issue and deliver at such office to the holder of Series A Convertible Preferred Stock, or to his, her, or its nominee(s), a certificate or certificates for the number of shares of Common Stock to which the holders) shall be entitled, together with cash in lieu of any fraction of a share.

(ii) The Corporation shall at all times while the Series A Convertible Preferred Stock is outstanding, reserve and keep available out of its authorized but unissued stock, for the purpose of effecting the conversion of the Series A Convertible Preferred Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding Series A Convertible Preferred Stock; and if, at any time, the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then-outstanding shares of the Series A Convertible Preferred Stock, die Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stack to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation.

(iii) All shares of Series A Convertible Preferred Stock that shall have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding, and all rights with respect to such shares, including the rights, if any, to receive notices, to vote, and to receive payment of any dividends accrued or declared but unpaid thereon, shall immediately cease and terminate at the Conversion Time, except only the right of the holders thereof to receive shares of Common Stock in exchange therefor. Any shares of Series A Convertible Preferred Stock so converted shall be retired and cancelled and shall not be reissued as shares of such series, and the Corporation (without the need for stockholder action) may from time to time take such appropriate action as may be necessary to reduce the authorized number of shares of Series A Convertible Preferred Stock accordingly.

(iv) The holders of Series A Convertible Preferred Stock shall pay any and all issue and other similar taxes that may be payable in respect of any issuance or delivery of shares of Common Stock upon conversion of shares of Series A Convertible Preferred Stock pursuant to this Section 5.

6. Mandatory Conversion. The Corporation has the right on any date 24 months after the date of issue of the Series A Convertible Preferred Stock, after giving 60 days prior written notice, (the “Mandatory Conversion Date”) to cause the Series A Convertible Preferred Stock not then converted to convert into a number of fully paid and nonassessable shares of Common Stock at the Series A Conversion Price as provided in Section 5 above. The procedures for Mandatory Conversion shall be similar to those for Voluntary Conversion set forth in Section 5 above, except the transaction shall be mandatory and not voluntary.

7. Intentionally omitted

8. Waiver. Any of the rights, powers, or preferences of the holders of Series A Convertible Preferred Stock set forth herein may be waived by the affirmative consent or vote of the holders of at least a majority of the shares of Series A Convertible Preferred Stock then outstanding.

9. Definitions. As used herein, the following terms shall have the following meanings:

a. “Affiliate” means with respect to any individual, corporation, partnership, association, trust, or any other entity (in each case, a “Person”), any Person that, directly or indirectly, Controls, is Controlled by, or is under common Control with such Person, including without limitation, any general partner, executive officer, or director of such Person or any holder of ten percent or more of the outstanding equity or voting power of such Person.

b. “Closing Price” for any day means: (i) the average closing bid price of the Common Stock on the ten prior trading days on die principal securities exchange on which the Common Stock is then listed or admitted to trading or on Nasdaq, as applicable, (ii) if on such day such shares of Common Stock are not then listed or admitted to trading on any securities exchange or system, the average closing bid price of the Common Stock on the ten prior trading days for the Common Stock in the domestic over-the-counter market as reported on the Over die Counter Bulletin Board (the “OTCBB”), or, (iii) if on such ten day period such shares of Common Stock are not then listed or admitted to trading on any securities exchange or system, the average closing bid price of the Common Stock on the ten prior trading days for the Common Stock in the domestic over-the-counter market as reported on the by the National Quotation Bureau, Incorporated, or any other successor organization. If at any time such shares of Common Stock are not listed on any domestic exchange or quoted in the NASDAQ System or the domestic over-the-counter market or reported in the “Pink Sheets,” the Closing Price shall be the fair market value thereof determined by an independent appraiser selected in good faith by die Board of Directors.

c. “Control” means me possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership of voting securities, by agreement or otherwise).

d. “Conversion Date” shall mean 12 months from the closing date of the Exchange Offer.

e. “Person” shall mean any individual, partnership, firm, corporation, association, trust, unincorporated organization or other entity, as well as any syndicate or group that would be deemed to be a person under Section 13(dX3) of the Securities Exchange Act of 1934, as amended.

f. “Trading Day” means a day on which the securities exchange, association, or quotation system on which shares of Common Stock are listed for trading shall be open for business or, if the shares of Common Stock shall not be listed on such exchange, association, or quotation system for such day, a day with respect to which trades in the United States domestic over-the-counter market shall be reported.

SERIES B PREFERRED STOCK DESIGNATION AND AMOUNT

1,500,000 shares of the authorized and unissued Preferred Stock of the Corporation are hereby designated “Series B Convertible Preferred Stock” with the following rights, preferences, powers, privileges, restrictions, qualifications and limitations.

1. Stated Value. For every ten dollars ($10.00) of Debt of Megola to you tendered in Company’s April 2009 Debt Exchange Offer (the “Exchange Offer”) to exchange Series B Convertible Preferred Stock for Debt of Megola, Megola will issue one (1) share of the Company’s Series B Convertible Preferred Stock. The stated value of each issued share of Series B Convertible Preferred Stock shall be deemed to be ten dollars ($10.00) (the “Stated Value”).

2. Dividends. No dividends are payable on the Series B Convertible Preferred Stock.

3. Voting. The Series B Convertible Preferred Stock has no voting rights.

4. Liquidation. Dissolution, or Winding-Up: Certain Mergers. Consolidations and Asset Sales.

a. Payments to Holders of Series B Convertible Preferred Stock. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, the holders of the shares of Series B Convertible Preferred Stock shall be paid, before any payment shall be paid to the holders of Common Stock, or any other stock ranking on liquidation junior to the Series B Convertible Preferred Stock, an amount for each share of Series B Convertible Preferred Stock held by such holder equal to the Stated Value.

b. Payments to Holders of Junior Stock. After the payment of all preferential amounts required to be paid to the holders of the Series B Convertible Preferred Stock and any other class or series of stock of the Corporation ranking on liquidation senior to or on a parity with the Series B Convertible Preferred Stock, the holders of shares of Junior Stock then outstanding shall be entitled to receive the remaining assets of the Corporation available for distribution to its stockholders as otherwise set forth in the Certificate of Incorporation.

5. Optional Conversion. The holders of Series B Convertible Preferred Shares shall have the conversion rights as follows (the “Conversion Rights”).

(a) Right to Convert. Each share of Series B Convertible Preferred Stock shall be convertible, at the option of the holder thereof, at any time after the “Conversion Date” (as defined below), and without the payment of additional consideration by the holder thereof, into such number of fully-paid and nonassessable shares of Common Stock as is determined by dividing (1) the Stated Value per share by (2) the Series B Conversion Price in effect at the time of conversion. The “Series B Conversion Price” shall be $0.10 per share or the “ Value of the Common Stock” at the time of conversion, whichever is less. That” Value of the Common Stock” will be equal to the average “Closing Price” (as defined in Section 9 below) of the Common Stock for each of the ten (10) consecutive trading days immediately prior to the date of conversion. The Series B Conversion Price, and the rate at which shares of Series B Convertible Preferred Stock may be converted into shares of Common Stock, shall not be subject to further adjustment.

(b) Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series B Convertible Preferred Stock. In lieu of any fractional shares to which the holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied by the fair market value of a share of Common Stock as determined in good faith by the Board of Directors, or round-up to the next whole number of shares, at the Corporation’s option. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series B Convertible Preferred Stock the holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable upon such conversion.

(c) Mechanics of Conversion.

(i) For a holder of Series B Convertible Preferred Stock to voluntarily convert shares of Series B Convertible Preferred Stock into shares of Common Stock, that holder shall surrender the certificate or certificates for such shares of Series B Convertible Preferred Stock (or, if the registered holder alleges mat such certificate has been lost, stolen, or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft, or destruction of such certificate), at the office of the transfer agent for the Series B Convertible Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent), together with written notice that the holder elects to convert all or any number of the shares of the Series B Convertible Preferred Stock represented by such certificate or certificates and, if applicable, any event on which such conversion is contingent. The notice shall state the holder’s name or die names of the nominees in which the bolder wishes the certificate or certificates for shares of Common Stock to be issued. If required by the Corporation, certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the registered holder or his, her, or its attorney duly authorized in writing. The close of business on the date of receipt by the transfer agent of such certificates (or lost certificate affidavit and agreement) and notice (or by the Corporation if the Corporation serves as its own transfer agent) shall be me time of conversion (the “Conversion Time”), and the shares of Common Stock issuable upon conversion of the shares represented by such certificate shall be deemed to be outstanding of record as of that date. The Corporation shall, as soon as practicable after die Conversion Time, issue and deliver at such office to die holder of Series B Convertible Preferred Stock, or to his, her, or its nominee(s), a certificate or certificates for the number of shares of Common Stock to which the holders) shall be entitled, together with cash in lieu of any fraction of a share.

(ii) The Corporation shall at all times while the Series B Convertible Preferred Stock is outstanding, reserve and keep available out of its authorized but unissued stock, for the purpose of effecting the conversion of the Series B Convertible Preferred Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding Series B Convertible Preferred Stock; and if, at any time, me number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then-outstanding shares of the Series B Convertible Preferred Stock, the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation.

(iii) All shares of Series B Convertible Preferred Stock that shall have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding, and all rights with respect to such shares, including the rights, if any, to receive notices, to vote, and to receive payment of any dividends accrued or declared but unpaid thereon, shall immediately cease and terminate at the Conversion Time, except only die right of the holders thereof to receive shares of Common Stock in exchange therefor. Any shares of Series B Convertible Preferred Stock so converted shall be retired and cancelled and shall not be reissued as shares of such series, and the Corporation (without the need for stockholder action) may from time to time take such appropriate action as may be necessary to reduce the authorized number of shares of Series B Convertible Preferred Stock accordingly.

(iv) Upon any such conversion, no adjustment to the Series B Conversion Price shall be made for any accrued or declared but unpaid dividends on the Series B Convertible Preferred Stock surrendered for conversion or on the Common Stock delivered upon conversion.

(v) The holders of Series B Convertible Preferred Stock shall pay any and all issue and other similar taxes that may be payable in respect of any issuance or delivery of shares of Common Stock upon conversion of shares of Series B Convertible Preferred Stock pursuant to this Section 5.

6._Mandatory Conversion, The Corporation has the right on any date 24 months after the date of issue of the Series B Convertible Preferred Stock, after giving 60 days prior written notice, (the “Mandatory Conversion Date”) to cause the Series B Convertible Preferred Stock not then converted to convert into a number of fully paid and nonassessable shares of Common Stock at the Series B Conversion Price as provided in Section 5 above. The procedures for Mandatory Conversion shall be similar to those for Voluntary Conversion set forth in Section 5 above, except the transaction shall be mandatory and not voluntary.

7. Definitions. As used herein, the following terms shall have the following meanings:

a. “Affiliate” means with respect to any individual, corporation, partnership, association, trust, or any other entity (in each case, a “Person”), any Person that, directly or indirectly. Controls, is Controlled by, or is under common Control with such Person, including without limitation, any general partner, executive officer, or director of such Person or any holder often percent or more of the outstanding equity or voting power of such Person,

b. “Closing Price” for any day means: (i) the average closing bid price of the Common Stock on the ten prior trading days on the principal securities exchange on which the Common Stock is then listed or admitted to trading or on Nasdaq, as applicable, (ii) if on such day such shares of Common Stock are not then listed or admitted to trading on any securities exchange or system, the average closing bid price of the Common Stock on the ten prior trading days for the Common Stock in the domestic over-the-counter market as reported on the Over the Counter Bulletin Board (the “OTCBB”), or, (iii) if on such ten day period such shares of Common Stock are not then listed or admitted to trading on any securities exchange or system, the average closing bid price of the Common Stock on the ten prior trading days for the Common Stock in the domestic over-the-counter market as reported on the by the National Quotation Bureau, Incorporated, or any other successor organization. If at any time such shares of Common Stock are not listed on any domestic exchange or quoted in the NASDAQ System or the domestic over- the-counter market or reported in the “Pink Sheets,” the Closing Price shall be the fair market value thereof determined by an independent appraiser selected in good faith by the Board of Directors.

c. “Control” means the possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership of voting securities, by agreement or otherwise).

d. “Conversion Date” shall mean 12 months from the closing date of the Exchange Offer.

e. “Person” shall mean any individual, partnership, firm, corporation, association, trust, unincorporated organization or other entity, as well as any syndicate or group that would be deemed to be a person under Section 13(dX3) of the Securities Exchange Act of 1934, as amended.

f. “Trading Day” means a day on which the securities exchange, association, or quotation system on which shares of Common Stock are listed for trading shall be open for business or, if the shares of Common Stock shall not be listed on such exchange, association, or quotation system for such day, a day with respect to which trades in the United States domestic over-the-counter market shall be reported.

[signature page follows]

IN WITNESS WHEREOF, this Certificate of Designation has been executed by a duly authorized officer of the Corporation on this 24 day of April, 2009.

| | MEGOLA INC. |

| | |

| | By: |  |

| | | Name: Joe E Gardner Title: President C.E.0 |

Certificate of Amendment to Articles of incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

1. Name of corporation:

Megola lnc.

2. The articles have been amended as follows: (provide article numbers, if available)

By adding the attached CERTIFICATE OF AMENDMENT TO MEGOLA, INC. CERTIFICATE OF DESIGNATION, PREFERENCES AND RIGHTS OF SERIES A AND SERIES B CONVERTIBLE PREFERRED STOCK to the Articles of Incorporation section authorizing stock.

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise a least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is:

Not required

4. Effective date of filing: (optional)

(must not be later than 90 days after the certificate is filed)

5. Signature: (required)

X  | |

| Signature of Officer | |

*lf any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

CERTIFICATE OF AMENDMENT TO

MEGOLA, INC.

CERTIFICATE OF DESIGNATION, PREFERENCES AND RIGHTS OF SERIES A

AND SERIES B CONVERTIBLE PREFERRED STOCK

Megola, Inc., a corporation organized and existing under the laws of the State of Nevada (the “Corporation”), does hereby certify that:

1. The following resolutions were duly adopted by an action of the Board of Directors of the Corporation, pursuant to the authority conferred upon the Board of Directors by the provisions of the Articles of Incorporation of the Corporation, as amended:

RESOLVED, that the provisions of the Articles of Amendment to Articles of Incorporation of Megola, Inc. Certificate of Designation, Preferences and Rights of Series A and Series B Convertible Preferred Stock, filed with the State of Nevada on April 28, 2009 (the “Certificate of Designation”), shall be amended by adding the following Section 5(d) after Section 5(c) of the Certificate of Designation in the Section entitled “Series B Preferred Stock Designation and Amount”:

“Notwithstanding anything to the contrary set forth herein, at no time may a holder of Series B Convertible Preferred Stock convert all or a portion of such holder’s shares of Series B Convertible Preferred Stock if the number of shares of Common Stock to be issued pursuant to such conversion, when aggregated with all other shares of Common Stock owned by such holder at such time, would result in the holder beneficially owning (as determined in accordance with Section 13(d) of the Exchange Act and the rules thereunder) in excess of 9.9% of the Common Stock issued and outstanding at such time.”

2. Such resolution also was duly approved by written consent of the holders of a majority of the outstanding shares of Series A Convertible Preferred Stock (as defined in the Certificate of Designation) and the Series B Convertible Preferred Stock (as defined in the Certificate of Designation) issued pursuant to the Certificate of Designation.

3. This amendment to the Certificate of Designation was duly adopted in accordance with the provisions of Section 78.1955 of the corporate law of the State of Nevada.

IN WITNESS WHEREOF, Megola, Inc. has caused this Certificate of Amendment to be executed this 17th day of August, 2009.

| | MEGOLA, INC. |

| | |

| | By: |  |

| | Name: | |

| | Title: | |

USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 78.385 and 78.390 - After Issuance of Stock)

1. Name of corporation:

MEGOLA, INC.

2. The articles have been amended as follows: (provide article numbers, if available)

Upon the effectiveness of the amendment contained in this Certificate of Amendment (the “Effective Date”) each fifty (50) shares of Common Stock, par value $.001 per share, of this Corporation’s issued and outstanding Common Stock at the close of business on the Effective Date shall be converted into one (1) I share of fully paid and nonassessable Common Stock, without change in the aggregate number of shares of I Common Stock this Corporation shall be authorized to issue pursuant to this Article 3. Each stockholder who would be entitled to a fraction of a share of Common Stock as a result of the conversion (the “Share Fraction”) will be rounded up to next nearest share.

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise a least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: 51.059%

Effective date and time of filing: (optional) Date: Time:

(must not be later than 90 days after the certificate is filed)

5. Signature/(required)

X  | |

| Signature of Officer | |

*lf any proposed amendment would alter or change any preference or any relative or other right given to any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY

Certificate of Amendment to Articles of Incorporation

For Nevada Profit Corporations

(Pursuant to NRS 781385 and 78.390 - After Issuance of Stock)

1. Name of corporation:

MEGOLA, INC

2. The articles have been amended as follows: (provide article numbers, if available)

1,500,000 Series B Convertible Preferred stock (stated value $10 per share) designation and| amount 4a) Right to Convert to Common shares:

Series B Convertible Preferred Stock conversion price to Common Shares shall be amended change the conversion price of $. 10 (ten cents) to .$05 (five cents)

Currently there are 367,879 preferred shires with stated value of $10 per share issued to date

Nothing herein shall prevent any officer, director or affiliate of the corporation from convert all of his or her series b preferred stock to common stock.

3. The vote by which the stockholder holding shares in the corporation entitling hereto exercise a least a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment is: 65%

4. Effective date and time of filing: (optional) Date: Time:

(must not be later than 90 days after the certificate is filed)

5. Signature: (required)

X | |

| Signature of Officer | |

*If any proposed/amendment would alter or change any preference or any relative or other right given to any (lass or series; of outstanding shares, then the amendment must be approved by the vote, in addition to the affirmative vote otherwise required of the holders of shares representing a majority of tie voting power of each class or series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

IMPORTANT: Failure to include any of the above information and submit with the proper fees may cause this filling to be rejected.

| This form must be accompanied by appropriate fees. See attached fee schedule. | |

USE BLACK INK ONLY - DO NOT HIGHLIGHT ABOVE SPACE IS FOR OFFICE USE ONLY

Certificate of Designation For

Nevada Profit Corporations

(Pursuant to NRS 78.1955)

1. Name of corporation:

Megola. Inc.

2. By resolution of the board of directors pursuant to a provision in the articles of incorporation this certificate establishes the following regarding the voting powers, designations, preferences, limitations, restrictions and relative rights of the following class or series of stock.

Pursuant to the authority vested in the Board of Directors of the Company, the provisions of its Articles of Incorporation, and in accordance with the Nevada Revised Statutes, the Board of Directors hereby authorizes the filing of a Certificate of Designation, Preferences and Rights of Series A, Series B and Series C Convertible Preferred Stock of the Company. The Company is authorized to issue Series A, Series B and Series C Convertible Preferred Stock with par value of $0,001 per share, which shall have the powers, preferences and rights and the qualifications, limitations and restrictions thereof, as follows: The designation of such series of the Preferred Stock shall be the Series A. Series B and Series C Convertible Preferred Stock, par value $0,001 per share. The maximum number of shares of Series A Convertible Preferred Stock shall be 2,000,000 shares. The maximum number of shares of Series B Convertible Preferred Stock shall be 1,500,000 shares. The maximum number of shares of Series C Convertible Preferred Stock shall be 1,500,000.

3. Effective date of filing: (optional)

(must not be later than 90 days after the certificate is filed)

4. Signature: (required)

X  | |

| Signature of Officer | |

Filing Fee: $175.00

IMPORTANT: Failure to include any of the above Information and submit with the proper fees may cause this filing to be rejected.

| This form must be accompanied by appropriate fees. | |

ARTICLES OF AMENDMENT TO

ARTICLES OF INCORPORATION OF

MEGOLA, INC.

CERTIFICATE OF DESIGNATION,

PREFERENCES AND RIGHTS

of

SERIES A, SERIES B AND SERIES C CONVERTIBLE PREFERRED STOCK

Megola, Inc., a corporation organized and existing under the laws of the State of Nevada (the “Corporation”), hereby certifies that the Board of Directors of the Corporation (the “Board of Directors” or the “Board”), pursuant to authority of the Board of Directors as required by applicable corporate law, and in accordance with the provisions of its Certificate of Incorporation and Bylaws, has and hereby amends the Series A and Series B Convertible Preferred Stock which was previously authorized and hereby authorizes Series C Convertible Preferred Stock, par value $0,001 per share (collectively the “Preferred Stock”), and hereby states the designation and number of shares, and fixes the rights, preferences, privileges, powers and restrictions thereof, as follows:

SERIES A CONVERTIBLE PREFERRED STOCK

DESIGNATION AND AMOUNT

The total amount previously authorized for the Series A Preferred Convertible Stock shall be reduced from 3,500,000 shares to 2,000,000 shares. The “Series A Convertible Preferred Stock” shall have the following rights, preferences, powers, privileges, restrictions, qualifications and limitations.

1. Stated Value. The stated value of each issued share of Series A Convertible Preferred Stock shall be deemed to be five dollars ($5.00) (the “Stated Value”).

2. Dividends. No dividends are payable on the Series A Convertible Preferred Stock.

3. Voting. On any matter presented to the stockholders of the Corporation for their action or consideration at any meeting of stockholders of the Corporation (or by written consent of stockholders in lieu of a meeting), each holder of outstanding shares of Series A Convertible Preferred Stock shall be entitled to cast one hundred (100) votes for each share of Series A Convertible Preferred Stock. Except as provided by law, holders of Series A Convertible Preferred Stock shall vote together with the holders of Common Stock, and with the holders of any other series of Preferred Stock the terms of which so provided, together as a single class.

4. Liquidation. Dissolution, or Winding-Up; Certain Mergers, Consolidations and Asset Sales.

a. Payments to Holders of Series A Convertible Preferred Stock. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, the holders of the shares of Series A Convertible Preferred Stock shall be paid, before any payment shall be paid to the holders of Common Stock, or any other stock ranking on liquidation junior to the Series A Convertible Preferred Stock, an amount for each share of Series A Convertible Preferred Stock held by such holder equal to the Stated Value.

b. Payments to Holders of Junior Stock. After the payment of all preferential amounts required to be paid to the holders of the Series A Convertible Preferred Stock and any other class or series of stock of the Corporation ranking on liquidation senior to or on a parity with the Series A Convertible Preferred Stock, the holders of shares of junior stock then outstanding shall be entitled to receive the remaining assets of the Corporation available for distribution to its stockholders as otherwise set forth in the Certificate of Incorporation.

5. Optional Conversion. The holders of Series A Convertible Preferred Shares shall have the conversion rights as follows (the “Conversion Rights”).

(a) Right to Convert. Each share of Series A Convertible Preferred Stock shall be convertible, at the option of die holder thereof, at any time after the “Conversion Date” (as defined below), and without the payment of additional consideration by the holder thereof, into such number of fully-paid and non-assessable shares of Common Stock as determined by dividing (1) the Stated Value per share by (2) the Series A Conversion Price in effect at the time of conversion. The “Series A Conversion Price” shall be $0.20 per share or the “Value of the Common Stock” at the time of conversion, whichever is less. That “Value of the Common Stock” will be equal to the average “Closing Price” (as defined in Section 9 below) of the Common Stock for each of the ten (10) consecutive trading days immediately prior to the date of conversion. The Series A Conversion Price, and the rate at which shares of Series A Convertible Preferred Stock may be converted into shares of Common Stock, shall not be subject to further adjustment.

(b) Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series A Convertible Preferred Stock. In lieu of any fractional shares to which the holder would otherwise be entitled, me Corporation shall pay cash equal to such fraction multiplied by the fair market value of a share of Common Stock as determined in good faith by the Board of Directors, or round-up to the next whole number of shares, at the Corporation’s option. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series A Convertible Preferred Stock the holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable upon such conversion.

(c) Mechanics of Conversion.

(i) For a holder of Series A Convertible Preferred Stock to voluntarily convert shares of Series A Convertible Preferred Stock into shares of Common Stock, that holder shall surrender the certificate or certificates for such shares of Series A Convertible Preferred Stock (or, if the registered holder alleges that such certificate has been lost, stolen, or destroyed, a lost certificate affidavit and agreement reasonably acceptable to the Corporation to indemnify the Corporation against any claim that may be made against the Corporation on account of the alleged loss, theft, or destruction of such certificate), at the office of the transfer agent for the

Series A Convertible Preferred Stock (or at the principal office of the Corporation if the Corporation serves as its own transfer agent), together with written notice that the holder elects to convert all or any number of the shares of the Series A Convertible Preferred Stock represented by such certificate or certificates and, if applicable, any event on which such conversion is contingent. The notice shall state the holder’s name or the names of the nominees in which the holder wishes the certificate or certificates for shares of Common Stock to be issued. If required by the Corporation, certificates surrendered for conversion shall be endorsed or accompanied by a written instrument or instruments of transfer, in form satisfactory to the Corporation, duly executed by the registered holder or his, her, or its attorney duly authorized in writing. The close of business on the date of receipt by the transfer agent of such certificates (or lost certificate affidavit and agreement) and notice (or by the Corporation if the Corporation serves as its own transfer agent) shall be the time of conversion (the “Conversion Time”), and the shares of Common Stock issuable upon conversion of the shares represented by such certificate shall be deemed to be outstanding of record as of that date. The Corporation shall, as soon as practicable after the Conversion Time, issue and deliver at such office to the holder of Series A Convertible Preferred Stock, or to his, her, or its nominee(s), a certificate or certificates for the number of shares of Common Stock to which the holders) shall be entitled, together with cash in lieu of any fraction of a share.

(ii) The Corporation shall at all times while the Series A Convertible Preferred Stock is outstanding, reserve and keep available out of its authorized but unissued stock, for the purpose of effecting the conversion of the Series A Convertible Preferred Stock, such number of its duly authorized shares of Common Stock as shall from time to time be sufficient to effect the conversion of all outstanding Series A Convertible Preferred Stock; and if, at any time, the number of authorized but unissued shares of Common Stock shall not be sufficient to effect the conversion of all then-outstanding shares of the Series A Convertible Preferred Stock, the Corporation shall take such corporate action as may be necessary to increase its authorized but unissued shares of Common Stock to such number of shares as shall be sufficient for such purposes, including, without limitation, engaging in best efforts to obtain the requisite stockholder approval of any necessary amendment to the Certificate of Incorporation.

(iii) All shares of Series A Convertible Preferred Stock that have been surrendered for conversion as herein provided shall no longer be deemed to be outstanding, and all rights with respect to such shares, including the rights, if any, to receive notices, to vote, and to receive payment of any dividends accrued or declared but unpaid thereon, shall immediately cease and terminate at the Conversion Time, except only the right of the holders thereof to receive shares of Common Stock in exchange therefor. Any shares of Series A Convertible Preferred Stock so converted shall be retired and cancelled and shall not be reissued as shares of such series, and the Corporation (without the need for stockholder action) may from time to time take such appropriate action as may be necessary to reduce the authorized number of shares of Series A Convertible Preferred Stock accordingly.

(iv) The holders of Series A Convertible Stock shall pay any and all issue and other similar taxes that may be payable in respect of any issuance or delivery of shares of Common Stock upon conversion of shares of Series A Convertible Preferred Stock pursuant to this Section 5.

6. Mandatory Conversion. The Corporation has the right on any date 24 months after the date of issue of the Series A Convertible Preferred Stock, after giving 60 days prior written notice, (the “Mandatory Conversion Date”) to cause the Series A Convertible Preferred Stock not then converted to convert into a number of fully paid and non-assessable shares of Common Stock at the Series A Conversion Price as provided in Section 5 above. The procedures for Mandatory Conversion shall be similar to those for Voluntary Conversion set forth in Section 5 above, except the transaction shall be mandatory and not voluntary.

7. Waiver. Any of the rights, powers, or preferences of the holders of Series A Convertible Preferred Stock set forth herein may be waived by the affirmative consent or vote of the holders of a least a majority of the shares of Series A Convertible Preferred Stock then outstanding.

8. Definitions. As used herein, the following terms shall have the following meanings:

a. “Affiliate” means with respect to any individual, corporation, partnership, association, trust, or any other entity (in each case, a “Person”), any Person that, directly or indirectly, Controls, is Controlled by, or is under common Control with such Person, including without limitation, any general partner, executive officer, or director of such Person or any holder often percent or more of the outstanding equity or voting power of such Person.

b. “Closing Price” for any day means: (i) the average closing bid price of the Common Stock for the ten prior trading days on the principal securities exchange on which the Common Stock is then listed or admitted to trading or on Nasdaq, as applicable, (ii) if on such day such shares of Common Stock are not then listed or admitted to trading on any securities exchange or system, the average closing bid price of the Common Stock on the ten prior trading days for the Common Stock in the domestic over-the-counter market as reported on the OTCMarkets (the “OTCM”), or, (Hi) if on such ten day period such shares of Common Stock are not then listed or admitted to trading on any securities exchange or system, the average closing bid price of the Common Stock on the ten prior trading days for the Common Stock in the domestic over-the-counter market as reported on the by the National Quotation Bureau, Incorporated, or any other successor organization. If at any time such shares of Common Stock are not listed on any domestic exchange or quoted in the NASDAQ System or the domestic over- the-counter market or reported in the “Pink Sheets,” the Closing Price shall be the fair market value thereof determined by an independent appraiser selected in good faith by the Board of Directors.

c. “Control” means the possession, directly or indirectly, of power to direct or cause the direction of management or policies (whether through ownership of voting securities, by agreement or otherwise).

d. “Conversion Date” the Class A Series Convertible Preferred Shares can only be converted to common stock following a 6 months period from the date the Class A Convertible Preferred shares are issued.

e. “Person” shall mean any individual, partnership, firm, corporation, association, trust, unincorporated organization or other entity, as well as any syndicate or group that would be deemed to be a person under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended.

f. “Trading Day” means a day on which the securities exchange, association, or quotation system on which shares of Common Stock are listed for trading shall be open for business or, if the shares of Common Stock shall not be listed on such exchange, association, or quotation system for such day, a day with respect to which trades in the United States domestic over-the-counter market shall be reported.

SERIES B CONVERTIBLE PREFERRED STOCK

DESIGNATION AND AMOUNT

1,500,000 shares of the authorized and unissued Preferred Stock of the Corporation are hereby designated “Series B Convertible Preferred Stock” with the following rights, preferences, powers, privileges, restrictions, qualifications and limitations.

1. Stated Value. The stated value of each issued share of Series B Convertible Preferred Stock shall be deemed to be ten dollars ($10.00) (the “Stated Value”).

2. Dividends. No dividends are payable on the Series B Convertible Preferred Stock.

3. Voting. The Series B Convertible Preferred Stock has no voting rights.

4. Liquidation, Dissolution, or Winding-Up; Certain Mergers. Consolidations and Asset Sales.

a. Payments to Holders of Series B Convertible Preferred Stock. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary, the holders of the shares of Series B Convertible Preferred Stock shall be paid, before any payment shall be paid to the holders of Common Stock, or any other stock ranking on liquidation junior to the Series A Convertible Preferred Stock, an amount per share equal to the Stated Value.

b. Payments to Holders of Junior Stock. After the payment of all preferential amounts required to be paid to the holders of the Series B Convertible Preferred Stock and any other class or series of stock of the Corporation ranking on liquidation senior to or on a parity with the Series B Convertible Preferred Stock, the holders of shares of junior stock then outstanding shall be entitled to receive the remaining assets of the Corporation available for distribution to its stockholders as otherwise set forth in the Certificate of Incorporation.

5. Optional Conversion. The holders of Series B Convertible Preferred Shares shall have the conversion rights as follows (the “Conversion Rights”).

(a) Right to Convert. Each share of Series B Convertible Preferred Stock shall be convertible, at the option of the holder thereof, at any time after the “Conversion Date” (as defined below), and without the payment of additional consideration by the holder thereof, into such number of fully-paid and non-assessable shares of Common Stock as is determined by dividing (1) the Stated Value per share by (2) the Series B Conversion Price in effect at the time

of conversion. The “Series B Conversion Price” shall be $0.05 per share or the “Value of the Common Stock” at the time of conversion, whichever is less. That “Value of the Common Stock” will be equal to the average “Closing Price” (as defined in Section 9 below) of the Common Stock for the ten (10) consecutive trading days immediately prior to the date of conversion. The Series B Conversion Price shall not be subject to further adjustment.

(b) Fractional Shares. No fractional shares of Common Stock shall be issued upon conversion of the Series B Convertible Preferred Stock. In lieu of any fractional shares to which the holder would otherwise be entitled, the Corporation shall pay cash equal to such fraction multiplied by the fair market value of a share of Common Stock as determined in good faith by the Board of Directors, or round-up to the next whole number of shares, at the Corporation’s option. Whether or not fractional shares would be issuable upon such conversion shall be determined on the basis of the total number of shares of Series B Convertible Preferred Stock the holder is at the time converting into Common Stock and the aggregate number of shares of Common Stock issuable upon such conversion.

(c) Mechanics of Conversion.