QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on April 17, 2003

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2002

Commission file number: 333-13690

ALFA LAVAL SPECIAL FINANCE AB

(Exact name of Registrant as specified in its charter)

The Kingdom of Sweden

(Jurisdiction of incorporation or organisation)

Rudeboksvägen 3

Lund, Sweden

+(46 46) 36 7000

(Address of principal executive office)

SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(b)

OF THE ACT:

None

SECURITIES REGISTERED OR TO BE REGISTERED PURSUANT TO SECTION 12(g)

OF THE ACT:

None

SECURITIES FOR WHICH THERE IS A REPORTING OBLIGATION PURSUANT

TO SECTION 15(d) OF THE ACT:

121/8% Senior Notes due 2010

The number of outstanding shares of Alfa Laval Special Finance AB's classes of

capital or common stock as of December 31, 2002:

8,191,000 Ordinary Shares, nominal value SEK 100 per share

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13

or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the Registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days:

Yes o No ý

Indicate by check mark which financial statement item the Registrant has elected to follow:

Item 17 ý Item 18 o

TABLE OF CONTENTS

| INTRODUCTION | | i |

FORWARD-LOOKING STATEMENTS |

|

i |

MARKET SHARE AND INDUSTRY DATA |

|

ii |

CERTAIN DEFINITIONS |

|

ii |

PART I |

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

|

I-1 |

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE |

|

I-2 |

ITEM 3: KEY INFORMATION |

|

I-3 |

ITEM 4: INFORMATION ABOUT THE COMPANY |

|

I-26 |

ITEM 5: OPERATING AND FINANCIAL REVIEW AND PROSPECTS |

|

I-47 |

ITEM 6: DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES |

|

I-75 |

ITEM 7: MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS |

|

I-80 |

ITEM 8: FINANCIAL INFORMATION |

|

I-84 |

ITEM 9: THE OFFER AND LISTING |

|

I-86 |

ITEM 10: ADDITIONAL INFORMATION |

|

I-87 |

ITEM 11: QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

|

I-92 |

ITEM 12: DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

|

I-96 |

PART II |

ITEM 13: DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES |

|

II-1 |

ITEM 14: MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS

AND USE OF PROCEEDS |

|

II-2 |

ITEM 15: CONTROLS AND PROCEDURES |

|

II-3 |

ITEM 16: [RESERVED.] |

|

II-4 |

PART III |

ITEM 17: FINANCIAL STATEMENTS |

|

III-1 |

ITEM 18: FINANCIAL STATEMENTS |

|

III-2 |

ITEM 19: EXHIBITS AND CERTIFICATIONS |

|

III-2 |

INTRODUCTION

The discussion under the caption "Item 5: Operating and Financial Review and Prospects" in this annual report contains references to Swedish kronor amounts on a constant exchange rate basis. These Swedish kronor amounts, which also include the impact of Alfa Laval's hedging activities, have been converted from a variety of foreign currencies, including the euro at a rate of €1.00 = SEK 9.2415, the average rate calculated on monthly closing rates issued by Reuters.

Certain amounts and percentages included in this annual report have been rounded and accordingly may not total.

FORWARD-LOOKING STATEMENTS

This annual report includes various forward-looking statements and includes assumptions about future market conditions, operations and results. These statements appear in a number of places, including "Item 3.D: Key Information—Risk Factors", "Item 4.B: Information about the Company—Business Overview" and "Item 5: Operating and Financial Review and Prospects", and include statements regarding our intentions, beliefs or current expectations. The words "believe", "expect", "anticipate", "intend" or "plan" and similar expressions identify certain of such forward-looking statements. Others can be identified from the context in which the statements are made. Actual events or results may differ materially as a result of risks and uncertainties that we face. Important factors that could cause these differences include:

- •

- worldwide economic and business conditions and regulatory, legislative and judicial developments;

- •

- business conditions of our customers;

- •

- increased competition from other companies in our industry;

- •

- emergence of new or substitute technologies;

- •

- availability and price fluctuations of raw materials;

- •

- changes in our business strategy or development plans;

- •

- success with our product development;

- •

- implementation of our corporate and operational restructuring;

- •

- the significant amount of debt we and our subsidiaries have incurred and our obligations to service such debt; and

- •

- contractual restrictions on our ability to receive loans and dividends from certain of our subsidiaries.

We caution you that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties. We also caution you that actual results may differ materially from those made in or suggested by the forward-looking statements as a result of various factors. The information contained in this annual report, including, without limitation, the information under "Item 3.D: Key Information—Risk Factors", "Item 4.B: Information about the Company—Business Overview" and "Item 5: Operating and Financial Review and Prospects" identify important factors that could cause such differences. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

i

MARKET SHARE AND INDUSTRY DATA

This annual report contains historical market data and industry forecasts, which have been obtained from industry publications, market research and publicly available information. The industry publications state that the historical information they provide has been obtained from sources, and through methods, believed to be reliable, but that they do not guarantee the accuracy and completeness of this information. Similarly, industry forecasts and market research, while believed to be reliable, have not been independently verified by us. We make no representation that this historical information is accurate. Industry forecasts are, by their nature, subject to significant uncertainty. There can be no assurance that any of the forecasts will be achieved.

We define the compact heat exchanger market to include brazed, welded and gasketed plate heat exchangers. We define the centrifugal separation market as decanter centrifuges and high speed separators. We define the sanitary flow market as sanitary liquid handling equipment, including pumps, valves and fittings.

CERTAIN DEFINITIONS

Unless otherwise noted, reference in this annual report to:

- •

- "Acquisition" refers to the acquisition by Industri Kapital and others, as described herein, of all of the outstanding capital stock of Alfa Laval Holding AB from Zarus Holding B.V., now operating under the name of Tetra Laval B.V.;

- •

- "Adjusted EBITA" is calculated by excluding from EBITA the effect of certain comparison distortion items (or non-recurring items), as further described under "Item 3.A: Key Information—Selected Consolidated Financial Data—Definitions of Operating Data and Key Ratios" and in our financial statements;

The following table shows how EBITA and Adjusted EBITA are calculated for 2000, 2001 and 2002:

| | Year Ended December 31,

|

|---|

| | Unaudited

Pro Forma Combined

2000

| | 2001

| | 2002

|

|---|

| | (SEK millions)

|

|---|

| Operating Income | | 810 | | 1,233 | | 1,224 |

| Amortisation of goodwill | | 164 | | 178 | | 188 |

| Step-Up Depreciation | | 316 | | 334 | | 319 |

| | |

| |

| |

|

| EBITA | | 1,290 | | 1,745 | | 1,731 |

| Comparison distortion items | | (130 | ) | (5 | ) | 29 |

| | |

| |

| |

|

| Adjusted EBITA | | 1,160 | | 1,740 | | 1,760 |

| | |

| |

| |

|

- •

- "Adjusted EBITDA" is calculated by excluding from EBITDA the effect of certain comparison distortion items (or non-recurring items), as further described under "Item 3.A: Key Information—Selected Consolidated Financial Data—Definitions of Operating Data and Key Ratios" and in our financial statements;

ii

| | Year Ended December 31,

|

|---|

| | Unaudited

Pro Forma Combined

2000

| | 2001

| | 2002

|

|---|

| | (SEK millions)

|

|---|

| Operating Income | | 810 | | 1,233 | | 1,224 |

| Depreciation | | 466 | | 400 | | 331 |

| Amortisation of goodwill | | 164 | | 178 | | 188 |

| Step-Up Depreciation | | 316 | | 334 | | 319 |

| | |

| |

| |

|

| EBITDA | | 1,756 | | 2,145 | | 2,062 |

| Comparison distortion items | | (130 | ) | (5 | ) | 29 |

| | |

| |

| |

|

| Adjusted EBITDA | | 1,626 | | 2,140 | | 2,091 |

| | |

| |

| |

|

- •

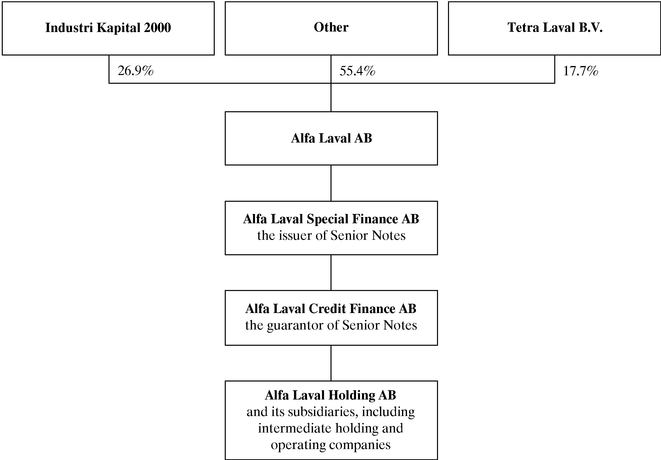

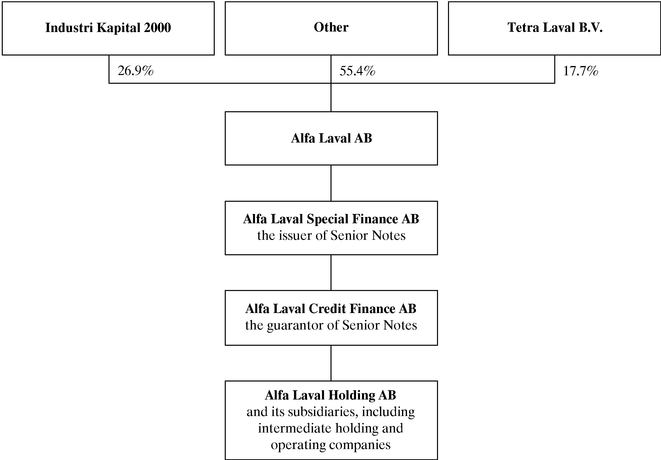

- "Alfa Laval AB" means Alfa Laval AB, our parent holding company;

- •

- "Alfa Laval Special Finance", "Company", "we", "our" and "us" mean Alfa Laval Special Finance AB, a limited liability company registered under the laws of Sweden, and, where the context requires, its consolidated subsidiaries, which include the Guarantor;

- •

- "Bond Loan" or, where the context so requires "Senior Notes" means the €220 million 121/8% senior notes due 2010 issued by us on November 9, 2000 and guaranteed on a senior subordinated basis by Alfa Laval Credit Finance AB, the Guarantor;

- •

- "EBITA" means Earnings Before Interest, Tax and Amortisation and is calculated as operating income or loss (including share of earnings from associated companies), before interest, taxes and goodwill Amortisation. In addition, we have added back to EBITA depreciation expense recorded on the additional basis recognised on certain tangible and intangible assets in connection with the Acquisition ("Step-Up Depreciation") when calculating EBITA because we view the step-up in asset values as equivalent to goodwill and the Step-Up Depreciation as equivalent to goodwill Amortisation;

- ���

- "EBITDA" means Earnings Before Interest, Tax, Depreciation and Amortisation and is calculated as operating income or loss (including share of earnings from associated companies), before interest, taxes, depreciation and goodwill Amortisation. In addition, we have added back to EBITDA depreciation expense recorded on the additional basis recognised on certain tangible and intangible assets in connection with the Acquisition ("Step-Up Depreciation") when calculating EBITDA because we view the step-up in asset values as equivalent to goodwill and the Step-Up Depreciation as equivalent to goodwill Amortisation;

- •

- "Existing Senior Credit Facility" means the senior facilities agreement dated April 29, 2002 as amended and restated on July 11, 2002 entered into by Alfa Laval Treasury International AB and Alfa Laval US Treasury Inc., as borrowers, and Alfa Laval Special Finance AB and others as guarantors for a maximum principal amount of €575 million, being €425 million term loan facilities and €150 million revolving loan facilities;

- •

- "Guarantor" and "Alfa Laval Credit Finance" means Alfa Laval Credit Finance AB (formerly known as Alfa Laval Bostadsförvaltning AB), a limited company being a subsidiary of Alfa Laval Special Finance AB, registered under the laws of Sweden;

iii

- •

- "Industri Kapital" means Industri Kapital Ltd., a private equity firm, together with, and, where the context requires, certain investment funds advised by Industri Kapital Ltd. and certain of its affiliates;

- •

- "Industri Kapital 2000" means a number of limited partnerships, commonly referred to as the Industri Kapital 2000 Fund, the general partner of each of which is Industri Kapital 2000 Ltd. Industri Kapital 2000 Ltd. is advised by Industri Kapital. Pursuant to contractual arrangements, Industri Kapital 2000 Ltd. exercises control of a majority of the shares of Alfa Laval AB, our parent holding company;

- •

- "Intercreditor Agreement" has the meaning given under the caption "Item 5.B: Liquidity and Capital Resources—Intercreditor Agreement";

- •

- "Management Warrants" means warrants to subscribe for 3,721,310 ordinary shares held by executive officers of Alfa Laval AB and having an exercise price of approximately SEK 59.5 per share. These warrants were exercised on April 23, 2002;

- •

- "Offering" means the offering by Alfa Laval AB, Industri Kapital 2000, Tetra Laval B.V. and certain of Alfa Laval AB's officers and directors of 56,515,022 ordinary shares in Alfa Laval AB. The ordinary shares in Alfa Laval AB were offered pursuant to an institutional offering, a public offering to investors in Sweden and an employee offering to employees in Denmark, Finland, Norway and Sweden. The ordinary shares offered were delivered to purchasers on May 23, 2002. Alfa Laval AB listed its ordinary shares on the O-list of the Stockholm Exchange at that time. The ordinary shares of Alfa Laval AB were offered in the United States only to qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the "Securities Act") and outside the United States in compliance with Regulation S under the Securities Act;

- •

- "Predecessor" or "Alfa Laval Holding" means Alfa Laval Holding AB, including its consolidated subsidiaries. Alfa Laval Holding AB is an indirect wholly owned subsidiary of Alfa Laval AB;

- •

- "Previous Senior Credit Facility" means the senior facilities agreement dated August 22, 2000 entered into by Alfa Laval AB, Alfa Laval Credit Finance AB as borrower and other group companies for a maximum principal amount of €651.8 equivalent term loan facilities and €475 million equivalent revolving loan facilities. This facility was refinanced with the proceeds of the Existing Senior Credit Facility on May 28, 2002;

- •

- "Senior Notes". See "Bond Loan" above.

- •

- "Share Sale and Purchase Agreement" means the agreement dated June 16, 2000, as amended on August 24, 2000, relating to the Acquisition;

- •

- "Subordinated Loan" means the €200.0 million subordinated vendor loan, extended by Tetra Laval Finance Limited. Alfa Laval AB used the proceeds from the Offering and the exercise of the Management Warrants and drawings under the Existing Senior Credit Facility to repay the Subordinated Loan, together with accrued and unpaid interest thereon, on May 23, 2002;

- •

- "Tetra Laval" and "Tetra Laval Group" means Tetra Laval and its affiliated entities as of the date of this annual report;

- •

- "Tetra Pak" and "Tetra Pak Group" means Tetra Pak International S.A. and all affiliated companies which are under the management control of Tetra Pak International S.A.;

- •

- "Tetra Laval B.V." means Zarus Holding B.V., a member of the Tetra Laval Group, now operating under the name Tetra Laval B.V.;

- •

- "Vendor" means Tetra Laval B.V.; and

iv

- •

- "Vendor Warrant" means the warrant to subscribe for shares up to a net amount of €40 million to be issued by Alfa Laval AB to Tetra Laval in the event that Industri Kapital 2000's internal rate of return on investments exceeds certain specified levels upon a trade sale or public offering of shares in Alfa Laval AB. Pursuant to the terms of an agreement dated April 23, 2002, the parties agreed to settle his obligation in cash, amounting to €40 million upon consummation of the Offering. The Vendor Warrant was assigned to Tetra Laval Finance Ltd. Prior to the execution of this agreement.

For definitions of operating data and key ratios used throughout this annual report, see "Item 3.A—Key Information—Definitions of Operating Data and Key Ratios".

v

PART I

ITEM 1: IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

I-1

ITEM 2: OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

I-2

ITEM 3: KEY INFORMATION

3.A. Selected Financial Data

Alfa Laval Special Finance AB

The table below sets forth (a) selected audited consolidated financial data of Alfa Laval Holding and its subsidiaries, Alfa Laval's predecessor, for the years ended December 31, 1998 and 1999, (b) selected unaudited pro forma combined financial data for Alfa Laval Special Finance AB for the year ended December 31, 2000, and (c) selected audited consolidated financial data for Alfa Laval Special Finance AB for the years ended December 31, 2001 and 2002. We acquired Alfa Laval Holding on August 24, 2000. The selected consolidated financial data set forth below as of and for the financial years ended December 31, 1998, 1999, 2000, 2001 and 2002 have been derived from, and are qualified by reference to, Alfa Laval Special Finance AB's consolidated financial statements and those of its predecessor, which have been audited by Ernst & Young, independent public accountants. The consolidated financial statements have been prepared in accordance with Swedish GAAP, which differs in certain material respects from US GAAP. The principal differences between Swedish GAAP and US GAAP, as applicable to Alfa Laval Special Finance AB and the Predecessor, are summarised in note 34 to our audited consolidated financial statements included elsewhere in this annual report.

The following information should be read in conjunction with (i) "Item 3.A: Key Information—Unaudited Pro Forma Consolidated Financial Information", (ii) "Item 5: Operating and Financial Review and Prospects" and (iii) the audited consolidated financial statements of Alfa Special Finance AB and its Predecessor included elsewhere in this annual report.

I-3

Selected Consolidated Historical Financial Data for

Alfa Laval Special Finance AB

| | Predecessor

| | Successor

| |

|---|

| | Year

Ended

December 31,

1998

| | Year

Ended

December 31

1999

| | Period

ended

August 23,

2000

| | Period

Ended

December 31,

2000

| | Pro

Forma(1)

Combined

2000

| | Year

Ended

December 31,

2001

| | Year

Ended

December 31,

2002

| |

|---|

| | (SEK millions, unless otherwise stated)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | |

| Swedish GAAP: | | | | | | | | | | | | | | | |

| Net sales | | 14,734 | | 14,405 | | 9,295 | | 5,717 | | 15,012 | | 15,830 | | 14,595 | |

| Cost of goods sold | | (9,297 | ) | (9,355 | ) | (5,963 | ) | (3,951 | ) | (10,124 | ) | (10,348 | ) | (9,262 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Gross profit | | 5,437 | | 5,051 | | 3,333 | | 1,766 | | 4,888 | | 5,482 | | 5,333 | |

Other operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales costs | | (2,803 | ) | (2,695 | ) | (1,748 | ) | (835 | ) | (2,584 | ) | (2,443 | ) | (2,115 | ) |

| Administrative costs | | (995 | ) | (976 | ) | (643 | ) | (218 | ) | (862 | ) | (787 | ) | (1,027 | ) |

| Research and development costs | | (514 | ) | (435 | ) | (279 | ) | (162 | ) | (441 | ) | (341 | ) | (355 | ) |

| Other operating income/(costs) | | (160 | ) | (11 | ) | (69 | ) | (88 | ) | (157 | ) | (504 | ) | (395 | ) |

| Goodwill amortisation | | (690 | ) | (715 | ) | (485 | ) | (55 | ) | (164 | ) | (178 | ) | (188 | ) |

| Comparison distortion items | | 497 | | 30 | | 523 | | (394 | ) | 130 | | 5 | | (29 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Operating income/(loss) | | 772 | | 249 | | 631 | | 14 | | 810 | | 1,233 | | 1,224 | |

| Interest and other financial income/(costs) | | (204 | ) | (133 | ) | (125 | ) | (329 | ) | (802 | ) | (861 | ) | (764 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Income/(loss) before taxes and minority interests | | 568 | | 116 | | 506 | | (315 | ) | 8 | | 373 | | 460 | |

| Income tax benefit/(expense) | | 40 | | (333 | ) | (245 | ) | (56 | ) | (105 | ) | 26 | | (218 | ) |

| Minority interests | | (16 | ) | (27 | ) | (36 | ) | (12 | ) | (48 | ) | (32 | ) | (34 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net income/(loss) | | 592 | | (244 | ) | 225 | | (383 | ) | (145 | ) | 367 | | 208 | |

| | |

| |

| |

| |

| |

| |

| |

| |

US GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income/(loss) | | 294 | | 223 | | 447 | | (443 | ) | (316 | ) | 294 | | 633 | |

| Income/(loss) from continuing operations before cumulative effect of change in accounting principle | | 371 | | 201 | | 447 | | (443 | ) | (316 | ) | 356 | | 633 | |

| Depreciation and Amortisation | | 928 | | 757 | | 516 | | 346 | | N/A | | 883 | | 704 | |

| Ratio of earnings to fixed charges, times(3) | | 2.4 | x | 2.9 | x | 4.0 | x | — | | N/A | | 1.3 | x | 2.2 | x |

Operating Data and Key Ratios(2): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Swedish GAAP: | | | | | | | | | | | | | | | |

| Orders received | | 13,866 | | 13,897 | | 10,301 | | 5,073 | | 15,374 | | 15,894 | | 14,675 | |

| Order backlog | | 3,907 | | 3,532 | | N/A | | N/A | | 4,063 | | 4,314 | | 4,340 | |

| Gross margin, % | | 36.9 | % | 35.1 | % | 35.9 | % | 30.9 | % | 32.6 | % | 34.6 | % | 36.5 | % |

| Operating income | | 772 | | 249 | | 631 | | 14 | | 810 | | 1,233 | | 1,224 | |

| Operating margin % | | 5.2 | % | 1.7 | % | 6.8 | % | 0.2 | % | 5.4 | % | 7.8 | % | 8.4 | % |

| EBITDA | | 1,958 | | 1,440 | | 1,427 | | 329 | | 1,756 | | 2,145 | | 2,062 | |

| Adjusted EBITDA | | 1,461 | | 1,410 | | 903 | | 723 | | 1,626 | | 2,140 | | 2,091 | |

| EBITA | | 1,462 | | 964 | | 1,116 | | 174 | | 1,290 | | 1,745 | | 1,730 | |

| Adjusted EBITA | | 965 | | 934 | | 592 | | 568 | | 1,160 | | 1,740 | | 1,760 | |

| EBITDA margin, % | | 13.3 | % | 10.0 | % | 15.4 | % | 5.8 | % | 11.7 | % | 13.6 | % | 14.1 | % |

| Adjusted EBITDA margin, % | | 9.9 | % | 9.8 | % | 9.7 | % | 12.6 | % | 10.8 | % | 13.5 | % | 14.3 | % |

| EBITA margin, % | | 9.9 | % | 6.7 | % | 12.0 | % | 3.0 | % | 8.6 | % | 11.0 | % | 11.9 | % |

| Adjusted EBITA margin, % | | 6.5 | % | 6.5 | % | 6.4 | % | 9.9 | % | 7.7 | % | 11.0 | % | 12.1 | % |

I-4

| Depreciation and amortisation | | 1,185 | | 1,191 | | 796 | | 315 | | 946 | | 912 | | 838 | |

| Investment in fixed assets | | 438 | | 431 | | 133 | | 179 | | 312 | | 275 | | 277 | |

| Return on capital employed, % | | 21.6 | % | 15.2 | % | N/A | | N/A | | 16.1 | % | 18.5 | % | 20.3 | % |

| Capital employed | | 6,781 | | 6,357 | | N/A | | N/A | | 8,013 | | 9,415 | | 8,527 | |

| Capital turnover rate, times | | 2.2 | x | 2.3 | x | N/A | | N/A | | 1.9 | x | 1.7 | x | 1.7 | x |

| Return on equity, % | | 16.2 | % | N/M | | N/A | | N/M | | N/M | | 10.1 | % | 4.7 | % |

| Equity/assets ratio, % | | 26.8 | % | 26.3 | % | N/A | | 16.8 | % | 16.8 | % | 20.6 | % | 28.6 | % |

| Net debt/equity ratio, times | | 0.8 | x | 0.9 | x | N/A | | N/A | | 2.1 | x | 1.6 | x | 0.8 | x |

| Average number of employees | | 12,613 | | 11,696 | | N/A | | N/A | | 11,001 | | 9,693 | | 9,292 | |

| Interest coverage ratio, times | | 6.2 | x | 5.9 | x | 5.4 | x | 0.75 | x | 2.0 | x | 2.5 | x | 3.4 | x |

| Ratio of earnings to fixed charges, times(3) | | 2.4 | x | 1.3 | x | 3.2 | x | — | | N/A | | 1.4 | x | 1.6 | x |

Consolidated Cash Flow Statement Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Swedish GAAP: | | | | | | | | | | | | | | | |

| Cash flows from operating activities | | 559 | | 1,324 | | 587 | | 583 | | 1,630 | | 1,977 | | 2,047 | |

| Cash flows from investing activities | | (189 | ) | (600 | ) | 278 | | (8,563 | ) | (8,284 | ) | 112 | | (548 | ) |

| Cash flows from financing activities | | (325 | ) | (586 | ) | (997 | ) | 8,381 | | 6,618 | | (2,069 | ) | (1,443 | ) |

Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Swedish GAAP: | | | | | | | | | | | | | | | |

| Cash and bank and other current deposits | | 646 | | 960 | | N/A | | 1,230 | | 1,230 | | 960 | | 1,020 | |

| Net working capital, excluding financial items | | 2,105 | | 3,346 | | N/A | | 3,458 | | 3,458 | | 3,323 | | 2,151 | |

| Total assets | | 13,647 | | 12,704 | | N/A | | 18,791 | | 18,791 | | 17,637 | | 15,427 | |

| Total interest bearing debt | | 3,383 | | 3,750 | | N/A | | 7,880 | | 7,880 | | 6,652 | | 4,519 | |

| Total shareholders' equity | | 3,652 | | 3,343 | | N/A | | 3,165 | | 3,165 | | 3,629 | | 4,413 | |

US GAAP: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets | | 13,833 | | 13,544 | | N/A | | 19,530 | | 19,530 | | 18,731 | | 16,477 | |

| Total interest bearing debt | | 3,383 | | 3,750 | | N/A | | 7,880 | | 7,880 | | 6,847 | | 4,519 | |

| Total shareholders' equity | | 4,823 | | 4,963 | | N/A | | 3,537 | | 3,537 | | 4,099 | | 5,168 | |

- (1)

- Adjusted to give effect to the Acquisition and related financing, including the issue of the Senior Notes, as if they had occurred on January 1, 2000. See "Unaudited Pro Forma Consolidated Financial Information" appearing on page I-10 of this annual report for a description of the pro forma adjustments made to the 2000 accounts.

- (2)

- For definitions, see "Definitions of Operating Data and Key Ratios" below.

- (3)

- For purposes of determining the ratio of earnings to fixed charges, earnings are defined as income before taxes plus fixed charges. Fixed charges include interest expense and one-third of rental expense on operating leases (representing that portion of rental expense deemed to be attributable to interest). Earnings in accordance with Swedish GAAP and US GAAP were insufficient to cover fixed charges by SEK 327 million and SEK 292 million respectively, during the period ended December 31, 2000.

I-5

Definitions of Operating Data and Key Ratios

The key ratios and certain other operating and per share data are provided in accordance with recommended Swedish market practice and are defined as follows:

| Orders received | | — | | Represents the total of orders received from customers during the year. Management believes that orders received represents a measure of current demand a for the group's products and services. Orders received cannot be directly related to future annual revenues due to the nature of certain orders (long-term contracts), which may be recognised in earnings over several periods. |

Order backlog |

|

— |

|

Represents total orders received which have not yet been recognised as revenues. Management believes that order backlog provides a general indication of the trend a of future net sales as the group's order backlog represents orders for products and services which management expect to complete and recognise as revenue in future periods. |

Gross margin (%) |

|

— |

|

The ratio of gross profits to net sales, expressed as a percentage. |

EBITDA |

|

— |

|

EBITDA is not a measure of operating performance calculated in accordance with Swedish GAAP or US GAAP. EBITDA should not be considered a substitute for a operating income, net income, cash flow from operating activities or other statement of operations data as determined in accordance with Swedish GAAP, or as a measure of profitability or liquidity. EBITDA does not necessarily indicate whether cash flow will be sufficient or available for cash requirements. EBITDA is included as supplemental disclosure because we believe that it, when considered in connection with cash flows from operating, investing and financing activities, provides useful information to investors and because management considers this a key measure used to evaluate financial operating performance. EBITDA, as it is generally defined, is calculated as operating income or loss (including share of earnings from associated companies), before interest, taxes, depreciation and amortisation. EBITDA may not be indicative of our historical operating results, nor is it indicative of potential future results. Since all companies do not calculate EBITDA identically, the presentation of EBITDA may not be comparable to similarly entitled measures of other companies. |

Adjusted EBITDA |

|

— |

|

Adjusted EBITDA is not a measure of operating performance calculated in accordance with Swedish GAAP or US GAAP. Adjusted EBITDA should not be considered a substitute for operating income, net income, cash flow from operating activities or other statement of operations data as determined in accordance with Swedish GAAP, or as a measure of profitability or liquidity. Adjusted EBITDA does not necessarily indicate whether cash flow will be sufficient or available for cash requirements. Adjusted EBITDA is included as supplemental disclosure because we believe that it, when considered in connection with cash flows from operating, investing and financing activities, provides useful information to investors and because management considers this a key measure used to evaluate financial operating performance. We calculate Adjusted EBITDA by excluding from EBITDA the effect of certain comparison distortion items (or non-recurring items), as disclosed in our financial statements. Adjusted EBITDA for 1999, 2000 pro forma, 2001 and 2002 has been calculated by excluding from EBITDA such comparison distortion items reported in the accompanying statements of operations, which aggregate to a net of SEK 30 million, SEK 130 million, SEK 5 million and SEK (29) million in 1999, 2000, 2001 and 2002, respectively. Adjusted EBITDA may not be indicative of our historical operating results, nor is it indicative of potential future results. Since all companies do not calculate Adjusted EBITDA identically, the presentation of Adjusted EBITDA may not be comparable to similarly entitled measures of other companies. |

|

|

|

|

|

I-6

EBITA |

|

— |

|

EBITA is not a measure of operating performance calculated in accordance with Swedish GAAP or US GAAP. EBITA should not be considered a substitute for operating income, net income, cash flow from operating activities or other statement of operations data as determined in accordance with Swedish GAAP or US GAAP, or as a measure of profitability or liquidity. EBITA does not necessarily indicate whether cash flow will be sufficient or available for cash requirements. EBITA is included as supplemental disclosure, because we believe that it, when considered in connection with cash flows from operating, investing and financing activities, provides useful information to investors and because management considers this a key measure used to evaluate financial operating performance. EBITA, as it is generally defined, is calculated as operating income or loss (including share of earnings from associated companies), before interest, taxes and goodwill amortisation. In addition, we have added back to EBITA depreciation expense recorded on the additional basis recognised on certain tangible and intangible assets in connection with the Acquisition ("Step-Up Depreciation") when calculating EBITA because we view the step-up in asset values as equivalent to goodwill and the Step-Up Depreciation as equivalent to goodwill amortisation. Step-Up Depreciation totaled SEK 319 million in 2002, SEK 334 million in 2001 and SEK 316 million for 2000 on a pro forma annual basis. This Step-Up Depreciation is included in costs of goods sold in our financial statements. EBITA may not be indicative of our historical operating results, nor is it meant to be predictive of potential future results. Since all companies do not calculate EBITA identically, the presentation of EBITA may not be comparable to similarly entitled measures of other companies. |

|

|

|

|

|

I-7

Adjusted EBITA |

|

— |

|

Adjusted EBITA is not a measure of operating performance calculated in accordance with Swedish GAAP or US GAAP. Adjusted EBITA should not be considered a substitute for operating income, net income, cash flow from operating activities or other statement of operations data as determined in accordance with Swedish GAAP or US GAAP, or as a measure of profitability or liquidity. Adjusted EBITA does not necessarily indicate whether cash flow will be sufficient or available for cash requirements. Adjusted EBITA is included as supplemental disclosure, because we believe that it, when considered in connection with cash flows from operating, investing and financing activities, provides useful information to investors and because management considers this a key measure used to evaluate financial operating performance. We calculate Adjusted EBITA by excluding from EBITA the effect of certain comparison distortion items (or non-recurring items), as disclosed in our financial statements. Adjusted EBITA for 1999, 2000 pro forma, 2001 and 2002 has been calculated by excluding from EBITA such comparison distortion items reported in the accompanying statements of operations which aggregate to a net of SEK 30 million, SEK 130 million, SEK 5 million and SEK (29) million in 1999, 2000, 2001 and 2002, respectively. Adjusted EBITA may not be indicative of our historical operating results, nor is it meant to be predictive of potential future results. Since all companies do not calculate Adjusted EBITA identically, the presentation of Adjusted EBITA may not be comparable to similarly entitled measures of other companies. |

Operating income |

|

— |

|

Gross profit less operating expenses (including comparison distortion items). |

Operating margin (%) |

|

— |

|

The ratio of Operating income to net sales expressed as a percentage. |

EBITDA margin (%) |

|

— |

|

The ratio of EBITDA to net sales expressed as a percentage. |

Adjusted EBITDA margin (%) |

|

— |

|

The ratio of Adjusted EBITDA to net sales expressed as a percentage. |

EBITA margin (%) |

|

— |

|

The ratio of EBITA to net sales expressed as a percentage. |

Adjusted EBITA margin (%) |

|

— |

|

The ratio of Adjusted EBITA to net sales expressed as a percentage. |

Investment in fixed assets |

|

— |

|

Cash flows used to acquire and/or maintain plant, property and equipment (Investments in fixed assets under cash flow from investing activities in the consolidated cash flow statement). |

Return on capital employed % |

|

— |

|

EBITA in relation to average capital employed, expressed as a percentage. |

|

|

|

|

|

I-8

Capital employed |

|

— |

|

Total assets less liquid funds, capitalised financing costs, other long-term securities, accrued interest income, operating liabilities and other non-interest bearing liabilities, including tax and deferred tax, but excluding accrued interest costs. Reflects the capital that is used in the operations. The capital employed for the group differs from the net capital for the segments concerning taxes, deferred taxes and pensions. |

Capital turnover rate, times |

|

— |

|

Ratio of net sales to average capital employed. |

Return on equity % |

|

— |

|

The ratio of net income divided by total equity expressed as a percentage. |

Total interest bearing debt |

|

— |

|

Total interest bearing debt comprises the sum of long-term liabilities, liabilities to credit institutions as reported under current liabilities, capitalised financial leases, and interest bearing pension liabilities. |

Net debt |

|

— |

|

Net debt comprises total interest bearing debt (see definition above) less cash and bank and other current deposits. |

Equity/assets ratio % |

|

— |

|

The ratio of total equity to total assets expressed as a percentage. |

Net debt/equity ratio |

|

— |

|

Ratio of net debt (see definition below) to total equity, expressed as a multiple. |

Interest coverage ratio, times |

|

— |

|

The ratio of EBITDA less interest and other financial income/(costs), plus interest costs to interest costs, expressed as a multiple. |

Net working capital excluding financial items |

|

— |

|

Current assets, excluding cash and bank and other current deposits, less current liabilities excluding liabilities to credit institutions. |

Ratio of earnings to fixed charges |

|

— |

|

The ratio of earnings (as defined) to fixed charges, expressed as a multiple. Earnings are defined as income before taxes plus fixed charges. Fixed charges are defined as interest expenses plus one-third of rental expense on operating leases, which represents the portion of rental expenses deemed to be attributable to interest. |

I-9

Unaudited Pro Forma Consolidated Financial Information for

Alfa Laval Special Finance AB

The unaudited pro forma consolidated financial information for the year ended December 31, 2000 has been prepared on the basis of our audited consolidated statement of operations and the audited consolidated statement of operations of Alfa Laval Holding, our predecessor, for 2000 included elsewhere in this annual report, which has been prepared in accordance with Swedish GAAP. Swedish GAAP differs in certain significant respects from US GAAP. See note 34 to our consolidated financial statements for the year ended December 31, 2000, included elsewhere in this annual report for a description of such differences, as they apply to Alfa Laval Special Finance AB. This pro forma consolidated financial information has not been prepared in accordance with Article 11 of Regulation S-X. The audited consolidated information has been adjusted to give effect to the Acquisition and related financing transactions including the offering of the Senior Notes, in each case as if such transactions had been completed on January 1, 2000, as described in the notes set forth below. In addition, the pro forma consolidated financial information has been adjusted to reflect purchase accounting under US GAAP. The pro forma adjustments are based upon available information and certain assumptions that management believes are reasonable. The unaudited pro forma financial information does not purport to represent what our results of operations or financial condition would actually have been had such transactions in fact occurred on January 1, 2000 or to project our results of operations for any future period or our financial condition for any future date. The unaudited pro forma consolidated financial information should be read in conjunction with "Item 5: Operating and Financial Review and Prospects" and our consolidated financial statements included elsewhere in this annual report.

I-10

Alfa Laval Special Finance AB

Unaudited Pro Forma Consolidated Statement of Operations

for the year ended December 31, 2000

| | Swedish GAAP

| | US GAAP

| |

|---|

| | Predecessor

period ended

August 23,

2000

| | Successor

period ended

December 31,

2000

| | Pro Forma

Adjustments

| | Pro Forma

Combined Year ended

December 31,

2000

| | Adjustments

| | Pro Forma

Year ended

December 31,

2000

| |

|---|

| | (SEK millions)

| |

|---|

| Consolidated Statement of Operating Data: | | | | | | | | | | | | | |

| Net sales | | 9,295 | | 5,717 | | | | 15,012 | | (200 | ) | 14,812 | |

| Cost of goods sold | | (5,963 | ) | (3,951 | ) | (210 | )(1) | (10,124 | ) | (82 | ) | (10,206 | ) |

| | |

| |

| | | |

| | | |

| |

| Gross profit | | 3,332 | | 1,766 | | | | 4,888 | | | | 4,606 | |

| Other operating expenses: | | | | | | | | | | | | | |

| Sales costs | | (1,749 | ) | (835 | ) | | | (2,584 | ) | | | (2,584 | ) |

| Administration costs | | (643 | ) | (218 | ) | | | (861 | ) | 61 | | (800 | ) |

| Research and development costs | | (279 | ) | (162 | ) | | | (441 | ) | (45 | ) | (486 | ) |

| Other operating income | | 258 | | 268 | | | | 525 | | 30 | | 555 | |

| Other operating costs | | (327 | ) | (356 | ) | | | (683 | ) | (291 | ) | (974 | ) |

| Goodwill amortisation | | (485 | ) | (55 | ) | 376 | (2) | (164 | ) | 6 | | (158 | ) |

| Comparison distortion items | | 524 | | (394 | ) | | | 130 | | 394 | | 524 | |

| | |

| |

| | | |

| | | |

| |

| Operating income/(loss) | | 631 | | 14 | | | | 810 | | | | 683 | |

| Interest and other financial income | | 139 | | 111 | | | | 250 | | | | 250 | |

| Interest and other financial costs | | (264 | ) | (440 | ) | (348 | )(3) | (1,052 | ) | (10 | ) | (1,061 | ) |

| | |

| |

| | | |

| | | |

| |

| Income/(loss) after financial items before taxes and minority interests | | 506 | | (315 | ) | | | 8 | | | | (128 | ) |

| Income tax benefit/(expense) | | (245 | ) | (56 | ) | 195 | (4) | (105 | ) | (34 | ) | (140 | ) |

| Minority interests | | (36 | ) | (12 | ) | | | (48 | ) | | | (48 | ) |

| | |

| |

| | | |

| | | |

| |

| Net income/(loss) | | 225 | | (383 | ) | | | (145 | ) | | | (316 | ) |

| | |

| |

| | | |

| | | |

| |

I-11

Notes to the Unaudited Pro Forma Financial Data for 2000

Swedish GAAP adjustments for the Acquisition and related financing,

including the offering of Senior Notes

The pro forma adjustments described below reflect the purchase accounting adjustments in accordance with Swedish GAAP, as described in our December 31, 2000 consolidated financial statements.

- (1)

- Reflects the adjustments to depreciation and amortisation expense related to the stepped-up fair values of tangible and intangible assets acquired upon the Acquisition of Alfa Laval Holding, as if the Acquisition and related financing had occurred on January 1, 2000.

- (2)

- Reflects the elimination of prior goodwill amortisation recorded for the period January 1, 2000 to August 23, 2000 and the addition of goodwill amortisation associated with the goodwill established as a result of the Acquisition and related financing as if the Acquisition and financing had occurred on January 1, 2000.

- (3)

- Reflects the elimination of interest expense associated with Tetra Laval debt incurred prior to the Acquisition and the related financing and the addition of interest expense associated with the incurrence of the new debt under the Previous Senior Credit Facility and the issuance of the Senior Notes to refinance the bridge loan facility as if the Acquisition and the related financing had occurred on January 1, 2000. The adjustment also includes the amortisation of additional debt issuance costs related to the Previous Senior Credit Facility and the Senior Notes as if the Acquisition and the related financing had occurred on January 1, 2000. The amounts outstanding under the Previous Senior Credit Facility bear interest at a rate of 1.5% over the applicable inter-bank offered rate. For purposes of this pro forma financial information, we have assumed an effective interest rate of 7.2%. A1/8 per cent variance in floating interest rates would result in a change in interest expense of SEK 7 million. The interest on the Senior Notes is 12.125%.

| | Interest Rate

| | Amount

| | Additional

interest as if

incurred on

January 1,

2000

| |

|---|

| |

| | (SEK in millions)

| |

|---|

| Actual interest on refinanced Tetra Laval Debt | | | | | | (84 | ) |

| Previous Senior Credit Facility | | 7.2 | % | 5,730 | | 250 | |

| Actual interest on bridge loan facility | | | | | | (44 | ) |

| Senior Notes issued to repay bridge loan facility | | 12.125 | % | 1,950 | | 202 | |

| | | | | | |

| |

| | | | | | | 324 | |

Previous Senior Credit Facility debt issue costs amortised over 8 years |

|

|

|

228 |

|

18 |

|

| Senior Notes issue costs amortised over 10 years | | | | 71 | | 6 | |

| | | | | | |

| |

| Total incremental interest expense | | | | | | 348 | |

| | | | | | |

| |

- *

- Prepared on the basis of our capital structure in 2000.

- (4)

- Reflects the tax impact at our effective tax rate of 35% of the change in interest expense, depreciation and amortisation expense related to the stepped-up fair values of tangible and intangible assets as a result of the pro forma adjustments. The goodwill is not deductible for tax purposes; thus no tax impact is included for the adjustments to goodwill amortisation.

I-12

US GAAP Adjustments

The adjustments reflect the sum of the reconciliation adjustments of the consolidated statements of operations for the period January 1, 2000 to August 23, 2000 and for the period August 24, 2000 to December 31, 2000, as described in note 34 of our December 31, 2000 consolidated financial statements included elsewhere in this annual report. The adjustments also reflect certain reclassifications for the realisation of stepped-up values relating to the Acquisition that are presented as comparison distortion items in the Swedish GAAP financial statements. In addition, the US GAAP adjustments reflect the pro forma impact of applying US GAAP differences in purchasing accounting as if the transaction had occurred on January 1, 2000. Such differences result in higher cost of goods sold relating to amortisation of intangible assets and lower goodwill amortisation.

I-13

Exchange Rate Information

The following table sets forth, for the periods ended and dates indicated, certain information concerning the exchange rate for Swedish kronor to US dollars based information published by the Swedish Central Bank, orRiksbanken. No representation is made that Swedish kronor amounts have been, could have been or could be converted into US dollars, or vice versa, at such exchange rates or at any other rate. On April 10, 2003, the rate was $1.00 = SEK 8.49.

| | Swedish kronor per one US dollar

|

|---|

Year ended December 31,

| | Period

End(1)

| | Average

Rate(2)

| | High

| | Low

|

|---|

| 1997 | | 7.87 | | 7.67 | | 8.09 | | 6.86 |

| 1998 | | 8.07 | | 7.96 | | 8.35 | | 7.59 |

| 1999 | | 8.53 | | 8.27 | | 8.66 | | 7.71 |

| 2000 | | 9.54 | | 9.17 | | 10.33 | | 8.34 |

| 2001 | | 10.67 | | 10.33 | | 11.00 | | 9.27 |

| 2002 October | | 9.20 | | N/A | | 9.39 | | 9.20 |

| 2002 November | | 9.13 | | N/A | | 9.16 | | 8.96 |

| 2002 December | | 8.83 | | N/A | | 9.08 | | 8.81 |

| 2003 January | | 8.50 | | N/A | | 8.80 | | 8.50 |

| 2003 February | | 8.48 | | N/A | | 8.64 | | 8.42 |

| 2003 March | | 8.51 | | N/A | | 8.68 | | 8.38 |

| 2003 April (through April 10, 2003) | | 8.49 | | N/A | | 8.67 | | 8.48 |

- (1)

- Represents the exchange rate on the last business day of the applicable period.

- (2)

- Represents the average of the exchange rates on the last business day of each month during the relevant period.

European Monetary Union and Sweden's Currency Policy

On January 1, 2002, the euro replaced national currencies in the twelve member states of the EMU. Monetary policy with respect to the euro is conducted by the European Central Bank which sets interest rate policy for, and manages the foreign reserves of, the euro states.

Three members of the European Union, Denmark, Sweden and the United Kingdom have not adopted the euro.

3.B. Capitalisation and Indebtedness

Not applicable.

3.C. Reasons for the Offer and Use of Proceeds

Not applicable.

I-14

3.D. Risk Factors

Set forth below is a description of certain risks that may affect our business, financial condition and results of operations from time to time.

This annual report contains certain forward-looking statements concerning, among other things, our revenue and Adjusted EBITA margin targets, as well as expected cost savings and operating efficiencies in connection with our cost reduction programme, known as "Beyond Expectations". These forward-looking statements are subject to risks and uncertainties that could cause actual revenue targets, Adjusted EBITA targets, cost savings and operating efficiencies to be substantially lower than those expressed or implied by such statements.

We have set as a target for our revenue growth that we should outperform the markets in which we operate over the course of the business cycle. In addition, we have set an Adjusted EBITA margin target of greater than 12%. This financial target requires that we obtain certain cost savings and operating efficiencies we expect to achieve from our Beyond Expectations restructuring programme. Our cost reduction programme, the implementation of which commenced in late 1999 and which is expected to be completed by the end of 2003, is estimated to generate cost savings and other operating efficiencies of approximately SEK 800 million to SEK 1,000 million by the end of 2003 on an annualised basis. While some of these cost savings and operating efficiencies, and the costs incurred in achieving them, have been recorded to date and are reflected in our results for the years ended December 31, 2001 and 2000, respectively, a significant portion of such cost savings and operating efficiencies, and the costs incurred in achieving them, have not yet been recorded. The discussion under "Item 5.A: Operating and Financial Review and Prospects—Operating Results—Our Restructuring and Cost Reduction Programme—Beyond Expectations" describes generally our revenue and Adjusted EBITA margins targets, together with the cost savings and operating efficiencies attributable to the Beyond Expectations programme, as well as the expected costs incurred in achieving such savings and efficiencies, to the extent not already recorded in our financial results. There can be no assurances, however, that such revenue targets, Adjusted EBITA margin targets, cost savings and operating efficiencies actually will be realised.

Our operating results, including our revenues, operating income, EBITA, Adjusted EBITA and cash flows, could be harmed during economic downturns as demand for our products and services is reduced. This, in turn, could affect our ability to make payments due to you on the Senior Notes.

The businesses of most of our industrial customers, particularly those operating within the marine and oil and gas production industries are, to varying degrees, cyclical and have experienced periodic downturns. Margins in those industries are sensitive to demand cycles, and our customers in those industries historically have tended to delay large capital projects, including expensive maintenance and upgrades, during economic downturns. For example, due to the simultaneous decline in oil and chemical prices in 1998 and 1999, as well as a decline in ship construction, many of our key customers reduced their capital spending, which resulted in declines in our revenues, operating income, EBITA, Adjusted EBITA and cash flows during those years. These industry downturns led to diminished product demand and excess manufacturing capacity.

Any significant downturn in our customers' markets or in general economic conditions could result in a reduction in demand for our products and services and under-utilisation of our facilities. Historically, we have experienced the negative impact of an economic downturn between 6 to 12 months after the onset of the decline. Since our personnel costs constitute a significant component of our operating expenses and these costs, as well as the cost of our facilities, are fixed at the commencement of each financial period, under-utilisation of our personnel and our facilities will negatively impact our revenues, operating income, EBITA, Adjusted EBITA and cash flow. This, in turn, could affect our ability to make payments due to you on the Senior Notes. Our business is also affected by the seasonality of end-user markets and invoicing, more fully discussed under "Item 5.A:

I-15

Operating and Financial Review and Prospects—Operating Results—Seasonality of end-user markets and invoicing".

The markets for our products are highly competitive. If we do not respond effectively and on a timely basis to changes in the industries we serve, our competitiveness may be affected and our business could suffer. We may also experience pricing pressure as a result of competition.

The markets for many of our products are highly competitive, especially as to product quality, product price, reliability of product supply, technical support and service. From time to time, we experience pricing pressure as a result of competitive pressures. To remain competitive, we will need to continue to invest in manufacturing, research and development, marketing, customer service and support and our distribution networks. We may not have sufficient resources to continue to make these investments and we may not maintain our competitive position. Our competitors include large, integrated companies that may have access to greater financial and other resources than we do. See "Item 4.B: Information about the Company—Business Overview—Competition" where the competition we face in our business is more fully described.

We may not be able to continue to increase our sales as a result of our recent corporate and operational reorganisation. This may have a material adverse effect on our results of operations.

Following the completion of our recent corporate and operational reorganisation, additional sales are dependent upon our ability to develop the necessary implementation plans, commit the necessary personnel and rationalise our workforce and operations to establish an integrated business focusing on our customers. In addition, as part of our recent reorganisation, we have integrated and centralised various systems and processes, such as management information, accounting and information technology systems. We may not be able to fully and successfully recognise any expected benefits from our reorganisation and consequently we may not be able to increase our sales. As a result, there may be a material adverse effect on our results of operations.

We are exposed to economic, political and business risks associated with international sales and operations. If we do not address these risks in a cost-effective manner, the growth of our operations may be limited, our operating margins could be reduced and our business, operating results and financial condition could materially adversely affected.

As we sell our products worldwide, our business is subject to risks associated with doing business internationally. Accordingly, our future results could be harmed by a variety of factors, including, but not limited to:

- •

- changes in a specific country's or region's political or economic conditions, particularly in the emerging markets;

- •

- trade protection measures and import or export licensing requirements;

- •

- potentially negative consequences from changes in tax laws;

- •

- difficulty in staffing and managing global operations;

- •

- stringent labour regulations;

- •

- inadequate protection of intellectual property;

- •

- unexpected changes in regulatory requirements; and

- •

- state-imposed restrictions on repatriation of funds.

We manufacture and distribute our products in many countries around the world. We are confronted with different legal and regulatory requirements in many jurisdictions. These include tariffs

I-16

and trade barriers, requirements relating to withholding taxes on remittances and other payments by subsidiaries and different regimes controlling the protection of our intellectual property. Our international operations also expose us to different local business risks and challenges. We are faced with potential difficulties in staffing and managing local operations. We have to manage credit risks of local customers and distributors. Our expansion in emerging markets requires us to respond to rapid changes in market conditions in these countries. Therefore, our overall success as a global business depends, in part, upon our ability to succeed in differing economic, social and political conditions.

We may not be able to succeed in developing and implementing policies and strategies that are effective in each location where we do business. If we fail to address the risks associated with our international operations in a cost-effective and timely manner, the growth of our operations may be limited, our operating margins could be reduced and our business, operating results and financial condition could be materially adversely affected.

Our operations depend on certain raw materials, the prices for which are volatile, and we depend on certain suppliers for those raw materials. Shortage of, or price increases for, supplies could harm our ability to manufacture and sell our products.

We rely on raw materials such as stainless steel, carbon steel, copper and titanium for the manufacture of our products. Shortages of supply have occurred in the past and may occur in the future. We depend on three suppliers for titanium and are subject to a substantial lead time in ordering and obtaining titanium from sources other than our key suppliers. The number of titanium suppliers is limited and a change of suppliers could cause a delay in manufacturing products such as our large heat exchangers, increase our costs and result in a loss of sales. Shortages of, or price increases for, supplies could have a material adverse effect on our ability to manufacture and sell certain of our products in a timely and cost-effective manner.

Prices under these contracts for raw materials are negotiated on a six-month or yearly basis. We also purchase raw materials directly on the spot market. Spot prices fluctuate and may be significantly less than or significantly greater than the prices we pay for our raw materials under long-term agreements. While we seek to balance increases in raw material costs with corresponding increases in the prices of our products, there have been in the past, and may be in the future, periods of time during which we cannot recover cost increases. These failures to recover costs can result in part because of competitive pressures, the timing of changes to the prices of raw materials and because at times, in certain markets, over-capacity prevents selling prices from being raised. Cost decreases are generally reflected more quickly in our sales prices than cost increases due to competitive pressures.

We are exposed to the risk of currency fluctuations in many countries and these fluctuations may have a material effect on our results of operation and financial position. Currency fluctuations may also affect the comparability of our results between financial periods.

Our operations are conducted by in approximately 100 countries. The results of the operations and the financial position of these subsidiaries are reported in the relevant foreign currencies and then translated into Swedish kronor at the applicable exchange rates for inclusion in our consolidated financial statements which are stated in Swedish kronor. The exchange rates between these currencies and the Swedish kronor in recent years have fluctuated significantly and may in the future fluctuate significantly. These fluctuations have had in the past, and may have in the future, a material effect on our results of operations and financial position and may significantly affect the comparability of our results between financial periods.

I-17

In addition, we incur currency transaction risk whenever one of our operating subsidiaries enters into a transaction using a different currency than its functional currency. We attempt to reduce currency transaction risk by:

- •

- matching cash flows and debt in the same currency;

- •

- foreign currency borrowing; and

- •

- entering into foreign exchange contracts for hedging purposes.

However, we may not be able to hedge this risk completely or at an acceptable cost, which may adversely affect our results of operations and financial condition. See "Item 11.A: Quantitative and Qualitative Disclosures About Market Risk—Foreign Currency Exchange Rate Exposure".

Principal and interest on the Senior Notes will be payable in euros. Our ability to pay interest and principal on the Senior Notes when due is in part dependent on the then current exchange rates between euros, on the one hand, and the Swedish kronor and other European, as well as US and Asian currencies that our sales are denominated in, on the other hand, which rates are and will be subject to fluctuation. Exchange rate fluctuations may have a material adverse effect on our results of operations and financial condition and therefore on our ability to make principal and interest payments on our debt, including the Senior Notes, when due.

We may have liabilities associated with the pending Desert Storm litigation. If we are found liable for the claims, our financial condition could be materially adversely affected.

Some of our subsidiaries, along with approximately 70 other defendants, have been sued in lawsuits in the United States arising from claims related to injuries allegedly suffered in the Gulf War in 1991, also known as Desert Storm. These two lawsuits were initiated in 1994. The lawsuits claim damages in excess of $1 billion each and allege that equipment supplied by our subsidiaries, among other defendants, was used to manufacture Iraqi chemical and/or biological weapons. While we consider our liability remote in these cases, litigation is impossible to predict and we may be found liable for these claims, which could have a material adverse effect on our financial condition. See "Item 8.A: Financial Information—Legal Proceedings" for further information regarding this litigation and for a description of the indemnification provisions set forth in the Share Sale and Purchase Agreement between us and Tetra Laval B.V. in respect of this litigation.

We may in the future face large liability and breach of contract claims for defective products which may cause us to lose revenues, cause a delay in market acceptance of our products or harm our reputation. These claims could also be costly and time-consuming to defend.

We are subject to litigation in the ordinary course of our business. Except as described in the previous risk factor, we are not engaged in and do not foresee, at the present time, any litigation that we believe could have a material adverse effect on our financial condition or results of operations. However, litigation having a material adverse effect on our financial condition or results of operations may arise in the future and this may adversely affect our reputation, cause us to lose revenues, cause a delay in the market acceptance of our products and adversely affect our ability to make principal and interest payments on our debt, including the Senior Notes. Our businesses expose us to possible claims for personal injury, death, property damage, breach of contract or other product liability claims which could result from a failure of a product we manufactured or of a product integrated into a product we manufactured, particularly in relation to our high-speed separators. Many factors beyond our control could lead to liability claims, including, but not limited to:

- •

- the failure of a product manufactured by a third party which incorporated components manufactured by us;

I-18

- •

- the reliability and skills of persons using our products or the products of our customers;

- •

- the use of our products that we produce for applications for which our product was not designed; and

- •

- the failure of a product manufactured by a third party whose products we later acquire. See "Item 8.A: Financial Information—Legal Proceedings" for a description of court proceedings initiated against us by the Amylum Group.

These claims could also cause damage to our reputation. Although we test our products extensively and our products are manufactured to industry standards, we have obtained insurance coverage for most of these types of liabilities and we believe that this insurance coverage is adequate. We could, however, be required to pay a material amount if a claim is made against us that is not fully covered by insurance and no third party is required to indemnify us or if a third party fails to indemnify us. Litigation involving significant product recalls or product liability could have a material adverse effect on our financial condition or results of operations. For a discussion of our litigation matters, see "Item 8.A: Financial Information—Legal Proceedings".

Environmental compliance costs and liabilities could adversely affect our financial condition and this, in turn, may adversely affect our ability to make principal and interest payments on our debt, including the Senior Notes.

Our operations and properties are subject to increasingly stringent laws and regulations relating to environmental protection, including laws and regulations governing air emissions, water discharges, waste management and workplace safety. These laws and regulations can impose substantial fines and sanctions for violations and require the installation of costly pollution control equipment or operational changes to limit pollution emissions and/or decrease the likelihood of accidental hazardous substance releases. We must conform our operations and properties to these laws, and adapt to regulatory requirements in all countries as these requirements change.

We use and generate hazardous substances and wastes in our manufacturing operations. In addition, many of our current and former properties are or have been used for industrial purposes and we have arranged for disposal of wastes at third-party disposal sites. Under certain environmental laws, liability for response actions at contaminated sites, including buildings and other facilities, is strict, and in some cases, joint and several. We may be subject to potentially material liabilities relating to the investigation and clean-up of contaminated areas, including groundwater at properties now or formerly owned, operated or used by us, and to claims alleging personal injury or damage to natural resources.

We have experienced, and expect to continue to experience, operating costs to comply with environmental laws and regulations. In addition, new laws and regulations, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements could require us to incur costs or become the basis of new or increased liabilities that could have a material adverse effect on our business, financial condition or results of operations and this may adversely affect our ability to make principal and interest payments on our debt, including the Senior Notes.

Our business could suffer if we are unsuccessful in negotiating new collective bargaining agreements. Strikes and other industrial actions could disrupt our operations or make it more costly to operate our facilities.

As of December 31, 2002, we had approximately 9,125 employees, the majority of whom are represented by unions. The majority of our material collective bargaining agreements with these unions range from one to five years in duration. We may not be successful in negotiating new collective bargaining agreements. Moreover, negotiations may result in significant increases in the cost of labour

I-19

or a breakdown in negotiations leading to a disruption of our operations. Any such action could have a material adverse effect on our results of operations.

Third parties may infringe our intellectual property, and we may expend significant resources enforcing our rights or suffer competitive injury, which could harm our operating results and, in turn, our ability to make principal and interest payments on our debt, including the Senior Notes.

Our success depends in part on our proprietary technology. We rely on a combination of patents, copyrights, trademarks, trade secrets and confidentiality provisions to establish and protect our proprietary rights. If we fail to successfully enforce our intellectual property rights, our competitive position could suffer, which could harm our operating results. We may be required to spend significant resources to monitor and protect our intellectual property rights.

Failure to continue to pursue product innovation would impair our future growth and competitive position. As a result, there could be a material adverse affect on our business, financial position and results of operations and this may affect our ability to make payments of principal and interest on our debt, including the Senior Notes.

Our business experiences technological change, ongoing product improvements and obsolescence of existing products, leading to the introduction of new products or production processes. Our future growth will depend on our ability to gauge the direction of the commercial progress in all key markets and upon our ability to successfully develop, manufacture, market products and sell products in these changing markets. We will have to continue to identify, develop, market and sell innovative products on a timely basis to replace existing products in order to maintain our competitive position.

We intend to devote significant resources to the development of new products and intend to continue to devote a substantial amount of spending to the research, development and technology process functions of our business. However, we may not be successful in developing new products or new products may not be accepted by our customers. If we fail to keep pace with the innovations in our markets, then there could be a material adverse affect on our business, financial position and results of operations and this may affect our ability to make payments of principal and interest on our debt, including the Senior Notes.

Our substantial amount of debt could hurt our financial health and stop us from fulfilling our obligations under our Senior Notes.

We have a significant amount of debt. As of December 31, 2002, we had total consolidated debt of SEK 4,519 million. If we had drawn down all amounts available under our revolving credit facility, the maximum amount of debt that would have been outstanding at December 31, 2002 would have increased by SEK 1,374 million to SEK 5,893 million.

Our annual debt service based on the outstanding debt at December 31, 2002 is SEK 538 million in interest expense and interest payments. The Existing Senior Credit Facility is amortisation free. The committed principal amount for 2002 under the Previous Senior Credit Facility was SEK 89 million. Actual repayments for 2002 totalled SEK 1,760 million. Through April 10, 2003, actual repayments totalled SEK 228 million.

Our Senior Notes have a fixed charge of 12.125%. We are not required to maintain hedging under the terms of the Existing Senior Credit Facility. If the interest rate is increased by 1 percentage unit on all loans with a floating interest charge, our annual debt service cost will increase by SEK 16 million.

I-20

Our substantial debt could have important consequences to you as a holder of the Senior Notes. For example it could:

- •

- limit our ability to obtain additional financing in order to fund future working capital requirements, capital expenditures, acquisitions or other needs;

- •

- require that a substantial portion of our cash flow from operations be dedicated to making periodic payments with respect to principal and interest on our debt, thereby reducing the funds available for operations and future business opportunities;

- •

- restrict our use of funds we acquire through asset dispositions or which constitute excess cash flow;

- •

- require us to maintain specified financial ratios;

- •

- increase our vulnerability to adverse economic and industry conditions;

- •

- limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and

- •

- place us at a comparative disadvantage compared to our competitors with less debt.

In addition, since all the borrowings under our Existing Senior Credit Facility will be at variable rates of interest, we will be required to make larger payments if interest rates increase.

Our ability to make scheduled payments of the principal of, to pay interest on or to refinance our debt, including the Senior Notes, and to make payments on our other obligations depends on our future performance. Furthermore, we expect that we will need to refinance all or a part of the Senior Notes at final maturity. Certain aspects of our future performance are subject to economic, financial, competitive and other factors beyond our control. We may not be able to generate sufficient cash flow from operations in the future to service our debt and make necessary capital expenditures. If we fail to do so, we may be required:

- •

- to refinance some or all of our existing debt;

- •

- to sell assets in order to make debt service payments; or

- •

- to obtain additional financing.

We may not be able to undertake any of these refinancings, sell any of our assets or obtain additional financing, particularly as our Existing Senior Credit Facility contains a covenant restricting disposals of assets.

If we fail to comply with the payment requirements of any of our debt, including the Senior Notes, it could lead to the acceleration of the related debt and the acceleration of debt under other debt instruments containing cross acceleration or cross default provisions. If this occurred, we might not be able to refinance or otherwise repay this debt.

Despite current debt levels, we may still be able to incur substantially more debt, which may be senior to the guarantee and the Senior Notes and this could further exacerbate the risks described above.

We and our subsidiaries may be able to incur substantial additional debt in the future. If additional debt is added to our current debt levels, the risks that we now face could intensify. The terms of the indenture restrict but do not fully prohibit us and our subsidiaries from borrowing. The additional debt we incur could be secured and debt of the Guarantor could be senior to the guarantee and the Senior Notes. Debt incurred by our subsidiaries, other than the Guarantor, will be senior in right of payment to the Senior Notes. If we incur additional debt, the related risks described above that we face could intensify.

I-21

We depend on payments from our subsidiaries to make payments on the Senior Notes. Our subsidiaries may not generate cash flow sufficient to enable us to meet our payment obligations on the Senior Notes. In addition, our Existing Senior Credit Facility restricts our subsidiaries' ability to provide funds to us and we may be unable to pay you amounts due on the Senior Notes.

Our only assets are shares in our wholly owned subsidiary, the Guarantor, and an intercompany loan to the Guarantor. Our cash flow and our ability to service the Senior Notes and any other debt depend solely upon the cash flow of our subsidiaries and our receipt of funds from them in the form of loans, dividends, interest or otherwise. Our subsidiaries may not generate cash flow sufficient to enable us to meet our payment obligations. Our subsidiaries have debt that is senior to the Senior Notes aggregating to SEK 3,391 million.