Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

WORLD-CLASS MANUFACTURING

[PHOTO]

INNOVATIVE PRODUCTS

SHARPENED CONSUMER FOCUS

SUPERIOR CRAFTSMANSHIP

FLEXIBILITY AND RESPONSIVENESS

Intier Automotive is an innovative leader in the development and manufacture of vehicle interior and closure components and systems for the global automotive industry. The Company's capabilities are among the most diversified in the industry, ranging from the understanding of end consumers' needs and wants, through market and consumer research, concept development, design and engineering, testing and validation and finally the manufacture of interior and closure systems. Intier is also a leader in vehicle interior integration and program management. Product expertise includes cockpit modules, modular doors and panels, complete seat systems and specialty seat mechanisms, overhead systems, latching systems, glass moving systems, power sliding doors and liftgates and electro-mechanical systems. Intier has approximately 22,500 employees at 65 manufacturing facilities, 17 product development, engineering and testing centres and 13 sales offices throughout North America, Europe, Brazil and Asia Pacific.

Intier Automotive.

Shaping the Inner Dimension™.

On the Cover: (Large image) The Jaguar S-type represents superior craftsmanship. Intier supplies the instrument panel, glove box and door panels. Inset: (Left) Innovative, highly engineered side door latch which represents a breakthrough with a major European customer. (Right) Chrysler Pacifica leather seat manufactured by Intier.

INTERIOR SYSTEMS

[PHOTOS]

COCKPIT SYSTEMS

- •

- Cockpit Modules

- •

- Instrument Panels

- •

- Genuine Leather IP Covering

- •

- Consoles

- •

- Glove Boxes

- •

- Assembly & Sequencing

OVERHEAD SYSTEMS

- •

- Complete Overhead Systems

- •

- Headliner Substrates

- •

- Sun Visors

- •

- Pillar Trim

- •

- Consoles

- •

- Assembly & Sequencing

SIDEWALL SYSTEMS

- •

- Door Trim Modules

- •

- Hard Trim

- •

- Door & Side Panels

- •

- Package Trays

- •

- Trim Hardware Modules

- •

- Assembly & Sequencing

FLOOR CARPET & ACOUSTIC SYSTEMS

REAR CARGO & TRUNK TRIM SYSTEMS

CARGO MANAGEMENT SYSTEMS

INTEGRATION OF SAFETY & ELECTRONIC SYSTEMS

COMPLETE INTERIOR INTEGRATION

SEATING SYSTEMS

- •

- Modular Seat Assemblies

- •

- Integrated Child Safety Seats

- •

- Integrated Occupant Safety Restraints

- •

- In-Vehicle Stowable Seating

- •

- Heavy Truck Sleeper Beds

- •

- Head Restraints & Armrests

- •

- Roof Integrated Head Restraints

- •

- Trim Covers

- •

- Molded Polyurethane Foam Pads

SEATING HARDWARE SYSTEMS

- •

- Manual Adjusters

- •

- Seat Height Adjusters

- •

- EZ Entry Mechanisms

- •

- Fold & Tumble™ Mechanisms

- •

- Manual Recliners

- •

- Fold Flat Mechanisms

- •

- Specialty Latches

- •

- Seat Frames

- •

- Wire Frames

- •

- Spring Suspension Systems

- •

- Risers

- •

- Folding Load Floor Panels

- •

- Sliding Cargo Load Floor

CLOSURE SYSTEMS

[PHOTOS]

LATCHING SYSTEMS

- •

- Side Doors

- •

- Sliding Doors

- •

- Front & Rear Latches

- •

- Seat Latches

- •

- Strikers

- •

- Mechanical Cable Assemblies

- •

- Plastic Handles

- •

- Door Handle Assemblies

- •

- Latch Actuators

- •

- Non-Contact Door Entry Systems

GLASS MOVING SYSTEMS

- •

- Cable & Drum—Single & Dual Rail

- •

- Arm & Sector

- •

- Quarter Systems

- •

- Rear Window Closure Systems

INTIER ENGINEERING AND TESTING CAPABILITIES

INTIER AUTOMOTIVE TESTING

- •

- Safety, structural, fatigue & durability testing for body & interior systems

- •

- Vehicle ride simulation, NVH & road load data acquisition

- •

- CAE, FEA, factory simulation

- •

- Assembly & test equipment

"ADVANCED CAR TECHNOLOGY SYSTEMS" (ACTS)

- •

- 50/50 Joint Venture with Magna Steyr

- •

- Development & supply of modular & functional systems, vehicle structures, occupant restraint systems, pedestrian protection systems & complete doors & new products

- •

- Advanced development & serial application of safety systems, complete doors & structure & Electrical/Electronic systems

- •

- Test execution & evaluation of passive safety testing; environment simulation testing; endurance testing

WELCOME TO INTIER—A MESSAGE FROM THE PRESIDENT

At Intier, we understand how quickly and dramatically the automotive industry is changing. Consumer demand for higher quality at lower prices, combined with increased global competition, is driving our customers to seek new and better ways to differentiate their vehicles in a highly crowded and competitive marketplace. When making a vehicle purchase, the interior is fast becoming a key differentiator in the eyes of the consumer, and at Intier we are uniquely positioned to help our customers adapt to this fast-changing environment.

With full interior capabilities, expertise in closure systems and a carefully defined and executed electronics strategy, we are well positioned to provide full-service, integrated solutions. We support these world-class capabilities with a superior understanding of the industry and extensive research into what drives a new car purchase.

We have proven our ability to manage systems integration with our delivery of complete interiors for the Cadillac CTS and complex modules for the MINI by BMW, the Nissan Micra, the Ford Escape/Mazda Tribute and the Audi A8 as well as complete closure systems such as doors, hardware modules and liftgates for a variety of vehicle platforms. Going forward, we will leverage this experience to meet the increasing demand for systems integration expertise.

Our products on new vehicle programs in both Europe and North America include the Jaguar XJ, the BMW 6 Series and the BMW X3, the Chrysler Pacifica, the Saturn ION, the Cadillac SRX, the Chevrolet Colorado/GMC Canyon and the Ford Freestar/Mercury Monterey. In addition, we have also been awarded business on New Domestic programs including the Mitsubishi Endeavor, the Nissan Maxima, Quest, and Titan and the Toyota Avensis. These programs will contribute to our continuing sales growth. We are also investigating new geographic markets, specifically in Asia as illustrated by our joint alliance with Toyoda Gosei.

Our world-class design, engineering, testing and manufacturing facilities are recognized for delivering innovative and cost-effective solutions. Our investment in engineering development supports our leading-edge capabilities and continues to foster innovation.

Most importantly, it is Intier Automotive's people who, through commitment to craftsmanship, innovation and world-class manufacturing, set us apart and are responsible for our growth, solid financial position, and our enduring customer relationships. We hope you enjoy learning more about us, and how we are trulyShaping the Inner Dimension™.

Donald J. Walker (Signature)

DONALD J. WALKER

President & Chief Executive Officer

[PHOTOS]

WORLD-CLASS MANUFACTURING

With approximately twenty-two thousand five hundred employees at sixty-five manufacturing facilities, seventeen product development, engineering and testing centres, and thirteen sales offices located throughout North America, Europe, Brazil and Asia Pacific, Intier Automotive's global capabilities have built a solid reputation for delivering innovative, high-quality, cost-effective components, modules and systems. Our world-class resources combine to offer a unique and integrated value proposition with complete interior capabilities, extensive closures expertise and a carefully defined electronics strategy. Significant investments have been made in new technologies, equipment, training and education, including the latest inventory, purchasing and workflow control management systems. "Six Sigma" processes have been adopted to ensure quality is built into every component and module, and our operations are independently certified to QS9000/ TS16949 and ISO 14001 standards. We have developed our own Global Manufacturing Standard, ensuring consistent practices and processes are followed at all our facilities around the world. This, in turn, drives competitive pricing and superior delivery performance across the entire organization. Specific performance metrics are developed and benchmarked at all operations, aimed at achieving Best-in-Class levels. Supporting these world-class capabilities, the Company has an ongoing partnership with Magna Steyr in "Advanced Car Technology Systems" (ACTS), a leading European-based automotive development and test facility that amplifies our significant research and development initiatives. As a testament to our industry-leading position, we have been honoured by numerous customers for our commitment to world-class manufacturing performance.

Ingenuity

[PHOTO]

Above: Chrysler Pacifica seating supplied by Intier Automotive. Luxurious leather seating with 2nd and 3rd row seats that fold flat in a variety of configurations, providing outstanding flexibility. Opposite: (Left) Operator prepares Saturn ION seat for delivery. (Middle) Intier Automotive's latch facilities produce more than 40 million latches annually. (Right) An operator completes assembly of the Cadillac CTS centre stack as the cockpit module nears completion.

Inspire

[PHOTO]

Above: Intier Automotive's dedication to craftsmanship and world-class quality is epitomized by the 2002 Jaguar S-Type instrument panel, glove box and door panels. Opposite: (Left) Use of superior materials to enhance the Chrysler Pacifica seating system. (Middle) Total Closures Systems integration includes latches, rods, cables and both inside and outside handles. (Right) Excellent grain definition and contour retention for improved fit and finish are achieved through the use of PUR-FECT™ Skin technology.

CRAFTSMANSHIP

At Intier, craftsmanship means rigorous attention to detail and taking pride in everything we do. It means designing quality, fit and finish from the outset into every component and system we make. It means developing measureables related to specific characteristics such as gap, fit, colour, gloss and grain. It means training and deploying specialized craftsmanship engineers dedicated to establishing performance metrics to ensure our rigorous quality standards are met. It means using the best and most appropriate materials and processes, although not necessarily the most expensive. It means combining strong design with aesthetics, style and flawless execution to deliver an overall impression of value in a vehicle interior. It means a level of fit and finish that works in harmony with the entire vehicle and appeals to all the senses of a new car owner. It means enhancing driver comfort while providing the right level of functionality and information. It also means constantly researching and analyzing each specific geographic marketplace and consumer to fully understand what drives a new car purchase. At Intier, craftsmanship is as much a process as a product, derived from our passionate commitment to make every component, module or system the best it can be. Our success is evidenced by the numerous quality awards we have received from our customers.

[PHOTOS]

[PHOTOS]

INNOVATION

Innovation at Intier continues to be derived from the entrepreneurial spirit and creativity of our people. By working closely with our customers to deliver new ideas, processes, materials and approaches, we help them to provide the right products in the right segments at the right price. Our heritage of innovative thinking has led to several industry-leading solutions such as a variety of highly- functional seating and interior solutions, including Fold & Tumble™ mechanisms, self-positioning head restraints, AudioLITE™ flat speaker system, in-como™ individual cockpit module, and closure systems such as power sliding doors, midgates, non-contact door entry systems, to name a few. Product innovations are also derived from our unique insight into what drives a new vehicle purchase. Every year hundreds of new car purchasers are brought together in our proprietary consumer research clinics where we explore what buyers want to see in a new vehicle, from an aesthetic and functional sense, as well as understanding their impressions of current and future designs and features. Innovation also extends into every aspect of our design, engineering and manufacturing processes. We were the first to develop a foam-in-place seating solution that enhanced product quality and performance. Innovations in our Just-in-Time delivery and material handling systems have reduced costs across the supply chain. New ways of assembly have been developed that increase efficiency while improving operator comfort and safety. At Intier Automotive, we strive for continuous improvement, looking beyond the obvious to seek new and better ways in everything we do.

Innovate

[PHOTO]

Above: Excellent integration of innovation and craftsmanship is seen in Audi A8's cockpit. Opposite: (Left) The Intellispace™ Advanced Cockpit System offers flexibility of design, increased storage space and enhanced safety features. (Middle) Innovative, highly-engineered side door latch which represents a breakthrough with a major European customer. (Right) Innovative, see-through mesh head restraint conceptual rendering.

Integrate

[PHOTO]

Above: Intier is responsible for the design, engineering, and management of the Cadillac SRX complete interior, including the convenient and versatile cargo management system. Opposite: (Left) Power cinching latch provides comfort and convenience. (Middle) Saturn ION coupe seats, manufactured by Intier, provide unique functionality with a fold flat front row passenger seat. (Right) In addition to manufacturing the Saturn ION headliner, Intier assembles and sequences the complete overhead system.

GROWTH

Intier Automotive's carefully defined and well-executed strategies have resulted in solid and consistent growth, a strong financial position, and continuing relationships with many of the world's leading vehicle manufacturers. By working closely as true partners with our customers, we help to build their competitive position and market share. Through our rigorous focus on continuous improvement, our efforts to enhance production efficiencies, and initiatives in such areas as value engineering and analysis, global sourcing and supply chain management, we effectively meet our customers' needs today, and in the future. Going forward, we will continue to leverage our proven world-class facilities, expertise and capabilities to build our position as a full-service, interiors and closures systems supplier. We will emphasize our heritage of innovation and our culture of craftsmanship, supporting our efforts with leading-edge research and in-depth industry knowledge. We will capitalize on our complete systems and proven integration expertise to meet the accelerating trend for ever-larger and more complex responsibilities and solutions. We will solidify and extend our geographic presence with both current and new customers to support their global mandates. We will extend our product reach by leveraging opportunities within our specific areas of expertise. Finally, we will grow and strengthen by simply doing things better each and every day, ultimately providing our customers with a better product for a better price.

[PHOTOS]

Left: The Cadillac SRX door, one of the main interior components for which Intier is responsible, includes unique storage, finely crafted seams, and luxurious material grain definition.

INTERIORS

Intier Automotive's Interior Systems group provides complete integrated vehicle interior systems, from the initial concept to development, validation, manufacture and sequenced delivery of all major interior sub-systems. Our use of state-of-the-art design and engineering tools, progressive program management systems, leading edge products, world-class manufacturing technologies and a skilled team of professional craftspeople enables our customers to effectively and efficiently manage costs while providing maximum flexibility to differentiate their vehicles with unique and well-crafted interiors. Through our in-depth market research, we have a thorough understanding of the evolving wants and needs of consumers, which helps drive our concept developments. With our dedication to craftsmanship, we approach the design of a vehicle interior as a whole, integrated unit, ensuring the entire system fits together seamlessly and harmoniously, with perfectly matching colours, textures and themes. We then combine our extensive capabilities with those of the best sub-suppliers to deliver complete systems that can easily be incorporated into the vehicle on our customers' assembly floor. As a commitment to continuous improvement, we conduct in-depth follow-up consumer research clinics to gauge feedback after a vehicle launches.

[PHOTOS]

Bottom: (Left) The well-crafted result of the Intier-designed Cadillac SRX complete cockpit and centre console assembly. (Middle) Employees assemble components of the Dodge Ram overhead system. (Right) Intier manufactures the cockpit module, door panels and numerous interior panels for the MINI by BMW.

[PHOTOS]

Above: (Left) Analysis of product designs using advanced software packages like MADYMO™ help Intier minimize development time. (Middle) The Integral Positive Engaging Latch (IPEL). Intier Automotive is a leading supplier of manual and specialty mechanisms for complete seat systems. (Right) Mesh head restraint concept improves driver visibility beyond the rear seats of the vehicle.

SEATING SOLUTIONS

Intier Automotive is recognized worldwide as the premier designer and manufacturer of innovative seating systems and components. Delivering world-class comfort, craftsmanship and functionality, we excel at combining an in-depth knowledge of consumer preferences with our superior mechanism capabilities to create unique seating solutions with efficient and cost-effective designs.

COCKPIT, OVERHEAD AND SIDEWALL SYSTEMS

Intier works closely with its customers to develop and supply complex and highly functional cockpit, overhead and sidewall systems that incorporate the latest advances and innovations in manufacturing processes, surface materials, structures, safety systems and electronics.

CARPET, ACOUSTIC AND CARGO MANAGEMENT SYSTEMS

Focused on driver comfort, convenience and safety, our acoustical and carpeting capabilities and cargo management systems deliver optimal noise reduction along with functionality and ease of use.

[PHOTO]

Right: Membrane seating technology built around and for the human body. The shape of the unique membrane surface is driven by the frame design and anthropometric factors. Intier Automotive's "inside-out" design process ensures seating comfort for occupants of different shapes and genders.

[PHOTO]

ELECTRICAL/ELECTRONICS

The importance of functionality and comfort is increasing as consumers spend more and more time in their vehicles. Intier Automotive is committed to providing innovative and unique electronic and electrical solutions to balance the demands of a fast-changing industry with cost competitiveness and flexibility. Intier has established in-house electrical engineering competencies to develop complete systems and detailed electronic product innovations. This capability is complemented through the establishment of tactical relationships, strategic alliances and joint ventures with various Magna partners including Magna Donnelly Electronics, and ACTS "Advanced Car Technology Systems", through our agreement with Magna Steyr, as well as other leading industry suppliers, such as our strategic alliance with Delphi Packard. By leveraging a "virtual enterprise" approach, Intier has expanded its product and technology development capabilities to support integrated interior and closure systems and provide the right solution at a competitive price.

[PHOTO]

Top:in-como™—individual cockpit module is one of Intier Automotive's advanced automotive developments demonstrating integration of electrical/electronic technologies. Bottom: CAD rendering of an instrument panel electrical architecture representing the scope of responsibility Intier has in the development and packaging of electrical systems into the interior.

[PHOTOS]

CLOSURES

Intier Automotive's unique ability to provide complete interior solutions is complemented by our significant closures capabilities. We are one of the world's largest suppliers of door, hood and trunk latching systems, providing customers with highly engineered solutions that combine superior strength with improved acoustics, safety and security. Our glass moving systems are recognized for their durability, quiet operation and long-term reliability. We are respected for our innovations in doors and liftgates, jointly introducing, with our customer, the first power liftgate for a production minivan and power sliding door driven by an operating mechanism contained entirely within the door. We recently developed a midgate module to expand the functionality and useability for hybrid personal-use trucks and sport utility vehicles. We also developed a non-contact, anti-pinch technology to enhance the safety of our doors, power liftgates and glass moving systems. In addition, we offer numerous electro-mechanical solutions such as wiper systems and innovative obstacle detection systems. The ability to tie our closures functionality and engineering excellence with the vehicle interior makes us a truly unique company.

[PHOTO]

Top: (Left) EXPRESS-SOFT™ software and hardware design for express close electronic control modules is completely designed and developed in-house. (Middle) Closures' growing share of wiper systems business reflects it's low-cost, high-quality designs. (Right) Sealed door module for a major New Domestic customer. Bottom: Innovative infinite door detent check mechanism provides infinite control of the door in the open position.

PEOPLE

At Intier Automotive, it is our people that truly make the difference. Our long-standing culture of employee empowerment has fostered an environment that encourages ingenuity, innovation, agility, responsiveness and performance. We provide our people with the appropriate level of autonomy and responsibility, enabling them to take pride of ownership in every product and system they produce. In short, everyone is focused on becoming the value-leader in our industry while meeting the needs of our customers better than any of our competitors.

Our culture of craftsmanship and innovation is supported by numerous initiatives that solicit employee input about current and future trends in vehicle interiors and design, and many of these ideas have been translated into new products and processes. We also reward and recognize the contribution of our people through profit sharing and incentive programs, as outlined in our Employee's Charter and Corporate Constitution. Annual events are also held to recognize specific employees for their innovative ideas and contributions to our success.

Involve

[PHOTO]

EMPLOYEE'S CHARTER

Intier Automotive is committed to an operating philosophy which is based on fairness and concern for people. This philosophy is part of Intier Automotive's Fair Enterprise culture in which employees and management share in the responsibility to ensure the success of the company. It includes these principles:

JOB SECURITY

Being competitive by making a better product for a better price is the best way to enhance job security. Intier Automotive is committed to working together with you to help protect your job security. To assist you, Intier Automotive will provide:

- •

- Job Counselling

- •

- Training

- •

- Employee Assistance Programs

A SAFE AND HEALTHFUL WORKPLACE

Intier Automotive strives to provide you with a working environment which is safe and healthful.

FAIR TREATMENT

Intier Automotive offers equal employment opportunities based on an individual's qualifications and performance, free from discrimination or favouritism.

COMPETITIVE WAGES AND BENEFITS

Intier Automotive will provide you with information which will enable you to compare your total compensation of total wages and total benefits with those earned by employees of your competitors, as well as with other plants in your community. If your total compensation is found not to be competitive, then your wages will be adjusted.

EMPLOYEE EQUITY AND PROFIT PARTICIPATION

Intier Automotive believes that every employee should share in the financial success of the company.

COMMUNICATION AND INFORMATION

Through regular monthly meetings between management and employees and through publications, Intier Automotive will provide you with information so that you will know what is going on in your company and within the industry.

THE HOTLINE

Should you have a problem, or feel the above principles are not being met, we encourage you to call the Hotline or use the self-addressed Hotline Envelopes to register your complaints. You do not have to give your name, but if you do, it will be held in strict confidence. Hotline Investigators will answer your call. The Hotline is committed to investigate and resolve all concerns or complaints and must report the outcome to Magna's Global Human Resources Department. Hotline Number: 1-800-263-1691

EMPLOYEE RELATIONS ADVISORY BOARD

The Employee Relations Advisory Board is a group of people who have proven recognition and credibility relating to humanitarian and social issues. This Board will monitor, advise and ensure that Intier Automotive operates within the spirit of the Intier Automotive Employee's Charter and the principles of Intier Automotive's Corporate Constitution.

CORPORATE CONSTITUTION

BOARD OF DIRECTORS

Intier Automotive believes that outside directors provide independent counsel and discipline. A majority of the members of Intier Automotive's Board of Directors will be outsiders.

EMPLOYEE EQUITY AND PROFIT PARTICIPATION

Ten percent of Intier Automotive's profit before tax will be allocated to employees. These funds will be used for the purchase of Intier Automotive shares in trust for employees for allocation to employee pension plans and for cash distributions to employees, recognizing length of service.

SHAREHOLDER PROFIT PARTICIPATION

Intier Automotive will distribute on average, not less than 20 percent of its annual net profit after tax to shareholders.

MANAGEMENT PROFIT PARTICIPATION

To obtain long-term contractual commitment from senior management, the Company provides a compensation arrangement which, in addition to a base salary below industry standards, allows for the distribution of up to six percent of Intier Automotive's profit before tax.

RESEARCH AND DEVELOPMENT

Intier Automotive will allocate a minimum of seven percent of its profit before tax for research and development to ensure the long-term viability of the Company.

SOCIAL RESPONSIBILITY

The Company will allocate a maximum of two percent of its profit before tax for charitable, cultural, educational and political purposes to support the basic fabric of society.

MINIMUM PROFIT PERFORMANCE

Management has an obligation to produce a profit. If Intier Automotive does not generate a minimum after-tax return of four percent on share capital for two consecutive years, the Class A shareholders, voting as a class, will have the right to elect additional directors.

UNRELATED INVESTMENTS

Class A and Class B shareholders, with each class voting separately, will have the right to approve any investment in an unrelated business in the event such investment together with all other investments in unrelated businesses exceeds 20 percent of Intier Automotive's equity.

CONSTITUTIONAL AMENDMENTS

Any change to Intier Automotive's Corporate Constitution will require the approval of the Class A and Class B shareholders, with each class voting separately.

[PHOTOS]

INNOVATION AWARDS

An important part of Intier Automotive's culture is honouring the Spirit of Innovation within the Company and recognizing the individuals who foster and keep that spirit alive. Every year at our Innovation Awards gala we celebrate the Best of the Best—those Intier employees who, according to their peers, have contributed the most to the Company's success. The event highlights our ability to remain at the forefront of the industry by using the innate skills and abilities of our people to develop new ideas and to think far ahead of the competition. The celebrations culminate with the Spirit of Innovation Award, presented to the individual who has demonstrated the most exceptional innovation in action.

CORPORATE INFORMATION

Office Locations for Intier and its Major Sales Offices

| INTIER AUTOMOTIVE INC. |

521 Newpark Blvd.

Newmarket, Ontario,

Canada L3Y 4X7

Tel: 905-898-5200

Email: info@intier.com |

CLOSURE SYSTEMS |

521 Newpark Blvd.

Newmarket, Ontario

Canada L3Y 4X7

Tel: 905-898-2665

Email: closures@intier.com |

INTERIOR SYSTEMS |

United States |

Intier Automotive (U.S.A.)

39600 Lewis Drive

Novi, Michigan 48377, USA

Tel: 248-567-4000

E-mail: usa@intier.com |

Europe |

Intier Automotive (Europe)

Taunusstr. 27

D-80807 Munich, Germany

Tel: +49-89-959796-200

E-mail: europe@intier.com |

FINANCIAL REVIEW 2002

[PHOTO]

INNOVATIVE PRODUCTS

SHARPENED CONSUMER FOCUS

SUPERIOR CRAFTSMANSHIP

FLEXIBILITY AND RESPONSIVENESS

Intier Automotive is an innovative leader in the development and manufacture of vehicle interior and closure components and systems for the global automotive industry. The Company's capabilities are among the most diversified in the industry, ranging from the understanding of end consumers' needs and wants, through market and consumer research, concept development, design and engineering, testing and validation and finally the manufacture of interior and closure systems. Intier is also a leader in vehicle interior integration and program management. Product expertise includes cockpit modules, modular doors and panels, complete seat systems and specialty seat mechanisms, overhead systems, latching systems, glass moving systems, power sliding doors and liftgates and electro-mechanical systems. Intier has approximately 22,500 employees at 65 manufacturing facilities, 17 product development, engineering and testing centres and 13 sales offices throughout North America, Europe, Brazil and Asia Pacific.

Intier Automotive.

Shaping the Inner Dimension™.

On the Cover: (Large image) The Jaguar S-type represents superior craftsmanship. Intier supplies the instrument panel, glove box and door panels. Inset: (Left) Innovative, highly engineered side door latch which represents a breakthrough with a major European customer. (Right) Chrysler Pacifica leather seat manufactured by Intier.

FINANCIAL HIGHLIGHTS

LETTER TO SHAREHOLDERS

| | | [PHOTO] |

|

|

DONALD J. WALKER

President &

Chief Executive Officer |

|

MICHAEL E. MCCARTHY

Executive Vice-President

& Chief Financial Officer |

"When Intier entered the capital markets in August 2001, we made a number of commitments to our shareholders, customers and employees. As we reflect on our first full year as a publicly-traded company, we are very proud to have met our goals and demonstrated our ability to generate strong growth in sales, profitability, and cashflow. Looking ahead we are confident that we will continue to build on this track record."

OUR COMMITMENT TO SHAREHOLDERS—SOLID FINANCIAL PERFORMANCE

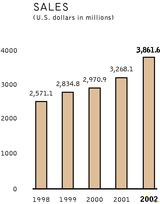

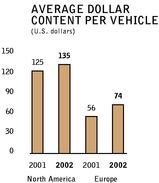

2002 was another strong year for the Company. Total sales rose 18% compared to 2001 as we leveraged our growing reputation for quality, craftsmanship and world-class manufacturing into new business in both North America and Europe. Our North American content per vehicle increased 8% as we expanded our presence with a number of key customers and won new take-over programs from our competitors. In Europe, content per vehicle increased by 32% as we benefited from new product launches and increased volumes for a number of vehicle platforms.

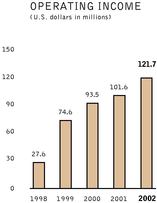

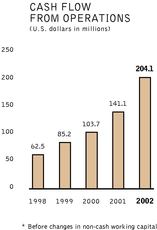

In addition to strong top-line growth, we increased cash flow from operations, before changes in non-cash working capital, by a significant 45% as our profitability improved while costs were largely kept in check to support our customers' need to maintain their competitive positions. We also made progress in improving certain under-performing operations, and are confident they will contribute to our profitability going forward.

Since 1998, Intier has demonstrated a solid track record of consistent year-over-year growth in sales, profitability and cash flow. Sales have risen 11% on a compound annual basis, while cash flow from operations before changes in non-cash working capital, has grown by a much higher 34%. Underpinning this performance is a strong balance sheet with a conservative net debt to equity ratio of approximately 8%, providing us with the financial strength and flexibility to continue delivering superior performance.

To reinforce our commitment to shareholders, Intier is proud of its leadership in matters pertaining to corporate governance and transparent financial accounting. We will continue to adopt best practices in these areas to ensure shareholder interests are encouraged and protected.

Going forward, we are confident in our continuing ability to meet our shareholder commitment—to deliver value through continued sales growth and bottom-line performance.

OUR COMMITMENT TO CUSTOMERS—INNOVATION, CRAFTSMANSHIP AND WORLD-CLASS MANUFACTURING

The automotive industry continues to experience a significant and rapid rate of change in most aspects of its business. Consumer demand for higher quality at lower prices, combined with increased competition in all global markets, is driving automotive manufacturers to seek innovative methods to control costs while finding new and better ways to differentiate their vehicles in a crowded marketplace. At Intier, we are well-positioned to help our customers adapt to this fast-changing and highly competitive environment.

The combination of our two business segments provides us with a unique competitive advantage. By offering our customers full interiors capabilities, combined with expertise in designing and manufacturing innovative closures components and systems, we are able to provide full-service integrated solutions to meet their needs. The styling, craftsmanship and functionality of a vehicle interior has become a key method of brand differentiation, and Intier Automotive's expertise in both interiors and closures is proving to be an important asset.

Our continuing focus on systems integration is also helping our customers reduce their costs and enhance production efficiency through the growing OEM trend to outsource larger and more complex modules and systems. We have proven our ability to manage systems integration with our delivery of complete interiors for the Cadillac CTS and complex modules for the MINI by BMW, Nissan Micra, the Ford Escape/Mazda Tribute, and the Audi A8 as well as complete closure systems such as doors, hardware modules and liftgates for a variety of vehicle platforms. Going forward, we will leverage this experience to meet the increasing demand for systems integration expertise.

Our world-class design, engineering, testing and manufacturing facilities in North America and Europe are recognized for delivering innovative, high-quality and cost-effective products and systems.

These world-class capabilities are supported by market research obtained through our comprehensive consumer clinics and in-depth understanding of the industry that provide true insight into what drives a new car purchase decision. In addition, our ongoing partnership with Magna-Steyr in "Advanced Car Technology Systems" (ACTS), a European-based automotive think-tank, supports our significant research and development initiatives.

However, it is our employees' involvement and commitment to all areas of our business and our expertise in craftsmanship and innovation that is the cornerstone of our Company's strong foundation and commitment to our customers.

At Intier, craftsmanship means a rigorous attention to care and detail, and pride in everything we do. It means combining strong design with aesthetics and style to deliver an overall impression of significant value in a vehicle interior. It means a level of fit and finish that works in harmony with the entire vehicle and appeals to all the senses of a new car owner. Our involvement with the interiors of such industry-leading vehicles as the MINI by BMW, Cadillac CTS, Audi A8, Jaguar XJ and Chrysler Pacifica are excellent examples of our commitment to craftsmanship.

Innovation at Intier continues to be derived from the entrepreneurial spirit and creativity of our people. By working closely with our customers to deliver new ideas, processes and approaches, we help them have the right products in the right segments at the right time. The many innovations developed in 2002 include a midgate that collapses to extend the box inside a light truck to expand storage space and improve vehicle functionality, and a non-contact door entry system to automatically unlock and release a vehicle door.

Our ongoing commitment to innovation and craftsmanship has resulted in long-term relationships with almost all of the world's leading vehicle manufacturers. In 2002, we strengthened these ties by working closely as true partners with our customers to help build their competitive position and market share. Through our rigorous focus on continuous improvement, efforts to enhance production efficiencies, and initiatives in such areas as value engineering and analysis, global sourcing and supply chain management, we have delivered high quality competitive products to our customers while continuing to enhance profitability. We are confident these efforts will further strengthen our customer relationships and generate solid growth over the long term.

OUR COMMITMENT TO EMPLOYEES—AN EMPOWERED AND ENTREPRENEURIAL CULTURE

One of the keys to our prosperity in the past—and going forward—is the significant contribution, dedication and ingenuity of our people. By providing an appropriate level of responsibility and autonomy, we have fostered a culture of empowerment that engenders pride and involvement in the overall success of the Company. This sense of ownership and teamwork is reinforced through annual events that recognize the contribution of individual employees and groups. Further support is lent by employee profit sharing as outlined in our corporate constitution, as well as other programs that reward innovative ideas and creativity.

Our commitment to our people is summarized in our Employee's Charter. In this document we outline our operating principles, which include job security, a safe and healthy workplace, fair treatment and competitive compensation. In short, it reinforces our commitment to fairness and concern for our people.

LOOKING AHEAD—DELIVERING ON OUR VALUE-ENHANCING STRATEGIES

As we look ahead, while the long-term trend of steadily increasing global vehicle production is positive for Intier, we anticipate a leveling or slight reduction in 2003 compared with the strong pace of vehicle production experienced during 2002. However, we are confident in our ability to deliver solid results despite a forecasted short-term softening in the market.

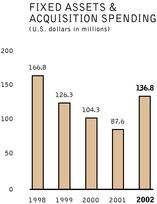

Our order backlog is strong, and is being reinforced with new business wins, take-over contracts and increased volumes on a number of major platforms in which we are involved. In 2002 significant investments in fixed assets totalling $137 million were made primarily in support of new and replacement business. Our products on new vehicles in both Europe and North America, include the Jaguar XJ, BMW 6 Series and the BMW X3, Chrysler Pacifica, Saturn ION, Cadillac SRX, Chevrolet Colorado/GMC Canyon and the Ford Freestar/Mercury Monterey. In addition, we have also been awarded business on New Domestic programs such as the Mitsubishi Endeavor, Nissan Maxima, Quest, and Titan, and the Toyota Avensis. All will contribute to our continuing sales growth. We are also investigating new geographic markets, specifically in Asia as illustrated by our joint alliance with Toyoda Gosei.

Supporting this growth is our solid position in all major vehicle markets, including such segments as luxury (Jaguar XJ), near luxury (Cadillac CTS), youth (MINI by BMW) and cross-over (Chrysler Pacifica). In addition, we have built a strong presence with New Domestic customers like Honda, Nissan and Toyota who are increasing their production capabilities in North America.

We are also very focused on enhancing our strong brand within the global automotive market. The Intier name has become synonymous with innovation, craftsmanship and world-class facilities, and we will continue to deliver the best quality, the best efficiency, and smooth program launches for our customers. Cost reductions and production efficiencies will also support our commitment to meeting our customers' competitive price demands, and to our shareholders to deliver industry-leading growth and solid bottom-line performance.

In closing, we are very proud of our success in meeting our commitments in 2002, and as we look to the future, we are confident in our ability to build on the significant progress made over the past two years. We would also like to take this opportunity to thank everyone on the Intier team for their contribution in helping us meet our objectives.

Donald J. Walker

(Signature) | | Michael E. McCarthy

(Signature) |

Donald J. Walker

President and Chief Executive Officer |

|

Michael E. McCarthy

Executive Vice-President and Chief Financial Officer |

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

BASIS OF PRESENTATION OF FINANCIAL INFORMATION

The amounts described below are based on the Company's consolidated financial statements, which are prepared in accordance with Canadian GAAP. The significant differences between Canadian and United States GAAP are detailed in note 23 to the consolidated financial statements. The following management's discussion and analysis should be read in conjunction with the consolidated financial statements, including "Significant Accounting Policies—Principles of Consolidation".

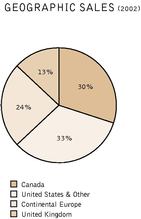

OVERVIEW

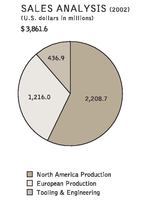

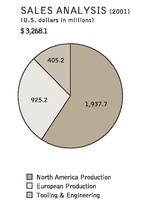

The Company's operations consist of two business segments, Interiors and Closures, which are generally aligned on a product basis with the corresponding purchasing and engineering groups of the Company's customers and which are further segregated between North America and Europe, the principle geographic regions in which the Company operates. In 2002, the Company's Interiors segment accounted for approximately 79% and 70% of the Company's consolidated sales and operating income, and the Company's Closures segment accounted for approximately 21% and 28% of the Company's consolidated sales and operating income. Corporate accounted for approximately 2% of the Company's consolidated operating income.

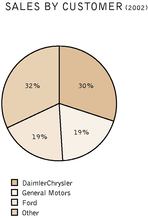

The Company is a global full service supplier of automotive interior and closure components, systems and modules whose principal products include interior systems, such as seating systems, cockpit systems, sidewall systems, cargo management systems and overhead, floor and acoustic systems and related components; and closure systems, including latching systems, glass moving systems, power sliding doors and liftgates, wiper systems and door modules. The Company directly supplies most of the major automobile manufacturers in the world and employs approximately 22,500 employees at 65 manufacturing facilities, 17 product development, engineering and testing centres and 13 sales offices in North America, Europe, Brazil and Asia Pacific. The Company's top five customers, based on consolidated 2002 sales, are DaimlerChrysler (30%), Ford (19%), General Motors (19%), BMW (9%) and Volkswagen (5%).

During 2002, the Company continued to execute its strategy of:

- •

- Delivering full service interior and closure systems capabilities to its customers. Vehicle launches in 2002 included the door cassette modules for the Ford Expedition/Lincoln Navigator, the complete seats for the Saturn ION in North America and the instrument panel for the Opel Epsilon platform, the latch system for the Ford Fiesta/Ka, the instrument panel for the Audi A8, door panels for the Toyota Avensis and the cockpit module for the Nissan Micra in Europe.

- •

- Emphasizing technological innovation and craftsmanship. Earlier in 2002, General Motors awarded the Company a General Motors' Supplier of the Year Award for superior performance as an interior supplier and integrator.

- •

- Improving operating efficiencies. Five of the Company's operations, which experienced an operating loss of approximately $40 million in 2000, incurred an operating loss of $12.5 million in 2002. The reduction in operating loss was as a result of the cost reduction, quality improvement, divisional rationalization and other initiatives taken by the Company. The Company intends to continue to improve its operating performance and competitiveness at these under-performing facilities.

- •

- Capitalizing on "complete system" and integration opportunities. The Company continued to increase its order backlog with the award of significant new programs including $55 million of new window regulator business on various Ford platforms that commenced production late in the fourth quarter of 2002. In addition, General Motors named the Company as the interior integrator for the next generation small car platform and awarded the Company the complete seats, instrument panel and overhead system for the new Chevrolet Equinox. Both programs are expected to commence production in 2004.

- •

- Promoting the Company's policies and principles, including its incentive-based corporate culture. In 2002, the Company established, subject to regulatory approvals, an Employee Equity and Profit Participation Program ("EEPPP"), which is similar to the profit sharing arrangement employees had in the Magna International Inc. ("Magna") EEPPP.

The following are some additional highlights concerning the Company's financial performance in 2002:

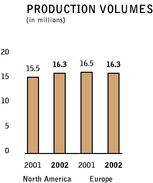

- •

- 2002 North American light vehicle production was 16.3 million units, representing a 5.2% increase from 2001. European vehicle production of 16.3 million units during 2002 was 1.2% lower than production levels in 2001. Total sales for 2002 were $3.9 billion representing an increase of 18.1% from 2001. The Company's growth in sales during 2002 was directly attributable to its higher content per vehicle in North America and Europe. The Company

increased its average dollar content on North American produced vehicles in 2002 by $10 to $135 as compared to $125 in 2001. In addition, European average dollar content per vehicle increased $18 to $74 during 2002 compared to $56 in 2001. The growth in content was primarily attributable to the Company's strong product content on a number of new products that launched in 2002 and in the second half of 2001. New products launched in the second half of 2001, included the overhead system, seat tracks and window regulators for the Dodge Ram pickup, the cockpit module, door panels, overhead system and other interior trim for the Cadillac CTS and the complete seats and overhead system for the Saturn VUE in North America and the complete interior, excluding the overhead system and instrument panel for the Mercedes-Benz Vaneo, and the cockpit module, door panels and interior components for the MINI by BMW in Europe.

- •

- Lower vehicle production volumes and higher than expected costs related to a new program launched at one division in the Company's Closures Europe reporting segment adversely impacted 2002 operating income.

- •

- The Company adopted new rules governing the accounting for goodwill under CICA 3062 and as required completed its review of goodwill impairment as at January 1, 2002. As a result of the new measurement criteria, the Company reduced $35.7 million of unamortized goodwill relating to reporting units in the Interiors Europe, Closures Europe and Interiors North America reporting segments. This transitional write-down was charged against the Company's opening retained earnings for 2002 in accordance with Canadian GAAP. In accordance with CICA 3062, the Company also completed its annual review of goodwill impairment at December 31, 2002 and a further write-down of $3.5 million was required relating to a reporting unit in the Interiors Europe reporting segment. In conjunction with the annual goodwill impairment test, the Company also reviewed the recoverability of its long-lived assets within the same reporting unit and reduced the carrying value of long-lived assets by $20.1 million. The reductions of goodwill and long-lived assets have been recorded in operating income as non-cash impairment charges for 2002. Net tax assets of $1.5 million associated with these operations were charged to income tax expense in 2002 (see "Other Charges").

- •

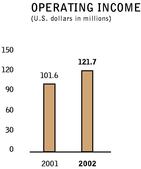

- 2002 operating income increased by 19.8% to $121.7 million from $101.6 million for 2001. The increase was attributable to the increased gross margin related to higher average dollar content per vehicle, increased North American vehicle production volumes, operating improvements at previously identified under-performing divisions, lower EEPPP expense and decreased amortization expense as a result of adopting new accounting recommendations for goodwill under CICA 3062. This was partially offset by $23.6 million of impairment charges for goodwill and other long-lived assets (see "Other Charges"), launch costs on certain new programs, increased SG&A costs and increased affiliation and social fees.

OUTLOOK

Although there is no certainty as to future levels of production, based on currently available information, the Company expects North American light vehicle production volumes to decline by approximately 2% to 16.0 million units for 2003. European vehicle production volumes are expected to decline by approximately 1% to 16.2 million units for 2003. Subject to exchange rate fluctuations and vehicle product mix, the Company expects average dollar content per vehicle to increase by approximately 15% - 20% and 12% - 14% in North America and Europe, respectively for 2003 compared to 2002. Based on these volume estimates, product mix assumptions and tooling sales estimates, 2003 total sales are expected to range between $4.2 billion and $4.4 billion. The forecasted growth in sales and content is attributable to several new significant programs launched in 2002, as well as significant new programs launching in 2003 including the complete seats for the new Chrysler Pacifica, the instrument panel, door panels and overhead system for the Cadillac SRX, the complete seats and other interior trim for the Ford Freestar/Mercury Monterey, the instrument panel for the Chevrolet Colorado/GMC Canyon, the complete interior, excluding seats, for the BMW 6 Series and the overhead system, load space and floor carpet for the BMW X3. The Company also has a strong order backlog beyond 2003 including the interior integration for the next generation of General Motors small car, the complete interior, excluding seats, for the Cadillac STS, and the complete seats, instrument panel and overhead system for the Chevrolet Equinox.

Although a decrease in North American and Western European automobile production volumes will create downward pressure on the Company's operating income, gross margins from a full year of production of new programs launched in 2002 together with continued cost management and improved operating efficiencies at specific under-performing divisions should help the Company achieve its profit targets in 2003.

Industry Risks and Trends

The following are some of the more significant risks and trends relating to the automotive industry that could affect the Company in achieving its results:

- •

- An economic downturn could reduce or eliminate the Company's profitability. The global automotive industry is cyclical and is sensitive to changes in economic conditions such as interest rates, consumer demand and international conflicts. Specifically, circumstances in the Middle East could impact future oil and other energy prices and global consumer demand for automobiles resulting in lower profits.

- •

- Increasing price reduction pressures from the Company's customers could reduce profit margins. In the past, the Company entered into, and will continue to enter into, long-term supply arrangements with automobile manufacturers, which provide for, among other things, price concessions over the supply term. To date, these concessions have been largely offset by cost reductions arising principally from product and process improvements and price reductions from the Company's suppliers. However, the competitive automotive industry environment in both North America and Europe has caused these pricing pressures to intensify. A number of the Company's customers continue to demand additional price reductions beyond existing contractual commitments, which could have an adverse impact on the Company's future profit margins. To the extent that these price reductions are not offset through cost reductions, the Company's future profit margins would be adversely affected.

- •

- The Company is under increasing pressure to absorb more costs related to product design and engineering and tooling as well as other items previously paid for directly by automobile manufacturers. In particular, some automobile manufacturers have requested that the Company pay for design and engineering and tooling costs that are incurred up to the start of production and recover these costs through increasing the unit price of the particular products. If estimated production volumes are not achieved, the design and engineering and tooling costs incurred by the Company may not be fully recovered.

- •

- Although the Company supplies parts to most of the leading automobile manufacturers for a wide variety of vehicles produced in North America and Europe, the Company does not supply parts for all vehicles produced, nor is the number or value of parts evenly distributed among the vehicles for which the Company does supply parts. Shifts in market share among vehicles could have an adverse effect on the Company's sales and profit margins. For example, the Company is affected by the sales mix between passenger cars, SUVs, minivans and other light trucks as the product content and profit margin vary among these types of vehicles.

- •

- Although the Company's financial results are reported in U.S. dollars, a significant portion of the Company's sales and operating costs are realized in Canadian dollars, euros, British pounds and other currencies. The Company's profitability is affected by movements of the U.S. dollar against the

Canadian dollar, the British pound, the euro or other currencies in which the Company generates its revenues.

- •

- In order to retain its global competitiveness with its customers, the Company is under increasing pressure to move operations to lower cost jurisdictions like Mexico, China and Eastern Europe. The impact to the Company could include higher costs associated with the impairment of redundant assets and labour in certain higher cost jurisdictions in which the Company currently carries on business, relocation and start-up costs, all of which would adversely impact profit in the short term. The Company could also be exposed to foreign exchange and liquidity risks in the long term.

- •

- The Company's customers are increasingly requesting that each of their suppliers bear the cost of the repair and replacement of defective products which are either covered under automobile manufacturer's warranty or are the subject of a recall by the customer and which were improperly designed, manufactured or assembled by their suppliers. The obligation to repair or replace such parts could have a negative impact on the Company's results. The Company is also subject to the risk of exposure to product liability claims in the event that the failure of the Company's products results in bodily injury and/or property damage. The Company may experience material product liability losses in the future and may incur significant costs to defend such claims. Currently, the Company has product liability coverage under Magna's insurance policies. This coverage will continue until August 2003, subject to renewal on an annual basis. In addition, some of the Company's European subsidiaries maintain product recall insurance, which is required by law in certain jurisdictions. A successful claim brought against the Company in excess of its available insurance coverage may have an adverse effect on the Company's operations and financial condition.

CRITICAL ACCOUNTING POLICIES

The preparation of the consolidated financial statements requires management to make estimates and judgements that affect the reported amounts of assets, liabilities, revenues and expenses, and the related disclosure of contingent assets and liabilities. On an ongoing basis, the Company evaluates its estimates, including those related to bad debts, inventories, long-lived assets, future tax assets, goodwill, preproduction costs related to long-term supply arrangements, future tax liabilities, warranty, recall and product liability obligations, and contingent liabilities. The Company bases its estimates on historical experience and various other assumptions that are believed to be reasonable in the circumstances, the results of which form the basis for making judgements about the carrying value of assets and liabilities. Actual results may differ from these estimates under different assumptions or conditions.

The Company believes the following critical accounting policies affect its more significant judgements and estimates used in the preparation of its consolidated financial statements.

Revenue Recognition—Integrator Contracts

The Company acts as the vehicle interior integrator on various programs in which the Company manufactures a portion of the integrated products but also collects components from various sub-suppliers for assembly and sale of an integrated product to the customer. Judgement is required in assessing whether these integrator contracts should be reported on a gross (reporting sales and cost of sales gross) or net (netting cost of sales against sales) basis. Some of the factors the Company considers in arriving at its conclusion to record sales on a gross versus net basis include whether the Company has the primary responsibility for providing the integrated product to the customer, exposure to inventory risk on sub-supplier parts, responsibility for design and specifications, latitude in establishing sub-supplier pricing, exposure to warranty and exposure to credit risk for sale of the integrated product to the customer. The method of revenue recognition is reviewed on a component by component basis. To date, all vehicle interior integrator supply contracts have been recorded on a gross basis.

Amortized Engineering and Customer Owned Tooling Arrangements

The Company incurs pre-production engineering, design, research and development ("ER&D") costs related to the products it produces for its customers under long-term supply agreements. The Company expenses ER&D costs which are paid for as part of subsequent related parts production piece-price amounts as incurred unless a contractual guarantee for reimbursement exists, in which case the costs would be capitalized. In addition, the Company expenses all costs as incurred related to the design and development of moulds, dies and other tools that the Company will not own and that will be used in, and reimbursed as part of the piece-price amount for subsequent related parts production. Such costs are capitalized only when the supply agreement provides the Company with a contractual guarantee for reimbursement of costs or the non-cancellable right to use the moulds, dies and other tools during the supply agreement.

ER&D and customer owned tooling costs capitalized in "Other assets" are amortized on a units of production basis over the related parts production long-term supply agreement. As at December 31, 2002 and 2001, total net ER&D and customer owned tooling costs capitalized in other assets amounted to $4.0 million and $4.2 million, respectively. A change in the commercial arrangement affecting any of the Company's significant programs that would require the Company to expense ER&D or customer owned tooling costs that are currently capitalized would have a negative impact on the Company's reported results of operations.

Goodwill

Effective January 1, 2002, the Company adopted new rules governing the accounting for goodwill for Canadian GAAP reporting purposes (see "Depreciation and Amortization" and "Other Charges"). Under the new rules, the Company's goodwill is no longer amortized and is subject to an annual impairment test.

Goodwill impairment is assessed based on a comparison of the fair value of an individual reporting unit to the underlying carrying value of the reporting unit's net assets including goodwill. When the carrying value of the reporting unit exceeds its fair value, the fair value of the reporting unit's goodwill should be compared with its carrying value to measure the amount of the impairment loss, if any. The fair value of goodwill is determined in the same manner as in a business combination.

Management completed its determination of the fair value of the Company's reporting units and its initial goodwill impairment assessments as at January 1, 2002 during the second quarter of 2002 and recorded a write-down of goodwill totalling $35.7 million, of which $27.6 million, $5.6 million and $2.5 million related to reporting units in the Interiors Europe, Closures Europe and Interiors North America reporting segments. In accordance with Canadian GAAP, this impairment loss has been recorded as a change in accounting policy and a charge to opening retained earnings as at January 1, 2002.

The goodwill of a reporting unit must be tested for impairment on an annual basis or between the annual tests when an event or circumstance occurs that more likely than not reduces the fair value of a reporting unit below its carrying value. The Company completed its annual impairment review as at December 31, 2002 and recorded a further write-down of $3.5 million relating to a reporting unit in the Interiors Europe reporting segment. This write-down was charged to operating income as "Other Charges".

The Company believes that the accounting estimates related to goodwill impairments are "critical accounting estimates" because (i) they are subject to significant measurement uncertainty and are susceptible to change as management is required to make forward looking assumptions regarding the impact of improvement plans on current operations, insourcing and other new business opportunities, program price and cost assumptions on current and future business, the timing of new program launches and future forecasted production volumes; and (ii) any resulting impairment loss could have a material impact on the Company's consolidated net income and on the amount of goodwill reported on the Company's consolidated balance sheet.

United States GAAP with respect to goodwill is based on the same accounting principles and estimates as Canadian GAAP. However, for United States GAAP purposes, the $35.7 million transitional impairment charged to opening retained earnings under Canadian GAAP has been recorded as a cumulative catch-up adjustment.

Impairment of Long-Lived Assets

Effective January 1, 2002, the Company adopted new rules governing the accounting for impairment of long-lived assets (see "Other Charges"). The Company evaluates long-lived assets for impairment whenever indicators of impairment exist. Indicators of impairment include prolonged operating losses, goodwill impairment or a decision to dispose of, or otherwise change the use of, an existing long-lived asset.

If the sum of the future cash flows expected to result from the asset, undiscounted and without interest charges, is less than the reported value of the asset, an asset impairment must be recognized in the financial statements. The amount of impairment to recognize is calculated by subtracting the fair value of the asset from the reported value of the asset. Fair value is measured by future discounted cash flows.

In conjunction with the annual impairment test for goodwill at December 31, 2002, the Company also reviewed the recoverability of its long-lived assets in a reporting unit within the Interiors Europe reporting segment where an indicator of goodwill impairment existed. As a result of this review, a $20.1 million write-down of long-lived assets was charged to operating income in the fourth quarter of 2002. This write-down was charged to operating income as "Other Charges".

The Company believes that accounting estimates related to long-lived asset impairment are "critical accounting estimates" because (i) they are subject to significant measurement uncertainty and are susceptible to change as management is required to make forward looking assumptions regarding the impact of improvement plans on current operations, insourcing and other new business opportunities, program price and cost assumptions on current and future business, the timing of new program launches and future forecasted production volumes; and (ii) any resulting impairment loss could have a material impact on the Company's consolidated net income and on the amount of long-lived assets reported on the Company's consolidated balance sheet.

Future Income Tax Assets and Future Income Tax Liabilities

Under both Canadian and United States GAAP, the Company uses the liability method of tax allocation for accounting for income taxes. Under the liability method of tax allocation, future tax assets and liabilities are determined based on differences between the financial reporting carrying value and tax cost bases of assets and liabilities. Future tax assets are reduced by a valuation allowance if it is more likely than not that some or all of the future tax asset will not be realized.

At December 31, 2002 and 2001, the Company had recorded net future tax assets (net of related liabilities and valuation allowances) of $37.5 million and $61.0 million, respectively, consisting primarily of the benefit of loss carryforwards. Future tax assets at December 31, 2002 related primarily to the Company's German and U.S. operations.

The Company evaluates quarterly the carrying value of its future tax assets by assessing its valuation allowance and by adjusting the amount of such allowance, if necessary. The factors used to assess the likelihood of realization are the Company's forecast of future taxable income and available tax planning strategies that could be implemented to realize the future tax assets.

At December 31, 2002, the Company had income tax loss carryforwards of approximately $122.1 million, which relate primarily to operations in Europe, the tax benefits of which have not been recognized in the consolidated financial statements. Of the total tax loss carryforwards, $92.5 million expire between 2003 and 2012 and the remainder have no expiry dates. If operations improve to profitable levels in these jurisdictions, and such improvements are sustained for a prolonged period of time, the Company's earnings will benefit from these tax loss carryforwards.

Employee Defined Benefit Plans

The Company has a number of arrangements in Canada, the United States, the United Kingdom and Europe which provide pension and future employee benefits to its retired and current employees. Pension arrangements include statutory pension plans as well as similar arrangements, which provide pension benefits as required by statute.

The determination of the obligation and expense for defined benefit pension and other post retirement benefits, such as retiree medical benefits, is dependent on the selection of certain assumptions used by actuaries in calculating such amounts. Those assumptions are included in note 12 to the Company's consolidated financial statements and include, among others, the discount rate, expected long-term rate of return on plan assets and rates of increase in compensation and healthcare costs. Actual results that differ from the assumptions used are accumulated and amortized over future periods and, therefore, impact the recognized expense and recorded obligation in future periods.

At December 31, 2002, the Company had obligations under its defined benefit pension plans and other statutory plans of $61.4 million. The defined benefit plans have assets of $28.4 million and unfunded unrecognized net actuarial losses of $12.6 million. The unfunded unrecognized net actuarial losses of $12.6 million, are amortized and charged to earnings over the average remaining service period of active employees. All pension plans and similar arrangements are funded to the minimum legal funding requirement. In certain plans, there is no legal requirement to fund the obligation until such time as they are actually incurred, and as a result these arrangements are unfunded. In addition to the registered plan assets, certain subsidiaries hold $1.2 million of guaranteed securities with respect to their unfunded termination and long service obligations. In addition, the Company has obligations with respect to post retirement medical benefit of $8.2 million. The Company pension and medical benefit expense was $ 6.5 million and $5.3 million in 2002 and 2001, respectively.

Foreign Exchange Contracts

The Company uses foreign exchange contracts to manage foreign exchange risk from its underlying customer and supplier contracts. In particular, the Company uses foreign exchange forward contracts for the sole purpose of hedging certain of the Company's future committed foreign currency outflows and inflows. These derivatives qualify for hedge accounting under Canadian GAAP. The Company does not enter into foreign exchange contracts for speculative purposes.

The Company determines the fair value of the derivatives based on market values provided by independent parties based on contracts with similar remaining terms to maturity. The values of the foreign exchange contracts will change over time as interest rates, currency rates and market conditions change.

While these contracts expose the Company to credit losses in the event of non-performance by counterparties to the agreements, the Company minimizes the risk of non-performance by only entering into contracts with financially sound counterparties and by limiting its exposure with any one financial institution.

The Company's use of foreign exchange contracts is dependent on forecasted future foreign currency outflows and inflows. If such cash flows were no longer probable of occurring, the foreign exchange contracts would cease to be effective as a hedge. For example, if projected net foreign currency cash inflows or outflows declined significantly, previously unrecognized gains or losses pertaining to the portion of the hedging transactions in excess of projected foreign currency denominated cash flows would be recognized in income at the time this condition was identified. At December 31, 2002, the losses not recognized in the Company's reported net income related to significant derivative financial instrument contracts is $14.7 million.

Under United States GAAP, effective January 1, 2002, the Company's foreign exchange forward contracts qualify for hedge accounting. As of January 1, 2002, the Company implemented a new treasury management system that complies with documentation requirements that allow hedge accounting. Changes to fair value of the Company's forward exchange contracts are recorded in other comprehensive income. Prior to January 1, 2002, for United States GAAP purposes, changes in the market value of the Company's foreign exchange forward contracts were recorded in earnings. If the Company's forward exchange contracts ceased to be effective as hedges, for example, if projected net foreign cash inflows declined significantly, previously unrecognized gains or losses pertaining to the portion of the hedging transactions in excess of projected foreign denominated cash flows would be recognized in income at the time this condition was identified.

Warranty, Product Liability and Recall Obligations

The Company is at risk for warranty, product liability and recall costs. Product liability provisions are established based on the Company's best estimate of the amounts necessary to settle existing claims on product default issues. Recall costs are costs incurred when the Company and/or the customer decide, either voluntarily or involuntarily, to recall a product due to a known or suspected performance issue. Costs typically include the cost of the product being replaced, customer cost of the recall and labour to remove and replace the defective part. When a decision to recall a product has been made or is probable, the Company's estimated cost of the recall is recorded as a charge to net earnings in that period. In making this estimate, judgement is required as to the number of units that may be returned as a result of the recall, the total cost of the recall campaign, the ultimate negotiated sharing of the cost between the Company and the customer and, in some cases, the extent to which a supplier to the Company will share the recall cost. Due to the nature of the costs, the Company makes its best estimate of the expected future costs, however, the ultimate amount of such costs could be materially different.

Given the nature of the Company's products, to date, the Company has not experienced significant warranty, including product liability and recall costs. However, the Company continues to experience increased customer pressure to assume greater warranty responsibility. Currently, the Company only accounts for existing or probable claims, however, a significant increase in warranty responsibility could require the Company to consider accounting for possible future claims.

In particular, one of the Company's customers has asserted a claim for reimbursement for warranty costs as well as additional expenses which it expects to incur as a result of a voluntary customer satisfaction-based recall of a product which forms part of a module supplied by the Company to the customer. The product in question is supplied to the Company by another large supplier that the Company was directed to use by its customer. The customer has claimed that the warranty and future recall costs could be up to $42 million. Based on the Company's investigations to date, the Company does not believe that it has any liability for this claim and that any liability that the Company may become subject to, if it is established that the product is defective, will be recoverable from the supplier of the product, although the Company cannot provide assurance that this will be the case.

Contingencies

In the ordinary course of business activities, the Company may be contingently liable for litigation and claims with customers, suppliers and former employees. In addition, the Company may be, or could become, liable to incur environmental remediation costs to bring environmental contamination levels back within acceptable legal limits. On an on-going basis, the Company assesses the likelihood of any adverse judgements or outcomes to these matters as well as potential ranges of probable costs and losses. A determination of the provision required, if any, for these contingencies is made after analysis of each individual issue. The required provision may change in the future due to new developments in each matter or changes in approach such as a change in settlement strategy in dealing with these matters.

To date, contingent liabilities recognized in the Company's consolidated financial statements are not significant.

Stock-Based Compensation

The Company's existing stock-based compensation plan requires its employees and directors to pay the option exercise price in order to obtain stock. As a result, under both current Canadian and United States GAAP, it is acceptable for the Company not to recognize compensation expense with respect to option grants to employees. Instead, the Company discloses the pro forma impact of stock option grants on reported earnings had the Company accounted for all employee and director stock options at fair value as of the date of grant. For this purpose, fair value is determined using the Black-Scholes option valuation model.

The Company has chosen not to recognize compensation expense in reported earnings. The dilutive impact of stock option grants is currently factored into the Company's reported diluted earnings per share. In addition, as a result of limitations with existing option valuation models, it is difficult to determine a reliable single measure of the fair value of stock option grants.

Notwithstanding the above, had the Company recognized compensation expense for stock option grants using the Black-Scholes option valuation model, 2002 net income attributable to Class A Subordinate Voting and Class B Shares would have decreased by $0.9 million under Canadian GAAP and $2.7 million under U.S. GAAP.

RESULTS OF OPERATIONS AND FINANCIAL POSITION FOR THE YEAR 2002 COMPARED TO 2001