UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, DC 20549 |

| |

FORM 20-F |

[ ] | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR |

[ X ] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | For the fiscal year ended: December 31, 2003 |

OR |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | | For the transition period from | | to | | |

| | | | | | |

| | | Commission file number | | | | |

| | | | | | |

| | INTIER AUTOMOTIVE INC. |

| | (Exact name of Registrant as specified in its charter) |

| | not applicable |

| | (Translation of Registrant's name into English) |

| | Province of Ontario, Canada |

| | (Jurisdiction of incorporation or organization) |

| | 521 Newpark Boulevard, Newmarket, Ontario, Canada L3Y 4X7 |

| | (Address of principal executive offices) |

| | Securities registered or to be registered pursuant to Section 12(b) of the Act. |

| | Title of each class | | Name of each Exchange on which registered |

| | None | | None |

| | Securities registered or to be registered pursuant to Section 12(g) of the Act. |

| | Class A Subordinate Voting Shares |

| | Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. |

| | None |

| | (Title of Class) |

| | Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. |

| | 6,431,261 | | Class A Subordinate Voting Shares |

| | 42,751,938 | | Class B Shares |

| | 1,085,500 | | Preferred Shares, Series 1 |

| | 1,125,000 | | Preferred Shares, Series 2 |

| | Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. |

| | | Yes | X | | No | | |

| | | | | | | |

| | Indicate by check mark which financial statement item the registrant has elected to follow. |

| | | Item 17 | | | Item 18 | X | |

| | | | | | | |

TABLE OF CONTENTS

| | PAGE |

PART I | | |

ITEM 1 | IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS | 3 |

ITEM 2 | OFFER STATISTICS AND EXPECTED TIMETABLE | 3 |

ITEM 3 | KEY INFORMATION | 3 |

ITEM 4 | INFORMATION ON THE COMPANY | 14 |

ITEM 5 | OPERATING AND FINANCIAL REVIEW AND PROSPECTS | 30 |

ITEM 6 | DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES | 31 |

ITEM 7 | MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS | 35 |

ITEM 8 | FINANCIAL INFORMATION | 36 |

ITEM 9 | THE OFFER AND LISTING | 37 |

ITEM 10 | ADDITIONAL INFORMATION | 38 |

ITEM 11 | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 45 |

ITEM 12 | DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES | 45 |

| | | |

PART II | | |

ITEM 13 | DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES | 45 |

ITEM 14 | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

45

|

ITEM 15 | CONTROLS AND PROCEDURES | 45 |

ITEM 16 | Reserved by the SEC | 46 |

ITEM 16A | AUDIT COMMITTEE FINANCIAL EXPERT | 46 |

ITEM 16B | CODE OF ETHICS | 46 |

ITEM 16C | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 46 |

ITEM 16D | EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES | 47 |

ITEM 16E | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

47

|

| | | |

PART III | | |

ITEM 17 | FINANCIAL STATEMENTS | 47 |

ITEM 18 | FINANCIAL STATEMENTS | 47 |

ITEM 19 | EXHIBITS | 47 |

In this Report, when we use the terms "we", "us", "Company" and "Intier", we are referring to Intier Automotive Inc. and its subsidiaries and jointly controlled entities, unless the context otherwise requires. When we use the term "Magna", we are referring to our controlling shareholder, Magna International Inc. and its subsidiaries and jointly controlled entities, other than us, unless the context otherwise requires. We publish our financial statements in U.S. dollars. In this Report we refer to United States dollars as "dollars", "$", "U.S.$" or "U.S. dollars" and we refer to Canadian dollars as "Cdn.$".

This Report contains statements which, to the extent that they are not recitations of historical fact, constitute "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934. The words "estimate", "anticipate", "believe", "expect", "intend", "may", "would", "could", "will", "likely", "plan", "forecast" and similar expressions are intended to identify forward-looking statements. Such forward-looking information involves important risks and uncertainties that could materially alter results in the future from those expressed in any forward-looking statements made by, or on behalf of, Intier. These risks and uncertainties include those described under "Item 3. Key Information - Risk Factors". Persons reading the Management's Discussion and Analysis of Financial Condition and Results of Operations for the year ended December 31, 2003 ("MD&A") attached as Exhibit 14.3 to this Report, as well as other parts of the Report, are cautioned that such state ments are only predictions and that actual events or results may differ materially. In evaluating such forward-looking statements readers should specifically consider the various factors which could cause actual events or results to differ materially from those indicated by such forward-looking statements.

PART I

1.

|

IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISORS

|

| |

Not applicable.

|

2.

|

OFFER STATISTICS AND EXPECTED TIMETABLE

|

| |

Not applicable.

|

3.

|

KEY INFORMATION

|

A.

|

Selected Financial Data

|

Basis of Presentation of Financial Information

The Company's Report to Shareholders for the year ended December 31, 2003, includes the consolidated financial statements (the "2003 Consolidated Financial Statements") and MD&A in each case for the period then ended. Such 2003 Consolidated Financial Statements and MD&A are incorporated by reference in this Report. In addition, the Company's audited consolidated statements of income (loss), changes in Magna's net investment and cash flows for the year ended December 31, 1999, as included in the Company's consolidated financial statements for the three year period ended December 31, 2001 (the "2001 Consolidated Financial Statements"), are incorporated by reference in this Report. The Consolidated Balance Sheet of the Company as at December 31, 2001 gives effect to the corporate reorganization of Intier which was completed in August 2001 in which we acquired from Magna certain operating divisions, subsidiaries, jointly controlled entitles and investments directly or indirectl y under the control of Magna in exchange for the issuance by us of 42,751,938 Class B Shares and 2,250,000 Convertible Series Preferred Shares to Magna. Our consolidated financial statements prior to August 1, 2001 present the historic combined financial position, results of operations and cash flows of the assets and liabilities reorganized under the Company on a carve out basis from Magna. To give effect to the continuity of Magna's interest in the assets and liabilities of the Company, all the assets and liabilities have been recorded in the 2003 Consolidated Financial Statements at Magna's book values except for assets under capital leases related to the distribution of land and buildings by us to a related party, MI Developments Inc. during the year ended December 31, 1998. The comparative information presented reflects financial statements, which present the consolidated financial position, results of operations, changes in retained earnings and Magna's net investment and cash flows of the Company as if it had operated as a stand-alone entity subject to Magna's control. We have attached our 2003 Consolidated Financial Statements, 2001 Consolidated Financial Statements and MD&A to this Report as Exhibits 14.1, 14.2 and 14.3, respectively.

Selected Historical and Pro Forma Consolidated Financial Information

The tables below set forth selected historical consolidated and pro forma consolidated financial data as at and for the periods indicated.

Except as indicated below, the selected historical consolidated financial data has been derived from the 2003 Consolidated Financial Statements and the 2001 Consolidated Financial Statements which were prepared in accordance with Canadian generally accepted accounting principles and should be read in conjunction with those statements and the disclosure under "Basis of Presentation of Financial Information" above.

The selected historical and pro forma consolidated financial data set forth below for the years ended December 31, 2003, 2002 and 2001 should also be read in conjunction with the MD&A.

| | Years ended December 31, |

| | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| | | (in millions of U.S. dollars) |

| | | | | | | | | | |

Income Statement Data (1) | | | | | | | | | | |

Sales | $ | 4,654.6 | $ | 3,861.6 | $ | 3,268.1 | $ | 2,970.9 | $ | 2,834.8 |

Cost of goods sold | | 4,117.8 | | 3,374.9 | | 2,861.6 | | 2,605.5 | | 2,508.8 |

Depreciation and amortization | | 99.5 | | 88.5 | | 88.0 | | 86.1 | | 87.2 |

Other charges (2) | | - | | 23.6 | | - | | - | | - |

Operating income | | 136.4 | | 121.7 | | 101.6 | | 93.5 | | 74.6 |

Net Interest expense (income) | | 1.6 | | (1.5) | | 16.2 | | 27.4 | | 24.3 |

Income before income taxes and minority

interest | |

122.8

| |

112.2

| |

80.2

| |

65.4

| |

49.1

|

Net income | | 62.3 | | 48.6 | | 39.9 | | 34.7 | | 26.6 |

Dividends on Class A Subordinate Voting

and Class B Shares | |

17.3

| |

9.7

| |

2.0

| |

- -

| |

- -

|

Earnings per Class A Subordinate

Voting or Class B Share (3) | | | | | | | | | | |

| | Basic | | 1.26 | | 0.97 | | 0.37 | | - | | - |

| | Diluted | | 1.18 | | 0.95 | | 0.37 | | - | | - |

Average number of Class A Subordinate

Voting and Class B Shares outstanding

(in millions) | | | | | | | | | | |

| | Basic | | 48.6 | | 48.2 | | 47.9 | | - | | - |

| | Diluted | | 63.5 | | 63.6 | | 47.9 | | - | | - |

Pro forma earnings per Class A Subordinate

Voting or Class B Share (4) | | | | | | | | | | |

| | Basic | | - | | - | | 0.91 | | 0.60 | | 0.34 |

| | Diluted | | - | | - | | 0.90 | | 0.60 | | 0.34 |

Average number of Class A

Subordinate Voting and Class B Shares

outstanding (in millions) | | | | | | | | | | |

| | Basic | | - | | - | | 44.9 | | 42.8 | | 42.8 |

| | Diluted | | - | | - | | 59.8 | | 42.8 | | 42.8 |

| | Years ended December 31, |

| | | 2003 | | 2002 | | 2001 | | 2000 | | 1999 |

| | | (in millions of U.S. dollars) |

| | | | | | | | | | (unaudited) |

Balance Sheet Data (1) | | | | | | | | | | |

Total assets | $ | 2,142.1 | $ | 1,781.8 | $ | 1,579.4 | $ | 1,465.7 | $ | 1,388.8 |

Convertible Series Preferred Shares

(debt portion) (5) | |

214.7

| |

206.2

| |

194.6

| |

- -

| |

- -

|

Long-term debt (excluding current portion) | | 33.0 | | 31.8 | | 30.6 | | 32.2 | | 38.9 |

Magna's net investment in Intier (6) | | - | | - | | - | | 850.2 | | 781.8 |

Convertible Series Preferred Shares

(equity portion) (7) | |

11.8

| |

22.0

| |

31.4

| |

- -

| |

- -

|

Class A Subordinate Voting Shares | | 86.1 | | 71.8 | | 71.7 | | - | | - |

Class B Shares | | 495.8 | | 495.8 | | 495.8 | | - | | - |

Contributed Surplus (8) | | 0.6 | | - | | - | | - | | - |

Retained earnings | | 61.1 | | 17.2 | | 15.9 | | - | | - |

Currency translation adjustment | | 115.3 | | 37.2 | | (4.9) | | - | | - |

Total shareholders' equity (7) | | 770.7 | | 644.0 | | 609.9 | | - | | - |

(1) | None of the line items in the table are materially different under United States generally accepted accounting principles, other than as set forth in Note 23 to our 2003 Consolidated Financial Statements, which is attached as Exhibit 14.1 to this Report, and Note 19 to our 2001 Consolidated Financial Statements, which is attached as Exhibit 14.2 to this Report. |

(2) | Effective January 1, 2002, we adopted new accounting Handbook Section 3062 "Goodwill and Other Intangible Assets" (CICA 3062) issued by the Canadian Institute of Chartered Accountants in August 2001. CICA 3062 requires us to review goodwill for impairment on an annual basis based upon new measurement criteria. This review indicated no impairment of goodwill in 2003. As a result of this review in 2002, we reduced the carrying value of goodwill by $3.5 million in our Interiors Europe reporting segment. In 2002, we also assessed the recoverability of long-lived assets in the reporting segment and determined it appropriate to reduce the carrying value by $20.1 million. In addition, net tax assets of $1.5 million associated with these Interiors Europe operations were charged against our earnings for 2002. |

(3) | As a result of the reorganization of the Company completed in August 2001, as described in the notes to the 2003 Consolidated Financial Statements and under "Basis of Presentation of Financial Information" above, basic and diluted earnings per share for the year ended December 31, 2001 only include net income for the five-month period subsequent to July 31, 2001. Historical basic and diluted earnings per share for prior periods have not been presented since they are not comparable or meaningful. |

(4) | Basic and diluted pro forma earnings per Class A Subordinate Voting or Class B Share are based on the public offering of 5,476,191 Class A Subordinate Voting Shares completed in August 2001, and on the assumption that 42,751,938 Class B Shares and 2,250,000 Convertible Series Preferred Shares were issued and outstanding for the entire periods presented. For a description of the pro forma adjustments made to arrive at pro forma earnings per share, please see Note 4 to the 2003 Consolidated Financial Statements. |

(5) | Effective January 1, 2003 the liability amount for the Series 1 Convertible Preferred Shares ($108.6 million) was recognized as a current liability. The liability amount for the Series 2 Convertible Preferred Shares ($106.1 million) remains as a long-term liability. For a detailed description, see Note 13 to the 2003 Consolidated Financial Statements. |

(6) | Magna's net investment includes both debt and equity investments, comprising our accumulated earnings, contributions by Magna less distributions by Magna, income taxes payable related to our unincorporated divisions and the currency translation adjustment. |

(7) | Under United States generally accepted accounting principles, no portion of the Convertible Series Preferred Shares (all of which are owned by Magna) would be included in Total shareholders' equity. |

(8) | Effective January 1, 2003 pursuant to the Canadian Institute of Chartered Accountants amended Handbook Section 3870 "Stock-Based Compensation and Other Stock-Based Payments" we adopted the fair value method for recognizing compensation expense for fixed price stock options. This resulted in an expense of $0.6 million in 2003. |

Exchange Rates

As previously indicated, Intier publishes its financial statements in U.S. dollars rather than Canadian dollars. The following table sets forth, for the fiscal years and periods indicated, certain information concerning the Canadian dollar exchange rate for U.S. dollars based on the noon buying rate in New York City for cable transfers payable in U.S. dollars as certified for customs purposes by the Federal Reserve Bank of New York (the "Noon Buying Rate"). At May 14, 2004, the Canadian dollar exchange rate for U.S. dollars was Cdn.$1.3928 per U.S.$1.00.

| | At Period

End |

Average

|

High

|

Low

|

| | (Cdn.$ per U.S.$1.00) |

| | | | | | | | |

1999 | 1.4440 | | 1.4827 | (1) | 1.5375 | | 1.4440 |

2000 | 1.4991 | | 1.4852 | (1) | 1.5571 | | 1.4347 |

2001 | 1.5635 | | 1.5518 | (1) | 1.5990 | | 1.4933 |

2002 | 1.5800 | | 1.5702 | (1) | 1.6128 | | 1.5108 |

2003 | 1.2923 | | 1.3916 | (1) | 1.5750 | | 1.2923 |

November 2003 | 1.2973 | | 1.3130 | | 1.3362 | | 1.2973 |

December 2003 | 1.2923 | | 1.3128 | | 1.3405 | | 1.2923 |

January 2004 | 1.3265 | | 1.2958 | | 1.3340 | | 1.2690 |

February 2004 | 1.3405 | | 1.3299 | | 1.3442 | | 1.3108 |

March 2004 | 1.3100 | | 1.3278 | | 1.3480 | | 1.3080 |

April 2004 | 1.3711 | | 1.3420 | | 1.3711 | | 1.3095 |

(1) | The average of the Noon Buying Rate on the last business day of each month during the period. |

B. | Capitalization and Indebtedness |

C. | Reasons for the Offer and Use of Proceeds |

You should carefully consider the following factors in addition to the other information contained in this Report.

Risks Relating to Our Industry

An economic downturn could reduce or eliminate our profitability

Our operations are directly impacted by the levels of global automotive production. The global automotive industry, which accounted for substantially all our consolidated sales in 2003, is cyclical and is sensitive to changes in economic conditions such as interest rates, consumer demand and fuel costs. The rate of global economic growth, particularly in our principal North American and Western European markets slowed in 2001 and in subsequent years, partially due to the events of September 11, 2001 and the ensuing war on terrorism in Afghanistan and Iraq, the impact of a series of corporate accounting scandals in North America and Europe and a number of other geopolitical and economic factors. Although lower interest rates and significant incentives offered by automobile manufacturers have stabilized consumer demand in North America in recent years, the threat of terrorism and war, the uncertainty in the economic outlook, higher fuel costs and the possibility of higher interest ra tes have negatively affected consumer confidence and a significant amount of uncertainty exists with respect to automotive demand in our principal markets. For fiscal 2004, North American light vehicle production volumes are expected to increase marginally to approximately 16.0 million units. Western Europe production volumes are expected to remain unchanged at approximately 16.4 million units. A decline in consumer demand for vehicles as a result of a loss of confidence in the economy, fears of war, political instability or terrorist attacks, interest rate increases, a reduction in vehicle incentive programs or any other political, economic or other factors, could prompt automobile manufacturers to reduce production volumes. Any significant and prolonged decline in production volumes in either our North American or European principal markets will significantly lower, and could eliminate, our profits.

We face increasing price reduction pressures from our customers that could reduce our profit margins

We have in the past entered into, and may continue to enter into, long-term supply arrangements with automobile manufacturers which provide for, among other things, price concessions over the supply term. In addition, there has been significant and continuing pressure from our customers to reduce our prices where there are no such long-term supply arrangements in order for us to maintain such business or be awarded new business. To date, these price concessions have been largely offset by cost reductions arising principally from product and process improvements and price reductions from our suppliers. However, the competitive automotive industry environment in both North America and Europe has caused these pricing pressures to intensify. A number of our largest customers have recently demanded additional price reductions beyond existing contractual commitments which could have an adverse impact on our future profit margins. In addition, we expect that our customers will increase th e use of various initiatives such as third party market tests on a global basis, withholding future business opportunities, statistical and other cost models, Internet-based auctions and other methods, in order to further increase the pressure on us to reduce our prices. The full effect of these customer initiatives on the prices of products and services we sell to automobile manufacturers and on the costs of products and services we obtain from our suppliers is uncertain. We may not continue to be successful in offsetting price reductions agreed to from time to time with automobile manufacturers. To the extent that these price reductions are not offset through cost reductions, our future profit margins will be adversely affected.

Our customers increasingly require us to absorb more fixed costs in our unit pricing, which could reduce our profitability

We are under increasing pressure to absorb more costs related to product design, engineering and tooling as well as other items previously paid for directly by automobile manufacturers. In particular, some automobile manufacturers have requested that we pay for design, engineering and tooling costs that are incurred up to the start of production and recover these costs through increasing the unit price of the particular products. Contract volumes for customer programs not yet in production are based on our customers' estimates of their own future production levels by vehicle body type. However, actual production volumes may vary significantly from our customers' estimates due to a reduction in consumer demand or new product launch delays, often without any compensation to us by our customer. We do not typically rely solely on customer estimates, but re-evaluate their estimates based on our own assessment of future production levels by vehicle body type. For programs currently under production, we are typically not in a position to request price changes when volumes differ significantly from production estimates used during the quotation stage. If estimated production volumes are not achieved, the design and engineering and tooling costs incurred by us may not be fully recovered. Similarly, future pricing pressures from our customers could also reduce the amount of amortized costs otherwise recoverable in the unit price of our products. Although these factors have not been material to date, either of these factors could have an adverse effect on our profitability.

We are under increasing pressure to move or establish operations in lower cost jurisdictions.

In order to retain our global competitiveness, we are under increasing pressure to move operations or establish new operations in lower cost jurisdictions as our customers continue to implement procurement strategies intended to increase their sourcing activities in such jurisdictions including China, Eastern Europe, India, Turkey and Mexico. The impact of these initiatives to us could include higher costs associated with the impairment of redundant assets, labour, pension, employee benefits and severance costs in certain higher cost jurisdictions in which we currently carry on business. During the transition period in which certain of our products are transferred to lower cost jurisdictions, our profitability may also be adversely impacted by quality or delivery issues which result in premium costs as well as relocation and start-up costs, all of which would adversely impact our short-term profitability. In the long term, we could also be exposed to certain other risks associated with doing business abroad, including: foreign exchange and currency controls, liquidity risks, local economic conditions, political instability, withholding and other taxes on remittances and other payments by subsidiaries, investment restrictions or requirements, expropriation and nationalization, export and import restrictions, and increases in working capital requirements related to longer supply chains. The likelihood of such occurrences and their potential effect on us varies from jurisdiction to jurisdiction but may have a material adverse effect on our business and profitability in the future.

We are increasingly requested to assume product warranty, recall and product liability costs, which could have a negative effect on our operations and financial condition

Automobile manufacturers are increasingly requesting that each of their suppliers bear the costs of the repair and replacement of defective products which are either covered under automobile manufacturer's warranty or are the subject of a recall or service bulletin by the customer. If our products are, or are alleged to be defective, we may be required to participate in a recall, particularly if the actual or alleged defect relates to vehicle safety or compliance with applicable regulatory requirements. In addition, we are party to warranty sharing agreements with certain of our customers which require payments to be made by us to the customer if warranty costs for our products exceed certain negotiated targets. A supplier's warranty and recall exposure towards additional warranty and product recall costs increases as its overall design, manufacturing, validation and integration responsibility increases. The obligation to repair or replace such parts and to fund increasing warranty and recall costs could have an adverse effect on our operations and financial condition. See Item 4. "Information on the Company - Our Business - Legal Proceedings and Environmental Matters".

We are also subject to the risk of exposure to product liability claims in the event that the failure of our products results in bodily injury and/or property damage. We may experience material product liability losses in the future and may incur increasingly significant costs to defend such claims. We currently have product liability coverage under Magna's insurance policies, subject to certain limits. This coverage will continue until August 2004, subject to renewal on an annual basis. In addition, some of our European subsidiaries maintain product recall insurance, which is required by law in certain jurisdictions. We cannot guarantee that our insurance coverage will be adequate for any liabilities we may incur. Furthermore, we cannot guarantee that our coverage will continue to be available on terms acceptable to us and even if such coverage is available, insurance premiums are likely to increase significantly. A successful claim or series of claims brought against us in excess of our available insurance coverage may have an adverse effect on our operations and financial condition.

We are dependent on outsourcing by North American and European automobile manufacturers

We are dependent on outsourcing by our North American and European automobile manufacturer customers. The extent of this outsourcing is dependent on a number of factors, including:

| | · | the cost, quality and timeliness of external production relative to in-house production by automobile manufacturers; |

| | · | relative technological capability; |

| | · | the degree of unutilized capacity at automobile manufacturers' facilities; |

| | · | collective bargaining agreements between labour unions and automobile manufacturers; and |

| | · | relations between labour unions and automobile manufacturers. |

Any significant decrease in outsourcing by automobile manufacturers would likely have an adverse effect on our profitability.

Technological and regulatory changes may adversely affect us

Changes in competitive technologies or regulatory or industry requirements may render some of our products obsolete. Our ability to anticipate changes in technology and regulatory or industry requirements and to develop and introduce new and enhanced products successfully on a timely basis will be a significant factor in our ability to grow and to remain competitive. We may not be able to anticipate or achieve the technological advances necessary for, or to comply with regulatory or industry requirements in a manner which will allow, us to remain competitive and prevent our products from becoming obsolete. We are also subject to the risks generally associated with new product introductions and applications, including lack of market acceptance, product de-contenting by our customers in their vehicles, delays in product development, potential third party patent infringement or trade secret claims and failure of products to operate properly. Any of these changes could have an adverse effect on our operations and financial condition.

Adverse developments affecting one or more of our major suppliers could materially harm our operating results

We obtain components and other products and services from numerous Tier Two automotive suppliers and other vendors throughout the world. As customer pricing pressures continue to intensify, it is likely that we will enter into significant commercial negotiations and disputes with our suppliers as we attempt to pass on price reductions to the supply base. In certain instances, it would be difficult and expensive for us to change suppliers of products and services critical to our business. Some of our suppliers are also financially distressed, may become financially distressed or have previously agreed upon fixed piece price levels and other terms and conditions in long-term supply contracts and therefore it may not be possible for us to pass on price reductions, increased fixed costs such as tooling and engineering costs, or warranty, recall and product liability costs imposed on us by our customers. In addition, the continued financial distress or the insolvency or bankruptcy of a major component sub-supplier could disrupt the supply of components to us by such suppliers, potentially resulting in a temporary disruption in the supply of systems by us to our customers. Any significant disruption in our supplier relationships, including certain relationships with sole-source suppliers, could materially harm our operating and financial results, particularly if such disruption results in an interruption in supply by us to our customers.

Where we act as a module supplier, integrator or system assembler, we are typically responsible for ensuring the quality of the components supplied to us by automotive components sub-suppliers. In some cases, these sub-suppliers are selected by our automobile manufacturer customers. We take steps to ensure that sub-suppliers remain liable for any product warranty claims, product liability claims or other costs arising from product recalls relating to the components supplied by them. However, we may be liable to our customers if these sub-suppliers become insolvent or are otherwise unable to assume full responsibility for the product warranty claim, product liability claim or product recall cost, which could have a material adverse effect on our financial condition.

Increased crude oil and energy prices could reduce global demand for automobiles and increase our costs, which could have an adverse effect on our profitability

Material increases in the price of crude oil have, historically, been a contributing factor to the overall reduction in the global demand for automobiles. A significant increase in the price of crude oil could further reduce global demand for automobiles and shift customer demand away from larger cars and light trucks (including sport utility vehicles) in which we have relatively higher content, which could have an adverse effect on our profitability.

Oil-based products are also critical elements in various components utilized by us and our suppliers, including resins, colorants and polymers. Material increases in the price of crude oil, natural gas or in energy would likely increase the costs of manufacturing or supplying some of our products. To the extent that we are not able to pass these increased costs along to our automobile manufacturer customers, such price increases could have an adverse effect on our profitability.

Shortages of raw materials or increased raw materials prices could have an adverse effect on our operations and financial condition or our profitability

We generally purchase our raw materials from suppliers located in the jurisdictions in which we have manufacturing operations. We generally do not carry inventories of raw materials in excess of those required to meet production and shipping schedules. To date, we have not experienced any significant difficulty in obtaining supplies of raw materials. However, the inability to obtain raw materials in the quantities in our operations could disrupt the supply of our products to our customers and have an adverse effect on our operations and financial condition.

Recently we have experienced significant increases in the cost of steel and steel products. The price increases are primarily the result of increasingly scarce steel-making ingredients, such as scrap steel, iron ore and coke coal, and a significant increase in demand for steel in China. In some cases, surcharges on existing prices are imposed by steel suppliers and sub-suppliers with the threat of withheld deliveries if the surcharges are not accepted. To the extent that steel prices continue to increase and we are unable to pass on the additional costs to our automobile manufacturer customers, such additional costs would have an adverse effect on our profitability.

Risks Relating to Our Business

Decreases in production volumes of specific vehicles, products or customers could have an adverse effect on our profitability

Although we supply parts to most of the leading automobile manufacturers for a wide variety of vehicles produced in North America and Europe, we do not supply parts for all vehicles produced, nor is the number or value of parts evenly distributed among the vehicles for which we do supply parts. In particular, in 2003, approximately 43% of our consolidated production sales were generated by products supplied for inclusion in 10 vehicle body types. Products and tooling supplied for the Chrysler Minivan constituted approximately 14% of our consolidated production sales for that period. There has been an industry trend toward more "brand hopping" among consumers in recent years, with consumers' preferences changing relatively quickly and dramatically in some instances. Shifts in market share among vehicles could have an adverse effect on our sales and on our profit margins. For example, we are affected by the sales mix between passenger cars, SUVs, minivans and other light trucks as ou r product content and profit margins vary among these types of vehicles. The contracts we have entered into with many of our customers are to supply a customer's requirements for all the vehicles it produces in a particular model, rather than for manufacturing a set quantity of products. Such contracts range from one year to the life of the model, usually several years, and do not require the purchase by the customer of any minimum number of parts.

In addition, DaimlerChrysler, Ford and General Motors accounted for 66% of our consolidated sales in 2003. In recent years, the "Big 3" have experienced declining market shares, particularly in North America. This reduced market share has led to increased cost pressures on Tier One suppliers such as Intier and a reduction in production volumes of certain of our high content vehicles. We cannot provide any assurance that we will be successful in the future in diversifying our business to other Asian-based automobile manufacturers who have been increasing their market share over the past few years.

Finally, the loss, renegotiation of the terms or delay in the implementation of any significant production contract with any of our customers could reduce our profitability. Any changes in the anticipated production volume of our products, particularly those supplied for the Chrysler Minivan, as a result of any of the above factors could reduce our profitability.

Fluctuations in relative currency values could adversely affect our profitability

Although our financial results are reported in U.S. dollars, a significant portion of our sales and operating costs are realized in Canadian dollars, euros, British pounds and other currencies. Significant long-term fluctuations in relative currency values may adversely affect our profitability. In particular, our profitability may be adversely affected by a significant strengthening of the U.S. dollar against the Canadian dollar, the British pound, the euro or other currencies in which we generate revenues.

Recent unionization drives at several of our plants may increase our costs

The National Automobile, Aerospace, Transportation and General Workers Union of Canada, also known as the CAW, has in the past mounted a number of major organizing drives at some of our Canadian plants. In June 2000, the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America, also known as the UAW, completed unionization drives in Michigan. During 2001, 2002 and 2003, we entered into collective agreements with the UAW, for our Ontegra Brighton plant, and the CAW for our Integram Windsor, Innovatech and Mississauga Seating Systems, which recognizes our operating principles, including our employee charter of rights. If we are successful in operating these plants with this form of collective agreement, we will examine whether to extend this form of agreement to some of our other plants if our employees at these plants vote in favour of unionization in the future. We also have collective agreements with our Integram St. Louis and Excelsior Sprin gs seating divisions in Missouri. In addition, the employees at our facilities in Lewisburg, Tennessee voted in favour of certifying the UAW as their bargaining agent. We are unable to predict whether we will successfully conclude additional collective bargaining agreements of this nature with these unions or what impact further unionization will have on our costs. In addition, the CAW and the UAW have in the past attempted to pressure some of our automobile manufacturer customers to encourage their suppliers to assume a neutral position with respect to unionization attempts at their plants.

Our operations may be adversely impacted by work stoppages and other labour relations matters

If our hourly workforce becomes more unionized in the future, we may be subject to work stoppages and may be affected by other labour disputes. To date, we have not experienced any work stoppages or other disputes that have had an adverse effect on our profitability. However, disputes with labour unions may not be resolved in our favour in the future. Furthermore, we may experience significant work stoppages in future years and may incur significant expenses related to work stoppages or other disputes.

We may not be able to compete successfully with some competitors that have substantially greater financial resources and market share than us

The automotive parts supply market is highly competitive. We face competition from a number of sources, including:

| |

·

|

our automobile manufacturer customers (and their related parts manufacturing organizations);

|

| | · | existing and new suppliers to these manufacturers; and |

| | · | manufacturers of product alternatives. |

Some of our competitors have substantially greater market share and financial resources than we have and are dominant in the markets in which we operate. Their market share and dominance may give them advantages over us in competition for new or existing business from our automobile manufacturer customers as well as negotiating cost reductions with the supply base. We may not be able to compete successfully with our existing competitors or with any new competitors.

We may be unable to implement our business strategy of improving our operating performance

We have implemented some, and intend to implement several other important strategic initiatives designed to improve our operating performance. We may not be able to sustain improvements made to date or to implement successfully or realize the expected benefits of any of these initiatives. Even if we are successful in implementing these initiatives, additional problems such as launch issues may develop at certain of our other operations which could further impact our future profit margins. Our failure to sustain improvements or to implement initiatives relating to new operational issues could have an adverse effect on our business, particularly since we rely on these initiatives to offset pricing pressures from our customers. These initiatives are dependent in many cases upon our ability to require participation by our suppliers and other third parties in our price reduction initiatives. To the extent that we are unable to pass on price reductions from our customers to our suppliers , our profit margins may be adversely affected.

Cancellation of vehicle programs and delays in launching new vehicle programs by our customers could have an adverse effect on our profitability

We incur engineering, design, tooling and other capital costs in advance of commencing production of parts to be supplied for our automobile manufacturers customers' new vehicle programs. For example, we typically incur significant design, engineering and tooling costs associated with larger modules and systems such as complete seating systems and door and cockpit modules in respect of new programs for which we have been awarded the business. Production volumes for our products to be supplied for these new programs are based on our customers' estimates of their future production levels, and our supply contracts typically are only for the supply of customers' actual requirements, not for a minimum or specified quantity of products. Our customers' actual production levels for new vehicle programs may vary significantly from their estimates, or such programs may be cancelled, or their launch may be delayed, or our customer may decide to source the manufacturing and assembly of the pro duct to one of our competitors after we have expended a significant amount of up-front engineering costs. To the extent that our estimated production volumes are not attained, due to cancellations of vehicle programs or delays in launching new vehicle programs, our production economies expected at the time of quotation may not be realized. Consequently, our capital or engineering costs incurred in connection with such programs may not be fully recovered, which could have an adverse effect on our profitability.

Delays in the construction of new facilities required for program launches could reduce our profitability

From time to time, we expand our production capacity through the construction of new manufacturing facilities and the expansion of existing facilities. New facilities or expansions of existing facilities are often required to accommodate the award of new business from our customers or to facilitate the introduction of new manufacturing processes or technologies. However, the construction of new facilities and the expansion of existing facilities involves a number of areas of operational and financial risks. For example, construction delays associated with poor weather, labour disruptions, cost overruns, shortages of construction materials and delays associated with the installation, testing and start-up of new production equipment or manufacturing processes could reduce our profitability. Since many new facilities are constructed and existing facilities are expanded to accommodate the launch of new customer production programs, the added complexity associated with new program launc hes can increase this risk. Any delays by us in product launches which impair our customer's ability to launch a new vehicle program could negatively impact our customer relationships as well as expose us to reimbursement claims by our customers for costs arising out of such delays, and could adversely affect our operations and future profitability.

We may be adversely affected by the environmental and safety regulations to which we are subject

We are subject to a wide range of environmental laws and regulations relating to air emissions, wastewater discharge, waste management and storage of hazardous substances. Our existing leases generally provide that we as tenant, must comply with applicable environmental laws. We are also responsible for removing all hazardous and toxic substances as and when required by applicable laws and in any event prior to the termination of our occupation of the leased properties, which may apply whether or not the contamination occurred prior to our use of the leased premises, unless it was not caused or exacerbated by our use.

We are also subject to environmental laws requiring investigation and clean-up of environmental contamination and are in various stages of investigation and clean-up at our manufacturing facilities where contamination has been alleged. Estimating environmental clean-up liabilities is complex and heavily dependent on the nature and extent of historical information and physical data relating to the contaminated site, the complexity of the contamination, the uncertainty of which remedy to apply and the outcome of discussions with regulatory authorities relating to the contamination. In addition, these environmental laws and regulations are complex, change frequently and have tended to become more stringent and expensive over time. Therefore, we may not have been, and in the future may not be, in complete compliance with all such laws and regulations, and we may incur material costs or liabilities as a result of such laws and regulations significantly in excess of amounts we have reserved.

Risks Relating to Our Relationship with Magna

Our relationship with Magna is not at "arm's length" and Magna will continue to control us

Our relationship with Magna is not at "arm's length" and none of our agreements with Magna or its affiliates, including the affiliation agreements, have been negotiated at arm's length. Through its ownership of all of our Class B Shares, such shares representing over 99% of the total votes attached to our outstanding share capital, Magna will continue to be able to elect all of our directors and will continue to control us. Therefore, Magna will continue to be able to cause us to effect corporate transactions without the consent of our minority shareholders and to control the amount and timing of dividends, subject in each case to our corporate constitution, the fiduciary duty of our directors to act in the best interests of our shareholders and other applicable laws governing related party transactions. In addition, Magna will continue to be able to cause or prevent a change in our control. In some cases, the interests of Magna may not be the same as those of Intier or our other s hareholders, and conflicts of interest may arise. See Item 4. "Information on the Company - Our Business - Legal Proceedings and Environmental Matters". Under the applicable laws of the Province of Ontario, Magna, as one of our shareholders, does not have a fiduciary duty to us or any of our other shareholders.

Magna may have a conflict of interest with our other shareholders due to the method of calculating the affiliation fees that we pay to Magna

Magna receives affiliation fees from us based on our annual sales revenue under the affiliation agreements between us and Magna. The aggregate affiliation fee in respect of fiscal 2003 was $60.8 million. Magna may prefer to see an increase in our sales even at the expense of our operating profits. In addition, while Magna has indicated that it has no current intention to do so, the affiliation agreements may be amended or terminated at any time by Magna acting individually and through its control of us, subject to approval by a majority of the independent directors of our Board of Directors. Our corporate constitution provides, however, that the affiliation agreements with Magna may not be amended to increase the affiliation fees without the prior approval of a majority of the holders of our Class A Subordinate Voting Shares (other than Magna or any person who, by agreement, is acting jointly with Magna or over which Magna or any such person exercises direct or indirect control or direction) and our Class B Shares, each voting as a separate class.

We obtain services from Magna or other related parties, which we may not be able to obtain on comparable terms from third parties

We have entered into several agreements with Magna, including an agreement for the provision to us of various services and insurance coverage and for the lease to us through MI Developments Inc., a related party ultimately controlled by the Stronach Trust, of a significant portion of the land and buildings we use. Although we believe that the existing leases are on arm's length commercial terms, there can be no assurance that independent parties negotiating at arm's length would have arrived at the same terms. Since we are under common control with MI Developments, there is a risk that future decisions or actions taken regarding these leases (including renewals, amendments, disputes or enforcement proceedings) and any new leases may not be the same as if we had proceeded with a thirty party on a completely arm's length basis. Magna also provides us various types of insurance coverage under its insurance policies with insurance companies. We expect to enter into additional agreement s with Magna in the future, the terms of any such material agreements with Magna will be determined through negotiations at such time and subject to approval by a majority of the independent directors of our Board of Directors. In addition, we may be dependent on Magna to provide other services in the future. To the extent the services we receive from Magna become unavailable for any reason, we may not be able to obtain similar services on comparable terms from other parties. See Item 7. "Major Shareholders and Related Party Transactions".

Certain of our historical financial statements prior to August 1, 2001 have been "carved out" from the consolidated financial statements of Magna and may not reflect our results of operations and financial position on a stand-alone basis

Our historical financial statements prior to August 1, 2001 presented in this Report have been "carved out" from the consolidated financial statements of Magna and may not be indicative of our results of operations and financial position had we actually operated on a stand-alone basis during the periods presented. In particular, our costs and expenses include allocations that could have caused our stand-alone results to differ.

Risks Relating to our Class A Subordinate Voting Shares

The trading market for our Class A Subordinate Voting Shares is not liquid, resulting in volatility of trading prices

The size of our public float is small compared to other public companies, including some of our competitors. In addition, employees who purchased our Class A Subordinate Voting Shares may be expected to trade those shares less actively than other investors, further reducing the liquidity of the trading market for our Class A Subordinate Voting Shares. Donald Walker, our President, Chief Executive Officer and Chairman owned 700,000 of our Class A Subordinate Voting Shares as at March 31, 2004, which was 10.75% of the total number of such shares outstanding at that time. Finally, effective fiscal 2002, we implemented deferred profit sharing plans in Canada, the United States, the United Kingdom and Austria which will invest primarily in our Class A Subordinate Voting Shares. Our deferred profit sharing plans in Canada and the U.S. as at March 31, 2004 owned 478,553 and 649,827, respectively, of our Class A Subordinate Voting Shares, which is 7.35% and 9.98%, respectively, of the total number of such shares outstanding at that time. Accordingly, there is a significant possibility that the market for our Class A Subordinate Voting Shares will continue to be thin and illiquid, which could result in increased volatility in the trading prices for our Class A Subordinate Voting Shares.

Sales of our Class A Subordinate Voting Shares by Magna could depress our share price

As of March 31, 2004 we had outstanding 6,511,939 Class A Subordinate Voting Shares, 42,751,938 Class B Shares (all of which are held by Magna and are convertible into an equal number of Class A Subordinate Voting Shares), 1,085,500 Preferred Shares, Series 1 and 1,125,000 Preferred Shares, Series 2, all of which are held by Magna and are convertible into Class A Subordinate Voting Shares, at a conversion price of $15.09 per Class A Subordinate Voting Share.

Sales of a substantial number of our Class A Subordinate Voting Shares by Magna after conversion, or the perception that such sales may occur, could depress prevailing market prices of our Class A Subordinate Voting Shares.

Issuance of Class A Subordinate Voting Shares on conversion of our Convertible Series Preferred Shares could be dilutive

The outstanding Convertible Series Preferred Shares constituted approximately 69.5%, on a fully diluted basis, of our outstanding Class A Subordinate Voting Shares at December 31, 2003. Conversion of the Convertible Series Preferred Shares will have a dilutive effect on the holders of the Class A Subordinate Voting Shares to the extent the market price of the Class A Subordinate Voting Shares at the time of conversion exceeds the conversion price of the Convertible Series Preferred Shares.

4.

|

INFORMATION ON THE COMPANY

|

A. | History and Development of the Company |

Intier was incorporated under the laws of the Province of Ontario, Canada, on May 4, 1987, as Atoma International Inc. The Company amalgamated with certain of its affiliates under the laws of the Province of Ontario on August 1, 1990, and subsequently on January 2, 2000. By Certificate and Articles of Amendment dated April 3, 2001, the Company changed its name to Intier Automotive Inc.

The Company is controlled by Magna through Magna's direct and indirect ownership of 100% of the Company's outstanding Class B Shares, which represented over 99% of the total votes attaching to all outstanding Class A Subordinate Voting Shares and Class B Shares of the Company as at December 31, 2003.

The Company's registered and principal office is located at 521 Newpark Boulevard, Newmarket, Ontario, Canada L3Y 4X7. The telephone number is (905) 898-5200 and the website is www.intier.com.

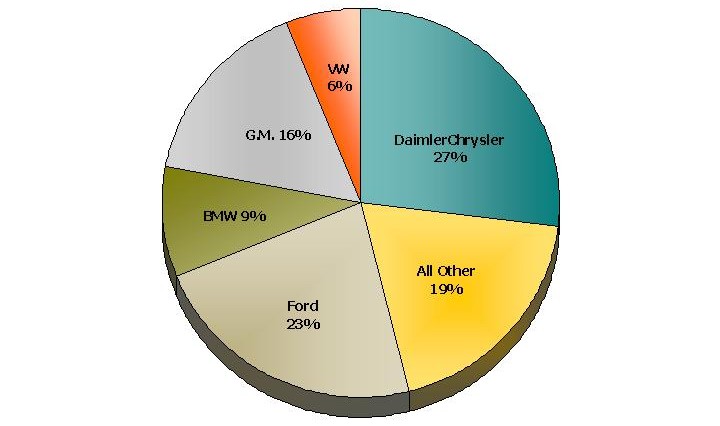

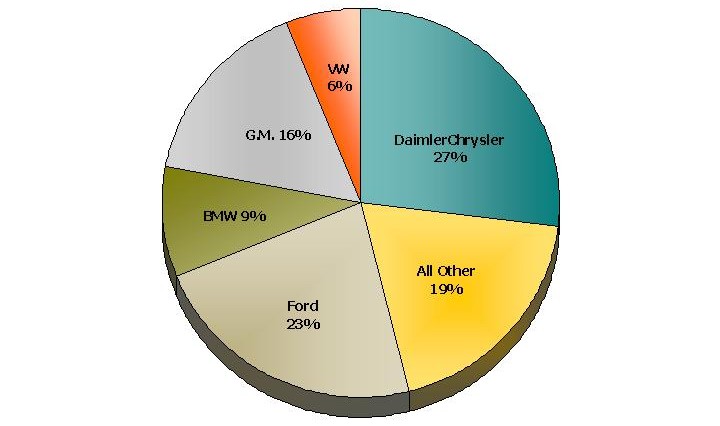

We are a global full service supplier of automotive interior and closure components, systems and modules. We directly supply most of the major automobile manufacturers in the world and at December 31, 2003 employed approximately 24,000 people at 71 manufacturing facilities, 17 product development, engineering and testing centres and 17 sales/purchasing offices in North America, Europe, Brazil and Asia Pacific. Our top five customers, based on our consolidated 2003 sales, are DaimlerChrysler (27%), Ford (23%), General Motors (16%), BMW (9%) and Volkswagen (6%).

Over the last nine years, we have grown rapidly through a focused strategy of internal growth and acquisitions. Our success in securing profitable interior and closure systems business, primarily in North America, has generated internal growth. We have also completed eight acquisitions in Europe and one in North America that have enhanced our system supply capabilities, expanded our customer base and broadened our geographic scope.

As a result of our strategy, our revenues increased from $2.83 billion in 1999 to $4.65 billion in 2003, representing a compound annual growth rate of 13.2%. During this period, our operating income increased from $74.6 million to $136.4 million, representing a compound annual growth rate of 16.3%.

Our principal products include:

| | · | Interior systems, such as seating systems, cockpit systems, sidewall systems, cargo management systems, overhead, floor and acoustic systems, instrument panels and related components; and |

| | · | Closure systems, including latching systems, window regulators, electro-mechanical systems, wiper systems, power sliding doors and liftgates, mid-door and door modules. |

Industry Trends Affecting Our Business

We anticipate growth in the global market for our products as a result of industry-wide trends caused by competitive pressures on automobile manufacturers, and in turn on their suppliers, to improve product quality, lower costs and shorten the product development cycle. These trends include:

Increased sourcing by automobile manufacturers to outside suppliers of more complex interior systems and closure systems, including cockpit systems and door and power liftgate modules

Automobile manufacturers are increasingly outsourcing their requirements for larger modules and complete systems of a vehicle interior, such as cockpit systems and door modules. This trend toward modularization is the result of several factors, including:

| | · | the significant cost savings achieved as a result of taking advantage of an outside supplier's lower variable costs, simplifying the vehicle assembly process and reducing the manufacturer's overall fixed cost investment; and |

| | · | the increased sophistication and capability of interiors suppliers in program management and logistics and product styling, design, assembly and testing. |

There has also been a general increase in the average value of outsourced modules as increasingly more complex modules and systems are outsourced. The extent of outsourcing of interior modules and systems varies by product line. For example, seating components and assemblies led the current outsourcing trend as seat frames and other seating components (which serve as the basis of overall seating design by virtue of their structural and safety importance) were outsourced much earlier than other interior components. This outsourcing trend gradually evolved into complete seating systems as suppliers improved their technical competency and engineering expertise in this product line. Automobile manufacturers have historically been slower in outsourcing cockpit modules because of their importance in the overall styling and functionality of the vehicle as well as the significant complexity of the modules themselves. Accordingly we believe that the rate of future industry growth in cockpit and door modules will be higher than in the case of outsourced seating systems.

Increased importance of the automotive interior as a means of product differentiation to consumers

A vehicle's interior is a significant factor in the consumer's purchasing decisions for a number of reasons, including:

| | · | the amount of time spent by drivers and passengers inside the vehicle; and |

| | · | the ability of distinctively styled interiors to improve consumer satisfaction. |

As a result of the increasingly competitive market, an automobile manufacturer's ability to offer new or different products to its customers as quickly as possible is an important method of maintaining or increasing its market share. There are three principal alternatives available to automobile manufacturers to attempt to differentiate their products. They can:

| | · | develop completely new vehicle platforms; |

| | · | change interior or exterior appearance attributes of existing vehicles to achieve vehicle "facelifts"; or |

| | · | introduce lower volume derivative or niche vehicles based on existing vehicle platforms, but with distinct styling packages and options. |

The first alternative is very costly and time consuming. The latter two alternatives provide opportunities to interiors suppliers such as us to generate additional revenues as automobile manufacturers develop new interior styling packages for existing vehicles in an effort to differentiate their products. In addition, this trend has provided opportunities for interiors suppliers to participate in the design and engineering, manufacture and assembly of larger portions of the interior of these vehicles.

Consolidation of the interiors segment of the automotive industry has created demand among automobile manufacturers for multiple strong full service global suppliers

The increasing demands on tier one suppliers regarding price competitiveness, product quality and technical innovation has led to consolidation among automotive suppliers, particularly in some interiors product lines, such as seating systems where some suppliers have a market share several times larger than ours. However, most automobile manufacturers have also implemented a policy of maintaining two to four strong alternative suppliers to ensure competitive pricing, quality manufacturing and innovative technological solutions for the major interior and closure modules and systems of their vehicles. For this reason, we believe that automobile manufacturers may award significant additional business in some interiors product lines to suppliers such as us whose current market share is less significant than some of our competitors, but who still have the proven capability of delivering high quality products at competitive prices.

Our Strategy

We intend to build on our position as a global supplier of automotive interior and closure systems and related components, assemblies and modules. We believe that we have the opportunity to expand our business significantly by capitalizing on industry trends and otherwise aggressively pursuing our strategy. Elements of our strategy to achieve disciplined and profitable growth include continuing to:

Deliver full service interior and closure systems capabilities to our customers

Outsourcing creates an opportunity for us to increase content per vehicle by coordinating the design, manufacture, integration and assembly of larger modular assemblies such as complete seats, cockpits, and overhead and door modules. For example, we supply (or will supply) cockpit modules and/or instrument panels on vehicles such as the BMW MINI and 6 Series, the Audi A3 and Audi A8, the Jaguar S-Type and XJ Series, the Nissan Micra, the Cadillac CTS, SRX and STS vehicles and various Land Rover sport utility vehicles as well as the Chevrolet Equinox and the Chevrolet Colorado/GMC Canyon. We also supply hardware door modules for the Ford Fiesta/Ka in Europe and the Ford Expedition/Lincoln Navigator and Nissan Maxima in North America and we have also developed a door trim module for a European-based automobile manufacturer which integrates all the door latching systems onto the inside of the door panel. We believe that combining our worldwide closures and interior capabilities will f urther assist us in designing, engineering, manufacturing and supplying modular products, such as complete door and cockpit modules, by enabling us to more closely coordinate our product styling, design and engineering and marketing efforts and to achieve greater efficiencies in our logistics and supply chain management.

Emphasize technological innovation and craftsmanship

We believe that our operating principles and commitment to product and technological innovation and craftsmanship have assisted us in generating new business opportunities with our customers. Our corporate constitution requires us to allocate a minimum of 7% of our pre-tax profits to research and development annually. Our recent product and technology innovations include:

| |

·

|

an industry-first power liftgate (developed in conjunction with DaimlerChrysler) for the minivan market;

|

| | · | the patentedFold and Tumbleä family of seating mechanisms which allow for additional storage space as well as easier passenger entry by automatically moving the seat to the full rear track position as the seat tumbles to the stowed position; |

| | · | theTailgate Swing Upä seat that swings up into the ceiling of the vehicle for self-storage, thereby eliminating floor-mounted seat risers, resulting in weight reduction and increased under-seat storage when the seat is in the down position; |

| | · | a reversible seat that reverses position to permit face-to-face contact with rear row passengers; |

| | · | a modular seat system with an elastomeric support structure which is lighter in weight and provides increased interior space within the vehicle as well as certain styling advantages; |

| | · | a patented technology known asPUR-fect Skinä, which produces polyurethane spray-skin coverings for instrument panels and other interior trim with two-tone capability and a more durable surface that other competitive products; |

| | · | a pedestrian protection system that deploys to take precautionary measures for pedestrian safety at the point of impact; |

| | · | patented headliner substrates known asStructurliteä, which incorporates safety design features directly into the headliner composite, thereby saving substantial cost, weight and packaging space; |

| | · | power sliding doors for the minivan market which allow power opening and closing as well as manual operation with no more effort than a regular sliding door; |

| | · | an obstacle detection system consisting of sensors installed along the door opening, which retract the door or window if it detects any object in the closure path; |

| | · | an electronic modular latching system with programmable logic for double lock, child lock and central lock features as well as independent control of door handles; |

| | · | an integrated door trim module which eliminates the water shield and provides weight reduction opportunities at a lower cost. |

To support our product development and innovation strategy, we operate 17 product development, engineering and testing centres and employ approximately 2,000 technicians, engineers and stylists to assist us in coordinating our product development activities. Our emphasis on craftsmanship throughout the product development process attempts to ensure that the fit and finish, quality, operability, appearance, ergonomics and overall coordination of the modules and systems we supply is at the highest level of consumer satisfaction.

We recognize that supplying high quality products on schedule is essential to remaining competitive. On an ongoing basis, automobile manufacturers assess their suppliers on a broad scope of business attributes, of which product quality is an important consideration. These assessments are relevant to automobile manufacturers in awarding new contracts and in respect of their supplier award programs. We are focused on reducing variations in quality through various techniques, including value analysis/value engineering, reliability studies, statistical process control and failure analysis. Additionally, our products are designed and developed on computer-aided design and manufacturing systems and submitted to complete finite element analysis and comprehensive in-house testing.

Improve operating efficiencies

Certain of our operations experience operating losses as a result of a number of factors, including low productivity, high material usage and excess capacity. Management is highly focused on improving the operating and financial performance of each underperforming division and has detailed action plans to resolve the issues at such divisions. During 2003, we closed three of these underperforming operations. Subsequent to December 31, 2003, we sold one of our European Interiors manufacturing facilities and we have shut down another Closure manufacturing facility in Europe. We intend to continue to improve our operating performance and competitiveness at the remaining underperforming facilities and reduce our costs at our other existing operations by refining our product strategy through the potential closure or disposition of certain underperforming or non-core assets, by adopting quality improvement principles such as "Six Sigma", increased capacity utilization, launching new prod ucts and programs and by other sourcing, labour and cost reduction initiatives. In addition, we have developed processes such as the Innovation Development Process and the Product Delivery Process that have assisted in ensuring first-to-market performance consistent with our customers' technology and vehicle cycle plans as well as reducing any unanticipated delays or costs in launching our products. We believe that these initiatives will position us to further improve our existing margins, return on capital employed and profitability in the future.

Capitalize on "complete system" and integration opportunities

Automobile manufacturers are consolidating their supply base in some product lines and shifting the design, engineering and manufacturing functions of larger portions of vehicles to outside suppliers. This has led suppliers to perform additional value-added engineering, integration and program management, assembly and sequencing functions. As a result of our emphasis on developing system integration and program management capabilities, we program managed the complete interior (excluding seats and electronics) of the 1998 Lincoln Navigator. We believe that this was the first time that a North American automobile manufacturer outsourced program management services to a North American external supplier. We are also the vehicle systems integrator for the total interior (excluding seats and electronics) of the Cadillac CTS, the Cadillac SRX and the 2005 Cadillac STS and are performing part of this function in conjunction with another automotive supplier in which we have retained a signi ficant equity interest. In addition, we were named as the interiors integrator for the future General Motors in 2002 for the full-size line of sport utility vehicles and in 2003 for the full-size line of pick-up trucks. As part of this award, we anticipate that we will be awarded interiors production contracts including the overhead systems and other interior trim components for these full-size sport utility vehicles and full-size pick-up trucks. We expect that these types of contracts will allow us to increase our content per vehicle significantly as our engineering and purchasing responsibility under these types of contracts becomes more significant in the future. We intend to capitalize on our capabilities and experience to pursue complete interior integration programs in the future.

Promote our policies and principles, including our incentive-based corporate culture

We believe that, as a separate public company, we are in a better position to benefit from Magna's corporate policies and principles, including decentralization, which increases our flexibility, customer responsiveness and productivity. In addition, as a public company, we are better able to develop profit-based compensation programs that more directly align the interests of our employees with those of our shareholders, which will assist us in attracting, retaining and motivating skilled and entrepreneurial management and employees. For example, we established effective fiscal 2002, an employee equity and profit participation program for our employees under which we will make contributions based on the amount of our employee pre-tax profits before profit sharing rather than Magna's and which will invest exclusively in our Class A Subordinate Voting Shares rather than Magna's. We believe that programs such as this one will more closely align the interests of our employees with those of our shareholders.

Our Internal Growth and Acquisition History

Over the past nine years, we have grown through a combination of internal growth and acquisitions. Our growth in North America has been primarily through greenfield operations established as a result of securing additional contracts from our customers. In October 1996, Magna also completed the acquisition of Douglas & Lomason Company, a U.S.-based manufacturer of seating systems, seat frames, seat mechanisms, other seating components and other automotive components for $134.9 million. This acquisition broadened the scope of our relationship with Ford as a significant portion of the acquired business forms part of our operations.

In Europe, our growth has been principally through acquisitions as we endeavoured to replicate our core North American product offerings and capabilities in Europe. Our eight European acquisitions are set out in the table below:

Date

|

Acquired Company

|

Purchase Price

|

Products

|

December 1998 | Pal International, a.s. | $9.3 million | Electric motors for windshield wiper systems and other applications |

March 1998 | Paulisch GmbH & Co KG | $18.0 million | Complete seating systems, seat frames and other seating components |

February 1998 | Roltra-Morse, S.p.A. | $30.0 million | Automotive latches, window regulators, cable systems, door modules and gear shift mechanisms |

November 1997 | Ymos Automotive Interiors Group | $31.7 million | Instrument panels, consoles and other interior components |

May 1997 | Tricom Group Holdings | $51.1 million | Complete seating systems, seat frames and other seating components |

May 1997 | Georg Näher GmbH | $35.5 million | Trunk linings, interior panels, and carpet and sound insulation systems |

April 1996 | Marley Automotive Components Group | $80.5 million | Instrument panels, consoles, door trim panels and other interior components |

June 1995 | Eybl Durmont AG | $34.5 million | Interior components and systems |

Our European expansion strategy significantly contributed to our development as a global supplier of interior and closure components, modules and systems. We are continuing to focus on improving operating efficiencies in Europe in order to increase our overall profitability.

Our Customers and Significant Customer Contracts

We generally sell our products and provide our support services directly to automobile manufacturers. Our primary customers are DaimlerChrysler, Ford and General Motors and their respective operating divisions and subsidiaries. The following chart provides a breakdown of our consolidated sales by customer for 2003.

The following table sets forth the top ten vehicles from which we derive revenues, based on our consolidated 2003 sales, and the products that we supplied on these vehicles during 2003:

| | Vehicle | Products |

1. | Chrysler Minivan | Complete seating system, power sliding doors, window regulators, power liftgates and latches |

2. | Ford Escape/Mazda Tribute | Complete seating system, door panels, overhead system, interior trim, latches |

3. | BMW MINI | Cockpit module, door panels, trim |

4. | Chrysler Pacifica | Complete seating system, latches |

5. | Dodge Ram Pick-up | Overhead system, seating mechanisms, latches, window regulators |

6. | Ford Freestar / Mercury Monterey | Overhead system, trim components, complete seats, latches, rear door panels, window regulators, handles |

7. | GM Sierra / Silverado / Yukon / Tahoe | Door panels, latches, window regulators |

8. | Ford Explorer / Mercury Mountaineer | Window regulators, latches |

9. | BMW 3 Series | Door panels, pillars, trim, trunk space, sunvisor |

10. | Ford Transit Van | Complete seating system, latches |

Our Operations

To better service our customers, we follow a policy of functional and operational decentralization. We believe that this approach increases our speed and responsiveness to our customers. Our operations consist of two business segments, Interiors and Closures, which are generally aligned with the corresponding purchasing and engineering groups of our customers. Effective January 2003, our Closures operations underwent an organizational structure change, effectively changing management's reporting and assessment of operating results for resource allocation decisions and performance assessment to be on a global basis. Our Interiors segment is further segregated geographically between North America and Europe.

Interiors

Our Interiors operations supply complete vehicle interior systems and components, consisting of complete seating systems, seating hardware, cockpit, sidewall and overhead systems and components, and floor carpet, trunk or rear compartment trim and acoustic products. We also manage the design, engineering, development, testing and final assembly of all interior systems and components. In 2003, our Interiors business generated consolidated sales of approximately $3.66 billion and operating income of $92.5 million, representing 79% of our consolidated sales and 68% of our consolidated operating income.

Our principal interior products include:

| |

·

|