As filed with the Securities and Exchange Commission on July 21, 2006

Registration No. 333-135556

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

WACCAMAW BANKSHARES, INC.

(Exact name of registrant as specified in charter)

| | | | |

| North Carolina | | 6022 | | 52-2329563 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

110 North J.K. Powell Boulevard

Whiteville, North Carolina 28472

(910) 641-0044

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

James G. Graham

President and Chief Executive Officer

Waccamaw Bankshares, Inc.

110 North J.K. Powell Boulevard

Whiteville, North Carolina 28472

(910) 641-0044

(Name, address, including zip code, and telephone number, including area code of agent for service)

Copies to:

Anthony Gaeta, Jr., Esq.

Phillip B. Kennedy, Esq.

Gaeta & Eveson, P.A.

8305 Falls of Neuse Road, Suite 203

Raleigh, North Carolina 27615

(919) 845-2558

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED July 21, 2006

PROSPECTUS

656,196 UNITS

(Consisting of One Share of Common Stock and One Warrant)

OFFERING PRICE $17.00 PER UNIT

[Waccamaw Bankshares, Inc. Logo]

We are Waccamaw Bankshares, Inc., the holding company for Waccamaw Bank, a North Carolina-chartered community bank headquartered in Whiteville, North Carolina.

We are offering up to 656,196 units at a price of $17.00 per unit. Each unit consists of one share of our common stock and one warrant to purchase one share of our common stock at a price of $24.00 at any time until September 30, 2009. Such units are being offered in a rights offering to our shareholders of record as of the close of business on July 12, 2006. Each shareholder has the right to purchase one unit for each seven shares of common stock owned as of July 12, 2006. Additionally, shareholders may oversubscribe for additional units, however, we can give no assurance that any such oversubscriptions will be filled. Shareholders of record on July 12, 2006 are not entitled to transfer or assign their right to purchase units in this rights offering.

There is currently no public market for either the units or the warrants. Upon closing, the common stock and the warrants represented by each unit will trade separately. Our common stock is traded on the Nasdaq Capital Market under the symbol “WBNK” and we expect the warrants to be approved for listing on the Nasdaq Capital Market under the symbol “WBNKW.” The last reported sales price of our common stock on , 2006 was $ per share.

Investing in our units involves risks. We urge you to carefully read “Risk Factors” beginning on page 9 before making your investment decision.

Neither the Securities and Exchange Commission nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful and complete. Any representation to the contrary is a criminal offense.

The securities offered by this prospectus are not savings accounts, deposits or obligations of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency.

| | | | | | |

| | | Per Unit | | Total |

Offering Price | | $ | 17.00 | | $ | 11,155,332 |

Estimated expenses of the Offering(1) | | $ | 0.32 | | $ | 210,000 |

Net proceeds before expenses to Waccamaw Bankshares, Inc. | | $ | 16.68 | | $ | 10,945,332 |

| (1) | Expenses of this offering include legal and accounting fees, printing and postage. |

The date of this prospectus is , 2006

[Waccamaw Bankshares, Inc. logo]

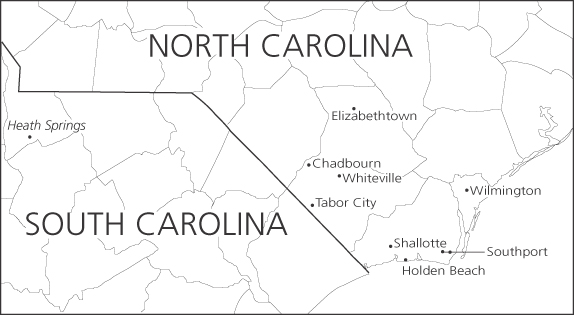

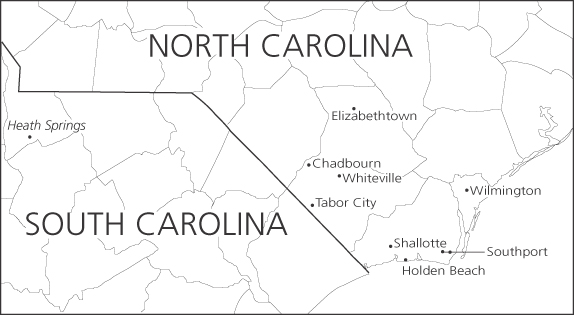

Offices

| | | | |

| Main Office | | Operations Center | | Tabor City |

110 N. Powell Blvd. Whiteville, NC 28472 | | 809 S. Madison St. Whiteville, NC 28472 | | 105 Hickman Rd. Tabor City, NC 28463 |

| | |

| Chadbourn | | Shallotte | | Holden Beach |

111 Strawberry Blvd. Chadbourn, NC 28431 | | 4949 Main St. Shallotte, NC 28470 | | 3178 Holden Beach Rd., SW Supply, NC 28462 |

| | |

| Southport | | Elizabethtown | | Wilmington |

701 N. Howe St. Towngate Crossing, Suite 3 Southport, NC 28461 | | 306 S. Poplar St. Elizabethtown, NC 28337 | | 29 S. Kerr Ave. Wilmington, NC 28403 |

| | |

| Southport* | | Heath Springs | | |

4945 Southport-Supply Road, SE Southport, NC 28461 *Under construction | | 202 N. Main St. Heath Springs, SC 29058 | | |

PROSPECTUS SUMMARY

This summary highlights information contained in this prospectus. Because this is a summary, it may not contain all of the information that is important to you. Therefore, you should also read the more detailed information in this prospectus and our consolidated financial statements included in this prospectus. References in this prospectus to “we,” “us,” and “our” refer to Waccamaw Bankshares, Inc. and its consolidated subsidiary, Waccamaw Bank, unless otherwise specified. References to the bank refer to Waccamaw Bank.

Who We Are

Waccamaw Bankshares, Inc. is the holding company for Waccamaw Bank, a North Carolina-chartered community bank. We are headquartered in Whiteville, North Carolina and conduct our business through nine full service banking offices located in Whiteville, Tabor City, Chadbourn, Elizabethtown, Shallotte, Holden Beach, Southport and Wilmington, North Carolina and Heath Springs, South Carolina. Our primary market area includes Columbus, Bladen, Brunswick and New Hanover Counties of North Carolina and Lancaster County, South Carolina. Waccamaw Bank began operations in Whiteville, North Carolina on September 2, 1997 and on June 30, 2001 became our wholly owned subsidiary upon completion of our reorganization into a bank holding company. In December 2005, we announced that we had entered into an agreement to acquire The Bank of Heath Springs, Heath Springs, South Carolina and merge that institution into Waccamaw Bank. We completed that merger on April 28, 2006 adding $20.1 million in assets and one additional office to Waccamaw Bank.

At March 31, 2006 we had:

| | • | | Assets of $336.7 million, |

| | • | | Loans of $267.1 million, |

| | • | | Deposits of $283.5 million, |

| | • | | Stockholders’ equity of $23.6 million, |

| | • | | Diluted earnings per share of $0.18 (first three months of 2006), |

| | • | | Return on average assets of 1.02%, and |

| | • | | Return on average equity of 14.50%. |

Our lending activities are oriented to the consumer and retail customer as well as small- to medium-sized businesses in our market area. Accordingly, we offer the standard compliment of commercial, consumer and mortgage lending products, as well as the ability to structure products to fit specialized needs. We emphasize superior customer service and responsive decision making delivered with the convenience of modern technology. We have developed a loan portfolio that is primarily composed of loans secured by real estate. Such loans comprised approximately 84.15% of our loan portfolio at March 31, 2006. We believe we have created and maintain a strong credit culture. As of March 31, 2006, our non-performing assets totaled $2,007,000 or 0.60% of total assets.

The deposit services offered by our bank include small business and personal checking, savings accounts and certificates of deposit. Our bank concentrates on customer relationships in building its customer deposit base and competes aggressively in the area of transaction accounts. At June 30, 2005, the most current data provided by the FDIC Deposit Market Share Report indicated that we controlled over 26% of the deposits in Columbus County where Whiteville is located, over 6% of the deposits in Brunswick County and 0.65% of the deposits in New Hanover County. Because we entered Bladen County after June 30, 2005, no market share data is available. With our acquisition of The Bank of Heath Springs, we control nearly 5% of the deposits in Lancaster County, South Carolina.

1

Our growth strategy has centered on the expansion of our franchise through the opening of new bank offices. Very soon after opening our main office in Whiteville, we opened offices in Tabor City and Chadbourn, North Carolina. In 2000, we established offices in Shallotte and Holden Beach in Brunswick County, North Carolina. In 2004, we opened our Wilmington office, expanding into the vibrant New Hanover market. A third Brunswick County location was opened in 2005 with the addition of our Southport office and in the same year we entered Bladen County with the opening of our Elizabethtown office. With the acquisition of The Bank of Heath Springs, we added an office in Heath Springs, South Carolina and the ability to establish additional offices throughout South Carolina. We expect in the future to branch into areas of South Carolina contiguous to our current primary market area along the North Carolina-South Carolina border and coastline, although no branch applications are currently pending.

We conduct all of our business activities through our banking subsidiary, Waccamaw Bank. The bank’s deposits are insured up to applicable limits by the FDIC. Our principal executive office is located at 110 North J.K. Powell Boulevard, Whiteville, North Carolina 28472 and our telephone number is (910) 641-0044. Our website is www.waccamawbank.com. Information contained on our website is not part of this prospectus.

Strategy

From our initial office in Whiteville, the county seat of Columbus County, we have expanded into neighboring towns and the contiguous counties of Bladen, Brunswick and New Hanover. With our strategic acquisition of the Bank of Heath Springs in Lancaster County, South Carolina, the legal restrictions on establishing branch offices in South Carolina have been eliminated and we may branch throughout the State of South Carolina. We currently anticipate that our future expansion will be along the North Carolina-South Carolina border and coastline. We will be open to opportunities that may present themselves in the form of whole bank or branch acquisitions in North and South Carolina. We believe our track record of opening community-based full service branches in contiguous towns and counties will continue to be the primary thrust of our expansion strategy. We have no immediate plans to expand our product and service base beyond that currently being provided and therefore will continue to direct our efforts to serving the banking needs of retail customers and small- to medium-sized businesses in our market area. Commercial lending secured by real estate will continue to be a focus of our lending activities and we will continue to focus our products and services to persons who reside, or do business, in our market areas.

Market Area

Our market area includes the counties of Columbus, Bladen, Brunswick, and New Hanover, North Carolina and Lancaster County, South Carolina. Total deposits in our market area exceed $5.7 billion.

Columbus County is located in the southeastern portion of North Carolina near the South Carolina border. Whiteville, the largest city in the county, is approximately 45 miles west of Wilmington, North Carolina, 150 miles southeast of Charlotte, North Carolina, and 45 miles north of Myrtle Beach, South Carolina. These cities all have national or regional airports. Columbus County had an estimated 2005 population of 55,000 and an estimated 2005 median family income of $39,000.

Brunswick County is adjacent to Columbus County to the southeast and also borders South Carolina. Shallotte, the largest city in the county, is approximately 35 miles southwest of Wilmington and 35 miles northeast of Myrtle Beach. Brunswick County had an estimated 2005 population of 89,000 and an estimated 2005 median family income of $54,200.

New Hanover County is a coastal county and adjacent to Brunswick County to the north. Wilmington, the largest city in the county, has a diversified economy which includes shipping, manufacturing, medical and retail industries. New Hanover County had an estimated 2005 population of 180,000 and an estimated 2005 median family income of $54,200.

2

Bladen County is adjacent to Columbus County to the northeast. Elizabethtown, the largest city in the county is approximately 50 miles northwest of Wilmington and 80 miles northwest of Myrtle Beach. Bladen County had an estimated 2005 population of 33,000 and an estimated 2005 median family income of $40,000.

Lancaster County is located in the Piedmont region of South Carolina and borders North Carolina to its north. Our branch in Heath Springs is approximately 50 miles south of Charlotte and 100 miles west of Whiteville. Lancaster County had an estimated 2005 population of 63,113 and an average estimated 2005 median family income of 47,449.

In our market area, the principal components of the economy are manufacturing, agriculture and tourism. Manufacturing employment is concentrated in the wood products and textile industries. The primary agriculture products are tobacco and hogs.

3

THE OFFERING

Units offered for sale | 656,196 units consisting of one share of our common stock and one detachable warrant. Each warrant will entitle the holder to purchase one share of our common stock at a price per share of $24.00 at any time until September 30, 2009, unless such warrants are subject to early cancellation. Holders of units will be holders of both the common stock and the warrants and will have the same rights, preferences and privileges as a holder of each security. The units will be represented by two separate certificates, one representing shares of our common stock and one representing warrants. You will not receive separate certificates for the units. |

Shares of common stock outstanding after the offering | 5,249,563 shares |

Offering price | $17.00 per unit |

Market for the units, common stock and warrants | Our common stock is listed for quotation on the Nasdaq Capital Market under the symbol “WBNK.” There is currently no public market for either the units or the warrants. Upon closing, the common stock and the warrants represented by each unit will trade separately. We expect the warrants to be listed for trading on the Nasdaq Capital Market under the symbol “WBNKW.” |

Rights Offering | Shareholders of record as of the close of business on July 12, 2006 may subscribe for units by submitting a completed Subscription Offer Form together with a check on or before the rights offering subscription deadline of August 31, 2006. Shareholders of record on July 12, 2006 may subscribe for units on a basis of one unit for each seven shares of common stock beneficially owned on that date. Fractional units will not be sold. Shareholders may not transfer or assign their subscription rights. See “Rights Offering” on page 15. |

Oversubscriptions | Shareholders participating in the rights offering may “oversubscribe” for additional units. Such oversubscriptions will be filled in whole or in part at our sole discretion. Oversubscriptions will be filled on a pro rata basis based upon the ratio that the number of shares of common stock owned by the oversubscriber on the record date bears to the number of shares of common stock owned by all of the oversubscribers on the record date. Payment for all units subscribed, including any requested oversubscription units, must be submitted with the Subscription Offer Form. In the event that all, or part, of an oversubscription offer cannot be filled, the corresponding portion of the aggregate subscription price will be refunded, without interest. |

Rights offering subscription deadline | No rights offering subscription offers will be accepted after 5:00 p.m. local time on August 31, 2006. |

4

Dividend policy | We have not paid any cash dividends to date and do not anticipate the payment of cash dividends in the future. We intend to retain future earnings to support our growth. |

| | We declared two stock splits effected in the form of stock dividends in 2004 and one in each of 2003, 2001 and 2000. We intend to continue to consider the declaration of pro rata stock distributions in the future. |

Use of proceeds | The proceeds of this offering will be used to support the growth and expansion of our franchise through additional lending activities, the possible addition of bank offices, and for general corporate purposes. |

Purchases by officers and directors | Certain of our officers and directors have indicated an interest in participating in the rights offering. Any such purchases by our directors and officers will be on the same terms and conditions as offered to other shareholders. |

Risk factors | Investment in our units involves certain risks, including the risk of loss of principal. You should read the “Risk Factors” section beginning on page 9 before deciding to purchase our units. |

5

SUMMARY CONSOLIDATED FINANCIAL INFORMATION AND OTHER DATA

The summary consolidated financial and other data presented below should be read in conjunction with, and is qualified in its entirety by, our audited financial statements and related notes contained elsewhere in this prospectus and the financial statements included in our annual reports filed with the Securities and Exchange Commission. Effective June 30, 2001, Waccamaw Bank became our wholly owned subsidiary. We have no material operations other than those of our bank subsidiary.

The information as of and for the three months ended March 31, 2006 and 2005 is unaudited but, in the opinion of our management, contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of our financial condition and results of operations for those periods. The selected financial and other data presented below as of and for the three months ended March 31, 2006 and 2005 should be read in conjunction with, and is qualified in its entirety by, the unaudited consolidated financial statements included elsewhere in this prospectus. The results of operations for the three month period ended March 31, 2006 are not necessarily indicative of the results to be expected for the remainder of the year or any other period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | At or for the Three Months Ended March 31,

(unaudited) | | | At or for the Years Ended December 31, |

| | | 2006 | | | 2005 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 |

| | | (Dollars in thousands, except share and per share data) |

Summary of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 5,514 | | | $ | 3,758 | | | $ | 18,228 | | | $ | 11,450 | | | $ | 9,957 | | | $ | 9,594 | | | $ | 8,789 |

Interest expense | | | 2,412 | | | | 1,473 | | | | 7,536 | | | | 3,766 | | | | 3,627 | | | | 3,978 | | | | 4,518 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 3,102 | | | | 2,285 | | | | 10,692 | | | | 7,684 | | | | 6,330 | | | | 5,616 | | | | 4,271 |

Provision for loan losses | | | 105 | | | | 225 | | | | 1,370 | | | | 819 | | | | 730 | | | | 794 | | | | 612 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income after the provision for loan losses | | | 2,997 | | | | 2,060 | | | | 9,322 | | | | 6,865 | | | | 5,600 | | | | 4,822 | | | | 3,659 |

Non-interest income | | | 648 | | | | 534 | | | | 2,269 | | | | 2,445 | | | | 2,053 | | | | 1,370 | | | | 1,243 |

Non-interest expense | | | 2,123 | | | | 1,569 | | | | 6,967 | | | | 5,687 | | | | 4,436 | | | | 3,893 | | | | 3,890 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 1,522 | | | | 1,025 | | | | 4,624 | | | | 3,623 | | | | 3,217 | | | | 2,299 | | | | 1,012 |

Income taxes (expense) benefit | | | (676 | ) | | | (369 | ) | | | (1,589 | ) | | | (1,209 | ) | | | (1,210 | ) | | | (740 | ) | | | 12 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 846 | | | | 656 | | | | 3,035 | | | | 2,414 | | | | 2,007 | | | | 1,559 | | | | 1,024 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share and Shares Outstanding(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income, basic(2) | | $ | .18 | | | $ | .14 | | | $ | .67 | | | $ | .54 | | | $ | .45 | | | $ | .36 | | | $ | .24 |

Net income, diluted(2) | | $ | .18 | | | $ | .14 | | | $ | .64 | | | $ | .52 | | | $ | .43 | | | $ | .34 | | | $ | .23 |

Book value at end of period | | $ | 5.14 | | | $ | 4.47 | | | $ | 4.93 | | | $ | 4.39 | | | $ | 3.80 | | | $ | 3.32 | | | $ | 2.97 |

Tangible book value | | $ | 4.96 | | | $ | 4.32 | | | $ | 4.74 | | | $ | 4.15 | | | $ | 3.50 | | | $ | 2.96 | | | $ | 2.55 |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 4,576,226 | | | | 4,531,865 | | | | 4,543,386 | | | | 4,507,523 | | | | 4,430,974 | | | | 4,387,686 | | | | 4,295,272 |

Diluted | | | 4,764,543 | | | | 4,723,877 | | | | 4,766,013 | | | | 4,595,501 | | | | 4,664,662 | | | | 4,581,513 | | | | 4,492,921 |

Shares outstanding at period end | | | 4,589,143 | | | | 4,562,646 | | | | 4,564,587 | | | | 4,530,402 | | | | 4,463,453 | | | | 4,400,957 | | | | 4,336,502 |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 336,712 | | | $ | 289,511 | | | $ | 322,792 | | | $ | 258,412 | | | $ | 193,207 | | | $ | 161,315 | | | $ | 132,060 |

Total investments(3) | | | 46,487 | | | | 49,170 | | | | 44,203 | | | | 35,736 | | | | 34,488 | | | | 23,981 | | | | 21,107 |

Total loans, net | | | 267,055 | | | | 222,166 | | | | 257,575 | | | | 206,666 | | | | 142,342 | | | | 125,669 | | | | 100,935 |

Total deposits | | | 283,530 | | | | 235,546 | | | | 271,035 | | | | 207,642 | | | | 154,796 | | | | 130,723 | | | | 111,266 |

Borrowings | | | 24,748 | | | | 26,748 | | | | 24,748 | | | | 26,748 | | | | 16,500 | | | | 8,600 | | | | 2,500 |

Stockholders’ equity | | | 23,597 | | | | 20,407 | | | | 22,499 | | | | 19,899 | | | | 16,963 | | | | 14,594 | | | | 12,852 |

6

| | | | | | | | | | | | | | | | | | | | | |

| | | At or for the Three Months Ended March 31,

(unaudited) | | | At or for the Years Ended December 31, | |

| | | 2006 | | | 2005 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | (Dollars in thousands, except share and per share data) | |

Selected Performance Ratios | | | | | | | | | | | | | | | | | | | | | |

Return on average assets(4) | | 1.02 | % | | 0.94 | % | | 1.00 | % | | 1.11 | % | | 1.13 | % | | 1.02 | % | | 0.85 | % |

Return on average stockholders’ equity(4) | | 14.50 | % | | 12.94 | % | | 14.98 | % | | 13.46 | % | | 12.84 | % | | 11.46 | % | | 8.36 | % |

Net interest spread(4)(5) | | 3.67 | % | | 3.39 | % | | 3.47 | % | | 3.60 | % | | 3.52 | % | | 3.55 | % | | 3.15 | % |

Net interest margin(4)(6) | | 4.01 | % | | 3.59 | % | | 3.76 | % | | 3.82 | % | | 3.82 | % | | 3.96 | % | | 3.81 | % |

Non-interest income as a percentage of total revenue(7) | | 17.28 | % | | 18.94 | % | | 17.50 | % | | 24.14 | % | | 24.99 | % | | 19.61 | % | | 22.54 | % |

Non-interest income as a percentage of average assets(4) | | 0.19 | % | | 0.19 | % | | 0.75 | % | | 1.13 | % | | 1.16 | % | | 0.90 | % | | 0.94 | % |

Non-interest expense to average assets(4) | | 0.64 | % | | 0.57 | % | | 2.30 | % | | 2.62 | % | | 2.50 | % | | 2.55 | % | | 3.22 | % |

Efficiency ratio(8) | | 56.60 | % | | 55.66 | % | | 53.75 | % | | 56.14 | % | | 57.97 | % | | 55.73 | % | | 70.55 | % |

Average stockholders’ equity to average total assets | | 7.00 | % | | 7.34 | % | | 6.70 | % | | 8.27 | % | | 8.80 | % | | 8.92 | % | | 10.15 | % |

Asset Quality Ratios | | | | | | | | | | | | | | | | | | | | | |

Net charge-offs to average loans outstanding | | 0.00 | % | | 0.05 | % | | 0.09 | % | | 0.15 | % | | 0.27 | % | | 0.32 | % | | 0.20 | % |

Allowance for loan losses to period end loans | | 1.49 | % | | 1.29 | % | | 1.50 | % | | 1.33 | % | | 1.53 | % | | 1.45 | % | | 1.39 | % |

Allowance for loan losses to non-performing loans | | 201.86 | % | | 195.84 | % | | 187.48 | % | | 114.71 | % | | 164.17 | % | | 87.74 | % | | 3,383.33 | % |

Non-performing loans to period end loans | | 0.74 | % | | 0.66 | % | | 0.80 | % | | 1.16 | % | | 0.93 | % | | 1.65 | % | | 0.04 | % |

Non-performing assets to total assets(9) | | 0.60 | % | | 0.51 | % | | 0.65 | % | | 0.94 | % | | 0.70 | % | | 1.31 | % | | 0.03 | % |

Capital Ratios | | | | | | | | | | | | | | | | | | | | | |

Total risk-based capital ratio | | 12.27 | % | | 12.78 | % | | 12.36 | % | | 13.64 | % | | 14.24 | % | | 11.22 | % | | 11.76 | % |

Tier 1 risk-based capital ratio | | 11.02 | % | | 9.86 | % | | 11.11 | % | | 10.53 | % | | 12.91 | % | | 9.97 | % | | 10.51 | % |

Leverage ratio | | 9.40 | % | | 8.50 | % | | 9.37 | % | | 9.44 | % | | 10.47 | % | | 8.05 | % | | 8.49 | % |

Equity to assets ratio | | 7.00 | % | | 7.05 | % | | 6.97 | % | | 7.70 | % | | 8.78 | % | | 9.04 | % | | 9.73 | % |

Other Data | | | | | | | | | | | | | | | | | | | | | |

Number of banking offices | | 8 | | | 7 | | | 8 | | | 6 | | | 5 | | | 5 | | | 5 | |

Number of full-time equivalent employees | | 86 | | | 73 | | | 85 | | | 73 | | | 58 | | | 55 | | | 53 | |

| (1) | Adjusted to reflect the effect of the stock splits effected in the form of a 100% stock dividend in 2004 and separate 20% stock dividends in 2004, 2003, and 2001 respectively. |

| (2) | Computed based on the weighted average number of shares outstanding during each period. |

| (3) | Consists of interest-earning deposits, federal funds sold, investment securities and FHLB stock. |

| (4) | Three month data presented on annualized basis. |

| (5) | Net interest spread is the difference between the average yield on interest-earning assets and the average cost of interest-bearing liabilities. |

| (6) | Net interest margin is net interest income divided by average interest-earning assets. |

| (7) | Total revenue consists of net interest income and non-interest income. |

| (8) | Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income. |

| (9) | Non-performing assets consist of non-accrual loans, restructured loans, and foreclosed assets, where applicable. |

7

RECENT DEVELOPMENTS

The Bank of Heath Springs

On December 19, 2005 we entered into a definitive agreement to acquire The Bank of Heath Springs, Heath Springs, South Carolina and merge it into our subsidiary, Waccamaw Bank. The merger was consummated on April 28, 2006. Upon consummation of the merger, we paid aggregate cash consideration of $8,000,000 in exchange for all of the outstanding shares of common stock of The Bank of Heath Springs. The Bank of Heath Springs was founded in 1936 and operated one banking office in Heath Springs, Lancaster County, South Carolina.

The merger permits us to branch into South Carolina, whereas prior to the merger we were not permitted to establish banking offices in South Carolina. With the merger, we expect to branch into areas of South Carolina that we consider to be our natural market area, such as Little River, Myrtle Beach, Conway and other areas of Horry County, South Carolina. No such branch applications are pending at this time.

The Bank of Heath Springs had total assets of $20.1 million, deposits of $14.5 million, loans of $5.3 million and stockholders’ equity of $5.7 million at March 31, 2006. The transaction is expected to be accretive to earnings in the first full year of combined operations, based on assumptions our management believes to be achievable and conservative. We can give no assurance, however, that the transaction will be accretive to earnings or that we otherwise will be successful in fully integrating the operations of The Bank of Heath Springs with ours.

8

RISK FACTORS

An investment in the units involves a number of risks. We urge you to read all of the information contained in this prospectus. In addition, we urge you to consider carefully the following factors before you purchase any of the units offered by this prospectus.

Risks Associated with our Merger with The Bank of Heath Springs

The merger may have an adverse effect on operating results.

Our acquisition of The Bank of Heath Springs and its merger into Waccamaw Bank involved the combination of two companies that previously operated independently. A successful combination of the companies’ operations depends primarily on retaining and expanding the customer base of The Bank of Heath Springs and on our ability to consolidate operations, systems and procedures and to eliminate redundancies and costs. Difficulties may be encountered in combining the operations of The Bank of Heath Springs and Waccamaw Bank, including:

| | • | | the loss of key employees and customers; |

| | • | | disruptions to our businesses; |

| | • | | possible inconsistencies in standards, control procedures and policies; |

| | • | | unexpected problems with costs, operations, personnel, technology or credit; |

| | • | | the assimilation of new operations, sites and personnel possibly diverting resources from regular banking operations; |

| | • | | difficulties assimilating acquired operations and personnel; |

| | • | | potential disruptions of our ongoing business; |

| | • | | the diversion of resources and management time; |

| | • | | the possibility that uniform standards, controls, procedures and policies may not be maintained; |

| | • | | the potential impairment of relationships with employees or customers as a result of changes in management; |

| | • | | difficulties in evaluating the historical or future financial performance of the combined business; and |

| | • | | brand awareness issues related to the acquired assets or customers. |

Further, we may be unable to realize fully any of the potential cost savings we expect to achieve from the merger. Any cost savings that are realized may be offset by losses in revenues, increases in expenses or other changes to earnings or required accounting treatments or valuations of our assets and liabilities.

Risks Associated with our Continued Operations

We may not be able to maintain and manage our growth, which may adversely affect our results of operations and financial condition and the value of our common stock.

Our strategy has been to increase the size of our company by opening new offices and aggressively pursuing business development opportunities. We have grown rapidly since we commenced operations. We can provide no assurance that we will continue to be successful in increasing the volume of loans and deposits at acceptable risk levels and upon acceptable terms while managing the costs and implementation risks associated with our growth strategy. There can be no assurance that our further expansion will be profitable or that we will continue to be able to sustain our historical rate of growth, either through internal growth or through successful expansion of our markets, or that we will be able to maintain capital sufficient to support our continued growth. If we grow

9

too quickly, however, and are not able to control costs and maintain asset quality, rapid growth also could adversely affect our financial performance. We may acquire other banks as a means to expand into new markets or to capture additional market share, like our acquisition of The Bank of Heath Springs. We are unable to predict whether or when any prospective acquisitions will occur or the likelihood of completing an acquisition on favorable terms and conditions. Any acquisition involves certain risks including, but not limited to:

| | • | | difficulties assimilating acquired operations and personnel; |

| | • | | potential disruptions of our ongoing business; |

| | • | | the diversion of resources and management time; |

| | • | | the possibility that uniform standards, controls, procedures and policies may not be maintained; |

| | • | | risks associated with entering new markets in which we have little or no experience; |

| | • | | the potential impairment of relationships with employees or customers as a result of changes in management; |

| | • | | difficulties in evaluating the historical or future financial performance of the acquired business; and |

| | • | | brand awareness issues related to the acquired assets or customers. |

If we decide to make additional acquisitions, there can be no assurance that the acquired banks would perform as expected.

The loss of one or more key executives could seriously impair our ability to implement our strategy.

For the foreseeable future, we will depend upon the services of James G. Graham, our President and Chief Executive Officer as well as other executive management that we employ. The loss of services of Mr. Graham or of one or more of the key members of our executive management team may have a material adverse effect on our operations. To help protect against such a loss, we have entered into an employment agreement with Mr. Graham.

If Mr. Graham or other members of our executive management team were no longer employed by us, our ability to implement our growth strategy could be impaired. In addition, if we are unable to hire qualified and experienced personnel to adequately staff our anticipated growth, our profits would be adversely affected.

A decrease in interest rates could adversely impact our profitability.

Our results of operations may be significantly affected by the monetary and fiscal policies of the federal government and the regulatory policies of government authorities. A significant component of our earnings is our net interest income. Net interest income is the difference between income from interest-earning assets, such as loans, and the expense of interest-bearing liabilities, such as deposits and our borrowings. Like many financial institutions, we are subject to the risk of fluctuations in interest rates. A significant decrease in interest rates could have a material adverse effect on our net income as we would expect the yields on our earning assets to decrease more quickly than the cost of our interest-bearing deposits and borrowings.

Our profitability depends significantly on economic conditions in our market area.

Our success depends to a large degree on the general economic conditions in our markets. The local economic conditions in these areas have a significant impact on the amount of loans that we make to our borrowers, the ability of our borrowers to repay these loans and the value of the collateral securing these loans. A significant decline in general economic conditions caused by inflation, recession, unemployment or other factors beyond our control would impact these local economic conditions and could negatively affect our financial condition and performance.

10

If we experience greater loan losses than anticipated, it will have an adverse effect on our net income.

While the risk of nonpayment of loans is inherent in banking, if we experience greater nonpayment levels than we anticipate, our earnings and overall financial condition, as well as the value of our common stock, could be adversely affected.

We cannot assure you that our monitoring procedures and policies will reduce certain lending risks or that our allowance for loan losses will be adequate to cover actual losses. In addition, as a result of the rapid growth in our loan portfolio, loan losses may be greater than management’s estimates of the appropriate level for the allowance. Loan losses can cause insolvency and failure of a financial institution and, in such an event, our shareholders could lose their entire investment. In addition, future provisions for loan losses could materially and adversely affect our profitability. Any loan losses will reduce the loan loss allowance. A reduction in the loan loss allowance will be restored by an increase in our provision for loan losses. This would reduce our earnings which could have an adverse effect on our stock price.

Our growth may require us to raise additional capital that may not be available when it is needed, or at all.

We are required by regulatory authorities to maintain adequate levels of capital to support our operations. We anticipate that our capital resources following this offering will satisfy our capital requirements for the foreseeable future. We may at some point, however, need to raise additional capital to support our continued growth. Our ability to raise additional capital, if needed, will depend in part on conditions in the capital markets at that time, which are outside our control, and on our financial performance. Accordingly, we may be unable to raise additional capital, if and when needed, on terms acceptable to us, or at all. If we cannot raise additional capital when needed, our ability to further expand our operations through internal growth and acquisitions could be materially impaired. In addition, if we issue additional equity capital, your interest would be diluted.

New or acquired bank office facilities and other facilities may not be profitable.

We may not be able to identify profitable locations for new bank offices and the costs to start up new bank office facilities or to acquire existing bank offices, and the additional costs to operate these facilities may increase our noninterest expense and decrease earnings in the short term. If offices of other banks become available for sale, we may acquire those offices. It may be difficult to adequately and profitably manage our growth through the establishment or purchase of bank offices. In addition, we can provide no assurance that any such offices will successfully attract enough deposits to offset the expenses of their operation.

In order to be profitable, we must compete successfully with other financial institutions which have greater resources and capabilities than we do.

The banking business in North Carolina and South Carolina in general, and in our markets in southeastern North Carolina in particular, is extremely competitive. Most of our competitors are larger and have greater resources than we do and have been in existence a longer period of time. We will have to overcome historical bank-customer relationships to attract customers away from our competition. We compete with the following types of institutions:

| | |

• other commercial banks | | • securities brokerage firms |

| |

• savings banks | | • mortgage brokers |

| |

• thrifts | | • insurance companies |

| |

• credit unions | | • mutual funds |

| |

• consumer finance companies | | • trust companies |

11

Some of our competitors are not regulated as extensively as we are and, therefore, may have greater flexibility in competing for business. Some of these competitors are subject to similar regulation but have the advantages of larger established customer bases, higher lending limits, extensive branch networks, numerous automated teller machines, greater advertising-marketing budgets or other factors.

Our legal lending limit is determined by law. The size of the loans which we offer to our customers may be less than the size of the loans that larger competitors are able to offer. This limit may affect to some degree our success in establishing relationships with the larger businesses in our market.

Risks Related to an Investment in the Units

Our common stock trading volume has been low compared with larger bank holding companies. There is no prior trading market for the units and the warrants.

The trading volume in our common stock on the Nasdaq Capital Market has been lower than other similarly sized bank holding companies since trading on the Capital Market began. Furthermore, this trading volume does not compare with more seasoned companies listed on other stock exchanges. Thus, the market in our common stock is somewhat limited in scope relative to some other companies. In addition, we can provide no assurance that a more active and liquid trading market for our stock will develop in the future.

There is currently no public market for either the units or the warrants. The common stock and the warrants represented by each unit are expected to trade separately after closing. We intend to apply to have the warrants listed for trading on the Nasdaq Capital Market after the closing of the offering. There can be no assurance that the warrants will be accepted for trading on the Nasdaq Capital Market. Further, there can be no assurance that an active and liquid market will develop for the warrants. While a trading market for the common stock has been established, it is unlikely that there will be an active trading market for the warrants.

We do not plan to pay cash dividends for the foreseeable future.

We do not expect to pay cash dividends on our common stock in the foreseeable future, as we intend to retain earnings in order to provide the capital necessary to fund our growth strategy. You should not buy shares in this offering if you need dividend income from this investment. Our ability to declare and pay cash dividends will be dependent upon, among other things, restrictions imposed by the reserve and capital requirements of North Carolina and federal banking regulations, our income and financial condition, tax considerations, and general business conditions. Therefore, investors should not purchase shares with a view for a current return on their investment in the form of cash dividends.

Purchasers of units in the offering will experience immediate dilution.

If you purchase units in the offering, you will experience immediate dilution of approximately 61.2% in the book value of your investment, in that our book value per share will be approximately $6.59, compared with an offering price of $17.00. Additionally, as of the date of this prospectus, we had outstanding options to purchase 470,391 shares at a weighted average exercise price of $10.86 per share. All of these options are held by our directors, executive officers and employees. The issuance of shares following the exercise of options under the plan will result in dilution of your ownership of our common stock.

We have implemented anti-takeover devices that could make it more difficult for another company to acquire us, even though such an acquisition may increase shareholder value.

In some cases, shareholders would receive a premium for their shares if we were acquired by another company. However, state and federal law and our articles of incorporation and bylaws make it difficult for anyone to acquire us without approval of our board of directors. Our bylaws divide the board of directors into three classes of directors serving staggered three-year terms with approximately one-third of the board of

12

directors elected at each annual meeting of shareholders. The classification of directors makes it more difficult for shareholders to change the composition of the board of directors. As a result, at least two annual meetings of shareholders would be required for the shareholders to change a majority of the directors, whether or not a change in the board of directors would be beneficial and whether or not a majority of shareholders believe that such a change would be desirable. Consequently, a takeover attempt may prove difficult, and shareholders may not realize the highest possible price for their securities. See “Description of Our Securities—Certain Articles and Bylaw Provisions Having Potential Anti-Takeover Effects.”

The holder of our junior subordinated debenture has rights that are senior to those of our common shareholders.

We have supported our continued growth through the issuance of trust preferred securities from a special purpose trust and an accompanying sale of an $8.2 million junior subordinated debenture to this trust. Payments of the principal and interest on the trust preferred securities of this trust are conditionally guaranteed by us. Further, the accompanying junior subordinated debenture that we issued to the trust is senior to our shares of common stock. As a result, we must make payments on the junior subordinated debenture before any dividends can be paid on our common stock and, in the event of our bankruptcy, dissolution or liquidation, the holder of the junior subordinated debenture must be satisfied before any distributions can be made on our common stock.

Our securities are not FDIC insured.

Our units, common stock and warrants are not savings or deposit accounts or other obligations of the bank, and are not insured by the FDIC or any other governmental agency and are subject to investment risk, including the possible loss of principal.

13

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements in this prospectus discuss future expectations, contain projections of results of operations or financial condition or state other “forward-looking” information. Those statements are subject to known and unknown risks, uncertainties and other factors that could cause the actual results to differ materially from those contemplated by the statements. We based the forward-looking information on various factors and the use of numerous assumptions.

Important factors that may cause actual results to differ from those contemplated by forward-looking statements include, for example:

| | • | | the success or failure of our efforts to implement our business strategy; |

| | • | | the effect of changing economic conditions; |

| | • | | changes in government regulations, tax rates and similar matters; |

| | • | | our ability to attract and retain quality employees; and |

| | • | | other risks which may be described in our future filings with the SEC. |

We do not promise to update forward-looking information to reflect actual results or changes in assumptions or other factors that could affect those statements other than material changes to such information.

14

RIGHTS OFFERING

We are offering 656,196 units consisting of one share of common stock and one warrant to purchase a share of common stock in a rights offering which expires at 5:00 p.m. local time on August 31, 2006. The units are offered for sale to the holders of record of our common stock at the close of business on July 12, 2006. Shareholders of record on this record date may subscribe for one unit for each seven shares of common stock beneficially owned by them on such date. Shareholders may subscribe for less than the maximum number of offering units allocated to them. Fractional units will not be sold. Shareholders may not transfer or assign their subscription rights.

Shareholders may also oversubscribe for units. If oversubscriptions exceed the available units, the available units will be allocated among the oversubscribers. This allocation will be based upon the ratio that the number of shares of common stock owned by the oversubscriber on the record date bears to the number of shares of common stock owned by all of the oversubscribers on the record date. Payment for all units subscribed, including any requested oversubscription units, must be submitted with the Subscription Offer Form. In the event that all, or part, of a requested oversubscription cannot be filled, the corresponding portion of the aggregate subscription price will be refunded, without interest.

The rights offering will terminate at 5:00 p.m. local time on August 31, 2006. The rights offering is not contingent upon the occurrence of any event, including the sale of a minimum or maximum number of units. Funds received by us from shareholders in the rights offering will be deposited with and held by us in a non-interest bearing escrow account until the closing of the offering. We do not intend to return subscription funds if fewer than all of the units offered are sold.

The price of the units offered by this prospectus was determined by us based on numerous factors. Among the factors considered in determining the price of units were current closing prices of our common stock on the Nasdaq Capital Market, the per share book value of our common stock as of March 31, 2006, the trading history of our common stock, our determination of the value of the right to purchase our common stock in the future, our operating history and our prospects for future earnings, our current performance, the prospects of the banking industry in which we compete, the general condition of the securities markets at the time of the offering, and the prices of equity securities of comparable companies.

There can be no assurance as to the number of units that may be sold in the rights offering.

To subscribe for units, shareholders should execute the Subscription Offer Form that accompanies this prospectus and deliver it, together with a check payable to the order of “Waccamaw Bankshares, Inc. Escrow Account” for the full purchase price, to:

Waccamaw Bankshares, Inc.

Attention: David A. Godwin

110 North Powell Boulevard

Whiteville, North Carolina 28472

Telephone: (910) 641-0044

SUBSCRIPTION OFFER FORMS AND FULL PAYMENT FOR THE UNITS SUBSCRIBED MUST BE RECEIVED BY US PRIOR TO 5:00 P.M. LOCAL TIME ON AUGUST 31, 2006 OR SUBSCRIBING SHAREHOLDERS WILL FORFEIT THEIR RIGHT TO PURCHASE UNITS IN THIS RIGHTS OFFERING.

SUBSCRIBERS WILL HAVE NO RIGHT TO REVOKE THEIR SUBSCRIPTIONS AFTER DELIVERY OF THEIR SUBSCRIPTION OFFER FORM TO US.

SUBSCRIBERS WILL HAVE NO RIGHTS AS SHAREHOLDERS WITH RESPECT TO SHARES OF OUR COMMON STOCK PURCHASED IN THE RIGHTS OFFERING UNTIL CLOSING OF THE RIGHTS OFFERING AND DELIVERY OF THE COMMON STOCK CERTIFICATES EVIDENCING SUCH SHARES, WHICH IS EXPECTED TO OCCUR ON OR ABOUT SEPTEMBER 15, 2006.

15

USE OF PROCEEDS

We anticipate that the net proceeds to us from the sale of the units will be approximately $10.9 million after deducting offering expenses, estimated to be $210 thousand. The following table illustrates the net proceeds that will be generated by the rights offering, assuming that we sell 10%, 50% and 100% of the 656,196 units being offered for sale.

| | | | | | | | | |

| | | 10% | | 50% | | 100% |

Units sold in the offering | | | 65,620 | | | 328,098 | | | 656,196 |

Gross offering proceeds | | $ | 1,115,540 | | $ | 5,577,666 | | $ | 11,155,332 |

Estimated expenses of the offering | | $ | 210,000 | | $ | 210,000 | | $ | 210,000 |

Net proceeds to us | | $ | 905,540 | | $ | 5,367,666 | | $ | 10,945,332 |

Use of net proceeds: | | | | | | | | | |

General corporate purposes | | $ | 905,540 | | $ | 5,367,666 | | $ | 10,945,332 |

Net proceeds may be applied: (i) to fund the continued growth and expansion of our franchise through investments in, or loans to, our bank subsidiary; (ii) to fund its operations and continued expansion; (iii) to maintain its status as “well capitalized” under applicable regulations; and (iv) to increase its regulatory legal lending limit. We may also use net proceeds for general corporate purposes or for possible acquisitions of, or investments in, bank or permissible non-bank entities although no agreements or understandings presently exist with respect to any acquisitions. Before we apply any of the proceeds for any of these uses, the proceeds likely will be temporarily invested in short-term investment securities. The precise amounts and timing of the application of proceeds will depend upon our funding and capital requirements, the funding and capital requirements of our bank subsidiary, and whether we have funds available from other sources that we can use for any of those purposes.

16

MARKET FOR OUR COMMON STOCK AND WARRANTS

There is currently no public market for either the units or the warrants. After closing, we expect to be approved to have the warrants listed for trading on the Nasdaq Capital Market. The qualification for quotation of the warrants on the Nasdaq Capital Market requires that at least three securities firms make a market in the warrants.

Our common stock is listed for quotation on the Nasdaq Capital Market under the symbol “WBNK.” As of June 15, 2006, we had 4,593,367 shares of common stock outstanding and approximately 1,900 shareholders of record. The following table sets forth the high and low published closing prices for shares of our common stock for the periods presented. Where appropriate, prices have been adjusted for the effects of stock splits effected in the form of stock dividends during the periods presented. The last reported sales price of our common stock on , 2006 was $ per share.

| | | | | | |

| | | SALES PRICE(1) |

| | | High | | Low |

2006 | | | | | | |

Third Quarter (through July 20) | | $ | | | $ | |

Second Quarter | | | 17.73 | | | 16.25 |

First Quarter | | | 19.00 | | | 17.50 |

| | |

2005 | | | | | | |

Fourth Quarter | | | 19.55 | | | 17.50 |

Third Quarter | | | 20.75 | | | 18.00 |

Second Quarter | | | 18.75 | | | 17.50 |

First Quarter | | | 19.25 | | | 17.25 |

| | |

2004 | | | | | | |

Fourth Quarter | | | 27.15 | | | 17.99 |

Third Quarter | | | 22.25 | | | 14.90 |

Second Quarter | | | 15.00 | | | 11.00 |

First Quarter | | | 12.08 | | | 10.83 |

| (1) | Adjusted to reflect the effect of stock splits effected in the form of a 100% stock dividend in 2004 and separate 20% stock dividends in 2004, 2003, 2001 and 2000. |

17

DIVIDEND POLICY

We anticipate that our future earnings, if any, will be retained to finance our growth and that we will not pay cash dividends for the foreseeable future.

We are organized under the North Carolina Business Corporation Act, which prohibits the payment of a dividend if, after giving it effect, we would not be able to pay our debts as they become due in the usual course of business or our total assets would be less than the sum of our total liabilities plus the amount that would be needed, if we were to be dissolved, to satisfy the preferential rights upon dissolution of any preferred shareholders. In addition, because we are a bank holding company, the Federal Reserve Board may impose restrictions on cash dividends paid by us.

If and when cash dividends are declared, they will be largely dependent upon our earnings, financial condition, business projections, general business conditions, statutory and regulatory restrictions and other pertinent factors.

We declared a 2-for-1 stock split effected in the form of a 100% stock dividend in 2004 and 6-for-5 stock splits effected in the form of 20% stock dividends in each of 2004, 2003, 2001 and 2000. We intend to continue to consider the declaration of pro rata stock distributions in the future.

18

CAPITALIZATION

The following table sets forth our consolidated capitalization as of March 31, 2006 on an actual basis, and as adjusted to reflect the effect of this offering. We have assumed net proceeds of approximately $10.9 million will result from the sale of the units offered by this prospectus, after deducting estimated offering expenses. You should read this information together with our consolidated financial statements and related notes, which are included elsewhere in this prospectus.

| | | | | | | | |

| | | March 31, 2006 | |

| | | Actual | | | As Adjusted(3) For Offering | |

Long Term Indebtedness | | | | | | | | |

Long-term debt(1) | | $ | 6,500,000 | | | $ | 6,500,000 | |

Junior subordinated debentures | | | 8,248,000 | | | | 8,248,000 | |

| | | | | | | | |

Total indebtedness | | $ | 14,748,000 | | | $ | 14,748,000 | |

| | |

Stockholders’ Equity(2) | | | | | | | | |

Common stock, no par value, 10,000,000 shares authorized; 4,589,143 shares issued and outstanding, (5,245,339 as adjusted(3)) | | $ | 13,482,786 | | | $ | 24,428,118 | |

Additional paid-in capital | | | — | | | | — | |

Retained earnings | | | 10,410,486 | | | | 10,410,486 | |

Accumulated other comprehensive loss | | | (296,506 | ) | | | (296,506 | ) |

| | | | | | | | |

Total stockholders’ equity | | $ | 23,596,766 | | | $ | 34,542,098 | |

Book value per share | | $ | 5.14 | | | $ | 6.59 | |

Tangible book value per share | | $ | 4.96 | | | $ | 6.43 | |

| | |

Capital Ratios: | | | | | | | | |

Total risk-based capital ratio | | | 12.27 | % | | | 16.13 | % |

Tier 1 risk-based capital ratio | | | 11.02 | % | | | 14.89 | % |

Leverage ratio(4) | | | 9.40 | % | | | 12.29 | % |

| (1) | Represents Federal Home Loan Bank advances maturing more than one year from March 31, 2006. |

| (2) | Does not include 495,516 shares issuable as of March 31, 2006 at prices ranging from $2.65 per share to $19.75 per share upon exercise of outstanding stock options. |

| (3) | Assumes the sale of 656,196 units in this offering, generating proceeds of $10.9 million, after deducting offering expenses. |

| (4) | The leverage ratio is Tier 1 capital divided by period end tangible average assets. |

19

SELECTED CONSOLIDATED FINANCIAL INFORMATION AND OTHER DATA

The selected consolidated financial and other data presented below should be read in conjunction with, and is qualified in its entirety by, our audited financial statements and related notes contained elsewhere in this prospectus and the financial statements included in our annual reports filed with the Securities and Exchange Commission and the Federal Reserve Board. Effective July 1, 2001, Waccamaw Bank became our wholly owned subsidiary. We have no material operations other than those of our bank subsidiary. Therefore, the financial statements of Waccamaw Bank prior to July 1, 2001 are our historical statements.

The information as of and for the three months ended March 31, 2006 and 2005 is unaudited but, in the opinion of our management, contains all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of our financial condition and results of operations for those periods. The selected financial and other data presented below as of and for the three months ended March 31, 2006 and 2005 should be read in conjunction with, and is qualified in its entirety by, the unaudited consolidated financial statements included elsewhere in this prospectus. The results of operations for the three month period ended March 31, 2006 are not necessarily indicative of the results to be expected for the remainder of the year or any other period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | At or for the Three

Months Ended March 31,

(unaudited) | | | At or for the Years Ended December 31, | |

| | | |

| | | 2006 | | | 2005 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | (Dollars in thousands, except share and per share data) | |

Summary of Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Interest income | | $ | 5,514 | | | $ | 3,758 | | | $ | 18,228 | | | $ | 11,450 | | | $ | 9,957 | | | $ | 9,594 | | | $ | 8,789 | |

Interest expense | | | 2,412 | | | | 1,473 | | | | 7,536 | | | | 3,766 | | | | 3,627 | | | | 3,978 | | | | 4,518 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income | | | 3,102 | | | | 2,285 | | | | 10,692 | | | | 7,684 | | | | 6,330 | | | | 5,616 | | | | 4,271 | |

Provision for loan losses | | | 105 | | | | 225 | | | | 1,370 | | | | 819 | | | | 730 | | | | 794 | | | | 612 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net interest income after the provision for loan losses | | | 2,997 | | | | 2,060 | | | | 9,322 | | | | 6,865 | | | | 5,600 | | | | 4,822 | | | | 3,659 | |

Non-interest income | | | 648 | | | | 534 | | | | 2,269 | | | | 2,445 | | | | 2,053 | | | | 1,370 | | | | 1,243 | |

Non-interest expense | | | 2,123 | | | | 1,569 | | | | 6,967 | | | | 5,687 | | | | 4,436 | | | | 3,893 | | | | 3,890 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 1,522 | | | | 1,025 | | | | 4,624 | | | | 3,623 | | | | 3,217 | | | | 2,299 | | | | 1,012 | |

Income taxes (expense) benefit | | | (676 | ) | | | (369 | ) | | | (1,589 | ) | | | (1,209 | ) | | | (1,210 | ) | | | (740 | ) | | | 12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income | | | 846 | | | | 656 | | | | 3,035 | | | | 2,414 | | | | 2,007 | | | | 1,559 | | | | 1,024 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Per Share and Shares Outstanding(1) | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net income, basic(2) | | $ | .18 | | | $ | .14 | | | $ | .67 | | | $ | .54 | | | $ | .45 | | | $ | .36 | | | $ | .24 | |

Net income, diluted(2) | | $ | .18 | | | $ | .14 | | | $ | .64 | | | $ | .52 | | | $ | .43 | | | $ | .34 | | | $ | .23 | |

Book value at end of period | | $ | 5.14 | | | $ | 4.47 | | | $ | 4.93 | | | $ | 4.39 | | | $ | 3.80 | | | $ | 3.32 | | | $ | 2.97 | |

Tangible book value | | $ | 4.96 | | | $ | 4.32 | | | $ | 4.74 | | | $ | 4.15 | | | $ | 3.50 | | | $ | 2.96 | | | $ | 2.55 | |

Weighted average shares outstanding: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Basic | | | 4,576,226 | | | | 4,531,865 | | | | 4,543,386 | | | | 4,507,523 | | | | 4,430,974 | | | | 4,387,686 | | | | 4,295,272 | |

Diluted | | | 4,764,543 | | | | 4,723,877 | | | | 4,766,013 | | | | 4,595,501 | | | | 4,664,662 | | | | 4,581,513 | | | | 4,492,921 | |

Shares outstanding at period end | | | 4,589,143 | | | | 4,562,646 | | | | 4,564,587 | | | | 4,530,402 | | | | 4,463,453 | | | | 4,400,957 | | | | 4,336,502 | |

| | | | | | | |

Balance Sheet Data | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total assets | | $ | 336,712 | | | $ | 289,511 | | | $ | 322,792 | | | $ | 258,412 | | | $ | 193,207 | | | $ | 161,315 | | | $ | 132,060 | |

Total investments(3) | | | 46,487 | | | | 49,170 | | | | 44,203 | | | | 35,736 | | | | 34,488 | | | | 23,981 | | | | 21,107 | |

Total loans, net | | | 267,055 | | | | 222,166 | | | | 257,575 | | | | 206,666 | | | | 142,342 | | | | 125,669 | | | | 100,935 | |

Total deposits | | | 283,530 | | | | 235,546 | | | | 271,035 | | | | 207,642 | | | | 154,796 | | | | 130,723 | | | | 111,266 | |

Borrowings | | | 24,748 | | | | 26,748 | | | | 24,748 | | | | 26,748 | | | | 16,500 | | | | 8,600 | | | | 2,500 | |

Stockholders’ equity | | | 23,597 | | | | 20,407 | | | | 22,499 | | | | 19,899 | | | | 16,963 | | | | 14,594 | | | | 12,852 | |

| | | | | | | |

Selected Performance Ratios | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Return on average assets(4) | | | 1.02 | % | | | 0.94 | % | | | 1.00 | % | | | 1.11 | % | | | 1.13 | % | | | 1.02 | % | | | 0.85 | % |

Return on average stockholders’ equity(4) | | | 14.50 | % | | | 12.94 | % | | | 14.98 | % | | | 13.46 | % | | | 12.84 | % | | | 11.46 | % | | | 8.36 | % |

Net interest spread(4)(5) | | | 3.67 | % | | | 3.39 | % | | | 3.47 | % | | | 3.60 | % | | | 3.52 | % | | | 3.55 | % | | | 3.15 | % |

Net interest margin(4)(6) | | | 4.01 | % | | | 3.59 | % | | | 3.76 | % | | | 3.82 | % | | | 3.82 | % | | | 3.96 | % | | | 3.81 | % |

Non-interest income as a percentage of total revenue(7) | | | 17.28 | % | | | 18.94 | % | | | 17.50 | % | | | 24.14 | % | | | 24.49 | % | | | 19.61 | % | | | 22.54 | % |

Non-interest income as a percentage of average assets(4) | | | 0.19 | % | | | 0.19 | % | | | 0.75 | % | | | 1.13 | % | | | 1.16 | % | | | 0.90 | % | | | 0.94 | % |

20

| | | | | | | | | | | | | | | | | | | | | |

| | | At or for the Three

Months Ended March 31,

(unaudited) | | | At or for the Years Ended December 31, | |

| | | |

| | | 2006 | | | 2005 | | | 2005 | | | 2004 | | | 2003 | | | 2002 | | | 2001 | |

| | | (Dollars in thousands, except share and per share data) | |

Non-interest expense to average assets(4) | | 0.64 | % | | 0.57 | % | | 2.30 | % | | 2.62 | % | | 2.50 | % | | 2.55 | % | | 3.22 | % |

Efficiency ratio(8) | | 56.60 | % | | 55.66 | % | | 53.75 | % | | 56.14 | % | | 57.97 | % | | 55.73 | % | | 70.55 | % |

Average stockholders’ equity to average total assets | | 7.00 | % | | 7.34 | % | | 6.70 | % | | 8.27 | % | | 8.80 | % | | 8.92 | % | | 10.15 | % |

| | | | | | | |

Asset Quality Ratios | | | | | | | | | | | | | | | | | | | | | |

Net charge-offs to average loans outstanding | | 0.00 | % | | 0.05 | % | | 0.09 | % | | 0.15 | % | | 0.27 | % | | 0.32 | % | | 0.20 | % |

Allowance for loan losses to period end loans | | 1.49 | % | | 1.29 | % | | 1.50 | % | | 1.33 | % | | 1.53 | % | | 1.45 | % | | 1.39 | % |

Allowance for loan losses to non-performing loans | | 201.86 | % | | 195.84 | % | | 187.48 | % | | 114.71 | % | | 164.17 | % | | 87.74 | % | | 3,383.33 | % |

Non-performing loans to period end loans | | 0.74 | % | | 0.66 | % | | 0.80 | % | | 1.16 | % | | 0.93 | % | | 1.65 | % | | 0.04 | % |

Non-performing assets to total assets(9) | | 0.60 | % | | 0.51 | % | | 0.65 | % | | 0.94 | % | | 0.70 | % | | 1.31 | % | | 0.03 | % |

| | | | | | | |

Capital Ratios | | | | | | | | | | | | | | | | | | | | | |

Total risk-based capital ratio | | 12.27 | % | | 12.78 | % | | 12.36 | % | | 13.64 | % | | 14.24 | % | | 11.22 | % | | 11.76 | % |

Tier 1 risk-based capital ratio | | 11.02 | % | | 9.86 | % | | 11.11 | % | | 10.53 | % | | 12.91 | % | | 9.97 | % | | 10.51 | % |

Leverage ratio | | 9.40 | % | | 8.50 | % | | 9.37 | % | | 9.44 | % | | 10.47 | % | | 8.05 | % | | 8.49 | % |

Equity to assets ratio | | 7.00 | % | | 7.05 | % | | 6.97 | % | | 7.70 | % | | 8.78 | % | | 9.04 | % | | 9.73 | % |

| | | | | | | |

Other Data | | | | | | | | | | | | | | | | | | | | | |

Number of banking offices | | 8 | | | 7 | | | 8 | | | 6 | | | 5 | | | 5 | | | 5 | |

Number of full-time equivalent employees | | 86 | | | 73 | | | 85 | | | 73 | | | 58 | | | 55 | | | 53 | |

| (1) | Adjusted to reflect the effect of the stock splits effected in the form of a 100% stock dividend in 2004, and separate 20% stock dividends in 2004, 2003, and 2001 respectively. |

| (2) | Computed based on the weighted average number of shares outstanding during each period. |

| (3) | Consists of interest-earning deposits, federal funds sold, investment securities and FHLB stock. |

| (4) | Three month data presented on annualized basis. |

| (5) | Net interest spread is the difference between the average yield on interest-earning assets and the average cost of interest-bearing liabilities. |

| (6) | Net interest margin is net interest income divided by average interest-earning assets. |

| (7) | Total revenue consists of net interest income and non-interest income. |

| (8) | Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income. |

| (9) | Non-performing assets consist of non-accrual loans, restructured loans, and foreclosed assets, where applicable. |

21

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

CONDITION AND RESULTS OF OPERATIONS

The following presents management’s discussion and analysis of our financial condition and results of operations and should be read in conjunction with the financial statements and related notes contained elsewhere in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results could differ significantly from those anticipated in these forward-looking statements as a result of various factors. The following discussion is intended to assist in understanding the financial condition and results of operations of Waccamaw Bankshares, Inc. Because Waccamaw Bankshares, Inc. has no material operations and conducts no business on its own other than owning its subsidiary, Waccamaw Bank, the discussion contained in this Management’s Discussion and Analysis concerns primarily the business of this subsidiary. However, for ease of reading and because the financial statements are presented on a consolidated basis, Waccamaw Bankshares, Inc. and Waccamaw Bank are collectively referred to herein as the company unless otherwise noted. All references in this prospectus to net income per share, price per share, book value per share and weighted average common and common equivalent shares outstanding have been adjusted to reflect the effect of the stock splits effected in the form of a 100% stock dividend in 2004 and four 20% stock dividends in each of 2004, 2003, 2001 and 2000.

Overview

Waccamaw Bankshares, Inc. is a bank holding company whose principal business activity is the ownership of Waccamaw Bank. Waccamaw Bank opened for business in September 1997 as a North Carolina-chartered banking corporation. Effective July 1, 2001, Waccamaw Bank became the wholly owned subsidiary of Waccamaw Bankshares, Inc. The shareholders of Waccamaw Bank received one share of no par value common stock of Waccamaw Bankshares, Inc. for each share of $5.00 par value common stock of Waccamaw Bank owned in a share exchange that accomplished the holding company reorganization. All outstanding options to purchase common stock of Waccamaw Bank were converted into options to purchase common stock of Waccamaw Bankshares, Inc.

Critical Accounting Policies

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States (GAAP). The notes to the audited consolidated financial statements included elsewhere in this prospectus contain a summary of its significant accounting policies. Management believes that our policies with respect to the methodology for the determination of the allowance for loan losses and asset impairment judgments, such as the recoverability of intangible assets, involve a higher degree of complexity and require management to make difficult and subjective judgments that often require assumptions or estimates about highly uncertain matters. Accordingly, we consider the policies related to those areas as critical.

The allowance for loan losses is an estimate of the losses that may be sustained in our loan portfolio. The allowance is based on two basic principles of accounting:(i) Statement of Financial Accounting Standards (“SFAS”) 5,Accounting for Contingencies, which requires that losses be accrued when they are probable of occurring and estimable, and(ii) SFAS 114,Accounting by Creditors for Impairment of a Loan, which requires that losses be accrued based on the differences between the value of collateral, present value of future cash flows or values that are observable in the secondary market, and the loan balance.

Our allowance for loan losses has three basic components:(i) the formula allowance,(ii) the specific allowance, and(iii) the unallocated allowance. Each of these components is determined based upon estimates that can and do change when the actual events occur. The formula allowance uses an historical loss view as an indicator of future losses and, as a result, could differ from the loss incurred in the future. However, since this history is updated with the most recent loss information, the errors that might otherwise occur are mitigated. The specific allowance uses various techniques to arrive at an estimate of loss. Historical loss information, expected

22

cash flows and fair market value of collateral are used to estimate these losses. The use of these values is inherently subjective and our actual losses could be greater or less than the estimates. The unallocated allowance captures losses that are attributable to various economic events, industry or geographic sectors whose impact on the portfolio have occurred but have yet to be recognized in either the formula or specific allowance.

Accounting for intangible assets is as prescribed by SFAS 142,Goodwill and Other Intangible Assets. We account for recognized intangible assets based on their estimated useful lives. Intangible assets with finite useful lives are amortized while intangible assets with an indefinite useful life are not amortized. Currently, our recognized intangible assets consist primarily of purchased core deposit intangible assets, having estimated useful lives of 10 years, and are being amortized. The useful life is the period over which the assets are expected to contribute directly or indirectly to future cash flows. Estimated useful lives of intangible assets are based on an analysis of pertinent factors, including (as applicable):

| | • | | the expected use of the asset; |

| | • | | the expected useful life of another asset or group of assets to which the useful life of the intangible asset may relate; |

| | • | | any legal, regulatory, or contractual provisions that may limit the useful life; |

| | • | | any legal, regulatory, or contractual provisions that enable renewal and extension of the asset’s legal or contractual life without substantial cost; |

| | • | | the effects of obsolescence, demand, competition, and other economic factors; and |

| | • | | the level of maintenance expenditures required to obtain the expected future cash flows from the asset. |

Straight-line amortization is used to expense recognized amortizable intangible assets since a method that more closely reflects the pattern in which the economic benefits of the intangible assets are consumed cannot readily be determined. Intangible assets are not written off in the period of acquisition unless they become impaired during that period.

We evaluate the remaining useful life of each intangible asset that is being amortized each reporting period to determine whether events and circumstances warrant a revision to the remaining period of amortization. If the estimate of the intangible asset’s remaining useful life is changed, the remaining carrying amount of the intangible asset shall be amortized prospectively over that revised remaining useful life.

If an intangible asset that is being amortized is subsequently determined to have an indefinite useful life, the asset will be tested for impairment. That intangible asset will no longer be amortized and will be accounted for in the same manner as intangible assets that are not subject to amortization.

Intangible assets that are not subject to amortization are reviewed for impairment in accordance with SFAS 121 and tested annually, or more frequently if events or changes in circumstances indicate that the asset might be impaired. The impairment test consists of a comparison of the fair value of the intangible asset with its carrying amount. If the carrying amount of the intangible asset exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. After an impairment loss is recognized, the adjusted carrying amount of the intangible asset becomes its new accounting basis. Subsequent reversal of a previously recognized impairment loss is not allowed. Based on the aforementioned testing, the company has determined that its recorded intangible assets are not impaired.

23

SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED)

PERIOD ENDED MARCH 31, 2006 AND

YEARS ENDED DECEMBER 31, 2005 AND 2004

| | | | | | | | | | | | |

| | | First

Quarter | | | | | | |

2006 | | | | | | | | | | | | |

Interest income | | $ | 5,514,326 | | | | | | | | | |

Interest expense | | | 2,412,259 | | | | | | | | | |

| | | | | | | | | | | | |

Net interest income | | | 3,102,067 | | | | | | | | | |

Provision for loan losses | | | 105,000 | | | | | | | | | |

| | | | | | | | | | | | |

Net interest income after provision for loan losses | | | 2,997,067 | | | | | | | | | |

Non interest income | | | 647,878 | | | | | | | | | |

Non interest expense | | | 2,122,681 | | | | | | | | | |

| | | | | | | | | | | | |

Income before taxes | | | 1,522,264 | | | | | | | | | |

Income taxes | | | 676,653 | | | | | | | | | |

| | | | | | | | | | | | |

Net income | | $ | 845,611 | | | | | | | | | |

| | | | | | | | | | | | |

Net income per share | | | | | | | | | | | | |

Basic | | $ | .18 | | | | | | | | | |

Diluted | | | .18 | | | | | | | | | |

Average shares outstanding | | | | | | | | | | | | |

Basic | | | 4,576,226 | | | | | | | | | |

Diluted | | | 4,764,543 | | | | | | | | | |

| | | | |

| | | First

Quarter | | Second