Exhibit 99.1

Power Low Cost Reliable Clean Firm TransAlta Corporation 2017 Annual Integrated Report set as FRONT section of Exhibit 99.1 - pdf file provided. hardcopy for style

Letter to Shareholders Message from the Chair Management’s Discussion and Analysis Consolidated Financial Statements Notes to Consolidated Financial Statements Eleven-Year Financial and Statistical Summary Plant Summary Sustainability Performance Indicators Independent Sustainability Assurance Statement Shareholder Information Shareholder Highlights Corporate Information Glossary of Key Terms 1 4 M1 F1 F10 200 202 203 206 208 210 211 212

Letter to Shareholders Dear Fellow Shareholders, At TransAlta we make the energy our customers need and want. For over 100 years we have produced reliable power. Today, the demand for low-cost and reliable energy is greater than ever — and it must be clean and available at the flip of a switch, 24/7. Renewable power sources alone cannot provide this guarantee. TransAlta’s asset mix can. With a mix of hydro, wind, gas and solar power, TransAlta has the assets, expertise and growth platform to help meet the demand for clean power, while not compromising on reliability. By 2025 we will deliver 100 per cent clean power and be the energy provider of choice. To achieve this, we are accelerating the conversion of our coal plants to natural gas, strengthening our balance sheet and advancing our growth projects. We will combine natural gas with renewable power to deliver the reliability the market demands. As I outline in this letter, we have already made significant headway and a future of clean energy leadership is well within our grasp. We preserved maximum value from our coal plants by securing an additional 75 years of combined life for our existing coal facilities and adding more than $1 billion in anticipated free cash flow and $37 million annual off-coal payments from the province of Alberta. We negotiated full credit for our renewable assets under the carbon credit regime. As a result, over time, our wind and hydropower assets in Alberta will deliver $30 million to $50 million in value annually. 2015-2017: Building the Framework for Success Over the course of two short years we eliminated the uncertainty surrounding TransAlta’s future in a clean energy environment and established the framework for future operating success. We supported the development of a capacity market in Alberta, which we expect will allow us to bid our converted gas plants to support our customers. We strengthened our balance sheet — reducing net debt by $500 million, increasing our financial flexibility and preserving our investment grade credit rating. TransAlta Corporation | 2017 Annual Integrated Report 1

“100 per cent clean power by 2025. Everything we do in 2018 and beyond will move us closer to These significant achievements, over the past two years, give us the clarity and confidence we need to execute informed plans that propel us forward to a future of 100 per cent clean electricity. Our 2017 financial performance also demonstrates the strength of the underlying fundamentals of our business. In terms of overall performance, in 2017, we generated more cash flow than we have ever generated, at $328 million, and we gained significant confidence in future cash flows through the execution of our strategic efficiency initiative, and our decision to transition to gas-fired generation. We are re-tooling our business to sharpen our focus on the customer and to enable our employees to get work done! Our internal efficiency initiative, Project Greenlight, is driving millions of dollars in cash value from more efficient processes that will equip us to serve more customers, better. We are already benefiting from leaner, more efficient operations with plenty of scope to generate additional recurring savings. What I love about Greenlight is that it involves and rewards our people from the front lines to the back lines in over 900 initiatives are improving the company in every corner of our operations. It is a new tool for the future and it’s a game-changer for our culture. 2018-2020: Becoming the Energy Provider of Choice Customers want power that helps make them competitive, environmentally sensitive, forward-looking and proud of who provides their power. We can offer this. To do so, we must enhance our balance sheet to preserve our investment grade credit rating — the assurance that major industrial and commercial customers require to do business with us. 2025: Generating 100 Per Cent Clean Power Everything we do in 2018 and beyond will move us closer to 100 per cent clean power by 2025. Our teams are motivated and focused around this common goal. We are moving ahead with our plans to transition from coal to gas. We will continue to strategically manage our operational flexibility to ensure efficient capital allocation and energy supply based on market demands. We are in the final innings of our debt repayment program. Between 2018 and 2020, we will reduce our senior corporate debt to $1.1 billion, and have $1.0 billion of amortizing project debt secured by our contracted portfolio. We believe this is an appropriate amount of leverage for our Alberta coal and hydro assets. By 2020, our FFO/debt ratio will give us a balance sheet that can weather any storm. It also means that capital allocation from here can start to focus on returns to shareholders and new growth. We know that customers value a strong balance sheet and it’s a key competitive advantage in our business. At the end of 2017, we had to take the unusual step of consolidating our operations at Sundance to improve efficiency by reducing coal and greenhouse gas emissions. With carbon now priced in Alberta, we simply must optimize around carbon costs. In the new capacity market, we will have the opportunity to return five Sundance units to service as we transition them to gas-fired generation. Our Sundance and Keephills units are part of our vision for clean power by 2025. When the wind isn’t blowing, the water isn’t flowing, and the sun isn’t shining, we’ll be supporting customers in Alberta out of these plants. 2 TransAlta Corporation | 2017 Annual Integrated Report

“renewables play a much larger part. As we think about a cleaner 2025, we are very clear that To meet the competitive pressures in Alberta, we’ve set a goal to have all our coal plants converted to gas by 2022. To ensure success, we have secured a pipeline agreement that will connect our plants to gas supply. This means we can begin to blend our coal with gas to reduce costs, emissions and carbon tax expenses and crucially get to work on our coal-to-gas conversions a year earlier than expected. Capital Allocation We have a clear line of sight to $1.2 billion in free cash flow from our existing operations between 2018 and 2020 — $1 billion coming from our ongoing operations and $200 million coming from the PPA termination of the Sundance units. This cash backs up our financial plan and positions us for strong capital allocation decisions going forward, including the share buyback as described in Chairman Giffin’s Letter to Shareholders. As we think about a cleaner 2025, we are very clear that renewables play a much larger part. Therefore, we are continuing to invest in the exploratory development of our Brazeau Hydro pumped storage expansion plan, which will meet the demand for clean, low cost, reliable and firm power. A project like Brazeau will require a policy environment that supports the vision that clean, carbon-free power will dominate in Canada. We look forward to large hydro being a key part of the mix for Alberta again. By pushing on projects like Brazeau today, we can take Alberta to a future where power is low cost — green — firm and reliable. Today, TransAlta is focused on converting our coal plants to gas and maximizing the value of our hydro assets. TransAlta Renewables is focused on growing contracted cash flows from wind, solar, hydro and storage for customers both inside and outside of Alberta. The great news is that we are returning to a time when TransAlta can take our cash from our Alberta assets and our contracted renewables assets and think carefully about capital allocation. On behalf of our leadership team, we very much appreciate all your support and we thank our people for all that they do every day to serve our customers and build our company. Dawn L. Farrell President and Chief Executive Officer March 1, 2018 TransAlta Corporation | 2017 Annual Integrated Report 3

Message from the Chair From your Board’s perspective, 2017 can be best characterized in one word — progress. Steady, strategic progress. First, let me assure you that the Board listened to the message delivered by our shareholders through the say-on-pay vote last spring. The Board and management are firmly committed to a compensation philosophy with the principle of pay for performance at its core. We have undertaken an extensive outreach program, creating an ongoing dialogue with shareholders so that we remain current on your thinking. We have also enhanced our approach to executive compensation, which is described in more detail in the Compensation Discussion & Analysis. program will be complete and we’ll start to have more significant discussions about capital allocation. While the public markets have yet to recognize TransAlta’s progress, the Board believes the financial performance of the company has improved and our strategy is strong. The market will catch up to the decisions we have made. As always, the Board and management are focused on the future. There are new opportunities ahead, including the transition to a capacity market and what is proving to be a very competitive environment in which to build the next generation of renewables. TransAlta is ready. The Board would like to express its ongoing confidence in TransAlta’s leadership team and their vision. We value and appreciate their determination and personal resolve. Much like the legendary tortoise, without a lot of flash or attention, your TransAlta employee team, across the company, made substantial progress to improve the company’s performance and to position it for success in the new and evolving power sector of the future. In early 2017, TransAlta stated its strategic mission to become Canada’s leading clean power company, thereby creating value for its shareholders, customers, employees and other stakeholders in the decades ahead. In pursuit of that vision, 2017 saw many achievements, among them greater efficiency and innovation, debt reduction and an accelerated plan to convert our coal plants to gas. These are described in greater detail in President and CEO Dawn Farrell’s accompanying letter. In summary, the Board and the dedicated team of TransAlta employees have been diligent in the rigorous pursuit of actions and policies to make TransAlta the leading clean power generator — a company that consistently delivers value to shareholders. This is a marathon, not a sprint, and the Board is confident that our management has its eyes on the finish line, and, like that tortoise, is on an inexorable path to cross it. With the better-than-expected performance from the business, and the strong outlook, we are confident in the execution of our plan for 2018 to 2020 and have decided to allocate a portion of our capital to buy back our shares when we feel they are undervalued. In 2019, as the business continues to thrive, our de-leveraging Ambassador Gordon D. Giffin Chair of the Board of Directors March 1, 2018 4 TransAlta Corporation | 2017 Annual Integrated Report

TRANSALTA CORPORATION

Management’s Discussion and Analysis

Table of Contents

Forward-Looking Statements | M2 | Critical Accounting Policies and Estimates | M37 |

Additional IFRS Measure and Non-IFRS Measures | M3 | Accounting Changes | M43 |

Business Model | M4 | Competitive Forces | M45 |

Highlights | M5 | TransAlta’s Capital | M48 |

Discussion of Consolidated Financial Results | M7 | 2017 Sustainability Performance | M76 |

Significant and Subsequent Events | M21 | 2018 Sustainability Performance Targets | M78 |

Financial Position | M27 | Governance and Risk Management | M80 |

Cash Flows | M28 | Fourth Quarter | M91 |

Financial Instruments | M29 | Discussion of Consolidated Financial Results | M92 |

2018 Financial Outlook | M31 | Selected Quarterly Information | M96 |

Other Consolidated Analysis | M33 | Disclosure Controls and Procedures | M98 |

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with our audited annual 2017 consolidated financial statements and our Annual Information Form for the year ended Dec. 31, 2017. Our consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) for Canadian publicly accountable enterprises as issued by the International Accounting Standards Board (“IASB”) and in effect at Dec. 31, 2017. All dollar amounts in the following discussion, including the tables, are in millions of Canadian dollars unless otherwise noted and except amounts per share which are in whole dollars to the nearest two decimals. This MD&A is dated March 1, 2018. Additional information respecting TransAlta Corporation (“TransAlta”, “we”, “our”, “us” or the “Corporation”), including our Annual Information Form, is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov and on our website at www.transalta.com. Information on or connected to our website or our social media channels is not incorporated by reference herein.

Forward-Looking Statements

This MD&A, the documents incorporated herein by reference, and other reports and filings made with securities regulatory authorities include forward-looking statements or information (collectively referred to herein as “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are presented for general information purposes only and not as specific investment advice. All forward-looking statements are based on our beliefs as well as assumptions based on information available at the time the assumptions were made and on management’s experience and perception of historical trends, current conditions, and expected future developments, as well as other factors deemed appropriate in the circumstances. Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as “may”, “will”, “believe”, “expect”, “anticipate”, “intend”, “plan”, “project”, “forecast”, “foresee”, “potential”, “enable”, “continue”, or other comparable terminology. These statements are not guarantees of our future performance and are subject to risks, uncertainties, and other important factors that could cause our actual performance to be materially different from that projected.

In particular, this MD&A contains forward-looking statements pertaining to: our business model and anticipated future financial performance; our success in executing on our growth projects; the timing of the construction and commissioning of projects under development, including the Brazeau Hydro pumped storage Project, the Kent Hills 3 Wind Project, the Antelope Coulee Wind Project, the Garden Plain wind Project, and the conversion of our Sundance Units 3 to 6 and Keephills Units 1 and 2 from coal-fired generation to gas-fired generation, and their timing, attendant costs and sources of funding; the benefits to be realized from converting coal-fired facilities to gas-fired facilities, including reductions in emissions; the retirement of Sundance Unit 1 and the mothballing of Sundance Units 2 to 5; the compensation expected from the Balancing Pool and sustaining capital expenditures in connection with the termination of the Alberta Power Purchase Arrangements; spending on growth and sustaining capital and productivity projects; expectations in terms of the cost of operations, capital spending, and maintenance, and the variability of those costs; expected decommissioning costs; the section titled “2018 Financial Outlook”; the ability of Sundance Unit 2 to qualify for the expected 2019 capacity market auction; coal supply constraints for our facilities in Alberta and their impact on our mining costs and power generation at our Sundance Units 3 to 6 and Keephills Units 1 to 3; the impact of certain hedges on future reported earnings and cash flows, including future reversals of unrealized gains or losses; our dividend payout ratio; expectations related to future earnings and cash flow from operating and contracting activities (including estimates of full-year 2018 comparable earnings before interest, depreciation and amortization (“EBITDA”), funds from operations (“FFO”) and free cash flow (“FCF”), and expected sustaining capital expenditures; expectations in respect of financial ratios and targets and the timing associated with meeting such targets (including FFO before interest to adjusted interest coverage, adjusted FFO to adjusted net debt, and adjusted net debt to comparable EBITDA); Canadian Coal Fleet availability; the anticipated financial impact to be realized from the commercial operation of the South Hedland Power Station; our ability to establish that all conditions to commercial operation of our South Hedland Power Station have been satisfied with Fortescue Metals Group Limited (“FMG”); the Corporation’s plans and strategies relating to repositioning its capital structure and strengthening its balance sheet and the anticipated debt reductions; the terms of the anticipated normal course issuer bid (“NCIB”), including the timing, number of shares to be repurchased pursuant to the NCIB, and the acceptance thereof by the Toronto Stock Exchange; expected governmental regulatory regimes and legislation, including the federal carbon price, the Government of Alberta’s intended shift to a capacity market and renewable auctions and the expected impacts on us and the timing of the implementation of such regimes and regulations, as well as the cost of complying with resulting regulations and laws; the expected results and impact of the Off-Coal Agreement (“OCA”) with the Government of Alberta on our business and financial performance; estimates of fuel supply and demand conditions and the costs of procuring fuel; the impact of load growth, increased capacity, and natural gas costs on power prices; expectations in respect of generation availability, capacity, and production; power prices in Alberta, Ontario, and the Pacific Northwest; expected financing of our capital expenditures; the anticipated financial impact of increased carbon prices, including under the Carbon Competitiveness Incentive Regulation (“CCIR”) in Alberta; expectations in respect of our environmental initiatives including reductions to our emissions, environmental incidents, and energy use, including the reduction in greenhouse gas (“GHG”) emissions of 60 per cent or 12 million tonnes CO2e; nitrogen dioxide emissions being reduced 50 per cent; our trading strategies and the risk involved in these strategies; estimates of future tax rates, future tax expense, and the adequacy of tax provisions; accounting estimates; anticipated growth rates in our markets; our expectations regarding the outcome of existing or potential legal and contractual claims, regulatory investigations, and disputes; expectations regarding the renewal of collective bargaining agreements; expectations for the ability to access capital markets on reasonable terms; the estimated impact of changes in interest rates and the value of the Canadian dollar relative to the US dollar, the Australian dollar, and other currencies in which we do business; our exposure to liquidity risk; expectations in respect of the global economic environment and growing scrutiny by investors relating to sustainability performance; our credit practices; expected cost savings and payback periods following the implementation of Project Greenlight and productivity initiatives, including

translating certain costs from our corporate transformation into significant long-term cost savings; the estimated contribution of Energy Marketing activities to gross margin; expectations relating to the performance of TransAlta Renewables Inc.’s (“TransAlta Renewables”) assets; expectations regarding our continued ownership of common shares of TransAlta Renewables; the refinancing of our upcoming debt maturities over the next two years; expectations regarding our de-leveraging strategy; expectations in respect of our community initiatives; impacts of future IFRS standards and the timing of the implementation of such standards; and amendments or interpretations by accounting standard setters prior to initial adoption of those standards.

Factors that may adversely impact our forward-looking statements include risks relating to: fluctuations in market prices and our ability to contract our generation for prices that will provide expected returns; the regulatory and political environments in the jurisdictions in which we operate; increasingly stringent environmental requirements and changes in, or liabilities under, these requirements; ability to compete effectively in the anticipated Alberta capacity market; changes in general economic conditions, including interest rates; operational risks involving our facilities, including unplanned outages at such facilities; accelerated growth, whether through acquisition or greenfield development; unanticipated operating conditions; disruptions in the transmission and distribution of electricity; the effects of weather; disruptions in the source of fuels, water, sun, or wind required to operate our facilities; natural or man-made disasters; physical risks related to climate change; the threat of terrorism and cyberattacks and our ability to manage such attacks; equipment failure and our ability to carry out or have completed the repairs in a cost-effective or timely manner; commodity risk management; industry risk and competition; fluctuations in the value of foreign currencies and foreign political risks; the need for additional financing and the ability to access financing at a reasonable cost and on reasonable terms; our ability to fund our growth projects; our ability to maintain our investment grade credit ratings; structural subordination of securities; counterparty credit risk; our ability to recover our losses through our insurance coverage; our provision for income taxes; outcomes of legal, regulatory, and contractual proceedings involving the Corporation including those with FMG at South Hedland; outcomes of investigations and disputes; reliance on key personnel; labour relations matters; risks associated with development projects and acquisitions, including delays or changes in costs in the construction and commissioning of the Kent Hills 3 wind project; and the maintenance or adoption of enabling regulatory frameworks or the satisfactory receipt of applicable regulatory approvals for existing and proposed operations and growth initiatives, including as it pertains to coal-to-gas conversions.

The foregoing risk factors, among others, are described in further detail in the Governance and Risk Management section of this MD&A and under the heading “Risk Factors” in our 2018 Annual Information Form.

Readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events, or otherwise, except as required by applicable laws. In light of these risks, uncertainties, and assumptions, the forward-looking events might occur to a different extent or at a different time than we have described, or might not occur. We cannot assure that projected results or events will be achieved.

Additional IFRS Measures and Non-IFRS Measures

An additional IFRS measure is a line item, heading, or subtotal that is relevant to an understanding of the financial statements but is not a minimum line item mandated under IFRS, or the presentation of a financial measure that is relevant to an understanding of the financial statements but is not presented elsewhere in the financial statements. We have included line items entitled gross margin and operating income (loss) in our Consolidated Statements of Earnings (Loss) for the years ended Dec. 31, 2017, 2016, and 2015. Presenting these line items provides management and investors with a measurement of ongoing operating performance that is readily comparable from period to period.

We evaluate our performance and the performance of our business segments using a variety of measures. Certain of the financial measures discussed in this MD&A are not defined under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures may not be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Comparable EBITDA, FFO, comparable FFO, FCF, and cash flow generated by the business are non-IFRS measures that are presented in this MD&A. See the Reconciliation of Non-IFRS Measures and Discussion of Segmented Comparable Results sections of this MD&A for additional information.

Business Model

Our Business

We are one of Canada’s largest publicly traded power generators with over 107 years of operating experience. As at March 1, 2018, we own, operate, and manage a highly contracted and geographically diversified portfolio of assets representing over 8,400 megawatts (“MW”)(1) of gross generating capacity and use a broad range of generation fuels including coal, natural gas, water, solar, and wind. Our energy marketing team adds value by optimizing assets as market conditions change and by supplying products for customers.

Vision and Values

Our vision is to supply low cost, clean, reliable and firm electricity to our markets and customers. Our values are grounded in accountability, integrity, safety, respect for people, innovation and loyalty, which together create a strong corporate culture and allow all of our people to work on a common ground and understanding. These values are at the heart of our success.

Strategy for Value Creation

We deliver shareholder value by delivering solid returns through a combination of dividend yield and disciplined growth in cash flow per share, while striving for a low to moderate risk profile over the long term. Over the next 12 months we will continue to deleverage our balance sheet and ensure financial flexibility as we transition our coal-fired plants to gas-fired plants and move into a capacity market in Alberta. Now that our cash flows have strengthened, we can allocate capital to growth, dividends and share re-purchases.

Material Sustainability Impacts

Sustainability means ensuring that our financial returns consider short and long-term economics, environmental impacts and societal and community needs. We track the performance of 74 sustainability-related Key Performance Indicators (“KPIs”). We obtained a limited assurance report from Ernst & Young LLP over material KPIs. Our MD&A integrates our financial and sustainability reporting.

(1) | We measure capacity as net maximum capacity (see Glossary of Key Terms for a definition of this and other key terms), which is consistent with industry standards. Capacity figures represent capacity owned and in operation unless otherwise stated, and reflect the basis of consolidation of underlying assets. |

Highlights

Consolidated Financial Highlights

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Revenues |

| 2,307 |

| 2,397 |

| 2,267 |

|

Net earnings (loss) attributable to common shareholders |

| (190 | ) | 117 |

| (24 | ) |

Cash flow from operating activities |

| 626 |

| 744 |

| 432 |

|

Comparable EBITDA(1,2) |

| 1,062 |

| 1,144 |

| 867 |

|

FFO(1,2) |

| 804 |

| 734 |

| 699 |

|

FCF(1,2) |

| 328 |

| 257 |

| 239 |

|

Net earnings (loss) per share attributable to common shareholders, basic and diluted |

| (0.66 | ) | 0.41 |

| (0.09 | ) |

FFO per share(1,2) |

| 2.79 |

| 2.55 |

| 2.50 |

|

FCF per share(1,2) |

| 1.14 |

| 0.89 |

| 0.85 |

|

Dividends declared per common share |

| 0.12 |

| 0.20 |

| 0.72 |

|

|

|

|

|

|

|

|

|

As at Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Total assets |

| 10,304 |

| 10,996 |

| 10,947 |

|

Total consolidated net debt(3) |

| 3,363 |

| 3,893 |

| 4,251 |

|

Total long-term liabilities |

| 4,311 |

| 5,116 |

| 5,704 |

|

2017 was a successful year for TransAlta. FCF totalled $328 million, up $72 million compared to last year. FFO was $804 million for 2017, compared to $734 million for 2016, an increase of $70 million, as most of our operations delivered year-over-year improvement in performance.

At the end of the year our total net debt was approximately $3.4 billion, down more than $500 million from the beginning of the year, due to the scheduled repayment of the US$400 million US Senior Note using existing liquidity. Our adjusted FFO to adjusted net debt and adjusted net debt to comparable EBITDA metrics improved significantly to 20.4 per cent and 3.6 times, respectively. Liquidity available at the end of the year remains at a similar level compared to last year following the payment received in November from FMG for the sale of the Solomon Power Station.

Net loss attributable to common shareholders in 2017 was $190 million ($0.66 net loss per share) compared to net earnings of $117 million ($0.41 net earnings per share) in 2016, a reduction of more than $300 million. Earnings in 2017 were negatively impacted by lower comparable EBITDA of $82 million, as well as the reduction of the US tax rate announced in December ($105 million). The US tax rate reduction was offset by an increase in other comprehensive income. Higher depreciation of $34 million year-over-year was due mostly to the shortening of the useful lives of Keephills 3 and Genesee 3 and to the commissioning of South Hedland in July. Net earnings in 2016 were positively impacted by a $48 million (net of related income tax expense and non-controlling interest) positive impact in connection with the Mississauga recontracting and the pre-tax $94 million Keephlils Unit 1 provision reversal, of which $80 million impacted comparable EBITDA.

(1) | These items are not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Reconciliation of Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. |

(2) | During the fourth quarter of 2017, we revised our approach to reporting adjustments to arrive at FFO, mainly to better represent FFO as a cash metric. Previously, FFO was adjusted to include, exclude, or to modify the timing of cash impacts related to adjustments made in arriving at comparable EBITDA. As a result, comparable EBITDA, FFO, and FCF for 2016 and 2015 have been revised accordingly. |

(3) | Total consolidated net debt includes long-term debt including current portion, amounts due under credit facilities, tax equity, and finance lease obligations, net of available cash and the fair value of economic hedging instruments on debt. See the table in the Capital Structure section of this MD&A for more details on the composition of net debt. |

Segmented Cash Flow Generated by the Business(1)

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Segmented cash inflow (outflow) |

|

|

|

|

|

|

|

Canadian Coal |

| 175 |

| 198 |

| 177 |

|

US Coal |

| 33 |

| 21 |

| 41 |

|

Canadian Gas |

| 221 |

| 235 |

| 194 |

|

Australian Gas |

| 127 |

| 99 |

| 114 |

|

Wind and Solar |

| 201 |

| 180 |

| 163 |

|

Hydro |

| 61 |

| 53 |

| 38 |

|

Generation cash inflow |

| 818 |

| 786 |

| 727 |

|

Energy Marketing |

| 39 |

| 25 |

| 17 |

|

Corporate |

| (108 | ) | (95 | ) | (102 | ) |

Total comparable cash inflow |

| 749 |

| 716 |

| 642 |

|

Segmented cash flows generated by the business measures the net cash generated by each of our segments after sustaining and productivity capital expenditures, reclamation costs, and provisions. It also excludes non-cash mark-to-market gains or losses. This is the annual cash flows available to pay our interest and cash taxes, distributions to our non-controlling partners and dividends to our preferred shareholders, grow the business, pay down debt and return capital to our shareholders. Cash flow generated by the business totalled $749 million in 2017, up $33 million over 2016 and $74 million over 2015 in a low price environment in most markets in North America. We achieved this through a prudent contracting approach, disciplined cost control and sustaining capital expenditure allocation.

Significant Events

Our strategic focus continues to be strengthening our balance sheet, improving our operating performance, and progressing our transition to clean power generation. We made the following progress throughout the year:

§ On March 1, 2018, we announced our intention to seek Toronto Stock Exchange acceptance of a normal course issuer bid (“NCIB”). See the Significant and Subsequent Events section of this MD&A for further details.

§ In April 2017, we announced our plan to transition to gas and renewables generation with the retirement of Sundance Unit 1 and the mothballing of Sundance Unit 2 at the end of 2017, as well as the conversion of Sundance Units 3 to 6 and Keephills Units 1 and 2 from coal-fired generation to gas-fired generation between 2021 and 2022. Subsequent to the September 2017 Balancing Pool’s announcement of the termination of the PPAs in respect of Sundance B and C, we announced the acceleration of the conversion of Sundance Units 3 to 6 and Keephills Units 1 and 2 from coal-fired generation in the 2021 to 2022 timeframe, a year earlier than originally planned. As a result of the termination of Sundance B and C PPAs, we determined to mothball additional capacity starting in April 2018. The coal-fired plants operated by us, once converted to gas, are anticipated to be able to run through to 2031 to 2039, which significantly lengthens their asset lives. See the Significant and Subsequent Events section of this MD&A for further details.

§ During the fourth quarter, we entered into a Letter of Intent to construct a 120-kilometre natural gas pipeline to our generating units at Sundance and Keephills, to facilitate our strategy of converting our coal units to natural gas units. See the Significant and Subsequent Events section of this MD&A for further details.

§ During the third quarter, we achieved commercial operation on our South Hedland Power Station. During the fourth quarter, we received formal notice of termination of the South Hedland PPA from a subsidiary of Fortescue Metals Group Limited (“FMG”), on the basis that the South Hedland Power Station had yet to achieve commercial operation. We remain confident that all conditions required to establish commercial operations, including all performance conditions, have been achieved under the terms of the PPA. The project is expected to generate approximately $80 million of comparable EBITDA annually. TransAlta Renewables converted the Class B shares we owned into common shares and also increased its monthly dividend by approximately seven per cent. See the Significant and Subsequent Events section of this MD&A for further details.

(1) | This item is not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Reconciliation of Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. |

§ In November, FMG repurchased the Solomon Power Station. We received approximately US$325 million. See the Significant and Subsequent Events section of this MD&A for further details.

§ During the second quarter, we entered into a long-term contract for the 17.25 MW Kent Hills 3 expansion project located in New Brunswick, which is expected to begin the construction phase in the spring of 2018.

§ In May, we repaid $US400 million of senior debt using existing liquidity.

§ During the third quarter, TransAlta Renewables’ indirect majority-owned subsidiary, Kent Hills Wind LP, closed a $260 million project level financing. The bonds are amortizing and bear interest at an annual rate of 4.454 per cent, payable quarterly and maturing Nov. 30, 2033. The proceeds from the financing were used to early repay maturing debt and will fund the expansion of the project. In early 2018, we announced our intention to early repay $US500 million of Senior Notes. See the Significant and Subsequent Events section of this MD&A for further details.

§ During the third quarter, TransAlta Renewables entered into a syndicated credit agreement giving it access to $500 million in direct borrowings. We reduced our syndicated credit facility by the same amount. Our consolidated liquidity remains unchanged. Both facilities expire in 2021.

§ In March 2017, we closed the sale of our 51 per cent interest in the Wintering Hills merchant wind facility for approximately $61 million. The sale reduced our merchant exposure in Alberta and the proceeds were used to repay debt.

§ During the second quarter, we settled the contract indexation dispute with the Ontario Electricity Financial Corporation (“OEFC”). The settlement consisted of a $34 million payment by the OEFC to TransAlta.

Discussion of Consolidated Financial Results

We evaluate our performance and the performance of our business segments using a variety of measures. Comparable figures are not defined under IFRS. Those discussed below, and elsewhere in this MD&A, are not defined under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures are not necessarily comparable to a similarly titled measure of another company. Each business segment assumes responsibility for its operating results measured to comparable EBITDA and cash flows generated by the business. Gross margin is also a useful measure as it provides management and investors with a measurement of operating performance that is readily comparable from period to period.

Comparable EBITDA

EBITDA is a widely adopted valuation metric and an important metric for management that represents our core business profitability. Interest, taxes, and depreciation and amortization are not included, as differences in accounting treatments may distort our core business results. In addition, we reclassify certain transactions to facilitate the discussion on the performance of our business:

(i) Certain assets we own in Canada and Australia are fully contracted and recorded as finance leases under IFRS. We believe it is more appropriate to reflect the payments we receive under the contracts as a capacity payment in our revenues instead of as finance lease income and a decrease in finance lease receivables. We depreciate these assets over their expected lives;

(ii) We also reclassify the depreciation on our mining equipment from fuel and purchased power to reflect the actual cash cost of our business in our comparable EBITDA;

(iii) In December 2016, we agreed to terminate our existing arrangement with the Independent Electricity System Operator (“IESO”) relating to our Mississauga cogeneration facility in Ontario and entered into a new Non-Utility Generator (“NUG”) Enhanced Dispatch Contract (the “NUG Contract”) effective Jan. 1, 2017. Under the new NUG Contract, we receive fixed monthly payments until December 31, 2018 with no delivery obligations. Under IFRS, for our reported results in 2016, as a result of the NUG Contract, we recognized a receivable of $207 million (discounted), a pre-tax gain of approximately $191 million net of costs to mothball the units, and accelerated depreciation of $46 million. In 2017 and 2018, on a comparable basis, we record the payments we receive as revenues as a proxy for operating income, and continue to depreciate the facility until Dec. 31, 2018; and

(iv) On commissioning of South Hedland Power Station, we prepaid approximately $74 million of electricity transmission and distribution costs. Interest income is recorded on the prepaid funds. We reclassify this interest income as reduction in the transmission and distribution costs expensed each period to reflect the net cost to the business.

A reconciliation of net earnings (loss) attributable to common shareholders to comparable EBITDA results is set out below:

Year ended Dec. 31 |

| 2017(1) |

| 2016(1) |

| 2015(1) |

|

Net earnings (loss) attributable to common shareholders |

| (190) |

| 117 |

| (24) |

|

Net earnings attributable to non-controlling interests |

| 42 |

| 107 |

| 94 |

|

Preferred share dividends |

| 30 |

| 52 |

| 46 |

|

Net earnings (loss) |

| (118) |

| 276 |

| 116 |

|

Adjustments to reconcile net income to comparable EBITDA |

|

|

|

|

|

|

|

Income tax expense |

| 64 |

| 38 |

| 105 |

|

Gain on sale of assets and other | �� | (2) |

| (4) |

| (262) |

|

Foreign exchange (gain) loss |

| 1 |

| 5 |

| (4) |

|

Net interest expense |

| 247 |

| 229 |

| 251 |

|

Depreciation and amortization |

| 635 |

| 601 |

| 545 |

|

|

|

|

|

|

|

|

|

Comparable reclassifications |

|

|

|

|

|

|

|

Decrease in finance lease receivables |

| 59 |

| 57 |

| 23 |

|

Mine depreciation included in fuel cost |

| 75 |

| 65 |

| 62 |

|

Australian interest income |

| 2 |

| - |

| - |

|

|

|

|

|

|

|

|

|

Adjustments to earnings to arrive at comparable EBITDA |

|

|

|

|

|

|

|

Impacts to revenue associated with certain de-designated and economic hedges |

| 2 |

| 26 |

| 60 |

|

Impacts associated with Mississauga recontracting(2) |

| 77 |

| (177) |

| - |

|

Asset impairment charge (reversal) |

| 20 |

| 28 |

| (2) |

|

Non-comparable portion of insurance recovery received |

| - |

| - |

| (18) |

|

Maintenance costs related to the Alberta flood of 2013, net of insurance recoveries |

| - |

| - |

| (9) |

|

Comparable EBITDA |

| 1,062 |

| 1,144 |

| 867 |

|

Comparable EBITDA decreased by $82 million for the year ended Dec. 31, 2017, compared to 2016. The 2016 results were positively impacted by an $80 million non-cash accounting provision reversal relating to the Keephills 1 outage in 2013.

Comparable EBITDA at our US Coal, Canadian Gas, Australian Gas, and Wind and Solar segments were all up year over year, and collectively accounted for an increase of $95 million of comparable EBITDA. At US Coal, lower coal transportation costs and favourable mark-to-market on economic hedges that do not qualify for hedge accounting contributed to higher results. Our Canadian Gas operations benefited from the settlement of the contract indexation dispute with the OEFC relating to the Ottawa and Windsor generating facilities, totalling $34 million, as well as the positive impact of the early shut down of our Mississauga gas plant in Ontario. Australian Gas’ improved results were mainly due to the commissioning of our South Hedland Power Station in the third quarter. Higher volumes, lower cost of sales from renewable energy certificates, and lower operations, maintenance, and administration expenses were primary drivers of higher comparable EBITDA at our Wind and Solar segment.

(1) | During the fourth quarter of 2017, we revised the way in which comparable EBITDA is reconciled to net earnings. Accordingly, prior years’ results have been revised. |

(2) | Impacts associated with Mississauga recontracting for the year ended Dec. 31, 2017, are as follows: revenue ($101 million), fuel and purchased power and de-designated hedges ($12 million), operations, maintenance, and administration ($3 million), and recovery related to renegotiated land lease ($9 million). Impacts associated with Mississauga recontracting for the year ended Dec. 31, 2016, are as follows: net other operating income ($191 million) and fuel and purchased power and de-designated hedges ($14 million). |

Comparable EBITDA for Canadian Coal was down $149 million from 2016. Comparable EBITDA in 2016 was positively impacted by the reversal of an $80 million non-cash accounting provision. In 2017, we recognized $40 million for OCA payments that were more than offset by lower prices due to the rolling off of higher priced hedges, higher coal costs caused by a higher strip ratio and lower equipment availability at our mine, and higher environmental compliance costs. EBITDA in Energy Marketing was down $7 million in 2017 compared to 2016. Results were impacted by unusual weather in the Northeast and the Pacific Northwest in the first quarter of 2017, but showed steady improvement in subsequent quarters.

Our overall results in 2017 also included costs of approximately $29 million relating to Project Greenlight, our transformation initiative. We estimate that the Project Greenlight initiatives generated between $35 million to $45 million of reduction in operations, maintenance, and administration (“OM&A”) expenses and fuel costs or efficiency gains.

Funds from Operations and Free Cash Flow

FFO is an important metric as it provides a proxy for cash generated from operating activities before changes in working capital, and provides the ability to evaluate cash flow trends in comparison with results from prior periods. FCF is an important metric as it represents the amount of cash that is available to invest in growth initiatives, make scheduled principal repayments on debt, repay maturing debt, pay common share dividends, or repurchase common shares. Changes in working capital are excluded so FFO and FCF are not distorted by changes that we consider temporary in nature, reflecting, among other things, the impact of seasonal factors and timing of receipts and payments. FFO per share and FCF per share are calculated using the weighted average number of common shares outstanding during the period.

The table below reconciles our cash flow from operating activities to our FFO and FCF.

Year ended Dec. 31 |

| 2017(1) |

| 2016(1) |

| 2015(1) |

|

Cash flow from operating activities |

| 626 |

| 744 |

| 432 |

|

Change in non-cash operating working capital balances |

| 114 |

| (73) |

| 242 |

|

Cash flow from operations before changes in working capital |

| 740 |

| 671 |

| 674 |

|

Adjustment: |

|

|

|

|

|

|

|

Decrease in finance lease receivable |

| 59 |

| 57 |

| 23 |

|

Other |

| 5 |

| 6 |

| 2 |

|

FFO |

| 804 |

| 734 |

| 699 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital |

| (235) |

| (272) |

| (305) |

|

Productivity capital |

| (24) |

| (8) |

| (6) |

|

Dividends paid on preferred shares |

| (40) |

| (42) |

| (46) |

|

Distributions paid to subsidiaries’ non-controlling interests |

| (172) |

| (151) |

| (99) |

|

Other |

| (5) |

| (4) |

| (4) |

|

FCF |

| 328 |

| 257 |

| 239 |

|

Weighted average number of common shares outstanding in the year |

| 288 |

| 288 |

| 280 |

|

FFO per share |

| 2.79 |

| 2.55 |

| 2.50 |

|

FCF per share(1) |

| 1.14 |

| 0.89 |

| 0.85 |

|

The increase in FCF was driven by year-over-year stronger cash flow from operations of $69 million and lower sustaining capital expenditures. This was partly offset by higher distributions to our non-controlling partners at our gas and renewables businesses and higher capital allocated to productivity capital. FCF in 2016 and 2015 was also reduced by payments to the Market Surveillance Administrator (“MSA”) of $25 million and $31 million, respectively.

(1) In the first quarter of 2017, we began deducting productivity capital in calculating FCF.

The table below bridges our comparable EBITDA to our FFO and FCF.

Year ended Dec. 31 |

| 2017(1) |

| 2016(1) |

| 2015(1) |

|

Comparable EBITDA |

| 1,062 |

| 1,144 |

| 867 |

|

Provisions |

| (7) |

| (114) |

| 101 |

|

Unrealized (gains) losses from risk management activities |

| (28) |

| 4 |

| 9 |

|

Interest expense |

| (218) |

| (229) |

| (233) |

|

Current income tax expense |

| (23) |

| (23) |

| (18) |

|

Realized foreign exchange gain (loss) |

| 15 |

| (5) |

| 9 |

|

Decommissioning and restoration costs settled |

| (19) |

| (23) |

| (24) |

|

Gain on curtailment and amendment of employee future benefit plans |

| - |

| - |

| (8) |

|

Other cash and non-cash items |

| 22 |

| (20) |

| (4) |

|

FFO |

| 804 |

| 734 |

| 699 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital |

| (235) |

| (272) |

| (305) |

|

Productivity capital |

| (24) |

| (8) |

| (6) |

|

Dividends paid on preferred shares |

| (40) |

| (42) |

| (46) |

|

Distributions paid to subsidiaries’ non-controlling interests |

| (172) |

| (151) |

| (99) |

|

Other |

| (5) |

| (4) |

| (4) |

|

FCF |

| 328 |

| 257 |

| 239 |

|

(1) During the fourth quarter of 2017 we removed certain comparable adjustments that reflect timing of payments and receipts, accordingly prior years’ results have been restated.

Segmented Comparable Results

Canadian Coal

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Availability (%) |

| 82.0 |

| 85.3 |

| 84.3 |

|

Contract production (GWh) |

| 18,683 |

| 19,823 |

| 20,256 |

|

Merchant production (GWh) |

| 3,786 |

| 3,787 |

| 3,827 |

|

Total production (GWh) |

| 22,469 |

| 23,610 |

| 24,083 |

|

Gross installed capacity (MW)(1) |

| 3,791 |

| 3,791 |

| 3,786 |

|

Revenues |

| 999 |

| 1,048 |

| 912 |

|

Fuel and purchased power |

| 510 |

| 386 |

| 379 |

|

Comparable gross margin |

| 489 |

| 662 |

| 533 |

|

Operations, maintenance, and administration |

| 192 |

| 178 |

| 194 |

|

Restructuring provision |

| - |

| - |

| 11 |

|

Taxes, other than income taxes |

| 13 |

| 13 |

| 12 |

|

Net other operating income |

| (40 | ) | (2 | ) | (7 | ) |

Comparable EBITDA |

| 324 |

| 473 |

| 323 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital: |

|

|

|

|

|

|

|

Routine capital |

| 22 |

| 33 |

| 48 |

|

Mine capital |

| 28 |

| 23 |

| 25 |

|

Finance leases |

| 14 |

| 13 |

| 10 |

|

Planned major maintenance |

| 54 |

| 100 |

| 107 |

|

Total sustaining capital expenditures |

| 118 |

| 169 |

| 190 |

|

Productivity capital |

| 12 |

| 1 |

| 2 |

|

Total sustaining and productivity capital |

| 130 |

| 170 |

| 192 |

|

|

|

|

|

|

|

|

|

Provisions |

| 5 |

| 85 |

| (64 | ) |

Unrealized (gains) losses on risk management activities |

| 3 |

| 7 |

| 4 |

|

Decommissioning and restoration costs settled |

| 11 |

| 13 |

| 14 |

|

Canadian Coal cash flow |

| 175 |

| 198 |

| 177 |

|

2017

Availability in 2017 was down compared to 2016 due to higher unplanned outages and derates due to coal supply disruptions at our mine during the last half of the year, which also resulted in lower production of 1,141 gigawatt hours (“GWh”) year-over-year.

Comparable EBITDA for the year ended Dec. 31, 2017, decreased $149 million compared to 2016, due to the $80 million reversal of the Keephills 1 provision in the fourth quarter of 2016. As expected, fuel and purchased power was impacted by higher coal costs related to the expected higher strip ratio and higher environmental compliance costs in 2017. In addition, we incurred additional costs in the third quarter to mitigate the impact of lower productivity at our mine. OM&A increased $14 million year-over-year due mostly to contractor spend on Project Greenlight improvement initiatives ($20 million) and higher material and operating expenses ($5 million), and was partially offset by lower compensation ($11 million). See the Strategic Growth and Corporate Transformation section of this MD&A for further details. This year’s results also included $40 million related to OCA payments included in net other operating income. We received our OCA payment in the third

(1) 2017 includes 560 MW for Sundance Units 1 and 2, which were both shut down and mothballed, on Jan. 1, 2018.

quarter.

Sustaining and productivity capital expenditures for the year ended Dec. 31, 2017, were lower by $40 million compared to 2016, mainly due to the timing of major outages in 2017 and pit stops executed in 2016 on our Sundance 1 and 2 units.

2016

Production for the year ended Dec. 31, 2016, decreased 473 GWh compared to 2015, primarily due to higher paid curtailments in the first half of the year and higher levels of economic dispatching, in both cases caused by lower prices in Alberta. This was partially offset by lower planned outages and derates. Unplanned outages remained at a similar level compared to last year.

Comparable EBITDA for the year ended Dec. 31, 2016, increased $150 million compared to 2015, primarily due to the reversal of the $80 million provision relating to the Keephills 1 outage in 2013. The year-over-year impact to comparable EBITDA of this provision was $139 million, as 2015’s comparable EBITDA was reduced by $59 million due to this provision, which also included $11 million of restructuring costs. Our high level of contracted generation and hedging strategy largely mitigated the impact of low power prices in Alberta. Comparable EBITDA was also positively impacted by a reduction in our operations, maintenance, and administration costs.

For the year ended Dec. 31, 2016, sustaining capital expenditures decreased by $21 million compared to 2015, mainly due to lower expenditures on our turnaround outages executed on two of our operated units and deferral of discretionary projects into 2017.

US Coal

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Availability (%) |

| 66.3 |

| 88.1 |

| 87.4 |

|

Adjusted availability (%)(1) |

| 86.2 |

| 88.9 |

| 89.5 |

|

Contract sales volume (GWh) |

| 3,609 |

| 3,535 |

| 2,868 |

|

Merchant sales volume (GWh) |

| 5,488 |

| 4,896 |

| 5,484 |

|

Purchased power (GWh) |

| (3,625 | ) | (3,854 | ) | (3,329 | ) |

Total production (GWh) |

| 5,472 |

| 4,577 |

| 5,023 |

|

Gross installed capacity (MW) |

| 1,340 |

| 1,340 |

| 1,340 |

|

Revenues |

| 437 |

| 380 |

| 432 |

|

Fuel and purchased power |

| 293 |

| 281 |

| 316 |

|

Comparable gross margin |

| 144 |

| 99 |

| 116 |

|

Operations, maintenance, and administration |

| 51 |

| 54 |

| 50 |

|

Restructuring provision |

| - |

| - |

| 1 |

|

Taxes, other than income taxes |

| 4 |

| 4 |

| 3 |

|

Comparable EBITDA |

| 89 |

| 41 |

| 62 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital: |

|

|

|

|

|

|

|

Routine capital |

| 3 |

| 3 |

| 2 |

|

Finance leases |

| 3 |

| 3 |

| 3 |

|

Planned major maintenance |

| 29 |

| 11 |

| 10 |

|

Total sustaining capital expenditures |

| 35 |

| 17 |

| 15 |

|

Productivity capital |

| 3 |

| - |

| - |

|

Total sustaining and productivity capital expenditures |

| 38 |

| 17 |

| 15 |

|

|

|

|

|

|

|

|

|

Provisions |

| - |

| 7 |

| (7 | ) |

Unrealized (gains) losses on risk management activities |

| 10 |

| (13 | ) | 4 |

|

Decommissioning and restoration costs settled |

| 8 |

| 9 |

| 9 |

|

US Coal cash flow |

| 33 |

| 21 |

| 41 |

|

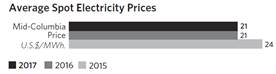

2017

Availability was down compared to 2016 due to a forced outage on Centralia Unit 1 in January. Both Centralia Units were taken out of service in February due to economic dispatch from low prices in the Pacific Northwest market. We performed major maintenance on both units during that time. The lower availability had a nominal impact on our results as our contractual obligations were supplied with less expensive power purchased in the market during the first half of the year.

Production was up 895 GWh in 2017 compared to 2016 due mainly to lower economic dispatching caused by higher prices. The increased generation was partially offset by higher unplanned and planned maintenance.

Comparable EBITDA increased by $48 million compared to 2016 due to increased sales volumes that led to increased margins from higher market prices and higher contract rates. Lower coal transportation costs and the favourable impact of mark-to-market (year-over-year gain of $13 million) on certain forward financial contracts that do not qualify for hedge accounting also positively impacted Comparable EBITDA.

(1) Adjusted for economic dispatching.

Sustaining and productivity capital expenditures for year ended Dec. 31, 2017, increased $21 million compared to 2016 due to planned outages executed during the second quarter of 2017. Productivity capital was invested in the installation of inspection equipment to optimize heat rates on coal and improve air distribution systems. See the Strategic Growth and Corporate Transformation section of this MD&A for further details.

2016

Production was down 446 GWh in 2016 compared to 2015, due mainly to increased economic dispatching in the first half of the year caused by lower prices. We supplied our contractual obligations by buying less expensive power in the market during such periods.

Comparable EBITDA decreased by $19 million compared to 2015 as a result of reduced margins due to lower prices and the unfavourable impact of mark-to-market on certain forward financial contracts that do not qualify for hedge accounting. This was partially offset by lower coal transportation costs and a reduction in our coal impairment charges.

Sustaining capital expenditures for 2016 were $2 million higher compared to 2015, primarily due to higher planned outages.

Canadian Gas

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Availability (%) |

| 91.6 |

| 95.7 |

| 95.6 |

|

Contract production (GWh) |

| 1,504 |

| 2,784 |

| 3,697 |

|

Merchant production (GWh) |

| 244 |

| 288 |

| 1,535 |

|

Total production (GWh) |

| 1,748 |

| 3,072 |

| 5,232 |

|

Gross installed capacity (MW)(1) |

| 953 |

| 1,057 |

| 1,057 |

|

Revenues |

| 430 |

| 470 |

| 486 |

|

Fuel and purchased power |

| 113 |

| 171 |

| 204 |

|

Comparable gross margin |

| 317 |

| 299 |

| 282 |

|

Operations, maintenance, and administration |

| 53 |

| 54 |

| 67 |

|

Restructuring provision |

| - |

| - |

| 1 |

|

Taxes, other than income taxes |

| 1 |

| 1 |

| 3 |

|

Comparable EBITDA |

| 263 |

| 244 |

| 211 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital: |

|

|

|

|

|

|

|

Routine capital |

| 8 |

| 7 |

| 4 |

|

Planned major maintenance |

| 22 |

| 5 |

| 19 |

|

Total sustaining capital expenditures |

| 30 |

| 12 |

| 23 |

|

Productivity capital |

| 2 |

| - |

| - |

|

Total sustaining and productivity capital expenditures |

| 32 |

| 12 |

| 23 |

|

|

|

|

|

|

|

|

|

Provisions |

| 3 |

| (2 | ) | (1 | ) |

Unrealized (gains) losses on risk management activities |

| 7 |

| (2 | ) | (6 | ) |

Decommissioning and restoration costs settled |

| - |

| 1 |

| 1 |

|

Canadian Gas cash flow |

| 221 |

| 235 |

| 194 |

|

(1) 2017 excludes capacity of Mississauga, which was mothballed in early 2017. All years Include production capacity for the Fort Saskatchewan power station, which has been accounted for as a finance lease. During 2015, operational control of our Poplar Creek facility was transferred to Suncor Energy (“Suncor”). We continue to own a portion of the facility and have included our portion as a part of gross capacity measures. Poplar Creek was removed from our availability and production metrics effective Sept. 1, 2015.

2017

Availability decreased approximately four per cent compared to 2016, primarily due to a planned major inspection at our Sarnia plant, the conversion to the peaking plant at Windsor and an unplanned steam turbine outage at Windsor.

Production in 2017 decreased 1,324 GWh compared to 2016, primarily due to changes in contracts at Mississauga and Windsor at the end of 2016.

Comparable EBITDA for 2017 increased by $19 million compared to 2016, primarily due to the settlement with the OEFC of the retroactive adjustment to price indices at Ottawa and Windsor and the positive impact from the temporary shutdown at our Mississauga gas facility, partially offset by unfavourable changes on unrealized mark-to-market positions in gas contracts that do not qualify for hedge accounting and the reduction in earnings from the change to a peaking contract at our Windsor facility. The Mississauga, Ottawa, Windsor and Fort Saskatchewan facilities are owned through our 50.01 per cent interest in TA Cogeneration L.P. (“TA Cogen”).

Sustaining capital for the year ended Dec. 31, 2017, increased $18 million compared to the same period in 2016, primarily due to the planned major inspection at Sarnia and the base to cycling conversion project at Windsor, which was undertaken to increase its flexibility to respond to market prices.

2016

Production for the year decreased 2,160 GWh compared to 2015, primarily due to the restructuring of our contract with Suncor at the Poplar Creek facility in the third quarter of 2015 and higher economic dispatching in Ontario driven by lower prices.

Comparable EBITDA for 2016 increased by $33 million compared to 2015, as a result of a year-over-year change in unrealized mark-to-market on our gas position, cost-efficiency initiatives and favourable pricing in Ontario from our contracts for power and gas. The recontracting of the Poplar Creek facility reduced our OM&A costs by more than $9 million in 2016, compared to 2015.

Sustaining capital totalled $12 million in 2016, a decrease of $11 million. In 2015, we refurbished two engines in Ontario. The change in our Poplar Creek operation also lowered our sustaining capital by approximately $7 million compared to 2015.

Australian Gas

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Availability (%) |

| 93.4 |

| 93.1 |

| 92.4 |

|

Contract production (GWh) |

| 1,803 |

| 1,529 |

| 1,381 |

|

Gross installed capacity (MW)(1) |

| 450 |

| 425 |

| 348 |

|

Revenues |

| 180 |

| 174 |

| 163 |

|

Fuel and purchased power |

| 12 |

| 20 |

| 20 |

|

Comparable gross margin |

| 168 |

| 154 |

| 143 |

|

Operations, maintenance, and administration |

| 31 |

| 25 |

| 21 |

|

Taxes, other than income taxes |

| - |

| 1 |

| - |

|

Comparable EBITDA |

| 137 |

| 128 |

| 122 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital: |

|

|

|

|

|

|

|

Routine capital |

| 9 |

| 3 |

| 4 |

|

Planned major maintenance |

| 1 |

| 11 |

| 4 |

|

Total sustaining capital |

| 10 |

| 14 |

| 8 |

|

|

|

|

|

|

|

|

|

Other |

| - |

| 15 |

| - |

|

Australian Gas cash flow |

| 127 |

| 99 |

| 114 |

|

2017

Production for 2017 increased by 274 GWh compared to 2016 due to the commissioning of our South Hedland Power Station on July 28, 2017, and an increase in customer load, partially offset by the early termination of our lease for our Solomon Power Station in November 2017. As a result of the early termination, we received US$325 million ($417 million) in the fourth quarter of 2017. Due to the nature of our contracts, the increase in customer load did not have a significant financial impact on our results as our contracts are structured as capacity payments with a pass-through of fuel costs.

Comparable EBITDA was up $9 million for 2017 compared to 2016 due to the commissioning of our South Hedland Power Station in July 2017, which was partially offset by the early termination of our lease for our Solomon Power Station in November 2017.

2016

Production for 2016 increased 148 GWh compared to 2015, mostly due to an increase in customer load. Due to the nature of our contracts, the increase did not have a significant financial impact as our contracts are structured as capacity payments with a pass-through of fuel costs.

Comparable EBITDA for 2016 increased by $6 million compared to 2015, mainly due to the addition of capacity payments for the gas conversion project at our Solomon gas plant that was completed in May 2016, as well as the uplift from our natural gas pipeline that was commissioned in March 2015. The change in value of the Australian dollar had limited impact on our comparable EBITDA in 2016.

Sustaining capital increased by $6 million compared to 2015, mainly driven by maintenance projects on two engines in 2016 compared to maintenance projects on only one engine in 2015.

(1) 2016 and 2017 figures include production capacity for the Solomon Power Station, which was accounted for as a finance lease. On Nov. 1, 2017, FMG repurchased the Solomon Power Station. The 2017 figures include capacity for the South Hedland Power Station, which achieved commercial operations on July 28, 2017.

Wind and Solar

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Availability (%) |

| 95.8 |

| 94.9 |

| 95.8 |

|

Contract production (GWh) |

| 2,362 |

| 2,301 |

| 2,146 |

|

Merchant production (GWh) |

| 1,098 |

| 1,212 |

| 1,060 |

|

Total production (GWh) |

| 3,460 |

| 3,513 |

| 3,206 |

|

Gross installed capacity (MW)(1) |

| 1,363 |

| 1,408 |

| 1,424 |

|

Revenues |

| 287 |

| 272 |

| 250 |

|

Fuel and purchased power |

| 17 |

| 18 |

| 19 |

|

Comparable gross margin |

| 270 |

| 254 |

| 231 |

|

Operations, maintenance, and administration |

| 48 |

| 52 |

| 48 |

|

Taxes, other than income taxes |

| 8 |

| 8 |

| 7 |

|

Net other operating income |

| - |

| (1 | ) | - |

|

Comparable EBITDA |

| 214 |

| 195 |

| 176 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital: |

|

|

|

|

|

|

|

Routine capital |

| 1 |

| 2 |

| 1 |

|

Planned major maintenance |

| 10 |

| 11 |

| 12 |

|

Total sustaining capital expenditures |

| 11 |

| 13 |

| 13 |

|

Productivity capital |

| 2 |

| 3 |

| - |

|

Total sustaining and productivity capital |

| 13 |

| 16 |

| 13 |

|

|

|

|

|

|

|

|

|

Provisions |

| - |

| (1 | ) | - |

|

Wind and Solar cash flow |

| 201 |

| 180 |

| 163 |

|

2017

Production for 2017 decreased by 53 GWh compared to 2016 as we sold the Wintering Hills wind facility in the first quarter of 2017. Generation from our other facilities was slightly higher than last year.

Comparable EBITDA for 2017 increased $19 million compared to 2016, primarily driven by higher volumes at contracted facilities, price increases on our contracted assets, higher prices in Alberta on our uncontracted assets and lower costs in our long-term service agreements.

2016

Production for 2016 increased by 307 GWh compared to 2015, mainly due to the full-year contribution from assets acquired during the second half of 2015, partly offset by lower wind resources negatively impacting generation across Canada.

Comparable EBITDA for 2016 increased $19 million compared to 2015, as assets acquired in the second half of 2015 contributed approximately $23 million to the increase. Lower merchant prices in Alberta and lower generation in Canada negatively impacted our EBITDA.

(1) The 2017 figure excludes capacity for the Wintering Hills wind facility, which was sold on March 1, 2017. Our 2015 capacity includes acquisitions completed during the second half of 2015.

Hydro

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Contract production (GWh) |

| 1,866 |

| 1,768 |

| 1,662 |

|

Merchant production (GWh) |

| 82 |

| 88 |

| 86 |

|

Total production (GWh) |

| 1,948 |

| 1,856 |

| 1,748 |

|

Gross installed capacity (MW) |

| 926 |

| 926 |

| 926 |

|

Revenues |

| 121 |

| 126 |

| 116 |

|

Fuel and purchased power |

| 6 |

| 8 |

| 8 |

|

Comparable gross margin |

| 115 |

| 118 |

| 108 |

|

Operations, maintenance, and administration |

| 37 |

| 33 |

| 38 |

|

Taxes, other than income taxes |

| 3 |

| 3 |

| 3 |

|

Net other operating income |

| - |

| - |

| (6 | ) |

Comparable EBITDA |

| 75 |

| 82 |

| 73 |

|

Deduct: |

|

|

|

|

|

|

|

Sustaining capital: |

|

|

|

|

|

|

|

Routine capital, excluding hydro life extension |

| 8 |

| 8 |

| 3 |

|

Hydro life extension |

| - |

| 9 |

| 18 |

|

Planned major maintenance |

| 5 |

| 10 |

| 10 |

|

Total before flood-recovery capital |

| 13 |

| 27 |

| 31 |

|

Flood-recovery capital |

| - |

| 2 |

| 4 |

|

Total sustaining capital expenditures |

| 13 |

| 29 |

| 35 |

|

Productivity capital |

| 1 |

| - |

| - |

|

Total sustaining and productivity capital |

| 14 |

| 29 |

| 35 |

|

|

|

|

|

|

|

|

|

Hydro cash flow |

| 61 |

| 53 |

| 38 |

|

2017

Production for 2017 increased by 92 GWh compared to 2016, primarily due to stronger water resources from spring run-off during the first nine months of 2017 in Alberta.

However, comparable EBITDA for the year ended Dec. 31, 2017 decreased by $7 million compared to 2016, due to higher operations, maintenance, and administration costs and a $3 million positive adjustment relating to a prior year metering issue at one of our facilities recorded in 2016.

Sustaining capital before insurance recoveries for 2017, decreased $16 million compared to 2016 due to lower expenditures on major overhauls. Life extension projects at Bighorn and Brazeau and flood recovery capital spend occurred in 2016.

2016

Production for 2016 increased by 108 GWh over 2015, primarily due to better water resources.

Comparable EBITDA for 2016 increased $9 million compared to 2015. Higher generation contributed to higher revenues. Our financial contracts partially offset lower levels of revenues in the Alberta ancillary market, and we also benefited from cost-reduction initiatives implemented in late 2015 as well as recognized business interruption recoveries in net other operating income (loss).

Sustaining capital (before insurance recoveries) for 2016 decreased $6 million compared to 2015 due to lower expenditures on hydro life extension projects, partially offset by higher expenditures on routine capital.

Energy Marketing

Year ended Dec. 31 |

| 2017 |

| 2016 |

| 2015 |

|

Revenues and comparable gross margin |

| 69 |

| 76 |

| 49 |

|

Operations, maintenance, and administration |

| 24 |

| 24 |

| 15 |

|

Market Surveillance Administrator settlement |

| - |

| - |

| 56 |

|

Comparable EBITDA |

| 45 |

| 52 |

| (22 | ) |

Deduct: |

|

|

|

|

|

|

|

Provisions |

| (2 | ) | 24 |

| (28 | ) |

Unrealized (gains) losses on risk management activities |

| 8 |

| 3 |

| (11 | ) |

Energy Marketing cash flow |

| 39 |

| 25 |

| 17 |

|

2017

Comparable EBITDA results were lower by $7 million compared to 2016, due to unfavourable first quarter of 2017 results impacted by warm winter weather in the Northeast, significant precipitation in the Pacific Northwest and reduced margins from our customer business.

2016

Comparable EBITDA from Energy Marketing increased $74 million compared to 2015 as a result of solid performances in all markets where we are active. During the second quarter of 2015, unexpectedly volatile markets in Alberta and the Pacific Northwest negatively impacted gross margin. Operating, maintenance, and administration costs increased $12 million to $24 million in 2016 compared to 2015, due to increases in share-based incentive compensation and lower charges to other business segments for energy hedging and optimization services. In 2015, we recognized $56 million in net other operating loss relating to the Alberta MSA settlement.

Corporate

2017