Management’s Discussion and Analysis

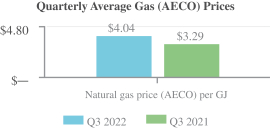

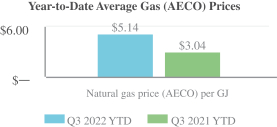

compared to 2021 due to higher natural gas prices and increased natural gas consumption for our converted units in 2022, partially offset by our hedged positions on gas, lower coal costs and no mine depreciation due to the termination of all coal-mining activities in Canada as of Dec. 31, 2021.

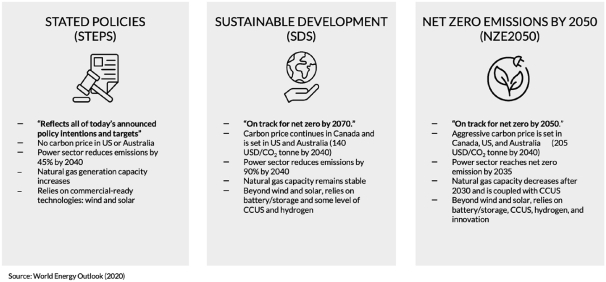

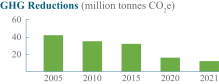

Carbon compliance costs decreased by $24 million and $88 million, respectively, for the three and nine months ended Sept. 30, 2022, compared to the same periods in 2021, primarily due to reductions in greenhouse gas (“GHG”) emissions, lower production and utilization of our compliance credits to settle a portion of the GHG obligation, partially offset by an increase in the carbon price per tonne. Lower GHG emissions were a direct result of operating exclusively on natural gas in Alberta rather than coal, resulting in changes in the fuel mix ratio.

Operations, maintenance and administration (“OM&A”) expenses increased by $5 million for the three months ended Sept. 30, 2022, compared to the same period in 2021. For the three months ended Sept. 30, 2021, the Company recorded a write-down of $5 million on parts and material inventory related to the Highvale mine and coal operations at our converted gas facilities. Excluding the impact of this write-down, OM&A increased by $10 million in 2022, mainly due to higher contractor costs, higher incentive accruals reflecting the Company’s performance, OM&A related to the addition of the Windrise wind and North Carolina Solar facilities and higher general operating expenses.

For the nine months ended Sept. 30, 2022, OM&A decreased by $17 million. For the nine months ended Sept. 30, 2021, the Company recorded a write-down of $30 million on parts and material inventory related to the retirement of the Highvale mine and coal operations at our converted gas facilities. In addition, during the first quarter of 2021, the Company recognized the Canada Emergency Wage Subsidy (“CEWS”) proceeds of $8 million. Excluding the impact of the write-downs and the CEWS funding, OM&A expenses were higher by $5 million in 2022, mainly due to higher contractor costs, higher incentive accruals reflecting Company’s performance, OM&A related to the addition of the Windrise wind and North Carolina Solar facilities and higher general operating expenses.

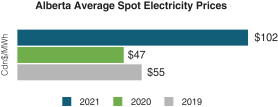

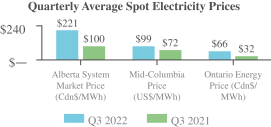

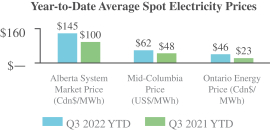

Adjusted EBITDA increased by $153 million for the three months ended Sept. 30, 2022, compared to the same period in 2021, largely due to strong performance from our Alberta Electricity Portfolio, driven primarily by the Hydro and Gas segments as a result of strong weather-adjusted demand and higher power prices. This was partially offset by lower adjusted EBITDA from the retirement of units in the Energy Transition segment, lower production and lower revenues in the Wind and Solar segment, lower gross margin in Energy Marketing and higher corporate expenses.

Adjusted EBITDA increased by $50 million for the nine months ended Sept. 30, 2022, compared to the same period in 2021, largely due to higher adjusted EBITDA from higher production and merchant power pricing in the Hydro segment, continuing strong performance and contribution from the Gas segment for Alberta, incremental production from new facilities, liquidated damages related to turbine availability at the Windrise wind facility, higher environmental credit sales in the Wind and Solar segment and lower carbon compliance costs in both the Gas and Energy Transition segments. This was partially offset from lower production from the Gas and Energy Transition segments, higher fuel and purchased power costs within the Gas segment. On a year-to-date basis, the Energy Marketing segment results were lower but in line with expectations compared with the exceptional results in the prior period. Significant changes in segmented adjusted EBITDA are highlighted in the Segmented Financial Performance and Operating Results section of this MD&A.

Earnings (loss) before income taxes increased by $567 million and $694 million, respectively, for the three and nine months ended Sept. 30, 2022, compared to the same periods in 2021. Net earnings attributable to common shareholders for the three and nine months ended Sept. 30, 2022, increased by $517 million and $665 million, respectively, to net earnings of $61 million and $167 million, respectively, compared to a net loss of $456 million and $498 million, respectively, for the same period in 2021. Net earnings attributable to common

SD-9