Management's Discussion and Analysis

TRANSALTA CORPORATION

First Quarter Report for 2018

This Management’s Discussion and Analysis (“MD&A”) contains forward-looking statements. These statements are based on certain estimates and assumptions and involve risks and uncertainties. Actual results may differ materially. See the Forward-Looking Statements section of this MD&A for additional information.

This MD&A should be read in conjunction with the unaudited interim condensed consolidated financial statements of TransAlta Corporation as at and for the three months ended March 31, 2018 and 2017, and should also be read in conjunction with the audited annual consolidated financial statements and MD&A contained within our 2017 Annual Integrated Report. In this MD&A, unless the context otherwise requires, “we”, “our”, “us”, the “Corporation”, and “TransAlta” refers to TransAlta Corporation and its subsidiaries. Our condensed consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) International Accounting Standards (“IAS”) 34 Interim Financial Reporting for Canadian publicly accountable enterprises as issued by the International Accounting Standards Board (“IASB”) and in effect at March 31, 2018. All tabular amounts in the following discussion are in millions of Canadian dollars unless otherwise noted. This MD&A is dated May 7, 2018. Additional information respecting TransAlta, including its Annual Information Form, is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov, and on our website at www.transalta.com. Information on or connected to our website is not incorporated by reference herein.

Additional IFRS Measures and Non-IFRS Measures

An additional IFRS measure is a line item, heading, or subtotal that is relevant to an understanding of the financial statements but is not a minimum line item mandated under IFRS, or the presentation of a financial measure that is relevant to an understanding of the financial statements but is not presented elsewhere in the financial statements. We have included line items entitled gross margin and operating income in our Condensed Consolidated Statements of Earnings (Loss) for the three months ended March 31, 2018 and 2017. Presenting these line items provides management and investors with a measurement of ongoing operating performance that is readily comparable from period to period.

We evaluate our performance and the performance of our business segments using a variety of measures. Certain of the financial measures discussed in this MD&A are not defined under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures may not be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Comparable EBITDA, FFO, comparable FFO, FCF, and cash flow generated by the business are non-IFRS measures that are presented in this MD&A. See the Reconciliation of Non-IFRS Measures and Discussion of Segmented Comparable Results sections of this MD&A for additional information.

Forward-Looking Statements

This MD&A, the documents incorporated herein by reference, and other reports and filings made with securities regulatory authorities include forward-looking statements or information (collectively referred to herein as “forward-looking statements”) within the meaning of applicable securities legislation. Forward-looking statements are presented for general information purposes only and not as specific investment advice. All forward-looking statements are based on our beliefs as well as assumptions based on information available at the time the assumptions were made and on management’s experience and perception of historical trends, current conditions, and expected future developments, as well as other factors deemed appropriate in the circumstances. Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as "may", "will", "believe", "expect", "anticipate", "intend", "plan", "project", "estimate", "forecast", "foresee", "potential", "enable", "continue", or other comparable terminology. These statements are not guarantees of our future performance and are subject to risks, uncertainties, and other important factors that could cause our actual performance to be materially different from that projected.

In particular, this MD&A contains forward-looking statements pertaining to: our business model and anticipated future financial performance; our success in executing on our growth projects; the timing of the construction and commissioning of projects under development, including the Brazeau Hydro pumped storage Project, the Kent Hills 3 Wind Project, the Pennsylvania and New Hampshire wind projects, and their attendant costs and sources of funding; the benefits of the Brazeau Hydro Pumped Storage project; the pre-tax savings to be delivered by Project Greenlight; spending on growth and sustaining capital and productivity projects, including in connection with Project Greenlight; expectations in terms of the cost of operations, capital spending, and maintenance, and the variability of those costs; purchases of shares under the Normal Course Issue Bid ("NCIB"); the regulatory developments, including the Federal Governments release of regulations for gas-fired generation; the ruling by the Alberta Utilities Commission ("AUC") in respect of line losses including our estimated maximum exposure; the section titled “2018 Financial Outlook”; expectations related to future earnings and cash flow from operating and contracting activities (including estimates of full-year 2018 comparable earnings

TRANSALTA CORPORATION M1

before interest, depreciation and amortization (“EBITDA”), funds from operations (“FFO”) and free cash flow (“FCF”), and expected sustaining capital expenditures; Canadian Coal Fleet availability and capacity factor; contributions to gross margin for Energy Marketing in 2018; significant planned major outages in 2018 and lost production; expected governmental regulatory regimes and legislation, including the Government of Alberta’s intended shift to a capacity market and the expected impacts on us and the timing of the implementation of such regimes and regulations, as well as the cost of complying with resulting regulations and laws; expectations in respect of generation availability, capacity, and production; power prices in Alberta, Ontario, and the Pacific Northwest; expected financing of our capital expenditures; the anticipated financial impact of increased carbon prices, including under the Carbon Competitiveness Incentive Regulation (“CCIR”) in Alberta; our trading strategies and the risk involved in these strategies; the estimated impact of changes in interest rates and the value of the Canadian dollar relative to the US dollar, the Australian dollar, and other currencies in which we do business; our exposure to liquidity risk; expectations in respect of the global economic environment; expected cost savings and payback periods following the implementation of Project Greenlight and productivity initiatives; expectations relating to the performance of TransAlta Renewables Inc.’s (“TransAlta Renewables”) assets; expectations regarding our continued ownership of common shares of TransAlta Renewables; the refinancing of our upcoming debt maturities over the next two years; expectations regarding our de-leveraging strategy; expectations in respect of our community initiatives; impacts of future IFRS standards and the timing of the implementation of such standards; and amendments or interpretations by accounting standard setters prior to initial adoption of those standards.

Factors that may adversely impact our forward-looking statements include risks relating to: fluctuations in market prices and our ability to contract our generation for prices that will provide expected returns; the regulatory and political environments in the jurisdictions in which we operate; increasingly stringent environmental requirements and changes in, or liabilities under, these requirements; ability to compete effectively in the anticipated Alberta capacity market; changes in general economic conditions, including interest rates; operational risks involving our facilities, including unplanned outages at such facilities; growth, whether through acquisition or greenfield development; unanticipated operating conditions; disruptions in the transmission and distribution of electricity; the effects of weather; disruptions in the source of fuels, water, sun, or wind required to operate our facilities; natural or man-made disasters; physical risks related to climate change; the threat of terrorism and cyberattacks and our ability to manage such attacks; equipment failure and our ability to carry out or have completed the repairs in a cost-effective or timely manner; commodity risk management; industry risk and competition; fluctuations in the value of foreign currencies and foreign political risks; the need for additional financing and the ability to access financing at a reasonable cost and on reasonable terms; our ability to fund our growth projects; our ability to maintain our investment grade credit ratings; structural subordination of securities; counterparty credit risk; our ability to recover our losses through our insurance coverage; our provision for income taxes; outcomes of legal, regulatory, and contractual proceedings involving the Corporation including those with Fortescue Metals Group LTd. ("FMG"); outcomes of investigations and disputes; reliance on key personnel; labour relations matters; risks associated with development projects and acquisitions, including delays or changes in costs in the construction and commissioning of our two new US wind projects and the Kent Hills 3 wind project; and the maintenance or adoption of enabling regulatory frameworks or the satisfactory receipt of applicable regulatory approvals for existing and proposed operations and growth initiatives, including as it pertains to coal-to-gas conversions.

The foregoing risk factors, among others, are described in further detail in the Governance and Risk Management section of our MD&A for our 2017 annual consolidated financial statements and under the heading “Risk Factors” in our 2018 Annual Information Form.

Readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events, or otherwise, except as required by applicable laws. In light of these risks, uncertainties, and assumptions, the forward-looking events might occur to a different extent or at a different time than we have described, or might not occur. We cannot assure that projected results or events will be achieved.

M2 TRANSALTA CORPORATION

Highlights

| 3 months ended March 31 | 2018 | 2017 | ||

| Revenues | 588 | 578 | ||

| Net earnings (loss) attributable to common shareholders | 65 | — | ||

| Cash flow from operating activities | 425 | 281 | ||

Comparable EBITDA(1, 2) | 416 | 274 | ||

FFO(1, 2) | 318 | 202 | ||

FCF(1, 2) | 238 | 96 | ||

| Net earnings (loss) per share attributable to common shareholders, basic and diluted | 0.23 | — | ||

FFO per share(1, 2) | 1.10 | 0.70 | ||

FCF per share(1, 2) | 0.83 | 0.33 | ||

| Dividends declared per common share | 0.04 | — | ||

| As at | March 31, 2018 | Dec. 31, 2017 | ||

| Total assets | 9,963 | 10,304 | ||

Total consolidated net debt(3) | 3,081 | 3,363 | ||

| Total long-term liabilities | 4,638 | 4,311 | ||

(1) These items are not defined under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Reconciliation of Non-IFRS Measures section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS.

(2) During the fourth quarter of 2017, we revised our approach to reporting adjustments to arrive at FFO, mainly to better represent FFO as a cash metric. Previously, FFO was adjusted to include, exclude, or to modify the timing of cash impacts related to adjustments made in arriving at comparable EBITDA. As a result, comparable EBITDA, FFO, and FCF for 2017 has been revised accordingly.

(3) Total consolidated net debt includes long-term debt including current portion, amounts due under credit facilities, tax equity, and finance lease obligations, net of available cash and the fair value of economic hedging instruments on debt. See the table in the Capital Structure section of this MD&A for more details on the composition of net debt.

Our performance during the first quarter was similar to last year after adjusting for the Sundance B and C PPA termination payment in 2018 and the settlement of a PPA indexation dispute with the Ontario Electrical Financial Corporation ("OEFC") in 2017. Availability from our coal generating assets in Alberta was solid during the quarter at 90.5 per cent compared to last year of 83.7 per cent. Prices in Alberta increased almost 60 per cent to $35/MWh to reflect the impact of carbon taxes paid by certain generators. During the first quarter of 2018, our results included $157 million relating to the early termination of the Sundance B and C PPA, to replace future capacity payments we would have received over the next 3 years. We are disputing the amount received from the Balancing Pool as we believe an additional $56 million is due to us under the terms of the PPAs. Last year's results included $17 million relating to our share of the settlement of a prior years indexation dispute with the OEFC. Excluding these unusual payments in 2018 and 2017, our FCF for the quarter would have been $81 million ($0.28 per share) and $79 million ($0.27 per share), respectively.

In January, we permanently shut down Sundance Unit 1 and mothballed Sundance Unit 2 following the scheduled expiry of the Power Purchase Arrangements with the Balancing Pool for these two units, reducing our installed capacity from our Canadian Coal segment by 560 MW or 14 per cent. Last year, comparable EBITDA generated by these two units totalled $12 million.

Net earnings attributable to common shares totalled $65 million during the quarter compared to nil last year, due mostly to the positive contribution of the $157 million ($115 million after-tax) Sundance B and C PPA termination payment.

Segmented Cash Flow Generated by the Business

| 3 months ended March 31 | 2018 | 2017 | ||||

| Segmented cash inflow (outflow) | ||||||

Canadian Coal(1) | 208 | 56 | ||||

| US Coal | 18 | 3 | ||||

Canadian Gas(2) | 60 | 83 | ||||

| Australian Gas | 31 | 30 | ||||

| Wind and Solar | 65 | 65 | ||||

| Hydro | 16 | 12 | ||||

| Generation cash inflow | 398 | 249 | ||||

| Energy Marketing | (18 | ) | 5 | |||

| Corporate | (25 | ) | (26 | ) | ||

| Total comparable cash inflow | 355 | 228 | ||||

(1) Includes $157 million received from the Balancing Pool for the early termination of Sundance B and C PPAs in the first quarter of 2018.

(2) Includes $17 million (our share) from the OEFC to settle an relating to the settlement of a prior years indexation dispute.

TRANSALTA CORPORATION M3

Segmented cash flows generated by the business measures the net cash generated by each of our segments after sustaining and productivity capital expenditures, reclamation costs, and provisions. It also excludes non-cash mark-to-market gains or losses. This is the cash flows available to pay our interest and cash taxes, distributions to our non-controlling partners and dividends to our preferred shareholders, grow the business, pay down debt and return capital to our shareholders. Cash flow generated by the business totalled $355 million during the first quarter of 2018, up $127 million compared to the same quarter in 2017. Despite higher availability in the first quarter, and higher prices, Canadian Coal's cash flow, excluding the termination payment, was down $5 million from 2017 due to the shutdown of the Sundance 1 and 2 units and higher coal costs. US coal improved by $15 million over 2017 due to lower purchased power costs and better rail costs. Canadian Gas returned to normal cash flow levels as 2017 recorded a one time adjustment of $17 million (our share, net of non-controlling interests) due to a payment from the OEFC for prior periods. Hydro's cash flow was up by $4 million due primarily to stronger pricing of ancillary services. Energy Marketing's cashflows were $23 million below 2017 due to the settlement in the quarter, of contracts with unrealized losses at Dec. 31, 2017. Overall, after accounting for the OEFC payment in 2017 and the Sundance B and C termination payment in 2018, cash flows from the businesses were $4 million higher during the first quarter of 2018 compared to 2017.

Significant Events

Our strategic focus continues to be reducing our corporate debt, improving our operating performance, and progressing our transition to clean power generation. We made the following progress throughout the period:

| ▪ | On Feb. 2, 2018, TransAlta Renewables entered into an arrangement to acquire two construction-ready wind projects in the Northeast United States. The wind development projects consist of: (i) a 90 Megawatt ("MW") project located in Pennsylvania which has a 15-year PPA and (ii) a 29 MW project located in New Hampshire with two 20-year PPAs (the "US Wind Projects"). All three counterparties have Standard & Poor's credit ratings of A+ or better. See the Significant and Subsequent Events section of this MD&A for further details. |

| ▪ | On March 15, 2018, we early redeemed our outstanding 6.650 per cent US $500 million Senior Notes due May 15, 2018. The redemption price for the Notes was approximately $617 million (US$516 million). Repayment of the US Senior notes were funded by cash on hand and our credit facility. See the Significant and Subsequent Events section of this MD&A for further details. |

| ▪ | During the quarter, we purchased and cancelled 374,900 Common Shares at an average price of $6.97 per Common Share through our NCIB program. See the Significant and Subsequent Events section of this MD&A for further details. |

| ▪ | On March 31, 2018, we received approximately $157 million in compensation for the termination of the Sundance B and C PPAs from the Balancing Pool. See the Significant and Subsequent Events section of this MD&A for further details. |

| ▪ | We permanently shutdown Sundance Unit 1 and mothballed Sundance Unit 2 on Jan. 1, 2018. We mothballed Sundance Unit 3 and Sundance Unit 5 on April 1, 2018. |

| ▪ | Donald Tremblay, Chief Financial Officer ("CFO") has chosen to leave the Corporation effective May 9, 2018 and will be returning to eastern Canada to be closer to his family. TransAlta has commenced a recruitment process for a new CFO. Brett Gellner, Chief Investment Officer, will act as Interim CFO, in addition to his current role, during the interim period. |

Adjusted Availability and Production

Adjusted availability for the three months ended March 31, 2018 was 93.9 per cent compared to 88.5 per cent for the same period in 2017. Canadian Coal, US Coal, and Australian Gas were all up compared to last year. Lower unplanned outages at Canadian and US Coal were the main cause of the increase in those segments.

Production for the three months ended March 31, 2018 was 7,171 gigawatt hours ("GWh"), compared to 9,051 GWh for the same period in 2017, mainly due to lower production at Canadian Coal due to higher paid curtailments on contracted assets, the retirement of Sundance Unit 1, and mothballing of Sundance Unit 2.

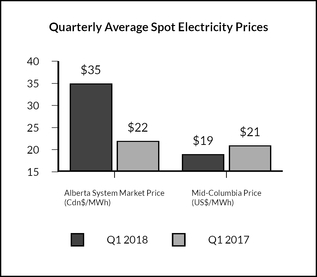

Electricity Prices

The average spot electricity prices in Alberta for the three months ended March 31, 2018 increased approximately 60 per cent compared to 2017 due to higher environmental levies and compliance costs which have increased the marginal cost to producers and tighter supply in the market. Natural gas prices were lower in the Pacific Northwest compared to last year and there were lower electricity loads due to warmer temperatures, which depressed electricity prices in the Pacific Northwest.

M4 TRANSALTA CORPORATION

Discussion of Consolidated Financial Results

We evaluate our performance and the performance of our business segments using a variety of measures. Comparable figures are not defined under IFRS. Those discussed below, and elsewhere in this MD&A, are not defined under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures are not necessarily comparable to a similarly titled measure of another company. Each business segment assumes responsibility for its operating results measured to comparable EBITDA and cash flows generated by the business. Gross margin is also a useful measure as it provides management and investors with a measurement of operating performance that is readily comparable from period to period.

Comparable EBITDA

EBITDA is a widely adopted valuation metric and an important metric for management that represents our core business profitability. Interest, taxes, and depreciation and amortization are not included, as differences in accounting treatments may distort our core business results. In addition, we reclassify certain transactions to facilitate the discussion on the performance of our business:

| (i) | Certain assets we own in Canada and Australia are fully contracted and recorded as finance leases under IFRS. We believe it is more appropriate to reflect the payments we receive under the contracts as a capacity payment in our revenues instead of as finance lease income and a decrease in finance lease receivables. We depreciate these assets over their expected lives; |

| (ii) | We also reclassify the depreciation on our mining equipment from fuel and purchased power to reflect the actual cash cost of our business in our comparable EBITDA; |

| (iii) | In December 2016, we agreed to terminate our existing arrangement with the Independent Electricity System Operator (“IESO”) relating to our Mississauga cogeneration facility in Ontario and entered into a new Non-Utility Generator (“NUG”) Enhanced Dispatch Contract (the “NUG Contract”) effective Jan. 1, 2017. Under the new NUG Contract, we receive fixed monthly payments until Dec. 31, 2018 with no delivery obligations. Under IFRS, for our reported results in 2016, as a result of the NUG Contract, we recognized a receivable of $207 million (discounted), a pre-tax gain of approximately $191 million net of costs to mothball the units, and accelerated depreciation of $46 million. In 2017 and 2018, on a comparable basis, we record the payments we receive as revenues as a proxy for operating income, and continue to depreciate the facility until Dec. 31, 2018; and |

| (iv) | On commissioning the South Hedland Power Station, we prepaid approximately $74 million of electricity transmission and distribution costs. Interest income is recorded on the prepaid funds. We reclassify this interest income as a reduction in the transmission and distribution costs expensed each period to reflect the net cost to the business. |

A reconciliation of net earnings (loss) attributable to common shareholders to comparable EBITDA results is set out below:

| 3 months ended March 31 | 2018 | 2017(1) | ||||

| Net earnings attributable to common shareholders | 65 | — | ||||

| Net earnings attributable to non-controlling interests | 28 | 32 | ||||

| Preferred share dividends | 10 | — | ||||

| Net earnings (loss) | 103 | 32 | ||||

| Adjustments to reconcile net income to comparable EBITDA | ||||||

| Depreciation and amortization | 130 | 143 | ||||

| Foreign exchange loss | 2 | 1 | ||||

| Net interest expense | 68 | 62 | ||||

| Income tax expense (recovery) | 37 | (17 | ) | |||

| Comparable reclassifications | ||||||

| Decrease in finance lease receivables | 15 | 15 | ||||

| Mine depreciation included in fuel cost | 31 | 17 | ||||

| Australian interest income | 1 | — | ||||

| Adjustments to earnings to arrive at comparable EBITDA | ||||||

Impacts associated with Mississauga recontracting(2) | 29 | 21 | ||||

| Comparable EBITDA | 416 | 274 | ||||

(1) During the fourth quarter of 2017, we revised the way in which comparable EBITDA is reconciled to net earnings. Accordingly, 2017 results have been revised.

(2) Impacts associated with Mississauga recontracting for the three months ended March 31, 2018, are as follows: revenue $29 million (2017 - $27 million), fuel and purchased power and de-designated hedges nil (2017 - $4 million), and operations, maintenance, and administration nil (2017 - $2 million).

Net earnings and comparable EBITDA for the first quarter of 2018 include the $157 million ($115 million after-tax) Sundance B and C PPAs early termination payment from the Balancing Pool. Last year's net earnings and comparable EBITDA included the $34 million settlement with the OEFC ($12 million after-tax and non-controlling interests).

TRANSALTA CORPORATION M5

Funds from Operations and Free Cash Flow

FFO is an important metric as it provides a proxy for cash generated from operating activities before changes in working capital, and provides the ability to evaluate cash flow trends in comparison with results from prior periods. FCF is an important metric as it represents the amount of cash that is available to invest in growth initiatives, make scheduled principal repayments on debt, repay maturing debt, pay common share dividends, or repurchase common shares. Changes in working capital are excluded so FFO and FCF are not distorted by changes that we consider temporary in nature, reflecting, among other things, the impact of seasonal factors and timing of receipts and payments. FFO per share and FCF per share are calculated using the weighted average number of common shares outstanding during the period.

The table below reconciles our cash flow from operating activities to our FFO and FCF.

| 3 months ended March 31 | 2018 | 2017 | ||||

| Cash flow from operating activities | 425 | 281 | ||||

| Change in non-cash operating working capital balances | (123 | ) | (95 | ) | ||

| Cash flow from operations before changes in working capital | 302 | 186 | ||||

| Adjustment: | ||||||

| Decrease in finance lease receivable | 15 | 15 | ||||

| Other | 1 | 1 | ||||

| FFO | 318 | 202 | ||||

| Deduct: | ||||||

| Sustaining capital | (24 | ) | (46 | ) | ||

| Productivity capital | (4 | ) | (2 | ) | ||

| Dividends paid on preferred shares | (10 | ) | (10 | ) | ||

| Distributions paid to subsidiaries' non-controlling interests | (41 | ) | (47 | ) | ||

| Other | (1 | ) | (1 | ) | ||

| FCF | 238 | 96 | ||||

| Weighted average number of common shares outstanding in the year | 288 | 288 | ||||

| FFO per share | 1.10 | 0.70 | ||||

| FCF per share | 0.83 | 0.33 | ||||

The increase in FCF was driven primarily by the Sundance B and C termination payment of $157 million and lower sustaining capital expenditures.

The table below bridges our comparable EBITDA to our FFO and FCF.

| 3 months ended March 31 | 2018 | 2017 | ||||

| Comparable EBITDA | 416 | 274 | ||||

| Interest expense | (53 | ) | (55 | ) | ||

| Provisions | 5 | 1 | ||||

| Unrealized gains (losses) from risk management activities | (31 | ) | 5 | |||

| Current income tax expense | (9 | ) | (6 | ) | ||

| Realized foreign exchange gain (loss) | 3 | 1 | ||||

| Decommissioning and restoration costs settled | (7 | ) | (4 | ) | ||

| Other cash and non-cash items | (6 | ) | (14 | ) | ||

| FFO | 318 | 202 | ||||

| Deduct: | ||||||

| Sustaining capital | (24 | ) | (46 | ) | ||

| Productivity capital | (4 | ) | (2 | ) | ||

| Dividends paid on preferred shares | (10 | ) | (10 | ) | ||

| Distributions paid to subsidiaries' non-controlling interests | (41 | ) | (47 | ) | ||

| Other | (1 | ) | (1 | ) | ||

| FCF | 238 | 96 | ||||

TRANSALTA CORPORATION M6

Segmented Comparable Results

Canadian Coal

| 3 months ended March 31 | 2018 | 2017 | ||

| Availability (%) | 90.5 | 83.7 | ||

| Contract production (GWh) | 3,300 | 4,971 | ||

| Merchant production (GWh) | 909 | 1,003 | ||

| Total production (GWh) | 4,209 | 5,974 | ||

Gross installed capacity (MW)(1) | 3,231 | 3,791 | ||

| Revenues | 269 | 250 | ||

| Fuel and purchased power | 165 | 122 | ||

| Comparable gross margin | 104 | 128 | ||

| Operations, maintenance, and administration | 47 | 44 | ||

| Taxes, other than income taxes | 3 | 3 | ||

| Net other operating income | (168 | ) | (10 | ) |

| Comparable EBITDA | 222 | 91 | ||

| Deduct: | ||||

| Sustaining capital: | ||||

| Routine capital | 4 | 5 | ||

| Mine capital | 2 | 3 | ||

| Finance leases | 3 | 4 | ||

| Planned major maintenance | — | 17 | ||

| Total sustaining capital expenditures | 9 | 29 | ||

| Productivity capital | 1 | 1 | ||

| Total sustaining and productivity capital expenditures | 10 | 30 | ||

| Provisions | (3 | ) | (1 | ) |

| Unrealized gains (losses) on risk management activities | 1 | 4 | ||

| Decommissioning and restoration costs settled | 6 | 2 | ||

| Canadian Coal cash flow | 208 | 56 | ||

(1) On Jan. 1, 2018, 560 MW Sundance Units 1 and 2 were shut down and mothballed, respectively.

Availability for the first quarter of 2018 improved compared to 2017 mainly due to no planned outages in the quarter compared to one planned outage in first quarter of 2017 relating to our Sundance Unit 6 and much lower levels of unplanned outages.

Production for the three months ended March 31, 2018 decreased 1,765 GWh compared to 2017, despite higher availability, due to the retirement of Sundance Unit 1 and the mothballing of Sundance Unit 2 as well as higher paid curtailments on units under PPAs.

Revenues and Fuel and purchased power both increased due to higher environmental compliance costs, which are mostly passed through to the PPA customer and higher mining costs. In both cases this was expected. The increase in revenues was due to higher pass through and the higher Alberta power prices due to increased environmental compliance costs.

Comparable EBITDA for the three months ended March 31, 2018 excluding the Sundance B and C PPA termination payment decreased $26 million compared to 2017. Gross margin was negatively impacted by the scheduled termination of the Sundance A PPA. The reduction of overall capacity due to the retirement of Sundance Unit 1 and the mothballing of Sundance Unit 2 and higher coal costs.

For the first quarter of 2018, sustaining and productivity capital expenditures decreased by $20 million compared to 2017, mainly due to lower planned outage expenditures. In 2017, one planned outage was performed on Sundance Unit 6, while during the first quarter of 2018 there were no planned major outages.

TRANSALTA CORPORATION M7

US Coal

| 3 months ended March 31 | 2018 | 2017 | ||

| Availability (%) | 99.7 | 54.7 | ||

Adjusted availability (%)(1) | 99.7 | 86.7 | ||

| Contract sales (GWh) | 821 | 905 | ||

| Merchant sales (GWh) | 749 | 959 | ||

| Purchased power (GWh) | (852 | ) | (1,052 | ) |

| Total production (GWh) | 718 | 812 | ||

| Gross installed capacity (MW) | 1,340 | 1,340 | ||

| Revenues | 87 | 88 | ||

| Fuel and purchased power | 44 | 64 | ||

| Comparable gross margin | 43 | 24 | ||

| Operations, maintenance, and administration | 15 | 13 | ||

| Taxes, other than income taxes | 1 | 1 | ||

| Comparable EBITDA | 27 | 10 | ||

| Deduct: | ||||

| Sustaining capital: | ||||

| Finance leases | 1 | 1 | ||

| Planned major maintenance | 5 | 5 | ||

| Total sustaining capital expenditures | 6 | 6 | ||

| Productivity capital | — | 1 | ||

| Total sustaining and productivity capital expenditures | 6 | 7 | ||

| Unrealized gains (losses) on risk management activities | 2 | (2 | ) | |

| Decommissioning and restoration costs settled | 1 | 2 | ||

| US Coal cash flow | 18 | 3 | ||

(1) Adjusted for economic dispatching.

Availability for the three months ended March 31, 2018 was up compared to 2017 as last year's performance was impacted by the forced outage on Unit 1 in January. In 2017 and 2018, both Units 1 and 2 commenced economic dispatching in February as a result of seasonally lower prices in the Pacific Northwest. This impacted our production for the quarter.

Contract sales are down compared to last year due to a 32 MW contract that ended in 2017.

Comparable EBITDA increased by $17 million compared to 2017, mainly due to purchasing power at lower power prices to fulfill our contract and hedge obligations and favourable impacts of mark-to-market on certain forward financial contracts that do not qualify for hedge accounting. Also positively impacting our comparable EBITDA is the reduction of our coal costs following renegotiation of our railway contracts with suppliers. Part of our fuel cost is now linked to natural gas prices, making the plant more competitive in a lower priced environment.

TRANSALTA CORPORATION M8

Canadian Gas

| 3 months ended March 31 | 2018 | 2017 | ||

| Availability (%) | 98.7 | 100.0 | ||

| Contract production (GWh) | 414 | 393 | ||

| Merchant production (GWh) | 39 | 44 | ||

| Total production (GWh) | 453 | 437 | ||

| Gross installed capacity (MW) | 953 | 953 | ||

| Revenues | 108 | 146 | ||

| Fuel and purchased power | 29 | 43 | ||

| Comparable gross margin | 79 | 103 | ||

| Operations, maintenance, and administration | 13 | 14 | ||

| Taxes, other than income taxes | 1 | 1 | ||

| Comparable EBITDA | 65 | 88 | ||

| Deduct: | ||||

| Sustaining capital: | ||||

| Routine capital | 1 | — | ||

| Planned major maintenance | 1 | 3 | ||

| Total sustaining capital expenditures | 2 | 3 | ||

| Productivity capital | 1 | — | ||

| Total sustaining and productivity capital expenditures | 3 | 3 | ||

| Provisions | (2 | ) | 1 | |

| Unrealized gains (losses) on risk management activities | 4 | 1 | ||

| Canadian Gas cash flow | 60 | 83 | ||

Availability was down this quarter due to unplanned outages at Ottawa and seasonal and equipment derates at Sarnia.

Production for the first quarter of 2018 increased 16 GWh compared to 2017, mainly due to increased contract production at Fort Saskatchewan due to higher customer demand, partially offset by lower merchant production at Sarnia due to market conditions.

Comparable EBITDA for the first quarter of 2018 decreased by $23 million compared to 2017 despite the positive impact from the Mississauga recontracting and cost reduction initiatives, offset by the retroactive contract indexation dispute settlement received in 2017 ($34 million). The Mississauga, Ottawa, Windsor, and our 60 per cent share of Fort Saskatchewan, generating facilities are owned through our 51 per cent interest in TA Cogen.

Australian Gas

| 3 months ended March 31 | 2018 | 2017 | ||

| Availability (%) | 91.7 | 89.9 | ||

| Contract production (GWh) | 440 | 398 | ||

| Gross installed capacity (MW) | 450 | 425 | ||

| Revenues | 41 | 40 | ||

| Fuel and purchased power | 1 | 2 | ||

| Comparable gross margin | 40 | 38 | ||

| Operations, maintenance, and administration | 9 | 7 | ||

| Comparable EBITDA | 31 | 31 | ||

| Deduct: | ||||

| Sustaining capital: | ||||

| Planned major maintenance | — | 1 | ||

| Australian Gas cash flow | 31 | 30 | ||

TRANSALTA CORPORATION M9

Production for the first quarter of 2018 increased 42 GWh compared to 2017, due mostly to the commissioning of the South Hedland Power Station in July 2017, offset by the termination of the Solomon Power Station contract. Our contracts in Australia are capacity contracts, and our results are not directly impacted by generation.

Comparable EBITDA for the three months ended March 31, 2018 was in line with the same period in 2017. Gross margin from South Hedland was largely offset by the loss of gross margin from the Solomon Power Station contract.

Wind and Solar

| 3 months ended March 31 | 2018 | 2017 | ||

| Availability (%) | 94.5 | 96.4 | ||

| Contract production (GWh) | 749 | 742 | ||

| Merchant production (GWh) | 279 | 313 | ||

| Total production (GWh) | 1,028 | 1,055 | ||

| Gross installed capacity (MW) | 1,363 | 1,363 | ||

| Revenues | 86 | 87 | ||

| Fuel and purchased power | 6 | 5 | ||

| Comparable gross margin | 80 | 82 | ||

| Operations, maintenance, and administration | 13 | 12 | ||

| Taxes, other than income taxes | 2 | 2 | ||

| Comparable EBITDA | 65 | 68 | ||

| Deduct: | ||||

| Sustaining capital: | ||||

| Planned major maintenance | 3 | 3 | ||

| Unrealized gains (losses) on risk management activities | (3 | ) | — | |

| Wind and Solar cash flow | 65 | 65 | ||

Production for the first quarter of 2018 decreased by 27 GWh compared to 2017, mainly due to the sale of the Wintering Hills merchant facility on March 1, 2017. Wind generation in eastern Canada and in the US was in line with last year.

Comparable EBITDA for the first quarter of 2018 was down $3 million compared to 2017 mainly due to unrealized mark-to-market losses recognized this period.

TRANSALTA CORPORATION M10

Hydro

| 3 months ended March 31 | 2018 | 2017 | ||

| Contract production (GWh) | 318 | 367 | ||

| Merchant production (GWh) | 5 | 8 | ||

| Total production (GWh) | 323 | 375 | ||

| Gross installed capacity (MW) | 926 | 926 | ||

| Revenues | 27 | 24 | ||

| Fuel and purchased power | 1 | 1 | ||

| Comparable gross margin | 26 | 23 | ||

| Operations, maintenance, and administration | 8 | 8 | ||

| Taxes, other than income taxes | 1 | 1 | ||

| Comparable EBITDA | 17 | 14 | ||

| Deduct: | ||||

| Sustaining capital: | ||||

| Routine capital | — | 1 | ||

| Planned major maintenance | 1 | 1 | ||

| Total sustaining capital expenditures | 1 | 2 | ||

| Hydro cash flow | 16 | 12 | ||

Production for the first quarter of 2018 decreased by 52 GWh compared to 2017, primarily due to lower water resources.

Comparable EBITDA for the first quarter of 2018 increased by $3 million compared to 2017, primarily due to increase in revenues from higher pricing of Ancillary Services, which more than offset the lower generation.

Energy Marketing

| 3 months ended March 31 | 2018 | 2017 | ||

| Revenues and gross margin | 17 | 1 | ||

| Operations, maintenance, and administration | 8 | 5 | ||

| Comparable EBITDA | 9 | (4 | ) | |

| Deduct: | ||||

| Provisions | — | (1 | ) | |

| Unrealized gains (losses) on risk management activities | 27 | (8 | ) | |

| Energy Marketing cash flow | (18 | ) | 5 | |

For the three months ended March 31, 2018, comparable EBITDA returned to a normal level and increased by $13 million compared to last year. Cashflows were $23 million below 2017 due to the settlement in the quarter, of contracts with unrealized losses at Dec. 31, 2017.

Corporate

Our Corporate overhead costs of $20 million were $4 million lower in the first quarter of 2018 compared to 2017 due to lower incentive payments.

Key Financial Ratios

The methodologies and ratios used by rating agencies to assess our credit ratings are not publicly disclosed. We have developed our own definitions of ratios and targets to help evaluate the strength of our financial position. These metrics and ratios are not defined under IFRS, and may not be comparable to those used by other entities or by rating agencies. We are focused on strengthening our financial position and flexibility and aim to meet all our target ranges by 2018.

TRANSALTA CORPORATION M11

FFO Before Interest to Adjusted Interest Coverage

| As at | March 31, 2018(1) | Dec. 31, 2017 | |||

| FFO | 920 | 804 | |||

| Less: Early termination payment received on Sundance B and C PPAs | (157 | ) | — | ||

| Add: Interest on debt and finance leases, net of interest income and capitalized interest | 203 | 205 | |||

| FFO before interest | 966 | 1,009 | |||

| Interest on debt and finance leases, net of interest income | 209 | 214 | |||

| Add: 50 per cent of dividends paid on preferred shares | 20 | 20 | |||

| Adjusted interest | 229 | 234 | |||

| FFO before interest to adjusted interest coverage (times) | 4.2 | 4.3 | |||

(1) Last 12 months. Our target range for FFO in 2018 is $775 million to $850 million. See the 2018 Financial Outlook for further details.

The ratio was comparable to 2017. Our target for FFO before interest to adjusted interest coverage is four to five times, and we expect this metric to improve as we execute on our deleveraging plan.

Adjusted Funds from Operations to Adjusted Net Debt

| As at | March 31, 2018 | Dec. 31, 2017 | |||

FFO(1,2) | 920 | 804 | |||

| Less: Early termination payment received on Sundance B and C PPAs | (157 | ) | — | ||

| Less: 50 per cent of dividends paid on preferred shares | (20 | ) | (20 | ) | |

| Adjusted FFO | 743 | 784 | |||

Period-end long-term debt(3) | 3,411 | 3,707 | |||

| Less: Cash and cash equivalents | (329 | ) | (314 | ) | |

| Add: 50 per cent of issued preferred shares | 471 | 471 | |||

Fair value asset of hedging instruments on debt(4) | (1 | ) | (30 | ) | |

| Adjusted net debt | 3,552 | 3,834 | |||

| Adjusted FFO to adjusted net debt (%) | 20.9 | 20.4 | |||

(1) Last 12 months.

(2) Our target range for FFO in 2018 is $750 million to $800 million. See the 2018 Financial Outlook for further details.

(3) Includes finance lease obligations and tax equity financing.

(4) Included in risk management assets and/or liabilities on the condensed consolidated financial statements as at March 31, 2018 and Dec. 31, 2017.

Our adjusted FFO to adjusted net debt was comparable to 2017. We expect this metric to improve towards our targeted level of 20 to 25 per cent as we execute on our deleveraging plan.

Adjusted Net Debt to Comparable EBITDA

| As at | March 31, 2018 | Dec. 31, 2017 | |||

Period-end long-term debt(1) | 3,411 | 3,707 | |||

| Less: Cash and cash equivalents | (329 | ) | (314 | ) | |

| Add: 50 per cent of issued preferred shares | 471 | 471 | |||

Fair value asset of hedging instruments on debt(2) | (1 | ) | (30 | ) | |

| Adjusted net debt | 3,552 | 3,834 | |||

Comparable EBITDA(3) | 1,204 | 1,062 | |||

| Less: Early termination payment received on Sundance B and C PPAs | (157 | ) | — | ||

| Adjusted comparable EBITDA | 1,047 | 1,062 | |||

| Adjusted net debt to comparable EBITDA (times) | 3.4 | 3.6 | |||

(1) Includes finance lease obligations and tax equity financing.

(2) Included in risk management assets and/or liabilities on the condensed consolidated financial statements as at March 31, 2018 and Dec. 31, 2017.

(3) Last 12 months.

Our adjusted net debt to comparable EBITDA ratio improved compared to 2017, mainly due to the significant reduction in our net debt during the quarter. Our target for adjusted net debt to comparable EBITDA is 3.0 to 3.5 times.

TRANSALTA CORPORATION M12

Strategic Growth and Corporate Transformation

Acquisition of Two US Wind Projects

On Feb. 20, 2018, TransAlta Renewables announced that it had entered into an arrangement to acquire two wind construction-ready projects in the United States. Construction on one of the two projects has started. The two projects are fully contracted with credit worthy counterparties. See the Significant and Subsequent Events section of this MD&A for further details.

Kent Hills Wind Project

During 2017, TransAlta Renewables entered into a long-term contract with the New Brunswick Power Corporation (“NB Power”) for the sale of all power generated by an additional 17.25 MW of capacity from the Kent Hills wind project. The additional 17.25 MW at Kent Hills is an expansion of our existing Kent Hills wind farms, increasing the total operating capacity of the Kent Hills wind farms to approximately 167 MW. We expect to begin the construction during the second quarter of 2018.

Brazeau Hydro Pumped Storage

The Brazeau Hydro Pumped Storage project will generate and support clean electricity in the Province of Alberta. It will store water that can be used to both generate power when it is needed and store excess power supply when demand is low. The Brazeau Hydro Pumped Storage project is a focus for us, as it has existing infrastructure that reduces the cost and environmental footprint of the project, is situated close to existing transmission infrastructure, and allows for increased renewables development by balancing intermittent generation from wind and solar.

We are currently working to secure a path that will advance our investment in the project and secure a long-term contract for the project. The Brazeau Hydro Pumped Storage project is expected to have new capacity ranging between 400 MW to 900 MW, bringing the total Brazeau facility to 755 to 1,255 MW, post-completion. We estimate an investment in the range of $1.5 billion to $2.7 billion and expect construction to begin upon receipt of a long-term contract and regulatory approvals, between 2020 and 2021, with operations to commence in 2025. During the first quarter of 2018, we invested approximately $1 million to advance the environmental study, work with stakeholders and execute geotechnical work to help further our design and construction phase.

Project Greenlight

Our transformation project is a top priority for us. Driven by engagement from all employees, the intent is to deliver ambitious improvements in every part of the Corporation. Initiatives include increasing revenue, improving generation, reducing operating and maintenance costs, reducing overhead costs and financing costs, and optimizing our capital spend. We expect Project Greenlight to deliver sustainable pre-tax savings of approximately $50 million to $70 million annually, in 2018. We are on track to achieve our expected annual savings targets. During the first quarter of 2018, we invested approximately $11 million in this program, the cost of the program was largely offset by the cost reductions and productivity gains. We expect to invest a further $9 million on this program throughout 2018 and also expect to spend $20 million to $30 million related to productivity capital in 2018.

The following table outlines our generation comparable OM&A, including greenlight costs:

| 3 months ended March 31 | 2018 | 2017 | |||

| Generation comparable OM&A | 105 | 98 | |||

| Greenlight transformation costs included in OM&A | |||||

| Canadian Coal | (4 | ) | — | ||

| US Coal | (1 | ) | — | ||

| Gas and Renewables | (3 | ) | — | ||

| Adjusted generation comparable OM&A | 97 | 98 | |||

Significant and Subsequent Events

A. TSX Acceptance of Normal Course Issuer Bid

In February we announced our intention to buy back up to a maximum of 14,000,000 Common Shares, representing approximately 4.86 per cent of issued and outstanding Common Shares as at March 2, 2018 through a NCIB. Purchases under the NCIB may be made through open market transactions on the TSX and any alternative Canadian trading platforms on which the Common Shares are traded, based on the prevailing market price. Any Common Shares purchased under the NCIB will be cancelled.

The period during which TransAlta is authorized to make purchases under the NCIB commenced on March 14, 2018 and ends on March 13, 2019 or such earlier date on which the maximum number of Common Shares are purchased under the NCIB or the NCIB is terminated at the Company's election.

Under TSX rules, not more than 102,039 Common Shares (being 25 per cent of the average daily trading volume on the TSX of 408,156 Common Shares for the six months ended February 28, 2018) can be purchased on the TSX on any single trading day under the NCIB, with the exception that one block purchase in excess of the daily maximum is permitted per calendar week.

TRANSALTA CORPORATION M13

During the first quarter of 2018, the Corporation purchased 374,900 Common Shares at an average price of $6.97 per Common Share. See Note 13 of the condensed consolidated financial statements for further details.

Further transactions under the NCIB will depend on market conditions. The Corporation retains discretion whether to make purchases under the NCIB, and to determine the timing, amount and acceptable price of any such purchases, subject at all times to applicable TSX and other regulatory requirements.

The NCIB provides us with a capital allocation alternative with a view to long-term shareholder value. We believe the market price of TransAlta’s Common Shares does not reflect the underlying value and purchases of Common Shares for cancellation under the NCIB may provide an opportunity to enhance shareholder value.

B. Early Redemption of Senior Notes

On March 15, 2018, the Corporation early redeemed all of its outstanding 6.650 per cent US Senior Notes due May 15, 2018. The Redemption price for the Notes was approximately $617 million (US$516 million), including $14 million of accrued interest. An early redemption premium was recognized in net interest expense for the three months ended March 31, 2018.

C. Balancing Pool Terminates the Alberta Sundance Power Purchase Arrangements

On Sept. 18, 2017, we received formal notice from the Balancing Pool for the termination of the Sundance B and C PPAs effective March 31, 2018. This announcement was expected and we took steps to re-take dispatch control for the units effective March 31, 2018.

Pursuant to a written agreement, the Balancing Pool paid us approximately $157 million on March 29, 2018. We are disputing the termination payment received. The Balancing Pool excluded certain mining assets that we believe should be included in the net book value calculation for an additional $56 million, which is now subject to the PPA arbitration process.

D. Acquisition of Two US Wind Projects

On Feb. 20, 2018, TransAlta Renewables announced it had entered into an arrangement to acquire two construction-ready projects in the Northeastern United States. The wind development projects consist of: (i) a 90 MW project located in Pennsylvania that has a 15-year PPA, and (ii) a 29 MW project located in New Hampshire with two 20-year PPAs. All three counterparties have Standard & Poor's credit ratings of A+ or better. The commercial operation date for both projects is expected during the second half of 2019. A subsidiary of TransAlta (“US HoldCo”) acquired the 90 MW project on Feb. 20, 2018 whereas the acquisition of the 29 MW project remains subject to certain closing conditions, including the receipt of a favourable regulatory ruling.

On April 20, 2018, TransAlta Renewables acquired an economic interest in the US wind projects from the subsidiary of TransAlta (“TA Power”) pursuant to the arrangement entered into with TransAlta on Feb. 20, 2018. Pursuant to the arrangement, US HoldCo will own the US wind projects directly and TA Power will issue to TransAlta Renewables preferred shares that pay quarterly dividends based on the pre-tax net earnings of the US wind projects. The remaining construction and acquisition costs of the two US wind projects are to be funded by TransAlta Renewables and are estimated to be US$240 million. TransAlta Renewables will fund these costs either by acquiring additional preferred shares issued by TA Power or will subscribe for interest bearing notes issued by US HoldCo. The proceeds from the issuance of such preferred shares or notes shall be used exclusively in connection with the acquisition and construction of the US wind projects. TransAlta Renewables will fund these acquisition and construction costs using its existing liquidity and tax equity.

E. Management Change

The Corporation hosted its Annual General Meeting on April 20, 2018, during which it was announced that Donald Tremblay, CFO, has chosen to leave the Corporation, effective May 9, 2018, and will be returning to eastern Canada to be closer to his family. The Corporation has commenced a recruitment process for a new CFO. Brett Gellner, Chief Investment Officer, will act as Interim CFO, in addition to his current role, during the interim period.

Regulatory Updates

Refer to the Regional Regulation and Compliance discussion in our 2017 annual MD&A for further details that supplement the recent developments as discussed below:

Canadian Federal Government

On Feb. 17, 2018, the Department of Environment and Climate Change Canada published the draft regulations for gas-fired electricity generation, which include specific rules for coal-to-gas converted units. Under the proposed regulations, TransAlta’s units are expected to receive an additional 75 years of operating life. Consultation on the draft regulations is expected to conclude in mid-2018 with finalized regulations expected by the end of 2018.

TRANSALTA CORPORATION M14

Alberta

On Jan. 1, 2018, the Alberta government transitioned from Specified Gas Emitters Regulation (“SGER”) to the Carbon Competitiveness Incentive Regulation (“CCIR”). Under the CCIR, the regulatory compliance moved from a facility-specific compliance standard to a product/sectoral performance compliance standard. The carbon price remains set at $30/tCO2e from 2018 to 2020 after which it is currently expected to follow the federal price increase to $40/tCO2e in 2021 and $50/tCO2e in 2022. The electricity sector performance standard was set at 0.37tCO2e/MWh but will decline over time. All renewable assets that received crediting under the SGER will continue to receive credits under CCIR on a one-to-one basis. All other renewable assets that did not receive credits under SGER will now be able to opt into the CCIR and get carbon crediting up to the electricity sector performance standard in perpetuity. Once the wind projects crediting standard under SGER ends, these renewable projects will also be able to opt into the CCIR and receive crediting.

Capital Structure and Liquidity

Our capital structure consists of the following components as shown below:

| March 31, 2018 | Dec. 31, 2017 | ||||||||

| As at | $ | % | $ | % | |||||

| TransAlta Corporation | |||||||||

| Recourse debt - CAD debentures | 1,047 | 14 | 1,046 | 14 | |||||

| Recourse debt - US senior notes | 891 | 12 | 1,499 | 19 | |||||

| Credit facilities | 325 | 4 | — | — | |||||

| US tax equity financing | 30 | — | 31 | — | |||||

| Other | 42 | 1 | 13 | — | |||||

| Less: cash and cash equivalents | (270 | ) | (4 | ) | (294 | ) | (4 | ) | |

Less: fair value asset of economic hedging instruments on debt | (1 | ) | — | (30 | ) | — | |||

| Net recourse debt | 2,064 | 27 | 2,265 | 29 | |||||

| Non-recourse debt | 197 | 3 | 208 | 3 | |||||

| Finance lease obligations | 66 | 1 | 69 | 1 | |||||

| Total net debt - TransAlta Corporation | 2,327 | 31 | 2,542 | 33 | |||||

| TransAlta Renewables | |||||||||

| Credit facility | — | — | 27 | — | |||||

| Less: cash and cash equivalents | (59 | ) | (1 | ) | (20 | ) | — | ||

| Net recourse debt | (59 | ) | (1 | ) | 7 | — | |||

| Non-recourse debt | 813 | 11 | 814 | 11 | |||||

| Total net debt - TransAlta Renewables | 754 | 10 | 821 | 11 | |||||

| Total consolidated net debt | 3,081 | 41 | 3,363 | 44 | |||||

| Non-controlling interests | 1,048 | 14 | 1,059 | 14 | |||||

| Equity attributable to shareholders | |||||||||

| Common shares | 3,090 | 41 | 3,094 | 40 | |||||

| Preferred shares | 942 | 13 | 942 | 12 | |||||

Contributed surplus, deficit, and accumulated other comprehensive income | (661 | ) | (9 | ) | (710 | ) | (9 | ) | |

| Total capital | 7,500 | 100 | 7,748 | 100 | |||||

During the quarter we reduced our corporate debt by approximately $600 million and enhanced shareholder value by:

| ▪ | early redeeming our outstanding 6.650 per cent US$500 million Senior Notes due May 15, 2018, for approximately $617 million (US$516 million) using proceeds from the Sundance B and C PPAs termination payment and existing liquidity. |

| ▪ | purchased and cancelled 374,900 Common Shares at an average price of $6.97 under our NCIB program. We believe the market price of TransAlta's Common Shares does not reflect the underlying value and purchases of Common Shares for cancellation under the NCIB provides an opportunity to enhance shareholder value. See the Significant and Subsequent Events section of this MD&A for further details. |

Overall, our net debt was reduced by close to $300 million during the quarter.

TRANSALTA CORPORATION M15

During 2019 to 2020, we have approximately $941 million of debt maturing. We expect to refinance some of these upcoming debt maturities by raising $300 to $400 million of debt secured by our contracted cash flows. We also expect to continue our deleveraging strategy as a significant part of our free cash flow over the three years will be allocated to debt reduction.

Our credit facilities provide us with significant liquidity. We have a total of $2.0 billion (Dec. 31, 2017 - $2.0 billion) of committed credit facilities, comprised of our $1.0 billion committed syndicated bank credit facility, TransAlta Renewables’ committed syndicated bank credit facility of $500 million (Dec. 31, 2017 - $500 million) and our US$200 million and $240 million committed bilateral facilities. These facilities expire in 2021, 2021, 2020, and 2019 respectively. The $1.5 billion (Dec. 31, 2017 - $1.5 billion) committed syndicated bank facilities are the primary source for short-term liquidity after the cash flow generated from the Corporation's business.

In total, $1.1 billion (Dec. 31, 2017 - $1.4 billion) is not drawn. At March 31, 2018, the $0.9 billion (Dec. 31, 2017 - $0.6 billion) of credit utilized under these facilities was comprised of actual drawings of $0.3 billion (Dec. 31, 2017 - nil) and letters of credit of $0.6 billion (Dec. 31, 2017 - $0.6 billion). The Corporation is in compliance with the terms of the credit facilities and all undrawn amounts are fully available. In addition to the $1.1 billion available under the credit facilities, the Corporation also has $329 million of available cash and cash equivalents.

The Corporation's subsidiaries have issued non-recourse bonds of $1,010 million (Dec. 31, 2017 - $1,021 million) that are subject to customary financing conditions and covenants that may restrict our ability to access funds generated by the facilities’ operations. Upon meeting certain distribution tests, typically performed once per quarter, the funds are able to be distributed by the subsidiary entities to their respective parent entity. These conditions include meeting a debt service coverage ratio prior to distribution, which was met by these entities in the first quarter. However, funds in these entities that have accumulated since the first quarter test will remain there until the next debt service coverage ratio can be calculated in the second quarter of 2018. At March 31, 2018, $53 million (Dec. 31, 2017 -$35 million) of cash was subject to these financial restrictions. In addition, we have $31 million of resctricted cash related to the Kent Hills project financing that are being held in a construction reserve account, which will be released upon certain conditions, including commissioning, being met.

Additionally, certain non-recourse bonds require that certain reserve accounts be established and funded through cash held on deposit and/or by providing letters of credit. We have elected to use letters of credit as at March 31, 2018. However, as at March 31, 2018, $1 million of cash was on deposit for certain reserve accounts that do not allow the use of letters of credit and was not available for general use.

The strengthening of the US dollar has increased our long-term debt balances by $21 million in 2018. Almost all our US-denominated debt is hedged either through financial contracts or net investments in our US operations. During the period, these changes in our US-denominated debt were offset as follows:

| As at Dec. 31 | March 31, 2018 | Dec. 31, 2017 | ||

Effects of foreign exchange on carrying amounts of US operations (net investment hedge) | 18 | (61 | ) | |

| Foreign currency economic cash flow hedges on debt | 3 | (45 | ) | |

| Economic hedges and other | — | (7 | ) | |

| Total | 21 | (113 | ) | |

Share Capital

The following tables outline the common and preferred shares issued and outstanding:

| As at | May 7, 2018 | March 31, 2018 | Dec. 31, 2017 | |||

Number of shares (millions) | ||||||

| Common shares issued and outstanding, end of period | 287.5 | 287.9 | 287.9 | |||

| Preferred shares | ||||||

| Series A | 10.2 | 10.2 | 10.2 | |||

| Series B | 1.8 | 1.8 | 1.8 | |||

| Series C | 11.0 | 11.0 | 11.0 | |||

| Series E | 9.0 | 9.0 | 9.0 | |||

| Series G | 6.6 | 6.6 | 6.6 | |||

| Preferred shares issued and outstanding, end of period | 38.6 | 38.6 | 38.6 | |||

M16 TRANSALTA CORPORATION

Non-Controlling Interests

As of March 31, 2018, we own 64.0 per cent (Dec. 31, 2017 – 64.0 per cent) of TransAlta Renewables. We remain committed to maintaining our position as the majority shareholder and sponsor of TransAlta Renewables with a stated goal of maintaining our interest between 60 to 80 per cent.

We also own 50.01 per cent of TransAlta Cogeneration L.P (“TA Cogen”), which owns, operates, or has an interest in four natural-gas-fired facilities (Mississauga, Ottawa, Windsor, and Fort Saskatchewan) and one coal-fired generating facility.

Reported earnings attributable to non-controlling interests for the first quarter of 2018 decreased to $28 million from $32 million in the first quarter of 2017, due to the settlement in 2017 of the contract indexation dispute with the OEFC relating to the Ottawa and Windsor facilities, partially offset by higher earnings at TransAlta Renewables resulting from a favourable reduction in unrealized foreign exchange losses on some of its financial interests in the Australian Assets.

Returns to Providers of Capital

Net Interest Expense

The components of net interest expense are shown below:

| Three months ended March 31 | 2018 | 2017 | ||

| Interest on debt | 53 | 56 | ||

| Interest income | (3 | ) | (1 | ) |

| Capitalized interest | — | (3 | ) | |

| Loss on early redemption of US Senior Notes | 5 | — | ||

| Interest on finance lease obligations | 1 | 1 | ||

| Credit facility and bank charges | 3 | 4 | ||

| Other interest | 3 | — | ||

| Accretion of provisions | 6 | 5 | ||

| Net interest expense | 68 | 62 | ||

Net interest expense was higher period-over-period due to the $5 million pre-payment premium relating to the early redemption of the US $500 million Senior Notes.

Dividends to Shareholders

On April 19, 2018, we declared a quarterly dividend of$0.04 per common share, payable on July 3, 2018. We also declared a quarterly dividend of$0.16931 on the Series A preferred shares, $0.19951 on the Series B preferred shares, $0.25169 on the Series C preferred shares, $0.32463 on the Series E preferred shares, and $0.33125 on the Series G preferred shares, all payable on July 3, 2018.

The following are the common and preferred shares dividends declared in the first quarter of 2018:

| Common | Preferred Series dividends per share | |||||||||||

| dividends | ||||||||||||

| Declaration date | per share | A | B | C | E | G | ||||||

| Feb. 2, 2018 | 0.04 | 0.1693 | 0.17889 | 0.2517 | 0.3246 | 0.33125 | ||||||

TRANSALTA CORPORATION M17

Financial Position

The following chart highlights significant changes in the Condensed Consolidated Statements of Financial Position from March 31, 2018, to Dec. 31, 2017:

| Increase/ | ||||

| Assets | (decrease) | Primary factors explaining change | ||

| Cash and cash equivalents | 15 | Timing of receipts and payments | ||

| Trade and other receivables | (262 | ) | Timing of customer receipts and seasonality of revenue | |

| Property, plant, and equipment, net | (109 | ) | Depreciation for the period ($147 million), partially offset by favourable changes in foreign exchange rates ($23 million), and additions ($23 million) | |

| Risk management assets (current and long term) | (27 | ) | Contract settlements, partially offset by favourable changes in foreign exchange rates, favourable changes in market price movements, and new contracts | |

| Other assets | 37 | Project development costs related to the acquisition of two US Wind projects | ||

| Others | 5 | |||

| Total decrease in assets | (341 | ) | ||

| Increase/ | ||||

| Liabilities and equity | (decrease | Primary factors explaining change | ||

| Accounts payable and accrued liabilities | (99 | ) | Timing of payments and accruals | |

| Credit facilities, long term debt, and finance lease obligations (including current portion) | (296 | ) | Repayment of long-term debt ($660 million), partially offset by draw dawn on credit facility ($298 million), and unfavourable foreign exchange rate ($21 million) | |

| Deferred income tax liabilities | 19 | Increase in taxable temporary differences | ||

| Risk management liabilities (current and long term) | (12 | ) | Contract settlements, partially offset by favourable changes in foreign exchange rates, favourable changes in market price movements, and new contracts | |

| Equity attributable to shareholders | 45 | Net earnings ($75 million), partially offset by common and preferred share dividends ($21 million), and the impact of changes in our accounting policies ($14 million) | ||

| Others | 2 | |||

| Total decrease in liabilities and equity | (341 | ) | ||

Cash Flows

The following chart highlights significant changes in the Condensed Consolidated Statements of Cash Flows for the three months ended March 31, 2018, compared to the same period March 31, 2017:

| 3 months ended March 31 | 2018 | 2017 | Primary factors explaining change | |||

| Cash and cash equivalents, beginning of period | 314 | 305 | ||||

| Provided by (used in): | ||||||

| Operating activities | 425 | 281 | Higher cash earnings ($116 million) and favourable change in non-cash working capital ($28 million) | |||

| Investing activities | (53 | ) | 5 | Lower proceeds on disposals ($60 million) and higher project development acquisitions ($36 million) | ||

| Financing activities | (357 | ) | (88 | ) | Increase in repayment of long-term debt ($646 million), partially offset by increase in borrowings under credit facilities ($326 million) and realized gains on financial instruments ($50 million) | |

| Translation of foreign currency cash | — | 1 | ||||

| Cash and cash equivalents, end of period | 329 | 504 | ||||

M18 TRANSALTA CORPORATION

Other Consolidated Analysis

Unconsolidated Structured Entities or Arrangements

Disclosure is required of all unconsolidated structured entities or arrangements such as transactions, agreements, or contractual arrangements with unconsolidated entities, structured finance entities, special purpose entities, or variable interest entities that are reasonably likely to materially affect liquidity or the availability of, or requirements for, capital resources. We currently have no such unconsolidated structured entities or arrangements.

Guarantee Contracts

We have obligations to issue letters of credit and cash collateral to secure potential liabilities to certain parties, including those related to potential environmental obligations, commodity risk management and hedging activities, construction projects, and purchase obligations. At March 31, 2018, we provided letters of credit totalling $639 million (Dec. 31, 2017 - $677 million) and cash collateral of $51 million (Dec. 31, 2017 - $67 million). These letters of credit and cash collateral secure certain amounts included on our Consolidated Statements of Financial Position under risk management liabilities and decommissioning and other provisions.

Contingencies

I. Line Loss Rule Proceeding

TransAlta has been participating in a line loss rule proceeding (the “LLRP”) before the Alberta Utilities Commission ("AUC"). The AUC determined that it has the ability to retroactively adjust line loss charges going back to 2006 and directed the AESO to, among other things, perform such retroactive calculations. The various decisions by the AUC are, however, subject to appeal and challenge. A recent decision by the AUC determined the methodology to be used retroactively and it is now possible to estimate the total potential retroactive exposure faced by TransAlta for its non-PPA MWs. The estimate of the maximum exposure is $15 million; however, if TransAlta and others are successful on the appeal of legal and jurisdictional questions regarding retroactivity, the amount owing will be nil; TransAlta accordingly recorded an appropriate provision in 2017.

II. FMG Disputes

The Corporation is currently engaged in two pieces of litigation with FMG. The first arose as a result of FMG’s purported termination of the South Hedland PPA. TransAlta has sued FMG, seeking payment of amounts invoiced and not paid under the PPA, as well as a declaration that the PPA is valid and in force. FMG, on the other hand, seeks a declaration that the PPA was lawfully terminated.

The second matter involves FMG’s claims against TransAlta related to the transfer of the Solomon Power Station to FMG. FMG claims certain amounts related to the condition of the facility while TransAlta claims certain outstanding costs that should be reimbursed.

III. Balancing Pool Dispute

Pursuant to a written agreement, the Balancing Pool paid the Corporation approximately $157 million on March 29, 2018. The Corporation is disputing the termination payment it received. The Balancing Pool excludes certain mining assets that the Corporation believes should be included in the net book value calculation for an additional $56 million, which is subject to the PPA arbitration process.

Financial Instruments

Refer to Note 13 of the notes to the audited annual consolidated financial statements within our 2017 Annual Integrated Report and Note 8 of our unaudited interim condensed consolidated financial statements as at and for the three months ended March 31, 2018 for details on Financial Instruments. Refer to the Governance and Risk Management section of our 2017 Annual Integrated Report and Note 9 of our unaudited interim condensed consolidated financial statements for further details on our risks and how we manage them. Refer to the Accounting Changes section of this MD&A for further details on the adoption of IFRS 9 Financial Instruments effective Jan. 1, 2018. Our risk management profile and practices have not changed materially from Dec. 31, 2017.

We may enter into commodity transactions involving non-standard features for which observable market data is not available. These are defined under IFRS as Level III financial instruments. Level III financial instruments are not traded in an active market and fair value is, therefore, developed using valuation models based upon internally developed assumptions or inputs. Our Level III fair values are determined using data such as unit availability, transmission congestion, or demand profiles. Fair values are validated on a quarterly basis by using reasonably possible alternative assumptions as inputs to valuation techniques, and any material differences are disclosed in the notes to the financial statements.

As at March 31, 2018, total Level III financial instruments had a net asset carrying value of $725 million (Dec. 31, 2017 - $771 million net asset). The decrease during the period is primarily due to the settlement of contracts, market price changes in value of the long-term power sale contract designated as an all-in-one cash flow hedge for which changes in fair value are recognized in other comprehensive income, partially offset by favourable foreign exchange rates.

TRANSALTA CORPORATION M19

2018 Financial Outlook

The following table outlines our expectation on key financial targets for 2018:

| Measure | Original Target | Revised Target |

| Comparable EBITDA | $950 million to $1,050 million | $1,000 million to $1,050 million |

| FFO | $725 million to $800 million | $750 million to $800 million |

| FCF | $275 million to $350 million | $300 million to $350 million |

| Canadian Coal capacity factor | 65 to 75 per cent | Unchanged |

| Dividend | $0.16 per share annualized, 13 to 17 per cent payout of FCF | $0.16 per share annualized, 13 to 15 per cent payout of FCF |

As a result of our strong performance during our first quarter, we revised our targets as outlined in the above table.

Operations

Availability

Total availability of our Canadian coal fleet is expected to be in the range of 87 to 89 per cent in 2018. Availability of our other generating assets (gas, renewables) is expected to be in the range of 95 per cent in 2018. We will be accelerating our transition to gas and renewables generation, and have retired Sundance Unit 1 effective Jan. 1, 2018, and temporarily mothballed Sundance Unit 2 effective Jan. 1, 2018 and Sundance Unit 3 and Sundance Unit 5 effective April 1, 2018.

Market Hedging Strategy

The objective of our portfolio management strategy is to deliver a high confidence for annual FCF which also provides for positive exposure to price volatility in Alberta. Given our cash operating costs, we can be more or less hedged in a given period, and we expect to realize our annual FCF targets through a combination of forward hedging and selling generation into the spot market.

Fuel Costs

In Alberta, we expect our cash fuel costs per tonne to be higher compared to 2017 due to lower produced volumes.

In the Pacific Northwest, our US Coal mine, adjacent to our power plant, is in the reclamation stage. Fuel at US Coal has been purchased primarily from external suppliers in the Powder River Basin and delivered by rail. In 2017 we amended our fuel and rail contract such that our costs fluctuate partly with gas prices. This should allow us to generate more electricity and increase profits.

Most of our generation from gas is sold under contract with pass-through provisions for fuel. For gas generation with no pass-through provision, we purchase natural gas from outside companies coincident with production, thereby minimizing our risk to changes in prices.

We closely monitor the risks associated with changes in electricity and input fuel prices on our future operations and, where we consider it appropriate, use various physical and financial instruments to hedge our assets and operations from such price risks.

Energy Marketing

Comparable EBITDA from our Energy Marketing segment is affected by prices and volatility in the market, overall strategies adopted, and changes in regulation and legislation. We continuously monitor both the market and our exposure to maximize earnings while still maintaining an acceptable risk profile. Our 2018 objective for Energy Marketing is for the segment to contribute between $70 million to $80 million in gross margin for the year.

Exposure to Fluctuations in Foreign Currencies

Our strategy is to minimize the impact of fluctuations in the Canadian dollar against the US dollar, and Australian dollar by offsetting foreign-denominated assets with foreign-denominated liabilities and by entering into foreign exchange contracts. We also have foreign-denominated expenses, including interest charges, which largely offset our net foreign-denominated revenues.

We expect to spend approximately US$240 million to construct and commission the two US wind development projects. We anticipate using foreign exchange contracts to manage the foreign exchange exposure created by these projects. See the Significant and Subsequent Events section of this MD&A for further details.

Net Interest Expense

Net interest expense for 2018 is expected to be lower than in 2017 largely due to lower levels of debt. However, changes in interest rates and in the value of the Canadian dollar relative to the US dollar can affect the amount of net interest expense incurred.

Net Debt, Liquidity, and Capital Resources

We expect to maintain adequate available liquidity under our committed credit facilities. We currently have access to $1.1 billion in liquidity, as well as more than $300 million in cash. Our continued focus will be toward repositioning our capital structure and we expect to be well positioned to address the upcoming debt maturities in 2018 and 2019.

M20 TRANSALTA CORPORATION

Growth Expenditures

Our growth projects are focused on sustaining our current operations and supporting our growth strategy in our renewables platform.