Management’s Discussion and Analysis

Table of Contents

| | | | | | | | | | | |

| Forward-Looking Statements | | 2020 Financial Outlook | |

| Business Model | | Competitive Forces | |

| Corporate Strategy | | Power-Generating Portfolio Capital | |

| Highlights | | Other Consolidated Analysis | |

| Significant and Subsequent Events | | Critical Accounting Policies and Estimates | |

| Additional IFRS Measures and Non-IFRS Measures | | Accounting Changes | |

| Discussion of Consolidated Financial Results | | Financial Instruments | |

| Segmented Comparable Results | | Environment, Social and Governance | |

| Fourth Quarter | | Human Capital | |

Discussion of Consolidated Financial Results for the

Fourth Quarter | | Social and Relationship Capital | |

| | Natural Capital | |

| Selected Quarterly Information | | Intellectual Capital | |

| Key Financial Ratios | | 2019 Sustainability Performance | |

| Financial Position | | 2020 Sustainable Development Targets | |

| Cash Flows | | Governance and Risk Management | |

| Financial Capital | | Disclosure Controls and Procedures | |

| | | |

This Management’s Discussion and Analysis (“MD&A”) should be read in conjunction with our 2019 audited annual consolidated financial statements (the "consolidated financial statements") and our 2020 annual information form ("AIF"), each for the fiscal year ended Dec. 31, 2019. The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards (“IFRS”) for Canadian publicly accountable enterprises as issued by the International Accounting Standards Board (“IASB”) and in effect at Dec. 31, 2019. All dollar amounts in the tables are in millions of Canadian dollars unless otherwise noted and except amounts per share, which are in whole dollars to the nearest two decimals. All other dollar amounts in this MD&A are in Canadian dollars, unless otherwise noted. This MD&A is dated Mar. 3, 2020. Additional information respecting TransAlta Corporation (“TransAlta”, “we”, “our”, “us” or the “Corporation”), including our AIF, is available on SEDAR at www.sedar.com, on EDGAR at www.sec.gov and on our website at www.transalta.com. Information on or connected to our website is not incorporated by reference herein.

Management’s Discussion and Analysis

Forward-Looking Statements

This MD&A includes "forward-looking information" within the meaning of applicable Canadian securities laws, and "forward-looking statements" within the meaning of applicable United States securities laws, including the United States Private Securities Litigation Reform Act of 1995 (collectively referred to herein as "forward-looking statements"). All forward-looking statements are based on our beliefs as well as assumptions based on information available at the time the assumption was made and on management's experience and perception of historical trends, current conditions and expected future developments, as well as other factors deemed appropriate in the circumstances. Forward-looking statements are not facts, but only predictions and generally can be identified by the use of statements that include phrases such as "may", "will", "can", "could", "would", "shall", "believe", "expect", "estimate", "anticipate", "intend", "plan", "forecast" "foresee", "potential", "enable", "continue" or other comparable terminology. These statements are not guarantees of our future performance, events or results and are subject to risks, uncertainties and other important factors that could cause our actual performance, events or results to be materially different from that set out in or implied by the forward-looking statements.

In particular, this MD&A contains forward-looking statements including, but not limited to: operating performance and transition to clean power generation, including our goal to have no generation from coal by the end of 2025; the Clean Energy Investment Plan and the benefits thereof; transitioning to 100 per cent clean electricity by 2025; the source of funding for the Clean Energy Investment Plan; our transformation, growth, capital allocation and debt reduction strategies; growth opportunities from 2020 to 2031 and beyond; potential for growth in renewables and on-site and cogeneration assets, including demand therefor and greenfield development acquisitions; the amount of capital allocated to new growth or development projects and funding thereof; our business, anticipated future financial performance and anticipated results, including our outlook and performance targets; our expectation that the $400 million second tranche of the investment by Brookfield Renewable Partners and its affiliates ("Brookfield") will close in October 2020; the benefit of the Brookfield Investment, including as it pertains to our expected success in executing on our growth projects, including expanding in the US renewable market and advancing our on-site and cogeneration business; the timing and the completion of growth and development projects, and their attendant costs; our estimated spend on growth and sustaining capital and productivity projects; expectations in terms of the cost of operations, capital spend and maintenance, and the variability of those costs; the conversion or repowering of our coal-fired units to natural gas, and the timing and costs thereof; expectations relating the benefits of the conversions and repowering; the terms of the current or any further proposed share buy back programs, including timing and number of shares to be repurchased pursuant to any normal course issuer bid and the acceptance thereof by the Toronto Stock Exchange ("TSX"); the mothballing of certain units; the impact of certain hedges on future earnings, results and cash flows; estimates of fuel supply and demand conditions and the costs of procuring fuel; expectations for demand for electricity, including for clean energy, in both the short term and long-term, and the resulting impact on electricity prices; the impact of load growth, increased capacity and natural gas and other fuel costs on power prices; expectations in respect of generation availability, capacity and production; expectations regarding the role that different energy sources will play in meeting future energy needs; expected financing of our capital expenditures; expected governmental regulatory regimes and legislation, as well as the cost of complying with resulting regulations and laws; our marketing and trading strategy and the risks involved in these strategies; estimates of future tax rates, future tax expense and the adequacy of tax provisions; changes in accounting estimates and accounting policies; the mitigation of risks and effectiveness thereof, including as it pertains to climate change risk, environmental management, cybersecurity, commodity prices and fuel supply; anticipated growth rates and competition in our markets; our expectations and obligations and anticipated liabilities relating to the outcome of existing or potential legal and contractual claims, regulatory investigations and disputes, including the litigation with Fortescue Metals Group Ltd. relating to the South Hedland facility and the Mangrove (as defined below) proceedings relating to the Brookfield investment, each discussed further below; ability to achieve 2020 ESG (as defined below) targets; expectations regarding the renewal of collective bargaining agreements; expectations for the ability to access capital markets at reasonable terms; the estimated impact of changes in interest rates and the value of the Canadian dollar relative to the US dollar and other currencies in locations where we do business; the monitoring of our exposure to liquidity risk; expectations in respect to the global economic environment and growing scrutiny by investors relating to sustainability performance; and our credit practices.

Management’s Discussion and Analysis

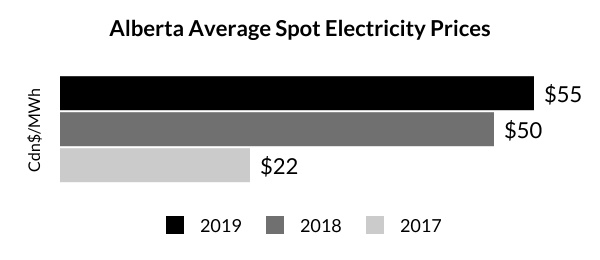

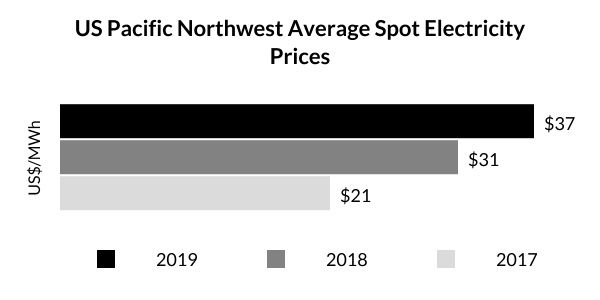

The forward-looking statements contained in this MD&A are based on many assumptions including, but not limited to, the following: no significant changes to applicable laws and regulations, including any tax and regulatory changes in the markets in which we operate; no material adverse impacts to the investment and credit markets; Alberta spot power price being equal to $53 to $63 per megawatt hours ("MWh") in 2020; Mid-C spot power prices equal to US$25 to US$35 per MWh in 2020; sustaining capital in 2020 being between $170 million and $200 million; productivity capital of $10 million to $15 million; discount rates; our proportionate ownership of TransAlta Renewables Inc. ("TransAlta Renewables") not changing materially; no decline in the dividends to be received from TransAlta Renewables; the expected life extension of the coal fleet and anticipated financial results generated on conversion or repowering; assumptions regarding the ability of the converted units to successfully compete in the Alberta energy market; and assumptions regarding our current strategy and priorities, including as it pertains to our current priorities relating to the coal-to-gas conversions, growing TransAlta Renewables and being able to realize the full economic benefit from the capacity, energy and ancillary services from our Alberta hydro assets once the applicable power purchase arrangement ("PPA") has expired; our being successful in defending against the claims alleged by Mangrove, discussed further below; the second $400 million tranche of the Brookfield investment closing as anticipated in October 2020; the Brookfield investment and its related arrangements with TransAlta having the expected benefits to the Corporation; and the higher adjusted EBITDA anticipated from our Alberta hydro assets subject to the Brookfield investment being realized.

Forward-looking statements are subject to a number of significant risks, uncertainties and assumptions that could cause actual plans, performance, results or outcomes to differ materially from current expectations. Factors that may adversely impact what is expressed or implied by forward-looking statements contained in this MD&A include, but are not limited to, risks relating to: fluctuations in market prices; changes in demand for electricity and capacity and our ability to contract our generation for prices that will provide expected returns and replace contracts as they expire; changes to the legislative, regulatory and political environments in the jurisdictions in which we operate; environmental requirements and changes in, or liabilities under, these requirements; changes in general economic or market conditions including interest rates; operational risks involving our facilities, including unplanned outages at such facilities; disruptions in the transmission and distribution of electricity; the effects of weather and other climate-change related risks; unexpected increases in cost structure; disruptions in the source of fuels, including natural gas required for the conversions and repowering, as well as the extent of water, solar or wind resources required to operate our facilities; failure to meet financial expectations; natural and manmade disasters, including those resulting in dam or dyke failures; the threat of domestic terrorism and cyberattacks; pandemic or epidemics and any associated impact on supply chain; equipment failure and our ability to carry out or have completed the repairs in a cost-effective manner or timely manner or at all; commodity risk management and energy trading risks; industry risk and competition; the need to engage or rely on certain stakeholder groups and third parties; fluctuations in the value of foreign currencies and foreign political risks; the need for and availability of additional financing; structural subordination of securities; counterparty credit risk; changes in credit and market conditions; changes to our relationship with, or ownership of, TransAlta Renewables; risks associated with development projects and acquisitions, including capital costs, permitting, labour and engineering risks, and delays in the construction or commissioning of projects or delays in the closing of acquisitions; increased costs or delays in the construction or commissioning of pipelines to converted units; changes in expectations in the payment of future dividends, including from TransAlta Renewables; inadequacy or unavailability of insurance coverage; downgrades in credit ratings; our provision for income taxes; legal, regulatory and contractual disputes and proceedings involving the Corporation, including as it pertains to establishing commercial operations at the South Hedland facility and in relation to the Brookfield investment; reliance on key personnel; and labour relations matters. The foregoing risk factors, among others, are described in further detail in the Governance and Risk Management section of this MD&A and the Risk Factors section in our AIF for the year ended Dec. 31, 2019.

Readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on them, which reflect the Corporation's expectations only as of the date hereof. The forward-looking statements included in this document are made only as of the date hereof and we do not undertake to publicly update these forward-looking statements to reflect new information, future events or otherwise, except as required by applicable laws. In light of these risks, uncertainties and assumptions, the forward-looking statements might occur to a different extent or at a different time than we have described, or might not occur at all. We cannot assure that projected results or events will be achieved.

Management’s Discussion and Analysis

Business Model

Our Business

We are one of Canada’s largest publicly traded power generators with over 108 years of operating experience. We own, operate and manage a highly contracted and geographically diversified portfolio of assets representing 8,385 MW(1) of capacity and use a broad range of generation fuels that include coal, natural gas, water, solar and wind. Our energy marketing operations maximize margins by securing and optimizing high-value products and markets for ourselves and our customers in dynamic market conditions.

Vision and Values

Our vision is to be a leader in clean electricity – committed to a sustainable future. We apply our expertise, scale and diversified fuel mix to capitalize on opportunities in our core markets and grow in areas where our competitive advantages can be employed. Our values are grounded in safety, innovation, sustainability, integrity and respect, which together create a strong corporate culture that allows our people to work on a common ground and understanding. These values are at the heart of our success.

Strategy for Value Creation

Our goals are to deliver shareholder value by delivering solid returns through a combination of dividend yield and disciplined growth in cash flow per share. We strive for a low to moderate risk profile over the long-term while balancing capital allocation and maintaining financial strength to allow for financial flexibility. Our segmented cash flow growth is driven by optimizing and diversifying our existing assets and further expanding our overall portfolio and presence in Canada, the United States of America ("US") and Australia. We are focusing on these geographic areas as our expertise, scale and diversified fuel mix create a competitive advantage that we can leverage to capture expansion opportunities in these core markets to create shareholder value.

Material Sustainability Impacts

Sustainability means ensuring that our financial returns consider short- and long-term economics, environmental impacts and societal and community needs. This MD&A integrates our financial and sustainability or Environment, Social and Governance (“ESG”) reporting. Key elements of our sustainability disclosure are guided by our sustainability materiality assessment. To help inform discussion and provide context on how ESG affects our business, we have referenced the provincial securities commission guidance, Global Reporting Index, Sustainability Accounting Standards Board and the Task Force on Climate-related Financial Disclosures. Our content is structured following guidance on non-traditional capitals from the International Integrated Reporting Framework. In addition, we track the performance of 80 sustainability-related Key Performance Indicator ("KPIs") and have obtained a limited assurance report from Ernst & Young LLP over material KPIs.

(1) We measure capacity as net maximum capacity (see the Glossary of Key Terms for definition of this and other key terms), which is consistent with industry standards. Capacity figures represent capacity owned and in operation unless otherwise stated, and reflect the basis of consolidation of underlying assets.

Management’s Discussion and Analysis

Corporate Strategy

Our strategic focus is to invest in a disciplined manner in a range of clean and renewable technologies such as wind, hydro, solar, battery and thermal (natural gas-fired and cogeneration) that produce electricity for industrial customers and communities to deliver returns to our shareholders.

On Sept. 16, 2019, TransAlta announced its Clean Energy Investment Plan, which includes converting our existing Alberta coal assets to natural gas and advancing our leadership position in onsite generation and renewable energy. The Clean Energy Investment Plan provided further details of previously highlighted initiatives that TransAlta has been continuing to progress since early 2017. TransAlta is currently pursuing opportunities of $1.8 billion to $2.0 billion as part of this plan, including approximately $800 million of renewable energy projects either recently completed or already under construction. The implementation and execution of TransAlta's Clean Energy Investment Plan, including the acceleration of certain features of that plan, is in large part being facilitated by the $750 million strategic investment by Brookfield that we announced in March 2019 in response to feedback received from our shareholders during extensive engagement held in 2018 and 2019. The first $350 million tranche of Brookfield's investment closed in May 2019 and facilitated the acceleration of our coal-to-gas conversion plan discussed below. The second $400 million tranche of Brookfield's investment, anticipated to close in October 2020, will help further the advancement and implementation of the remainder of our Clean Energy Investment Plan, including our expected growth in renewables, while helping the Corporation maintain a strong balance sheet and financial flexibility to carry out the other pillars of our strategy discussed below. Refer to the Significant and Subsequent Events section of this MD&A for further details.

On Jan. 16, 2020, TransAlta announced near-term objectives that further support the Clean Energy Investment Plan. In addition, we announced our 2020 sustainability targets. For further details, refer to the 2020 Sustainable Development Targets section of this MD&A.

Our strategic priorities are focused on the following outcomes:

1.Successfully execute our coal-to-gas conversions

We are transitioning our Alberta thermal fleet to natural gas, as part of our Clean Energy Investment Plan. We plan to invest between $800 million to $1.0 billion to convert or repower our Alberta thermal fleet to natural gas. This will repurpose and reposition our fleet to a cleaner gas-fired fleet and advance our leadership position in onsite generation while generating attractive returns by leveraging the Corporation's existing infrastructure.

TransAlta’s Clean Energy Investment Plan includes converting three of our existing Alberta thermal units to gas in 2020 and 2021 by replacing existing coal burners with natural gas burners. The cost to convert each unit is expected to be approximately $30 to $35 million per unit.

The Clean Energy Investment Plan also includes permitting to repower the steam turbines at Sundance Unit 5 and Keephills Unit 1 by installing one or more combustion turbines and heat recovery steam generators, thereby creating highly efficient combined-cycle units. Repowered units are expected to have a 40 per cent lower capital investment when compared to a new combined-cycle facility while achieving a similar heat rate. The Clean Energy Investment Plan assumes there are no delays in securing the natural gas supply requirements, which may result from regulatory or other constraints.

The highlights of these gas conversion investments include:

▪Positioning TransAlta’s fleet as a low-cost generator in the Alberta energy-only market;

▪Generating attractive returns by leveraging the Corporation’s existing infrastructure;

▪Significantly extending the life and cash flows of our Alberta thermal assets; and

▪Significantly reducing air emissions and costs.

The following key achievements over the past year helped us advance this part of our strategy:

On Dec. 17, 2018, the Corporation exercised our option to acquire 50 per cent ownership in the Pioneer gas pipeline ("Pioneer Pipeline"). During the second quarter of 2019, the Pioneer Pipeline transported its first gas four months ahead of schedule to TransAlta's generating units at Sundance and Keephills. The Pioneer Pipeline initially had approximately 50 MMcf/day of natural gas flowing during the start-up phase where initial flows fluctuated depending on market conditions. Firm throughput of approximately 130 MMcf/day of natural gas began flowing through the Pioneer Pipeline on Nov. 1, 2019. Tidewater Midstream and Infrastructure Ltd. ("Tidewater") and TransAlta each own a 50 per cent interest in the Pioneer Pipeline, which is backstopped by a 15-year take-or-pay agreement from TransAlta at market rate tolls. The investment for TransAlta, including associated infrastructure, was approximately $100 million.

Management’s Discussion and Analysis

In 2019, we issued Full Notice to Proceed (“FNTP”) to convert Sundance Unit 6 and Keephills Unit 2 to natural gas by replacing the existing coal burners with natural gas burners. We are targeting to complete the conversion of Sundance Unit 6 by the second half of 2020 and Keephills Unit 2 by the first half of 2021.

We expect to issue Limited Notice to Proceed ("LNTP") for Keephills Unit 3 during the first half of 2020 and expect to complete the conversion of that unit during 2021. We are evaluating the potential to install dual fuel capability at Keephills Unit 3 to ensure we have optimal fuel flexibility as we transition the fleet from coal to gas, and to manage any timing delays in obtaining full gas requirements that may occur due to regulatory or other constraints.

We are currently seeking regulatory permits to repower the steam turbines at Sundance Unit 5 and Keephills Unit 1 by installing combustion turbines and heat recovery steam generators, thereby creating highly efficient combined-cycle units. Repowered units are expected to have a 40 per cent lower capital investment when compared to a new combined- cycle facility while achieving a similar heat rate.

To advance this repowering strategy, on Oct. 30, 2019, TransAlta acquired two 230 MW Siemens F-class gas turbines and related equipment for $84 million. These turbines will be redeployed to our Sundance site as part of the strategy to repower Sundance Unit 5 to a highly efficient combined-cycle unit. We expect to issue LNTP in 2020 and FNTP in 2021 for Sundance Unit 5, with an expected commercial operation date in 2023. The Sundance Unit 5 repowered combined- cycle unit will have a capacity of approximately 730 MW and is expected to cost approximately $750 million to $770 million, well below a greenfield combined-cycle project. In conjunction with the Sundance Unit 5 permitting, we are also permitting Keephills Unit 1 to maintain the option to repower Keephills Unit 1 to a combined-cycle unit, depending on market fundamentals. As part of this transaction, we also acquired a long-term PPA for capacity plus energy, including the passthrough of greenhouse gas ("GHG") costs, starting in late 2023 with Shell Energy North America (Canada).

2. Deliver growth in our renewables fleet

We are further expanding our renewables platform. We currently have over $400 million of renewable energy construction projects to be completed in 2020 and 2021. We completed and commissioned two wind farms in 2019 investing over $340 million through TransAlta Renewables. Our focus is to ensure that we solidify returns through exceptional project execution and integration where we are able to commission and operate assets within our schedule and cost objectives.

The following key achievements in 2019 helped us advance this part of our strategy:

US Wind Projects

In 2019, we completed the construction of two wind projects (collectively, the "US Wind Projects") in the Northeastern US. The Big Level wind project ("Big Level") acquired on Mar. 1, 2018, consists of a 90 MW project located in Pennsylvania that has a 15-year PPA with Microsoft Corp. The Antrim wind project ("Antrim") acquired on Mar. 28, 2019 consists of a 29 MW project located in New Hampshire with two 20-year PPAs with Partners Healthcare and New Hampshire Electric Co-op. Big Level and Antrim began commercial operations on Dec. 19, 2019, and Dec. 24, 2019, respectively. The US Wind Projects have added an additional 119 MW of generating capacity to our Wind and Solar portfolio.

Cost estimates for the US Wind Projects were reforecasted to be within the range of US$250 million to US$270 million, primarily due to construction and weather-related impacts as well as higher interconnection costs.

Windrise Wind Project

On Dec. 17, 2018, TransAlta's 207 MW Windrise wind project was selected by the Alberta Electric System Operator ("AESO") as one of the three selected projects in the third round of the Renewable Electricity Program. TransAlta and the AESO executed a Renewable Electricity Support Agreement with a 20-year term. The Windrise wind project is situated on 11,000 acres of land located in the county of Willow Creek, Alberta, and is expected to cost approximately $270 million to $285 million. The project development work is on schedule. Windrise has secured approval for the facility from the Alberta Utilities Commission ("AUC") and is currently permitting transmission lines required to connect the facility to the Alberta grid. Construction activities will start in the second quarter of 2020 and the project is on track to reach commercial operation during the first half of 2021.

Management’s Discussion and Analysis

Skookumchuck Wind Project

On Apr. 12, 2019, TransAlta signed an agreement with Southern Power to purchase a 49 per cent interest in the Skookumchuck wind project, a 136.8 MW wind project currently under construction and located in Lewis and Thurston counties near Centralia in Washington state. The project has a 20-year PPA with Puget Sound Energy. TransAlta has the option to make its investment when the facility reaches its commercial operation date, which is expected to be in the first half of 2020. TransAlta's 49 per cent interest in the total capital investment is expected to be approximately $150 million to $160 million, a portion of which is expected to be funded with tax equity financing.

WindCharger Project

During the first quarter of 2019, TransAlta approved the WindCharger project, an innovative energy storage project, which will have a nameplate capacity of 10 MW with a total storage capacity of 20 MWh. WindCharger is located in southern Alberta in the Municipal District of Pincher Creek next to TransAlta’s existing Summerview Wind Farm Substation. WindCharger will store energy produced by the nearby Summerview II Wind Farm and discharge into the Alberta electricity grid at times of peak demand. This project is expected to be the first utility-scale battery storage facility in Alberta and will be receiving co-funding support from Emissions Reduction Alberta. Regulatory applications, including a facilities application to the AUC and an interconnection application to the AESO, were submitted in 2019. AUC approval was granted in November 2019 and the AESO approval is expected by the end of the first quarter of 2020. Detailed engineering designs, as well as the procurement of long-lead equipment, has been completed. Construction is on track to begin in March 2020 with a commercial operation date expected within the second quarter of 2020. The total expected cost of the project to TransAlta is $7 million to $8 million.

3. Expand presence in the US renewables market

We are focusing our business development efforts in the renewables segment of the US market. Demand for new renewables in the US is expected to grow in the near term. We currently have 2,000 MW at different stages in our development pipeline. These opportunities are expected to grow TransAlta Renewables, utilize its excess debt capacity and deliver stable dividends back to TransAlta.

In addition to the US Wind Projects and the Skookumchuk wind project discussed above, during 2019, TransAlta acquired a portfolio of wind development projects in the US. If we decide to move forward with any of these projects, additional consideration may be payable on a project-by-project basis only in the event a project achieves commercial operations prior to Dec. 31, 2025. If a decision is made to not move forward with a project or the costs are no longer considered to be recoverable, the costs are charged to earnings. Estimated returns on these projects and similar projects are sufficient to recover costs of unsuccessful development projects.

4. Advance and expand our on-site generation and cogeneration business

We will grow our on-site and cogeneration asset base, a business segment we have deep experience in, having provided on-site cogeneration services to various customers since the early 1990s. Our current pipeline under evaluation is approximately 900 MW and our technical design, operations experience and safety culture make us a strong partner in this segment. We see this segment growing as industrial and large-scale customers are looking to find solutions to help lower costs of power production, replace aging or inefficient equipment, reduce network costs and meet their ESG objectives.

Consistent with this strategy, on Oct. 1, 2019, TransAlta and SemCAMS announced that they entered into definitive agreements to develop, construct and operate a cogeneration facility at the Kaybob South No. 3 sour gas processing plant. The Kaybob facility is strategically located in the Western Canadian Sedimentary Basin and accepts natural gas production out of the Montney and Duvernay formations. TransAlta will construct the cogeneration plant, which will be jointly owned, operated and maintained with SemCAMS. The capital cost of the new cogeneration facility is expected to be approximately $105 million to $115 million and the project is expected to deliver approximately $18 million in annual EBITDA. TransAlta will be responsible for all capital costs during construction and, subject to the satisfaction of certain conditions, SemCAMS is expected to purchase a 50 per cent interest in the new cogeneration facility as of the commercial operation date, which is targeted for late 2021.

The highly efficient cogeneration facility will have an installed capacity of 40 MW. All of the steam production and approximately half of the electricity output will be contracted to SemCAMS under a 13-year fixed price contract. The remaining electricity generation will be sold into the Alberta power market by TransAlta. The agreement contemplates an automatic seven-year extension subject to certain termination rights. The development of the cogeneration facility at Kaybob South No. 3 is expected to eliminate the need for traditional boilers and reduce annual carbon emissions of the operation by approximately 100,000 tonnes carbon dioxide equivalent ("CO2e"), which is equivalent to removing 20,000 vehicles off Alberta roads.

Management’s Discussion and Analysis

5. Maintain a strong financial position

We intend to remain disciplined in our capital investment strategy and continue to build on our already strong financial position.

We currently have access to $1.7 billion in liquidity, including $411 million in cash. During 2019, we entered into transactions to strengthen our position to execute on the Clean Energy Investment Plan including: (i) entering into an investment agreement with Brookfield providing us with $750 million in strategic financing, (ii) increasing our credit facilities by $200 million to a total of $2.2 billion and extending the maturity of the term by one year, and (iii) successfully obtaining US$126 million of tax equity financing associated with the US Wind Projects.

To further this strategy in 2020, we will repay the $400 million bond maturing in November 2020 and continue our share buyback program in an amount up to $80 million.

The Clean Energy Investment Plan will be funded from the cash raised through the strategic investment by Brookfield, cash generated from operations and raising capital through TransAlta Renewables. For further details on the Brookfield investment, refer to the Significant and Subsequent Events section of this MD&A.

In addition, we continue to execute on our multi-year Greenlight program that is focused on transforming our business and delivering TransAlta’s strategy by reducing our cost structure. The program is entering its fourth year since implementation, and with each passing year it creates a continuous improvement culture that improves the way employees work together to deliver better business results. The program is focused on creating a structure around our people that enables them to identify, develop and deliver projects that improve performance across the Corporation with an emphasis on delivering sustainable value and cash flow improvements. Through the program, we have instituted ways to optimize our assets, minimize GHG emissions, reduce capital and operating costs, improve fuel usage and streamline processes. As this approach is increasingly embedded into the Corporation it has increased the empowerment of our employees, strengthened our processes and improved our corporate culture while reducing our operating costs.

Management’s Discussion and Analysis

Growth and coal-to-gas conversion expenditures

Our growth projects are focused on sustaining our current operations and supporting our growth strategy in our Clean Energy Investment Plan. A summary of the significant growth and major projects that are in progress is outlined below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total project | | | | | Estimated spend in 2020 | Target completion date | | |

| | Estimated

spend | | | Spent to date(1) | | | | | Details |

| Project | | | | | | | | | |

Big Level wind development project(2) | 225 | | - | | 240 | | 234 | | | 4 | | Commissioned | | 90 MW wind project with a 15-year PPA |

Antrim wind development project(3) | 100 | | - | | 110 | | 106 | | | — | | Commissioned | | 29 MW wind project with two 20-year PPAs |

Pioneer gas pipeline

partnership | 95 | | - | | 100 | | 100 | | | — | | Commissioned | | 50 per cent ownership in the 120 km natural gas pipeline to supply gas to Sundance and Keephills |

Skookumchuck wind development project(4,5) | 150 | | - | | 160 | | — | | | 80 | | Q2 2020 | | Option to purchase a 49 per cent ownership in the 136.8 MW wind project with a 20-year PPA |

Windrise wind development project(5) | 270 | | - | | 285 | | 49 | | | 233 | | Q2 2021 | | 207 MW wind project with a 20-year Renewable Electricity Support Agreement with AESO |

WindCharger battery(5,6) | 7 | | - | | 8 | | 1 | | | 6 | | Q2 2020 | | 10 MW/20 MWh utility-scale storage project |

| Boiler conversions | 100 | | - | | 200 | | 28 | | | 69 | | 2020 to 2022 | | Coal-to-gas conversions at Canadian Coal |

| Repowering | 750 | | - | | 770 | | 85 | | | 20 | | 2023 | | Repower the steam turbines at Sundance Unit 5 |

Kaybob cogeneration project(5) | 105 | | - | | 115 | | 17 | | | 59 | | Q4 2021 | | 40 MW cogeneration project with SemCAMS under a 13-year fixed price contract |

| Total | 1,802 | | - | | 1,988 | | 620 | | | 471 | | | | |

(1) Represents cumulative amounts spent as of Dec. 31, 2019.

(2) The numbers reflected above are in CAD but the actual cash spend on this project is in US funds and therefore these amounts will fluctuate with changes in foreign exchange rates. The estimated total spend is approximately US$173 million to US$185 million, spent to date is US$179 million and estimated remaining spend in 2020 is US$3 million. TransAlta Renewables funded a portion of the construction costs using its existing liquidity and the remaining was funded with tax equity financing.

(3) The numbers reflected above are in CAD but the actual cash spend on this project is in US funds and therefore these amounts will fluctuate with changes in foreign exchange rates. The estimated total spend is approximately US$77 million to US$85 million, spent to date is US$80 million and estimated remaining spend in 2020 is nil. TransAlta Renewables funded a portion of the construction costs using its existing liquidity and the remaining was funded with tax equity financing.

(4) The estimated spend in 2020 assumes the project will receive tax equity financing for the remainder of the total project spend.

(5) These projects will potentially be dropped down to TransAlta Renewables.

(6) Net of expected government reimbursements.

Management’s Discussion and Analysis

Highlights

Consolidated Financial Highlights

| | | | | | | | | | | |

| Year ended Dec. 31 | 2019 | 2018 | 2017 |

| Revenues | 2,347 | | 2,249 | | 2,307 | |

| Fuel, carbon compliance and purchased power | 1,086 | | 1,100 | | 1,016 | |

| Operations, maintenance and administration | 475 | | 515 | | 517 | |

| Net earnings (loss) attributable to common shareholders | 52 | | (248) | | (190) | |

| Cash flow from operating activities | 849 | | 820 | | 626 | |

Comparable EBITDA(1,2,3) | 984 | | 1,161 | | 1,030 | |

Funds from operations(1,3) | 757 | | 927 | | 804 | |

Free cash flow(1,3) | 435 | | 524 | | 328 | |

| Net earnings (loss) per share attributable to common shareholders, basic and diluted | 0.18 | | (0.86) | | (0.66) | |

Funds from operations per share(1,3) | 2.67 | | 3.23 | | 2.79 | |

Free cash flow per share(1,3) | 1.54 | | 1.83 | | 1.14 | |

| Dividends declared per common share | 0.12 | | 0.20 | | 0.12 | |

Dividends declared per preferred share(4) | 0.78 | | 1.29 | | 0.77 | |

| | | |

| As at Dec. 31 | 2019 | 2018 | 2017 |

| Total assets | 9,508 | | 9,428 | | 10,304 | |

Total consolidated net debt(1,5) | 3,110 | | 3,141 | | 3,363 | |

Total long-term liabilities(6) | 4,329 | | 4,414 | | 4,311 | |

(1) These items are not defined and have no standardized meaning under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings trends more readily in comparison with prior periods’ results. Refer to the Discussion of Consolidated Financial Results section of this MD&A for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. See also the Additional IFRS measures and Non-IFRS Measures section of this MD&A.

(2) During the first quarter of 2019, we revised our approach to reporting adjustments to arrive at comparable EBITDA, mainly to be more comparable with other companies in the industry. Comparable EBITDA is now adjusted to exclude the impact of unrealized mark-to-market gains or losses. The current and prior period amounts have been adjusted to reflect this change.

(3) Includes $157 million received from the Balancing Pool for the early termination of Sundance B and C PPAs in the first quarter of 2018 and the remaining $56 million received on winning the arbitration against the Balancing Pool in the third quarter of 2019 ("PPA Termination Payments"). See the Significant and Subsequent Events section for further details.

(4) Weighted average of the Series A, B, C, E and G preferred share dividends declared. Dividends declared vary year over year due to timing of dividend declarations.

(5) Total consolidated net debt includes long-term debt, including current portion, amounts due under credit facilities, exchangeable securities, US tax equity financing and lease obligations, net of available cash and cash equivalents, the principal portion of restricted cash on TransAlta OCP and the fair value of economic hedging instruments on debt. See the table in the Financial Capital section of this MD&A for more details on the composition of total consolidated net debt.

(6) Certain comparative figures have been reclassified to conform to the current period’s presentation. These reclassifications did not impact previously reported net earnings.

At the end of 2018, we had a number of contracts expire, which impacted our comparable EBITDA. Through our strong performance in 2019, we recovered a significant amount of these expected declines through innovation, cost reductions and higher revenue from our Energy Marketing segment.

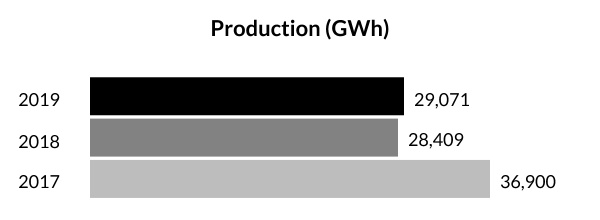

Revenues in 2019 were $2,347 million, up $98 million compared to 2018, mainly as a result of strong revenue generated from our Energy Marketing segment as well as higher production, resulting in higher revenue, within the US Coal segment due to the strong merchant pricing in the Pacific Northwest.

Comparable EBITDA decreased by $177 million compared to 2018. After adjusting for the PPA Termination Payments in 2019 and 2018, comparable EBITDA decreased by $76 million for the year ended Dec. 31, 2019, compared to 2018. This decrease was expected as a result of the expiry of the Mississauga contract and lower scheduled payments on the Poplar Creek contract. Strong performance at the Canadian Coal and Energy Marketing segments as well as lower Corporate costs have significantly offset this expected decrease. Comparable EBITDA for the year ended Dec. 31, 2019, was negatively impacted by the unplanned outage at US Coal during the first quarter of 2019.

At Canadian Coal, comparable EBITDA improved in 2019 due to the combined impact of higher realized prices as a result of greater merchant production, increased co-firing resulting in lower fuel, carbon compliance and purchased power costs, as well as lower operations, maintenance and administration ("OM&A") costs. In addition, performance from our Energy Marketing segment was stronger than 2018, particularly from US Western and Eastern markets due to continued high levels of volatility across North American power markets.

TRANSALTA CORPORATION M10

Management’s Discussion and Analysis

Free cash flow ("FCF"), one of the Corporation's key financial metrics, totalled $435 million, down $89 million compared to last year. FCF, after adjusting for the PPA Termination Payments, increased $12 million compared to last year, primarily as a result of lower sustaining and productivity capital expenditures and lower distributions paid to subsidiaries' non-controlling interests. Significant changes in segmented cash flows are highlighted in the Segmented Comparable Results within this MD&A.

OM&A expense for the year-ended Dec. 31, 2019, decreased by $40 million compared to 2018. This decline in OM&A is largely due to lower costs in our Canadian Coal and Corporate segments and ongoing streamlining of our workforce. Lower salary, contractor and materials expenses were partially offset by higher legal fees.

Fuel, carbon compliance and purchased power costs were lower in 2019 compared to 2018. This decrease was mainly due to our increased gas supply available for co-firing, as a result of the Corporation transporting natural gas on the Pioneer Pipeline earlier than expected. Co-firing, when economical, allows us to produce fewer GHG emissions than coal combustion, which lowers our GHG compliance costs.

Net earnings attributable to common shareholders for the year ended Dec. 31, 2019, were $52 million, compared to a loss of $248 million in the prior year. Increased earnings were partially driven by the Keephills 3 and Genesee 3 swap with Capital Power Corporation that closed in the fourth quarter of 2019, where we recognized a gain on termination of the coal rights contract of $88 million and a gain on the sale of Genesee 3 of $77 million, in addition to the $56 million PPA Termination Payments received during the third quarter of 2019. Excluding the PPA Termination Payments and impairment charges in both years, as well as the gains related to Keephills 3 and Genesee 3 in 2019, we have a net loss of $20 million in 2019 compared to a net loss of $174 million in 2018. Stronger earnings are attributable to stronger performance at Canadian Coal and Energy Marketing, strong Alberta pricing, the Alberta tax rate reduction, lower OM&A costs and lower interest expense, partially offset by other losses on sale of property, plant and equipment ("PP&E").

Ability to Deliver Financial Results

The metrics we use to track our performance are comparable earnings before interest, taxes, depreciation and amortization ("comparable EBITDA"), funds from operations ("FFO") and FCF. The overall performance of our portfolio was in line with our 2019 outlook. The Corporation is within the upper end of the revised FCF target of $350 million to $380 million, excluding the impact of the PPA Termination Payments. Reported FCF benefited from the receipt of $56 million from the Balancing Pool on settlement of the termination of the Sundance B and C PPA dispute.

The following table compares target to actual amounts for each of the three past fiscal years:

| | | | | | | | | | | | | | |

| Year ended Dec. 31 | | 2019 | 2018 | 2017 |

| Comparable EBITDA | Target(1) | 875-975 | 1,000-1,050 | 1,025-1,100 |

| Actual(2) | 984 | | 1,161 | | 1,030 | |

| Adjusted Actual(3) | 928 | | 1,004 | | 996 | |

| | | | |

| | | | |

| | | | |

| FCF | Target(1) | 350-380 | 300-350 | 270-310 |

| Actual | 435 | | 524 | | 328 | |

| Adjusted Actual(3) | 379 | | 367 | | 311 | |

(1) Represents our revised outlook. Due to strong results from our Canadian Coal segment, in the fourth quarter of 2019, we revised our FCF target from a range of $270 million to $330 million to a range of $350 million to $380 million. As a result of strong performance in the first quarter of 2018, we revised the following 2018 targets: comparable EBITDA from the previously announced target range of $950 million to $1,050 million to $1,000 to $1,050 million, FCF target range from $275 million to $350 million to the target range of$300 million to $350 million. In the second quarter of 2017, we reduced the following 2017 targets: Comparable EBITDA from target range of $1,025 million to $1,135 million to $1,025 to $1,100 million, FCF target range from $300 million to $365 million to the target range of $270 million to $310 million.

(2) During the first quarter of 2019, we revised our approach to reporting adjustments to arrive at comparable EBITDA, mainly to be more comparable with other companies in the industry. Comparable EBITDA is now adjusted to exclude the impact of unrealized mark-to-market gains or losses. The current and prior period amounts have been adjusted to reflect this change.

(3) 2019 and 2018 were adjusted for the PPA Termination Payments as these were not included in the targets. 2017 amounts were adjusted to remove the impact related to the Ontario Electricity Financial Corporation ("OEFC") indexation dispute: Comparable EBITDA was reduced by $34 million and FCF was reduced by $17 million.

TRANSALTA CORPORATION M11

Management’s Discussion and Analysis

Significant and Subsequent Events

Investor Day

On Sept. 16, 2019, TransAlta held our 2019 Investor Day, and announced our Clean Energy Investment Plan. See the Corporate Strategy section of this MD&A for additional 2019 significant events to advance our Clean Energy Investment Plan.

In addition, the Corporation announced that it adopted, based on TransAlta level deconsolidated cash flows, a deconsolidated Debt/EBITDA target of 2.5 to 3.0 times, and a dividend policy of returning between 10 and 15 per cent of TransAlta deconsolidated FFO to common shareholders. The credit metrics and dividend policy are being presented on a deconsolidated basis, allowing investors to understand how the dividends received from TransAlta Renewables and TransAlta Cogeneration L.P. ("TA Cogen") are either being returned or invested for TransAlta shareholders. See the Key Financial Ratios section of this MD&A for further details.

On Jan. 16, 2020, the Board declared a quarterly dividend of $0.0425 per common share payable on Apr. 1, 2020, to shareholders of record at the close of business on Mar. 2, 2020, which represents a 6.25 per cent increase in our dividend level.

Strategic Investment by Brookfield

Following extensive engagement by the Corporation with several of its shareholders, on Mar. 25, 2019, the Corporation announced it entered into an agreement (the "Investment Agreement") whereby Brookfield agreed to invest $750 million (the "Investment") in the Corporation. The Investment provides the financial flexibility to drive TransAlta's transition to 100 per cent clean electricity by 2025, recognizes the anticipated future value of TransAlta's Alberta Hydro Assets and accelerates the Corporation's plan to return capital to its shareholders. As discussed in the Corporate Strategy section of this MD&A, the Brookfield Investment was key to the implementation and advancement of the Corporation's Clean Energy Investment Plan, including facilitating or accelerating several key pillars of the Corporations' strategic plan.

Under the terms of the Investment Agreement, Brookfield agreed to invest $750 million in TransAlta through the purchase of exchangeable securities, which are exchangeable by Brookfield into an equity ownership interest in TransAlta’s Alberta Hydro Assets in the future at a value based on a multiple of the Alberta Hydro Assets’ future adjusted EBITDA.

On May 1, 2019, Brookfield invested the initial tranche of $350 million in exchange for seven per cent unsecured subordinated debentures due May 1, 2039. The remaining $400 million will be invested in October 2020 in exchange for a new series of redeemable, retractable first preferred shares, subject to the satisfaction of certain conditions being met.

Upon entering into the Investment Agreement and as required under the terms of the agreement, the Corporation paid Brookfield a $7.5 million structuring fee. A commitment fee of $15 million was also paid upon completion of the initial funding. These transaction costs were recognized as part of the carrying value of the unsecured subordinated debentures issued at that time.

In addition, subject to the exceptions in the Investment Agreement, Brookfield has committed to purchase TransAlta common shares on the open market to increase its share ownership in TransAlta to not less than nine per cent at the conclusion of the prescribed share purchase period, provided that Brookfield is not obligated to purchase any common shares at a price per share in excess of $10 per share. In connection with the Investment, Brookfield nominated and TransAlta shareholders elected two experienced officers of Brookfield, Harry Goldgut and Richard Legault, to our Board of Directors at the 2019 Annual and Special Meeting of shareholders. TransAlta and Brookfield intend to work together to complete TransAlta’s transition to clean electricity, maximize the value of the Alberta Hydro Assets and create long-term shareholder value.

In accordance with the terms of the Investment Agreement, TransAlta has formed a Hydro Assets Operating Committee

consisting of two representatives from Brookfield and two representatives from TransAlta to provide advice and recommendations in connection with the operation and maximizing the value of the Alberta Hydro Assets. In connection with this, the Corporation has committed to pay Brookfield an annual fee of $1.5 million for six years beginning May 1, 2019 (the "Brookfield Hydro Fee"), which is recognized in the OM&A expense on the statement of earnings (loss).

TransAlta has indicated that it intends to return up to $250 million of capital to shareholders through share repurchases within three years of receiving the first tranche of the Investment (which occurred on May 1, 2019).

TRANSALTA CORPORATION M12

Management’s Discussion and Analysis

Additional details about the Investment can be found in our material change report dated Mar. 26, 2019, available electronically on SEDAR at www.sedar.com and on EDGAR at www.sec.gov as well as in our AIF. Copies of the Investment Agreement, together with copies of the exchangeable debenture issued to Brookfield on May 1, 2019, the registration rights agreement entered into with Brookfield in respect of common shares held in TransAlta, and the exchange and option agreement with Brookfield governing the terms of the exchange of the exchangeable securities issued under the Investment, are also available on SEDAR and on EDGAR. Shareholders are urged to read these documents in their entirety.

On Apr. 23, 2019, The Mangrove Partners Master Fund Ltd. ("Mangrove") commenced an action in the Ontario Superior Court of Justice alleging, among other things, oppression by the Corporation and its directors and seeking to set aside the Brookfield transaction. TransAlta believes the claim is wholly lacking in merit and is taking all steps to defend against the allegations. This matter is scheduled to proceed to trial beginning Sept. 14, 2020. See the Other Consolidated Analysis section of this MD&A for additional information on the Mangrove proceedings.

Normal Course Issuer Bid

On May 27, 2019, the Corporation announced that the TSX accepted the notice filed by the Corporation to implement a Normal Course Issuer Bid ("NCIB") for a portion of its common shares. Pursuant to the NCIB, the Corporation may purchase up to a maximum of 14,000,000 common shares, representing approximately 4.92 per cent of issued and outstanding common shares as at May 27, 2019. Purchases under the NCIB may be made through open market transactions on the TSX and any alternative Canadian trading platforms on which the common shares are traded, based on the prevailing market price. Any common shares purchased under the NCIB will be cancelled.

The period during which TransAlta is authorized to make purchases under the NCIB commenced on May 29, 2019, and ends on May 28, 2020, or such earlier date on which the maximum number of common shares are purchased under the NCIB or the NCIB is terminated at the Corporation's election.

Under TSX rules, no more than 176,447 common shares (being 25 per cent of the average daily trading volume on the TSX of 705,788 common shares for the six months ended Apr. 30, 2019) can be purchased on the TSX on any single trading day under the NCIB, with the exception that one block purchase in excess of the daily maximum is permitted per calendar week.

During the year ended Dec. 31, 2019, the Corporation purchased and cancelled a total of 7,716,300 common shares at an average price of $8.80 per common share, for a total cost of $68 million.

Termination of the Alberta Sundance PPAs with the Balancing Pool

On Sept 18. 2017, the Corporation received formal notice from the Balancing Pool for the termination of the Sundance B and C PPAs effective Mar. 31, 2018. This announcement was expected and the Corporation took steps to re-take dispatch control for the units effective Mar. 31, 2018.

Pursuant to a written agreement, the Balancing Pool paid the Corporation approximately $157 million on Mar. 29, 2018. The Corporation disputed the termination payment received. The Balancing Pool excluded certain mining and corporate assets that should have been included in the net book value calculation which the Corporation pursued from the Balancing Pool through an arbitration initiated under the PPAs. On Aug. 26, 2019, the Corporation announced it was successful in the arbitration and received the full additional amount it was seeking to recover, being $56 million, plus GST and interest.

TransAlta and Capital Power Swap Non-Operating Interests in Keephills 3 and Genesee 3

On Oct. 1, 2019, the Corporation closed a transaction with Capital Power Corporation ("Capital Power") to swap TransAlta's 50 per cent ownership interest in the Genesee 3 facility for Capital Power's 50 per cent ownership interest in the Keephills 3 facility. As a result, TransAlta now owns 100 per cent of the Keephills 3 facility and Capital Power owns 100 per cent of the Genesee 3 facility.

The Keephills 3 facility is a 463 MW coal-fired generating facility located approximately 70 kilometres west of Edmonton, Alberta, adjacent to TransAlta’s existing Keephills Unit 1 and Unit 2 power plants. The Keephills 3 facility achieved commercial operation in 2011 and has been identified as a candidate for TransAlta’s intended coal-to-gas conversions.

TRANSALTA CORPORATION M13

Management’s Discussion and Analysis

The transaction price for each non-operating interest largely offset each other, resulting in a payment of approximately $10 million from Capital Power to TransAlta. Final working capital true-ups and settlements occurred in November 2019, with a net working capital difference of less than $1 million paid by TransAlta to Capital Power.

The Corporation early-adopted amendments to IFRS 3 Business Combinations, which introduce an optional fair value concentration test, that the Corporation elected to apply to its acquisition of the non-operating interest in Keephills 3. As a result, on the transaction closing of Oct. 1, 2019, the acquisition has been accounted for as an asset acquisition and the transaction price was allocated based on the relative fair values of those assets and liabilities as at the date of the acquisition. The transaction price of $301 million was allocated as follows: working capital of $11 million, PP&E of $308 million, other assets of $3 million, less other liabilities of $2 million and decommissioning and other provisions of $19 million. The net increase to our PP&E balance relating to Keephills 3 and Genesee 3 swap, including the impact of shortening the useful lives of the coal assets at Keephills 3, is estimated to increase depreciation expense in 2020 by approximately $72 million.

As a result of the sale of our interest in Genesee 3, we recognized a gain on sale of approximately $77 million in the fourth quarter.

On closing of the transaction, all of the Keephills 3 and Genesee 3 project agreements with Capital Power were terminated, including the agreement governing the supply of coal from TransAlta's Sunhills mine to the Keephills 3 facility. The Sunhills mine accounted for the revenues generated under this agreement pursuant to IFRS 15 Revenue from Contracts with Customers, which resulted in the recognition of a contract liability representing the mine’s unsatisfied performance obligations for which consideration was received in advance. Upon termination of this agreement in the fourth quarter of 2019, the Sunhills mine had no future performance obligations and accordingly, the balance of the contract liability of $88 million was recognized in earnings.

Board of Director Changes

On Jan. 16, 2020, we announced that the Board has appointed John P. Dielwart as Chair of the Board, upon his re-election as an independent director at TransAlta’s next annual shareholder meeting and immediately following Ambassador Gordon Giffin’s retirement from the Board. As previously announced, Ambassador Giffin is retiring from the Board in 2020 after serving as Chair since 2011.

Mr. Dielwart has served as an independent director on the Board since 2014, and currently serves as the Chair of the Governance, Safety and Sustainability Committee. He is also on the Investment Performance Committee of the Board and has previously served on the Audit, Finance and Risk Committee. Mr. Dielwart is a founder and director of ARC Resources Ltd. from 1996 to present and served as Chief Executive Officer of ARC Resources Ltd. from 2001 to 2013. Mr. Dielwart earned a Bachelor of Science (Distinction) in Civil Engineering from the University of Calgary, is a member of the Association of Professional Engineers and Geoscientists of Alberta and a Past-Chairman of the Board of Governors of the Canadian Association of Petroleum Producers. Mr. Dielwart is also a director and former Co-Chair of the Calgary and Area Child Advocacy Centre. In 2015, Mr. Dielwart was inducted into the Calgary Business Hall of Fame.

On Jan. 25, 2019, we also announced the retirement decision of Timothy Faithfull. In 2018, Mr. Faithfull indicated to the Board his intention to retire from the Board of Directors immediately following TransAlta's 2019 Annual Shareholders Meeting.

Management Changes

On July 18, 2019, the Corporation appointed John Kousinioris as Chief Operating Officer of TransAlta Corporation. Mr. Kousinioris previously held the roles Chief Growth Officer and Chief Legal and Compliance Officer and Corporate Secretary at TransAlta. In the role of Chief Growth Officer, Mr. Kousinioris was responsible for overseeing the areas of business development, gas and renewables operations, commercial and energy marketing. Mr. Kousinioris also remains the President of TransAlta Renewables.

On May 16, 2019, the Corporation promoted Todd Stack to Chief Financial Officer. Mr. Stack, who has served as Managing Director and Corporate Controller of the Corporation since February 2017, has been responsible for providing leadership and direction over TransAlta’s financial activities, corporate accounting, reporting, tax and corporate planning. Since joining TransAlta in 1990, Mr. Stack has acted as the Corporation's Treasurer and Corporate Controller, as well as a member of the corporate development team reviewing greenfield and acquisition opportunities. Prior to joining the finance team at TransAlta, Mr. Stack held a number of roles in the engineering team, including design, operations and project management.

TRANSALTA CORPORATION M14

Management’s Discussion and Analysis

Mothballing of Sundance Units

On Mar. 8, 2019, the Corporation announced that the AESO granted an extension to the mothballing of Sundance Units 3 and 5, which will remain mothballed until Nov. 1, 2021, extended from Apr. 1, 2020. The extensions were requested by TransAlta based on our assessment of market prices and market conditions. TransAlta has the ability to return either of the units back to full operation by providing three months’ notice to the AESO.

Financing of the US Wind Projects

TransAlta Renewables completed the acquisition of an economic interest in the US Wind Projects from a subsidiary of TransAlta Power Ltd. ("TA Power"). Pursuant to the arrangement, a TransAlta subsidiary owns the US Wind Projects directly and TA Power issued to TransAlta Renewables tracking preferred shares that pay quarterly dividends based on the pre-tax net earnings of the US Wind Projects. The tracking preferred shares have preference over the common shares of TA Power held by TransAlta, in respect of dividends and the distribution of assets in the event of the liquidation, dissolution or winding-up of TA Power. The construction and acquisition costs of the US Wind Projects were funded by tax equity financing and TransAlta Renewables. As at Dec. 31, 2019, TransAlta Renewables funded these costs by acquiring tracking preferred shares issued by TA Power or by subscribing for interest-bearing promissory notes issued by the project entity.

Big Level and Antrim began commercial operation on Dec. 19, 2019, and Dec. 24, 2019, respectively. In conjunction with reaching commercial operation, tax equity proceeds were raised to partially fund the US Wind Projects in the amount of approximately US$85 million for Big Level and approximately US$41 million for Antrim. The tax equity financing is classified as long-term debt on the statements of financial position.

Refer to the Corporate Strategy section of this MD&A for further updates on ongoing projects.

Refer to Note 4 of the consolidated financial statements within our 2019 Annual Integrated Report for significant events impacting both prior and current year results.

Additional IFRS Measures and Non-IFRS Measures

An additional IFRS measure is a line item, heading or subtotal that is relevant to an understanding of the consolidated financial statements but is not a minimum line item mandated under IFRS, or the presentation of a financial measure that is relevant to an understanding of the consolidated financial statements but is not presented elsewhere in the consolidated financial statements. We have included line items entitled gross margin and operating income (loss) in our Consolidated Statements of Earnings (Loss) for the years ended Dec. 31, 2019, 2018 and 2017. Presenting these line items provides management and investors with a measurement of ongoing operating performance that is readily comparable from period to period.

We evaluate our performance and the performance of our business segments using a variety of measures to provide management and investors with an understanding of our financial position and results. Certain financial measures discussed in this MD&A are not defined under IFRS, are not standard measures under IFRS and, therefore, should not be considered in isolation or as an alternative to or to be more meaningful than net earnings attributable to common shareholders or cash flow from operating activities, as determined in accordance with IFRS, when assessing our financial performance or liquidity. These measures may not be comparable to similar measures presented by other issuers and should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS. Comparable EBITDA, deconsolidated Comparable EBITDA, FFO, deconsolidated FFO, FCF, total net debt, total consolidated net debt, adjusted net debt, deconsolidated net debt and segmented cash flow generated by the business, all as defined below, are non-IFRS measures that are presented in this MD&A. See the Discussion of Consolidated Financial Results, Segmented Comparable Results, Selected Quarterly Information, Key Financial Ratios and Financial Capital sections of this MD&A for additional information, including a reconciliation of such non-IFRS measures to the most comparable IFRS measure.

TRANSALTA CORPORATION M15

Management’s Discussion and Analysis

Discussion of Consolidated Financial Results

Each business segment assumes responsibility for its operating results measured to comparable EBITDA and cash flows generated by the business. Gross margin is also a useful measure as it provides management and investors with a measurement of operating performance that is readily comparable from period to period.

Comparable EBITDA

EBITDA is a widely adopted valuation metric and an important metric for management that represents our core business profitability. Interest, taxes, depreciation and amortization are not included, as differences in accounting treatments may distort our core business results. In addition, under comparable EBITDA we reclassify certain transactions to facilitate the discussion of the performance of our business:

▪During the first quarter of 2019, we revised our approach to reporting adjustments to arrive at comparable EBITDA, mainly to be more comparable with other companies in the industry. Comparable EBITDA is now adjusted to exclude the impact of unrealized mark-to-market gains or losses. The current and prior period amounts have been adjusted to reflect this change.

▪Any gains or losses on asset sales are not included as these are not part of ongoing operations.

▪Certain assets we own in Canada (and in Australia in 2017) are fully contracted and recorded as finance leases under IFRS. We believe it is more appropriate to reflect the payments we receive under the contracts as a capacity payment in our revenues instead of as finance lease income and a decrease in finance lease receivables. We depreciate these assets over their expected lives.

▪We also reclassify the depreciation on our mining equipment from fuel, carbon compliance and purchased power to reflect the actual cash cost of our business in our comparable EBITDA.

▪In December 2016, we agreed to terminate our existing arrangement with the Independent Electricity System Operator (“IESO”) relating to our Mississauga cogeneration facility in Ontario and entered into a new Non-Utility Generator (“NUG”) Enhanced Dispatch Contract (the “NUG Contract”) effective Jan. 1, 2017. Under the new NUG Contract, we received fixed monthly payments until Dec. 31, 2018, with no delivery obligations. Under IFRS, for our reported results in 2016, as a result of the NUG Contract, we recognized a receivable of $207 million (discounted), a pre-tax gain of approximately $191 million net of costs to mothball the units and accelerated depreciation of $46 million. In 2017 and 2018, on a comparable basis, we recorded the payments we received as revenues as a proxy for operating income, and depreciated the facility until Dec. 31, 2018.

▪On the commissioning of the South Hedland facility in July 2017, we prepaid approximately $74 million of electricity transmission and distribution costs. Interest income is recorded on the prepaid funds. We reclassify this interest income as a reduction in the transmission and distribution costs expensed each period to reflect the net cost to the business.

▪In October 2019, we acquired Capital Power's 50 per cent ownership of Keephills 3 in exchange for selling our 50 per cent ownership in the Genesee 3 facility to Capital Power, and we now own 100 per cent of the Keephills 3 facility. As a result, all of the Keephills 3 and Genesee 3 project agreements with Capital Power were terminated, including the agreement governing the supply of coal from TransAlta’s Sunhills mine to the Keephills 3 facility. Upon termination of this agreement in the fourth quarter of 2019, the Sunhills mine had no future performance obligations and accordingly, the balance of the contract liability of $88 million was recognized in earnings. On a comparable basis, we removed this gain from 2019 results.

▪Asset impairment charges (reversals) are removed to calculate comparable EBITDA as these are accounting adjustments that impact depreciation and amortization and do not reflect business performance.

TRANSALTA CORPORATION M16

Management’s Discussion and Analysis

A reconciliation of net earnings (loss) attributable to common shareholders to Comparable EBITDA results is set out below:

| | | | | | | | | | | |

| Year ended Dec. 31 | 2019 | 2018 | 2017 |

| Net earnings (loss) attributable to common shareholders | 52 | | (248) | | (190) | |

| Net earnings attributable to non-controlling interests | 94 | | 108 | | 42 | |

| Preferred share dividends | 30 | | 50 | | 30 | |

| Net earnings (loss) | 176 | | (90) | | (118) | |

| Adjustments to reconcile net income to comparable EBITDA | | | |

| Income tax expense (recovery) | 17 | | (6) | | 64 | |

| Gain on sale of assets and other | (46) | | (1) | | (2) | |

| Foreign exchange loss | 15 | | 15 | | 1 | |

| Net interest expense | 179 | | 250 | | 247 | |

| Depreciation and amortization | 590 | | 574 | | 635 | |

| Comparable reclassifications | | | |

| Decrease in finance lease receivables | 24 | | 59 | | 59 | |

| Mine depreciation included in fuel cost | 121 | | 140 | | 75 | |

| Australian interest income | 4 | | 4 | | 2 | |

| Unrealized mark-to-market (gains) losses | (33) | | 38 | | (32) | |

| Adjustments to earnings to arrive at comparable EBITDA | | | |

Impacts to revenue associated with certain de-designated and economic

hedges | — | | — | | 2 | |

Impacts associated with Mississauga recontracting(1) | — | | 105 | | 77 | |

| Gain on termination of Keephills 3 coal rights contract | (88) | | — | | — | |

Asset impairment charge(2) | 25 | | 73 | | 20 | |

| Comparable EBITDA | 984 | | 1,161 | | 1,030 | |

| Comparable EBITDA - excluding the PPA Termination Payments | 928 | | 1,004 | | 1,030 | |

(1) Impacts associated with Mississauga recontracting for the year ended Dec. 31, 2018, are as follows: revenue ($108 million) and fuel and purchased power and de-designated hedges ($3 million). Impacts associated with Mississauga recontracting for the year ended Dec. 31, 2017, are as follows: revenue ($101 million), fuel and purchased power and de-designated hedges ($12 million), operations, maintenance and administration ($3 million) and recovery related to a renegotiated land lease ($9 million).

(2) Asset impairment charges for 2019 primarily includes the $141 million increase for the decommissioning and restoration liability at the Centralia mine, the $15 million for trucks held for sale and written down to net realizable value and the $18 million write-off of project development costs, partially offset by a $151 million impairment reversal at US Coal (2018 - $38 million charge related to the retirement of Sundance Unit 2, Lakeswind and Kent Breeze impairment of $12 million and a write-off of project development costs of $23 million; 2017 - $20 million retirement of Sundance Unit 1).

Funds from Operations and Free Cash Flow

FFO is an important metric as it provides a proxy for cash generated from operating activities before changes in working capital and provides the ability to evaluate cash flow trends in comparison with results from prior periods. FCF is an important metric as it represents the amount of cash that is available to invest in growth initiatives, make scheduled principal repayments on debt, repay maturing debt, pay common share dividends or repurchase common shares. Changes in working capital are excluded so FFO and FCF are not distorted by changes that we consider temporary in nature, reflecting, among other things, the impact of seasonal factors and timing of receipts and payments. FFO per share and FCF per share are calculated using the weighted average number of common shares outstanding during the period.

TRANSALTA CORPORATION M17

Management’s Discussion and Analysis

The table below reconciles our cash flow from operating activities to our FFO and FCF:. (

| | | | | | | | | | | |

| Year ended Dec. 31 | 2019 | 2018 | 2017 |

Cash flow from operating activities(1) | 849 | | 820 | | 626 | |

| Change in non-cash operating working capital balances | (121) | | 44 | | 114 | |

| Cash flow from operations before changes in working capital | 728 | | 864 | | 740 | |

| Adjustments | | | |

| Decrease in finance lease receivable | 24 | | 59 | | 59 | |

| Other | 5 | | 4 | | 5 | |

| FFO | 757 | | 927 | | 804 | |

| Deduct: | | | |

Sustaining capital(2) | (141) | | (150) | | (218) | |

| Productivity capital | (9) | | (21) | | (24) | |

| Dividends paid on preferred shares | (40) | | (40) | | (40) | |

| Distributions paid to subsidiaries’ non-controlling interests | (111) | | (169) | | (172) | |

Payments on lease obligations(2) | (21) | | (18) | | (17) | |

| Other | — | | (5) | | (5) | |

| FCF | 435 | | 524 | | 328 | |

| Weighted average number of common shares outstanding in the year | 283 | | 287 | | 288 | |

| FFO per share | 2.67 | | 3.23 | | 2.79 | |

| FCF per share | 1.54 | | 1.83 | | 1.14 | |

(1) 2019 and 2018 amounts include the PPA Termination Payments. See the Significant and Subsequent Events section for further details.

(2) During the first quarter of 2019, we revised the way in which FFO and FCF are reconciled to reflect the payments related to lease obligations as a separate line and removed finance leases from sustaining capital. Prior period results have been revised to reflect these changes.

The table below bridges our comparable EBITDA to our FFO and FCF:

| | | | | | | | | | | |

| Year ended Dec. 31 | 2019 | 2018 | 2017 |

Comparable EBITDA(1) | 984 | | 1,161 | | 1,030 | |

| Provisions and other | 13 | | (9) | | (3) | |

| Interest expense | (174) | | (187) | | (218) | |

| Current income tax expense | (35) | | (28) | | (23) | |

| Realized foreign exchange gain (loss) | (6) | | 5 | | 15 | |

| Decommissioning and restoration costs settled | (34) | | (31) | | (19) | |

| Other cash and non-cash items | 9 | | 16 | | 22 | |

| FFO | 757 | | 927 | | 804 | |

| Deduct: | | | | |

Sustaining capital(2) | (141) | | (150) | | (218) | |

| Productivity capital | (9) | | (21) | | (24) | |

| Dividends paid on preferred shares | (40) | | (40) | | (40) | |

| Distributions paid to subsidiaries’ non-controlling interests | (111) | | (169) | | (172) | |

Payments on lease obligations(2) | (21) | | (18) | | (17) | |

| Other | — | | (5) | | (5) | |

| FCF | 435 | | 524 | | 328 | |

(1) During the first quarter of 2019, we revised comparable EBITDA to exclude the impact of unrealized mark-to-market gains or losses. The current and prior period amounts have been adjusted to reflect this change. 2019 and 2018 amounts include the PPA Termination Payments. See the Significant and Subsequent Events section for further details.

(2) During the first quarter of 2019, we revised the way in which FFO and FCF are reconciled to reflect the payments related to lease obligations as a separate line and removed finance leases from sustaining capital. Prior period results have been revised to reflect these changes.

TRANSALTA CORPORATION M18

Management’s Discussion and Analysis

| | | | | | | | | | | |

| Supplemental disclosure | 2019 | 2018 | 2017 |

| FFO - excluding the PPA Termination Payments | 701 | | 770 | | 804 | |

| FCF - excluding the PPA Termination Payments | 379 | | 367 | | 328 | |

| | | |

| FFO per share - excluding the PPA Termination Payments | 2.48 | | 2.68 | | 2.79 | |

| FCF per share - excluding the PPA Termination Payments | 1.34 | | 1.28 | | 1.14 | |