CATALYST PAPER CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | 1 |  |

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following management discussion and analysis (“MD&A”) should be read in conjunction with the consolidated financial statements for the years ended December 31, 2005, 2004, and 2003 and the notes thereto.

Throughout the discussion, reference is made to EBITDA, which represents earnings before interest, taxes, depreciation and amortization, and before other non-operating income and expenses. EBITDA, as defined, equates to operating earnings (loss) plus amortization. As Canadian Generally Accepted Accounting Principles (“GAAP”) do not define a method of calculating EBITDA, the measure as calculated by Catalyst Paper Corporation (“the Company”) might not be comparable to similarly-titled measures reported by other entities. EBITDA is presented because the Company believes it is a useful indicator of a company’s operating performance, and subsequently, a company’s ability to meet debt service and capital expenditure requirements. EBITDA should not be considered by an investor as an alternative to net earnings, an indicator of the financial performance of the Company, or an alternative to cash flows as a measure of liquidity. Refer to the “Non-GAAP Measures” section for a reconciliation of this non-GAAP measure to net earnings (loss).

Except for the historical information contained herein, the matters set forth in this report are forward-looking. These include, for example, statements with respect to general economic conditions in the U.S., Canada, and internationally, assessment of market conditions and demand for the Company’s products, the outlook for inventories, production and pricing, performance improvements and cost savings, expected cash flows, capital expenditures and completion of capital projects, shifts in industry capacity, fluctuations in foreign exchange and interest rates, business strategies, fluctuations in availability and cost of raw materials or energy, ability to obtain financing and other factors beyond the Company’s control. These statements reflect management’s current views and are based on certain assumptions. Such statements are subject to risks and uncertainties that may cause actual results, performance or developments to differ materially from those contained in the statements. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investors are cautioned not to place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future results.

In accordance with industry practice, in this MD&A, the term “ton” or the symbol “ST” refers to a short ton, an imperial unit of measurement equal to 0.9072 metric tonnes, and the term “tonne” or the symbol “MT” refers to a metric tonne.

In this MD&A, unless otherwise indicated, all dollar amounts are expressed in Canadian dollars, as are the term “dollars” and the symbols “$” and “CDN$”. The term “U.S. dollars” and the symbol “US$” refer to United States dollars.

The information in this report is as at January 25, 2006. Disclosure contained in this document is current to that date, unless otherwise stated.

| | 2 |  |

Table of Contents

| | 3 |  |

| 1.0 | CORPORATE OVERVIEW AND HIGHLIGHTS |

| | | |

| 1.1 | Overview of the Business |

| | | |

| | The Company is the third largest North American based producer of newsprint and uncoated mechanical groundwood specialty papers, measured by production capacity. It is also the largest producer of coated and uncoated specialty papers and newsprint, and the only producer of lightweight coated paper, on the West Coast of North America. The Company is the largest producer of directory paper in the world by capacity, and operates the largest paper recycling operation in Western Canada. It also has a significant presence in most major international markets, serving customers in countries around the world. The 2005 geographical sales mix can be found on page 6 of this MD&A. |

| | | |

| | The Company’s business includes printing papers and market pulp, operating in three business segments: |

| | | |

| | Specialty Papers |

| | The specialty papers segment consists of soft-calendered and machine finished (“MF”) hi-brite uncoated, lightweight coated, directory, and kraft paper grades. These groundwood specialty paper grades are manufactured on eleven1paper machines at Crofton, Elk Falls, Port Alberni and Powell River. The specialty papers business segment has a total production capacity of 1,141,000 tonnes. |

| | | |

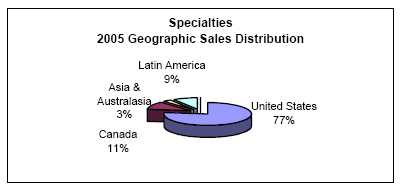

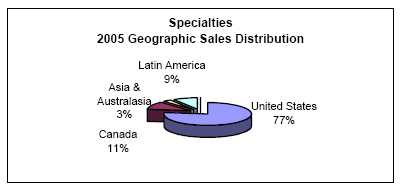

| | Specialty papers is the Company’s largest business segment, representing approximately 55% of 2005 consolidated sales revenue. The Company’s customer base consists primarily of retailers, magazine and catalogue publishers, commercial printers, telephone directory publishers, and corrugated box manufacturers. Specialty paper products are sold primarily through the Company’s sales and marketing personnel in North America, and through distributors and agents in other geographic markets. In 2005, approximately 88% of specialty paper sales volumes were made to customers in North America. Specialty paper is shipped by a combination of ship, barge, rail, and truck. |

| | | |

| | Newsprint |

| | Newsprint is currently produced on five1paper machines at Crofton, Elk Falls, and Powell River. The segment has a total annual production capacity of 841,000 tonnes, of which, one machine at Port Alberni, or 140,000 tonnes on a 45.0 g/m2equivalent basis is currently idled. |

| 1 | The Company has 13 paper machines. The number of machines noted in the segments above reflects the ability of the Company’s machines to switch between newsprint and specialty paper grades. |

| | 4 |  |

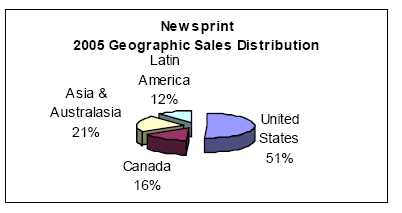

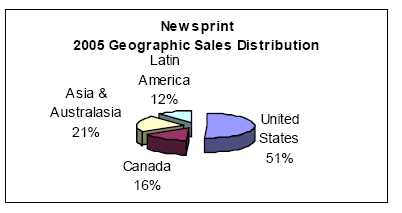

Newsprint sales represented approximately 29% of 2005 consolidated sales revenue. The newsprint customer base consists primarily of newsprint publishers located in Western and Central North America and Asia. In 2005, approximately 88% of newsprint sales volumes were to customers in North America and Asia. Newsprint is shipped primarily by deep-sea vessel, and by a combination of ship, barge, rail, and truck for inland destinations.

Pulp

The pulp segment is comprised of sawdust-based pulp, manufactured at the Elk Falls mill, and Northern Bleached Softwood Kraft (“NBSK”) pulp, manufactured at the Crofton mill. The segment has a total production capacity of 509,000 tonnes.

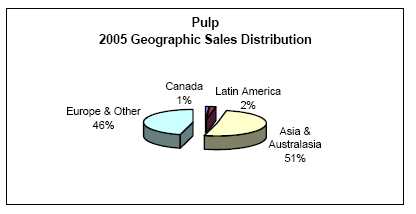

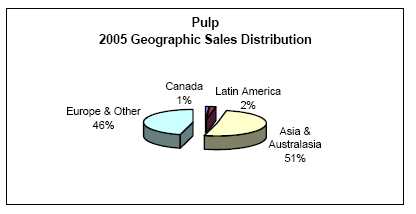

Pulp sales represented approximately 16% of 2005 consolidated sales revenue. The pulp customer base includes producers of tissue, magazine papers, woodfree printing and writing papers, and certain specialty paper products located primarily in Asia and Europe. Pulp products are sold primarily through sales and marketing personnel in Canada and Japan, and through a network of agents in locations throughout the world. In 2005, approximately 97% of pulp sales volumes were made to customers in Europe and Asia and Australasia. The Crofton and Elk Falls pulp mills are located on tidewater and have deep-sea vessel loading facilities. Pulp is shipped by both break-bulk on deep-sea vessels and container shipment.

The Company also operates the largest paper recycling operation in Western Canada, in support of its business segments. This facility has a production capacity of 148,000 air-dried equivalent tonnes of pulp per year, the majority of which is consumed internally.

| | 5 |  |

The chart below illustrates the Company’s principal paper and pulp products, applications, and annual 2006 capacity.

| PRODUCT PROFILE |

| | Specialty Paper Grades | Newsprint | Pulp |

| Category | Uncoated Papers | Coated

Paper | Directory | Kraft Paper | Newsprint | Market Pulp |

Soft-

Calendered | Machine-Finished |

|

| Brand Name | Electrasoft

Electracal

Electraprime | Electrabrite

Electrastar | Electracote | Catalyst | Silverliner

Platinumliner

Chromiumliner

Bronzeliner | Marathon | Elk Prime

Crofton

Kraft |

|

|

|

|

|

|

|

|

|

| Basis Weight (g/m2) | 36.6 – 52 | 45 – 66.5 | 44.4 – 63.6 | 28 – 40 | 127 – 250 | 43 - 48.8 | n/a |

|

|

|

|

|

| Applications | Magazines,

Supplements,

Catalogues,

Inserts, Flyers,

Directories | Magazines,

Supplements, Inserts,

Flyers, Direct

mail, PR and

corporate

communication

books/manuals | Magazines,

Catalogues,

Inserts, Flyers,

Direct mail | Telephone books,

Airline schedules,

Catalogues | Packaging

applications | Newspapers,

Inserts, Flyers,

Supplements,

Directories,

Timetables | Tissue,

Freesheet,

Specialty paper,

Whitetop

linerboard |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capacity(tonnes) | 466,0002 | 223,000 | 315,0001, 2 | 137,000 | 841,0001, 2 | 509,000 |

|

|

|

|

| % of TotalCapacity | 19% | 9% | 13% | 5% | 34% | 20% |

|

|

|

| | 1 | Effective February, 2005, the Company indefinitely idled its Port Alberni paper machine No 3. This curtailment reduced the Company’s capacity of its newsprint business a further 140,000 tonnes from the amounts expressed in this table. |

| | 2 | Capacities expressed in the above table can vary as the Company is able to switch production between products, particularly newsprint, directory, and machine-finished uncoated grades. |

The Company’s diverse range of products are sold on five continents. The North American market accounts for 63% of the Company’s sales and continues to be the principal market for the Company followed by Asia and Australasia, Latin America, and Europe. The consolidated sales volume distribution for 2005 was as follows:

| | 6 |  |

| | 1.2 | 2005 Overview |

| | | |

| | | Difficult business conditions for pulp and paper producers persisted throughout 2005, the strength of the Canadian dollar being a key factor in the Company’s unsatisfactory financial performance. The 2005 net loss was comparable with the prior year, as gains from the 2005 performance improvement program and higher average transaction prices for paper products were eroded by the negative impact of the strengthening Canadian dollar, lower pulp prices, and rising input costs. |

| | | |

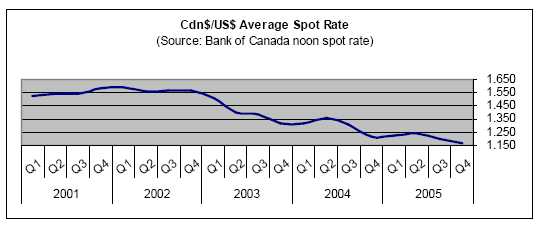

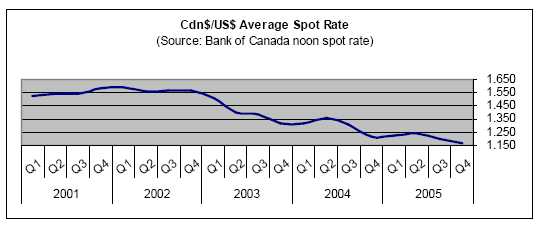

| | | For the third consecutive year, the strengthening Canadian dollar had a significant adverse impact on the Company’s earnings, as the majority of sales are denominated in U.S. dollars. During the year, the Canadian dollar strengthened 6.9% compared to the U.S. dollar, with an average spot exchange rate of CDN$1.212 compared to CDN$1.302 for 2004 and 1.402 for 2003. The strengthening Canadian dollar negatively impacted operating earnings by approximately $140 million in the current year. For further details about the Company’s sensitivity to fluctuations in foreign exchange refer to the “Sensitivity Analysis” section. |

| | | |

| | | The negative impact of the dollar’s strengthening on operating earnings was somewhat offset by a positive impact of the translation of the Company’s U.S.-dollar-denominated debt into Canadian dollars which totalled $24.7 million pre-tax for the year ended December 31, 2005. |

| | | |

| | | The chart below illustrates the movement of the CDN$/US$ spot rate over the past five years. |

Globally, the industry also continued to struggle with rising input costs, particularly with respect to increased energy and fibre prices. Due to its location in British Columbia, the Company was, to a certain extent, insulated from these effects because it benefits from lower fibre and electricity costs compared to other regions.

| | 7 |  |

In addition, the Company’s relatively low use of fossil fuels, due to its ability to use lower priced alternatives, lessens its exposure to rising fuel prices. However, like other producers, the Company is exposed to rising energy prices as they significantly impact transportation and chemical costs. In addition, it is one of the few companies fully exposed to Canadian dollar fluctuations. As a result of these challenging conditions, several producers indefinitely idled or permanently closed down a number of their mill operations during the year.

Despite the various challenges facing the Company, its 2005 performance improvement program exceeded expectations, surpassing its goal by 5%. With the conclusion of the 2005 program, the Company realized $84 million in year-over-year EBITDA improvements, exceeding its $80 million target by $4 million. The “Progress on 2005 Strategic Initiatives” section includes a detailed discussion on the current year results.

The U.S. economy continued its strong performance in 2005, driven by consumer spending, industrial production, job growth, and homebuilding which offset high energy costs during the year. Despite the strong U.S. economy, market conditions for the Company’s suite of products were mixed during 2005.

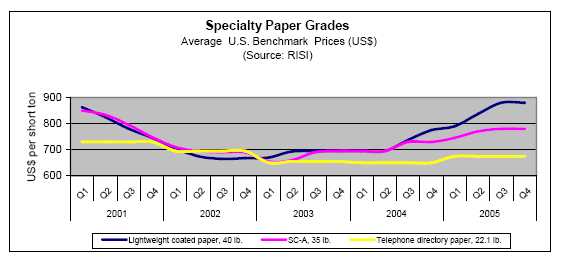

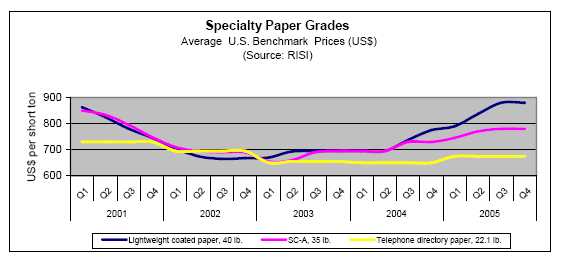

Coated mechanical markets were tight for much of the year despite weaker demand. As a result of tight market conditions, lightweight coated (“LWC”) prices in 2005 increased by approximately 17% over 2004.

Uncoated mechanical markets were strong, with job growth and consumer confidence leading to strong retail sales. Prices for super-calendered A grades (“SC-A”), a common benchmark for a number of uncoated mechanical paper grades, increased by approximately 8% in 2005. Prices for MF hi-brite and super-brite grades increased between 7% and 9% over the previous year, depending on the grade.

Directory markets were stable in 2005. Competition between traditional telephone directory publishers and independents in the yellow pages book market resulted in new publications and additional page counts in the year. Contract pricing in 2005 was up by approximately 4% from 2004.

Kraft paper markets were sluggish for much of the year, largely due to weak corrugated box shipments. A combination of falling inventories and cost pressures resulted in some improvement in market conditions late in the year. Compared to 2004, 2005 average prices for white top linerboard showed a marginal improvement.

Newsprint markets in the U.S. continued to experience declining demand and consumption due to decreases in ad lineage, circulation, and average basis weights. However, cost pressures and the strong Canadian dollar drove transaction prices higher compared to the previous year.

| | 8 |  |

As a result, prices moved up slowly but steadily over the year. Average prices for 2005 were up by an average of 10% compared to 2004.

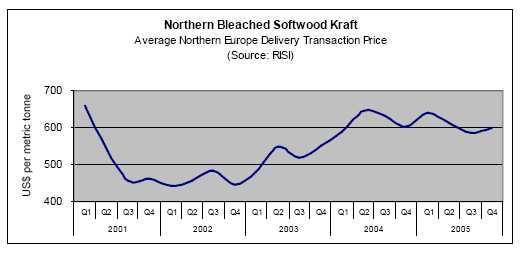

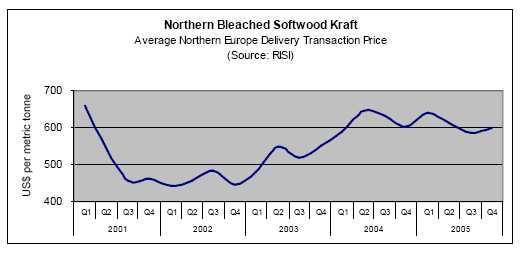

Pulp markets weakened in 2005. Despite a slight increase in global shipments compared to 2004, new capacity in Asia and South America during the year resulted in softer than anticipated pricing in Asia and Europe. In Europe NBSK pulp benchmark prices declined by approximately 1% compared to 2004; however transaction prices fared worse due to competitive pressures and generally weaker non-contract markets.

In early February 2005, the Company indefinitely idled its Port Alberni No.3 paper machine displacing 140,000 tonnes per year of the Company’s newsprint capacity. Related restructuring costs for the year were approximately $6 million.

On October 3, 2005, the Company’s shareholders voted 99.9% in favour of changing the Company’s name from Norske Skog Canada Limited to Catalyst Paper Corporation. In addition, effective October 1, 2005, the Company dissolved its U.S. marketing joint venture with Norske Skogindustrier ASA (“Norske Skog”).

| | | Ø | Changed the Company’s name, reflecting its unique identity as an independent producer of paper and pulp products that are sold globally. |

|

|

| | | | |

| | | Ø | Dissolved the Company’s U.S. marketing joint venture with Norske Skog, after which the Company returned to marketing its specialty paper products directly to North American customers. |

|

|

| | | | |

| | | Ø | Recorded the safest year in the Company’s history with the lowest medical incident rate and lost-time injury frequency. |

|

| | | | |

| | | Ø | Realized an $84 million improvement in EBITDA as a result of the Company’s 2005 performance improvement program. |

|

| | | | |

| | | Ø | Increased sales of Electraprime, the Company’s SC-A alternative product, by 56,000 tonnes to 89,000 tonnes during 2005. |

|

| | | | |

| | | Ø | Reduced the use of high-cost kraft in paper production to the lowest level in the Company’s history, resulting in savings of $18 million. |

|

| | | | |

| | | Ø | Optimized the Company’s fibre mix, including the realization of the lowest delivered chip cost since 2002. |

|

| | | | |

| | | Ø | Reduced the Company’s reliance on fossil fuels to record lows through the use of lower priced alternatives and conservation initiatives. |

|

| | | | |

| | | Ø | Received recognition for product quality, including supplier of the year from Verizon Information Services and Vertis Inc. |

|

| | 9 |  |

| | | Ø | Recognized as one of the top ten companies of the decade for the Company’s amount of greenhouse gas reduction over the past ten years. By the end of 2005, the Company has reduced greenhouse gas emissions by 71% below 1990 levels. |

|

|

|

| | 1.4 | Selected Financial Information |

| (In millions of dollars, except where otherwise stated) | | | | | | | | | |

| | | 2005 | | | 2004 | | | 2003 | |

| Sales | $ | 1,823.9 | | $ | 1,878.2 | | $ | 1,820.5 | |

| Operating earnings (loss) | | (25.1 | ) | | (31.3 | ) | | (111.6 | ) |

| EBITDA1 | | 155.2 | | | 152.8 | | | 78.3 | |

| Net earnings (loss) | | (25.6 | ) | | (28.6 | ) | | (84.5 | ) |

| EBITDA margin2 | | 8.5% | | | 8.1% | | | 4.3% | |

| Net earnings (loss) per share (in dollars) – basic | | | | | | | | | |

| and diluted | | (0.12 | ) | | (0.13 | ) | | (0.41 | ) |

| Total assets | | 2,695.9 | | | 2,745.9 | | | 2,816.4 | |

| Total long-term liabilities | $ | 1,396.8 | | $ | 1,417.6 | | $ | 1,479.9 | |

| Sales (000 tonnes) | | | | | | | | | |

| Specialty papers | | 1,063.2 | | | 1,115.5 | | | 1,084.7 | |

| Newsprint | | 707.1 | | | 754.7 | | | 768.7 | |

| Total paper | | 1,770.3 | | | 1,870.2 | | | 1,853.4 | |

| Pulp | | 482.7 | | | 405.5 | | | 421.3 | |

| Total sales | | 2,253.0 | | | 2,275.7 | | | 2,274.7 | |

| Production (000 tonnes) | | | | | | | | | |

| Specialty papers | | 1,066.0 | | | 1,123.1 | | | 1,075.3 | |

| Newsprint | | 699.5 | | | 757.8 | | | 774.8 | |

| Total paper | | 1,765.5 | | | 1,880.9 | | | 1,850.1 | |

| Pulp | | 474.2 | | | 420.9 | | | 418.8 | |

| Total production | | 2,239.7 | | | 2,301.8 | | | 2,268.9 | |

| Average spot foreign exchange rate C$/US$3 | | 1.212 | | | 1.302 | | | 1.402 | |

| Period-end spot foreign exchange rate C$/US$4 | | 1.166 | | | 1.204 | | | 1.292 | |

| Effective foreign exchange rate C$/US$5 | | 1.239 | | | 1.359 | | | 1.454 | |

| Common shares (millions): | | | | | | | | | |

| At period end | | 214.6 | | | 214.6 | | | 214.6 | |

| Weighted average | | 214.6 | | | 214.6 | | | 206.6 | |

| | | 1. | EBITDA is a non-GAAP measure. Refer to “Non-GAAP Measures” for further details. |

| | | 2. | EBITDA margin is defined as EBITDA as a percentage of sales. |

| | | 3. | Average spot foreign exchange rate is the average Bank of Canada noon spot rate over the reporting period. |

| | | 4. | Period-end spot foreign exchange rate is the Bank of Canada noon spot rate. |

| | | 5. | Effective foreign exchange rate represents a blended rate which takes into account the applicable spot rates and the Company’s revenue hedging program in the reporting period. |

| | 1.5 | Strategy |

| | | |

| | | The Company’s long-term objective is to achieve higher, sustainable earnings and maximize cash flow by strengthening its position as a leading producer of value-added paper and related forest products within Western North America. |

| | | |

| | | Key Performance Drivers |

| | | The Company believes the following key performance drivers are critical in achieving its strategic goals and creating value for its investors. |

| | 10 |  |

Strong Market Position

Market positioning is a significant driver of the Company’s success. As one of the largest North American based producers of newsprint and uncoated groundwood specialty papers, market penetration is important. The Company’s brand names are well recognized in the marketplace and it has worked hard to build a reputation for reliability, value and service.

Upgraded, Cost-Competitive Manufacturing

In the past five years, capital expenditures of approximately $463 million have been directed primarily towards the Company’s manufacturing facilities to shift production towards higher margin papers, reduce unit production costs, increase operating efficiency, improve product quality, increase capacity, and meet or exceed environmental regulations.

Diversified Product Mix

In recent years, the Company has introduced or expanded a number of specialty paper and differentiated product lines, including lightweight newsprint grades, coated papers, MF hi-brites, super hi-brites, soft-calendered grades, directory, sawdust-based pulp, and whitetop linerboard. These products offer improved margins over standard commodity newsprint grades. Additionally, market pulp accounts for only 20% of the Company’s manufacturing capacity, significantly limiting the Company’s relative exposure to volatile pulp markets.

Strong Supply Chain

The Company has a strong and flexible distribution network. The Company utilizes all transportation modes available to it such as truck, rail, container, and break-bulk shipping. The Company’s supply chain systems have enabled better planning and scheduling, allowing the Company to use the most cost-efficient mode of transportation on its shipments.

Production Expertise

Over the last several years, the Company has developed expertise in the production of lightweight papers. Lower basis weight papers improve the Company’s costs by reducing fibre, conversion, shipping, storage and handling costs and warehouse space required for inventories. The use of lower basis weight paper by the Company’s customers also reduces their costs. The Company’s papermaking expertise enables it to produce high quality, higher brightness uncoated groundwood grades. In addition, new product development continues to be an important focus.

The Company is also one of the few manufacturers of sawdust-based pulp in the world. This product is valued by producers of tissue and wood-free printing papers as a substitute for more costly NBSK pulp.

| | 11 |  |

Skilled People

The Company’s employees act as strategic partners when tackling challenges and improving the Company’s performance. Recognizing this, the Company strives to be a top employer by providing a work environment that is safe, challenging, interesting, and rewarding.

The Company’s management team is comprised of seasoned industry professionals with experience operating through multiple business cycles in the paper and forest products industry. The Company’s executives have an average of over 16 years of industry experience and 11 years with the Company.

Sound Corporate Social Responsibility

Corporate social responsibility is one of the Company’s core values. The Company views success in this area as the health of citizens in its communities, safety and well-being of its employees, vibrancy of its communities, and sustainability of the Company’s practices with respect to their impact on the environment. For a complete description of the Company’s objectives and progress please see the Company’s 2005 Accountability Report.

Key Performance Indicators

The Company believes the following key performance indicators are meaningful indicators for measuring the Company’s progress in achieving its strategic goals and creating value for investors.

Safety

The well being of its employees is the Company’s first priority. Safety is measured in terms of the medical incident rate (“MIR”), which is the number of incidents requiring medical attention per 200,000 hours worked, and the lost-time injury frequency (“LTI”), which is the number of lost-time injuries per 200,000 hours worked. 2005 was the safest year on record for the Company, and for additional details on current year results see the Company’s 2005 Accountability Report.

EBITDA

EBITDA is widely used in the financial community to compare the profitability of corporations, and is used by management as an indicator of relative operating performance. See the “Consolidated Results of Operations”, “Segmented Results of Operations”, and the “Non-GAAP Measures” sections for further analysis and discussion of this indicator.

Performance Improvement Program

One of the characteristics of the Company’s culture is that of engaging its people in projects that challenge the status quo. The Company, for several years, has aggregated these initiatives on an annual basis into “Performance Improvement Programs”. Performance improvement initiatives challenge the Company to create innovative and cost effective business solutions.

| | 12 |  |

In 2005, the Company launched its fourth consecutive performance improvement program. See “Progress on 2005 Strategic Initiatives” for a detailed summary of the 2005 Performance Improvement Program.

Average Sales Revenue per Tonne

Average sale revenue per tonne for each core business provides key insights on how the Company maximizes its market position. The main factors in revenue growth are U.S. dollar transaction prices, and the relationship between the Canadian and U.S. dollar. For details on 2005 results see “Segmented Results of Operations”.

Average Cash Costs

Reducing cash costs, while maintaining product quality is essential to sustaining profitability in each of the Company’s core businesses. The Company continually examines all areas of its business for cost reduction opportunities. For details on 2005 results see “Segmented Results of Operations”.

Debt to Capitalization

The Company’s success also depends on its liquidity and continued ability to finance its growth. The Company focuses on its total debt to total capitalization ratio, and net debt to net capitalization ratio, in order to assess its debt position. See “Liquidity and Capital Resources” for further discussion.

Greenhouse Gas Emissions (“GHG”)

The Company takes its environmental responsibility seriously and as such has invested heavily in environmental initiatives. The Company has reduced GHGs by 71% since 1990, and is well positioned to meet objectives established by the Kyoto Protocol. Emissions are measured in direct GHGs per tonne. In recognition of its progress, in 2005 the Company was named one of the top ten companies of the decade in terms of reducing greenhouse gases. For further details on current year results see the Company’s 2005 Accountability Report.

| | 13 |  |

Strategic Initiatives

The Company’s strategic initiatives in 2005 and 2004 were as follows:

| (All amounts pre-tax and in millions of dollars) |

Initiative

| Performance Goal

| 2005

Goal | 2005

Achievement | 2004

Achievement |

|

| Components of Performance Improvement Programs |

i) Grade Development

and Product

Optimization | Develop new, higher-value specialty products, reduce exposure to the commodity newsprint market, and optimize product, grade and customer mix. | $16 | $19 | $ 18 |

|

|

|

|

ii) Cost Reduction

| Reduce kraft usage

Fibre optimization

Improve energy efficiencies

Freight optimization

Optimize chemical usage

Productivity improvements

Deinked pulp cost reduction

Other | 13

9

7

6

4

9

-

16 | 18

12

10

7

4

-

-

14 | 21

15

3

4

-

-

19

23 |

|

|

|

|

|

|

|

| | | 64 | 65 | 85 |

| | | $80 | $84 | $103 |

Progress on 2005 Strategic Initiatives

| | | (a) | Performance Improvement Program |

| | | | In January 2005, the Company commenced its fourth consecutive annual performance improvement program. The 2005 performance improvement program was aimed at generating $80 million in year-over-year EBITDA improvements across all areas of the Company. The Company identified improvements in the areas of grade development and product optimization, and cost reduction. In 2005, $84 million in realized savings was delivered from the Performance Improvement Program. |

|

|

|

|

|

|

| | | | |

| | | i) | Grade Development and Product Optimization |

| | | | This strategic initiative included the marketing of new high-value specialty paper products, and the reduction of the Company’s exposure to standard newsprint. In 2005, the Company realized EBITDA improvements of $19 million as a result of its various grade development and product optimization initiatives. |

|

|

|

|

| | 14 |  |

| | | | In pursuit of these performance initiatives, the Company accomplished the following in 2005: |

| | | | |

| | | | Sales of Electraprime and Electrastar |

| | | | In 2003, the Company introduced Electraprime to the market. The Electraprime grade is a soft-calendered, high-brightness paper designed to compete as an alternative to SC-A grades used primarily for advertising flyers and inserts. Electraprime was well received in the market with sales of approximately 89,000 tonnes in 2005, an improvement of approximately 56,000 tonnes from the previous year. This was in excess of its goal to sell an additional 40,000 tonnes in 2005. The Company intends to continue growing its Electraprime business through 2006. |

| | | | |

| | | | The Electrastar grade was also introduced to the market in 2003 and is a super high-brightness grade designed for applications in which brightness is a desirable characteristic, such as inserts and specialty newspapers. Electrastar sales volumes were up 10% to 60,000 tonnes from the previous year, which was in line with the Company’s expectations. Potential opportunities to grow the Electrastar grade will depend, amongst other things, on its profitability relative to other MF hi-brite grades, machine capacity constraints, and competitive factors. |

| | | | |

| | | ii) | Cost Reduction |

| | | | On the Company’s initiative to reduce costs, the following was accomplished in 2005: |

| | | | |

| | | | Reduce Kraft Usage |

| | | | The Company continued to use low-cost fillers and reduced kraft input while maintaining quality and improving printability. In 2005, kraft usage was the lowest in Company history. The amount of kraft used in specialty and newsprint paper products was reduced by 2.6%, from 6.5% in 2004 to 3.9% in the current year. Approximately $18 million in savings were realized as a result of this initiative. |

| | | | |

| | | | Fibre Optimization |

| | | | The Company further optimized its fibre mix during the year. Specifically, the Company improved utilization of lower cost chips, recording the lowest delivered chip cost since 2002. In addition, the start-up of the reconfigured thermo-mechanical pulp (“TMP”) mill at Crofton resulted in higher use of lower cost TMP. This and other smaller initiatives yielded an additional $12 million in savings. |

| | 15 |  |

| | | | Improve Energy Efficiencies |

| | | | The Company is a significant consumer of energy. The continuing optimization of the fuel mix in the Company’s power boilers has resulted in less reliance on fossil fuels in favour of wood waste hog fuel. In addition the Company has increased the amount of steam generated from its recovery boilers, and renegotiated delivery costs associated with a natural gas contract. These and other energy reduction initiatives resulted in additional savings of $10 million in 2005. |

| | | | | |

| | | | Freight Optimization |

| | | | The Company’s key freight initiatives included improving the destination mix to reduce volumes to high-cost markets, rationalizing routes and mode mix, and reducing container shipment costs. These and other initiatives resulted in additional savings of $7 million in the current year. |

| | | | | |

| | | | Optimize Chemical Usage |

| | | | The Company optimized its chemical mix to include more low-cost chemicals, resulting in additional savings of $4 million during the current year. |

| | | | | |

| | | | Productivity Improvements |

| | | | The Company had a number of productivity initiatives during 2005 that were focused on improved efficiency and speed. While many of the initiatives were completed, several unforeseen events such as delays with the mills returning to production after their annual shutdowns mitigated the positive impact of these improvements. Consequently, the Company did not report any net savings from these initiatives. |

| | | | | |

| | | | Other |

| | | | The Company also completed a series of smaller initiatives, primarily with respect to procurement improvements and its maintenance practices. Approximately $14 million in savings were realized as a result of these initiatives. |

| | | | | |

| | | (b) | Other Strategic Initiatives |

| | | | | |

| | | | i) | Preferred Supplier |

| | | | | |

| | | | | Quality Initiatives |

| | | | | During the year, the Company focused on advancing its preferred supplier status with key customers by continuing to improve the consistency, runnability, and reliability of its products, and on time delivery service. In addition the Company was recognized for its product quality, receiving supplier of the year from Verizon Information Services and Vertis Inc. |

| | 16 |  |

| | | | Chain of Custody Certification |

| | | | During the previous year, the Company implemented the “independent chain of custody” system to certify its wood fibre supply. This is a third party audited system that identifies the source of wood fibre, and whether or not it is derived from a forest independently certified as being managed in accordance with a recognized sustainable forest certification. The independent chain of custody provides a valuable tool to assure customers that paper contains wood fibre derived from well-managed forests, and has resulted in additional sales opportunities. |

| | | | |

| | | Systems and Processes |

| | | | |

| | | As part of its ongoing initiatives to improve efficiency, the Company will further invest in improved systems and processes in 2006. The Company anticipates that an upgrade in its enterprise reporting system will be completed by the third quarter of 2006, and will cost approximately $2.5 million for capitalizable software, hardware, and consulting. |

| | | | |

| | | 2006 Performance Improvement Program |

| | | | |

| | | In January 2006, the Company announced its fifth consecutive annual performance improvement program. The Company identified further improvements in the areas of grade development and product optimization, and cost reduction. The 2006 Performance Improvement Program is aimed at generating $70 million in EBITDA improvements across all areas of the Company, year over year. |

| | | | |

| | 1.6 | Consolidated Results of Operations |

| | | | |

| | | Sales |

| | | Sales for the current year of $1,823.9 million were down 2.9%, compared to $1,878.2 million in the previous year. Higher average paper prices and an improved customer, grade, and market mix were more than offset by the negative impact of the stronger Canadian dollar, and lower sales volumes resulting from the indefinite idling of the Company’s Port Alberni No. 3 paper machine in early February 2005. |

| Sales ($ millions) |

| Year ended

December 31 |

| Total

Change | Increase (decrease) from 2004

as a result of: |

|

|

2005 |

2004 |

Volume |

Mix |

Price |

F/X |

|

Specialties

Newsprint | $ 994.7

529.1 | $1,037.2

553.1 | $(42.5)

(24.0) | $(48.6)

(34.9) | $12.0

5.5 | $ 81.6

49.9 | $ (87.5)

(44.5) |

|

Total Paper

Pulp | $1,523.8

300.1 | $1,590.3

287.9 | $(66.5)

12.2 | $(83.5)

54.8 | $17.5

2.4 | $131.5

(18.1) | $(132.0)

(26.9) |

|

| Total | $1,823.9 | $1,878.2 | $(54.3) | $(28.7) | $19.9 | $113.4 | $(158.9) |

| | 17 |  |

EBITDA

EBITDA for the current year of $155.2 million was up 1.6% compared to $152.8 million in the previous year. The positive impact of higher paper prices, performance improvement benefits, and the absence of costs associated with the Elk Falls kraft mill rationalization, which occurred in the first quarter of 2004, was largely offset by the stronger Canadian dollar, and to a lesser extent, lower pulp prices. Other influences on costs included inflation on energy, inputs and services, higher levels of biannual planned maintenance and curtailment, and higher selling, general and administration (“SG&A”) costs which included costs associated with the dissolution of the Company’s U.S. marketing joint venture and the Company’s name change, along with higher audit and regulatory costs. The following table summarizes the key changes in EBITDA from the year ended December 31, 2004 to the year ended December 31, 2005:

| ($millions) | |

2004 EBITDA

Improved paper prices

Lower pulp prices

Impact of stronger Canadian dollar, net of hedging program(1)

Performance improvements

Absence of 2004 Elk Falls rationalization project

Inflation

Maintenance shutdowns and curtailment

SG&A

Other, net | $ 152.8

130.0

(15.7)

(139.9)

84.0

24.0

(36.7)

(17.9)

(7.2)

(18.2) |

|

|

|

|

|

|

|

|

|

| 2005 EBITDA | $ 155.2 |

|

| | | 1. | Includes foreign exchange impact on costs. |

Operating earnings (loss)

The Company recorded an operating loss of $25.1 million for the current year, compared to an operating loss of $31.3 million for the previous year. The decrease in operating loss was related to the $2.4 million increase in EBITDA (see EBITDA section above) and a $3.8 million reduction in amortization expense.

Net earnings (loss)

Net loss for the current year was $25.6 million ($0.12 per common share) compared to net loss of $28.6 million ($0.13 per common share) for the same period last year. The net loss for the current year included a $20.7 million ($0.10 per common share) after-tax foreign exchange gain on the translation of U.S.-dollar-denominated debt, compared to an after-tax gain of $44.0 million ($0.21 per common share) for the previous year. The decrease in net loss was largely attributable to the decrease in foreign exchange gain, which was partially offset by net favourable future income tax adjustments totalling $18.3 million ($0.09 per common share), consisting primarily of a $14.2 million positive future income tax adjustment from a decrease in the British Columbia provincial income tax rate, effective July 1, 2005.

| | 18 |  |

The following table reconciles 2005 earnings (loss) to 2004:

| ($millions) | Pre-tax | After-tax |

| 2004 earnings (loss) | $ (56.7) | $ (28.6) |

| Higher EBITDA | 2.4 | 1.6 |

| Lower amortization | 3.8 | 2.5 |

| Decreased foreign exchange gain on translation of long-term debt | (28.8) | (23.8) |

| Absence of 2004 loss on repayment of long-term debt | 5.2 | 3.4 |

| Interest | (0.8) | (0.5) |

| Income tax adjustments, net | - | 18.3 |

| Non-controlling interest | (0.6) | (0.6) |

| Other, net | 3.3 | 2.1 |

| 2005 earnings (loss) | $ (72.2) | $ (25.6) |

| 2.0 | SEGMENTED RESULTS OF OPERATIONS |

| | | |

| | 2.1 | Specialty Papers |

| Summary of Selected Financial Information |

| (In millions of dollars, except where otherwisestated) | 2005 | 2004 | 2003 |

Sales

EBITDA1

Operating earnings (loss)

EBITDA margin |

$ 994.7

119.2

21.4

12.0% |

$ 1,037.2

103.4

1.9

10.0% |

$ 1,002.7

66.0

(32.5)

6.6% |

|

|

|

|

Sales (000 tonnes)

Production (000 tonnes) |

1,063.2

1,066.0 |

1,115.5

1,123.1 |

1,084.7

1,075.3 |

|

|

Average sales revenue per tonne

Average cash costs per tonne2 |

$ 936

824 |

$ 930

837 |

$ 924

864 |

|

|

SC-A paper, 35lb. (US$ per ton)3

LWC paper, No.5, 40lb (US$ per ton)3

Telephone directory paper, 22.1 lb. (US$ per

ton)3 |

769

846

675 |

713

726

650 |

675

688

654 |

|

|

|

|

| | | 1. | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| | | 2. | Average cash costs per tonne for these purposes consist of cost of sales and SG&A costs. |

| | | 3. | Benchmark prices are sourced from Resource Information Systems, Inc. (“RISI”). |

| | 2.1.1 | Markets |

| | | |

| | | Coated mechanical paper markets were tight during the first half of the year before levelling off in the fall of 2005. On a year-over-year basis, demand for North American LWC paper was down 3.1% in 2005, largely |

| | 19 |  |

as a result of weaker magazine circulation, flat ad pages, and some grade substitution, namely to SC-A. Despite weak demand, markets were tight for the majority of the year as a result of supply disruptions in Canada and Finland, which more than offset demand declines. As a result, average LWC benchmark prices increased by US$120 per ton compared to 2004.

North American uncoated mechanical paper markets remained strong as job growth and consumer confidence drove retail sales. As a result, demand for uncoated mechanical grades, which service the retail insert and flyer market, were up 2.3% in 2005 over the previous year. Average SC-A benchmark prices increased approximately US$56 per ton from the previous year. Average MF hi-brite and super-brite prices increased between US$50 and US$60 per tonne, depending on the grade, from the previous year.

Demand for directory grades remained steady as competition between traditional telephone directory publishers and independents in the yellow pages phone book markets resulted in new publications and additional page counts. Demand increased 1.5% year over year in 2005, and contract prices were up by 3.8%, or US$25 per ton, versus 2004. Kraft paper markets were sluggish for much of the year as weak corrugated box shipments led to a 3.1% decrease in demand in 2005. A combination of falling inventories, cost pressures, and improving corrugated box shipments resulted in some improvement in market conditions late in the year. As previously mentioned, average whitetop linerboard prices in 2005 were up slightly over 2004.

| | 20 |  |

The North American economy continues to be a key driver for the Company’s specialty paper business with 88% of its product sold to this market. The Company continues to look for ways to optimize its customer mix as part of its initiatives to improve profitability.

The 2005 geographical sales distribution, based on sales volumes, is depicted in the chart below.

| | 2.1.2 | Segment Overview |

| | | |

| | | In addition to growing its sales of its Electraprime grade, the Company’s key areas of focus for specialty papers in 2005 were grade optimization, reducing grade switches resulting in longer production runs, enhancing its customer and grade mix, and shipping to more freight logical locations. |

| | | |

| | | Sales volumes for coated grades were consistent with the previous year. |

| | | |

| | | Sales volumes for uncoated mechanical grades, excluding directory, were up, in large measure due to the previously mentioned additional sales of Electraprime. The Company’s uncoated mechanical grades benefited from the strong market conditions during the year. |

| | | |

| | | Sales volumes for directory papers were lower than the previous year, due to the grade and customer rationalization. The Company’s focus continues to be the growth of its more profitable lighter basis weight directory business, and the enhancement of its customer and grade mix. The Company capitalized on stronger spot pricing in the second half of the year. |

| | | |

| | | The kraft paper business experienced sluggish market conditions for much of 2005, causing the Company to curtail its Elk Falls No.4 paper for 31 days during the year. As a result, kraft paper volumes were lower than the previous year, and prices were weaker for much of the year. The Company’s focus continued to be on optimizing business with customers producing high graphic products and more freight logical customers. |

| | 21 |  |

| | 2.1.3 | Operational Performance |

| | | |

| | | The specialty papers business recorded operating earnings of $21.4 million on sales of $994.7 million in the current year, compared to operating earnings of $1.9 million on sales of $1,037.2 million for the same period last year. EBITDA of $119.2 million for the current year was $15.8 million higher than the $103.4 million recorded in the same period last year. |

| | | |

| | | Sales volume of 1,063,200 tonnes in the current period decreased 52,300 tonnes, or 4.7%. The decline from the previous year was largely due to lower directory shipments, primarily resulting from the Company’s grade and customer rationalization, which was partially offset by growth in the Company’s uncoated specialty paper business. |

| | | |

| | | Average sales revenue in the current period of $936 per tonne increased $6 per tonne compared to the previous year. Higher transaction prices across most grades, particularly for coated and uncoated mechanical grades, and an enhanced grade and customer mix driven by various performance improvement initiatives more than offset the adverse impact of the significantly stronger Canadian dollar. |

| | | |

| | | Average cash costs in the current period were $824 per tonne, an improvement of $13 per tonne compared to the previous year. Savings from performance improvements and lower fibre prices were the primary drivers of the improvement. |

| | | |

| | 2.1.4 | Outlook |

| | | |

| | | Specialty paper markets are expected to be generally stable, with some unique differences by product. |

| | | |

| | | For coated mechanical papers, demand is expected to be relatively flat due to weak magazine circulation and ad page growth. In addition, the U.S. postal rate increase of 5.4% effective January 8, 2006, is expected to have some negative impact on catalogue demand in the first half of the year. Despite flat demand, cost pressures are likely to keep prices relatively stable early in the year before gradually declining in the second half of the year as the economy slows. |

| | | |

| | | Uncoated mechanical paper demand is forecast to grow slightly as consumer spending, while weaker than 2005, is expected to remain relatively strong. Prices for MF hi-brite grades are expected to trend upwards in the first half of the year, and possibly beyond this, depending on newsprint price levels. |

| | | |

| | | Directory demand is expected to be up slightly in 2006 as a result of new independent publications and increased page counts from traditional telephone directory companies. On the supply side, directory mills are |

| | 22 |  |

| | | expected to continue running at high operating rates. For directory, 2006 contract prices are expected to show a modest improvement over 2005. |

| | | |

| | | Kraft paper demand is expected to increase in 2006 due to strengthening demand for durable and non-durable goods, and inventory restocking. The improving market fundamentals should lead to increasing prices in 2006. An announced price increase of $40 per ton effective January 1, 2006, reflects the improving market conditions. |

| | | |

| | | The Company intends to continue focusing on product, customer, and geographical optimization for its specialty paper grades in 2006. |

| | | |

| | 2.2 | Newsprint |

| Summary of Selected Financial Information |

| (In millions of dollars, except where otherwise stated) | 2005 | 2004 | 2003 |

Sales

EBITDA1

Operating earnings (loss)

EBITDA margin |

$ 529.1

58.1

12.3

11.0% |

$ 553.1

45.2

(4.3)

8.2% |

$ 539.2

5.1

(56.6)

0.9% |

|

|

|

|

Sales (000 tonnes)

Production (000 tonnes) |

707.1

699.5 |

754.7

757.8 |

768.7

774.8 |

|

|

Average sales revenue per tonne

Average cash costs per tonne2 |

$ 748

666 |

$ 733

673 |

$ 701

695 |

|

|

| Newsprint 48.8 gsm, West Coast Delivery (US$ per tonne)3 | 600 | 544 | 493 |

| | | 1. | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| | | 2. | Average cash costs per tonne for these purposes consist of cost of sales and SG&A costs. |

| | | 3. | Benchmark prices are sourced from RISI. |

| | 2.2.1 | Markets |

| | | |

| | | The trend in newsprint consumption decline continued throughout 2005 with U.S. consumption and demand down 5.1% and 6.3%, respectively in 2005 compared to 2004. The consumption declines are due in large part to decreases in ad lineage, circulation, and lower average basis weights. The shift to lower average basis weights accounts for 1.7% of the decline; a shift that the Company views as favourable. Cost pressures and the stronger Canadian dollar drove transaction prices higher and average benchmark prices increased US$56 per tonne compared to the previous year, ending the year at US$635 per tonne. |

| | 23 |  |

Approximately 67% of the Company’s newsprint sales were to the U.S. and Canada. The 2005 geographical sales distribution, based on sales volumes, is depicted in the chart below.

| | 2.2.2 | Segment Overview |

| | | |

| | | The primary focus areas for newsprint in 2005 were enhancing customer mix, developing specialty lighter and smoother newsprint grades, and optimizing the Company’s significant newsprint swing capacity. |

| | | |

| | | The Company continued to make progress on its drive towards lowering basis weights in 2005. In addition, successful cost reduction initiatives included freight optimization, particularly with respect to international sales, and a further reduction of kraft in its newsprint from 3.7% in 2004 to 1.3% in 2005. |

| | 24 |  |

Effective early February 2005, the Company indefinitely idled its Port Alberni No.3 paper machine displacing 140,000 tonnes per year of newsprint capacity, in response to the prolonged strength of the Canadian dollar and related cost pressures.

The chart below illustrates the decline in the Company’s newsprint cash costs per tonne since 2002.

| | 2.2.3 | Operational Performance |

| | | |

| | | The newsprint business recorded operating earnings of $12.3 million on sales of $529.1 million in the current year, compared to an operating loss of $4.3 million on sales of $553.1 million for the previous year. EBITDA of $58.1 million for the current year was $12.9 million higher than the $45.2 million recorded in 2004. |

| | | |

| | | Sales volume of 707,100 tonnes in the current period was down 47,600 tonnes, or 6.3%, from the same period last year, primarily due to the indefinite idling of the Port Alberni No.3 paper machine in early February 2005. |

| | | |

| | | Average sales revenue in the current period of $748 per tonne increased $15 per tonne compared to the previous year. Higher prices and, to a lesser extent, a higher-value market, grade, and customer mix were the major factors that more than offset the adverse impact of the stronger Canadian dollar. |

| | | |

| | | Average cash costs in the current period were $666 per tonne, an improvement of $7 per tonne from the previous year. Savings from performance improvements and lower fibre prices more than offset increased SG&A costs and higher restructuring costs related to the indefinite idling of the Port Alberni No.3 paper machine. |

| | 25 |  |

| | 2.2.4 | Outlook |

| | | |

| | | For newsprint, the downward consumption trend is expected to continue in 2006 due to lower circulation, ad lineage and basis weights, albeit at a lower rate of decline than 2005. The high Canadian dollar and cost pressures have prompted a US$40 per tonne price increase announcement, for effect February 1, 2006.The Company believes the decline in newsprint consumption is in part due to a shift by advertisers to uncoated specialty grades as growth in these grades has partially offset the decline in newsprint consumption. As a result, the Company believes that it is well positioned to address either further demand reductions, or a recovery in the newsprint market due to its ability to switch grades. |

| | | |

| | | Optimization of newsprint swing capacity will continue to be a priority for 2006. In addition, the Company intends to continue its drive to more profitable lighter basis weight grades, where it is widely recognized as a market leader. |

| | | |

| | 2.3 | Pulp |

| Summary of Selected Financial Information |

| (In millions of dollars, except where otherwise stated) | 2005 | 2004 | 2003 |

Sales

EBITDA1

Operating earnings (loss)

EBITDA margin | $300.1

(22.1)

(58.8)

(7.4%) | $287.9

4.2

(28.9)

1.5% | $278.6

7.2

(22.5)

2.6% |

|

|

|

Sales (000 tonnes)

Production (000 tonnes) |

482.7

474.2 |

405.5

420.9 |

421.3

418.8 |

|

|

Average sales revenue per tonne

Average cash costs per tonne2 |

$ 622

667 |

$ 710

699 |

$ 661

644 |

|

|

NBSK pulp, Northern Europe Delivery (US$ per

tonne)3 |

611 |

618 |

525 |

|

| | | 1. | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| | | 2. | Average cash costs per tonne for these purposes consist of cost of sales and SG&A costs. |

| | | 3. | Benchmark prices are sourced from RISI. |

| | 2.3.1 | Markets |

| | | |

| | | Pulp markets remained sluggish throughout most of the year. Global pulp shipments increased slightly by 0.5% in 2005 compared to 2004, however the benefit was muted as new capacity came on line in 2005, which led to lower operating rates and weaker prices. Conditions improved somewhat towards the end of the year resulting in modest price improvements in most key markets. Overall, year-over-year average NBSK pulp benchmark prices decreased slightly by US$7 per tonne or 1%, to US$611 per tonne, compared to the previous year. Transaction prices fared worse |

| | 26 |  |

due to competitive pressures and weak non-contract market conditions for most of the year.

The primary markets for the Company’s market pulp are Asia and Australasia and Europe. The 2005 geographical sales distribution, based on sales volumes, is depicted in the chart below.

| | 2.3.2 | Segment Overview |

| | | |

| | | In 2005, market pulp sales capacity increased signficantly through the considerable reduction of kraft pulp used in paper operations, as well as the absence of the Elk Falls kraft mill rationalization completed in early 2004. |

| | | |

| | | Cost reduction remained a key priority in 2005. In particular the segment significantly reduced its delivered chip costs, due in part to taking advantage of the abundant supply of low cost spruce, pine, and fir (“SPF”) fibre in British Columbia. This, and other performance improvement |

| | 27 |  |

| | | initiatives, reduced the Company’s manufacturing costs by $25 per tonne compared to 2004. |

| | | |

| | 2.3.3 | Operational Performance |

| | | |

| | | The pulp business recorded an operating loss of $58.8 million on sales of $300.1 million in the current year, compared to an operating loss of $28.9 million on sales of $287.9 million for the previous year. Negative EBITDA of $22.1 million for the current year decreased $26.3 million from EBITDA of $4.2 million in 2004. |

| | | |

| | | Sales volume of 482,700 tonnes in the current period increased 77,200 tonnes, or 19.0%, from the same period last year due to the factors highlighted in the segment overview section. |

| | | |

| | | Average sales revenue in the current period of $622 per tonne was down $88 per tonne compared to the previous year, due primarily to the stronger Canadian dollar and lower year-over-year NBSK pulp prices. |

| | | |

| | | Average cash costs in the current year were $667 per tonne, an improvement of $32 per tonne compared to the same period last year. Savings from performance improvement initiatives,the absence of the Elk Falls rationalization noted above, and lower fibre prices offset higher SG&A costs. |

| | | |

| | 2.3.4 | Outlook |

| | | |

| | | For NBSK pulp markets, demand is expected to show modest improvement in 2006 due to anticipated increased printing and writing demand in China and Western Europe as well as inventory restocking. The Company expects prices on average to remain relatively flat in 2006, with an improvement in the first half of the year, partly offset by a decline later in the year. |

| | 28 |  |

| 3.0 | FINANCIAL CONDITION |

| | |

| The following table highlights the significant changes in the consolidated balance sheets between December 31, 2005, and December 31, 2004. |

| (In millions of dollars) | 2005 | 2004 | Variance | Explanation |

| Working Capital | $ 237.1 | $ 260.0 | $ (22.9) | Decrease primarily reflects lower cash and cash equivalents and inventory levels, partially offset by lower payables. |

|

|

|

| Capital assets, net | 2,139.3 | 2,172.9 | (33.6) | Amortization expense exceeded capital asset additions and the impact of consolidating 100% of a variable interest entity in 2005 (see the “Changes in Accounting Policies” section for further details). Refer to the “Investing Activities” section for additional details on capital asset additions. |

|

|

|

|

|

|

|

|

| Other assets, net | 40.1 | 27.5 | 12.6 | Increase largely due to recording non- controlling interest as part of consolidating 100% of a variable interest entity in 2005 (see the “Changes in Accounting Policies” section for further details), partly offset by amortization of deferred financing costs. |

|

|

|

|

|

|

| Long-term debt | 861.9 | 823.6 | 38.3 | Increase primarily reflects approximately $57 million of new debt related to consolidating 100% of a variable interest entity in 2005 (see the “Changes in Accounting Policies” section for further details). Refer to the “Capital Resources” section for further details on the change in long-term debt. |

|

|

|

|

|

|

|

|

| Other long-term obligations | 209.7 | 233.6 | (23.9) | Decrease primarily relates to a reduction in the fair value of hedging instruments. |

|

|

| Future income taxes and deferred credits | 300.9 | 332.9 | (32.0) | Decrease primarily relates to the reduction in the provincial corporate tax rate and increased tax losses. |

|

|

|

| Contributed surplus | 7.3 | 4.8 | 2.5 | Increase relates to the recording of stock based compensation. |

|

|

| | 29 |  |

| 4.0 | LIQUIDITY AND CAPITAL RESOURCES |

| Selected Financial Information | | | | | | | | | |

| (In millions of dollars, except where otherwise stated) | | 2005 | | | 2004 | | | 2003 | |

| Cash flows provided by operations before changes in | | | | | | | | | |

| non-cash working capital | $ | 104.5 | | $ | 88.9 | | $ | 0.1 | |

| Changes in non-cash working capital | | (11.5 | ) | | (24.4 | ) | | 22.4 | |

| Cash flows provided by operations | | 93.0 | | | 64.5 | | | 22.5 | |

| Cash flows used by investing activities | | (93.0 | ) | | (41.8 | ) | | (96.1 | ) |

| Cash flows provided (used) by financing activities | | (26.0 | ) | | 3.3 | | | 73.6 | |

| Capital spending | | 95.2 | | | 68.0 | | | 81.4 | |

| Amortization | | 180.3 | | | 184.1 | | | 189.9 | |

| Capital spending as % of amortization | | 53 | % | | 37 | % | | 43 | % |

| Total debt to total capitalization1,2 | | 46 | % | | 44 | % | | 44 | % |

| Net debt to net capitalization3,4 | | 46 | % | | 43 | % | | 44 | % |

| | | 1. | Total debt comprises long-term debt, including current portion. |

| | | 2. | Total capitalization comprises total debt and shareholders’ equity. |

| | | 3. | Net debt comprises total debt, less cash on hand. |

| | | 4. | Net capitalization comprises net debt and shareholders’ equity. |

The Company’s principal cash requirements are for working capital, capital expenditures, and interest payments on the Company’s debt. Cash flows are funded through operations and where necessary, through the revolving operating facility (the “Facility”). If necessary, liquidity requirements may be funded through the issuance of debt, equity or both. Access to current and alternative sources of financing at competitive cost is dependent upon the Company’s credit ratings and capital market conditions. The Company believes that the cash flow from operations and the Facility will be sufficient to meet its anticipated capital expenditures and debt repayment obligations in the near and intermediate term.

| | 4.1 | Operating Activities |

| | | |

| | | Cash flow provided from operating activities, after changes in non-cash working capital, in the current year was $93.0 million compared to cash provided from operating activities of $64.5 million in the previous year. The increase of $28.5 million was primarily attributed to decreased non- cash working capital requirements in the current year. The Company’s operating cash flow requirements are primarily for labour, salaries and benefits, the purchase of raw materials, energy, and distribution services. Working capital requirements in 2006 are not expected to be materially different than 2005 requirements. |

| | 30 |  |

| | 4.2 | Investing Activities |

| | | |

| | | Cash flow used for investing activities in the current year totalled $93.0 million, compared to $41.8 million in the previous year. The absence of a $26.6 million purchase price adjustment, which was received in 2004, and increased capital spending in the current year were the primary drivers of the increase. |

| | | |

| | | The Company’s capital spending totalled $95.2 million, compared to $68.0 million in the previous year. Major capital investments during the year included an $8.3 million installation of sawdust screening equipment at the Elk Falls division, which is expected to increase the production of Elk Prime market pulp by approximately 17,000 tonnes annually, a $6.9 million upgrade to the Crofton division’s TMP facilities, which is expected to increase TMP production by approximately 21,000 tonnes annually, and a $5.1 million expansion of the bleaching capacity at the Powell River division. The bleaching capacity expansion will allow the Company to replace 36,000 tonnes of newsprint with higher-value uncoated specialty products. |

| | | |

| | | Capital spending levels are expected to be similar in 2006. Cash flows are expected to be generated primarily from operations and the Facility, if necessary. |

| | | |

| | 4.3 | Financing Activities |

| | | |

| | | Cash flow drawn by financing activities was $26.0 million in the current year compared to cash flow generated of $3.3 million in the previous year. The increase in cash flow drawn by financing activities of $29.3 million was primarily attributable to the absence of net proceeds on the senior note refinancing in March 2004. |

| | | |

| | 4.3.1 | Capital Resources |

| | | |

| | | The Company’s capital resources at December 31, 2005, included cash and cash equivalents along with the amount available under the Facility. The borrowing base on the Company’s $350.0 million Facility was $344.8 million. After outstanding letters of credit of $22.3 million, and a $6.5 million draw on the Facility, $316.0 million was available at year-end, compared to $318.5 million in the previous year. These resources, together with operating cash flows, are expected to enable the Company to meet the minimum payments, described in the table below. |

| | 31 |  |

The following table presents the aggregate amount of future cash outflows for contractual obligations as of December 31, 2005, excluding amounts due for interest on outstanding indebtedness.

| | | Payments due by Period | |

| (In millions of dollars) | | 2006 | | | 2007 | | | 2008 | | | 2009 | | | 2010 | | | Thereafter | |

| | | | | | | | | | | | | | | | | | | |

| Long-term debt | $ | - | | $ | - | | $ | 6.5 | | $ | 75.0 | | $ | - | | $ | 780.4 | |

| | | | | | | | | | | | | | | | | | | |

| Capital lease obligations | | 0.7 | | | 0.7 | | | 0.7 | | | 0.7 | | | 0.7 | | | 3.6 | |

| | | | | | | | | | | | | | | | | | | |

| Operating leases | | 12.8 | | | 10.2 | | | 9.2 | | | 7.7 | | | 7.2 | | | 46.3 | |

| | | | | | | | | | | | | | | | | | | |

| Total | $ | 13.5 | | $ | 10.9 | | $ | 16.4 | | $ | 83.4 | | $ | 7.9 | | $ | 830.3 | |

As at December 31, 2005, the total long-term debt outstanding was $861.9 million. Principal repayments on this debt do not begin until June 2009. The Company’s net debt to net capitalization ratio as of December 31, 2005, was 46%, or 3% higher than December 31, 2004.

The following table illustrates the changes in the Company’s long-term debt during 2005.

Issue |

Carrying Value

December 31, 2004 |

Net Increase

(Decrease) | Foreign

Exchange

Impact |

Carrying Value

December 31, 2005 |

|

|

| (In millions of dollars) | | | | |

Recourse

Senior notes, 8.625% due June 2011

(US$400.0 million) |

$ 485.1 |

$ - |

$ (15.7) |

$ 469.4 |

|

|

Senior notes, 7.375% due March 2014

(US$250.0 million)1 |

300.9 |

- |

(9.4) |

291.5 |

|

Revolving operating facility of up to $350.0

million due July 2008 with interest based

on Canadian Prime/BA rates or U.S.

Base/LIBOR rates |

- |

6.5 |

- |

6.5 |

|

|

|

Non-recourse (PREI) |

|

|

|

|

|

First mortgage bonds, 6.387% due July

2009 |

37.6 |

37.42 |

- |

75.0 |

|

| Subordinated promissory notes | - | 19.52 | - | 19.5 |

| Total long-term debt | $ 823.6 | $ 63.4 | $ (25.1) | $ 861.9 |

| | 1. | US$250.0 million senior notes issued March 23, 2004. |

| | 2. | Net increase reflects approximately $57 million of new debt in 2005 due to the 100% consolidation of a variable interest entity (see the “Changes in Accounting Policies” section for further details). |

The Company is in compliance with the covenants under its Facility and senior notes indentures. The Company’s consolidated fixed charge coverage ratio (“CFCC Ratio”), as calculated under its senior notes, was at 2.0:1 for the last twelve months ended December 31, 2005 (also at 2.0:1, for the twelve months ended December 31, 2004). If this CFCC Ratio goes below 2.0:1, the Company is limited in the amount of additional debt it may incur beyond drawings under the Facility or other debt as permitted under the senior notes. Also the Company’s restricted payments basket under the senior notes was negative $69 million as at December 31, 2005 (negative $26 million as at December 31, 2004), as a result of accumulated losses in recent years.

| | 32 |  |

Under the 8.625% senior notes, the Company cannot pay dividends unless the balance in this basket is positive.

Credit Ratings

Like many others in the industry, the Company’s credit ratings were downgraded during the fourth quarter.

In December 2005, Moody’s lowered its credit ratings on the Company’s corporate family rating and senior unsecured debt to B1 from Ba3, and the Company’s bank loan debt to Ba3 from Ba2, and confirmed its outlook on the Company’s debt ratings as negative. The downgrade was cited because in Moody’s view, current newsprint and related paper grade fundamentals are not likely to facilitate a significant, sustainable margin improvement.

In December 2005, Standard and Poor’s (S&P) lowered its long-term corporate credit and senior unsecured ratings to B+ from BB- and its senior secured rating to BB- from BB, and revised the outlook from negative to stable. The Company’s lower than expected profitability and cash flow generation due to the stronger Canadian dollar and higher energy costs were factors cited in the downgrade.

In October, Dominion Bond Rating Service (“DBRS”) confirmed its senior debt rating of BB and changed the outlook to negative. Growing signs that the Canadian dollar and energy costs will remain high were cited in the revision.

The following table highlights the Company’s credit ratings and outlook with Moody’s, S&P, and DBRS as of December 31, 2005, 2004, and 2003:

| | December 31, |

| | 2005 | 2004 | 2003 |

Moody’s

Outlook

Corporate family rating

Senior unsecured debt

Bank loan debt

Standard & Poor’s

Outlook

Long term corporate credit

Senior unsecured debt

Senior secured debt

Dominion Bond Rating Service

Outlook

Senior debt |

Negative

B1

B1

Ba3

Stable

B+

B+

BB-

Negative

BB |

Negative

Ba3

Ba3

Ba2

Negative

BB-

BB-

BB

Stable

BB |

Negative

Ba2

Ba2

Ba1

Negative

BB

BB

BB+

Stable

BBH |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| | 33 |  |

| | | As a result of these downgrades, any future borrowings under the Facility will be at a slightly higher rate because the interest rate includes a margin that varies with the Company’s credit rating. Under current levels of borrowing, the credit rating downgrades are expected to increase the Company’s cost of borrowing under its Facility by an estimated $0.8 million per annum. These downgrades do not have any other direct impacts. However, they could negatively impact the Company’s cost of additional borrowing, and potentially its cost of capital. |

| | | |

| | 4.3.2 | Financial Instruments |

| | | |

| | | In the normal course of business, the Company is exposed to foreign currency and price risk associated with revenues and long-term debt, which are predominately in U.S. dollars, and energy costs. In accordance with its foreign exchange risk management program, the Company manages its exposure to these risks through the use of financial instruments. The Company also uses interest rate swaps to reduce its exposure to long-term fixed interest rates associated with its senior notes. The Company does not enter into financial instruments for speculative purposes. |

| | | |

| | | Revenue Risk Management Instruments |

| | | |

| | | In respect of revenues, the Company uses foreign currency options and forward contracts outstanding to sell U.S. dollars. At December 31, 2005, 67% of the options and contracts are designated as hedging instruments and the resulting foreign exchange translation gains and losses will be recognized concurrently with the hedged revenue in “Sales”. At period- end exchange rates, the net amount the Company would receive to settle the foreign currency options and forward contracts is $23.6 million, of which $13.1 million is included in “Prepaids and other”, and $7.7 million has been recognized and included in “Sales”. The hedging program improved the Company’s sales value by $32.3 million in 2005. |

| | | |

| | | At December 31, 2005 and 2004, no price hedging instruments were outstanding in respect of products sold. |

| | | |

| | | Long-term Debt Risk Management Instruments |

| | | |

| | | In respect of long-term debt, the Company has US$59.0 million in forward foreign exchange contracts to acquire U.S. dollars. These instruments are not designated as hedging instruments for accounting purposes, and are included in “Other long-term obligations” on the balance sheet at their fair value. Settlements and changes in fair value are recognized in earnings as “Foreign exchange gain on translation of long-term debt”. At period-end exchange rates, the net amount the Company would pay to settle these contracts is $24.3 million. |

| | 34 |  |

Cost Risk Management Instruments

To hedge against the effect of energy cost fluctuations, the Company enters into contracts to fix the price of a portion of the Company’s oil and gas exposure. The contracts are not designated as hedging instruments for accounting purposes and are reported as “Prepaids and other” on the balance sheet at their fair value. Settlements and changes in fair value are recognized in “Cost of sales”. At period-end contract rates, the net amount the Company would receive to settle these contracts is $2.7 million, all of which is included in “Cost of sales” and “Prepaids and other”.

Interest Rate Swaps

The Company occasionally uses interest rate swap contracts to manage its net exposure to interest rate changes. At December 31, 2005, the Company has pay-floating, receive-fixed interest rate swap contracts for notional US$40 million, and has designated them as hedging instruments. At period-end rates, the net amount the Company would receive to settle these contracts is $0.4 million.

| 5.0 | RELATED PARTY TRANSACTIONS |

| | |

| The Company’s related parties include Norske Skog, a significant shareholder, together with its subsidiaries and affiliates, and Norske Skog North America LLC (“NSNALLC”), which was a joint venture between Norske Skog and the Company. |

| | |

| NSNALLC |

| | |

| The Company had an agency agreement with NSNALLC, which provided for sales of certain specialty products in the U.S. During the year the Company paid $4.4 million in commission expenses. These transactions were in accordance with normal third party trade practices. |

| | |

| In the second quarter of 2005, the shareholders of NSNALLC announced the dissolution of its U.S. marketing joint venture. The dissolution was effective October 1, 2005, after which the Company returned to marketing its specialty papers directly to North American customers. The change did not materially impact net earnings for the year ended December 31, 2005. |

| | |

| Norske Skog |

| | |

| In prior years, the Company acquired from wholly owned subsidiaries of Fletcher Challenge Limited (now subsidiaries of Norske Skog) companies with tax losses. The purchase price for these companies is subject to adjustment under certain conditions. The Company recorded a $2.4 million adjustment in the fourth quarter of 2005, reflecting a reduction to the purchase price. |

| | 35 |  |

Subsidiaries and Affiliates of Norske Skog

The Company has entered into agency and distribution agreements with affiliates of Norske Skog whereby all sales of the Company’s newsprint and specialty papers in certain international markets are affected through affiliates of Norske Skog. During the year, product sales to these affiliates were $118.1 million (2004 - $121.7 million). These transactions were in accordance with normal third party trade practices.

Directors and Employees

The Company undertakes certain transactions with companies affiliated with a director of the Company. These transactions are in the normal course of business, and are on the same terms as those accorded to third parties. During 2005, the Company paid aggregate fees of approximately $nil (2004 - $0.4 million) primarily for legal services from a firm affiliated with a director of the Company. The Company has charged the costs to SG&A expense.

The Company has advanced interest-free loans to three officers of the Company. As at December 31, 2005, the balance outstanding was $0.4 million (2004 -$0.5 million). These loans were issued prior to the enactment of the United States Sarbanes-Oxley Act of 2002, which prohibits such loans effective July 30, 2002. The Company has made no loans to any of its directors or officers since that date.

| 6.0 | OFF-BALANCE SHEET ARRANGEMENTS |

| | | |

| 6.1 | Financial Instruments |

| | | |