CATALYST PAPER CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following management discussion and analysis (“MD&A”) should be read in conjunction with the consolidated financial statements for the years ended December 31, 2006, 2005, and 2004, and the notes thereto.

Throughout the discussion, reference is made to EBITDA, which represents earnings before interest, taxes, depreciation and amortization, and before other non-operating income and expenses. EBITDA, as defined, equates to operating earnings (loss) plus amortization. Canadian Generally Accepted Accounting Principles (“GAAP”) do not define a method of calculating EBITDA, therefore the measure as calculated by Catalyst Paper Corporation (“the Company”) might not be comparable to similarly titled measures reported by other entities. EBITDA is presented because the Company believes it is a useful indicator of a company’s operational performance, and subsequently, a company’s ability to meet debt service and capital expenditure requirements. EBITDA should not be considered by an investor as an alternative to net earnings, an indicator of the financial performance of the Company, or an alternative to cash flows as a measure of liquidity. Refer to the “Non-GAAP Measures” section for a reconciliation of this non-GAAP measure to net earnings (loss).

In accordance with industry practice, the term “ton” or the symbol “ST” in this MD&A refers to a short ton, which is an imperial unit of measurement equal to 0.9072 metric tonnes, and the term “tonne” or the symbol “MT” refers to a metric tonne.

In this MD&A, unless otherwise indicated, all dollar amounts are expressed in Canadian dollars. The term “dollars” and the symbols “$” and “CDN$” refer to Canadian dollars. The term “U.S. dollars” and the symbol “US$” refer to United States dollars.

The information in this report is as at February 13, 2007. Disclosure contained in this document is current to that date, unless otherwise stated.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements. Forward-looking statements are statements, other than statements of historical fact, that address or discuss activities, events or developments that the Company expects or anticipates may occur in the future. These forward-looking statements can be identified by the use of words such as “anticipate”, “could”, “expect”, “seek”, “may”, “likely”, “intend”, “will”, “believe” and similar expressions or the negative thereof. These forward-looking statements reflect management’s current views and are based on certain assumptions including assumptions as to future economic conditions and courses of action, as well as other factors management believes are appropriate in the circumstances. Such forward-looking statements are subject to risks and uncertainties and no assurance can be given that any of the events anticipated by such statements will occur or, if they do occur, what benefit the Company will derive from them. A number of factors could cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements, including the general economic conditions in the United States (“U.S.”), Canada and internationally, market conditions and demand for the Company’s products, the outlook for inventories, production and pricing, the Company’s ability to successfully obtain performance improvements and cost savings, expected cash flows, capital expenditures and completion of capital projects, shifts in industry capacity, fluctuations in foreign exchange and interest rates, fluctuations in availability and cost of raw materials or energy, the Company’s ability to obtain financing and other factors beyond the Company’s control. Additional information concerning these and other factors can be found in section 13 of this MD&A under the heading "Risks and Uncertainties". The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investors are cautioned not to place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future results.

| | | Page | | | | Page |

| | 4 | | | | 36 |

| | | 4 | | | | 36 |

| | | 7 | | | | 37 |

| | | 10 | | | | 37 |

| | | 11 | | | | 37 39 |

| | | 13 | | | | |

| | | 18 | | | | 40 |

| | | | | | | |

| | 21 | | | | 41 |

| | | 21 | | | | 41 |

| | | 21 | | | | 41 |

| | | 22 | | | | |

| | | 23 | | | | 42 |

| | | 23 | | | | |

| | | 24 | | | | 43 |

| | | 24 | | | | |

| | | 25 | | | | 43 |

| | | 25 | | | | 44 |

| | | 26 | | | | 44 |

| | | 26 | | | | 46 |

| | | 27 | | | | |

| | | 28 | | | accounts | 47 |

| | | 28 | | | | 47 |

| | | 28 | | | | |

| | | | | | | 48 |

| | 30 | | | | |

| | | | | | | |

| | | | | | affecting future periods | 48 |

| | | 31 | | | | |

| | | 31 | | | | 49 49 |

| | | | | | | 50 |

| | - specialty papers | 31 | | | | 50 |

| | | | | | | 50 |

| | - newsprint | 32 | | | | 51 |

| | | | | | | 51 |

| | - pulp | 32 | | | | 52 |

| | 2006 compared to three months | | | | | 53 54 |

| | ended December 31, 2005 | 33 | | | | 54 |

| | | | | | | 54 |

| | operations | 33 | | | | 54 |

| | - specialty papers | 33 | | | | 55 |

| | | | | | | |

| | - newsprint | 34 | | | | 56 |

| | | | | | | |

| | - pulp | 34 | | | | |

| | | | | | financial reporting | 57 |

| | 35 | | | | |

| | | | | | | 58 |

1.0 | CORPORATE OVERVIEW AND HIGHLIGHTS |

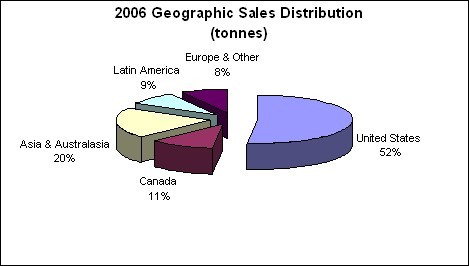

| | The Company is the fourth largest North America-based producer of newsprint and uncoated mechanical groundwood specialty papers, measured by production capacity. It is also the largest producer of coated and uncoated specialty papers and newsprint and the only producer of lightweight coated paper on the West Coast of North America. The Company is the largest producer of directory paper in the world by capacity and operates the largest paper recycling operation in Western Canada. It also has a significant presence in most major international markets, serving customers around the world. The 2006 geographic sales distribution can be found at the end of this section. |

The Company’s business includes printing papers and market pulp, operating in three business segments:

| | The specialty papers segment consists of soft-calendered (“SC”) and machine-finished (“MF”) hi-brite uncoated, lightweight coated (“LWC”) and directory paper grades. These groundwood specialty paper grades are manufactured on 101 paper machines in British Columbia at Crofton, Elk Falls, Port Alberni and Powell River. The specialty papers business segment has a total production capacity of 1,100,000 tonnes. |

| | Specialty paper represents the Company’s largest business segment, generating approximately 49% of 2006 consolidated sales revenue. The Company’s customer base consists primarily of retailers, magazine and catalogue publishers, commercial printers and telephone directory publishers. Specialty paper products are sold primarily through the Company’s sales and marketing personnel in North America, and through distributors and agents in other geographic markets. In 2006, approximately 94% of specialty paper sales volumes were with customers in North America. Specialty papers are shipped by ship, barge, rail or truck or by a combination of some or all of these transportation modes. |

Newsprint

| | Newsprint is currently produced on five1 paper machines at Crofton, Elk Falls and Powell River. The newsprint segment has a total annual production capacity of 617,000 tonnes. During the first quarter (“Q1”) of 2006, the Company permanently closed its Port Alberni No. 3 (“A3”) paper machine, representing 140,000 tonnes of equivalent newsprint production capacity. |

| 1 | The Company has 11 paper machines. The number of machines noted in the segments above reflects the ability of the Company’s machines to switch between newsprint and specialty paper grades. |

| | Newsprint sales represented approximately 28% of 2006 consolidated sales revenue. The newsprint customer base consists primarily of newsprint publishers located in Western and Central North America and in Asia. In 2006, approximately 85% of newsprint sales volumes were with customers in North America and Asia. Newsprint is shipped overseas by deep-sea vessel and inland by ship, barge, rail or truck or a combination of some or all of these modes. |

| | The pulp segment includes sawdust-based pulp and containerboard (formerly referred to as “kraft paper”) manufactured at the Elk Falls mill, and northern bleached softwood kraft (“NBSK”) pulp manufactured at the Crofton mill. The segment has a total market production capacity of 638,000 tonnes. |

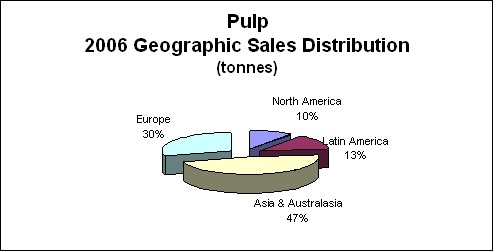

| | Pulp and containerboard sales represented approximately 23% of 2006 consolidated sales revenue. The pulp customer base is located primarily in Asia and Europe and includes producers of tissue, magazine papers, woodfree printing and writing papers and certain specialty paper products. The containerboard customer base consists primarily of corrugated box manufacturers. Pulp and containerboard products are sold primarily through sales and marketing personnel in Canada, and through a network of agents in locations throughout the world. In 2006, approximately 77% of pulp and containerboard sales volumes were with customers in Europe, Asia and Australasia. The Crofton and Elk Falls pulp mills are located on tidewater and have deep-sea vessel loading facilities. Pulp and containerboard are shipped by both break-bulk and container deep-sea vessels. |

| | The Company also has the largest paper recycling operation in Western Canada. Operated in support of its business segments, the recycling facility has a production capacity of 148,000 air-dried equivalent tonnes of pulp per year, the majority of which is consumed internally. After a project planned for mid-2007 is completed, this facility will increase production capacity to 160,000 air-dried equivalent tonnes of pulp per year. |

The chart below illustrates the Company’s principal paper and pulp products, applications, and annual 2007 capacity.

PRODUCT PROFILE |

| | Specialty paper grades | Newsprint | Pulp |

Category | Uncoated papers | Coated paper | Directory | Newsprint | Containerboard | Market pulp |

Soft-calendered | Machine-finished | | | | | |

Brand names | Electrasoft Electracal Electraprime | Electrabrite Electrastar | Electracote | Catalyst | Marathon | Silverliner Platinumliner Chromiumliner Bronzeliner | Elk Prime Crofton Kraft |

Basis weight (g/m2) | 36.6 - 52 | 45 - 66.5 | 44.4 - 63.6 | 28 - 40 | 43 - 48.8 | 127 - 270 | n/a |

Applications | Magazines, Supplements, Catalogues, Inserts, Flyers, Directories | Magazines, Supplements, Inserts, Flyers, Direct mail, PR and corporate communication books/manuals | Magazines, Catalogues, Inserts, Flyers, Direct mail | Telephone books, Airline schedules, Catalogues | Newspapers, Inserts, Flyers, Supplements, Directories, Timetables | Packaging applications | Tissue, Freesheet, Specialty papers, White-top linerboard |

Capacity (tonnes) | 531,0001 | 231,000 | 338,0001 | 617,0001 | 127,000 | 511,0002 |

% of total capacity | 23% | 10% | 14% | 26% | 5% | 22% |

| | 1 | Capacities expressed in the above table can vary as the Company is able to switch production between products, particularly newsprint, directory and machine-finished uncoated grades. |

| | The Company’s products are sold on five continents. The North American market, which accounts for 63% of sales, continues to be the Company’s principal market, followed by Asia and Australasia, Europe and Latin America. The consolidated sales volume distribution for 2006 was as follows: |

| | The Company delivered improved operational performance in 2006, recording operating earnings of $3.9 million despite the strength of the Canadian dollar against the U.S. dollar. This compares to an operating loss of $25.1 million in 2005. |

| | The Company improved operational performance in 2006 by focusing on machine efficiency, asset care, product quality and sharing cross-mill best practices. By making high-return investments through its Performance Improvement Program, the Company improved asset efficiency, which resulted in a significant increase in the Company’s production volume, and an overall improvement in machine efficiency of 3%, compared to 2005. Tight supply chain management and optimizing the mix of major inputs also helped control costs. |

| | The steady U.S. economy, particularly retail sales, resulted in higher prices for most paper products. The Company’s improved operating results in 2006 were also supported both by strong pulp prices, which hit their highest level since 1995, and reduced pulp costs. The Company’s performance improvement initiatives exceeded expectations, but rising fibre prices and the strong Canadian dollar kept the Company from delivering a better financial performance in 2006. |

| | In 2006, the Company and the industry in which it operates continued to experience an environment of rising input costs, most notably increasing energy and fibre costs. The Company benefits from relatively low fibre and electricity costs due to the location of its production facilities. In addition, the Company’s ability to use lower-priced energy alternatives helps mitigate rising prices. Nonetheless, the Company’s fibre costs increased late in the year due to regional supply limitations and their impact on market prices. Fibre supplies were constrained by curtailed sawmill activity and harsh West Coast weather conditions throughout the year. |

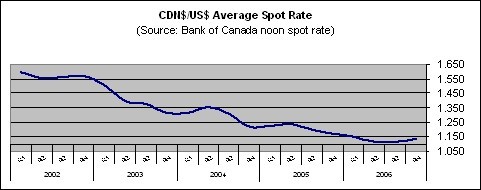

| | The majority of the Company’s sales are denominated in U.S. dollars. As a result, the strengthening Canadian dollar had a significant negative impact on the Company’s earnings for the fourth consecutive year. The average spot rate for 2006 was CDN$1.134 compared to CDN$1.212 for 2005 and CDN$1.302 for 2004. The “Sensitivity Analysis” section provides further details on the Company’s sensitivity to fluctuations in foreign exchange. |

| | The chart below illustrates the movement of the CDN$/US$ spot rate over the past five years. |

| | The Company’s 2006 Performance Improvement Program exceeded its goal of $70 million by 6% realizing $74 million in year-over-year EBITDA improvements. A discussion of the 2006 Performance Improvement Program’s results is provided under “Progress on 2006 Strategic Initiatives” in the “Strategy” section. |

| | Market conditions for the Company’s products were mixed in 2006, despite the positive effect of the steady U.S. economy. |

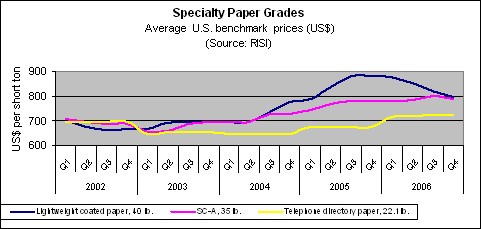

| | Coated mechanical demand was essentially flat for the year due to weak magazine and catalogue demand. Coated mechanical demand strengthened in the second half of the year, but only enough to offset the weakness in the first half of 2006. Flat demand and high mill inventories led to weak LWC prices for most of the year. The average LWC benchmark price decreased 1.3% in 2006, compared to 2005. |

| | Uncoated mechanical demand remained stable for most grades in 2006. Demand for high-gloss grades was down due to grade switching resulting from supply disruptions. Pricing remained firm during the year, increasing at the beginning of the third quarter (“Q3”) of 2006 before falling slightly at the end of the year. Overall, the average soft-calendered A grade (“SC-A”) benchmark price increased 2.5% over the previous year. |

| | Directory demand was strong in 2006 due to the increase in large publisher and independent books printed. The average benchmark price was up 6.8% over 2005. |

| | Newsprint demand and U.S. consumption were weak during 2006, but benchmark prices were up due to cost pressures and the strong Canadian dollar. The average newsprint benchmark price increased 8.2% over 2005, but decreased 1.4% in the fourth quarter (“Q4”) of 2006 from the preceding quarter. |

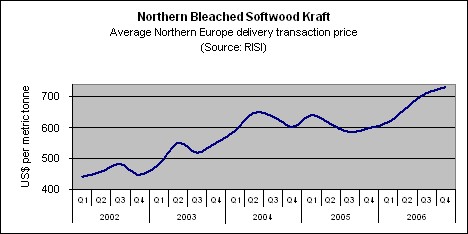

| | Pulp demand was strong and NBSK supply continued to decline because of the closure of several uncompetitive North American mills. The combination of strong demand and tight supply resulted in prices increasing to their highest level since 1995. The average Northern Europe benchmark price in 2006 increased 11.6% over 2005, and increased 2.8% in Q4, 2006 over the preceding quarter. |

| | Containerboard demand was steady in 2006 because of strong U.S. box shipments, which were driven by steady demand for non-durable goods and processed foods, and low mill and box inventories in the first half of 2006. The steady demand led to the average white-top linerboard benchmark price increasing 10.7% in 2006, compared to 2005. |

| | Effective February 16, 2006, Norske Skogindustrier ASA (“Norske Skog”) sold its 29.4% shareholding in the Company. Concurrently, the three directors from Norske Skog resigned from the Company’s board of directors. Norske Skog had not been involved in the management of the Company since 2001, and the shareholder transaction has not affected the Company’s operations or its current distribution agreement with Norske Skog in Asia. The Company did not receive any proceeds related to this transaction. |

| | During Q1, 2006, the Company permanently closed its Port Alberni A3 paper machine, which had been indefinitely idled since February 2005. The permanent closure has been assumed to be effective January 1, 2006, and accordingly, 140,000 tonnes of previously idled equivalent newsprint capacity has been removed from the Company’s total capacity. The permanent closure resulted in a $19.1 million impairment loss in 2006, of which $1.5 million was recorded in Q4 upon completion of a detailed review of the assets. The impairment losses were recorded in the newsprint segment in amortization expense. |

| | During Q3, 2006, the Company announced the temporary idling of its Port Alberni groundwood pulp mill, effective September 30, 2006, and the replacement of high-cost groundwood pulp with recycled fibre. In Q4, 2006, the Company determined that this closure was permanent due to the successful transition to recycled fibre and wrote off approximately $0.8 million of ancillary assets to cost of sales in the specialty segment in Q4. |

The Company also recorded an additional $4.3 million of impairment losses in Q4 on assets that had been previously idled because the Company determined that these assets would not be brought back into service. The impairment losses were recorded in amortization expense, $0.5 million in the specialty segment and $3.8 million in the pulp segment, respectively. More details on these impairment losses are provided in the “Critical Accounting Policies and Estimates” section.

| | On October 23, 2006, Third Avenue Management, LLC (“TAM”) increased its holdings in the Company on behalf of certain client accounts to 37.97%. On December 1, 2006, the Company appointed four new directors to its board of directors at TAM’s request and accepted the resignations of two directors. |

| | On January 15, 2007, the Company’s board of directors accepted the resignations of President and Chief Executive Officer Russell J. Horner and Vice-President, Finance and Chief Financial Officer Ralph Leverton, both of whom elected to exercise their rights under change-of-control agreements. |

| Ø | Realized a $74 million improvement in year-over-year EBITDA as a result of the Company’s 2006 Performance Improvement Program. |

| Ø | Achieved significant improvements in production levels, compared to 2005, by increasing machine speed and efficiency, focusing on asset reliability and product quality and sharing best practices across mills. |

| Ø | Set sales volume records for pulp, containerboard, and total pulp and paper (500,900 tonnes, 125,300 tonnes and 2,315,500 tonnes, respectively). |

| Ø | Achieved highest EBITDA since 2000. |

| Ø | Reduced the use of high-cost kraft pulp in paper production to the lowest level in the Company’s history in 2005 and sustained low kraft levels in 2006. |

| Ø | Formed a joint venture company with the Tla’Amin First Nation and the City of Powell River to allow its partners to develop surplus mill land around the Company’s Powell River Division. |

| Ø | Registered Crofton paper and pulp mill to the PricewaterhouseCoopers (“PwC”) certified chain-of-custody standard, the last of the Company’s mills to be registered, and achieved Forest Stewardship Council chain-of-custody certification for the de-inked pulp produced by the Paper Recycling Division. |

| Ø | Received third-party recognition through the BC Export Award in the primary products and resources category and selected as a finalist for the 2006 Metafore Innovation Award for developing the Electraprime and Electrastar grades. |

| Ø | Received social responsibility recognition as recipient of the Ethics in Action Award for environmental excellence and as one of 25 companies for greenhouse gas reductions in the Carbon Disclosure Project - Canada 280 Report. |

| Ø | Received the Canadian Institute of Chartered Accountants Award of Excellence for Corporate Reporting in the forestry products category, and ranked 50th out of more than 200 companies in the Globe and Mail newspaper’s Report on Business corporate governance rankings, up from 89th in 2005. |

| | 1.4 | Selected annual financial information |

(In millions of dollars, except where otherwise stated) | |

| | | 2006 | | 2005 | | 2004 | |

| Sales | | $ | 1,882.5 | | $ | 1,823.9 | | $ | 1,878.2 | |

| Operating earnings (loss) | | | 3.9 | | | (25.1 | ) | | (31.3 | ) |

EBITDA1 | | | 211.0 | | | 155.2 | | | 152.8 | |

| Net earnings (loss) | | | (15.9 | ) | | (25.6 | ) | | (28.6 | ) |

EBITDA margin1,2 | | | 11.2 | % | | 8.5 | % | | 8.1 | % |

| Net earnings (loss) per share (in dollars) - basic and diluted | | $ | (0.07 | ) | $ | (0.12 | ) | $ | (0.13 | ) |

| Total assets | | | 2,637.7 | | | 2,695.9 | | | 2,745.9 | |

| Total long-term liabilities | | | 1,338.6 | | | 1,396.8 | | | 1,417.6 | |

Sales (000 tonnes)3 | | | | | | | | | | |

Specialty papers | | | 990.2 | | | 942.9 | | | 993.7 | |

Newsprint | | | 699.1 | | | 707.1 | | | 754.7 | |

Total paper | | | 1,689.3 | | | 1,650.0 | | | 1,748.4 | |

Pulp | | | 626.2 | | | 603.0 | | | 527.3 | |

Total sales | | | 2,315.5 | | | 2,253.0 | | | 2,275.7 | |

Production (000 tonnes) 3 | | | | | | | | | | |

Specialty papers | | | 983.7 | | | 949.3 | | | 1,000.0 | |

Newsprint | | | 703.7 | | | 699.5 | | | 757.8 | |

Total paper | | | 1,687.4 | | | 1,648.8 | | | 1,757.8 | |

Pulp | | | 624.3 | | | 590.9 | | | 544.0 | |

| Total production | | | 2,311.7 | | | 2,239.7 | | | 2,301.8 | |

Average spot foreign exchange rate C$/US$4 | | | 1.134 | | | 1.212 | | | 1.302 | |

Period-end spot foreign exchange rate C$/US$5 | | | 1.165 | | | 1.166 | | | 1.204 | |

Effective foreign exchange rate C$/US$6 | | | 1.146 | | | 1.239 | | | 1.359 | |

| Common shares (millions) | | | | | | | | | | |

At period end | | | 214.6 | | | 214.6 | | | 214.6 | |

Weighted average | | | 214.6 | | | 214.6 | | | 214.6 | |

| 1 | EBITDA is a non-GAAP measure. Refer to “Non-GAAP Measures” for further details. |

| 2 | EBITDA margin is defined as EBITDA as a percentage of sales. |

| 3 | Effective January 1, 2006, the Company reclassified containerboard out of its specialty paper segment into its pulp segment. Prior period comparatives have been reclassified to reflect this change. |

| 4 | Average spot foreign exchange rate is the average Bank of Canada noon spot rate over the reporting period. |

| 5 | Period-end spot foreign exchange rate is the Bank of Canada noon spot rate. |

| 6 | Effective foreign exchange rate represents a blended rate which takes into account the applicable spot rates and the Company’s revenue hedging program in the reporting period. |

Selected quarterly financial information

(In millions of dollars, except where otherwise stated) | |

| | | 2006 | | 2005 | |

| | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | |

| Sales | | $ | 456.3 | | $ | 469.6 | | $ | 486.0 | | $ | 470.6 | | $ | 462.7 | | $ | 439.0 | | $ | 450.3 | | $ | 471.9 | |

| Operating earnings (loss) | | | (15.9 | ) | | 6.1 | | | 17.0 | | | (3.3 | ) | | (10.7 | ) | | (19.5 | ) | | 2.8 | | | 2.3 | |

EBITDA1 | | | 47.3 | | | 52.4 | | | 62.8 | | | 48.5 | | | 33.6 | | | 25.4 | | | 47.9 | | | 48.3 | |

| Net earnings (loss) | | | (23.6 | ) | | 42.4 | | | 2.5 | | | (37.2 | ) | | (21.8 | ) | | (30.0 | ) | | 34.2 | | | (8.0 | ) |

EBITDA margin1,2 | | | 10.4 | % | | 11.2 | % | | 12.9 | % | | 10.3 | % | | 7.3 | % | | 5.8 | % | | 10.6 | % | | 10.2 | % |

| Net earnings (loss) per share (in dollars) - basic and diluted | | $ | (0.11 | ) | $ | 0.20 | | $ | 0.01 | | $ | (0.17 | ) | $ | (0.10 | ) | $ | (0.14 | ) | $ | 0.16 | | $ | (0.04 | ) |

Sales (000 tonnes) 3 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty papers | | | 235.1 | | | 237.8 | | | 264.6 | | | 252.7 | | | 238.0 | | | 219.9 | | | 235.0 | | | 250.0 | |

| Newsprint | | | 181.1 | | | 178.4 | | | 169.5 | | | 170.1 | | | 180.7 | | | 169.2 | | | 169.9 | | | 187.3 | |

| Total paper | | | 416.2 | | | 416.2 | | | 434.1 | | | 422.8 | | | 418.7 | | | 389.1 | | | 404.9 | | | 437.3 | |

| Pulp | | | 153.4 | | | 171.4 | | | 155.9 | | | 145.5 | | | 150.6 | | | 150.3 | | | 157.7 | | | 144.4 | |

| Total sales | | | 569.6 | | | 587.6 | | | 590.0 | | | 568.3 | | | 569.3 | | | 539.4 | | | 562.6 | | | 581.7 | |

Production (000 tonnes) 3 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty papers | | | 235.7 | | | 244.2 | | | 254.8 | | | 249.0 | | | 237.5 | | | 228.6 | | | 242.3 | | | 240.9 | |

| Newsprint | | | 183.9 | | | 179.6 | | | 170.0 | | | 170.2 | | | 176.7 | | | 167.4 | | | 167.9 | | | 187.5 | |

| Total paper | | | 419.6 | | | 423.8 | | | 424.8 | | | 419.2 | | | 414.2 | | | 396.0 | | | 410.2 | | | 428.4 | |

| Pulp | | | 153.1 | | | 155.6 | | | 162.8 | | | 152.8 | | | 142.3 | | | 141.4 | | | 157.1 | | | 150.1 | |

| Total production | | | 572.7 | | | 579.4 | | | 587.6 | | | 572.0 | | | 556.5 | | | 537.4 | | | 567.3 | | | 578.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Average spot foreign exchange rate C$/US$4 | | | 1.155 | | | 1.121 | | | 1.121 | | | 1.139 | | | 1.227 | | | 1.244 | | | 1.201 | | | 1.173 | |

Period-end spot foreign exchange rate C$/US$5 | | | 1.167 | | | 1.115 | | | 1.115 | | | 1.165 | | | 1.210 | | | 1.226 | | | 1.161 | | | 1.166 | |

Effective foreign exchange rate C$/US$6 | | | 1.172 | | | 1.147 | | | 1.129 | | | 1.139 | | | 1.265 | | | 1.267 | | | 1.221 | | | 1.206 | |

| Common shares (millions) | | | | | | | | | | | | | | | | | | | | | | | | | |

| At period end | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | |

| Weighted average | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | | | 214.6 | |

| 1 | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

2 EBITDA margin is defined as EBITDA as a percentage of sales.

3 Effective January 1, 2006, the Company reclassified containerboard out of its specialty paper segment into its pulp segment. Prior period comparatives have been reclassified to reflect this change

4 Average spot foreign exchange rate is the average Bank of Canada noon spot rate over the reporting period.

5 Period-end spot foreign exchange rate is the Bank of Canada noon spot rate.

6 Effective foreign exchange rate represents a blended rate which takes account of the applicable spot rates and the Company’s revenue hedging program in the period.

| | The Company’s long-term objective is to achieve higher sustainable earnings and maximize cash flow by strengthening its position as a leading producer of value-added paper. |

| | The Company believes the following key performance drivers are critical to achieving its strategic goals and creating value for its investors. |

| | Market position is a significant driver of the Company’s success. As one of the largest North America-based producers of uncoated groundwood specialty papers and newsprint, market penetration is important. The Company’s brand names are well recognized in the marketplace and it has built a reputation for reliability, value and service. |

| | Upgraded, cost-competitive manufacturing |

| | In the past five years, capital expenditures of approximately $419 million have been directed primarily towards the Company’s manufacturing facilities to shift production towards higher-margin papers, reduce unit production costs, increase machine productivity, improve product quality, increase capacity, and meet or exceed environmental regulations. |

| | In recent years, the Company has introduced or expanded a number of specialty paper and differentiated product lines, including lightweight newsprint grades, coated papers, MF hi-brites, super hi-brites, soft-calendered grades, directory, sawdust-based pulp, and white-top linerboard. These products offer improved margins over standard commodity newsprint grades. In addition, market pulp further diversifies the product mix. |

| | The Company has a strong and flexible distribution network. The Company utilizes all transportation modes available to it, such as truck, rail, and container and break-bulk shipping. The Company’s supply chain systems have enabled better planning and scheduling, allowing the Company to use the most cost-efficient means of transportation to ship its products. |

| | Over the last several years, the Company has developed expertise in the production of lightweight papers. Lower basis weight papers reduce the Company’s costs by decreasing fibre, conversion, shipping, storage and handling expenses, and reducing warehouse space required for inventories, thus creating a competitive advantage. The use of lower basis weight paper by the Company’s customers also reduces their costs. The Company’s paper-making expertise enables it to produce high-quality, high-brightness uncoated groundwood grades. In addition, new product development continues to be an important focus. |

| | The Company is also one of the few manufacturers of sawdust-based pulp in the world. This product is valued by producers of tissue and wood-free printing papers as a substitute for more costly NBSK pulp. |

| | The Company’s employees act as strategic partners when tackling challenges and improving the Company’s performance. Recognizing this, the Company strives to be a top employer by providing a work environment that is safe, challenging, interesting and rewarding. |

| | Sound corporate social responsibility |

| | Corporate social responsibility is one of the Company’s core values. The Company judges success in this area through the health of citizens in its communities, the safety and well-being of its employees, the vibrancy of its communities, and the sustainability of the Company’s practices with respect to their impact on the environment. A complete description of the Company’s objectives and progress in corporate social responsibility will be provided in the Company’s 2006 Sustainability Report, which will be released in April 2007. |

| | Key performance indicators |

| | The Company believes the following key performance indicators are meaningful for measuring the Company’s progress in achieving its strategic goals and creating value for investors. |

| | The Company’s first priority is the well-being of its employees. Safety is measured in terms of the medical incident rate (“MIR”), which is the number of incidents requiring medical attention per 200,000 hours worked, and the lost-time injury frequency (“LTI”), which is the number of lost-time injuries per 200,000 hours worked. The Company achieved its safest year on record in 2005 and set even higher safety goals for 2006. However, 2006 was disappointing in that the Company’s safety record slipped, compared to 2005. Additional details on 2006 safety results will be provided in the Company’s 2006 Sustainability Report, which will be released in April 2007. |

| | EBITDA is widely used in the financial community to compare the profitability of corporations, and is used by management as an indicator of relative operating performance. Further analysis and discussion of this indicator is provided in all discussions of operations and the “Non-GAAP Measures” section. |

| | Performance Improvement Program |

| | One of the characteristics of the Company’s culture is that of engaging its people in projects that challenge the status quo. The Company has for several years aggregated these initiatives on an annual basis into a Performance Improvement Program. Performance improvement initiatives challenge the Company to create innovative and cost-effective business solutions. In addition, the Company focuses on significant capital projects to improve the quality of products and improve machine efficiency. In 2006, the Company launched its fifth consecutive Performance Improvement Program. A detailed summary of the 2006 Performance Improvement Program results is available in this section under “Progress on 2006 Strategic Initiatives”. |

| | Average sales revenue per tonne |

| | Average sales revenue per tonne for each core business provides key insights into how the Company maximizes its market position. The main factors in revenue growth are U.S. dollar transaction prices, and the relationship between the Canadian and U.S. dollar. Details on 2006 results are provided in the “Annual Segmented Results of Operations” and “Quarterly Segmented Results of Operations” sections. |

| | Reducing cash costs while maintaining product quality is essential to sustaining profitability in each of the Company’s core businesses. The Company continually examines all areas of its business for cost reduction opportunities. Details on 2006 results are provided in the “Annual Segmented Results of Operations” and “Quarterly Segmented Results of Operations” sections. |

| | The Company’s success also depends on its liquidity and continued ability to finance its growth. The Company focuses on its total-debt to total-capitalization ratio and on its net-debt to net-capitalization ratio in order to assess its debt position. Further discussion is provided in the “Liquidity and Capital Resources” section. |

| | Greenhouse gas emissions (“GHG”) |

| | The Company takes its environmental responsibility seriously and, as such, has invested heavily in environmental initiatives. The Company has had a 70% absolute reduction of GHGs and a 69% intensity reduction of GHGs since 1990, and is well positioned to meet objectives established by the Kyoto Protocol. Emissions are measured in direct GHGs per tonne. In recognition of its progress in 2006, the Company was one of 25 companies recognized for reducing greenhouse gases in the Carbon Disclosure Project - Canada 280 Report. Further details will be provided in the Company’s 2006 Sustainability Report, which will be released in April 2007. |

The Company’s strategic initiative achievements in 2006 and 2005 were as follows:

(All amounts pre-tax and in millions of dollars) | |

Initiative | | Performance goal | | 2006 Goal | | 2006 Achievement | | 2005 Achievement | |

Components of Performance Improvement Programs | |

i) Grade development and product optimization | | | Develop new, higher-value specialty products, reduce exposure to the commodity newsprint market, and optimize product, grade and customer mix | | $ | 9 | | $ | 11 | | $ | 19 | |

ii) Cost Reduction | | | Improve productivity | | | 24 | | | 20 | | | - | |

| | | | Optimize fibre | | | 8 | | | 12 | | | 12 | |

| | | | Improve energy efficiencies | | | 6 | | | 12 | | | 10 | |

| | | | Optimize freight | | | 4 | | | 5 | | | 7 | |

| | | | Optimize chemical usage | | | 6 | | | 5 | | | 4 | |

| | | | Reduce kraft usage | | | 2 | | | (1 | ) | | 18 | |

| | | | Other | | | 11 | | | 10 | | | 14 | |

| | | | | | | 61 | | | 63 | | | 65 | |

| | | | | | $ | 70 | | $ | 74 | | $ | 84 | |

| | Progress on 2006 strategic initiatives |

| | (a) | Performance Improvement Program |

| | In January 2006, the Company commenced its fifth consecutive annual Performance Improvement Program. The 2006 Performance Improvement Program was aimed at generating $70 million in year-over-year EBITDA improvements across all areas of the Company. Improvements were targeted in the areas of grade development and product optimization and cost reduction. In 2006, the program delivered $74 million in realized improvements. |

| | | i) | Grade development and product optimization |

| | This strategic initiative included the marketing of new high-value specialty paper products, and the reduction of the Company’s exposure to standard newsprint. In 2006, the Company realized EBITDA improvements of $11 million as a result of its various grade development and product optimization initiatives. |

| | In pursuit of these performance initiatives, the Company accomplished the following in 2006: |

| | Sales of Electraprime and Electrastar |

In 2003, the Company introduced Electraprime to the market. The Electraprime grade is a soft-calendered, high-brightness paper designed to compete as an alternative to SC-A grades used primarily for advertising flyers and inserts. Electraprime was well received in the market with sales of approximately 103,000 tonnes in 2006, an improvement of approximately 14,000 tonnes, or 15.7%, from 2005, and 70,000 tonnes, or 212.1%, from 2004. The Company intends to continue growing its Electraprime business through 2007.

The Electrastar grade was also introduced to the market in 2003 and is a super-high brightness grade designed for applications in which brightness is a desirable characteristic, such as inserts and specialty newspapers. Electrastar sales volumes in 2006 were up 36% to 82,000 tonnes, compared to 2005. The growth was in line with the Company’s expectations.

ii) Cost reduction

| | The Company’s cost-reduction initiatives produced the following key results in 2006: |

The Company’s productivity improvement initiatives in 2006 were focused mainly on increasing asset reliability, improving machine speed and efficiency by cutting operating and maintenance-related downtime, and reducing dry-end paper losses. These and other initiatives resulted in savings of $20 million in 2006.

| | The Company continued to optimize its furnish mix during the year by using lower-cost chips and optimizing the use of other lower-cost furnishes. These and other initiatives resulted in savings of $12 million in 2006. |

| | Improve energy efficiencies |

| | The Company is a significant consumer of steam and electrical energy. The overall reduction in steam usage and the continuing optimization of the fuel mix in the Company’s power boilers resulted in less reliance on fossil fuels in favour of wood waste hog fuel. In addition, the Company focused on a number of electrical energy initiatives that reduced overall electrical consumption. These and other energy reduction initiatives resulted in additional savings of $12 million in 2006. |

The Company’s key freight initiatives included improvements on rail, truck and container shipment yields as well as initiatives to reduce barge costs. These and other initiatives resulted in additional savings of $5 million in 2006.

| | The Company had a number of initiatives to reduce the usage and costs of bleaching and additive chemicals during the year. These and other initiatives resulted in additional savings of $5 million in 2006. |

| | The Company also completed a series of smaller initiatives, primarily with respect to manpower reductions, procurement improvements and its maintenance practices. Approximately $10 million in savings were realized as a result of these initiatives. |

| | (b) | Other strategic initiatives |

In 2006, the Company focused further on advancing its preferred supplier status with key customers by continuing to improve the consistency, runnability and reliability of its products, and its on-time delivery service. As a result, there were significant reductions in 2006 quality claims.

| | Chain-of-custody certification |

| | The Company has implemented over the 2004-to-2006 period an “independent chain-of-custody” system to certify its wood fibre supply. The PwC standard is a third-party audited system that identifies the source of wood fibre and whether it is derived from a forest independently certified as being managed in accordance with a recognized sustainable forest certification system. By 2006, all the Company’s paper and pulp mills were certified under the PwC standard. The independent chain-of-custody system tracks the fibre from source to finished product and provides a valuable tool to assure customers that paper contains wood fibre derived from well-managed forests. It is expected to continue to result in additional sales opportunities. |

| | As part of its ongoing initiatives to improve efficiency, the Company intends to further invest in improved systems and processes in 2007. In the second quarter (“Q2”) of 2006, the Company completed an upgrade in its enterprise business system with the primary focus on improving order visibility. In 2007, the Company expects to undertake a project to expand the use of its enterprise business system to locations currently using a legacy system. |

| | 2007 Performance Improvement Program |

| | The 2007 Performance Improvement Program is currently under review with the expectation that there will be identified improvements across all areas of the Company similar to those of previous years. |

| | 1.6 | Consolidated results of operations |

| | Year ended December 31, 2006 compared to year ended December 31, 2005 |

| | Sales were $1,882.5 million in 2006, an increase of $58.6 million, or 3.2%, compared to $1,823.9 million in 2005. The positive impact on sales from improved prices across most paper and pulp grades together with higher sales volumes for most grades more than offset the negative impact from the stronger Canadian dollar. |

| | The following table highlights the factors that affected the Company’s sales by segment: |

| Sales ($ millions) | |

| | | Year ended December 31, | | | | Increase (decrease) from 2005 as a result of | |

| | | 2006 | | 2005 | | Total change | | Volume | | Mix | | Price | | F/X | |

| Specialty papers | | $ | 918.4 | | $ | 900.5 | | $ | 17.9 | | $ | 45.1 | | $ | 5.2 | | $ | 34.1 | | $ | (66.5 | ) |

| Newsprint | | | 529.8 | | | 529.1 | | | 0.7 | | | (5.9 | ) | | 2.1 | | | 39.0 | | | (34.5 | ) |

| Total paper | | $ | 1,448.2 | | $ | 1,429.6 | | $ | 18.6 | | $ | 39.2 | | $ | 7.3 | | $ | 73.1 | | $ | (101.0 | ) |

| Pulp | | | 434.3 | | | 394.3 | | | 40.0 | | | 15.2 | | | (1.0 | ) | | 62.8 | | | (37.0 | ) |

| Total | | $ | 1,882.5 | | $ | 1,823.9 | | $ | 58.6 | | $ | 54.4 | | $ | 6.3 | | $ | 135.9 | | $ | (138.0 | ) |

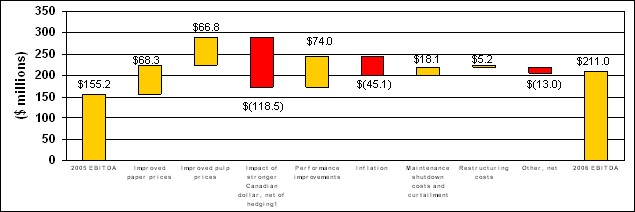

| | EBITDA was $211.0 million in 2006, an increase of $55.8 million, or 36.0%, compared to $155.2 million in the previous year. The positive impact of higher transaction prices, performance improvements, primarily reflecting productivity improvements, lower planned maintenance shutdown costs and lower restructuring costs more than offset the negative impact of the stronger Canadian dollar and inflationary impacts including chip prices. |

| | The following table summarizes the key changes in EBITDA from the year ended December 31, 2005, to the year ended December 31, 2006: |

1 Includes foreign exchange impact on costs.

| | Operating earnings (loss) |

| | The Company recorded operating earnings of $3.9 million in 2006, compared to an operating loss of $25.1 million for the previous year. The improvement was mainly related to the $55.8 million increase in EBITDA noted above, partially offset by $23.4 million of impairment losses related to the permanent closure of the A3 paper machine and other asset impairments. More details are provided in the “Critical Accounting Policies and Estimates” section. |

| | Net loss in 2006 was $15.9 million ($0.07 per common share), compared to a net loss of $25.6 million ($0.12 per common share) in 2005. The 2006 net loss included a $0.2 million (less than $0.01 per common share) after-tax foreign exchange loss on the translation of U.S.-dollar-denominated debt, compared to an after-tax gain of $20.7 million ($0.10 per common share) in the previous year. Net loss in 2006 also included an after-tax impairment loss of $15.4 million ($0.07 per common share), a $22.9 million ($0.11 per common share) release of future income taxes related to the reduction in the federal corporate income tax rate, a net $4.0 million ($0.02 per common share) favourable future income tax provision adjustment, and $2.2 million ($0.01 per common share) of after-tax advisory costs resulting from a tender offer initiated by TAM. Net loss in 2005 included net favourable future income tax adjustments totalling $18.3 million ($0.09 per common share), which consisted primarily of a $14.2 million ($0.07 per common share) favourable future income tax adjustment related to a decrease in the British Columbia provincial income tax rate. |

| | Net loss before the abovementioned items in 2006 was $25.0 million ($0.12 per common share), compared to a net loss of $64.6 million ($0.30 per common share) in the previous year. |

| | The following table reconciles 2006 earnings (loss) to 2005: |

($millions) | | Pre-tax | | After-tax | |

2005 earnings (loss) | | $ | (72.2 | ) | $ | (25.6 | ) |

Higher EBITDA | | | 55.8 | | | 36.8 | |

Higher amortization expense | | | (3.4 | ) | | (2.2 | ) |

Impairment loss | | | (23.4 | ) | | (15.4 | ) |

Decreased foreign exchange gain on translation of long-term debt | | | (25.0 | ) | | (20.9 | ) |

Lower other income, net | | | (2.7 | ) | | (1.7 | ) |

Lower interest expense | | | 1.9 | | | 1.3 | |

| Income tax adjustments, net | | | - | | | 12.7 | |

Non-controlling interest | | | (0.9 | ) | | (0.9 | ) |

2006 earnings (loss) | | $ | (69.9 | ) | $ | (15.9 | ) |

2.0 | ANNUAL SEGMENTED RESULTS OF OPERATIONS |

| Summary of Selected Financial Information | |

(In millions of dollars, except where otherwise stated) | | 2006 | | 20051 | | 20041 | |

| Sales | | $ | 918.4 | | $ | 900.5 | | $ | 935.3 | |

EBITDA2 | | | 104.8 | | | 115.8 | | | 95.6 | |

| Operating earnings (loss) | | | 9.7 | | | 24.8 | | | 1.0 | |

EBITDA margin2, 3 | | | 11.4 | % | | 12.9 | % | | 10.2 | % |

| Sales (000 tonnes) | | | 990.2 | | | 942.9 | | | 993.7 | |

| Production (000 tonnes) | | | 983.7 | | | 949.3 | | | 1,000.0 | |

| Average sales revenue per tonne | | $ | 928 | | $ | 955 | | $ | 941 | |

Average delivered cash costs per tonne4 | | | 822 | | | 832 | | | 846 | |

SC-A paper, 35lb. (US$/ton)5 | | | 788 | | | 769 | | | 713 | |

LWC paper, No.5, 40lb (US$/ton)5 | | | 836 | | | 847 | | | 726 | |

Telephone directory paper, 22.1 lb. (US$/ton)5 | | | 721 | | | 675 | | | 650 | |

| 1 | Effective January 1, 2006, the Company reclassified containerboard out of its specialty paper segment into its pulp segment. Prior period comparatives have been reclassified to reflect this change. |

| 2 | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| 3 | EBITDA margin is defined as EBITDA as a percentage of sales. |

| 4 | Average cash costs per tonne for these purposes consist of cost of sales and Sales, general and administrative (“SG&A”) costs, including delivery costs. |

| 5 | Benchmark selling prices are sourced from Resource Information Systems, Inc. (“RISI”). |

| | During 2006, market conditions for specialty paper products were mixed. |

| | Coated mechanical markets were weak for most of the year due to flat demand, which was caused by high North American mill inventories and weak catalogue and magazine demand. Demand in 2006 was up 0.6% over 2005, as demand in the second half of the year offset the weakness in the first six months. Nevertheless, prices continued to fall in 2006, and spot prices faced pressure due to strong competition and weak order books. The average LWC benchmark price in 2006 was down US$11 per ton, or 1.3%, compared to the previous year. |

| | Demand for uncoated mechanical grades was down 0.3% in 2006. The demand for high gloss and MF grades decreased 2.3% and 2.0%, respectively, due to grade switching as a result of supply disruptions and slightly lower insert circulation. Pricing remained firm throughout 2006 due to strong operating rates on a supply adjusted basis, with a slight decline in prices near the end of the year. The average benchmark price for SC-A in 2006 increased US$19 per ton, or 2.5%, over 2005. |

| | Directory demand was strong in 2006, up 10.3% year-over-year. The growth was driven by an increase in the number of large publisher and independent books, and increased circulation, which contributed to an 8.2% increase in large publisher yellow pages in North America. In addition, a shift to lighter basis weights also contributed to a higher demand for the Company's paper. The average benchmark price for 2006 was up US$46 per ton, or 6.8%, over the previous year. |

| | The North American economy is a key driver for the Company’s specialty paper business with 94% of its product sold to this market. Among its initiatives to improve profitability, the Company continues to look for ways to optimize its customer mix. |

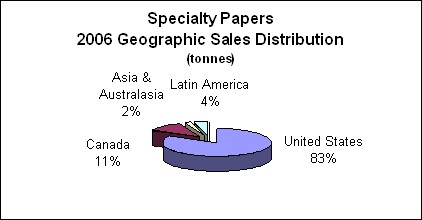

The 2006 geographic sales distribution, based on sales volumes, is depicted in the chart below.

| | The Company focused on growing its specialty paper grades in addition to grade optimization, enhancing its customer and grade mix, and shipping to more low-cost freight locations. |

| | Sales volumes for coated mechanical grades in 2006 were up 5.8% from the previous year. The growth matched the increased production in 2006 from the Company’s coated mechanical machine. |

| | Sales volumes for uncoated mechanical grades in 2006 increased 14.5% over 2005 due to significant growth in the Company’s Electraprime, Electrastar and Electrabrite grades. |

| | In a strategic move, the Company reduced directory sales volumes in 2006 by 9.1% to take advantage of relatively strong newsprint and uncoated mechanical prices in 2006. |

| | The specialty papers business recorded operating earnings of $9.7 million on sales of $918.4 million in 2006, compared to operating earnings of $24.8 million on sales of $900.5 million in 2005. EBITDA of $104.8 million in 2006 was $11.0 million lower than the $115.8 million recorded in the previous year. |

| | Sales volume of 990,200 tonnes in 2006 increased 47,300 tonnes, or 5.0%, compared to the previous year. The increase was largely due to the significant growth of the Company’s uncoated specialty grades. |

| | Average sales revenue of $928 per tonne in 2006 was down $27 per tonne compared to the previous year. The negative impact of the stronger Canadian dollar on revenues more than offset higher average transaction prices across most grades, improvements in customer and grade mix, and a favourable adjustment to allowance for doubtful accounts. |

| | Average cash costs in 2006 were $822 per tonne, an improvement of $10 per tonne, compared to $832 recorded in 2005. Savings from performance improvements more than offset higher chip costs, rising energy prices, increased labour expense and the impact of inflation. |

| | Market conditions are expected to remain mixed for specialty paper products in 2007. |

| | Coated mechanical paper demand is expected to remain relatively flat, reflecting an anticipated slowing of magazine and catalogue demand and a switch to SC-A grade. Recent capacity closures in Western Europe as well as the rising Euro are expected to result in lower imports to North America, which should help stabilize the North American coated market. In addition, rising chip, pulp, and energy costs are expected to increase the cash-cost floor thereby preventing significant price erosion. Benchmark prices are expected to fall in Q1, 2007, matching the seasonally slower first quarter before stabilizing in the second half of the year. |

| | Markets for uncoated mechanical grades are expected to remain relatively stable in 2007. Demand for high-gloss paper is expected to grow due to grade switching from coated mechanical and lower-gloss grades, but excess capacity and European imports are expected to keep operating rates low. Demand for MF grades is expected to be stable in 2007. Benchmark prices for high-gloss grades are expected to weaken in the seasonally slower first quarter and remain flat for the remainder of the year. |

| | Directory demand is expected to be solid through 2007 as large and independent publishers continue to print more books. In addition, benchmark prices are expected to increase in 2007, compared to 2006. |

| Summary of Selected Financial Information | |

(In millions of dollars, except where otherwise stated) | | 2006 | | 2005 | | 2004 | |

| Sales | | $ | 529.8 | | $ | 529.1 | | $ | 553.1 | |

EBITDA1 | | | 71.8 | | | 58.1 | | | 45.2 | |

| Operating earnings (loss) | | | 6.9 | | | 12.3 | | | (4.3 | ) |

EBITDA margin1, 2 | | | 13.6 | % | | 11.0 | % | | 8.2 | % |

| Sales (000 tonnes) | | | 699.1 | | | 707.1 | | | 754.7 | |

| Production (000 tonnes) | | | 703.7 | | | 699.5 | | | 757.8 | |

| Average sales revenue per tonne | | $ | 758 | | $ | 748 | | $ | 733 | |

Average delivered cash costs per tonne3 | | | 655 | | | 666 | | | 673 | |

Newsprint, 48.8 gsm, West Coast delivery (US$/tonne)4 | | | 649 | | | 600 | | | 544 | |

| 1 | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| 2 | EBITDA margin is defined as EBITDA as a percentage of sales. |

| 3 | Average cash costs per tonne for these purposes consist of cost of sales and SG&A costs, including delivery costs. |

| 4 | Benchmark selling prices are sourced from RISI. |

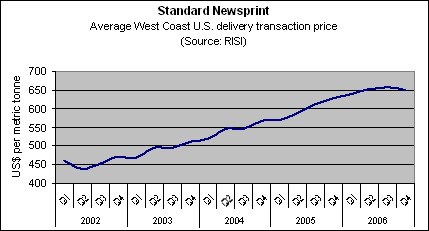

| | Newsprint demand continued to decline in 2006 with total U.S. consumption down 6.3% year-over-year. The decline was due mainly to daily newspapers employing a number of conservation measures to reduce paper consumption. Despite falling demand, operating rates were strong for most of the year, resulting in higher benchmark prices. The average newsprint benchmark price in 2006 was up US$49 per tonne, or 8.2%, compared to 2005. Continued weakness in U.S. consumption and lower operating rates resulted in prices softening late in 2006. |

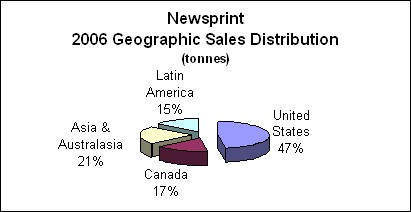

| | Approximately 85% of the Company’s newsprint sales volumes were to North America and Asia. The 2006 geographical sales distribution, based on sales volumes, is depicted in the chart below. |

| | The Company reduced newsprint sales volumes in 2006 by 1.1% in a strategic move to optimize swing machine capacity to meet the higher demand for its specialty grades and to improve productivity. The Company continued to shift to lighter basis weights and increased its volume of value-added newsprint during the year, while also continuing to focus on freight optimization and customer mix. |

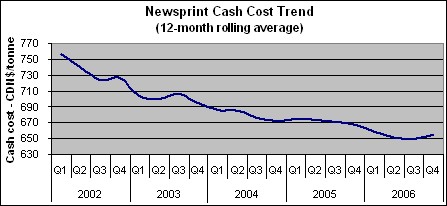

| | The chart below illustrates the decline in the Company’s newsprint cash costs per tonne since 2002, which has been driven primarily by the Company’s Performance Improvement Programs. |

| | The newsprint business recorded operating earnings of $6.9 million on sales of $529.8 million in 2006, compared to operating earnings of $12.3 million on sales of $529.1 million in 2005. EBITDA of $71.8 million in 2006 was $13.7 million higher than the $58.1 million recorded in 2005. The decline in operating earnings was primarily due to $19.1 million of impairment losses recorded on the Company’s A3 paper machine. Further details are provided in the “Critical Accounting Policies and Estimates” section. |

| | Sales volumes were 699,100 tonnes in 2006, down 8,000 tonnes, or 1.1%, from the previous year, primarily due to the Company’s strategic decision to optimize its swing machine capacity to meet higher demand for its specialty grades. |

| | Average sales revenue was $758 per tonne in 2006, an increase of $10 per tonne compared to the previous year. Higher transaction prices outweighed the impact of the stronger Canadian dollar. |

| | Average cash costs in 2006 were $655 per tonne, an improvement of $11 per tonne from the previous year. Savings from performance improvements and lower shutdown and restructuring costs more than offset higher maintenance spending and higher prices for fibre, energy and fuel, and the impact of inflation. |

| | The Company expects the newsprint market to continue to soften in 2007 due to decreases in ad lineage, circulation, average basis weights, and increased publisher conservation. The downward trend in newsprint consumption and lower expected operating rates in 2007 are expected to negatively impact prices. West Coast benchmark newsprint prices, which have risen for the last four years, are expected to weaken in 2007. Despite the downward trend in newsprint consumption, the Company believes it is well positioned to address further demand reductions due to its ability to switch grades. |

| Summary of Selected Financial Information | |

(In millions of dollars, except where otherwise stated) | | 2006 | | 20051 | | 20041 | |

| Sales | | $ | 434.3 | | $ | 394.3 | | $ | 389.8 | |

EBITDA2 | | | 34.4 | | | (18.7 | ) | | 12.0 | |

| Operating earnings (loss) | | | (12.7 | ) | | (62.2 | ) | | (28.0 | ) |

EBITDA margin2, 3 | | | 7.9 | % | | (4.7 | %) | | 3.1 | % |

| Sales (000 tonnes) | | | 626.2 | | | 603.0 | | | 527.3 | |

| Production (000 tonnes) | | | 624.3 | | | 590.9 | | | 544.0 | |

| Average sales revenue per tonne$ | | $ | 693 | | $ | 654 | | $ | 739 | |

Average delivered cash costs per tonne4 | | | 638 | | | 684 | | | 716 | |

NBSK pulp, Northern Europe delivery (US$/tonne)5 | | | 681 | | | 610 | | | 618 | |

White-top linerboard, 42 lb., Eastern U.S. delivery (US$/tonne)5 | | | 673 | | | 608 | | | 591 | |

| 1 | Effective January 1, 2006, the Company reclassified containerboard out of its specialty paper segment into its pulp segment. Prior period comparatives have been reclassified to reflect this change. |

| 2 | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| 3 | EBITDA margin is defined as EBITDA as a percentage of sales. |

| 4 | Average cash costs per tonne for these purposes consist of cost of sales and SG&A costs, including delivery costs. |

| 5 | Benchmark selling prices are sourced from RISI. |

| | Pulp markets were strong throughout 2006 with global pulp shipments up 3.9% year-over-year. The closure of a number of uncompetitive North American mills in 2006, coupled with relatively strong global paper and tissue demand resulted in multiple pulp price increases during the year. This helped push the European benchmark pulp price to its highest level since 1995. The average Northern Europe NBSK benchmark price for 2006 was up US$71 per tonne, or 11.6%, compared to the previous year. |

| | U.S. containerboard consumption remained steady in 2006, up 1.8% from the previous year, as U.S. box shipments increased with the relatively steady demand for non-durable goods and processed foods, and mill and box inventories were low for most of the year. Benchmark white-top linerboard prices increased in 2006 by US$65 per tonne, or 10.7%, compared to 2005. Prices in the second half of 2006 were relatively stable. |

| | The primary markets for the Company’s market pulp are Asia and Australasia and Europe. The 2006 geographical sales distribution, based on sales volumes, is depicted in the chart below. |

Market pulp sales volumes improved in 2006 by 3.8%, compared with 2005, due to higher production at the Company’s mills. The Company continued to increase its mix of contract business and optimize sales to customers in its major pulp markets.

Containerboard sales volumes in 2006 were 4.2% higher than in the previous year, as stronger markets allowed the Company to run its machine at full capacity. The Company continued to focus on stronger margins and improving its customer mix by targeting customers that are low-cost freight and value the Company’s high-graphic white-top linerboard product.

The pulp business recorded an operating loss of $12.7 million on sales of $434.3 million in 2006, compared to an operating loss of $62.2 million on sales of $394.3 million in the previous year. EBITDA of $34.4 million in 2006 increased $53.1 million from negative EBITDA of $18.7 million in 2005, which was the primary reason for the operating earnings improvement noted above. However, the improvement in operating earnings was partially offset by impairment losses recorded on the Company’s pulp assets. Further details are provided in the “Critical Accounting Policies and Estimates” section. The significant improvement in EBITDA was driven by both price increases and the Company’s cost-reduction initiatives.

Sales volumes were 626,200 tonnes in 2006, an increase of 23,200 tonnes, or 3.8%, from the previous year. The growth was due largely to improved pulp production.

Average sales revenue was $693 per tonne in 2006, up $39 per tonne compared to the previous year, due primarily to higher pulp and containerboard transaction prices, which more than offset the negative impact of the stronger Canadian dollar.

Average cash costs in 2006 were $638 per tonne, an improvement of $46 per tonne compared to 2005. Savings from performance improvements, lower maintenance spending and reduced shutdowns were the primary factors accounting for the reduction in average cash costs. The savings more than offset higher energy prices and chip costs and the impact of inflation.

Demand for NBSK pulp is expected to remain steady during the first half of 2007, with the expectation that benchmark prices will increase modestly in early 2007 and weaken in the second half of the year. Higher consumption by China is expected to be offset by weaker demand from paper markets in the U.S. and Europe, which is expected to limit overall growth in demand in 2007. New hardwood capacity coming on line in 2007 is expected to have a negative impact on operating rates, while chip scarcity and high energy costs could result in additional mill closures in North America and Europe. A price increase of US$30 per tonne in Europe and US$20 per tonne in North America has been announced for NBSK pulp, effective January 1, 2007.

| | The Company is expecting that demand and prices for containerboard will remain flat in 2007 as a result of the weakening U.S. economy. A US$40 per tonne increase for containerboard and white-top linerboard has been announced by a number of suppliers, effective January 1, 2007. |

Summary of Selected Financial Information (In millions of dollars, except where otherwise stated) | |

| | | 2006 | | 2005 | |

Specialty Papers1 | | Q1 | | Q2 | | Q3 | | Q4 | | Q1 | | Q2 | | Q3 | | Q4 | |

| Sales | | $ | 220.8 | | $ | 218.6 | | $ | 245.0 | | $ | 234.0 | | $ | 226.1 | | $ | 211.7 | | $ | 223.9 | | $ | 238.8 | |

EBITDA2 | | | 29.1 | | | 25.7 | | | 31.6 | | | 18.4 | | | 25.5 | | | 24.5 | | | 33.7 | | | 32.1 | |

| Operating earnings (loss) | | | 6.6 | | | 2.8 | | | 6.9 | | | (6.6 | ) | | 2.5 | | | 2.1 | | | 10.9 | | | 9.3 | |

EBITDA margin2, 3 | | | 13.2 | % | | 11.8 | % | | 12.9 | % | | 7.9 | % | | 11.3 | % | | 11.6 | % | | 15.1 | % | | 13.4 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales (000 tonnes) | | | 235.1 | | | 237.8 | | | 264.6 | | | 252.7 | | | 238.0 | | | 219.9 | | | 235.0 | | | 250.0 | |

| Production (000 tonnes) | | | 235.7 | | | 244.2 | | | 254.8 | | | 249.0 | | | 237.5 | | | 228.6 | | | 242.3 | | | 240.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 939 | | $ | 920 | | $ | 926 | | $ | 927 | | $ | 950 | | $ | 963 | | $ | 953 | | $ | 956 | |

Average delivered cash costs per tonne4 | | | 815 | | | 811 | | | 806 | | | 853 | | | 843 | | | 852 | | | 809 | | | 827 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

SC-A paper, 35 lb. (US$/ton)5 | | | 780 | | | 785 | | | 800 | | | 787 | | | 745 | | | 770 | | | 780 | | | 780 | |

LWC paper, No. 5, 40 lb. (US$/ton)5 | | | 875 | | | 852 | | | 820 | | | 798 | | | 790 | | | 837 | | | 880 | | | 880 | |

Telephone directory paper, 22.1 lb. (US$/ton)5 | | | 715 | | | 720 | | | 725 | | | 725 | | | 675 | | | 675 | | | 675 | | | 675 | |

| Newsprint | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 137.2 | | $ | 135.4 | | $ | 128.8 | | $ | 128.4 | | $ | 133.0 | | $ | 127.1 | | $ | 127.1 | | $ | 141.9 | |

EBITDA2 | | | 19.8 | | | 19.3 | | | 18.2 | | | 14.5 | | | 9.9 | | | 12.7 | | | 14.7 | | | 20.8 | |

Operating earnings (loss) | | | (9.9 | ) | | 7.4 | | | 7.5 | | | 1.9 | | | (0.9 | ) | | 1.4 | | | 3.4 | | | 8.4 | |

EBITDA margin2, 3 | | | 14.4 | % | | 14.3 | % | | 14.1 | % | | 11.3 | % | | 7.4 | % | | 10.0 | % | | 11.6 | % | | 14.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales (000 tonnes) | | | 181.1 | | | 178.4 | | | 169.5 | | | 170.1 | | | 180.7 | | | 169.2 | | | 169.9 | | | 187.3 | |

| Production (000 tonnes) | | | 183.9 | | | 179.6 | | | 170.0 | | | 170.2 | | | 176.7 | | | 167.4 | | | 167.9 | | | 187.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 758 | | $ | 759 | | $ | 761 | | $ | 754 | | $ | 736 | | $ | 752 | | $ | 748 | | $ | 758 | |

Average delivered cash costs per tonne4 | | | 647 | | | 651 | | | 653 | | | 669 | | | 682 | | | 677 | | | 662 | | | 647 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Newsprint 48.8 gsm, West Coast delivery (US$/tonne)5 | | | 640 | | | 651 | | | 658 | | | 649 | | | 571 | | | 589 | | | 612 | | | 627 | |

Pulp1 | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 98.3 | | $ | 115.6 | | $ | 112.2 | | $ | 108.2 | | $ | 103.6 | | $ | 100.2 | | $ | 99.3 | | $ | 91.2 | |

EBITDA2 | | | (1.6 | ) | | 7.4 | | | 13.0 | | | 15.6 | | | (1.8 | ) | | (11.8 | ) | | (0.5 | ) | | (4.6 | ) |

| Operating earnings (loss) | | | (12.6 | ) | | (4.1 | ) | | 2.6 | | | 1.4 | | | (12.3 | ) | | (23.0 | ) | | (11.5 | ) | | (15.4 | ) |

EBITDA margin2, 3 | | | (1.6 | %) | | 6.4 | % | | 11.6 | % | | 14.4 | % | | (1.7 | %) | | (11.8 | %) | | (0.5 | %) | | (5.0 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales (000 tonnes) | | | 153.4 | | | 171.4 | | | 155.9 | | | 145.5 | | | 150.6 | | | 150.3 | | | 157.7 | | | 144.4 | |

| Production (000 tonnes) | | | 153.1 | | | 155.6 | | | 162.8 | | | 152.8 | | | 142.3 | | | 141.4 | | | 157.1 | | | 150.1 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 641 | | $ | 674 | | $ | 720 | | $ | 744 | | $ | 688 | | $ | 666 | | $ | 630 | | $ | 632 | |

Average delivered cash costs per tonne4 | | | 652 | | | 630 | | | 637 | | | 636 | | | 699 | | | 745 | | | 633 | | | 664 | |

NBSK pulp, Northern Europe delivery (US$/tonne)5 | | | 618 | | | 665 | | | 710 | | | 730 | | | 640 | | | 613 | | | 587 | | | 600 | |

White-top linerboard, 42 lb., Eastern U.S. delivery (US$/tonne)5 | | | 650 | | | 680 | | | 680 | | | 680 | | | 620 | | | 620 | | | 583 | | | 610 | |

| 1 | Effective January 1, 2006, the Company reclassified containerboard out of its specialty paper segment into its pulp segment. Prior period comparatives have been reclassified to reflect this change. |

| 2 | EBITDA is a non-GAAP measure. Refer to the “Non-GAAP Measures” section for further details. |

| 3 | EBITDA margin is defined as EBITDA as a percentage of sales. |

| 4 | Average cash costs per tonne for these purposes consist of cost of sales and SG&A costs, including delivery costs. |

| 5 | Benchmark selling prices are sourced from RISI. |

| | 3.1 | Three months ended December 31, 2006 compared to three months ended |

| | EBITDA in Q4, 2006 was $48.5 million, a decrease of $14.3 million, or 22.8%, from $62.8 million in Q3, 2006. The reduction was caused by the negative impact of higher fibre prices, higher maintenance costs and poor weather conditions, which more than offset the positive impact of the weaker Canadian dollar, the absence of the tender offer advisory costs recorded in the previous quarter, and higher pulp and paper prices. |

| | The following table summarizes the key changes in EBITDA from Q3, 2006 to Q4, 2006: |

($ millions) | | | |

Q3, 2006 EBITDA | | $ | 62.8 | |

| Pulp and paper prices | | | 0.7 | |

| Impact of weaker Canadian dollar, net of hedging program | | | 4.2 | |

| Fibre prices | | | (5.2 | ) |

| Maintenance and other operating costs | | | (6.0 | ) |

| Energy costs | | | (2.6 | ) |

| Impact of poor weather conditions | | | (4.6 | ) |

| Non-recurring tender offer advisory and other related costs | | | 3.4 | |

| Other, net | | | (4.2 | ) |

Q4, 2006 EBITDA | | $ | 48.5 | |

| | Net loss in Q4, 2006 was $37.2 million ($0.17 per common share), compared to net earnings of $2.5 million ($0.01 per common share) in the previous quarter. Net loss in Q4 included a $26.2 million ($0.12 per common share) after-tax foreign exchange loss on the translation of U.S.-dollar-denominated debt, compared to a $0.1 million (less than $0.01 per common share) after-tax foreign exchange gain on the translation of U.S.-dollar-denominated debt in the previous quarter. Net loss in Q4 also included an after-tax impairment loss of $3.8 million ($0.02 per common share). Net earnings in the previous period also included a net $4.0 million ($0.02 per common share) favourable future income tax provision adjustment and $2.2 million ($0.01 per common share) of after-tax costs resulting from a tender offer initiated by TAM. |

| | Net loss before the abovementioned items in Q4 was $7.2 million ($0.03 per common share), compared to net earnings before the abovementioned items of $0.6 million (less than $0.01 per common share) in the previous quarter. |

| | 3.1.2 | Operational performance - specialty papers |

| | The specialty papers business recorded an operating loss of $6.6 million on sales of $234.0 million in Q4, 2006, compared to operating earnings of $6.9 million on sales of $245.0 million in Q3, 2006. EBITDA in Q4 was $18.4 million, a $13.2 million decrease from $31.6 million recorded in the previous quarter. The primary reasons for the decreases are discussed below. |

| | Sales volume of 252,700 tonnes in Q4 decreased 11,900 tonnes, or 4.5%, from the previous quarter when the Company shipped record-high coated and uncoated specialty sales volumes. |

| | Average sales revenue in Q4 of $927 per tonne remained consistent with the $926 per tonne recorded in Q3. |

| | Average cash costs in Q4 were $853 per tonne, an increase of $47 per tonne compared to the previous quarter. Higher maintenance spending and fibre prices, increased usage of fossil fuel and one-time closure costs for the Port Alberni groundwood pulp mill more than offset savings from performance improvements. |

| | The newsprint business recorded operating earnings of $1.9 million on sales of $128.4 million in Q4, 2006, compared to operating earnings of $7.5 million on sales of $128.8 million in Q3, 2006. EBITDA in Q4 was $14.5 million, a $3.7 million decrease from $18.2 million recorded in the previous quarter. The primary reasons for the decreases are discussed below. The decline in operating earnings was also partially due to impairment losses of $1.5 million recorded on the Company’s A3 paper machine in Q4. Further details are provided in the “Critical Accounting Policies and Estimates” section. |

| | Sales volume of 170,100 tonnes in Q4 was consistent with the previous quarter. |

| | Average sales revenue in Q4 of $754 per tonne decreased $7 per tonne compared to the previous quarter, with weaker transaction prices being the primary factor for the decrease. |

| | Average cash costs in Q4 were $669 per tonne, an increase of $16 per tonne from the previous quarter. Higher maintenance spending and fibre prices and increased usage of fossil fuel more than offset savings from performance improvements. |

| | The pulp business recorded operating earnings of $1.4 million on sales of $108.2 million in Q4, 2006, compared to operating earnings of $2.6 million on sales of $112.2 million in Q3, 2006. EBITDA in Q4 was $15.6 million, a $2.6 million increase from $13.0 million recorded in the previous quarter. The primary reasons for the movements are discussed below. The decline in operating earnings was also due in part to impairment losses of $3.8 million recorded on the Company’s assets in Q4. Further details are provided in the “Critical Accounting Policies and Estimates” section. |

| | Sales volume of 145,500 tonnes in Q4 decreased by 10,400 tonnes, or 6.7%, from the previous quarter, reflecting primarily the timing of pulp shipments to Asia. |

| | Average sales revenue in Q4 was $744 per tonne, an increase of $24 per tonne from the previous quarter, primarily due to higher pricing for pulp. |

Average cash costs in Q4 were $636 per tonne, which was consistent with the previous quarter. Higher fibre and energy prices, increased steam usage, and higher regular maintenance spending were offset mainly by lower scheduled maintenance shutdown costs and the impact of an eight-day curtailment in Q4.

| | 3.2 | Three months ended December 31, 2006 compared to three months ended |

| | EBITDA in Q4, 2006 was $48.5 million, up $0.2 million, or 0.4%, from $48.3 million in Q4, 2005. Higher product prices across most paper and pulp grades and further performance improvements were offset by the negative impacts of the stronger Canadian dollar and inflation, and by higher costs. |

| | The following table summarizes the key changes in EBITDA from Q4, 2005 to Q4, 2006: |

($ millions) | | | |

Q4 2005 EBITDA | | $ | 48.3 | |

| Improved pulp prices | | | 22.9 | |

| Improved paper prices | | | 9.2 | |

| Impact of stronger Canadian dollar, net of hedging program | | | (20.9 | ) |

| Inflation | | | (15.4 | ) |

| Other, net | | | 4.4 | |

Q4 2006 EBITDA | | $ | 48.5 | |

| | Net loss in Q4, 2006 was $37.2 million ($0.17 per common share), compared to a net loss of $8.0 million ($0.04 per common share) in Q4, 2005. Net loss in Q4, 2006 included a $26.2 million ($0.12 per common share) after-tax foreign exchange loss on the translation of U.S.-dollar-denominated debt, compared to an after-tax foreign exchange loss of $2.2 million ($0.01 per common share) in Q4, 2005. Net loss in Q4, 2006 also included an after-tax impairment loss of $3.8 million ($0.02 per common share). Net loss in Q4, 2005 also included favourable income tax adjustments of $5.0 million ($0.02 per common share). |

| | Net loss before the abovementioned items in Q4, 2006 was $7.2 million ($0.03 per common share), compared to a net loss before the abovementioned items of $10.8 million ($0.05 per common share) in the same period of 2005. |

| | The specialty papers business recorded an operating loss of $6.6 million on sales of $234.0 million in Q4, 2006, compared to operating earnings of $9.3 million on sales of $238.8 million in the same quarter of 2005. EBITDA in Q4, 2006 was $18.4 million, a $13.7 million decrease from $32.1 million recorded in the same quarter last year. The primary reasons for the decreases are discussed below. |

| | Sales volume of 252,700 tonnes in Q4, 2006 was in line with the same quarter last year. |

| | Average sales revenue in Q4, 2006 was $927 per tonne, a decrease of $29 per tonne from Q4, 2005. The decrease was due to the negative impact of the significantly stronger Canadian dollar and, to a lesser extent, weaker coated prices, which together more than offset stronger prices for uncoated and directory grades, and an improved customer and grade mix. |

| | Average cash costs in Q4, 2006 were $853 per tonne, an increase of $26 per tonne from the same quarter of 2005. Higher maintenance spending and shutdowns in addition to increased fibre and energy prices more than offset savings from performance improvements. |

| | The newsprint business recorded operating earnings of $1.9 million on sales of $128.4 million in Q4, 2006, compared to operating earnings of $8.4 million on sales of $141.9 million in the same quarter of 2005. EBITDA of $14.5 million in Q4, 2006 was down $6.3 million from $20.8 million recorded in Q4, 2005. The primary reasons for the decreases are noted below. The decline in operating earnings was also partially due to impairment losses of $1.5 million recorded on the Company’s A3 paper machine in Q4, 2006. Further details are provided in the “Critical Accounting Policies and Estimates” section. |

| | Sales volume of 170,100 tonnes in Q4, 2006 was down 17,200 tonnes, or 9.2%, from Q4, 2005, due primarily to the Company optimizing its swing machine capacity to meet the higher demand for other grades. |

| | Average sales revenue of $754 per tonne in Q4, 2006 decreased $4 per tonne from the same period of 2005, with the negative impact of the stronger Canadian dollar more than offsetting higher transaction prices and a favourable market, grade and customer mix. |

| | Average cash costs in Q4, 2006 were $669 per tonne, an increase of $22 per tonne from the same quarter of 2005. Higher fibre costs and fossil fuel usage, increased maintenance spending and the impact of inflation more than offset the savings from performance improvements. |