CATALYST PAPER CORPORATION

MANAGEMENT’S DISCUSSION AND ANALYSIS

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following management discussion and analysis (“MD&A”) of Catalyst Paper Corporation (the “Company”) should be read in conjunction with the consolidated financial statements for the years ended December 31, 2007, 2006, and 2005, and the notes thereto.

Throughout this discussion, reference is made to EBITDA, which represents earnings before interest, taxes, depreciation and amortization, and before other non-operating income and expenses, EBITDA before specific items, average delivered cash costs per tonne before specific items, net earnings (loss) before specific items, net earnings (loss) per share before specific items, and free cash flow. Management believes these measures are useful to evaluate the performance of the Company and its business segments. As Canadian Generally Accepted Accounting Principles (“GAAP”) do not define a method of calculating these measures, securities regulations require that non-GAAP measures be clearly defined and qualified, and reconciled with their nearest GAAP measure. The definition, calculation, and reconciliation of these non-GAAP measures is provided in Section 9: “Non-GAAP Measures”.

In accordance with industry practice, in this MD&A, the term “tonne” or the symbol “MT” refers to a metric tonne and the term “ton” or the symbol “ST” refers to a short ton, an imperial unit of measurement equal to 0.9072 metric tonnes.

In this MD&A, unless otherwise indicated, all dollar amounts are expressed in Canadian dollars, as are the term “dollars” and the symbols “$” and “CDN$”. The term “U.S. dollars” and the symbol “US$” refer to United States dollars.

The information in this report is as at February 13, 2008, which is the date of filing in conjunction with the Company’s press release announcing its results for the fourth quarter and twelve months ended December 31, 2007. Disclosure contained in this document is current to that date, unless otherwise stated.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains forward-looking statements. Forward-looking statements are statements, other than statements of historical fact, that address or discuss activities, events or developments that the Company expects or anticipates may occur in the future. These forward-looking statements can be identified by the use of words such as “anticipate”, “could”, “expect”, “seek”, “may”, “likely”, “intend”, “will”, “believe” and similar expressions or the negative thereof. These forward-looking statements reflect management’s current views and are based on certain assumptions including assumptions as to future economic conditions and courses of action, as well as other factors management believes are appropriate in the circumstances. Such forward-looking statements are subject to risks and uncertainties and no assurance can be given that any of the events anticipated by such statements will occur or, if they do occur, what benefit the Company will derive from them. A number of factors could cause actual results, performance or developments to differ materially from those expressed or implied by such forward-looking statements, including the general economic conditions in the U.S., Canada and internationally, market conditions and demand for the Company’s products, the outlook for inventories, production and pricing, the Company’s ability to successfully obtain performance improvements and cost savings from its cost reduction initiatives, expected cash flows, capital expenditures and completion of capital projects, shifts in industry capacity, fluctuations in foreign exchange and interest rates, fluctuations in availability and cost of raw materials or energy, the implementation of environmental legislation requiring capital for operational changes, the Company’s ability to obtain financing and other factors beyond the Company’s control. Additional information concerning these and other factors can be found in Section 13 of this MD&A under the heading "Risks and Uncertainties". The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Investors are cautioned not to place undue reliance on these forward-looking statements. No forward-looking statement is a guarantee of future results.

| | | Page |

| | | |

| Overview and highlights | 4 |

| Segmented results – Annual | 21 |

| Segmented results – Quarterly | 30 |

| Financial condition | 36 |

| Liquidity and capital resources | 37 |

| Related party transactions | 43 |

| Off-balance sheet arrangements | 43 |

| Summary of quarterly results | 44 |

| Non-GAAP measures | 45 |

| Critical accounting policies and estimates | 49 |

| Changes in accounting policies | 53 |

| Impact of accounting pronouncements affecting future periods | 54 |

| Risks and uncertainties | 54 |

| Sensitivity analysis | 61 |

| Outlook | 62 |

| Disclosure controls and internal control over financial reporting | 64 |

| Outstanding share data | 65 |

| | 1.1 | Overview of the business |

Catalyst is a leading producer of specialty printing papers and newsprint in North America. The Company also produces market kraft pulp and white top containerboard and owns Western Canada’s largest paper recycling facility. With five mills located within a 160-kilometre radius on the south coast of British Columbia, Catalyst has a combined annual capacity of 2,403,000 tonnes of product. The Company is headquartered in Richmond, B.C.

The Company is the largest producer of specialty printing papers and newsprint in Western North America. Catalyst’s specialty printing papers include lightweight coated, uncoated mechanical papers (soft-calendered and machine-finished hi-brites and super-brites) and directory paper. The Company is one of the largest producers of directory paper in the world and the only producer of lightweight coated paper in Western North America.

The Company’s business is comprised of three business segments: specialty paper, newsprint, and pulp. The split of production capacity between the three business segments is as follows:

Specialty paper

The specialty paper segment consists of lightweight coated (“LWC”), uncoated mechanical papers such as soft-calendered (“SC”) and machine-finished (“MF”) hi-brites and super-brites, and directory. These specialty printing paper grades are manufactured on ten1 paper machines in British Columbia at Crofton, Elk Falls, Port Alberni and Powell River. The specialty paper business segment has a total production capacity of 1,123,000 million tonnes.

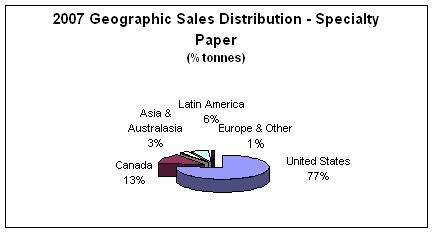

Specialty paper represents the Company’s largest business segment, generating 54% of 2007 consolidated sales revenue. The Company’s customer base consists primarily of retailers, magazine and catalogue publishers, commercial printers and telephone directory publishers. Specialty printing paper products are sold primarily through the Company’s sales and marketing personnel in North America, and through distributors and agents in other geographic markets. In 2007, 90% of specialty paper sales volumes were with customers in North America. Specialty paper is shipped by ship, barge, rail or truck, or by a combination of some or all of these transportation modes.

Newsprint

Newsprint is currently manufactured on five1 paper machines at Crofton, Elk Falls and Powell River. The newsprint business segment has a total annual production capacity of 606,000 tonnes. Effective September 1, 2007 the Port Alberni No. 4 paper machine (“A4”) was indefinitely idled, displacing 134,000 tonnes of newsprint on a 45.0 g/m2 basis.

Newsprint sales generated 20% of 2007 consolidated sales revenue. The newsprint customer base consists primarily of newsprint publishers located in Western and Central North America and in Asia. In 2007, 82% of newsprint sales volumes were with customers in North America, Asia and Australasia. Newsprint is shipped overseas by deep-sea vessel and inland by ship, barge, rail or truck, or by a combination of some or all of these transportation modes.

Pulp

The pulp segment consists of Northern Bleached Softwood Kraft (“NBSK”) pulp manufactured at the Crofton mill and sawdust-based pulp and containerboard manufactured at the Elk Falls mill. The pulp business segment has a total market production capacity of 674,000 tonnes.

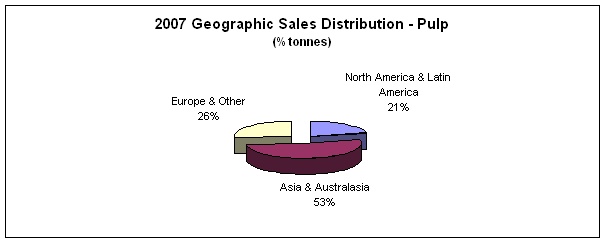

Pulp and containerboard sales generated 26% of 2007 consolidated sales revenue. The pulp customer base is located primarily in Europe and Asia and includes producers of tissue, magazine papers, woodfree printing and writing papers and certain specialty paper products. The containerboard customer base consists primarily of corrugated box manufacturers. Pulp and containerboard products are sold primarily through sales and marketing personnel in Canada, and through a network of agents in locations throughout the world. In 2007, 79% of pulp and containerboard sales volumes were with customers in Europe, Asia and Australasia. The Crofton and Elk Falls pulp mills are located on tidewater and have deep-sea vessel loading facilities. Pulp and containerboard are shipped by both break-bulk and container deep-sea vessels.

The Company also owns the largest paper recycling facility in Western Canada. Operated in support of the business segments described above, the recycling facility has an annual production capacity of 175,000 air-dried equivalent tonnes of pulp per year, the majority of which is consumed internally.

| | 1 | The Company has 11 paper machines. The number of machines noted in the segments above reflects the ability of the Company’s machines to switch between newsprint and specialty paper grades. |

The chart below illustrates the Company’s principal paper and pulp products, their applications, and annual 2008 production capacity:

| PRODUCT PROFILE |

| Segment | Specialty paper | Newsprint | Pulp |

| Category | Uncoated mechanical | Lightweight Coated | Directory | Newsprint | Containerboard | Market pulp |

| Soft-calendered | Machine-finished |

Brand names | Electrasoft Electracal Electraprime | Electrabrite Electrastar | Electracote | Catalyst | Marathon | Silverliner Platinumliner Chromiumliner Bronzeliner | Elk Prime Crofton Kraft |

Basis weight (g/m2) | 45 – 52 | 45 – 66.5 | 44.4 – 63.6 | 28 – 40 | 43 – 48.8 | 127 – 270 | n/a |

Applications | Magazines, Supplements, Catalogues, Inserts, Flyers, Direct mail, Directories | Magazines, Supplements, Inserts, Flyers, Direct mail, PR and corporate communication books/manuals | Magazines, Catalogues, Inserts, Flyers, Direct mail | Telephone books, Airline schedules, Catalogues | Newspapers, Inserts, Flyers, Supplements, Directories, Timetables | Packaging applications | Tissue, Freesheet, Specialty paper, White-top linerboard |

| Total capacity (tonnes) | 540,0001 | 231,000 | 352,0001 | 606,0001,2 | 131,000 | 543,000 |

| % of total capacity | 22% | 10% | 15% | 25% | 5% | 23% |

| | 1 | Capacities expressed in the above table can vary as the Company is able to switch production between products - particularly newsprint, directory and machine-finished uncoated grades. |

| | 2 | The Company indefinitely curtailed A4 effective September 1, 2007, displacing the equivalent of 134,000 tonnes of the Company’s annual newsprint production. The capacity noted in the table above has not been adjusted to reflect this indefinite curtailment. |

The chart below illustrates the annual 2008 production capacity by mill and product line:

| CAPACITY BY MILL LOCATION AND PRODUCT LINE |

| | | Specialty paper | Newsprint | Pulp |

Mill location | Number of Paper machines | Uncoated mechanical | Lightweight Coated | Directory | Newsprint | Containerboard | Market pulp |

Crofton, B.C. | 3 | - | - | 246,000 | 150,000 | - | 343,000 |

| Elk Falls, B.C. | 3 | 153,000 | - | - | 373,000 | 131,000 | 200,000 |

| Port Alberni, B.C. | 22 | - | 231,000 | 106,000 | - | - | - |

| Powell River, B.C. | 3 | 387,000 | - | - | 83,000 | - | - |

Total capacity (tonnes) | | 540,0001 | 231,000 | 352,0001 | 606,0001,2 | 131,000 | 543,000 |

| | 1 | Capacities expressed in the above table can vary as the Company is able to switch production between products - particularly newsprint, directory and machine-finished uncoated grades. |

| | 2 | The Company indefinitely curtailed A4 effective September 1, 2007, displacing the equivalent of 134,000 tonnes of the Company’s annual newsprint production. The capacity and number of machines noted in the table above have not been adjusted to reflect this indefinite curtailment. |

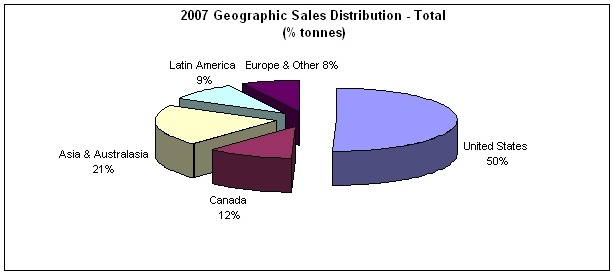

Geographic Sales Distribution

The Company’s products are sold on five continents. At 62% of sales, the North American market continues to be the Company’s principal market, and is followed in significance by Asia and Australasia, Latin America, and Europe. The consolidated sales volume distribution for 2007 was as follows:

The paper sales volume distribution for 2007 was as follows:

The pulp sales volume distribution for 2007 was as follows:

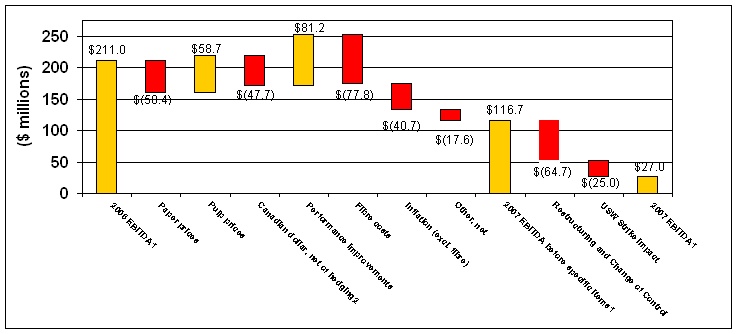

After four consecutive years of improvement in operating earnings, 2007 was a particularly challenging environment for the Company, resulting in the Company’s earnings declining versus their prior year. A Canadian dollar that reached 50 year record highs against the U.S. dollar in 2007, a price downcycle for most of our paper products, a constrained fibre supply, and the impact of a strike further affecting coastal fibre supply in the third and fourth quarters, all combined to create significant headwinds. However, on the positive side pulp prices increased rapidly during the year and towards the end of the year most groundwood paper products started to see positive price momentum. In addition, the Company took action to improve profitability through the indefinite closure of newsprint capacity and the reduction of approximately 15% of the workforce through the Company’s restructuring program, which contributed the largest part of another successful Performance Improvement Program that delivered $81 million of benefit to operating earnings and EBITDA in 2007.

The Company recorded a net loss of $31.6 million, compared to a net loss of $15.9 million in 2006. EBITDA was $27.0 million, compared to $211.0 million in 2006. The Company’s results in 2007 included restructuring and change-of-control costs of $64.7 million and were also negatively impacted by $25.0 million related to a disruption in fibre supply resulting from the United Steelworkers of Canada union (“USW”) work stoppage. EBITDA before these specific items was $116.7 million, compared to $211.0 million in 2006.

Restructuring Initiatives and Change-of-Control

The Company announced and implemented, in phases during 2007, a restructuring program to eliminate approximately 565 positions across the Company, relocate the corporate office, and centralize certain mill administrative functions. This program was substantially completed during the year and is expected to deliver total annualized cost savings of approximately $67 million. In 2007, total restructuring costs for this program were $58.3 million, including $3.0 million of capital expenditures.

The Company indefinitely curtailed operations of A4 on September 1, 2007. Production of directory paper made on A4 was moved to Crofton and displaced the equivalent of 134,000 tonnes per year of the Company’s least profitable newsprint business. The curtailment also reduced the Company’s highest cost fibre and power requirements.

Significant management changes occurred during 2007. Richard Garneau joined the Company as the President and Chief Executive Officer and David Smales, formerly Vice-President of Strategy, was appointed Vice-President, Finance and Chief Financial Officer replacing former President and Chief Executive Officer and former Vice-President, Finance and Chief Financial Officer, respectively, after they exercised their rights under change-of-control agreements and left the Company during the first quarter of 2007. The Company recorded $8.3 million in severance, pension-benefit and stock-compensation expenses related to these change-of-control agreements plus $1.1 million relating to certain employee retention agreements.

Performance Improvements

The Company continued to deliver on its performance improvement objectives, including the restructuring program, and realized a year-over-year operating earnings and EBITDA increase of $81 million from performance improvements. A discussion of the 2007 Performance Improvement Program’s results is provided under “Progress on 2007 Strategic Initiatives” in Section 1.5, “Strategy”.

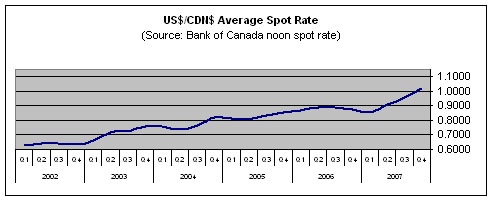

Canadian Dollar

The majority of the Company’s sales are denominated in U.S. dollars. As a result, the strengthening Canadian dollar, which reached its highest value against the U.S. dollar in more than 50 years during 2007, had a significant negative impact on the Company’s operating earnings for the year. The average spot rate for 2007 was US$0.930 compared to US$0.882 for 2006 and US$0.825 for 2005. Despite the mitigation provided by the Company’s hedging program, the currency movement in 2007 reduced EBITDA by $48 million when compared to 2006.

The chart below illustrates the movement of the US$/CDN$ spot rate over the past six years:

Product Demand and Pricing

Market conditions for the Company’s products were mixed in 2007.

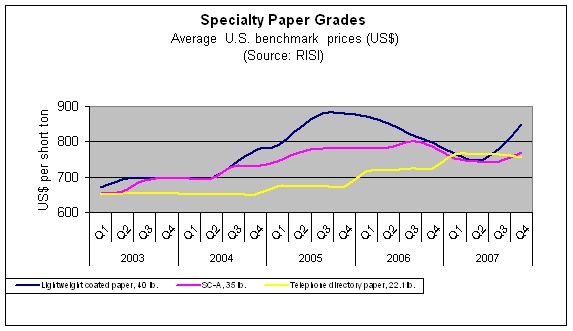

Coated mechanical demand was higher in the year largely due to substitution of coated mechanical grades for coated woodfree. Supply in the coated market tightened late in 2007, primarily due to significant North American mill closures in the latter half of the year combined with lower mill inventories. These factors led to improving LWC prices in the second half of the year. In December 2007, the Company announced a third consecutive US$60 per ton price increase for its LWC paper grades, bringing the total announced increases by the end of the year to $180 per ton since July 1, 2007. Despite the recent upward pricing momentum, the average LWC benchmark price was 6% lower in 2007, compared to 2006.

Overall uncoated mechanical demand remained flat. The increased demand for high-gloss grades offset the decrease in demand for standard grades. Prices softened during the first half of the year, but started to reverse in the fourth quarter. The average soft-calendered A grade (“SC-A”) benchmark price was 4% lower than the previous year.

After robust growth in 2006, directory demand was steady in 2007 due to slower growth in the number of independent books printed and flat total page and book circulation for incumbent publishers. The average directory benchmark price was 3% higher than in 2006.

Newsprint demand continued to weaken at a significant rate during 2007, leading to an average newsprint benchmark price decrease of 11% from 2006. Prices began to stabilize late in the year as capacity closures reduced supply and a US$25 per tonne price increase was implemented in December 2007 in the U.S.

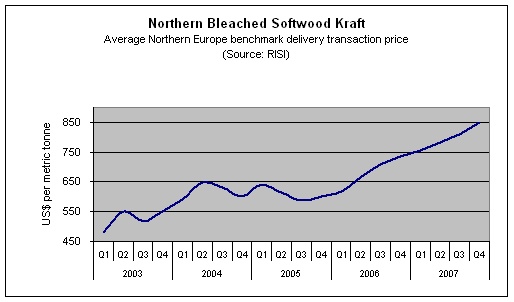

Pulp demand continued to be strong in 2007. The combination of strong demand and tight supply resulted in US$ prices increasing to their highest level since 1995. The average NBSK benchmark price in 2007 was 17% higher than in 2006.

For containerboard markets, supply and demand remained in balance, with low inventory and healthy export levels despite flat demand. The 2007 benchmark price was 4% higher than in 2006.

Fibre Costs and Supply

A combination of factors made 2007 a difficult year with respect to fibre supply. Coming into 2007 low inventory levels throughout the fibre supply chain, due to lower log volume harvested in the fourth quarter of 2006, was made more challenging by continued poor weather in Q1, 2007. This resulted in higher fibre prices in the first half of the year. Although harvesting conditions returned to normal by mid-2007, the three month USW strike that began in late July and reduced sawmill activity as a result of poor market conditions for lumber kept fibre prices high all year. Overall, increased fibre costs and the total impact of the USW strike had a negative impact of $103 million on EBITDA in 2007 when compared to 2006.

Fibre lost to Catalyst during the USW strike was 284,000 bone dry tonnes, although the impact was partially mitigated through higher than expected logging activity and increased supply from other suppliers. This loss of fibre led to production curtailments in the third and fourth quarters of 106,100 tonnes of paper and 44,200 tonnes of pulp and containerboard at the Elk Falls mill; and 10,500 tonnes of pulp at the Crofton mill.

Liquidity and Capital assets

The Company’s available liquidity was $241 million at the end of 2007, compared to $324 million at the end of 2006. Of the $83 million decrease, $41 million was due to a reduction in borrowing base on the Company’s revolving operating facility as a result of lower accounts receivable and inventory following curtailment related to the reduced fibre availability in Q4, and the indefinite closure of A4 in September, 2007. Lower EBITDA, in large part due to restructuring and change-of-control costs and the impact of the USW strike, further reduced the Company’s liquidity.

In September 2007, the Company sold the Port Alberni No. 3 (“A3”) paper machine and ancillary assets. The Company received proceeds of $1.3 million and recorded a loss on disposal of $7.5 million.

| Ø | Realized year-over-year operating earnings and EBITDA benefits of $81 million from the Company’s 2007 Performance Improvement Program, of which $29 million was related to workforce reductions. |

| Ø | Implemented a restructuring program which is expected to deliver annualized cost savings of approximately $67 million through: |

| o | total workforce reductions of 565; |

| o | relocation of the corporate office from Vancouver, B.C. to lower cost premises in Richmond, B.C., and |

| o | centralization of certain mill administrative functions in Nanaimo, B.C. |

| Ø | Indefinitely curtailed A4, displacing 134,000 tonnes of the Company’s least profitable newsprint production. |

| Ø | Made high-return capital investments totalling $56.5 million, including $8.1 million to facilitate receipt of de-inked pulp (“DIP”) in more efficient crumb form at the Crofton mill. |

| Ø | Received a national energy efficiency stewardship award from CIPEC, an organization founded by the federal government in conjunction with business, to promote energy efficiency. |

| Ø | Recognized for environmental and social responsibility programs including: |

| o | Launched Catalyst Cooled, a product line whose manufacture results in no net carbon emissions – on which Rolling Stone magazine prints and for which the Company received the Metafore Innovation Award in the products category. |

| o | Recognized as the only forest-products company on the Conference Board of Canada’s Carbon Disclosure Leadership Index (CDLI), in recognition of transparency regarding emissions and reduction efforts. |

| o | Received – “Gift to the Earth” recognition from the WWF, in connection with the conservation and management agreement reached for the Great Bear Rainforest. |

| o | Recognized by the United Way (BC Lower Mainland) for 15 consecutive years of “gold level” employee giving, calculated as 80% of an organization’s one-day payroll. |

| Ø | Received the Canadian Institute of Chartered Accountants award of excellence for financial and corporate reporting in the forest products category. |

| | 1.4 | Selected annual financial information |

| (In millions of dollars, except where otherwise stated) | |

| | | 2007 | | | 2006 | | | 2005 | |

Sales | | $ | 1,714.6 | | | $ | 1,882.5 | | | $ | 1,823.9 | |

| Operating earnings (loss) | | | (149.4 | ) | | | 3.9 | | | | (25.1 | ) |

EBITDA1 | | | 27.0 | | | | 211.0 | | | | 155.2 | |

EBITDA before specific items1 | | | 116.7 | | | | 211.0 | | | | 161.9 | |

| Net earnings (loss) | | | (31.6 | ) | | | (15.9 | ) | | | (25.6 | ) |

Net earnings (loss) before specific items1 | | | (89.3 | ) | | | (25.0 | ) | | | (64.6 | ) |

| Total assets | | | 2,453.4 | | | | 2,637.7 | | | | 2,695.9 | |

| Total long-term liabilities | | | 1,195.4 | | | | 1,338.6 | | | | 1,396.8 | |

EBITDA margin1,2 | | | 1.6 | % | | | 11.2 | % | | | 8.5 | % |

EBITDA margin before specific items1,2 | | | 6.8 | % | | | 11.2 | % | | | 8.9 | % |

| Net earnings (loss) per share (in dollars) – basic and diluted | | $ | (0.15 | ) | | $ | (0.07 | ) | | $ | (0.12 | ) |

Net earnings (loss) per share before specific items (in dollars) – basic and diluted1 | | | (0.42 | ) | | | (0.12 | ) | | | (0.30 | ) |

| Sales (000 tonnes) | | | | | | | | | | | | |

Specialty paper | | | 1,054.8 | | | | 990.2 | | | | 942.9 | |

Newsprint | | | 496.3 | | | | 699.1 | | | | 707.1 | |

Total paper | | | 1,551.1 | | | | 1,689.3 | | | | 1,650.0 | |

Pulp | | | 603.2 | | | | 626.2 | | | | 603.0 | |

Total sales | | | 2,154.3 | | | | 2,315.5 | | | | 2,253.0 | |

| Production (000 tonnes) | | | | | | | | | | | | |

Specialty paper | | | 1,055.4 | | | | 983.7 | | | | 949.3 | |

Newsprint | | | 472.8 | | | | 703.7 | | | | 699.5 | |

Total paper | | | 1,528.2 | | | | 1,687.4 | | | | 1,648.8 | |

Pulp | | | 601.8 | | | | 624.3 | | | | 590.9 | |

Total production | | | 2,130.0 | | | | 2,311.7 | | | | 2,239.7 | |

| US$/CDN$ foreign exchange | | | | | | | | | | | | |

Average spot rate3 | | | 0.930 | | | | 0.882 | | | | 0.825 | |

Period-end spot rate4 | | | 1.012 | | | | 0.858 | | | | 0.858 | |

Effective rate5 | | | 0.917 | | | | 0.872 | | | | 0.807 | |

| Common shares (millions) | | | | | | | | | | | | |

At period end | | | 214.7 | | | | 214.6 | | | | 214.6 | |

Weighted average | | | 214.7 | | | | 214.6 | | | | 214.6 | |

| 1 | EBITDA, EBITDA before specific items, EBITDA margin, EBITDA margin before specific items, net earnings (loss) before specific items, and net earnings (loss) per share before specific items are non-GAAP measures. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 2 | EBITDA margin and EBITDA margin before specific items are defined as EBITDA and EBITDA before specific items, as a percentage of sales and adjusted sales, respectively. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 3 | Average spot rate is the average Bank of Canada noon spot rate over the reporting period. |

| 4 | Period-end spot rate is the Bank of Canada noon spot rate on December 31. |

| 5 | Effective rate represents a blended rate which takes account of the applicable spot rates, the Company’s revenue hedging program in the period, and translation of US$-denominated working capital at period opening and closing rates. See Section 9, “Summary of Quarterly Results” for further details. |

The Company’s long-term objective is to achieve higher sustainable earnings and maximize cash flow by strengthening its position as a leading producer of groundwood printing papers, including specialty printing paper grades and newsprint.

Key performance drivers

The Company believes the following key performance drivers are critical to achieving its strategic goals and creating value for its investors.

Market position

Market position is a significant driver of the Company’s success. As one of the largest producers of specialty printing papers in North America, market penetration and diversification is important. The Company’s brand names are well recognized in the marketplace and it has built a reputation for reliability, value and service.

Product mix

In recent years, the Company has expanded the number of grades manufactured in the market. The Company has introduced new product lines which include Electraprime (an “SCA” alternative), Electrastar (a super-brite), Electrabrite Lite (a lightweight hi-brite), Silverliner (a kraft paper whitetop), and Elk Prime (a sawdust-based pulp). These newer and more specialized products generally provide higher margins than standard commodity grades. The Company also manages fluctuations in demand for its products through its ability to switch production capacity between products, particularly newsprint, directory, and machine-finished uncoated mechanical grades. In addition, market pulp, sawdust-based pulp, and white-top linerboard further diversify the product mix.

Supply chain

Distribution costs have a significant impact on net sales realizations. The Company’s strong and flexible distribution network optimizes all transportation modes available to it, such as truck, rail, and container and break-bulk shipping.

The mill sites directly ship break bulk paper and pulp to offshore customers via regularly scheduled vessels. The Company operates a central distribution centre in Surrey, B.C. which receives volumes from its four manufacturing sites and then ships via rail, truck and container to its customers. This allows the Company to choose the most cost effective transportation mode in conjunction with customer requirements.

The Company leases 980 rail cars to ensure damage free, on time delivery to its rail customers and the Company leases five paper barges which it uses to transport its products to the Surrey distribution centre. Controlling key elements of its supply chain have allowed the Company to achieve a high on time performance and low damage level. Combined with its focus on lowering costs and the reduction of inventory levels, the Company improved its service delivery business processes and further centralized its organization in 2007 to provide cost-efficient and reliable transportation to customers.

Cost-competitive manufacturing

The Company’s manufacturing costs are key to being competitive over the long term, particularly with respect to fibre, energy, and labour costs and the Company is focused on reducing these costs and improving margins. Over the past five years, capital expenditures of approximately $423 million have been directed primarily towards shifting production towards higher-margin printing papers, reducing unit production costs, increasing machine productivity, improving product quality, increasing capacity, and meeting or exceeding environmental regulations.

In addition, over the last several years, the Company has developed expertise in the production of lightweight papers. Lower basis weight papers reduce the Company’s costs by decreasing fibre, shipping, and storage and handling expenses.

Production and capacity utilization

The ability to increase production rates and minimize production downtime impacts the Company’s per unit cash costs. Over the last several years the Company has been focused on improving machine productivity through several initiatives such as implementing an asset reliability program, operator technical training, and increasing focus on reducing machine dry end losses. These and other initiatives from the Company’s Performance Improvement Program have been instrumental in improving machine productivity.

Corporate social responsibility

Corporate social responsibility is one of the Company’s core values. The Company judges success in this area through the safety and well-being of its employees, the vibrancy of its communities, and the sustainability of the Company’s practices with respect to their impact on the environment. A complete description of the Company’s commitments and progress in corporate social responsibility is provided in the Company’s 2007 Sustainability Report, produced concurrently with the Company’s 2007 annual report.

Key performance indicators

The Company believes the following key performance indicators are meaningful for measuring the Company’s progress in achieving its strategic goals and creating value for investors:

Safety

The Company’s first priority is the well-being of its employees. Key metrics include the medical incident rate (“MIR”), which is the number of incidents requiring medical attention per 200,000 hours worked, and the lost-time injury frequency (“LTI”), which is the number of lost-time injuries per 200,000 hours worked. The Company’s overall safety performance declined on these and other key safety measures during 2007. Additional details on 2007 safety results are provided in the Company’s 2007 Sustainability Report, produced concurrently with the Company’s 2007 annual report.

Performance Improvement Program

One of the characteristics of the Company’s culture is that of engaging its people in projects that challenge the status quo. The Company has for several years aggregated these initiatives on an annual basis into a Performance Improvement Program. Performance improvement initiatives challenge the Company to create innovative and cost-effective business solutions. In 2007, the Company launched its sixth consecutive Performance Improvement Program, which included the 2007 restructuring program. A detailed summary of the 2007 Performance Improvement Program results is available in this section under “Progress on 2007 Strategic Initiatives”.

EBITDA and EBITDA before specific items

EBITDA and EBITDA before specific items are widely used in the financial community to compare the profitability of corporations, and are used by management as an indicator of relative operating performance. Further analysis and discussion of these indicators are provided in all discussions of operations and in the “Non-GAAP Measures” section.

Average sales revenue per tonne

Average sales revenue per tonne for each core business provides key insights into how the Company maximizes its market position and product mix. The main factors in revenue growth are U.S. dollar transaction prices, and the relationship between the Canadian and U.S. dollar. Details on 2007 results are provided in the “Segmented Results - Annual” and “Segmented Results - - Quarterly” sections.

Average delivered cash costs per tonne and average delivered cash costs per tonne before specific items

Reducing cash costs while maintaining product quality is essential to sustaining profitability in each of the Company’s core businesses. The Company continually examines all areas of its business for cost reduction opportunities. Details on 2007 results are provided in the “Segmented Results - Annual” and “Segmented Results - Quarterly” sections.

Free cash flow

Free cash flow is a measure of cash that is generated by operations and available after capital expenditures, but before changes in working capital items and proceeds from divested assets. Further analysis and discussion of this indicator is provided in the “Non-GAAP Measures” section.

Leverage and interest coverage

The Company’s success also depends on its liquidity and continued ability to finance its growth. The Company focuses on total-debt to total-capitalization, net-debt to net-capitalization, net-debt to EBITDA, and EBITDA to interest ratios in order to assess its debt position. Further analysis and discussion of these indicators are provided in the “Liquidity and Capital Resources” section.

Greenhouse gas emissions (“GHG”)

The Company takes its environmental compliance seriously and focuses on continuous improvement of its performance through operational efficiency and process innovation. The Company has achieved a 69% absolute and intensity reduction of GHGs since 1990 (as measured by direct emissions), and management believes the Company is well positioned to meet emerging regulatory objectives and market expectations. The Company received third-party recognition for the transparency and depth of its reporting on greenhouse gases in 2007, and launched a manufactured carbon-neutral product line. Further details are provided in the Company’s 2007 Sustainability Report, produced concurrently with the Company’s 2007 annual report.

Progress on 2007 strategic initiatives

| | (a) | Performance Improvement Program |

The Company’s achievements relating to specific performance improvements in 2007, 2006, and 2005 were as follows:

| Performance Improvement Program Initiatives | |

| (All amounts are pre-tax and in millions of dollars) | | 2007 Realized | | | 2006 Realized | | | 2005 Realized | |

Workforce reduction | | $ | 29 | | | $ | - | | | $ | - | |

| Product, grade, and customer optimization | | | 21 | | | | 11 | | | | 19 | |

| Productivity improvements | | | 6 | | | | 20 | | | | - | |

| Reduce energy consumption | | | 6 | | | | 12 | | | | 10 | |

| Furnish costs | | | 5 | | | | 12 | | | | 12 | |

| Optimize chemical usage | | | 2 | | | | 5 | | | | 4 | |

| Other | | | 12 | | | | 14 | | | | 39 | |

Total Performance Improvement Program | | $ | 81 | | | $ | 74 | | | $ | 84 | |

Early in 2007, the Company commenced its sixth consecutive annual Performance Improvement Program. Improvements were targeted in the areas of workforce reductions, product, grade, and customer optimization, and other cost reduction initiatives. In 2007, the program delivered $81 million in realized improvements by the following means:

Workforce reduction

Workforce reductions related to the 2007 restructuring program resulted in savings of $29 million. The Company reduced its workforce positions from 3,673 on January 1, 2007 to 3,038 on January 1, 2008. The reduction to date includes 551, or 98%, of the 565 positions targeted for elimination, in addition to employees laid off as a result of the indefinite closure of the A4 paper machine.

Product, grade, and customer optimization

This strategic initiative involved the marketing of higher-value specialty printing paper products, allowing margin optimization compared to standard grades. In 2007, the Company realized EBITDA improvements of $21 million as a result of its various product, grade, and customer optimization initiatives.

Sales of Electraprime were of particular relevance in 2007. This is a soft-calendered high-brite paper grade designed to compete as an alternative to SC-A grades and is used primarily for advertising flyers, inserts and direct mail. It continued to be well received in the market with sales of approximately 125,000 tonnes in 2007, an improvement of approximately 22,000 tonnes, or 21%, from 2006. Electraprime was introduced to the market in 2003 and the Company intends to continue growing this business.

In addition the Company sold approximately 57,200 tonnes of additional directory paper in 2007 versus 2006 and reduced newsprint volume to take advantage of stronger directory pricing and weaker newsprint pricing in 2007.

Productivity Improvements

The Company’s productivity improvement initiatives in 2007 were focused mainly on increasing asset reliability, improving machine speed and efficiency by cutting operating and maintenance-related downtime, and reducing dry-end paper losses. These and other initiatives resulted in savings of $6 million in 2007.

Reduce energy consumption

The Company is a significant consumer of electrical energy. The Company focused on a number of electrical energy initiatives that reduced overall electrical consumption which included a demand management program with B.C. Hydro. This and other energy reduction initiatives resulted in savings of $6 million in 2007.

Furnish costs

The Company continued to optimize its furnish mix during the year by substituting lower-cost furnishes. These and other initiatives resulted in savings of $5 million in 2007.

Optimize chemical usage

The Company had a number of initiatives to reduce the usage and costs of bleaching and additive chemicals during the year. These and other initiatives resulted in savings of $2 million in 2007.

Other

The Company also completed a series of smaller initiatives, primarily with respect to freight, procurement improvements and its maintenance practices. Approximately $12 million in savings were realized as a result of these initiatives.

| | (b) | Other strategic initiatives |

Preferred supplier

Quality initiatives

In 2007, the Company focused further on advancing its preferred supplier status with key customers by continuing to improve the consistency, runnability and reliability of its products, and its on-time delivery service. As a result, the Company was able to maintain low quality claims in 2007.

Catalyst Cooled

In 2007, the Company launched “Catalyst Cooled”, a product line whose manufacture results in no net carbon emissions – on which Rolling Stone magazine prints. The product is designed for customers who do not want their paper to contribute to carbon emissions. The Company intends to keep growing this product.

Chain-of-custody certification

The Company has implemented an “independent chain-of-custody” system to certify its wood fibre supply. The PricewaterhouseCoopers standard is a third-party audited system that verifies fibre is derived from a forest managed in accordance with the requirements of a major sustainability certification program. The independent chain-of-custody system tracks the fibre from source to finished product and provides a valuable tool to assure customers that paper contains fibre originating from well-managed forests. It is expected to continue to result in additional sales opportunities.

| | 1.6 | Consolidated results of operations |

Year ended December 31, 2007 compared to year ended December 31, 2006

Sales

Sales in 2007 decreased $167.9 million, or 8.9%. The decline in sales was due to lower sales volumes due to curtailment relating to the USW strike and curtailment of the A4 paper machine in September 2007, the strong Canadian dollar, and lower transaction prices across most paper grades, particularly newsprint and LWC. The decrease in sales was partially offset by the positive impact of average transaction prices for pulp and a more favourable product mix.

The following table highlights the factors that affected the Company’s sales by segment:

| Sales ($ millions) | |

| | | Year ended December 31, | | | | | | Increase (decrease) from 2006 as a result of | |

| | | 2007 | | | 2006 | | | Total change | | | Volume1 | | | Price | | | Mix | | | | F/X | |

Specialty paper | | $ | 919.6 | | | $ | 918.4 | | | $ | 1.2 | | | $ | 61.8 | | | $ | (21.4 | ) | | $ | 4.8 | | | $ | (44.0 | ) |

| Newsprint | | | 338.0 | | | | 529.8 | | | | (191.8 | ) | | | (154.6 | ) | | | (29.0 | ) | | | 3.1 | | | | (11.3 | ) |

| Total paper | | | 1,257.6 | | | | 1,448.2 | | | | (190.6 | ) | | | (92.8 | ) | | | (50.4 | ) | | | 7.9 | | | | (55.3 | ) |

| Pulp | | | 457.0 | | | | 434.3 | | | | 22.7 | | | | (16.0 | ) | | | 58.7 | | | | 1.8 | | | | (21.8 | ) |

Total | | $ | 1,714.6 | | | $ | 1,882.5 | | | $ | (167.9 | ) | | $ | (108.8 | ) | | $ | 8.3 | | | $ | 9.7 | | | $ | (77.1 | ) |

| 1 | Decrease in volume is due to curtailment of certain assets in the third and fourth quarters related to the USW strike and curtailment of the A4 paper machine effective September 1, 2007. |

EBITDA

EBITDA before specific items was $116.7 million, a decrease of $94.3 million in 2007 compared to 2006. The negative impact of higher fibre costs, weaker newsprint and LWC prices, inflation, and the stronger Canadian dollar, more than offset higher transaction prices for pulp products, and the realization of benefits from the Performance Improvement Program. Including the impact of restructuring and change-of-control costs, and USW strike related costs, EBITDA decreased $184.0 million in 2007 compared to 2006.

The following table summarizes the key changes in EBITDA1 and EBITDA before specific items1 from the year ended December 31, 2006 to year ended December 31, 2007:

| | 1 | EBITDA and EBITDA before specific items are non-GAAP measures. Refer to Section 9, "Non-GAAP Measures" for further details. |

| | 2 | Includes foreign exchange impact on costs. |

Operating earnings (loss)

The Company recorded an operating loss of $149.4 million in 2007, compared to operating earnings of $3.9 million for the previous year. The decrease was mainly related to the $184.0 million decrease in EBITDA noted above, offset by the $23.4 million impairment loss recorded in the previous year.

Net earnings (loss)

Net loss of $31.6 million ($0.15 per common share) increased $15.7 million compared to a net loss of $15.9 million ($0.07 per common share) in 2006. After adjusting for certain specific items, net loss before specific items in 2007 was $89.3 million ($0.42 per common share), a decrease of $64.3 million from net loss before specific items of $25.0 million ($0.12 per common share) in the previous year. Refer to Section 9, “Non-GAAP Measures” for details on net earnings (loss) before specific items.

The following table reconciles 2007 net earnings (loss) to 2006:

| ($millions) | | Pre-tax | | | After-tax | |

2006 net earnings (loss) | | $ | (69.9 | ) | | $ | (15.9 | ) |

Lower EBITDA before specific items | | | (94.3 | ) | | | (62.2 | ) |

Restructuring and change-of-control costs | | | (64.7 | ) | | | (42.7 | ) |

Impact of the USW strike | | | (25.0 | ) | | | (16.5 | ) |

Lower amortization expense | | | 7.3 | | | | 4.8 | |

Lower impairment loss | | | 23.4 | | | | 15.4 | |

| Loss on disposal of A3 paper machine | | | (7.5 | ) | | | (4.9 | ) |

Increase in foreign exchange gain on long-term debt | | | 104.2 | | | | 86.5 | |

Lower other income, net | | | (9.6 | ) | | | (6.3 | ) |

Lower interest expense | | | 3.1 | | | | 2.0 | |

Income tax adjustments, net | | | - | | | | 6.8 | |

Non-controlling interest | | | 1.4 | | | | 1.4 | |

2007 net earnings (loss) | | $ | (131.6 | ) | | $ | (31.6 | ) |

| SEGMENTED RESULTS - ANNUAL |

| (In millions of dollars, except where otherwise stated) | |

| | | 2007 | | | 2006 | | | 2005 | |

Sales | | $ | 919.6 | | | $ | 918.4 | | | $ | 900.5 | |

EBITDA1 | | | 26.2 | | | | 104.8 | | | | 115.8 | |

EBITDA before specific items1 | | | 73.4 | | | | 104.8 | | | | 116.3 | |

| Operating earnings (loss) | | | (75.1 | ) | | | 9.7 | | | | 24.8 | |

EBITDA margin1,2 | | | 2.8 | % | | | 11.4 | % | | | 12.9 | % |

EBITDA margin before specific items1,2 | | | 8.0 | % | | | 11.4 | % | | | 12.9 | % |

| | | | | | | | | | | | | |

| Sales (000 tonnes) | | | 1,054.8 | | | | 990.2 | | | | 942.9 | |

| Production (000 tonnes) | | | 1,055.4 | | | | 983.7 | | | | 949.3 | |

Curtailment (000 tonnes)3 | | | 7.2 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 872 | | | $ | 928 | | | $ | 955 | |

Average delivered cash costs per tonne4 | | | 847 | | | | 822 | | | | 832 | |

Average delivered cash costs per tonne before specific items1,4 | | | 802 | | | | 822 | | | | 832 | |

| | | | | | | | | | | | | |

| Benchmark prices | | | | | | | | | | | | |

SC-A paper, 35 lb. (US$/ton)5 | | | 753 | | | | 788 | | | | 769 | |

LWC paper, No. 5, 40 lb. (US$/ton)5 | | | 786 | | | | 836 | | | | 847 | |

Telephone directory paper, 22.1 lb. (US$/ton)5 | | | 740 | | | | 721 | | | | 675 | |

| 1 | EBITDA, EBITDA before specific items, EBITDA margin, EBITDA margin before specific items, and average delivered cash costs per tonne before specific items are non-GAAP measures. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 2 | EBITDA margin and EBITDA margin before specific items are defined as EBITDA and EBITDA before specific items as a percentage of sales and adjusted sales, respectively. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 3 | Curtailment consists of downtime related to the USW strike. |

| 4 | Average delivered cash costs per tonne consist of cost of sales, including the impact of the USW strike, selling, general and administration (“SG&A”) costs, and restructuring and change-of-control costs. |

| 5 | Benchmark selling prices are sourced from Resource Information Systems, Inc. (“RISI”). |

During 2007, market conditions for most of our specialty printing paper products were challenging.

Coated mechanical demand was 5% higher in 2007 compared to 2006 largely due to substitution of coated mechanical grades for coated woodfree. Supply in the coated market tightened during 2007, primarily due to significant North American mill closures in the latter half of the year and lower mill inventories. Combined, these factors led to stronger LWC prices in the second half of the year. In December 2007, the Company announced a third consecutive US$60 per ton price increase for its LWC paper grades, bringing the total announced increases by the end of the year to $180 per ton since July 1, 2007. Despite the recent upward pricing momentum, the average LWC benchmark price was 6% lower in 2007 compared to 2006.

Demand for uncoated mechanical grades was up slightly in 2007. The demand for high gloss grades increased 4.9%, due to grade switching from coated mechanical, offsetting the decrease in demand in standard grades of 3.5%. SC-A pricing was weak throughout most of 2007, however, a US$30 per ton price increase was implemented in the fourth quarter. The average benchmark price for SC-A in 2007 decreased US$35 per ton, or 4%, over 2006.

Directory demand remained steady in 2007. Limited growth was due to slower growth of independent publishers and flat total page and book circulation for incumbent publishers. The average benchmark price for 2007 increased US$19 per ton.

The 2007 specialty paper product grade distribution, based on sales volumes, is depicted in the chart below.

The 2007 geographic sales distribution, based on sales volumes, is depicted in the chart below.

The North American economy is a key driver for the Company’s specialty paper business with 90% of its product sold to this market. Among its initiatives to improve profitability, the Company continues to look for ways to optimize its product, customer and geographic mix.

Sales volumes for lightweight coated in 2007 were down 13,900 tonnes or 6% from the previous year as a result of lower production volume in 2007.

Sales volumes for uncoated mechanical grades in 2007 increased 21,300 tonnes or 4% from 2006. The growth in uncoated mechanical was due to the growth of Electraprime and Electrabrite into the retail insert market, which was offset by a decrease in demand for standard grades.

Sales volumes for directory in 2007 increased 57,200 tonnes or 21% compared to 2006. The growth was due to switching production to directory from newsprint to match increased sales volume opportunities to take advantage of stronger directory pricing.

| | 2.1.3 | Operational performance |

The specialty paper business made an operating loss of $75.1 million in 2007 compared to operating earnings of $9.7 million in 2006. 2007 EBITDA before specific items of $73.4 million, was $31.4 million lower compared to an EBITDA before specific items of $104.8 million in 2006.

Sales volumes increased 64,600 tonnes, or 6.5%, compared to the previous year. The increase was largely due to the increased production of directory grades. Average sales revenue was down $56 per tonne compared to the previous year primarily due to the stronger Canadian dollar and weaker average transaction prices across most grades other than directory.

Average delivered cash costs increased $25 per tonne compared to 2006. Higher fibre costs, the impact of restructuring, and USW strike costs more than offset performance improvements. Before the impact of specific items, average delivered cash costs were $802 per tonne, an improvement of $20 per tonne from the previous year.

Conditions are expected to improve for specialty printing paper products in 2008. Although demand across most grades is expected to be relatively flat, supply dynamics are leading to tighter market conditions.

Coated mechanical paper demand is expected to be flat, due to an anticipated slowing of magazine and catalogue circulation and increasing coated mechanical paper prices which will continue to encourage users to switch to SC-A grades. Recent capacity closures in Western Europe as well as the rising Euro are expected to result in lower imports to North America, which should cause the North American coated market to remain relatively tight in 2008. Benchmark prices are expected to increase in 2008.

Markets for uncoated mechanical grades are expected to remain relatively stable in 2008. Demand for high-gloss paper is expected to grow due to grade switching from coated mechanical and lower-gloss grades. Reduced imports from Europe as a result of the strong Euro and increased ocean freight costs, and reduced capacity in North America should keep North American operating rates high. Demand for machine-finished grades is expected to be stable in 2008. Benchmark prices for high-gloss grades are expected to strengthen throughout the year.

Directory demand is expected to be stable through 2008. Benchmark prices are expected to be flat. Contracts are in place for the upcoming year and price increases are estimated to average 1%.

| (In millions of dollars, except where otherwise stated) | |

| | | 2007 | | | 2006 | | | 2005 | |

Sales | | $ | 338.0 | | | $ | 529.8 | | | $ | 529.1 | |

EBITDA1 | | | (23.7 | ) | | | 71.8 | | | | 58.1 | |

EBITDA before specific items1 | | | (4.4 | ) | | | 71.8 | | | | 64.3 | |

| Operating earnings (loss) | | | (56.9 | ) | | | 6.9 | | | | 12.3 | |

EBITDA margin1,2 | | | (7.0 | )% | | | 13.6 | % | | | 11.0 | % |

EBITDA margin before specific items1,2 | | | (1.2 | )% | | | 13.6 | % | | | 12.2 | % |

| Sales (000 tonnes) | | | 496.3 | | | | 699.1 | | | | 707.1 | |

| Production (000 tonnes) | | | 472.8 | | | | 703.7 | | | | 699.5 | |

Curtailment (000 tonnes)3 | | | 98.9 | | | | - | | | | - | |

| Average sales revenue per tonne | | $ | 681 | | | $ | 758 | | | $ | 748 | |

Average delivered cash costs per tonne4 | | | 729 | | | | 655 | | | | 666 | |

Average delivered cash costs per tonne before specific items1,4 | | | 674 | | | | 655 | | | | 657 | |

| Benchmark prices | | | | | | | | | | | | |

Newsprint 48.8 gsm, West Coast delivery (US$/tonne)5 | | | 579 | | | | 649 | | | | 600 | |

| 1 | EBITDA, EBITDA before specific items, EBITDA margin, EBITDA margin before specific items, and average delivered cash costs per tonne before specific items are non-GAAP measures. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 2 | EBITDA margin and EBITDA margin before specific items are defined as EBITDA and EBITDA before specific items as a percentage of sales and adjusted sales, respectively. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 3 | Curtailment consists of downtime related to the USW strike. |

| 4 | Average delivered cash costs per tonne consist of cost of sales, including the impact of the USW strike, SG&A costs, and restructuring and change-of-control costs. |

| 5 | Benchmark selling prices are sourced from RISI. |

Newsprint demand in North America continued to decline in 2007 with total U.S. consumption down 10.5% year-over-year. The decline was due to reduced ad lineage, circulation, reduced web widths, lower basis weights and increased conservation measures by publishers. The falling demand resulted in lower benchmark prices. The average newsprint benchmark price in 2007 was US$579 per tonne, down US$70 per tonne or 11%, compared to 2006. Relatively strong demand overseas compared to weakness in U.S. consumption resulted in an increase in exports outside North America, but did not prevent prices from decreasing in 2007.

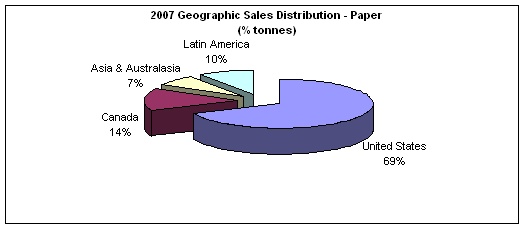

Approximately 82% of the Company’s newsprint sales volumes were to North America, Asia and Australasia. The 2007 geographical sales distribution, based on sales volumes, is depicted in the chart below.

In response to challenging newsprint market conditions, the Company continued its drive to optimize product mix in 2007 as it shifted production from newsprint to specialty paper grades, primarily directory. Overall, newsprint production decreased by approximately 231,000 tonnes in 2007:

| o | The Company indefinitely curtailed the A4 paper machine in Port Alberni on September 1, 2007, displacing the equivalent of 134,000 tonnes per year of the Company’s least profitable newsprint business. Management estimates this reduced the Company’s newsprint production by approximately 44,700 tonnes in 2007. |

| o | The Company utilized its ability to swing machine capacity between different grades to reduce newsprint and increase production of directory and certain uncoated specialty paper grades. |

| o | In addition to these initiatives, management estimates newsprint production was also reduced by 98,900 tonnes during the year as a result of the USW strike and related fibre supply disruptions. |

| | 2.2.3 | Operational performance |

The newsprint business made an operating loss of $56.9 million in 2007 compared to operating earnings of $6.9 million in 2006. 2007 EBITDA before specific items of negative $4.4 million was $76.2 million lower compared to an EBITDA before specific items of $71.8 million in 2006.

Sales volumes decreased 202,800 tonnes, or 29%, from the previous year, primarily due to the USW strike related fibre shortage, the flexibility to swing machine production to increase directory production, and the indefinite closure of the A4 paper machine in 2007. Average sales revenue decreased $77 per tonne compared to the previous year, largely due to lower transaction prices and the negative impact of the stronger Canadian dollar.

Average delivered cash costs increased $74 per tonne from the previous year. Savings from performance improvements were more than offset by the restructuring costs, higher fibre costs, and the impact of the USW strike. Before the impact of specific items, average delivered cash costs were $674 per tonne, an increase of $19 per tonne from the previous year.

The Company expects the newsprint market to tighten in 2008 due to significant capacity closures announced by North American producers. Approximately 5% of North American capacity is expected to shut down in the first quarter of 2008. As a result, newsprint prices have started to improve following the announcement of a US$25 per tonne increase effective November 1, 2007 and an announced price increase of US$60 per tonne to be phased in equally over January, February, and March 2008. The average benchmark newsprint price is expected to increase significantly in 2008.

Pulp

| (In millions of dollars, except where otherwise stated) | |

| | | 2007 | | | 2006 | | | 2005 | |

Sales | | $ | 457.0 | | | $ | 434.3 | | | $ | 394.3 | |

EBITDA1 | | | 24.5 | | | | 34.4 | | | | (18.7 | ) |

EBITDA before specific items1 | | | 47.7 | | | | 34.4 | | | | (18.7 | ) |

| Operating earnings (loss) | | | (17.4 | ) | | | (12.7 | ) | | | (62.2 | ) |

EBITDA margin1,2 | | | 5.4 | % | | | 7.9 | % | | | (4.7 | %) |

EBITDA margin before specific items1,2 | | | 9.8 | % | | | 7.9 | % | | | (4.7 | %) |

| | | | | | | | | | | | | |

| Sales (000 tonnes) | | | 603.2 | | | | 626.2 | | | | 603.0 | |

| Production (000 tonnes) | | | 601.8 | | | | 624.3 | | | | 590.9 | |

Curtailment (000 tonnes)3 | | | 54.7 | | | | - | | | | - | |

| | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 757 | | | $ | 693 | | | $ | 654 | |

Average delivered cash costs per tonne4 | | | 717 | | | | 638 | | | | 684 | |

Average delivered cash costs per tonne before specific items1,4 | | | 679 | | | | 638 | | | | 684 | |

| | | | | | | | | | | | | |

| Benchmark prices | | | | | | | | | | | | |

NBSK pulp, Northern Europe delivery (US$/tonne)5 | | | 800 | | | | 681 | | | | 610 | |

White-top linerboard, 42 lb., Eastern U.S. delivery (US$/ton)5 | | | 697 | | | | 673 | | | | 608 | |

| 1 | EBITDA, EBITDA before specific items, EBITDA margin, EBITDA margin before specific items, and average delivered cash costs per tonne before specific items are non-GAAP measures. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 2 | EBITDA margin and EBITDA margin before specific items are defined as EBITDA and EBITDA before specific items as a percentage of sales and adjusted sales, respectively. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 3 | Curtailment consists of downtime related to the USW strike. |

| 4 | Average delivered cash costs per tonne consist of cost of sales, including the impact of the USW strike, SG&A costs, and restructuring and change-of-control costs. |

| 5 | Benchmark selling prices are sourced from RISI. |

Pulp markets were strong throughout 2007 with global pulp shipments up 3% year-over-year and low world producer and consumer inventories during the year. Good demand and low inventories provided support for a number of price increases during the year and brought the Northern Europe benchmark price to US$870 per tonne at the end of 2007. The average Northern Europe NBSK benchmark price for 2007 was up US$119 per tonne, or 17%, compared to the previous year.

The U.S. containerboard market remained balanced in the year. U.S. producers took advantage of stronger currencies against the US$ to increase their export volume, which resulted in the average 2007 benchmark white-top linerboard price increasing US$24 per ton, or 4%, compared to 2006.

The primary markets for the Company’s market pulp are Asia and Europe. The 2007 geographical sales distribution, based on sales volumes, is depicted in the chart below.

Pulp and containerboard sales volumes decreased in 2007 by 3.7%, compared to 2006, due to production curtailment related to the fibre supply shortage as a result of the USW strike. However, the Company was able to take advantage of strong pulp markets to continue to increase its mix of contract business and optimize sales to customers in its major pulp markets.

Containerboard sales volumes in 2007 were 8.7% lower than in the previous year, due to the USW strike. The Company continued to focus on improving its customer mix by targeting North American customers that are more freight logical.

As a result of the USW strike and related fibre supply disruptions in the second half of the year, the Company temporarily curtailed its Elk Falls pulp mill and containerboard machine for 50 days and its Crofton pulp mill for 9 days. Management estimates pulp and containerboard production was reduced by 54,700 tonnes in the year as a result of these curtailments.

| | 2.3.3 | Operational performance |

The pulp and containerboard business made an operating loss of $17.4 million in 2007 compared to an operating loss of $12.7 million in 2006. 2007 EBITDA before specific items of $47.7 million was $13.3 million higher compared to an EBITDA before specific items of $34.4 million in 2006.

Sales volumes decreased 23,000 tonnes from the previous year. The decrease was due to decreased pulp production as a result of the USW strike related fibre shortage. Average sales revenue improved $64 per tonne compared to the previous year, due primarily to higher pulp prices, which more than offset the negative impact of the stronger Canadian dollar.

Average delivered cash costs increased $79 per tonne in 2007 compared to 2006. Savings from performance improvements were more than offset by costs associated with the USW strike, higher fibre costs, and restructuring costs. Before specific items, average delivered cash costs were $679 per tonne, comparable to the previous year.

Demand for NBSK pulp is expected to remain steady during the first half of 2008, with the expectation that benchmark prices will increase modestly in early 2008 followed by potentially softer pulp prices in the second half of the year. Higher consumption by China is expected to be offset by weaker demand from markets in the U.S. and Europe, which is expected to limit overall growth in demand in 2008.

The Company is expecting that demand and prices for containerboard will remain flat in 2008 as North American producers are expected to continue to access export markets because of the slower U.S. economy.

| SEGMENTED RESULTS - QUARTERLY |

Selected quarterly financial information

| (In millions of dollars, except where otherwise stated) | |

| | | 2007 | | | 2006 | |

| | | TOTAL | | | | Q4 | | | | Q3 | | | | Q2 | | | | Q1 | | | TOTAL | | | | Q4 | | | | Q3 | | | | Q2 | | | | Q1 | |

Sales | | $ | 1,714.6 | | | $ | 381.0 | | | $ | 413.7 | | | $ | 441.8 | | | $ | 478.1 | | | $ | 1,882.5 | | | $ | 470.6 | | | $ | 486.0 | | | $ | 469.6 | | | $ | 456.3 | |

| Operating earnings (loss) | | | (149.4 | ) | | | (27.7 | ) | | | (44.3 | ) | | | (46.7 | ) | | | (30.7 | ) | | | 3.9 | | | | (3.3 | ) | | | 17.0 | | | | 6.1 | | | | (15.9 | ) |

EBITDA 1 | | | 27.0 | | | | 15.1 | | | | (0.3 | ) | | | (1.9 | ) | | | 14.1 | | | | 211.0 | | | | 48.5 | | | | 62.8 | | | | 52.4 | | | | 47.3 | |

EBITDA before specific items 1 | | | 116.7 | | | | 28.8 | | | | 37.4 | | | | 17.4 | | | | 33.1 | | | | 211.0 | | | | 48.5 | | | | 62.8 | | | | 52.4 | | | | 47.3 | |

| Net earnings (loss) | | | (31.6 | ) | | | 12.4 | | | | (18.6 | ) | | | 0.2 | | | | (25.6 | ) | | | (15.9 | ) | | | (37.2 | ) | | | 2.5 | | | | 42.4 | | | | (23.6 | ) |

Net earnings (loss) before specific items 1 | | | (89.3 | ) | | | (20.9 | ) | | | (16.9 | ) | | | (31.8 | ) | | | (19.7 | ) | | | (25.0 | ) | | | (7.2 | ) | | | 0.6 | | | | (6.7 | ) | | | (11.7 | ) |

EBITDA margin 1,2 | | | 1.6 | % | | | 4.0 | % | | | (0.1 | %) | | | (0.4 | %) | | | 2.9 | % | | | 11.2 | % | | | 10.3 | % | | | 12.9 | % | | | 11.2 | % | | | 10.4 | % |

EBITDA margin before specific items 1,2 | | | 6.5 | % | | | 6.6 | % | | | 8.5 | % | | | 3.9 | % | | | 6.9 | % | | | 11.2 | % | | | 10.3 | % | | | 12.9 | % | | | 11.2 | % | | | 10.4 | % |

| Net earnings (loss) per share (in dollars) – basic and diluted | | $ | (0.15 | ) | | $ | 0.06 | | | $ | (0.09 | ) | | $ | 0.00 | | | $ | (0.12 | ) | | $ | (0.07 | ) | | $ | (0.17 | ) | | $ | 0.01 | | | $ | 0.20 | | | $ | (0.11 | ) |

Net earnings (loss) per share before specific items (in dollars) – basic and diluted 1 | | $ | (0.42 | ) | | $ | (0.10 | ) | | | (0.08 | ) | | | (0.15 | ) | | | (0.09 | ) | | | (0.12 | ) | | | (0.03 | ) | | | 0.00 | | | | (0.03 | ) | | | (0.06 | ) |

| Sales (000 tonnes) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty paper | | | 1,054.8 | | | | 279.3 | | | | 261.1 | | | | 259.2 | | | | 255.2 | | | | 990.2 | | | | 252.7 | | | | 264.6 | | | | 237.8 | | | | 235.1 | |

| Newsprint | | | 496.3 | | | | 70.7 | | | | 119.8 | | | | 157.1 | | | | 148.7 | | | | 699.1 | | | | 170.1 | | | | 169.5 | | | | 178.4 | | | | 181.1 | |

| Total paper | | | 1,551.1 | | | | 350.0 | | | | 380.9 | | | | 416.3 | | | | 403.9 | | | | 1,689.3 | | | | 422.8 | | | | 434.1 | | | | 416.2 | | | | 416.2 | |

| Pulp | | | 603.2 | | | | 136.1 | | | | 151.8 | | | | 147.4 | | | | 167.9 | | | | 626.2 | | | | 145.5 | | | | 155.9 | | | | 171.4 | | | | 153.4 | |

| Total sales | | | 2,154.3 | | | | 486.1 | | | | 532.7 | | | | 563.7 | | | | 571.8 | | | | 2,315.5 | | | | 568.3 | | | | 590.0 | | | | 587.6 | | | | 569.6 | |

| Production (000 tonnes) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty paper | | | 1,055.4 | | | | 265.8 | | | | 262.6 | | | | 270.4 | | | | 256.6 | | | | 983.7 | | | | 249.0 | | | | 254.8 | | | | 244.2 | | | | 235.7 | |

| Newsprint | | | 472.8 | | | | 60.9 | | | | 110.9 | | | | 148.9 | | | | 152.1 | | | | 703.7 | | | | 170.2 | | | | 170.0 | | | | 179.6 | | | | 183.9 | |

| Total paper | | | 1,528.2 | | | | 326.7 | | | | 373.5 | | | | 419.3 | | | | 408.7 | | | | 1,687.4 | | | | 419.2 | | | | 424.8 | | | | 423.8 | | | | 419.6 | |

| Pulp | | | 601.8 | | | | 144.7 | | | | 143.2 | | | | 157.1 | | | | 156.8 | | | | 624.3 | | | | 152.8 | | | | 162.8 | | | | 155.6 | | | | 153.1 | |

| Total production | | | 2,130.0 | | | | 471.4 | | | | 516.7 | | | | 576.4 | | | | 565.5 | | | | 2,311.7 | | | | 572.0 | | | | 587.6 | | | | 579.4 | | | | 572.7 | |

| US$/CDN$ foreign exchange | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Average spot rate 3 | | | 0.930 | | | | 1.019 | | | | 0.957 | | | | 0.911 | | | | 0.854 | | | | 0.882 | | | | 0.878 | | | | 0.892 | | | | 0.892 | | | | 0.866 | |

Period-end spot rate 4 | | | 1.012 | | | | 1.012 | | | | 1.004 | | | | 0.940 | | | | 0.867 | | | | 0.858 | | | | 0.858 | | | | 0.897 | | | | 0.897 | | | | 0.857 | |

Effective rate 5 | | | 0.917 | | | | 0.970 | | | | 0.935 | | | | 0.916 | | | | 0.860 | | | | 0.872 | | | | 0.878 | | | | 0.886 | | | | 0.872 | | | | 0.853 | |

| Common shares (millions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At period-end | | | 214.7 | | | | 214.7 | | | | 214.7 | | | | 214.7 | | | | 214.6 | | | | 214.6 | | | | 214.6 | | | | 214.6 | | | | 214.6 | | | | 214.6 | |

| Weighted average | | | 214.7 | | | | 214.7 | | | | 214.7 | | | | 214.7 | | | | 214.6 | | | | 214.6 | | | | 214.6 | | | | 214.6 | | | | 214.6 | | | | 214.6 | |

| 1 | EBITDA, EBITDA before specific items, EBITDA margin, EBITDA margin before specific items, net earnings (loss) before specific items, and net earnings (loss) per share before specific items are non-GAAP measures. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 2 | EBITDA margin and EBITDA margin before specific items are defined as EBITDA and EBITDA before specific items, as a percentage of sales and adjusted sales, respectively. Refer to Section 9, “Non-GAAP Measures” for further details. |

| 3 | Average spot rate is the average Bank of Canada noon spot rate over the reporting period. |

| 4 | Period-end spot rate is the Bank of Canada noon spot rate. |

| 5 | Effective rate represents a blended rate which takes account of the applicable spot rates, the Company’s revenue hedging program in the period, and translation of US$-denominated working capital at period opening and closing rates. See Section 8, “Summary of Quarterly Results” for further details. |

Summary of selected segmented financial information

| (In millions of dollars, except where otherwise stated) | |

| | | 2007 | | | 2006 | |

| Specialty paper | | TOTAL | | | | Q4 | | | | Q3 | | | | Q2 | | | | Q1 | | | TOTAL | | | | Q4 | | | | Q3 | | | | Q2 | | | | Q1 | |

Sales | | $ | 919.6 | | | $ | 234.3 | | | $ | 222.1 | | | $ | 225.1 | | | $ | 238.1 | | | $ | 918.4 | | | $ | 234.0 | | | $ | 245.0 | | | $ | 218.6 | | | $ | 220.8 | |

EBITDA1 | | | 26.2 | | | | 12.5 | | | | 0.0 | | | | 4.1 | | | | 9.6 | | | | 104.8 | | | | 18.4 | | | | 31.6 | | | | 25.7 | | | | 29.1 | |

EBITDA before specific items1 | | | 73.4 | | | | 16.1 | | | | 17.6 | | | | 17.0 | | | | 22.7 | | | | 104.8 | | | | 18.4 | | | | 31.6 | | | | 25.7 | | | | 29.1 | |

| Operating earnings (loss) | | | (75.1 | ) | | | (13.5 | ) | | | (26.3 | ) | | | (21.1 | ) | | | (14.2 | ) | | | 9.7 | | | | (6.6 | ) | | | 6.9 | | | | 2.8 | | | | 6.6 | |

EBITDA margin1, 2 | | | 2.8 | % | | | 5.3 | % | | | 0.0 | % | | | 1.8 | % | | | 4.0 | % | | | 11.4 | % | | | 7.9 | % | | | 12.9 | % | | | 11.8 | % | | | 13.2 | % |

EBITDA margin before specific items1, 2 | | | 8.0 | % | | | 6.9 | % | | | 8.0 | % | | | 7.6 | % | | | 9.5 | % | | | 11.4 | % | | | 7.9 | % | | | 12.9 | % | | | 11.8 | % | | | 13.2 | % |

| Sales (000 tonnes) | | | 1,054.8 | | | | 279.3 | | | | 261.1 | | | | 259.2 | | | | 255.2 | | | | 990.2 | | | | 252.7 | | | | 264.6 | | | | 237.8 | | | | 235.1 | |

| Production (000 tonnes) | | | 1,055.4 | | | | 265.8 | | | | 262.6 | | | | 270.4 | | | | 256.6 | | | | 983.7 | | | | 249.0 | | | | 254.8 | | | | 244.2 | | | | 235.7 | |

Curtailment (000 tonnes)3 | | | 7.2 | | | | 4.0 | | | | 3.2 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 872 | | | $ | 839 | | | $ | 850 | | | $ | 868 | | | $ | 933 | | | $ | 928 | | | $ | 927 | | | $ | 926 | | | $ | 920 | | | $ | 939 | |

Average delivered cash costs per tonne4 | | | 847 | | | | 794 | | | | 849 | | | | 852 | | | | 896 | | | | 822 | | | | 853 | | | | 806 | | | | 811 | | | | 815 | |

Average delivered cash costs per tonne before specific items4 | | | 802 | | | | 783 | | | | 781 | | | | 802 | | | | 845 | | | | 822 | | | | 853 | | | | 806 | | | | 811 | | | | 815 | |

SC-A paper, 35 lb. (US$/ton)5 | | | 753 | | | | 770 | | | | 745 | | | | 745 | | | | 752 | | | | 788 | | | | 787 | | | | 800 | | | | 785 | | | | 780 | |

LWC paper, No. 5, 40 lb. (US$/ton)5 | | | 786 | | | | 848 | | | | 782 | | | | 748 | | | | 767 | | | | 836 | | | | 798 | | | | 820 | | | | 852 | | | | 875 | |

Telephone directory paper, 22.1 lb. (US$/ton)5 | | | 740 | | | | 740 | | | | 740 | | | | 740 | | | | 740 | | | | 721 | | | | 725 | | | | 725 | | | | 720 | | | | 715 | |

| Newsprint | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 338.0 | | | $ | 44.2 | | | $ | 77.8 | | | $ | 106.7 | | | $ | 109.3 | | | $ | 529.8 | | | $ | 128.4 | | | $ | 128.8 | | | $ | 135.4 | | | $ | 137.2 | |

EBITDA1 | | | (23.7 | ) | | | (8.3 | ) | | | (8.1 | ) | | | (4.2 | ) | | | (3.1 | ) | | | 71.8 | | | | 14.5 | | | | 18.2 | | | | 19.3 | | | | 19.8 | |

EBITDA before specific items1 | | | (4.4 | ) | | | (4.4 | ) | | | (0.4 | ) | | | (0.2 | ) | | | 0.6 | | | | 71.8 | | | | 14.5 | | | | 18.2 | | | | 19.3 | | | | 19.8 | |

| Operating earnings (loss) | | | (56.9 | ) | | | (14.5 | ) | | | (15.6 | ) | | | (13.5 | ) | | | (13.3 | ) | | | 6.9 | | | | 1.9 | | | | 7.5 | | | | 7.4 | | | | (9.9 | ) |

EBITDA margin1, 2 | | | (7.0 | %) | | | (18.8 | %) | | | (10.4 | %) | | | (3.9 | %) | | | (2.8 | %) | | | 13.6 | % | | | 11.3 | % | | | 14.1 | % | | | 14.3 | % | | | 14.4 | % |

EBITDA margin before specific items1, 2 | | | (1.2 | %) | | | (5.5 | %) | | | (0.8 | %) | | | 0.0 | % | | | 0.0 | % | | | 13.6 | % | | | 11.3 | % | | | 14.1 | % | | | 14.3 | % | | | 14.4 | % |

| Sales (000 tonnes) | | | 496.3 | | | | 70.7 | | | | 119.8 | | | | 157.1 | | | | 148.7 | | | | 699.1 | | | | 170.1 | | | | 169.5 | | | | 178.4 | | | | 181.1 | |

| Production (000 tonnes) | | | 472.8 | | | | 60.9 | | | | 110.9 | | | | 148.9 | | | | 152.1 | | | | 703.7 | | | | 170.2 | | | | 170.0 | | | | 179.6 | | | | 183.9 | |

Curtailment (000 tonnes)3 | | | 98.9 | | | | 65.8 | | | | 33.1 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 681 | | | $ | 625 | | | $ | 650 | | | $ | 679 | | | $ | 735 | | | $ | 758 | | | $ | 754 | | | $ | 761 | | | $ | 759 | | | $ | 758 | |

Average delivered cash costs per tonne4 | | | 729 | | | | 742 | | | | 720 | | | | 706 | | | | 756 | | | | 655 | | | | 669 | | | | 653 | | | | 651 | | | | 647 | |

Average delivered cash costs per tonne before specific items4 | | | 674 | | | | 636 | | | | 646 | | | | 681 | | | | 731 | | | | 655 | | | | 669 | | | | 653 | | | | 651 | | | | 647 | |

Newsprint 48.8 gsm, West Coast delivery (US$/tonne)5 | | | 579 | | | | 565 | | | | 561 | | | | 584 | | | | 606 | | | | 649 | | | | 649 | | | | 658 | | | | 651 | | | | 640 | |

| Pulp | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 457.0 | | | $ | 102.5 | | | $ | 113.8 | | | $ | 110.0 | | | $ | 130.7 | | | $ | 434.3 | | | $ | 108.2 | | | $ | 112.2 | | | $ | 115.6 | | | $ | 98.3 | |

EBITDA1 | | | 24.5 | | | | 10.9 | | | | 7.8 | | | | (1.8 | ) | | | 7.6 | | | | 34.4 | | | | 15.6 | | | | 13.0 | | | | 7.4 | | | | (1.6 | ) |

EBITDA before specific items1 | | | 47.7 | | | | 17.1 | | | | 20.2 | | | | 0.6 | | | | 9.8 | | | | 34.4 | | | | 15.6 | | | | 13.0 | | | | 7.4 | | | | (1.6 | ) |

| Operating earnings (loss) | | | (17.4 | ) | | | 0.3 | | | | (2.4 | ) | | | (12.1 | ) | | | (3.2 | ) | | | (12.7 | ) | | | 1.4 | | | | 2.6 | | | | (4.1 | ) | | | (12.6 | ) |

EBITDA margin1, 2 | | | 5.4 | % | | | 10.6 | % | | | 6.9 | % | | | (1.6 | %) | | | 5.8 | % | | | 7.9 | % | | | 14.4 | % | | | 11.6 | % | | | 6.4 | % | | | (1.6 | %) |

EBITDA margin before specific items1, 2 | | | 9.8 | % | | | 14.2 | % | | | 16.2 | % | | | 0.5 | % | | | 7.5 | % | | | 7.9 | % | | | 14.4 | % | | | 11.6 | % | | | 6.4 | % | | | (1.6 | %) |

| Sales (000 tonnes) | | | 603.2 | | | | 136.1 | | | | 151.8 | | | | 147.4 | | | | 167.9 | | | | 626.2 | | | | 145.5 | | | | 155.9 | | | | 171.4 | | | | 153.4 | |

| Production (000 tonnes) | | | 601.8 | | | | 144.7 | | | | 143.2 | | | | 157.1 | | | | 156.8 | | | | 624.3 | | | | 152.8 | | | | 162.8 | | | | 155.6 | | | | 153.1 | |

Curtailment (000 tonnes)3 | | | 54.7 | | | | 26.8 | | | | 27.9 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | | | | - | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average sales revenue per tonne | | $ | 757 | | | $ | 753 | | | $ | 750 | | | $ | 746 | | | $ | 778 | | | $ | 693 | | | $ | 744 | | | $ | 720 | | | $ | 674 | | | $ | 641 | |

Average delivered cash costs per tonne4 | | | 717 | | | | 672 | | | | 699 | | | | 759 | | | | 732 | | | | 638 | | | | 636 | | | | 637 | | | | 630 | | | | 652 | |

Average delivered cash costs per tonne before specific items4 | | | 679 | | | | 637 | | | | 622 | | | | 743 | | | | 719 | | | | 638 | | | | 636 | | | | 637 | | | | 630 | | | | 652 | |

NBSK pulp, Northern Europe delivery (US$/tonne)5 | | | 800 | | | | 850 | | | | 810 | | | | 783 | | | | 757 | | | | 681 | | | | 737 | | | | 710 | | | | 665 | | | | 618 | |

White-top linerboard, 42 lb., Eastern U.S.delivery (US$/ton)5 | | | 697 | | | | 720 | | | | 707 | | | | 680 | | | | 680 | | | | 673 | | | | 680 | | | | 680 | | | | 680 | | | | 650 | |