FORM 13-502F1CLASS 1 AND CLASS 3B REPORTING ISSUERS - PARTICIPATION FEEMANAGEMENT CERTIFICATIONI, _Jameslsaac,anofficerof the reporting issuer noted below have examined this Form13-502F1 (the Form) being submitted hereunder to the Ontario Securities Commission and certify that to my knowledge, having exercised reasonable diligence, the information provided in the Form is complete and accurate.(s)_Jameslsaac February29,2016Name: James IsaacDate:Title: Corporate Legal Counsel & Corporate SecretaryReporting Issuer Name:Catalyst Paper CorporationEnd date of previous financial year:December 31, 2015Type of Reporting Issuer:0 Class 1 reportingissuer □ Class 3B reporting issuerHighest Trading Marketplace:TSX(refer to the definition of “highest trading marketplace” under OSC Rule 13-502 Fees)Market value of listed or quoted equity securities:(in Canadian Dollars - refer to section 7.1 of OSC Rule 13-502 Fees)Equity SymbolCYT1st Specified Trading Period (dd/mm/yy)(refer to the definition of “specified trading period” under OSC01101/15to 31/03/15Rule 13-502 Fees)Closing price of the security in the class or series on the last trading day of the specified trading period in which such security was listed or quotedon the highest trading marketplace$4.21(i)Number of securities in the class or series of such security outstanding at the end of the last tradingday of the specified trading period 14,527,571 (ii)Market value of class or series(i)x(ii)(i) x (ii)$ 61,161,073.91(A)2nd Specified Trading Period (dd/mm/yy)(refer to the definition of “specified trading period” under OSC01/04/15to30/06/15Rule 13-502 Fees)

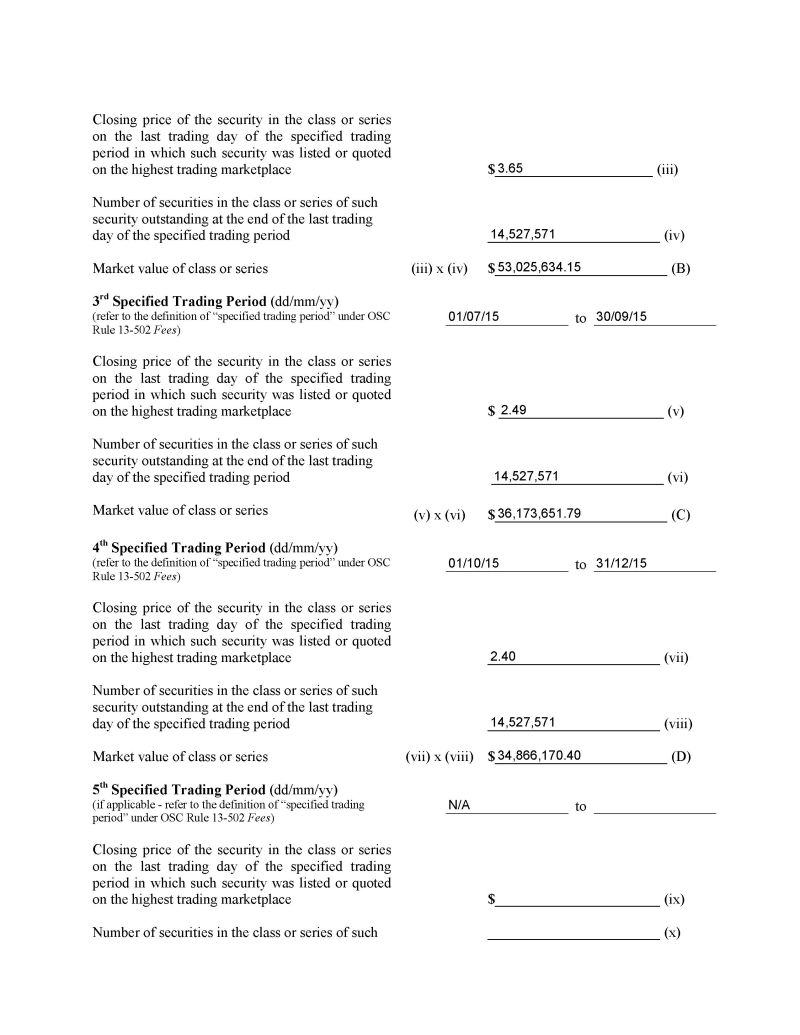

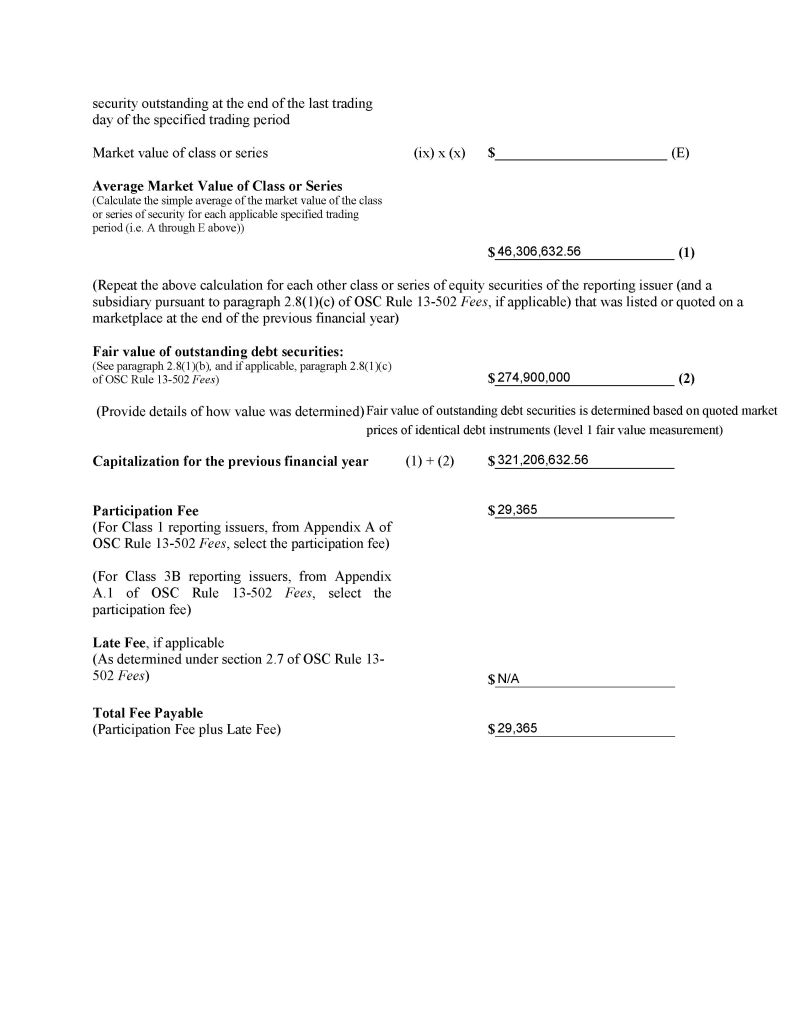

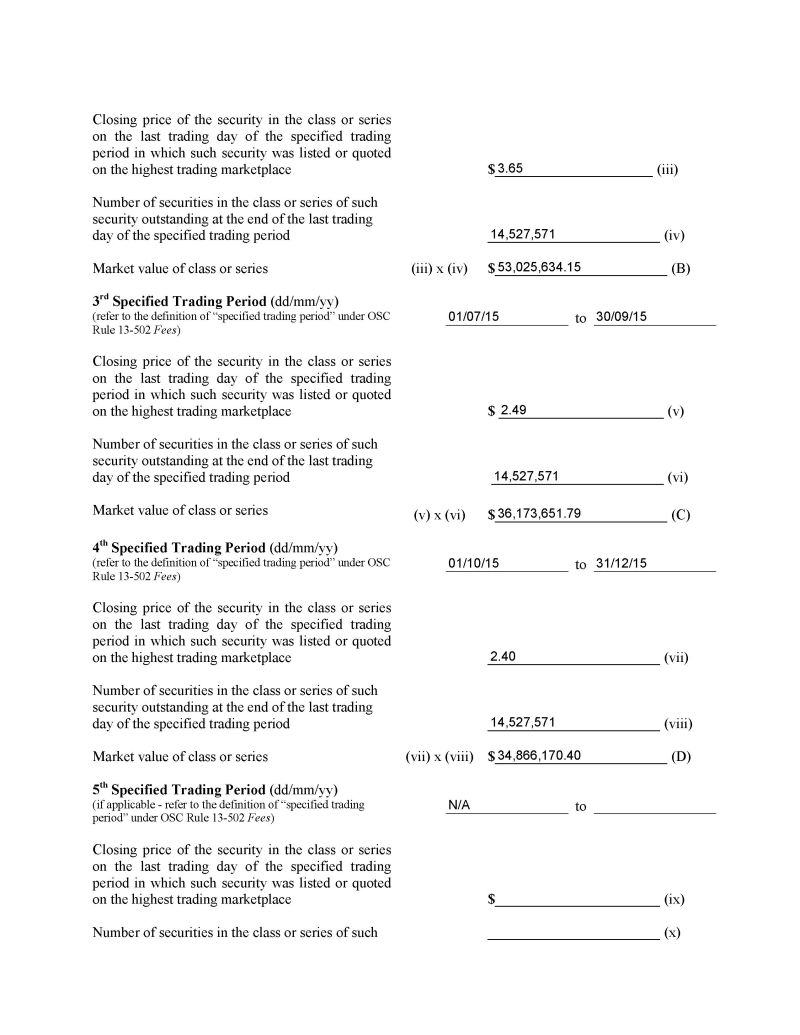

Closing price of the security in the class or series on the last trading day of the specified trading period in which such security was listed or quoted on the highest trading marketplaceNumber of securities in the class or series of such security outstanding at the end of the last trading day of the specified trading periodMarket value of class or series3rd Specified Trading Period (dd/mm/yy)(refer to the definition of “specified trading period” under OSC Rule 13-502 Fees)Closing price of the security in the class or series on the last trading day of the specified trading period in which such security was listed or quoted on the highest trading marketplaceNumber of securities in the class or series of such security outstanding at the end of the last trading day of the specified trading periodMarket value of class or series4th Specified Trading Period (dd/mm/yy)(refer to the definition of “specified trading period” under OSC Rule 13-502 Fees)Closing price of the security in the class or series on the last trading day of the specified trading period in which such security was listed or quoted on the highest trading marketplaceNumber of securities in the class or series of such security outstanding at the end of the last trading day of the specified trading periodMarket value of class or series5th Specified Trading Period (dd/mm/yy)(if applicable - refer to the definition of “specified trading period” under OSC Rule 13-502 Fees)Closing price of the security in the class or series on the last trading day of the specified trading period in which such security was listed or quoted on the highest trading marketplace$3.65(iii)Number of securities in the class or series of such14,527,571(iv)(iii) x (iv)$_____________53,025,634.15 (B)01/07/15 to 30/09/15$ 2.49(v)14,527,571 (vi)(v) x (vi)$36,173,651.79 (C)01/10/15 to 31/12/152.40 (vii)14,527,571 (viii)(vii) x (viii)$34,866,170.40 (D)N/A to$ (ix)(x)

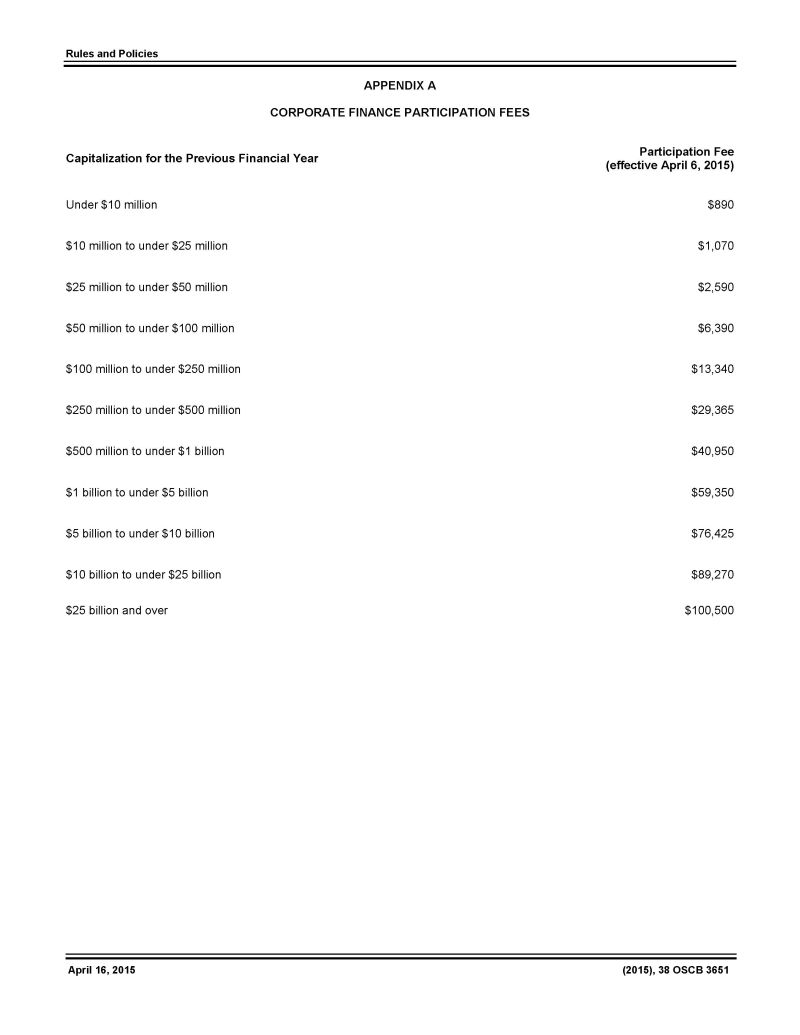

Rules and PoliciesAPPENDIX A CORPORATE FINANCE PARTICIPATION FEESCapitalization for the Previous Financial YearUnder $10 millionParticipation Fee (effective April 6, 2015)$890$10 million to under $25 million$25 million to under $50 million$50 million to under $100 million$100 million to under $250 million$250 million to under $500 million$500 million to under $1 billion$1 billion to under $5 billion$5 billion to under $10 billion$10 billion to under $25 billion$25 billion and over$1,070$2,590$6,390$13,340$29,365$40,950$59,350$76,425$89,270$100,500April 16, 2015(2015), 38 OSCB 3651