CATALYST PAPER 2012 SECOND QUARTER REPORT

For the three months ended June 30, 2012

PRESIDENT’S MESSAGE

Creditors approve reorganization plan; company prepares to emerge from CCAA

Our second quarter was dominated by actions that led to creditor approval on June 25th of the second amended plan of arrangement, Supreme Court of British Columbia verification of the creditor vote on June 28th and confirmation under Chapter 15 by the US Court in Delaware on July 27th. These milestones were reached only five months after Catalyst Paper entered creditor protection on January 31, 2012 under theCompanies’ Creditors Arrangement Act (CCAA). A key priority for 2012 was to put our business on better financial footing and we have focused relentlessly on navigating the complex CCAA process with that objective in mind. We reduced our debt by nearly 60 per cent, significantly improved liquidity and reduced operating costs with the support of our workforce and community stakeholders. As importantly, we held our position with customers and gained entry to new market segments for our products. Other highlights marking our steady progress through creditor protection included:

| — | arranging debtor-in-possession (DIP) financing to provide assurance of liquidity while in creditor protection; |

| — | reaching new competitive five-year labour agreements in B.C. to help reposition the business; |

| — | achieving lower property tax rates for all three B.C. mills as host municipalities took supportive steps; |

| — | provincial approval of our application for funding relief on our salaried pension plan solvency deficit resulting in estimated annual cash savings of $7 million; and |

| — | disposal of surplus assets in the second quarter, generating $7.4 million in proceeds. |

The following table shows how our financial structure has been strengthened through reorganization.

| (in millions) | | Pre-restructuring | | | Post-restructuring | | | Change | |

| Debt notes (non-recourse) | | US$ | 640.4 | | | US$ | 250.0 | | | US$ | 390.4 | |

| | | | | | | | | | | | | |

| Annual cash interest expense* | | US$ | 61.4 | | | Cash: US$ | 27.5 | | | Cash: US$ | 33.9 | |

| | | | | | | PIK: US$ | 18.8 | | | PIK: US$ | 42.6 | |

| Annual property tax expense | | $ | 18.3 | | | $ | 12.2 | | | $ | 6.1 | |

| | | | | | | | | | | | | |

| Annual labour expense | | $ | 158.0 | | | $ | 139.0 | | | $ | 19.0 | |

| | | | | | | | | | | | | |

| Annual pension funding obligations | | $ | 11.0 | | | $ | 4.0 | | | $ | 7.0 | |

| | | | | | | | | | | | | |

| Annual retiree extended health benefits | | $ | 2.4 | | | $ | 1.2 | | | $ | 1.2 | |

| | | | | | | | | | | | | |

| Annual PRD lease savings | | $ | 2.4 | | | $ | 0.0 | | | $ | 2.4 | |

| * | Interest on the newly issued debt notes will be payable semi-annually in cash at an annual interest rate of 11% or, at the option of the company, interest may be partially paid in kind, at an annual rate of 13% with 7.5% being paid in cash and 5.5% being paid in kind through the issuance of additional secured notes. |

Subsequent to the end of the quarter and despite extensive efforts to improve the financial performance of our Snowflake recycle paper mill in Arizona, we announced that the facility would be permanently closed effective September 30, 2012. We regret the difficult impact within the Snowflake community and surrounding region created by the mill closure and I want to acknowledge and thank employees, unions and public officials who have given the mill unwavering support and cooperation as we battle to overcome market challenges and input cost pressures. However with the newsprint demand down more than 10% annually since the end of 2008, ONP quality deterioration and higher freight costs as procurement and sales have been forced further afield to source recycled paper supply and secure product orders, there was no reasonable prospect that mill profitability could be restored and stakeholders needed the certainty that our decision now provides.

Turning to our financial results for the second quarter of 2012, we recorded a net loss of $11.7 million ($0.03 per common share) on sales of $312.8 million. This compares to a net loss of $25.6 million ($0.07 per common share) on sales of $315.8 million in the first quarter and a net loss of $47.4 million ($0.13 per common share) on sales of $297.8 million in Q2 2011. Significant specific items in the quarter included a net reorganization credit resulting from the CCAA proceedings of $6.0 million and a foreign exchange loss on the translation of U.S. dollar denominated debt of $12.8 million. This compared to prior quarter specific items of $5.2 million in restructuring costs incurred prior to entering protection, net reorganization expenses from the CCAA proceedings of $22.4 million, and a foreign exchange gain on the translation of U.S. dollar denominated debt of $11.6 million.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | ~ 2 ~ |

EBITDA of $14.6 million and operating earnings of $7.0 million in the second quarter compared to EBITDA of $18.1 million and operating earnings of $10.2 million in Q1 2012. We achieved a substantial improvement from negative $3.9 million in EBITDA and an operating loss of $30.6 million in Q2 2011. Operating results this year were positively impacted by the weaker Canadian dollar and substantial cost reductions that included savings from the new labour agreements that took effect May 1st, and lower maintenance costs due to the deferral of certain maintenance projects to save cash during the CCAA proceedings.

On the paper side, sales volumes increased compared to the prior year, both for the second quarter and on a year-to-date basis as all mills ran without interruption. Sales of newsprint and uncoated specialty were negatively impacted in the second quarter of 2011 by fires and extended maintenance outages at our Snowflake and Powell River mills. Average transaction prices increased for directory and uncoated in the quarter compared to Q2 2011, partially offset by lower average transaction prices for lightweight coated and newsprint.

Pulp sales volumes were down in the quarter compared to Q2 2011 due to a maintenance outage originally scheduled for March that was deferred to April 2012. On a year-to-date basis, sales volumes were 14,900 tonnes above 2011 levels, however average transaction prices for pulp continued to trend down in Q2 2012 due to soft demand and excess inventory in China.

Operations ran well and daily production volumes have improved. We continued to monitor inventory levels closely and with the support of our vendors, shipments flowed smoothly and customer orders were delivered without interruption through the quarter. Safety performance took a step back in the second quarter, though we made progress in reducing frequency and severity of incidents compared with the prior year as field hazard assessments, investigation of near misses and personal accountability for prevention of incidents become standard practices across all operations.

We continued to incur significant reorganization costs under the CCAA proceedings in the quarter, mostly consisting of consulting and legal fees. We recognized significant non-cash reorganization credits in the quarter to adjust the book values of certain compromised liabilities to the amounts allowed as valid claims against the company by the Supreme Court of British Columbia.

Our liquidity improved in the second quarter due to an increase in our borrowing base and a decrease in the amount drawn on our DIP Facility. Our DIP Credit Agreement was amended in the quarter requiring excess availability on the Facility be maintained at no less than $21.9 million.

Looking to the latter half of 2012, we anticipate an orderly emergence from CCAA protection within the next several weeks once exit financing and a new asset-based loan facility (ABL Facility) is in place. We expect the company’s operating revenue combined with the current DIP Facility to provide sufficient liquidity to run operations and meet vendor obligations through the remainder of the CCAA protection period.

Against the backdrop of global economic challenges, industry consolidation and highly competitive markets for our products, we made considerable headway in the first half of this year to address the financial requirements that will enable Catalyst to secure a stronger business position for the future. Our focus on safety and operational performance and our organizational ability to innovate, lead, adapt and resolve stakeholder issues became increasingly clear in the first half of 2012 and we will leverage this momentum as we emerge from creditor protection with a stronger balance sheet, more competitive operating costs and improved capacity to participate in the ongoing transformation of the paper and pulp industry worldwide.

Kevin J. Clarke

President & Chief Executive Officer

| CATALYST PAPER 2012 SECOND QUARTER REPORT | ~ 3 ~ |

catalyst paper corporation

MANAGEMENT’S DISCUSSION AND ANALYSIS

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 1 ~ |

| MANAGEMENT’S DISCUSSION AND ANALYSIS | 3 |

| | |

| 1 | Overview and highlights | 5 |

| | | |

| 2 | Segmented results | 12 |

| | | |

| 3 | Liquidity and capital resources | 18 |

| | | |

| 4 | Contingent liabilities | 20 |

| | | |

| 5 | Summary of quarterly results | 21 |

| | | |

| 6 | Non-GAAP measures | 21 |

| | | |

| 7 | Critical accounting policies and estimates | 23 |

| | | |

| 8 | Changes in accounting policies | 23 |

| | | |

| 9 | Impact of accounting pronouncements affecting future periods | 24 |

| | | |

| 10 | Risks and uncertainties | 24 |

| | | |

| 11 | Sensitivity analysis | 26 |

| | | |

| 12 | Outlook | 27 |

| | | |

| 13 | Disclosure controls and internal control over financial reporting | 28 |

| | | |

| CONSOLIDATED FINANCIAL STATEMENTS | 29 |

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 2 ~ |

MANAGEMENT’S DISCUSSION AND ANALYSIS

The following management’s discussion and analysis (MD&A) of Catalyst Paper Corporation (the company, we, us, and our) should be read in conjunction with our interim consolidated financial statements for the three month and six month periods ended June 30, 2012 and June 30, 2011 and our audited annual consolidated financial statements for the year ended December 31, 2011 and the notes thereto, which have been prepared in accordance with generally accepted accounting principles (GAAP) in the United States (U.S.). Additional information about the company, including our most recent Annual Information Form is available on our website atwww.catalystpaper.com, or the Canadian Securities Administrator’s electronic filing website atwww.sedar.com.

Throughout this discussion, references are made to certain measures that are not measures of performance under U.S. GAAP, including operating earnings, EBITDA, EBITDA before restructuring costs, average delivered cash costs per tonne before specific items, net earnings (loss) attributable to the company before specific items, net earnings (loss) per share attributable to the company’s common shareholders before specific items, and free cash flow. We believe that these non-GAAP measures are useful in evaluating our performance. These non-GAAP measures are defined and reconciled to their nearest GAAP measure in section 6, Non-GAAP measures.

In this MD&A, unless otherwise indicated, all dollar amounts are expressed in Canadian dollars. The term “dollars” and the symbols “$” and “CDN$” refer to Canadian dollars and the term “U.S. dollars” and the symbol “US$” refer to United States dollars.

In this MD&A, the term “tonne” and the symbol “MT” refer to a metric tonne and the term “ton” or the symbol “ST” refer to a short ton, a measure of weight equal to 0.9072 metric tonne. Use of these symbols is in accordance with industry practice.

The information in this report is as of August 1, 2012 which is the date of filing in conjunction with our press release announcing our results for the second quarter of 2012. Disclosure contained in this document is current to August 1, 2012 unless otherwise stated.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 3 ~ |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this MD&A are not based on historical facts and constitute forward-looking statements or forward-looking information within the meaning of Canadian securities laws and the U.S. Private Securities Litigation Reform Act of 1995 (forward-looking statements), including but not limited to, statements about our strategy, plans, future operating performance, contingent liabilities and outlook as well as statements about our creditor protection proceedings, debtor-in possession financing, reorganization process and debt restructuring.

Forward-looking statements:

| — | Are statements that address or discuss activities, events or developments that we expect or anticipate may occur in the future; |

| — | Can be identified by the use of words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “likely”, “predicts”, “estimates”, “forecasts”, and similar words or phrases or the negative of such words or phrases; |

| — | Reflect our current beliefs, intentions or expectations based on certain assumptions and estimates, including those identified below, which could prove to be significantly incorrect: |

| – | Our ability to develop, manufacture and sell new products and services that meet the needs of our customers and gain commercial acceptance; |

| – | Our ability to continue to sell our products and services in the expected quantities at the expected prices and expected times; |

| – | Our ability to successfully obtain cost savings from our cost reduction initiatives; |

| – | Our ability to implement business strategies and pursue opportunities; |

| – | Expected cost of goods sold; |

| – | Expected component supply costs and constraints; |

– Expected foreign exchange and tax rates.

| — | While considered reasonable by management, are inherently subject to known and unknown risks and uncertainties and other factors that could cause actual results or events to differ from historical or anticipated results or events. These risk factors and others are discussed in the MD&A. Certain of these risks are: |

| – | The impact of general economic conditions in the countries in which we do business; |

| – | Conditions in the capital markets and our ability to obtain financing and refinance existing debt; |

| – | Market conditions and demand for our products (including declines in advertising and circulation); |

| – | The implementation of trade restrictions in jurisdictions where our products are marketed; |

| – | Fluctuations in foreign exchange or interest rates; |

| – | Raw material prices (including wood fibre, chemicals and energy); |

| – | The effect of, or change in, environmental and other governmental regulations; |

| – | Uncertainty relating to labour relations; |

| – | The availability of qualified personnel; |

| – | The effects of competition from domestic and foreign producers; |

| – | The risk of natural disaster and other factors many of which are beyond our control; |

| – | Risks and uncertainties relating to our creditor protection proceedings, including our ability to continue as a going concern and ability to implement a debt restructuring. |

As a result, no assurance can be given that any of the events or results anticipated by such forward-looking statements will occur or, if they do occur, what benefit they will have on our operations or financial condition. Readers are cautioned not to place undue reliance on these forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 4 ~ |

| 1. | OVERVIEW AND HIGHLIGHTS |

BUSINESS OVERVIEW

We are the largest producer of mechanical printing papers in western North America. We also produce NBSK pulp which is marketed primarily in Asia. Our business is comprised of three business segments: specialty printing papers; newsprint; and pulp. Specialty printing papers include coated mechanical, uncoated mechanical, and directory paper. We are the only producer of coated mechanical paper and soft calender (SC) paper in western North America. We operate four paper mills, three of which are located in British Columbia (B.C.) in Crofton, Port Alberni, and Powell River, and one in Snowflake, Arizona, which produces 100% recycled-content paper. Our Crofton mill includes a two-line kraft pulp operation.

More information about our business segments, product profile and our geographic sales distribution is provided on pages 4 to 6 of our 2011 Annual Report. Our production capacity by mill and product line is summarized in the following chart:

2012 Capacity by Mill Location and Product Line1

| | | Specialty printing papers 1 | | | Newsprint 1 | | | Pulp 2 | | | | |

| Mill location | | Number of

paper

machines | | | Uncoated

mechanical | | | Coated

mechanical | | | Directory | | | Newsprint | | | NBSK

pulp | | | Total | |

| Crofton, B.C.3 | | | 2 | | | | – | | | | – | | | | 111,000 | | | | 194,000 | | | | 335,000 | 2 | | | 640,000 | |

| Port Alberni, B.C. | | | 2 | | | | – | | | | 223,000 | | | | 115,000 | | | | – | | | | – | | | | 338,000 | |

| Powell River, B.C. | | | 3 | | | | 480,000 | | | | – | | | | – | | | | – | | | | – | | | | 480,000 | |

| Snowflake, Arizona | | | 2 | | | | 60,000 | | | | – | | | | – | | | | 277,000 | | | | – | | | | 337,000 | |

| Total capacity (tonnes) | | | 9 | | | | 540,000 | | | | 223,000 | | | | 226,000 | | | | 471,000 | | | | 335,000 | | | | 1,795,000 | |

| % of total capacity | | | | | | | 30 | % | | | 12 | % | | | 13 | % | | | 26 | % | | | 19 | % | | | 100 | % |

| 1 | Capacities expressed in the above table can vary as we are able to switch production between products, particularly newsprint, directory and machine-finished uncoated grades. |

| 2 | Total pulp capacity at Crofton is 395,000 tonnes, of which 335,000 tonnes are designated as market pulp with the remainder 60,000 tonnes being consumed internally. |

| 3 | No. 1 paper machine at Crofton remains indefinitely curtailed. If this machine were to be restarted we do not expect it would produce newsprint. |

SECOND QUARTER OVERVIEW

Creditor Protection and Restructuring Process

On January 31, 2012 we obtained an Initial Order from the Supreme Court of British Columbia under the Companies’ Creditors Arrangement Act (CCAA) staying creditor proceedings during our restructuring process under the CCAA. The Canadian Court Order under the CCAA was recognized under chapter 15 of title 11 of the US Bankruptcy Code. PricewaterhouseCoopers Inc. was appointed by the court as the monitor under the CCAA.

We arranged for a $175 million debtor-in possession facility (DIP Facility) as part of the CCAA proceedings. The DIP Facility has an 18-month maturity and is expected to provide for ongoing working capital, capital expenditure requirements as well as for general corporate purposes during the restructuring process under the CCAA. For further details on the DIP Facility, refer to note 14,Long-term debt, in our interim consolidated financial statements for the three months and six months ended June 30, 2012.

On March 9, 2012 the company entered into a restructuring and support agreement (RSA) with certain holders of our 11% senior secured notes due 2016 (2016 Notes) and our 7.375% notes due 2014 (2014 Notes) to proceed with a proposed recapitalization transaction to be implemented by way of a plan of arrangement under the CCAA. The original terms of the plan of arrangement as contemplated in the RSA are disclosed in our interim consolidated financial statements for the three months ended March 31, 2012.

On May 15, 2012 we announced amendments to the proposed plan of arrangement. This amended plan of arrangement was voted on by the company’s secured and unsecured creditors on May 23, 2012 but was not approved by the required voting threshold. With the amended plan of arrangement not being approved, the company commenced a sale process in accordance with court approved sale and investor solicitation procedures (SISP).

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 5 ~ |

Approval of Plan of Arrangement

On June 14, 2012 we announced further amendments to the proposed plan of arrangement by way of a second amended plan of arrangement. The second amended plan of arrangement incorporated the principal changes in the first amended plan of arrangement, including:

| – | reduction of the principal amount of 11.0% secured notes to be issued to holders of 2016 Notes from US$325.0 million to US$250.0 million; |

| – | elimination of the new secured coupon notes contemplated in the original plan of arrangement in exchange for unpaid interest on the 2016 Notes (approximately US$45 million); |

| – | distribution of 50.0% of the net proceeds from the sale of our interest in Powell River Energy Inc. and Powell River Energy Limited Partnership (PREI) to unsecured creditors who do not make a cash election or equity election (see below); and |

| – | 100.0% of new shares to be issued to holders of 2016 Notes subject to dilution by those unsecured creditors who make an equity election to acquire up to 600,000 new common shares (4.0%) of the company; |

and, in addition, provided for the compromise of certain extended health benefits plans for former salaried employees. The company also obtained government approval of proposed modifications to the company’s defined benefit pension plan for salaried employees providing for a special portability election option and funding relief in respect of the solvency deficiency of the pension plan which, when implemented, would result in estimated annual savings of approximately $7 million.

Under the proposed recapitalization transaction under the second amended plan of arrangement:

| – | Holders of 2016 Notes will receive, in exchange for their US$390.4 million of notes plus accrued and unpaid interest: |

| Ø | US$250.0 million secured notes due in 2017 that bear interest, at the option of the company, of 11% cash or 7.5% cash plus 5.5% payment-in-kind (PIK); and |

| Ø | 100.0% of the company’s new common stock, subject to dilution for (i) the issuance of common shares of up to 4.0% to unsecured creditors who make an equity election, and (ii) a new management incentive plan. |

| | | |

| – | Holders of 2014 Notes will receive, in exchange for their US$250.0 million of notes plus accrued and unpaid interest: |

| Ø | the PREI proceeds pool (see above) subject to dilution for general creditors who make the PREI cash election; or |

| Ø | if an equity election is made, 4.0% of the company’s new common stock, subject to dilution for (i) general creditors who make an equity election, and (ii) a new management incentive plan. |

| | | |

| – | General creditors will receive, in exchange for their general unsecured claims: |

| Ø | their pro rata share of the PREI proceeds pool; or |

| Ø | if an equity election is made, their pro rata share of 4.0% new common stock, subject to dilution for a new management incentive plan; or |

| Ø | if a valid cash election is made, cash in an amount equal to 50.0% of the creditor’s claim, provided that the aggregate amount of cash payable to all such holders does not exceed $2.5 million. |

| – | Existing common shares of the company will be cancelled. |

On June 25, 2012 the second amended plan of arrangement received the necessary creditor approval through positive votes of approximately 99% of the secured creditors and 99% of the unsecured creditors who voted on the plan. The second amended plan of arrangement was subsequently approved by the British Columbia Supreme Court on June 28, 2012 and by the United States Court in Delaware under Chapter 15 of title 11 of the US Bankruptcy Code on July 27, 2012. The SISP process was suspended effective June 28, 2012 except in respect of PREI.

The British Columbia Supreme Court has approved an extension of the Company’s CCAA protection to September 30, 2012. Implementation of the second amended plan of arrangement is conditional on the company securing a new asset-based loan facility (ABL Facility) and/or other exit loan facility. This condition must be met before the company can exit the CCAA process.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 6 ~ |

Permanent closure of Snowflake recycle paper mill

On July 30, 2012 we announced the permanent closure of our Snowflake recycle mill operations. The mill, which is located in northeastern Arizona, will be permanently shut on September 30, 2012. The decision to close the mill was driven by continued financial losses resulting from intense supply input and market pressures. Snowflake has generated negative EBITDA since 2009, and a $161.8 million impairment charge was recorded on its assets under U.S. GAAP in the third quarter of 2011.

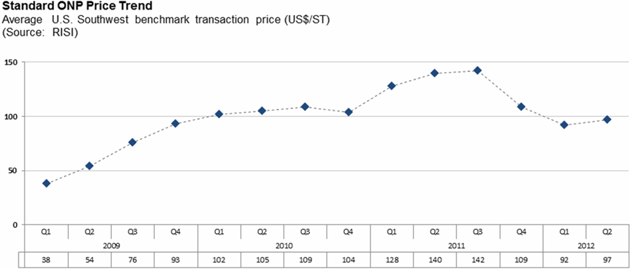

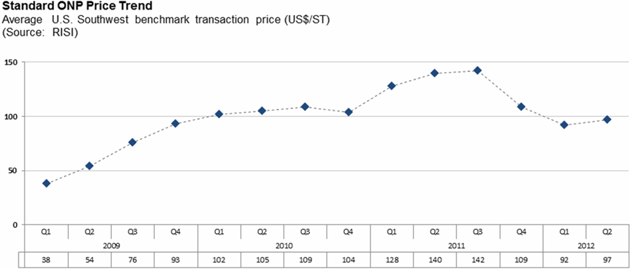

The company implemented a number of measures since acquiring the Snowflake operation in 2008 to address these market and input cost pressures, including the production of higher-value specialty paper grades at what was formerly a newsprint-only mill, capital investment, full leverage of the mill’s environmental attributes, competitive labour agreements, as well as productivity, quality and service improvements. However, with newsprint demand down more than 10% annually since the end of 2008, old newsprint (ONP) prices approximately 163% higher since 2009, and higher freight costs resulting from procurement and sales being forced to go further afield to source ONP and secure product orders, the mill could not be restored to profitability. The mill’s paper products are derived from ONP, and a US$5 per ton increase in ONP price has a negative impact of approximately US$2.0 million on EBITDA and approximately US$1.0 million on net earnings.

The mill closure, which will result in certain initial cash costs of approximately US$5.0 million which we expect to recoup from working capital and the sale of mill assets in 2013, is expected to result in the elimination of future operating losses associated with the mill and savings of annualized selling, general and administrative expenses.

Business Overview

Operating earnings for the quarter were down from the previous quarter due to reduced sales volumes, lower sales prices and higher maintenance spending, partially offset by the positive impact of a weaker Canadian dollar and labour savings that reflected the impact of the new labour deal.

While paper sales volumes increased, average transaction prices declined for all paper segments. Sales volumes for NBSK pulp declined and average transaction prices increased in the quarter. Manufacturing costs increased in the quarter primarily due to higher electric power and maintenance costs, partially offset by labour savings. The increase in maintenance costs was mostly due to a maintenance outage taken on our pulp assets that had originally been scheduled for the first quarter.

We continued to incur significant reorganization costs under the CCAA proceedings in the quarter, mostly consisting of professional fees for legal and consulting services. These reorganization charges were offset in the quarter by significant non-cash reorganization credits to adjust the historical book values of certain compromised liabilities to their allowed claims amounts as confirmed by the second amended plan of arrangement.

Financial Performance

We recorded a net loss attributable to the company of $11.7 million and a net loss attributable to the company before specific items of $5.0 million in Q2. This compared to a net loss of $25.6 million and $9.6 million, respectively, in Q1. Significant specific items in Q2 included a net reorganization credit resulting from the CCAA proceedings, and a foreign exchange loss on the translation of U.S. dollar denominated debt. Significant specific items in the prior quarter included restructuring costs incurred prior to entering into the CCAA proceedings, net reorganization expenses resulting from the CCAA proceedings, and a foreign exchange gain on the translation of U.S. dollar denominated debt.

EBITDA was $14.6 million and EBITDA before restructuring costs was $14.5 million in Q2 compared to EBITDA of $18.1 million and EBITDA before restructuring costs of $23.3 million in Q1. Refer to section 6,Non-GAAP measures, for additional information on specific items in the reported financial results.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 7 ~ |

SELECTED FINANCIAL INFORMATION

| | | 2012 | | 2011 |

(In millions of Canadian dollars, except where

otherwise stated) | | YTD | | Q2 | | Q1 | | Total | | Q4 | | Q3 | | Q2 | | Q1 |

| Sales | | $ | 628.6 | | | $ | 312.8 | | | $ | 315.8 | | | $ | 1,261.5 | | | $ | 319.8 | | | $ | 340.3 | | | $ | 297.8 | | | $ | 303.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating earnings (loss) | | | 17.2 | | | | 7.0 | | | | 10.2 | | | | (894.4 | ) | | | (701.3 | ) | | | (151.6 | ) | | | (30.6 | ) | | | (10.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 15.5 | | | | 7.6 | | | | 7.9 | | | | 112.4 | | | | 30.8 | | | | 27.8 | | | | 27.0 | | | | 26.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA1 | | | 32.7 | | | | 14.6 | | | | 18.1 | | | | 41.6 | | | | 2.8 | | | | 26.8 | | | | (3.9 | ) | | | 15.9 | |

| – before restructuring costs1 | | | 37.8 | | | | 14.5 | | | | 23.3 | | | | 47.5 | | | | 8.7 | | | | 26.8 | | | | (3.9 | ) | | | 15.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net earnings (loss) attributable to the company | | | (37.3 | ) | | | (11.7 | ) | | | (25.6 | ) | | | (974.0 | ) | | | (708.0 | ) | | | (205.7 | ) | | | (47.4 | ) | | | (12.9 | ) |

| – before specific items1 | | | (14.6 | ) | | | (5.0 | ) | | | (9.6 | ) | | | (126.3 | ) | | | (41.7 | ) | | | (14.1 | ) | | | (46.9 | ) | | | (23.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA margin1 | | | 5.2 | % | | | 4.7 | % | | | 5.7 | % | | | 3.3 | % | | | 0.9 | % | | | 7.9 | % | | | (1.3 | %) | | | 5.2 | % |

| – before restructuring costs1 | | | 6.0 | % | | | 4.6 | % | | | 7.4 | % | | | 3.8 | % | | | 2.7 | % | | | 7.9 | % | | | (1.3 | %) | | | 5.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net earnings (loss) per share attributable to the company’s common shareholders (in dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – basic and diluted | | $ | (0.10 | ) | | $ | (0.03 | ) | | $ | (0.07 | ) | | $ | (2.55 | ) | | $ | (1.85 | ) | | $ | (0.54 | ) | | $ | (0.13 | ) | | $ | (0.03 | ) |

| – before specific items1 | | | (0.04 | ) | | | (0.01 | ) | | | (0.03 | ) | | | (0.33 | ) | | | (0.11 | ) | | | (0.04 | ) | | | (0.12 | ) | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands of tonnes) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | | 848.1 | | | | 421.0 | | | | 427.1 | | | | 1,638.8 | | | | 406.6 | | | | 439.8 | | | | 393.0 | | | | 399.4 | |

| Production | | | 854.5 | | | | 428.4 | | | | 426.1 | | | | 1,655.8 | | | | 421.0 | | | | 428.3 | | | | 396.1 | | | | 410.4 | |

| 1 | Refer to section 6, Non-GAAP measures. |

Market Overview

* Uncoated mechanical is comprised of high-gloss and standard grades.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 8 ~ |

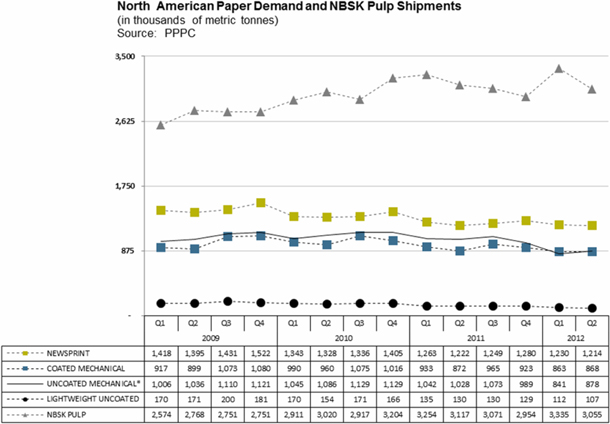

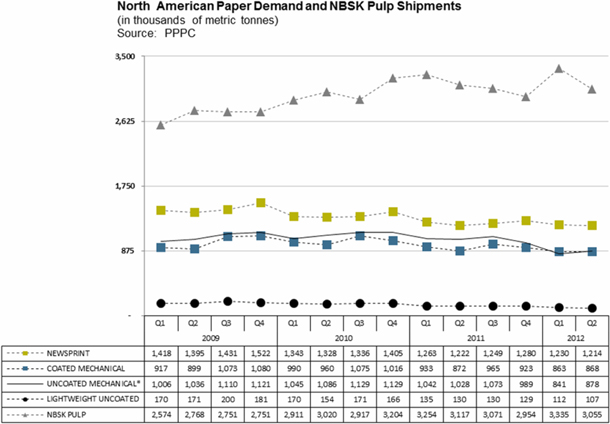

Overall, market conditions remained challenging in the second quarter of 2012. North American demand for all paper grades decreased compared to the second quarter of 2011. North American demand for uncoated mechanical declined significantly compared to Q2 2011. Demand for lightweight coated paper declined slightly compared to levels of a year ago, and demand for newsprint and directory paper fell by 0.7% and 17.7%. Benchmark prices in the second quarter for coated and newsprint were down from the first quarter, while uncoated mechanical and directory prices remained flat.

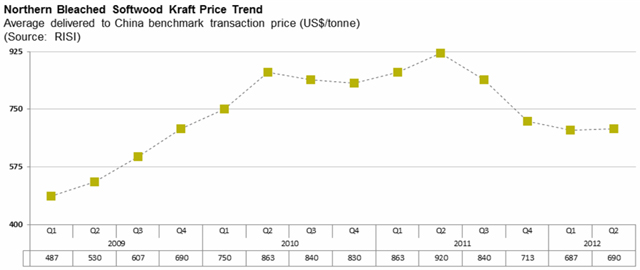

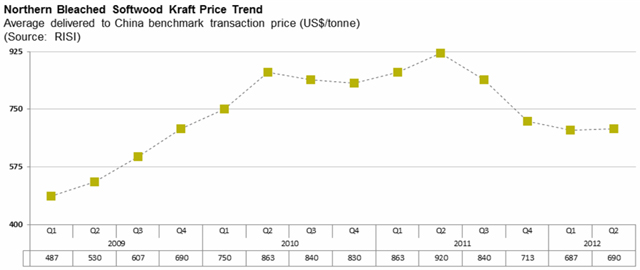

NBSK pulp shipments were 2.0% lower year over year due to declining demand and excess inventory in China. NBSK pulp benchmark prices for China strengthened compared to the first quarter.

STRATEGY UPDATE

Our objective is to return to profitability and maximize cash flows by focusing on reducing manufacturing costs and optimizing our brands and customer base. Additional information related to our corporate strategy, including key performance drivers and indicators, can be found on pages 12 to 21 of our 2011 Annual Report.

2012 Key Objectives

The following is an update on our second quarter progress towards our 2012 key objectives:

Social:

| — | Continue the progress made in 2011 to significantly improve our overall safety performance |

| – | We took a step back in the quarter on safety, with our lost-time injury frequency in Q2 2012 increasing to 2.15 compared to 0.22 in Q1 and our target of 1.10. Our medical incident rate increased to 4.94 in Q2 compared to 1.97 in Q1 and our target of 2.26. |

| — | Continue to seek competitive business conditions in B.C., including joint municipal infrastructure agreements and “value based” opportunities which will reduce operating costs for Catalyst Paper and municipalities |

| – | Reductions in the Class 4 municipal tax rate were confirmed for all three B.C. mills and total annual property taxes paid on July 3, 2012 were reduced by approximately $6.1 million to $12.2 million. |

| – | The joint infrastructure and tax agreement with the City of Powell River was finalized to transfer certain non-core interests, certain defined services under a long-term agreement, settle the mortgage receivable from PRSC Limited Partnership and sell the company’s interest in PRSC Land Developments Ltd., with proceeds expected in the third quarter. |

Financial:

| — | Continue to focus on cash flows, liquidity and cost reductions |

| – | Liquidity increased by $3.9 million from Q1 due to the increase in borrowing base and a decrease in the amount drawn on our DIP Facility. Free cash flow for the quarter was negative $4.8 million. |

| – | Cash on hand declined in the quarter primarily due to the payment of reorganization costs and pension contributions that were applied against the solvency deficit on our pension plans. |

| – | Capital spending was held at $3.0 million in the current quarter and directed primarily to maintenance of business. |

| — | Implement a restructuring process or other reorganization under the CCAA that will significantly improve our capital structure, liquidity and competitive footing |

| – | A second amended plan of arrangement received creditor approval on June 25, 2012 and was sanctioned by the B.C. Court on June 28, 2012 reducing debt by US$390.4 million, interest expense by US$33.9 million with more than $35.0 million expected in other annual cash savings once the company emerges from creditor protection. |

| — | Evaluate every existing physical asset to maximize financial contributions, product flexibility and capital structure |

| – | Total proceeds from the sale of non-core fixed assets for the six months ended June 30, 2012 was $7.9 million, with $7.4 million generated in the second quarter. |

| – | The sale of scrap metal / equipment components from the shuttered mill at Elk Falls is expected to take approximately five months and achieve approximately $8.0 million in proceeds. |

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 9 ~ |

| — | Achieve a new collective labour agreement with all six local B.C. unions that is market competitive and innovative to help positively position Catalyst Paper for the future |

| – | New five-year labour agreements took effect on May 1, 2012 and are expected to deliver annual labour savings of $18 to $20 million. The new agreements include a 10% reduction in hourly wages and amended work rules, and provide for no wage inflation for the first three years with 2% increases in years four and five. |

Commercial:

| — | Continue to expand sales reach into new markets and increase market share with capital segments |

| – | We continue to grow sales of our book paper which has been positively received by book publishers. In addition, we have developed a 40 gram newsprint product that is helping us grow our sales while providing newspaper publishers with economic and environmental benefits. |

| — | Expand geographic reach of Catalyst Paper into emerging world markets of Latin America, India and Asia |

| – | We grew sales of all grades in key international markets that we are able to serve cost effectively from British Columbia and Arizona. We signed long-term contracts for telephone directory paper with a number of large publishers in Latin America. |

Environmental:

| — | Achieve conservation targets in water and energy |

| – | Data collection and water mapping in the baseline water usage audit at Powell River mill began in Q2 and supports a company-wide water usage conservation program associated with energy efficiency to be developed in the latter half of 2012. |

| — | Maintain international disclosure standards as set out in the UN Global Compact |

| – | Catalyst’s environmental, social and governance performance, and its reporting of progress on non-financial measures, earned the company a place during Q2 on the Corporate Knights list of Canada’s 50 Best Corporate Citizens for the sixth consecutive year. |

| — | Retain sales-supporting relationships with leading environmental groups |

| – | The company is actively engaged with a variety of recognized environmental groups including GreenBlue which has initiated development of Guidelines for Sustainable Paper Products as a collaborative market education project designed to inform and improve existing procurement policies and systems. |

CONSOLIDATED RESULTS OF OPERATIONS

Sales

Q2 2012 vs. Q1 2012

Sales revenues decreased by 0.9% as a result of reduced sales volumes for newsprint and pulp, and lower transaction prices for all paper segments, partially offset by the positive impact of a weaker Canadian dollar, higher sales volumes on the paper side for all specialty grades and higher average transaction prices for pulp.

Q2 2012 vs. Q2 2011

Sales revenues increased by 5.0% due to higher sales volumes for all paper segments except directory, the positive impact of a weaker Canadian dollar and higher average transaction prices in the current quarter for directory and uncoated mechanical paper. These factors were partially offset by reduced sales volumes for pulp and directory, and lower average transaction prices for pulp, newsprint and lightweight coated. Sales volumes for newsprint and uncoated mechanical paper were negatively impacted in Q2 2011 by fires and extended maintenance outages at our Snowflake and Powell River mills.

2012 YTD vs. 2011 YTD

Sales revenues increased by 4.5% due to the positive impact of a weaker Canadian dollar, higher sales volumes for pulp and all paper segments except directory, and higher average transaction prices for directory and uncoated mechanical paper. This was partially offset by reduced sales volumes for directory and lower average transaction prices for pulp, newsprint and lightweight coated paper.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 10 ~ |

EBITDA and EBITDA before Restructuring Costs

The following table provides variances between periods for EBITDA and EBITDA before restructuring costs:

| (In millions of Canadian dollars) | | Q1 2012 | | | Q2 2011 | | | 2011 YTD | |

| EBITDA in comparative period1 | | $ | 18.1 | | | $ | (3.9 | ) | | $ | 12.0 | |

| Restructuring costs | | | 5.2 | | �� | | – | | | | – | |

| EBITDA before restructuring costs in comparative period1 | | | 23.3 | | | | (3.9 | ) | | | 12.0 | |

| Paper prices | | | (4.4 | ) | | | (0.6 | ) | | | 3.1 | |

| Pulp prices | | | 0.5 | | | | (15.3 | ) | | | (30.6 | ) |

| Impact of Canadian dollar | | | 2.0 | | | | 7.2 | | | | 10.3 | |

| Volume and mix | | | 1.3 | | | | 4.6 | | | | 7.8 | |

| Distribution costs | | | (0.5 | ) | | | (0.9 | ) | | | (4.8 | ) |

| Furnish mix and costs | | | 2.0 | | | | 9.4 | | | | 12.3 | |

| Power and fuel costs | | | 0.2 | | | | 1.0 | | | | (2.7 | ) |

| Labour costs | | | 3.3 | | | | 5.3 | | | | 4.9 | |

| Maintenance costs | | | (4.6 | ) | | | 5.6 | | | | 12.7 | |

| Property taxes, licenses and insurance | | | 1.4 | | | | 1.9 | | | | 2.3 | |

| Selling, general and administrative | | | 0.5 | | | | 0.4 | | | | 1.3 | |

| Lower of cost or market impact on inventory, net of inventory change | | | (7.1 | ) | | | 2.4 | | | | 10.4 | |

| Other, net | | | (3.4 | ) | | | (2.6 | ) | | | (1.2 | ) |

| EBITDA before restructuring costs in the current period1 | | | 14.5 | | | | 14.5 | | | | 37.8 | |

| Restructuring costs | | | 0.1 | | | | 0.1 | | | | (5.1 | ) |

| EBITDA in the current period1 | | $ | 14.6 | | | $ | 14.6 | | | $ | 32.7 | |

| 1 | Refer to section 6,Non-GAAP measures. |

Operating Earnings (Loss)

Q2 2012 vs. Q1 2012

Operating earnings decreased by $3.2 million primarily due to lower EBITDA of $3.5 million.

Q2 2012 vs. Q2 2011

Operating earnings increased by $37.6 million due to increased EBITDA of $18.5 million and lower depreciation and amortization expense of $19.4 million due to the lower depreciable asset base resulting from impairment of property, plant and equipment in the fourth quarter of 2011.

2012 YTD vs. 2011 YTD

Operating earnings increased by $58.7 million due to increased EBITDA of $20.7 million and lower depreciation and amortization expense of $38.3 million.

Net Earnings (Loss) Attributable to the Company

Q2 2012 vs. Q1 2012

Net loss attributable to the company decreased by $13.9 million. This was mostly due to a $6.0 million after-tax credit to reorganization items in the quarter compared to an after-tax reorganization charge of $22.4 million in the prior quarter, an after-tax gain on the disposal of fixed assets of $6.6 million in the quarter compared to $0.5 million in Q1 2012, and an after-tax foreign exchange gain on the revaluation of U.S dollar denominated working capital of $3.9 million compared to an after-tax loss of $4.0 million in the prior quarter. This was partially offset by lower after-tax operating earnings of $3.2 million, higher after-tax interest expense of $2.3 million and an after-tax foreign exchange loss on translation of U.S. dollar denominated debt of $12.8 million compared to an after-tax gain of $11.6 million in the first quarter.

Q2 2012 vs. Q2 2011

Net loss attributable to the company decreased by $35.7 million primarily due to higher after-tax operating earnings of $37.6 million, a $6.0 million after-tax credit to reorganization items in the quarter, an after-tax loss on fires of $5.3 million in Q2 2011, an after-tax gain on the disposal of fixed assets of $6.6 million, and an after-tax foreign exchange gain on the revaluation of U.S dollar denominated working capital of $3.9 million compared to an after-tax loss of $1.1 million in Q2 2011, partially offset by higher after-tax interest expense of $7.1 million and an after-tax foreign exchange loss on translation of U.S. dollar denominated debt of $12.8 million compared to an after-tax gain of $4.5 million in Q2 2011.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 11 ~ |

2012 YTD vs. 2011 YTD

Net loss attributable to the company decreased by $23.0 million primarily due to higher after-tax operating earnings of $58.1 million, an after-tax loss on fires of $5.3 million in 2011, and an after-tax gain on the disposal of fixed assets of $7.1 million, partially offset by a year-to-date after-tax reorganization charge of $16.4 million, higher after-tax interest expense of $14.6 million and an after-tax foreign exchange loss on translation of U.S. dollar denominated debt of $1.2 million compared to an after-tax gain of $15.2 million in 2011.

SPECIALTY PRINTING PAPERS

| | | Three months

ended June 30, | | | Six months

ended June 30, | |

| (In millions of Canadian dollars, except where otherwise stated) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Sales | | $ | 179.1 | | | $ | 160.9 | | | $ | 18.2 | | | $ | 349.0 | | | $ | 328.0 | | | $ | 21.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating earnings (loss) | | | 7.7 | | | | (29.3 | ) | | | 37.0 | | | | 12.8 | | | | (36.5 | ) | | | 49.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 6.2 | | | | 18.8 | | | | (12.6 | ) | | | 12.4 | | | | 37.3 | | | | (24.9 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA1 | | | 13.9 | | | | (10.6 | ) | | | 24.5 | | | | 25.2 | | | | 0.7 | | | | 24.5 | |

| – before restructuring costs1 | | | 13.8 | | | | (10.6 | ) | | | 24.4 | | | | 27.5 | | | | 0.7 | | | | 26.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA margin1 | | | 7.8 | % | | | (6.6 | %) | | | 14.4 | % | | | 7.2 | % | | | 0.2 | % | | | 7.0 | % |

| – before restructuring costs1 | | | 7.7 | % | | | (6.6 | %) | | | 14.3 | % | | | 7.9 | % | | | 0.2 | % | | | 7.7 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands of tonnes) | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | | 216.3 | | | | 202.8 | | | | 13.5 | | | | 420.1 | | | | 409.5 | | | | 10.6 | |

| Production | | | 219.9 | | | | 200.9 | | | | 19.0 | | | | 429.5 | | | | 415.2 | | | | 14.3 | |

| 1 | Refer to section 6,Non-GAAP measures. |

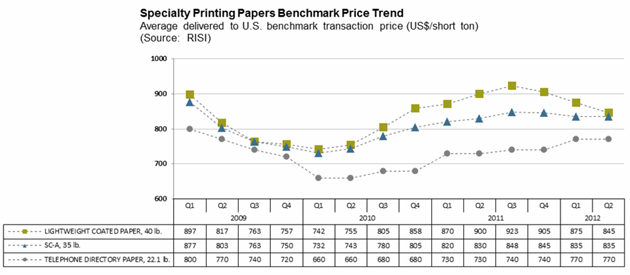

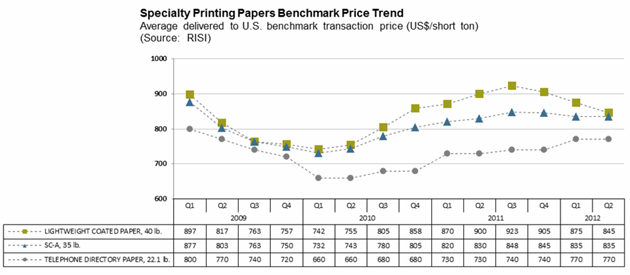

Segment Overview

North American demand for coated mechanical and uncoated mechanical (high-gloss and standard grades) decreased 0.5% and 14.6% respectively, from the same quarter last year due to continued weakness in print advertising and significant SC capacity reductions. Coated mechanical inventories were lower year over year, while inventory levels for uncoated mechanical inventories remained flat. Adjusted operating rates continued to remain steady as mill and machine closures and curtailment offset lower demand. The average lightweight coated benchmark price decreased 3.4% to US$845 per short ton while the average benchmark price for soft-calendered A grade (SC-A) remained unchanged at US$835 per short ton compared to the previous quarter.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 12 ~ |

North American directory demand fell 17.7% in Q2 compared to the prior year due to ongoing pressure to reduce or eliminate white pages, smaller books, lower circulation, and the continued migration from printed books to the Internet. The average Q2 directory benchmark price remained unchanged at US$770 per short ton compared to the previous quarter. Operating rates for directory paper remain strong despite declining demand due to continued capacity reduction in the directory marketplace.

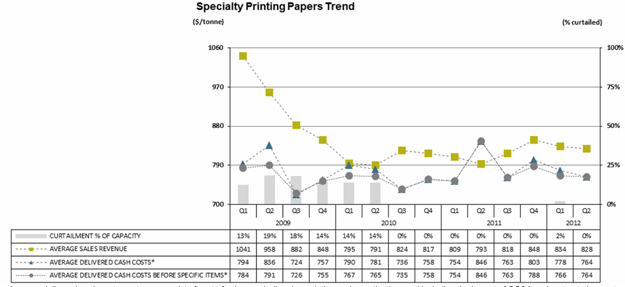

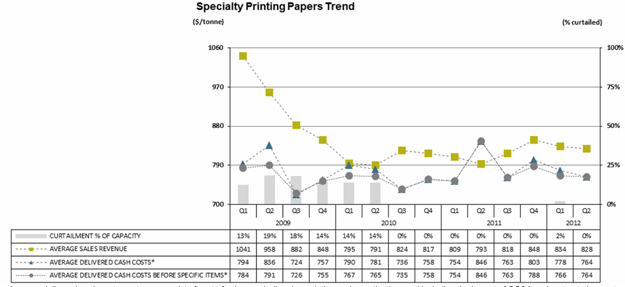

Operational Performance

The following chart summarizes the operating performance of our specialty printing papers segment:

| * | Average delivered cash costs per tonne consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A and restructuring costs. Average delivered cash costs per tonne before specific items consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A, but excluding the impact of restructuring costs. |

Q2 2012 vs. Q2 2011

| — | Sales volume increased by 13,500 tonnes due to higher sales volumes for uncoated mechanical and lightweight coated paper, partially offset by lower sales for directory paper. Production and sales of uncoated mechanical in Q2 2011 was negatively impacted by an extended maintenance outage and fire at our Powell River mill. |

| — | Average sales revenue increased $35 per tonne due to the positive impact of a weaker Canadian dollar and higher average transaction prices for directory and uncoated mechanical, partially offset by lower average transaction prices for lightweight coated. |

| — | Average delivered cash costs decreased $82 per tonne primarily due to lower maintenance and labour cost, partially offset by increased distribution cost. The lower labour cost in the quarter was mostly due to the positive impact of the new labour deal that went into effect on May 1, 2012. Maintenance cost was lower due to the deferral of certain maintenance projects during the CCAA proceedings and due to an extended maintenance outage and fire at our Powell River mill in Q2 2011. |

2012 YTD vs. 2011 YTD

| — | Sales volume increased by 10,600 tonnes due to higher sales volumes for all specialty grades except directory paper. |

| — | Average sales revenue increased $30 per tonne due to the positive impact of a weaker Canadian dollar and higher average transaction prices for all specialty grades excluding lightweight coated paper. |

| — | Average delivered cash costs decreased by $28 per tonne primarily due to lower maintenance, labour and kraft costs, partially offset by higher chemicals and electric power costs and the incurrence of restructuring costs in 2012. |

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 13 ~ |

Newsprint

| | | Three months

ended June 30, | | | Six months

ended June 30, | |

| (In millions of Canadian dollars, except where otherwise stated) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Sales | | $ | 83.2 | | | $ | 71.5 | | | $ | 11.7 | | | $ | 168.7 | | | $ | 146.9 | | | $ | 21.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating earnings (loss) | | | 2.3 | | | | (11.9 | ) | | | 14.2 | | | | 4.0 | | | | (17.2 | ) | | | 21.2 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 0.8 | | | | 4.5 | | | | (3.7 | ) | | | 2.0 | | | | 9.2 | | | | (7.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA1 | | | 3.1 | | | | (7.6 | ) | | | 10.7 | | | | 6.0 | | | | (8.2 | ) | | | 14.2 | |

| – before restructuring costs1 | | | 3.1 | | | | (7.6 | ) | | | 10.7 | | | | 7.5 | | | | (8.2 | ) | | | 15.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA margin1 | | | 3.7 | % | | | (10.6 | %) | | | 14.3 | % | | | 3.6 | % | | | (5.6 | %) | | | 9.2 | % |

| – before restructuring costs1 | | | 3.7 | % | | | (10.6 | %) | | | 14.3 | % | | | 4.4 | % | | | (5.6 | %) | | | 10.0 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands of tonnes) | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | | 128.2 | | | | 111.8 | | | | 16.4 | | | | 258.4 | | | | 228.2 | | | | 30.2 | |

| Production | | | 130.8 | | | | 111.7 | | | | 19.1 | | | | 261.8 | | | | 236.5 | | | | 25.3 | |

| 1 | Refer to section 6,Non-GAAP measures. |

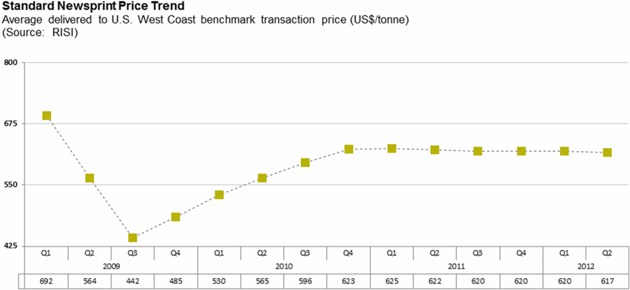

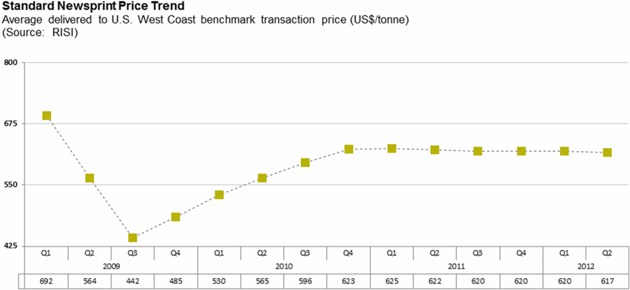

Segment Overview

Total North American demand for newsprint was down 0.7% in Q2 year over year reflecting lower newspaper print advertising and circulation. Operating rates were similar to the previous year due to North American newsprint capacity being reduced at a rate to compensate for declining demand. The average Q2 North American newsprint benchmark price declined slightly to US$617 per tonne compared to the previous quarter.

The Crofton No.1 paper machine remained indefinitely curtailed throughout the quarter and, if it were restarted on an unspecified future date, we do not expect that it would produce newsprint.

The price of ONP strengthened in Q2 compared to Q1, and challenges surrounding the quality of supply, lack of price stability, and limited availability in cost effective locations near our Snowflake facility continued to be a concern.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 14 ~ |

Operational Performance

The following chart summarizes the operating performance of our newsprint segment:

| * | Although C1 remains indefinitely curtailed it isn’t included in our 2012 capacity table. |

| ** | Average delivered cash costs per tonne consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A and restructuring costs. Average delivered cash costs per tonne before specific items consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A, but excluding the impact of restructuring costs. |

Q2 2012 vs. Q2 2011

| — | Sales volume increased by 16,400 tonnes as a result of increased production in the current quarter. Production and sales in Q2 2011 were negatively impacted by an extended maintenance outage, fire and market curtailment at our Snowflake mill. |

| — | Average sales revenue increased $9 per tonne due to the positive impact of a weaker Canadian dollar, partially offset by lower average transaction prices. |

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 15 ~ |

| — | Average delivered cash costs decreased $83 per tonne due primarily to the lower cost of ONP and reduced maintenance and labour spending. Labour cost was lower due to the impact of the new labour deal and maintenance cost was lower due to the deferral of certain maintenance projects during the CCAA proceedings and due to an extended maintenance outage at our Snowflake mill in Q2 2011. |

2012 YTD vs. 2011 YTD

| — | Sales volume increased by 30,200 tonnes due to stronger production in 2012 and the impact of a maintenance outage, fire and market curtailment at the Snowflake mill on the prior year’s results. |

| — | Average sales revenue increased by $9 per tonne due to the positive impact of a weaker Canadian dollar, partially offset by lower average transaction prices. |

| — | Average delivered cash costs decreased $50 per tonne primarily due to lower ONP, maintenance and labour costs, partially offset by higher electric power costs and the incurrence of restructuring costs in 2012. |

Pulp

| | | Three months

ended June 30, | | | Six months

ended June 30, | |

| (In millions of Canadian dollars, except where otherwise stated) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Sales | | $ | 50.5 | | | $ | 65.4 | | | $ | (14.9 | ) | | $ | 110.9 | | | $ | 126.5 | | | $ | (15.6 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating earnings (loss) | | | (3.0 | ) | | | 10.6 | | | | (13.6 | ) | | | 0.4 | | | | 12.2 | | | | (11.8 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Depreciation and amortization | | | 0.6 | | | | 3.7 | | | | (3.1 | ) | | | 1.1 | | | | 7.3 | | | | (6.2 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA1 | | | (2.4 | ) | | | 14.3 | | | | (16.7 | ) | | | 1.5 | | | | 19.5 | | | | (18.0 | ) |

| – before restructuring costs1 | | | (2.4 | ) | | | 14.3 | | | | (16.7 | ) | | | 2.8 | | | | 19.5 | | | | (16.7 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA margin1 | | | (4.8 | %) | | | 21.9 | % | | | (26.7 | %) | | | 1.4 | % | | | 15.4 | % | | | (14.0 | %) |

| – before restructuring costs1 | | | (4.8 | %) | | | 21.9 | % | | | (26.7 | %) | | | 2.5 | % | | | 15.4 | % | | | (12.9 | %) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands of tonnes) | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | | 76.5 | | | | 78.4 | | | | (1.9 | ) | | | 169.6 | | | | 154.7 | | | | 14.9 | |

| Production | | | 77.7 | | | | 83.5 | | | | (5.8 | ) | | | 163.2 | | | | 154.8 | | | | 8.4 | |

| 1 | Refer to section 6,Non-GAAP measures. |

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 16 ~ |

Segment Overview

NBSK pulp markets remained weak in the second quarter due to weak demand and excess end-user inventory in China. Global NBSK shipments declined by 2.0% from the same quarter last year. The average NBSK benchmark pulp price for China increased to US$690 per tonne compared to the previous quarter.

Operational Performance

The following chart summarizes the operating performance of our pulp segment:

| * | Average delivered cash costs per tonne consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A and restructuring costs. Average delivered cash costs per tonne before specific items consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A, but excluding the impact of restructuring costs. |

Q2 2012 vs. Q2 2011

| — | Sales volume decreased by 1,900 tonnes compared to the same quarter last year. |

| — | Average sales revenue decreased $173 per tonne due to lower average transaction prices in the current quarter, partially offset by the positive impact of a weaker Canadian dollar. Weak pulp prices in 2012 reflect soft demand and excess inventory in China. |

| — | Average delivered cash costs increased by $41 per tonne due to higher maintenance spending and a lower-of-cost-or-market (LCM) adjustment to inventory in the quarter, partially offset by lower chip prices. The higher maintenance spending reflected a maintenance outage originally scheduled for the first quarter that was delayed and taken in the second quarter of 2012. |

2012 YTD vs. 2011 YTD

| —· | Sales volume increased by 14,900 tonnes due to increased production and the inclusion of an 8,000 tonne shipment in current year that was delayed in December 2011. |

| — | Average sales revenue decreased $164 per tonne due to lower average transaction prices, partially offset by the positive impact of a weaker Canadian dollar. |

| — | Average delivered cash costs decreased $47 per tonne due to lower chip prices and labour costs, partially offset by the incurrence of restructuring costs in 2012. |

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 17 ~ |

| 3. | LIQUIDITY AND CAPITAL RESOURCES |

Selected Financial Information

| | | Three months

ended June 30, | | | Six months

ended June 30, | |

| (In millions of Canadian dollars, except where otherwise stated) | | 2012 | | | 2011 | | | Change | | | 2012 | | | 2011 | | | Change | |

| Cash flows provided (used) by operations before changes in non-cash working capital | | $ | (3.2 | ) | | $ | (30.1 | ) | | $ | 26.9 | | | $ | (3.4 | ) | | $ | (35.9 | ) | | $ | 32.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Changes in non-cash working capital | | | (5.0 | ) | | | 14.4 | | | | (19.4 | ) | | | (19.5 | ) | | | 7.2 | | | | (26.7 | ) |

| Cash flows provided (used) by | | | | | | | | | | | | | | | | | | | | | | | | |

| Operations | | | (8.2 | ) | | | (15.7 | ) | | | 7.5 | | | | (22.9 | ) | | | (28.7 | ) | | | 5.8 | |

| Investing activities | | | 14.2 | | | | (5.2 | ) | | | 19.4 | | | | (2.8 | ) | | | (7.8 | ) | | | 5.0 | |

| Financing activities | | | (7.5 | ) | | | (2.7 | ) | | | (4.8 | ) | | | 18.4 | | | | (28.7 | ) | | | 47.1 | |

| Capital spending | | | 3.0 | | | | 5.6 | | | | (2.6 | ) | | | 4.9 | | | | 7.9 | | | | (3.0 | ) |

| Depreciation and amortization | | | 7.6 | | | | 27.0 | | | | (19.4 | ) | | | 15.5 | | | | 53.8 | | | | (38.3 | ) |

| Impairment (recovery) and other closure costs | | | – | | | | (0.3 | ) | | | 0.3 | | | | – | | | | (0.3 | ) | | | 0.3 | |

| Capital spending as % of depreciation and amortization | | | 39 | % | | | 21 | % | | | 18 | % | | | 32 | % | | | 15 | % | | | 17 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net debt to net capitalization at June 301 | | | 417 | % | | | 67 | % | | | 350 | % | | | 417 | % | | | 67 | % | | | 350 | % |

| 1 | Net debt ratio equals net debt (total debt less cash) divided by net capitalization (shareholder’s equity attributable to the company and total debt less cash). |

Refer to page 37 of our 2011 Annual Report for a discussion of the nature and sources of funding for our principal cash requirements.

Operating Activities

Cash flows from operating activities increased by $7.5 million in Q2 from the same quarter in the previous year, primarily due to an increase in EBITDA of $18.5 million and lower cash interest paid in the quarter, partially offset by reorganization expenses paid in the quarter, and an increase in non-cash working capital primarily due to increased accounts receivable and reduced accounts payable.

Investing Activities

Cash provided by investing activities was $14.2 million in Q2 compared to cash used of $5.2 million in the same quarter last year. This increase was largely due to reduced capital spending, a decrease in restricted cash and increased proceeds from the sale of fixed assets in the current quarter. Capital spending in the current period related primarily to maintenance of business projects.

Financing Activities

Cash used by financing activities in Q2 was $7.5 million compared to cash used of $2.7 million in the same quarter last year. This was primarily due to a $7.3 million repayment on our DIP Facility in the current quarter.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 18 ~ |

Capital Resources

Availability on the DIP Facility (ABL Facility for pre-filing periods) and total liquidity is summarized in the following table:

| | | DIP Facility | | | ABL Facility | |

| | | 2012 | | | 2011 | |

| (In millions of Canadian dollars) | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| | | | | | | | | | | | | | | | | | | |

| Borrowing base | | $ | 159.6 | 1 | | $ | 142.1 | 1 | | $ | 151.8 | 2 | | $ | 167.3 | 2 | | $ | 134.3 | 2 | | $ | 174.1 | 2 |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Letters of credit | | | (19.6 | ) | | | (17.8 | ) | | | (32.2 | ) | | | (27.7 | ) | | | (28.1 | ) | | | (25.5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Amount drawn, net | | | (70.5 | ) | | | (77.8 | ) | | | (48.0 | ) | | | (31.5 | ) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Minimum excess availability | | | (21.9) | 3 | | | – | | | | – | | | | – | | | | – | | | | (35.0 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Availability | | | 47.6 | | | | 46.5 | 4 | | | 71.6 | 4 | | | 108.1 | 4 | | | 106.2 | 4 | | | 113.6 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Cash on hand | | | 17.8 | | | | 19.3 | | | | 25.1 | | | | 17.8 | | | | 30.2 | | | | 53.8 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Restricted cash5 | | | 6.4 | | | | 2.1 | | | | – | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total liquidity | | $ | 71.8 | | | $ | 67.9 | | | $ | 96.7 | | | $ | 125.9 | | | $ | 136.4 | | | $ | 167.4 | |

| 1 | Borrowing base for the DIP Facility includes reserves of $2.7 million for pension, $3.6 million for employees, $2.0 million for landlord waivers, $1.5 million for insured receivables dilution, $2.0 million for credit insurance deductibles, and $1.5 million for CCAA charges in priority to DIP charge. |

| 2 | Borrowing base for the ABL Facility included a reserve of $0.4 million at December 31, 2011 for unpaid property taxes and associated penalties (Q3 2011 - $0.4 million, Q2 2011 - $4.5 million, Q1 2011 - $4.4 million). |

| 3 | The DIP Facility is subject to an excess availability condition as disclosed in our interim consolidated financial statements for the three and six months ended June 30, 2012 in note 14,Long-term debt. |

| 4 | Requirement to maintain a minimum fixed charge coverage ratio of 1.1/1.0 if excess availability falls below $21.9 million. |

| 5 | Restricted cash consists of $6.4 million in frozen proceeds on the sale of certain assets at our discontinued Elk Falls paper mill, our discontinued paper recycling operation and poplar plantation land. |

We had restricted cash on June 30, 2012 of $9.0 million, which included $2.6 million collateral against letters of credit, and $6.4 million in frozen proceeds on the sale of certain assets. Asset sales included $1.8 million at our discontinued Elk Falls paper mill, $1.0 million at our discontinued paper recycling operation, and $3.6 million poplar plantation land. The $2.6 million cash collateral, held at a rate of 105% of letters of credit formerly recognized under our ABL Facility but not presently recognized under our DIP Facility, is netted against letters of credit in the liquidity table above.

As disclosed in note 14,Long-term debt, in our interim consolidated financial statements for the three and six months ended June 30, 2012 the DIP Credit Agreement was amended in the quarter to include a new condition to maintain excess availability of no less than $21.9 million, replacing the former financial covenant that required us to maintain a minimum fixed charge coverage ratio of 1.1/1.0 if excess availability under the Facility fell below $21.9 million.

Our total liquidity decreased by $64.6 million from the same quarter last year primarily due to reduced cash on hand, the excess availability requirement under the DIP Facility (discussed above), and the significant amount drawn on our DIP Facility, partially offset by an increase in our borrowing base. Liquidity increased by $3.9 million compared to the previous quarter largely due to an increase in our borrowing base, and a decrease in the amount drawn on our DIP Facility, partially offset by the excess availability requirement in the current quarter. The borrowing base increased in the current quarter due to increased working capital levels at the end of June. The reduction in cash on hand was attributable primarily to the payment of reorganization costs and pension contributions that were applied against the solvency deficit on our pension plans.

At August 1, 2012 the company had 381,900,450 common shares issued and outstanding and 7,148,807 stock options for 7,148,807 common shares that at August 1, 2012 were exercisable.All existing common shares, options, warrants, rights and similar instruments of the company will be cancelled on emergence from the CCAA process.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 19 ~ |

Financial Instruments

Our financial instruments consist primarily of cash and cash equivalents, accounts receivable, accounts payable and accrued liabilities, long-term debt, and derivatives. Derivatives are used primarily to reduce exposure to currency risk on revenues, or occasionally debt, as well as price risk associated with revenue and energy costs.

For a description of the nature and extent of risk to the company from our financial instruments, as well as our respective accounting treatment of financial instruments, refer to our annual consolidated financial statements for the year ended December 31, 2011 note 25,Financial instruments. For the methods and assumptions we use to determine the fair value of financial instruments, refer to note 24,Fair value measurement, of those statements. Our methods and assumptions for determining the fair value of financial instruments have not changed materially since those used in the preparation of our consolidated financial statements for the year ended December 31, 2011.

We settled our foreign currency options in the quarter for proceeds of $2.4 million. At June 30, 2012 the company did not have any foreign currency or commodity contracts outstanding.

The following table reconciles the average spot exchange rate to our effective exchange rate and provides the impact to EBITDA related to the cash flow hedges that were in place as at March 31, 2010 and were designated as hedging instruments at that time:

US$/CDN$ FOREIGN EXCHANGE

| | | 2012 | | | 2011 | |

| | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Average Bank of Canada noon spot rate | | | 0.990 | | | | 0.999 | | | | 0.977 | | | | 1.020 | | | | 1.033 | | | | 1.015 | |

| (Favourable)/unfavourable impact of derivatives designated as effective hedges for accounting purposes1 | | | – | | | | – | | | | – | | | | – | | | | (0.001 | ) | | | (0.004 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Average effective rate included in EBITDA | | | 0.990 | | | | 0.999 | | | | 0.977 | | | | 1.020 | | | | 1.032 | | | | 1.011 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (Favourable)/unfavourable impact of derivatives, other than those designated as effective hedges for accounting purposes, included in other expenses2 | | | 0.001 | | | | 0.004 | | | | (0.004 | ) | | | 0.023 | | | | (0.002 | ) | | | (0.011 | ) |

| Foreign exchange (gain)/loss, on working capital balances, included in other expenses3 | | | (0.017 | ) | | | 0.017 | | | | 0.020 | | | | (0.043 | ) | | | 0.006 | | | | 0.007 | |

| Average effective rate in net earnings/(loss) before income taxes4 | | | 0.974 | | | | 1.020 | | | | 0.993 | | | | 1.000 | | | | 1.036 | | | | 1.007 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| (In millions of dollars) | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 Favourable/(unfavourable) impact of derivatives designated as effective hedges for accounting purposes included in EBITDA | | $ | – | | | $ | – | | | $ | 0.1 | | | $ | 0.2 | | | $ | 0.3 | | | $ | 0.9 | |

| 2 Favourable/(unfavourable) impact of derivatives other than those designated as effective hedges for accounting purposes included in other expenses | | | (0.2 | ) | | | (0.9 | ) | | | 0.9 | | | | (5.8 | ) | | | 0.3 | | | | 2.5 | |

| 3 Foreign exchange gain/(loss) on working capital balances included in other expenses | | | 3.9 | | | | (4.0 | ) | | | (4.9 | ) | | | 10.9 | | | | (1.2 | ) | | | (1.6 | ) |

| 4 Excludes foreign exchange gain/(loss) on long term debt and $US interest expense | | | | | | | | | | | | | | | | | | | | | | | | |

The company’s contingent liabilities at December 31, 2011 are described on page 41 of our 2011 Annual Report. For additional and updated information regarding the company’s contingent liabilities, refer to our interim consolidated financial statements for the three and six months ended June 30, 2012 note 22,Contingent liabilities. There were no significant changes in Q2 2012.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 20 ~ |

| 5. | SUMMARY OF QUARTERLY RESULTS |

The following table highlights selected financial information for the eight consecutive quarters ending June 30, 2012:

| | | 2012 | | | 2011 | | | 2010 | |

| (In millions of Canadian dollars, except per share amounts) | | Q2 | | | Q1 | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Q4 | | | Q3 | |

| Sales | | $ | 312.8 | | | $ | 315.8 | | | $ | 319.8 | | | $ | 340.3 | | | $ | 297.8 | | | $ | 303.6 | | | $ | 333.6 | | | $ | 322.3 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA1 | | | 14.6 | | | | 18.1 | | | | 2.8 | | | | 26.8 | | | | (3.9 | ) | | | 15.9 | | | | 28.7 | | | | 34.2 | |

| Net earnings (loss) attributable to the company | | | (11.7 | ) | | | (25.6 | ) | | | (708.0 | ) | | | (205.7 | ) | | | (47.4 | ) | | | (12.9 | ) | | | 9.6 | | | | 6.0 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Net earnings (loss) per share attributable to the company’s common shareholders | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – basic and diluted | | $ | (0.03 | ) | | $ | (0.07 | ) | | $ | (1.85 | ) | | $ | (0.54 | ) | | $ | (0.13 | ) | | $ | (0.03 | ) | | $ | 0.02 | | | $ | 0.02 | |

| 1 | Refer to section 6,Non-GAAP measures. |

Refer to section 1,Overview and highlights, and the discussion onConsolidated results of operations,for details of Q2 2012 results compared to Q1 2012.

For summary financial information about Powell River Energy Inc., a variable interest entity for which we are the primary beneficiary, refer to note 6,Variable interest entities, of our interim consolidated financial statements for the three and six months ended June 30, 2012.

Management uses certain measures that are not defined by U.S. GAAP to evaluate our performance and, as a result, the measures as employed by management may not be comparable to similarly titled measures reported by other entities. These non-GAAP measures should not be considered by an investor as an alternative to their nearest respective GAAP measure. Our non-GAAP measures include operating earnings (loss), EBITDA (earnings before interest, taxes, depreciation and amortization, impairment and other closure costs, and before other non-operating income and expenses), EBITDA before restructuring costs, EBITDA margin, EBITDA margin before restructuring costs, average delivered cash costs per tonne before specific items, net earnings (loss) attributable to the company before specific items, net earnings (loss) per share attributable to the company’s common shareholders before specific items, and free cash flow.

Specific items are items of an unusual or non-recurring nature, or items that are subject to material volatility based on factors outside of management’s control. Specific items include: foreign exchange gain or loss on long-term debt; gain or loss on cancellation of long-term debt; asset-impairment and other closure costs; restructuring costs; unusual non-recurring items; and certain income tax adjustments.

| CATALYST PAPER 2012 SECOND QUARTER REPORT | MANAGEMENT’S DISCUSSION AND ANALYSIS | ~ 21 ~ |

EBITDA and EBITDA before restructuring costs

EBITDA as defined equates to operating earnings (loss) plus depreciation and amortization and impairment and other closure costs. EBITDA margin and EBITDA margin before restructuring costs are defined as EBITDA and EBITDA before restructuring costs as a percentage of sales. These measures enable comparison of consolidated and segment operating results between periods without regard to debt service, income taxes, capital expenditure requirements, and specific items.

Reconciliation to Net Earnings (Loss) Attributable to the Company:

| | | 2012 | | | 2011 | |

| (In millions of Canadian dollars) | | YTD | | | Q2 | | | Q1 | | | Total | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Net earnings (loss) attributable to the company | | $ | (37.3 | ) | | $ | (11.7 | ) | | $ | (25.6 | ) | | $ | (974.0 | ) | | $ | (708.0 | ) | | $ | (205.7 | ) | | $ | (47.4 | ) | | $ | (12.9 | ) |

| Net earnings (loss) attributable to non-controlling interest | | | (0.8 | ) | | | (0.6 | ) | | | (0.2 | ) | | | (2.6 | ) | | | (2.3 | ) | | | – | | | | (0.3 | ) | | | – | |

| Net earnings (loss) | | | (38.1 | ) | | | (12.3 | ) | | | (25.8 | ) | | | (976.6 | ) | | | (710.3 | ) | | | (205.7 | ) | | | (47.7 | ) | | | (12.9 | ) |

| Depreciation and amortization | | | 15.5 | | | | 7.6 | | | | 7.9 | | | | 112.4 | | | | 30.8 | | | | 27.8 | | | | 27.0 | | | | 26.8 | |

| Impairment (recovery) and other closure costs | | | – | | | | – | | | | – | | | | 823.6 | | | | 673.3 | | | | 150.6 | | | | (0.3 | ) | | | – | |

| Foreign exchange (gain) loss on long-term debt | | | 1.2 | | | | 12.8 | | | | (11.6 | ) | | | 9.7 | | | | (14.0 | ) | | | 41.0 | | | | (5.1 | ) | | | (12.2 | ) |

| Loss on Snowflake fire | | | – | | | | – | | | | – | | | | 4.4 | | | | 0.3 | | | | – | | | | 4.1 | | | | – | |

| Loss on Powell River fire | | | – | | | | – | | | | – | | | | 2.4 | | | | 0.8 | | | | – | | | | 1.6 | | | | – | |

| Other (income) expense | | | (5.6 | ) | | | (10.3 | ) | | | 4.7 | | | | (0.3 | ) | | | 4.1 | | | | (5.6 | ) | | | 0.7 | | | | 0.5 | |

| Interest expense, net | | | 44.0 | | | | 23.4 | | | | 20.6 | | | | 73.4 | | | | 18.4 | | | | 19.0 | | | | 18.7 | | | | 17.3 | |

| Income tax expense (recovery) | | | (0.7 | ) | | | (0.6 | ) | | | (0.1 | ) | | | (7.4 | ) | | | (0.6 | ) | | | (0.3 | ) | | | (2.9 | ) | | | (3.6 | ) |

| Reorganization items, net | | | 16.4 | | | | (6.0 | ) | | | 22.4 | | | | – | | | | – | | | | – | | | | – | | | | – | |

| EBITDA | | $ | 32.7 | | | $ | 14.6 | | | $ | 18.1 | | | $ | 41.6 | | | $ | 2.8 | | | $ | 26.8 | | | $ | (3.9 | ) | | $ | 15.9 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Restructuring costs | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty printing papers | | | 2.3 | | | | (0.1 | ) | | | 2.4 | | | | 3.5 | | | | 3.5 | | | | – | | | | – | | | | – | |

| Newsprint | | | 1.5 | | | | – | | | | 1.5 | | | | 1.5 | | | | 1.5 | | | | – | | | | – | | | | – | |

| Pulp | | | 1.3 | | | | – | | | | 1.3 | | | | 0.9 | | | | 0.9 | | | | – | | | | – | | | | – | |

| Total restructuring costs | | | 5.1 | | | | (0.1 | ) | | | 5.2 | | | | 5.9 | | | | 5.9 | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| EBITDA before restructuring costs | | $ | 37.8 | | | $ | 14.5 | | | $ | 23.3 | | | $ | 47.5 | | | $ | 8.7 | | | $ | 26.8 | | | $ | (3.9 | ) | | $ | 15.9 | |