catalyst paper corporation

MANAGEMENT’S DISCUSSION AND ANALYSIS

Management’s Discussion and Analysis

The following management’s discussion and analysis (MD&A) of Catalyst Paper Corporation (the company, we, us, and our) should be read in conjunction with our consolidated financial statements for the years ended December 31, 2013, 2012 and 2011, and the notes thereto, which have been prepared in accordance with generally accepted accounting principles (GAAP) in the United States (U.S.). Additional information about the company, including our most recent Annual Information Form is available on our website atwww.catalystpaper.com, or the Canadian Securities Administrators’ electronic filing website atwww.sedar.com.

Throughout this discussion, references are made to certain measures that are not measures of performance under U.S. GAAP, including operating earnings, adjusted EBITDA, adjusted EBITDA before restructuring costs, average delivered cash costs per tonne before specific items, net earnings (loss) attributable to the company before specific items, net earnings (loss) per share attributable to the company’s common shareholders before specific items, and free cash flow. We believe that these non-GAAP measures are useful in evaluating our performance. These non-GAAP measures are defined and reconciled to their nearest GAAP measure in section 12,Non-GAAP measures.

In this MD&A, unless otherwise indicated, all dollar amounts are expressed in Canadian dollars. The term “dollars” and the symbols “$” and “CDN$” refer to Canadian dollars and the term “U.S. dollars” and the symbol “US$” refer to United States dollars.

In this MD&A, the term “tonne” and the symbol “MT” refer to a metric tonne and the term “ton” or the symbol “ST” refer to a short ton, a measure of weight equal to 0.9072 metric tonne. Use of these symbols is in accordance with industry practice.

The information in this report is as at March 4, 2014, which is the date of filing in conjunction with our press release announcing our results for the fourth quarter of 2013 and 12 months ended December 31, 2013. Disclosure contained in this document is current to March 4, 2014, unless otherwise stated.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements and information in this MD&A are not based on historical facts and constitute forward-looking statements or forward-looking information within the meaning of Canadian securities laws and the U.S. Private Securities Litigation Reform Act of 1995 (forward-looking statements), including but not limited to, statements about our strategy, plans, future operating performance, contingent liabilities and outlook.

Forward-looking statements:

| · | Are statements that address or discuss activities, events or developments that we expect or anticipate may occur in the future; |

| · | Can be identified by the use of words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “likely”, “predicts”, “estimates”, “forecasts”, and similar words or phrases or the negative of such words or phrases; |

| · | Reflect our current beliefs, intentions or expectations based on certain assumptions and estimates, including those identified below, which could prove to be significantly incorrect: |

| – | Our ability to develop, manufacture and sell new products and services that meet the needs of our customers and gain commercial acceptance; |

| – | Our ability to continue to sell our products and services in the expected quantities at the expected prices and expected times; |

| – | Our ability to successfully obtain cost savings from our cost reduction initiatives; |

| – | Our ability to implement business strategies and pursue opportunities; |

| – | Expected cost of goods sold; |

| – | Expected component supply costs and constraints; |

| – | Expected foreign exchange and tax rates. |

| · | While considered reasonable by management, are inherently subject to known and unknown risks and uncertainties and other factors that could cause actual results or events to differ from historical or anticipated results or events. These risk factors and others are discussed in this MD&A. Certain of these risks are: |

| – | The impact of general economic conditions in the countries in which we do business; |

| – | Conditions in the capital markets and our ability to obtain financing and refinance existing debt; |

| – | Market conditions and demand for our products (including declines in advertising and circulation); |

| – | The implementation of trade restrictions in jurisdictions where our products are marketed; |

| – | Fluctuations in foreign exchange or interest rates; |

| – | Raw material prices (including wood fibre, chemicals and energy); |

| – | The effect of, or change in, environmental and other governmental regulations; |

| – | Uncertainty relating to labour relations; |

| – | The availability of qualified personnel; |

| – | The availability of wood fibre; |

| – | The effects of competition from domestic and foreign producers; |

| – | The risk of natural disaster and other factors, many of which are beyond our control. |

As a result, no assurance can be given that any of the events or results anticipated by such forward-looking statements will occur or, if they do occur, what benefit they will have on our operations or financial condition. Readers are cautioned not to place undue reliance on these forward-looking statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Management’s Discussion and Analysis

| 1. | Company Profile | 4 |

| | | |

| 2. | Annual Overview - 2013 | 5 |

| | | |

| 3. | Strategy | 10 |

| | | |

| 4. | Consolidated Results - Annual | 16 |

| | | |

| 5. | Segmented Results - Annual | 18 |

| | | |

| 6. | Consolidated and Segmented Results - Quarterly | 24 |

| | | |

| 7. | Financial Condition | 29 |

| | | |

| 8. | Liquidity and Capital Resources | 30 |

| | | |

| 9. | Contingent Liabilities | 33 |

| | | |

| 10. | Off-Balance Sheet Arrangements | 33 |

| | | |

| 11. | Summary of Quarterly Results | 34 |

| | | |

| 12. | Non-GAAP Measures | 34 |

| | | |

| 13. | Critical Accounting Policies and Estimates | 38 |

| | | |

| 14. | Changes in Accounting Policies | 42 |

| | | |

| 15. | Impact of Accounting Pronouncements Affecting Future Periods | 43 |

| | | |

| 16. | Risks and Uncertainties | 43 |

| | | |

| 17. | Governance and Management Systems | 50 |

| | | |

| 18. | Sensitivity Analysis | 50 |

| | | |

| 19. | Outlook | 51 |

| | | |

| 20. | 2014 Key Objectives | 53 |

| | | |

| 21. | Disclosure Controls and Internal Control over Financial Reporting | 53 |

We are the largest producer of mechanical printing papers in western North America. We also produce Northern Bleached Softwood Kraft (NBSK) pulp which is marketed primarily in Asia. Our business is comprised of three business segments: specialty printing papers, newsprint, and pulp. Specialty printing papers include coated mechanical, uncoated mechanical and directory paper. We are the only producer of coated mechanical paper and soft-calender (SC) paper in western North America. We operate three paper mills in British Columbia (B.C.) in Crofton, Port Alberni and Powell River. Our Crofton mill includes a two-line kraft pulp operation.

Our products are sold by our sales and marketing personnel in North America and through distributors and agents in other geographic markets. These products are shipped by a combination of rail, truck, and barge for customers located in North America and by break-bulk and deep-sea container vessels for customers located overseas.

Specialty Printing Papers

Our largest business segment is specialty printing papers, which generated 61% of 2013 consolidated sales revenue; our papers are sold to a diversified customer base consisting of retailers, magazine and catalogue publishers, commercial printers and telephone directory publishers. In 2013, 89% of specialty printing papers sales volume was sold to customers in North America.

Newsprint

Newsprint sales generated 18% of 2013 consolidated sales revenue. The newsprint customer base consists primarily of newspaper publishers located in western and central North America, Asia and Latin America. In 2013, 44% of newsprint sales volume was sold to customers in North America.

Pulp

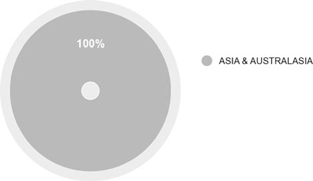

Pulp sales generated 21% of 2013 consolidated sales revenue. The pulp customer base is located primarily in Asia and includes producers of tissue, magazine papers, wood-free printing and writing papers, and certain specialty printing paper products. In 2013, 100% of pulp sales volume was sold to customers in Asia. The Crofton pulp mill is located on tidewater and has a deep-sea vessel loading facility which provides a competitive advantage shipping direct to Asian markets.

2014 Product Applications

| Segment | | Specialty Printing Papers | | Newsprint | | Market Pulp | |

| | | Uncoated Mechanical | | | | | | | | | |

| Category | | Soft-

calendered | | Machine-

finished | | Coated

Mechanical | | Directory | | Newsprint | | NBSK Pulp | |

| Brand names | | Electracal

Electraprime | | Electrabrite

Electrabrite Lite Electrastar

Electra Max

Electrabrite Book | | Electracote

Electracote Brite

Pacificote

Ascent | | Catalyst | | Marathon

Marathon Lite | | Crofton Kraft | |

| Basis weight (g/m2) | | 45 – 52 | | 45 – 74 | | 47.3-74 | | 29 – 40 | | 40 – 48.8 | | n/a | |

| Applications | | retail inserts,

magazines,

catalogues,

flyers,

direct mail, directories | | retail inserts, magazines, supplements, flyers, direct mail, books, corporate communication

books/manuals | | retail inserts,

magazines,

catalogues,

direct mail | | telephone books,

catalogues | | newspapers,

retail inserts, flyers,

supplements,

directories | | tissue,

printing and writing papers,

specialty paper products,

containerboard | |

| Total capacity (tonnes) | | 469,0001 | | 224,000 | | 116,0001 | | 349,0001 | | 355,0002 | |

| % of total capacity | | 31% | | 15% | | 8% | | 23% | | 23% | |

2014 Capacity by Mill Location and Product Line1

| | | | | Specialty Printing Papers 1 | | Newsprint 1 | | Market Pulp | | Total | |

| Mill Location | | Number

Of Paper

Machines | | Uncoated

Mechanical | | Coated

Mechanical | | Directory | | Newsprint | | NBSK Pulp | | | |

| Crofton, B.C. 3 | | 2 | | – | | – | | – | | 349,000 | | 355,000 | 2 | 704,000 | |

| Port Alberni, B.C. | | 2 | | – | | 224,000 | | 116,000 | | – | | – | | 340,000 | |

| Powell River, B.C. | | 3 | | 469,000 | | – | | – | | – | | – | | 469,000 | |

| Total capacity (tonnes) | | 7 | | 469,000 | | 224,000 | | 116,000 | | 349,000 | | 355,000 | | 1,513,000 | |

| % of total capacity | | | | 31 | % | 15 | % | 8 | % | 23 | % | 23 | % | 100 | % |

| 1 | Capacities expressed in the above tables can vary as we are able to switch production between products, particularly newsprint, directory and machine-finished uncoated grades. |

| | |

| 2 | Total pulp capacity at Crofton is 393,000 tonnes, of which 355,000 tonnes are designated as market pulp with the remaining 38,000 tonnes being consumed internally. |

| | |

| 3 | No. 1 paper machine at Crofton remains indefinitely curtailed. |

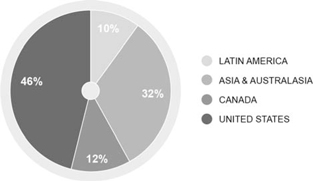

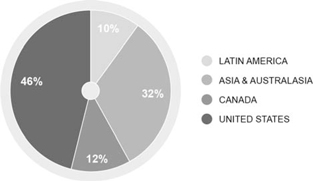

Geographic sales distribution

Total Geographic Sales Distribution

(% tonnes)

Our products are sold globally. North America continues to be our principal market, comprising 58% of consolidated sales volume for 2013.

Business overview

Operating earnings for the year declined due to reduced paper sales, lower average transaction prices for all paper segments and higher manufacturing costs. This was partially offset by better pulp sales volumes and pricing, and the positive impact of a weaker Canadian dollar. Total sales volumes were down primarily due to a shortfall in our production volumes resulting from a number of unforeseen maintenance events and start-up issues related to our major maintenance outages in the year.

Manufacturing costs crept higher due to significantly higher electric power cost and increased maintenance and labour spending. Power cost increased due to rate increases by BC Hydro as well as the reinstitution of provincial sales tax. These cost increases were partially offset by power sales generated by the G12 steam turbine generator located at our Powell River mill.

We completed the sale of most of our non-core assets in the year, including the Snowflake mill, our interest in Powell River Energy, the Elk Falls site, and the Port Alberni wastewater treatment facility, for total proceeds of $51.4 million. We also completed the partial settlement of our defined benefit plan for salaried employees (Salaried Plan) under the special portability election option.

Financial Performance

We recorded a net loss attributable to the company of $127.6 million and a net loss attributable to the company before specific items of $31.5 million in 2013. This compared to a net gain of $583.2 million in 2012, reflecting the impact of reorganization under creditor protection proceedings, and a net loss attributable to the company before specific items of $37.8 million.

Significant specific items in 2013 included reorganization costs related to finalizing the creditor protection proceedings, a net gain on the sale of non-core assets including the Snowflake mill, our interest in Powell River Energy and the Elk Falls site, a settlement gain on our Salaried Plan under the special portability election option, a loss on the purchase of floating rate senior secured notes due 2016 (Exit Notes), an impairment charge on goodwill and fixed assets, and a foreign exchange loss on the translation of U.S. dollar denominated debt.

Significant specific items in the prior year included reorganization credits related to the forgiveness of pre-petition debt and accounts payable and fair value adjustments from the implementation of fresh start accounting, reorganization expenses related to legal and consulting fees, restructuring fees incurred prior to entering creditor protection, closure costs related to the discontinued Snowflake mill, and a foreign exchange gain on the translation of U.S. dollar denominated debt.

Selected Annual Financial Information

| (In millions of dollars, except where otherwise stated) | | 2013 | | | 2012 | | | 2011 | |

| Sales2 | | $ | 1,051.4 | | | $ | 1,058.2 | | | $ | 1,079.7 | |

| Operating earnings (loss)2 | | | (87.8 | ) | | | 19.1 | | | | (704.5 | ) |

| Depreciation and amortization2 | | | 47.0 | | | | 36.3 | | | | 105.5 | |

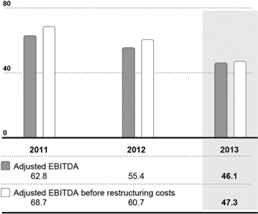

| Adjusted EBITDA1,2 | | | 46.1 | | | | 55.4 | | | | 62.8 | |

| − before restructuring costs1,2 | | | 47.3 | | | | 60.7 | | | | 68.7 | |

| Net earnings (loss) attributable to the company | | | (127.6 | ) | | | 583.2 | | | | (974.0 | ) |

| − before specific items1 | | | (31.5 | ) | | | (37.8 | ) | | | (126.3 | ) |

| Total assets | | | 700.1 | | | | 978.8 | | | | 737.6 | |

| Total long-term liabilities | | | 565.5 | | | | 720.6 | | | | 713.6 | |

| Adjusted EBITDA margin1,2 | | | 4.4 | % | | | 5.2 | % | | | 5.8 | % |

| − before restructuring costs1,2 | | | 4.5 | % | | | 5.7 | % | | | 6.4 | % |

| Net earnings (loss) per share attributable to the company’s common shareholders (in dollars) | | | | | | | | | | | | |

| − basic and diluted from continuing operations3 | | $ | (9.01 | ) | | $ | 41.65 | | | $ | (2.04 | ) |

| − basic and diluted from discontinued operations 3 | | | 0.21 | | | | (1.15 | ) | | | (0.51 | ) |

| − before specific items 3 | | | (2.17 | ) | | | (2.62 | ) | | | (0.33 | ) |

| (In thousands of tonnes) | | | | | | | | | | | | |

| Sales2 | | | 1,373.3 | | | | 1,401.4 | | | | 1,351.2 | |

| Production2 | | | 1,382.6 | | | | 1,388.6 | | | | 1,365.1 | |

| Common shares (millions) | | | | | | | | | | | | |

| At period-end3 | | | 14.5 | | | | 14.5 | | | | 381.9 | |

| Weighted average3 | | | 14.5 | | | | 14.4 | | | | 381.9 | |

| 1 | Refer to section 12, Non-GAAP measures. |

| | |

| 2 | Numbers exclude the Snowflake mill’s results from operations which have been reclassified as discontinued operations; earnings from discontinued operations, net of tax, are shown separately from continuing operations in the consolidated statements of earnings (loss) in our annual consolidated financial statements for the year ended December 31, 2013. |

| | |

| 3 | Earnings per share data for periods ended on and subsequent to September 30, 2012 were based on the weighted average common shares issued pursuant to our reorganization under CCAA. Earnings per share data for periods prior to September 30, 2012 were based on the weighted average common shares outstanding prior to emergence from the creditor protection proceedings. These shares were cancelled on September 13, 2012. |

Market Overview

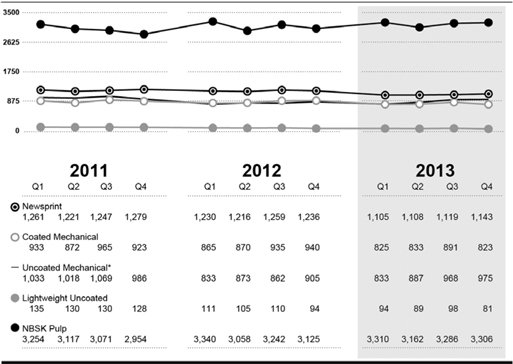

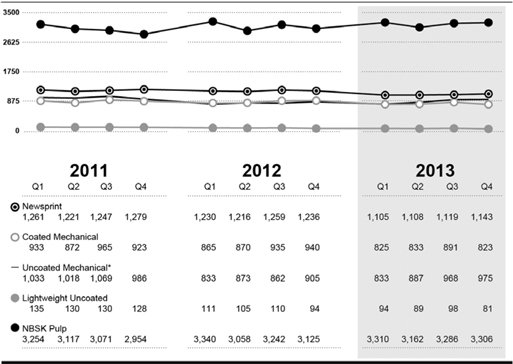

North American Paper Demand and NBSK Pulp Shipments

(in thousands of metric tonnes)

(Source: PPPC)

* Uncoated mechanical is comprised of high-gloss and standard grades.

North American demand decreased for all paper grades in 2013 except for uncoated mechanical. After a slow start, demand for uncoated mechanical increased significantly in the second half of the year. The decline in North American demand was most significant for directory and newsprint. Strong exports to Asia, however, partly compensated for weak domestic newsprint demand. Compared to 2012, inventory levels at the end of 2013 increased for lightweight coated (LWC) and uncoated mechanical, remained flat for newsprint and declined for directory. Average benchmark prices for the year were down for all paper segments compared to the prior year. Prices and operating rates for uncoated paper recovered in the second half of the year due to stronger market conditions.

The global market for NBSK pulp increased due to increased demand in China. NBSK pulp benchmark prices for China increased in 2013.

Organizational Changes

Joe Nemeth was appointed President, Chief Executive Officer, and director of the company effective October 1, 2013.Leslie T. Lederer, who held this position on an interim basis with the departure of Kevin J. Clarke at the end of June 2013, continues as a director and Chairman of the Board of directors.

On November 21, 2013, we began implementing a decision to reduce the size of the executive team by three positions in accordance with the company’s plan to improve operational efficiency and cost competitiveness.

On June 24, 2013, Jill Leversage was appointed to, and Giorgio Caputo resigned from, the Board of directors.

Asset Sales

During 2013, we completed the sale of a number of non-core assets, including:

| · | Sale of interest in Powell River Energy |

On March 20, 2013 we completed the sale of our 50% interest in Powell River Energy Inc (PREI), and Powell River Energy Limited Partnership (collectively “Powell River Energy”) for $33.0 million. Electricity generated by PREI will continue to be sold to the company under the existing power purchase agreement which expires in 2016 with extension to 2021 in one-year renewal term increments at the option of the company. Under the company’s plan of arrangement (Plan) under theCompanies’ Creditors Arrangement Act(CCAA),approximately $12.7 million of the net proceeds of the sale were distributed to unsecured creditors who, pursuant to our restructuring under the Plan, did not elect to receive shares in settlement of their claims. The company made an offer to purchase US$20.0 million of its Exit Notes with the balance of the net proceeds. See “Purchase of Exit Notes”.

On January 30, 2013 we completed the U.S. Court approved sale of the assets of the closed Snowflake facility and the shares of The Apache Railway Company to a third party for US$13.5 million and other non-monetary consideration. The Snowflake facility permanently closed on September 30, 2012.

On May 24, 2013 we completed the sale of our Elk Falls industrial site and related assets for proceeds of $8.6 million to Quicksilver Resources Canada Inc. The pulp and paper mill which formerly operated at Elk Falls was indefinitely curtailed in 2009 and permanently closed in 2010.

| · | Sale of Port Alberni Wastewater Treatment Facility |

On September 30, 2013 we completed the sale of a wastewater treatment facility and related infrastructure to the City of Port Alberni for proceeds of $5.8 million. The sale included the 13.4 hectare wastewater treatment facility and 3.9 hectare parcel of lands combined with a road dedication to facilitate development of an industrial truck route along the waterfront. We received $5.0 million of the proceeds on September 30, 2013 and will receive $0.8 million in September 2014.

We have agreed to settle the mortgage receivable due from PRSC Limited Partnership and sell our interest in PRSC Land Developments Ltd. for approximately $3.0 million and continue to work toward completion of that transaction. We also continue to actively market our remaining poplar plantation land.

Special Portability Election

Under a special portability election option we offered members of our Salaried Plan a one-time reduced lump sum payment option as full settlement of their entitlements under the plan. Members had to make their elections by no later than December 15, 2012 and had until June 30, 2013 to revoke their elections in favour of continuing to receive monthly pension payments. 285 plan members representing $38.3 million of reduced lump-sum value (representing $59.6 million of commuted value as described below) maintained their elections. Lump-sum payments were funded in July 2013 from plan assets.

Members who exercised the election received reduced lump-sum payments calculated as the commuted value of future pension payments multiplied by the solvency ratio of the plan on December 31, 2012. In addition, these members will receive quarterly top-up payments over the next four years totaling 8% of their commuted value. Commuted value is the amount a plan member needed to invest on December 31, 2012 to provide for future pension benefits, incorporating an interest rate based on Government of Canada bonds.

Implementation of the special portability option resulted in a reduction of approximately $21 million in the plan’s solvency deficit as at December 31, 2012. The company’s contribution to the solvency deficit of the plan and top-up payments for 2013 will total approximately $4 million.The lump-sum payments represented a partial settlement of the Salaried Plan in the third quarter. Seesection13, Critical Accounting Policies and Estimatesfor a description of the accounting impact of the partial settlement of the Salaried Plan on our financial results.

Adjustment to carrying value of long-lived assets

On December 31, 2013 we wrote down the full carrying value of our goodwill by $56.7 million and the carrying value of our buildings, plant and equipment by $30.2 million due to the need to record an asset impairment charge required by accounting rules under U.S. GAAP. Potential impairment indicators that led to this adjustment included declines in current and forecasted paper prices and announced rate increases in future electric power purchases that may negatively impact future operating costs and profitability.

The total earnings projections of our mills as at December 31, 2013 used in the impairment calculation were higher than the earnings projections as at September 30, 2012 used for fresh start accounting; however, accounting rules under U.S. GAAP require downward adjustments, but do not allow upward adjustments, on fixed asset values.The reduction in carrying values were to the fixed assets of our Powell River and Port Alberni mills due in part to reduced pricing forecast for specialty paper as compared to pricing forecasts in 2012 that were utilized when we assigned fair values to our assets under fresh start accounting. Conversely, the impact of stronger current and forecasted pricing for newsprint and pulp and forecasted currency weakness supported a higher fair value for the Crofton pulp and paper mills than the fair value established under fresh start accounting in 2012.

Refer to section 13Critical accounting policies and estimates for a description of the assumptions and estimates used to calculate this impairment charge.

Successful Appeal of Sales Tax Reassessment

On January 28, 2014, the Supreme Court of British Columbia ruled in favour of Catalyst Paper in our action against the Province of British Columbia involving a reassessment of the amount of sales tax payable under the Social Services Tax Act on electricity purchased from PREI in 2001 through 2010. We estimate that we will receive a sales tax refund of $5.8 million including interest. The Province of British Columbia has applied to the British Columbia Court of Appeal for leave to appeal this decision.

Purchase of Exit Notes

Holders of US$15.6 million of the Exit Notes accepted the offer made on March 26, 2013 to purchase up to US$20.0 million of the Exit Notes with the balance of net proceeds from the sale of our interest in PREI. On April 24, 2013, the company completed the purchase of US$15.6 million of Exit Notes at par plus accrued and unpaid interest.

Return to Provincial Sales Tax

On April 1, 2013, the Province of British Columbia reverted back to a provincial sales tax (PST) regime. The additional direct annualized cost to our business is estimated to be approximately $12 million, based on actual 2013 expenditures. Approximately $9 million of this increase relates to purchased electric power.

Listing of New Common Shares

On January 7, 2013, our new common shares were listed and began trading on the Toronto Stock Exchange (TSX) under the symbol “CYT”. The company initiated a small shareholder selling program that commenced on January 7, 2013 and ended February 28, 2013 that gave shareholders who held 99 or fewer new common shares the opportunity to sell their shares without incurring commission charges. The program was entirely voluntary and no recommendations were made by the company or its Board of Directors in respect of the sale of shares pursuant to the program.

Canadian Dollar

The chart below illustrates the movement of the US$/CDN$ average spot rate over the past three years:

US$ / CDN$ Foreign Exchange Rates

(Average Spot Rate)

US$/CDN$ Exchange

| | | 2011 | | | 2012 | | | 2013 | |

| | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Q1 | | | Q2 | | | Q3 | | | Q4 | | | Q1 | | | Q2 | | | Q3 | | | Q4 | |

| Average spot rate | | | 1.015 | | | | 1.033 | | | | 1.020 | | | | 0.977 | | | | 0.999 | | | | 0.990 | | | | 1.005 | | | | 1.009 | | | | 0.992 | | | | 0.977 | | | | 0.963 | | | | 0.953 | |

| Average effective rate | | | 1.011 | | | | 1.032 | | | | 1.020 | | | | 0.977 | | | | 0.999 | | | | 0.990 | | | | 1.005 | | | | 1.009 | | | | 0.992 | | | | 0.977 | | | | 0.963 | | | | 0.953 | |

| Period-end spot rate | | | 1.029 | | | | 1.037 | | | | 0.963 | | | | 0.983 | | | | 1.001 | | | | 0.981 | | | | 1.017 | | | | 1.005 | | | | 0.985 | | | | 0.951 | | | | 0.972 | | | | 0.940 | |

The majority of our sales are denominated in U.S. dollars. The Canadian dollar weakened in 2013 and traded below par against the U.S. dollar. There was no difference between our average effective exchange rate and the average spot rate in 2013. The US$/CDN$ exchange rate movement in 2013 compared to 2012 resulted in a positive variance of $27.6 million on revenue and a positive variance of $21.1 million on adjusted EBITDA. Year-end spot rate movement resulted in an after-tax foreign exchange loss of $18.8 million on the translation of U.S. dollar denominated debt in 2013, compared to an after-tax foreign exchange gain of $20.8 million in 2012. We have a program in place to hedge a portion of our anticipated U.S. dollar sales, although, effective April 1, 2010, we no longer designate the positions as hedges for accounting purposes. At December 31, 2013 we did not have any foreign currency options or forward contracts outstanding. Refer to our annual consolidated financial statements for the year ended December 31, 2013 note 27,Financial instruments, for additional details.

Our objective is to return to profitability and maximize cash flows through capital restructuring, reduced manufacturing costs and optimizing our brands and customer base.

2013 Performance Metrics

The following performance drivers were identified as key to achieving our strategic goals and creating value for our investors in 2013:

| 1. | Financial performance and flexibility |

Our ability to generate adequate liquidity and establish an appropriate capital structure enables us to maintain our operations, finance growth and service our debt and other obligations.

Key objectives

| · | Complete outstanding restructuring items and use proceeds of assets sales to pay down debt. |

| · | Reduce operating costs, and focus on generating positive free cash flow. |

| · | Complete special portability option program developed to deal with the salaried pension deficit. |

Key performance indicators

Key metrics to measure our ability to generate operating income and implement cost reduction initiatives include:

| · | Adjusted EBITDA and adjusted EBITDA before restructuring costs1. |

| · | Average delivered cash costs per tonne and average delivered cash costs per tonne before specific items1. |

1 Refer to section 12,Non-GAAP measures, for definitions of these measures.

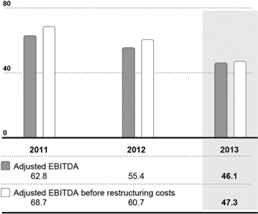

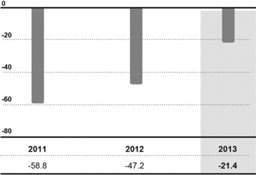

Adjusted EBITDA and Adjusted EBITDA Before Restructuring Costs

(in millions of dollars)

Excludes Snowflake’s results

Achievements

| · | Adjusted EBITDA declined in 2013 mostly due to lower sales volumes and average transaction prices for paper, and increased maintenance, labour and electric power cost. This was partially offset by increased pulp pricing and sales, and the positive impact of a weaker Canadian dollar. |

| · | Completed non-core asset sales in 2013 for proceeds of $51.4 million including the Snowflake mill, our interest in PREI, the Elk Falls site, the Port Alberni wastewater treatment facility, and poplar plantation land. |

| · | Purchased US$15.6 million Exit Notes from the net proceeds from the sale of our interest in PREI. |

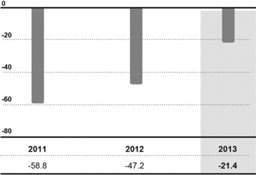

Free Cash Flow

(in millions of dollars)

| · | Free cash flow for the year was negative $21.4 million. Free cash flow was positive for the last two quarters of the year and improved compared to the prior year due to reduced reorganization costs and lower expenses related to discontinued operations, partially offset by lower adjusted EBITDA and higher cash interest expense. |

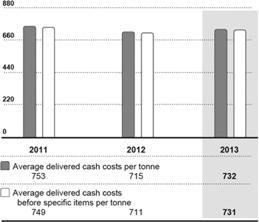

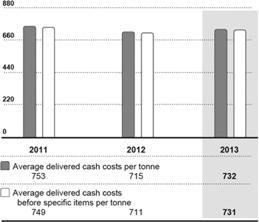

Average Delivered Cash Costs

($/tonne)

Excludes Snowflake’s results

| · | Operating costs in 2013 were negatively impacted by a number of unforeseen maintenance and operational events. |

| · | Power cost increased significantly due to rate increases by BC Hydro and the reinstitution of PST, partially offset by increased power sales. |

| · | Prior to the sale of our interest in PREI we consolidated PREI’s results, thereby recognizing the adjusted EBITDA generated by PREI from power sales as a reduction to our consolidated operating costs (see discussion below the heading “Variable Interest Entities” under section 13,Critical Accounting Policies and Estimates). With the sale of our interest in PREI on March 20, 2013, adjusted EBITDA generated by PREI is no longer included. |

| · | Capital spending for the year was $23.4 million which included $16.0 million for maintenance of business. Prior year capital spending of $22.6 million included $16.1 million for maintenance of business. |

| · | Completed the special portability option program. Elections under the program were finalized by June 30, 2013, and lump-sum payments were distributed to members exiting the plan in July. |

| 2. | Optimizing brands, customer base and sales reach |

Shifting our production mix to higher value grades, capturing a bigger share of the market, penetrating new markets and diversifying our product mix to manage fluctuations in demand to ensure that we remain competitive in a challenging marketplace.

Product Mix

Key objectives

| · | Increase breadth of product range and solidify position as the most flexible and diverse producer and marketer of paper in the West. |

Key performance indicators

| · | Key metrics include average sales revenue per tonne. Further details on 2013 results are provided in section 4,Consolidated results – annual,section 5,Segmented results – annual,and section 6,Consolidated and segmented results – quarterly. |

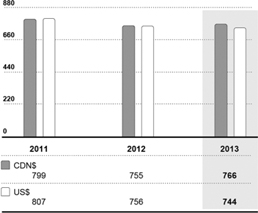

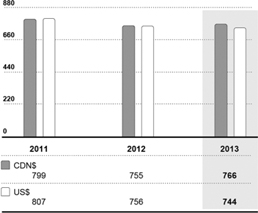

Average Sales Revenue per Tonne – Consolidated

($/tonne)

Excludes Snowflake’s results

Achievements

| · | Officially launched and grew sales of Ascent, the newest addition to our coated product line. Ascent is a coated three paper, the highest value grade we now produce. |

| · | Continued to penetrate the highest range of the machine-finished high bright market segment with Electrastar Max, our highest bright, highest value uncoated grade. |

| · | Retained customers as they moved from one grade to another. Our western location and broad product line allow customers to make the best choices for their business without the risk of changing paper suppliers. |

Market Position

Key objective

| · | Gain market share and expand sales reach into new markets with new products. |

| · | Expand geographic reach of Catalyst Paper into emerging world markets of Latin America and Asia. |

Key performance indicators

| · | Key metrics include total sales tonnes. Further details on 2013 results are provided in section 4,Consolidatedresults – annual, section 5,Segmented results – annual, and section 6,Consolidated and segmented results – quarterly. |

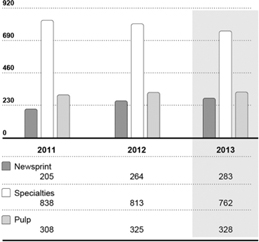

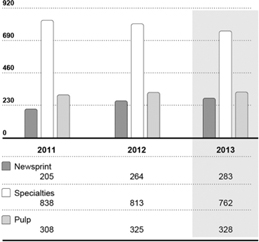

Total Sales Tonnes

(tonnes 000s)

Excludes Snowflake’s results

Achievements

| · | Launched Marathon Lite and increased worldwide sales to a third of our current newsprint sales. |

| · | Introduced and converted a growing number of customers to Electrabrite Ultra-Lite, a lighter basis weight, more economical alternative to traditional high bright papers. |

| · | Increased coated market share on the strength of our highest value coated grades, Pacificote and Ascent. |

| · | Grew market share in Latin America in each quarter of 2013. |

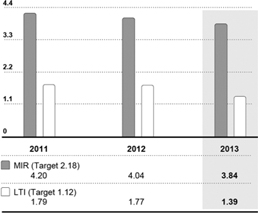

| 3. | Corporate Social Responsibility |

Corporate social responsibility is a core value. We are focused on improving workplace safety, promoting better communication with employees and following conservation practices that reduce our environmental impact.

Key objective

| · | Significantly improve safety results reducing medical incidents by 50% and lost time injuries by 41% to achieve 2nd quartile or better industry ranking. |

| · | Establish Catalyst Paper as an employer-of-choice, and further strengthen linkages with training institutions and other recruitment-supporting initiatives. |

| · | Continue to seek competitive business conditions in B.C. including reductions in hydro and taxation rates and work with municipalities to achieve joint cost-saving service and infrastructure agreements. |

Key performance indicators

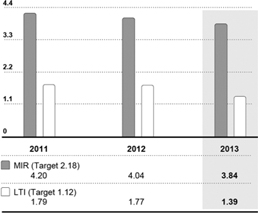

Key metrics to measure social responsibility include:

| · | Medical incident rate (MIR) which is the number of incidents requiring medical attention per 200,000 hours worked, and the lost-time injury frequency (LTI) which is the number of lost-time injuries per 200,000 hours worked. |

| · | Level of municipal and provincial property taxes levied in respect of our operations. |

| · | Level of BC Hydro electricity rates levied in respect of our operations. |

Safety

(Per 200,000 hours worked)

Achievements

| · | There was an improvement in safety in 2013 compared to the prior year. However, safety results still fell short of our targets. |

| · | Expanded employee engagement process with leadership workshops for supervisors, recruitment process review, and completion and examination of the results of a baseline survey of new employees. |

| · | Implemented a new pre-employment assessment process for hourly new hires. |

B.C. Property Taxes

(in millions of dollars)

| · | Class 4 municipal tax rates levied in 2013 were in line with the lower rates implemented in 2012. |

| · | Completed the sale of wastewater treatment facility to City of Port Alberni for proceeds of $5.8 million; agreement being finalized with City of Powell River to transfer our interest in PRSC Land Development Ltd. for approximately $3.0 million. |

Annual Power Costs

(in millions of dollars)

| · | Electric power cost increased significantly in the year due to the reinstitution of PST and rate increases by BC Hydro. |

Conservation Practices and Processes

Key objectives

| · | Work with community stakeholders to identify and implement sustainable watershed management solutions. |

| · | Adhere to high international standards for transparency and reporting of performance on social, governance and environmental factors. |

| · | Support revision of the B.C. Forest Stewardship Council standard to achieve increased access to FSC fibre. |

Achievements

| · | Assessment underway of new BC Water Sustainability Act proposed for legislative introduction in Spring 2014. |

| · | Completed assessment of our current sustainability disclosure against Global Reporting Initiative guidelines. |

| · | Industry working group formed to review B.C. Forest Stewardship Council standard, implementation challenges and opportunities for streamlining. Actively engaged with other forest sector stakeholders to identify and prioritize key aspects for revision. |

Our 2013 Sustainability Report provides a comprehensive overview of our conservation practices and processes.

See section 20 for details of our key priorities for 2014.

| 4. | Consolidated Results - Annual |

CONSOLIDATED RESULTS OF OPERATIONS

Year ended December 31, 2013 compared to year ended December 31, 2012

Sales

Sales decreased by $6.8 million in 2013 due to lower transaction prices for all paper segments, and lower sales volumes for all specialty grades, partially offset by the positive impact of a weaker Canadian dollar, higher sales volumes and transaction prices for pulp, and increases sales volumes for newsprint.

Adjusted EBITDA and Adjusted EBITDA before Restructuring Costs

The following table provides variances between periods for adjusted EBITDA and adjusted EBITDA before restructuring costs:

| (In millions of dollars) | | Adjusted EBITDA 1, 2 | | | Adjusted

EBITDA before

restructuring costs1, 2 | |

| 2012 | | $ | 55.4 | | | $ | 60.7 | |

| Paper prices | | | (18.1 | ) | | | (18.1 | ) |

| Pulp prices | | | 10.7 | | | | 10.7 | |

| Impact of Canadian dollar | | | 21.1 | | | | 21.1 | |

| Volume and mix | | | (4.7 | ) | | | (4.7 | ) |

| Furnish mix and costs | | | 3.5 | | | | 3.5 | |

| Power and fuel costs | | | (13.8 | ) | | | (13.8 | ) |

| Labour costs | | | (0.9 | ) | | | (0.9 | ) |

| Maintenance costs | | | (5.4 | ) | | | (5.4 | ) |

| Lower of cost or market impact on inventory, net of inventory change | | | (3.9 | ) | | | (3.9 | ) |

| Selling, general and administrative costs | | | 0.9 | | | | 0.9 | |

| Restructuring costs | | | 4.1 | | | | – | |

| De-recognition of interest in PREI | | | (8.9 | ) | | | (8.9 | ) |

| Power generation | | | 1.6 | | | | 1.6 | |

| Other, net | | | 4.5 | | | | 4.5 | |

| 2013 | | $ | 46.1 | | | $ | 47.3 | |

| 1 | Refer to section 12, Non-GAAP measures, for further details. |

| | |

| 2 | Numbers exclude the Snowflake mill’s results which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

Operating Earnings (Loss)

Operating earnings decreased by $106.9 million due to an impairment charge in the current year of $86.9 million, lower adjusted EBITDA of $9.3 million and higher depreciation and amortization expense of $10.7 million.

Net Earnings (loss) Attributable to the Company

Net earnings attributable to the company decreased by $710.8 million. Net earnings for the current year included an after-tax operating loss of $87.8 million, an after-tax foreign exchange loss on the translation of U.S. dollar debt of $18.8 million, and after-tax interest expense of $37.5 million, partially offset by an after-tax settlement gain of $2.6 million related to the special pension portability election, and a net gain after tax on the sale of non-core assets including the Snowflake mill, our interest in PREI, the Elk Falls site and two parcels of poplar land of $12.3 million. Net earnings for the prior year included after-tax operating earnings of $19.1 million, a net after-tax reorganization credit of $663.7 million, and an after-tax foreign exchange gain on the translation of U.S. dollar debt of $20.8 million, partially offset by after-tax interest expense of $71.0 million, an after-tax fair value adjustment to non-controlling interest of $41.2 million, and impairment and other closure costs incurred on the discontinued Snowflake mill of $19.7 million.

The following table reconciles 2013 net earnings (loss) attributable to the company to 2012:

| (In millions of dollars) | | Pre-tax | | | After-tax | |

| 2012 net earnings (loss) attributable to the company | | $ | 582.3 | | | $ | 583.2 | |

| Lower adjusted EBITDA before restructuring costs | | | (13.4 | ) | | | (13.4 | ) |

| Lower restructuring costs | | | 4.1 | | | | 4.1 | |

| Higher depreciation and amortization expense | | | (10.7 | ) | | | (10.7 | ) |

| Impairment charge in 2013 | | | (86.9 | ) | | | (86.9 | ) |

| Change in foreign exchange gain (loss) on long-term debt | | | (39.6 | ) | | | (39.6 | ) |

| Change in reorganization items, net | | | (664.9 | ) | | | (664.9 | ) |

| Higher other income, net | | | 17.4 | | | | 17.4 | |

| Lower interest expense | | | 34.5 | | | | 33.5 | |

| Change in discontinued operations earnings (loss) | | | 19.6 | | | | 19.6 | |

| Change in net earnings (loss) attributable to non-controlling interest | | | 30.1 | | | | 30.1 | |

| 2013 net earnings (loss) attributable to the company | | $ | (127.5 | ) | | $ | (127.6 | ) |

| 5. | Segmented Results - Annual |

Specialty Printing Papers

| (In millions of dollars, except where otherwise stated) | | 2013 | | | 20122 | | | 20112 | |

| Sales | | $ | 635.1 | | | $ | 675.6 | | | $ | 690.4 | |

| Operating earnings (loss) | | | (102.3 | ) | | | 20.5 | | | | (565.1 | ) |

| Depreciation and amortization | | | 40.4 | | | | 30.1 | | | | 81.3 | |

| Adjusted EBITDA1 | | | 25.0 | | | | 50.6 | | | | 23.4 | |

| – before restructuring costs1 | | | 25.6 | | | | 53.5 | | | | 27.4 | |

| Adjusted EBITDA margin1 | | | 3.9 | % | | | 7.5 | % | | | 3.4 | % |

| – before restructuring costs1 | | | 4.0 | % | | | 7.9 | % | | | 4.0 | % |

| (In thousands of tonnes) | | | | | | | | | | | | |

| Sales | | | 762.0 | | | | 812.6 | | | | 837.5 | |

| Production | | | 770.9 | | | | 805.5 | | | | 842.0 | |

| 1 | Refer to section 12,Non-GAAP measures. |

| 2 | Numbers exclude the Snowflake mill’s results from operations which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

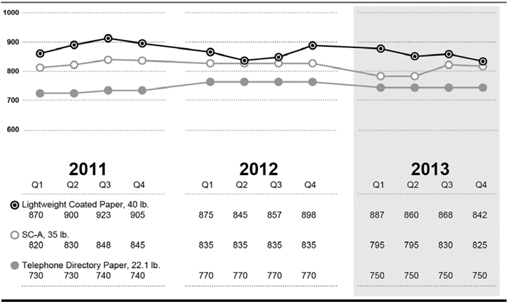

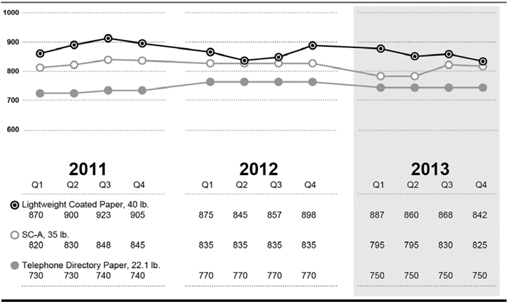

Specialty Printing Papers Benchmark Price Trend

Average delivered to U.S. benchmark transaction price (US$/short ton)

(Source: RISI)

Segment Overview

North American demand for coated mechanical decreased 6.6% for the year due to reduced advertising pages in magazines and a decrease in catalogues being mailed out. LWC inventories increased in the current year. The average benchmark price for LWC decreased to US$864 per short ton from US$869 per short ton in 2012.

North American uncoated mechanical demand (high-gloss and standard grades) increased 5.5% due to strong demand for high-gloss grades as customers sought lower cost alternatives to coated mechanical. Inventories for uncoated mechanical increased compared to 2012. Average benchmark prices for super-calendered A grade (SC-A) declined 2.9% to US$811 per short ton compared to the prior year. The SC-A benchmark price declined in the first half of 2013 before stronger market conditions pushed prices higher for the balance of the year. We implemented a US$50 per short ton price increase on our SC-A paper in the third and fourth quarter.

North American directory demand decreased 13.8% in 2013 from the prior year due to reduced publication of white pages, smaller book sizes, lower circulation, and the continued migration from printed directory books to the Internet. At US$750 per short ton, the average directory benchmark price for the current year decreased by 2.6% compared to the prior year. The majority of our directory pricing was largely fixed for the year based on 2013 contract pricing.

Operational Performance

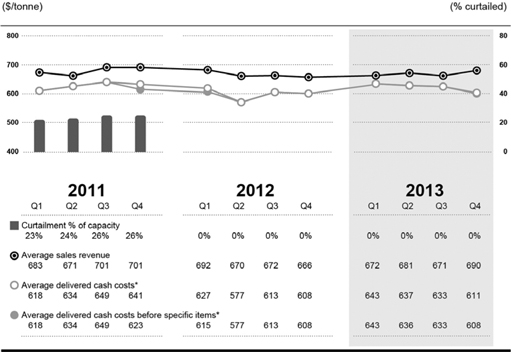

The following chart summarizes the operating performance of our specialty printing papers segment:

Specialty Printing Papers Trend

| * | Average delivered cash costs per tonne consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A and restructuring costs. Average delivered cash costs per tonne before specific items consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A, but excluding the impact of restructuring costs. |

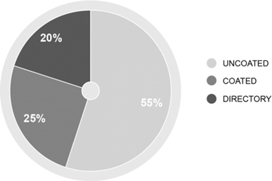

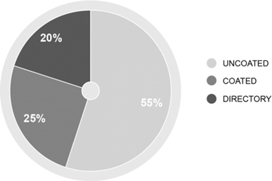

| The 2013 specialty printing papers product-grade distribution, based on sales volume, is depicted in the chart below: |

| |

| Product Sales Distribution |

| (% tonnes) |

|

| The 2013 specialty printing papers geographic sales distribution, based on sales volume, is depicted in the chart below: |

| |

| Geographic Sales Distribution |

| (% tonnes) |

|

| · | Sales volume decreased by 50,600 tonnes. Sales volumes were down mostly due to converting directory to newsprint at our Crofton mill. |

| · | Average sales revenue per tonne increased $2 per tonne due to the positive impact of a weaker Canadian dollar, mostly offset by lower average transaction prices for all specialty grades. |

| · | Average delivered cash costs increased $32 per tonne mostly due to increased spending on maintenance and indirect material and services, as well as cost increases in coating, electric power and operating supplies, partially offset by lower restructuring costs. |

Newsprint

| (In millions of dollars, except where otherwise stated) | | 2013 | | | 20122 | | | 20112 | |

| Sales | | $ | 192.3 | | | $ | 178.1 | | | $ | 141.3 | |

| Operating earnings (loss) | | | 8.4 | | | | 14.1 | | | | (69.2 | ) |

| Depreciation and amortization | | | 5.1 | | | | 4.1 | | | | 9.1 | |

| Adjusted EBITDA1 | | | 13.5 | | | | 18.2 | | | | 11.0 | |

| – before restructuring costs1 | | | 13.9 | | | | 19.0 | | | | 11.8 | |

| Adjusted EBITDA margin1 | | | 7.0 | % | | | 10.2 | % | | | 7.8 | % |

| – before restructuring costs1 | | | 7.2 | % | | | 10.7 | % | | | 8.4 | % |

| (In thousands of tonnes) | | | | | | | | | | | | |

| Sales | | | 283.3 | | | | 264.0 | | | | 205.2 | |

| Production | | | 288.5 | | | | 265.1 | | | | 208.1 | |

| 1 | Refer to section 12,Non-GAAP measures. |

| | |

| 2 | Numbers exclude the Snowflake mill’s results from operations which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

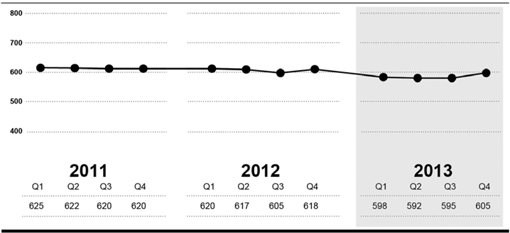

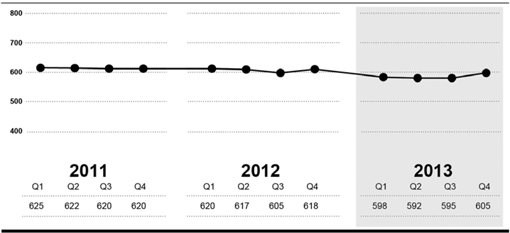

Standard Newsprint Price Trend

Average delivered to U.S. West Coast benchmark transaction price (US$/tonne)

(Source: RISI)

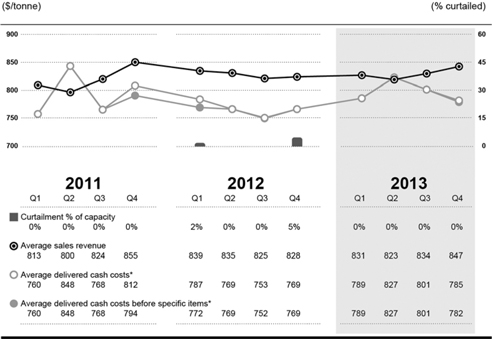

Segment Overview

North American newsprint shipments were down by 9.4% in 2013 mostly due to lower newspaper print advertising and declining circulation. Strong exports in the year, especially to Asia, partly compensated for weak domestic demand. Newsprint inventories remained flat for the year compared to 2012 levels.

The average North American newsprint benchmark price decreased 2.8% to US$598 per metric tonne compared to the previous year. On September 1, 2013, we implemented a US$15 per tonne price increase on our US customer accounts.

The Crofton No. 1 paper machine, originally curtailed in January 2010, remained indefinitely curtailed throughout 2013, resulting in 140,000 tonnes of curtailment on an annualized basis.

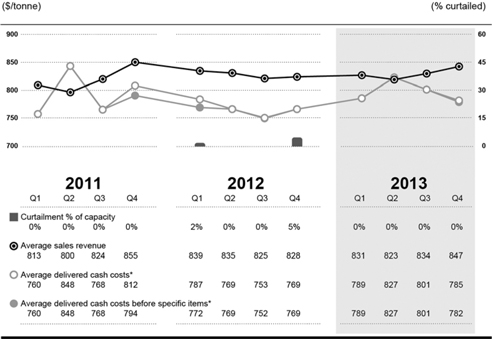

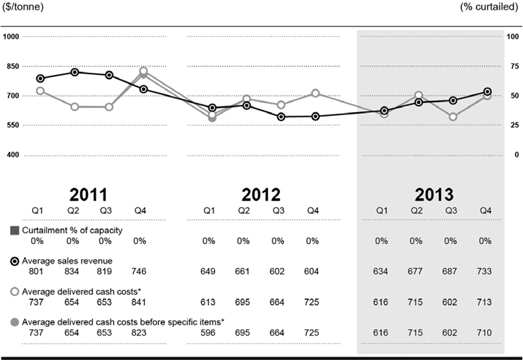

Operational Performance

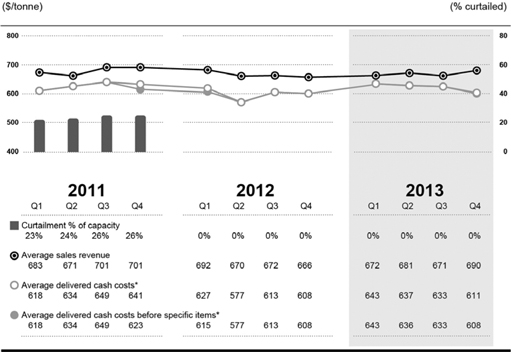

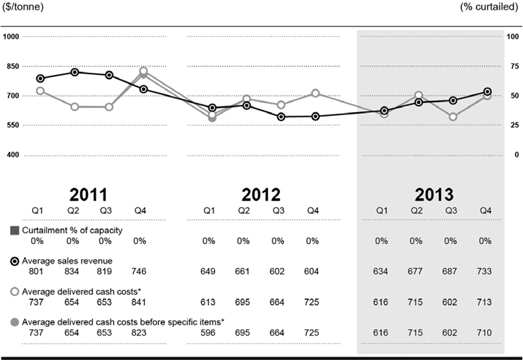

The following chart summarizes the operating performance of our newsprint segment:

Newsprint Trend

| * | Average delivered cash costs per tonne consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A and restructuring costs. Average delivered cash costs per tonne before specific items consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A, but excluding the impact of restructuring costs. |

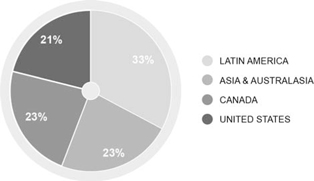

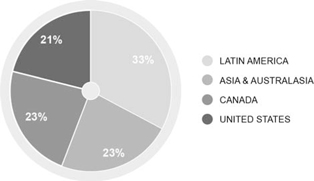

The 2013 newsprint geographic sales distribution, based on sales volume, is depicted in the chart below:

Geographic Sales Distribution

(% tonnes)

| · | Sales volume increased by 19,300 tonnes primarily due to increased newsprint production which partly offset lower directory production. |

| · | Average sales revenue increased $4 per tonne due to the positive impact of a weaker Canadian dollar, partially offset by lower average transaction prices. |

| · | Average delivered cash costs increased $24 per tonne mostly due to increases in maintenance, indirect material and services, operating supplies and electric power cost. |

Pulp

| (In millions of dollars, except where otherwise stated) | | 2013 | | | 20122 | | | 20112 | |

| Sales | | $ | 224.0 | | | $ | 204.5 | | | $ | 248.0 | |

| Operating earnings (loss) | | | 6.1 | | | | (15.5 | ) | | | (70.2 | ) |

| Depreciation and amortization | | | 1.5 | | | | 2.1 | | | | 15.1 | |

| Adjusted EBITDA1 | | | 7.6 | | | | (13.4 | ) | | | 28.4 | |

| – before restructuring costs1 | | | 7.8 | | | | (11.8 | ) | | | 29.5 | |

| Adjusted EBITDA margin1 | | | 3.4 | % | | | (6.6 | )% | | | 11.5 | % |

| – before restructuring costs1 | | | 3.5 | % | | | (5.8 | )% | | | 11.9 | % |

| (In thousands of tonnes) | | | | | | | | | | | | |

| Sales | | | 328.0 | | | | 324.8 | | | | 308.5 | |

| Production | | | 323.2 | | | | 318.0 | | | | 315.0 | |

| 1 | Refer to section 12,Non-GAAP measures. |

| | |

| 2 | Numbers exclude the Snowflake mill’s results from operations which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

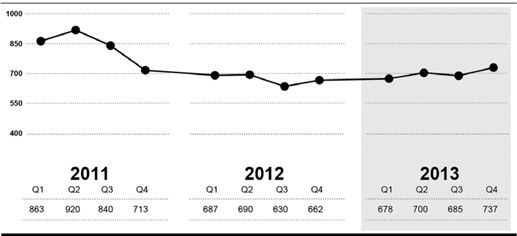

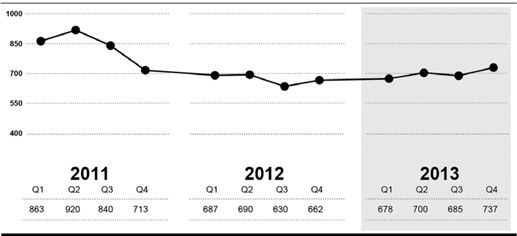

Northern Bleached Softwood Kraft Price Trend

Average delivered to China benchmark transaction price (US$/tonne)

(Source: RISI)

Segment Overview

Global shipments of NBSK pulp increased by 2.3% in 2013 compared to prior year shipments fueled by improved demand in Asia and North America. The average NBSK benchmark price for China increased by 4.9% to US$700 per tonne compared to the prior year. We implemented price increases in China of US$20 per tonne in September, US$30 per tonne in October, and US$20 per tonne in November.

Operational Performance

The following chart summarizes the operating performance of our pulp segment:

Pulp Trend

| * | Average delivered cash costs per tonne consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A and restructuring costs. Average delivered cash costs per tonne before specific items consist of cost of sales, excluding depreciation and amortization, and including the impact of SG&A, but excluding the impact of restructuring costs. |

The primary market for our market pulp is Asia. The 2013 pulp geographic sales distribution, based on sales volume, is depicted in the chart below:

Geographic Sales Distribution

(% tonnes)

| · | Sales volume increased by 3,200 tonnes due to better production in the current year. |

| · | Average sales revenue increased by $53 per tonne due to higher average transaction prices and the positive impact of a weaker Canadian dollar. |

| · | Average delivered cash costs decreased by $9 per tonne due to a reduction in the cost of fibre and chemicals and lower restructuring costs. |

| 6. | Consolidated and Segmented Results - Quarterly |

Selected Quarterly Financial Information

| (In millions of dollars, except | | 2013 | | | 2012 | |

| where otherwise stated) | | Total | | | Q4 | | | Q3 | | | Q2 | | | Q1 | | | Total | | | Q4 | | | Q3 | | | Q2 | | | Q1 | |

| Sales2 | | $ | 1,051.4 | | | $ | 272.1 | | | $ | 268.8 | | | $ | 263.4 | | | $ | 247.1 | | | $ | 1,058.2 | | | $ | 260.5 | | | $ | 265.7 | | | $ | 264.8 | | | $ | 267.2 | |

| Operating earnings (loss)2 | | | (87.8 | ) | | | (79.5 | ) | | | 4.9 | | | | (12.0 | ) | | | (1.2 | ) | | | 19.1 | | | | (5.7 | ) | | | 5.9 | | | | 9.3 | | | | 9.6 | |

Depreciation and

amortization2 | | | 47.0 | | | | 11.7 | | | | 11.5 | | | | 11.4 | | | | 12.4 | | | | 36.3 | | | | 12.9 | | | | 7.9 | | | | 7.7 | | | | 7.8 | |

| Adjusted EBITDA1 2 | | | 46.1 | | | | 19.1 | | | | 16.4 | | | | (0.6 | ) | | | 11.2 | | | | 55.4 | | | | 7.2 | | | | 13.8 | | | | 17.0 | | | | 17.4 | |

| – before restructuring costs1,2 | | | 47.3 | | | | 20.2 | | | | 16.4 | | | | (0.5 | ) | | | 11.2 | | | | 60.7 | | | | 7.2 | | | | 14.0 | | | | 16.9 | | | | 22.6 | |

| Net earnings (loss) attributable to the company | | | (127.6 | ) | | | (95.0 | ) | | | 5.2 | | | | (28.0 | ) | | | (9.8 | ) | | | 583.2 | | | | (35.2 | ) | | | 655.7 | | | | (11.7 | ) | | | (25.6 | ) |

| – before specific items1 | | | (31.5 | ) | | | 1.7 | | | | (3.5 | ) | | | (18.1 | ) | | | (11.6 | ) | | | (37.8 | ) | | | (15.7 | ) | | | (7.5 | ) | | | (5.0 | ) | | | (9.6 | ) |

| Adjusted EBITDA margin1,2 | | | 4.4 | % | | | 7.0 | % | | | 6.1 | % | | | (0.2 | )% | | | 4.5 | % | | | 5.2 | % | | | 2.8 | % | | | 5.2 | % | | | 6.4 | % | | | 6.5 | % |

– before restructuring

costs1 2 | | | 4.5 | % | | | 7.4 | % | | | 6.1 | % | | | (0.2 | )% | | | 4.5 | % | | | 5.7 | % | | | 2.8 | % | | | 5.3 | % | | | 6.4 | % | | | 8.5 | % |

| Net earnings (loss) per share attributable to the company’s common shareholders (in dollars) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| – basic and diluted from continuing operations3 | | $ | (9.01 | ) | | $ | (6.55 | ) | | $ | 0.36 | | | $ | (1.93 | ) | | $ | (0.89 | ) | | $ | 41.65 | | | $ | (1.55 | ) | | $ | 1.73 | | | $ | (0.03 | ) | | $ | (0.07 | ) |

| – basic and diluted from discontinued operations3 | | | 0.21 | | | | – | | | | – | | | | – | | | | 0.21 | | | | (1.15 | ) | | | (0.89 | ) | | | (0.01 | ) | | | 0.00 | | | | 0.00 | |

| – before specific items1,3 | | | (2.17 | ) | | | 0.12 | | | | (0.24 | ) | | | (1.25 | ) | | | (0.80 | ) | | | (2.62 | ) | | | (1.09 | ) | | | (0.02 | ) | | | (0.01 | ) | | | (0.03 | ) |

| (In thousands of tonnes) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales (000 tonnes) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty printing papers2 | | | 762.0 | | | | 188.8 | | | | 197.4 | | | | 195.8 | | | | 180.0 | | | | 812.6 | | | | 207.4 | | | | 207.6 | | | | 202.9 | | | | 194.7 | |

| Newsprint2 | | | 283.3 | | | | 75.3 | | | | 66.1 | | | | 72.6 | | | | 69.3 | | | | 264.0 | | | | 66.2 | | | | 67.8 | | | | 67.0 | | | | 63.0 | |

| Total paper2 | | | 1,045.3 | | | | 264.1 | | | | 263.5 | | | | 268.4 | | | | 249.3 | | | | 1,076.6 | | | | 273.6 | | | | 275.4 | | | | 269.9 | | | | 257.7 | |

| Pulp2 | | | 328.0 | | | | 82.4 | | | | 87.1 | | | | 78.2 | | | | 80.3 | | | | 324.8 | | | | 74.0 | | | | 81.2 | | | | 76.5 | | | | 93.1 | |

| Total sales2 | | | 1,373.3 | | | | 346.5 | | | | 350.6 | | | | 346.6 | | | | 329.6 | | | | 1,401.4 | | | | 347.6 | | | | 356.6 | | | | 346.4 | | | | 350.8 | |

| Production (000 tonnes) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Specialty printing papers2 | | | 770.9 | | | | 193.1 | | | | 197.4 | | | | 195.1 | | | | 185.3 | | | | 805.5 | | | | 192.8 | | | | 206.5 | | | | 206.3 | | | | 199.9 | |

| Newsprint2 | | | 288.5 | | | | 78.0 | | | | 70.1 | | | | 68.9 | | | | 71.5 | | | | 265.1 | | | | 65.3 | | | | 67.3 | | | | 68.4 | | | | 64.1 | |

| Total paper2 | | | 1,059.4 | | | | 271.1 | | | | 267.5 | | | | 264.0 | | | | 256.8 | | | | 1,070.6 | | | | 258.1 | | | | 273.8 | | | | 274.7 | | | | 264.0 | |

| Pulp2 | | | 323.2 | | | | 79.1 | | | | 90.1 | | | | 74.5 | | | | 79.5 | | | | 318.0 | | | | 75.2 | | | | 79.6 | | | | 77.7 | | | | 85.5 | |

| Total production2 | | | 1,382.6 | | | | 350.2 | | | | 357.6 | | | | 338.5 | | | | 336.3 | | | | 1,388.6 | | | | 333.3 | | | | 353.4 | | | | 352.4 | | | | 349.5 | |

| Common shares (millions) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At period-end | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.4 | | | | 381.9 | | | | 381.9 | |

| Weighted average | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.5 | | | | 14.4 | | | | 14.4 | | | | 381.9 | | | | 381.9 | | | | 381.9 | |

| 1 | Refer to section 12, Non-GAAP measures. |

| | |

| 2 | Numbers exclude the Snowflake mill’s results from operations which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

| | |

| 3 | Earnings per share data for periods ending on and subsequent to September 30, 2012 were based on our weighted average common shares issues pursuant to our reorganization under CCAA. Earnings per share data for periods prior to September 30, 2012 were based on our weighted average common shares outstanding prior to emergence from the CCAA proceedings. These shares were cancelled on September 13, 2012 |

Summary of Selected Segmented Quarterly Financial Information

| (In millions of dollars, except | | 2013 | | | 2012 | |

| where otherwise stated) | | Total | | | Q4 3 | | | Q3 3 | | | Q2 3 | | | Q13 | | | Total 3 | | | Q4 3 | | | Q3 3 | | | Q2 3 | | | Q1 3 | |

| Specialty printing papers | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 635.1 | | | $ | 159.8 | | | $ | 164.6 | | | $ | 161.1 | | | $ | 149.6 | | | $ | 675.6 | | | $ | 171.8 | | | $ | 171.2 | | | $ | 169.4 | | | $ | 163.2 | |

| Operating earnings (loss) | | | (102.3 | ) | | | (85.3 | ) | | | (3.4 | ) | | | (10.7 | ) | | | (2.9 | ) | | | 20.5 | | | | 1.2 | | | | 8.5 | | | | 7.2 | | | | 3.6 | |

| Depreciation and amortization | | | 40.4 | | | | 10.0 | | | | 9.9 | | | | 9.9 | | | | 10.6 | | | | 30.1 | | | | 11.2 | | | | 6.4 | | | | 6.2 | | | | 6.3 | |

| Adjusted EBITDA1 | | | 25.0 | | | | 11.6 | | | | 6.5 | | | | (0.8 | ) | | | 7.7 | | | | 50.6 | | | | 12.4 | | | | 14.9 | | | | 13.4 | | | | 9.9 | |

| –before restructuring costs1 | | | 25.6 | | | | 12.2 | | | | 6.5 | | | | (0.8 | ) | | | 7.7 | | | | 53.5 | | | | 12.4 | | | | 15.1 | | | | 13.3 | | | | 12.7 | |

| Adjusted EBITDA margin1 | | | 3.9 | % | | | 7.3 | % | | | 3.9 | % | | | (0.5 | )% | | | 5.1 | % | | | 7.5 | % | | | 7.2 | % | | | 8.7 | % | | | 7.9 | % | | | 6.1 | % |

| –before restructuring costs1 | | | 4.0 | % | | | 7.6 | % | | | 3.9 | % | | | (0.5 | )% | | | 5.1 | % | | | 7.9 | % | | | 7.2 | % | | | 8.8 | % | | | 7.9 | % | | | 7.8 | % |

| Sales (000 tonnes) | | | 762.0 | | | | 188.8 | | | | 197.4 | | | | 195.8 | | | | 180.0 | | | | 812.6 | | | | 207.4 | | | | 207.6 | | | | 202.9 | | | | 194.7 | |

| Production (000 tonnes) | | | 770.9 | | | | 193.1 | | | | 197.4 | | | | 195.1 | | | | 185.3 | | | | 805.5 | | | | 192.8 | | | | 206.5 | | | | 206.3 | | | | 199.9 | |

Curtailment

(000 tonnes)2 | | | – | | | | – | | | | – | | | | – | | | | – | | | | 17.6 | | | | 12.1 | | | | – | | | | – | | | | 5.5 | |

| Newsprint | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 192.3 | | | $ | 52.0 | | | $ | 44.3 | | | $ | 49.4 | | | $ | 46.6 | | | $ | 178.1 | | | $ | 44.0 | | | $ | 45.6 | | | $ | 44.9 | | | $ | 43.6 | |

| Operating earnings (loss) | | | 8.4 | | | | 4.4 | | | | 1.4 | | | | 1.9 | | | | 0.7 | | | | 14.1 | | | | 2.4 | | | | 3.1 | | | | 5.4 | | | | 3.2 | |

| Depreciation and amortization | | | 5.1 | | | | 1.4 | | | | 1.1 | | | | 1.2 | | | | 1.4 | | | | 4.1 | | | | 1.4 | | | | 0.9 | | | | 0.8 | | | | 1.0 | |

| Adjusted EBITDA1 | | | 13.5 | | | | 5.8 | | | | 2.5 | | | | 3.1 | | | | 2.1 | | | | 18.2 | | | | 3.8 | | | | 4.0 | | | | 6.2 | | | | 4.2 | |

| –before restructuring costs1 | | | 13.9 | | | | 6.1 | | | | 2.5 | | | | 3.2 | | | | 2.1 | | | | 19.0 | | | | 3.8 | | | | 4.0 | | | | 6.2 | | | | 5.0 | |

| Adjusted EBITDA margin1 | | | 7.0 | % | | | 11.2 | % | | | 5.6 | % | | | 6.3 | % | | | 4.5 | % | | | 10.2 | % | | | 8.6 | % | | | 8.8 | % | | | 13.8 | % | | | 9.6 | % |

| –before restructuring costs1 | | | 7.2 | % | | | 11.7 | % | | | 5.6 | % | | | 6.5 | % | | | 4.5 | % | | | 10.7 | % | | | 8.6 | % | | | 8.8 | % | | | 13.8 | % | | | 11.5 | % |

| Sales (000 tonnes) | | | 283.3 | | | | 75.3 | | | | 66.1 | | | | 72.6 | | | | 69.3 | | | | 264.0 | | | | 66.2 | | | | 67.8 | | | | 67.0 | | | | 63.0 | |

| Production (000 tonnes) | | | 288.5 | | | | 78.0 | | | | 70.1 | | | | 68.9 | | | | 71.5 | | | | 265.1 | | | | 65.3 | | | | 67.3 | | | | 68.4 | | | | 64.1 | |

Curtailment

(000 tonnes)2 | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| Pulp | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Sales | | $ | 224.0 | | | $ | 60.3 | | | $ | 59.9 | | | $ | 52.9 | | | $ | 50.9 | | | $ | 204.5 | | | $ | 44.7 | | | $ | 48.9 | | | $ | 50.5 | | | $ | 60.4 | |

| Operating earnings (loss) | | | 6.1 | | | | 1.4 | | | | 6.9 | | | | (3.2 | ) | | | 1.0 | | | | (15.5 | ) | | | (9.3 | ) | | | (5.7 | ) | | | (3.3 | ) | | | 2.8 | |

| Depreciation and amortization | | | 1.5 | | | | 0.3 | | | | 0.5 | | | | 0.3 | | | | 0.4 | | | | 2.1 | | | | 0.3 | | | | 0.6 | | | | 0.7 | | | | 0.5 | |

| Adjusted EBITDA1 | | | 7.6 | | | | 1.7 | | | | 7.4 | | | | (2.9 | ) | | | 1.4 | | | | (13.4 | ) | | | (9.0 | ) | | | (5.1 | ) | | | (2.6 | ) | | | 3.3 | |

| –before restructuring costs1 | | | 7.8 | | | | 1.9 | | | | 7.4 | | | | (2.9 | ) | | | 1.4 | | | | (11.8 | ) | | | (9.0 | ) | | | (5.1 | ) | | | (2.6 | ) | | | 4.9 | |

| Adjusted EBITDA margin1 | | | 3.4 | % | | | 2.8 | % | | | 12.4 | % | | | (5.5 | )% | | | 2.8 | % | | | (6.6 | )% | | | (20.1 | )% | | | (10.4 | )% | | | (5.1 | )% | | | 5.5 | % |

| –before restructuring costs1 | | | 3.5 | % | | | 3.2 | % | | | 12.4 | % | | | (5.5 | )% | | | 2.8 | % | | | (5.8 | )% | | | (20.1 | )% | | | (10.4 | )% | | | (5.1 | )% | | | 8.1 | % |

| Sales (000 tonnes) | | | 328.0 | | | | 82.4 | | | | 87.1 | | | | 78.2 | | | | 80.3 | | | | 324.8 | | | | 74.0 | | | | 81.2 | | | | 76.5 | | | | 93.1 | |

| Production (000 tonnes) | | | 323.2 | | | | 79.1 | | | | 90.1 | | | | 74.5 | | | | 79.5 | | | | 318.0 | | | | 75.2 | | | | 79.6 | | | | 77.7 | | | | 85.5 | |

| Curtailment (000 tonnes)2 | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | |

| 1 | Refer to section 12,Non-GAAP measures. |

| | |

| 2 | Curtailment consists of downtime related to market demand. |

| | |

| 3 | Numbers exclude the Snowflake mill’s results from operations which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

Fourth Quarter Overview

North American paper demand was down in the fourth quarter year-over-year for all segments except uncoated mechanical. Global pulp shipments in the fourth quarter increased compared to Q4 2012. Benchmark prices declined quarter-over-quarter for uncoated mechanical by 0.6% to US$825 per short ton and for LWC by 3.0% to US$842 per short ton while remaining flat for directory paper at US$750 per short ton. For newsprint, benchmark prices increased 1.7% to US$605 per tonne. Benchmark prices for pulp increased significantly in the fourth quarter to US$737 per tonne from US$685 per tonne in Q3.

Operating earnings for the quarter increased due to the positive impact of a weaker Canadian dollar, an increase in pulp and paper transaction prices, higher sales volumes for newsprint, and increased sale of electric power generated by our steam turbine generator located at the Powell River mill. This was partly offset by higher maintenance cost and lower sales volumes for our specialty paper grades and pulp. Maintenance costs were higher in the quarter due to a major maintenance outage on our recovery boiler at Crofton. In December, we sold two parcels of our remaining poplar plantation land.

We recorded a net loss attributable to the company of $95.0 million and net earnings attributable to the company before specific items of $1.7 million in Q4. This compared to net earnings attributable to the company of $5.2 million and a net loss attributable to the company before specific items of $3.5 million, respectively, in Q3. Specific items in Q4 included an impairment charge on goodwill and fixed assets, restructuring costs and a foreign exchange loss on the translation of U.S. dollar denominated debt. Significant specific items in the prior quarter included a gain on the partial settlement of our Salaried Plan under the special portability election option, and a foreign exchange gain on the translation of U.S. dollar denominated debt.

Adjusted EBITDA increased to $19.1 million from $16.4 million in the prior quarter and adjusted EBITDA before restructuring costs was $20.2 million in Q4 compared to $16.4 million for Q3. Refer to section 12,Non-GAAP measures,for additional information on specific items in the reported financial results.

Consolidated Results of Operations

Sales

Q4 2013 vs. Q3 2013

Sales revenues increased 1.2% due to the positive impact of a weaker Canadian dollar, higher average transaction prices for pulp and all paper segments excluding directory, and increased sales volumes for newsprint, partially offset by lower sales volumes for specialty paper and pulp, and slightly lower average transaction prices for directory paper.

Q4 2013 vs. Q4 2012

Sales revenues increased by 4.5% due to the positive impact of a weaker Canadian dollar, higher average transaction prices for newsprint and pulp, and increased sales volumes for newsprint, uncoated mechanical and pulp, partially offset by lower average transaction prices for all specialty paper segments and lower sales volumes for directory and LWC.

Adjusted EBITDA and adjusted EBITDA before Restructuring Costs

The following table provides variances between periods for adjusted EBITDA and adjusted EBITDA before restructuring costs:

| (In millions of dollars) | | Q3 2013 | | | Q4 2012 | |

| Adjusted EBITDAin comparative period1 | | $ | 16.4 | | | $ | 7.2 | |

| Specific items: restructuring costs | | | – | | | | – | |

| Adjusted EBITDAbefore restructuring costs in comparative period1 | | | 16.4 | | | | 7.2 | |

| Paper prices | | | 2.2 | | | | (4.4 | ) |

| Pulp prices | | | 3.0 | | | | 7.1 | |

| Impact of Canadian dollar | | | 2.3 | | | | 10.2 | |

| Volume and mix | | | (2.1 | ) | | | 2.6 | |

| Furnish mix and costs | | | (0.9 | ) | | | (3.0 | ) |

| Power and fuel costs | | | (2.1 | ) | | | (2.5 | ) |

| Labour costs | | | (1.4 | ) | | | (1.7 | ) |

| Maintenance costs | | | (2.0 | ) | | | 5.0 | |

| Lower of cost or market impact on inventory, net of inventory change | | | (0.3 | ) | | | (1.2 | ) |

| Selling, general and administrative | | | 0.8 | | | | 0.3 | |

| De-recognition of interest in PREI | | | – | | | | (2.6 | ) |

| Power generation | | | 3.7 | | | | 1.7 | |

| Other, net | | | 0.6 | | | | 1.5 | |

| Adjusted EBITDAbefore restructuring costs in Q4 20131 | | | 20.2 | | | | 20.2 | |

| Specific items: restructuring costs | | | (1.1 | ) | | | (1.1 | ) |

| Adjusted EBITDAin Q4 20131 | | $ | 19.1 | | | $ | 19.1 | |

| 1 | Refer to section 12,Non-GAAP measures. |

| 2 | Numbers exclude the Snowflake mill’s results which have been reclassified as discontinued operations in the consolidated statements of earnings (loss) in the annual consolidated financial statements for the year ended December 31, 2013. |

Operating Earnings (Loss)

Q4 2013 vs. Q3 2013

Operating earnings decreased by $84.4 million due to an impairment charge of $86.9 million in the current quarter and increased depreciation of $0.2 million, partially offset by an increase in adjusted EBITDA of $2.7 million.

Q4 2013 vs. Q4 2012

Operating earnings decreased by $73.8 million due to an impairment charge of $86.9 million in Q4, partially offset by an increase in adjusted EBITDA of $11.9 million and reduced depreciation of $1.2 million.

Net Earnings (Loss) Attributable to the Company

Q4 2013 vs. Q3 2013

Net earnings attributable to the company decreased $100.2 million primarily due to reduced after-tax operating earnings of $84.4 million, an after-tax foreign exchange loss on the translation of U.S. dollar debt of $9.4 million compared to an after-tax foreign exchange gain of $6.1 million for the prior quarter, and an after-tax settlement gain of $2.6 million in Q3 2013 related to the special pension portability election.

Q4 2013 vs. Q4 2012

Net earnings attributable to the company decreased by $59.8 million primarily due to decreased after-tax operating earnings of $73.8 million and an increase in after-tax foreign exchange loss on the translation of U.S. dollar debt of $6.2 million, partially offset by a decrease in after-tax interest expense of $2.7 million, an increase in other income after tax of $2.9 million, an after-tax loss from discontinued operations incurred in Q4 2012 of $12.9 million and after-tax reorganization expense incurred in Q4 2012 of $3.2 million.

Operational performance – Specialty Printing Papers

Q4 2013 vs. Q3 2013

| · | Sales volume decreased by 8,600 tonnes due to reduced production and sales of directory, as well as lower LWC sales reflecting weaker market conditions in the quarter. Sales volumes of uncoated mechanical paper remained flat. |

| · | Average sales revenue increased $13 per tonne, reflecting the positive impact of a weaker Canadian dollar and an increase in average transaction prices for uncoated mechanical and LWC, partially offset by lower average transaction prices for directory paper. |

| · | Average delivered cash costs decreased by $16 per tonne primarily due to increased power sales and reductions in chemicals and electric power costs. This was partly offset by increased steam fuel costs and the incurrence of restructuring costs in the quarter. |

Q4 2013 vs. Q4 2012

| · | Sales volume decreased by 18,600 tonnes due to lower sales volumes for directory and LWC, partially offset by slightly higher sales volumes for uncoated mechanical. |

| · | Average sales revenue increased $19 per tonne reflecting the positive impact of a weaker Canadian dollar, partially offset by lower average transaction prices for all specialty paper grades. |

| · | Average delivered cash costs increased $16 per tonne primarily due to higher fibre and electric power cost and the incurrence of restructuring costs in the quarter, partially offset by reduced maintenance spending. |

Operational performance – Newsprint

Q4 2013 vs. Q3 2013

| · | Sales volumes increased by 9,200 tonnes in line with increased production in the quarter. |

| · | Average sales revenue increased $19 per tonne compared to Q3 due to higher average transaction prices and favourable exchange rate movement. |

| · | Average delivered cash costs decreased $22 per tonne mostly due to lower maintenance costs, partially offset by increased fibre cost and the incurrence of restructuring costs in the quarter. Maintenance costs in the prior quarter included a maintenance outage on the power boiler at Crofton. |

Q4 2013 vs. Q4 2012

| · | Sales volumes increased by 9,100 tonnes due to increased newsprint production which partly offset lower directory production. |

| · | Average sales revenue increased $24 per tonne due to slightly higher average transaction prices and the positive impact of a weaker Canadian dollar. |

| · | Average delivered cash costs increased $3 per tonne primarily due to higher fibre and electric power cost, and the incurrence of restructuring costs in the quarter, partially offset by lower chemicals, steam fuel and maintenance cost. |

Operational performance – Pulp

Q4 2013 vs. Q3 2013

| · | Sales volume decreased by 4,700 tonnes in the fourth quarter. Pulp production was significantly lower in the quarter due to production downtime related to a major maintenance outage on our recovery boiler at Crofton. |

| · | Average sales revenue increased by $46 per tonne due to higher average transaction prices and the positive impact of a weaker Canadian dollar. |

| · | Average delivered cash costs increased $111 per tonne mostly due to production downtime and increased maintenance and labour spending related to the maintenance shut on our recovery boiler, and increased cost of chemicals and steam fuel. |

Q4 2013 vs. Q4 2012

| · | Sales volume increased by 8,400 tonnes due to strong market conditions in the quarter. |

| · | Average sales revenue increased $129 per tonne due to significantly higher average transaction prices and the positive impact of a weaker Canadian dollar. |

| · | Average delivered cash costs decreased by $12 per tonne mostly due to reduced maintenance spending and lower cost of chemicals, partially offset by increased fibre cost. |

The following table highlights the significant changes between the consolidated balance sheets as at December 31, 2013 and December 31, 2012:

| (In millions of dollars) | | 2013 | | | 2012 | | | Variance | | | Comments |

| Working capital | | $ | 153.6 | | | $ | 151.4 | | | $ | 2.2 | | | Increase reflects a $15.2 million increase to inventory and a $2.5 million increase in accounts receivable, partially offset by a $4.5 million decrease in cash and cash equivalents, a $4.4 million decrease in prepaids, a $0.7 million reduction in restricted cash, and a $5.9 million increase in accounts payable and other accrued liabilities. Inventories increased due to an increase in operating supplies and the buildup of finished goods on our paper products due to seasonally slower year-end sales falling short of production. The increase in accounts payable mostly reflects an increase in trade payables due, in part, to improved trade terms. |

| Assets held for sale | | | 5.7 | | | | 34.3 | | | | (28.6 | ) | | Decrease due to the sale of Elk Falls, Snowflake, two parcels of poplar land, and the Port Alberni wastewater lagoon. Remaining assets held for sale consist of poplar land, the mortgage receivable from PRSC Limited Partnership and our interest in PRSC Land Development Ltd. |

| Property, plant and equipment | | | 412.2 | | | | 611.6 | | | | (199.4 | ) | | Decrease mainly due to the de-recognition of the property, plant and equipment of PREI due to the sale of our interest in PREI, an impairment charge on the fixed assets of the Port Alberni and Powell River mills, and the impact of depreciation exceeding capital spending for the year. |

| Goodwill | | | – | | | | 56.7 | | | | (56.7 | ) | | Goodwill was fully impaired in the year. |

| Other assets | | | 8.9 | | | | 11.0 | | | | (2.1 | ) | | Decrease mainly due to amortization recognized on deferred financing cost related to our debt. |

| Liabilities associated with assets held for sale | | | – | | | | 15.2 | | | | (15.2 | ) | | The liability was settled due to the sale of the Snowflake mill. The mill’s accounts payable and other liabilities had been classified as held for sale up to the date of disposal. |

| Total debt | | | 303.8 | | | | 428.6 | | | | (124.8 | ) | | Decrease mainly due to the de-recognition of non-recourse debt on the sale of our interest in PREI, as well as the purchase of a portion of our Exit Notes. |

| Employee future benefits | | | 254.9 | | | | 289.7 | | | | (34.8 | ) | | Decrease reflects an actuarial gain recognized on our pension plans that included a settlement credit related to the partial settlement of the Salaried Plan under the special portability election option, as well as the fact that cash contributions to fund employee future benefits exceeded related expenses recognized for the year. |

| Other long-term obligations | | | 8.8 | | | | 8.9 | | | | (0.1 | ) | | Slight decrease due to progress made on an environmental remediation project resulting in a reduction to the related liability. |

| 8. | Liquidity and Capital Resources |