Exhibit 99.1

CATALYST PAPER CORPORATION

NOTICE OF

2016 ANNUAL GENERAL MEETING

OF THE SHAREHOLDERS OF

CATALYST PAPER CORPORATION

TO BE HELD ON MAY 10, 2016

MANAGEMENT INFORMATION CIRCULAR

NOTICE OF ANNUAL GENERAL MEETING

TO: THE HOLDERS OF COMMON SHARES OF CATALYST PAPER CORPORATION

Notice is hereby given that the Annual General Meeting (the “Meeting”) of the shareholders of Catalyst Paper Corporation (the “Corporation”) will be held at Catalyst’s Head Office, 1st Floor, 3600 Lysander Lane, Richmond, British Columbia, V7B 1C3 on Tuesday, May 10, 2016 at 12:30 p.m. Vancouver time, for the following purposes:

| 1. | To place before the Meeting the audited consolidated financial statements of the Corporation for the year ended December 31, 2015, and the auditors’ report thereon; |

| 2. | To reappoint KPMG LLP as auditors of the Corporation for the ensuing year; |

| 3. | To elect directors for the ensuing year; and |

| 4. | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

The specific details of the foregoing matters to be put before the Meeting are set forth in the Management Information Circular accompanying this Notice.

The directors have fixed the close of business on March 14, 2016 as the record date for determining shareholders who are entitled to attend and vote at the Meeting.

The consolidated financial statements for the year ended December 31, 2015, together with the auditors’ reports thereon, are included in the 2015 Annual Report of the Company, available on our website atwww.catalystpaper.com and on SEDAR atwww.sedar.com. Copies may be obtained, free of charge, upon request from the Corporate Secretary, Catalyst Paper Corporation, 2nd Floor, 3600 Lysander Lane, Richmond, British Columbia, Canada, V7B 1C3. Shareholders are invited to attend the Meeting.

Registered shareholders who cannot attend the Meeting in person are encouraged to date, sign and deliver the accompanying proxy and return it in the enclosed envelope to the Corporation c/o Proxy Department, CST Trust Company, PO Box 721, Agincourt, Ontario M1S 0A1, Canada. To be effective, the proxy must be received by CST Trust Company prior to 12:30 p.m. Vancouver time on May 6, 2016, or if the Meeting is adjourned, not less than 48 hours (excluding Saturdays and holidays) before the time for holding the adjourned Meeting.

Non-registered shareholders who receive these materials through their broker or other intermediary should complete and send the form of proxy in accordance with the instructions provided by their broker or intermediary.

DATED at Vancouver, British Columbia, this 14th day of March, 2016.

| | By order of the Board of Directors |

| | |

| | “James Isaac” |

| | |

| | James Isaac |

| | Corporate Legal Counsel and Corporate Secretary |

TABLE OF CONTENTS

| general Proxy Information | 3 |

| Solicitation of Proxies | 3 |

| Voting by Proxies | 3 |

| Advice to Beneficial Holders of Shares | 3 |

| Additional Information for Non-Registered Shareholders | 4 |

| Revocability of Proxies | 4 |

| Voting Shares and Principal Holders | 5 |

| | |

| ELECTION OF DIRECTORS | 5 |

| Majority Voting Policy | 10 |

| | |

| APPOINTMENT OF AUDITORS | 10 |

| | |

| Catalyst Paper Corporation Background | 10 |

| | |

| STATEMENT OF EXECUTIVE COMPENSATION | 11 |

| Compensation Discussion and Analysis | 11 |

| Performance Graph | 13 |

| Compensation Governance | 14 |

| Summary Compensation Table | 16 |

| Incentive Plan Awards | 16 |

| Outstanding Share Based and Option Based Awards | 17 |

| Incentive Plan Awards – Value Vested or Earned During the Year | 17 |

| Pension Plan Benefits | 17 |

| Defined Contribution Plans Table | 19 |

| Termination and Change of Control Benefits | 19 |

| Board of Directors Compensation | 20 |

| Securities Authorized for Issuance Under Equity Compensation Plans | 23 |

| Indebtedness of Directors and Executive Officers | 23 |

| Interests of Informed Persons in Material Transactions | 23 |

| Directors’ and Officers’ Liability Insurance | 23 |

| | |

| STATEMENT OF CORPORATE GOVERNANCE PRACTICES | 24 |

| Composition of the Board | 24 |

| Board Mandate | 24 |

| Position Descriptions | 25 |

| Orientation and Continuing Legal Education | 25 |

| Ethical Business Conduct | 25 |

| Nomination of Directors | 26 |

| Committees of the Board | 26 |

| Term Limits | 29 |

| Gender Diversity Policy | 29 |

| | |

| Other Information | 29 |

| Availability of Documents | 29 |

| Shareholder Proposal for 2017 Annual Meeting | 30 |

| Approval of Circular | 30 |

| | |

| schedules | |

| Schedule A – Compliance with Corporate Governance Guidelines | 31 |

| Schedule B – Board Administration Guidelines and Terms of Reference | 37 |

| Schedule C – Terms of Reference for the Board of Directors | 40 |

| Schedule D – Audit Committee Terms of Reference | 43 |

| Schedule E – Governance, Human Resources and Compensation Committee Terms of Reference | 50 |

Catalyst Paper Corporation

Management information circular

Dated March 14, 2016

general Proxy Information

Solicitation of Proxies

This management information circular (the “Circular”) is furnished in connection with the solicitation of proxies by the management of CATALYST PAPER CORPORATION (the “Corporation”) for use at the Annual General Meeting (the “Meeting”) of the Shareholders (the “Shareholders”) of the Corporation to be held on Tuesday, May 10, 2016 and any adjournments thereof, at the time and place and for the purposes set forth in the accompanying Notice of Annual General Meeting (the “Notice”).The cost of the solicitation will be born by the Corporation.It is expected that the solicitation will be made primarily by mail but proxies may also be solicited personally by directors, officers or employees of the Corporation. Such persons will not receive any extra compensation for such activities. The Corporation may also retain, and pay a fee to, one or more proxy solicitation firms to solicit proxies from the shareholders of the Corporation in favour of the matters set forth in the Notice.

Voting by Proxies

The persons designated by management of the Corporation in the enclosed form of proxy are directors or officers of the Corporation.

The form of proxy accompanying this Circular confers discretionary authority upon the proxy nominee with respect to any amendments or variations to the matters identified in the Notice and any other matters which may properly come before the Meeting or any adjournment thereof. Management of the Corporation is not aware of any amendments to the matters to be presented for action at the Meeting or of any other matters to be presented for action at the Meeting. However, if any amendment to matters identified in the accompanying Notice or any other matters which are not now known to management should properly come before the Meeting or any adjournment thereof, the common shares of the Corporation (“Common Shares”) represented by properly executed proxies in favour of the persons designated by management will be voted on such matters pursuant to such discretionary authority.

On any ballot, the Common Shares represented by the proxy will be voted or withheld from voting in accordance with the instructions of the registered Shareholder as specified in the proxy with respect to any matter to be acted on.If a choice is not specified with respect to any matter, the Common Shares represented by a proxy given in favour of the persons designated by management are intended to be voted in favour of each of the matters referred to herein, including FOR the nominees of management for directors and auditors.

A registered Shareholder has the right to appoint as proxyholder a person (who need not be a Shareholder) to attend and act for the Shareholder and on the Shareholder’s behalf at the Meeting or at any adjournment thereof other than the persons designated by management in the enclosed form of proxy, and may exercise such right by inserting the name in full of the desired person in the blank space provided in the form of proxy. In the case ofregistered Shareholders, the completed, dated and signed form of proxy must be delivered to the Corporation, c/o Proxy Department, CST Trust Company, PO Box 721, Agincourt, Ontario M1S 0A1, prior to 12:30 p.m. Vancouver time on Friday, May 6, 2016. A self-addressed envelope is enclosed. In the case ofnon-registered Shareholders who receive these materials through their broker or other intermediary, such Shareholders should complete the form of proxy in accordance with the instructions provided by their broker or intermediary. See“Advice to Beneficial Holders of Shares” below.

Advice to Beneficial Holders of Shares

The information set forth in this section is of significant importance to persons who beneficially own Common Shares which are not registered in their own name. Shareholders who hold Common Shares through intermediaries (such as banks, trust companies, securities dealers or brokers or the trustee or administrator of a self-administered RRSP, RRIF, RESP or similar plan) or who otherwise do not hold the Common Shares in their own name should note that only proxies deposited by persons whose names appear on the records of the Corporation may be recognized and acted upon at the Meeting. Common Shares held through intermediaries by Shareholders who have not received the Meeting materials directly from the Corporation or CST Trust Company (the “Transfer Agent”) can only be voted for or against the matters to be considered at the Meeting by following instructions received from the intermediary through which those Common Shares are held. Without specific instructions from the beneficial holder, intermediaries are required not to vote the Common Shares held by them. The directors and officers of the Corporation do not know for whose benefit the Common Shares registered in the name of intermediaries are held unless the beneficial holder has consented to the disclosure of such information to the Corporation. See “Additional Information for Non-Registered Shareholders” below.

Applicable securities laws require intermediaries to forward meeting materials and seek voting instructions from beneficial holders of Common Shares in advance of the Meeting. Intermediaries typically have their own mailing procedures and provide their own return instructions, which should be carefully followed by beneficial holders in order to ensure that their Common Shares are voted at the Meeting. Typically, intermediaries will use service companies to forward meeting materials and voting instructions to beneficial holders. Beneficial holders who receive Meeting materials from an intermediary will generally either be provided with:

| (a) | a form of proxy which has already been signed by the intermediary (typically by facsimile stamped signature), which is restricted as to the number of securities beneficially owned by the beneficial holder, but which is otherwise not completed by the intermediary. In this case, the beneficial holder who wishes to submit a proxy in respect of beneficially owned Common Shares should properly complete the remainder of this form of proxy and follow the instructions from the intermediary as to delivery; or |

| (b) | more typically, a voting instruction form (a “VIF”), which must be completed, signed and delivered by the beneficial holder (or, if applicable, such other means as set out in the form) in accordance with the directions on the VIF. |

The purpose of these procedures is to permit beneficial holders to direct the voting of the Common Shares they beneficially own. If you are a beneficial holder who receives either a form of proxy or a VIF from an intermediary and you wish to attend and vote at the Meeting in person (or have another individual attend and vote in person on your behalf), you should strike out the names of the individuals named in the form of proxy and insert your name (or such other person’s name) in the blank space provided or, in the case of a VIF, contact the intermediary. A beneficial holder should carefully follow the instructions of his or her intermediary and/or his or her intermediary’s service company.

Additional Information for Non-Registered Shareholders

This Circular and accompanying materials are being sent to both registered and beneficial owners of Common Shares. There are two kinds of beneficial holders of Common Shares: those who object to their name being made known to the Corporation (called OBOs or Objecting Beneficial Owners) and those who do not object to the Corporation knowing who they are (called NOBOs or Non-Objecting Beneficial Owners). Provided the Corporation complies with the applicable provisions of National Instrument 54-101, Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), the Corporation is permitted to directly deliver the Meeting materials to its NOBOs. If you are a non-registered Shareholder and the Corporation or its agent has sent these materials directly to you, your name and address and information about your holdings of Common Shares have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding the Common Shares on your behalf.

By choosing to send these materials to you directly, the Corporation has assumed responsibility for (i) delivering these materials to you, and (ii) executing your proper voting instructions. As a result, if you are a NOBO, you can expect to receive with your Meeting materials a VIF. These VIFs are to be completed and returned to the Transfer Agent in the envelope provided or by facsimile. The Transfer Agent will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the Common Shares represented by the VIFs it receives. Please return your voting instructions as specified in the request for voting instructions.

Revocability of Proxies

A registered Shareholder executing and delivering a proxy has the power to revoke it in accordance with the provisions of section 148(4) of theCanada Business Corporations Act, which provides that every proxy may be revoked by an instrument in writing executed by the Shareholder or by his or her attorney authorized in writing and delivered either to the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof at which the proxy is to be used, or to the chair of the Meeting on the day of the Meeting or any adjournment thereof, or in any other manner provided by law.

Voting Shares and Principal Holders

As at March 14, 2016, the authorized capital of the Corporation consists of an unlimited number of Common Shares and 100,000,000preferred shares, of which 14,527,571Common Shares and no preferred shares are issued and outstanding. The Common Shares are entitled to be voted at the Meeting and on a ballot each Common Share is entitled to one vote. The board of directors of the Corporation (the “Board”) has fixed the record date for determination of the Shareholders entitled to attend and vote at the Meeting as March 14, 2016. Only holders of record at the close of business on the record date are entitled to vote the Common Shares registered in such Shareholder’s name at that date on each matter to be acted upon at the Meeting. A simple majority of votes cast are required to approve all matters to be submitted to a vote of Shareholders at the Meeting.

To the knowledge of the directors and executive officers of the Corporation, as at March 1, 2016, the only persons that beneficially own, directly or indirectly, or exercise control or direction over, more than 10 per cent of the outstanding Common Shares are:

| (i) | Cyrus Capital Partners L.P., which maintains an aggregate number of Common Shares held by all of its managed accounts of 6,452,141 Common Shares, which represents approximately 44.4% of the outstanding Common Shares; and |

| (ii) | Mudrick Capital Management, L.P., which maintains an aggregate number of Common Shares held by all of its managed accounts of 2,860,473 Common Shares, which represents approximately 19.7% of the outstanding Common Shares. |

As at March 14, 2016, the directors and officers of the Corporation as a group beneficially own, directly or indirectly, or exercise control or direction over, less than one percent of the issued and outstanding Common Shares.

ELECTION OF DIRECTORS

The number of directors to be elected at the Meeting is seven. Each person whose name appears hereunder is proposed by management to be nominated for election as a director of the Corporation to serve until the next annual meeting of the Shareholders of the Corporation or until they sooner cease to hold office.

In the absence of a contrary instruction, the person(s) designated by management of the Corporation in the enclosed form of proxy intend to vote FOR the election as directors of the proposed nominees whose names are set forth below, each of whom has been a director since the date indicated below opposite the proposed nominee’s name. Management does not contemplate that any of the proposed nominees will be unable to serve as a director, but if that should occur for any reason prior to the Meeting, the Common Shares represented by properly executed proxies given in favour of such nominee(s) may be voted by the person(s) designated by management of the Corporation in the enclosed form of proxy, in their discretion, in favour of another nominee.

The following table sets forth information with respect to each person proposed to be nominated for election as a director, including the number of Common Shares beneficially owned, directly or indirectly, or over which control or direction was exercised, by such person or the person’s associates or affiliates as at March 14, 2016. The information as to Common Shares beneficially owned or over which control or direction is exercised has been furnished by the respective proposed nominees individually.

| JOHN BRECKER

Age: 52

New York, New York USA

Director since: September 13, 2012

Independent Mr. Brecker is a director of Bowery Management and a principal of Drivetrain Advisors. He is a Co-founder of Longacre Fund Management, LLC with offices in New York, NY and London, England and has served as a principal of that organization since 1999. Mr. Brecker has both domestic and international experience in investing and operations management. Mr. Brecker has a law degree from St. John’s University School of Law, J.D. and a Bachelor of Arts in Political Science from American University. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | Nil | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Audit Committee | 7/7 | 100% |

| Options | Nil | Other Public Boards | | |

| Phantom Share Units | 38,489 | Broadview Networks, Inc. – Director | | |

| Restricted Share Units | Nil | Dune Energy Inc. – Director | | |

| | | PMI Group, Inc. – Director | | |

| | | Targus Group International, Inc. – Director | | |

| TODD DILLABOUGH

Age: 54

Calgary, Alberta Canada

Director since: September 13, 2012

Independent Mr. Dillabough is the Chairman, President and Chief Executive Officer of Barons Resources Corp., a director of San Antonio Oil and Gas Services Ltd. and a former director of Aveos Fleet Performance Inc. Previously, he was President, Chief Executive Officer and Chief Operating Officer of Trident Resources Corporation and Pioneer Natural Resources Canada Inc. Mr. Dillabough has domestic and international operational management, M&A, capital markets and financial restructuring experience. Mr. Dillabough has a B.Sc Geology from the University of Calgary and is a member of both APEGA and SPE. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | Nil | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Governance, Human Resources & | | |

| Options | Nil | Compensation Committee | 12/12 | 100% |

| Phantom Share Units | 38,489 | Environmental, Health & Safety Committee | 4/4 | 100% |

| Restricted Share Units | Nil | Other Public Boards | | |

| | | Nil | | |

| WALTER JONES

Age: 62

Denver, CO USA

Director since: September 13, 2012

Independent Mr. Jones was the Managing Director of CoMetrics Partners LLC from 2010 thru 2013 specializing in restructuring and financial advisory services. From 2006 to 2010, he was a partner with JH Cohn, LLP, a consulting, audit and tax advisory firm. From 1997 to 2006, he was a Principal with Mahoney Cohen, a consulting, audit and tax advisory firm. Prior to that from 1987 thru 1997, Mr Jones was a Principal of GDL Management a boutique firm specializing in restructuring and financial advisory services. Mr. Jones is currently a director and member of the Audit Committee of Neenah Enterprises, Inc. and a director of International Wire Group, Inc. He is also currently serving as the Financial Advisor to the bondholders of American Eagle Energy Corp. Mr. Jones has a Bachelor of Science degree in industrial engineering from Pennsylvania State University. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | Nil | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Audit Committee | 7/7 | 100% |

| Options | Nil | Other Public Boards | | |

| Phantom Share Units | 38,489 | Neenah Enterprises Inc. – Director and Member of the Audit Committee |

| Restricted Share Units | Nil | International Wire Group, Inc. – Director | | |

| LESLIE LEDERER

Age: 67

Chicago, Illinois USA

Director since: September 13, 2012

Independent Mr. Lederer is an attorney who assists his clients with financing, restructuring and M&A activities. He has worked with both Canadian and American counsel and financiers in turning companies around. He has acted as a consultant in financing, restructuring and mergers and acquisitions since 2008. Mr. Lederer was interim President and Chief Executive Officer of Catalyst Paper Corporation from June 2013 to September 2013. From July 2007 to August 2008, he was senior advisor for SSAB Svenskt Stal AB a Swedish based international steel producer. Prior to that he was at IPSCO Inc. in the capacity of Vice President, Secretary and General Counsel when it was acquired by SSAB. Mr. Lederer has a B.Sc Accounting, from the University of Illinois, is a Certified Public Accountant, and a J.D. College of Law from the University of Illinois. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | Nil | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Governance, Human Resources & | | |

| Options | Nil | Compensation Committee | 12/12 | 100% |

| Phantom Share Units | 38,489 | Environmental, Health & Safety Committee | 4/4 | 100% |

| Restricted Share Units | Nil | | | |

| | | Other Public Boards | | |

| | | Nil | | |

| JILL LEVERSAGE

Age: 59

Vancouver, BC, Canada

Director since: June 24, 2013

Independent Ms. Leversage has over 30 years of experience working in financial services in Vancouver. She currently serves as a director for a portfolio of companies, providing her extensive expertise in the public, private and not-for-profit sectors. Ms. Leversage has a track record of providing strategic advice to clients, executing M&A mandates, as well as numerous debt and equity financings for both public and private markets. She served as a Managing Director of Highland West Capital from 2013-2015. In 2012, Ms. Leversage spent a year as a financial consultant, and for nine years prior to that, was the Managing Director, Investment Banking of TD Securities. From 1993 to 2002, she was Managing Director of RBC Capital Markets. Ms. Leversage is a Fellow of the Institute of Chartered Professional Accountants of British Columbia. She is also a Chartered Business Valuator of the Canadian Institute of Chartered Business Valuators and an Accredited Director of the Chartered Secretaries & Administrators. She holds a Bachelor of Commerce degree from the University of Calgary. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | 3,940 | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Audit Committee | 7/7 | 100% |

| Options | Nil | Other Public Boards | | |

| Phantom Share Units | 38,489 | MAG Silver – Director, Member of the Audit Committee and Chair of the Sustainability Committee |

| Restricted Share Units | Nil |

| JOE NEMETH

Age: 51

Langley, BC, Canada

Director since: October 1, 2013

Non-independent Mr. Nemeth was appointed the Corporation’s President and Chief Executive Officer on October 1, 2013. Mr. Nemeth has over 30 years of pulp and paper experience, including line management positions in sales, marketing and operations. From 2010 to 2012 Mr. Nemeth was the President and Chief Executive Officer of Canfor Pulp Products Inc. and from 2003 to 2009 was Vice-President, Sales and Marketing of the Canfor Pulp Income Fund. Mr. Nemeth has a Master of Business Administration from the University of Western Ontario and a Bachelor of Forestry (Honours) from the University of British Columbia. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | Nil | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Other Public Boards | | |

| Options | Nil | Fortress Paper Ltd. - Lead Director. Chair, Compensation Committee and Member, Governance Committee |

| Phantom Share Units | 449,438 |

| Restricted Share Units | Nil | | | |

| PIERRE RAYMOND

Age: 61

Montreal, PQ, Canada

Director since: July 8, 2014

Independent Mr. Raymond retired in May 2014 from Stikeman Elliott as a partner in the Montréal office. He served as Chair of the firm from 2006 to 2012 and as a member of the Partnership Board and the Executive Committee from 1997 to 2012. After he stepped down as Chair of the firm, Mr. Raymond continued to coordinate the firm’s multiple country and regional initiatives and maintained a management role in the Montréal office, with a focus on client relations. His practice focused primarily on public mergers and acquisitions, securities regulation and corporate finance. Mr. Raymond was counsel to various corporations with regard to national and international securities offerings, tender offers and financings. Mr. Raymond also counselled US and European clients with respect to Québec law in connection with international privatizations, tender offers and acquisitions. |

| Securities Held | | Board and Committee Membership | Meeting | Attendance |

| Common Shares | Nil | Board of Directors | 10/10 | 100% |

| Deferred Share Units | Nil | Governance, Human Resources & | | |

| Options | Nil | Compensation Committee | 12/12 | 100% |

| | | | |

| Phantom Share Units | 38,489 | Environmental, Health & Safety Committee | 4/4 | 100% |

| Restricted Share Units | Nil | | | |

| | | Other Public Boards | | |

| | | Imvescor Restaurant Group Inc. – Director and Chair of the Human Resources and Governance Committee | | |

The Corporation does not have an executive committee.

Except as disclosed in this Circular, to the knowledge of the Corporation, none of the directors of the Corporation:

| (a) | is, at the date of this Circular, or has been, within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company that, while that person was acting in that capacity: |

| (i) | was the subject of a cease trade or similar order, or an order that denied the other relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; |

| (ii) | was subject to an event that resulted, after the director, chief executive officer or chief financial officer ceased to be a director or executive officer, in the company being the subject of a cease trade or similar order, or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or |

| (b) | is, at the date of this Circular, or has been, within 10 years before the date of this Circular, a director or executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | has, within 10 years before the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of such person. |

To the knowledge of the Corporation, no director of the Corporation has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

Mr. Brecker was a director of Dune Energy, Inc. when the company and two affiliated debtors each filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code on March 8, 2015.

Mr. Dillabough was the Chief Executive Officer of Trident Exploration Corp. when it filed a voluntary petition for relief under theCompanies’ Creditors Arrangement Act (Canada)(“CCAA”)and under Chapter 11 of the United States Bankruptcy Code in September 2009 and then emerged successfully in June 2010. Mr. Dillabough was a director of Aveos Fleet Performance Inc. when that company filed a voluntary petition for relief under the CCAA on March 19, 2012. Mr. Dillabough resigned from Aveos Fleet Performance Inc. immediately following the filing.

Mr. Lederer was a director of Port Townsend Paper Corporation in 2007 when it filed for relief under Chapter 11 of the United States Bankruptcy Code.

Majority Voting Policy

As part of its ongoing review of corporate governance practices, on March 6, 2013 the Board adopted a policy providing that in an uncontested election of directors, if the number of shares “withheld” for any nominee exceeds the number of shares voted “for” such nominee, then, notwithstanding that such director was duly elected as a matter of corporate law, he or she shall, within five days following the date of the final scrutineer’s report on the ballot, tender his or her written resignation to the Chair of the Board.

The Governance, Human Resources and Compensation Committee (the “GHRCC”) will consider such offer of resignation and will make a recommendation to the Board concerning the acceptance or rejection of the resignation. In its deliberations, the GHRCC will consider all factors deemed relevant. The Board will take formal action on the GHRCC’s recommendation no later than 90 days following the date of the applicable shareholders’ meeting and will announce its decision via press release. No director who is required to tender his or her resignation shall participate in the GHRCC’s deliberations or recommendations or in the Board’s deliberations or determination.

If a resignation is accepted by the Board, and subject to any corporate law restrictions, the Board may leave any resulting vacancy unfilled until the next annual general meeting, or may appoint a new director, who the Board considers to merit the confidence of the Shareholders, to fill the vacancy, or may call a special meeting of Shareholders at which there will be presented a management slate to fill the vacant position or positions.

APPOINTMENT OF AUDITORS

KPMG LLP are the current auditors of the Corporation. At the Meeting, the holders of Common Shares will be asked to reappoint KPMG as auditors of the Corporation to hold office until the next annual meeting of the Shareholders of the Corporation or until a successor is appointed. A predecessor firm of KPMG LLP was first appointed to such office in 1946.

In the absence of a contrary instruction, the person(s) designated by management of the Corporation in the enclosed form of proxy intend to vote FOR the re-appointment of KPMG LLP as auditors of the Corporation to hold office until the next annual meeting of the Shareholders or until a successor is appointed.

Catalyst Paper Corporation Background

The Corporation and certain of its subsidiaries filed for protection under the CCAA on January 31, 2012. As a result of that filing, the TSX suspended the trading of the Corporation’s common shares on the TSX on February 1, 2012 and delisted the Corporation’s common shares effective as of the close of markets on March 8, 2012. The Corporation’s stock option and restricted share unit plans in effect at that time ceased to be in effect upon the delisting.

The Corporation implemented a plan of arrangement (“Plan of Arrangement”) under the CCAA that was completed on September 13, 2012. Effective on that date, all issued and outstanding common shares, stock options, restricted share units and deferred share units of the Corporation were deemed automatically cancelled and of no further force and effect. Pursuant to the Plan of Arrangement 14,400,000 new Common Shares were issued to certain secured creditors of the Corporation on September 13, 2012 and a further 127,571 new Common Shares were issued to certain creditors of the Corporation on December 19, 2012.

On January 7, 2013, the Corporation’s new Common Shares were listed on the TSX.

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Corporation’s executive compensation strategy is based on a philosophy which includes three principal components:

| (i) | base salary and benefits aimed at compensating the executive for specific and general accountabilities as well as the skills, knowledge and experience brought to the job; |

| (ii) | short term incentives payable in cash intended to focus initiative on annual objectives and reward behaviour that achieves corporate performance targets; and |

| (iii) | mid and long term incentives granted partly through the issuance of equity based compensation, such as stock options, restricted share units, phantom share units and deferred share units, to encourage the enhancement of Shareholder value and partly payable in cash. |

The total compensation strategy is intended to accomplish the following objectives:

| · | to attract executive officers who have demonstrated superior leadership and management skills; |

| · | to retain the services of valued members of the executive team throughout the normal business cycles typical of resource-based companies; |

| · | to link the interests of the executive officers with those of the Shareholders; and |

| · | to motivate executive officers to achieve excellence within their respective areas of accountability. |

Current Peer Group

The Corporation believes its compensation objectives will be reached with a total compensation package which corresponds to base salaries targeted at or below the median of primary and/or secondary peer groups established by the Board.

The 2015 acquisition of the Biron, Wisconsin and Rumford Maine Mills expanded the Corporation’s production capacity by 65%. The Corporation’s product lines and customer base also expanded and results in further penetration of the US market. Close to 50% of Corporation’s business is now in the U.S.

Because of the added scale and complexity of the Corporation, and as part of the 2015 executive compensation review, the GHRCC revised the primary peer group to include publicly-traded Canadian forest and paper product companies with annual revenue between $500 million and $4.5 billion and publicly-traded U.S. paper product companies with revenue between $800 million and $2 billion. Catalyst’s estimated 2015 revenue is positioned close to the 75th percentile of this larger group of companies.

The primary peers are as follows:

Canadian Peers

| Canfor Corporation | Canfor Pulp Products Inc. |

| Interfor Corporation | Mercer International Inc. |

| Norbord Inc. | Resolute Forest Products Inc. |

| Stella-Jones Inc. | Tembec Inc. |

| West Fraser Timber Co. Ltd. | West Forest Products Inc. |

U.S. Peers

| Clearwater Paper Corporation | Neenah Paper Ltd. |

| PH Glatfelter Co. | Verso Paper Corporation |

As a secondary reference, Catalyst also compares its compensation to capital intensive industries. No revenue restriction is applied, as the data used is size-adjusted based on Catalyst’s annual revenue.

The GHRCC reviews and benchmarks the Corporation’s total compensation for its executives against the comparator peer group to ensure that Catalyst is providing competitive compensation. Actual awards paid to executives will vary based upon both individual and corporate performance as determined by the GHRCC. Under this philosophy average performance is expected to merit below average pay and superior performance is rewarded with top decile pay, subject to significant weighting towards the impact of corporate performance. Further variability may exist between the 50th and 90th percentile based on the knowledge, experience and performance that the executive brings to his or her respective position.

Salaries, benefits and perquisites are generally reviewed annually and adjustments are made when appropriate.

Various sources of market data are used to ensure that executive compensation levels are aligned with competitive market trends and that the executive compensation plan remains competitive relative to total compensation packages for similar roles in the forest industry and general industry. The Corporation intends, over time, to adjust the compensation opportunity for the executives to reflect the scope and complexity of their roles and to align pay levels according to the Corporation’s compensation philosophy relative to the peer group.

Base Salary, Benefits and Perquisites

Base salary is a fixed element of compensation for each executive officer for performing his or her position’s specific responsibilities and is typically determined with general reference to, among other things, base salary compensation at industry peers. Base salary is intended to fit into the Corporation’s overall compensation objectives by serving to attract and retain talented executive officers. Base salaries are targeted at or below the median of primary and/or secondary peer groups established by the Board with the assistance of independent consultants. Variability may exist between the 50th and 90th percentile based on the knowledge, experience and performance that the executive brings to his or her respective position.

Short Term Incentive Plan

The executive short-term incentive plan (“STIP”) is intended to provide variable pay based on the achievement of measurable corporate and individual performance objectives. Each executive position has a target STIP award value that is expressed as a percentage of base salary. The percentage of base salary represented by the target STIP award for the CEO and each Named Executive Officer (as defined below) is as follows: Mr. Nemeth: 100%; Mr. Bayles: 60%; Mr. De Costanzo: 60%, Mr. Maule: 60% and Mr. Posyniak: 60%. Target STIP potential is established such that target total cash compensation is positioned between the 75th and 90th percentile levels of the primary peer group. STIP targets and awards are designed to be reflective of executive performance and are linked to specific value creation within the organization. STIP awards are allocated in cash.

The Board adopted a new design for the STIP plan for use in 2015 that is driven by improvement in free cash flow and important corporate, business unit and individual performance measures. The plan becomes active once the free cash flow trigger set by the Board has been hurdled. Employees then become eligible for a STIP award based on corporate, divisional and individual performance. As the Free Cash flow trigger was not hurdled in 2015, there were no STIP payments to the CEO and Named Executive Officers for 2015.

Mid to Long Term Incentive Plan

The Board believes that executives should have a stake in the Corporation’s future and their interests should be aligned with those of the shareholders.

The MLTIP has targets established for each participant and has three components, each based on 1/3 of the target MLTIP over the MLTIP period for each executive:

| 1. | Time based awards, payable in three instalments at the end of each year of the applicable MLTIP period in cash. |

| 2. | Performance based cash awards where free cash flow (calculated as EBITDA less capital expenditures, interest expense, taxes and employee future benefits (excess cash funding over expense)) for any year in the MLTIP period exceeds $1 million. The payment is calculated for each year by multiplying the 1/3 target MLTIP amount which are divided into three equal annual components that are adjusted for each year using the performance multiplier (the ratio of free cash flow for the year over $12.5 million to a maximum ratio of 2 to 1). There were no performance based cash awards earned in respect of 2014 or 2015. |

| 3. | Grants of PhantomSUs which provide for payments in an amount by which the market value of a Catalyst share on the vesting date exceeds the market value of a catalyst share on the grant date of that share unit. PhantomSUs are issued and paid in CAD currency. Market value is based on a 20 day volume weighted average trading price per share. For the NEOs, PSUs have been granted with the following grant prices: $1.17 per share in the case of Mr. Nemeth; $3.59 in the case of Mr. De Costanzo; $2.73 in the case of Mr. Maule; $2.59 per share in the case of Mr. Bayles and $2.20 per share in the case of Mr. Posyniak. |

In order to be eligible for time based awards, the executive has to be employed by the Corporation on the applicable vesting date. Vesting of performance based cash awards and PhantomSUs granted under the MLTIP vest, on December 31, 2016 with accelerated vesting and payment on a pro-rated basis in the event of retirement, death or disability, termination without cause or change of control and similar events. Applicable payments occur shortly after vest. Performance based cash awards and PhantomSUs are forfeited on resignation or termination with cause.

As described under “Compensation Discussion and Analysis”, the Corporation’s compensation strategy is intended to encourage the enhancement of Shareholder value and link the interests of the executive officers with those of the shareholders. The Corporation is considering alternatives to the present MLTIP model. Specifically, the Corporation wishes to consider moving to a long term incentive pay plan.

TheBoard and the GHRCC have considered the implications of the risks associated with the Corporation’s compensation policies and practices. No risks have been identified arising from the Corporation’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Corporation. As a result, the Board and the GHRCC do not believe that the Corporation’s compensation policies and practices encourage executive officers of the Corporation to expose the Corporation to inappropriate or excessive risks.

Both the Board and the GHRCC are regularly briefed on the Corporation’s results and their effect on the Corporation’s compensation plans. The STIP for salaried employees is both driven by the financial gains made from operational improvements as well as several key performance indicators. The gains are subject to review and validation by the Director of Audit and Risk Management, who reports his finding directly to the Audit Committee.

The MLTIP provides the GHRCC with the capacity to apply informed judgment to adjust payouts in the case of an extraordinary event.

The Corporation does not currently have a policy on whether or not a named executive officer (as described below) or director is permitted to purchase financial instruments that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the named executive officer or director.

Performance Graph

As described elsewhere in this Circular, the Corporation’s current Common Shares (symbol: CYT) were listed and commenced trading on the TSX on January 7, 2013. The TSX had previously suspended trading of the Corporation’s former common shares (symbol: CTL) on February 1, 2012 and delisted them on March 8, 2012 due to the Corporation’s proceedings under the CCAA. The Corporation’s former common shares were then cancelled on September 13, 2012 for no consideration when the restructuring under the Plan of Arrangement completed.

For historical purposes, the following graph compares the yearly percentage change in the Corporation’s cumulative total shareholder return from an investment in the Corporation’s former common shares (symbol: CTL) with the cumulative total return of the S&P/TSX Composite Index (“S&P/TSX”) and the TSX Paper & Forest Products Group and Sub Group (“TSX P&FP”) over the period from December 31, 2010 to March 8, 2012 when they were delisted and illustrates a cumulative return on a $100 investment in the Corporation’s former common shares made on December 31, 2010 as compared with the cumulative return on the S&P/TSX and the TSX P&FP on the same dates.

The graph also provides a corresponding comparison for the new Common Shares (symbol: CYT) from January 7, 2013 to December 31, 2015. Performance as indicated in the graph does not necessarily indicate future performance.

| | | Dec 31/11 | | | Dec 31/12 | | | Dec 31/13 | | | Dec 31/14 | | | Dec 31/15 | |

| CTL | | | 14.9 | | | | 6.4 | | | | n/a | | | | n/a | | | | n/a | |

| CYT | | | n/a | | | | n/a | | | | 100.0 | | | | 152.0 | | | | 120.0 | |

| S&P/TSX | | | 91.4 | | | | 97.9 | | | | 97.9 | | | | 121.9 | | | | 112.0 | |

| TSX P&FP | | | 26.0 | | | | 42.8 | | | | 42.8 | | | | 76.2 | | | | 59.9 | |

The graph above reflects how the Corporation continued to be negatively impacted by structural changes in the industry in 2011 to 2015 including permanently reduced demand for certain paper products and significant excess production capacity. During this period, the Corporation structured its executive compensation strategy to take into account the cyclical nature and structural deficiencies of the industry. No STIP awards were made in respect of 2012 or 2013. A STIP award in respect of 2014 performance was awarded in 2015.

Compensation Governance

The GHRCC was established by the Board to assist the Board in fulfilling its responsibilities relating to, among other things, determining compensation matters, including the evaluation and approval of the Corporation’s compensation plans, policies and programs. It is the GHRCC’s responsibility to ensure that the Corporation develops and maintains a compensation program for its executive officers that will be fair and competitive, consistent with the best interests of the Corporation.

The GHRCC is responsible for reviewing the position description and performance goals and objectives relevant to the compensation of the Chief Executive Officer (the “CEO” or “Chief Executive Officer”) and for evaluating the CEO’s performance in light of those goals and objectives. The GHRCC recommends to the Board the CEO’s compensation based on such evaluation. The GHRCC is also responsible for making recommendations to the Board with respect to the compensation of all executive officers, including incentive compensation plans, equity-based plans, the terms of any employment agreement, severance and change of control arrangements and any special or supplemental benefits.

The GHRCC reviews and approves, at the beginning of each year, corporate objectives for the CEO. At the end of the year, the GHRCC evaluates the CEO’s performance against those objectives. The results of the assessment are reported to the Board. The GHRCC also reviews the performance of other executives with input from the CEO.

The GHRCC determines the compensation of the Corporation’s executive officers, reviews the compensation philosophy and guidelines for executive management as well as the individual compensation of each member of the executive team, and reports its conclusions to the Board for its consideration and approval. The GHRCC also administers any stock option or share-based compensation plans, if applicable, and makes recommendations regarding the granting of stock options or share-based compensation to executive management and other key employees of the Corporation where such stock option or share-based compensation plans are in effect.

The GHRCC met twelve (12) times in the year ended December 31, 2015.

Messrs. Raymond, Lederer, and Dillabough are all experienced in corporate governance matters. Messrs. Lederer and Dillabough have served as corporate officers of publicly traded companies, and each has significant experience serving on human resources and compensation committees. Prior to joining the Corporation, Mr. Raymond was a securities and corporate finance lawyer with experience handling corporate governance matters.

Executive Compensation – Committee Activities and Related Fees

The GHRCC has the authority to retain and receive advice from compensation consultants to carry out its duties. The GHRCC periodically receives reports on current executive compensation practices from independent consultants.

The GHRCC engaged Towers Watson to complete a formal review of executive compensation in 2015. The GHRCC’s work plan developed with Towers Watson included both a review of total compensation as well as specific study of the Corporation’s MLTIP plan. The fees paid to Towers Watson for work in relation to executive and director compensation matters was $119,019 in 2015.

In 2015, because of the significant change in the scale and complexity of the corporation, the Board adopted a new compensation peer group, and adjusted the salaries and STIP targets of the CEO and NEOs to better align with the peer group.

In Q4 2015, the Board entered into negotiations with the CEO to renew his employment contract, which was to expire on December 31, 2016. The board wanted to recognize Mr. Nemeth’s contributions and leadership since joining Catalyst in October, 2013 and the secure his services going forward. A new employment agreement was agreed to by the parties on March 1, 2016, and provides for a base salary of $725,000in 2016, and provides revised terms to Mr. Nemeth’s participation in the STIP, the MLTIP (in 2016) and for participation in a new long term incentive plan (“LTIP”) to be introduced in 2017.

Executive Compensation – All Other Fees

Towers Watson provides other services to the Corporation in connection with the administration of its salaried employee defined benefit pension plan (closed to new entrants since 1994). The consulting fees paid to Towers Watson for work related to pension plan administration, valuation and other activities was $387,675 in 2015.

The Corporation and Towers Watson have taken several steps to maintain the independence of the executive compensation consultant, including ensuring the consultant’s pay is not directly affected by any change in services provided by Towers Watson to management. In addition, the executive compensation consultant:

| · | Is not the client relationship manager; |

| · | Is not involved in any client development activities related to increase consulting services to the Corporation; |

| · | Has limited interactions with management unless they specifically relate to matters for the GHRCC’s review and approval; and |

| · | Does not share any confidential information obtained through work with the GHRCC with other segments of Towers Watson. |

Any decisions made by the Corporation with respect to the compensation of its executives are its own responsibility and may reflect factors and considerations other than the information provided by any compensation consulting firms.

Summary Compensation Table

The following table reflects compensation paid during 2015, 2014 and 2013 to each of the Chief Executive Officer, the Chief Financial Officer and the Corporation’s three most highly compensated executive officers other than the Chief Executive Officer and Chief Financial Officer earning a combined salary and bonus in excess of $150,000 in 2015 (each a “Named Executive Officer” or “NEO).

| | | | | | | | | | | | | | Non-Equity Incentive

Plan Compensation | | | | | | | | | | |

Name and Principal

Position | | Year | | Salary ($) | | | Share

based

Awards(1)

($) | | | Option

based

Awards(2) ($) | | | Annual Incentive

Plans(3) ($) | | | Long term

Incentive

Plans(4) ($) | | | Pension Value(5) ($) | | | All Other

Compensation(6) ($) | | | Total Compensation ($) | |

| J. Nemeth | | 2015 | | | 625,000 | | | | — | | | | — | | | | 86,250 | (7) | | | 175,000 | | | | 295,370 | | | | — | | | | 1,181,620 | |

| President and Chief | | 2014 | | | 575,000 | | | | — | | | | — | | | | 85,000 | | | | 175,000 | | | | 294,390 | | | | — | | | | 1,129,390 | |

| Executive Officer | | 2013 | | | 157,019 | | | | 275,612 | | | | — | | | | — | | | | 50,000 | | | | 75,351 | | | | — | | | | 557,982 | |

| B. Baarda(8) | | 2015 | | | 98,302 | | | | — | | | | — | | | | 47,300 | (7) | | | — | | | | 10,659 | | | | — | | | | 156,261 | |

| Vice President, | | 2014 | | | 315,000 | | | | — | | | | — | | | | 31,894 | | | | 66,667 | | | | 31,501 | | | | — | | | | 445,062 | (8) |

| Finance and Chief Financial Officer | | 2013 | | | 290,000 | | | | 94,554 | | | | — | | | | — | | | | 258,400 | | | | 29,000 | | | | — | | | | 671,954 | |

| J. Bayles(9) | | 2015 | | | 275,000 | | | | — | | | | — | | | | 25,000 | (7) | | | 66,667 | | | | 28,132 | | | | — | | | | 394,799 | |

| Senior Vice President, | | 2014 | | | 237,500 | | | | 87,824 | (9) | | | — | | | | 34,557 | | | | 50,000 | | | | 21,612 | | | | — | | | | 431,493 | (9) |

| Sales & Marketing | | 2013 | | | 198,750 | | | | — | | | | — | | | | 605 | | | | — | | | | 9,968 | | | | — | | | | 209,323 | (9) |

| F. De Costanzo(10) | | 2015 | | | 184,750 | | | | 91,854 | | | | — | | | | — | | | | 100,000 | | | | 18,475 | | | | 38,975 | (10) | | | 434,054 | |

| Senior Vice President & Chief Financial Officer | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| G. Maule(11) | | 2015 | | | 402,629 | | | | 81,820 | | | | — | | | | — | | | | 94,820 | | | | 25,729 | | | | — | | | | 604,998 | |

| Senior Vice President, Operations | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L. Posyniak | | 2015 | | | 275,000 | | | | — | | | | — | | | | 37,500 | (7) | | | 66,667 | | | | 27,937 | | | | — | | | | 407,104 | |

| Senior Vice President, | | 2014 | | | 98,557 | | | | 98,420 | | | | — | | | | 48,747 | | | | 66,667 | | | | 9,856 | | | | — | | | | 322,247 | |

| Human Resources and Corporate Services | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Represents the fair value of PhantomSUs as at Grant Date. The fair value was estimated using the Black-Scholes option-pricing model. The 2013 share based awards for Mr. Nemeth was corrected in the 2014 circular (the previously reported amount was $327,313). The 2013 share based award for Mr. Baarda was also corrected in the 2014 circular (the previously reported amount was $101,683). |

| (2) | There are no outstanding option based awards. |

| (3) | No STIP payment was made for 2015. Amounts in this column reflect other bonuses paid to be made in 2016 for 2015 performance. |

| (4) | Consists of payments made under the 2014 MLTIP. |

| (5) | Amounts in this column for all NEOs reflect annual contributions and allocations to the Corporation’s defined contribution pension plan, including the SERP, for the years ended December 31, 2015, 2014, and 2013. The total pension contribution for Mr. Nemeth includes SERP allocations of $67,500 for 2013 and $270,000 for 2014 and 2015 made pursuant to his employment contract. |

| (6) | Except where indicated, perquisites, including property and personal benefits, do not exceed in the aggregate $50,000 or more than 10% of the respective Named Executive Officer’s total salary for the financial year. |

| (7) | Bonus payments for the acquisition of Biron and Rumford. |

| (8) | Mr. Baarda resigned on April 15, 2015. Mr. Baarda has been corrected in the current version of the circular to $445,062 (the previously reported amount was $413,168) |

| (9) | Mr. Bayles announced his retirement on January 29, 2016, to take effect March 31, 2016. The 2013 total compensation for Mr. Bayles has been corrected in the current version of the circular to $431,493 (the previously reported amount was $445,062). The 2012 total compensation has been corrected to $209,323 (the previously reported amount was $206,332) |

| (10) | Mr. De Costanzo was appointed Senior Vice-President & Chief Financial Officer on July 10, 2015. Amounts in this column for Mr. De Costanzo includes a moving allowance of $31,850. |

| (11) | Mr. Maule was appointed Senior Vice President, Operations on January 5, 2015. He is paid in USD, the amounts presented above have been converted to CDN using the monthly average noon exchange rate for the month the earnings was paid out. |

Incentive Plan Awards

Phantom Share Unit Plan

The Corporation has a PhantomSU plan in connection with the current MLTIP. PhantomSUs do not entitle the holder to any shares of the Corporation. Each PhantomSU represents one Common Share and entitles the holder to a payment on the vesting date that corresponds to the increase in value of the underlying Common Shares from the grant date to the vesting date under the MLTIP calculated using the 20 day volume weighted average trading price on the TSX preceding the applicable date. PhantomSUs issued to participants are credited to them by means of an entry in a notional account in their favour on the books of the Corporation. Vesting and payment is determined in accordance with the terms of the MLTIP. Currently there are 721,939 PhantomSUs outstanding under the MLTIP that are held by Named Executive Officers.

Share Compensation Plan

The 2015 share compensation plan (the “Share Compensation Plan”) was approved and adopted at the Annual General and Special Meeting of Shareholders on May 13, 2015. The Share Compensation Plan enables the Corporation to issue Restricted Share Units (RSUs), Performance Share Units (PSUs) and stock options. As at December 31, 2015 there were no RSUs, PSUs or stock options outstanding.

Outstanding Share Based and Option Based Awards

The following table shows all outstanding PhantomSUs held by each of the Named Executive Officers as at December 31, 2015. There were no other share-based or option-based awards held by Named Executive Officers as at December 31, 2015.

| | | Share Based Awards(1)(2) | |

| Name | | Number of shares or units of shares

that have not vested

(#) | | | Market or payout value of share based

awards that have not vested

($) | |

| J. Nemeth | | | 449,438 | | | | 635,990 | |

| J. Bayles(3) | | | 77,220 | | | | 61,485 | |

| F. De Costanzo(4) | | | 55,710 | | | | 31,269 | |

| G. Maule(5) | | | 48,840 | | | | 36,945 | |

| L. Posyniak(6) | | | 90,731 | | | | 83,585 | |

| (1) | Represents PhantomSUs under the 2014 MLTIP. |

| (2) | PhantomSUs were granted to executive officers in 2013, 2014 and 2015 and vest on December 31, 2016. Represents the fair value of PhantomSUs as at December 31, 2015. The fair value was estimated using the Black-Scholes option-pricing model assuming, a risk-free interest rate of 0.5%, no annual dividends, a 92% volatility rate, a remaining PhantomSU life of 1 year and grant date values of $1.17 per share in the case of Mr. Nemeth; $3.59 in the case of Mr. De Costanzo; $2.73 in the case of Mr. Maule; $2.59 per share in the case of Mr. Bayles and $2.20 per share in the case of Mr. Posyniak. The risk-free interest rate was based on a zero-coupon Government of Canada bond with a remaining term approximately equivalent to the expected life of the PSUs. The Corporation estimated the annual dividends per share and, expected price volatility based upon historical experience. |

| (3) | Mr. Bayles announced his resignation on January 29, 2016 to take effect on March 31, 2016 |

| (4) | Mr. De Costanzo was appointed Senior Vice-President & Chief Financial Officer on July 10, 2015. |

| (5) | Mr. Maule was appointed Senior Vice President, Operations on January 5, 2015. |

| (6) | Mr. Posyniak was appointed Senior Vice President, Human Resources and Corporate Services on August 11, 2014. |

Incentive Plan Awards – Value Vested or Earned During the Year

No share-based awards vested during 2015. There are no outstanding option based awards as at December 31, 2015.

Pension Plan Benefits

Defined Contribution Plans

Named Executive Officers who are Canadian residents participate in a defined contribution plan pursuant to which the Corporation contributes 5% of the executive’s base salary and STIP to a maximum of $25,370 in 2015 ($24,930 in 2014 and $24,270 in 2013). The executive directs the investment of his or her defined contribution account based on a number of alternatives. Upon retirement the executive is entitled to all amounts contributed to and earned on his or her defined contribution account, but no minimum amount of investment return or payout is guaranteed.

Named Executive Officers who are United States residents were entitled to participate in a US defined contribution 401K plan (“US DC Plan”). The US DC Plan provides for employer matching contributions equal to 100% of the first 3% of eligible pay contributed to the plan, and 50% of the next 2% of eligible pay contributed to the plan. In addition, the Corporation would make regular discretionary non-elective contributions for eligible employees equal to 7% of eligible pay (which is subject to certain limits). The employee directs the investment of his defined contribution account based on a number of alternatives. The employee contribution level and matching contribution levels are subject to certain maximums as limited by law. An employee may choose to contribute after tax contributions up to 10% of eligible pay as limited by law. Under the US DC Plan, eligible pay includes salary, bonus, employer share purchase contributions, and vacation taken in pay. Upon retirement the employee may elect to receive installments or lump sum as provided for by the plan.

Supplemental Executive Retirement Plan (SERP)

The Corporation has established a defined contribution segment of the Corporation’s SERP for Named Executive Officers domiciled in Canada. As at December 31, 2015, each of the Named Executive Officers with the exception of Mr. Maule was a member of the defined contribution segment of the SERP.

The purpose of the SERP is to provide benefits to Participants to enable them to retire with a total retirement income deemed appropriate by the Board of Directors. Benefits provided by the SERP are in addition to and integrated with the benefits provided under the Catalyst Paper Corporation Retirement Plan for Salaried Employees.

The SERP brings the company’s total contribution towards a Named Executive Officer retirement plan to 10% of salary and STIP less the amount credited to the defined contribution plan (see below for more detail). This is done through regular contributions to a notional account. Monies contributed to the account are then notionally invested in the employee’s choice of three funds from the defined contribution plan. Monies within the SERP are secured by a letter of credit.

The Corporation makes regular notional contributions to the SERP, on behalf of the executives, by way of allocations to their SERP accounts, the amount of which varies among the executives. The SERP credits for the CEO are in accordance with Mr. Nemeth’s employment agreement.

The eligible Canadian domiciled Named Executive Officers’ SERP accounts, other than Mr. Nemeth, are credited with an amount equal to 10% of their salary and STIP less the amount credited to the defined contribution plan referred to above. Under the defined contribution segment of the SERP, the amount of STIP recognized in pensionable earnings is the lesser of 50% of the STIP payment received for the year and 50% of the executive’s target STIP for the year. In the event that 50% of actual STIP payments received are greater than 50% of the executive’s target STIP, the excess amount is carried forward as a banked STIP credit and may be used in years where the executive’s actual incentive compensation is less than the target incentive. In the event that 50% of actual bonus received is less than 50% of target STIP, the unrecognized portion between actual STIP received and the target STIP is carried forward until retirement, termination of employment or death, and any banked STIP credits at that time are applied to the cumulative amount of the unrecognized target STIP awards from prior years. Amounts for Named Executive Officers, other than Mr. Nemeth, vest at the earlier of age 55 or completion of five years of SERP participation.

Mr. Nemeth’s SERP account was credited with lump sum allocations of $270,000 on January 1, 2014, January 1, 2015 and January 1, 2016. All such allocations vest on December 31, 2016 so long as he remains actively employed by Catalyst as of the vesting date. Pursuant to the employment agreement between Mr. Nemeth and the Corporation dated March 1, 2016, Mr. Nemeth will continue to receive lump sum allocations of $270,000 on January 1 of each year. The 2017 and 2018 allocations, and the allocations for each two year period thereafter, shall vest on December 31 of the second year of such two year period, but shall vest only if actively employed as of the respective vesting date. In the case of a termination without cause, all allocations made to the date of termination will vest on the termination date.

On retirement, the executive can elect to receive benefits as either a lump sum or in ten equal annual installments, calculated based on the 10-year Government of Canada bond rate.

Defined Contribution Plans Table

| Name | | Accumulated value

at start of year

($) | | | Compensatory(1)

($) | | | Non-compensatory(2)

($) | | | Accumulated value at

year end

($) | |

| J. Nemeth | | | 411,223 | | | | 295,370 | | | | (23,450 | ) | | | 683,143 | |

| J. Bayles(3) | | | 75,661 | | | | 28,132 | | | | 2,899 | | | | 106,691 | |

| F. De Costanzo(4) | | | 0 | | | | 18,475 | | | | 129 | | | | 18,604 | |

| B. Baarda(5) | | | 700,592 | | | | 10,659 | | | | 35,046 | | | | 0 | |

| L. Posyniak(6) | | | 9,961 | | | | 27,937 | | | | 227 | | | | 38,124 | |

| (1) | Represents the employer contribution. |

| (2) | Represents non-compensatory amounts including employee contributions and regular investment earnings on employer and employee contributions. |

| (3) | Mr. Bayles announced his resignation on January 29, 2016 to take effect March 31, 2016. |

| (4) | Mr. De Costanzo was appointed Senior Vice-President & Chief Financial Officer on July 10, 2015. |

| (5) | Mr. Baarda resigned on April 15, 2015. |

| (6) | Mr. Posyniak was appointed Senior Vice President, Human Resources and Corporate Services on August 11, 2014. |

In addition, the amounts in the above table include amounts under the column entitled “Long Term Incentive Plans” in the Summary Compensation Table that were taken as allocations to individual SERP accounts as indicated in Note 5 to the Summary Compensation Table.

Termination and Change of Control Benefits

Pursuant to the employment agreement between Mr. Nemeth and the Corporation March 1, 2016, if Mr. Nemeth’s employment is terminated without cause, by way of one or more lump sums or by monthly payments over a period not exceeding 24 months: (i) he will be paid his then current base salary for a period of 2 years from the date of termination; (ii) the Corporation will make pension contributions or otherwise pay him the equivalent amount for a period of 2 years from the date of termination; and (iii) he will be paid an amount equal to two times the average STIP payment actually paid to him in the preceding two years. In the case of: (i) a termination prior to January 1, 2017, he will be paid payments under the 2014 MLTIP in accordance with its terms, and (ii) in the case of a termination after January 1, 2017, he will be paid payments under the LTIP in effect immediately prior to termination, in accordance with its terms, as applicable, on a pro rata basis to the date of termination. Medical and dental benefits will continue for two years after termination or until eligibility for benefits from new employment, whichever occurs first. All contributions made to the SERP will vest on the date of termination. If Mr. Nemeth’s employment is terminated or the accountabilities or authority of his role is significantly altered within 12 months after a change of control of the Corporation, he will be entitled to a lump sum payment equal to two years’ base salary and pension contributions together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years (or, if only one annual STIP payment has been made, two times the amount of that STIP payment), payment under the 2014 MLTIP in accordance with its terms (if applicable), payment under the LTIP in accordance with its terms (if applicable), and continuation of medical and dental benefits for two years after termination or until eligibility for benefits from new employment whichever occurs first. Assuming that such termination had occurred on December 31, 2015, the estimated value of the incremental payments and benefits to which Mr. Nemeth would be entitled under the agreement is $2,296,129

Pursuant to the employment agreement between Mr. Posyniak and the Corporation dated July 11, 2014, if Mr. Posyniak’s employment is terminated without cause he will be entitled to continuation of his base salary and pension plan contributions for 24 months following the date of termination (the salary continuance period), together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years and payments under the 2014 MLTIP in accordance with its terms. Medical and dental benefits will continue for two years after termination or until eligibility for benefits from new employment whichever occurs first. The Corporation will continue all employment perquisites and privileges during such period. In addition, Mr. Posyniak will receive outplacement service and financial counselling services to a maximum of $10,000. If Mr. Posyniak’s employment is terminated or the accountabilities or authority of his role is significantly altered within 12 months after a change of control of the Corporation, he will be entitled to a lump sum payment equal to the sum of two years’ base salary and pension contributions, together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years, payment under the 2014 MLTIP in accordance with its terms and continuation of medical and dental benefits for two years after termination or until eligibility for benefits from new employment whichever occurs first. Assuming that such termination had occurred on December 31, 2015, the estimated value of the incremental payments and benefits to which Mr. Posyniak would be entitled under the agreement is $700,838.

Pursuant to the employment agreement between Mr. Bayles and the Corporation dated April 2, 2014, if Mr. Bayles’ employment is terminated without cause he will be entitled to continuation of his base salary and pension plan contributions for 24 months following the date of termination (the salary continuance period), and payments under the 2014 MLTIP in accordance with its terms. Medical and dental benefits will continue for two years after termination or until eligibility for benefits from new employment, whichever occurs first. The Corporation will continue all employment perquisites and privileges during the salary continuance period. Assuming that such termination had occurred on December 31, 2015, the estimated value of the incremental payments and benefits to which Mr. Bayles would be entitled under the agreement is $674,938. Mr. Bayles announced his resignation on January 29, 2016 to take effect on March 31, 2016.

Pursuant to the employment agreement between Mr. De Costanzo and the Corporation dated June 15, 2015, if Mr. De Costanzo’s employment is terminated without cause he will be entitled to continuation of his base salary and pension plan contributions for 24 months following the date of termination (the salary continuance period), together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years and payments under the 2014 MLTIP in accordance with its terms. Medical and dental benefits will continue for two years after termination or until eligibility for benefits from new employment whichever occurs first. In addition, Mr. De Costanzo will receive outplacement service and financial counselling services to a maximum of $10,000. If De Costanzo’s employment is terminated or the accountabilities or authority of his role is significantly altered within 12 months after a change of control of the Corporation, he will be entitled to a lump sum payment equal to the sum of two years’ base salary and pension contribution, together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years, payment under the 2014 MLTIP in accordance with its terms and continuation of medical and dental benefits for two years after termination or until eligibility for benefits from new employment whichever occurs first. Assuming that such termination had occurred on December 31, 2015, the estimated value of the incremental payments and benefits to which De Costanzo’s would be entitled under the agreement is $941,019.

Pursuant to the employment agreement between Mr. Maule and the Corporation dated July 11, 2014, if Mr. Maule’s employment is terminated without cause he will be entitled to continuation of his base salary and pension plan contribution for 24 months following the date of termination (the salary continuance period), together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years and payments under the 2014 MLTIP in accordance with its terms. Medical and dental benefits will continue for two years after termination or until eligibility for benefits from new employment whichever occurs first. In addition, Mr. Maule will receive outplacement service and financial counselling services to a maximum of $10,000. If Mr. Maule’s employment is terminated or the accountabilities or authority of his role is significantly altered within 12 months after a change of control of the Corporation, he will be entitled to a lump sum payment equal to the sum of two years’ base salary and pension contribution, together with an amount equal to two times the average STIP payment actually paid to him in the preceding two years, payment under the 2014 MLTIP in accordance with its terms and continuation of medical and dental benefits for two years after termination or until eligibility for benefits from new employment whichever occurs first. Assuming that such termination had occurred on December 31, 2015, the estimated value of the incremental payments and benefits to which Mr. Maule would be entitled under the agreement is $1,109,325

Board of Directors Compensation

The GHRCC is responsible for annually reviewing directors’ compensation and making recommendations to the Board. Directors may receive their compensation in the form of cash or deferred share units, or a combination of both.

Under the current directors’ compensation policy, directors are paid an annual cash retainer, meeting fees and equity compensation through PhantomSUs. The Corporation’s Share Compensation Plan enables the Corporation to issue stock options. No stock options were issued in fiscal 2015.

Remuneration of Directors

The following table shows the value and components of the cash compensation elements paid to the Corporation’s directors in 2015:

| | | Retainer | | | Attendance Fees | | | | | | | |

| Director | | Board Chair

Retainer

($) | | | Board

Retainer

($) | | | Committee

Chair

Retainer

($)(1) | | | Committee

Retainer

($) | | | Board

Meetings

($)(2) | | | Committee

Meetings

($)(3) | | | Travel

Fees

($)(4) | | | Total

Paid(5)

($) | |

| John Brecker | | | — | | | $ | 55,000 | | | | — | | | $ | 5,000 | | | $ | 15,000 | | | $ | 11,000 | | | $ | 5,000 | | | $ | 91,000 | |

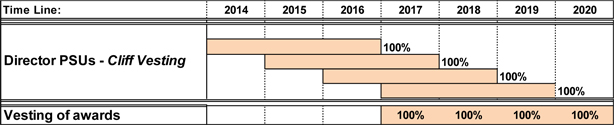

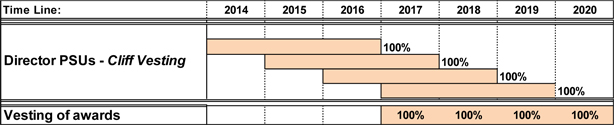

| Todd Dillabough | | | — | | | $ | 55,000 | | | $ | 10,000 | | | $ | 5,000 | | | $ | 14,000 | | | $ | 18,000 | | | | — | | | $ | 102,000 | |