Exhibit 99.2

Regency Energy Partners LP

Acquisition of PVR Partners, L.P. October 10, 2013

Cautionary Statement Regarding Forward-Looking Statements

This presentation includes “forward-looking” statements. Forward-looking statements are identified as any statement that does not relate strictly to historical or current facts. Statements using words such as “anticipate,” “believe,” “intend,”

“project,” “plan,” “expect,” “continue,” “estimate,” “goal,” “forecast,” “may” or similar expressions help identify forward-looking statements. Regency Energy Partners LP (“Regency”) and PVR Partner, L.P. (“PVR”) cannot give any assurance that expectations and projections about future events will prove to be correct. Forward-looking statements are subject to a variety of risks, uncertainties and assumptions. These risks and uncertainties include the risks that the proposed transaction may not be consummated or the benefits contemplated therefrom may not be realized. Additional risks include: the ability to obtain requisite regulatory and unitholder approval and the satisfaction of the other conditions to the consummation of the proposed transaction, the ability of Regency to successfully integrate PVR’s operations and employees and realize anticipated synergies and cost savings, the potential impact of the announcement or consummation of the proposed transaction on relationships, including with employees, suppliers, customers, competitors and credit rating agencies, the ability to achieve revenue, DCF and EBITDA growth, volatility in the price of oil, natural gas, and natural gas liquids, declines in the credit markets and the availability of credit for the combined company as well as for producers connected to the combined company’s system and its customers, the level of creditworthiness of, and performance by counterparties and customers, the ability to access capital to fund organic growth projects and acquisitions, including significant acquisitions, and the ability to obtain debt and equity financing on satisfactory terms, the use of derivative financial instruments to hedge commodity and interest rate risks, the amount of collateral required to be posted from time-to-time, changes in commodity prices, interest rates, and demand for the combined company’s services, changes in laws and regulations impacting the midstream sector of the natural gas industry, weather and other natural phenomena, acts of terrorism and war, industry changes including the impact of consolidations and changes in competition, the ability to obtain required approvals for construction or modernization of facilities and the timing of production from such facilities, and the effect of accounting pronouncements issued periodically by accounting standard setting boards. Therefore, actual results and outcomes may differ materially from those expressed in such forward-looking statements.

These and other risks and uncertainties are discussed in more detail in filings made by Regency and PVR with the Securities and Exchange Commission, which are available to the public. Regency and PVR undertake no obligation to update publicly or to revise any forward-looking statements, whether as a result of new information, future events or otherwise.

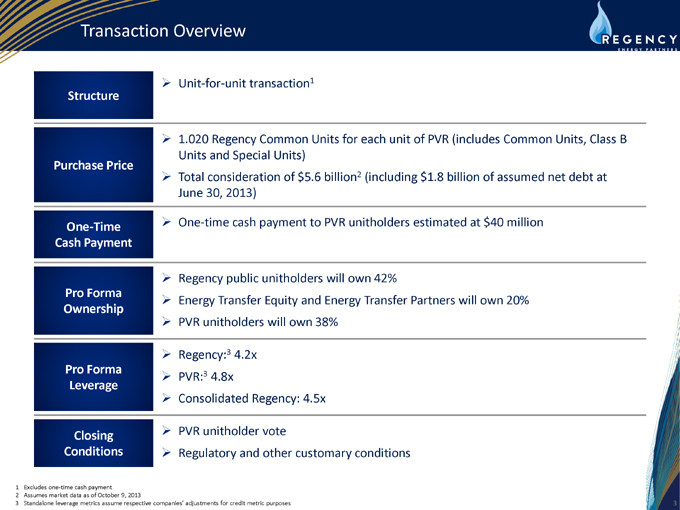

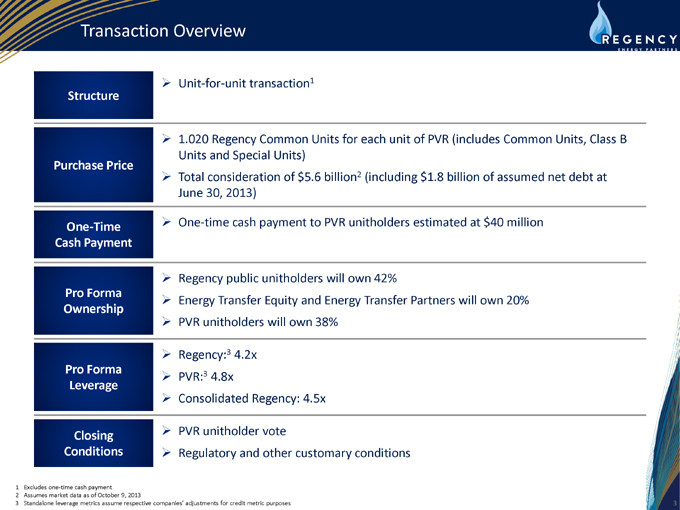

Transaction Overview

? Unit-for-unit transaction1

Structure

? 1.020 Regency Common Units for each unit of PVR (includes Common Units, Class B

Units and Special Units)

Purchase Price

? Total consideration of $5.6 billion2 (including $1.8 billion of assumed net debt at

June 30, 2013)

One-Time ? One-time cash payment to PVR unitholders estimated at $40 million

Cash Payment

? Regency public unitholders will own 42%

Pro Forma ? Energy Transfer Equity and Energy Transfer Partners will own 20%

Ownership

? PVR unitholders will own 38%

? Regency:3 4.2x

Pro Forma ? PVR:3 4.8x

Leverage

? Consolidated Regency: 4.5x

Closing ? PVR unitholder vote

Conditions ? Regulatory and other customary conditions

1 | | Excludes one-time cash payment |

2 | | Assumes market data as of October 9, 2013 |

3 | | Standalone leverage metrics assume respective companies’ adjustments for credit metric purposes |

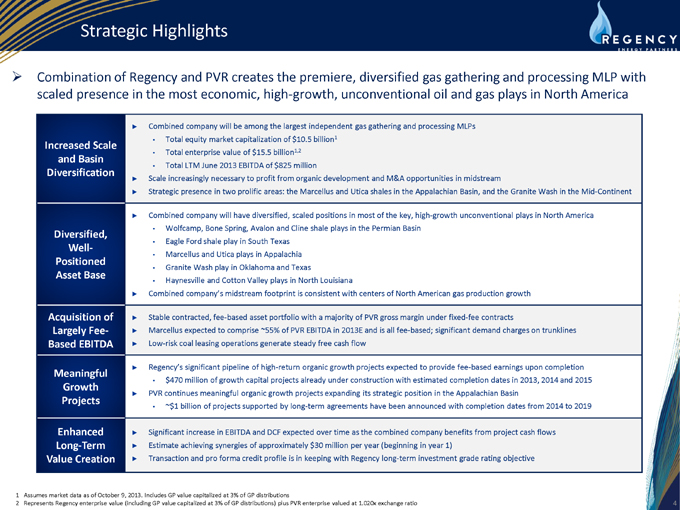

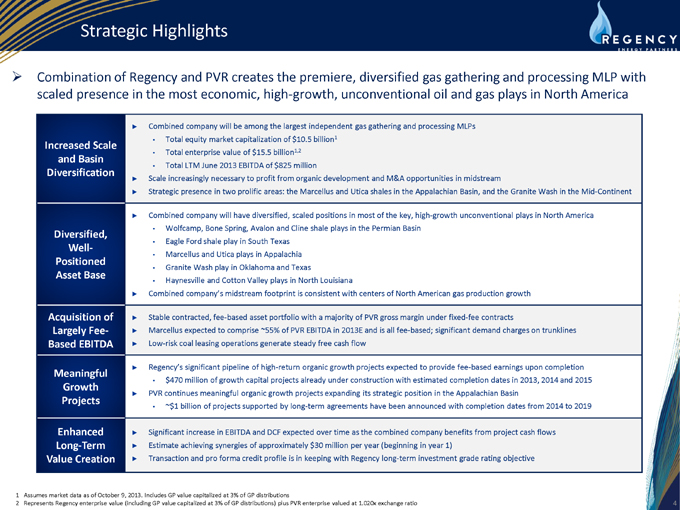

Strategic Highlights

Combination of Regency and PVR creates the premiere, diversified gas gathering and processing MLP with scaled presence in the most economic, high-growth, unconventional oil and gas plays in North America

? Combined company will be among the largest independent gas gathering and processing MLPs

Total equity market capitalization of $10.5 billion1

Increased Scale

Total enterprise value of $15.5 billion1,2

and Basin

Total LTM June 2013 EBITDA of $825 million

Diversification

? Scale increasingly necessary to profit from organic development and M&A opportunities in midstream

? Strategic presence in two prolific areas: the Marcellus and Utica shales in the Appalachian Basin, and the Granite Wash in the Mid-Continent

? Combined company will have diversified, scaled positions in most of the key, high-growth unconventional plays in North America

Wolfcamp, Bone Spring, Avalon and Cline shale plays in the Permian Basin

Diversified,

Eagle Ford shale play in South Texas

Well-

Marcellus and Utica plays in Appalachia

Positioned

Granite Wash play in Oklahoma and Texas

Asset Base • Haynesville and Cotton Valley plays in North Louisiana

? Combined company’s midstream footprint is consistent with centers of North American gas production growth

Acquisition of ? Stable contracted, fee-based asset portfolio with a majority of PVR gross margin under fixed-fee contracts

Largely Fee- ? Marcellus expected to comprise ~55% of PVR EBITDA in 2013E and is all fee-based; significant demand charges on trunklines

Based EBITDA ? Low-risk coal leasing operations generate steady free cash flow

? Regency’s significant pipeline of high-return organic growth projects expected to provide fee-based earnings upon completion

Meaningful

$470 million of growth capital projects already under construction with estimated completion dates in 2013, 2014 and 2015

Growth

? PVR continues meaningful organic growth projects expanding its strategic position in the Appalachian Basin

Projects

~$1 billion of projects supported by long-term agreements have been announced with completion dates from 2014 to 2019

Enhanced ? Significant increase in EBITDA and DCF expected over time as the combined company benefits from project cash flows

Long-Term ? Estimate achieving synergies of approximately $30 million per year (beginning in year 1)

Value Creation ? Transaction and pro forma credit profile is in keeping with Regency long-term investment grade rating objective

1 Assumes market data as of October 9, 2013. Includes GP value capitalized at 3% of GP distributions

2 Represents Regency enterprise value (including GP value capitalized at 3% of GP distributions) plus PVR enterprise valued at 1.020x exchange ratio

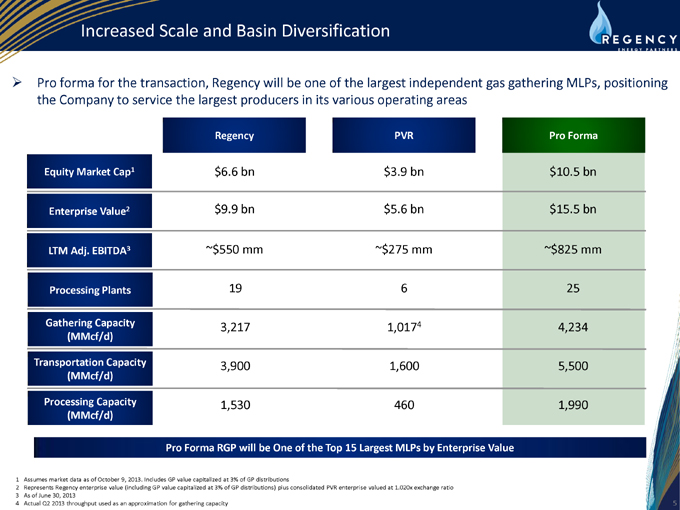

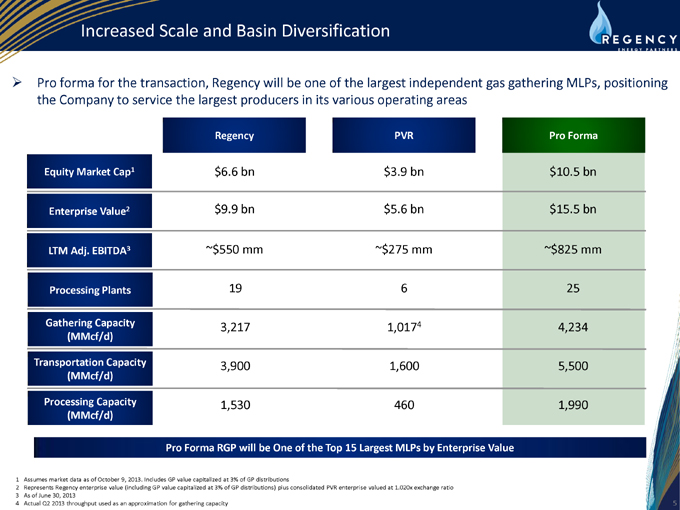

Increased Scale and Basin Diversification

Pro forma for the transaction, Regency will be one of the largest independent gas gathering MLPs, positioning the Company to service the largest producers in its various operating areas

Regency PVR Pro Forma

Equity Market Cap1 $6.6 bn $3.9 bn $10.5 bn

Enterprise Value2 $9.9 bn $5.6 bn $15.5 bn

LTM Adj. EBITDA3 ~$550 mm ~$275 mm ~$825 mm

Processing Plants 19 6 25

Gathering Capacity 3,217 1,0174 4,234

(MMcf/d)

Transportation Capacity 3,900 1,600 5,500

(MMcf/d)

Processing Capacity 1,530 460 1,990

(MMcf/d)

Pro Forma RGP will be One of the Top 15 Largest MLPs by Enterprise Value

1 | | Assumes market data as of October 9, 2013. Includes GP value capitalized at 3% of GP distributions |

2 Represents Regency enterprise value (including GP value capitalized at 3% of GP distributions) plus consolidated PVR enterprise valued at 1.020x exchange ratio

4 | | Actual Q2 2013 throughput used as an approximation for gathering capacity |

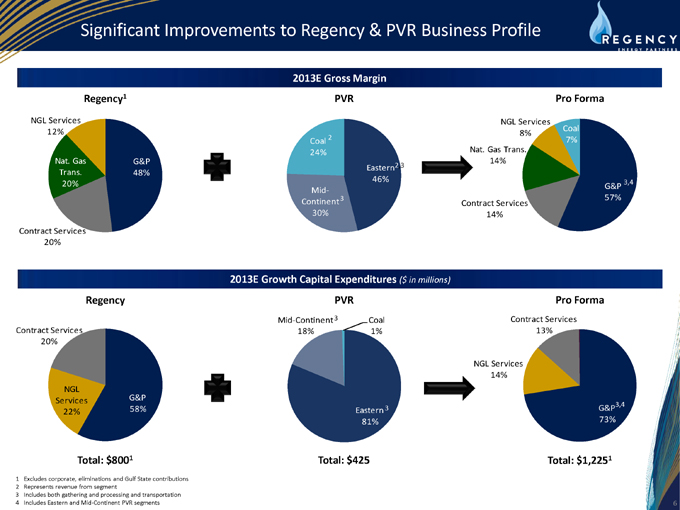

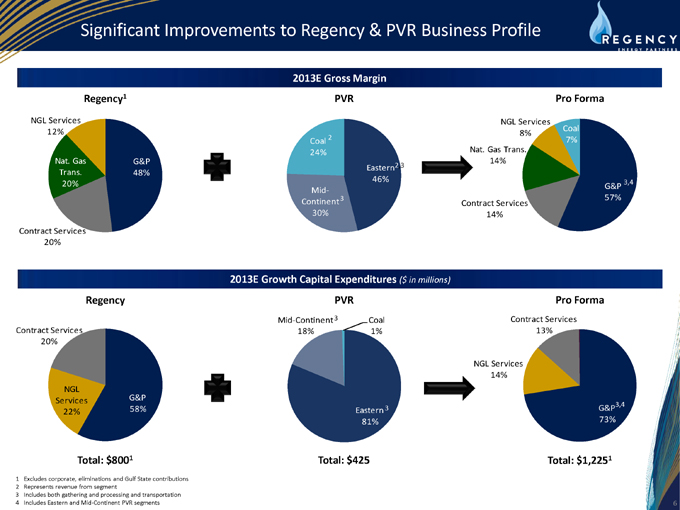

Significant Improvements to Regency & PVR Business Profile

2013E Gross Margin

Regency1 PVR Pro Forma

NGL Services NGL Services 12% Coal 8%

2 | | 7% Coal 24% Nat. Gas Trans. |

Nat. Gas G&P 14% Eastern 2,3 Trans. 48% 46%

20% 3,4 G&P

Mid- 57% Continent 3 Contract Services 30% 14% Contract Services 20%

2013E Growth Capital Expenditures ($ in millions)

Regency PVR Pro Forma

Mid-Continent3 Coal Contract Services Contract Services 18% 1% 13% 20%

NGL Services 14% NGL

Services G&P

3,4

58% Eastern 3 G&P 22% 81% 73%

Total: $8001 Total: $425 Total: $1,2251

1 | | Excludes corporate, eliminations and Gulf State contributions |

2 | | Represents revenue from segment |

3 | | Includes both gathering and processing and transportation |

4 | | Includes Eastern and Mid-Continent PVR segments |

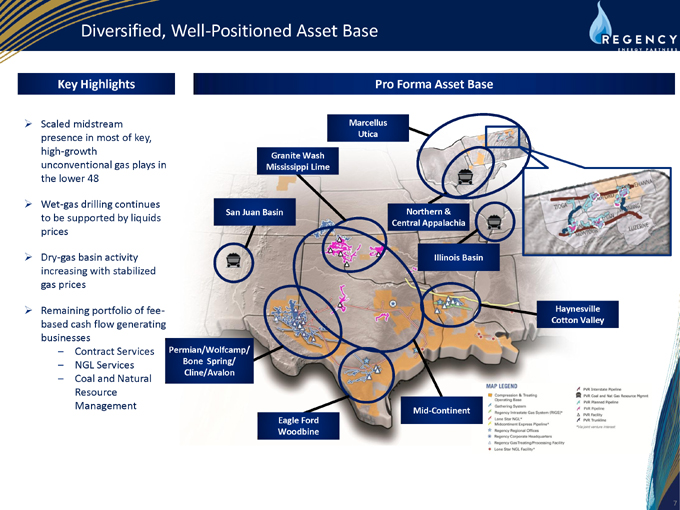

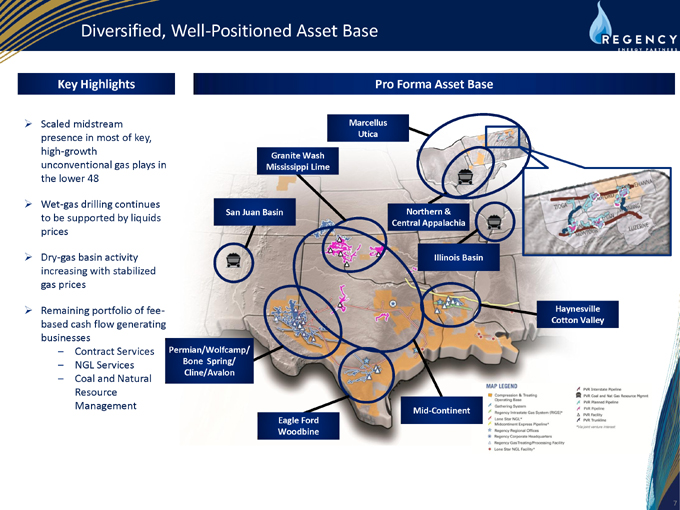

Diversified, Well-Positioned Asset Base

Key Highlights Pro Forma Asset Base

??Scaled midstream Marcellus presence in most of key, Utica high-growth

Granite Wash

unconventional gas plays in Mississippi Lime the lower 48

??Wet-gas drilling continues San Juan Basin Northern & to be supported by liquids

prices Central Appalachia

??Dry-gas basin activity Illinois Basin increasing with stabilized gas prices

??Remaining portfolio of fee- Haynesville based cash flow generating Cotton Valley businesses

– Contract Services Permian/Wolfcamp/

– NGL Services Bone Spring/

Cline/Avalon

– Coal and Natural Resource Management

Mid-Continent Eagle Ford Woodbine

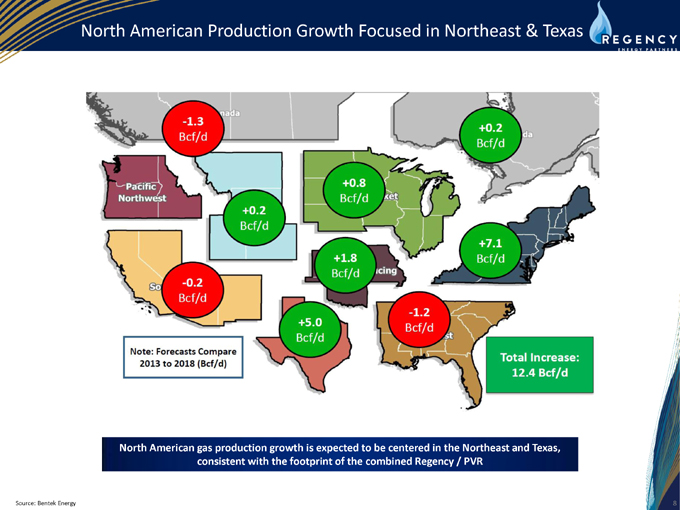

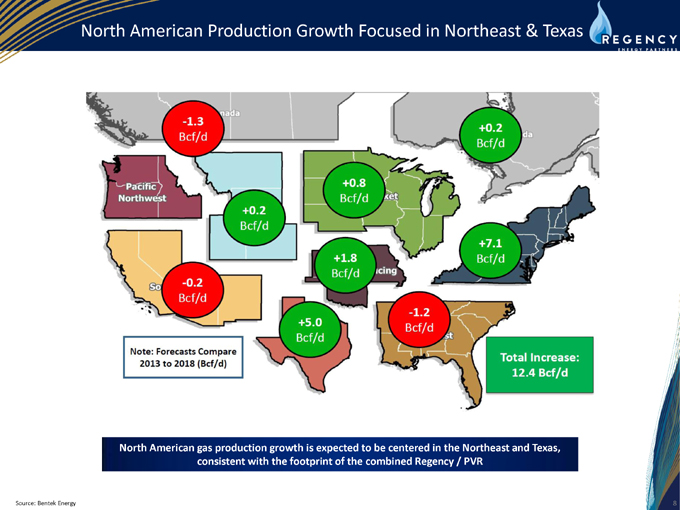

North American Production Growth Focused in Northeast & Texas

North American gas production growth is expected to be centered in the Northeast and Texas, consistent with the footprint of the combined Regency / PVR

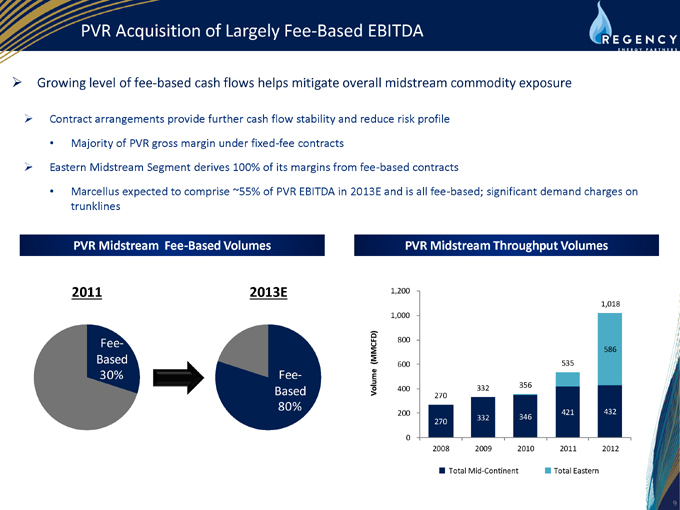

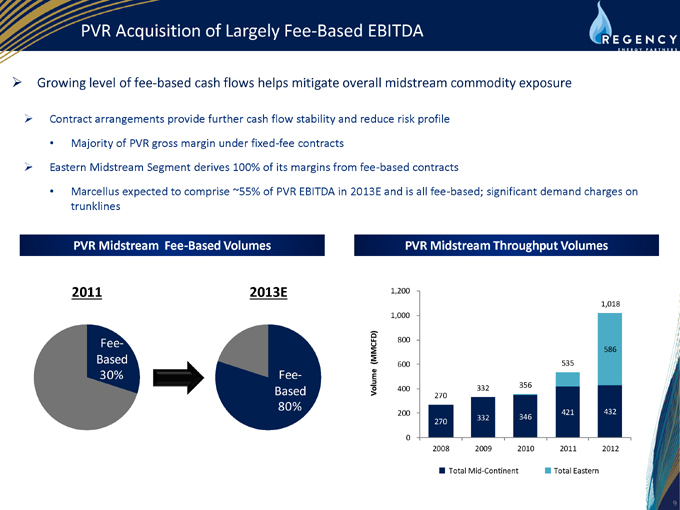

PVR Acquisition of Largely Fee-Based EBITDA

??Growing level of fee-based cash flows helps mitigate overall midstream commodity exposure

??Contract arrangements provide further cash flow stability and reduce risk profile

Majority of PVR gross margin under fixed-fee contracts

??Eastern Midstream Segment derives 100% of its margins from fee-based contracts

Marcellus expected to comprise ~55% of PVR EBITDA in 2013E and is all fee-based; significant demand charges trunklines

PVR Midstream Fee-Based Volumes PVR Midstream Throughput Volumes

2011 2013E 1,200

1,018 1,000

Fee- 800

586

Based (MMCFD) 535

600

30% Fee-

332 356

Based Volume 400

270

80%

200 421 432 332 346 270

0

2008 2009 2010 2011 2012

Total Mid-Continent Total Eastern

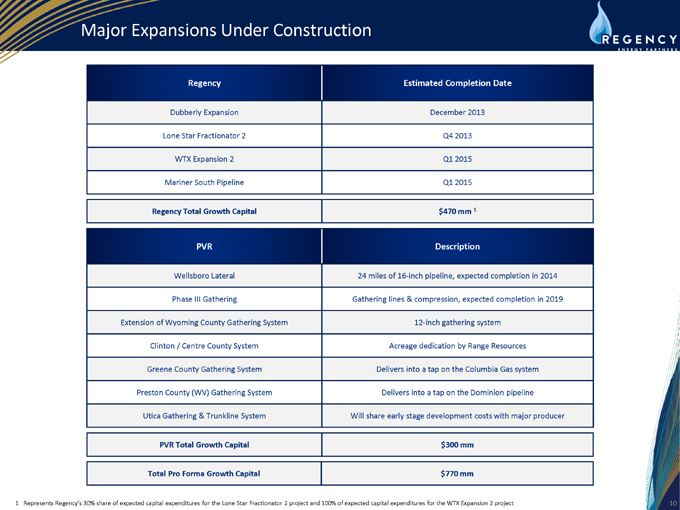

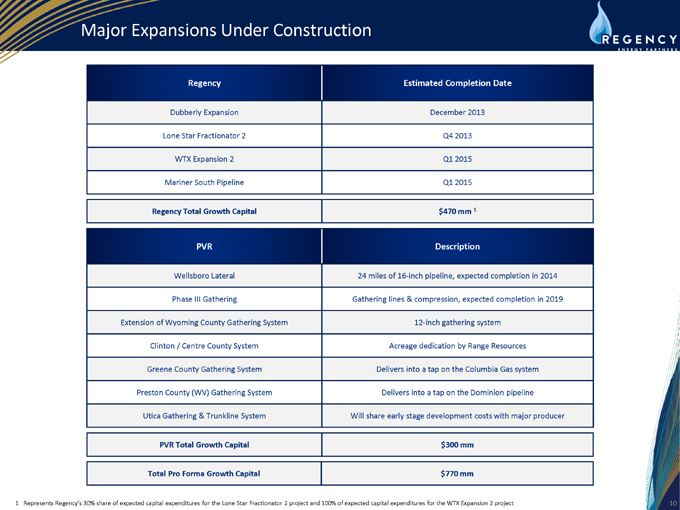

Major Expansions Under Construction

Regency Estimated Completion Date

Dubberly Expansion December 2013 Lone Star Fractionator 2 Q4 2013 WTX Expansion 2 Q1 2015 Mariner South Pipeline Q1 2015

Regency Total Growth Capital $470 mm 1

PVR Description

Wellsboro Lateral 24 miles of 16-inch pipeline, expected completion in 2014 Phase III Gathering Gathering lines & compression, expected completion in 2019 Extension of Wyoming County Gathering System 12-inch gathering system Clinton / Centre County System Acreage dedication by Range Resources Greene County Gathering System Delivers into a tap on the Columbia Gas system Preston County (WV) Gathering System Delivers into a tap on the Dominion pipeline Utica Gathering & Trunkline System Will share early stage development costs with major producer

PVR Total Growth Capital $300 mm

Total Pro Forma Growth Capital $770 mm

1 Represents Regency’s 30% share of expected capital expenditures for the Lone Star Fractionator 2 project and 100% of expected capital expenditures for the WTX Expansion 2 project

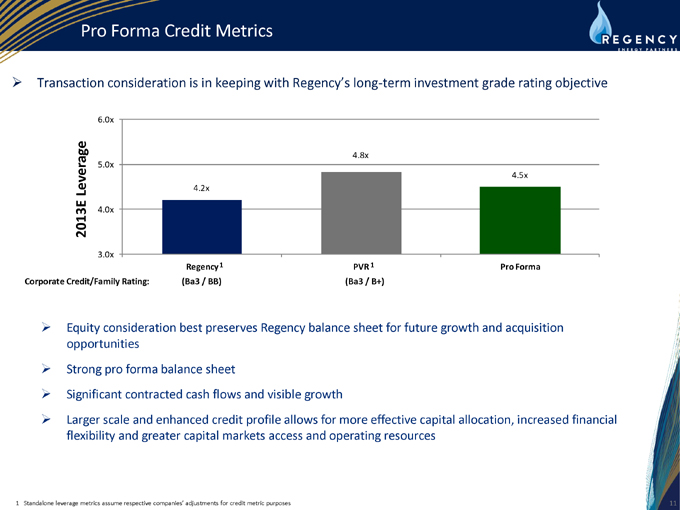

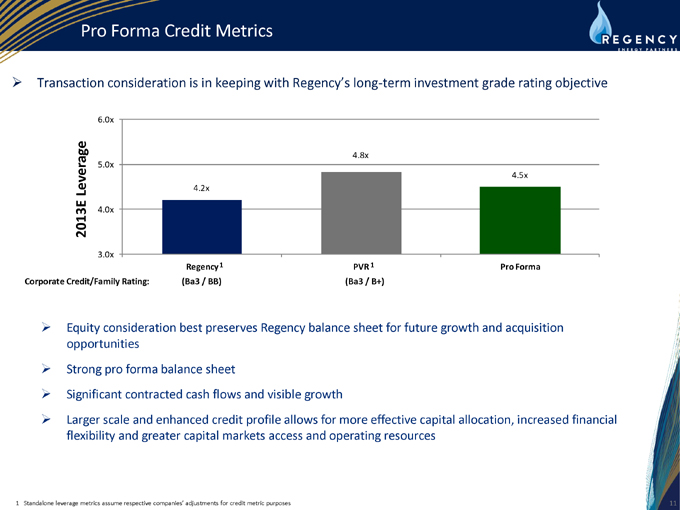

Pro Forma Credit Metrics

??Transaction consideration is in keeping with Regency’s long-term investment grade rating objective

6.0x

4.8x 5.0x

4.5x

Leverage 4.2x 2013E 4.0x

3.0x

Regency 1 PVR 1 Pro Forma

Corporate Credit/Family Rating: (Ba3 / BB) (Ba3 / B+)

??Equity consideration best preserves Regency balance sheet for future growth and acquisition opportunities

??Strong pro forma balance sheet

??Significant contracted cash flows and visible growth

??Larger scale and enhanced credit profile allows for more effective capital allocation, increased financial flexibility and greater capital markets access and operating resources

1 | | Standalone leverage metrics assume respective companies’ adjustments for credit metric purposes |

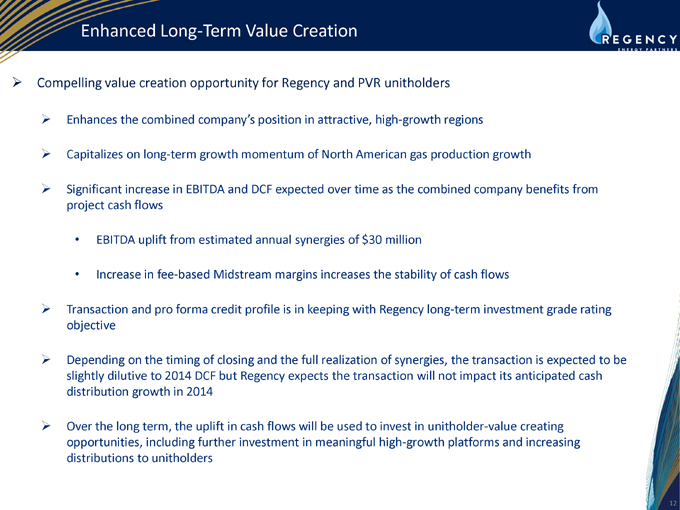

Enhanced Long-Term Value Creation

??Compelling value creation opportunity for Regency and PVR unitholders

??Enhances the combined company’s position in attractive, high-growth regions

??Capitalizes on long-term growth momentum of North American gas production growth

??Significant increase in EBITDA and DCF expected over time as the combined company benefits from project cash flows

EBITDA uplift from estimated annual synergies of $30 million

Increase in fee-based Midstream margins increases the stability of cash flows

??Transaction and pro forma credit profile is in keeping with Regency long-term investment grade rating objective

??Depending on the timing of closing and the full realization of synergies, the transaction is expected to be slightly dilutive to 2014 DCF but Regency expects the transaction will not impact its anticipated cash distribution growth in 2014

??Over the long term, the uplift in cash flows will be used to invest in unitholder-value creating opportunities, including further investment in meaningful high-growth platforms and increasing distributions to unitholders

Q&A

Appendix

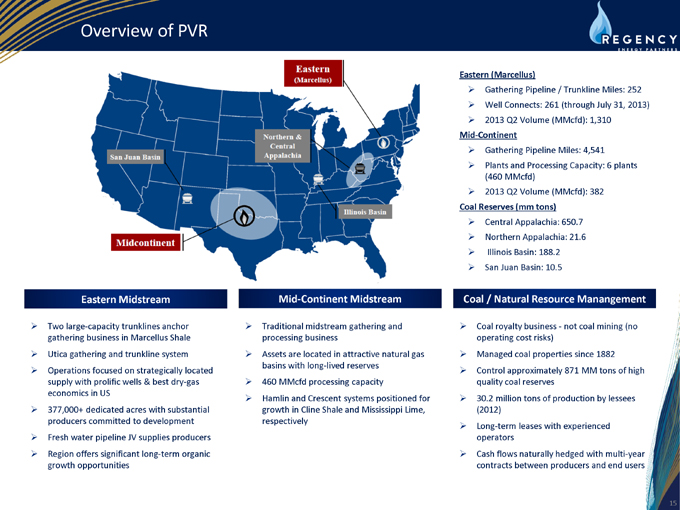

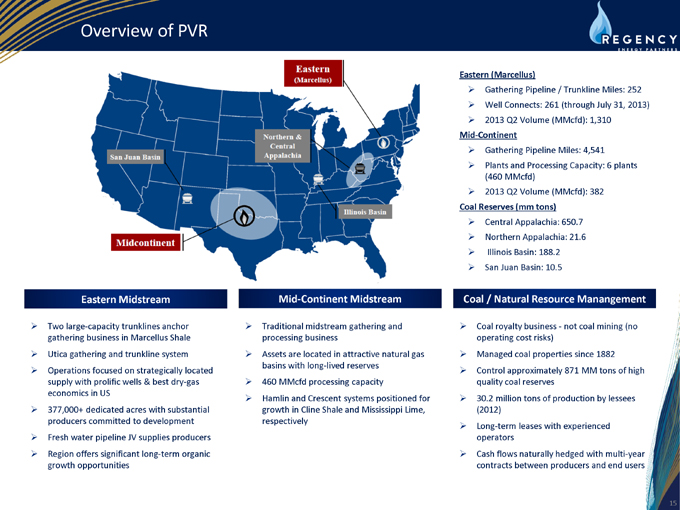

Overview of PVR

Eastern (Marcellus)

??Gathering Pipeline / Trunkline Miles: 252 ??Well Connects: 261 (through July 31, 2013) ??2013 Q2 Volume (MMcfd): 1,310

Mid-Continent

??Gathering Pipeline Miles: 4,541 ??Plants and Processing Capacity: 6 plants (460 MMcfd) ??2013 Q2 Volume (MMcfd): 382

Coal Reserves (mm tons)

??Central Appalachia: 650.7 ??Northern Appalachia: 21.6 ? Illinois Basin: 188.2 ??San Juan Basin: 10.5

Eastern Midstream Mid-Continent Midstream Coal / Natural Resource Manangement

??Two large-capacity trunklines anchor ??Traditional midstream gathering and ??Coal royalty business—not coal mining (no gathering business in Marcellus Shale processing business operating cost risks) ??Utica gathering and trunkline system ??Assets are located in attractive natural gas ??Managed coal properties since 1882 basins with long-lived reserves ??Operations focused on strategically located ??Control approximately 871 MM tons of high supply with prolific wells & best dry-gas ??460 MMcfd processing capacity quality coal reserves economics in US

??Hamlin and Crescent systems positioned for ??30.2 million tons of production by lessees ??377,000+ dedicated acres with substantial growth in Cline Shale and Mississippi Lime, (2012) producers committed to development respectively ??Long-term leases with experienced ??Fresh water pipeline JV supplies producers operators ??Region offers significant long-term organic ??Cash flows naturally hedged with multi-year growth opportunities contracts between producers and end users

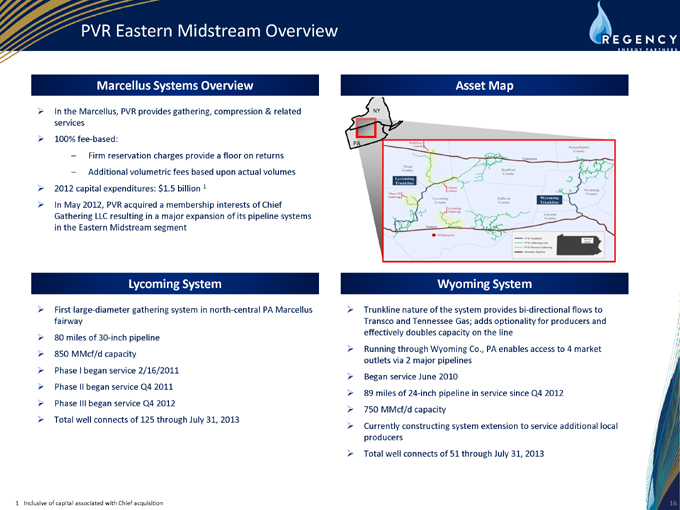

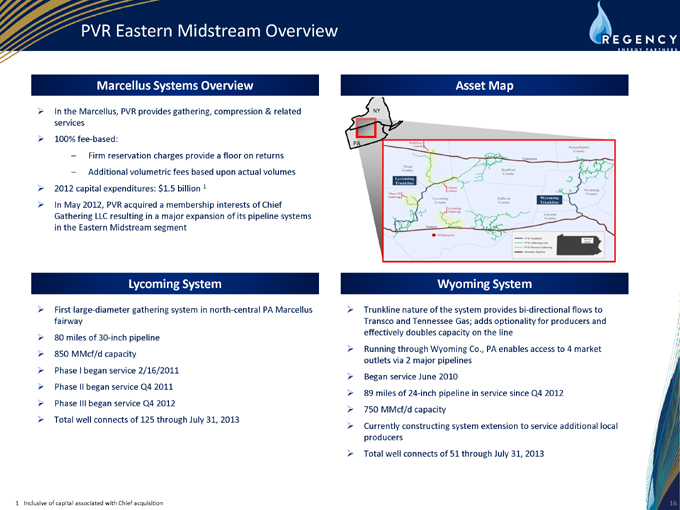

PVR Eastern Midstream Overview

Marcellus Systems Overview Asset Map

??In the Marcellus, PVR provides gathering, compression & related NY services ??100% fee-based:

PA

– Firm reservation charges provide a floor on returns

– Additional volumetric fees based upon actual volumes ??2012 capital expenditures: $1.5 billion 1 ??In May 2012, PVR acquired a membership interests of Chief Gathering LLC resulting in a major expansion of its pipeline systems in the Eastern Midstream segment

Lycoming System Wyoming System

??First large-diameter gathering system in north-central PA Marcellus ??Trunkline nature of the system provides bi-directional flows to fairway Transco and Tennessee Gas; adds optionality for producers and effectively doubles capacity on the line ??80 miles of 30-inch pipeline ??Running through Wyoming Co., PA enables access to 4 market ??850 MMcf/d capacity outlets via 2 major pipelines ??Phase I began service 2/16/2011 ??Began service June 2010 ??Phase II began service Q4 2011 ??89 miles of 24-inch pipeline in service since Q4 2012 ??Phase III began service Q4 2012 ??750 MMcf/d capacity ??Total well connects of 125 through July 31, 2013 ??Currently constructing system extension to service additional local producers ??Total well connects of 51 through July 31, 2013

1 | | Inclusive of capital associated with Chief acquisition |

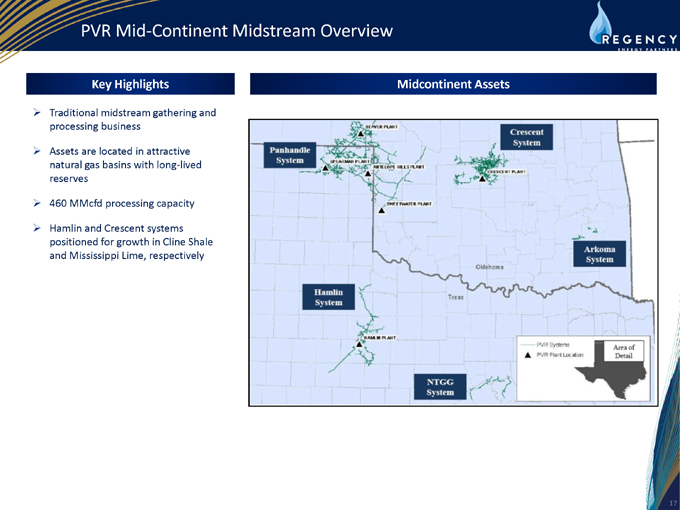

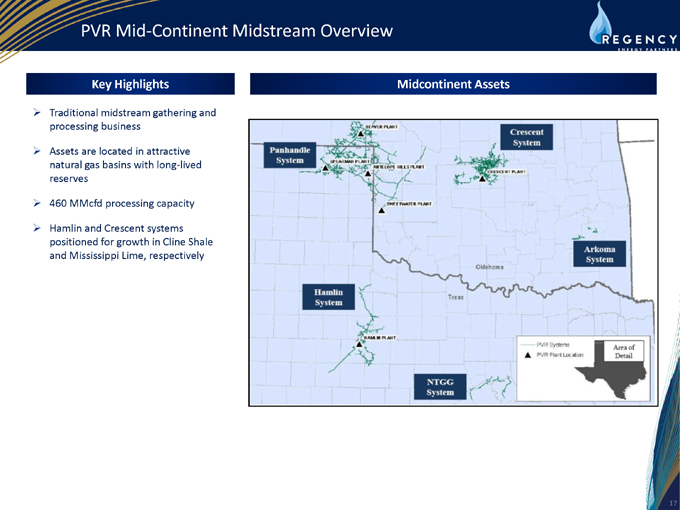

PVR Mid-Continent Midstream Overview

Key Highlights Midcontinent Assets

??Traditional midstream gathering and processing business

??Assets are located in attractive natural gas basins with long-lived reserves

??460 MMcfd processing capacity

??Hamlin and Crescent systems positioned for growth in Cline Shale and Mississippi Lime, respectively

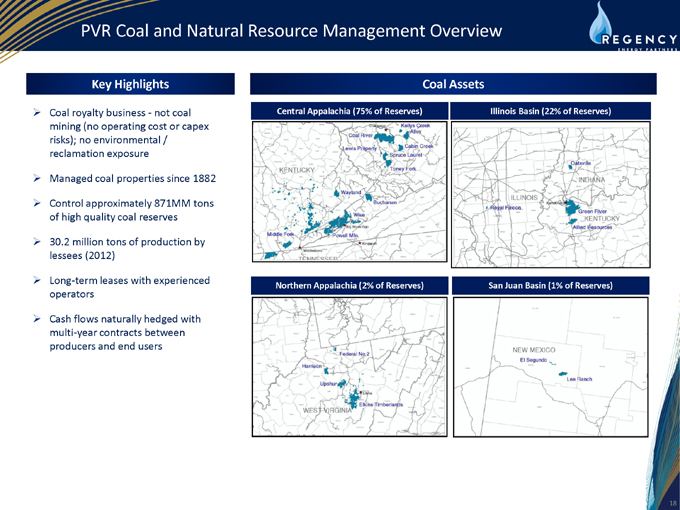

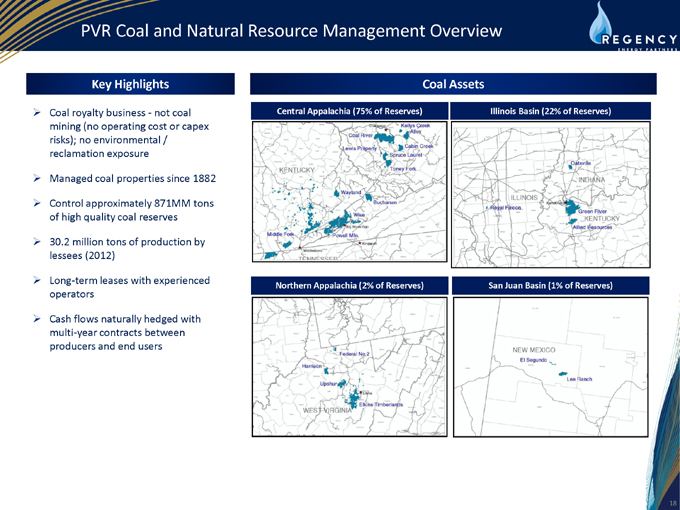

PVR Coal and Natural Resource Management Overview

Key Highlights Coal Assets

??Coal royalty business—not coal Central Appalachia (75% of Reserves) Illinois Basin (22% of Reserves)

mining (no operating cost or capex risks); no environmental / reclamation exposure

??Managed coal properties since 1882

??Control approximately 871MM tons of high quality coal reserves

??30.2 million tons of production by lessees (2012)

??Long-term leases with experienced

Northern Appalachia (2% of Reserves) San Juan Basin (1% of Reserves)

operators

??Cash flows naturally hedged with multi-year contracts between producers and end users