Acquisition of Park Place Dealerships December 12, 2019 Exhibit 99.2

To the extent that statements in this presentation are not recitations of historical fact, such statements constitute “forward-looking statements" as such term is defined in the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this presentation may include statements relating to goals, plans, expectations, projections regarding the expected benefits of the proposed acquisition, managements plans, projections and objectives for future operations, scale and performance, integration plans and expected synergies therefrom, the timing of completion of the proposed acquisition, our financial position, liquidity, results of operations, market position, dealership portfolio, capital allocation strategy, business strategy and expectations of our management with respect to, among other things: our relationships with vehicle manufacturers; our ability to improve our margins; operating cash flows and availability of capital; capital expenditures; the amount of our indebtedness; the completion of pending and future acquisitions and divestitures; future return targets; future annual savings; general economic trends, including consumer confidence levels, interest rates, and fuel prices; and automotive retail industry trends. The following are some but not all of the factors that could cause actual results or events to differ materially from those anticipated, including: the occurrence of any event, change or other circumstances that could give rise to the termination of the definitive agreements; the risk that the necessary manufacturer approvals may not be obtained; the risk that the necessary regulatory approvals may not be obtained or may be obtained subject to conditions that are not anticipated; the risk that the proposed acquisition will not be consummated in a timely manner; risks that any of the closing conditions to the proposed acquisition may not be satisfied or may not be satisfied in a timely manner; risks related to disruption of management time from ongoing business operations due to the proposed acquisition; failure to realize the benefits expected from the proposed acquisition; failure to promptly and effectively integrate the acquisition; and the effect of the announcement of the proposed acquisition on the operating results and businesses of Asbury and Park Place Dealerships and their ability to retain and hire key personnel, maintain relationships with suppliers; our ability to execute our business strategy; the annual rate of new vehicle sales in the U.S.; our ability to generate sufficient cash flows; our ability to improve our liquidity position; market factors and the future economic environment, including consumer confidence, interest rates, the price of oil and gasoline, the level of manufacturer incentives and the availability of consumer credit; the reputation and financial condition of vehicle manufacturers whose brands we represent and our relationships with such manufacturers, and their ability to design, manufacture, deliver and market their vehicles successfully; significant disruptions in the production and delivery of vehicles and parts for any reason, including natural disasters, affecting the manufacturers whose brand we sell; our ability to enter into, maintain and/or renew our framework and dealership agreements on favorable terms; the inability of our dealership operations to perform at expected levels or achieve expected return targets; our ability to successfully integrate recent and future acquisitions; changes in, failure or inability to comply with, laws and regulations governing the operation of automobile franchises, accounting standards, the environment and taxation requirements; our ability to leverage gains from our dealership portfolio; high levels of competition in the automotive retailing industry which may create pricing pressures on the products and services we offer; our ability to minimize operating expenses or adjust our cost structure; our ability to execute our capital expenditure plans; our ability to capitalize on opportunities to repurchase our debt and equity securities; our ability to achieve estimated future savings from our various cost saving initiatives and strategies; our ability to comply with our debt or lease covenants and obtain waivers for the covenants as necessary; and any negative outcome from any future litigation. These risks, uncertainties and other factors are disclosed in Asbury’s Annual Report on Form 10-K, subsequent quarterly reports on Form 10-Q and other periodic and current reports filed with the Securities and Exchange Commission from time to time. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this presentation. We expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, whether as a result of new information, future events or otherwise. Forward Looking Statements

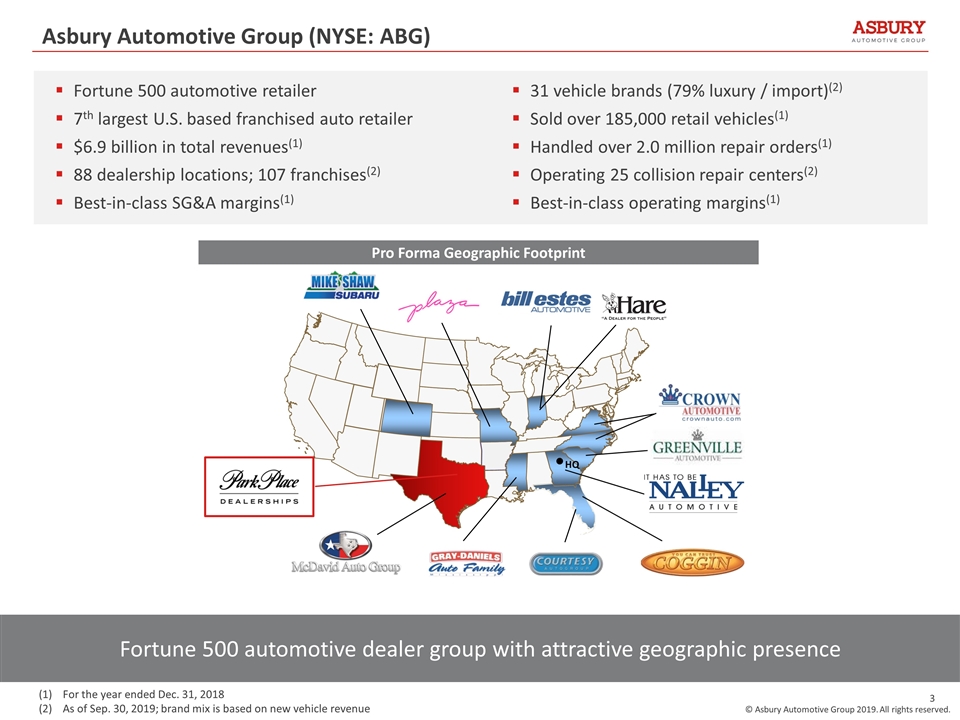

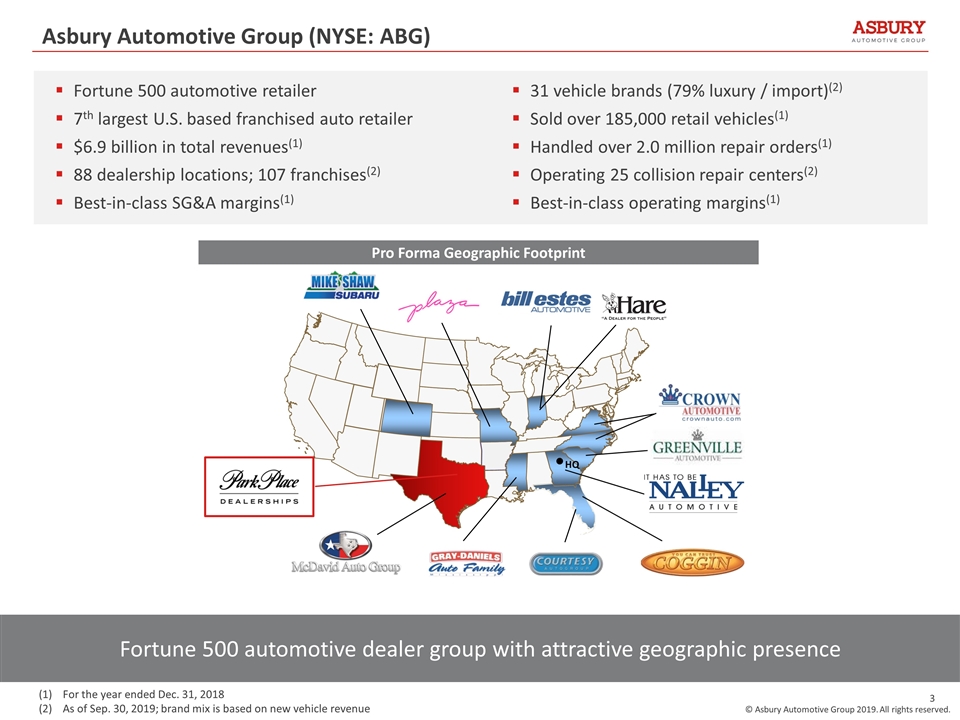

For the year ended Dec. 31, 2018 As of Sep. 30, 2019; brand mix is based on new vehicle revenue HQ Asbury Automotive Group (NYSE: ABG) Fortune 500 automotive dealer group with attractive geographic presence Fortune 500 automotive retailer 7th largest U.S. based franchised auto retailer $6.9 billion in total revenues(1) 88 dealership locations; 107 franchises(2) Best-in-class SG&A margins(1) 31 vehicle brands (79% luxury / import)(2) Sold over 185,000 retail vehicles(1) Handled over 2.0 million repair orders(1) Operating 25 collision repair centers(2) Best-in-class operating margins(1) Pro Forma Geographic Footprint

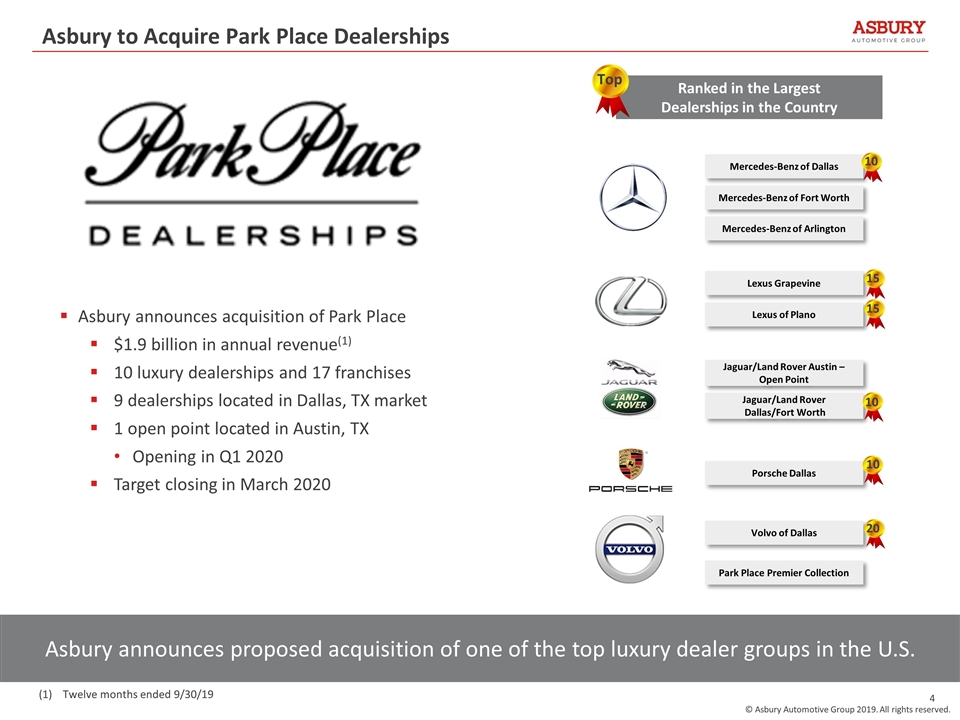

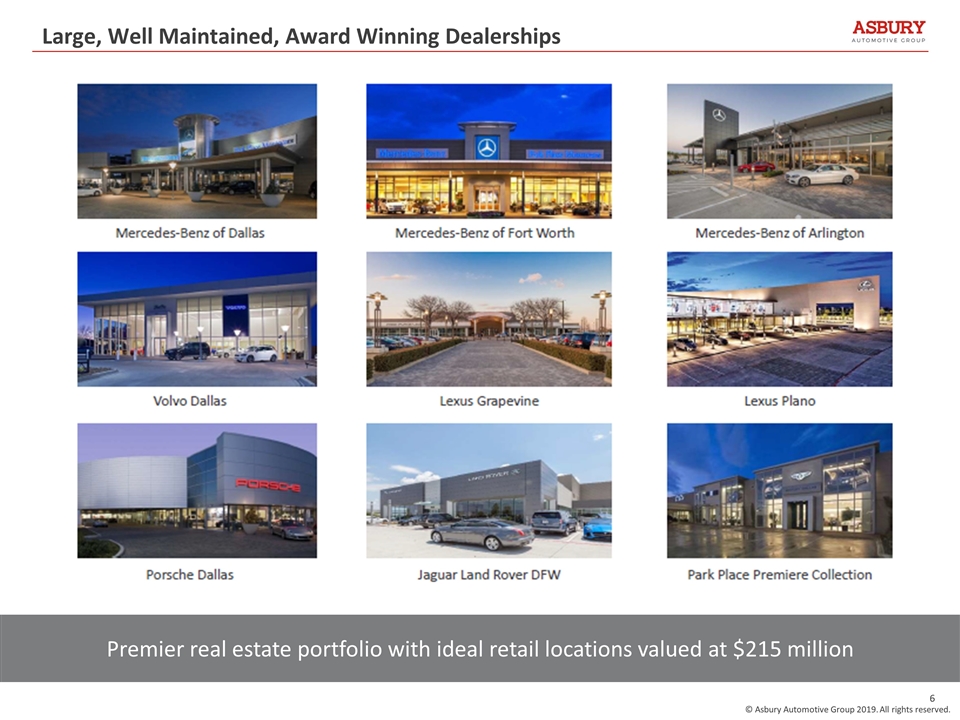

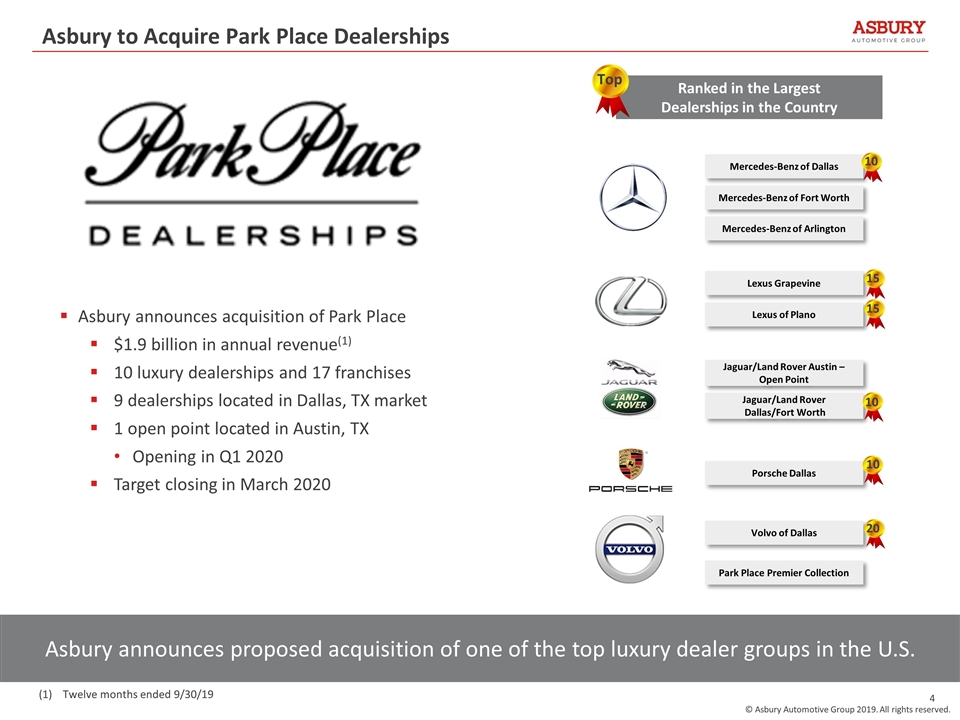

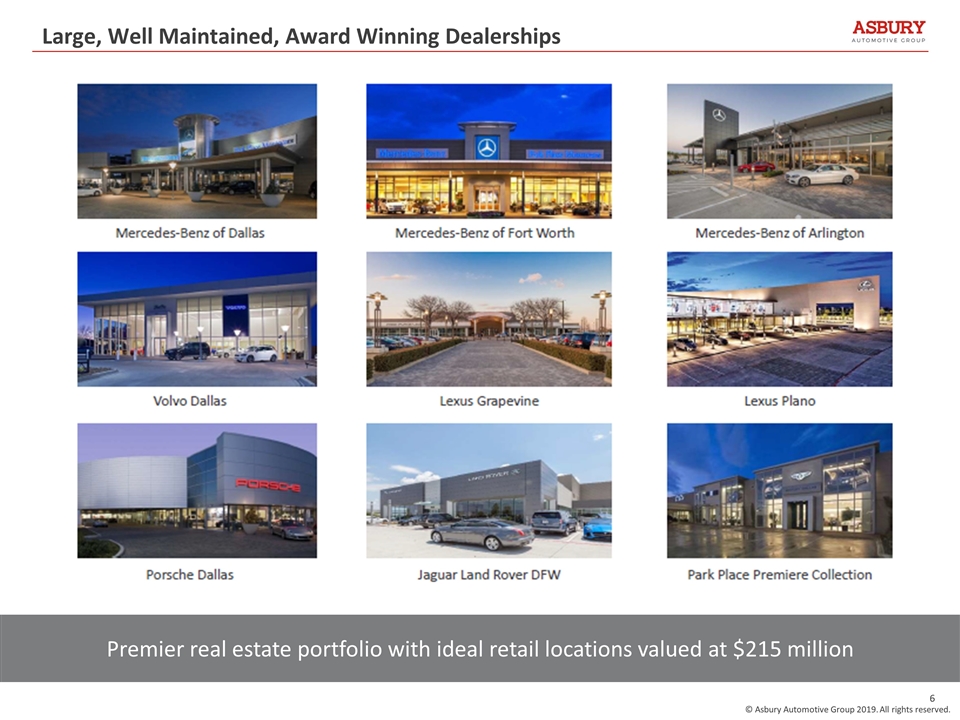

Asbury to Acquire Park Place Dealerships Asbury announces proposed acquisition of one of the top luxury dealer groups in the U.S. Asbury announces acquisition of Park Place $1.9 billion in annual revenue(1) 10 luxury dealerships and 17 franchises 9 dealerships located in Dallas, TX market 1 open point located in Austin, TX Opening in Q1 2020 Target closing in March 2020 Ranked in the Largest Dealerships in the Country Mercedes-Benz of Dallas Mercedes-Benz of Fort Worth Mercedes-Benz of Arlington Lexus Grapevine Lexus of Plano Volvo of Dallas Porsche Dallas Park Place Premier Collection Jaguar/Land Rover Austin – Open Point Jaguar/Land Rover Dallas/Fort Worth Top 10 10 15 10 15 20 Twelve months ended 9/30/19

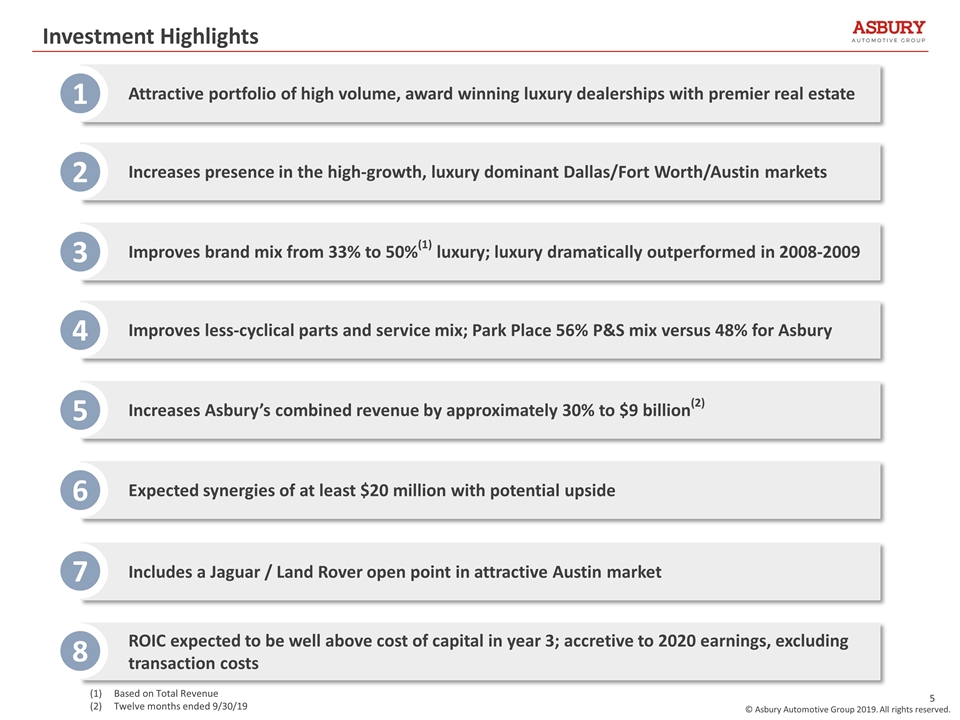

Investment Highlights Increases presence in the high-growth, luxury dominant Dallas/Fort Worth/Austin markets Improves brand mix from 33% to 50%(1) luxury; luxury dramatically outperformed in 2008-2009 Expected synergies of at least $20 million with potential upside Includes a Jaguar / Land Rover open point in attractive Austin market Attractive portfolio of high volume, award winning luxury dealerships with premier real estate 1 2 3 6 7 Increases Asbury’s combined revenue by approximately 30% to $9 billion(2) 5 Improves less-cyclical parts and service mix; Park Place 56% P&S mix versus 48% for Asbury 4 Based on Total Revenue Twelve months ended 9/30/19 ROIC expected to be well above cost of capital in year 3; accretive to 2020 earnings, excluding transaction costs 8

Large, Well Maintained, Award Winning Dealerships Premier real estate portfolio with ideal retail locations valued at $215 million

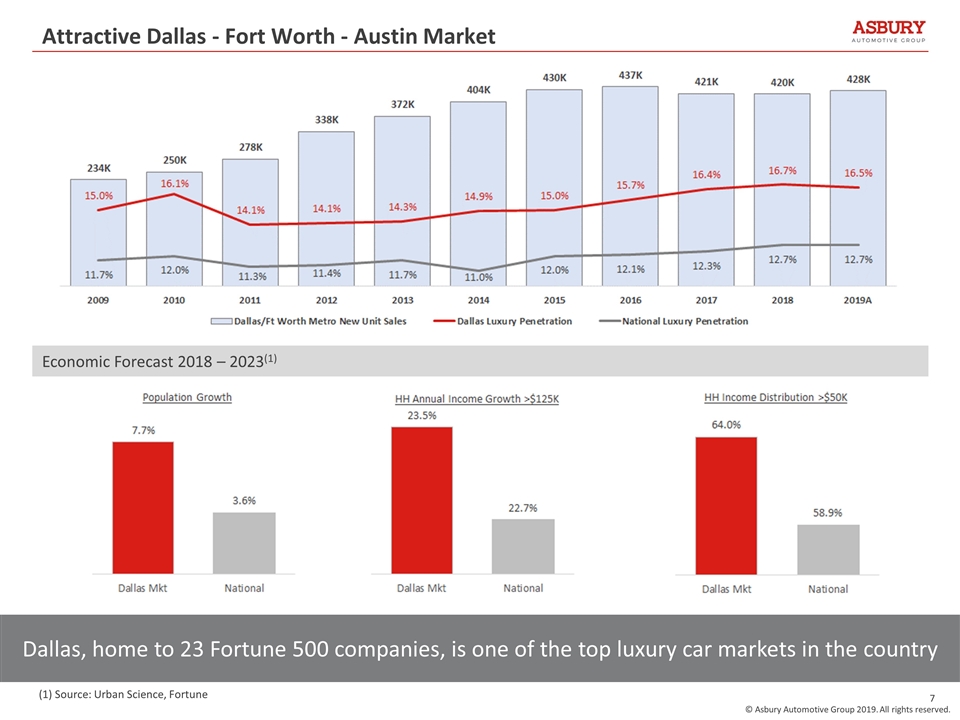

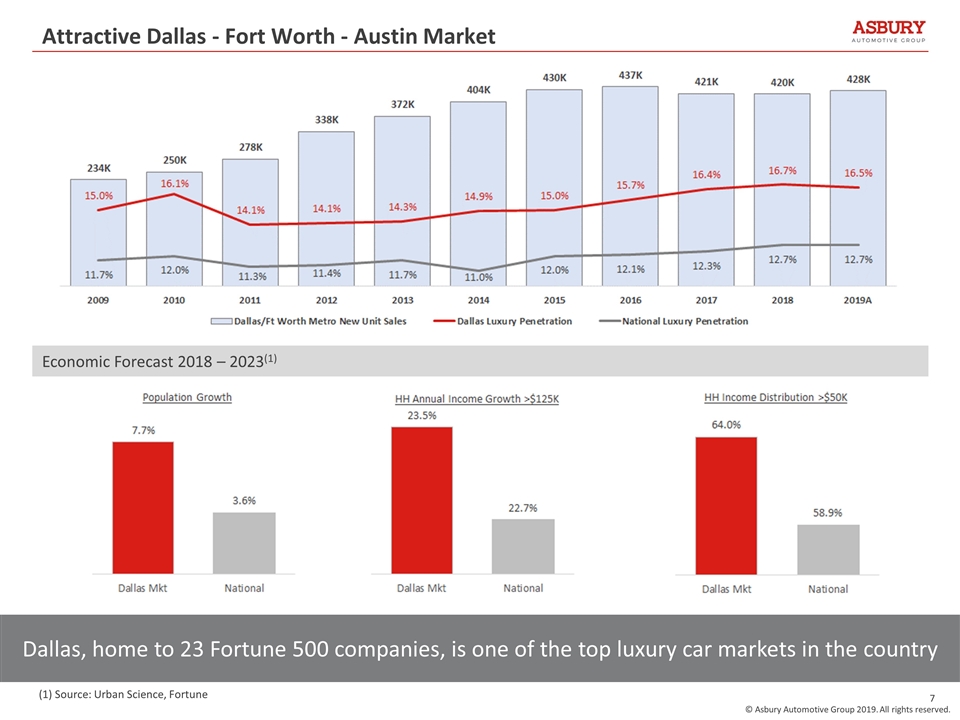

Attractive Dallas - Fort Worth - Austin Market (1) Source: Urban Science, Fortune Dallas, home to 23 Fortune 500 companies, is one of the top luxury car markets in the country Economic Forecast 2018 – 2023(1)

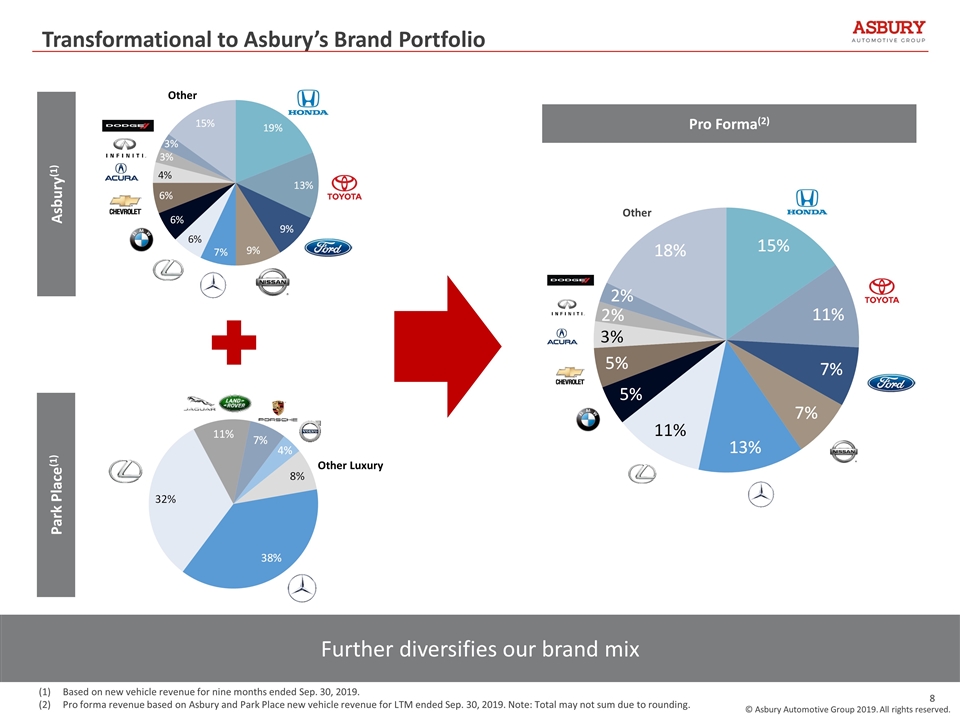

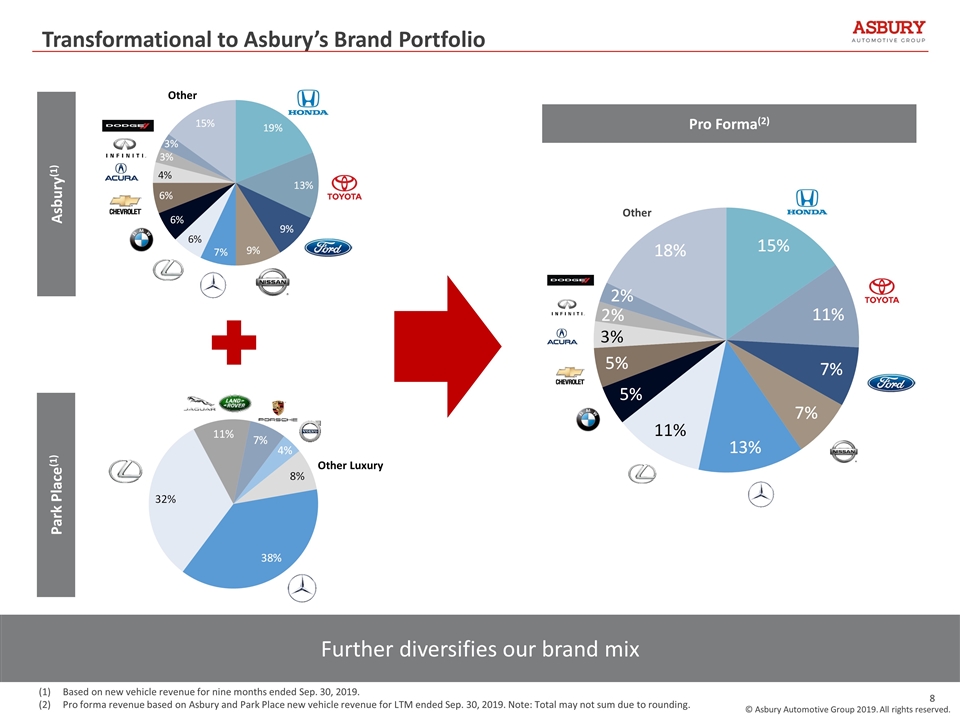

Transformational to Asbury’s Brand Portfolio Further diversifies our brand mix Other Other Luxury Other Asbury(1) Park Place(1) Pro Forma(2) Based on new vehicle revenue for nine months ended Sep. 30, 2019. Pro forma revenue based on Asbury and Park Place new vehicle revenue for LTM ended Sep. 30, 2019. Note: Total may not sum due to rounding.

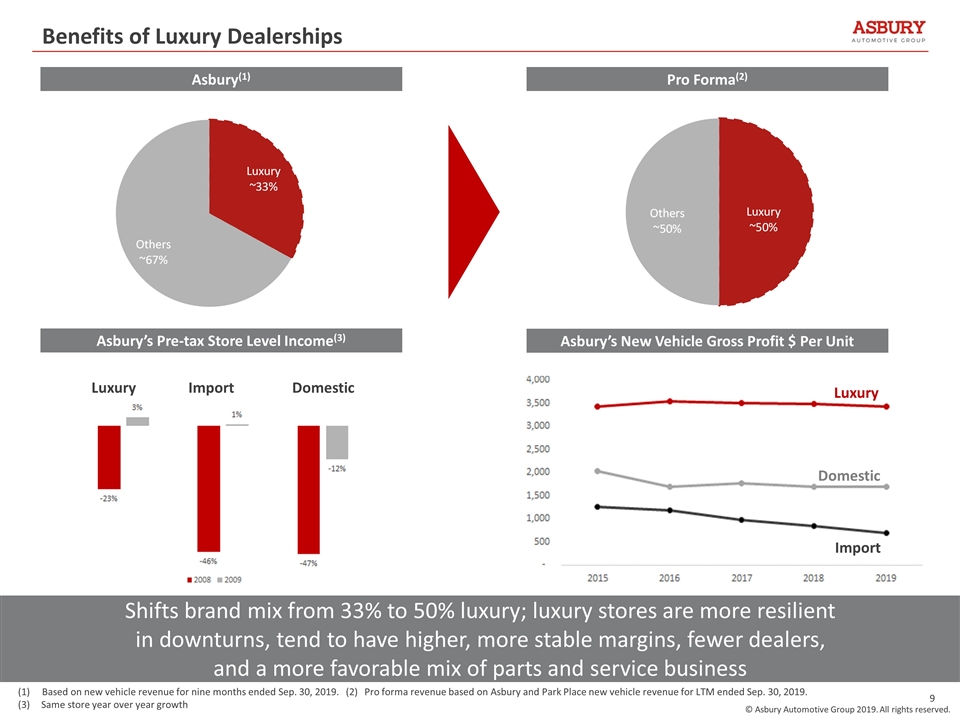

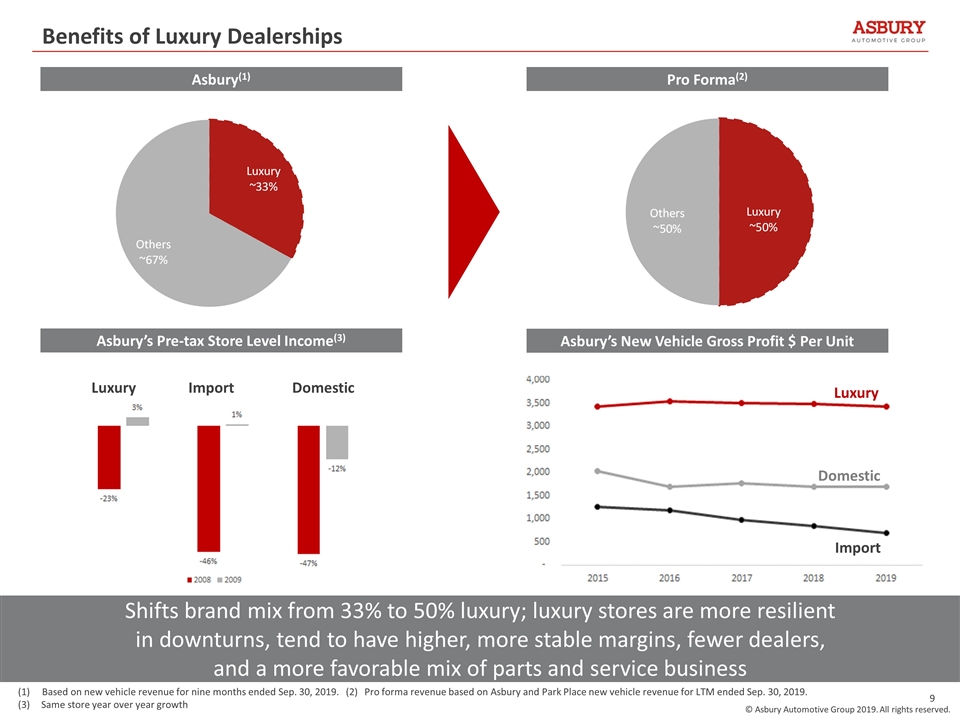

Benefits of Luxury Dealerships Shifts brand mix from 33% to 50% luxury; luxury stores are more resilient in downturns, tend to have higher, more stable margins, fewer dealers, and a more favorable mix of parts and service business Based on new vehicle revenue for nine months ended Sep. 30, 2019. (2) Pro forma revenue based on Asbury and Park Place new vehicle revenue for LTM ended Sep. 30, 2019. (3) Same store year over year growth Pro Forma(2) Asbury(1) Luxury Import Domestic Asbury’s Pre-tax Store Level Income(3) Asbury’s New Vehicle Gross Profit $ Per Unit Luxury Import Domestic

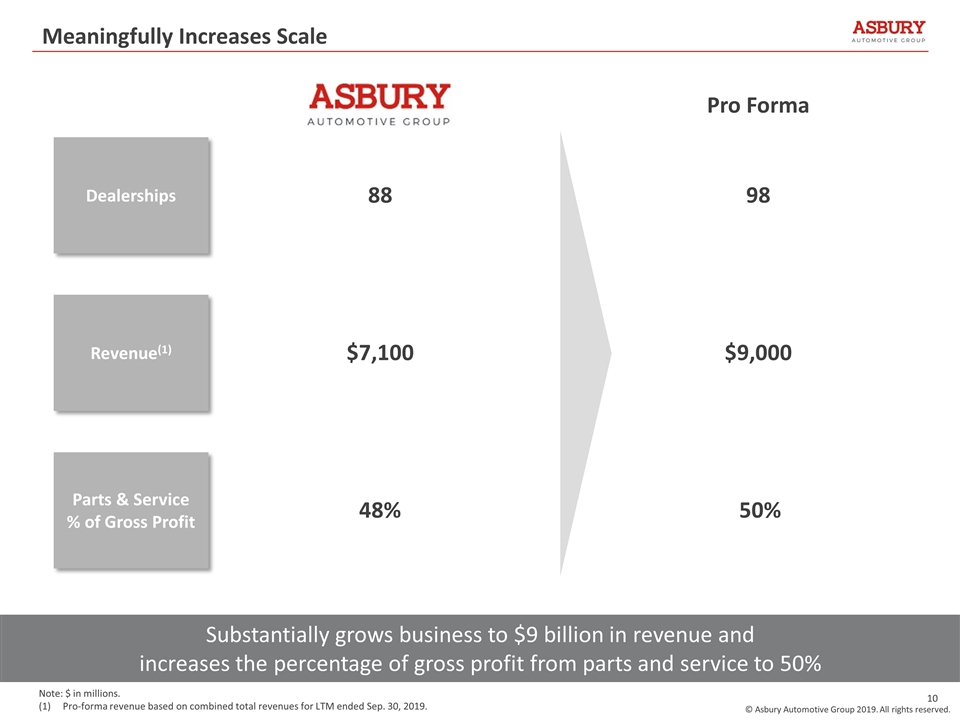

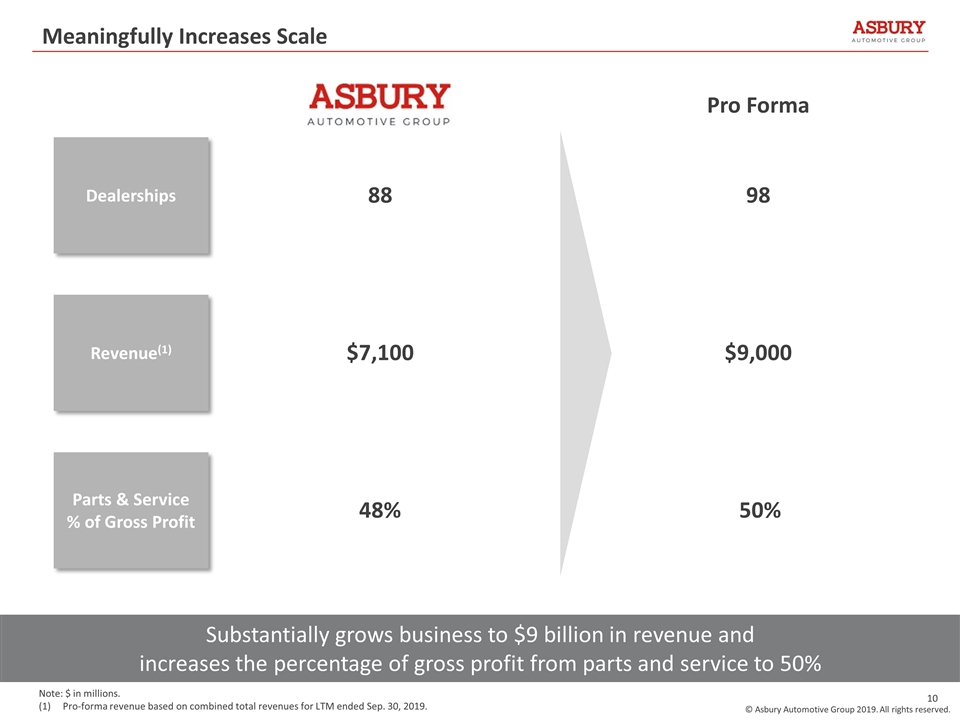

Meaningfully Increases Scale Substantially grows business to $9 billion in revenue and increases the percentage of gross profit from parts and service to 50% Revenue(1) Parts & Service % of Gross Profit Dealerships Pro Forma 88 $7,100 $9,000 98 48% 50% Note: $ in millions. Pro-forma revenue based on combined total revenues for LTM ended Sep. 30, 2019.

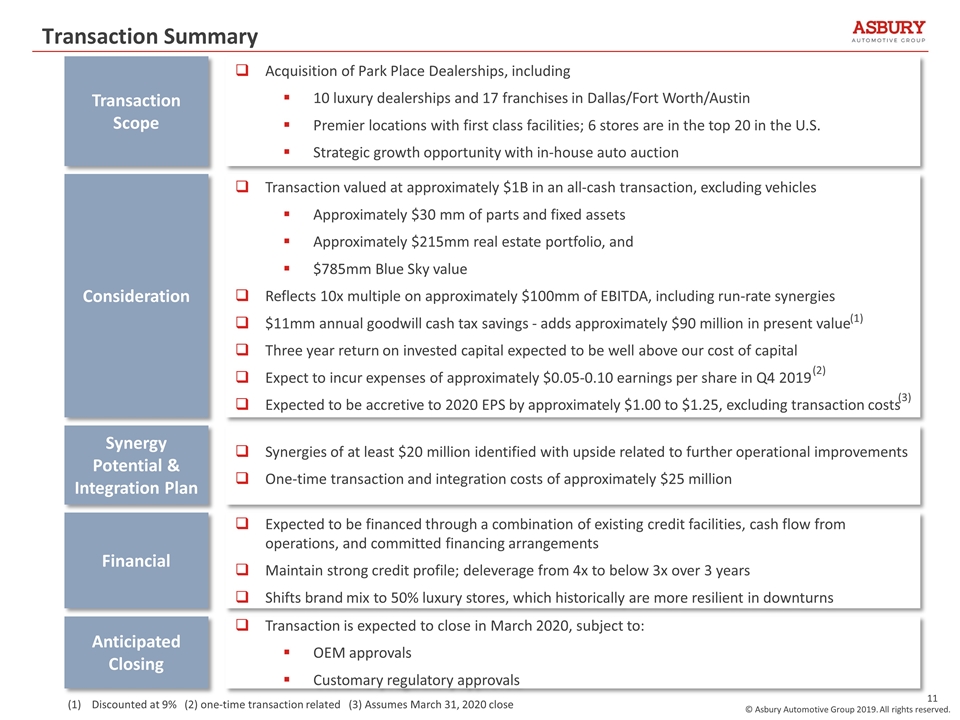

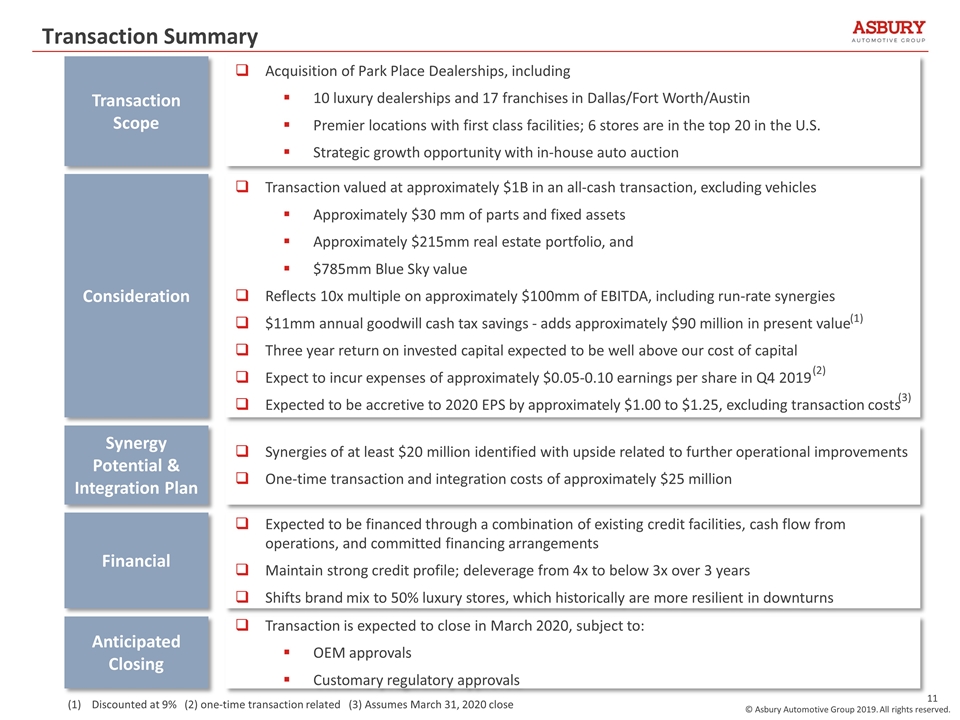

Transaction Summary Consideration Financial Anticipated Closing Synergy Potential & Integration Plan Transaction valued at approximately $1B in an all-cash transaction, excluding vehicles Approximately $30 mm of parts and fixed assets Approximately $215mm real estate portfolio, and $785mm Blue Sky value Reflects 10x multiple on approximately $100mm of EBITDA, including run-rate synergies $11mm annual goodwill cash tax savings - adds approximately $90 million in present value Three year return on invested capital expected to be well above our cost of capital Expect to incur expenses of approximately $0.05-0.10 earnings per share in Q4 2019 Expected to be accretive to 2020 EPS by approximately $1.00 to $1.25, excluding transaction costs Expected to be financed through a combination of existing credit facilities, cash flow from operations, and committed financing arrangements Maintain strong credit profile; deleverage from 4x to below 3x over 3 years Shifts brand mix to 50% luxury stores, which historically are more resilient in downturns Transaction is expected to close in March 2020, subject to: OEM approvals Customary regulatory approvals Synergies of at least $20 million identified with upside related to further operational improvements One-time transaction and integration costs of approximately $25 million Transaction Scope Acquisition of Park Place Dealerships, including 10 luxury dealerships and 17 franchises in Dallas/Fort Worth/Austin Premier locations with first class facilities; 6 stores are in the top 20 in the U.S. Strategic growth opportunity with in-house auto auction Discounted at 9% (2) one-time transaction related (3) Assumes March 31, 2020 close (3) (2)