QuickLinks -- Click here to rapidly navigate through this document

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of April 2004

Preem Holdings AB (publ)

(Translation of registrant's name into English)

Sandhamnsgatan 51, S-11590, Stockholm, Sweden

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F /X/ Form 40-F / /

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): / /

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): / /

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2 (b) under the Securities Exchange Act of 1934.

Yes / / No /X/

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Preem Holdings AB (publ) |

Date: April 28, 2004 |

|

By: |

|

/s/ PER HÖJGÅRD

Name: Per Höjgård

Title: Chief Financial Officer

|

On April 27, 2004, Preem Holdings AB (publ) announced, and submitted the press release containing such announcement in a separate Form 6-K dated April 27, 2004, that it intends to raise, subject to market and other conditions, approximately €125 million of debt financing by the issuance of senior subordinated notes through its wholly owned subsidiary, Preem Petroleum AB (publ), in the international bond markets. Preem Holdings AB (publ) will guarantee the notes on a senior basis. The offering is expected to close during the second quarter of 2004. In connection therewith, we anticipate disclosing to prospective purchasers of the senior subordinated notes information that has not been previously publicly reported. We have elected to provide this information, together with other information that has been previously publicly disclosed, in this Form 6-K.

Nothing herein shall constitute an offer to sell or the solicitation of an offer to buy the notes, nor shall there be any sale of the notes in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state. The notes will be offered to qualified institutional buyers in reliance on Rule 144A under the U.S. Securities Act of 1933, as amended (the "Securities Act") and outside the United States in reliance on Regulation S under the Securities Act. The notes will not be registered under the Securities Act. Unless and until so registered, the notes may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and applicable state securities laws.

Certain Information with Respect to Preem Holdings AB (publ)

to be Disclosed to Prospective Purchasers of Senior Subordinated Notes

not Previously Publicly Reported

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This offering memorandum includes forward-looking statements. These forward-looking statements can be identified by the use of forward-looking terminology, including the terms "believes," "estimates," "anticipates," "expects," "intends," "may," "will" or "should" or, in each case, their negative, or other variations or comparable terminology. These forward-looking statements include all matters that are not historical facts. They appear in a number of places throughout this offering memorandum and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, growth, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity, and the development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this offering memorandum. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this offering memorandum, those results or developments may not be indicative of results or developments in subsequent periods. Important factors that could cause those differences include, but are not limited to:

- •

- our substantial indebtedness;

- •

- our ability to obtain sufficient short-term credit to finance our spot market crude oil purchases and long-term credit to finance our future capital expenditures;

- •

- volatility in refining margins and in market prices for crude oil and refined products;

- •

- operational hazards;

- •

- our future capital needs;

- •

- our ability to comply with existing or newly implemented environmental regimes in the countries in which we operate;

- •

- our liability for violations, known and unknown, under environmental laws;

- •

- our ability to remediate contaminated sites within budgeted amounts;

- •

- our ability to hedge against currency, commodity and interest rate risks;

- •

- agreements or disagreements among members of OPEC; and

- •

- limitations on our operational flexibility arising under agreements governing our debt.

We urge you to read the sections of this offering memorandum entitled "Risk Factors," "Operating and Financial Review and Prospects" and "Business" for a more complete discussion of the factors that could affect our future performance and the industry in which we operate. In light of these risks, uncertainties and assumptions, the forward-looking events described in this offering memorandum may not occur.

We undertake no obligation to publicly update or publicly revise any forward-looking statement, whether as a result of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above and contained elsewhere in this offering memorandum.

i

PRESENTATION OF INFORMATION

We have generally obtained the market and competitive position data in this offering memorandum from industry publications and from surveys or studies conducted by third-party sources that we believe to be reliable, including the Swedish Petroleum Institute. However, we cannot assure you of the accuracy and completeness of such information and we have not independently verified such market and position data. We do, however, accept responsibility for the correct reproduction of this information.

In addition, in many cases we have made statements in this offering memorandum regarding our industry and our position in the industry based on our experience and our own investigation of market conditions. We cannot assure you that any of these assumptions are accurate or correctly reflect our position in the industry, and none of our internal surveys or information have been verified by any independent sources.

In this offering memorandum, unless otherwise provided below:

- •

- "bridge loan" refers to a €170 million bridge loan, which matures on June 11, 2004, from a group of Swedish banks to Preem Petroleum and Preem Finans, guaranteed by Preem Holdings and Preem Petroleum, which we obtained in connection with our acquisition of 25% of the capital stock of Skandinaviska Raffinaderi AB Scanraff, the owner of the Scanraff refinery;

- •

- "EU" refers to the European Union;

- •

- "existing Preem Holdings notes" refers to the €305 million aggregate principal amount of 105/8% senior secured notes due 2011 issued by Preem Holdings in 2001;

- •

- "inter-company loan" refers to a SEK 2,277 million interest-free, subordinated inter-company loan to Preem Petroleum from Preem Holdings, which matures on March 31, 2011;

- •

- "Preem Finans" refers to Preem Finans AB, a wholly owned subsidiary of the Issuer;

- •

- "Preem Holdings" or the "Guarantor" refers to Preem Holdings AB (publ), the guarantor of the notes;

- •

- "Preem Petroleum" or the "Issuer" refers to Preem Petroleum AB (publ), the issuer of the notes;

- •

- "proposed new credit facilities" refers to proposed new multi-currency revolving credit and term loan facilities for Preem Petroleum, which we expect to be in an approximate amount of €300 million to €355 million for which we have signed an appointment letter dated April 27, 2004 with SEB Merchant Banking, Skandinaviska Enskilda Banken AB (publ) and Svenska Handelsbanken AB (publ), pursuant to which they are appointed to act, on a best efforts basis, as lead arrangers;

- •

- "shareholder loan" refers to a SEK 242 million interest-free, subordinated shareholder loan to Preem Holdings from Corral Petroleum Holdings AB (publ), which has no maturity date and may not be repaid while the existing Preem Holdings notes or these Notes are outstanding;

- •

- "Swedish GAAP" refers to generally accepted accounting principles in Sweden;

- •

- "United States" or the "U.S." refer to the United States of America;

- •

- "U.S. GAAP" refers to generally accepted accounting principles in the United States; and

- •

- "we," "us," "our," and other similar terms refer to Preem Holdings and its consolidated subsidiaries, including Preem Petroleum, except where the context otherwise requires.

In the petroleum refining industry, crude oil and refined product amounts are generally stated in cubic meters ("m3") or barrels, each of which is a unit of volume, or in metric tonnes, a unit of weight, depending on the product and the reason for which the amount is being measured. These volumes may

ii

be expressed in terms of barrels. A barrel ("bbl") contains 42 U.S. gallons. We have converted cubic meters to barrels at the rate of 1 cubic meter = 6.2898 barrels.

PRESENTATION OF FINANCIAL INFORMATION

Unless otherwise indicated, financial information in this offering memorandum has been prepared in accordance with Swedish GAAP. Swedish GAAP differs in certain significant respects from U.S. GAAP. For a discussion of the most significant differences between Swedish GAAP and U.S. GAAP as they apply to us, see "Selected Consolidated Financial Data—Principle Differences Between Swedish GAAP and U.S. GAAP" and note 26 to our audited consolidated financial statements included elsewhere in this offering memorandum.

Some financial information in this offering memorandum has been rounded and, as a result, the numerical figures shown as totals in this offering memorandum may vary slightly from the exact arithmetic aggregation of the figures that precede them.

CURRENCY PRESENTATION

In this offering memorandum:

- •

- "$" or "dollar" refer to the lawful currency of the United States;

- •

- "€" or "euro" refer to the single currency of the participating Member States in the Third Stage of European Economic and Monetary Union of the Treaty Establishing the European Community, as amended from time to time; and

- •

- "SEK," "krona" or "kronor" refer to the lawful currency of Sweden.

EXCHANGE RATE INFORMATION

We publish our financial statements in kronor. For your convenience, this offering memorandum presents translations into euro of certain krona amounts at the Swedish Central Bank's exchange rate for the krona against the euro on December 31, 2003 of €1.00=SEK 9.09. The following chart shows, for the period from January 1, 1999 through April 23, 2004, the period end, average, high and low Swedish Central Bank foreign exchange reference rate for cable transfers of euro expressed as kronor per €1.00.

| | SEK per €1.00

|

|---|

| | High

| | Low

| | Period

average(1)

| | Period end

|

|---|

| Year | | | | | | | | |

| 1999 | | 9.5400 | | 8.5500 | | 8.7850 | | 8.5635 |

| 2000 | | 8.8740 | | 8.0850 | | 8.4736 | | 8.8570 |

| 2001 | | 9.9410 | | 8.8400 | | 9.2870 | | 9.4190 |

| 2002 | | 9.5150 | | 8.9765 | | 9.1328 | | 9.1925 |

| 2003 | | 9.2965 | | 8.8990 | | 9.1185 | | 9.0940 |

Month |

|

|

|

|

|

|

|

|

| October 2003 | | 9.0760 | | 8.9305 | | 9.0099 | | 9.0440 |

| November 2003 | | 9.0760 | | 8.9445 | | 8.9908 | | 9.0085 |

| December 2003 | | 9.1165 | | 8.9280 | | 9.0169 | | 9.0940 |

| January 2004 | | 9.1940 | | 9.0570 | | 9.1373 | | 9.1780 |

| February 2004 | | 9.2415 | | 9.1060 | | 9.1814 | | 9.2175 |

| March 2004 | | 9.2730 | | 9.1565 | | 9.2305 | | 9.2635 |

| April 2004 (through April 23, 2004) | | 9.2615 | | 9.1330 | | 9.1883 | | 9.1330 |

- (1)

- The period average for 1999 to 2003 represents the average of the noon buying rates on the last business day of each month during the relevant period.

iii

The following chart shows, for the period from January 1, 1999 through April 23, 2004, the period end, average, high and low Swedish Central Bank foreign exchange reference rate for cable transfers of dollars expressed as kronor per $1.00.

| | SEK per $1.00

|

|---|

| | High

| | Low

| | Period

average(1)

| | Period end

|

|---|

| Year | | | | | | | | |

| 1999 | | 8.6575 | | 7.7100 | | 8.3038 | | 8.5250 |

| 2000 | | 10.3325 | | 8.3425 | | 9.2394 | | 9.5350 |

| 2001 | | 10.9950 | | 9.2650 | | 10.4174 | | 10.6675 |

| 2002 | | 10.7275 | | 8.8050 | | 9.6442 | | 8.8250 |

| 2003 | | 8.8000 | | 7.2750 | | 8.0165 | | 7.2750 |

Month |

|

|

|

|

|

|

|

|

| October 2003 | | 7.7775 | | 7.5825 | | 7.6966 | | 7.7750 |

| November 2003 | | 7.8900 | | 7.5225 | | 7.6831 | | 7.5550 |

| December 2003 | | 7.5300 | | 7.2750 | | 7.3632 | | 7.2750 |

| January 2004 | | 7.4175 | | 7.0750 | | 7.2493 | | 7.4125 |

| February 2004 | | 7.4150 | | 7.1275 | | 7.2599 | | 7.4125 |

| March 2004 | | 7.6625 | | 7.3650 | | 7.5243 | | 7.5650 |

| April 2004 (through April 23, 2004) | | 7.7475 | | 7.4850 | | 7.6380 | | 7.6750 |

- (1)

- The period average for 1999 to 2003 represents the average of the noon buying rates on the last business day of each month during the relevant period.

The following chart shows, for the period from January 1, 1999 through April 23, 2004, the period end, average, high and low noon buying rate in the City of New York for cable transfers of euro expressed as dollars per €1.00, as certified for customs purposes by the Federal Reserve Bank of New York.

| | $ per €1.00

|

|---|

| | High

| | Low

| | Period

average(1)

| | Period end

|

|---|

| Year | | | | | | | | |

| 1999 | | 1.1812 | | 1.0016 | | 1.0588 | | 1.0070 |

| 2000 | | 1.0335 | | 0.8270 | | 0.9207 | | 0.9388 |

| 2001 | | 0.9535 | | 0.8370 | | 0.8909 | | 0.8901 |

| 2002 | | 1.0485 | | 0.8594 | | 0.9495 | | 1.0485 |

| 2003 | | 1.2597 | | 1.0361 | | 1.1411 | | 1.2597 |

Month |

|

|

|

|

|

|

|

|

| October 2003 | | 1.1833 | | 1.1596 | | 1.1714 | | 1.1609 |

| November 2003 | | 1.1995 | | 1.1417 | | 1.1710 | | 1.1995 |

| December 2003 | | 1.2597 | | 1.1956 | | 1.2298 | | 1.2597 |

| January 2004 | | 1.2853 | | 1.2389 | | 1.2638 | | 1.2452 |

| February 2004 | | 1.2848 | | 1.2426 | | 1.2640 | | 1.2441 |

| March 2004 | | 1.2431 | | 1.2088 | | 1.2261 | | 1.2292 |

| April 2004 (through April 23, 2004) | | 1.2358 | | 1.1802 | | 1.2014 | | 1.1802 |

- (1)

- The period average for 1999 to 2003 represents the average of the noon buying rates on the last business day of each month during the relevant period.

The rates in the above tables may differ from the actual rates used in the preparation of the consolidated financial statements and other financial information appearing in this offering memorandum. Our inclusion of these exchange rates is not meant to suggest that any amount of the currencies specified above has been, or could be, converted into the applicable currency at the rates indicated or any other rate.

iv

SUMMARY

This summary highlights information contained elsewhere in this offering memorandum. It is not complete and may not contain all of the information that you should consider before investing in the Notes. This offering memorandum contains a description of the specific terms of the Notes, as well as information about our business and detailed financial data. You should read this offering memorandum in its entirety. We have provided a glossary of certain industry defined terms on page 167 of this offering memorandum.

Overview

We are one of Europe's largest independent oil refining companies and the largest Swedish oil company. We conduct our business through our wholly owned operating company, Preem Petroleum, which operates its business through two segments, a supply and refining segment and a marketing segment. We refine crude oil in Sweden and then market and sell refined products primarily in Sweden and other northwestern European markets, including Scandinavia, the United Kingdom and Germany. Our refineries represent approximately 75% of the refining capacity in Sweden and approximately 30% of the refining capacity in Scandinavia. We sell more refined products in Sweden than any of our competitors. In Sweden, we had leading market shares in 2003 in terms of sales volume of approximately 30% in diesel, 41% in heating oil and 49% in fuel oil, based on data from the Swedish Petroleum Institute. In addition, our marketing segment's share of the Swedish gasoline market in terms of sales volume was approximately 11% in 2003, based on data from the Swedish Petroleum Institute. In 2003, we had sales revenue of SEK 34,789 million (€3,827 million), operating income of SEK 453 million (€50 million) and operating income before depreciation and amortization of SEK 1,334 million (€147 million).

Supply and Refining Operations

Our supply and refining segment operates our wholly owned Scanraff and Preemraff refineries. We also own an extensive network of storage depots in Sweden. Together, these two refineries have an aggregate capacity of approximately 335,000 barrels per calendar day. Through these refineries, we produced approximately 92 million barrels of refined products in 2003, 85 million barrels in 2002, and 94.3 million barrels in 2001. The refining margins at Scanraff were $3.47 per barrel in 2003, $1.61 per barrel in 2002, and $1.86 per barrel in 2001. The refining margins at Preemraff were $1.79 per barrel in 2003, $0.82 per barrel in 2002, and $1.01 per barrel in 2001. In 2003, our supply and refining segment had sales revenue of SEK 31,609 million (€3,477 million) and operating income of SEK 966 million (€106 million).

Scanraff Refinery. Scanraff is the largest oil refinery in Sweden in terms of capacity, representing approximately 50% of Swedish refining capacity. Scanraff is a complex, large-scale refinery with a strong market position producing a full-range of refined products. The refinery has visbreaker, catalytic cracker and mild hydrocracker upgrading units geared towards converting a significant portion of our residual fuel oil to lighter, higher value products. In addition, Scanraff has a storage capacity of 17 million barrels, which provides it with additional operating flexibility. The refinery is located on a 470-acre site on the west coast of Sweden, north of the city of Gothenburg. The refinery is situated on a peninsula providing direct jetty access to oil tankers for both the import of crude oil and the distribution of refined products. In December 2003, we acquired 25% of the capital stock of Skandinaviska Raffinaderi AB Scanraff (the owner of the Scanraff refinery) from Hydro R&M Holding AB, an affiliate of Norsk Hydro ASA, for a total consideration of approximately SEK 1,500 million (€165 million), which increased our ownership in Scanraff from 75% to 100%. The total consideration includes payment for capital stock and assumed debt. In addition, we acquired the inventory at Scanraff owned by Hydro R&M Holding. The refinery has a total refining capacity of approximately 210,000 barrels per calendar day. Prior to our acquisition of the remaining interests in Scanraff, our share of

1

the aggregate production of refined products was approximately 55.3 million barrels in 2003, 48.1 million barrels in 2002, and 53.1 million barrels in 2001.

Preemraff Refinery. We believe that Preemraff is one of the most sophisticated hydroskimming refineries in Europe and represents approximately 25% of Swedish refining capacity. The refinery has a highly sophisticated desulphurization/dearomatization unit, which permits it to manufacture diesel that is virtually sulphur-free (10 parts per million). In addition, the refinery uses its catalytic reformer and isomerization unit to convert naphtha, a portion of which is received from Scanraff, into higher-value gasoline. Preemraff also sells surplus heat generated as a result of the refining process to the city of Gothenburg and to AB Volvo. The refinery is located on a 340-acre site near the harbor of Torshamnen, Sweden's largest harbor, in Gothenburg. Preemraff's proximity to this harbor helps it to maintain low crude oil transportation costs and its proximity to Gothenburg, the second largest city in Sweden, helps it to minimize distribution costs. The refinery has a total refining capacity of approximately 125,000 barrels per calendar day. Aggregate production of refined products at Preemraff was approximately 36.7 million barrels in 2003, 36.9 million barrels in 2002, and 41.2 million barrels in 2001.

Marketing Operations

Our marketing segment, which consists of a home-heating division, a business-to-business division and a station and consumer division, obtains all of its refined products from our supply and refining segment. Our marketing segment sells heating oil directly to end-users and sells heating oil, diesel and fuel oil directly to Swedish companies using refined products purchased from our supply and refining segment. We also sell gasoline, diesel, lubricants, convenience store items and other products through 509 Preem-branded service stations. In 2003, our marketing segment had sales revenue of SEK 10,920 million (€1,201 million) and operating income of SEK 106 million (€12 million).

Our Strengths

Our competitive strengths include:

Our Refineries Generate High Refining Margins. The Scanraff refinery generates relatively high margins in comparison to most northwestern European cracking refineries as a result of its sophisticated configuration, which enables it to produce a wide range of premium refined products, including diesel, that meet and, in some cases, surpass the highest EU environmental specifications. Our low operating costs and low crude oil delivery costs at Scanraff enhance our refining margins. Our Preemraff refinery benefits from high refining margins compared to other northwestern European hydroskimming refineries as a result of its ability to produce premium-priced, virtually sulphur-free (10 parts per million) diesel, which meets environmental specifications of the Swedish market and which is in increasing demand in our other target markets in northwestern Europe. These strong refining margins have allowed both refineries to generate positive cash flow even in adverse market conditions.

We Are the Largest Swedish Oil Company. We sell more petroleum products in Sweden than any other company and our refineries represent approximately 75% of Sweden's refining capacity. As Sweden's largest oil company, we participate in virtually every aspect of the petroleum refining and marketing industry, and we also own an extensive network of storage depots in Sweden. In Sweden, we had leading market shares in 2003 in terms of sales volume of approximately 30% in diesel, 41% in heating oil and 49% in fuel oil. We have been a leader in each of these markets for at least 10 years, based on sales volume data from the Swedish Petroleum Institute. We believe that our leadership position in these markets is sustainable and contributes to the stability of our cash flow.

2

We Are in a Strong Competitive Position as a Result of Our Focused Capital Investments. By making focused capital investments that have increased the sophistication of our refining operations, we have developed and profitably marketed premium refined products that meet and, in some cases, surpass the highest EU environmental specifications, which we believe contributes to our high refining margins relative to our competitors. As a result of these capital investments, we have a competitive advantage over other northern European refineries that do not have the ability to produce products that meet Swedish environmental specifications, which specifications are among the most stringent in Europe. This competitive advantage enables us to sell refined products both wholesale and retail to the Swedish market and wholesale to our target markets in northwestern Europe. Furthermore, we are already capable of producing gasoline and diesel that comply with the EU's specifications on the sulphur content for gasoline and diesel that will take effect in 2009. As a result, we do not have to incur the additional capital investments that some of our competitors may be required to incur to produce these EU-compliant products.

We Are Well Positioned Geographically to Access Our Target Markets. The geographical proximity of our refineries to our target markets in northwestern Europe allows us to maintain relatively low transportation costs. The lower transportation costs contribute to our refining margins and provide us with a competitive advantage relative to our competitors located outside of Sweden.

Our Non-Refining Businesses Help Insulate Us From Refining Margin Volatility. Through our marketing operations, we are insulated, to a degree, from refining margin volatility. In particular, our market-leading position in the diesel, heating oil and fuel oil markets provides us with a relatively stable source of earnings. In addition, our substantial storage capacity enables us to profit from occasional "contango" conditions (in which forward prices are greater than spot prices) in the crude oil and refined product markets without exposing us to market risk. We also use our storage capacity to earn rental income by selling storage certificates to other oil companies for their EU-imposed compulsory storage obligations. In addition, certain of our other income streams, such as the sale of surplus heat from our Preemraff refinery to the city of Gothenburg and to AB Volvo, our income from depot-throughput fees and harbor-usage fees and our sales of lubricants and other store merchandise, are also unaffected by movements in refining margins. Many of these revenue streams can be generated with relatively little additional operating cost and, thus, contribute directly to our net profit. In 2003, we generated revenues of SEK 268 million (€29 million) from these activities.

We Have an Experienced Management Team. Preem Petroleum's senior management team has significant experience in the oil refining and marketing industry. This senior management team includes industry veterans, such as Michael G:son Löw, who is President, Chief Executive Officer and a director of Preem Petroleum. Before joining Preem Petroleum in 2003, Mr. Löw spent 27 years with Du Pont Conoco. This depth of experience and technical knowledge enhance management's ability to improve operating and cost efficiencies and to manage our business successfully through changing market conditions.

Our Strategy

Our business strategy is to enhance our operating margins and strengthen our position as one of Europe's largest independent oil refining companies and the largest Swedish oil company. We intend to implement this strategy through the following measures:

Enhance Our Refineries' Margins. We believe that our margins are among the highest in the industry and we intend to continue to enhance our margin advantage and relative competitive position. Our objective is to maximize the operating margins generated by our refineries by increasing sales in Sweden, which minimizes transportation costs, and by exploiting the synergies between our two refineries. We will continue to focus on improving our refining margins and generating cost efficiencies, and we intend to make disciplined capital investments in the years ahead to accomplish these

3

objectives. In addition, we have commenced construction of an isocracker unit at Scanraff, which will enhance Scanraff's strong market position. The new isocracker unit is expected to enable Scanraff to increase its throughput by 10% and to produce more virtually sulphur free (10 parts per million) diesel, which is a higher-margin product and for which there has been increasing demand in Europe. In addition, Scanraff will be able to process a larger proportion of sour crude oil, which is typically lower in price compared to sweet crude oil. After the isocracker unit becomes operational, which, if construction proceeds as contemplated, is expected to occur in the first half of 2006, we intend to decrease our production of heating oil, a lower margin product, and use the capacity we gain to increase our production of diesel, a higher margin product, which we expect will improve our overall refining margins.

Streamline Our Refining Operations. Because both of our refineries are now wholly owned, we are able to operate them as a single unit, which we believe will create greater value and generate stronger financial returns than could be achieved if we operated the two refineries separately. By combining the operations of our two refineries, we plan to reduce our combined operating costs, consolidate our management and administrative infrastructure, and optimize investments in upgrading our refining capabilities.

Leverage Our Competitive Advantage. We intend to increase sales of, and develop new markets for, high-margin products, such as middle distillates, including high value-added products, such as virtually sulphur-free diesel. Due in part to long-term underinvestment in refining capacity by the refining industry, we believe that demand will continue to outpace supply for these high-margin products in the coming years. We believe this to be the case, particularly outside of Sweden, as a result of recent and potential regulatory changes, tax and other incentives to market and purchase these products, and increased environmental awareness.

Improve the Margins and Market Share of Our Marketing Operations. In the home-heating and business-to-business divisions of our marketing segment, our objective is to retain and enhance our strong market position by developing products and service packages to increase customer loyalty. In the station and consumer division of our marketing segment, we intend to strengthen our network of service stations by increasing the number of low-cost unmanned stations and developing full-service convenience stores at stations that have relatively high throughput. We also intend to transfer a substantial number of our company-owned stations to dealers to increase the proportion of franchised stations in our network. This transfer will enable us to streamline our marketing operations and reduce our administrative expenses. We also disposed of our Norwegian marketing operations in March 2004 and finalized the sale of our Polish marketing operations in January 2003, which follows our decision to focus our marketing activities on the Swedish market.

Recent Developments

Construction of an Isocracker Unit. In January 2004, we commenced construction of a new isocracker unit at Scanraff. We estimate that the aggregate cost of construction of the isocracker unit will be approximately SEK 3,500 million (€385 million). Of this amount, we have paid SEK 104 million (€11 million) as of March 31, 2004, and we have present contractual purchase commitments of approximately SEK 1,100 million (€121 million), of which approximately SEK 500 million (€55 million) will be paid by September 30, 2004. We expect that, if construction proceeds as contemplated, the new unit will become operational in the first half of 2006. Subject to completion and closing of our proposed new senior credit facilities, which we expect to be in an approximate amount of €300 million to €355 million, we intend to use the proceeds of this offering of Notes to finance a portion of the cost of the construction of the isocracker unit. See "Use of Proceeds."

4

Scanraff Purchase. In December 2003, we acquired 25% of the capital stock of Skandinaviska Raffinaderi AB Scanraff (the owner of the Scanraff refinery) from Hydro R&M Holding AB, an affiliate of Norsk Hydro ASA, which increased our ownership in Scanraff from 75% to 100%.

From April 2002 up to the time of our December 2003 acquisition of the 25% interest in Scanraff, we accounted for our ownership in Scanraff using the proportional method under Swedish GAAP, which resulted in the inclusion of only 75% of the revenues, expenses, assets and liabilities attributable to Scanraff. Since our December 2003 acquisition of the remaining 25% of Scanraff, our financial statements reflect our 100% ownership of Scanraff. Our share of the aggregate production of refined products at Scanraff was approximately 55.3 million barrels in 2003 out of a total of 73.7 million barrels. Our net cash refining margin at Scanraff was $2.71 per barrel in 2003, resulting in an aggregate net cash refining margin for our share of production at Scanraff of approximately $149.9 million. The share of the aggregate production at Scanraff attributable to Hydro R&M Holding's 25% ownership in Scanraff was 18.4 million barrels in 2003. Applying our 2003 net cash refining margin of $2.71 per barrel for Scanraff to the 2003 production of 18.4 million barrels attributable to the 25% of Scanraff owned by Hydro R&M Holding would result in an aggregate net cash refining margin of approximately $49.9 million with respect to the 25% of the refinery we recently purchased. The incremental aggregate net cash refining margin attributable to the 25% of the Scanraff refinery owned by Hydro R&M Holding is calculated by applying our net cash refining margin in 2003 at Scanraff of $2.71. However, this incremental amount is not necessarily indicative of the actual refining margins that we would have been able to achieve had we owned 100% of Scanraff for all of 2003 and had fully consolidated its results.

Proposed New Credit Facilities. On April 27, 2004, we signed an appointment letter with SEB Merchant Banking, Skandinaviska Enskilda Banken AB (publ) and Svenska Handelsbanken AB (publ), pursuant to which they are appointed to act, on a best efforts basis, as lead arrangers in connection with proposed new multi-currency revolving credit and term loan facilities for Preem Petroleum as described in a term sheet attached thereto for an approximate amount of €300 million to €355 million. We refer to the credit facilities contemplated by the appointment letter and attached term sheet in this offering memorandum as the "proposed new credit facilities." Preem Holdings will act as guarantor under the proposed new credit facilities. We have not yet entered into any definitive documents and the proposed lenders have conditioned their best efforts upon satisfactory completion of due diligence, execution of satisfactory documentation, and successful syndication, among others things. In addition, even if all of the foregoing are satisfied, draw downs will require investment of additional equity and satisfaction of certain other conditions. The proposed new credit facilities will consist of (i) a €170 million amortizing term loan facility, or Facility A; (ii) an amortizing multi-currency term loan facility of an amount from €100 million to €155 million, or Facility B; and (iii) a €30 million revolving credit facility, or Facility C.

We intend to use Facility A to repay the €170 million bridge loan, which we obtained to finance the December 2003 acquisition of the remaining 25% of the Scanraff refinery that we did not own. The bridge loan matures on June 11, 2004. We intend to use Facility B to finance a portion of the cost of the construction of the isocracker unit at the Scanraff refinery. Facility C is intended to be used for general corporate purposes. The proposed new credit facilities, if entered into on the terms currently contemplated, will require as a condition precedent to funding that Preem Holdings make certain required cash equity investments into Preem Petroleum. These equity investments are tied to drawings under the facilities and total up to €80 million. A cash equity investment of €25 million is a condition precedent to drawing down on Facility A. A second cash equity investment of €25 million is a condition precedent to drawing down on Facility B. In addition, in the event that we draw down an amount in excess of the difference between the total amount of funds made available under Facility B minus €30 million, Preem Holdings will be required to make a further cash equity investment, up to a maximum of €30 million, into Preem Petroleum in the same amount as the amount of Facility B that we draw

5

down in excess of such amount. We intend to use such equity investments as additional funding for the construction of the isocracker unit at the Scanraff refinery.

Merger of Subsidiaries. The management of Preem Petroleum intends, subject to approval by its board of directors and the completion of corporate due diligence, to merge certain of its wholly owned subsidiaries, including Skandinaviska Raffinaderi AB Scanraff and Preem Raffinaderi AB, which own the Scanraff and Preemraff refineries, respectively, into Preem Petroleum. The merger of these subsidiaries will enable us to streamline operations and reduce administrative costs.

Financial Information for the First Quarter of 2004. We are currently in the process of completing our consolidated results for the three months ended March 31, 2004. The financial information in the following two paragraphs is based on the preliminary unaudited information available to us on the date hereof and reflects the best estimates of our management. Our actual results may differ significantly from the amounts reflected below as a result of various factors. In addition, our results for an interim period are not necessarily indicative of what our results will be for the full year.

Based on our preliminary results for the three months ended March 31, 2004, we expect that sales revenues, gross profit and operating income for this period will be approximately SEK 8,461 million (€931 million), SEK 606 million (€67 million) and SEK 384 million (€42 million), respectively. These results represent decreases in sales revenues, gross profit and operating income of approximately 18%, 14% and 18%, respectively, compared to the same period in 2003. The decreases, as compared to the same period in 2003, are primarily attributable to exceptionally strong results in the first quarter of 2003, the weakening of the dollar against the krona and lower refining margins. The decreases were to a certain extent offset by higher sales volumes primarily attributable to the acquisition in December 2003 of the 25% of Scanraff that we did not own. We also expect that net profit for this period will be approximately SEK 96 million (€11 million), which represents a decrease of approximately 65% compared to the same period in 2003. The decrease was due primarily to the decrease in operating income and foreign exchange losses on our indebtedness, which, in turn resulted from an increase in the value of the dollar against the krona during the first quarter of 2004.

In addition, since December 31, 2003, we have sold some of our excess inventory and used the proceeds to reduce our indebtedness. As a result, based on our preliminary results for the three months ended March 31, 2004, we expect that our cash and cash equivalents will be SEK 1,110 million (€122 million), total consolidated indebtedness (excluding a shareholder loan from our parent company) will be SEK 6,901 million (€759 million) and approximately SEK 1,761 million (€194 million) will be available under our unutilized credit facilities.

Risk Factors

You should carefully consider the information under the caption "Risk Factors" and all other information in this offering memorandum before investing in the Notes.

6

Organizational Structure

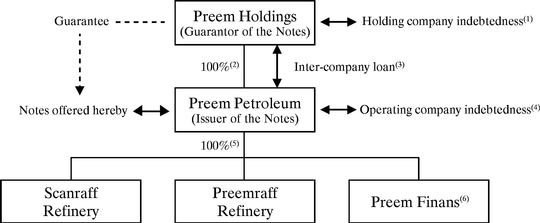

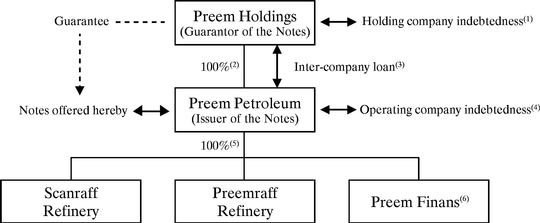

The issuer of the Notes is Preem Petroleum AB (publ), a Swedish company. As of the date of this offering memorandum, Preem Petroleum was wholly owned by Preem Holdings AB (publ), a Swedish company. Preem Holdings will guarantee the Notes. Preem Holdings is wholly owned by Corral Petroleum Holdings AB (publ), which is wholly owned by Moroncha Holdings Company Limited, which, in turn, is wholly owned by Mr. Mohammed Hussein Al-Amoudi. The following chart sets forth our summary organizational structure and our financing arrangements as of December 31, 2003. See "Description of Certain Indebtedness."

- (1)

- As of December 31, 2003, Preem Holdings had total consolidated debt (excluding a shareholder loan from Corral Petroleum Holdings) of SEK 7,797 million (€858 million) and total non-consolidated debt (excluding the shareholder loan) of SEK 2,774 million (€305 million), which represents the existing Preem Holdings notes. As of December 31, 2003, Preem Holdings owed SEK 242 million (€27 million) to Corral Petroleum Holdings in the form of an interest-free, subordinated shareholder loan, which has no maturity date and may not be repaid while the existing Preem Holdings notes and these Notes are outstanding. The shareholder loan is contractually subordinated to both the existing Preem Holdings notes and the Preem Holdings Guarantee of these Notes.

- (2)

- All outstanding shares of capital stock of Preem Petroleum were pledged in favor of the holders of the existing Preem Holdings notes.

- (3)

- As of December 31, 2003, Preem Petroleum owed SEK 2,277 million (€250 million) in the form of an interest-free, subordinated inter-company loan, which matures on March 31, 2011. This loan is contractually subordinated to the Notes and has been pledged in favor of the holders of the existing Preem Holdings notes.

- (4)

- As of December 31, 2003, Preem Petroleum had total consolidated debt (excluding the inter-company loan) of SEK 5,023 million (€553 million) and total non-consolidated debt (excluding the inter-company loan) of SEK 2,787 million (€307 million). Subsidiaries of Preem Petroleum had total debt of SEK 2,236 million (€246 million). On April 27, 2004, we signed an appointment letter with SEB Merchant Banking, Skandinaviska Enskilda Banken AB (publ) and Svenska Handelsbanken AB (publ), pursuant to which they are appointed to act, on a best efforts basis, as lead arrangers in connection with proposed new credit facilities for Preem Petroleum as described in a term sheet attached thereto for an approximate amount of €300 million to €355 million. Preem Holdings will act as guarantor under the facilities. The proposed new credit facilities, if entered into on the terms currently contemplated, will require as one of the conditions precedent to funding that Preem Holdings make certain required cash equity investments into Preem Petroleum of up to €80 million. For more information about the proposed new credit facilities, see "Operating and Financial Review and Prospects—Liquidity and Capital Resources—Future Capital Needs and Resources."

- (5)

- Preem Petroleum owns 100% of Skandinaviska Raffinaderi AB Scanraff and Preem Raffinaderi AB, which own the Scanraff and Preemraff refineries, respectively, and Preem Finans. The management of Preem Petroleum intends, subject to approval by its board of directors and the completion of corporate due diligence, to merge certain of its wholly owned subsidiaries, including Skandinaviska Raffinaderi AB Scanraff and Preem Raffinaderi AB, but not Preem Finans AB, into Preem Petroleum.

- (6)

- As of December 31, 2003, Preem Finans had total debt of SEK 1,735 million (€191 million).

7

The Offering

The following summary contains basic information about the Notes. It does not contain all the information that is important to you. For a more complete understanding of the Notes, please refer to the section of this offering memorandum entitled "Description of Notes," and particularly those sub-sections to which we refer you below.

| Issuer of the Notes | | Preem Petroleum AB (publ) |

Notes Offered |

|

€125,000,000 aggregate principal amount of % Senior Subordinated Notes due 2014. |

Maturity Date |

|

, 2014. |

Interest Payment Dates |

|

Semi-annually each and , commencing , 2004. Interest will accrue from the issue date of the Notes. |

Guarantee |

|

The Notes will be unconditionally guaranteed on a senior basis by Preem Holdings AB (publ). |

Ranking of the Notes and the Guarantee |

|

The Notes will be contractually subordinated in right of payment to all existing and future senior indebtedness of the Issuer, including indebtedness under the proposed new credit facilities and other designated senior indebtedness. Otherwise, the Notes will rank equally in right of payment with all other indebtedness of the Issuer and will rank senior in right of payment to all of the existing and future obligations of the Issuer that are expressly subordinated in right of payment to the Notes, including the inter-company loan from the Guarantor. The Notes will be effectively subordinated in right of payment to all existing and future secured debt of the Issuer. |

|

|

The Guarantee will be a general unsecured senior obligation of the Guarantor and will rank equally in right of payment with any existing and future unsecured senior indebtedness of the Guarantor, including any guarantee of indebtedness under the proposed new credit facilities. The Guarantee will rank senior in right of payment to all existing and future obligations of the Guarantor expressly subordinated to the Guarantee, including the shareholder loan from the Guarantor's parent company, Corral Petroleum Holdings AB (publ). The Guarantee will be effectively subordinated in right of payment to all existing and future secured debt of the Guarantor, including the existing Preem Holdings notes. |

|

|

The Notes and the Guarantee will be structurally subordinated in right of payment to all existing and future debt and other liabilities of each subsidiary of the Issuer, whether or not such debt is secured. |

|

|

As of December 31, 2003, on an as-adjusted basis to give effect to the offering of the Notes but not the repayment of any existing indebtedness (i) the Issuer would have had outstanding approximately €307 million of non-consolidated indebtedness that would have been senior in right of payment to the Notes, (ii) the Guarantor would have had outstanding €305 million of non-consolidated senior indebtedness, which represents the existing Preem Holdings notes and (iii) the Issuer's consolidated subsidiaries would have had outstanding approximately €246 million of indebtedness that would have been structurally senior in right of payment to the Notes and the Guarantee. In addition, the Guarantee would have been effectively subordinated to the existing Preem Holdings notes to the extent of the value of the security interests granted in favor of the holders of the existing Preem Holdings notes. |

| | | | | |

8

Optional Redemption |

|

The Issuer may redeem all or part of the Notes on or after , 2009, at the redemption prices listed in "Description of Notes—Optional Redemption." |

|

|

On or before , 2007, the Issuer may use the proceeds of specified equity offerings to redeem up to 35% of the original principal amount of the Notes at a redemption price equal to % of their principal amount, plus accrued and unpaid interest, if any, to the redemption date, provided that at least 65% of the aggregate principal amount of the Notes remains outstanding after the redemption. See "Description of Notes—Optional Redemption." |

|

|

The Issuer may also redeem the Notes in whole, but not in part, at any time, upon giving proper notice, if changes in tax laws impose certain withholding taxes on amounts payable on the Notes. If the Issuer decides to do this, it must pay you a price equal to the principal amount of the Notes plus interest and certain other amounts. See "Description of Notes—Redemption for Taxation Reasons." |

Change of Control |

|

If the Guarantor experiences a change of control, the Issuer will be required to offer to repurchase the Notes at 101% of their principal amount plus accrued and unpaid interest. See "Description of Notes—Change of Control." |

Covenants |

|

The Notes will be issued under an indenture (the "Indenture"), which will limit, among other things, our ability to: |

| | | • | | incur additional indebtedness; |

| | | • | | pay dividends or make other distributions; |

| | | • | | make certain other restricted payments and investments; |

| | | • | | create liens; |

| | | • | | enter into any agreement that would limit the ability of the Issuer's subsidiaries to pay dividends or make other payments to the Issuer; |

| | | • | | transfer or sell assets; |

| | | • | | enter into transactions with affiliates; |

| | | • | | create additional classes of senior subordinated indebtedness of the Issuer; |

| | | • | | enter into sale-leaseback transactions; and |

| | | • | | merge or consolidate with other entities. |

|

|

Each of the covenants is subject to a number of important exceptions and qualifications. See "Description of Notes—Certain Covenants." |

| | | | | |

9

Transfer Restrictions |

|

We have not registered the Notes or the Guarantee under the U.S. Securities Act. The Notes are subject to restrictions on transfer and may only be offered or sold in transactions that are exempt from or not subject to the registration requirements of the U.S. Securities Act. Furthermore, the Notes and the Guarantee have not been registered under any other country's securities laws. See "Notice to Investors." |

No Prior Market |

|

The Notes will be new securities for which there is currently no market. Although the Initial Purchaser has informed us that it intends to make a market for the Notes, it is not obligated to do so and it may discontinue market-making at any time without notice. Accordingly, a liquid market for the Notes may not be developed or maintained. |

Listing |

|

Application has been made to list the Notes on the Luxembourg Stock Exchange. |

Governing Law |

|

The laws of the state of New York. |

Use of Proceeds |

|

Subject to completion and closing of the proposed new credit facilities, the money raised from the offering will be used to finance a portion of the cost of the construction of an isocracker unit at Scanraff. If for any reason the proposed new credit facilities are not available, or are not available in an amount or within the time contemplated, then a portion of the proceeds of these Notes will be used, together with amounts available under our unutilized credit facilities and cash on hand, to repay the bridge loan, which may materially adversely affect our liquidity. Pending the final application of the net proceeds, we expect to hold a portion of the proceeds in the form of cash and cash equivalents and to use a portion of the proceeds to repay amounts outstanding under our short-term revolving credit facilities, which amounts we intend to draw down later as needed to finance construction of the isocracker unit. See "Use of Proceeds." |

10

RISK FACTORS

In addition to the other information contained in this offering memorandum, you should carefully consider the following risk factors before purchasing the Notes. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties of which we are not aware or that we currently believe are immaterial may also adversely affect our business, financial condition or results of operation. If any of the possible events described below occur, our business, financial condition or results of operation could be materially and adversely affected. If that happens, we may not be able to pay interest or principal on the Notes when due and you could lose all or part of your investment.

Risks related to our Business

Our substantial indebtedness could adversely affect our operations or financial results and prevent us from fulfilling our debt obligations.

As of December 31, 2003, we had total consolidated indebtedness (consisting of total long-term debt and total current debt, but excluding the shareholder loan) of SEK 7,797 million. We also had SEK 697 million available under our unutilized credit facilities. Our substantial indebtedness could adversely affect our operations or financial results and could have important consequences for you. For example, such indebtedness could, in and of itself and in light of the restrictive covenants included in the indentures related to the Notes and the existing Preem Holdings notes:

- •

- make it more difficult for us to fulfill our obligations under the Notes and the existing Preem Holdings notes;

- •

- restrict our ability to borrow money in the future for working capital, capital expenditures, acquisitions or other purposes;

- •

- expose us to the risk of increased interest rates with respect to the debt we carry at variable interest rates;

- •

- make us more vulnerable to economic downturns and adverse developments in our business;

- •

- reduce our flexibility in responding to changing business and economic conditions, including increased competition in the oil and gas industry; and

- •

- limit our ability to take advantage of significant business opportunities, to respond to competitive pressures and to implement our business strategies.

If the proposed new credit facilities are not available to us in the time contemplated, or at all, we would have to use a portion of the proceeds of the offering of the Notes to repay the bridge loan, which matures on June 11, 2004, we may have to postpone construction of the isocracker and our liquidity would be adversely affected.

The bridge loan that we obtained in order to finance our December 2003 acquisition of the 25% of the Scanraff refinery that we did not already own matures on June 11, 2004. We intend to repay amounts outstanding under the bridge loan by drawing down amounts under Facility A of the proposed new credit facilities. In addition, we intend to draw down amounts on Facility B to finance a portion of the cost of construction of the isocracker. However, we have not yet entered into any definitive documents concerning the proposed new credit facilities. Even assuming that due diligence is completed satisfactorily and that definitive documents are successfully negotiated, executed and delivered as contemplated prior to the June 11, 2004 maturity date of the bridge loan, funding under such facilities will be subject to a number of conditions, including successful syndication and the completion of further equity investments from Preem Holdings. For further information, see "Summary—Recent Developments—Proposed New Credit Facilities."

Although management believes that negotiations are progressing well, we can provide no assurance that the proposed lenders will satisfactorily complete their due diligence or that definitive documents for the proposed new credit facilities will be successfully negotiated, executed and delivered,

11

or if successfully negotiated, executed and delivered, that such new proposed credit facilities will be available in the amount or on the terms contemplated. In addition, Preem Holdings is dependent on its parent company, Corral Petroleum Holdings, to provide funds to make some or all of its required equity investments. If Corral Petroleum Holdings does not make sufficient funds available to Preem Holdings, or if Preem Holdings is otherwise unable to make the required equity investments, or if other conditions precedent are not satisfied, the proposed new credit facilities may not be made available to us. If the proposed new credit facilities are for any reason not available in an amount or within the time contemplated, or at all, then a portion of the proceeds of these Notes will be used, together with available cash reserves and amounts available under our unutilized credit facilities, to repay the bridge loan, which would mean we may have to postpone construction of the isocracker unit and that we may not have sufficient funds to finance our other capital requirements. Any of the foregoing developments could be expected to materially adversely affect our business, financial condition, results of operations and cash flows.

Prices for crude oil and refined products are subject to rapid and large fluctuations and our margins may be adversely affected by market conditions.

Our results of operations from refining are influenced by the relationship between market prices for crude oil and refined products. We will not generate operating profit or positive cash flow from our refining operations unless we are able to buy crude oil and sell refined products at margins sufficient to cover the fixed and variable costs of our refineries. In recent years, both crude oil and refined product prices have fluctuated substantially. Consequently, our inventory of crude oil and refined products is exposed to fluctuations in price. Prices of crude oil and refined products depend on numerous factors, including global and regional demand for, and supply of, crude oil and refined products, and regulatory, legislative and emergency actions of national, regional and local agencies and governments. Decreases in the supply of crude oil or the demand for refined product may adversely affect our liquidity and capital resources.

Supply and demand of crude oil and refined products depend on a variety of factors. These factors include:

- •

- changes in global economic conditions, including exchange rate fluctuations;

- •

- political stability in major oil-producing countries;

- •

- actions by OPEC and crude oil production levels;

- •

- the availability of crude oil and refined product imports;

- •

- worldwide inventory levels of crude oil and refined products;

- •

- the availability and suitability of competitive fuels;

- •

- the extent of government regulation, in particular, as it relates to environmental policy;

- •

- market imperfections caused by regional price differentials;

- •

- local market conditions and the level of operations of other refineries in Europe;

- •

- the ability of suppliers, transporters and purchasers to perform on a timely basis or at all under their agreements (including risks associated with physical delivery);

- •

- seasonal demand fluctuations;

- •

- expected and actual weather conditions; and

- •

- changes in technology.

These external factors and the volatile nature of the energy markets make oil-refining margins volatile. Generally, an increase or decrease in the price of crude oil results in a corresponding increase or decrease in the price of refined products, although the timing and magnitude of these increases and

12

decreases may not correspond. During periods of excess inventories of refined products, crude oil prices can increase significantly without corresponding increases in refined products prices and, in such a case, refining margins will be adversely affected. Differentials in the timing and magnitude of movements in crude oil and refined product prices could have a significant short-term impact on our refining margins and our business, financial condition and results of operations.

We may not always be able to obtain sufficient credit to finance our spot market crude oil purchases, which could severely limit our ability to obtain crude oil.

We purchase a significant portion of our crude oil on the spot market, primarily by means of internally generated cash flow and short-term working capital facilities. Because the price of crude oil on the spot market can be volatile, access to adequate short-term credit is crucial to our business. If our working capital facilities were cancelled or restricted or we could not renew or replace them, or if we had to use them for other purposes, our financial condition would be adversely impacted. Utilizing short-term credit to finance our spot market purchases also makes us vulnerable to interest rate volatility. Increases in short-term interest rates also may limit our ability to obtain crude oil supplies.

If we become involved in legal proceedings related to construction of the isocracker, or if we experience difficulty in obtaining the necessary operating permit for the isocracker, construction of the isocracker unit or the date on which it is taken into operation may be delayed, which may have a negative impact on our margins.

In October 2003, the Supreme Environmental Court in Sweden cancelled approval of the construction of the isocracker unit, which had previously been granted by the Environmental Court of Vänersborg in October 2002. The case was transferred back to the local Environmental Court to reconsider the approval in light of the Supreme Environmental Court's findings. In January 2004, the local Environmental Court again granted approval for the construction of the isocracker unit at Scanraff. If we become involved in additional legal proceedings related to the construction of the isocracker unit, we may have to postpone its construction. In addition, we have not yet obtained the permit required to operate the isocracker unit. We may be unable to obtain, or we may experience significant delays in obtaining, the required permit, which could lead to delays on the return on our investment, or even the loss of our investment. Even if we obtain the required permit, it may be subject to stringent conditions, including with respect to emissions and discharge amounts that may require further capital expenditures or increase our operating costs. If any of the foregoing risks materialize, our business, financial condition, results of operations and cash flows could be adversely affected.

Our business is very competitive and increased competition could adversely affect our financial condition and results of operations.

Increased competition in the oil refining industry could result in a decrease in our market share, which could adversely affect our financial condition and results of operations. Competition is based on the ability to obtain and process crude oil and other feedstocks at the lowest cost, refinery efficiency, refinery product mix and product distribution. Our supply and refining segment competes principally with AB Svenska Shell and Svenska Statoil AB as well as with Fortum Oy. Our marketing segment, which includes the station and consumer division through which we sell gasoline and other refined products to retail customers, competes primarily with Svenska Statoil AB, OK-Q8 AB, AB Svenska Shell, Norsk Hydro ASA and Conoco Jet Nordic AB. In 2003, our marketing segment's gasoline sales in Sweden ranked fourth in market share, based on data from the Swedish Petroleum Institute. Our small market presence in the retail gasoline business has had an adverse effect on the results and prospects of our marketing segment and there is a risk that we will not be able to increase our marketing segment's share of the Swedish gasoline market in the future.

13

We are faced with operational hazards and uninsured risks that could have a material adverse effect on our financial condition and results of operations.

Our operations are subject to all of the risks normally associated with oil refining, transportation and distribution that could result in damage to or loss of property, suspension of operations, or injury or death to personnel or third parties. These risks and hazards could result in damage or harm to, or destruction of, properties, production facilities or the environment. Any or all of these hazards could have a material adverse effect on our financial condition and results of operations. Our property, business interruption and public and product liability insurance may not fully cover the consequences of all property damage, business interruptions and other liabilities. In particular, our business interruption insurance may not cover blockades, interruption due to political circumstances in foreign countries, hostilities or labor strikes. Our property and liability insurance does not cover gradual environmental and other damage that was not the result of a sudden, unintended and unexpected insurable accident. Insurance coverage of our chartered vessels does not include coverage of liabilities, costs and expenses related to cargo carried on ship. The occurrence of an event that affects operations and that is not fully covered by insurance could have an adverse impact on our business, financial condition, results of operations and cash flows.

We are subject to governmental and environmental regulations, which could expose us to fines or penalties or force us to modify our operations.

We are subject to various supranational, national, regional and local environmental laws and regulations relating to emissions standards for, and the safe storage and transportation of, our products. We also are subject to EU and Swedish environmental regulations concerning refined products. Sweden has among the strictest environmental specifications in the European Union. The European Union has announced stricter environmental regulations, which will take effect in 2005, restricting the sulphur content of both gasoline and diesel and the aromatic content of gasoline and imposing a CO2 emissions trading program. In addition, the European Union has recently announced even stricter restrictions on the sulphur content of gasoline and diesel, which will take effect in 2009. We already produce diesel and gasoline in compliance with the EU's 2009 specifications. However, we may be required to incur additional capital expenditures if more stringent standards are implemented. Additionally, certain aspects of the CO2 emissions trading program have not yet been finalized and could, when implemented, result in substantial additional costs. We may not have sufficient funds to make the necessary capital expenditures. Failure to make these capital expenditures could negatively impact our business, financial condition and results of operations.

In addition, we are subject to laws and regulations relating to the production, discharge, storage, treatment, handling, disposal and remediation of crude oil and refined petroleum products and certain materials, substances and wastes used in our operations and other decontamination and remedial costs. Our failure to comply with these requirements, which in some cases would constitute a criminal offense, would subject us (including individual members of management) to fines and penalties or force us to modify our operations. In addition, we need a variety of permits to conduct our operations. From time to time, we must obtain, comply with, expand and renew permits to operate our facilities. Failure to do so could subject us to civil penalties, criminal sanctions and closure of our facilities. In particular, we are currently working with environmental authorities to determine final operating conditions, such as emissions and discharge amounts, for some of the permits that we have obtained to operate certain components of our Preemraff refinery and certain of our depots. The risk exists that we will be unable to obtain or renew material permits or that obtaining or renewing material permits will require adopting controls or conditions that would result in additional capital expenditures or increased operating costs.

14

Changes in legislation affecting our operations or changes to the way such legislation is interpreted or administered may result in additional expenses, changes in our operations or fines and penalties.

The oil refining industry and the transportation and distribution of our products is highly regulated and we are subject to environmental and other laws and regulations in each jurisdiction in which we operate, including the European Union. In particular, Sweden, where both of our refineries are located, has among the strictest environmental specifications in the European Union. Changes in legislation or regulations and actions by Swedish and other regulators, including changes in administration and enforcement policies, may from time to time require operational improvements or modifications at, or possibly the closure of, various locations or the payment of fines and penalties. Generally, environmental laws and regulations affect our operations and have become and are becoming increasingly stringent. We cannot predict the nature, scope or effect of legislation or regulatory requirements that could be adopted in the future or how existing or future laws or regulations will be administered or interpreted in the future. Consequently, we may need to make additional and potentially significant expenditures in the future to comply with new or amended environmental laws and regulations. See "—We are subject to governmental and environmental regulations, which could expose us to fines or penalties or force us to modify our operations" herein.

We are subject to occupational health and safety laws in Sweden and elsewhere, which could expose us to fines or penalties or force us to modify our operations.

Our oil refining transportation and distribution activities are also subject to a wide range of supranational, national, regional and local occupational health and safety laws and regulations in each jurisdiction in which we operate. These health and safety laws change frequently, as do the priorities of those who enforce them. Our failure to comply with these health and safety laws could lead to criminal violations, civil fines and changes in the way we operate our facilities, which could increase the costs of operating our business.

We may be liable for environmental damages, which could adversely affect our financial results and reduce our ability to pay interest and principal due on the Notes.

We believe that the risk of significant environmental liability is inherent in our business. We are subject to risks relating to crude oil or refined product spills, discharge of hazardous materials into the soil, air and water, and other environmental damage. In our industry, there is an ever-present risk of accidental discharges of hazardous materials and of the assertion of claims by third parties (including governmental authorities) against us for violation of applicable law and/or damages arising out of any past or future contamination. Environmental regulators are currently investigating soil and groundwater contamination at our Preemraff facility and at some of our depot sites, which, we believe, could lead to legal proceedings being initiated against us and/or third-party contractors.

We may have to pay substantial amounts in fees and penalties, for remediation, or as compensation to third parties, in each case in respect of past or future operations, acquisitions or disposals. Any amounts paid in fees and penalties, for remediation, or as compensation to third parties would reduce, and could eliminate, the funds available for paying interest or principal on the Notes and for financing our normal operations and planned development.

We may be liable for environmental damage caused by previous owners of operations or properties that we have acquired, use, or have used. We may be liable for decontamination and other remedial costs at, and in the vicinity of, most of the sites we operate or own and that we (and companies with which we have merged) have operated and owned, including following the closure or sale of, or expiration of leases for, such sites. We may be liable for decontamination and other remedial costs as a result of contamination caused in connection with the transportation and distribution of our products. In some instances, such as the closure of a number of our depots, we are currently unable to accurately estimate the costs of necessary remediation and may face significant unexpected costs, which could materially adversely affect our financial condition, results of operations and cash flows.

15

In connection with the sale of each of our Polish and Norwegian subsidiaries, we have undertaken to reimburse the purchaser for costs incurred as a result of any final remediation orders issued by relevant authorities up to a certain amount. This obligation extends only to contamination occurring prior to the sale and only to costs in excess of a certain amount. As of the date of this offering memorandum, no claims have been made for reimbursement of remediation costs in connection with the sale of our Norwegian subsidiary and we have received claims of an aggregate amount of approximately SEK 1.6 million (€0.2 million) in connection with the sale of our Polish subsidiary. In the event that remediation of these sites is required, our exposure could materially adversely affect our financial condition, results of operations and cash flows.

Our lease on the Finnberget storage depot expired in September 2001. Our lease agreement had a provision limiting our liability for any decontamination to a maximum of SEK 4 million. We are in a dispute, however, with the landlord over whether this limitation extends to third-party claims, including claims made by governmental authorities. If we are unsuccessful in our dispute, we may be liable for all or part of the decontamination of this site. The total estimated cost of decontamination ranges from approximately SEK 75 million to SEK 120 million, depending on the intended future use of the site. Our lease on the Loudden storage depot expired in December 2003. We have reached an oral agreement with the lessor to extend the lease until December 31, 2008. Since there are a number of other lessees at the Loudden site and given that the term of the lease has been extended, we do not have an estimate for the decontamination and other remedial costs for Loudden. Any requirement that we pay decontamination costs at either of these sites could materially adversely affect our financial condition, results of operations and cash flows.

Legal action by the Swedish Competition Authority, other European regulatory authorities or any related third-party claims may expose us to liability for fines and damages.

We are subject to strict Swedish and European anti-competition laws, which limit the types of supply, sales, marketing and cooperation arrangements we can enter into, and may subject us to fines and penalties. Anti-competition regulations are subject to interpretation by governmental authorities. Agreements that we enter into in the ordinary course of our business, or other aspects of our business practices, may be subject to challenge as restrictive of competition or abusive of a dominant market position. Some of our long-standing commercial arrangements may not be fully in compliance with recent interpretations of, or changes in, anti-competition laws, or may no longer qualify for exemptions. Any of these risks could lead to material fines and penalties, restrictions on our business practices, and/or nullification of our existing agreements with third parties. Given our leading position in the Swedish market, and the nature of the European oil refining and marketing industry, we may be more closely watched by regulators and/or subject to restrictions not applicable to other competitors.

On June 29, 2000, the Swedish Competition Authority filed a summons application to the City Court of Stockholm against Preem Petroleum and four other oil companies operating in Sweden, demanding that the City Court impose fines on all five oil companies for alleged participation in a gasoline cartel. The Competition Authority demanded that fines of SEK 81 million be imposed on Preem Petroleum. Court proceedings took place during the third quarter of 2002 and on April 29, 2003, the District Court of Stockholm announced its judgment, finding that the five companies had violated the Competition Act. The court assessed Preem Petroleum with a fine of SEK 6 million. The court also ordered the Competition Authority to pay up to SEK 2.3 million of Preem Petroleum's legal fees. Both the Competition Authority and we have appealed the court's judgment.

The Swedish Competition Act also provides the possibility for companies and private parties to recover damages attributable to infringements of the Competition Act, in which case the total amount of our liability would be uncertain. If there are court rulings against us based on either existing or future claims, the fines imposed or damages awarded could be material, in which case our financial condition and results of operation would be adversely affected. Given our leading position in the

16