QuickLinks -- Click here to rapidly navigate through this documentExhibit 1

| From |

| 2003 to 2004, |

Geac's net earnings increased 79.4%.

New license revenue increased 32.0%.

Revenue increased 9.0%. |

Geac. Delivering results through change. |

2004 Annual Report |

"Action [is] the great business of mankind."—John Locke

Successful companies, like successful

people, are defined by their actions.

At Geac, fiscal 2004 was a year of action

and change. Having formulated a master

plan to revitalize and reinvent the

company based on several key strategies—

"Build, Buy and Partner," Business

Performance Management, organic growth

and rigorous cost control—Geac took

many actions this year to execute its goals.

While its reinvention is still a work in

progress, Geac's FY2004 financial results

began to demonstrate the soundness of its

strategies, and the efficacy of its actions.

Change comes in bursts, so financial

results will follow unevenly.

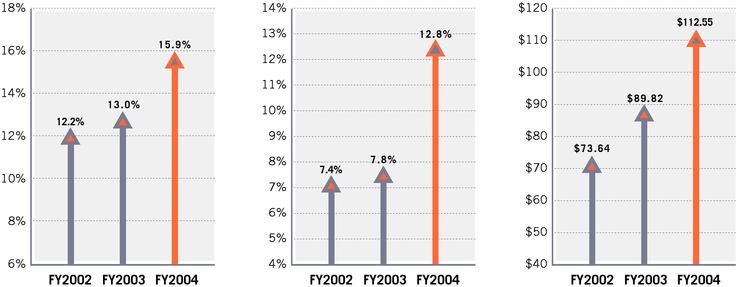

Geac 2004 Financial Highlights (U.S. Dollars)

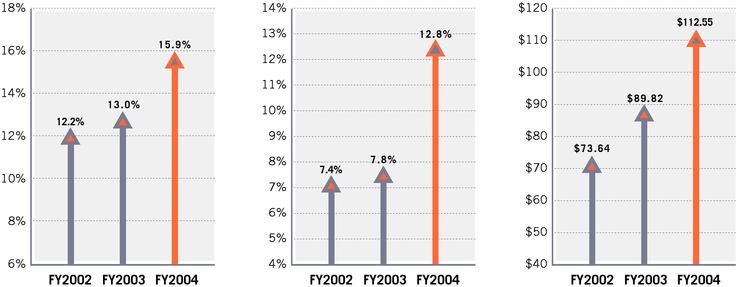

Earnings Before Income Taxes

as a Percent of Total Revenue | | Net Earnings as a Percent

of Total Revenue | | Cash and Cash Equivalents

in Millions |

|

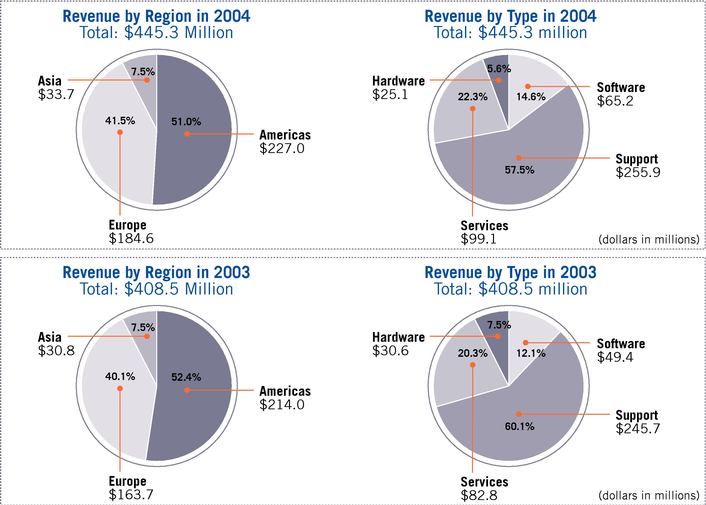

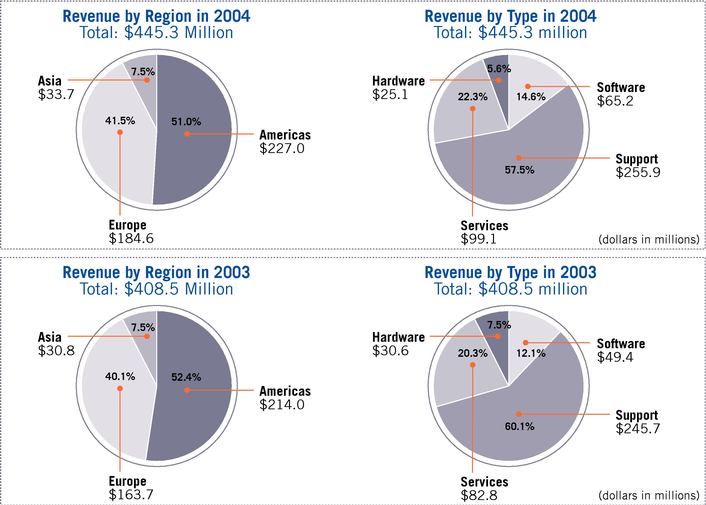

Revenue Segmentation

1

| |

Geac: Change for Profitability | | |

Charles S. Jones, President & Chief Executive Officer

|

To Our Shareholders:

Last year, Geac promised change—change for the profitability of our shareholders, change for the benefit of our customers, and change for the long-term opportunity of our employees. In fiscal year 2004, we delivered upon our promise.

In my letter to you a year ago, we committed to growing our revenue. We strove to make our acquisitions successful. And, importantly, we asserted that we would improve our earnings. Collectively, we have accomplished these tasks.

REVENUE GROWTH

In fiscal year 2004, Geac's revenue reached US $445.3 million, compared to US $408.5 million last year. Your management team has diligently focused on increasing license sales across product lines in the many regions in which we operate. This effort permeated every corporate action taken, but was driven by three major initiatives. First, we closely examined key product lines in place—product lines that could capitalize on emerging market opportunity—and we invested in strategic development initiatives within those lines to expand product functionality and market presence. The result was the significant organic growth of three traditional applications within the existing product suite. Second, we built advanced connectivity and utility applications to link our traditional back office solutions with new flexible front end applications in Geac's expanded Performance Management suite of products. This development effort enabled existing customers to extend the lives and functionality of their current Geac systems and generated additional license and service sales from our customer base. Third, and most important, through acquisition and partnership, we increased our activity within the Performance Management product family and benefited from marketing, sales and distributor alliances as we worked to expand the reach of this newest product line across our existing customer base and with new prospects. By expanding both our product footprint and our customer base, we accelerated sales opportunities across many of Geac's product lines.

With a commitment in these areas, Geac delivered strong results year over year with license revenue growth of 32%. The Company will continue to pursue initiatives with organic product growth, with internal development and with strategic acquisitions and partnerships.

ACQUISITION INTEGRATION

Throughout fiscal year 2004, we continued to deliver against our Business Performance Management strategy. This year, we integrated the Extensity expense and resource management applications into Comshare's offerings to broaden the capability of Geac's financial planning and budgeting applications. Comshare's expanded Performance Management suite of budgeting, planning, forecasting and consolidation was enhanced with additional internal development, which enabled easier integration with existing Geac customer installations and which offered expanded capability. Not only was the newly acquired product suite valuable to our existing customer base, but Comshare's and Extensity's products also assisted our own management in implementing budgeting policies. Additional integration into Geac's enterprise applications is ongoing as we expand this essential front office technology to an increasing number of Geac product lines in both our Enterprise Applications Systems and our Industry Specific Applications divisions. With the successful melding and evolution of these highly regarded software suites into Geac, the Company has launched its Geac Performance Management family of products.

2

| | Donna de Winter

Senior Vice President and Chief Financial Officer | |  | | Timothy J. Wright

Chief Executive, EMEA and Asia Pacific and Chief Technology Officer | |  | | James M. Travers

Senior Vice President and President, Geac Americas |

"The Company's 79.4% increase in net earnings year over year is testament to the fiscally responsible manner in which Geac management has integrated new businesses, invested in key products and managed all Company resources."

The success of Geac Performance Management in fiscal year 2004 underscores a cornerstone of the Company's acquisition strategy—increasing sales by providing incremental functionality to our extensive existing customer base with new product offerings that create value. Importantly, the existing pipeline for Geac Performance Management continues to include existing Geac customers. Partnerships with companies such as Microsoft and American Express have provided additional momentum, as a significant number of license deals closed in this past year were through distributors or through joint selling initiatives.

EARNINGS IMPROVEMENT

The Company's 79.4% increase in net earnings year over year is testament to the fiscally responsible manner in which Geac management has integrated new businesses, invested in key products and managed all Company resources. The results throughout the year provided a sequential increase for our shareholders in earnings per share in each quarter with a year over year increase in basic earnings per share of $0.28. We executed in a deliberate and focused manner against key business priorities. Geac managed its costs in anticipation of changes in revenue in various parts of its business. Our success in building net earnings was achieved not only with an increase in revenue, but also with a decrease in general and administrative costs over the year. In addition, the Company was able to increase its gross margin from 58.6% to 60.7%. Management remained diligently focused on cost control throughout the year and worked aggressively to reduce redundancies and to create efficiencies around the new acquisitions. Our employee headcount before the Comshare acquisition was approximately 2,500. We added 333 employees with the Comshare acquisition and finished the year with approximately 2,300 employees worldwide, representing a reduction of about 530 redundant positions, or more than 21%, while increasing sales by 9%. The Company ended fiscal year 2004 with a cash position of $112.6 million, generating net cash from operations of $66.6 million.

Fiscal Year 2004 Diluted Net Earnings Per Share

3

| |

Letter to Shareholders (continued) |

"Whether our customers have a need to do more with less as a result of an increasingly competitive environment or as a result of regulatory pressure, Geac delivers best-in-class technology solutions for the issues confronting the CFO."

With the achievement of key change initiatives focused on revenue growth, acquisition integration and earnings improvement in fiscal year 2004, Geac is well positioned to seize new opportunities for growth and product expansion over the longer term in support of new customers and its existing 18,000 customers worldwide.

CHANGE FOR THE BENEFIT OF OUR CUSTOMERS

Not only did Geac achieve its operational execution goals, but Geac also developed more client solution specificity and capability with System21 Aurora, Libraries, Local Government, and Performance Management. Geac is the software solution for the Chief Financial Officer. Whether our customers have a need to do more with less as a result of an increasingly competitive environment or as a result of regulatory pressure, Geac delivers best-in-class technology solutions for the issues confronting the CFO.

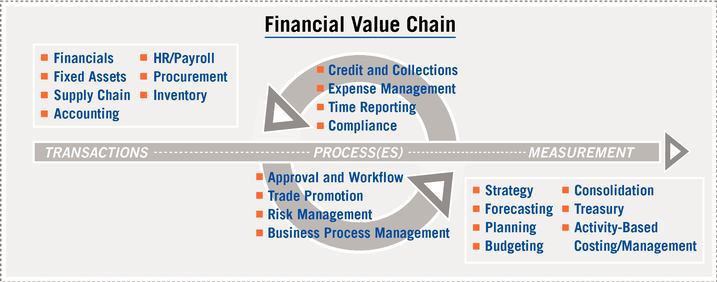

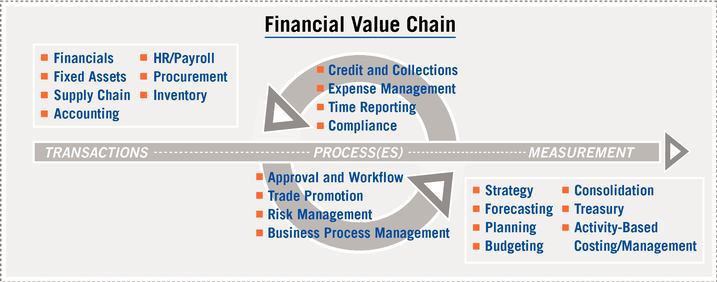

CFOs are focused on the financial value chain, which enables financial management over end-to-end business processes. Geac offers solutions that enable a range of business transactions and processes, as well as the precise measurement and insightful analysis crucial to successfully managing any business.

Through internal development, strategic partnerships and target acquisitions, Geac was able to extend value to our current customer base with expanded front-end technology solutions and with critical new business performance management functionality. Beyond mere functionality, we enabled the leadership of our customers' financial teams by facilitating visibility and control over all financial information. This is not simply the provision of accurate and timely financial information, it is also access to superior, sophisticated analytical results.

Geac's product strategy and the new Geac Performance Management family of products benefited from certain market conditions in fiscal year 2004. In this changing environment, our customers began to address increasing regulatory requirements, they attempted to rationalize their own organizations in the wake of rapid consolidation, and they worked to address the limitations of current technology models and platforms in the face of an increasingly mobile and Web-based workforce. Through our "Build, Buy and Partner" strategy, we focused on the market challenges our customers faced and delivered the technology solutions they needed.

CHANGE FOR THE BENEFIT OF OUR EMPLOYEES

Ourchange philosophy has permeated every effort throughout the Company this year. The impact of our change actions on our financial results and customer offerings has been dramatic. In turn, we have built better relationships, confidence in our future success and an improving environment for all of our employees. Quite simply, Geac is a better place to work at today than it was a year ago, and it will become even better. We have increased the opportunity for professional and career development across the employee base and witnessed the benefits through enriched customer relationships and a unified focus on long-term shared success.

4

| | Jack Dolmat-Connell

Senior Vice President, Human Resources | |  | | Alys Scott

Vice President, Global Communications | |  | | Jeff Snider

Senior Vice President and General Counsel |

"Geac focuses on its financial performance with a rigid commitment to the way in which we account for and communicate our performance."

We were delighted to see a strong participation rate of nearly 25% of all North American employees in the Company's new Employee Stock Purchase Plan offering, which exhibited a 43% increase in value over the six-month offering period. With this effort, Geac is aligning the interests of its employees with those of its shareholders. We anticipate even greater participation in this program as we introduce it worldwide in fiscal year 2005.

GOING FORWARD

Geac embraced change in fiscal year 2004. The impact of this change created opportunity for our shareholders, for our customers and for our employees.

We take measured pride in the consistency of the Company's performance throughout fiscal year 2004 and with our ability so far to deliver to our shareholders continually improving results, quarter over quarter and year over year. Geac focuses on its financial performance with a rigid commitment to the way in which we account for and communicate our performance. In fiscal year 2004, approximately 1% of total annual revenue was allocated to corporate governance costs assuring proper adherence to Regulatory, Exchange and Board Policy. Our corporate governance commitment is more formally outlined by our Chairman of Corporate Governance preceding the financial section of this annual report.

We have solidified a business path and a technology direction through our expanded Geac Performance Management suite. Importantly, this direction not only preserves the integrity of our important enterprise applications, but it also delivers additional value through our improved front end applications. In so doing, we believe we are serving our customers well. While we understand that market conditions and the complexity of our business will continue to be intensely challenging for Geac, our performance demonstrates the ability of this management team to achieve success in a fiscally responsible manner and, importantly, to steer a steady course in a complex and variable global business environment. These attributes become increasingly important as we examine our strategic alternatives for revenue growth and product expansion in the coming year. We recognize the short-term necessity to grow the business by acquisition. Improving our business will be an uneven activity, but we are committed to the long-term success of our customer and employee relationships, which, in turn, will benefit our shareholders.

We ask you to join us in thanking our 2,300 loyal employees in 53 offices in 22 countries for their continued dedication and hard work. We are grateful for the ongoing commitment of our customers to invest in Geac's growing product lines. And we thank you, our shareholders, for your continuing support as we strive to transform Geac into a leading Performance Management software company serving markets throughout the world.

On behalf of our entire team,

Respectfully submitted, | | |

Charles S. Jones |

|

|

President and Chief Executive Officer

July 21, 2004 | | |

5

| |

Geac: The Software Company for the CFO |

Geac is the software solution for the Chief Financial Officer. Whether our customers have a need to do more with less as a result of an increasingly competitive environment, or as a result of regulatory pressure, Geac delivers best-in-class technology solutions for the issues confronting the Chief Financial Officer.

6

Geac Lines of Business: A Profile

Geac is engaged in a process of strategic change as it creates a software company uniquely geared to optimizing an organization's financial value chain. In so doing, Geac is bringing Performance Management to its customer base, and to the industry at large.

The CFO is responsible for thefinancial value chain of an organization in its entirety, but virtually every employee of an organization touches at least one link in that chain. That means the information systems designed to optimize an organization's financial value chain must, by definition, be pervasive. And so it is with Geac systems: They are used continuously and widely throughout the organizations in which they are deployed—approximately 18,000 worldwide, including about half of the Fortune 100.

The financial value chain enables financial management over end-to-end business processes. So, Geac offers software and services that address fundamental transactional activities, such as accounting, procurement and inventory. Geac also offers solutions that optimize processes embedded within the financial value chain, such as expense management and compliance. And Geac offers solutions that enable the precise measurement and insightful analysis so crucial to successfully managing any business—including strategic planning, budgeting, forecasting, and more.

Organizationally, Geac segments its business intoEnterprise Applications Systems (EAS), which represent about 80 percent of Geac's global revenue, andIndustry Specific Applications (ISA). Geac's EAS offerings include various ERP systems and the Geac Performance Management product family, the newest line of Geac solutions and a growth engine for Geac's software license revenue. Geac's ISA business units develop and sell specialized software and systems for libraries, local government administration, public safety agencies and the real estate, restaurant, property management and construction marketplaces.

7

| |

Geac: Extending the Value of Customers' Technology Investments |

Strategy: Build, Buy & Partner

Deploy Geac's technical and financial resources creatively and efficiently to develop internally, acquire, or forge alliances to strengthen Geac's product and service portfolio for optimizing the financial value chain.

THE ACTIONS

In 2004, Geac executed a strategy for company growth and a more competitive leadership position in Business Performance Management through "Build, Buy and Partner" initiatives. With internal product development, acquisition, and strategic partnering, Geac continued to expand its range of products and solutions, enabling CFOs to address more effectively business challenges such as remaining competitive and compliant, managing change and measuring results, growing their businesses and containing costs, and maximizing the return of their existing investments. Additionally, Geac's "Build, Buy, and Partner" initiatives created opportunities to grow Geac's top line revenue across the business with increased license sales.

THE RESULTS

› BUILD

Extending the value of existing Geac applications and customer solutions, Geac developed new E and M Series integration applications linking new Performance Management functionality with existing product lines. Building on acquired products, Geac developed Strategy Management to help companies measure the effectiveness of business strategies; introduced a new version of MPC (Management Planning & Control) to offer greater financial consolidation and reporting capabilities; and created a browser-enabled version of Geac Expense Management. Recently Geac announced more new home-grown products, including Geac Compliance Management, SmartStream 7.0 and System21 Performance Analyzer.

› BUY

Geac's acquisition strategy has focused on buying technologies at a discount and revitalizing and integrating them with existing applications. Geac's acquisition of Comshare, Inc. and its MPC suite provided Geac with the centerpiece of the Geac Performance Management product line, creating incremental revenue opportunities with new and established customers.

› PARTNER

Geac's partnership with Lombardi Software introduced business process management to Geac's product suite, which provides the foundation for a range of offerings including the new Geac Compliance Management product. Through a partnership with IBI, Geac delivered advanced Web extensions with its newest Enterprise Intelligence product. Geac also expanded its global strategic alliance with Microsoft, which has contributed to new license sales, and entered into a partnership with American Express Tax and Business Services to extend the North American sales channel for Geac Performance Management.

"We are partnering with Geac to utilize their market leading performance management solutions in an effort to further bolster companies' operational effectiveness."

American Express Tax and Business Services

8

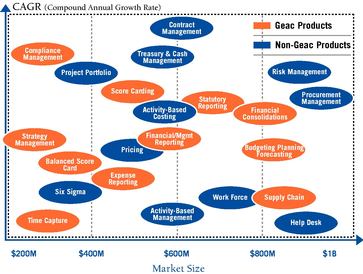

Focus: Business Performance Management

Offer an expanding set of solutions for CFOs that builds on their existing systems, that provides new capabilities for strategic planning and management, and that enables CFOs to run more efficient and effective finance operations.

THE ACTIONS

Geac fortified its position as a Business Performance Management leader with its acquisition of Comshare, Inc. Geac successfully integrated Comshare's worldwide operations and began to sell the MPC software suite into Geac's customer base. MPC, already highly respected in the marketplace, became even more attractive to prospective customers because of Geac's strong global support and financial resources. MPC joined Expense Management in a portfolio of solutions now known as Geac Performance Management.

THE RESULTS

Upon the Comshare acquisition, Geac's priority becameproduct integration: A focused effort to sell Geac Performance Management to existing Geac customers, to infuse new capabilities into key Geac product lines and to extend the performance of customers' financial value chains. With new rapid integration tools, Geac EnterpriseServer customers were the first to benefit. By fiscal year-end, Geac had incorporated budgeting and reporting capabilities into System21 Aurora, Geac's flagship mid-market ERP offering; AMSI property management software; and commenced developing integration products for SmartStream and other ISA solutions.

Geac also executed on its Business Performance Management focus by creating a hosted offering and pure Web-based version of Geac Expense Management, now available worldwide. These developments provided customers more ways to buy, deploy and use automated expense reporting capabilities.

"With Geac Performance Management, we'll be able to analyze data faster because the system is so efficient and the information is easy to access. We'll be more efficient at budgeting and better able to understand our financials."

Commerce Bancshares, Inc.

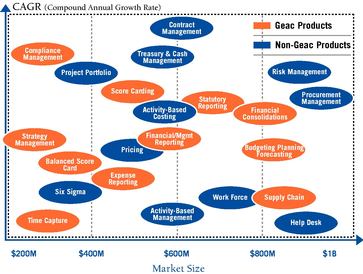

PERFORMANCE MANAGEMENT SOLUTIONS MAP

Geac helps companies track operations against strategy; forecast, manage, and measure business processes; control costs; and ensure compliance. Geac will continue to "Build, Buy and Partner" to expand the Geac Performance Management product line, carefully considering our customers' needs and the market opportunity for specific new solutions.

9

| |

Geac: Reliable, Secure and Flexible Solutions to Address and Manage Change |

Priority: Organic Growth

Drive increased software license sales from established Geac product lines by identifying new customers and markets, and by adding new value to those products for existing customers.

THE ACTIONS

Assessing the stabilization of the ERP market, Geac's traditional and majority line of business, Geac determined that the acquisition of Business Performance Management solutions alone would not be enough to generate new license sales and reduce customer base attrition. It was imperative that Geac create cross-sell and up-sell opportunities within established Geac lines of business, opening doors for future license sales with existing and new customers.

Geac's reinvention efforts made an impact on three of its business units in particular, with new license revenue generated by product investments: System21, Library Solutions and Local Government.

THE RESULTS

Geac System21 Aurora exemplifies the benefits of Geac's investment of financial and technical resources to reinvigorate a product line. Deployed in 2004, System21 Aurora is a state-of-the-art, mid-market ERP offering that offers expanded functionality and the ability to integrate with the customer's enterprise network. Aurora is re-energizing the System21 customer base and winning new business—as evidenced by year-over-year revenue growth for the System21 business in the fourth quarter of 29%.

Geac Library Solutions' Vubis Smart Web-based library automation system surpassed 100 customer installations this year—even prior to its launch in North America, which is currently in process. Success with existing customers—including some of the most prestigious universities in Europe—and expansion into new organizations, such as Belgium's Library for the Blind, has accounted for this business unit's growth. License revenue in Library Solutions grew nearly 45% in fiscal fourth quarter from the previous quarter.

Geac Local Government continued to grow its business with municipal councils in Australia and New Zealand. Recently the City of Auburn, home to the majority of the Sydney Olympics sporting venues and a population of more than 50,000, purchased Geac's land information system, Pathway PPR, and the City of Melbourne signed a six-figure contract to install additional Pathway PPR to expedite the processing of approximately 450,000 parking tickets a year. License revenue in Geac Local Government grew 41% in the fiscal fourth quarter compared to the previous quarter.

"Geac's Vubis Smart is the most innovative and flexible system for managing data in a variety of formats. We are confident that Vubis Smart will enable us to provide excellent access and service to our customers."

Kingston Frontenac Public Library

10

Imperative: Rigorous Cost Control

Maximize profit and shareholders' equity by rigorously controlling costs and instilling a philosophy of creatively doing more with less throughout the organization.

THE ACTIONS

Similar to the needs of customers that use Geac's Performance Management solutions to help them contain costs and make the most of their resources, Geac has also undertaken measures to examine its operating and development expenses to improve its bottom line.

Geac is using its own performance management technologies to integrate back office business processes to share resources better across the organization. Implementing Geac budgeting, planning and expense management solutions, Geac is creating more efficiency and eliminating operational redundancies throughout the organization. Geac continues to assess real estate, legal and other administrative costs and is increasing its use, reporting and tracking of key financial and operational benchmarking metrics. These improvements will be required to absorb the increased regulatory costs of corporate governance.

THE RESULTS

Two numbers tell the story: This year Geac grew its top line by 9.0%, and its bottom line by 79.4%. The improved outcome was in large part due to effective cost control.

For example, Geac continues to reassess its real estate holdings and, as appropriate, to consolidate facilities and renegotiate leases in order to drive cost out of operations.

Geac was able to reduce total headcount again during a year of revenue growth, product innovation, and strategic acquisitions. Starting fiscal year 2004 at approximately 2,500 employees and acquiring Comshare with nearly 333 employees, Geac ended its fiscal year with approximately 2,300 employees, effectively reducing the global workforce by 8% from the start of the year, even after the integration of Comshare.

During the year, the Company increased license sales by 32%, improved its gross profit margin and reduced its General and Administrative expenses as a percentage of sales. In total, Geac was successful in decreasing continuing development costs 6.3% in the fourth quarter from the third quarter run rate.

"Using System21, we were able save millions of dollars by giving our manufacturing personnel visibility and control of the systems they needed to adjust inventories quickly and efficiently."

Smith & Wesson

11

| |

Geac: Good Governance Builds Great Reputation

| | |

Corporate Governance at Geac

The increased focus on corporate governance by shareholders and regulatory authorities has resulted in new legislative requirements and policy guidelines. Geac has followed these developments carefully and implemented a number of measures to meet existing and pending legislative and stock exchange requirements. These measures involve an additional commitment of management resources and related expenses for all public companies, including Geac.

Board Structure

Your Board is composed of unrelated directors, with the sole exception of the President and Chief Executive Officer (and former Chairman of the Board). This allows for maximum breadth of participation on committees by outside directors, since there is no shortage of unrelated directors. The Board committees include Audit, Human Resources and Governance.

At Geac, the roles of Chairman and Chief Executive Officer are separated. This separation was, in fact, encouraged by the former Chairman (now President and Chief Executive Officer) in the belief that it is an appropriate separation of roles to allow for a healthy degree of enquiry on behalf of the Board into executive activity and strategic planning.

Risk Management

Risk Management, together with succession planning and strategic planning, are the three principal activities of a Board. With respect to risk management, governance at Geac includes the creation of an internal audit function whose mandate is to assist senior management and the Board in the effective discharge of their responsibilities by furnishing them with analyses, recommendations, counsel and information concerning the activities reviewed, and new or revised systems recommended or decreed by the Board or senior management. The company has appointed a Director of Internal Audit, Wendy Conrod, and has retained the services of Ernst & Young to assist the Director in carrying out a comprehensive annual program of internal audit review. The internal audit function reports to the Chair of the Audit Committee.

A further risk factor facing public companies in the post-Enron era is the risk of reputational damage flowing from inadequate or untimely disclosure. Geac has responded to regulatory suggestions through the creation of a senior management disclosure committee.

Board Functioning

Apart from regularly scheduled quarterly Board meetings, Geac's Board devotes two exclusive days a year to strategic planning. Additionally, a budget review and approval meeting is conducted once a year, or more often if necessary. At all regularly scheduled Board meetings, as a matter of course the independent directors meet among themselves in camera, in the absence of management.

Board Evaluation

Geac has a program of director self-evaluation, conducted by the Chairman of the Board, in association with the Chairman of the Corporate Governance Committee, so as to maximize the benefit which the Board draws from each member's potential contribution.

12

Ethical Conduct

Finally a matter which perhaps should better be placed first in this discussion: Ethical conduct in the course of the conduct of Geac's business. Geac has a Code of Business Conduct and Ethics, which can be found on its web site. This code has been circulated to all employees.

IN SUMMARY: Governance is a matter which we take seriously. We believe that we have responded positively to the requirements of regulators and investors in our stock.

Respectfully submitted,

Thomas Allen | | |

PROFESSIONAL INVOLVEMENT

- •

- Mr. Allen is a Senior Partner of Ogilvy Renault in Toronto.

- •

- Mr. Allen is also Chairman of the Accounting Standards Oversight Council of Canada and a member of the Advisory Board of the Office of the Superintendent of Financial Institutions of Canada.

- •

- Mr. Allen is past Chairman of the Corporate Finance Committee of the Investment Dealers Association of Canada (IDA), a former public director of the IDA, and a former member of the IDA's Executive Committee.

- •

- Mr. Allen is a Fellow of the Chartered Institute of Arbitrators (London, England).

- •

- Mr. Allen was a member of a committee commissioned last year by the Ministry of Finance in Canada to review the structure of securities regulation in Canada.

- •

- Mr. Allen has been a frequent speaker at conferences held by many organizations on topics relevant to the investment industry.

13

| Board of Directors |

|

|

|

|

|

|

|

C. Kent Jespersen

Chairman of the Board,

Geac Computer

Corporation Limited |

|

Thomas I. A. Allen, Q. C.

Senior Partner,

Ogilvy Renault |

|

David Friend

General Partner,

Orchid Partners |

|

Pierre MacDonald

Chairman and Chief

Executive Officer,

MacD Consult Inc. |

|

|

|

|

|

|

|

Michael D. Marvin

Founder and Chairman

Emeritus, MapInfo

Corporation |

|

William G. Nelson

Private Investor |

|

Robert L. Sillcox

Chairman,

Quant Investment

Strategies, Inc. |

|

Charles S. Jones

President and Chief

Executive Officer,

Geac Computer

Corporation Limited |

Management Team |

|

|

|

|

|

|

|

Charles S. Jones

President and

Chief Executive Officer |

|

Hema Anganu

Treasurer |

|

Donna de Winter

Senior Vice President and

Chief Financial Officer |

|

Jack Dolmat-Connell

Senior Vice President,

Human Resources |

|

|

|

|

|

|

|

Larry Kaplan

Senior Vice President |

|

Alys Scott

Vice President,

Global Communications

and Investor Relations |

|

Jeffrey Snider

Senior Vice President

and General Counsel |

|

Craig C. Thorburn

Senior Vice President,

Mergers & Acquisitions and

Corporate Secretary |

|

|

|

|

|

|

|

James M. Travers

Senior Vice President

and President,

Geac Americas |

|

|

|

Timothy J. Wright

Chief Executive, EMEA

and Asia Pacific and

Chief Technology Officer |

|

|

14

Table of Contents

| Management Discussion and Analysis | | 16 |

Auditors' Report |

|

45 |

Consolidated Financial Statements |

|

46 |

Notes to the Consolidated Financial Statements |

|

50 |

Management Discussion and Analysis

The following management discussion and analysis of results of operations and financial position should be read in conjunction with the consolidated financial statements and notes for the fiscal years (FY) ended April 30, 2004 and April 30, 2003. This following discussion and analysis contains forward-looking statements that relate to future events or our future financial performance or results. In addition, these forward-looking statements include, but are not limited to, statements regarding our plans, objectives, expectations and intentions. These forward-looking statements are neither promises nor guarantees but rather are subject to a number of risks and uncertainties which could cause actual results to differ materially from those described in the forward-looking statements, including the risks and uncertainties set forth in the section entitled "Risks and Uncertainties." You should not place undue reliance on any such forward-looking statements, which are current only as of the date when made. You should not expect that these forward-looking statements will be updated or supplemented as a result of changing circumstances or otherwise, and we disavow and disclaim any obligation to do so.

Our financial statements are prepared and filed in accordance with accounting principles generally accepted in Canada ("Canadian GAAP"). Note 23 to our consolidated financial statements sets out the differences between accounting principles generally accepted in the United States ("U.S. GAAP") and Canadian GAAP that would affect our financial statements. Our financial statements have historically been reported in Canadian dollars. Effective May 1, 2003, we adopted the U.S. dollar as our reporting currency since U.S. dollar denominated operations represent an increasingly significant portion of our operations. Accordingly, the change of our reporting currency from the Canadian dollar to the U.S. dollar reduces our exposure to foreign currency translation adjustments. Comparative financial information for the fiscal year ended April 30, 2003 has been recast as if the U.S. dollar had always been used as our reporting currency, and financial information has been translated into U.S. dollars for all periods presented. As used in this discussion, and unless the context otherwise requires or unless otherwise indicated, all references to "Geac," "we," "our," "the Company" or similar expression refer to Geac Computer Corporation Limited and its consolidated subsidiaries. All dollar amounts herein are expressed in U.S. dollars unless otherwise noted, and references to "FY" are references to our fiscal year end, which ends on April 30 of each year.

On February 3, 2004 our common shares were registered under the Securities and Exchange Act of 1934 and began trading on the NASDAQ National Market under the ticker symbol "GEAC." Our common shares also continue to be listed on the Toronto Stock Exchange under the ticker symbol "GAC."

OVERVIEW

Geac is the software solution for the Chief Financial Officer. Whether there is a need to do more with less as a result of an increasingly competitive environment or as a result of regulatory pressure, Geac provides best-in-class technology solutions for the issues confronting the Chief Financial Officer.

We are a leading global provider of software solutions for business performance management, providing customers worldwide with financial and operational technology solutions to improve their business performance in real time. Geac Performance Management (GPM) is an integrated product suite that we offer for business performance management that enables companies to bolster their effectiveness by tightening the linkage between business strategy formulation and operational execution. Our software solutions include cross-industry enterprise application systems (EAS) for financial administration and human resources functions, expense management, time capture, budgeting, financial consolidation, management reporting and analysis and enterprise resource planning applications for manufacturing, distribution, and supply chain management. We also provide industry specific applications (ISA) tailored to the real estate, restaurant, property management, local government and construction marketplaces, and for libraries and public safety agencies. In addition, we resell computer

16

hardware and software, and provide a broad range of professional services, including application hosting, consulting, implementation services, and training worldwide.

To deliver these products and services, we employed approximately 2300 people worldwide on April 30, 2004 compared to approximately 2500 on April 30, 2003. On April 30, 2004, 16% of our employees were in sales and marketing, 27% in services, 23% in support, 22% in research and development and 12% in corporate services.

Today we assist many of the largest companies in the world who rely on our software applications for their financial transaction analysis and operational processing.

GEAC GROWTH STRATEGY

Software Revenue Growth

We intend (i) to extend relationships with our existing customers by improving the productivity and return on investment of our customers' existing business processes with new products that build on our customers' enterprise and resource planning (ERP) systems and Internet frameworks, and (ii) to attract new customers by delivering a suite of software solutions that can be integrated with their existing enterprise application systems. In both cases, we target our software solutions to the Chief Financial Officer of customers to help improve business performance utilizing their existing information technology investments. We need to continue to identify compelling products that expand upon and complement our existing suite of performance management products and then employ a combination of three strategies to aggregate those complementary target product offerings: build, buy and partner. Each component of the build, buy and partner strategy is critically important for us to achieve our growth strategy. We believe that if we are successful in achieving new product offerings from organic development or acquisitions and we develop partnerships to enhance our product offerings, sales and/or services, these objectives may be fulfilled and new software license revenue will likely increase. Software license revenue is the principal driver for support revenue and professional services revenue and therefore needs to increase as a percentage of the revenue mix to generate total revenue growth. Furthermore, our ability to increase software license revenue is an essential component in offsetting the attrition in maintenance contract renewals we have experienced in the past and that we expect to continue.

Build: Organic Growth

Selling new software licenses has and will continue to play an important role in our growth strategy. During FY 2004, we continued to focus on growing our business organically along key product lines, which resulted in revenue growth in several of our legacy products with sales to both new and existing customers. We need to continue to invest in new product development so we can offer our customers a portfolio of performance management solutions. To maintain revenue growth momentum, we also announced several complementary products at our recently held annual user conference, including Geac Compliance, SmartStream 7.0, and Enterprise Intelligence.

Software license sales growth has contributed to an increase in the demand for our professional services. In response, we have broadened our service offerings, expanded our delivery model, and created a "best practices" consulting group. Our integrated technology solutions deliver more value and utility to our customers by combining new products, product expansions, product integrations and practical business services.

Value for Maintenance—In the second quarter of FY 2004 we introduced a value-based maintenance offering, which delivers new technology to users of our mainframe software products that simplifies the web-enablement of, and integration with, Geac and non-Geac systems. The new program was rolled out to existing Geac E and M Series customers coming up for maintenance

17

renewal in the third quarter of FY 2004. An important component of this program is an initiative that offers multiple years of support services including incentives to encourage customers to extend beyond our typical one-year maintenance contract. At April 30, 2004, 40 renewing E and M series customers had elected to participate in the Value for Maintenance (VFM) program, representing approximately 15% of the total renewal dollars since the program was launched. An additional 18% of customers in the renewal pipeline are evaluating the VFM program. We expect to continue to refine the VFM program as we receive customer feedback and expect more of our customers to make the transition to this program as they renew their maintenance contracts.

Hosted Application Offering—We have expanded our delivery model by broadening the availability of our application service provider (ASP) offerings across certain products within our GPM suite. We currently provide hosting solutions in America, Europe and Australia across a range of product lines for some applications and are also assessing the expansion of hosted offerings across additional product lines. Our hosted solutions represent one of several application delivery and deployment options that we offer our customers as part of our commitment to provide customers with effective solutions that are flexible, easier to implement, and competitively priced. The increase in ASP offerings also has an effect on our revenue recognition: while perpetual licenses are generally recognized at the beginning of the contract when they meet the criteria described in the critical accounting policies, ASP offerings are recognized on a straight-line basis over the life of the contract. Thus, the dollar value of an ASP contract may be larger than a combined license and maintenance contract, although less revenue may be recognized in the first year after the contract is executed.

Product Expansion

Geac System21—System21 Aurora, our next generation ERP system for the iSeries with real-time business process management capabilities, continues to attract customers for us in the mid-market ERP sector. During the fourth quarter of FY 2004, System21 closed approximately 230 deals contributing to 29.2% revenue growth attributable to software license sales over the fourth quarter of FY 2003 and 6.2% growth from FY 2004 compared to FY 2003 for this product suite. Also during the fourth quarter of FY 2004, System21 Aurora was enhanced with integrated reporting and analysis and budgeting functionality derived from GPM.

Geac Library Solutions—Continuing to build upon the momentum it established earlier in FY 2004, in the fourth quarter of FY 2004 Geac Library Solutions won a dozen new license, maintenance and service contracts, including two new customers for Vubis Smart, our next-generation library automation system. Revenue for FY 2004 grew by 4.5% compared to FY 2003 revenue for this product suite.

Geac Local Government—Focused on opportunities in Australia and New Zealand, Geac Local Government has been awarded contracts with 10 councils (municipalities or counties) during FY 2004 to replace their existing land information systems (LIS). Most recently, the City of Auburn (Australia), home to the majority of the Sydney Olympics sporting venues purchased our LIS, named Pathway PPR. In addition, the City of Melbourne (Australia) acquired additional Pathway PPR modules to undertake their PINS3 (Penalty Infringement Notice System) project, to expedite processing of approximately 450,000 parking tickets per year. By delivering products to meet the unique demands of government customers, revenue for FY 2004 increased by 28% compared to FY 2003 revenue for this product suite; however, new license revenue in this business increased only modestly year over year.

Buy: Growth Through Acquisitions

On August 6, 2003, we acquired Comshare Incorporated ("Comshare"), a leading provider of Business Performance Management software for planning, budgeting, forecasting, financial

18

consolidation, management reporting and analysis—the MPC product line. Our current GPM software sales pipeline continues to include our legacy customers, which underscores a critical component of our acquisition strategy—the ability to sell newly acquired GPM products into our legacy customer accounts worldwide. During FY 2004, we closed several GPM sales with existing customers, including planning and expense management applications.

GPM is an integrated product suite that enables companies to bolster their effectiveness by tightening the linkage between business strategy formulation and operational execution. GPM can be integrated with many general ledger, ERP, CRM, and other applications provided by us and other software vendors, including SAP, PeopleSoft, Oracle, and Lawson. As part of our growth strategy we have begun to integrate GPM solutions into some of our existing ERP product offerings in both the EAS and ISA segments. In the third quarter of FY 2004, we integrated GPM with the Enterprise Server software and this integrated offering is gaining traction with our Enterprise server customers. In FY 2005, we plan to integrate GPM into our Anael, SmartStream, System21, Libraries, Local Government and Commercial Systems product suites.

In Q4 of FY 2004, we announced new releases of the MPC, our planning, budgeting, forecasting, financial consolidation, and management reporting and analysis software, and Expense Management solutions within the GPM product family. These new releases offer existing and potential customers greater functionality and flexibility, such as, the ability to submit or approve an employee expense report from any Web-enabled device.

Partner: Key Relationships

During FY 2004, we were successful in leveraging an existing partnership between Comshare and Microsoft® to encompass most of our major product lines in all regions. We are working with Microsoft® to develop joint marketing and sales programs within the business performance management market. We expect to receive focused technical, marketing and sales support from Microsoft®. In turn, we intend to utilize our experience and credibility providing technology-based solutions to financial executives, to assist Microsoft® in expanding its opportunities within the finance function of enterprises.

During FY 2004, we also leveraged our relationship with Lombardi Software and its expertise in business process design to develop a Sarbanes Oxley (SOX) compliance tool. The SOX certification cycle has created a growing demand for remediation activity as businesses try to extract value from their significant investment in regulatory compliance. There are two types of SOX compliance software offered by Geac: (1) applications that streamline processes and workflow allowing a company to reach scalable repeatable processes and (2) software to assist in making the SOX certifications.

Finally, during FY 2004 we partnered with Information Builders to develop our Enterprise Intelligence offering, an enhanced reporting solution for our E Series and M Series customers.

Subsequent to FY 2004, we announced a new alliance relationship with American Express Tax and Business Services Inc. (AMEX TBS). Under the terms of the agreement, AMEX TBS will now offer GPM to its North American customers. Our alliance with AMEX TBS will combine the financial services expertise of AMEX TBS with our technology strengths to extend GPM to a broader audience.

19

RESULTS OF OPERATIONS

Twelve Months Ended April 30, 2004 compared to the Twelve Months Ended April 30, 2003

(all dollar figures in tables are presented in thousands of U.S. dollars)

| | For the year ended April 30

| |

| |

| |

|---|

Revenue

| | $ change

from 2003

| | % Change

from 2003

| |

|---|

| | 2004

| | 2003

| |

|---|

| Software | | $ | 65,190 | | $ | 49,380 | | $ | 15,810 | | 32.0 | % |

| Support and services | | | 355,019 | | | 328,472 | | | 26,547 | | 8.1 | % |

| Hardware | | | 25,063 | | | 30,625 | | | (5,562 | ) | (18.2 | )% |

| | |

| |

| |

| |

| |

| | | $ | 445,272 | | $ | 408,477 | | $ | 36,795 | | 9.0 | % |

| | |

| |

| |

| |

| |

Total revenue increased 9.0% to $445.3 million for FY 2004, compared to $408.5 million for FY 2003. This increase is a result of organic revenue growth and the acquisitions of Extensity, Incorporated ("Extensity") and Comshare. We continue to execute on our strategy to increase software revenue as a percentage of our total revenue mix. As a percentage of total revenue, software revenue has increased from 12.1% in FY 2003 to 14.6% in FY 2004. Excluding the increase in support revenue resulting from the acquisitions of Extensity and Comshare and the effect of foreign exchange, support revenue declined $22.3 million or 9.4%. This decline was in line with our expectations. Services revenue increased $2.4 million or 2.9% in FY 2004, compared to FY 2003, excluding the increase in services revenue resulting from the acquisitions of Extensity and Comshare. Our focus shifted away from the lower margin hardware business in FY 2004 and the result was a hardware revenue decrease of $5.6 million or 18.2% from FY 2003. We are not seeking to grow our hardware business, which is a service we provide only to accommodate certain customers.

For FY 2004 we managed and reported our business on our two major business segments: EAS and ISA. The software products acquired in the Comshare and Extensity transactions are components of the EAS business segment, but may be extended into the ISA business segment in FY 2005. As a result of the integration of the Comshare and Extensity businesses as product lines in the EAS business segment, it is not possible to identify the expense components of the merged businesses separately.

| | For the year ended April 30

| |

| |

| |

|---|

Revenue—Segmented

| | $ change

from 2003

| | % Change

from 2003

| |

|---|

| | 2004

| | 2003

| |

|---|

| EAS | | $ | 351,259 | | $ | 305,156 | | $ | 46,103 | | 15.1 | % |

| ISA | | | 94,013 | | | 103,321 | | | (9,308 | ) | (9.0 | )% |

| | |

| |

| |

| |

| |

| | | $ | 445,272 | | $ | 408,477 | | $ | 36,795 | | 9.0 | % |

| | |

| |

| |

| |

| |

As a result of the acquisition of Comshare and Extensity, revenue in the EAS segment increased $46.1 million, or 15.1%, from $305.2 million in FY 2003 to $351.3 million in FY 2004. The increase was attributable to growth both in software and support and services revenue. New product lines from the Comshare and Extensity acquisitions contributed $52.2 million to the total revenue for the EAS business segment and, we also experienced organic growth from legacy products such as System21 Aurora. This growth was offset predominantly by a decline in total support revenue of approximately $16.2 million or 9.6%, and a decline in revenue related to the sale of the Northern Ontario division.

EAS software license sales to new and existing customers, from both newly-acquired and existing software, totalled $54.8 million in FY 2004 compared to $37.4 million in FY 2003. This represents an increase of $17.5 million, or 46.7%, of which $2.4 million was generated from our legacy product suites.

20

The software products acquired in the Comshare and Extensity transactions represented $15.1 million of total EAS software license sales during FY 2004.

EAS support and services revenue was $274.9 million in FY 2004, compared to $242.5 million in FY 2003. Support and services revenue generated by the Comshare and Extensity businesses represented $35.4 million of the increase in FY 2004. Therefore, excluding revenue from acquisitions, there was a $3.0 million decrease in EAS support and services revenue attributable to a decline in support revenue from the existing EAS business and foreign exchange. This decline, which was in line with our expectations, was due to attrition in maintenance contract renewals within the various EAS business units. As the integration of the Comshare and Extensity product lines into our other businesses continue, it will not be possible to report the revenue components of the merged businesses separately.

EAS hardware sales revenue was $21.6 million in FY 2004, compared to $25.3 million in FY 2003. This represents a 14.8% decline in hardware revenue. The decline in EAS hardware sales revenue may continue as a result of our de-emphasis of this low margin business.

Revenue in the ISA segment decreased $9.3 million or 9.0%, from $103.3 million in FY 2003 to $94.0 million in FY 2004. This $9.3 million decline was primarily attributable to:

- •

- $9.1 million decline in the Interealty business reflecting significant price pressure, customer losses in the core Multiple Listing Service (MLS) application business and the anticipated continuing decline in revenue from the MLS book publishing business;

- •

- $2.2 million decline in the Restaurants business attributable in part to a decrease in hardware sales due to our focus to shift away from this lower margin business; and

- •

- $1.3 million decline in the Construction business which was due to a a legacy software conversion program which expired in FY 2003.

An increase of $2.7 million in the Local Government business resulting from new installations and higher volumes of professional service engagements partially offset these declines.

| | For the year ended April 30

| |

| |

|---|

Gross Profit

| | % Change

from 2003

| |

|---|

| | 2004

| | 2003

| |

|---|

| Margin on software revenue | | 88.2 | % | 86.8 | % | 1.4 | % |

| Margin on support and services revenue | | 58.8 | % | 58.4 | % | 0.4 | % |

| Margin on hardware revenue | | 15.7 | % | 15.5 | % | 0.2 | % |

| | |

| |

| |

| |

| Margin on total revenue | | 60.7 | % | 58.6 | % | 2.1 | % |

| | |

| |

| |

| |

Gross profit increased by $30.7 million, or 12.8%, from $239.4 million in FY 2003 to $270.2 million in FY 2004 versus an increase of total revenue of 9%. Overall gross profit margins increased from 58.6% in FY 2003 to 60.7% in FY 2004 as a result of higher margin software revenue increasing as a percentage of the revenue mix, a decrease in lower margin hardware sales as a percentage of the revenue mix and cost reductions. However, it is uncertain if such growth will continue in future years. Included in cost of revenue in FY 2004 is $0.3 million in compensation expenses relating to the adoption of the fair value method of accounting for stock options.

21

Management Discussion and Analysis

Operating Expenses—Operating expenses increased 6.8% to $197.9 million in FY 2004, compared to $185.3 million in FY 2003. Sales and marketing, product development, and general and administrative expenses increased by $26.6 million primarily as a result of the acquired Extensity and Comshare businesses and the accounting for the fair value of stock options which was adopted in the fourth quarter of FY 2004. Our total operating expenses increased by 6.8% in absolute dollars in FY 2004 compared to FY 2003, while total revenue increased by 9.0%. Therefore, as a percentage of total revenue, operating expenses decreased from 45.4% in FY 2003 to 44.5% in FY 2004.

In accordance with accounting standards set by the CICA, we elected to adopt Handbook Section 3870 "Stock-based compensation and other stock-based payments" ("Section 3870") in the fourth quarter of FY 2004, and began recording stock-based compensation expense using the prospective method of accounting for stock options, available to companies that adopt Section 3870 in their 2004 fiscal years. Recording the compensation expense related to stock options increased our operating and cost of sales expenses by approximately $2.4 million and decreased Earnings Per Diluted Share ("EPS") by $0.03. The full-year expense was recognized in the fourth quarter; the amount per quarter going forward may be less.

| | For the year ended April 30

| |

| |

| |

|---|

| | $ change

from 2003

| | % Change

from 2003

| |

|---|

| | 2004

| | 2003

| |

|---|

| Sales and marketing | | $ | 74,051 | | $ | 58,730 | | $ | 15,321 | | 26.1 | % |

| Product development | | | 58,805 | | | 51,905 | | | 6,900 | | 13.3 | % |

| General and administrative | | | 62,774 | | | 58,420 | | | 4,354 | | 7.5 | % |

Sales and Marketing—Sales and marketing expenses increased by $15.3 million, or 26.1%, in FY 2004. As a percentage of revenue, sales and marketing expenses increased from 14.4% in FY 2003 to 16.6% in FY 2004 reflecting our ongoing expenses from personnel costs and sales and marketing costs intended to drive new software revenue. Sales and marketing expenses may increase in the future as a percentage of total revenue as we focus on growing new software license revenue. Included in sales and marketing expenses in FY 2004 is $0.9 million of compensation expense for the adoption of the fair value method of accounting for stock options.

Product Development—Product development expenses increased by $6.9 million, or 13.3%, in FY 2004 and increased as a percentage of total revenue from 12.7% in FY 2003 to 13.2% in FY 2004. The increase in product development expenses is primarily attributable to the acquisitions of Extensity and Comshare and our focused organic growth, each of which has contributed to our strategy of build, buy and partner to generate software revenue growth. We expect product development expenses to continue at this rate as we continue to execute on our strategy. Included in product development expenses in FY 2004 is $0.3 million of compensation expense relating to the adoption of the fair value method of accounting for stock options.

General and Administrative—General and administrative expenses increased by $4.4 million, or 7.5%, in FY 2004. As a percentage of total revenues, general and administrative expenses decreased from 14.3% in FY 2003 to 14.1% in FY 2004. Included in general and administrative expenses in FY 2004, is $0.9 million of compensation expense relating to the adoption of the fair value method of accounting for stock options. Going forward, it is anticipated that general and administrative expenses will be adversely and significantly impacted by new corporate governance regulations and requirements.

Net Restructuring and Other Unusual Items—During FY 2004, we recorded a net reversal of $5.3 million in net restructuring and other unusual items. The net reversal for the year included $7.0 million in the release of severance, premises, litigation and other reserves set up in prior years that are no longer required. Also included in the net restructuring and other unusual items was a gain of

22

$0.2 million resulting from the sale of assets associated with our Northern Ontario NTC division. These amounts were partially offset by charges of $0.8 million relating to new information obtained on a lease obligation, $0.5 million for severance costs related to the restructuring of our business in North America and $0.6 million for a pension liability relating to our French operations.

Amortization of Intangible Assets and Goodwill Impairment—Our past acquisitions resulted in the recording of goodwill and other intangible assets that represent the excess of the purchase price paid over the fair value of the net tangible assets acquired. Intangible assets are amortized over periods ranging from one to five years. Amortization of intangible assets, primarily acquired software, was $7.6 million for FY 2004, compared to $1.1 million in FY 2003. This $6.5 million increase is attributable to amortization of intangible assets associated with the Extensity and Comshare businesses, which were acquired in the fourth quarter of FY 2003 and the second quarter of FY 2004, respectively. In accordance with CICA 3062, "Goodwill and Other Intangible Assets," goodwill is reviewed for impairment annually. We completed our review for potential impairment as of February 29, 2004, and concluded that there was no impairment. In FY 2003, we completed the same review and it was determined that goodwill had been impaired by $11.5 million.

Other Expense—Interest expense increased by $0.8 million in FY 2004. The increase was attributable to the amortization of the financing costs related to the $50.0 million credit facility obtained in FY 2004.

Income Taxes—Income taxes are accounted for under the liability method, whereby future income tax assets and liabilities are recognized for temporary differences between the tax and accounting bases of assets and liabilities, as well as for the benefit of losses available to be carried forward to future years for income tax purposes. Future income tax assets are recognized only to the extent that, in the opinion of management, it is more likely than not that the future income tax assets will be realized. Future income tax assets and liabilities are measured using income tax rates applicable to taxable income in the years in which those temporary differences are expected to be recovered or settled. Future income tax assets and liabilities are adjusted for the effects of changes in income tax laws and rates in the period in which the change occurs.

The provision for income taxes was $13.7 million for FY 2004, compared to $21.3 million for FY 2003. Of the total $13.7 million provision recorded in FY 2004, $6.0 million related to future tax expense and $7.6 million represented cash taxes. Of the total $21.3 million provision recorded in FY 2003, $16.4 million related to future tax expense and $4.9 million represented cash taxes due for the period.

The effective tax rate for FY 2004 was 19.3%, compared to a rate of 40.1% for FY 2003. When the FY 2003 income before taxes is adjusted for the non-tax deductible goodwill impairment charge of $11.5M (discussed above), the effective tax rate for FY 2003 is reduced to 33.0%.

The decrease in the effective tax rate from FY 2003 to FY 2004 is due primarily to the release of valuation allowances on future tax assets and release of reserves for tax exposures due to changes in circumstances in various subsidiaries.

Net Earnings—Net earnings were $57.2 million, or $0.66 per diluted share in FY 2004, compared to $31.9 million, or $0.39 per diluted share in FY 2003. We are organized globally such that many of our expenses are incurred in the same currency as our revenue, which mitigates our exposure to currency fluctuations. Compared to FY 2003, currency fluctuations—primarily attributable to the British Pound Sterling, Euro, and Australian Dollar versus the U.S. Dollar—had the effect of increasing net income by $3.7 million, or $0.04 per diluted share, in FY 2004. This net increase resulted from the positive impact on revenue of $29.3 million, offset by the negative impact on expenses of $25.6 million. The British Pound Sterling, Euro and Australian Dollar appreciated by approximately 10.0%, 17.3% and 24.3%, respectively against the U.S. Dollar in FY 2004.

23

QUARTERLY RESULTS

The following table sets forth the unaudited consolidated statements of earnings for each of our last eight fiscal quarters. Our data has been derived from our unaudited consolidated statements of earnings that have been prepared on the same basis as the annual audited consolidated statements of earnings and, in our opinion, include all adjustments necessary for a fair presentation of such information. These unaudited quarterly results should be read in conjunction with our audited consolidated financial statements and notes thereto for FY 2004 and FY 2003. The consolidated results of operations for any quarter are not necessarily indicative of the results for any future period.

Condensed Consolidated Quarterly Statements of Earnings

(in thousands of U.S. dollars, except share and per share data)

| | 2003

| | 2004

|

|---|

| | Quarter 1

| | Quarter 2

| | Quarter 3

| | Quarter 4

| | Quarter 1

| | Quarter 2

| | Quarter 3

| | Quarter 4

|

|---|

| Total revenues | | $ | 101,364 | | $ | 101,937 | | $ | 102,588 | | $ | 102,588 | | $ | 101,525 | | $ | 111,467 | | $ | 116,175 | | $ | 116,105 |

| Cost of revenues | | | 45,430 | | | 41,964 | | | 41,863 | | | 39,785 | | | 40,836 | | | 45,142 | | | 45,863 | | | 43,255 |

| Gross profit | | | 55,934 | | | 59,973 | | | 60,725 | | | 62,803 | | | 60,689 | | | 66,325 | | | 70,312 | | | 72,850 |

| Operating expenses | | | 40,585 | | | 41,259 | | | 42,494 | | | 60,914 | | | 46,488 | | | 50,275 | | | 51,108 | | | 50,067 |

| Earnings from operations | | | 15,349 | | | 18,714 | | | 18,231 | | | 1,889 | | | 14,201 | | | 16,050 | | | 19,204 | | | 22,783 |

| Net earnings | | | 10,480 | | | 11,643 | | | 12,013 | | | (2,265 | ) | | 9,407 | | | 10,746 | | | 14,437 | | | 22,576 |

| Basic EPS | | | 0.13 | | | 0.15 | | | 0.15 | | | (0.03 | ) | | 0.11 | | | 0.13 | | | 0.17 | | | 0.27 |

| Diluted EPS | | | 0.13 | | | 0.15 | | | 0.15 | | | (0.03 | ) | | 0.11 | | | 0.13 | | | 0.17 | | | 0.26 |

During FY 2004, we continued to see quarterly year-over-year revenue growth. Though the majority of growth came from our acquisitions, we did experience some organic growth in our business.

During FY 2004, we also saw an increase in gross profit as a result of higher margin revenue replacing lower margin hardware sales in the revenue mix.

We continue to see an increase in quarterly operating expenses primarily as a result of our acquisitions. However, operating expenses as a percentage of revenue are decreasing as we integrate our expense management disciplines into the acquired businesses.

Operating expenses for the fourth quarter of FY 2003 included the impact of restructuring and goodwill impairment charges of $15.8 million. There was no such impairment charge in FY 2004.

Included in cost of revenues and operating expenses in the fourth quarter of FY 2004 is $2.4 million in compensation expense relating to the adoption of the fair value method of accounting for stock options.

In FY 2004, net earnings and EPS grew in each consecutive quarter, with the fourth quarter of FY 2004 contributing to the largest portion of the growth for the year. Significant restructuring and unusual items impacted the net earnings and EPS in the fourth quarter of FY 2003. On a quarterly basis, we will continue to focus on operating results, including employee headcount requirements, to reduce the risk of future significant restructuring and unusual item charges.

LIQUIDITY AND FINANCIAL CONDITION

| | For the year ended April 30

| |

| |

|---|

| | $ Change

from 2003

| |

|---|

| | 2004

| | 2003

| |

|---|

| Cash and cash equivalents | | $ | 112,550 | | $ | 89,819 | | $ | 22,731 | |

| Current assets | | | 195,192 | | | 179,128 | | | 16,064 | |

| Total assets | | | 406,903 | | | 332,756 | | | 74,147 | |

| Current liabilities | | | 232,520 | | | 233,268 | | | (748 | ) |

| Long-term liabilities | | | 38,312 | | | 23,318 | | | 14,994 | |

| Total shareholders' equity | | | 136,071 | | | 76,170 | | | 59,901 | |

24

At April 30, 2004, cash and cash equivalents (cash) totalled $112.6 million, compared to $89.8 million at April 30, 2003.

During the second quarter of FY 2004, we acquired Comshare by way of a cash tender offer for all outstanding shares, followed by a cash merger for a purchase price, excluding acquisition costs, of $53.8 million. Since Comshare had $16.6 million in cash and cash equivalents at the date of acquisition, the net cash outflow resulting from completion of the transaction was $37.2 million plus transaction costs of $1.9 million. As a result, exclusive of an increase of $0.7 million from the effect of foreign exchange rates, cash increased by $22.0 million for FY 2004 compared to FY 2003.

Total assets increased $74.1 million to $406.9 million at April 30, 2004 compared to $332.8 million at April FY 2003. In addition to the increase in cash and cash equivalents, the remaining increase in total assets was attributable to the increase in goodwill and intangible assets resulting from the acquisition of Comshare during FY 2004.

Long-term liabilities increased $15.0 million to $38.3 million at April 30, 2004, compared to $23.3 million at April 30, 2003. The majority of the increase was as a result of a defined benefit pension plan obligation of $22.3 million that was assumed as part of the acquisition of Comshare. This was offset by a decrease in restructuring costs and long-term debt.

Net Changes in Cash Flow

| | For the year ended April 30

| |

| |

|---|

| | $ Change

from 2003

| |

|---|

| | 2004

| | 2003

| |

|---|

| Net cash provided by operating activities | | $ | 66,618 | | $ | 29,044 | | $ | 37,574 | |

| Net cash used in investing activities | | | (41,817 | ) | | (23,828 | ) | | (17,989 | ) |

| Net cash (used in)/provided by financing activities | | | (2,796 | ) | | 6,589 | | | (9,385 | ) |

| Effect of exchange rate changes on cash and cash equivalents | | | 726 | | | 4,376 | | | (3,650 | ) |

| | |

| |

| |

| |

| Net increase in cash and cash equivalents | | $ | 22,731 | | $ | 16,181 | | $ | 6,550 | |

| | |

| |

| |

| |

Net cash provided by operating activities increased 129.4% to $66.6 million in FY 2004, compared to $29.0 million in FY 2003. The improvement in net cash flow from operating activities was primarily due to the significant increase in net income for the year. Balance sheet changes for non-cash working capital were affected significantly by acquisitions.

Net cash used in investing activities increased 75.5% to $41.8 million in FY 2004, compared to $23.8 million in FY 2003. There was an increase in net cash used in investing activities of $39.1 million due to the acquisition of Comshare, compared to the net acquisition of Extensity and EBC, which used $22.7 million in the prior year. In addition, net capital asset acquisitions were $1.6 million higher than in the prior year.

25

Net cash used in financing activities was $2.8 million in FY 2004, compared to $6.6 million, which was provided in FY 2003. In FY 2004, we received $2.9 million in proceeds from stock options exercised. This was more than offset by a $2.9 million repayment of long-term debt and deferred financing costs of $2.8 million attributable to the financing costs associated with the Wells Fargo Foothill, Inc. $50.0 million credit facility ("the facility"). As of April 30, 2004, we utilized $1.8 million of the letter of credit sub-facility for general working capital needs. Approximately $48.2 million of the revolving line of credit remains available to us.

CONTRACTS AND COMMITMENTS

The facility discussed above is collateralized by substantially all of our assets and the assets of certain of our U.S. and Canadian subsidiaries and guaranteed by certain of our U.S., Canadian, UK and Hungarian subsidiaries. The facility is available for our working capital needs and other general corporate purposes and for the needs of our subsidiaries that are parties to the facility agreement.

We do not enter into off-balance sheet financing as a general practice. Except for operating leases, as disclosed in note 14 to the FY 2004 consolidated financial statements and in accordance with Canadian GAAP, we have no commitments that are not reflected in our balance sheets. Commitments include operating leases for office equipment and premises, and letters of credit, bank guarantees, and performance bonds that are routinely issued on our behalf by financial institutions, primarily in connection with premises leases and contracts with public sector customers. In addition, as disclosed in note 13 to the FY 2004 consolidated financial statements, in connection with the acquisition of Comshare, we assumed responsibility for a defined benefit pension plan, which will require continued payments until the plan is fully funded. Except as otherwise disclosed in the financial statements, we do not have any other business arrangements, derivative financial instruments, or any equity interests in unconsolidated companies that would have a material effect on our assets and liabilities at April 30, 2004.

The following table summarizes our outstanding cash commitments as of April 30, 2004:

| | Payments due by period

|

|---|

| | Total

| | Less than

1 Year

| | 1 - 3 Years

| | 3 - 5 Years

| | More than

5 Years

|

|---|

| Operating leases | | $ | 43,109 | | $ | 17,400 | | $ | 16,375 | | $ | 4,323 | | $ | 5,011 |

| Capital leases | | | 5,885 | | | 603 | | | 1,206 | | | 1,206 | | | 2,870 |

| Future benefit payments | | | 3,685 | | | 598 | | | 1,213 | | | 1,239 | | | 635 |

| Long-term debt | | | 4,941 | | | 391 | | | 818 | | | 955 | | | 2,777 |

| | |

| |

| |

| |

| |

|

| Total outstanding cash commitments | | $ | 57,620 | | $ | 18,992 | | $ | 19,612 | | $ | 7,723 | | $ | 11,293 |

| | |

| |

| |

| |

| |

|

RISKS AND UNCERTAINTIES

This Management Discussion and Analysis, and other reports, statements and other communications to shareholders, as well as oral statements made by our officers or agents, contains forward-looking statements, including statements regarding the future success of our business and technology strategies, and future market opportunities. These forward-looking statements are neither promises nor guarantees but rather are subject to a number of risks and uncertainties, which could cause actual results to differ materially from those described in the forward-looking statements. Some of the risks and uncertainties that may cause such variation are discussed below. You should not place undue reliance on any such forward-looking statements, which are current only as of the date when made. You should not expect that these forward-looking statements will be updated or supplemented as a result of changing circumstances or otherwise, and we disavow and disclaim any obligation to do so. You should understand that the sole purpose of discussing

26

these risks and uncertainties is to alert you to certain factors which could cause actual results to differ materially from those described in the forward-looking statements and not to describe facts, trends and circumstances that could have a beneficial impact on the Company's results.

We operate in a dynamic and rapidly changing environment and industry that involve numerous risks and uncertainties. The following section describes some, but not all, of these risks and uncertainties that may adversely affect our business, financial condition or results of operations. Additional risks and uncertainties not described below or not presently known to us may also affect our business operations. If any of these risks actually occurs, our business, financial condition, or results of operations could be seriously harmed. This section should be read in conjunction with the audited Consolidated Financial Statements and Notes thereto, and the other parts of Management's Discussion and Analysis of Financial Condition and Results of Operations.

We have had losses in the past and may not maintain our current profitability in the future. The trading price of our common shares may fall if we fail to maintain profitability or generate sufficient cash from operations.