UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

______________________________

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-2

FORESCOUT TECHNOLOGIES, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

_____________________________________________________________________

| |

| (2) | Aggregate number of securities to which transaction applies: |

__________________________________________________________________________________

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

_____________________________________________________________________

| |

| (4) | Proposed maximum aggregate value of transaction: |

_____________________________________________________________________

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| |

| (1) | Amount Previously Paid: |

_____________________________________________________________________

| |

| (2) | Form, Schedule or Registration Statement No.: |

_____________________________________________________________________

_____________________________________________________________________

_____________________________________________________________________

FORESCOUT TECHNOLOGIES, INC.

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD AT 8:00 A.M. PACIFIC TIME, ON WEDNESDAY, MAY 23, 2018

Dear Stockholders of ForeScout Technologies, Inc.:

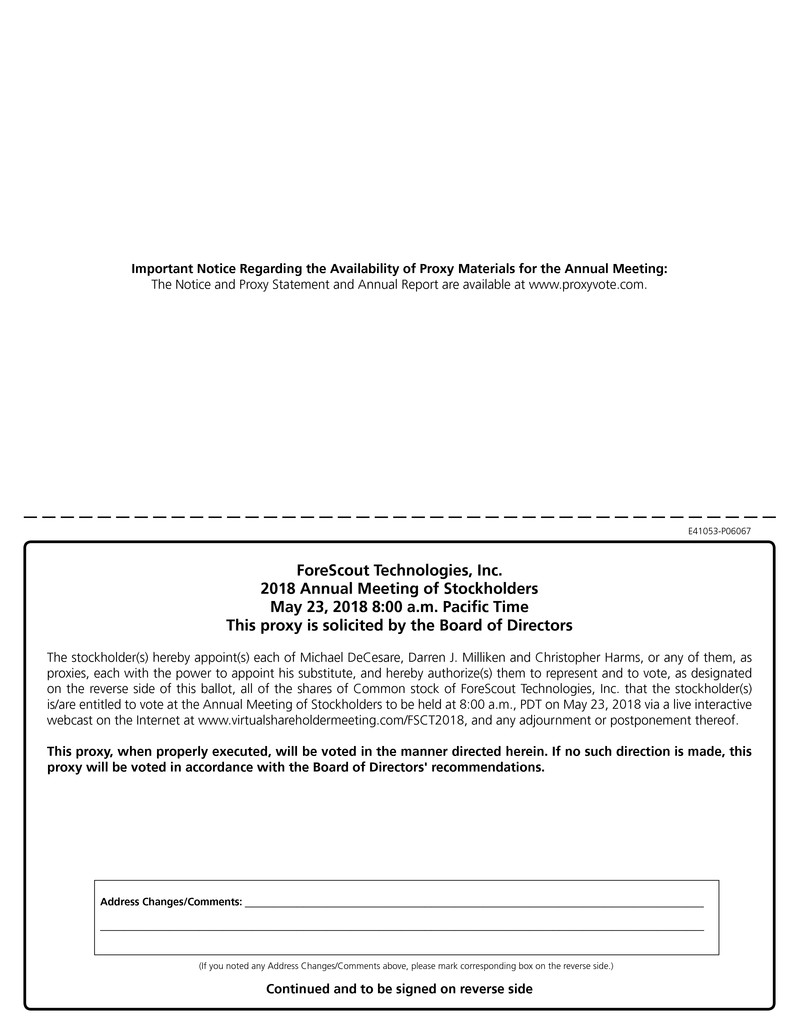

You are cordially invited to attend the 2018 annual meeting of stockholders and any postponements, adjournments or continuations thereof (the “Annual Meeting”) of ForeScout Technologies, Inc., a Delaware corporation (“ForeScout”), which will be held as a virtual meeting on Wednesday, May 23, 2018 at 8:00 a.m. Pacific Time. You can attend the Annual Meeting via a live interactive webcast on the internet at http://www.virtualshareholdermeeting.com/FSCT2018 where you will be able to listen to the meeting live, submit questions (before and during the meeting) and vote online.

We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement (the “Proxy Statement”):

| |

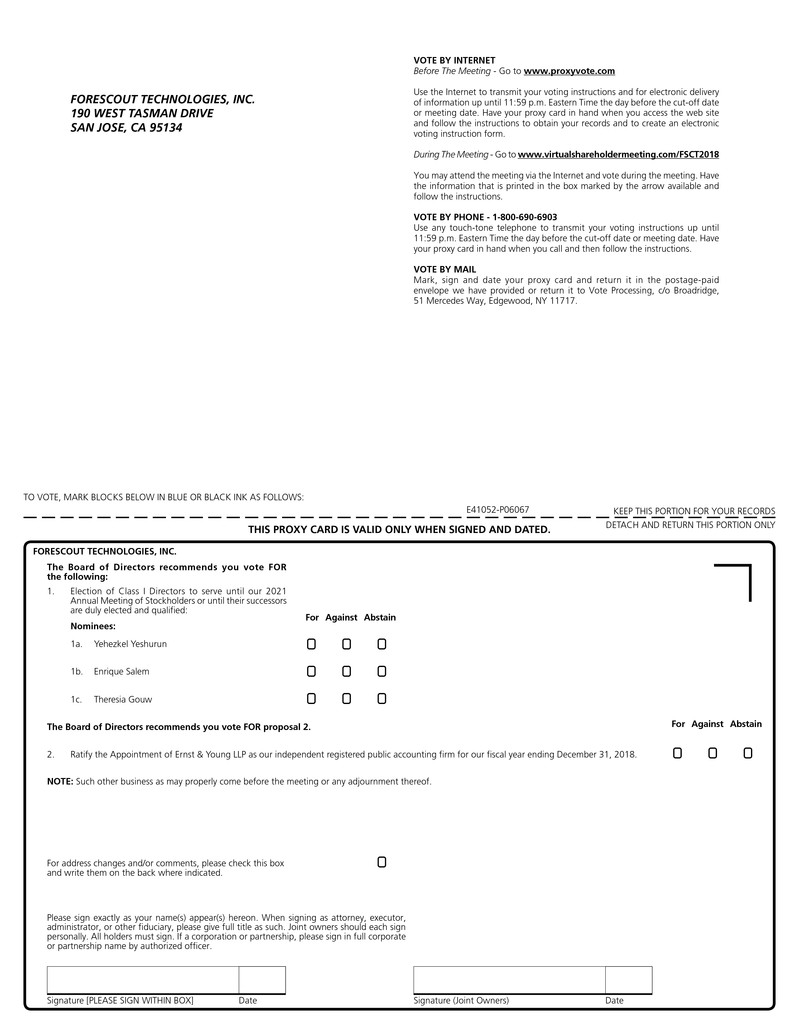

| 1. | To elect three Class I directors to serve until our 2021 annual meeting of stockholders and until their successors are duly elected and qualified; |

| |

| 2. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018; and |

| |

| 3. | To transact other business that may properly come before the Annual Meeting or any adjournments or postponements thereof. |

The Annual Meeting will begin promptly at 8:00 a.m. and on-line check-in will begin at 7:55 a.m. Pacific Time. Only holders of record and beneficial owners of shares of our common stock at the close of business on March 29, 2018, the record date, are entitled to notice of, to attend, and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying Proxy Statement.

We expect to make available to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) on or about April 10, 2018, and this Notice will contain instructions on how to access our Proxy Statement and our annual report. The Notice provides instructions on how to vote via the Internet or by telephone and includes instructions on how to receive a paper copy of our proxy materials by mail. The accompanying Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2017 (the “annual report”) can be accessed directly at the following Internet address: http://www.proxyvote.com. All you have to do is enter the control number located on your proxy card.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible to ensure your shares are represented. For additional instructions on voting by telephone or the Internet, please refer to your proxy card.

We appreciate your continued support of ForeScout Technologies, Inc. and look forward to either virtually greeting you at the Annual Meeting or receiving your proxy.

By order of the Board of Directors,

Michael DeCesare

President and Chief Executive Officer

190 W Tasman Drive

San Jose, California, 95134

April 10, 2018

TABLE OF CONTENTS

|

| |

| | Page |

| Questions and Answers Regarding this Solicitation and Voting at the Annual Meeting | |

| Board of Directors and Corporate Governance | |

| Composition of the Board | |

| Director Nominees - Class I Directors | |

| Continuing Directors - Class II and III Directors | |

| Director Independence | |

| Board Oversight of Risk | |

| Board of Directors Leadership | |

| Board Meetings and Committees | |

| Compensation Committee Interlocks and Insider Participation | |

| Considerations in Evaluating Director Nominees | |

| Stockholder Recommendations for Nominations to the Board of Directors | |

| Communications with the Board of Directors | |

| Corporate Governance Guidelines and Code of Business Conduct and Ethics | |

| Compensation of Non-Employee Directors | |

| Director Compensation Table for Fiscal Year 2017 | |

| Proposal No. 1 - Election of Directors | |

| Nominees for Director | |

| Vote Required | |

| Board of Directors Recommendation | |

| Proposal No. 2 - Ratification of Appointment of Independent Registered Public Accounting Firm | |

| General | |

| Audit and Non-Audit Services | |

| Auditor Independence | |

| Audit Committee Pre-Approval Policies and Procedures | |

| Vote Required | |

| Board of Directors Recommendation | |

| Audit Committee Report | |

| Executive Officers | |

| Executive Compensation | |

| Process and Procedures for Executive and Director Compensation | |

| Summary Compensation Table for Fiscal Years 2017 and 2016 | |

| Non-Equity Incentive Plan Compensation | |

| Named Executive Officer Employment Arrangements and Potential Payments Upon Termination or Change in Control | |

| Outstanding Equity Awards at 2017 Fiscal Year-End | |

| Equity Compensation Plan Information | |

| Compensation Committee Report | |

| Certain Related Party Transactions | |

| Special Stockholder Voting Agreement and Irrevocable Proxy | |

| Employment Arrangement with an Immediate Family Member of Our Chairman | |

| Policies and Procedures for Related Party Transactions | |

| Security Ownership of Certain Beneficial Owners and Management | |

| Other Matters | |

| Fiscal Year 2017 Annual Report and SEC Filings | |

| Company Website | |

PROXY STATEMENT FOR

FORESCOUT TECHNOLOGIES, INC.

2018 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD AT 8:00 A.M. PACIFIC TIME, ON WEDNESDAY, MAY 23, 2018

This Proxy Statement and the enclosed form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use in connection with the 2018 annual meeting of stockholders of ForeScout Technologies, Inc. (“ForeScout”), a Delaware corporation, and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held as a virtual meeting on Wednesday, May 23, 2018 at 8:00 a.m. Pacific Time via a live interactive webcast on the internet at http://www.virtualshareholdermeeting.com/FSCT2018 where you will be able to listen to the meeting live, submit questions (before and during the meeting) and vote online. A Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this Proxy Statement and our annual report is first being made available on or about April 10, 2018 to all stockholders entitled to vote at the Annual Meeting. Information contained on or that can be accessed through our website is not intended to be incorporated by reference into this Proxy Statement and references to our website address in this Proxy Statement are inactive textual references only.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully.

QUESTIONS AND ANSWERS REGARDING

THIS SOLICITATION AND VOTING AT THE ANNUAL MEETING

What matters am I voting on?

You will be voting on:

| |

| • | the election of three Class I directors to serve until our 2021 annual meeting of stockholders and until their successors are duly elected and qualified; |

| |

| • | a proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018; and |

| |

| • | any other business as may properly come before the Annual Meeting, including any adjournment or postponement thereof. |

How does the board of directors recommend I vote on these proposals?

Our board of directors recommends a vote:

| |

| • | “FOR” the election of Yehezkel Yeshurun, Enrique Salem, and Theresia Gouw as Class I directors; and |

| |

| • | “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018. |

Who is entitled to vote at the Annual Meeting?

Holders of our common stock as of the close of business on March 29, 2018 (the “Record Date”), may vote at the Annual Meeting. As of the Record Date, 39,333,158 shares of our common stock were outstanding. In deciding all matters at the Annual Meeting, each stockholder will be entitled to one vote for each share of our common stock held by them on the Record Date. Stockholders may not cumulate votes in the election of directors.

Registered Stockholders. If shares of our common stock are registered directly in your name with our transfer agent, Computershare, you are considered the stockholder of record with respect to those shares, and the Notice was provided to you directly by us. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote live at the Annual Meeting. Throughout this Proxy Statement, we will refer to registered stockholders as “stockholders of record.”

Street Name Stockholders. If shares of our common stock are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice was forwarded to you by your broker, bank or other nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares. Although beneficial owners are also invited to attend the Annual Meeting, because a beneficial owner is not the stockholder of record, you may not vote your shares live at the Annual Meeting unless you follow your broker, bank, or other nominee’s procedures for obtaining a legal proxy and present your legal proxy at the Annual Meeting. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. In this Proxy Statement, we will refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

Can I attend the Annual Meeting?

You will be able to attend the Annual Meeting online, submit your questions during the meeting and vote your shares electronically at the meeting by visiting http://www.virtualshareholdermeeting.com/FSCT2018. To participate in the Annual Meeting online, you will need the control number included on your proxy card. The Annual Meeting webcast will begin promptly at 8:00 a.m. Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 7:55 a.m. Pacific Time and you should allow sufficient time for the check-in procedures.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

| |

| • | by Internet at http://www.proxyvote.com, 24 hours a day, seven days a week until 11:59 p.m. Eastern Standard Time, on May 22, 2018 (have your proxy card in hand when you visit the website); |

| |

| • | by toll-free telephone at 1(800) 690-6903 until 11:59 p.m. Eastern Standard Time, on May 22, 2018 (have your proxy card in hand when you call); |

| |

| • | by completing and mailing your proxy card timely in order for it to be received prior to the Annual Meeting (if you received printed proxy materials); or |

| |

| • | by attending and voting at the Annual Meeting by visiting http://www.virtualshareholdermeeting.com/FSCT2018, where stockholders may vote and submit questions (before and during ) the Annual Meeting (have your proxy card in hand when you visit the website). |

Even if you plan to attend the Annual Meeting online, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to direct your broker, bank or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning a voting instruction form, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As mentioned above, if you are a street name stockholder, you may not vote your shares live at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

| |

| • | entering a new vote by Internet or by telephone; |

| |

| • | returning a later-dated proxy card; |

| |

| • | sending a written notification to the Corporate Secretary of ForeScout at 190 West Tasman Drive, San Jose California 95134; or |

| |

| • | attending and voting at the online Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy). |

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote or revoke your proxy.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. The persons named in the proxy have been designated as proxies by our board of directors. When a proxy card is properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instruction of the stockholder. If a proxy card is signed, but no specific instructions are given, the shares represented by such proxy card will be voted in accordance with the recommendations of our board of directors, as described above. If any matters not described in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares subject to proxies. If the Annual Meeting is adjourned, the proxy holders can vote your shares subject to proxies when the Annual Meeting is rescheduled, unless you have properly revoked your proxy instructions, as described above.

Why did I receive the Notice in the mail regarding the Internet availability of proxy materials instead of a paper copy of the full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this Proxy Statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being made available on or about April 10, 2018 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact of our annual meetings of stockholders.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. The persons named in the proxy, Michael DeCesare, our Chief Executive Officer, Christopher Harms, our Chief Financial Officer, and Darren Milliken, our General Counsel, have been designated as proxies for the Annual Meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder on such proxy. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above and, if any other matters are properly brought before the annual meeting, the shares will be voted in accordance with the proxies’ judgment.

In addition, Mr. DeCesare holds an irrevocable proxy to vote shares of common stock held by certain of our stockholders, as described in the section titled “Security Ownership of Certain Beneficial Owners and Management.” Stockholders who have granted such proxy are not entitled to vote such shares at the Annual Meeting. Mr. DeCesare intends to vote such shares in accordance with the recommendations of our board of directors on the proposals as described.

What is a quorum?

A quorum is the minimum number of shares required to be present for the Annual Meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, virtually or by proxy, of a majority of all issued and outstanding shares of our common stock entitled to vote at the Annual Meeting will constitute a quorum at the Annual Meeting. A proxy submitted by a stockholder may

indicate that all or a portion of the shares represented by the proxy are not being voted (“stockholder withholding”) with respect to a particular matter. Similarly, a broker may not be permitted to vote shares held in street name on a particular matter in the absence of instructions from the beneficial owner of such shares (“broker non-vote”). Refer to the section titled “How may my broker, bank or other nominee vote my shares if I fail to timely provide voting instructions?” The shares of our common stock subject to a proxy that are not being voted on a particular matter because of either stockholder withholding or a broker non-vote will count for purposes of determining the presence of a quorum. Abstentions are also counted in the determination of a quorum.

How many votes are needed for approval of each proposal?

| |

| • | Proposal No. 1: The election of directors requires a plurality vote of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. “Plurality” means that the nominees who receive the largest number of votes cast “for” such nominees are elected as directors. As a result, any shares not voted “for” a particular nominee (whether as a result of stockholder abstention or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “for” or “withhold” on each of the nominees for election as a director. |

| |

| • | Proposal No. 2: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018 requires the affirmative vote of a majority of the shares of our common stock present virtually or by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote “for,” “against,” or “abstain” with respect to this proposal. Abstentions are considered votes present and entitled to vote on this proposal, and thus will have the same effect as a vote “against” this proposal. Broker non-votes will have no effect on the outcome of this proposal. |

How are proxies solicited for the Annual Meeting?

Our board of directors is soliciting proxies for use at the Annual Meeting. All expenses associated with this solicitation will be borne by us. We will reimburse brokers, banks or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank or other nominee holds your shares of our common stock. In addition to using the internet, our directors, officers and employees may solicit proxies in person by telephone, or by other means of communication, for which they will not receive any additional compensation. We have not retained a proxy solicitor firm to assist us in soliciting proxies. If you choose to access the proxy materials through the Internet, you are responsible for any Internet access charges you may incur.

How may my broker, bank or other nominee vote my shares if I fail to timely provide voting instructions?

Brokerage firms, banks or other nominees holding shares of our common stock in street name for beneficial owners are generally required to vote such shares in the manner directed by the beneficial owner. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole “routine” matter, the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018. Your broker will not have discretion to vote on any other proposals, which are “non-routine” matters, absent direction from you.

Is my vote confidential?

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within ForeScout or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation. Occasionally, stockholders provide written comments on their proxy cards, which may be forwarded to management and our board of directors.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. The final results will be tallied by the inspector of elections and filed with the SEC in a current report on Form 8-K within four business days of the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and, within four business days after final results are known, file an additional Current Report on Form 8-K to publish the final results.

I share an address with another stockholder and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice, and if applicable, our proxy materials, to multiple stockholders who share the same address unless we receive contrary instructions from one or more of the stockholders sharing the same address. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate copies of the Notice, or if applicable, our proxy materials. Upon written or oral request, we will deliver promptly separate copies of the Notice and, if applicable, our proxy materials, to any stockholder at a shared address which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice or, if applicable, our proxy materials, stockholders may contact us at the following: ForeScout Technologies, Inc., Attention: Investor Relations, 190 West Tasman Drive, San Jose California 95134 or telephone: (408) 213-3191.

Stockholders who hold shares of our common stock in street name may contact their brokerage firm, bank, broker-dealer or other similar organization to request information about householding.

Who will count the votes?

A representative of Broadridge Financial Solutions, Inc., will tabulate and certify the votes and act as inspector of elections appointed for the Annual Meeting.

How can I contact ForeScout’s transfer agent?

You may contact our transfer agent, Computershare, by telephone at (877) 575-3100 (toll-free for United States residents) or (781) 575-3100, or by writing Computershare Trust Company, N.A., at P.O. Box 30170, College Station, Texas 77842. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at http://www.computershare.com/investor.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the annual meeting and from our corporate secretary for ten days prior to the meeting for any purpose germane to the annual meeting, between the hours of 9:00 a.m. and 4:30 p.m., local time, at our corporate headquarters located at 190 Tasman Dr., San Jose, CA 95134.

What are the implications of being an “emerging growth company”?

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), including certain executive compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an emerging growth company until the earliest of (i) the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, (ii) the last day of the first fiscal year in which our annual gross revenue is $1.07 billion or more, (iii) the date on which we have, during the previous rolling three-year period, issued more than $1 billion in non-convertible debt securities or (iv) the date on which we are deemed to be a “large accelerated filer” as defined in the Exchange Act.

What is the deadline to propose actions for consideration at next year’s Annual Meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our Proxy Statement and for consideration at the next Annual Meeting of stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our Proxy Statement for our 2019 Annual Meeting of stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than December 11, 2018. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to: ForeScout Technologies, Inc., Attention: Corporate Secretary, 190 West Tasman Drive, San Jose California 95134.

Our amended and restated bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an Annual Meeting of stockholders but do not intend for the proposal to be included in our Proxy Statement. Our amended and restated bylaws provide that the only business that may be conducted at an Annual Meeting is business that is (i) specified in our proxy materials with respect to such Annual Meeting, (ii) by or at the direction of our board of directors, or (iii) properly brought before the Annual Meeting by a stockholder of record entitled to vote at the Annual Meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our amended and restated bylaws. To be timely for our 2019 Annual Meeting of stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

| |

| • | not earlier than the close of business January 25, 2019; and |

| |

| • | not later than the close of business on February 25, 2019. |

In the event that we hold our 2019 Annual Meeting of stockholders more than 30 days before or more than 60 days after the one-year anniversary of the Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our Proxy Statement must be received no earlier than the close of business on the 120th day before such Annual Meeting and no later than the close of business on the later of the following two dates:

| |

| • | the 90th day prior to such Annual Meeting; or |

| |

| • | the 10th day following the day on which public announcement of the date of such Annual Meeting is first made. |

If a stockholder who has notified us of his, her or its intention to present a proposal at an Annual Meeting does not appear to present his, her or its proposal at such Annual Meeting, we are not required to present the proposal for a vote at such Annual Meeting.

Recommendation and Nomination of Director Candidates

You may recommend director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include, among other requirements, information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate addressed to our Corporate Secretary confirming willingness to serve on our board of directors. For additional information regarding stockholder recommendations for director candidates, see the section titled “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors.”

In addition, our amended and restated bylaws permit stockholders to nominate directors for election at an Annual Meeting of stockholders. To nominate a director, the stockholder must provide the information required by our amended and restated bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our amended and restated bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time periods described above under the section titled “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Availability of Bylaws

A copy of our amended and restated bylaws may be obtained by accessing our public filings on the SEC’s website at http://www.sec.gov. You may also contact our Corporate Secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

COMPOSITION OF THE BOARD

Our business affairs are managed under the direction of our board of directors, which is currently composed of nine members. Eight of our directors are independent within the meaning of the listing standards of the NASDAQ Stock Market, LLC (“NASDAQ”). Our board of directors is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the class of directors whose terms are then expiring.

Each director’s term continues until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal. Any increase or decrease in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of our directors. This classification of our board of directors may have the effect of delaying or preventing changes in control of our company.

The names, ages, and certain other information as of March 31, 2018 for each of the nominees for election as a director and for each of the continuing members of the board of directors are set forth below.

|

| | | | | | | | | | | | |

| | | Class | | Age | | Position | | Director Since | | Current Term Expires | | Expiration of Term for Which Nominated |

| Nominees for Director | | | | | | | | | | | |

| Yehezkel Yeshurun | I | | 68 | | Chairman of the Board | | 2000 | | 2018 | | 2021 |

Enrique Salem(2)(3) | I | | 52 | | Director | | 2013 | | 2018 | | 2021 |

Theresia Gouw(1)(3) | I | | 50 | | Director | | 2001 | | 2018 | | 2021 |

| | | | | | | | | | | | | |

| Continuing Directors | | | | | | | | | | | |

T. Kent Elliott(1)(2) | II | | 65 | | Director | | 2003 | | 2019 | | |

Mark Jensen(2) | II | | 67 | | Director | | 2013 | | 2019 | | |

Rami Kalish(1)(3) | II | | 61 | | Director | | 2001 | | 2019 | | |

| James Beer | III | | 57 | | Director | | 2016 | | 2020 | | |

| Michael DeCesare | III | | 52 | | Director | | 2015 | | 2020 | | |

David G. DeWalt(1) | III | | 53 | | Vice-Chairman of the Board | | 2015 | | 2020 | | |

__________

| |

| (1) | Member of our nominating and corporate governance committee. |

| |

| (2) | Member of our audit committee. |

| |

| (3) | Member of our compensation committee. |

Director Nominees – Class I Directors

Our Board has nominated Ms. Gouw and Messrs. Yeshurun and Salem for election as Class I directors. Each nominee for director has consented to being named in this Proxy Statement and has indicated a willingness to serve if elected. If a nominee is unavailable for election, the persons named as proxyholders will use their discretion to vote for any substitute nominee in accordance with their best judgment, as they deem advisable. Listed below are the biographies of each director nominee. The biographies include information regarding each nominee’s service as a director of ForeScout, business experience and principal occupations for at least the past five years, director positions at public companies held currently or at any time during the past five years, and the experiences, qualifications, attributes or skills that led the nominating and corporate governance committee of our board of directors to recommend, and our board of directors to determine, that the person should serve as a director for ForeScout. There are no family relationships among any of our directors or executive officers.

Yehezkel “Hezy” Yeshurun co-founded our company and has served as our Chairman and a member of our board of directors since April 2000 and as our Executive Chairman from September 2001 to July 2003. Since 1988, Mr. Yeshurun has been a Professor of Computer Science at Tel Aviv University has co-founded several other technology companies, including TapGuard Technologies Ltd., a technology company acquired by Elron Software Inc. in 1997, and Top Image Systems Ltd., a publicly traded intelligent document processing solutions company for which Mr. Yeshurun served as a director from 1996 to 2001. Mr. Yeshurun holds a B.Sc, an M.S., and a Ph.D. in Applied Mathematics from Tel Aviv University and did his post-doctorate in Computational Neuroscience at New York University.

Mr. Yeshurun was selected to serve on our board of directors because of the perspective and experience he brings as one of our founders and his extensive knowledge of the technology industry.

Enrique Salem has served as a member of our board of directors since September 2013. Since July 2014, Mr. Salem has served as a Managing Director of Bain Capital Ventures LLC, a venture capital division of Bain Capital, LP. Mr. Salem served as President, Chief Executive Officer and a director of Symantec from April 2009 until July 2012. Prior to that, Mr. Salem served as Chief Operating Officer of Symantec from January 2008 to April 2009, group President, Worldwide Sales and Marketing from April 2007 to January 2008, group President, Consumer Products from May 2006 to April 2007, Senior Vice President, Consumer Products and Solutions from February 2006 to May 2006, Senior Vice President, Security Products and Solutions from January 2006 to February 2006, and Senior Vice President, Network and Gateway Security Solutions from June 2004 to February 2006. Prior to Symantec, from April 2002 to June 2004, Mr. Salem served as President and Chief Executive Officer of Brightmail, Inc., an email filtering company, prior to its acquisition by Symantec in 2004. Mr. Salem also held senior leadership roles at Oblix Inc., Ask Jeeves Inc., Peter Norton Computing, Inc. and Security Pacific Merchant Bank. In March 2011, he was appointed to President Barack Obama’s Management Advisory Board. Mr. Salem has served on the board of directors of FireEye since February 2013, including as Chairman of FireEye’s board of directors since March 2017, and Atlassian Corporation Plc, since August 2013. Mr. Salem previously served on the board of directors of Automatic Data Processing, Inc. from January 2010 to November 2013 and the board of directors of Symantec from April 2009 to July 2012. He received the Estrella Award from the Hispanic IT Executive Council in 2010 and was named Entrepreneur of the Year in 2004 by Ernst & Young. Mr. Salem holds an A.B. in Computer Science from Dartmouth College.

Mr. Salem was selected to serve on our board of directors because of his extensive leadership experience, including oversight of global operations, as well as a strong background in information technology, data security, compliance and systems management.

Theresia Gouw has served as a member of our board of directors since July 2001. Since February 2014, Ms. Gouw has served as a co-founder and Managing Partner of Aspect Ventures, L.P., a venture capital firm. From February 1999 to February 2014, Ms. Gouw served in various senior roles at Accel Partners, a venture capital firm, most recently serving as a Managing Partner. She previously served on the board of directors of Trulia, Inc., an online real estate site and Imperva Inc., a cybersecurity company. Ms. Gouw holds a Sc.B. in Engineering from Brown University and an M.B.A. from Stanford University Graduate School of Business.

Ms. Gouw was selected to serve on our board of directors because of her experience in the venture capital industry and as a director of both publicly- and privately-held technology companies.

Continuing Directors – Class II and III Directors

Listed below are the biographies of each of our Class II and Class III directors. The biographies include information regarding each director's service as a director of the Company, business experience and principal occupations for at least the past five years, director positions at public companies held currently or at any time during the past five years, and the experiences, qualifications, attributes or skills that led the nominating and corporate governance committee to recommend, and our board of directors to determine, that the person should serve as a director for ForeScout. There are no family relationships among any of our directors or executive officers.

T. Kent Elliott has served as a member of our board of directors since January 2003. From July 2014 to February 2015, Mr. Elliott served as our Interim Chief Executive Officer and prior to that, from January 2003 until his retirement in December 2009, he served as our Chief Executive Officer. Since his retirement, Mr. Elliott currently serves on the board of directors of Vecima Networks Inc. (“Vecima”), a Canadian designer and manufacturer of broadband telecommunications products and chairs Vecima’s audit committee. Mr. Elliott was the Chief Executive Officer of Vienna Systems Corporation, a voice over IP company that was bought by Nokia in 1998. He has held international executive positions with both Nokia Internet Communications as the Head of Business Development, General Manager of the Asia Pacific Region, and Senior Vice President of Product Management for Mitel Corporation. Mr. Elliott holds a Bachelor of Commerce in Accounting and Finance and an M.B.A. from Queen’s University.

Mr. Elliott was selected to serve on our board of directors because of his extensive experience leading and advising technology companies.

Mark Jensen has served as a member of our board of directors since May 2013. From October 2001 to June 2012, Mr. Jensen served as U.S. Managing Partner of the Venture Capital Services Group and U.S. Managing Partner of the Technology, Media and Telecommunications Industry Group for Audit and Enterprise Risk Services at Deloitte & Touche LLP, a professional services firm. Mr. Jensen currently serves on the board of directors and as the chair of the Audit Committee of Control4 Corporation, a smart home automation systems company, and Lattice Semiconductor Corporation, a manufacturer of high-performance programmable logic devices. He previously served on the board of directors of Unwired Planet, Inc., an intellectual property and technology licensing company now known as Great Elm Capital Group, Inc. from October 2012 to November 2015. Mr. Jensen has a B.S. in Accounting from Metropolitan State College of Denver and a B.Ed. in Education from Colorado State University.

Mr. Jensen was selected to serve on our board of directors because of his extensive accounting and financial expertise and his experience with technology companies and as a director of publicly- and privately-held companies.

Rami Kalish has served as a member of our board of directors since January 2001. Since 1993, Mr. Kalish has served as Managing General Partner and Co-Founder of Pitango Venture Capital Fund (“Pitango”), a venture capital firm. Prior to founding Pitango, Mr. Kalish gained managerial experience at high-technology firms in the United States, Europe, and Israel. He has served on the board of directors of various private companies. Mr. Kalish holds a B.Sc. in Industrial Engineering and Information Science from the Technion Institute of Technology.

Mr. Kalish was selected to serve on our board of directors because of his experience in the venture capital industry and as a director of both publicly- and privately-held technology companies.

James Beer has served as a member of our board of directors since August 2016. In February 2018, Mr. Beer joined Atlassian Corporation Plc. (“Atlassian”), a software company based in San Francisco, as its Chief Financial Officer. Before joining Atlassian, Mr. Beer has served as Executive Vice President and Chief Financial Officer of McKesson Corporation, a healthcare company distributing pharmaceuticals and medical supplies and providing health information technology tools, from October 2013 to December 2017. From February 2006 to October 2013, Mr. Beer served as Executive Vice President and Chief Financial Officer of Symantec Corporation (“Symantec”), a provider of information security, storage and systems management solutions. Mr. Beer currently serves on the board of directors of Alaska Air Group, Inc., the airline holding company of Alaska Airlines and Virgin America. Mr. Beer holds a B.S. in Aeronautical Engineering from Imperial College, London University and an M.B.A. from Harvard Business School.

Mr. Beer was selected to serve on our board of directors because of his extensive experience in operations, strategy, accounting, financial management, and investor relations at both publicly- and privately-held technology companies.

Michael DeCesare has served as our President and Chief Executive Officer and as a member of our board of directors since March 2015. Prior to joining ForeScout, Mr. DeCesare served in a variety of executive roles at Intel Security, previously McAfee Security, a computer security software company and wholly-owned subsidiary of Intel Corporation, from October 2007 to February 2015, including as President and as Executive Vice President, Worldwide Sales and Operations. Prior to joining Intel Security, Mr. DeCesare served as Senior Vice President of Worldwide Field Operations for Documentum, an enterprise content management company, from January 2001 to September 2007, during which time the company was acquired by EMC Corporation, a cloud computing, data storage, IT security, and big data company. Following the acquisition in December 2003, Mr. DeCesare served as Senior Vice President of EMC Software, a division of EMC Corporation, that included Documentum. Prior to joining Documentum, Mr. DeCesare served as Vice President of Field Sales at Oracle, a cloud application and platform services company, from February 1989 to June 2000. Mr. DeCesare holds a B.A. in Communications from Villanova University.

Mr. DeCesare was selected to serve on our board of directors because of the operational perspective he brings as our President and Chief Executive Officer and his extensive experience leading and growing technology companies.

David G. DeWalt has served as our Vice-Chairman and a member of our board of directors since June 2015. From June 2016 to January 2017, Mr. DeWalt served as Executive Chairman of FireEye, Inc. (“FireEye”), a global network cybersecurity company. Mr. DeWalt also served on the board of directors of FireEye from May 2012 to November 2012 and as its Chief Executive Officer and Chairman of the Board from November 2012 to June 2016. Prior to joining FireEye, Mr. DeWalt served as President, Chief Executive Officer, and Director of Intel Security from April 2007 until February 2011 when Intel Security was acquired by Intel Corporation. Mr. DeWalt served as President of McAfee Security from February 2011 to August 2011. From December 2003 to March 2007, Mr. DeWalt held various positions at EMC Corporation, including Executive Vice President, EMC Software Group and President of EMC’s Documentum and Legato Software divisions. Prior to joining EMC Corporation, Mr. DeWalt served as President and Chief Executive Officer of Documentum, Inc. from July 2001 to December 2003, Executive Vice President and Chief Operating Officer of Documentum from October 2000 to July 2001 and Executive Vice President and General Manager, eBusiness Unit, of Documentum from August 1999 to October 2000. In addition to FireEye, Mr. DeWalt has served on the board of directors of Delta Air Lines, Inc. since November 2011 and the board of directors of Five9, Inc. since April 2012. Mr. DeWalt served on the board of directors of Polycom, Inc. from November 2005 to May 2013 and as its Chairman of the Board from May 2010 to May 2013 and served on the board of directors of Jive Software, Inc. from February 2011 to April 2013. Mr. DeWalt holds a Ph.D. in Computer and Information Sciences and a B.S. in Computer Science from the University of Delaware.

Mr. DeWalt was selected to serve on our board of directors because of his extensive senior management expertise in the network security industry.

Director Independence

Our common stock is listed on The NASDAQ Global Market. Under the rules of NASDAQ, independent directors must comprise a majority of a listed company’s board of directors within a specified period of time after the completion of such company’s initial public offering. In addition, the rules of NASDAQ require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent. Under the rules of NASDAQ, a director will only qualify as an “independent director” if, in the opinion of the company’s board of directors, the director does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our board of directors has undertaken a review of the independence of each director who serves as a member of our board of directors and considered whether such director has a material relationship with us that could compromise the director’s ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our board of directors has determined that Messrs. Yeshurun, DeWalt, Beer, Elliott, Jensen, Kalish and Salem and Ms. Gouw are “independent directors” as defined under the applicable rules and regulations of the SEC, and the listing requirements and rules of NASDAQ.

Board Oversight of Risk

Risk is inherent with every business and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.

While our board of directors is ultimately responsible for risk oversight, our board committees assist our board of directors in fulfilling its oversight responsibilities in certain areas of risk. The committees of our board of directors consider risks within their respective areas of oversight responsibility and the respective committee chairs advise the board of directors of any significant risks and management's response via periodic committee reports to the full board of directors. In particular, the audit committee focuses on financial and accounting risk, including internal controls. The compensation committee considers risks relating to our compensation programs and policies and the nominating and corporate governance considers risks relating to our corporate governance.

Board of Directors Leadership

Mr. Yeshurun currently serves as the Chairman of our board of directors and Mr. DeWalt serves as Vice-Chairman. The general policy outlined in our Corporate Governance Guidelines is that the Chairman of the board of directors and the CEO positions may, but need not be, served by the same person. Currently, the Chairman of the board of directors and the CEO positions are served by separate individuals. Our board of directors believes that the current board leadership structure provides effective independent oversight of management while allowing our board of directors and management to benefit from Mr. Yeshurun’s history as a co-founder of our Company and years of experience in leadership and executive roles in the technology industry.

Board Meetings and Committees

During our 2017 fiscal year, our board of directors held 8 meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our board of directors held during the period for which he or she has been a director and (ii) the total number of meetings held by all committees of our board of directors on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage, but do not require, our directors to attend.

Our board of directors has established an audit committee, a compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each of the committees of our board of directors is described below. Members serve on these committees until their resignation or until otherwise determined by our board of directors.

Audit Committee

Our audit committee is composed of T. Kent Elliott, Mark Jensen, and Enrique Salem, each of whom is a non-employee member of our board of directors. Mr. Jensen is the chair of our audit committee. Our board of directors has determined that each of the members of our audit committee satisfies the requirements for independence and financial literacy under the rules and regulations of NASDAQ and the SEC, including Rule 10A-3. Our board of directors has also determined that Mr. Jensen qualifies as an “audit committee financial expert” as defined in the SEC rules and satisfies the financial sophistication requirements of NASDAQ. Our audit committee is responsible for, among other things:

| |

| • | overseeing the integrity of our financial statements and our accounting and financial reporting processes and financial statement audits; |

| |

| • | overseeing our compliance with legal and regulatory requirements; |

| |

| • | overseeing the independence and qualifications of our registered public accounting firm, or independent auditor; |

| |

| • | overseeing the performance of our independent auditor; |

| |

| • | overseeing our disclosure controls and procedures, internal control over financial reporting, and compliance with ethical standards adopted by us; |

| |

| • | reviewing and approving related person transactions; |

| |

| • | reviewing and assessing the adequacy of the audit committee’s charter and submitting any changes to our board of directors for approval; |

| |

| • | performing an evaluation of the performance of the audit committee; |

| |

| • | meeting with management to review our annual and quarterly financial statements and related disclosures; |

| |

| • | recommending to the board of directors whether financial statements should be included in our annual report on Form 10-K; |

| |

| • | overseeing, reviewing and periodically updating our code of business conduct and ethics and our system to monitor compliance with and enforce this code; and |

| |

| • | preparing the audit committee report that the SEC requires in our annual Proxy Statement. |

Our audit committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of NASDAQ. A copy of the charter of our audit committee is available on our website at http://www.investors.forescout.com. Our audit committee had 10 meetings in 2017.

Compensation Committee

Our compensation committee is composed of Theresia Gouw, Rami Kalish, and Enrique Salem, each of whom is a non-employee member of our board of directors. Mr. Salem is the chair of our compensation committee. Our board of directors has determined that each member of our compensation committee meets the requirements for independence under the rules of NASDAQ and the SEC, including Rule 10C-1, is a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended. Our compensation committee is responsible for, among other things:

| |

| • | reviewing and assessing the adequacy of the compensation committee’s charter and submitting any changes to our board of directors for approval; |

| |

| • | performing an evaluation of the performance of the compensation committee; |

| |

| • | reviewing and making recommendations to our board of directors regarding the amount of compensation payable to our Chief Executive Officer; |

| |

| • | reviewing and approving our Chief Executive Officer’s and other executive officers’ annual base salaries, incentive compensation plans, equity compensation, and any other benefits, compensation, or arrangements; |

| |

| • | reviewing and making recommendations to our board of directors regarding any changes to or grants under our equity compensation plans; |

| |

| • | overseeing our overall compensation philosophy, compensation plans, and benefits programs; |

| |

| • | reviewing our process and procedures for the consideration and determination of director and executive officer compensation; and |

| |

| • | preparing the compensation committee report that the SEC requires in our annual Proxy Statement. |

Our compensation committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of NASDAQ. A copy of the charter of our compensation committee is available on our website at http://www.investors.forescout.com. Our compensation committee had 4 meetings in 2017.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee is composed of David G. DeWalt, Rami Kalish, Theresia Gouw, and T. Kent Elliott, with Mr. Elliott serving as chair of the committee. Our nominating and corporate governance committee is responsible for, among other things:

| |

| • | developing and recommending to our board of directors criteria for board and committee membership; |

| |

| • | establishing procedures for identifying and evaluating director candidates, including nominees recommended by stockholders; |

| |

| • | identifying individuals qualified to become members of our board of directors; |

| |

| • | recommending to our board of directors the persons to be nominated for election as directors and to each of the committees of our board of directors; |

| |

| • | developing and recommending to our board of directors a set of corporate governance guidelines; |

| |

| • | reviewing and recommending to our board of directors the composition of the committees of our board of directors; |

| |

| • | making recommendations for director continuing education; |

| |

| • | reviewing and assessing the adequacy of the nominating and corporate governance committee’s charter and submitting any changes to our board of directors for approval; |

| |

| • | performing an evaluation of the performance of the nominating and corporate governance committee; and |

| |

| • | overseeing the evaluation of our board of directors. |

Our nominating and corporate governance committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of NASDAQ. A copy of the charter of our nominating and corporate governance committee is available on our website at http://www.investors.forescout.com. Our nominating and corporate governance committee had 3 meetings in 2017.

Compensation Committee Interlocks and Insider Participation

None of the members of our compensation committee is or has been an officer or employee of our company or had any relationship requiring disclosure under Item 404 of Regulation S-K, under the Securities Act. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee, or other board committee performing equivalent functions, of any entity that has one or more executive officers serving on our compensation committee or our board of directors.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, experience of particular relevance to us and the board of directors, accomplishments, superior credentials, independence, area of expertise, and the highest ethical and moral standards. Although the board of directors does not maintain a specific policy with respect to board diversity, the board of directors believes that the board should be a diverse body, and the nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, the nominating committee may take into account the benefits of diverse viewpoints. Any search firm retained by our nominating and corporate governance committee to find director candidates would be instructed to take into account all of the considerations used by our nominating and corporate governance committee. After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full board of directors the director nominees for selection.

Stockholder Recommendations for Nominations to the Board of Directors

Our nominating and corporate governance committee will consider candidates for director recommended by stockholders of our company who are stockholders of record at the time of the submission of the director recommendation and on the record date for the determination of stockholders entitled to vote at the Annual Meeting, so long as such recommendations comply with our amended and restated certificate of incorporation and amended and restated bylaws and applicable laws, rules and regulations, including those promulgated by the SEC.

The nominating and corporate governance committee will evaluate such recommendations in accordance with its charter, our amended and restated bylaws, our policies and procedures for director candidates, as well as the regular director nominee criteria described above. This process is designed to ensure that our board of directors includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our Corporate Secretary in writing. Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our common stock and a signed letter from the candidate confirming willingness to serve on our board of directors. Our nominating and corporate governance committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and recommendations should be sent in writing to our Corporate Secretary at ForeScout Technologies, Inc., 190 West Tasman Drive, San Jose California 95134.

Communications with the Board of Directors

Interested parties wishing to communicate with our board of directors or with an individual member or members of our board of directors may do so by writing to the board of directors or to the particular member or members of our board of directors and mailing the correspondence to our General Counsel at ForeScout Technologies, Inc., 190 West Tasman Drive, San Jose California 95134. Our General Counsel, in consultation with appropriate members of our board of directors, as necessary, will review all incoming communications and, if appropriate, all such communications will be forwarded to the appropriate member or members of our board of directors, or if none is specified, to the Chairman of our board of directors.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted Corporate Governance Guidelines. These guidelines address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Guidelines and our Code of Business Conduct and Ethics is posted on the Investor Information portion of our website at http://www.investors.forescout.com. We will post amendments to our Code of Business Conduct and Ethics or waivers of our Code of Business Conduct and Ethics for directors and executive officers on the same website.

COMPENSATION OF NON-EMPLOYEE DIRECTORS

Prior to our initial public offering, we had not implemented a formal policy with respect to compensation payable to our non-employee directors for service as directors. Our board of directors adopted our Outside Director Compensation Policy in connection with our initial public offering. Members of our board of directors who are not employees are eligible for compensation under our Outside Director Compensation Policy. Other than as set forth in the table and described more fully below, we did not pay any compensation, including equity awards, to any of the non-employee members of our board of directors in 2017. During 2017, Michael DeCesare was an employee director and his compensation is discussed in the section titled “Executive Compensation.”

Our board of directors adopted our Outside Director Compensation Policy in connection with our initial public offering, with all annual equity award grants under the policy to begin as of the second Annual Meeting of our stockholders following the effective date of the policy, unless otherwise determined by our compensation committee. Only non-employee directors who are also independent within the meaning of the corporate governance rules of NASDAQ are eligible to receive compensation as a non-employee director under the policy. Accordingly, Mr. DeCesare, our Chief Executive Officer, is not eligible for awards under our Outside Director Compensation Policy. Additionally, Mr. DeCesare does not receive any cash compensation for his role as a director.

Cash Compensation

Effective as of our 2018 Annual Meeting of our stockholders, non-employee directors will receive annual cash retainers for service in the following positions:

|

| | | |

| Position | | Annual Cash Retainer ($) |

| Board member | | 30,000 | |

| Chairperson of the board | | 27,000 | |

| Vice Chairperson of the board | | 20,000 | |

| Audit committee chair | | 20,000 | |

| Audit committee member other than chair | | 10,000 | |

| Compensation committee chair | | 12,000 | |

| Compensation committee member other than chair | | 6,000 | |

| Nominating and corporate governance committee chair | | 7,500 | |

| Nominating and corporate governance committee member other than chair | | 4,500 | |

Annual cash retainers will be paid in quarterly installments in arrears on a prorated basis.

Equity Compensation

Subject to any limits in the equity plan under which the award is granted, each newly-elected non-employee director will receive an initial award of restricted stock units (“RSUs”) on the date of his or her appointment to our board of directors, with such award covering a number of shares of our common stock determined as $450,000 divided by the grant date closing price of a share of our common stock, rounded down to the nearest whole share. However, if an individual was a member of our board of directors and also an employee, he or she will not receive such an award even if he or she becomes a non-employee director due to termination of his or her employment. Each non-employee director’s initial award will vest in three equal annual installments on each successive anniversary of the grant date, in each case, subject to the non-employee director’s continued service with us through each such date.

Commencing as of our second Annual Meeting of our stockholders, and subject to any limits in the Outside Director Compensation Policy and the equity plan under which the award is granted, on the date of each Annual Meeting of our stockholders, each continuing non-

employee director will receive an annual award of RSUs covering a number of shares of our common stock determined as $150,000 divided by the grant date closing price of a share of our common stock, rounded down to the nearest whole share. Each such annual award will be scheduled to fully vest on the earlier of (i) the one-year anniversary of the grant date and (ii) the day prior to the next Annual Meeting of our stockholders, subject to the non-employee director’s continued service with us through such date.

The awards granted to non-employee directors under the policy will fully vest immediately prior to a “change in control” as defined in our 2017 Equity Incentive Plan.

The table below shows the total compensation earned by our non-employee directors during 2017.

Director Compensation Table for Fiscal Year 2017

|

| | | | | | | | |

Name(1) | | Fees Earned or Paid in Cash ($) | | Stock Awards ($) | | Option Awards ($) | | Total ($) |

Yehezkel Yeshurun, Chairman of the Board(2) | | 63,921 | | — | | — | | 63,921 |

David G. DeWalt, Vice-Chairman of the Board(3) | | 9,923 | | — | | — | | 9,923 |

Richard Anton(4) | | — | | — | | — | | — |

James Beer(5) | | 5,462 | | — | | — | | 5,462 |

T. Kent Elliott(6) | | 8,648 | | — | | — | | 8,648 |

| Theresia Gouw | | 7,374 | | — | | — | | 7,374 |

Mark Jensen(7) | | 9,103 | | — | | — | | 9,103 |

| Rami Kalish | | 7,374 | | — | | — | | 7,374 |

Enrique Salem(8) | | 9,467 | | — | | — | | 9,467 |

__________

| |

| (1) | Each of the outstanding equity awards held by our directors, as described below, was granted pursuant to our 2000 Stock Option and Incentive Plan. |

| |

| (2) | As of December 31, 2017, Mr. Yeshurun held (i) an option to purchase 85,000 shares of common stock at an exercise price of $7.98 per share, which vests in 36 equal monthly installments commencing on February 27, 2015, (ii) an option to purchase 64,909 shares of common stock at an exercise price of $8.52 per share, which vests over a four-year period, one-fifth of the shares subject to the option vesting in equal monthly installments over each of the first and second annual periods following June 29, 2015 and three-tenths of the shares subject to the option vesting in equal monthly installments over each of the third and fourth annual periods following June 29, 2015, (iii) an option to purchase 45,137 shares of common stock at an exercise price of $1.47 per share, which are fully vested and (iv) an option to purchase 43,000 shares of common stock at an exercise price of $2.18 per share, of which one-fourth of the shares subject to the option vested on March 13, 2014, and the remaining shares vest in 36 equal monthly installments thereafter. For all awards, vesting is conditioned on Mr. Yeshurun’s continued service to us through the applicable vesting date. All unvested shares subject to the options are early exercisable. |

| |

| (3) | As of December 31, 2017, Mr. DeWalt held (i) a restricted stock unit award covering 167,913 shares of common stock and (ii) 209,872 shares of restricted stock issued upon the early exercise of a stock option that remained subject to a right of repurchase by us as of such date. 100% of the shares subject to the restricted stock units will vest 181 days following the completion of our initial public offering. For the 209,872 shares of restricted stock, our right of repurchase lapses with respect to 6,996 shares of common stock each month commencing on June 16, 2015. For all awards, vesting is conditioned upon Mr. DeWalt’s continued service to us through the applicable vesting date. If we are subject to a change in control while Mr. DeWalt is serving as a director, then all of his restricted stock units will immediately vest and our right of repurchase will immediately lapse with respect to all of his restricted common stock. |

| |

| (4) | Mr. Anton resigned from our board of directors as of October 26, 2017, the date of the effectiveness of the registration statement for our initial public offering. |

| |

| (5) | As of December 31, 2017, Mr. Beer held a restricted stock unit award covering 100,000 shares of common stock, all of which remain outstanding. One-fourth of the shares subject to the restricted stock unit award vest in equal annual installments commencing on November 15, 2016. Notwithstanding the satisfaction of the time-based vesting requirement, no shares underlying the restricted stock unit award will vest until 181 days following our initial public offering. If Mr. Beer is involuntarily terminated prior to an initial public offering, the shares underlying the restricted stock unit award shall be deemed vested solely based upon the achievement of the time-based vesting requirements (without regard to the occurrence of an initial public offering). The vesting of such restricted stock units is conditioned upon Mr. Beer’s continued service to us as a director through the applicable vesting date. If we are subject to a change in control while Mr. Beer is serving as a director, then the shares that still remain subject to the time-based vesting requirement pursuant to the restricted stock unit award will immediately vest and settle. |

| |

| (6) | As of December 31, 2017, Mr. Elliott held (i) an option to purchase 49,944 shares of common stock at an exercise price of $4.78 per share, which vests in 48 equal monthly installments commencing on September 10, 2013, (ii) an option to purchase 202,500 shares of common stock at an exercise price of $7.04 per share, which are fully vested, and (iii) an option to purchase 22,781 shares of common stock at an exercise price of $8.52, of which one-fifth of the shares subject to the option vest in equal monthly installments |

over each of the first and second annual periods following June 29, 2015 and three-tenths of the shares subject to the option vest in equal monthly installments over each of the third and fourth annual periods following June 29, 2015. For all awards, vesting is conditioned on Mr. Elliott’s continued service to us through the applicable vesting date. If we are subject to a change in control while Mr. Elliott is serving as a director, then any unvested portion of Mr. Elliott’s options shall accelerate and become fully vested. All unvested shares subject to the options are early exercisable.

| |

| (7) | As of December 31, 2017, Mr. Jensen held (i) an option to purchase 39,495 shares of common stock at an exercise price of $8.52 per share, which vests over a four-year period, of which one-fifth of the shares subject to the option vesting in equal monthly installments over each of the first and second annual periods following June 29, 2015 and three-tenths of the shares subject to the option vesting in equal monthly installments over each of the third and fourth annual periods following June 29, 2015 and (ii) an option to purchase 73,174 shares of common stock at an exercise price of $4.78 per share, which vests in 48 equal monthly installments commencing on April 26, 2013. Vesting of unvested options is conditioned on Mr. Jensen’s continued service to us through the applicable vesting date. |

| |

| (8) | As of December 31, 2017, Mr. Salem held 45,888 shares of restricted stock issued upon the early exercise of a stock option that remained subject to a right of repurchase by us as of such date. Of the 45,888 shares of restricted stock, (i) our right of repurchase lapses with respect to 22,477 shares of restricted stock over a four-year period, with one-fifth of the shares subject to the award vesting in equal monthly installments over each of the first and second annual periods following June 29, 2015 and three-tenths of the shares subject to the option award vesting in equal monthly installments over each of the third and fourth annual periods following June 29, 2015 and (ii) our right of repurchase lapses with respect to 23,411 shares of restricted stock at a rate of 2,341 shares each month commencing on June 16, 2015. |

Director Stock Ownership Guidelines

Currently, we have not implemented policies regarding minimum stock ownership requirements for our directors.

PROPOSAL NO. 1

ELECTION OF DIRECTORS